Commission, July 9, 2018, No M.8808

EUROPEAN COMMISSION

Judgment

T-MOBILE AUSTRIA / UPC AUSTRIA

Subject: Case M.8808 – T-Mobile Austria / UPC Austria Commission decision pursuant to Article 6(1)(b) of Council

Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 18.05.2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which T-Mobile Austria Holding GmbH ("TMA-H", Austria), controlled by Deutsche Telekom AG ("DTAG", Germany), intends to acquire sole control of the whole of UPC Austria GmbH ("UPC", Austria), controlled by Liberty Global Group ("LG", United Kingdom) within the meaning of Article 3(1)(b) of the Merger Regulation, by way of purchase of shares (the "Transaction").3 TMA-H is a holding company which conducts its business operations mainly through its subsidiary T-Mobile Austria GmbH ("TMA", Austria). DTAG, TMA-H and TMA are designated hereinafter as the 'Notifying Party' and, together with UPC, as the 'Parties'.

(2) On 18 June 2018, after the Commission informed the Parties that it could not be excluded that the Transaction would raise serious doubts on a potential market for home internet services, the Notifying Party submitted commitments pursuant to Article 6(2) with a view to removing these possible serious doubts. The commitments were subsequently amended on 20 June 2018.

(3) Upon further investigation, the Commission then found that the Transaction would not raise serious doubts on this potential market as further explained in this Decision, and informed the Notifying Party accordingly. The Notifying Party withdrew the commitments on 6 July 2018. For this reason, neither are the commitments proposed by the Notifying Party assessed in this Decision, nor is the authorisation of the Transaction conditional upon compliance with the proposed commitments.

1. THE PARTIES AND THE TRANSACTION

(4) TMA is mainly a mobile network operator ("MNO") which owns a 2G, 3G and 4G network with nationwide coverage in Austria and offers inter alia mobile telecommunications services to private and business customers at retail level and to mobile virtual network operators ("MVNOs") at wholesale level. TMA also offers retail internet access services. TMA is ultimately controlled by DTAG.

(5) UPC owns and operates a hybrid fibre-coaxial cable network in parts of Austria, primarily in urban areas such as Vienna, Graz, Innsbruck and Klagenfurt. UPC offers cable TV, fixed internet and fixed telecommunications services to private and business customers over its cable network. In addition, UPC offers fixed internet and fixed telecommunications services on the basis of wholesale DSL products outside of the footprint of its own cable network. UPC also offers voice, internet and data services to business customers and wholesale customers. UPC has minor activities in the area of retail mobile telecommunications services as an MVNO, on the basis of a wholesale agreement with Hutchison 3G Austria ("H3A").

(6) On 22 December 2017, a Sale and Purchase Agreement was concluded between Liberty Global Europe Holdco 2 BV, an indirect wholly-owned subsidiary of LG, as the seller and TMA-H as the purchaser, pursuant to which TMA-H would acquire the entire issued share capital of UPC. As a result, TMA-H will acquire sole control of UPC within the meaning of Article 3(1)(b) of the Merger Regulation.

(7) The Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(8) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million4. Each of them has an EU-wide turnover in excess of EUR 250 million, but the Parties do not achieve more than two-thirds of their respective aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

3. RELEVANT MARKETS

(9) In Austria, the Parties' activities mainly overlap in the areas of: (i) retail internet access services; (ii) retail mobile telecommunications services; and (iii) wholesale leased lines.

(10) Besides there are minor horizontal overlaps between the Parties' activities in: (i) retail internet hosting services in the EEA; (ii) wholesale internet connectivity services (worldwide), and (iii) global telecommunications services on retail level (worldwide).

(11) In addition, TMA and/or UPC are present upstream in: (i) wholesale access and call origination on mobile networks (TMA); (ii) wholesale mobile call termination services (TMA and UPC); (iii) wholesale fixed call termination services (TMA and UPC); (iv) wholesale international roaming services (TMA); (v) and in wholesale leased lines (TMA and UPC). Those services are vertically linked to (i) retail mobile telecommunications services, (ii) retail fixed telephony services, (iii) retail home internet access services (including both fixed and mobile technologies), (iv) wholesale end-to-end calls, (v) retail business connectivity services; (vi) wholesale broadband access, and (vii) global telecommunications services at wholesale level. Further details on the vertical relationships between the Parties are in the table under section 4.3 and in paragraph (324).

(12) Finally, since UPC offers multiple-play packages in Austria and both Parties offer communications services that can be included in multiple-play offers, a potential multiple-play market is analysed as well.

3.1. Internet access services

3.1.1. Retail internet access services

(13) Retail internet access services consist of the provision of a telecommunications link enabling end customers to access the internet.

3.1.1.1. Product market definition

(a) The Notifying Party's views

(14) The Notifying Party submits that the product market for retail fixed internet services is separate from mobile internet (data) services which are part of the overall retail market for mobile telecommunications services in Austria. The Austrian market environment does not exhibit characteristics which would justify a deviation from the Commission's definition of the relevant product market in previous cases.5 The Notifying Party refers to the following main reasons for this conclusion:

i) The bandwidth, performance, quality and actual speed of mobile networks in Austria are supposedly inferior to those of fixed networks, in particular those of UPC's high-speed HFC cable network. This would be demonstrated by a network throughput analysis carried out by TMA which shows that the average download user throughput of TMA's customers of unlimited data only tariffs (probably used together with routers ("cubes")) is only approximately […] Mbps. This is low compared to fixed networks in Austria. Considering this limited capacity of mobile broadband connections, TMA's mobile data-only product would face a high return rate of approximately […]% during the first two to four weeks after purchasing the product.

ii) Customers of fixed internet connections and mobile customers show very different usage patterns in Austria. The average monthly data usage of fixed customers is substantially higher than the usage of mobile customers.

iii) In Austria, fixed internet services are mostly purchased in bundles with other services (e.g., fixed telephony services or retail TV services) whereas mobile internet (data) services are not. From a demand side perspective, mobile internet (data) services could not substitute those product bundles.

iv) The volume of sales and prices of fixed internet services on the one hand and those of mobile internet (data) services on the other hand in Austria develop independently of each other.

v) Fixed internet services and mobile internet (data) services are typically used as complementary products in Austria.

vi) Mobile data-only products offered in combination with a router are niche products. Due to the enormous increase in data consumption over the last years, [confidential information about the implications of the increase in data consumption for mobile data-only products].

(15) The Notifying Party submits that these arguments apply both to services offered to residential customers and to services offered to business customers. In any event, the Notifying Party submits that the precise definition of the relevant product market can be left open in the present case.

(16) Finally, according to the Notifying Party, no distinctions should be made within mobile internet (data) services as mobile internet (data) services are all mobile data enabled SIM cards that can be used with a multitude of various mobile devices (hardware) such as routers (cubes), dongles, tablets or smartphones. An MNO has no control over the actual use of a SIM card by a customer. According to the Notifying Party, distinguishing mobile internet (data) services on the basis of the hardware product with which the mobile internet (data) services (i.e., the SIM card) have been sold would, therefore, be meaningless.

(b) The Commission's assessment

(17) The Commission notes that in previous cases, it has distinguished between fixed and mobile internet access services (both for residential and business customers) as (i) mobile internet access services often do not offer the same product functionalities as fixed services, specifically with respect to network quality (speed, bandwidth, security of the connection); and (ii) mobile and fixed data services are mainly aimed at different customer needs, i.e. to access the internet whilst on the move for mobile data services. In particular, the Commission found that in Spain fixed and mobile internet access services were not substitutable for a number of reasons, such as different uses (mobile broadband permits mobility but also access to mobile applications), different capacity and pricing models (mobile broadband unlike fixed broadband was almost always capped at a certain amount of data transferred and was also invoiced per amount of data traffic) as well as different speeds (only 4G/LTE mobile technology could provide comparable speeds to fixed broadband). In addition, customers demanded both mobile and fixed broadband which demonstrated the complementary character of the two services. Finally, it was considered that mobile internet access could in some cases substitute fixed internet access services but not the other way around.6

(18) The issue of substitution between fixed and mobile internet access services was analysed specifically for Austria in another case, where the Commission found that there was only limited substitutability for mobile data services by fixed internet access services.7 However, the question in that case was whether fixed internet access services were a substitute for mobile data services in general or for mobile internet access services specifically.

(19) In the present case the question is the reverse, namely whether mobile internet access services for fixed connections can be a substitute for fixed internet access, i.e. whether mobile internet access services can be used for accessing the internet at home, in the same way as fixed connections are used. The mentioned decision relating to Austria did not assess the latter question, as it was not relevant for the case at issue. However, that decision made express reference to an ordinance of the national Austrian Regulatory Authority for Broadcasting and Telecommunications ("RTR")8 from 2003, which found that for residential customers mobile internet access was a substitute for fixed line internet services.9

(20) Notably the RTR found in its ordinance that there existed a high degree of demand substitution between fixed internet products and fixed-mobile substitution ("FMS") products10 (such as cubes) for residential customers, and defined a residential "home broadband" market that included both fixed and FMS products.

(21) This market definition was recognised in 2009 by the Commission in the periodic review of market definitions in the telecommunications sector for the purposes of ex-ante regulation.11 In its position the Commission noted that "fixed and mobile retail broadband services are normally not belonging to the same market. However, on the basis of the following circumstances closely related to the specificity of the Austrian market, the Commission accepts the inclusion of mobile and broadband connections into the retail residential market for the purposes of the present notification […] according to the evidence submitted by RTR, product characteristic differences as detailed above do not currently have a considerable impact on demand-side substitutability in Austria, as they are not preventing residential customers from using applications needing secure connections, such as online banking. Moreover, RTR also provides evidence that the data transfer limits imposed by mobile operators would not prevent subscribers from using advanced multimedia services, such as streaming media or downloading large files, as even low price packages currently offered already include rather high volumes, and attractive pre- and post-paid tariffs exist. Finally, the particularly high HSDPA network coverage in Austria should also be taken into account in this respect. In light of the above information regarding the similar use and pricing of fixed and mobile broadband products in Austria, the Commission considers that, despite the different product characteristics, the information provided by RTR adequately supports the conclusion that, on the basis of specific national circumstances relating to demand-side substitutability in the Austrian market, mobile broadband connections can be considered as an adequate substitute to fixed broadband connections within the current review period. Thus, mobile broadband connections can be included in the residential customers' retail broadband access market. For those reasons the Commission considers that RTR has provided sufficient evidence supporting its conclusion that fixed and mobile broadband connections can be considered as substitutes in the residential customers' retail broadband access market in Austria".

(22) The analysis of the RTR in its ordinance is confirmed in more recent documents. In an expert opinion from February 2016 (the "2016 Opinion"), RTR found evidence that fixed and mobile internet access services are likely to be part of the same retail market for residential users but not for business users. This evidence was mainly based on survey data from January 2015 and data from the operators up to end 2014. The 2016 Opinion observed that with the introduction of 4G/LTE, the number of mobile broadband lines increased, as mobile operators were aggressively marketing FMS products for the use at home with unlimited data allowance.

(23) Also, according to recent RTR documents, data from network/speed tests showed that mobile broadband on average performed better than fixed broadband (although bandwidths decreased somewhat in the last year as the networks were getting closer to capacity limits).12

(24) The Notifying Party claims that the Commission cannot rely on the 2016 Opinion, because it is based on data of a survey conducted in 2015. According to the Notifying Party, RTR found indications in its opinion that the competitive pressure resulting from mobile broadband services was decreasing.

(25) In this respect, the RTR has confirmed this market definition in a decision on the local access market of July 2017.13 This market definition has also been accepted by the Commission in relation to Austria.14

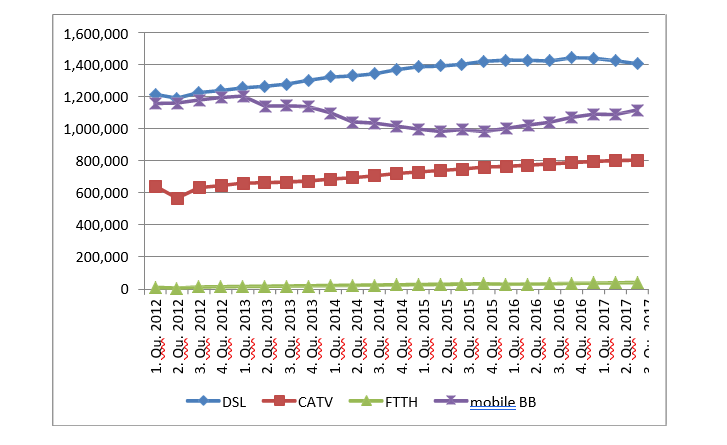

(26) As for the alleged indication found by the RTR of a decreasing competitive pressure exerted by mobile broadband products on fixed, the RTR found that mobile broadband connections declined in the years 2013 and 2014. However, with the introduction of 4G/LTE, the number of mobile broadband lines increased again, as mobile operators were aggressively marketing FMS products for the use at home with unlimited data allowance. Recently, the number of DSL lines even decreased (see Figure 1).

Figure 1: Development of number of access lines by technology (residential segment, mobile BB without prepaid) - RTR15

(27) The substitution trend is confirmed in 2017 by the Commission in the 2017 Europe's Digital Progress Report (EDPR) on Austria: "The area where Austria performs considerably lower is take-up, which in the case of fixed and fast broadband may be attributed to a considerable mobile substitution trend. The Austrian telecommunications market is characterised by price-driven competition and the prominent role of mobile services, on both voice and broadband markets".16

(28) The Notifying Party further maintains that in any case the results of the analysis in the 2016 Opinion cannot be relied on in the present merger control proceedings, as the purpose of the analysis was to assess whether A1, the incumbent telecommunications provider in Austria and which mainly offered DSL broadband services, held significant market power. As a consequence, DSL broadband services served as the starting point of RTR's market definition and hypothetical monopolist test. On the contrary, the Parties are mainly active in the provision of cable broadband services and mobile broadband services (and not DSL broadband services), respectively. In the present case, the starting point of the definition of relevant markets and of any hypothetical monopolist test would need to be the Parties' products.

(29) In this respect, the Commission notes that the market analysis carried out by the RTR involved explicitly DSL and cable and concluded that mobile internet access services were to be included in the relevant market. DSL broadband services are commonly included in the internet access services market and compete directly with other fixed access technologies such as cable and FTTX, although they can differ in terms of performance, quality and speed. In general, even though different services at the two opposite extremes of the spectrum may not be direct substitutes, they can belong to the same market as long as there is a chain of substitution between them. It can be added that the conclusions of the documents mentioned in paragraphs (18) to

(27) do not make any distinctions on the basis of the fixed technologies.

(30) A market definition covering both fixed and mobile technologies is supported by the submissions of a number of Austrian telecom providers received by the Commission in the present case. Those providers point out that in Austria the mobile network is a viable alternative for residential customers to access the internet at home. According to them, internet access at home is often provided via mobile connections, e.g. through routers which are connected to the provider via mobile technology ("cubes"). Their performance is similar to the one of comparable fixed products; fixed and mobile internet tariffs are equally positioned in terms of pricing, data volumes and down-/ upload-speeds.

(31) One Austrian telecom provider (Ventocom) has also submitted an economic study, based on RTR data, which in its view confirms that:

- in Austria, differently than in other countries, mobile internet devices are used from a fixed (static) location;

- mobile internet access is predominantly used as standalone home access solution;

- fixed and mobile internet access tariffs are equally positioned in terms of prices, included data volumes and down-/ upload speeds;

- network tests suggest that mobile internet access is of at least similar quality as fixed one.

(32) The Notifying Party submits that the speed-test used by Ventocom is inappropriate to address the serious performance issues of mobile data services, as it provides monthly average speeds, not taking account of the time of the day and different tariffs, suppliers and products; it is hence entirely undifferentiated. According to the Notifying Party, the performance of mobile data services depends on a variety of factors and is particularly low during peak hours. The tool used in Ventocom's study does not address these points nor does it take account of congested cells at many locations. Therefore, according to the Notifying Party, the results of that study provide a distorted picture of the reality.

(33) In any case, the Commission notes that a number of the responses to the market investigation provide indications that a market for home internet access services including both fixed and mobile solutions can be considered. The majority of respondents17 have considered fixed internet access services and FMS internet access services to a certain extent comparable in terms of product characteristics.18 It is to be noted that some respondents pointed out that the differences were mainly relevant for customers having specific needs (in particular for business customers). In general, respondents have stated that, from a technical perspective, quality, reliability and steadiness of dedicated, high-speed fixed internet services is still difficult to reach for FMS products. However, due to the good performance of mobile networks in recent years, customers with the need of access to standard internet services (as most residential customers) do not experience significant disadvantages in using a mobile technology where transmission capacity is shared. In any case, hybrid internet access solutions are gaining importance.

(34) In terms of price, the result is mixed, with some respondents considering the two categories of products comparable to each other, while some other respondents consider that FMS products can be cheaper than purely fixed ones.19

(35) The Commission notes that in general even if the different products in the spectrum are not perfectly similar in terms of price and quality, they may still be considered substitutes for many customers and that also different products/services which are not direct substitutes can belong to the same market as long as there is a chain of substitution between them.

(36) This market definition also appears to be supported, as regards residential customers, by the Parties' internal documents regarding the Transaction and recent developments in the Austrian telecommunications market. Some of these documents define a "BB@home" (broadband at home) market, where both mobile and fixed operators are active and compete directly. In internal documents, it is also pointed out that the Austrian market differs from other mature markets within the EU: in particular, the mobile networks in Austria are of very high quality, while the fixed networks have low penetration and quality.20 According to a document, these circumstances favoured the emergence of FMS products, such as cubes or hybrid solutions. A document dated January 2017 expressly refers to mobile broadband providers as a rising threat to fixed-line operators, pointing out that in Austria 16% of households only had mobile connections, compared to the 8% EU average. Several documents highlight the relevance of mobile 4G/LTE offers as home solutions, directly competing with fixed offers. Market shares of the main actors in this market are reported in some documents, where both fixed and mobile offers are included.

(37) In order to provide the Commission with further information on the possible home internet access services market, the Notifying Party conducted a specific customer survey in Austria in May 2018. This consumer survey was designed to reveal diversion ratios between the Parties, but also included questions about whether fixed and mobile internet access services are in the same relevant market. However, the Notifying Party has underlined that the survey has important limitations and that the results are distorted and biased. In particular, a substantial number of respondents submitted implausible second-preferred choices. The Notifying Party concludes that in light of these limitations, the Commission should interpret the results of the survey with great caution.

(38) The Commission considers that the evidentiary value of the survey is substantially undermined by a number of flaws (see paragraph (250) below). The results appear to be of limited use, primarily because, looking at the replies in detail, those can be interpreted in several different ways due to a significant number of respondents choosing counterintuitive answers that are difficult to reconcile. As a consequence, it is difficult to draw any meaningful conclusion on market definition or diversion ratios on the basis of the survey.

(39) In conclusion, the Commission considers that a series of elements, mentioned above, seems to indicate that in Austria a relevant product market for home internet access services, including both fixed and mobile technologies, could be defined as far as residential customers are concerned. In any case, the question of the inclusion of mobile internet access services in this home internet services market can be left open, as the assessment would not change irrespective of the definition of the market in this respect.

(40) Also the question as to whether all pre-paid and post-paid mobile data-only access services should be included in the relevant market, or only post-paid mobile data-only access services, or just services based on cubes (i.e. on devices specifically designed for home mobile connection), can be left open, as the assessment would not change irrespective of the definition of the market in this respect.

(41) Finally, the Commission notes that market participants seem to agree that the specific needs of business customers in terms of stability, performance, quality and speed of the connections are better satisfied by (high quality) fixed connections and that FMS products do not exert a sufficient competitive constraint for this customer group. The elements gathered also indicate that, with respect to business customers, the degree of substitutability between fixed and mobile internet access services appears to be rather low.21 However, it can be left open whether internet access services for business customers are part of the same market as those for residential customers, as the assessment would not change irrespective of the definition of the market in this respect.

3.1.1.2. Geographic market definition

(a) The Notifying Party's views

(42) The Notifying Party considers that the retail market for the provision of internet access services is national in scope. The Notifying Party points out that the Commission has in the past found that the geographic scope of the retail market for fixed internet services is national, including in cases which concerned the acquisition of a provider of fixed internet services not active on a nationwide level.

(43) The Notifying Party submits that the arguments used in past Commission decisions would also be fully applicable to the geographic scope of a retail market for the supply of home internet services including fixed internet services and mobile internet services. In this respect, the Notifying Party points out that the providers of mobile internet connections (MNOs and MVNOs) compete at national level. Moreover, mobile telecommunications services providers would have no control over how and where its customers use a mobile data-only SIM card in Austria.

(44) The Notifying Party further submits that TMA offers its mobile and hybrid broadband services on the basis of a national pricing and marketing policy. Occasional regional campaigns are only aimed at [description of objective of occasional regional campaigns], but they are not based on the competitive conditions in the area concerned and prices and conditions that are promoted in such regional campaigns are available nationally throughout Austria. Similarly, UPC sets prices for fixed internet services at the national level and does not differentiate per region or location of customers, the only exception being occasional short-term localised promotion campaigns targeted at [description of UPC's sales strategy].

(b) The Commission's assessment

(45) The majority of respondents to the market investigation in the present case submitted that the market for the provision of retail internet services is national in scope. Most respondents, in particular fixed operators, stated that there are no relevant price differences for internet access services across different regions in Austria.22 With specific regard to the internet services provided by mobile operators, although some of them pointed to price differences in some regions, all of them are active at national level and one respondent highlighted that MNOs operate nationwide high quality mobile networks and are subject to coverage obligations required under their licenses.23

(46) A1 submitted that decisions by the Belgian, Polish and Hungarian authorities support the view that the geographic market should be defined locally on the basis of the footprint of the network in question. In A1's view, a regional market definition is also supported by the technological differences between rural and urban areas, mainly served respectively by DSL networks and by cable networks. In addition, different players are active in the various regions, with alternative players holding a strong position in urban areas. Finally, there is regional price differentiation. A1 also submitted (i) an economic study pointing to a regional segmentation of the market, with particular reference to the urban area of Vienna, where UPC's presence is particularly relevant and (ii) a few examples of promotions addressed exclusively to customers in Vienna.

(47) The Commission considers that the market for the provision of internet access services is national in scope.

(48) First of all, the Commission notes that the RTR has expressly qualified as national the internet access service market in Austria and this definition has been accepted by the Commission.24

(49) Moreover, in line with previous Commission decisions related to the market for the provision of fixed internet access services and with the result of the market investigation in the present case, the Commission considers that although operators of cable networks have sometimes a presence limited to a certain part of the national territory, they compete with nationwide providers of other fixed internet services which offer their services on the basis of a national strategy across the national territory.25

(50) In the present case, it has to be added that mobile operators normally offer their services at national level and that mobile connections – including FMS products – can usually be used in the whole territory of Austria. The penetration of FMS products does not appear to be substantially different in areas covered by cable networks (such as the UPC one) compared to other areas.

(51) In particular, with respect to the argument that operators such as UPC provide telecommunications services via a cable network only in certain areas, the Commission notes that UPC interacts within its footprint with providers of fixed internet services such as A1 and mobile operators such as TMA that operate nationally. Moreover, UPC offers internet access services to residential customers also outside of its HFC footprint mainly based on A1’s regulated wholesale access. Hence, UPC ultimately competes on the basis of nation-wide dynamics.

(52) The Commission also did not find material geographic price discrimination. In particular, the Parties appear to charge largely uniform prices among different locations. TMA does not engage in regional or local pricing. Where TMA runs occasional marketing campaigns that target certain regions, these do never involve any regional/local pricing or conditions26. UPC sets prices for fixed internet services at the national level and does not differentiate per region or location of customers. UPC harmonises prices and quality to ensure a consistent product offering throughout its footprint.27

(53) Most fixed (cable) operators have also confirmed that pricing is generally uniform in Austria and all mobile operators (including MVNO) are active at nationwide level. This element indicates that the market should be defined to be nationwide. Occasional local promotions cannot call into question this conclusion.

(54) As for the different number and size of competitors in densely populated areas compared to rural areas, the Commission considers that the availability of competitors as a supply source is more relevant for market definition purposes than the extent of their current sales presence. Accordingly, the Commission has consistently defined the market for retail internet access services to be national in scope.28 Moreover, the two main technologies (DSL vs. cable) available in the different areas (rural vs. urban) are included in the same product market(s) because they compete directly (see above paragraph (29)) and the Commission does not see how, conversely, they could justify the definition of different geographic markets.

(55) Therefore, the Commission concludes that the retail market for the provision of internet access services is national in scope.

3.1.1.3. Affected market

(56) In the market for retail home internet access services including both fixed and mobile connections in Austria the Parties have a combined market share of [20-30]% (UPC [10-20]% and TMA [10-20]%), according to data provided by the Notifying Party.29 The market in question is horizontally affected. 30

(57) Should the market be defined as the retail market for fixed internet access services (excluding mobile connections) in 2017 UPC had a market share of [20-30]% in terms of revenues and of [20-30]% in terms of subscribers (residential and business). TMA was not active in 2017 in the fixed internet sector and only in January 2018 launched a hybrid broadband product for residential customers on the basis of its 4G/LTE mobile network in combination with a DSL component based on wholesale access provided by A1. Should this offer be considered as part of the retail fixed internet access market, TMA's market share would be marginal, in any case inferior to [0-5]% (limited to residential customers). In any case, this market would be horizontally affected.

(58) In addition, the market for retail internet access services in Austria is vertically affected also insofar as there is a vertical link to the wholesale leased lines market if defined on the level of communes. In 24 communes where TMA is active and the Parties combined market share is equal or larger than 30%.

3.1.2. Retail internet hosting services

(59) Internet hosting service providers operate Internet servers and offer organisations and individuals to serve content to the Internet via these servers. By using internet hosting services, organisations outsource their internal IT applications and infrastructure.

3.1.2.1. Product market definition

(60) In the KPNQWEST / EBONE / GTS decision, the Commission considered four market segments within the general web-hosting sector, based on the range of different services and products offered: (a) the local (limited to the area where the web-hosting centre is located) supply of basic co-location services such as connectivity, power, and the facilities; (b) the national supply of shared and dedicated hosting consisting of hosting a customer's web-site on the web host's servers and providing the necessary support applications; (c) the national, possibly cross-border regional, supply of managed services to outsource complex enterprise applications and support infrastructure, including "front-end" and "back-office" applications hosted on the providers' platforms (so-called ASP), and (d) the national supply of content delivery services (CDS) such as Streaming Content Delivery Services and Static Content Delivery Products.31 However, the Commission did not conclude on the exact market definition.

(61) The Commission agrees with the Notifying Party that, for the purpose of the present decision, there is no need to take a definitive view on the precise product market definition, as the Transaction does not raise serious doubts as to its compatibility with the internal market under any possible market definition.

3.1.2.2. Geographic market definition

(62) The Notifying Party submits that for the purposes of this Transaction, the retail market for internet hosting services is wider than national in scope, although the precise market definition can be left open. In previous decisions, the Commission did not conclude on the exact definition of the geographic market for retail internet hosting services, whether it is national, EEA-wide or worldwide.32 As the Transaction does not raise serious doubts as to its compatibility with the internal market under any geographic market definition, it is not necessary to conclude on the precise definition for the purpose of the current decision.

3.1.2.3. Affected markets

(63) The retail market for internet hosting services is horizontally not affected. The Transaction only leads to a potential minor horizontal overlap (if any) on the retail market for internet hosting services, whether in Austria or in the EEA. Both Parties have only minor activities on this market. According to the Notifying Party's estimates UPC achieved revenues of approximately EUR […] in Austria33 from retail internet hosting services in 2017 which would amount to a market share of only approximately [0-5]% in Austria and to less than [0-5]% in the EEA. DTAG sold its subsidiary Strato, which used to be DTAG's dedicated subsidiary for internet hosting activities, in the first half of 2017. DTAG's remaining activities in the wider area of internet hosting services are very limited,34 and consequently, also the overlap between UPC's and DTAG's activities in the area of internet hosting services.

(64) The retail market for internet hosting services is vertically not affected either. There is a potential vertical link between the Parties' minor activities on the retail market for internet hosting services in the EEA and the Parties' activities on the upstream worldwide wholesale market for internet connectivity services which, however, does not constitute an affected market due to the Parties' negligible market shares on the worldwide wholesale market for internet connectivity services (TMA: approx. [0-5]% UPC: below [0-5]%).

3.1.3. Retail business connectivity services

(65) The retail market for business connectivity includes fixed telecommunications services purchased by large businesses, enterprises and public sector customers in order to provide data connectivity between multiple sites.

3.1.3.1. Product market definition

(66) The Notifying Party considers that retail business connectivity services constitute a separate product market. In its decisional practice, the Commission35 considered potential subdivisions into: (i) broadband access for large business customers;36 (ii) leased lines;37 and (iii) VPN services.38 The Notifying Party does not take a view with regard to these sub-segmentations of the market. It considers that, in any event, the exact definition of the product market can be left open in this case as the Transaction does not raise any competitive concern under any plausible market definition.

(67) In previous decisions, the Commission noted that the requirements and purchase processes of larger business customers with respect to the combinations of fixed or fixed-mobile services for business connectivity are different than those of SMEs and SOHOs, but left the market definition open.39

(68) In any event, for the purposes of the present decision the exact product market definition for the retail provision of business connectivity services can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any alternative product market definition.

3.1.3.2. Geographic market definition

(69) In its decisional practice, the Commission has found that the retail market for business connectivity was national in scope.40 The Notifying Party agrees that the geographic scope of the retail market for business connectivity services is national and corresponds to the territory of Austria.

(70) The Commission considers that in the present case there is no reason to depart from the geographic market definition adopted in its past decisional practice.

3.1.3.3. Affected markets

(71) The Transaction does not lead to a horizontal overlap on the retail market for business connectivity services in Austria: Only UPC has some activities on this market whereas TMA is not active on this fixed telecommunications market.

(72) However, the retail market for business connectivity services is vertically affected with regard to the Parties' activities on the upstream wholesale market for leased lines if defined locally, at the level of communes. Based on the data submitted by the Austrian regulator RTR, there are 24 communes41 where, based the overall leased lines market but also on the various technological sub-segmentations thereof, the Parties' combined market shares in the wholesale upstream market, in terms of number of terminating segments, are equal or above 30%.

3.1.4. Wholesale broadband access

(73) Wholesale broadband access includes different types of access to fixed connections that allow internet service providers to provide services to end consumers. It comprises physical access at a fixed location, such as LLU42; non-physical or virtual network access, such as bitstream access, at a fixed location; and resale of a fixed provider's internet access services.43

3.1.4.1. Product market definition

(74) The Notifying Party does not take a view on the exact definition of the market for wholesale broadband access.

(75) In previous decisions44, the Commission defined a separate market for wholesale broadband access and left open the question of whether it should be sub-divided per type of access (LLU, bitstream or resale of the incumbent's offering).

(76) For the purposes of this Decision, the Commission considers that the question of the exact scope of the wholesale market for broadband access with respect to its possible segmentations (standalone access to DSL, standalone access to cable, access to cable for TV and internet together) can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market under any product market definition.

3.1.4.2. Geographic market definition

(77) The Notifying Party does not take a view on the exact geographic definition of the wholesale market for broadband access.

(78) In Carphone Warehouse/Tiscali UK, while there were indications supporting a national scope of the market, the Commission ultimately left open the exact geographic market definition.45

(79) For the purposes of this Decision, the Commission considers that the question of whether the geographic scope of the wholesale broadband access is national (that is to say Austria) or limited to the footprint of UPC's cable network can be left open, as Transaction does not raise serious doubts as to its compatibility with the internal market under any geographic market definition.

3.1.4.3. Affected markets

(80) The market for wholesale broadband access is horizontally not affected. Only UPC is active on this market. Moreover, the market for wholesale broadband access is not vertically affected with respect to the vertical link with the downstream market for internet access services since UPC's market share in the upstream market for wholesale broadband access is below 30% and the combined market share of the merged entity in the downstream market for internet access services would be similarly below 30%.

(81) Some operators need wholesale leased lines as an input for their network based on which wholesale broadband access is provided. The market for wholesale broadband access could hence be vertically affected insofar as the Parties' combined market shares on the wholesale leased lines market if defined on the level of communes, in 24 communes46 are equal or larger than 30%.

3.1.5. Wholesale leased lines

(82) Wholesale leased lines are part-circuits that allow telecommunications providers to connect their own networks to end user sites for the supply of business connectivity services. In addition, wholesale leased lines are an input for the provision of telecommunications services.

3.1.5.1. Product market definition

(a) The Notifying Party's views

(83) The Notifying Party submits that that the relevant market definition may be left open, as the Transaction will not give rise to any competition concerns under any possible segmentation of the wholesale market for leased lines.

(84) The RTR segments the wholesale leased lines between the element that can be considered to be customer access or backhaul (terminating segments) and that which can be considered part of the core network (trunk segments).47 In its recommendation on market definitions in the electronic communications sector, the Commission considers a separate market for terminating segments for leased lines48.

(b) The Commission's assessment

(85) In previous decisions, the Commission considered that the market for wholesale leased lines could be further segmented between trunk and terminating segments but ultimately left the market definition open.49 The market investigation carried out for the assessment of the Transaction was not conclusive as to whether the market for wholesale leased lines should be further segmented between trunk and terminating segments.

(86) In the past the Commission has also considered a further segmentation of the wholesale leased lines market into terminating leased lines with bandwidth above and below 2 Mbps respectively but ultimately left the exact product market definition open.50 Respondents to the market investigation indicated that terminating segments of leased lines with bandwidth below 2 Mbps may not be substitutable with terminating segments of leased lines with bandwidth above 2 Mbps in Austria because bandwidth below 2 Mbps would be legacy services and not of interest anymore.

(87) The Commission has not yet considered a segmentation of the wholesale leased lines market into terminating leased lines with bandwidth above 10 Mbps versus terminating leased lines with bandwidth below 10 Mbps. Respondents to the market investigation indicated that terminating leased lines with bandwidth below 10 Mbps and terminating leased lines with bandwidth above 10 Mbps may not be substitutable since bandwidth above 10 Mbps is not available everywhere in Austria.

(88) In past decisions, the Commission has considered a further segmentation of the wholesale leased lines market into passive (dark fibre) and active infrastructure (traditional managed leased lines, Ethernet services with guaranteed bandwidth) but finally left the exact product market definition open.51 Responses to the market investigation were not conclusive on the question whether passive infrastructure (dark fibre) and active infrastructure (leased lines with traditional interfaces, Ethernet services with guaranteed bandwidth) are substitutable for each other.52 UPC primarily offers Ethernet services and currently supplies only [0-5] dark fibre connections at wholesale level. TMA supplies wholesale trunk segments and wholesale terminating segments of leased lines on the basis of Ethernet services and currently only supplies [5-10] dark fibre connections at wholesale level.

(89) The Commission has not yet considered whether the wholesale leased lines market should be further divided into leased lines with traditional interfaces and Ethernet services with guaranteed bandwidth. The market investigation was not conclusive as to whether leased lines with traditional interfaces and Ethernet services with guaranteed bandwidth are substitutable. There were however indications that traditional interfaces are outdated. [UPC's sales policy regarding leased lines with traditional interfaces].

(90) The Commission considers that in the present case the exact definition of the product market can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

3.1.5.2. Geographic market definition

(a) The Notifying Party's views

(91) The Notifying Party considers that the geographic scope of the wholesale market for leased lines is national and corresponds to the territory of Austria irrespective of the precise definition of the product market.

(92) The Notifying Party submits that the definition of narrower geographic markets would not reflect the actual market realities since negotiations between providers of wholesale leased lines (including Ethernet services and dark fibre) and wholesale customers often take place on a project basis and concern a larger number of customer sites across the whole of Austria or at least across a large number of regions in Austria. In addition, prices and conditions of contracts agreed on a project basis depend on the number of customer sites and lines included in the project (and not on the theoretical competitive conditions at the level of single communes).

(b) The Commission's assessment

(93) In previous decisions, the Commission considered that the market for wholesale leased lines irrespective of its precise product market definition is nationwide in scope.53

(94) With regard to terminating segments of wholesale leased lines and its potential sub-segments the RTR distinguishes in principle two broad sub- markets within Austria by grouping together on the one hand communes in Austria where A1 was found to hold significant market power and on the other hand communes where the market was found to be competitive with no suppliers having single or joint significant market power.54 The market investigation suggests that regional differences in competitive conditions may exist in Austria.55 Some respondents indicated that competitive conditions (including pricing) are better in urban areas like Vienna where there are more competitors present than in rural areas.56

(95) For terminating segments of leased lines and its potential sub-segments the Commission considers that in the present case the exact definition of the geographic market can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market even under the narrowest market definition that is on the level of single communes.

(96) As regards wholesale trunk segments of leased lines, (i.e. leased lines between the 28 trunk cities in which A1 installed the points of interconnection of its telephony network)57 the Commission recalls that in previous cases the market for wholesale leased lines irrespective of its precise product market definition was found by the Commission to be national as described in paragraph (93) above.

(97) Past decisions of the RTR also suggest that the wholesale trunk market is national. In particular, in its latest regulatory review of this market (dating back in 2006, before the market was deregulated), the RTR found this market to be national in scope, which was not objected to by the Commission.58

(98) The market investigation carried out in the present case did not provide any indication in relation to wholesale trunk leased lines that would clearly point to a sub-national geographical dimension.

(99) The Commission, hence, considers that in the present case the definition of the geographic market for trunk segments of leased lines and its potential sub- segments is national in scope.

3.1.5.3. Affected market

(100) Both Parties have activities in the area of wholesale leased lines. UPC achieved revenues of approximately EUR […] in 2017 from wholesale leased lines in Austria. It achieved approximately […] from wholesale trunk segments and approximately EUR […] from wholesale terminating segments of leased lines (including leased lines with traditional interfaces and Ethernet services with guaranteed bandwidth) in 2017. UPC has negligible activities regarding dark fibre; it currently supplies [0-5] dark fibre connections at wholesale level.59

(101) TMA, which provides wholesale leased lines services on the basis of the backbone infrastructure of its mobile network, generated revenues of approximately EUR […] with wholesale leased lines services in Austria in 2017. According to TMA's estimates, approximately [60-80]% of its wholesale leased lines revenues originated from the lease of wholesale trunk segments and the rest [30-40]% from the lease of wholesale terminating segments (including leased lines with traditional interfaces and Ethernet services with guaranteed bandwidth).60

(102) At the national level, the wholesale leased lines market and its potential product segments are not horizontally affected. In the overall wholesale leased lines market the Parties have a combined market share in terms of revenues of [0-5]% in Austria (UPC with [0-5]% and TMA with [0-5]%). As regards wholesale trunk segments the Parties have a combined share of [10-20]% (UPC with [0-5]% and TMA with [10-20]% in terms of revenues) in Austria. Regarding wholesale terminating segment the Parties have a combined share of [0-5]% (UPC with [0-5]% and TMA with [0-5]% in terms of revenues) in Austria. In relation to terminating leased lines with bandwidth above 2 Mbps the Parties have a combined market share of [0-5]% (UPC: [0-5]%; TMA: [0-5]% in terms of revenues). In relation to terminating leased lines with bandwidth equal and below 2 Mbps, the Parties have a combined market shares of [0-5]% (UPC: [0-5]%; TMA: [0-5]% in terms of revenues). As regards terminating leased lines with bandwidth above 10 Mbps the Parties have a combined market share of [0-5]% (UPC: [0-5]%; TMA: [0-5]% in terms of revenues). In relation to terminating leased lines with bandwidth equal and below 10 Mbps the Parties have a combined market share of [0-5]% (UPC: [0-5]%; TMA: [0-5]% in terms of revenues). As regards passive infrastructure (dark fibre) the Parties have a combined market share of [0-5]% (UPC: [0-5]%; TMA: [0-5]% in terms of revenues). Regarding active infrastructure (traditional managed leased lines and Ethernet services with guaranteed bandwidth) the Parties have a combined market share of [0-5]% (UPC: [0-5]%; TMA: [0-5]% in terms of revenues).

(103) At the commune level, based on data submitted by the RTR on the number of terminating segments leased per technology in each commune in 2015, and data submitted by the Parties on the terminating segments per technology they currently (2017Q4) lease, a single potentially horizontally affected market exists in the sub-segment of Ethernet services with guaranteed bandwidth in a single commune61 representing less than 0.1% of the Austrian population where each of the Parties leases […] of the […] Ethernet based leased lines in total (thus [20-30]%; TMA: [10-20]% and UPC:[10-20]%) of total Ethernet lines. When considering the sub-segment of Ethernet services with guaranteed bandwidth with bandwidth above 10Mbit/s) in this commune the combined market share increases to [40-50]% (TMA: [20-30]% and UPC: [20-30]%).

(104) According to the Notifying Party, the Parties' activities on the wholesale market for leased lines are vertically related (as a necessary input to telecommunications service providers that do not own their own fixed network infrastructure or only own a fixed network that covers specific geographic locations) to (i) the Parties' activities on the downstream retail market for retail mobile telecommunications services, (ii) TMA's activities on the downstream wholesale market for access and call origination on mobile networks, (iii) UPC's activities on the downstream retail market for fixed telephony services, (iv) UPC's activities on the downstream retail market for business connectivity services, (v) DTAG's activities on the downstream worldwide wholesale market for global telecommunications services, and (vi) the Parties' activities on the downstream worldwide retail market for global telecommunications services. The Commission further notes that to the extent that the retail internet access services market includes both mobile and fixed offerings it follows from point (i) that a vertical relationship exists also between the wholesale market for leased lines and the Parties' activities in the downstream retail internet access services market. Finally, a vertical relationship exists between the wholesale market for leased lines and UPC's activities in the wholesale broadband access services market for which leased lines can also be an input.

(105) Based on these vertical relationships, the market for wholesale leased lines is vertically affected both at the national level as well as the level of communes.

(106) At the national level, there is no plausible segmentation of the wholesale leased lines market where the Parties have a market share exceeding 30% (see paragraph (102)). However, this is still a vertically affected market on account of the Parties' combined shares on the downstream wholesale mobile access and call originations services market, which are [70-80]% in terms of revenue, in Austria (TMA: approx. [70-80]%; UPC: [0-5]%).

(107) At the commune level, and based on recent (2017Q4) data submitted by the Parties and the 2015 RTR data, there exist 24 communes62 where, based on the overall leased lines market and on sub-segmentations thereof based on technology and bandwidth speed, the Parties' combined market shares, in terms of number of terminating segments, are above 30%. The wholesale leased lines market is therefore vertically affected in these 24 communes with respect to the vertical relationship to all the downstream markets described in paragraph (104) for which access to leased lines is potentially necessary for the provision of telecommunication services.

3.1.6. Wholesale internet connectivity services

(108) Internet connectivity services allow corporate customers to be present on the internet by providing access to the entire routing table of the global internet or to a subset of the same, in which case the customer will need to cover the totality of its needs by means of a multi-homing strategy. Connectivity to the internet can be achieved (i) by the purchasing of transit services, (ii) by means of peering with selected networks, or (iii) by means of a combination of the two. Entities which do not connect directly to the internet may also call upon hosting providers, who aggregate hosting needs and procure in turn internet connectivity for their customers.63 Whilst global coverage is a primary requirement, more specific performance criteria also enter into a customer's internet connectivity strategy such as latency, reliability, speed and minimization of traffic-related costs.

(109) Transit is a service whereby a customer pays for access to all or a large part of the internet, with performance characteristics which may vary according to the destination of the traffic. Peering, on the other hand, whether settlement- free or paid, provides access to individual networks but no further onward connectivity. Providers of transit services will in their turn use a combination of peering relationships and paid commercial relationships with other transit providers in order to provide global internet coverage. A transit provider which does not purchase transit services from other providers because it is able to reach the entire internet merely by means of peering relationships is referred to as "Tier 1".

(110) Operators of retail internet access networks, sometimes called "eyeball networks", procure internet connectivity in the same way as any other corporate customer, and may themselves also provide wholesale internet connectivity services. Certain internet access providers ("IAPs") offer transit services, whereas many offer direct connectivity to their own network and subscribers. To the extent that the IAP purchases transit services, these may also be used to reach its users. The end users of a given IAP can also be reached by means of relationships with those networks which peer with the IAP in question.

3.1.6.1. Product market definition

(111) In previous Commission decisions, the Commission considered a market for wholesale internet connectivity services. In addition, the Commission considered a possible segmentation between peering and transit, but ultimately left the exact product market definition open.64 In MCI/Verizon the Commission identified a separate market for Tier 1 transit providers. 65

(112) In line with the Notifying Party's view, in the present case, the exact definition of the product market can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

3.1.6.2. Geographic market definition

(113) The Commission has in the past considered that markets for internet connectivity were global in scope but ultimately left the exact market definition open.66

(114) The Notifying Party submits that the market for internet connectivity is worldwide in scope.67

(115) In the present case, the precise geographic market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of the market definition considered.

3.1.6.3. Affected markets

(116) The market for wholesale internet connectivity services and its potential sub- markets are not horizontally affected. Both Parties have only minor activities on this market. DTAG achieved worldwide revenues of approximately EUR […] from wholesale internet connectivity services in 2017 which corresponds to an estimated market share of approximately [0-5]%. UPC has only very limited activities in the area of wholesale internet connectivity services. It achieved revenues of approximately EUR […] from wholesale internet connectivity services in 2017 which corresponds to an estimated market share of below [0-5]%. Based on the Parties' estimates the Parties' combined market share in each potential segment of worldwide wholesale internet connectivity services would be in any event below 20%.

3.2. Mobile services

3.2.1. Retail mobile telecommunications services

(117) Mobile telecommunications services to end customers include services for national and international voice calls68, SMS (including MMS and other messages), mobile internet data services and retail international roaming services.

3.2.1.1. Product market definition

(118) The Notifying Party submits that there is a single retail market for mobile telecommunications services and that "over-the-top" ("OTT") services should be considered as part of the retail market for mobile telecommunications services. The Notifying Party also considers that it is not appropriate to distinguish between residential and business customers, notably because of a high level of supply-side substitutability between the services provided to business and private customers.

(119) The Notifying Party also submits that it is not appropriate to further segment the retail mobile telecommunications services market on the basis either of post-paid and pre-paid customers, or of network technology. A company offering only pre-paid or post-paid services could start offering the other type of services without incurring significant additional cost, as the network used for both services is the same. Moreover, all MNOs active in Austria could offer 4G services in parallel with 2G and 3G services at no extra cost.

(120) The Commission considers that, in line with its previous practice,69 the product market for retail mobile telecommunications includes mobile services such as voice, SMS/MMS, data and international roaming services.

(121) The Commission has also considered whether the product market can be further segmented between residential and business customers. The market investigation in the present case is not conclusive in this regard.70

(122) As for the inclusion of OTT services in the relevant market, the majority of respondents consider that OTT services are not part of the market for the provision of mobile telecommunications services.71

(123) For the purpose of the present decision, the exact product market definition in relation to the provision of retail mobile telecommunications services can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any possible market definition.

3.2.1.2. Geographic market definition

(124) The Notifying Party considers that the market should be considered national in scope in line with previous Commission's decisions.

(125) The Commission has consistently found that the markets for retail mobile services provided to end consumers are national in scope.72

(126) The majority of respondents to the market investigation in the present case indicated that the market for the provision of retail mobile telecommunications services is national in scope.73 Licenses are granted on a nation-wide basis and the competitive conditions existing in each Member State are still different.

(127) The Commission considers the retail market for mobile telecommunications services to be national in scope.

3.2.1.3. Affected markets

(128) The retail market for mobile telecommunications services in Austria and its potential segments for private and for business customers are horizontally affected. In the overall retail market for mobile telecommunications sector (excluding OTT services), the Parties have a combined share of [20-30]% in Austria (UPC with [0-5]% and TMA with [20-30]% in terms of subscribers). On the potential segment for residential customers the Parties have a combined share of [20-30]% (UPC with [0-5]% and TMA with [20-30]% in terms of subscribers) and on the potential segment for business customers the Parties have a combined share of [20-30]% (UPC with [0-5]% and TMA with [20-30]% in terms of revenues) in Austria.74

(129) The retail market for mobile telecommunications services in Austria and its potential segments for private and for business customers are vertically affected insofar as they are related to the upstream wholesale market for mobile access and call origination on which TMA has a market share of approximately [70-80]% in terms of subscribers and [80-90]% in terms of revenues. In addition, the retail market for mobile telecommunications services in Austria and its potential sub-segments for private and for business customers are also (technically) vertically affected due to a vertical link with (i) the upstream wholesale markets for international roaming services in other Member States in which DTAG offers international roaming services (provided that DTAG has a market share of more than 30% on such national wholesale market for international roaming services), and (ii) the upstream markets for call termination services on mobile and fixed networks on which TMA, UPC and DTAG (outside Austria) are active. Finally, the Parties' activities on the retail market for mobile telecommunications services in Austria are vertically affected insofar as there is a vertical link to the Parties' activities on the wholesale market for leased lines to the extent that this market is defined locally and the combined market shares of the Parties are equal or more than 30% in the respective commune75.

3.2.2. Wholesale access and call origination services on mobile networks

(130) MNOs, such as TMA, provide wholesale access and call origination services, which enable operators without their own mobile network, MVNOs, to provide retail mobile services to end customers. There is a wide variety of MVNOs, ranging from MVNOs that have a fully operational proprietary core network and that purchase access to the radio access network of MNOs on the one end, to pure re-sellers of a MNO services on the other end.

3.2.2.1. Product market definition

(131) The Notifying Party submits that there is an overall wholesale market for access and call origination on mobile networks, without any further segmentation by type of service (i.e. access and call origination) or by type of MVNO (i.e. full MVNOs, light MVNOs or branded resellers). In any case, the Notifying Party submits that the exact product market definition in this case can be left open.

(132) The Commission has previously defined a single wholesale market including both access and call origination on mobile networks without segmenting the market by type of services on mobile networks, since MNOs generally supply these services jointly to MVNOs and both services are essential to MVNOs.76 The Commission sees no reason to depart from this approach in the present case.

(133) The Commission has also considered that branded resellers should not be regarded as buyers of wholesale access to a network as they merely resell SIM cards and services of an MNO under a different brand.77 For the purpose of the present decision, the question whether branded resellers should be included as buyers of wholesale access to a network can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any possible market definition.

3.2.2.2. Geographic market definition

(134) In line with previous Commission decisions, the Notifying Party considers that the relevant geographic scope of the market for wholesale access and call origination on mobile networks is national, limited to the territory of Austria.78

(135) The Commission considers that the relevant geographic market is national.

3.2.2.3. Affected markets

(136) The wholesale market for access and call origination services on mobile networks is not horizontally affected since only TMA is active on this market. However, since TMA's market share on the wholesale market for access and call origination services on mobile networks is approximately [70-80]% in terms of subscribers and approximately [80-90]% in terms of revenues and UPC is active on the downstream retail mobile market as MVNO, this market is vertically affected.

3.2.3. Wholesale mobile call termination services

(137) When someone calls a mobile phone connected to a different network that call is terminated on the network of the receiving mobile phone. In order for a retail mobile service provider to be able to provide calls to a different network, it must purchase wholesale terminations services on these other networks. This is done through interconnection agreements between the various network operators.

3.2.3.1. Product market definition

(138) The Notifying Party submits that each individual mobile network constitutes a separate market for call termination because the operator transmitting the call can reach the intended recipient only through the operator of the network to which the recipient is connected. There is thus no substitute for call termination on each individual network.

(139) The Notifying Party submits that also full MVNOs (such as UPC) provide wholesale call termination services given that full MVNOs own certain parts of the mobile core network.79

(140) The Commission considers that there is no substitute for call termination on each individual network since the operator transmitting the outgoing call can reach the intended recipient only through the operator of the network to which the recipient is connected.

(141) The Commission concludes, in line with previous decisions, that termination on each individual mobile network constitutes a separate product market.80 As for the question whether full MVNOs also provide wholesale call termination services, for the purpose of the present decision it can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any possible market definition.

3.2.3.2. Geographic market definition

(142) In line with previous Commission decisions, the Notifying Party submits that the market for mobile call termination services should be considered national in scope.

(143) The Commission concludes, in line with previous decisions81, that the market for mobile call termination services is national in scope.

3.2.3.3. Affected markets

(144) The wholesale market for mobile call termination services is horizontally not affected since each network constitutes a separate relevant market. However, since each of the Parties has a 100% market share on the wholesale market for mobile call termination services on its own mobile networks and each of the Parties is active in the downstream retail markets (mobile and fixed telecommunications services), the wholesale markets for mobile call termination services where the Parties are active, in Austria and in other Member States (for TMA/DTAG)82, are vertically affected.

3.2.4. Wholesale market for international roaming

(145) For a provider of retail mobile services to be able to provide its end customers with telecommunication services outside their home countries, it enters into wholesale roaming agreements with providers of wholesale international roaming on other national markets. Roaming consists of both terminating calls and originating calls.

(146) Retail mobile service providers sometimes have preferred roaming partners in certain countries. This means that the preferred partners' network will be used in the first instance when it has coverage and the mobile user has not manually chosen a different network. A home network will normally have multiple agreements with operators in a particular county in order to provide optimal coverage.

3.2.4.1. Product market definition

(147) In line with previous Commission decisions, the Notifying Party submits that there is a relevant product market for wholesale international roaming services.

(148) Wholesale international roaming services are regulated.83 Mobile network operators must meet all reasonable requests for wholesale roaming access under a reference offer and wholesale charges for the making of regulated roaming services (voice, message and data roaming) are capped.

(149) The Commission concludes, in line with previous decisions, that the market for international roaming comprising both terminating calls and originating calls constitutes a separate product market. 84

3.2.4.2. Geographic market definition

(150) In line with previous Commission decisions, the Notifying Party submits that the relevant geographic scope of the market for the supply of wholesale international roaming services is national.

(151) In previous decisions, the Commission found that the wholesale market for international roaming is national in scope, given that wholesale international agreements can be concluded only with companies which have an operating licence in the relevant country and the licences to provide mobile services are restricted to a national territory.85

(152) The Commission concludes that the markets for international roaming are national.

3.2.4.3. Affected markets

(153) The wholesale market for international roaming is horizontally not affected since UPC is not active in this market. However, since DTAG is active in the wholesale market for international roaming in Member States other than Austria86 and UPC is active in the downstream retail market for the provision of mobile telecommunications services in Austria, the wholesale markets for international roaming in other Member States where DTAG is active and has a market share of more than 30%, are vertically affected.

3.3. Fixed telephony and related services

3.3.1. Retail market for the supply of fixed telephony services

(154) On the market for retail supply of fixed telephony services, operators provide fixed voice services to end-customers. In line with previous Commission decisions, fixed voice services include the provision of connection services or access at a fixed location or address to the public telephone network for the purpose of making and receiving calls and related services.87

3.3.1.1. Product market definition

(155) The Notifying Party submits that there is an overall retail fixed telephony services market, which includes managed VoIP services, in line with recent Commission decisions.

(156) In previous decisions, the Commission considered that a distinction between local / national and international calls as well as between residential and business customers may not be relevant.88 The Commission did not take a definitive view with regard to these possible further segmentations of the retail fixed voice services market. The Commission concluded however that traditional fixed voice services and managed VoIP services are interchangeable within a single market for the retail supply of fixed voice services.89

(157) For the purpose of the present decision, the exact product market definition can be left open as the Transaction does not raise serious doubts as to its compatibility with the internal market under any possible market definition.

3.3.1.2. Geographic market definition

(158) The Notifying Party considers the market to be national in scope, based on the Commission's precedents.

(159) The Commission considers the market for the supply of fixed telephony service to be national in scope.

3.3.1.3. Affected markets

(160) The market for retail supply of fixed telephony services is horizontally not affected since only UPC is active on this market, with a market share of [10-20]% in revenue and [10-20]% in subscribers.90 However, since TMA has a 100% market share on the upstream wholesale market for mobile call termination services on its own mobile network in Austria and DTAG has a 100% market share on the upstream wholesale markets for mobile and fixed call termination services in other Member States, the market for retail supply of fixed telephony services in Austria is vertically affected. In addition, the market for retail supply of fixed telephony services in Austria is vertically affected also insofar as there is a vertical link to the wholesale leased lines market if defined on the level of communes, in 24 communes where TMA is active and the Parties combined market share is equal or larger than 30%.91

3.3.2. Wholesale market for fixed call termination services