Commission, February 29, 2016, No M.7861

EUROPEAN COMMISSION

Judgment

DELL / EMC

Dear Sir/Madam,

Subject: Case M.7861 - Dell / EMC

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

(1) On 25 January 2016, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Denali Holding, Inc. ("Denali", USA), the owner of Dell Inc. ("Dell", USA) acquires within the meaning of Article 3(1)(b) of the EU Merger Regulation sole control of the whole of the undertaking EMC Corporation ("EMC", USA) by way of purchase of shares (the "transaction"). (3) Denali/Dell is designated hereinafter as the "Notifying Party". Denali/Dell and EMC are collectively referred to as the "Parties" or "the merging parties", while the company resulting from the transaction is referred to as "the merged entity"

1. THE PARTIES AND THE CONCENTRATION

(2) Denali is a holding company, the parent of Dell. Denali is solely controlled by Michael S. Dell, the founder and CEO of Dell. Dell is active in the development, sales, repairs, and support for computers and related products and services, including storage products. Dell was founded in 1984 and is headquartered in Round Rock, Texas.

(3) EMC is active in data storage, information security, virtualization, analytics, cloud computing, and other products and services that enable businesses to store, manage, protect and analyse data. Organised as a federation, EMC owns, inter alia, approximately 81% of VMware, Inc., a publicly-traded provider of virtualization software. It also owns […]% of VCE Company LLC, a joint venture with Cisco that sells converged infrastructure appliances, and specifically converged data centre units. (4) EMC's federation also includes businesses active in backup software, identity and access management, and cloud technologies.

(4) Pursuant to an agreement and plan of merger dated 12 October 2015, Denali is to acquire 100% of the share capital of EMC via a newly created acquisition company. Upon completion of the merger, EMC shareholders will receive shares of tracking stock that will be publicly traded and that are intended to track, in the aggregate, an approximately 53% of economic interest in the VMware business. (5) EMC will become a wholly-owned subsidiary of Denali and a sister company of Dell. The transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

(5) The Notifying Party submits that the transaction seeks to combine the complementary strengths of Dell (in personal computers and servers) and EMC (in storage and software) to offer large and small customers a full range of solutions, including storage, security, software, cloud, converged and virtualized environments. (6) In particular, the proposed concentration will position the combined company to capitalise on trends in the information technology ("IT") industry, such as the rapid explosion in data and the need for sophisticated data analytics, and the transition from on-premises to cloud infrastructures. Internal documents confirm that the parties seek to combine their expertise to expand and strengthen their portfolio in these areas, […]. (7)

2. UNION DIMENSION

(6) The Parties concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (8) (Dell: EUR […]; EMC: EUR […]). Each of them has a Union-wide turnover in excess of EUR 250 million (Dell: EUR […]; EMC: […]), but they do not achieve more than two-thirds of their aggregate Union-wide turnover within one and the same Member State. The transaction therefore has a Union dimension under Article 1(2) of the Merger Regulation.

3. RELEVANT MARKETS

(7) The transaction combines two global providers of IT systems and IT software, resulting in a horizontal overlap mainly in relation to storage systems and, in particular, external enterprise storage systems ("external ESS"). (9)

(8) In addition, the transaction gives rise to non-horizontal links since Dell is active in servers and storage systems, and VMware (owned by EMC) is a supplier of virtualization software that can be used in conjunction with servers and storage. Customers can buy their IT equipment separately and integrate the components themselves, or acquire pre-integrated "converged" systems, combining server hardware, external ESS, networking equipment, virtualization software, unified management software and/or other software applications.

(9) In light of the above, the Commission will examine the relevant market definition in relation to the following product areas: (i) storage systems; (ii) servers; (iii) virtualization software; and (iv) converged infrastructure solutions.

3.1. Storage systems and external ESS

(10) The storage resources of a business' IT infrastructure allow for information to be written to a storage solution (hard disk drive or flash drive), retained and retrieved (read).

(11) Broadly speaking, there are two types of storage: internal storage and external storage. Internal storage is the storage housed within the server enclosure: servers typically come with a limited amount of storage, dedicated to the server. External storage consists of the additional storage resources of a data centre, outside the servers: external storage systems are commonly required, due to the massive amount of data involved in modern enterprise operations.

(12) Another relevant distinction is enterprise storage as opposed to client storage. Enterprise storage is storage for use in corporate environments (such as data centres), while client storage refers to storage for lower workload environments, usually for use by individual consumers.

(13) External ESS is one component of a typical data centre, which works in conjunction with other IT components (such as servers, networking hardware such as cables and switches), security hardware (e.g., firewalls), and redundant power and cooling systems to store, manage and disseminate data for an enterprise.

(14) External ESS (also referred to as "storage arrays") are composed of one or more physical controllers (each a processor and firmware) that manage and provide a common interface to multiple hard disk drives (“HDDs”) or solid-state (flash) drives (“SSDs”) (or a combination of both HDDs and SSDs) (10) as well as other components such as cables, housing, and host bus adapters.

(15) The array then presents its multiple component drives as one resource to the data centre servers and frequently external clients, allowing them to read and write data. Traditional storage systems can be directly attached to the server (so-called “directly attached storage” or “DAS”), or connected via a computer network, which has the additional advantage of providing a shared pool of storage accessible across multiple servers.

3.1.1. Product market definition

(16) In previous decisions, the Commission has considered several markets in the IT industry including IT services, IT software, and IT systems (comprising electronic information processing systems including servers and storage systems). (11) The Commission identified a separate product market for storage solutions in its HP/Compaq decision. (12)

(17) The Commission also investigated relevant storage systems markets in cases Sun/Storagetek (13) and Oracle/Sun Microsystems. (14)

(18) In HP/Compaq, Sun/Storagetek and Oracle/Sun Microsystems, the Commission considered whether, within the overall storage solutions market, separate markets could be identified based on the type of media used (disk, optical and tape). (15) In addition, in HP/Compaq and Sun/Storagetek, the Commission considered whether disk storage should be further segmented by the type of the installation/architecture of the storage system, into DAS, storage area networks ("SAN") and network attached storage ("NAS"). (16) Finally in Sun/Storagetek, the Commission also examined the possibility of further segmenting tape storage solutions. (17) Ultimately, the Commission left the market definition in those cases open. Moreover, in those previous decisions no distinction was made between enterprise and client storage, and internal and external storage.

3.1.1.1. The Notifying Party’s view

(19) According to the Notifying Party, the market for storage systems has evolved considerably over the last few years, which has rendered past Commission decisions to some extent obsolete.

(20) The Notifying Party submits that internal storage (storage contained within a server) is not part of the relevant product market. Internal storage capacity is limited by the physical size of the server enclosure and the unused internal storage capacity generally cannot be accessed by or reallocated to other server systems. External storage, however, can be either directly attached to a server or connected via a computer network, so as to create a shared pool of storage accessible simultaneously by several servers.

(21) According to the Notifying Party, internal storage systems are not substitutes for external storage systems because of the limited ability, scalability and performance of internal storage systems. As internal storage belongs to a server, without software that makes the server behave like a storage system (i.e., software-defined storage or "SDS") or a hyperconverged appliance with storage, it would not be possible – according to the Notifying Party – for an internal storage system to perform as an external storage. Moreover, unlike external storage that can be shared between various servers, internal storage (without SDS) cannot be shared and is unique to a server. From a supply-side perspective, the Notifying Party notes that companies such as EMC, NetApp or Nimble Storage are focused on their external storage offering and do not offer internal storage systems at all, as opposed to companies such as Dell and HP selling servers which do offer internal storage systems. In summary, according to the Notifying Party the relevant product market is not narrower than the supply of external ESS.

(22) In addition, according to the Notifying Party the relevant product includes enterprise storage only, as opposed to consumer storage which is offered to individuals.

(23) The Notifying Party further submits that a categorization of the market for storage solutions by type of media used, i.e. between disk, optical and tape, is not relevant. According to the Notifying Party the main type of media used today are disks, while optical or tape are used less frequently. (18)

(24) The Notifying Party further submits that, both for demand and supply-side considerations, it is not possible to segment the market for external ESS between HDD arrays, all-flash arrays ("AFA") and hybrid flash arrays ("HFA"), which would belong to the same product market.

(25) Furthermore, according to the Notifying Party the distinction between storage systems directly attached to the server (so-called "directly attached storage" or "DAS"), network-attached storage ("NAS") and storage area networks ("SAN"), would no longer be relevant, both from the demand and the supply side.

(26) Finally, in support of its claim that the Parties' respective ESS portfolios are complementary, the Notifying Party has submitted market share data for different price bands of external ESS, namely (i) entry-level storage systems, comprising all systems with an average selling value below USD 25 000; (ii) mid-range enterprise storage systems, consisting of all systems with an average selling value of USD 25 000 to USD 249 999; and, (iii) the high-end band, covering all systems with an average selling value of USD 250 000 and above. The International Data Corporation ("IDC"), a market analyst, publishes data based on these three segments. (19)

(27) According to the Notifying Party, the prices reflect the sophistication of the storage products in terms of workload capabilities, scalability performance, reliability, data processing efficiency, data recoverability, data sharing features, data security and energy efficiency. However, none of the three segments would have niche customers with specific feature requirements. On the supply-side, the Notifying Party submits that there are no storage vendors providing external ESS with special features that no other vendor is able to replicate.

3.1.1.2. The results of the market investigation and the Commission’s assessment

(28) With regard to the possible distinction between internal and external storage, the majority of respondents to the market investigation consider that within the overall storage systems sector, there are separate markets for internal and external storage. (20) Respondents pointed out that external storage has significantly different characteristics compared to internal storage and that the segmentation is common practice in the industry. (21)

(29) As to enterprise storage (storage for servers and for storage systems in high workload environments, such as corporate data centres) and client storage (storage for lower workload environments that are usually for use by individual consumers, such as personal computers and portable electronic devices) most respondents to the market investigation consider that these constitute separate markets. (22)

(30) Most respondents to the market investigation also submitted that the possible market for external ESS should be segmented based on type of media used (disk, optical and tape). (23) Respondents pointed out, among other things, differences in terms of price and use, as tape (and increasingly optical) media are being used for archiving / backup. (24)

(31) With regard to a possible segmentation into HDD arrays, AFAs and HFAs (depending on the use of HDDs, SSDs or both), the majority of respondents to the market investigation disagreed with such a segmentation. (25) Respondents pointed out that – despite SSDs' lower capacity, higher price and higher speed – these types of drives can be used interchangeably in most ESS solutions and that frequently a combination of both types of drives is used. (26) The Commission notes that in previous decisions, the Commission found that SSDs and HDDs do not belong to the same relevant product markets. (27) However, the Commission notes that the present investigation concerns the market for external ESS, i.e., storage arrays, rather than the market for HDDs or SSDs contained in such arrays.

(32) As to the segmentation by type of installation / architecture (DAS, NAS, SAN), the majority of respondents to the market investigation disagreed with this distinction. (28) Respondents pointed out the demand-side and supply-side substitutability among these storage topographies and the development of new technologies (network unified storage or "NUS", software-defined storage or "SDS", hyper-converged solutions). (29)

(33) As regards another possible segmentation of external ESS by price bands (in line with the segmentation included in the IDC reports), (30) most respondents agreed with this segmentation. (31) Respondents pointed out differences in terms of volume of storage offered, performance of storage and advanced features (such as replication, deduplication, compression, and manageability features). However, competitors indicated that they are typically present in two or three price bands and that it is possible to switch production from one segment, (32) though with differing degrees of difficulty (e.g., it would not be easily feasible to switch production from low-end to high-end).

3.1.2. Geographic market definition

(34) In previous decisions, the Commission considered that the market for storage solutions was at least EEA-wide, if not worldwide, but ultimately left the exact geographic market definition open. (33)

3.1.2.1. The Notifying Party’s view

(35) The Notifying Party submits that the relevant geographic market for ESSs should be considered as worldwide in scope, since (i) manufacturers offer the same products under the same brands to all their customers regardless of geographic location; (ii) almost all suppliers of storage have a presence (in their own name or through distributors) in all parts of the globe; (iii) transportation costs are low; (iv) technical requirements and language differences do not have any impact on cross- border trade; and (v) prices are broadly similar across geographic regions.

3.1.2.2. The results of the market investigation and the Commission’s assessment

(36) Most respondents to the market investigation confirmed the Notifying Party’s view indicating that the geographic scope of the market for external storage solutions is worldwide. (34)

3.1.3. Conclusion on market definition for storage systems

(37) In light of the considerations in this section, and for the purpose of this decision, the exact delineation of the relevant product and geographic market(s) for storage systems can be left open, as the transaction does not give rise to serious doubts about its compatibility with the internal market under any plausible market definition.

3.2. Servers

3.2.1. Product market definition

(38) Servers are the computing power of the data centre. Servers can be used in many ways, and in large companies usually have a single function per server, for example file servers, web servers, printer servers, application servers. Servers also have a limited amount of internal storage capacity. A server can take different forms, such as rack, blade, tower or cloud physical servers, or a cloud logical server, which is delivered through server virtualization.

(39) Dell only sells servers based on open x86 architecture (as opposed to proprietary CPU architecture designed to run proprietary operating systems). The Notifying Party notes that the virtualisation software of VMware, Red Hat, Microsoft and other competitors only works on x86 servers, and that x86 servers represent more than 80% of all servers sold by revenue and more than 90% by units sold. EMC is not active in the server business. For the purposes of this investigation, "servers" is therefore understood to refer to x86 servers.

(40) In previous decisions, the Commission considered the "IT stack", of which the first layer is hardware, including servers. In Oracle/Sun Microsystems, the Commission looked at the party's claim that the relevant market for servers should be sub- divided into three segments, for low-end, mid-range and high-end servers. (35) In HP/Compaq, the parties argued that all servers constitute one market but considered alternative market definitions based on price and platform. (36) The Commission's market investigation in HP/Compaq confirmed its previous approach to delineate on the basis of price bands, as proxies to reflect different functionalities by band (entry-level below USD 100 000, mid-range USD 100 000 to USD 999 999, high-end above USD 1 million). In both those decisions, the Commission ultimately left the product market for servers open.

3.2.1.1. The Notifying Party’s view

(41) The Notifying Party refers to the Commission's previous decisions, in which the Commission suggested a possible segmentation of servers by price band as proxies reflecting the different functionalities, while ruling out a further segmentation by operating systems and/or applications served. The Notifying Party submits that it is ultimately not necessary to decide on the relevant product market as the transaction does not give rise to any competition (non-horizontal) concerns under any possible product market definition.

3.2.1.2. The results of the market investigation and the Commission’s assessment

(42) During the market investigation in this case the possible segmentations of the server market were tested. Most respondents to the market investigation agreed with the segmentation of servers by price-band into low-end, mid-range and high- end, as a proxy for functionality or task. (37) The market investigation did not provide a clear result as to a possible segmentation of servers by operating systems or by the applications they serve.

3.2.2. Geographic market definition

3.2.2.1. The Notifying Party’s view

(43) The Notifying Party refers to previous decisions by the Commission in which it has considered the server market to be at least EEA-wide, if not world-wide. It submits that, due to low transport costs, similar customer preferences, product specifications and patterns of sales of most major manufacturers, the relevant geographic market is world-wide in scope.

3.2.2.2. The results of the market investigation and the Commission’s assessment

(44) The results of the market investigation indicated that the geographic scope of the market for servers is at least EEA-wide or even worldwide, in line with previous Commission merger decisions. (38)

3.2.3. Conclusion on market definition for servers

(45) In light of the considerations in this section, the Commission considers that, for the purpose of this decision, the exact delineation of the relevant product and geographic market(s) for servers can be left open, as the transaction does not give rise to serious doubts about its compatibility with the internal market under any plausible market definition.

3.3. Virtualization software

3.3.1. Product market definition

(46) In computing, virtualization refers to the act of creating virtual versions of computer resources, like computer hardware, operating systems, storage devices, or network resources. Virtualization is, therefore, an intermediary layer between hardware and other software components, such as operating systems and applications. Virtualization software is one of the main software products marketed by VMware. (39)

(47) VMware provides x86-based (40) virtualization and management software for the entire data centre, including server, storage and network virtualization. (41)

(48) Combined with servers, virtualization software technology makes it possible to run multiple operating systems and multiple applications on the same server at the same time, by separating them in virtual machines. Virtualization software is therefore used by customers to increase the efficiency of a given physical server and, more generally, a data centre, by running multiple isolated workloads on a single server, rather than requiring multiple physical servers, as might have been the case in the absence of server virtualization technology.

(49) Server virtualization is also a key component of cloud computing, which typically depends on the ability to dynamically allocate new virtual machines, storage resources, networking, etc. to meet changing demand, and to automate the management of those resources through software interfaces.

(50) Combined with storage, virtualization software technology aims to provide a layer of abstraction by pooling physical storage from multiple network storage devices into a single virtual storage interface. More specifically, storage virtualization software (or "SDS") maps storage space by logical location (virtual) rather than physical location (hardware), which provides more efficiency, flexibility and scalability. These features allow workloads to be deployed faster, operations to become automated, and create significant cost savings for data centres.

(51) Combined with physical network components, (42) virtualization software technology creates virtual networks which are programmatically created, provisioned and managed, with the underlying physical network serving as a simple packet- forwarding backplane. More specifically, the software allocates network and security services to each virtual machine according to its needs while the virtual machine moves among hosts in the dynamic virtualized environment.

(52) Combined with desktops, virtualization software technology separates the desktop environment and associated application software from the hardware device that is used to access it. In essence, this software is decoupling a PC desktop environment from a physical device so that the virtual machine (“VM”) of the PC desktop stored in a centralised server can be accessed from a remote client device through a network. (43)

(53) In previous decisions in Computer Sciences Corporation / iSOFT Group (44) and IMB / INF Business of Deutsche Lufthansa, (45) the Commission considered a segmentation of software based on (i) the different functionalities of the software and the sector concerned, and (ii) the end uses offered by that particular software.

(54) As regards functionality, the Commission found that distinctions in the software industry are generally made between (i) infrastructure software (i.e., servers and databases); (ii) middleware (i.e., integration platforms); (iii) application software and office software; and (iv) operating/browser software. As regards end uses, the software industry was generally segmented between high and low-end or between high-end, mid-range and low-end. The exact product market definition was ultimately left open.

(55) In its decision Oracle / Sun Microsystems (46) the Commission considered a further segmentation of middleware (47) into, among other things, virtualization software. The product market definition was ultimately left open.

(56) With regard to middleware, in Oracle/Sun Microsystems (48) and Oracle/BEA, (49) the Commission investigated whether all types of middleware belonged to a single market or needed to be further segmented according to the end use of the product, including a sub-segment for virtualization software. Ultimately, the market definition was left open.

3.3.1.1. The Notifying Party’s view

(57) The Notifying Party submits that the four segmentations considered in previous decisions are now out-dated, as the software industry is currently fragmented and in flux. In support of its submission, the Notifying Party provided the Commission with IDC industry report data, according to which the industry should be segmented into three "primary" segments, namely: (i) application development and deployment, (ii) applications, and (iii) system infrastructure software (including virtualization software).

(58) The Notifying Party additionally submits IDC data (50) according to which the industry is further segmented into eighteen "secondary markets", namely: (i) Application Development Software; (ii) Application Platforms; (iii) Collaborative Applications; (iv) Content Applications; (v) Customer Relationship Management (CRM) Applications; (vi) Data Access, Analysis and Delivery; (vii) Engineering Applications; (viii) Enterprise Resource Management (ERM) Applications; (ix) Integration and Orchestration middleware; (x) Network Software; (xi) Operations and Manufacturing Applications; (xii) Quality and Life-Cycle Tools; (xiii) Security Software; (xiv) Storage Software; (xv) Structured Data Management Software; (xvi) Supply Chain Management (SCM) Applications; (xvii) System Management Software and (xviii) System Software (which is the parent secondary market for virtualization software).

(59) The Notifying Party does not consider “server virtualization software” to constitute a relevant market. It submits that the relevant market in which VMware operates is likely to be broader than server virtualization software. According to the Notifying Party, VMware competes against a wide range of different software, hardware and service providers that offer customers a variety of ways to run applications and workloads within an x86 environment. Examples of such providers are: operating system vendors, traditional and software-defined storage vendors, traditional and software-defined networking vendors, application remoting/delivery vendors, management vendors, public cloud providers, containers-related technology companies, and mobile device and application management vendors. Nonetheless, the Notifying Party notes the absence of independent market research data allowing appropriate business models to be measured.

(60) In any event, the Notifying Party suggests that the relevant product market definition for virtualization software can be left open because the transaction would not significantly impede effective competition under any plausible market definition.

3.3.1.2.The results of the market investigation and the Commission’s assessment

(61) The market investigation tested the possible segmentations of the software market. More specifically, it tested whether virtualization software can be considered as a separate sub-segment of middleware and whether virtualization software should be further sub-segmented based on the hardware or other components it is paired with (e.g., servers, storage systems and networking).

(62) Most of the respondents to the market investigation confirmed that virtualization software should be considered as a separate market within middleware. (51)

(63) The respondents indicated that the virtualization market, though part of the overall middleware software sector, has different functions and characteristics. In particular, virtualization software is a software that converts a physical IT asset into a virtual resource and creates logical representations of all of the components that it functions on top of (e.g., CPU, memory, BIOS, (52) and the Operating System) in order to deliver unique capabilities, not duplicated by other products in the middleware space. Middleware, on the other hand, traditionally focuses on application stacks, such as application servers, enterprise service bus and other SOA software technologies. (53) It has greater functionality and features, and is commonly understood as the “glue” that provides services to software applications beyond those available from the operating system.

(64) As regards a possible further segmentation of virtualization software, the responses to the market investigation were mixed. (54) Some of the respondents consider that virtualization software should be further segmented based on the hardware or other components it is paired with (e.g., servers, storage systems, networking and desktop) as these are typically treated as distinct markets. In their view, virtualization market segmentation typically follows the market dynamics of each of those components. The hardware affinity of virtualization is very strong; hence, it could be categorised closer to the hardware technologies. Additionally, the different types of virtualization software may have different key players depending on the underlying hardware they virtualize.

(65) On the other hand, some respondents did not agree with a possible further segmentation of virtualization software. In their view, virtualization software products which are functional across servers, storage, networking, and desktop products all share common concepts, and may at times have overlapping capabilities.

(66) Furthermore, the market investigation tested whether technologies, such as container technology, (55) can be considered to belong to a separate product market than virtual machine-based virtualization software, by taking into account demand and supply-side substitutability, main features, strengths and weaknesses.

(67) The responses to the market investigation indicated that containers, despite providing a simplified way to deploy an application on shared infrastructure, deliver a different type of virtualization than traditional virtual machine-based virtualization software. The two technologies are not functionally interchangeable as they have different fundamental features and functionalities. (56) Therefore, containers should not be considered as belonging in the same product market.

3.3.2. Geographic market definition

(68) In previous decisions, the Commission took the view that the geographic scope of the market for software was at least EEA-wide. In relation to middleware, in Oracle/Sun Microsystems, (57) the Commission considered the relevant geographic market for the overall middleware market and sub-segments thereof to be worldwide.

(69) The Notifying Party agrees with this finding in relation to VMware’s virtualization software and believes that the relevant geographic market is no narrower than global.

(70) From the results of the market investigation it can be inferred that the relevant geographic market for middleware and its sub-segments (including virtualization software) is global in scope. The majority of the respondents confirmed that, when considering middleware, the market could be viewed as global because (i) transportation costs are low compared to the price of the products; (ii) customers have similar preferences and requests worldwide; and (iii) product specifications and distribution patterns are similar throughout Europe and worldwide.

3.3.3. Conclusion on market definition for virtualization software

(71) In any event and in light of the outcome of the market investigation, the Commission considers that, for the purposes of this decision, as regards virtualization software, the precise product market definition can be left open, as the transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

3.4. Converged infrastructure systems

3.4.1. Product and geographic market definition

(72) Converged infrastructure systems (“CI” systems) refer to pre-bundled and pre- integrated data centre infrastructure which brings together products from one or more vendors across servers, storage, networking and supporting software.

(73) As an additional convenience for some end-customers, CI systems offer an alternative to the traditional mix-and-match model of integration of the various components of the data centre, also known as “best-of-breed”. However, servers, storage devices, networking systems and supporting software can still be sold on a standalone basis and can be integrated by either customers, value-added resellers ("VARs") (58) or System Integration Vendors ("SIs"). (59)

(74) CI systems can be assembled by VARs or SIs which procure hardware components separately, following a reference architecture supplied by any component manufacturer. Alternatively, CI systems can be pre-assembled by a single component manufacturer or in a partnership involving several vendors.

(75) Hyper-converged infrastructure systems (“HCI” systems) are physically integrated systems combining a commodity server and supporting software allowing the server to present itself as a single system that has both computing and storage capabilities. Similar to converged systems, customers may purchase a single hyper- converged system, or instead obtain similar functionality by purchasing servers and storage systems separately, or by purchasing commodity servers and developing or licensing software separately to make them hyper-converged.

(76) In the CI systems' space, neither Dell nor EMC are able to offer a converged system on their own, but each is able to partner with third party vendors on an ad hoc basis to make a converged offer. More specifically, EMC sells CI appliances through "VCE", a joint venture with Cisco, which incorporate Cisco servers and networking hardware, EMC storage systems, and VMware software. (60)

(77) In the HCI systems' space, Dell does not offer HCI systems by itself but has cooperative agreements with a number of vendors in order to develop and market such appliances.61 EMC does not have a HCI system offering either, but markets such a product based on VMware's virtualization software reference architecture. (62)

3.4.1.1.The Notifying Party’s view

(78) The Notifying Party submits that most enterprises with a data centre infrastructure are sophisticated consumers with dedicated IT procurement, operations, and engineering staff. Enterprise customers leverage this in-house expertise to build their data centres and to employ various strategies to maximize and diversify their range of product and technology choices, increase their flexibility, and lower their cost of operation.

(79) Moreover, the Notifying Party notes that both sophisticated and less sophisticated enterprises further augment their IT expertise and purchasing power by buying through VARs and SIs who build and deploy complex IT systems and provide valuable services in selecting, integrating and installing IT infrastructure from different vendors.

(80) The Notifying Party further submits that, given their own sophistication and that of VARs and SIs, enterprise customers normally mix and match different IT systems and platforms from best-of-breed vendors in order to best meet their needs, instead of purchasing CI or HCI solutions. As a result, most customers have several different server, storage and networking products and platforms in their IT infrastructure, which all need to work well together. Due to this industry practice, enterprises, VARs and SIs demand a high level of interoperability from servers, storage, networking and software vendors.

(81) The Notifying Party takes the view that mixing and matching remains the preferred option for most end-customers. Given that most server, storage and networking systems are still sold on a standalone basis and are integrated by end-customers, VARs or SIs, each of these components of a CI system can be viewed as exercising a competitive constraint on the standalone products.

(82) In any event, the Notifying Party submits that CI and HCI systems do not constitute a distinct relevant product market. They are alternative modes of purchasing used by some end-customers instead of buying best-of breed hardware and integrating the components themselves. CI and HCI systems are fully interchangeable with comparable non-converged, "best-of-breed" alternatives. While some customers may choose a CI or HCI system for convenience, they can and would switch to a non-converged system in the face of a Small Significant Non-transitory Increase in Price or an attempt to foreclose them from the ability to efficiently use their chosen hardware and software. Therefore, in the Notifying Party's view, customers always have the option of obtaining similar functionality by purchasing hardware and software components separately and assembling them themselves or through a VAR or SI.

3.4.1.2. The results of the market investigation and the Commission’s assessment

(83) Most respondents to the market investigation agreed that CI and HCI systems provide an alternative approach to the traditional mix and match of different hardware and software components from best-of-breed vendors However, the market investigation was inconclusive as to whether CI and HCI systems constitute a distinct product market. (63)

(84) While the market investigation revealed that the traditional mix and match of different hardware and software components from best-of-breed vendors remains the preferred approach for end-customers, some respondents noted the increase of purchases of CI and HCI systems over the last few years. (64)

3.4.2. Conclusion on market definition for converged infrastructure systems

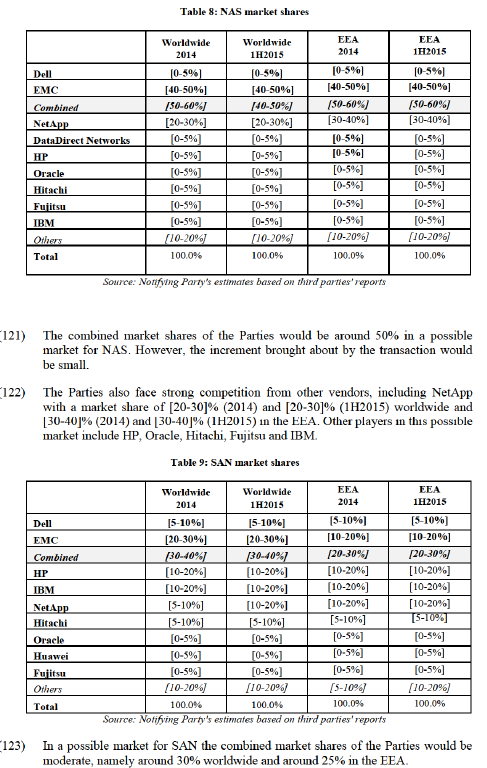

(85) The question whether CI and HCI systems as pre-assembled solutions bundling a number of hardware and software components (namely, servers, storage, networking and supporting software, including virtualization software) constitute a separate product market from each of their components, as well as the geographic scope of any such possible relevant market, can be left open, as the transaction does not raise serious doubts as to its compatibility with the internal market.

4. COMPETITIVE ASSESSMENT

4.1. Horizontal overlaps

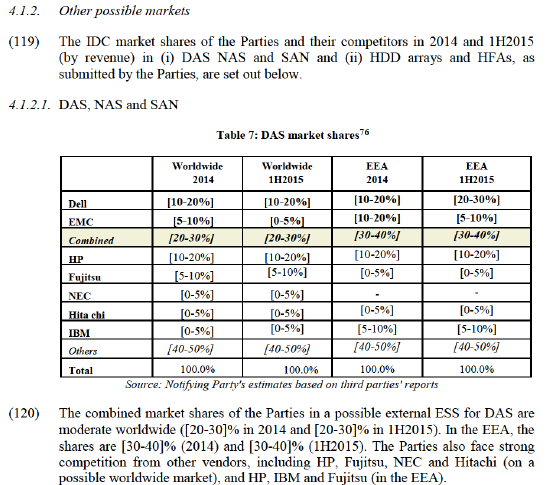

(86) The Parties' activities overlap in relation to external ESS and in some of its possible segments, in particular (i) in the entry-level and mid-range price bands (based on IDC); (ii) in DAS, NAS and SAN; and (iii) in HDD arrays and HFAs. (65) EMC does not manufacture internal storage, optical and tape storage. Dell is not active in the high-end segment and in AFAs.

4.1.1. Overall external ESS and price band segments

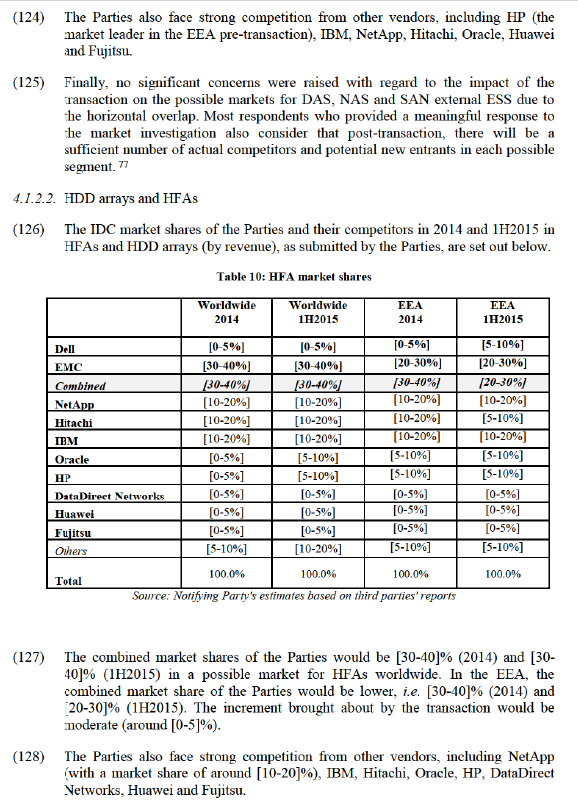

4.1.1.1. The Notifying Party’s view

(87) According to the Notifying Party, the Parties' activities overlap with respect to the supply of external ESSs, in particular in the mid-range systems, as Dell does not offer any high-end systems (66), while EMC does not offer any true “entry-level” systems. (67)

(88) The Notifying Party submits that the transaction would not lead to a significant impediment to effective competition in the market for the supply of external ESSs for the following reasons.

(89) First, the Parties would not be close competitors as they only compete in the sale of mid-range systems and, in that space, each of the Parties faces greater competition from other vendors.

(90) Second, the costs of switching in ESS would be low. Dell's server customers would not be locked into a Dell storage solution and could easily replace their Dell storage product with a storage product from a competitor without incurring any material additional costs.

(91) Third, competitors would increase supply if the merged entity were to restrict its output or raise its prices. It would not be profitable for the merged entity to reduce output, as competitors are not subject to capacity constraints. The growth in the storage market would be such that competitors are likely to increase supply to meet the increased demand.

(92) Fourth, the merged entity would not be able to hinder entry or expansion by competitors, many of which have recently entered the market or expanded their offerings. (68)

(93) Fifth, external ESS would be highly competitive and dynamic. The transaction would allow the merged entity to develop new products addressing important IT trends, notably the explosion in data and real-time analytics and the transition from on-premises to hybrid public/private cloud infrastructure. In addition, neither EMC nor Dell would be a "maverick" player in the market.

(94) Sixth, the merged entity would face sophisticated customers able to play the many different storage vendors off against each other to secure the most optimal and cost-effective storage solution for their IT needs.

(95) Seventh, coordinated effects would not arise as a result of the transaction.

4.1.1.2. Competitive landscape and the Commission’s assessment

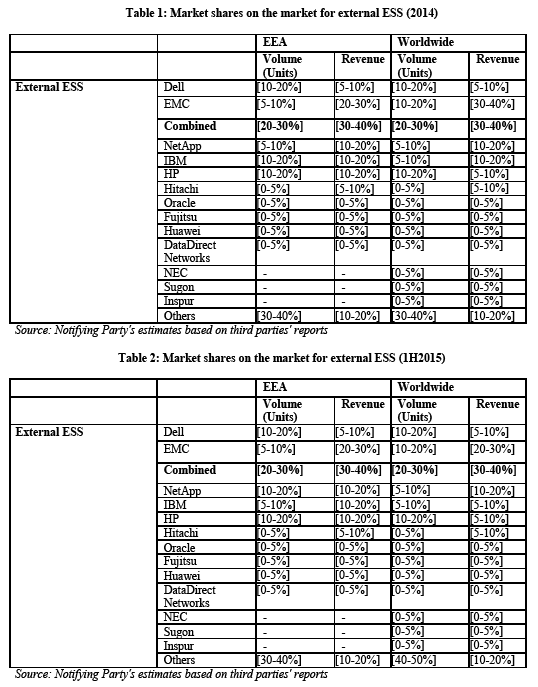

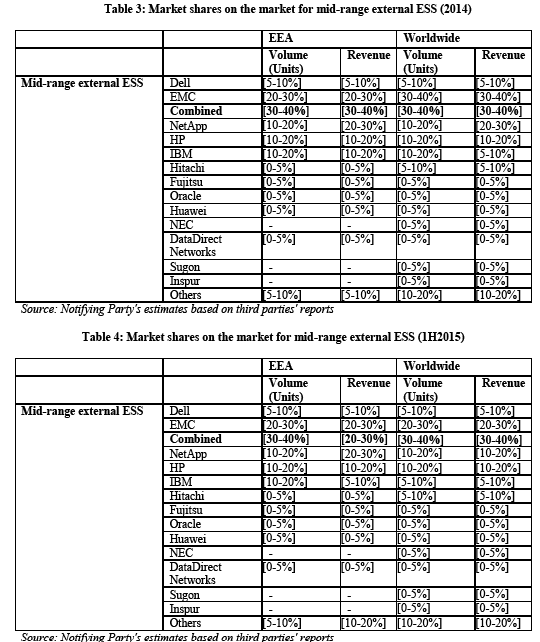

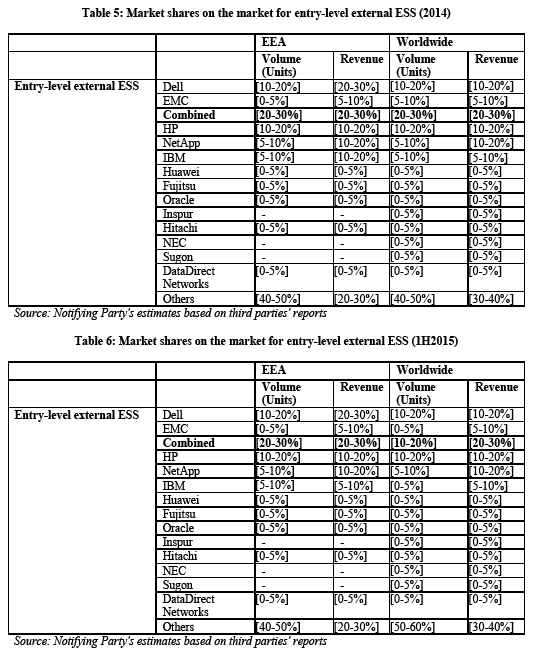

(96) Tables 1 and 2 below illustrate the market shares of the Parties and their competitors in external ESS in 2014 and 1H2015.

(97) As regards a possible overall market for external ESS, Tables 1 and 2 show that the Parties' combined market share by revenue would remain below 40% worldwide and around 30% in the EEA, […]. Expressed in units, the combined market shares would be around 25% both in the EEA and worldwide. In a possible worldwide market, the largest competitors would be NetApp, with a market share based on revenue of [10-20]% in 2014 and [10-20]% in 1H2015, followed by HP ([5-10]% / [5-10]%), IBM ([10-20]% / [5-10]%) and Hitachi ([5-10]% / [5-10]%), among others. Similarly, the largest competitor in an overall external ESS market in the EEA would be NetApp, with a market share based on revenue of [10-20]% in 2014 and [10-20]% in 1H2015, followed by HP ([10-20]% / [10-20]%), IBM ([10-20]% / [10-20]%), Hitachi ([5-10]% / [5-10]%).

(98) In possible market segments based on price bands, the Parties' activities mainly overlap in the mid-range and less in the entry-level. The Parties' activities do not overlap in high-end external ESS (which is therefore not discussed further).

(99) In the mid-range segment, the Parties' combined market share by revenue is similar as in a possible overall external ESS market, but the market share measured in units is higher (still well below 40% worldwide and closer to 30% in the EEA). […]. The largest competitors to the Parties would be again NetApp, with a worldwide market share based on revenue of [20-30]% in 2014 and [20-30]% in 1H2015, followed by HP ([10-20]% / [10-20]%), IBM ([5-10]% / [5-10]%) and Hitachi ([5-10]% / [5- 10]%), among others. Similarly, the largest competitor in the mid-range segment in the EEA would be NetApp, with a market share based on revenue of [20-30]% in 2014 and [20-30]% in 1H2015, followed by HP ([10-20]% / [10-20]%), IBM ([10- 20]% /[5-10]%), Hitachi ([0-5]% / [0-5]%).

(100) In a possible market for the entry-level external ESS, the Parties' combined market shares would remain below 30% worldwide and in the EEA, with a slightly higher share in the EEA ([20-30]% in 2014 and [20-30]% in 1H2015) than worldwide. The Parties' combined market share expressed in units is close to 20% in the entry- level segment, which is only [<5] points higher than the market share of the largest competitor (HP) in the EEA. In this possible entry-level market, HP is also the largest competitor worldwide, with a market share based on revenue of [10-20]% both in 2014 and in 1H2015, followed by NetApp ([10-20]% / [10-20]%), IBM ([5- 10]% / [5-10]%) and Huawei ([0-5]% / [0-5]%), among others. Similarly, the largest competitor in an entry-level external ESS market in the EEA would be HP, with a market share based on revenue of [10-20]% in 2014 and [10-20]% in 1H2015, followed by NetApp ([10-20]% / [10-20]%), IBM ([10-20]% /[5-10]%) and Huawei ([0-5]% / [0-5]%).

(101) First, based on the above Parties' pre-transaction market shares, the Commission notes that the addition of market shares by Dell in the possible markets for external ESS and mid-range external ESS and of EMC in the possible entry-level external ESS market are moderate.

(102) Second, the possible markets for overall external ESS, mid-range external ESS and entry-level external ESS are characterised by the presence of a sufficient number of competitors that will remain active post-transaction ensuring effective competition.

(103) In particular, NetApp is a major vendor of storage arrays and is considered by the Notifying Party to be a "pure storage" company like EMC, focusing on storage (and not on servers). In particular, it is strong in a possible EEA market for mid- range systems, where NetApp's [20-30]% market share in 1H2015 is close to EMC's [20-30]% (pre transaction).

(104) Hewlett Packard Enterprise ("HPE" or "HP") is active in the computing and non- computing portions of the data centre. Besides being a competitor of the Parties in storage devices, HP is a competitor of Dell in a number of other IT product and service markets, namely servers, networking, software and cloud-based services. With [10-20]% market share (EEA, 2014), HP is pre-transaction the largest competitor to Dell in a possible entry-level external ESS market. HP's share in this segment increased 1.2 points in 1H2015. In the mid-range segment, HP has enjoyed a steady increase in its (worldwide) share year-on-year with a total increase of 2.8 points added between 2012 and 2014 and another 1.2 points in 1H2015. In the EEA, HP is pre-transaction the strongest player by units in a possible overall external ESS market and in the entry-level. Post-transaction, the merged entity's market share in the EEA (in units) in the possible entry-level external ESS market would only be 1.2 points higher (1H2015) than HP's share.

(105) IBM is a provider of IT infrastructure and services worldwide including servers and storage technology along with virtualization software. At entry-level external ESS, the market shares of IBM peaked at [10-20]% (EEA) in 2014.

(106) Hitachi is a strong competitor in the overall external ESS market and also in the possible mid-range external ESS market.

(107) Huawei almost tripled its worldwide market share between 2012 and 1H2015 in external ESS, as it has expanded its business beyond China and Asia into other parts of the world. In the entry-level, Huawei's worldwide market share is [0-5]% (by revenue). In addition, Huawei has almost doubled its share in the mid-range segment since 2012, accounting for [0-5]% in 1H2015.

(108) In addition, there are many other players, such as Oracle, Fujitsu, DataDirect Networks, NEC, Sugon, Inspur, as well as other competitors which are not individually tracked by IDC. The latter category includes (i) companies such as Pure Storage, Nimbus Data, and Kaminario which have developed all-flash or hybrid-flash arrays; (ii) start-ups such as Nimble Storage, Tintri, Tegile, and Dot Hill, which offer general-purpose disk storage systems that support multiple virtual or physical servers, and multiple databases and files; and, (iii) original design manufacturers (“ODMs”, also known as "white box manufacturers"), often based in Asia which focus heavily on providing entry-level ESS (such as Quanta, Wistron and Foxconn). ODMs serve cloud service providers and large owners of hyperscale data centers such as Google or Facebook directly, without any involvement from a storage original equipment manufacturer (“OEM”). (69)

(109) The majority of respondents who provided a response to the market investigation also consider that post-merger there will be a sufficient number of actual competitors in the possible market for external ESS and in each price band. (70)

(110) Second, the merging firms are not particularly close competitors. Considering a possible overall market of external ESS, Dell’s focus is on entry-level external ESS, which is also due to the fact that Dell is well-established as a provider of servers. [Most] of Dell’s storage sales are in fact generated by Dell’s server customers. EMC on the other hand derives more than [one third] of its storage revenues from solutions priced above USD 250 000 (i.e. the high-end segment). Dell does not offer any high-end product and EMC is not very strong in the entry- level.

(111) Even in relation to the sale of mid-range systems, Dell and EMC are not each other’s closest competitors. While Dell’s EqualLogic line of storage arrays line (like EMC’s VNX line) qualifies as a mid-range system, EqualLogic focuses on simplicity of use over features, functions and performance and does not contain the advanced features of EMC’s VNX line. In addition, in the sales of Dell’s Compellent line, Dell faces greater and closer competition from HP than any other vendor, followed by NetApp and then EMC and other vendors (Huawei, Nimble Storage and Pure Storage).

(112) The respondents to the market investigation also considered that in the possible overall external ESS market and in all the possible price bands, Dell is not EMC's close competitor. (71) NetApp, followed by IBM and HP, is considered to be EMC's closest competitor in the possible overall external ESS market and the mid-range external ESS.

(113) Third, customers have the possibility to switch to one of the numerous other storage providers. While switching storage supplier may involve costs and time, respondents to the market investigation indicated that switching is technically feasible and does occur. (72)

(114) Fourth, the market investigation did not provide any indication that competitors could not increase supply. In fact, IBM confirmed that it "could easily increase supply" if, post-transaction, the merged entity were to increase its prices or restrict its output of external ESS. Microsoft noted that it was "not aware of any resource constraints that would preclude it from increasing supply". (73)

(115) Fifth, there has been entry in the storage market in the past years. Several start-ups, such as Pure Storage, Nimble Storage, Nimbus Data and Kaminario have entered the external ESS market and expanded their product offerings. Other traditional IT suppliers have also recently entered and expanded in ESS: notably Huawei (2009), Oracle (2010) and Sugon (2011). […]:

Figure 1: […]

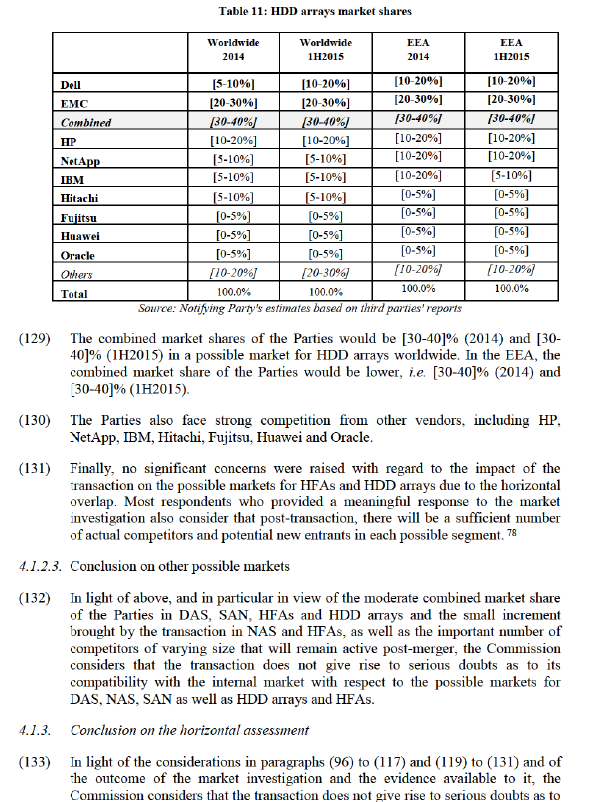

[…]

(116) Furthermore, white box suppliers have increased their shares in the ESS market and in particular in the entry-level and mid-range. (74) The merging parties therefore do not have the ability to hinder expansion of their competitors in ESS.

(117) Finally, no significant concerns were raised with regard to the impact of the transaction on the market for external ESS due to the horizontal overlap. (75)

4.1.1.3. Conclusion on overall external ESS and price band segments

(118) In light of the considerations set out in paragraphs (96) to (117) and of the outcome of the market investigation and the information available to the Commission, and taking particular account of the moderate combined market share of the Parties as well as of the important number of competitors of varying size that will remain active post-merger, the Commission considers that the transaction does not give rise to serious doubts as to its compatibility with the internal market with respect to the possible markets for external ESS.

its compatibility with the internal market with respect to the horizontal overlaps of the Parties' activities under any plausible segmentation.

4.2. Non-horizontal assessment

(134) The transaction gives rise to non-horizontal links on some of the markets on which the Parties are active. In particular, VMware's virtualization software can be used in conjunction with some of Dell's hardware products, namely, servers, external ESSs, as well as CI and HCI solutions.

(135) Thus, there might be a risk that, post-transaction, the merged entity could attempt to restrict or degrade access to VMware's software to competing hardware vendors and/or to foreclose other storage virtualization software vendors by depriving them of a sufficient customer base.

(136) According to the Non-Horizontal Merger Guidelines, foreclosure occurs when actual or potential rivals’ access to supplies or markets is hampered, thereby reducing those companies’ ability and/or incentive to compete. Such foreclosure may discourage entry or expansion of rivals or encourage their exit. (79)

(137) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure: input foreclosure occurs where the merger is likely to raise the costs of downstream rivals by restricting their access to an important input and customer foreclosure occurs where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base. (80)

(138) In order for foreclosure to be a concern, three conditions need to be met post- merger: (i) the merged entity needs to have the ability to foreclose its rivals (81); (ii) the merged entity needs to have the incentive to foreclose its rivals (82); and (iii) the foreclosure strategy needs to have a significant detrimental effect on the parameters of competition on the downstream market (input foreclosure) (83) or on consumers (customer foreclosure). In practice, these factors are often examined together since they are closely intertwined. (84)

(139) In this section, the Commission will thus assess whether there is a risk that the integration brought about by the transaction might lead to foreclosure with respect to the potential markets for: (i) servers and virtualization software (section 4.2.1); (ii) storage and virtualization software (section 4.2.2); and (iii) CI and HCI solutions (section 4.2.3).

(140) The Commission will not assess any vertical links in the desktop virtualization space (85) as: (i) Dell does not offer any proprietary desktop platform (86), (ii) VMware's market shares in this type of software are very low ([10-20]% worldwide, behind Microsoft (87) with [20-30]% and Citrix with [40-50]%) and Dell's market share in desktops and notebooks combined is equally very low ([10-20]% worldwide (88), behind Apple with [10-20]%, HP with [10-20]% and Lenovo with [10-20]%).

(141) Additionally, no respondents to the market investigation raised any concerns with regard to the vertical link between desktop virtualization software and desktops.

(142) Similarly, the Commission notes the absence of any vertical links in the network virtualization space (89) as Dell does not offer a software-defined networking product.

4.2.1. Servers and virtualization software

4.2.1.1. Notifying Party's view

(143) The Notifying Party submits that the merged entity would not have the ability to foreclose.

(144) According to the Notifying Party, VMware does not have significant market power in virtualization software, given the competitive environment in which it operates. VMware virtualization software is far from unique and, to the contrary, it faces strong competition from a number of traditional server virtualization software vendors (such as Microsoft, Red Hat or Citrix), open-source solutions, public cloud providers, as well as new technologies such as containers.

(145) Customers, including major corporations with sophisticated needs, could easily switch to those alternative providers without much effort, and many have already done so in the past. Therefore, any indication of a move towards even partial foreclosure would encourage customers to seek alternative solutions, making such strategy unsuccessful.

(146) Moreover, the Notifying Party submits that VMware's vSphere is structured to function in an open ecosystem, and claims that it is both hardware and operating system-neutral. The Notifying Party explains that VMware's vSphere product is the first piece of software that sits on an x86 server, and therefore VMware needs to keep fostering relationships both with hardware companies such as Dell, HP, Lenovo, NetApp, Hitachi and IBM, and with enterprises selling operating system and enterprise applications that sit above the virtualization software layer (different operating systems). Promoting an open and non-discriminatory architecture strategy has been the basis of VMware's success. Abandoning such strategy would undermine VMware's value, risk customer backlash and cause irreparable harm not only to VMware and Dell's server business, but also to Dell's storage business, ultimately damaging Dell's brand.

(147) As to the merged entity's incentive to engage in foreclosure, the Notifying Party submits that moving away from the current VMware's hardware/software-neutral strategy would have severe consequences because it would alienate all or a significant proportion of customers, who value flexibility and freedom to choose best-of-breed hardware and software from different vendors.

(148) Moreover, from a financial point of view, it would not be plausible for the merged entity to adopt a foreclosure strategy designed to "force" prospective customers to buy a Dell server, due to the high percentage of such sales that would have to be achieved to be profitable. (90)

(149) Finally, the Notifying Party concludes that there would be no anti-competitive effects. It submits that the extent and range of effective competitors in both hardware and virtualization software means that competition is unlikely to deteriorate following the merger, that barriers to entry and expansion are low, and that new technologies pose a significant competitive constraint.

4.2.1.2.The results of the market investigation and the Commission's assessment

(150) The Commission will assess the risk of input foreclosure of VMware's server virtualization software, considering whether the transaction would change the merged entity's (i) ability and (ii) incentive to grant access to its server virtualization software and, (iii) if this were to have an impact on the servers' market.

a. Ability to engage in input foreclosure

(151) During the pre-notification phase and the market investigation, (91) some companies (competitors of Dell and EMC in server and/or storage hardware) raised the concern that the merged entity might partially foreclose VMware's software from competing server vendors, thus making their server offerings less attractive.

(152) This could be achieved in a number of ways, for example, by adopting specific software or hardware design choices favouring Dell, tying services and support offerings, engaging in bundling/discount strategies, and/or degrading or delaying access to updates/new versions, certification, application programming interfaces ("APIs"), and customer support.

(153) According those competitors, customers would not be able to switch to competing offers, in light of the very high costs and significant length of switching and the fact that vSphere's specific advanced features make it the only suitable option especially for large corporations.

(154) Moreover, those competitors submit that the transaction would harm competition and enhance the merged entity's long-term ability to raise prices and limit choices for customers.

(155) The Commission notes that, given the proprietary nature of VMware's software vSphere, the merged entity would have the technical ability to limit or prevent access to it for competing servers' vendors.

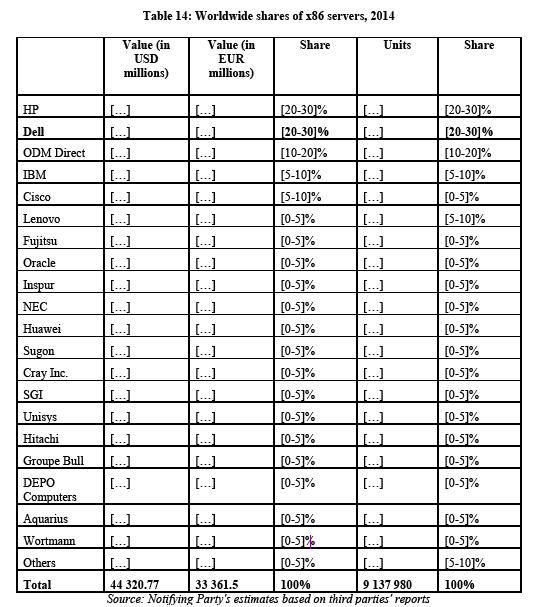

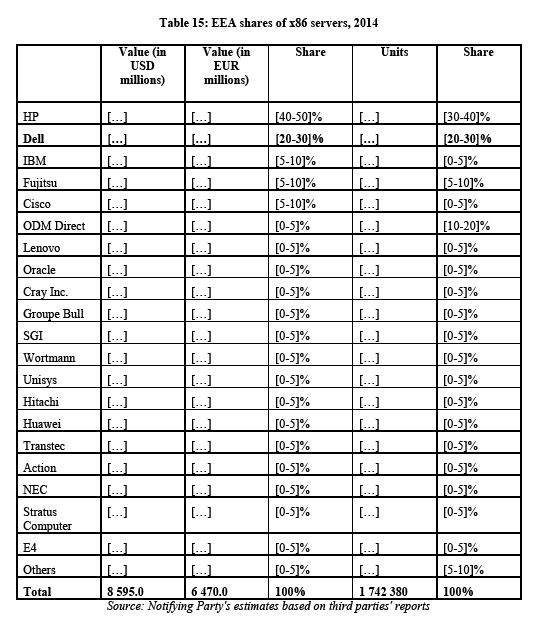

(156) However, for input foreclosure to be a concern, the merged entity must have a significant degree of market power, and a significant influence on the conditions of competition in the upstream market. (92) In the following paragraphs the Commission will assess whether the merged entity would have such a market power.

(157) As to the most appropriate metric to be used in this regard, market intelligence firm IDC (93) as well as the majority of the respondents to the market investigation submit, in line with the Notifying Party's view, that the number of virtualization hosts is a reliable proxy for market power in the server virtualization software. In fact, some vendors (such Microsoft) do not separately charge for their software because they either bundle it with other products or because they offer open source-based software and monetize their business by charging for services. Therefore, their sales are not entirely captured by IDC data. (94)

(158) In particular, according to IDC data, VMware's share of server virtualization software in terms of volume (measured on the basis of the number of virtualizations hosts) has been declining from [50-60]% in 2010 to [40-50]% in the 1Q2015 at a worldwide level. (95)

(159) Figure 2 below shows the decline in VMware's share in volume.98

Figure 2: Share based on number of virtualization hosts [graphic]

(160) To the contrary, VMware's share in revenue has been relatively stable in the last few years at more than [70-80]% ([70-80]% in the 1Q2015, [70-80]% in 2014, [70- 80]% in 2013, [70-80]% in 2012, [70-80]% in 2011, and [70-80]% in 2010 at worldwide level). As evidenced also by Table 13 above, the difference with the evolution of VMware's declining shares in volume can be ascribed to the fact that customers are increasingly deploying alternative options from competing vendors, including those who do not charge separately for their server virtualization software.

(161) In fact, VMware's server virtualization software is facing an increasing competitive pressure by other providers of server virtualization software.

(162) In particular, the market investigation showed that a number of alternative server virtualization vendors are active in this segment, e.g., Microsoft, Citrix, Red Hat, or Oracle.

(163) According to the respondents to the market investigation,99 there are varying degrees of maturity and features in each of those competing products, which have dynamically evolved in the last years. While most of respondents consider that vSphere is the leading virtualization software solution offering a broad set of functionalities, (100) most respondents (including major customers) consider that the features of VMware's product can be replicated by competitors. (101) According to market participants, server virtualization offerings "are largely comparable to each other," (102) "as [of] today, all server virtualization solutions are close [to] each other in term[s] of feature" (103) and "for the core function of server virtualization, different products from different providers generally offer the same functionality," (104) while another player noted that "the maturity of virtualization products in the market are of sufficient technical and performance level." (105)

(164) In particular, the overwhelming majority of respondents to the market investigation (106) submitted that the closest competitor and main alternative to VMware's vSphere is Microsoft's Hyper-V. (107) When comparing HyperV to vSphere, a major IT player explained that "there is almost feature parity between the two virtualization options" and another participant to the market investigation submitted that "Hyper-V does very well against VMware in terms of cost and in terms of integration with Windows Server." (108) In fact, as shown by Figure 2 above, the gap between VMware's and Microsoft's deployments has narrowed from more than 40% in 2008 (when Hyper-V was launched) to just under 17% in 2014. (109)

(165) Microsoft's HyperV is offered for free as a standalone downloadable product or as a feature to customers of Microsoft's Windows Serverv (110) and has progressively expanded its feature set over the years, (111) making it an increasingly viable option for customers, including major ones. This is evidenced also by the fact that several major clients across a variety of industries, including ones that have mission- critical needs (such large financial institutions, healthcare providers, as well as telecom and media companies), have selected Hyper-V as their virtualization software or have switched away from VMware in favour of Hyper-V.(112)

(166) In addition, Red Hat's Enterprise Virtualization product ("RHEV") uses the Linux kernel as a hypervisor with virtual machines having direct access to the hardware resources. As shown by internal documents and publicly available information, (113) VMware monitors closely RHEV, comparing it regularly against vSphere either through internal evaluations or third party studies. As with Microsoft's Hyper-V, many customers, including major banking clients, energy companies and government departments, select RHEV for new deployments or switch away from VMware. (114)

(167) Other offerings include Citrix's Xen (which has no licensing fees and is freely available, with Citrix charging customers only for support and maintenance) and open-source based software KVM, which "are very attractive because of the open source nature and community associated with them [and] also do very well in terms of cost." (115) In particular, KVM "makes the most sense" (116) for cloud solutions based on OpenStack (a free and open-source software platform for cloud computing).

(168) Regarding alternatives to server virtualization software, although not in a conclusive manner, the market investigation (117) provided some indications that VMware might be facing competitive pressure from public cloud providers, such as Amazon (Amazon Web Services, "AWS"), Microsoft (Azure) or Google (Google Cloud). In fact, as research firm Gartner reports, in 2014 "the majority of new VM [virtual machines] were deployed to public cloud IaaS providers, rather than on- premise." (118)

(169) Similarly to traditional hypervisors, public cloud providers allow users to create and execute as many virtual machines are they need, the difference being that customers enjoy more flexibility as they only pay for the computing resources they actually use (converting upfront hardware and software costs into a per-minute rental) and, most importantly, they are indifferent to the underlying hardware used by the public cloud provider.

(170) Therefore, public cloud offerings might potentially affect the demand for hardware as well as traditional virtualization software, since virtual machines are increasingly created in the cloud instead of in a traditional virtualized data centre.(119) Moreover, the current largest providers of public cloud offerings (AWS, Microsoft and Google) do not need and are not major customers of VMware's products, (120) either because they rely on open source hypervisor technology or because they have their own virtualization technology.

(171) Moreover, a number of major customers in a variety of industries (e.g., in automotive, energy, banking and hotel sectors) have either decided against incremental additions to their traditional data centre in favour of a public cloud solution or completely replaced their data centre with a public cloud solution. (121)

(172) In addition, although the market investigation provided mixed views on the subject, (122) the emerging technology of containers might in the future evolve to displace the need for traditional virtualization software, (123) especially for next-generation workloads, with one respondent to the market investigation remarking that "we are watching the emergence of containers as a potential alternative to virtualization, and will continue to evaluate the maturity of containers." (124)

(173) If the merged entity were to attempt to degrade access to VMware to competing servers' vendors, a number of alternative server virtualization software options could be available to customers, depending on their needs and business models. In this respect, the market investigation showed that, although it typically involves significant time and resources, it is possible to switch to alternative solutions, also thanks to a number of ad hoc tools that facilitate migration. (125)

(174) Moreover, as confirmed by the market investigation, (126) clients typically multi- source with more than one server virtualization software supplier for a variety of reasons. Therefore, if the merged entity would attempt to partially foreclose its server virtualization software, customers might switch to a competing product which they already use. There is a view that switching is difficult in terms of cost and time, however, respondents to the market investigation also reported that the process of switching was technically possible and fairly straightforward. (127)

(175) Most of the end customers who participated in the market investigation considered that there would be sufficient credible alternative options post-transaction." (128)

(176) In light of the findings of this section and of the outcome of the market investigation, the Commission concludes that the effect on VMware of competition from alternative server virtualization software vendors is such that the merged entity would lack the ability to engage in input foreclosure.

b. Incentive to engage in input foreclosure

(177) The Commission notes that, according to the large majority of market participants, (129) VMware has so far adopted a hardware/software-neutral approach, fostering relationships with a very large number of vendors without limiting or degrading access to, e.g., certification, support, or new updates. (130)

(178) In fact, on the basis of the market investigation, (131) the Commission considers that customers value the freedom to combine best-of-breed hardware and software offerings and typically multi-source x86 servers and server virtualization software from multiple vendors. Therefore, in order to promote a large adoption of its product, VMware had to endorse an open and non-discriminatory architecture policy.

(179) In this regard, the Commission also notes that the CEO of Dell (Michael S. Dell) has made a public commitment not to change VMware's approach and keeping it independent and open. (132)

(180) Some market players who participated in the investigation submit that changing such business strategy, by foreclosing or degrading access to vSphere, is "extremely unlikely […] as it would open up a large opportunity for competitive hypervisors to take market share." (133)

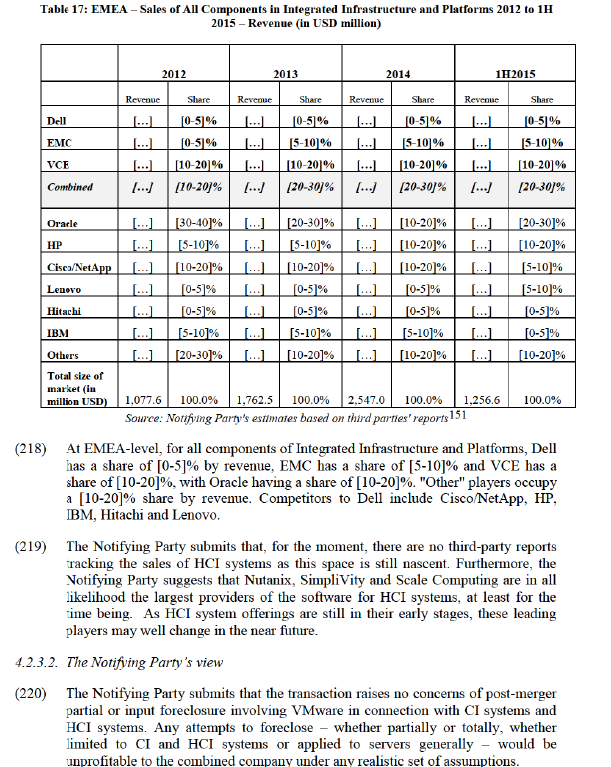

(181) The Commission considers that, if the merged entity were to engage in such a strategy, customers would likely switch to one or more of the alternative solutions available in the market (discussed in the section 4.2.1.2.a)), in order to avoid the risk of being locked-in into a specific solution.

(182) Furthermore, the incentive to pursue a foreclosure strategy depends on the extent to which such strategy would be profitable from a financial point of view. In particular, the cost to the merged entity in terms of lost sales of VMware's software (that – absent the strategy – would have been made to customers deploying it on non-Dell's servers) would have to be lower than the benefit coming from the increased sales of Dell's servers (i.e., the sales of Dell's servers that are diverted from Dell's competitors as a result of the foreclosure strategy).

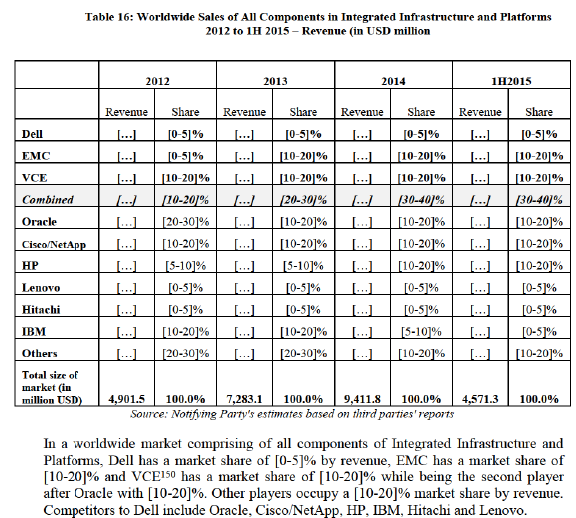

(183) In this regard, an economic paper submitted by the Notifying Party focuses on the question of how many customers would need to switch from a rival hardware vendor to the merged entity (with a view to obtaining VMware's virtualization software) for the merged entity to find it profitable to engage in a foreclosure strategy. Based on average selling prices and gross margins, the economic paper calculated the profit generated by Dell and VMware on the sale of a typical server and a licence, respectively. (134) Using these figures, it then calculated the proportion of VMware virtualization software customers that would need to divert to the merged entity's for the foreclosure strategy to be profitable.

(184) The proportion of new customers (that wished to buy VMware's virtualization software and a server) that would need to be diverted is more than […]%, which – given the alternative solutions available in the market – is considered implausibly high. (135) Moreover, in order to be sustainable, the foreclosure strategy would need to keep diverting such an implausibly high proportion of customers regardless of the possible future alternatives that server virtualization's competitors might develop over time in reaction to the strategy.

(185) Complainants argued that, in light of the issuance of tracking stock under the corporate structure of the transaction, Denali would have only a 28% economic interest in VMware (i.e., the 35% of 81% VMware interest currently owned by EMC) and, if it were to engage in a foreclosure strategy, it would thus forego only 28% of profits for the lost sales of VMware's software. As such, the sales of incremental Dell's servers would compensate such foregone profit, making a foreclosure strategy profitable. Finally, the public shareholders who will be holding 19% of VMware's stock post-transaction would not be able to discipline such adverse conduct because they would only have limited legal protection.

(186) In this regard, the Notifying Party submits, first, that the issuance of tracking stock has a clear rationale, which is unrelated to any foreclosure strategy. (136) Second, a foreclosure strategy would run counter to Denali's tracking stock policy, which obliges it to pursue the best interests of VMware. Third, even taking into account a reduced economic interest in VMware, a foreclosure strategy would still be financially harmful and thus unlikely for the same reasons explained in paragraphs 183 and 184 above. Finally, post-transaction, the shareholders of VMware other than the Denali shareholders, would have sufficient legal protection against any attempt to favour Dell's servers to the detriment of VMware's software.

(187) Based on the results of the market investigation and on the available evidence, the Commission considers that it is unlikely that the value of foregone vSphere's sales would be more than compensated by the value of incremental sales of Dell's servers.

(188) This is also because, as discussed in section 4.2.1.2.a, customers would be able to switch to competing server virtualization offerings and therefore would move away from the merged entity's servers.

(189) In light of the findings of this section based on the results of the market investigation and the evidence available to it, the Commission concludes that the merged entity will lack the incentive to engage in input foreclosure.

c. Overall impact of input foreclosure

(190) Even if arguendo the merged entity were to have the ability and incentive to engage in input foreclosure, the impact of those attempts on effective competition would depend on the possibility of customers to source servers from alternative providers.

(191) In this respect, as shown by Tables 13 and 14 below, Dell's worldwide market share for x86 servers is [20-30]% (in value, and [20-30]% volume) and [20-30]% at EEA-level (value, and [20-30]% volume), facing strong competition from a large number of established players such as HP (having a larger market share at [20- 30]% and [40-50]% in value, at worldwide and EEA-level respectively), IBM, Cisco or Fujitsu, as well as a large number of ODMs. (137)

(192) Therefore, even if the merged entity had the ability and incentive to engage in the claimed input foreclosure strategy, the Commission considers it unlikely that any such conduct would result in the foreclosure or marginalisation of Dell’s server competitors to such an extent that competition would be negatively affected on the server market. (138) The Commission also considers that the fact that none of the server customers who responded to the market investigation raised any concerns in relation to the possible impact of the transaction further supports this conclusion.

(193) In light of the evidence available to it and based on the result of the market investigation, the Commission concludes that an input foreclosure strategy is unlikely.

4.2.2. Storage and virtualization software

4.2.2.1. The Notifying Party’s view

(194) As with server virtualization software, described in section 4.2.1, the Notifying Party submits that the merged entity would not have the ability to foreclose its hardware competitors in the storage market. It submits that VMware does not have significant market power in storage virtualization software, and operates within a very competitive virtualization software environment, where it faces competition from traditional virtualization software vendors, open-source solutions, public cloud providers, new technology such as containers, and new market entrants. Customers could switch to these alternative providers.

(195) The Notifying Party refers to IDC data for 2014, showing that EMC/VMware’s share in storage virtualization was [10-20]% by revenue, behind IBM, the market leader, with [30-40]%. According to IDC figures, Microsoft’s share was [10-20]%, DataCore Software [5-10]% and “Others” a total of [10-20]%.

(196) The Notifying Party submits that when EMC acquired VMware in 2004, EMC did not attempt to disadvantage storage competitors by restricting access to VMware software. It argues that any attempt to change the business model by abandoning its open and non-discriminatory architecture strategy would undermine VMware's value and success in the marketplace, risk customer backlash and cause reputational damage.