Commission, December 11, 2018, No M.8950

EUROPEAN COMMISSION

Judgment

BASF DOM BUSINESS / SOLENIS / JV

Subject: Case M.8950 – BASF DOM Business/Solenis/JV Commission decision pursuant to Article 6(1)(b) of Council

Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 6 November 2018, the Commission received notification of a concentration pursuant to Article 4 of Regulation (EC) No 139/2004 (‘the Merger Regulation’) which would result from a proposed transaction by which BASF SE (“BASF”, Germany) and Clayton, Dubilier & Rice (“CD&R”, United States) intend to acquire joint control, within the meaning of Article 3(1)(b) and 3(4) of the Merger, over a newly formed Joint Venture that would combine Solenis, a CD&R portfolio company, with the global paper and water chemicals business of BASF SE (“BASF DOM”) (the “JV” or “the combined entity”) (3).

(2) In this Decision, BASF (including BASF DOM) and Solenis are collectively referred to as the 'Parties’ or “the Notifying Parties”.

1. THE PARTIES

(3) BASF is a publicly traded company and its business focuses on chemicals (e.g. petrochemicals and intermediates), performance products (e.g. dispersion and pigments), functional materials and solutions (e.g. construction chemicals and coatings), oil and gas, and agricultural solutions.

(4) BASF DOM comprises all the assets constituting BASF’s global business in developing, manufacturing, marketing and selling wet-end paper chemicals and water treatment chemicals.

(5) CD&R is a private equity investment group based in the US that originates, structures, and frequently acts as lead equity investor in management buyouts, strategic minority equity investments and other strategic investments.

(6) Solenis, a CD&R portfolio company, is a specialty chemical company and provider of process and water solutions. Solenis’ product portfolio includes process aids, water treatment chemistries, functional additives and monitoring and control systems.

2. THE OPERATION

(7) The notified concentration consists of the acquisition of joint control over a newly formed JV by BASF and CD&R. Subsidiaries of Solenis would acquire BASF DOM, and a direct wholly owned subsidiary of BASF would acquire an approximate [CONFIDENTIAL] interest in “UK Topco”, a newly formed parent company of Solenis. Both BASF and CD&R would have veto rights that grant them the possibility to exercise decisive influence over UK Topco. This means that CD&R and BASF would acquire joint control over UK Topco, which would indirectly hold the combined Solenis and BASF DOM businesses (the “Transaction”).

(8) Following the Transaction, the JV would perform all the functions of an autonomous undertaking on a lasting basis. In this respect, the Commission notes that, pre-Transaction, Solenis is already operating independently on the market, with an established market presence and sufficient resources. The JV would continue Solenis' existing business, combining it with BASF DOM, and would therefore continue to operate independently on the market, with sufficient resources and its own access to the market (with activities beyond one specific function of the parent companies). Moreover, the JV is expected to operate on a lasting basis as it is not incorporated for a specific period of time.

(9) Therefore, the Transaction would result in a concentration within the meaning of Articles 3(1)(b) and 3(4) of the Merger Regulation.

3. UNION DIMENSION

(10) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (4) (BASF EUR 64 475 million, CD&R EUR [CONFIDENTIAL] million). Each of them has a Union-wide turnover in excess of EUR 250 million (BASF EUR [CONFIDENTIAL] million, CD&R EUR [CONFIDENTIAL] million), but neither of them achieves more than two-thirds of their aggregate Union-wide turnover within one and the same Member State.

(11) Therefore, the notified concentration has a Union dimension within the meaning of Article 1(2) of the Merger Regulation.

4. MARKET DEFINITION

4.1. End Chemicals with Paper and Pulp Applications

(12) In previous decisions (5), the Commission considered that paper and pulp chemicals could be categorised into (i) commodity chemicals, (ii) process chemicals, and (iii) functional chemicals:

- Commodity chemicals are non-specialty chemicals which are generally inexpensive and suitable for multiple different applications and industries;

- Process chemicals are used to improve the efficiency of and to provide ecological advantages to the production process itself, including preventing deposit and foam build-up, reducing the consumption of fresh water and energy and improving the drainage and/or reduction in fibre losses; and

- Functional chemicals are designed to impart various properties to the finished paper product ranging from enhanced optical properties and improved strength to enhanced printability, depending on the paper type produced, including paper for newspapers and magazines, printing paper, sanitary and household paper, packaging material and other specialised paper.

(13) BASF DOM and Solenis are not involved in the production of commodity chemicals. These chemicals will therefore not be considered further for the purpose of this Decision.

4.1.1. Process Chemicals

(14) As described above, process chemicals are used to improve the paper and pulp making process.

(15) In Clayton Dubilier & Rice/Ashland Water Technologies and CIBA/Raisio Chemicals, the Commission considered that process chemicals could be further sub-segmented into the following individual markets: (6) (a) Defoamers, (b) Contaminant Control Agents (“CC”), (c) Retention and Drainage agents (“RDA”), and (d) Biocides and slimicides (“BSA”). (7)

(a) Defoamers

(16) Defoamers are chemical agents that remove, prevent, and block foam in manufacturing processes in all water-reliant processing industries. The build-up of foam can have a significant adverse effect on production processes and is a manufacturing hazard in a wide range of industries relying on liquids either as part of the production process or in the paper product itself. Defoamers can be based on several different chemicals, including silicone and silica, ethylene oxide/propylene oxide (“EO/PO”) surfactants, polyethylene glycol (“PEG”) and fatty acids and alcohols.

(17) As regards product market definition, the Commission previously considered the defoamers market in Ashland/Hercules and in Clayton […]* & Rice/Ashland Water Technologies, (8) but ultimately left open the question of whether the product market was limited to the defoamers supplied to the pulp and paper industry or whether the product market should include all defoamers.

(18) The Parties submit that, due to demand-side and supply-side substitutability, the market should be defined broader than the supply of defoamers to the paper and pulp industry. According to the Parties, there is no difference between the chemistries in the defoamers used in the paper and pulp industries and those used by other industries. The Parties also submit that Solenis, and the majority of its main competitors, supply defoamers to all industries.

(19) The Parties add that no separate markets should be defined for defoamers based on the defoamer chemistry. Defoamers of different chemistry are largely used interchangeably across industries.

(20) As for geographic market definition, the Commission considered in previous decisions that the geographic market for defoamers is at least EEA-wide, but ultimately left the precise geographic market definition open (9). The Parties submit that the geographic market is at least EEA-wide in scope. According to the Parties, customers have no national preferences and the commonality of products across different countries is supported by EU-wide standards with regard to environmental and production processes.

(21) In any event, for the purposes of this Decision, it can be left open whether defoamers for the paper and pulp industry constitute a relevant product market separate from defoamers used in other industries, and whether there are separate product markets for defoamers based on their chemical components, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition. The exact geographic scope of the market for defoamers can also be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition.

(b) Contaminant Control Agents ("CC")

(22) CC are used to prevent particle contamination in manufacturing processes. They remove contaminants altogether or are used to break them down into smaller particles which can be washed away easily or scraped away in a next production step. The paper and pulp industry uses CC to eradicate contaminants that can have a negative impact on both the machinery and the end-product.

(23) According to the Parties, the main types of CC are (i) fixation agents, (ii) dispersion agents and (iii) adsorption agents. The Parties submit that the various types of CC all serve the same purpose. Each type of CC utilises a different mechanism to solve the same underlying problem. In Clayton Dubilier & Rice/Ashland Water Technologies, the Commission considered all types of CC to belong to a single relevant product market including fixation agents, dispersion agents and adsorption agents but eventually left open the question of precise market definition. (10) In BASF/CIBA, the Commission examined fixation agents (or fixatives) as a distinct relevant product market but ultimately left open the relevant product market definition. (11)

(24) With regard to geographic market definition, the Commission in its past decisional practice considered the market for the supply of CC to be EEA-wide, but ultimately left the issue open. (12) The Commission also considered the market for fixation agents to be at least EEA-wide but eventually left open the precise geographic market definition. The Parties submit that the relevant markets are EEA-wide, reflective of trans-border production and supply, competition and a customer base that is dispersed across the EEA.

(25) In any event, for the purpose of this Decision, it can be left open whether the relevant product market includes all CC or whether there is a distinct relevant market for fixation agents, since no serious doubts arise under any plausible product market definition. The exact geographic scope of the market can also be left open, since no serious doubts arise under any plausible geographic market definition.

(c) Retention and Drainage Aids ("RDA")

(26) RDA are added to the pulp at the wet end of the paper and pulp making process, during sheet formation and while promoting the drainage of water. Poor retention and/or drainage creates several problems with the production process (e.g., higher consumption of chemicals) and the quality of the final product. RDA compensate the negative anionic surface charges on the fillers, fibres and fines by forming molecular bridges between two particles to which they are absorbed. In so doing, RDA flocculate the fillers, fibres and fines into the pulp mat during sheet formation to prevent them from being drained away.

(27) The Commission considered in previous decisions all RDA to belong to a single product market, (13) but also considered a sub-segmentation of RDA into (i) RDA based on polymers such as PAM, PEI and PVAm, (ii) RDA based on dual/multicomponent systems and (iii) RDA including inorganic micro particles such as silica or bentonites. The Commission ultimately left the product market definition open. (14)

(28) The Parties submitted that there is one single relevant market for RDA which must not be further sub-segmented. There is a high degree of substitutability between the different types of RDA and customers easily switch between retention and drainage aid chemical suppliers. In any event, the Parties explained that all RDA are based on polymers and that dual/multi-component systems can also include inorganic micro particles. On that basis, the Parties submitted that the tripartite classification of RDA that the Commission considered in BASF/CIBA should be understood as follows: (i) RDA based on a single polymer such as PAM, PEI, and PVAm (single-polymer RDA); (ii) RDA based on more than one polymers but excluding micro particles (multi-polymer RDA); and (iii) RDA including micro particles (micro-particle RDA). However, according to the Parties, any such segmentation “would be artificial and would not properly reflect demand”. (15)

(29) As for geographic market definition, the Commission in its past decisional practice considered the geographic market for RDA to be at least EEA-wide, but ultimately left the product market definition open (16). The Parties agree that the geographic market definition is at least EEA-wide.

(30) In any event, for the purposes of this Decision, it can be left open whether the relevant product market includes all RDA or whether there are distinct relevant product markets for (i) single-polymer RDA; (ii) multi-polymer RDA; and (iii) micro particle RDA since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition. The exact geographic scope of the market for RDA can also be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible geographic market definition.

4.1.2. Functional Chemicals

(31) Functional chemicals are used to determine the specific properties of the end- product. Property alterations include increasing tensile strength, improving water resistance and varying colour and brightness. In its past decisional practice, the Commission considered that the following categories of functional chemicals could be considered as separate markets: (i) Dry […]* Agents (“DSA”), (ii) Wet […]* Agents (“WSA”) and (iii) Sizing Agents (17).

(b) Dry Strength Agents ("DSA")

(32) DSA improve the bonds between fibres of paper to impart additional strength. DSA are specifically […]** on improving the general strength of paper and board in the dry state, in order to obtain the same strength at lower weight and generally improve the mechanical properties of the finished product. There are two types of DSA: (i) natural starch-based DSA and (ii) synthetic DSA, including products based on gPAM, PVAm, PAE resins, cellulose enzymes and carboxymethyl cellulose ("CMC").

(33) Regarding product market definition, the Parties submit that the market covers all DSA used in the paper and pulp industry, namely natural starch-based DSA and synthetic DSA. The Parties argue that further segmenting DSA does not reflect the current and future demand patterns. According to the Parties, customers regularly combine natural and synthetic DSA in their processes and both types of DSA are interchangeable.

(34) In BASF/CIBA (18), the Commission considered natural starch-based DSA and synthetic DSA constitute two separate relevant product markets. The market investigation in the present case confirmed this. The majority of both informative respondents stated that starch-based DSA and synthetic DSA are not substitutable with each other. (19)

(35) The Commission also considered whether the relevant market for synthetic DSA should be further sub-segmented based on the chemistry of each DSA (i.e., whether there should be distinct relevant markets for gPAM-based DSA, PVAm-based DSA, etc). The market investigation showed that there are no distinct relevant markets for synthetic DSA of different chemistry. Customers and competitors indicated that DSA are purchased on the basis of their functionality – not their chemistry. (20) One customer added that for dry strength, it often purchases packages of products with different chemistries. (21)

(36) As for geographic market definition, the Commission in a previous decision considered the market for synthetic DSA to be at least EEA-wide, but ultimately left the issue open. (22) The Parties submit that the market for DSA is at least EEA- wide, referring to the absence of national preferences of customers, low transport costs and comparable prices throughout the EEA.

(37) The market investigation in the present case confirmed that the market for synthetic DSA is likely EEA-wide. The vast majority of informative customer respondents sourced synthetic DSA solely from the EEA irrespective of the chemistry included in the synthetic DSA. (23) The majority of competitors added that they do not compete with players located outside the EEA in the supply of synthetic DSA. (24)

(38) For the purposes of this Decision, the Commission concludes that the relevant product market includes all synthetic DSA. The exact geographic scope of the market for synthetic DSA can be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible geographic market definition.

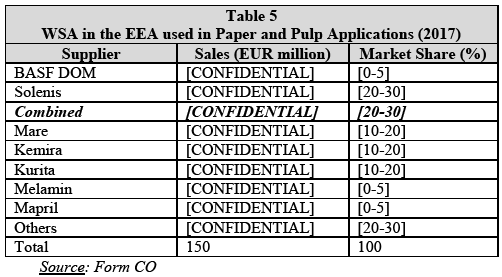

(b) Wet Strength Agents ("WSA")

(39) WSA chemicals improve the properties of paper in both wet and dry state by creating stronger permanent molecular bonds. The aim is to improve the tensile strength of the paper product when wet to minimise rupture during use (e.g. kitchen paper towelling). Another application for WSA is packaging and paperboard (e.g. paper sacks, cardboard, fruit trays). WSA are based on different types of resins including PAE resins; glyoxal resins; amino resins; and PVAm resins.

(40) In BASF/CIBA, the Commission stated that WSA must be distinguished from DSA. (25) But it has not assessed in detail the relevant product market definition. The Parties submit that WSA constitute a separate relevant product market encompassing all different types of resins.

(41) As regards the geographic market definition, the Parties submit that the market for WSA is EEA-wide because market characteristics; demand; and regulation for WSA is similar across the EEA.

(42) In any event, for the purposes of this Decision, it can be left open whether there is one relevant product market including all WSA or whether there are distinct relevant product markets for PAE resin-based WSA; glyoxal-based resin WSA; amino resin-based WSA; and PVAm resin-based WSA, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition. The exact geographic scope of the market can be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible geographic market definition.

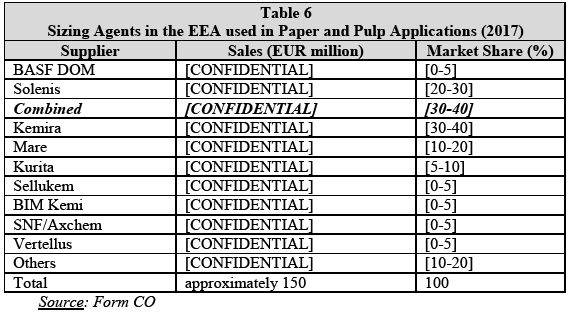

(c) Sizing Agents

(43) Sizing agents are used in the paper and pulp industry during paper manufacturing to provide resistance to liquid penetration, control the spread of inks and impart other performance-related properties (i.e abrasiveness, creasibility, finish, printability, smoothness and surface bond strength, while decreasing surface porosity and fuzzing).

(44) There are two types of sizing agents, depending on where in the paper-making process they are added: (i) internal sizing agents and (ii) surface sizing agents. The former are mixed into the pulp slurry before sheet formation on the machine, while the latter are applied after sheet formation at the size press.

(45) As regards relevant product market definition, the Commission acknowledged in previous decisions that sizing agents may be segmented into internal sizing agents and surface sizing agents, and that within internal sizing agents a further distinction could be made based on the chemical components. (26) The Commission ultimately left the issue open. The Parties consider that all sizing agents belong to one single relevant product market. However, they ultimately conclude that the issue can be left open.

(46) As regards the geographic market definition, the Commission in past decisions considered that the market for sizing agents is at least EEA-wide but ultimately left the issue open. (27) The Parties agree that the market for sizing agents is EEA- wide in scope, because product prices are comparable within the EEA and most customers and suppliers operate across the EEA.

(47) In any event, for the purposes of this Decision, it can be left open whether there is one single market including all sizing agents or whether there are separate product markets for surface sizing agents and internal sizing agents or whether there are separate product markets within internal sizing agents based on product chemistry, since no serious doubts arise under any plausible product market definition. The exact geographic scope of the market for sizing agents can also be left open, since no serious doubts arise under any plausible geographic market definition.

4.2. End Chemicals with Water Treatment Applications

(48) Water treatment is the process of removing impurities that are present in the water using either mechanical or chemical processes to make it more suitable for use for either industrial or human consumption.

(49) According to the Parties, the relevant product market includes all water treatment chemicals. The Parties submit in this respect that, even though there are certain differences between the municipal and industrial water treatment, there are also many similarities between the chemistries used. However, the Parties submit that, for the purpose of this Decision, the water treatment chemicals market can be sub-segmented into: (i) chemicals for municipal water treatment and (ii) chemicals for industrial water treatment could be considered as relevant.

(50) In its past practice, the Commission considered water treatment chemicals as forming a separate relevant product market. The Commission also considered that there could be distinct relevant product markets for (i) chemicals for industrial water treatment and (ii) chemicals for municipal water treatment. But ultimately the issue was left open. (28)

(51) In previous decisions, the Commission has considered the markets for (i) chemicals for industrial water treatment and (ii) chemicals for municipal water treatment to be likely EEA-wide in scope. The exact market definition was however left open. (29) The Parties agree that these relevant markets are at least EEA-wide.

4.2.1. Industrial Water Treatment Chemicals

(52) Within chemicals for industrial water treatment, the Commission considered in past decisions distinct relevant markets for (i) chemicals for water cooling and boiler applications and (ii) chemicals for influent and effluent water treatment (30). The exact product market definition was ultimately left open.

(53) Chemicals for water cooling and boiler applications aim at ensuring safe and efficient operations by preventing corrosion and eliminating scale and deposition. In previous decisions, the Commission has left the exact scope of the product market for chemicals for water cooling and boiler applications open (31). The Parties submit that the exact product market can be left open as the Transaction does not raise concerns under any plausible product market definition.

(54) Chemicals for influent and effluent water treatment are supplied for the treatment of influent water, that is water that goes into an industrial plant and which is used in the production process and effluent water, i.e. waste water that flows from an industrial plant. In its previous decisions, the Commission considered whether to distinguish the market for influent and water treatment chemicals into coagulants and flocculants or based on the physical forms in which chemicals for influent and effluent water treatment are sold. (32) The Commission ultimately left the exact product market definition open. The Parties submit that the exact product market can be left open as the Transaction does not raise concerns under any plausible product market definition.

(55) In past decisions, the Commission considered whether the above relevant markets are EEA-wide in scope. The Commission ultimately left the exact geographic market definition open. (33) The Parties agree that these relevant markets are at least EEA-wide.

4.2.2. Municipal Water Treatment Chemicals

(56) In previous decisions, the Commission considered whether the market for municipal water treatment chemicals should be further segmented into (i) municipal wastewater treatment chemicals and (ii) chemicals for treatment for potable water. However, the Commission ultimately left the exact product market definition open (34). The Parties submit that the exact product market can be left open as the Transaction does not raise concerns under any plausible product market definition.

(57) In past decisions, the Commission considered whether the above relevant markets are EEA-wide in scope. The Commission ultimately left the exact geographic market definition open. (35) The Parties agree that these relevant markets are at least EEA-wide.

4.2.3. Conclusion

(58) For the purpose of this Decision, the Commission considers that it can be left open whether there is a relevant market for all water treatment chemicals or whether there are separate relevant markets for chemicals for industrial water treatment and chemicals for municipal water treatment, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition.

(59) The Commission also considers that the question whether within industrial water treatment chemicals, distinct relevant markets can be defined for (i) chemicals for water cooling and boiler applications and (ii) chemicals for influent and effluent water treatment can be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition.

(60) Similarly, the Commission also considers that the question whether within municipal water treatment chemicals, distinct relevant markets should be defined for (i) municipal wastewater treatment chemicals and (ii) potable water treatment chemicals can be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition.

(61) The exact geographic scope of the market can also be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible geographic market definition.

4.3. End Chemicals Divided by Chemistry

(62) End chemicals with different functionalities (e.g., DSA or RDA) are often based on the same chemistry. Moreover, a single end chemical product can have several functionalities, if its chemistry so allows.

(63) The Commission considered whether separate relevant markets can be delineated for end-chemicals with paper and pulp applications on the basis of the product's chemistry.

4.3.1. PVAm-based chemicals

(64) The polymer polyvinylamine ("PVAm") can be used in functional chemicals to increase the dry strength of the paper product. It can also be used in process chemicals for retention and drainage during the paper and pulp making process.

(65) The Parties submitted that there is no separate relevant market for PVAm-based chemicals. Relevant markets in end chemicals for paper and pulp applications should be defined based on functionality, i.e., the parameter that is most relevant to customers. In more detail, according to the Parties: (36)

- Each of the effects for which PVAm is used in papermaking can be, and is, successfully achieved by other chemistries (e.g. cationic starches, cationic PAM, gPAM, amphoPAM) or through process modifications (e.g. different fibre mix, or small modifications to the paper machine). There is no specific functionality or application requiring PVAm-based chemicals;

- From a demand-side perspective, customers (i.e. paper mills) do not purchase end chemicals based on their chemistry. Rather, they ask suppliers to present offers for a dry strength programme or a retention & drainage programme;

- From a supply-side perspective, end chemicals for paper and pulp applications are not marketed with a specific reference to their chemistry. These chemicals are typically sold under the supplier's brand (e.g., BASF DOM's PVAm-based product is called Xelorex) and no specific reference is made to the product's chemistry. Marketing of end chemicals for paper and pulp applications focuses on explaining the properties of the product to customers but no the underlying chemistry;

- There is no grade of paper which requires or which lists PVAm as its component. Industry guidance (37) summarizing the requirements for different paper grades refers to the functionality of the paper and not its components, e.g., PVAm; and

- None of the main market studies on chemicals for paper and pulp applications suggests separate relevant markets based on the chemistry of the products.

(66) The market investigation confirmed the position of the Notifying Parties that no separate relevant market should be defined for PVAm-based end chemicals in the paper and pulp sector. In more detail:

- The vast majority of informative customer respondents explained that end chemicals for paper and pulp applications are purchased on the basis of their functionality – not their chemistry. (38) Customers added that for a given functionality (e.g., dry strength) they often purchase packages of products with different chemistries. (39) Several customers acknowledged that they did not know what the chemistry in the products purchased for retention and drainage or for dry strength is. As one customer put it, "suppliers make available safety data sheets in the course of the product trials, but these sheets are not always clear on the active ingredients that the product combines"; (40)

- Customers trial gPAM-based or cPAM-based chemicals when they seek to switch away from PVAm-based chemicals. Several customers who consider switching away from a PVAm-based product have completed lab trials or engaged in commercial discussions with suppliers of gPAM-based or cPAM- based chemicals. (41) According to one of the respondents, "PVAm-based products are substitutable with products containing different chemistries, as long as they all have the same functionality. [We] would consider replacing [a PVAm-based product] with a gPAM-based or a cPAM-based product used for retention and drainage and dry strength… PVAm is one chemistry among others"; (42)

- Customers use PVAm-based chemicals typically only in one of their plants while they use products of a different chemistry to achieve the same result (e.g., increased dry strength) in other plants. Yet, customers explained that the paper product must be of a consistent quality irrespective of the plant where it was manufactured and of the chemistries used. This indicates that customers do not consider PVAm-based chemicals as essential to impart specific qualities to the paper product;

- Market respondents also suggested a supplier of end chemicals with paper and pulp applications can easily start supplying PVAm-based chemicals. The cost of the reactors required to manufacture PVAm is limited. One of the competitors of the Notifying Parties, who manufactures PVAm-based chemicals in the EEA, stated that it has spare capacity and that it could make available PVAm-based chemicals for resale in the EEA to any supplier who would require so. (43)

(67) Based on the results of the market investigation, the Commission concludes that there is no distinct relevant product market for PVAm-based chemicals with paper and pulp applications.

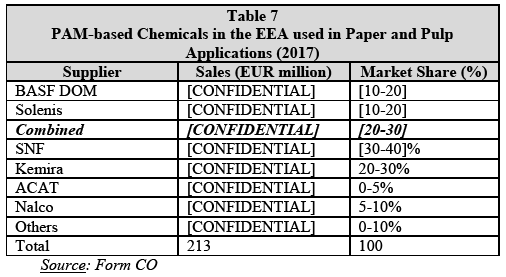

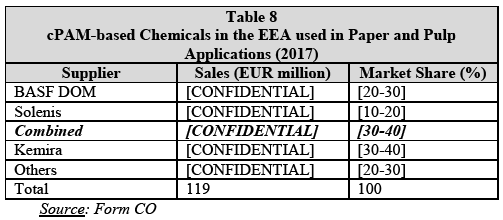

4.3.2. PAM-based Chemicals and cPAM-based Chemicals

(68) Polyacrylamide (“PAM”) is a water soluble polymer which can be anionic ("aPAM"), cationic ("cPAM") or non-ionic. It has a medium to high molecular weight and is used to flocculate solids in solutions containing organic and inorganic chemical substances. PAM is produced as liquid, powder or emulsion. It is mainly used as an input chemical in the manufacture of waste water products or water treatment products, for paper manufacturing and for mineral processing. In the paper and pulp sector, cPAM is used predominantly for retention and drainage but also for contaminant control purposes and to impart wet strength to the paper product. Other types of PAM (e.g., aPAM) can be used to impart dry strength to the paper product.

(69) The Parties submitted that customers (i.e. paper mills) do not purchase end chemicals based on their chemistry. Rather, they ask suppliers to present offers for a programme to achieve a specific functionality, e.g., retention and drainage. The Parties added that in each product market where the Parties offer PAM- based or (more specifically) cPAM-based products, usually several alternative formulations are available on the basis of different chemistries and they all compete with each other if they can achieve comparable results. (44)

(70) The market investigation did not provide clear indications whether PAM-based or cPAM-based chemicals constitute distinct relevant product markets. The majority of informative customer respondents stated that cPAM-based chemicals are not substitutable with products based on other chemistries in the EEA for the paper and pulp sector. (45) However, customers also insisted that "it is possible to get similar effects with different basic chemicals". (46) Some customers acknowledged that they do not distinguish end chemicals based on chemistry but only based on functionality. (47)

(71) For the purposes of this Decision, it can be left open whether PAM-based chemicals constitute a relevant product market separate from products based on other chemistries. No serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition (separate relevant product market for PAM-based chemicals or relevant product markets based on functionality as described in paragraphs (12)-(47) above).

(72) It can also be left open whether cPAM-based chemicals constitute a relevant product market separate from products based on other chemistries. No serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible product market definition (separate relevant product market for cPAM-based chemicals or relevant product markets based on functionality as described in paragraphs (12)-(47) above).

(73) The Commission previously considered the geographic scope of PAM to be EEA-wide, however left the precise geographic definition open. (48) The Parties did not contest that the geographic market for PAM-based chemicals, including cPAM-based chemicals, is at least EEA-wide in scope. In any event, the precise definition can be left open, since no serious doubts as to the compatibility of the notified concentration with the internal market arise under any plausible geographic market definition.

4.4. Raw and Intermediate Chemicals

4.4.1. Dimethylaminopropylamine ("DMAPA")

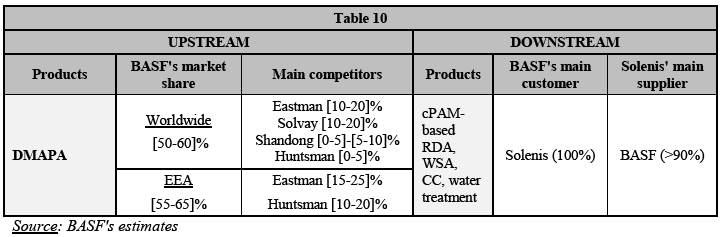

(74) DMAPA is a colourless liquid used as an intermediate commodity chemical. DMAPA is used in the manufacture of betaines which are used as co-surfactants in personal care products like shampoo and body wash. DMAPA is also used in various other applications, such as the production of, inter alia, APTAC and APTAC Q, which Solenis uses to produce, cPAM.

(75) As regards product market definition, in BASF/Cognis, the Commission found that DMAPA constitutes a separate product market. (49)

(76) According to the Parties, DMA3 (ADAME) and DMA3Q (ADAMEQ) could be used as an alternative for the production of cPAM. The Parties therefore submit that the relevant upstream market should be defined widely to include both alternatives for the production of cPAM. However, the Parties also submit the relevant product market can be left open in the absence of vertical concerns.

(77) As regards geographic market definition, in a previous decision, the Commission found that the market for DMAPA was at least EEA-wide, but ultimately left open the question whether the exact geographic scope was EEA- wide or worldwide (50).

(78) The Parties submit that the geographic scope of the market should be worldwide, based on the fact that most DMAPA producers either have a single production plant or two production plants worldwide. The Parties further argue that exports from the EEA are substantial, i.e. [20-30]% of all EEA DMAPA production in 2017.

(79) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of DMAPA in the EEA.

4.4.2. Diethylenetriamine ("DETA")

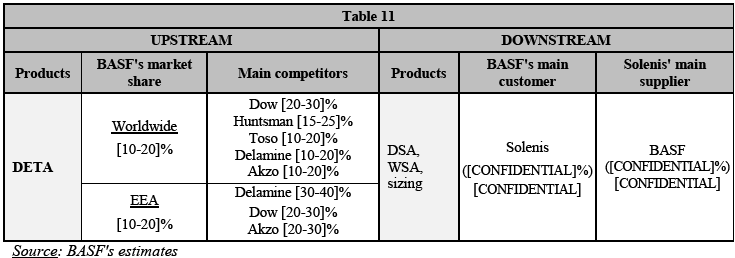

(80) DETA is used mainly as a building block for WSA in the paper industry, in chelating agent synthesis and for detergents. DETA is also used as an intermediate in corrosion inhibitors, polyamide resins, asphalt additives and epoxy hardener systems. Solenis purchases DETA to produce DSA, WSA and sizing agents.

(81) As regards product market definition, in previous decisions, the Commission identified DETA as a sub-segment of the product market for ethylene amines (commodity chemical intermediate products derived from ethylene). In Dow Chemical / Union Carbide (51), the Commission considered different types of ethylene amines (i.e. DETA, AEEA, TETA, TEPA and AEP) as separate product markets, but ultimately left the product market definition open. In Huntsman/CIBA TE business (52), the Commission confirmed each type of ethylene amines is likely to form a separate product market, leaving the exact market definition open.

(82) The Parties do not contest the Commission’s precedents to consider DETA as a separate product market, but submit that the exact product market definition can be left open.

(83) As regards geographic market definition, in previous decisions (53), the Commission considered the market for ethylene amines (including DETA) to be worldwide in scope, but ultimately left the exact market open.

(84) The Parties submit that the geographic market for DETA is worldwide. The Parties argue that transport costs are low and there are no safety or other restrictions to transportation. According to the results of the market investigation, the majority of competitors of the Parties in the supply of DETA consider they compete with suppliers from outside the EEA (54).

(85) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of DETA in the EEA.

4.4.3. Amino ethyl ethanol amine ("AEEA")

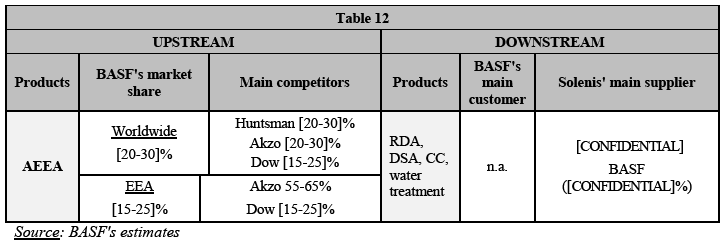

(86) AEEA is a commodity chemical intermediate product, derived from ethylene. AEEA is used for various applications, including epoxy hardeners, fuel additives, chelating agents, surfactants and fabric softeners among others. In paper and water chemicals, AEE is used to produce CC, DSA, RDA and water treatment chemicals.

(87) As regards product market definition, as stated in paragraph (81), the Commission identified AEEA as a sub-segment of ethylene amines in DOW Chemical / Union Carbide (55), but ultimately left the product market definition open. In BASF/Cognis (56), the Commission confirmed that AEEA is likely to be a separate product market, but kept the exact market definition open.

(88) The Parties submit that AEEA forms a single product market, as it is a homogenous product, which differs from other ethylene amines.

(89) As regards geographic market definition, in previous decisions, the Commission considered the geographic market for AEEA to be likely worldwide, but ultimately left the exact geographic scope of the market open.

(90) The Parties submit that the market should be considered as worldwide since substantial amounts of products are imported and exported from and to the EEA, transportation costs are low and there are no significant barriers to import and export AEEA.

(91) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of AEEA in the EEA.

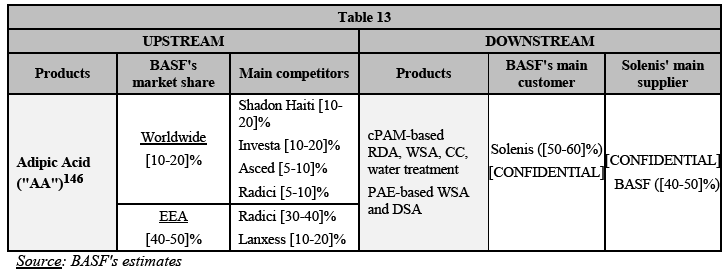

4.4.4. Adipic Acid (“AA”)

(92) AA has multiple downstream applications, including in the automotive, textiles and electronics industries. The foremost application of AA is to produce nylon for the automotive industry. Paper and water chemicals use AA to a limited extend as an input for the production of cPAM and PAE resins for use as WSA and DSA. Solenis purchases its AA from BASF for use as WSA.

(93) As regards product market definition, in Solvay/Rhodia (57), the Commission considered AA as a separate product market, but ultimately left the exact product market definition open. More specifically, the Commission left open the question whether AA and hexamethylene diamine (HMD) belong to the product market.

(94) The Parties submit that AA constitutes the relevant product market upstream, taking into account that HMD cannot be considered as an alternative to AA.

(95) As regards geographic market definition, the Commission considered, in a previous decision (58), the market for AA and HMD to be at least EEA wide. The Parties submit that the exact geographic scope of the market can be left open. According to the results of the market investigation, suppliers of AA consider themselves to be in competition with suppliers of AA located outside the EEA, irrespective of the final application of the AA supplied. (59) However, the majority of customers indicated that they only purchase AA from suppliers located in the EEA, due to the need for consistent quality and security of supply. The results of the market investigation do not change based on the final application of AA (60).

(96) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of AA in the EEA.

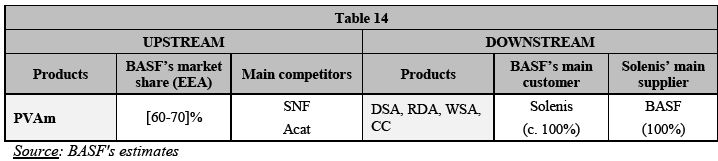

4.4.5. Polyvinylamine (“PVAm”)

(97) PVAm can be used as a viable alternative or complementary chemical to natural starch when applied to increase strength levels. In the paper production processes, PVAm can be used as an input for the manufacturing of DSA, RDA and to a much lesser extent for CC. The Parties submit that PVAm can either be sold as an end-us product or combine with other monomers to produce specialty chemicals for DSA, RDA and to a lesser extent CC.

(98) The Commission has not previously analysed the market for PVAm.

(99) The Parties submit that the relevant product market is PVAm. The results of the market investigation indicate that the majority of the customers consider PVAm as an important input in the manufacturing of CC, RDA and DSA, irrespective of the end-use of the PVAm (61).

(100) According to the results of the market investigation, all customers of PVAm replying to the questionnaire indicated that they source PVAm solely from suppliers inside the EEA, irrespective of the end-use of the purchased PVAm (62).

(101) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of PVAm in the EEA.

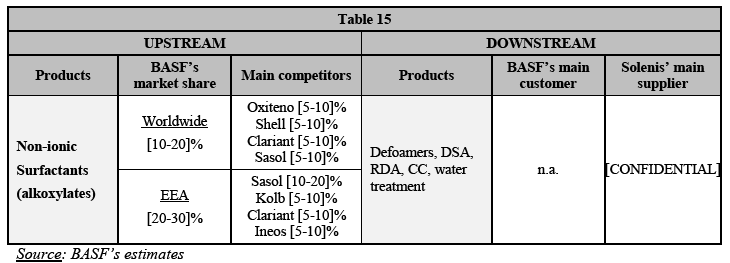

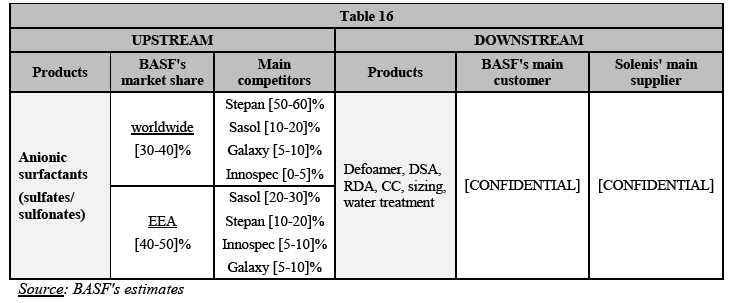

4.4.6. Surfactants

(102) Surfactants are used in the consumer goods sector as inputs for detergents, cleaners and personal care products and in the industrial sector as processing aids.

(103) As regards product market definition, in previous decisions, (63) the Commission found that anionic surfactants (i.e., surfactants with a negative charge, such as sulfates/sulfonates (64)) and non-ionic surfactants (i.e., surfactants with no charge, such as alkoxylates (65)) constitute distinct product markets. The Commission also considered further segmenting the markets of anionic and non-ionic surfactants, but ultimately left the question open.

(104) The Parties submit that the relevant product market for anionic surfactants and non-ionic surfactants can be left open since the Transaction only gives rise to minor vertical links between the activities of the Parties and only with respect the supply of alkoxylates and sulfates/sulfonates.

(105) As regards geographic market definition, in previous decisions, (66) the Commission concluded that the plausible markets for anionic and non-ionic surfactants were at least EEA-wide. The Parties submit that the market for non- ionic surfactants is at least EEA-wide in scope but likely worldwide, while they consider the market for anionic surfactants is worldwide in scope.

(106) According to the results of the market investigation, the vast majority of customers of anionic surfactants source solely from suppliers located in the EEA, irrespective of the use of the anionic surfactants (67). These results are confirmed by the suppliers of anionic surfactants (68).

(107) For the purpose of the present Decision, taking into account the fact that the Transaction only gives rise to vertical links limited to the supply of alkoxylates and sulfates/sulfonates, the Commission considers that the exact product market definition can be left open as no serious doubt as to the compatibility of the notified concentration with the internal market arise under any product market definitions. In relation to the exact geographic scope of the market, the Commission considers that it can be left open, as no serious doubts as to the compatibility of the notified concentration with the internal market arise under the narrowest EEA-wide definition.

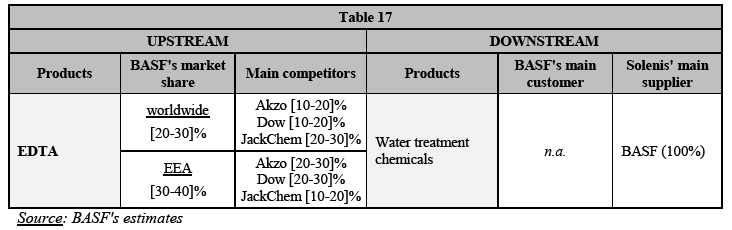

4.4.7. Edetic acid ("EDTA")

(108) EDTA is used for industrial water treatment and many other applications (e.g., laundry detergents, soap, textile processing). In water treatment, EDTA is effective at preventing scale and deposits of calcium carbonate, sulphate, and phosphate from forming in boilers, evaporators, heat exchangers, and filters. In paper & pulp, EDTA use is primarily for mechanical pulping and bleaching with sodium hydrosulfite.

(109) The Commission has not previously analysed the market of EDTA.

(110) The Parties submit that there is some evidence that EDTA can be substituted with at least one aminopolycarboxylic acid chelating agent in the paper & pulp industry. In particular, the Parties argue that EDTA can be (at least partially) substituted by DTPA. The Parties submit that the product market definition should not just include EDTA, but could also include all aminopolycarboxylic acid chelating agents. However, for the purpose of this decision, the Parties submit that the product market definition can be left open.

(111) The Parties submit that the market for EDTA is at least EEA-wide. The Parties also submit that the market for aminopolycarboxylic acid could be global. However, for the purpose of this decision, the Parties submit that the exact geographic scope of the market can be left open.

(112) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of EDTA in the EEA.

4.4.8. Poly-diallyldimethylammonium-chloride ("PolyDADMAC")

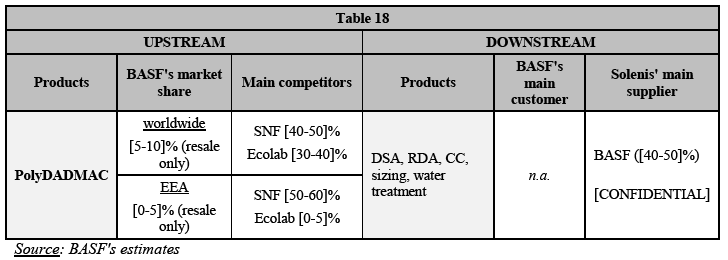

(113) PolyDADMAC is used to produce pulp and paper and water treatment chemicals which can be used to produce CC, DSA, RDA and sizing agents and water treatment chemicals. In addition, PolyDADMAC can also be used as a coagulant for water purification.

(114) As regards product market definition, in BASF/CIBA, (69) the Commission considered a separate market for PolyDADMAC, distinct from the market for DADMAC, but eventually left the question open. The Parties agree that PolyDADMAC is the narrowest possible market definition, but submit that the relevant product market for PolyDADMAC can be left open.

(115) As regards geographic market definition, the Commission also left open the exact scope of the market (EEA-wide or worldwide) (70). The Parties submit that the relevant market is at least EEA-wide, but can be left open between EEA- wide and global

(116) For the purpose of the present Decision, the Commission considers that the manufacture and supply of PolyDADMAC constitutes a separate product market. The exact geographic scope of the market can be left open, as no serious doubts as to the compatibility of the notified concentration with the internal market arise under the narrowest possible EEA-definition.

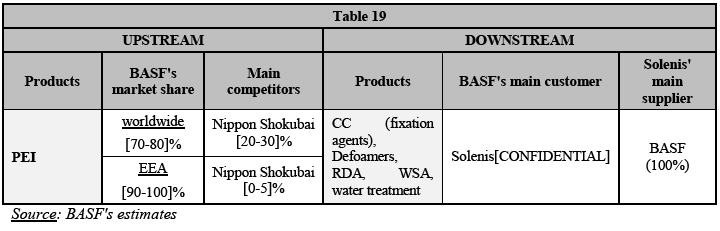

4.4.9. Polyethylenimines ("PEI")

(117) PEI is a polymer which can be used in paper and pulp and water treatment chemicals, as well as in other applications (e.g., detergents, adhesives, and cosmetics). PEI can also be used for CO2 capture and laboratory biology. BASF is the only PEI manufacturer in the EEA.

(118) According to the Parties, PEI is not an intermediate product and that PEI can be either sold by itself or combined with other chemicals as part of a holistic customer solution.

(119) The Commission has not previously assessed the market for PEI. However, in BASF/CIBA (71), the Commission considered that PEI, as well as other highly cationic polymers could be used as a fixation agent and that PEI could also be used as an RDA.

(120) The Parties submit that the relevant upstream market should be determined by end-use, whereby the product market definition would include defoamers, RDA, WSA, CC (fixation agents) and other water treatment chemicals. However, the Parties submit that the exact product market can be left open.

(121) The Parties submit that the geographic market definition is worldwide. According to the results of the market investigation, none of the customers of PEI currently source the product from suppliers from outside the EEA. According to one customer, they would consider a PEI supplier from outside the EEA if a suitable supplier if available (72), suggesting that the market is at least EEA-wide, but could be worldwide.

(122) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of PEI in the EEA.

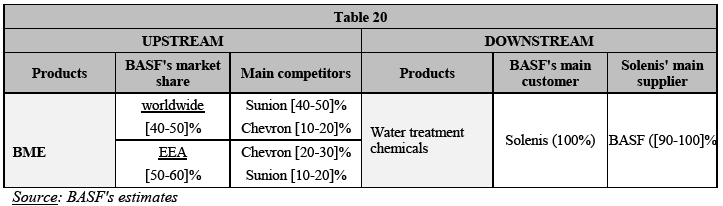

4.4.10. 2-Mercaptoethanol ("BME")

(123) BME is used to produce polyacrylates that are used as inputs for water treatment. The major applications of BME are precursors for PVC stabilizers, boosters, in corrosion inhibitor formulations for oilfield and gas applications, co-monomers for polyurethane based optical lenses, additives for PAN fibres and building blocks for agriculture and pharmaceuticals. Solenis uses BME as an input in the product of various products, among which industrial water treatment chemicals as well as CC, DSA and RDA.

(124) The Commission has not previously assessed the market for BME. The Parties argue that the relevant product market can be left open.

(125) In relation to the geographic market definition, the Parties submit that, if the product market is defined as BME, the geographic scope is worldwide, taking into account that all global suppliers serve the EEA market.

(126) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of BME in the EEA.

4.4.11. Glyoxal

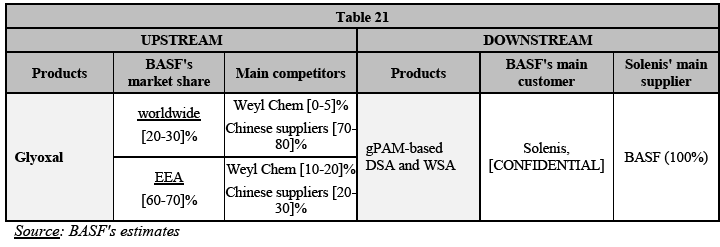

(127) Glyoxal is used in the production of textiles, leather, cosmetics, epoxy applications, oil and gas, biocides, glyoxylic acid and […]* hardening applications In the paper & pulp chemicals, glyoxal is used to produce glyoxylated PAM (gPAM), which is mainly used for dray strength and to a lesser extend wet strength.

(128) The Commission has not assessed the market for glyoxal in the past. In the absence of past decisional practice, the Parties claim that the product market can be defined as including all glyoxal chemical.

(129) The Parties argue that the market is at least EEA-wide, if not worldwide. According to the Parties they can export glyoxal globally and regulatory restrictions have minor impact on the glyoxal business. The results of the market test were not conclusive on the geographic market definition. Half of the customers of Glyoxal participating in the market investigation indicated that they currently purchase glyoxal from suppliers outside the EEA, while the other half did not (73).

(130) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of glyoxal in the EEA.

4.4.12. Morpholine

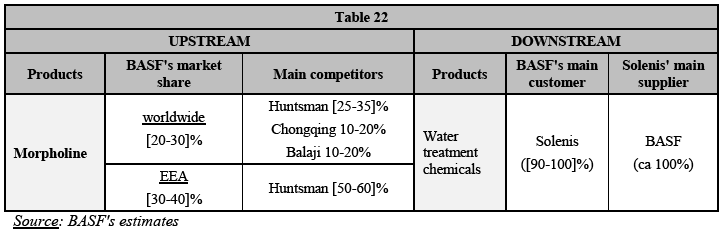

(131) Morpholine is a colourless to yellow liquid chemical that is used in the production of corrosion inhibitors, crop protection agents, dyes, optical brighteners, pharmaceuticals and rubber chemicals. Morpholine is also used in water treatment chemicals. In water treatment, morpoholine can be used to neutralise carbonic acid in steam condensate systems

(132) As regards product market definition, in Huntsman/CIBA, the Commission considered that morpholine is substitutable with MOPA, cyclohexylamine and DMEA (74). In BASF/CIBA, (75) the Commission considered a relevant product market including all morpholine chemicals but ultimately left the question open. The Parties submit that the product market definition can be left open

(133) As regards geographic market definition, the Commission left the exact scope of the market open (EEA-wide or worldwide) in BASF/CIBA. The Parties submit that the market for morpholine is worldwide in scope in the absence of significant regulatory barriers to prevent transportation and low transport costs. The Parties also submit that ultimately the exact geographic scope of the market can be left open.

(134) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of morpholine in the EEA.

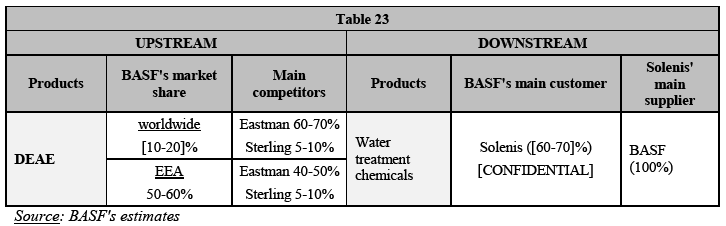

4.4.13. Diethylaminoethanol ("DEAE")

(135) DEAE is used as neutralizing agent and CO2 scavenger in boiler water. Solenis uses DEAE as corrosion inhibitor in boiler applications. DEAE can also be used in lubricants, as a building block in the agrochemical, pharmaceutical industries and as an additive in paper coatings.

(136) The Commission has not assessed the market of DEAE in its past decisions. The Parties claim that the product market can be defined as including all DEAE products. However, the Parties also submit that the exact product market definition can be left open.

(137) The Parties submit that the geographic scope of the DEAE market is worldwide, due to low transport costs or other specific trade barriers. [CONFIDENTIAL – BASF’s production set-up].

(138) For the purpose of this Decision, the Commission considers that the exact product and geographic market definitions can be left open, since the notified concentration does not raise serious doubts as to its compatibility with the internal market even on the narrowest possible market definition, that is to say the supply of DEAE in the EEA.

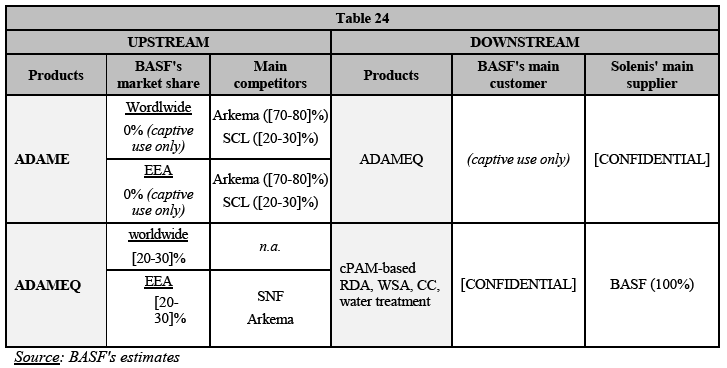

4.4.14. Dimethylaminoethyl acrylate ("DMA3" or "ADAME") / ADAMEQuat ("ADAMEQ")

(139) In paper and pulp chemicals, ADAME is used in the production of cPAM-based RDA, WSA, CC, and water treatment. ADAME can be quaternised to produce ADAMEQ for use as a co-monomer in the production of cPAM-based chemicals.

(140) In past decisions, (76) the Commission considered ADAME and ADAMEQ to each form separate product markets. The Commission also considered the geographic scope of both markets to be at least EEA-wide in BASF/CIBA. However, the Commission ultimately left open both the product and geographic delineation of the market. The Parties submit that the relevant product market for ADAME and ADAMEQ can be left open.

(141) In relation to the geographic market definition, the Parties submit that the market has changed since BASF/CIBA and that suppliers of ADAME are now active on a global scale. The results of the market investigation seem to indicate that the market is global for ADAMEQ, since all of the respondents indicated that they purchased from suppliers from outside the EEA (77). According to the respondents in the questionnaire to suppliers of ADAME, the competition on the market takes place on a global level (78).

(142) For the purpose of the present Decision, the Commission considers that the manufacture and supply of ADAME and ADAMEQ constitute separate product markets, but the market definition can ultimately be left open since even under the narrowest product market definition, the transaction does not raise serious doubts as to its compatibility with the internal market. In relation to the geographic market scope, the Commission considers that the market is likely to be EEA-wide, but the exact geographic scope can be left open, as no serious doubts as to the compatibility of the notified concentration with the internal market arise under the narrowest possible EEA definition.

5. COMPETITIVE ASSESSMENT

(143) Article 2 of the Merger Regulation requires the Commission to examine whether notified concentrations are to be declared compatible with the internal market, by assessing whether they would significantly impede effective competition in the internal market or in a substantial part of it.

(144) The Commission Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings (79) (the "Horizontal Merger Guidelines") distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non-coordinated effects and coordinated effects.

(145) Non-coordinated effects may significantly impede effective competition by eliminating the competitive constraint imposed by each merging party on the other, as a result of which the merged entity would have increased market power without resorting to coordinated behaviour. In this regard, the Horizontal Merger Guidelines consider not only the direct loss of competition between the merging firms, but also the reduction in competitive pressure on non-merging firms in the same market that could be brought about by the merger. According to recital (25) of the preamble of the Merger Regulation, a significant impediment to effective competition can result from the anticompetitive effects of a concentration even if the merged entity would not have a dominant position on the market concerned.

(146) The Horizontal Merger Guidelines list a number of factors which may influence whether or not significant non-coordinated effects are likely to result from a merger, such as the large market shares of the merging firms, the fact that the merging firms are close competitors, the limited possibilities for customers to switch suppliers or the fact that the merger would eliminate an important competitive force. Not all of these factors need to be present for significant non- coordinated effects to be likely. The list of factors, each of which is not necessarily decisive in its own right, is also not an exhaustive list.

(147) In addition, the Commission Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings (80) (the "Non-Horizontal Merger Guidelines") distinguish between two main ways in which vertical mergers may significantly impede effective competition, namely input foreclosure and customer foreclosure.

(148) For a Transaction to raise input foreclosure competition concerns, the merged entity must have a significant amount of market power upstream. (81) In assessing the likelihood of an anticompetitive input foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to substantially foreclose access to inputs, (ii) whether it would have the incentive to do so, and (iii) whether a foreclosure strategy would have a significant detrimental on competition downstream. (82)

(149) For a Transaction to raise customer foreclosure competition concerns, it must be the case that the vertical merger involves a company which is an important customer with a significant degree of market power in the downstream market. (83) In assessing the likelihood of an anticompetitive customer foreclosure scenario, the Commission has to examine whether (i) the merged entity would have the ability to foreclose access to downstream markets by reducing its purchases from its upstream rivals, (ii) whether it would have the incentive to reduce its purchases upstream, and (iii) whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market. (84)

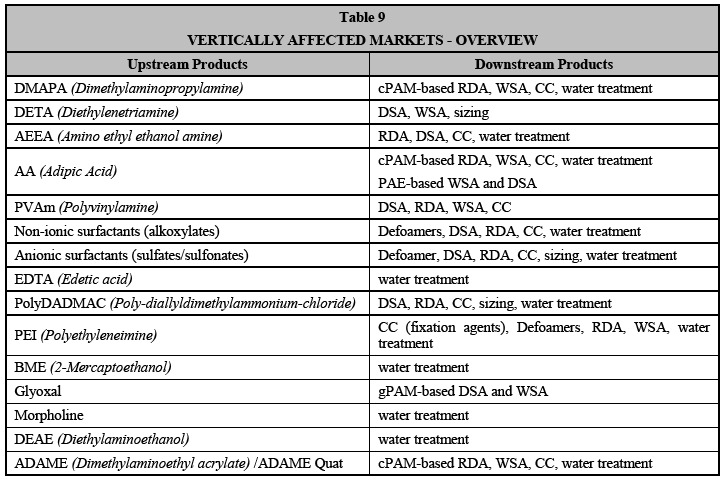

(150) BASF DOM and Solenis are both active in the manufacture and sale of chemicals that are sold for paper and pulp applications. The Transaction gives rise to a number of horizontally affected markets, which are discussed in Section 5.1 . BASF also supplies raw/intermediate chemicals which are used by Solenis and/or its competitors as input for the manufacture of paper and pulp chemicals and water treatment chemicals. The Transaction also gives rise to a number of vertically affected markets, which are discussed in Section 5.2.

5.1 Horizontal Analysis

(151) As a general remark, the Notifying Parties submitted that BASF DOM and Solenis are not close competitors in any paper and pulp market segment, because they have different business models. On the one hand, BASF DOM is particularly focused on product manufacturing, its technologies and production processes, but with a low level of customer service. On the other hand, Solenis is recognised for its strong market knowledge, technical expertise and customer service-based model, which involves frequent customer site visits and service personnel located in customer’s plants. The notified concentration would bring together these different yet complementary business models. (85)

(152) The market investigation confirmed the statement of the Parties that their business models are fundamentally different. (86)

5.1.1. Defoamers for Paper and Pulp Applications

(153) BASF DOM manufactures and supplies in the EEA fatty acid/alcohol and EO/PO defoamers under its Afranil brand. Afranil defoamers are sold into the paper and pulp industry. Solenis manufactures and supplies defoamers under the following trade names: Advantage, Antispumin, De Airex, Nopcomaster, and Protocol. None of these brands are technology-specific and Solenis sells defoamers based on different chemistries under the same trade names. Solenis' portfolio includes defoamers based on silicone; fatty acid/alcohol; EO/PO; and PEG. Solenis either buys the basic component of the defoamer from a third- party and then mixes it or it simply resells defoamers from third parties ([CONFIDENTIAL]).

(154) The Notifying Parties submitted that the notified concentration would not give rise to competition concerns in a relevant market including defoamers for the paper and pulp industry in the EEA.

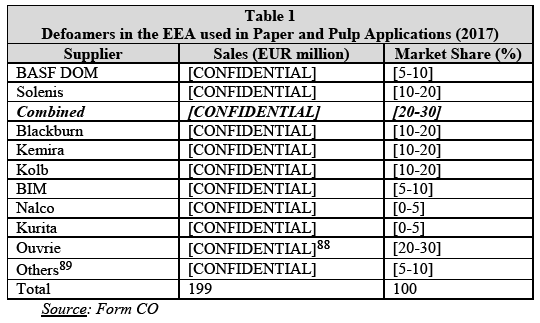

(155) Set forth below are the market shares of the Notifying Parties and their competitors in defoamers in the EEA (taking into account sales to end- customers by manufacturers and resellers): (87)

(156) The Parties' combined share is [20-30]% in defoamers in the EEA in 2017. Post- Transaction, the combined entity would continue to face competitive constraints from at least 5 competitors with a market share of 5% or more. These competitors would be Ouvrie ([20-30]%), Blackburn ([10-20]%), Kemira ([10- 20]%), Kolb ([10-20]%), and BIM ([5-10]%).

(157) The Parties do not seem to compete closely in defoamers in the EEA for the following reasons. First, they have different business models. For most defoamers (for instance, fatty acid/alcohol ones) Solenis purchases the basic component and mixes it before reselling the end chemicals to the customer. Solenis also resells end chemicals that it sources from third parties. By contrast, BASF DOM sells defoamers in which it manufactures itself the basic component. Second, the Parties focus on different chemistries of defoamers. Approximately [CONFIDENTIAL] of BASF DOM's sales of defoamers in the EEA in 2017 represented fatty acid/alcohol based defoamers. Solenis' product portfolio is much more diverse in terms of product chemistries. [CONFIDENTIAL] of its total sales of defoamers was driven by fatty acid/alcohol based products. The defoamers that Solenis typically sells are silicone based defoamers. (90) Third, as explained above, (91) Solenis has a service- orientated business model driven by customer intimacy while BASF DOM focuses on product manufacturing.

(158) Finally, the vast majority of informative respondents in the market investigation did not raise any competition concerns in relation to defoamers for paper and pulp applications in the EEA, during the market investigation. (92)

(159) In view of the above, taking into account the results of the market investigation and all the evidence available to it, the Commission concludes that the notified concentration does not raise serious doubts as to its compatibility with the internal market with respect to the EEA-wide market for defoamers for paper and pulp applications.

(160) Nor does the notified concentration give rise to competition concerns, if a narrower relevant market were defined including only EO/PO based defoamers in the EEA for paper and pulp applications. In such a relevant market the Parties' combined share would be 15-25%. Post-Transaction, the combined entity would face two large rivals with comparable market shares, namely Blackburn ([20-30]%) and Nalco ([20-30]%). Other competitors with a market share of 5% or more include Kemira ([10-20]%) and Kolb (5-10%).

(161) The market investigation did not reveal any competition concerns in relation to EO/PO defoamers for paper and pulp applications in the EEA. (93)

(162) In view of the above, taking into account the results of the market investigation and all the evidence available to it, the Commission concludes that the notified concentration does not raise serious doubts as to its compatibility with the internal market regarding EO/PO defoamers in the EEA for paper and pulp applications in the EEA.

5.1.2. Contaminant Control Agents

(163) BASF DOM manufactures and supplies CC under the following trade names: Catiofast (based on PEI, PVAm, PAm, and polyDADMAC). [CONFIDENTIAL– BASF DOM’s business set-up regarding the supply of Catiofast products]. In the EEA, BASF DOM also has limited sales of Cedesorb, a bentonite clay. Solenis manufactures and supplies the following CC in the EEA: DeTac (based on polyvinyl alcohol), Zenix, Renew, Presstige (including surfactants), and Infinity (based on polyacrylates).

(164) The Notifying Parties submitted that the notified concentration would not give rise to competition concerns in a relevant market including CC in the EEA.

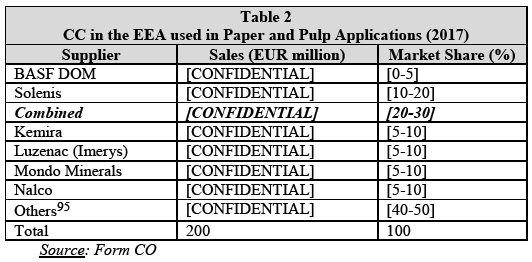

(165) Set forth below are the market shares of the Notifying Parties and their competitors in CC in the EEA (taking into account sales to end-customers by manufacturers and resellers): (94)

(166) The Parties' combined share is [20-30]% in CC in the EEA in 2017. The share increment contributed by BASF DOM is [0-5]%. Post-Transaction, the combined entity would continue to face competitive constraints from at least 4 competitors with a market share of 5% or more. These competitors would be Kemira ([5-10]%), Luzenac (Imerys) ([5-10]%), Mondo Minerals ([5-10]%), and Nalco ([5-10]%).

(167) The Parties do not seem to compete closely in CC in the EEA. First, BASF DOM and Solenis have different business models regarding CCs. (96) BASF DOM is more focused on product manufacturing while Solenis offers a more service- orientated supply model, involving on-site support and solutions tailored to the customer's problem. Second, BASF DOM has a product portfolio highly specialized in fixation agents. [90-100]% of BASF DOM's total CC sales in the EEA in 2017 came from fixation agents. On the contrary, Solenis' portfolio is more balanced and includes fixation agents (representing [50-60]% of the total sales in the EEA in 2017); dispersion agents (approx. [10-20]%) and adsorption agents (approx. [30-40]%). (97)

(168) Finally, the vast majority of informative respondents did not raise any competition concerns in relation to CC in the EEA, during the market investigation. (98)

(169) In view of the above, taking into account the results of the market investigation and all the evidence available to it, the Commission concludes that the notified concentration does not raise serious doubts as to its compatibility with the internal market regarding CC in the EEA.

(170) Nor does the Transaction give rise to competition concerns, if a narrower relevant market were defined including only fixation agents. In such a relevant market, the Parties' combined share would be 15-25%. Post-Transaction, the combined entity would face 4 large rivals with market shares exceeding 5%, namely, Kemira (10-20%), Luzenac (Imerys) (15-25%), Mondo Minerals (15-25%), and Nalco (15-25%). Other competitors include ACAT (0-5%) and SNF/Axchem (0-5%).

(171) The market investigation did not reveal any competition concerns in relation to a narrow relevant market for fixation agents in the EEA. (99)

(172) In view of the above, taking into account the results of the market investigation and all the evidence available to it, the Commission concludes that the notified concentration does not raise serious doubts as to its compatibility with the internal market regarding a relevant market for fixation agents in the EEA.

5.1.3. Retention and Drainage Aids

(173) BASF DOM supplies in the EEA single-polymer RDA under the following trade names: Percol (based on PAM); HM Polymin (based on PEI); Polymin VX/VT and Xelorex (based on PVAm). BASF DOM also supplies RDA which include micro particles under the following trade names: Hydrocol (including cPAM and bentonites) and Telioform (including PAM and bentonite).

(174) Solenis supplies in the EEA single-polymer RDA under the following trade names: PerForm SP (based on PAM) and Praestaret (based on polyamines). Solenis also supplies RDA which include micro particles, under the brand PerForm MP.

(175) The Notifying Parties submitted that the notified concentration would not give rise to competition concerns in a relevant market including all RDA in the EEA. (100)

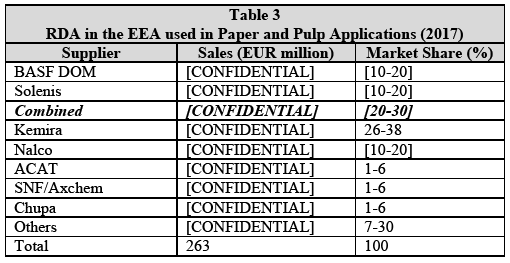

(176) Set forth below are the market shares of the Notifying Parties and their competitors in RDA in the EEA (taking into account sales to end-customers by manufacturers and resellers): (101)

(177) The Parties' combined share is [20-30]% in RDA in the EEA in 2017. Post- Transaction, the combined entity would continue to face competitive constraints from at least 5 competitors with a market share of 5% or more. (102) These competitors are Kemira (26-38%), Nalco ([10-20]%), and ACAT, SNF/Axchem, and Chupa (each with a share of 1-6%).

(178) The Parties do not seem to compete closely in RDA in the EEA. First, each of BASF DOM and Solenis has a different focus in their RDA portfolio. BASF DOM mainly supplies PVAm-based and micro particle-based RDA chemistries, including bentonites. Solenis is predominantly focused on PAM-based RDA (which are more commoditized) and offers a limited number of micro particle- based products. Second, each of the Parties targets different types of customers. BASF DOM's products increase the strength in the final product, which means this undertaking has been targeting large packaging producers for RDA and producers of graphical paper. On the other hand, Solenis offers RDA for all applications.

(179) Solenis submitted bidding data regarding RDA in EMEA. Solenis found that it has lost to rivals business of approximately EUR [CONFIDENTIAL] million in 2015-2017 but only approximately [0-20]% of this business was lost to BASF DOM. Solenis also estimated that it won from rivals business of approximately EUR [CONFIDENTIAL] million in 2015-2017 but approximately [10-30]% was won from BASF DOM. (103)

(180) In BASF/CIBA, the Commission also found that RDA customers have high buyer power, which means they can negotiate lower prices and favourable conditions for themselves using sophisticated procurement procedures. (104)

(181) Finally, the vast majority of customers and competitors did not raise any competition concerns in relation to RDA in the EEA, during the market investigation. (105)

(182) In view of the above, taking into account the results of the market investigation and all the evidence available to it, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market regarding RDA in the EEA.

(183) Nor does the notified concentration give rise to competition concerns, if distinct relevant product markets are identified for (i) single-polymer RDA; (ii) multi- polymer RDA; and (iii) micro particle RDA:

- The Parties' combined share in single-polymer RDA is estimated at approximately 20-35%. Post-Transaction, the combined entity would continue to face competitive constraints from large RDA players, such as Kemira (20- 30%), Nalco ([10-20]%), ACAT, SNF/Axchem, and Chupa (each [5-10]%). All of these players have wide product portfolios including both single- polymer and multi-polymer RDA;

- The Parties’ combined share in multi-polymer RDA is estimated at approximately [20-30]%. Post-Transaction, the combined entity would continue to face competitive constraints from large RDA players, such as Kemira (20-30%), Nalco (15-25%), ACAT, SNF/Axchem, and Chupa (each [5-10]%). All of these players have wide product portfolios including both single-polymer and multi-polymer RDA;

- The Parties’ combined share in micro particle RDA is estimated at approximately 20-35%. In RDA including micro particles, Solenis is not an important player. Post-Transaction, the combined entity would continue to face competitive constraints from large RDA players, such as Kemira (25- 35%), Nalco (10-20%) and also from ACAT, SNF/Axchem, and Chupa (each [0-5]%).

(184) The market investigation did not reveal any competition concerns in relation to single-polymer, multi-polymer or micro particle RDA in the EEA. (106)

(185) In view of the above, taking into account the results of the market investigation and all the evidence available to it, the Commission concludes that the notified concentration does not raise serious doubts as to its compatibility with the internal market regarding single-polymer, multi-polymer or micro particle RDA in the EEA.

5.1.4. Synthetic Dry Strength Agents

(186) BASF DOM manufactures and supplies in the EEA Xelorex, a PVAm-based chemical that can be used among other things as a DSA and Luredur Plus, a synthetic DSA based on gPAM. (107) BASF DOM also manufactures Lupamin, a PVAm-based DSA that is purchased by resellers who react it and then sell it further to customers in the paper and pulp industry. Solenis offers synthetic DSA in the EEA under its Hercobond brand family. Solenis manufactures and supplies cPAM-based, aPAM-based, and gPAM-based DSA. Solenis also manufactures and supplies PAE resins which can be used as DSA, although they are primarily used as a wet strength additive. Finally, Solenis resells PVAm- based chemicals and also cellulose enzymes and CMC as DSA.

(187) The Notifying Parties submitted that the notified concentration would not give rise to competition concerns in a relevant market including only synthetic DSA in the EEA. (108)

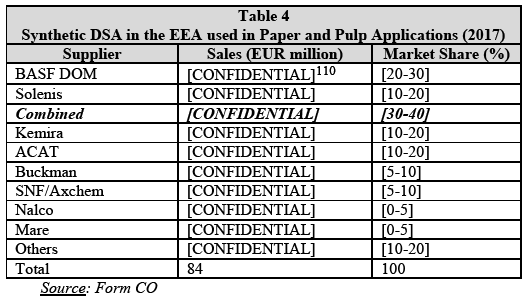

(188) Set forth below are the market shares of the Notifying Parties and their competitors in synthetic DSA in the EEA (taking into account sales to end- customers by manufacturers and resellers): (109)

(189) The Parties' combined share is [30-40]% in synthetic DSA in the EEA in 2017. Post-Transaction, the combined entity would continue to face competitive constraints from at least 4 competitors with a market share of 5% or more. These competitors would Kemira ([10-20]%), ACAT ([10-20]%), Buckman ([5-10]%), and SNF/Axchem ([5-10]%).

(190) The Parties do not seem to compete closely in terms of chemistries included in the product portfolio. First, the focus of BASF DOM and Solenis is on different types of synthetic DSA. Approximately [CONFIDENTIAL] of BASF DOM's total sales of synthetic DSA in the EEA in 2017 represented PVAm-based DSA. Solenis' product portfolio is much more diverse in terms of product chemistries. Only [CONFIDENTIAL]% of its total sales of synthetic DSA was driven by PVAm-based products. The remaining synthetic DSA sales concern mainly PAM-based products ([CONFIDENTIAL]%), PAE resin-based products ([CONFIDENTIAL]%) and gPAM-based products ([CONFIDENTIAL]%). (111) Second, as explained above, (112) Solenis has a service-orientated business model driven by customer intimacy while BASF DOM focuses on product manufacturing.