Commission, September 29, 2017, No M.8486

EUROPEAN COMMISSION

Judgment

3M COMPANY / SCOTT SAFETY

Subject: Case M.8486- 3M COMPANY / SCOTT SAFETY

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 25 August 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 and following a referral pursuant to Article 4(5) of the Merger Regulation by which the undertaking 3M Company ("3M", United States) acquires within the meaning of Article 3(1)(b) of the Merger Regulation, control of the whole of certain subsidiaries of Johnson Controls International plc, together making up the Scott Safety business ("Scott", United States), by way of a purchase of shares (the "Transaction"). (3) 3M is referred to as the "Notifying Party", and 3M and Scott are together referred to as the "Parties".

1 THE PARTIES AND THE OPERATION

(2) 3M is a U.S.-based diversified technology company listed on the New York Stock Exchange. 3M's business is segmented on a worldwide basis into five major business areas: (i) Industrial; (ii) Safety and Graphics; (iii) Health Care; (iv) Electronics and Energy; and (v) Consumer. The Safety and Graphics Group manufactures and sells 3M's personal protective equipment offering, which cover products ranging from fall, respiratory, head & face, hearing, and eye protection, to visibility/reflective clothing and protective apparel, and welding safety.

(3) Scott is a U.S.-based global personal protection equipment manufacturer, which consists of five subsidiaries: (i) Scott Technologies, Inc.; (ii) Rindin Enterprises Pty Ltd.; (iii) Scott Health & Safety Ltd.; and (iv) Fondermann GmbH. Scott is currently owned by Johnson Controls International plc ("JCI").

(4) On 16 March 2017, 3M entered into a stock purchase agreement with JCI to acquire 100% of the share capital of Scott, thereby acquiring sole control of Scott. Therefore, the Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

2 EU DIMENSION

(5) The Transaction does not have a Community dimension within the meaning of Article 1 of the Merger Regulation. The Notifying Party submitted a referral request pursuant to Article 4(5) of the Merger Regulation on 22 May 2017. The concentration was capable of being reviewed under the laws of at least three Member States, namely Austria, Czech Republic, France, Germany; and possibly Spain and the United Kingdom. None of these Member States expressed its disagreement as regards the request to refer the case to the Commission.

(6) The notified operation therefore is deemed to have an EU dimension pursuant to Article 4(5) of the Merger Regulation.

3 RELEVANT MARKETS

(7) The Parties are active in the EEA in the manufacture and supply of personal protection equipment ("PPE"). PPE is designed to protect users from injuries or illnesses resulting from contact with radiological, chemical, physical, mechanical, electrical, or other hazards. (4)

(8) PPE includes a variety of products, such as traditional work wear, protective clothing, footwear protection, fall protection, hand protection, respiratory protection, head, eye and face protection and hearing protection. The Commission has previously considered that the different categories of PPE do not constitute a single product market. (5) The Parties' activities overlap in the EEA with respect to: (i) respiratory protection; (ii) hearing protection; and (iii) head, eye and face protection; which are considered further below.

3.1 Respiratory protection

(9) Respiratory protection products offer protection against hazardous particulates, gases, and/or vapours, and, with respect to breathing apparatus, protection in oxygen-deficient atmospheres. Respiratory protection products range from very simple disposable masks to more sophisticated powered reusable respirators, and self-contained breathing apparatus.

(10) Disposable respirators: Disposable respirators are filter-based products generally designed for single use protection from particulate hazards in the ambient air.

(11) Reusable respirators: Reusable respirators generally consist of two connected modules: (a) a reusable facepiece or headtop; and (b) a disposable particulate and/or gas & vapour filter that removes particulate and gaseous hazards from the ambient air. Air flow for reusable respirators is generated either by a blower (known as a powered, or positive pressure reusable respirator), or by the user generating air flow with their own breath (known as a non-powered, or negative pressure reusable respirator).

(12) Escape respirators: Escape respirators have an external air source but are designed for a single use application in the event of an emergency to escape from hazardous environments such as fire, toxins, or sudden lack of oxygen.

(13) Breathing apparatus: Unlike respirators, which filter the ambient air, breathing apparatus supplies a user with air from an external source such as a tank or compressed air system. Breathing apparatus is typically used in situations where filters would not offer adequate protection or in oxygen deficient environments. Different types of breathing apparatus include: (i) self-contained breathing apparatus ("SCBA"); (ii) pressure demand airline systems; and (iii) constant flow airline systems.

(14) SCBA: SCBA includes a full-face mask, a regulator/valve, a cylinder/tank, and a carrying assembly designed to supply breathable air from a transportable air source carried by the user for a maximum of one hour (though some products can be combined with supplied air systems to provide air for a longer period). As such they are similar to SCUBA equipment, except that they are used on land. SCBAs are sophisticated products used in environments immediately dangerous to life or health. SCBAs are commonly used, for example, by fire fighters, first responders and militaries.

(15) Pressure demand airline systems: Pressure demand airline systems include a face mask attached to an external air source but can also be fitted with a small optional transportable air source. These systems tend to be used, for example, in mining and in environments where failure of the system would be dangerous to life or health, but where use of an SCBA unit would not be practical (either because a large air tank would not fit in a tight environment, or air tank capacity would not allow use for a sufficiently long period of time).

(16) Constant flow airline systems: Constant flow airline systems do not involve a tank or cylinder of air, but simply attach a head piece to a constant flow airline with an external air source. These tend to be used in niche applications such as in spray paint shops in OEM vehicle manufacturing.

3.1.1 The Commission precedents

(17) The Commission has previously differentiated: (i) disposable; and (ii) reusable respiratory protection products given different end users' needs and significant price differences, but ultimately left the market definition open. (6) The Commission has not previously considered any potential segmentation of these markets. The Commission has also not previously considered whether breathing apparatus fall within the market for reusable respirators or should be considered as a separate segment.

3.1.2 The Notifying Party's view

(18) The Notifying Party submits that reusable respirators should form a separate market from disposable respirators. It submits that reusable respirators are: (i) more sophisticated products; (ii) have higher initial acquisition costs; (iii) generally offer higher protection levels (the protection levels required in some applications cannot be achieved with disposable respirators); (iv) allow a multitude of product combinations; and (v) in contrast to disposable respirators, require service and maintenance. Notably, disposable respirators are generally certified for use only for particulate protection, and not for protection against high concentrations of gas or vapour. Reusable respirators can protect against not only particulates, but also gases and vapours.

(19) With regard to reusable respirators, the Notifying Party notes that there are both powered and non-powered reusable respirators available on the market. It considers that these two products fall within the same product market as both types of respirators offer comparable protection levels (between 5 and 2000 times OEL), can be used for particulate and/or gas and vapour protection, have relatively comparable costs of use, and offer a similar price value proposition. The decision whether to use a powered or non-powered reusable respirator largely depends on customer preferences (such as comfort or fit, and whether the customer wants its users to power the respirator with their own breath or via a blower).

(20) The Notifying Party submits that breathing apparatus should form a separate market from reusable and disposable respirators. Within the breathing apparatus product range, it considers, given the lack of demand- and supply-side substitutability, separate markets exist for: (i) escape respirators; (ii) SCBA; (iii) pressure demand airline; and (iv) constant flow airline products.

3.1.3 The Commission's assessment

3.1.3.1 Disposable respirators

(21) The results of the market investigation indicate that disposable and reusable respirators are not in the same product market. The vast majority of respondents consider that disposable and reusable respirators cannot be used interchangeably for the same end uses or that they can be used interchangeably but there is a material price difference. In particular, a number of respondents noted that disposable respirators can only be used to protect against particulate risks but not gas or aerosols. With regard to the price difference, respondents indicated that reusable respirators have a higher purchase cost but given that they are reusable, the total cost of ownership over the life time of the product needs to be taken into account. (7)

(22) For the purpose of this decision, the questions of whether disposable and reusable respirators should be considered as being in the same product market can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market whether they are considered together or separately.

3.1.3.2 Reusable respirators

(23) The results of the market investigation suggest that it would be appropriate to segment the market for reusable respirators according to whether they are powered or non-powered.

(24) From the demand side, the vast majority of respondents consider that powered and non-powered reusable respirators cannot be used interchangeably for the same end uses, or that they can be used interchangeably but there is a material price difference between the two products. (8)

(25) The results of the market investigation were inconclusive on the issue of whether powered and non-powered reusable respirators offer differing levels of protection for a variety of risks. The results did indicate, however, that there are a number of material differences between powered and non-powered reusable respirators. In particular: (i) both the initial purchase price and the on-going costs of ownership are higher for powered reusable respirators compared to non-powered; (ii) the two products do not offer equivalent levels of comfort if worn for long periods of time; and (iii) that different EU standards are applicable to the different products. (9) In addition, respondents identified a range of situations where an end user could use a powered reusable respirator but not a non-powered reusable respirator such as asbestos removal, welding or applications that require the user to wear the equipment for periods in excess of an hour. (10)

(26) From the supply-side, the vast majority of manufacturers of respirators stated that the know-how and technology is sufficiently different that switching from the production of non-powered to powered reusable respirators would imply significant technical difficulties, substantial costs or could not be done in a short period of time. (11)

(27) For the purpose of this decision, the question of whether the market for reusable respirators should be further segmented between powered and non-powered reusable respirators can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market whether considered together or separately.

3.1.3.3 Breathing apparatus

(28) The results of the market investigation confirm that respirators that filter ambient air and breathing apparatus which provide the user with air from an external source are not generally used for the same end applications, in particular in oxygen deficient environments or where a high level of protection is required and a respirator would not be sufficient. (12)

(29) For the purpose of this decision, the question of whether: (i) breathing apparatus and respirators form separate product markets; and (ii) whether the potential market for breathing apparatus should be further segmented by type of breathing apparatus can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market whether considered separately or together.

3.2 Hearing protection

(30) Hearing protection products consist of equipment (whether worn outside or inside the ear) which protects a user’s hearing from ambient noise. Hearing protection products mainly consist of muffs and plugs and may be disposable or reusable. Hearing protection may be solely designed to protect the wearer from outside noise, acting as a physical acoustic barrier or seal (referred to as "passive hearing protection"), or it may include an electronic unit for communication or entertainment such as music and radio) (referred to as "active hearing protection"). Main industries of use include construction, manufacturing, transportation, forestry, mining, health care, military, and consumer sectors.

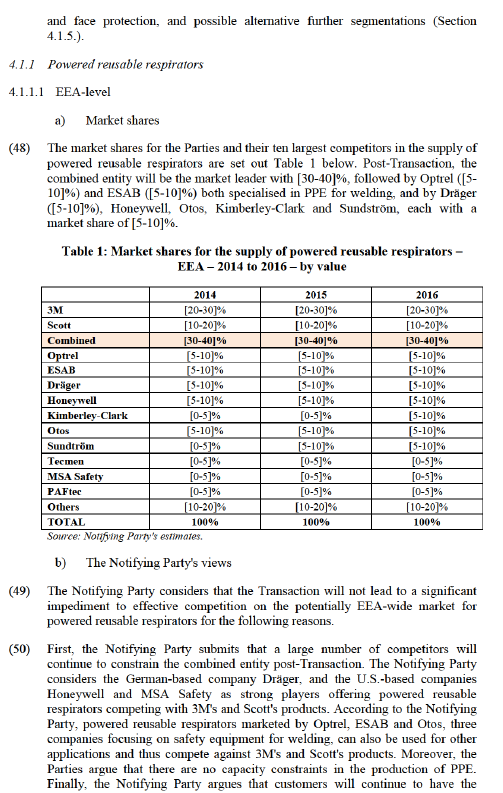

3.2.1 The Commission precedents

(31) The Commission has previously concluded that there are separate product markets for: (i) passive hearing protection products which are solely designed to protect the wearer from outside noise; and (ii) active hearing protection products which in addition to protecting the user from outside noise are equipped with an electronic unit for communication or entertainment.

(32) The Commission found that there is limited or no demand-side substitutability between passive and active hearing protective products, as they are used in different working environments and active hearing protection products are much more expensive than passive hearing protection products. Similarly, the Commission found that supply-side substitutability between both types of products was limited because they are produced based on different technologies and not all producers of passive hearing protection products supply active ones as well. (13)

3.2.2 The Notifying Party's view

(33) In line with Commission precedent, the Notifying Party considers that active and passive hearing protection products constitute separate product markets.

3.2.3 The Commission's assessment

(34) For the purpose of this decision, the exact product market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market whether passive hearing protection products are considered together or separately.

3.3 Head, eye and face protection

(35) Head and face protective equipment is used to safeguard the user from overhead hazards or from potentially toxic, corrosive, or infectious material. This category covers safety helmets and the corresponding accessories (including attached visors, ear muffs, neck/front covers, integrated eyewear, and rain protection) which are specially designed to fit on a helmet. Head and face protection products are used in a variety of industries, such as construction, engineering and manufacturing, oil and gas, and forestry. Protective eyewear includes a variety of lens types, in particular safety spectacles and goggles. Protective eyewear is used in a variety of industries such as construction, engineering and manufacturing, oil and gas, as well as emergency services.

3.3.1 The Commission precedents

(36) The Commission has previously considered the market for head, eye and face protection but has left the precise product market definition open. In 3M/Aearo, the Commission considered a possible segmentation of the market between: (i) head and face protection on the one hand; and (ii) eye protection on the other hand; (14) whereas in Honeywell/Sperian, it considered a different segmentation: (i) head and eye protection; separately from (ii) face protection. (15)

3.3.2 The Notifying Party's view

(37) The Notifying Party submits that, in line with the Commission's approach in 3M/Aearo, there are distinct markets for: (i) head and face protection; and (ii) protective eyewear. It argues that from the demand-side, the vast majority of face protection products are sold as attachments to head protection products (i.e. helmets) and cannot be used as stand-alone products; whereas protective eyewear is sold separately from helmets. From the supply-side, it argues that the limited face protection products that are not sold as attachments to head protection are manufactured by the same companies who manufacture face protection attached to helmets (and the helmets overall); whereas the largest protective eyewear manufacturers are a different group of competitors from traditional PPE manufacturers.

3.3.3 The Commission's assessment

(38) For the purpose of this decision, the exact product market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market whether head, eye and face protection products are assessed individually or in any of the combinations referred to above.

3.4 Relevant geographic market

3.4.1 The Commission precedents

(39) In previous cases, the Commission has left open whether the markets for PPE products are national or EEA-wide in scope. On the one hand, the Commission has noted that: (i) prices can differ across Member States with manufacturers applying national price lists; (ii) it is important for manufacturers to have a local presence; and (iii) there are different commercial contexts in different Member States for historical reasons. (16) On the other hand, the Commission considered that: (i) there is an increasing number of customers active in a number of Member States that source at an EEA-wide level on the basis of an EEA-wide price list;

(ii) that transport costs constitute a small percentage of sales price; (iii) that there are EEA-wide standards; and (iv) that the most important manufacturers at the EEA level are present across various Member States. (17)

3.4.2 The Notifying Party's view

(40) The Notifying Party submits that the reasons the Commission has previously identified in support of an EEA-wide market are being reinforced, in particular: (i) the existence of EEA-wide regulatory standards for PPE products; (ii) the EEA-wide presence of manufacturers; (iii) the low transport costs between Member States; (iv) the absence of material national/regional price differences; (v) the absence of national preferences; (vi) the fact that no local presence is required; and (vii) increasing consolidation of customers applying centralized purchasing patterns.

3.4.3 The Commission's assessment

(41) The results of the market investigation has indicated that while there are EEA- wide regulatory standards and most important manufacturers at the EEA level are present across various Member States, a number of key indicators remain that may support a finding of national markets.

(42) The majority of respondents to the market investigation consider that it is either essential that manufacturers of PPE equipment have a local presence on the ground in a country to support the activities of distributors, or that it is quite important but they can still be competitive if they partner with the right distributor and/or have a sales person for the overall region. (18)

(43) With regard to whether prices for reusable respirators in particular are homogenous across the EEA, the majority of distributors and customers observe price differences between Member States. Manufacturers gave mixed responses on whether prices of reusable respirators were the same across the Member States, whether they had EEA-wide or national price lists and whether they negotiated prices including rebates and discounts on an EEA-wide or national basis. (19) The results of the market investigation also indicated that the majority of reusable respirator customers continue to source on a national basis. (20)

(44) For the purpose of this decision, the exact geographic market definition can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market whether the PPE markets are considered to be national or EEA-wide in scope.

4 COMPETITIVE ASSESSMENT

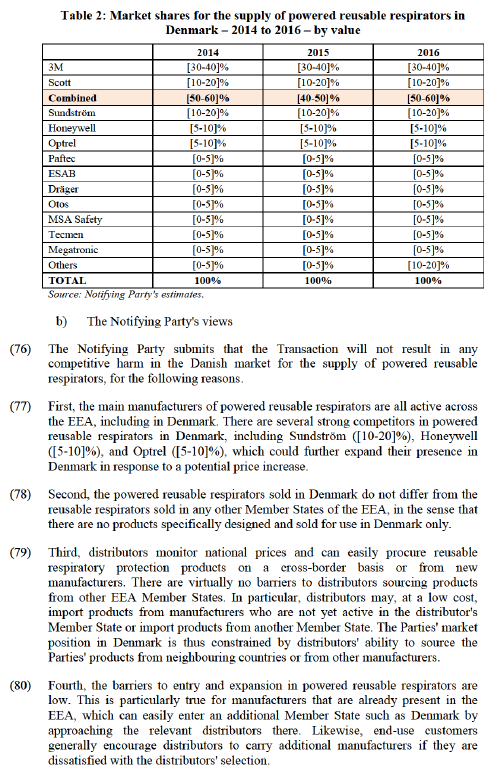

(45) The Transaction leads to horizontally affected markets (21) (i) at EEA level for powered reusable respirators; non-powered reusable respirators; (22) constant flow airline systems; active hearing protection; passive hearing protection; head, eye and face protection (and possible alternative further segmentations); and (ii) in a number of EEA Member States with regard to powered reusable respirators; non- powered reusable respirators; constant flow airline systems; active hearing protection; passive hearing protection; head, eye and face protection (and possible alternative further segmentations) (Section 4.1).

(46) The Commission has also investigated whether the Transaction may give rise to conglomerate effects (Section 4.2).

4.1 Horizontal assessment

(47) The assessment of the compatibility of the Transaction with the internal market will focus on non-coordinated horizontal effects in the markets where the Parties' activities overlap, namely: powered reusable respirators (Section 4.1.1.); non- powered reusable respirators (Section 4.1.2.); constant flow airline systems (Section 4.1.3.); active and passive hearing protection (Section 4.1.4.); head,eye

choice to purchase powered reusable respirators from more regional players such as Sundström (Sweden), Spasciani (Italy), Delta Plus (France) or Malina (Czech Republic).

(51) Second, the Notifying Party claims that Scott is not a unique competitive constraint on 3M, as competitors such as Dräger, Honeywell, MSA Safety, Sundström and Malina offer a comparable set of respiratory protection products of similar quality and price ranges compared to those of 3M or Scott, and would serve as a good replacement for the combined entity's powered reusable respirators.

(52) Third, the Notifying Party argues that switching costs are low for both distributors and end-use customers. Distributors typically apply a multiple sourcing policy and offer several different brands of powered reusable respirators in their product catalogues. The supply agreements between manufacturers and distributors are generally non-exclusive, without minimum purchase requirements, and concluded for a short period of time [confidential business information]. According to the Notifying Party, distributors can therefore easily stock up products from additional manufacturers without incurring significant costs. Similarly, end-use customers do not face significant hurdles in switching to other powered reusable respirator manufacturers: they would typically organize trials with several manufacturers and would generally be open to different manufacturers’ products as long as they offer the features that the customer needs specified in the RFQs. Large end-use customers generally multi-source powered reusable respirators from various manufacturers.

(53) Fourth, the Notifying Party emphasises that entry and expansion in the market for the supply of powered reusable respirators is relatively easy with low barriers to entry, notably because: (i) the technology for manufacturing a powered reusable respirator is established and available without prohibitive IP barriers; (ii) R&D costs tend to be limited as innovation mainly occurs in ergonomics and design; (iii) product certification can be obtained centrally at the European level in a matter of months; (iv) local sales presence is not essential; (v) new entrants are not required to invest heavily in manufacturing facilities as they can source components from third-party suppliers.

(54) Finally, the Notifying Party argues that the customers tend to be sophisticated players: (i) the distributors (23) have a thorough knowledge of the various powered reusable respirators and they closely monitor different manufacturers' pricing and quality; (ii) large end-use customers exert pressure on PPE manufacturers to offer high quality products at competitive terms through their sourcing processes.

c) The Commission's assessment

(55) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to powered reusable respirators when considering an EEA-wide market.

(56) First, the results of the market investigation showed that the market for powered reusable respirators is fragmented with more than 20 players active in the EEA (24) and that a large number of established competitors will continue to constrain the combined entity post-Transaction in the market for the supply of powered reusable respirators when considering an EEA-wide market.

(57) When asked to list three alternative manufacturers that end-use customers would choose to 3M's powered reusable respirators, respondents to the market investigation indicated not only Scott, but also to a significant extent Dräger, Honeywell, MSA Safety and Sundström. (25) In a similar fashion, when providing the alternative manufacturers to Scott's powered reusable respirators, in addition to 3M, Dräger, Honeywell, MSA Safety and Sundström were indicated by respondents. (26) For example Honeywell indicated that "Scott, Dräger and MSA Safety, together with 3M, have the most well established brands" in the EEA in powered reusable respirators. One end-use customer indicated that it was already currently procuring powered reusable respirators from 3M, Honeywell, MSA Safety and Scott; another one specified that alternatively to 3M's powered reusable respirators it would choose Dräger and MSA Safety before Scott; a third end-use customer replied that 3M, Honeywell, Dräger and Scott offer same level of quality and a fourth end-use customer considered that several powered reusable respirators manufacturers are known brands with an history of good performance of equal standing. (27)

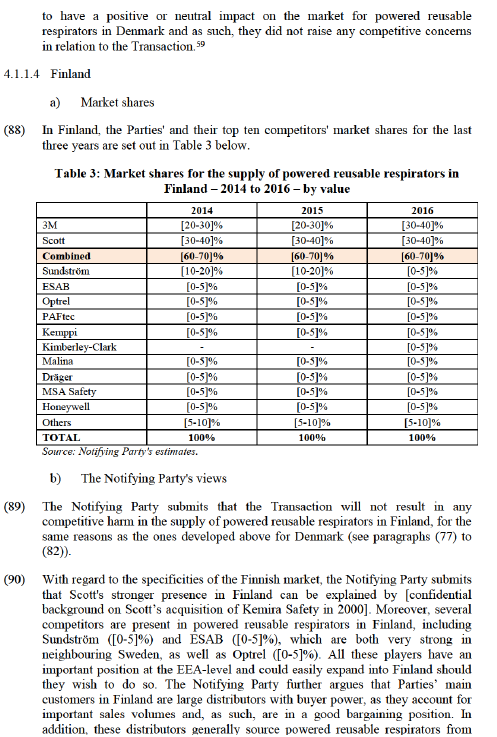

(58) Moreover, the distributors and end-use customers who replied to the market investigation assign the same principal features to 3M, Scott, Dräger, Honeywell, MSA Safety and Sundström: they consider that these players are characterised in particular by the high quality of their powered reusable respirators; their EEA- footprint and their broad range of products. (28) Offering the same characteristics than the Parties, Dräger, Honeywell, MSA Safety and Sundström will continue to exert a strong competitive constraint on the combined entity post-Transaction.

(59) In addition, even if they were cited to a lesser extent, competitors such as Avon, ESAB, JSP, Kimberly-Clark, Malina, Optrel, Otos, PAFtec, Spaciani were considered by market respondents as alternative brands to either 3M's or Scott's powered reusable respirators. Other players such as Matisec, Bullard, Centurion Martindale were also identified as possible alternative manufacturers to either 3M or Scott. (29) Even though these companies are considered as smaller competitors compared to the Parties, Dräger, MSA Safety, Honeywell and Sundström, they will still be able to exert a competitive constraint on the combined entity post- Transaction. In particular, ESAB, Kimberly-Clark, Optrel and Otos are specialised in PPE for welding applications and will be strong competitors in this field; PAFtec's powered reusable respirators are referred to as innovative solutions and JSP and Malina offer lower cost powered reusable respirators and along with Spaciani are considered as regional players. (30)

(60) Second, the results of the market investigation also supported the Notifying Party's view that market entry and expansion is not particularly difficult. In that sense, the results of the market investigation indicated that several players (i) recently entered the market for powered reusable respirators in the EEA, (ii) expanded their geographic footprint or their product portfolio to offer powered reusable respirators, or (iii) have plans to expand their existing range of powered reusable respirators.

(61) In response to the market investigation, several competitors explained that they entered the powered reusable respirators market in Europe within the last five years. This is for example the case of Bullard which started selling powered reusable respirators in the EEA in 2012. Another example is the Australian company, PAFtec, which had its first respirators certified in the EU in 2012 and started to sell its respiratory protection products in the EEA in 2013. (31) Dräger also indicated that its powered reusable respirator, the x-plore 8000, came to market in the last five years and Avon declared that it expanded its powered reusable respirators capability and range to complement its products range of non-powered reusable respirators. (32) The U.S.-based manufacturer RPB announced on its website in March 2017 the opening of a new location in the UK, which will allow the company to better serve its European customers. A majority of distributors also indicated that manufacturers of powered reusable respirators have entered the market for powered reusable respirators in Europe in the last five years, referring to companies such as Kasco, PAFtec, Shigematsu, (33) RSG Safety, and some private label companies. (34) The customers mentioning PAFtec generally indicated that this Australian company offers innovative products with a good potential.

(62) Furthermore, with regard to expansion of competitors into the EEA, the Commission understands that the process to receive the EN certification usually takes between three and nine months, so that market participants active outside the EEA can have their product certified and should be able to start selling powered reusable respirators in Europe within a relatively short period of time. This was for example the case for RPB and Bullard, two U.S.-based manufacturers which recently entered the EEA with their powered reusable respirators. (35) Moreover, various players, such as some Chinese manufacturers and some Russian manufacturers which have already received the EEA certification are expected to enter the reusable respirator industry in the EEA, and notably the market for powered reusable respirators. (36)

(63) Similarly, with regard to expansion of the geographic footprint of players already active in Europe, the Commission found that a manufacturer of powered reusable respirators in a given EEA Member State would not face significant hurdles in expanding its presence in another EEA country. The majority of competitors who replied to the market investigation considered that in order to be successful in a new EEA country, they do not necessarily need to hire local sales force, have local distribution facilities, or meet different regulatory requirements compared to the EEA country where the manufacturer is already active. (37) Moreover, the results of the market investigation provided evidence of competitors planning to expand their geographic footprint across the EEA. This is for example the case of RPB which indicated that it is already selling powered reusable respirators in the EEA and is planning to expand its activities in the EEA within the next two to three years. (38)

(64) The Commission also notes that, with regard to the product range expansion, several competitors have plans to expand their product portfolio of powered reusable respirators within the next two to three years. (39)

(65) Third, the results of the market investigation indicated that it is not particularly difficult for distributors and end-use customers to switch between manufacturers or add new brands of powered reusable respirators to their portfolio.

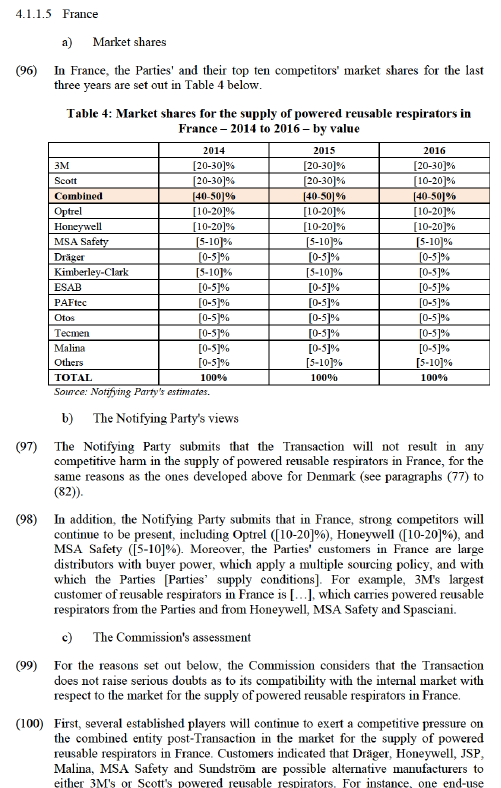

(66) The vast majority of distributors who replied to the market investigation questionnaire responded that they have a multi-sourcing strategy, and half of them indicated that they carry at least three different brands of powered reusable respirators. (40) The large majority of end-use customers corroborated the fact that most of their distributors source powered reusable respirators from different manufacturers and indicated that most of the distributors typically offer at least three different brands of powered reusable respirators. (41)

(67) Moreover, manufacturers typically appoint more than one distributor in a given EEA country. (42) Nearly all competitors and distributors indicated that their supply agreements do not include exclusivity clauses, so that distributors can carry brands of other manufacturers of powered reusable respirators. (43) In addition, some distributors indicated that they are willing to add new brands to their portfolio upon request of their customers. End-use customers do not necessarily rely on only one distributor and can purchase powered reusable respirators of various brands from various distributors. (44) As a result, end-use customers typically have the choice between various brands of powered reusable respirators carried by their distributors. (45)

(68) Finally, several distributors and end-use customers indicated that, in the last three years, they have switched a large portion of their purchase of powered reusable respirators from one manufacturer to another or have added new brands of powered reusable respirators to their portfolio. (46) For example, PAFtec was added by several distributors and end-use customers; other brands to which customers recently turned to were 3M, Dräger, Honeywell, JSP, Kasco, MSA Safety, RSG, Scott and Uvex. In general, distributors indicated that they have not faced any difficulties in adding new brands of powered reusable respirators to their portfolio. The only concern that was raised by some distributors was the challenge to create brand awareness and promote the products of manufacturers not well-known to end-use customers. (47) End-use customers did not report any challenges in adopting new brands of powered reusable respirators, except for some of them who indicated the necessity to change the habits of their employees. (48) As a matter of fact, a majority of end-use customers indicated that brand is not an important criteria that they take into account in their decision to switch manufacturers of powered reusable respirators; they rather base their decision to switch between manufacturers on the suitability of the powered reusable respirator for the application that the employee will perform. (49) Finally, several end-use customers specified that the inventory of accessories is generally managed by their distributor, so that it is only one criterion to take into consideration when switching manufacturers and will not impede them from changing brand of powered reusable respirators. (50)

d) Conclusions

(69) Based on the above the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to powered reusable respirators when considering a potentially EEA-wide market.

(70) As the geographic market definition was left open, the Commission will also analyse the horizontal effects of the Transaction at national level.

4.1.1.2 National level

(71) At national level, the Parties' combined market share in powered reusable respirators will exceed 25% and lead to an increment of more than 5% in the following EEA Member States: Denmark, Finland, France, Ireland, Lithuania, Netherlands, Slovenia, Sweden, and the United Kingdom. The Commission conducts its horizontal competitive assessment in each of these EEA Member States in the sub-sections below.

(72) The Transaction also gives rise to horizontally affected markets in powered reusable respirators in the following EEA Member States: Austria (3M: [20- 30]%, Scott: [0-5]%); Belgium (3M: [30-40]%, Scott: [0-5]%); Bulgaria (3M: [40-50]%, Scott: [0-5]%); Croatia (3M: [10-20]%, Scott: [5-10]%); Czech Republic (3M: [20-30]%, Scott: [0-5]%); Estonia (3M: [50-60]%, Scott: [0-5]%); Germany (3M: [20-30]%, Scott: [0-5]%); Hungary (3M: %, Scott: [0-5]%); Poland (3M: [10-20]%, Scott: [0-5]%); Slovakia (3M: [20-30]%, Scott: [0-5]%) and Spain (3M: [20-30]%, Scott: [0-5]%). However, in these EEA Member States, the Parties' combined market share either does not exceed 25%, (51) or the increment in market share brought by the Transaction is not higher than 5%, as Scott is a small player in all these EEA Member States.

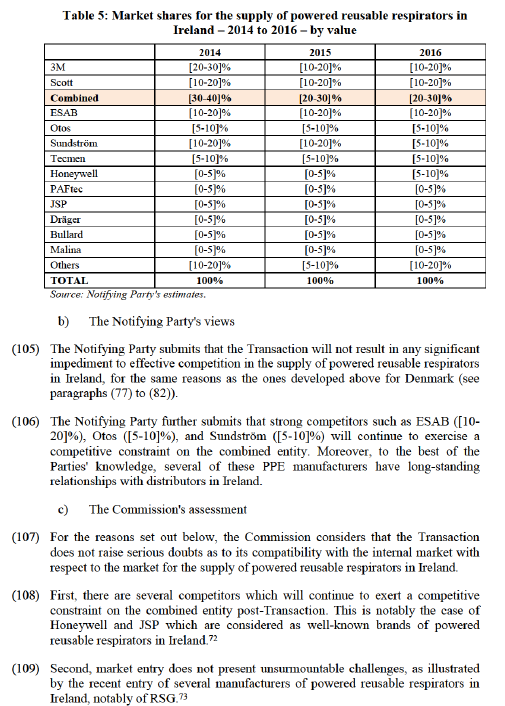

(73) Moreover, in each of these EEA Member States, the combined entity will continue to face competition from established players, in particular Dräger ([30- 40]%) and MSA Safety ([10-20]%) in Austria; Honeywell ([10-20]%) in Belgium; Dräger ([5-10]%) and Honeywell ([5-10]%) in Bulgaria; Malina ([5- 10]%) in Croatia; Malina ([10-20]%) in the Czech Republic; Sundström ([5- 10]%) in Estonia; Dräger ([10-20]%) in Germany; Malina ([10-20]%) in Hungary; Dräger ([5-10]%) in Poland; Malina ([5-10]%) in Slovakia; Sundström ([10-20]%) and PAFtec ([5-10]%) in Spain. These market players were considered as viable alternatives to 3M or Scott in powered reusable respirators by the end-use customers who replied to the market investigation. (52) Finally, the end-use customers did not raise any specific concerns in these EEA Member States during the market investigation. (53)

(74) For these reasons, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to powered reusable respirators in these EEA Member States.

4.1.1.3 Denmark

a) Market shares

(75) In Denmark, the Parties' and their top ten competitors' market shares for the last three years are set out in Table 2 below.

(81) Fifth, the Parties' main customers in Denmark are large distributors with buyer power that apply a multiple sourcing policy, and with whom the Parties [Parties’ supply conditions]. Moreover, the Parties' customer base in Denmark is concentrated, so that if the Parties were to lose one of their main customers, their market share would drop significantly. For example, Scott's […] largest customers account for […] of its sales in powered reusable respirators in this country.

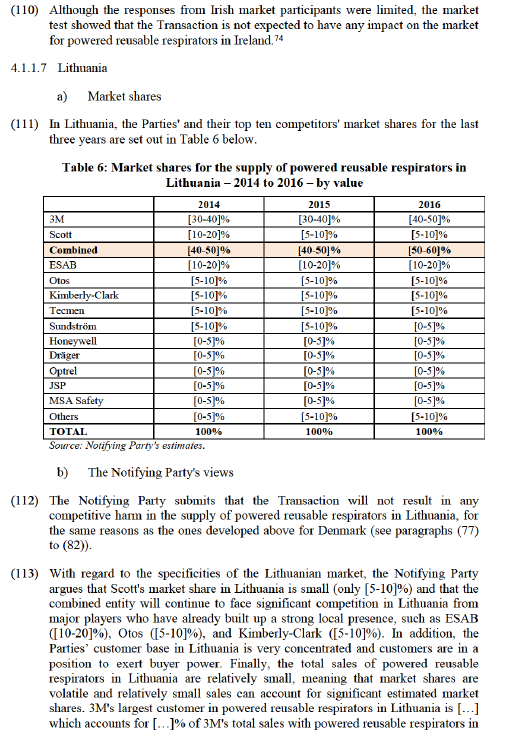

(82) Finally, distributors and end-use customers can easily switch manufacturers or add another manufacturer to their portfolio, as switching costs are low. The Notifying Party provide a recent example in which the end-use customer switched its procurement of powered reusable respirators from 3M to […].

c) The Commission's assessment

(83) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for the supply of powered reusable respirators in Denmark.

(84) First, the Parties will continue to face, post-Transaction, a strong competitive constraint exercised by established players, most notably from Sundström ([10- 20]%) and Honeywell ([5-10]%). In their responses to the market investigation, Danish customers indicated that Dräger, MSA Safety, Honeywell and Sundström can be considered as alternative manufacturers to 3M's and Scott's powered reusable respirators. (54)

(85) Second, as explained above in paragraph (63), barriers to geographic expansion of competitors from neighbouring countries are low. As a result, competitors such as Sundström, which has a strong footprint in the Nordics, (55) and in particular in Sweden, (56) could easily expand its market share in Denmark. A Danish distributor could also turn to a manufacturer such as Dräger, which is already present in Denmark and is strong in neighbouring Germany. (57)

(86) Third, as explained above in paragraphs (65) to (68), switching between manufacturers of powered reusable respirators does not present any unsurmountable hurdles. Distributors in Denmark responded to the market investigation that they pursue a multi-sourcing strategy and that their supply agreements with their manufacturers do not restrict the other brands that they can offer to end-use customers. (58)

(87) Finally, the Commission notes that the Danish distributors and end-use customers who replied to the market investigation indicated that they expect the Transaction

several different manufacturers. Finally, some of the Parties' distributors are active in other EEA Member States [confidential information on Parties’ customer relations] and, as such could easily source products across borders.

c) The Commission's assessment

(91) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for the supply of powered reusable respirators in Finland.

(92) First, beside the Parties,60 there will still be several competitors in Finland to which customers could turn to. Finnish distributors and end-use customers listed Dräger, ESAB, Honeywell, Malina, MSA Safety and Sundström as possible alternative manufacturers to the Parties' powered reusable respirators in Finland. (61) Furthermore, Sundström, Pureflo (the powered reusable respirators from the company Helmet Integrated Systems) and PAFtec were considered by Finnish customers as offering high quality powered reusable respirators. (62)

(93) Second, manufacturers present in neighbouring countries or in other product category in Finland, could easily expand their activities in Finland. One of the Parties' main customers in Finland, [customer], is already procuring non-powered reusable respirators from Honeywell, and could extend this relationship and starting purchasing Honeywell's powered reusable respirators. The distributor [customer], which is active in the Nordics and the Baltics countries, is currently carrying at least five different brands of powered reusable respirators, notably the products of Sundström and PAFtec, and could help these competitors expand their activities in Finland. (63)

(94) Third, several Finnish end-use customers who replied to the market investigation indicated that they have switched manufacturers of powered reusable respirators and added new brands. (64) Moreover, Finnish distributors indicated that they apply a multi-sourcing strategy and do not face restrictions from their manufacturers to carry other brands of powered reusable respirators in their portfolio and that manufacturers usually appoint several distributors in Finland. (65)

(95) Finally, the Commission notes that the end-use customers who replied to the market investigation indicated that they expect the Transaction to have a positive or neutral impact on the market for powered reusable respirators in Finland. (66)

customers indicated that it is currently purchasing powered reusable respirators from five different manufacturers and another one explained that it would consider buying Dräger or MSA Safety as an alternative to 3M products before considering Scott; finally another end-use customers stated that it had good experiences with the powered reusable respirators of the Parties, and their competitors Honeywell and MSA Safety. (67)

(101) Second, there are several examples of successful recent entrant in the powered reusable respirators market in France, most notably from PAFtec. (68) PAFtec is considered by several customers as offering innovative products and has already been adopted or is currently being tested by customers. (69)

(102) Third, distributors in France apply a multi-sourcing policy, with the majority of distributors who replied to the market investigation offering at least three different brands of powered reusable respirators. End-use customers responded that they typically have the choice of at least three (and more often four) different brands of powered reusable respirators. (70)

(103) Finally, the Commission notes that a few customers raised some concerns in relation to the possible impact of the Transaction on the market for powered reusable respirators in the France. However, the large majority of customers (both distributors and end-use customers) expect the impact of the Transaction on the powered reusable respirators market to be neutral. For example, one end-use customer stated that "there are other competitors on the market" while a distributor said that there will be no impact and that the market for powered reusable respirators will not be perturbed by the Transaction. (71)

4.1.1.6 Ireland

a) Market shares

(104) In Ireland, the Parties' and their top ten competitors' market shares for the last three years are set out in Table 5 below.

Lithuania. Thus, if […] were to switch from 3M to another manufacturer, 3M's market share in powered reusable respirators would drop to [20-30]%.

c) The Commission's assessment

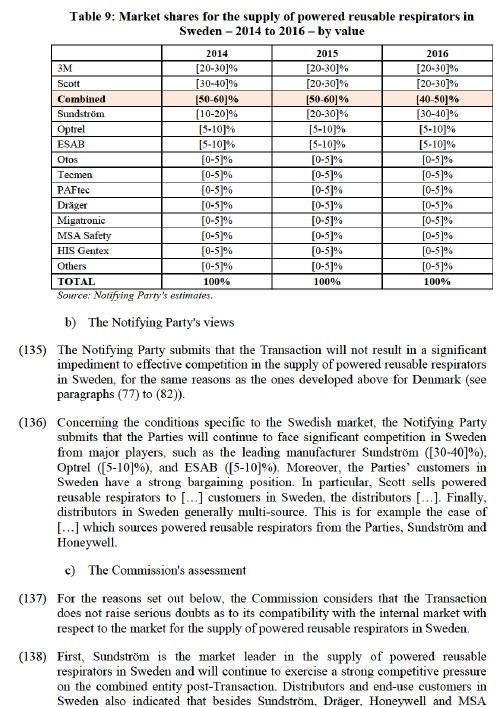

(114) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for the supply of powered reusable respirators in Lithuania.

(115) First, several competitors will continue to exert, post-Transaction, a competitive constrain on the combined entity in the market for powered reusable respirators in Lithuania. This is for example the case of the manufacturers MSA Safety and Centurion Martindale which were listed as alternative manufacturers to the 3M's powered reusable respirators.- (75)

(116) Second, Scott's market share in powered reusable respirators in Lithuania is relatively small. The Lithuanian customers (both distributors and end-use customers) who replied to the market investigation indicated that they do not purchase Scott's powered reusable respirators. One of them explained that it does not consider that 3M's and Scott's brands compete against each other in Lithuania and another one specified that 3M's and Scott's powered reusable respirators are designed for different purposes. (76) As a result, the Transaction will not impact the structure of the market for powered reusable respirators in Lithuania.

(117) Finally, the Commission notes that the Lithuanian customers who replied to the market investigation indicated that they expect the Transaction to have a positive or neutral impact on the market for powered reusable respirators in Lithuania, in particular as they do not observe competition between 3M and Scott. (77)

4.1.1.8 The Netherlands

a) Market shares

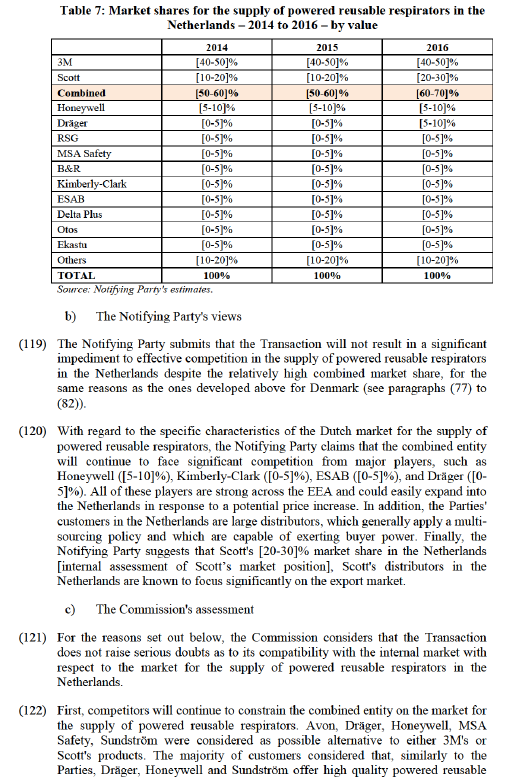

(118) In the Netherlands, the Parties' and their top ten competitors' market shares for the last three years are set out in Table 7 below.

respirators. (78) Moreover, the Commission understands that Scott is a strong player in a niche market (asbestos removal) in the Netherlands and that it has a good distribution network in the Netherlands. (79)

(123) Second, as explained in paragraphs (60) to (64), barriers to expansion into the market for powered reusable respirators are low. For instance, one Dutch distributor listed PAFtec, RSG and Shigematsu as manufacturers having recently entered the Dutch market for powered reusable respirators, and specified that it already added Shigematsu to its portfolio. (80)

(124) Third, end-use customers based in the Netherlands all indicated that their distributors multi-source powered reusable respirators from different manufacturers, and offer at least three different brands. (81) The majority of distributors stated in response to the market investigation that they apply a multi- sourcing strategy, typically offering at least three different brands of powered reusable respirators. In that sense, the Dutch distributors who replied to the market investigation stated that their supply agreements with the manufacturers of powered reusable respirators do not restrict the other brands that they are allowed to carry. (82)

(125) Finally, the Commission notes that while a few distributors raised concerns in relation to the possible impact of the Transaction on the market for powered reusable respirators in the Netherlands, the majority of customers (both distributors and end-use customers) expect that the impact of the Transaction will be either positive or neutral. For example, one end-use customer explained that "there are plenty of other parties on the market" while another end-use customer said that "the two suppliers are primarily complementary so the merger would offer a greater opportunity for single source solutions making tendering and contractual processes simpler." (83)

4.1.1.9 Slovenia

a) Market shares

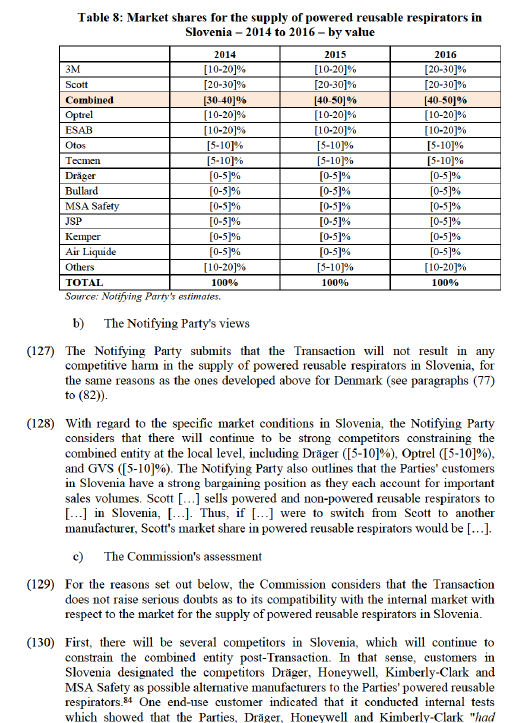

(126) In Slovenia, the Parties' and their top ten competitors' market shares for the last three years are set out in Table 8 below.

acceptable results which were suitable with [its] user requirement specifications."85 Moreover, Dräger and Spasciani were considered as manufacturers offering high quality products able to compete the 3M's and Scott's products. (86)

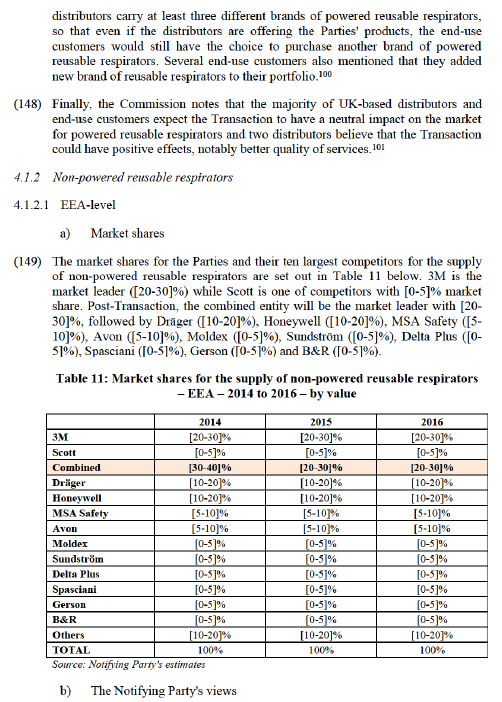

(131) Second, as explained in paragraphs (63), expansion of competitors from neighbouring countries is not particularly difficult. Thus, Dräger, already active in Slovenia and a strong player in Austria, could expand its presence in Slovenia; similarly, the Italian-based manufacturer Spasciani could also increase its presence in Slovenia if it wishes to do so.

(132) Third, distributors can easily add new brands to their product portfolio, as their supply agreements with the manufacturers of powered reusable respirators do not restrict the other brands that the distributors can carry. (87) For example, one distributor indicated that it recently and without any difficulties added new brands to its product portfolio in order to satisfy its customers' demand. (88)

(133) Finally, the Commission notes that one customer raised concerns in relation to the possible impact of the Transaction on the market for powered reusable respirators in the Slovenia. (89) However, the Slovenian distributors who replied to the market investigation questionnaire indicated that they expect the Transaction to have a positive or neutral impact on the market for powered reusable respirators in Slovenia. For example, one distributor considered that there is enough competition in this market and another one explained that end-use customers have buyer power and will be able to obtain better conditions, notably better services from the combined entity post-Transaction. (90)

4.1.1.10 Sweden

a) Market shares

(134) In Sweden, the Parties' and their top ten competitors' market shares for the last three years are set out in Table 9 below.

b) The Notifying Party's views

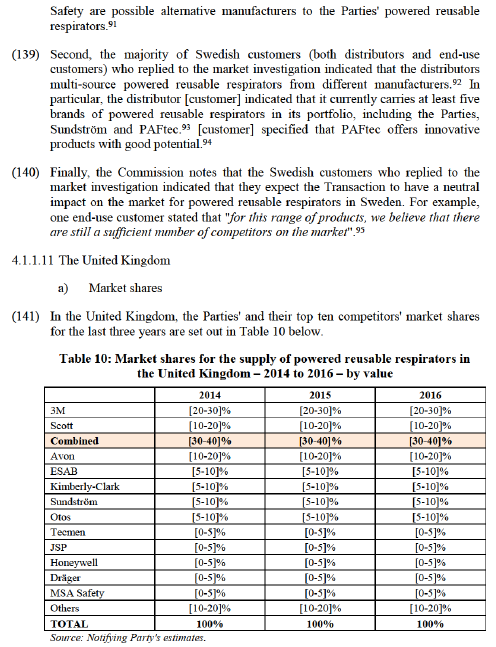

(142) The Notifying Party submits that the Transaction will not result in any competitive harm in the supply of powered reusable respirators in the United Kingdom, for the same reasons as the ones developed above for Denmark (see paragraphs (77) to (82)).

(143) In relation to the particularities of the market for powered reusable respirators in the United Kingdom, the Notifying Party submits that the combined entity will continue to face significant competition from major players, such as Avon ([10- 20]%), ESAB ([5-10]%), and Kimberly-Clark ([5-10]%). Moreover, Parties' main customers of powered reusable respirators in the United Kingdom are large distributors with buyer power, which apply a multiple sourcing policy, [confidential information on Parties’ customer relations]. Finally, to the best of the Parties' knowledge, the other manufacturers of powered reusable respirators also have long-standing relationship with several distributors in the United Kingdom.

c) The Commission's assessment

(144) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for the supply of powered reusable respirators in the United Kingdom.

(145) First, there will be several competitors able to constrain the combined entity post- Transaction in the supply of powered reusable respirators. This is for example the case of the UK-based companies Avon and JSP. Moreover, Avon, ESAB, Dräger, Honeywell, JSP and Sundström were listed as potential alternative manufacturers to the Parties' powered reusable respirators. (96) For example, one customer indicated that products of 3M, ESAB, Honeywell, Scott and Sundström would all be suitable for their needs and two other customers considered Sundström as a strong competitor offering products similar to Scott's products for the applications they perform. Finally, a majority of customers considered that Sundström was the Parties' strongest competitor in the United Kingdom and offering high quality products. (97)

(146) Second, as explained in paragraph (62), the entry into the EEA by manufacturers based outside the EEA can be achieved within a relatively short period of time. This was for example the case in the United Kingdom of the U.S.-based manufacturer, RPB, which recently opened a location in the United Kingdom. (98)

(147) Third, all end-use customers, which provided meaningful responses to the market investigation, indicated that their distributors offer powered reusable respirators from different manufacturers. (99) According to these end-use customers, their

(150) The Notifying Party considers that the Transaction will not lead to a significant impediment to effective competition on the EEA market for supply of non- powered reusable respirators for the same reasons as the ones developed above for powered reusable respirators (see paragraphs (51) to (54).

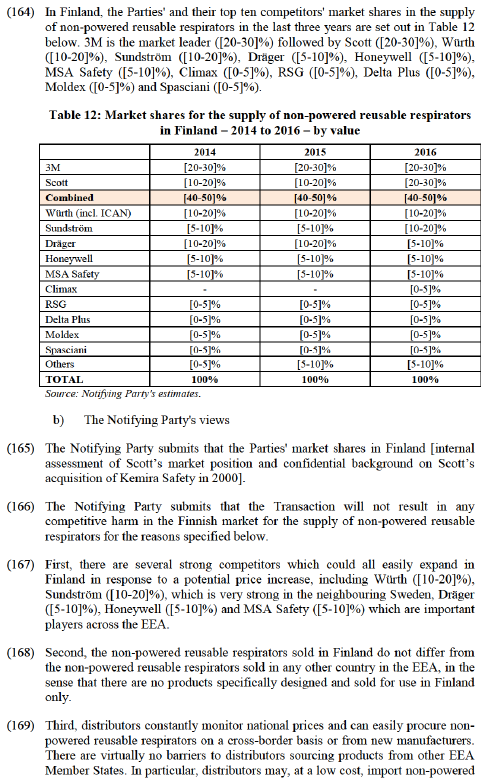

(151) Concerning the market conditions specific to non-powered reusable respirators, the Notifying Party submits that with only a [0-5]% market share in the EEA, Scott is a minor player in non-powered reusable respirators and that the Transaction will therefore not significantly change the market structure. The Notifying Party adds that a large number of competitors will continue to constrain the combined entity post-Transaction, including Dräger ([10-20]%), Honeywell ([10-20]%), MSA Safety ([5-10]%), and Avon ([5-10]%) which are all larger than Scott in non-powered reusable respirators segment.

c) The Commission's assessment

(152) The Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to non-powered reusable respirators when considering an EEA-wide market, for the reasons set out below.

(153) First, the Commission notes that 3M is the market leader ([20-30]%) while Scott is a smaller player ([0-5]%) ranking behind top manufacturers as 10th largest manufacturer of non-powered reusable respirators in the EEA. Therefore the increment brought by the Transaction is low.

(154) Second, there are several established competitors in the EEA, such as Dräger ([10-20]%), Honeywell ([10-20]%), MSA Safety ([0-5]%) which will continue to constrain the combined entity post-Transaction. Indeed, the products of Dräger, Honeywell, MSA Safety, Moldex and Sundström were all considered to be plausible alternatives to the Parties’ non-powered reusable respirators by respondents. (102) A customer explained that it "is mainly buying from 3M, Honeywell, Scott Safety, MSA Safety and Dräger products, as these companies have the best products range in terms of technicity and protection, on this segment." (103) Another customer stated regarding Dräger, Honeywell and the Parties that internal tests showed them to have "… acceptable results which were suitable with our user requirement specifications." (104) Furthermore, distributors and end-use customers who replied to the market investigation, indicate that the Parties did not compete any more closely than the other suppliers assigning the same features to 3M, Scott, Dräger, Honeywell, MSA Safety, Moldex and Sundström. Respondents consider that each of these players are characterised by the high quality of the non-powered reusable respirators they offer, by their EEA- footprint and by their broad range of products. (105)

(155) Third, the results of the market investigation also supported the Notifying Party's view that market entry and expansion is not particularly difficult. In that sense, the results of the market investigation indicated that within the last five years two players entered the market for non-powered reusable respirators in the EEA or materially expanded their range of non-powered reusable respirators in the EEA. This is the case of Delta Plus which launched its own full face mask and GVS which started selling non-powered reusable respirators in the EEA in 2013. (106) A manufacturer of non-powered respirators also indicated that it has plans to enter the market for non-powered reusable respirators in the EEA within the next two to three years. (107) Some of the distributors also indicated that in the last five years the manufacturers of reusable respirators have entered or expanded their product range, referring to companies such as Kasco, RSG Safety and Malina. (108)

(156) Fourth, barriers to expansion are low. As explained in paragraph (62), the EN certification of non-powered reusable respirators does not represent significant barrier for expansion of competitors from outside and into the EEA, and as explained in paragraph (63), barriers to expansion of the geographic footprint of players already active in Europe are low.

(157) Finally, the results of the market investigation also indicated that it is not particularly difficult for distributors and end-use customers to switch between manufacturers or add new brands of non-powered reusable respirators to their portfolio as explained above in paragraphs (67) and (68) for powered reusable respirators. Moreover, the vast majority of distributors who responded to the market investigation stated that they have a multi-sourcing strategy and almost all of them indicated that they carry at least three different brands of non-powered reusable respirators. (109) The large majority of end-use customers responded that their distributors carry non-powered reusable respirators from different manufacturers and typically offer at least three different brands of non-powered reusable respirators. (110)

d) Conclusion

(158) Based on the above, the Commission therefore concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to non-powered reusable respirators when considering a potentially EEA- wide market.

(159) As the geographic market definition was however left open, the Commission will also analyse the horizontal effects of the Transaction at national level.

4.1.2.2 National level

(160) At national level, the Parties' combined market share in non-powered reusable respirators will exceed 25% and lead to an increment of more than 5% in the following EEA Member States: Finland, Lithuania and the Netherlands. The Commission conducts its competitive assessment in each of these EEA Member States in the sub-sections below.

(161) The Transaction also gives rise to affected markets in non-powered reusable respirators in the following EEA Member States: Austria (3M: [20-30]%, Scott: less than [0-5]%); Belgium (3M: [30-40]%, Scott: [0-5]%); Bulgaria (3M: [50- 60]%, Scott: [0-5]%); Cyprus (3M: [30-40]%, Scott: less than [0-5]%); Czech Republic (3M: [30-40]%, Scott: [0-5]%); Denmark (3M: [10-20]%, Scott: [0- 5]%); Estonia (3M: [40-50]%, Scott: [0-5]%); France (3M: [20-30]%, Scott: [0- 5]%); Greece (3M: [50-60]%, Scott: [0-5]%); Hungary (3M: [40-50]%, Scott: [0- 5]%); Iceland (3M: [20-30]%, Scott: [0-5]%); Ireland (3M: [10-20]%, Scott: [5- 10]%); Italy (3M: [20-30]%, Scott: less than [0-5]%); Latvia (3M: [20-30]%, Scott: [0-5]%); Norway (3M: [30-40]%, Scott: less than [0-5]%); Poland (3M: [30-40]%, Scott: less than [0-5]%); Portugal (3M: [30-40]%, Scott: [0-5]%); Slovakia (3M: [20-30]%, Scott: [0-5]%); Slovenia (3M: [30-40]%, Scott: [0- 5]%); Spain (3M: [30-40]%, Scott: [0-5]%); Sweden (3M: [10-20]%, Scott: [5- 10]%); United Kingdom (3M: [10-20]%, Scott: [5-10]%). However, in these EEA Member States the Parties' combined market share either does not exceed 25% or the increment in the market share brought by the Transaction is not higher than 5%.

(162) Moreover, in each of these EEA Member States, the combined entity will continue to face competition from established players, such as Dräger ([30-40]%) and MSA Safety ([10-20]%) in Austria; Dräger ([10-20]%) and Honeywell ([10- 20]%) in Belgium; Dräger ([10-20]%) and Honeywell ([10-20]%) in Bulgaria; Dräger ([20-30]%) and Honeywell ([10-20]%) in Cyprus; Malina ([20-30]%) and Dräger ([10-20]%) in Czech Republic; Sundström ([20-30]%) and Dräger ([10- 20]%) in Denmark; Sundström ([10-20]%) and Dräger ([10-20]%) in Estonia; Honeywell ([20-30]%) and Dräger ([10-20]%) in France; Dräger ([10-20]%) and Honeywell ([5-10]%) in Greece; Dräger ([10-20]%) and Malina ([5-10]%) in Hungary; Sundström ([10-20]%) and Dräger ([10-20]%) in Iceland; JSP ([20- 30]%) and Honeywell ([10-20]%) in Ireland; Spasciani ([10-20]%) and Dräger ([10-20]%) in Italy; Dräger ([20-30]%) and Honeywell ([10-20]%) in Latvia; Sundström ([10-20]%) and Honeywell ([10-20]%) in Norway; Honeywell ([10- 20]%) and Dräger ([10-20]%) in Poland; Dräger ([10-20]%) and Honeywell ([5- 10]%) in Portugal; Dräger ([10-20]%) and Honeywell ([10-20]%) in Slovakia; Dräger ([10-20]%) and GVS ([5-10]%) in Slovenia; Dräger ([10-20]%) and Honeywell ([5-10]%) in Spain; Sundström ([30-40]%) and Honeywell ([20-30]%) in Sweden; Avon ([20-30]%) and JSP ([10-20]%) in United Kingdom. These market players were considered as viable alternatives to 3M or Scott in non- powered reusable respirators by the end-use customers who replied to the Commission's market investigation and no meaningful concerns were raised by end-use customers in these EEA Member States. (111)

(163) For these reasons, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to non- powered reusable respirators in these EEA Member States.

4.1.2.3 Finland

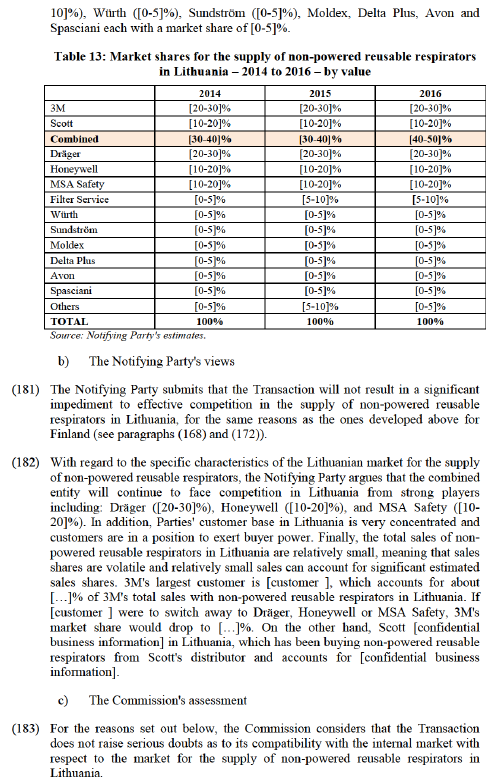

a) Market shares

reusable respirators from manufacturers who are not yet active in the distributor’s Member State or, should they wish to, parallel import products from another Member State. The combined entity's market position in Finland would thus be constrained by distributors' ability to source its products from neighbouring countries or from other manufacturers.

(170) Fourth, the barriers to entry and expansion in non-powered reusable respirators are low. This is particularly true for manufacturers that are already present in the EEA, which can easily enter an additional Member State such as Finland by approaching the relevant distributors there. Establishing a limited sales force in a new country, if required, is possible at limited cost and with limited delay. The end-use customers generally encourage distributors to carry additional manufacturers if they are dissatisfied with the distributors' selection. Similarly, all of the smaller players in non-powered reusable respirators could easily expand their presence in Finland in response to a potential price increase.

(171) Fifth, the Parties’ main customers in Finland are large distributors with buyer power that apply a multiple sourcing policy, and with whom the Parties [Parties’ supply conditions]. The Parties' customer base in Finland is concentrated. 3M's three largest distributors ([customer], [customer ], [customer ]) account for […] % of its sales of non-powered reusable respirators. Similarly, Scott's three largest customers ([customer ], [customer ], [customer ]) account for […] % of its sales of non-powered reusable respirators.

(172) Finally, the distributors and end-use customers can easily switch manufacturers or add additional manufacturer to their portfolio. For distributors, the contracts are generally of short term and non-exclusive, the distributors already work with at least two manufacturers and can easily add additional manufacturer to their portfolio. End-use customers who have already purchased respirators from one manufacturer have the opportunity to purchase respirators from other manufacturers when they purchase additional units. Respirators tend to be simple to operate such that there are no significant costs associated with re-training employees on a new respirator type.

c) The Commission's assessment

(173) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the market for the supply of non-powered reusable respirators in Finland.

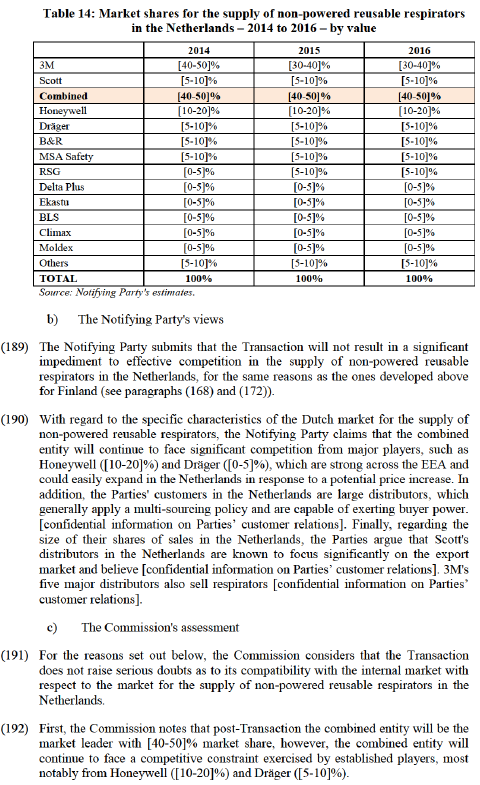

(174) First, the Commission notes that post-Transaction the combined entity will be the market leader with [40-50]% market share, however, the combined entity will continue to face a competitive constraint exercised by established players, most notably from Sundström ([10-20]%), Dräger ([5-10]%), Honeywell ([5-10]%) and MSA Safety ([5-10]%).

(175) End-use customers and distributors active in Finland who replied to the market investigation questionnaire indicated that the products of Dräger, MSA Safety, Sundström, Honeywell and Moldex can be considered as plausible alternatives to 3M's and Scott's non-powered reusable respirators. (112)

(176) As explained above in paragraph (156), barriers to geographic expansion of competitors from neighbouring countries are low. As a result, competitors such as Sundström, which has a strong footprint in neighbouring Sweden, (113) already present in Finland and recognised by customers as a high quality manufacturer, (114) could easily expand its market share in Finland.

(177) As explained above in paragraphs (157), switching between manufacturers of non-powered reusable respirators does not present any unsurmountable hurdles. The distributors active in Finland, who replied to the market investigation, indicated that they apply a multi-sourcing strategy and do not face restrictions from their manufacturers to carry other brands of non-powered reusable respirators in their portfolio and that manufacturers usually appoint several distributors in Finland. (115) The respondents indicated they carry between 3 and 5 manufacturers of non-powered reusable respirators. (116)

(178) Finnish end-use customers who responded to market investigation indicated that brand is not a very important criterion that they take into account in their decision to switch manufacturers of non-powered reusable respirators; they give more importance in their decision to switch between manufacturers on the suitability of the non-powered reusable respirators for the application that the employee will perform. (117) This was corroborated by almost all distributors who responded to market investigation. (118) Some end-use customers also indicated that in the last three years they switched or added new manufacturers of reusable respirators to their portfolio. For example, an end-use customer indicated it had recently added the Moldex half mask to its non-powered reusable respirators portfolio. (119)

(179) Finally, the Commission notes that the end-use customers that replied to the market investigation indicated that they expect the Transaction to have a neutral, or positive, impact on the market for non-powered reusable respirators in Finland. (120)

4.1.2.4 Lithuania

a) Market shares

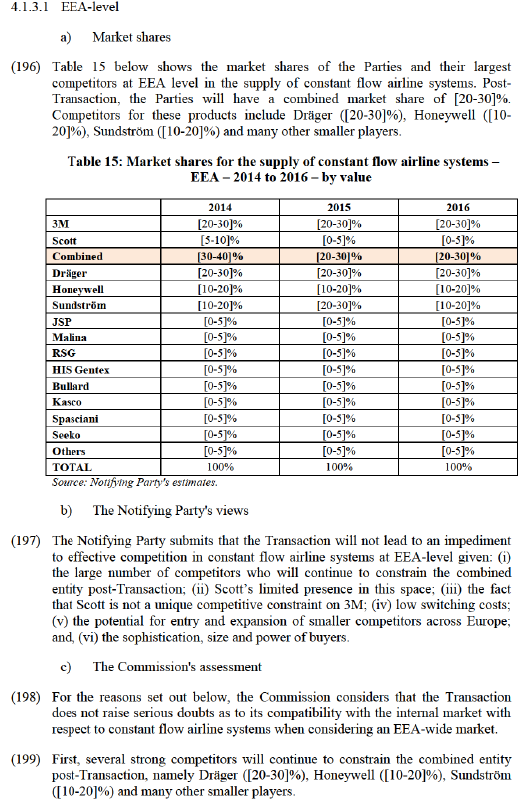

(180) In Lithuania, the Parties' and their top ten competitors' market shares in the supply of non-powered reusable respirators in the last three years are set out in Table 13 below. 3M is the market leader ([20-30]%) followed by Dräger ([20-30]%), Scott ([10-20]%), Honeywell ([10-20]%), MSA Safety ([10-20]%), Filter Service ([5-

(184) First, the Commission notes that post-Transaction the combined entity will be the market leader with [40-50]% market share. However, the combined entity will continue to face a competitive constraint exercised by established players, such as Dräger ([20-30]%), Honeywell ([10-20]%) and MSA Safety ([10-20]%).

(185) End-use customers and distributors active in Lithuania that replied to the market investigation indicated that the products of MSA Safety, Moldex, Delta Plus, Honeywell, Dräger and Sundström can all be considered as plausible alternatives to 3M's and Scott's non-powered reusable respirators. (121)

(186) The distributors that replied to the market investigation indicated that they multi- source non-powered reusable respirators from different manufacturers. (122) The customers who responded to the market investigation indicated that brand is not a very important criterion that end-use customers take into account in their decision to switch manufacturers of non-powered reusable respirators but they give more importance in their decision to switch between manufacturers on the suitability of the non-powered reusable respirators for the application. (123) An end-use customer stated that in the last three years it had added non-powered reusable respirators from JSP as it was "Looking for items that would be more effective and comfortable as well as cheaper." (124)

(187) Finally, the Lithuanian customers who replied to the market investigation indicated that they expect the Transaction to have a neutral or positive impact on the market for non-powered reusable respirators in Lithuania. One end-use customer explained that "there is huge variety of non powered reusable respirators so the will be very little impact, if any, of such proposed transaction", while a distributor observed that it is "not seeing the brands as competitive". (125)

4.1.2.5 The Netherlands

a) Market shares

(188) In the Netherlands, the Parties' and their top ten competitors' market shares in the supply of non-powered reusable respirators in the last three years are set out in Table 14 below. 3M is the market leader ([30-40]%), followed by Honeywell ([10-20]%), Dräger ([5-10]%), Scott ([5-10]%), B&R ([5-10]%), MSA Safety ([5-10]%), RSG ([5-10]%), Delta Plus ([0-5]%), Ekastu ([0-5]%), BLS, Climax and Moldex each with a market share of [0-5]%.

(193) End-use customers and distributors active in the Netherlands who replied to the market investigation indicated that Dräger, Honeywell, MSA Safety, Moldex, Delta Plus and Spasciani can be considered as manufacturing plausible alternatives to 3M's and Scott's non-powered reusable respirators. (126) The customers indicated that, similarly to the Parties, Dräger, Honeywell, MSA and Moldex offer high quality non-powered reusable respirators. (127)

(194) Second, the majority of distributors who responded to market investigation stated that they apply a multi-sourcing strategy, typically offering at least three different brands of non-powered reusable respirators. (128) For example a distributor explained "We do not want to become to dependent on one supplier, for both segments. Important to offer alternatives to customers." (129) In that sense, the Dutch distributors who replied to the market investigation stated that their supply agreements with the manufacturers of non-powered reusable respirators do not restrict the other brands that they are allowed to carry. (130) The end-use customers who responded to market investigation all indicated that their distributors multi- source non-powered reusable respirators from different manufacturers, and offer at least three different brands. (131) A customer also explained "We look for distributors that can multi-source to obtain best price and solutions based on the hazards rather than what a manufacturer can offer." (132) Moreover, all the customers who responded to market investigation also indicated that brand is not a very important criterion that end-use customers take into account in their decision to switch manufacturers of non-powered reusable respirators but they give more importance in their decision to switch between manufacturers on the suitability of the non-powered reusable respirators for the application. (133)

(195) Finally, the large majority of customers who replied to the market investigation indicated that they expect the Transaction to have a neutral or positive impact on the market for non-powered reusable respirators in the Netherlands. (134) For example, a distributor explained that "Enough competition left" while an end-use customer stated "There are plenty of other parties on the market". (135)

(200) Second, Scott is a small competitor, ranking behind the top three manufacturers Dräger, Honeywell and Sundström. The increment brought by the Transaction would be [0-5]%; the Transaction will therefore only have a limited impact on the current market structure.

(201) Third, a majority of each of competitors, distributors and customers indicated during the market investigation that the impact of the Transaction on the market for constant flow airline systems would be neutral. (136)

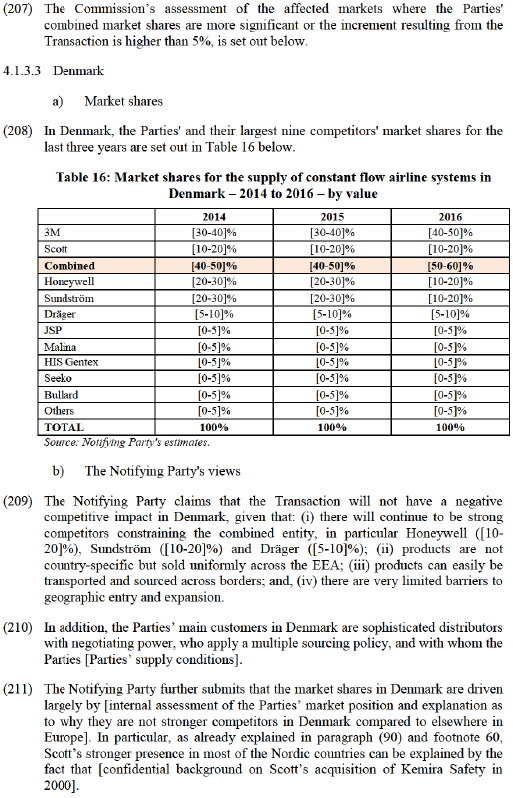

4.1.3.2 National level

(202) At national level, the Parties' combined market share in constant flow airline systems will exceed 25% and lead to an increment of more than 5% in the following EEA Member States: Denmark, Finland, Lithuania and the Netherlands. The Commission conducts its horizontal competitive assessment of each of these EEA Member States in the sub-sections below.

(203) The Transaction also gives rise to horizontally affected markets in constant flow airline systems in the following EEA Member States: Belgium (3M: [30-40]%, Scott: less than [0-5]%), Croatia (3M: [30-40]%, Scott: [0-5]%), Estonia (3M: [20-30]%, Scott: [0-5]%), France (3M: [20-30]%, Scott: [5-10]%), Germany (3M: [20-30]%, Scott: [0-5]%), Hungary (3M: [30-40]%, Scott: [0-5]%), Norway (3M: [30-40]%, Scott: [0-5]%), Portugal (3M: [20-30]%, Scott: [0-5]%), Spain (3M: [20-30]%, Scott: [0-5]%), Sweden (3M: [10-20]%, Scott: [0-5]%) and the United Kingdom (3M: [20-30]%, Scott: [0-5]%).

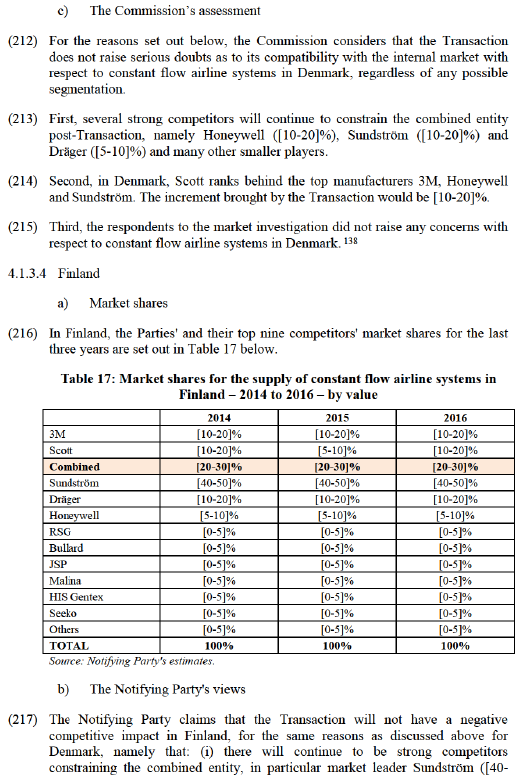

(204) The Commission considers that the Transaction does not raise serious doubts in the market for constant flow airline systems in Belgium, Croatia, Estonia, France, Germany, Hungary, Norway, Portugal, Spain, Sweden and the United Kingdom for the following reasons.

(205) First, the Parties' combined market share either does not exceed 25% (137), or the increment in market share brought by the Transaction is not higher than 5%, as Scott is a small player in all these EEA Member States.

(206) Second, in each of these Member States, the combined entity will continue to face competition from competing manufacturers, such as: Honeywell ([40-50]%) and Dräger ([5-10]%) in Belgium; Malina ([20-30]%), Honeywell ([10-20]%) and Dräger ([10-20]%) in Croatia; Sundström ([20-30]%) and Dräger ([10-20]%) in Estonia; Honeywell ([40-50]%) and Dräger ([10-20]%) in France; Dräger ([50- 60]%) and Honeywell ([10-20]%) in Germany; Dräger ([20-30]%) and Malina ([20-30]%) in Hungary; Honeywell ([20-30]%) and Sundström ([10-20]%) in Norway; Sundström ([20-30]%) and Dräger ([20-30]%) in Portugal; Sundström ([50-60]%), RSG ([5-10]%) and Dräger ([5-10]%) in Spain; Sundström ([60- 70]%) and Dräger ([5-10]%) in Sweden; and, Sundström ([20-30]%) and Honeywell ([10-20]%) in the United Kingdom.

b) The Notifying Party's views

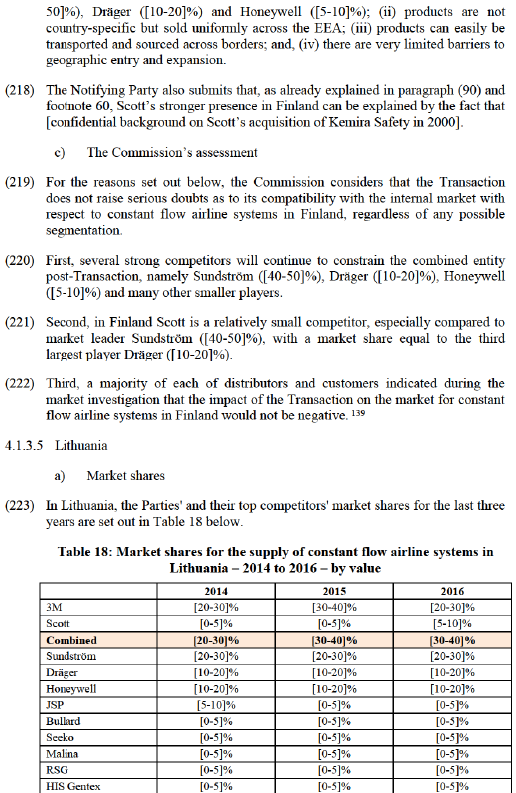

(224) The Notifying Party submits that Scott (with only a [5-10]% share) is not a major player in constant flow airline systems in Lithuania such that the Transaction will not significantly change the market structure. The same arguments discussed above for Denmark apply in Lithuania as well, including the facts that (i) there will continue to be strong competitors constraining the combined entity at the local level (including Sundström ([20-30]%), Dräger ([10-20]%), and Honeywell ([10-20]%)); (ii) products are not country-specific but sold uniformly across the EEA; (iii) products can easily be transported and sourced across borders; and (iv) there are very limited barriers to geographic entry and expansion.

c) The Commission’s assessment

(225) For the reasons set out below, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to constant flow airline systems in Lithuania, regardless of any possible segmentation.

(226) First, several strong competitors will continue to constrain the combined entity post-Transaction, namely Sundström ([20-30]%), Dräger ([10-20]%), and Honeywell ([10-20]%) and many other smaller players.

(227) Second, in Lithuania Scott is the smallest of the five largest competitors, ranking behind the top four manufacturers 3M, Sundström, Dräger and Honeywell. The increment brought by the Transaction would be [5-10]%.

4.1.3.6 The Netherlands

a) Market shares

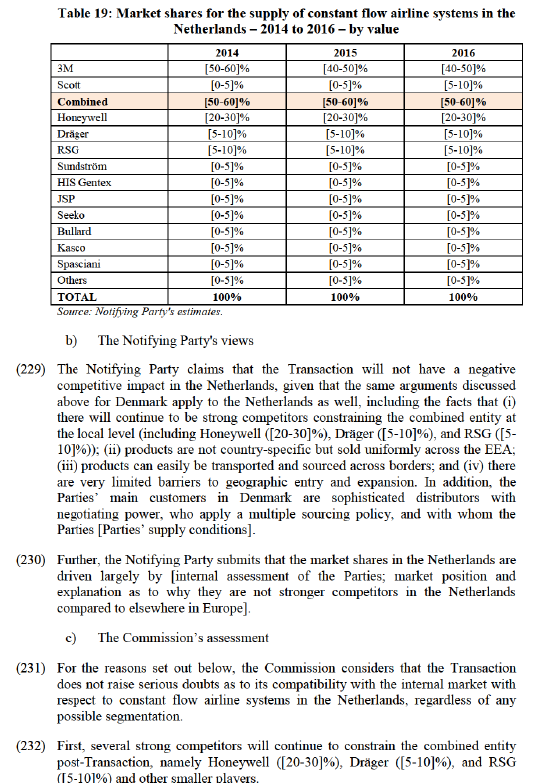

(228) In the Netherlands, the Parties' and their top ten competitors' market shares for the last three years are set out in Table 19 below.

(233) Second, in the Netherlands Scott is a relatively small competitor behind 3M and Honeywell ([20-30]%), with a market share equal to the third largest player Dräger ([5-10]%).

(234) Third, during the market investigation no competitors in the Netherlands raised any concern with respect to the Netherlands. (140) All customers in the Netherlands and a majority of distributors who responded to the market investigation indicated that the impact of the Transaction on the market for constant flow airline systems would not be negative (either neutral or positive). (141)

4.1.4 Hearing protection

4.1.4.1 Active hearing protection

a) EEA-level

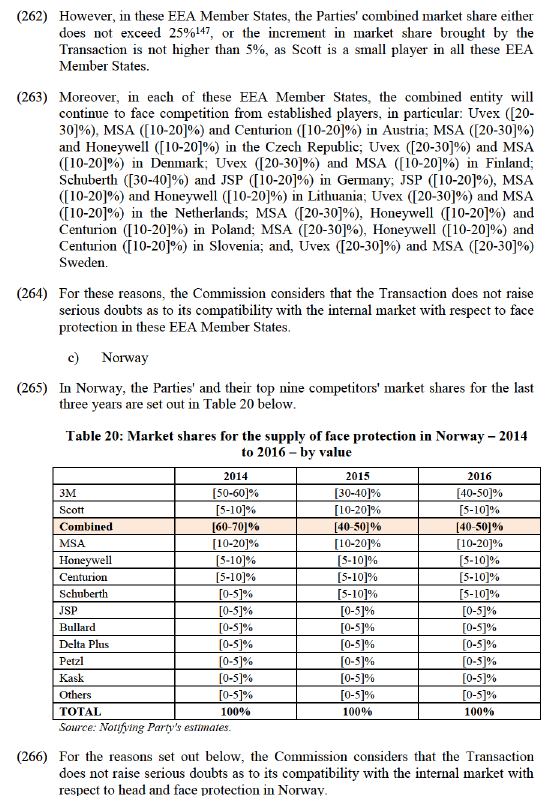

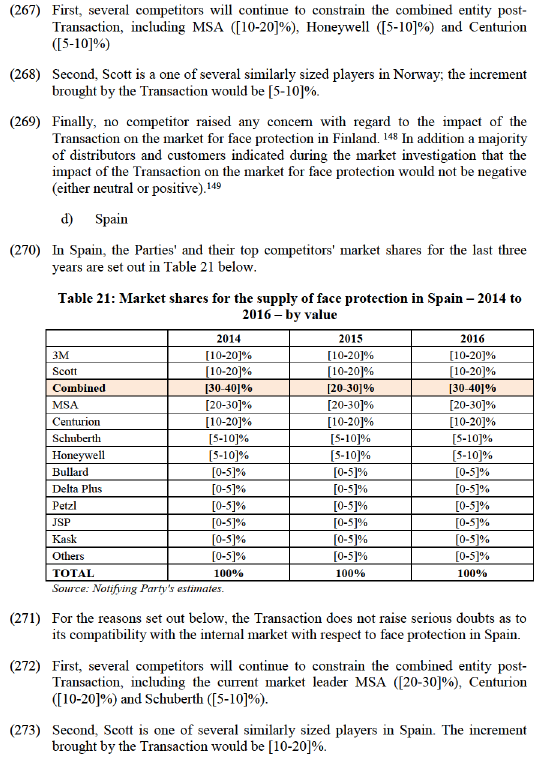

(235) At EEA-level, the combined entity will be the market leader with [30-40]% post- Transaction (3M: [30-40]%, Scott: less than [0-5]%), followed by Invisio ([10- 20]%), Ceotronics ([10-20]%), MSA Safety ([5-10]%) and Honeywell ([5-10]%).