Commission, June 15, 2018, No M.8660

EUROPEAN COMMISSION

Decision

FORTUM / UNIPER

Subject: Case M.8660 – FORTUM / UNIPER

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 7 May 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Fortum Oyj ("Fortum", Finland) acquires sole control over Uniper SE ("Uniper", Germany) within the meaning of Article 3(1)(b) of the Merger Regulation, by way of a public takeover offer (the "Proposed Transaction"). Fortum is hereafter referred to as the "Notifying Party" and Fortum and Uniper are collectively referred to as the "Parties".

1. THE PARTIES

(2) Fortum is an energy group majority-owned by the Finnish State and principally active in power and heat generation and energy-related services, mainly in the Nordic (3) and Baltic regions but also with operations elsewhere in Europe and Russia, as well as in India.

(3) Uniper is an energy company that comprises the former conventional power utility and commodities trading business of E.ON and is currently owned 46.65% by E.ON, with activities in Europe and Russia.

2. THE CONCENTRATION

(4) On 26 September 2017, Fortum announced an agreement with E.ON whereby E.ON could tender its 46.65% stake in Uniper in a public takeover offer for Uniper initiated by Fortum. While opposed by Uniper's management, Fortum's public offer eventually resulted in acceptances by shareholders – including E.ON – representing 47.12% of Uniper's share capital. In accordance with paragraph 59 of the Commission Consolidated Jurisdictional Notice (4), the Commission considers that the ownership by Fortum of a 47.12% interest and associated voting rights in Uniper is sufficient to confer Fortum sole control over Uniper.

(5) In effect, given the dispersed shareholding structure of Uniper, (5) and the attendance rate in Uniper's previous (and only) General Meeting of Shareholders of 72-73%, (6) the ownership of a 47.12% interest is highly likely to enable Fortum to achieve a majority at Uniper shareholders' meetings going forward. (7) According to Uniper's Articles of Association, Fortum would then be able to secure the appointment of the six shareholder representatives at Uniper's Supervisory Board, (8) as they are elected by a simple majority vote of the General Meeting, (9) including the chairman who holds a casting vote. (10)

(6) In turn, Fortum would be able to exercise decisive influence over Uniper because the Supervisory Board is required to approve Uniper's annual budget and business plan, as well as other material decisions, by a simple majority vote. (11) Likewise, the Supervisory Board appoints (and dismisses) Uniper's Board of Management by simple majority vote; (12) the latter having overall responsibility for Uniper's commercial decision-making.

(7) As a result, the Proposed Transaction enables a lasting change of control over Uniper and therefore qualifies as a concentration pursuant to Article 3 of the Merger Regulation.

3. EU DIMENSION

(8) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (13) (Fortum: EUR […] million; Uniper: EUR 72 238 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Fortum: EUR […] million; Uniper: EUR […] million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension. (14)

4. MARKET DEFINITION

(9) The Proposed Transaction involves the cross-border combination of two EEA- based energy groups with significant electricity generation assets, notably hydropower plants. The Proposed Transaction's stated rationale lies in the combination of Uniper's ability to provide security of electricity supply with Fortum's long-term emphasis on renewable energy generation, in order to accompany the transition towards full decarbonisation. (15)

(10) The Parties' electricity generation activities are widely complementary from a geographic point of view, as Fortum's geographic focus is the Nordic and Baltic regions while Uniper's focus is continental Europe. In particular, their electricity generation activities only overlap in Sweden. That overlap has been the focal point of the Commission's assessment of the compatibility of the Proposed Transaction with the internal market in relation to the generation and wholesale supply of electricity and the supply of ancillary services contributing to the balancing of electricity supply and demand.

(11) In addition, the Commission has assessed the impact of the Proposed Transaction in a number of energy-related activities giving rise to horizontal or vertical relationships between the Parties, including financial electricity trading, the retail supply of electricity, trading in CO2 allowances, renewable energy certificates and guarantees of origin, physical commodity trading, the supply of energy production-related services and of district heating.

(12) The present section aims to define the relevant markets with a view to identifying the boundaries of competition between the Parties and the competitive constraints that they face, (16) and thereby frame the competitive assessment of the Proposed Transaction.

4.1. Generation and wholesale supply of electricity

(13) Both Parties own and operate electricity generation assets in Sweden. Sweden is divided into four bidding zones for the purpose of wholesale electricity trading (i.e. sale and purchase of generated electricity), and the overlap between the Parties' assets lies in SE2 and SE3 (central zones). In addition, Uniper also has some limited production capacity in SE4 (southern zone). Conversely, neither Party generates electricity in SE1 (northern zone). (17)

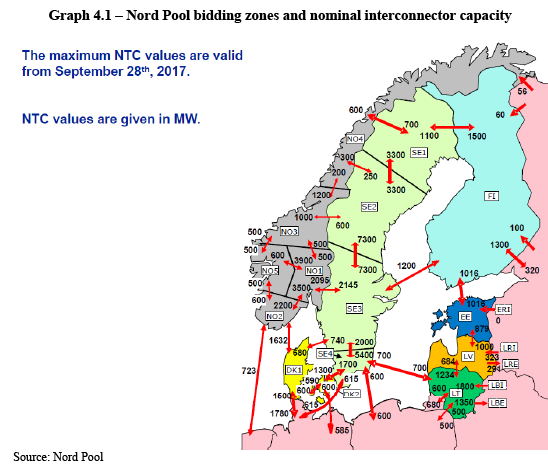

(14) Electricity generated in Sweden is traded for the most part on the Nord Pool power exchange (18) where prices are determined for each bidding zone by the intersection of aggregated demand and supply curves resulting from bids entered the day before physical delivery (so-called "day ahead" market, called Elspot), or on a "pay-as-bid" basis in case of same day delivery (so-called "intra-day" market, called Elbas). (19) Prices are also a function of imports of electricity through interconnectors with other bidding zones, either within Sweden or with neighbouring countries, primarily Norway, Denmark and Finland, though the geographical scope of Nord Pool now extends to all Nordic and Baltic countries (Norway, Sweden, Finland, Denmark, Estonia, Latvia and Lithuania). The availability of imports is a function of interconnectors' capacity. An overview of the Nord Pool bidding zones and of the nominal interconnector capacities (that is, the maximum net transmission capacities, "NTC"), is provided in Graph 4.1.

4.1.1. Product market definition The Notifying Party's view

(15) The Notifying Party submits that there is a close substitutability between the generation and wholesale supply of electricity, the provision of ancillary services and the financial trading of electricity. (20)

(16) From a supply-side perspective, according to the Notifying Party, the electricity used for ancillary services is no different from the electricity sold on the wholesale market and producers are able to switch between the wholesale supply of electricity and the provision of ancillary services, while there is a close relationship between the physical and financial trading of electricity. (21) From a demand-side perspective, there is a strong degree of inter-relationship between wholesale and financial trading activities since purchasers can engage in financial hedging strategies to alter their exposure to wholesale spot prices, while prices and price expectations in wholesale and financial trading mutually influence each other. (22)

(17) As a result, the Notifying Party argues that these segments all belong to the same product market. However, the Notifying Party submits that no competition concern arises even based on the narrowest plausible market definition limited to the generation and wholesale supply of electricity, and proceeds to discuss the relevant geographic segmentation on that basis. (23)

The Commission's assessment

(18) The Commission has consistently defined a relevant product market encompassing both the generation and wholesale supply of electricity, irrespective of the generation sources and trading channels. (24) As a result, in relation to electricity supply in the Nordic region, the Commission has, in the past, considered that the relevant market covered electricity sold by means of bilateral contracts and on the Nord Pool platform, both on Elspot (day-ahead) and Elbas (intra-day). (25)

(19) The Commission has also considered in the past whether the financial trading of electricity (26) and ancillary services (27) belonged to the same product market as the generation and wholesale supply of electricity, or to distinct markets. Generally, ancillary services have been distinguished from wholesale supply based on demand-side and functionality considerations, including in the Nordic region. (28) Financial trading has also been distinguished from wholesale supply due to differences in settlement, duration and overall function since financially settled contracts are about trading risk while physically traded ones are about trading electricity for consumption. (29) In particular, in relation to the Nordic region, the Commission found that the physical and financial electricity trading were separate markets irrespective of their close interconnection. (30)

(20) In the present case, replies to the market investigation indicated that whilst generation and wholesale of electricity, ancillary services and the financial trading of electricity are all linked to each other, each has different functionalities and dynamics. (31)

(21) Ultimately, the Commission considers that the precise market definition can be left open since no serious doubts arise about the compatibility of the Proposed Transaction with the internal market, even on the narrowest plausible segmentation, which is at the level of the generation and wholesale supply of electricity, separate from ancillary services and financial trading. (32) Hence, the Commission carried out separate assessments of the impact of the Proposed Transaction on the generation and wholesale supply of electricity, the provision of ancillary services and financial trading, respectively.

4.1.2.Geographic market definition The Notifying Party's view

(22) The Notifying Party submits that the relevant geographic market for the generation and wholesale supply of electricity is Nord Pool-wide, thus covering the Nordic (Finland, Sweden, Norway, Denmark) and the Baltic countries (Estonia, Latvia and Lithuania).

(23) In essence, the Notifying Party contends that: (i) the Nord Pool area is highly integrated due to a large number of interconnectors allowing electricity to flow across the area; (ii) the regulatory environment is effectively Nord Pool-wide; (iii) there is no barrier to sellers and purchasers from any part of Nord Pool agreeing in principle to the sale and purchase of electricity; (iv) Nord Pool prices are formed automatically through an algorithm that secures optimal utilisation of transmission capacity on the basis of supply/demand across Nord Pool as a whole. (33)

(24) In addition, the Notifying Party considers the possibility of limiting the scope of the relevant market to Sweden but points out that Swedish bidding zones are interconnected and frequently coupled with various (and varying) other zones outside of Sweden, which would render such segmentation somewhat arbitrary. (34) Thus, even if the market were to be defined on a national basis (Sweden), Nord Pool-wide market dynamics need to be taken into account in the assessment of the Proposed Transaction. (35) In any event, the Notifying Party argues that there is no plausible basis for segmenting the relevant market at the level of individual Swedish bidding zones because these are (almost) never isolated from all other bidding zones but generally form part of wider pricing areas. (36)

(25) In any event, the Notifying Party submits that it is unnecessary to conclude on the geographic scope of the relevant market because the Proposed Transaction would not raise serious doubts as to its compatibility with the internal market under any of the contemplated bases. (37)

The Commission's assessment

(26) The Commission has historically defined the market for the generation and wholesale supply of electricity at national level. (38) However, the Commission has also recognised the relevance of interconnection capacity between Member States and of pricing relationships across interconnection points. Hence, with regard to the Nordic region in particular, the Commission has considered that the relevant geographic market might be wider (or narrower) than national, though it ultimately left the question open. (39)

(27) In the present case, the Commission has carefully assessed the relevant geographic scope of the market for the generation and wholesale supply of electricity in the Nordic region, and in relation to Sweden in particular, based on the following factual premises: (i) the Parties' generation assets overlap only in bidding zones SE2 and SE3 within Sweden; (ii) each of SE2 and SE3 are connected to other bidding zones within and outside Sweden; (40) (iii) prices are determined on Nord Pool for each individual bidding zone; and (iv) the Nord Pool algorithm determines prices on the basis of supply and demand functions (or individual bids on Elbas) entered into at the level of each zone combined with other zones up to the level of available interconnection capacity, i.e. by optimising the utilisation of transmission capacity.

(28) In line with the precedents referred to in paragraph (26), the Commission undertook an assessment of the magnitude of the existing interconnection of each of SE2 and SE3 with other bidding zones within Nord Pool and the resulting effects on prices, with a view to drawing an area in which the conditions of competition are sufficiently homogeneous. (41) The analysis was carried out using hourly day-ahead price and interconnector utilisation data published by Nord Pool. The data revealed, first of all, that SE2 and SE3 individually are (almost) never isolated but always coupled with at least one other bidding area within Nord Pool. (42) Second, the data indicated that SE2 is (almost) always coupled with SE1, and that SE3 and SE4 are also rarely decoupled from each other. (43) Third, the analysis showed that prices in SE3 and SE4 are materially higher than prices in SE1-SE2 (and lower than prices in Finland) in only a very limited number of hours. (44) Fourth, the data indicated that, on average, the four Swedish bidding zones shared a common price in 89.7% of the hours over the 2016-2017 period. These figures are consistent with the fact that the capacity of interconnectors between Swedish bidding zones is significant, and significantly higher overall than with neighbouring zones outside of Sweden, (45) as apparent from Graph 4.1. (46)

(29) As a result, the Commission observes that SE2 and SE3 do not constitute distinctive areas in terms of pricing, as a reflection of supply and demand dynamics and, in particular, of interconnections with other bidding zones. In this particular case, defining relevant markets at the level of each of SE2 and SE3 appears therefore inappropriate, irrespective of the fact that bids are entered on Nord Pool and prices are determined by Nord Pool at a bidding zone level and that generators' market shares vary across single bidding zones, notably within Sweden. Defining a relevant market at the level of a single bidding zone cannot be excluded in principle, also within the Nord Pool area, but evidence does not support this in relation to SE2 and SE3 specifically, where the generation assets of the Parties overlap.

(30) In contrast, the Commission considers plausible a market definition encompassing all four Swedish bidding zones. At that level, the Commission acknowledges that individual bidding zones within Sweden are also frequently coupled with other bidding zones outside of Sweden within the Nord Pool system. In fact, the analysis has showed that the four Swedish bidding zones formed one single pricing area – decoupled from all the other neighbouring zones – in only 0.48% of hours over the 2016-2017 period. This means that at least one Swedish bidding zone is coupled with at least one bidding zone outside of Sweden, within the Nord Pool system, virtually all the time. Consequently, it means that when all four Swedish bidding zones are coupled together, they are also coupled with at least one other bidding zone outside of Sweden.

(31) In that regard, the Notifying Party has also submitted its own analysis showing that, over the 2014-2017 period: (i) SE1 and SE2 together and SE3 individually shared a price with at least one bidding area outside Sweden in more than 98% of hours; (ii) Sweden as a whole was coupled with at least three other bidding areas in 81.7% of hours; and (iii) SE3 was fully decoupled in only 0.05% of all hours and was coupled with 1 and up to 14 other bidding zones for the rest of the time, with a widespread distribution of hours across the number of coupled bidding zones. (47)

(32) On the basis of its own analysis and that of the Notifying Party, the Commission therefore finds that: (i) production outside of Sweden, mainly in Norway and to a lesser extent Denmark, (48) constitutes an important competitive constraint on the generation and wholesale supply of electricity within Sweden and within each Swedish bidding zone, thus including SE2 and SE3; (ii) there are various constellations of possible coupling combinations across bidding zones, and these combinations do vary widely across hours; and (iii) all 15 bidding zones across Nord Pool as a whole share the same price only in a limited number of hours, calculated by the Notifying Party as being 5.2% of all (day and night) hours over the 2014-2017 period. (49)

(33) In turn, the Commission concludes that a Nord Pool-wide market appears implausible. Contrary to the Notifying Party's views, there still remains significant capacity limitations constraining the flow of electricity across the Nord Pool area as a whole, which are unlikely to disappear in the short to medium term, (50) as reflected in the limited number of hours during which the same price prevails across Nord Pool. The fact that the Nord Pool algorithm optimises existing interconnection capacity throughout Nord Pool does not alleviate that reality. Moreover, the ability of traders across Nord Pool to agree to the sale and purchase of electricity is either subject to congestion constraints or governed by (bilateral) conditions that do not reflect actual Nord Pool prices, at least not completely. (51) Furthermore, from a regulatory point of view, the management of interconnections remains in the hands of national transmission system operators ("TSOs"), which determine by themselves the capacity of the interconnectors that is made available to Nord Pool. (52)

(34) Conversely, the Commission concludes that the relevant geographic market, in the present case, could entail different combinations of bidding zones including SE2 and/or SE3. However, these combinations vary constantly, depending on the specific hour of the day/night and based on various circumstances such as weather conditions and the way they influence flows through interconnectors. In turn, carrying out a meaningful assessment of the Proposed Transaction on the basis of continuously changing constellations of bidding zones is impracticable. Conversely, a combination of all four Swedish bidding zones emerges as both a plausible and practicable geographic delineation of the generation and wholesale supply market in the present case. In this respect, the Commission further notes that: (i) the number of hours during which all four Swedish bidding zones share the same price (89.7% of all hours) is particularly high; (ii) no single Swedish bidding zone is coupled with one and the same bidding zone outside of Sweden more than 90% of the time, (53) i.e. more than the time in which the four Swedish bidding zones are coupled together; (iii) actual (vs nominal, as presented in Graph 4.1) interconnection capacity available on average across the four Swedish bidding zones is significantly higher than with any bidding zone outside Sweden; (54) and (iv) by far the largest generator and wholesale supplier of electricity in Sweden, Vattenfall, has no or only very minor activities in other parts of the Nord Pool area (and Uniper is not active at all outside of Sweden). (55)

(35) As a result, Sweden as a whole can be distinguished from neighbouring areas due to appreciably different conditions of competition resulting from the available interconnection capacity and reflected in pricing commonalities across Swedish bidding zones. (56) In any event, the Commission will equally take into account the constraints arising from interconnection flows and overall Nord Pool-wide market dynamics in its competitive assessment, as suggested by the Notifying Party.

(36) In light of the above, the Commission concludes that for the purposes of the present case, although the boundaries of the geographic market may vary depending on the hour based on changing constellations of different bidding zones as per the evidence summarised above, the most plausible geographic market consists of a combination of all four Swedish bidding zones, subject to external constraints in the form of flows into Sweden from other bidding zones; hence, the competitive assessment will focus on the effects of the Proposed Transaction on Sweden as a whole.

4.2. Financial trading

(37) Aside from the physical trading of electricity on the generation and wholesale market, it is also possible to trade in financial instruments relating to electricity. Financial trading is either done via exchanges or on an over-the-counter ("OTC") basis. (57) Financial derivatives traded or cleared by an exchange are financially settled. Bilateral financial contracts can be settled either financially or physically.

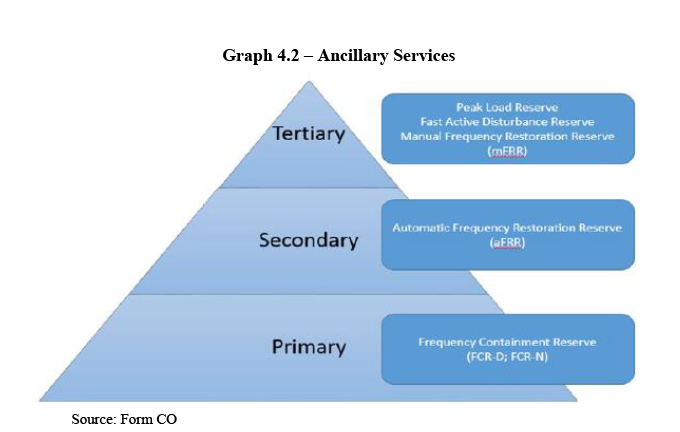

(38) Electricity derivatives are contracts whereby the price of a certain volume of electricity is fixed for a certain period in the future. The derivative price is then compared to the reference market price of electricity (e.g. the system spot price on Nord Pool) in the delivery period; if the realised reference price is lower than the derivative price, the buyer pays the difference to the seller and vice versa.

(39) The purpose of the financial trading of electricity can be either hedging; for generators to hedge their future income and for consumers to have their future costs of electricity managed to an acceptable level, or speculation.

(40) The main types of electricity derivatives in the Nordics are the following:

· Forwards: electricity forward contracts represent the future obligation to buy or sell a fixed amount of electricity at a pre-specified price ("the forward price"). Forwards can be either physically or financially settled and are traded both via exchanges and on an OTC basis. (58)

· Futures: electricity futures function similarly to forwards, however they are more standardised products and their settlement involves both a daily mark- to-market settlement and a final spot reference cash settlement. Futures are traded exclusively via exchanges.

· Options: Options are contracts giving the holder the right – but not the obligation – to buy or sell a fixed volume during a future time period at a pre-specified price. Options therefore give more flexibility to their holder, however the associated costs also should be taken into account as there is a non-refundable premium to buy or sell an option.

· Electricity Price Area Differentials ("EPADs"): known in other regions as contracts for differences ("CfDs"), EPADs are products hedging the realised bidding area price against the Nordic system price, therefore allowing market participants to hedge against the price risk caused by transmission interconnection constraints. EPADs are financially settled.

4.2.1. Product market definition The Notifying Party's view

(41) The Notifying Party submits that financial and physical trading of electricity are closely related with each other, but notes that the Proposed Transaction does not raise competition concerns even if financial trading is considered to be a separate product market. (59)

(42) The Notifying Party further argues that all different types of electricity derivatives belong to the same relevant product market. Furthermore, other commodity derivatives that can be used for hedging purposes ("proxy hedging") may also belong to the same product market whereas for purely speculative traders, even all other types of financial instruments are substitutable with electricity derivatives. However, the Notifying Party submits that the Proposed Transaction does not raise competition concerns even if only electricity derivatives are considered. Furthermore, it argues that no competition concerns arise even if – based on the Commission's decisional practice – EPADs are considered to constitute a separate product market. (60)

The Commission's assessment

(43) As explained in paragraph (19) although the decisional practice is not uniform in this regard, (61) the Commission has previously considered that the financial trading of electricity might constitute a distinct relevant product market, separate from the generation and wholesale supply of electricity. (62) Financial trading of electricity, whether on an OTC basis, bilaterally or on organised market places (exchanges), has been considered to be part of one and the same market. (63) However, the Commission has considered that contracts for differences (here: EPADs) (64) might form a product market separate from the other financial electricity derivatives based on their limited substitutability. (65)

(44) For the purposes of the present case, the Commission considers first, that the financial trading of electricity constitutes a relevant product market, separate from the generation and wholesale supply of electricity. Although the Commission acknowledges that these two activities are closely linked, having the system price as a common reference price, the settlement and the delivery time differs on the physical and the financial markets as the financial trading of electricity is ultimately about trading risks or speculative trading, and not the consumption of electricity. Furthermore, the presence of speculative traders, as well as the overall trading volume which is multiple times the volume physically produced, also underlines the differences between the two markets. Furthermore, the physical and financial trading activity is separated from the generation activity within the producers' organisation, and internal information barriers ("Chinese walls") are implemented in order to comply with the prohibition of insider trading under REMIT (66) and the Market Abuse Regulation. (67)

(45) Second, the Commission considers that there is a sufficient degree of supply- and demand-side substitutability between the different system price-based electricity derivatives given that their overall purpose is the same, i.e. risk management or purely speculative trading. Indeed, the market investigation results (68) support the Notifying Party's argument that market participants choose one derivative or another irrespective of the precise format but based on its liquidity. (69) It should, however, be noted that respondents to the market investigation did not indicate that they see proxy hedging as an alternative to Nordic electricity derivatives.

(46) However the Commission considers that EPADs constitute a separate product market based on their limited substitutability (70) with other electricity derivatives given that their purpose is to hedge the remaining area specific price risk. (71)

(47) Finally, the Commission considers, in line with its previous decisional practice, that a distinction between financial electricity trading via exchanges on the one hand and on an OTC basis on the other hand is not appropriate. Irrespective of the exact mechanism of trading, electricity derivatives ultimately serve the same – hedging or speculative – purposes. It should also be noted that volumes traded on an OTC basis can and are to some extent cleared by exchanges, therefore removing some differences between organised and OTC trading, as regards transparency and counterparty risk management.

(48) Based on the considerations explained in paragraphs (44) to (47), the Commission therefore considers that the financial trading of electricity – including all system price-based electricity derivatives, and excluding proxy hedging – on the one hand, and the trading of EPADs on the other hand, constitute two distinct product markets.

4.2.2. Geographic market definition The Notifying Party's view

(49) The Notifying Party submits that the market for financial trading of electricity is global, and in any event at least EEA-wide in scope. This is because the physical location of the counterparties is irrelevant, given that there is no physical settlement involved. The Notifying Party argues that the practice of proxy hedging also points towards a global market. It submits that these arguments are equally valid for EPADs. (72)

(50) However, the Notifying Party submits that the Proposed Transaction does not raise competition concerns even if the market for financial trading of electricity is considered on a regional basis and the market for EPADs on a bidding zone basis. (73)

The Commission's assessment

(51) The Commission previously considered the market for financial trading of electricity to be global or at least EEA-wide, (74) and in relation to the Nord Pool area, comprising at least the Nord Pool region. (75) As for the market for EPADs, the Commission previously considered that the relevant market could comprise each particular price area. (76)

(52) Given that the market investigation has not brought to light any indication that would contradict the Commission's earlier findings, the Commission has taken a conservative approach and analysed the effects of the Proposed Transaction on the narrowest possible basis, considering the market for financial trading of electricity to be regional (Nord Pool-wide) and the market for EPADs to be local (comprising each particular bidding zone) in scope.

4.3. Ancillary services

(53) Ancillary services are the services procured by each of the national TSOs to maintain the frequency of the electricity grid in the Nordic power system (77) at 50 Hz by ensuring a balance between electricity production and electricity consumption at any moment. If an imbalance occurs with excess consumption (demand) on the grid, a TSO requests up-regulation which can be an increase in generation or a reduction in consumption. The reverse is true for down-regulation.

(54) Ancillary services can generally be categorised as primary, secondary or tertiary regulation, on the basis of the order of activation and the magnitude of frequency deviation. As further explained in paragraphs (55) to (64) and summarised in Graph 4.2, primary regulation consists of Frequency Containment Reserve ("FCR"), secondary regulation consists of automatic Frequency Restoration Reserve ("aFRR"), and tertiary regulation consists of manual Frequency Restoration Reserve ("mFRR"), Fast Active Disturbance Reserve ("FADR") and Peak Load Reserve ("PLR").

FCR

(55) FCR is a capacity reservation mechanism used for the constant control of frequency and activated automatically within seconds in response to frequency changes. There are two types of FCR: FCR-N (normal) and FCR-D (disturbance). The provision of FCR-N relates to small frequency imbalances in the electricity system (78), while FCR-D is required to re-balance more significant frequency shortfalls. (79)

(56) In the Nordic region, FCR capacity is procured for every hour of every day. The capacity is fixed (80) annually based on a system agreement between the Nordic TSOs with a distribution key to allocate capacity to individual TSOs. (81) In addition, Nordic TSOs can purchase from other Nordic TSOs up to one-third of their individual FCR requirement.

(57) The Swedish TSO, Svenska Kraftnät, procures FCR capacity one or two days in advance (ahead of delivery). The FCR capacity is procured based on the bids made by suppliers. Those suppliers whose bids are accepted by the TSO receive a capacity payment. Upon activation of reserved capacity, the suppliers also receive an energy payment for the activated electricity. Not all reserved capacity is ultimately activated. (82)

aFRR

(58) The aFRR is a capacity reservation mechanism which can be activated automatically within 2 minutes. aFRR is procured for every day but not for every hour. It generally only covers morning and evening hours when the risk of frequency deviation is highest. (83)

(59) In the Nordic region, every 6 months, the TSOs decide how much aFRR capacity will be procured by each of the TSOs for both up- and down regulation. (84) The actual activation is automatic and controlled by Statnett, the Norwegian TSO for the whole Nordic region.

(60) The Swedish TSO procures aFRR capacity every Thursday for the whole of the following week. The aFRR capacity is procured based on the bids made by suppliers. Those suppliers whose bids are accepted by the TSO receive a capacity payment. Upon activation of reserved capacity, the suppliers also receive an energy payment for the activated electricity. Not all reserved capacity is ultimately activated. (85)

mFRR

(61) Unlike for FCR and aFRR, no capacity reservation takes place for mFRR. mFRR is procured in the hours when supply and demand differs. The suppliers only receive an energy payment. The TSO pays an energy payment on a clearing price basis (unlike for FCR and aFRR, the marginal price determines the price for all accepted bids). mFRR is procured on the Nordic regulation power market which functions in a similar manner to the generation and wholesale market. (86)

(62) mFRR is procured by each of the Nordic TSOs and can be manually activated within 15 minutes. Suppliers (producers and consumers) can bid up to 45 minutes before the delivery hour. In practice, mFRR is always needed as the Swedish TSO has a preference not to have the automatic reserves (FCR and aFRR) fully activated at all times, as this would mean that the automatic reserves would not be ready for any disturbances; mFRR is thus also used to relieve and reset aFRR. (87)

FADR

(63) FADR is procured for situations when mFRR is insufficient and can be manually activated in 15 minutes (88), but also for other uses such as a black start. (89) The procurement takes place several years ahead and it is a requirement that assets providing FADR are not in commercial use. (90)

PLR

(64) PLR is procured for situations where the planned electricity production may not be sufficient to cover anticipated consumption. (91) In Sweden, it is provided under long-term arrangements in the area in which such reserves are needed. (92) The demand response (93) part of the PLR (25%) is procured every year, and the remaining part of the PLR is procured ever 4 years. (94) PLR can be activated within 1 to 2 days. (95)

4.3.1. Product market definition The Notifying Party's view

(65) The Notifying Party takes the view that hourly reserves (i.e. FCR, aFRR and mFRR) form part of the market of the generation and wholesale supply of electricity as production plants supplying electricity for these ancillary services are already (and simultaneously) supplying electricity to Nord Pool. The Notifying Party argues that there is no difference in the electricity sold depending on the purpose of its use whether for the generation and wholesale market or for the hourly reserves. Consequently, generators face no delays in switching capacity between Nord Pool and hourly reserves (or between hourly reserves). (96)

(66) Moreover, provided that a hydro plant has the necessary inherent flexibility and size, which is typically the case for reservoir hydro plants in Sweden, no or only limited costs are required to equip that plant to provide hourly reserves according to the TSO requirements. (97)

(67) Therefore, the Notifying Party argues that hourly reserves are substitutable between themselves and with the generation and wholesale supply of electricity. Nevertheless, on a conservative basis, the Notifying Party submits information on the basis of a product market comprising each of the hourly reserves separately. (98)

(68) The Notifying Party also takes the view that the two non-hourly reserves (i.e. FADR and PLR) form one or two separate product markets as they are outside the commercial day-ahead and intra-day power market, and are only activated in exceptional circumstances of severe disturbances or capacity shortages. (99) However, the Notifying Party argues that no conclusion on the exact product definition for FADR and PLR is necessary given the lack of overlap between the Parties' activities in these two markets. (100)

The Commission's assessment

(69) As explained in paragraph (19), the Commission has generally considered the supply of ancillary services as a separate product market from the generation and wholesale supply of electricity based on demand-side and functionality considerations, also in the Nordic region. (101) The Commission has also considered, without concluding, sub-segmenting (102) the market further into different types of balancing activities (103), depending on the national framework. (104) However, in some cases, a separate product market for balancing power has been defined from the generation and wholesale of electricity market, whereas, in other case, the exact product market definition has been left open. (105)

(70) The Commission acknowledges that there is a clear link between the generation and wholesale supply of electricity on the day-ahead and intraday market and the hourly reserve markets. Each affects the other, in terms of where capacity is allocated as well as in respect of price. This is, in particular, as regards mFRR which is a reserve where no capacity is reserved and where the pricing formulation is similar to that of the generation and wholesale supply market.

(71) That being said, the facts brought to light by the Commission's investigation show that the demand- and supply-side dynamics of ancillary services generally differ from those of generation and wholesale supply. This will first be discussed for the hourly reserves, as for the non-hourly reserves the Notifying Party argues these are separate product markets from the generation and wholesale market.

(72) First, ancillary services are not traded on Nord Pool but procured directly by the TSO. While for the wholesale and generation market any electricity consumer active on the Nord Pool market can be the buyer of the electricity sold; for all ancillary services there is only one buyer, the TSO.

(73) Second, the price setting mechanisms are different, in particular for FCR and aFRR for which capacity is procured based on actual supplier bids (but that capacity may not be fully activated). Capacity procurement requires suppliers to pledge capacity to the TSO, which can be activated at short notice, fully or partially, which differs from the generation and wholesale market where electricity production is sold.

(74) Third, the ancillary services are procured at different points in time and generally before the day-ahead market. (106) This is particularly the case for aFRR where the market investigation indicated that, for some producers, it may be difficult to plan one week ahead. (107)

(75) Fourth, ancillary services require higher levels of flexibility in order to meet the requirements of the different reserves, in particular the maximum activation time. The Notifying Party themselves note that a hydro plant needs to have sufficient "inherent flexibility" to provide hourly reserves to the TSO (FCR, aFRR, mFRR). (108) The lack of flexibility in production was also highlighted by respondents to the market investigation (109) as a factor preventing some production plants from supplying ancillary services while being active on the generation and wholesale market.

(76) Furthermore, respondents to the market investigation highlighted that differences in activation time as well as other technical reasons (110) mean that not all market participants may be able to provide all ancillary services, therefore supporting the notion that each type of hourly reserve should be considered as a separate market.

(77) As regards the non-hourly reserves (i.e. FADR and PLR) the Commission considers that these reserves are likely to be distinct from hourly reserves as (i) they are outside the generation and wholesale market and likely each a separate product market as (ii) there is a significant difference in activation time.

(78) In any event, for the purpose of this decision, the Commission considers that the precise market definition can be left open as no serious doubts arise even on the narrowest plausible market definition which is each hourly reserve (FCR, aFRR and mFRR) and non-hourly reserve (FADR and PLR), separately.

4.3.2. Geographic market definition The Notifying Party's view

(79) The Notifying Party submits that the geographic market for hourly reserves is at least Nord Pool-wide as (i) hourly reserves are part of the overall market for the generation and wholesale supply of electricity; or (ii) even if not part of a combined market, they are still procured by the TSOs on a pan-Nordic basis. (111)

(80) The Notifying Party argues that (i) up to one-third of FCR demand can be procured cross-border; (ii) the Nordic TSOs have agreed on a system for the reservation of transmission capacity such as to allow aFRR to be procured on a Nordic-wide basis; and (iii) mFRR functions similarly to the Nord Pool spot market. (112) The Notifying Party notes that the Nordic regulation market can have a joint regulation price even though the Elspot price is divided into area prices. (113)

(81) However, the Notifying Party argues that the precise geographic definition can be left open as no competition concerns arise even if the market were considered to be national.

(82) For both FADR and PLR, the Notifying Party submits that these markets are national since they are procured by the TSO from domestic operators through a tendering process. (114)

The Commission's assessment

(83) The Commission has previously considered the supply of ancillary services to be at most national in scope (possibly limited to a bidding zone). (115) However, concerning the Nordic region, a broader Nordic-wide market has also been considered but ultimately the market definition has been left open. (116)

(84) Some respondents to the market investigation indicated that the geographic scope of the hourly reserves may differ for each product, because the current rules in force do not necessarily enable the procurement of each product on the same geographic basis. (117)

(85) The Commission first notes that, while the required overall volume of the hourly reserves may be determined on a pan-Nordic basis, the overall volume is subsequently allocated to individual TSOs and the actual procurement of such hourly reserves largely takes place on a national basis. The ability to procure cross-border currently varies depending on the ancillary service in question.

(86) As regards FCR, each Nordic TSO procures FCR capacity in principle on a national basis. However, the TSO can procure up to one-third of its capacity needs from other TSOs cross-border if needed (i.e. not directly from market participants located in a neighbouring country) within the transmission reliability margin. (118) As currently, the majority of the FCR reserves are still procured nationally, the most plausible geographic market is national.

(87) For the purposes of this decision, the Commission considers the FCR market to be national (Sweden) but will take into account, in its competitive assessment, the fact that the TSO can procure up to one-third of its needs from other Nordic TSOs.

(88) As regards aFRR, each Nordic TSO currently procures this reserve nationally. However, the Nordic TSOs are in the process of implementing changes in the applicable rules which will, as of Q2 2019, broaden the market to Nordic-wide procurement and activation. (119) Such Nordic-wide procurement will be subject to transmission capacity being available (no congestion) but the possibility of reserving transmission capacity for the use of aFRR will exist.

(89) Transmission capacity will be reserved for aFRR if such reservation is socio- economic beneficial compared to more expensive reserves in the other area. (120) In the market investigation, one respondent further indicated that it foresees that the Nordic TSOs will agree to allow imports up to one-third of the national requirements for aFRR. (121) As aFRR is currently procured nationally and imports have not yet commenced, the plausible geographic market is national.

(90) For the purposes of this decision, the Commission considers the aFRR market to be national (Sweden) but will take into account, in its competitive assessment, the fact that the system will change to Nordic wide in 2019 and as such, imports from other Nordic countries will play a role.

(91) As regards mFRR, each Nordic TSO procures this on a Nordic-wide basis (delivery is dependent on interconnector capacity, just as generation and wholesale supply). The procurement, as explained in paragraphs (61) to (62), is similar to the functioning of the generation and wholesale market. Suppliers in the Nordic market can bid mFRR from any bidding zone as long as no congestion takes place.

(92) The Notifying Party has submitted an analysis based on the concept of 'regulation zone' that the Notifying Party uses internally. A regulation zone is defined as the collection of bidding zones with the same regulation price (mFRR price). The regulation zones can change every hour depending on the physical grid situation. (122) The Notifying Party focused its analysis on SE2 and SE3 as it is in these bidding zones that the Parties supply mFRR in Sweden. (123)

(93) The Notifying Party's analysis shows that SE2 and SE3 were coupled in 97% of the hours in the period 2014-2016. (124) Furthermore (125), when SE2 and SE3 were in the same regulation zone (coupled), at least one more bidding zone (126) was part of the same regulation zone, but almost always at least 5 bidding zones were part of the regulation zone (and on average 10).

(94) The Notifying Party's analysis further shows that when SE2 was not coupled with SE3, it was virtually always coupled with at least 4 bidding zones or at least with SE1. (127) When SE3 was not coupled with SE2, it was also virtually always coupled with at least 4 bidding zones or most often with SE4. (128) SE2 and SE3, where the Notifying Party offers its mFRR services, has not been observed as a single regulation zone (decoupled from all other bidding zones) in 2016 and very rarely in 2014 and 2015. (129)

(95) The Commission notes that even though SE2 and SE3 may never, or very sporadically, have been fully decoupled, during the hours when SE2 and SE3 were coupled, a varying number of other bidding zones formed part of the same regulation zone but not consistently all the Nordic bidding zones. Logically, also during the few hours when SE2 and SE3 were not coupled, the geographic scope of the market was less than Nordic-wide.

(96) In essence, the combinations tend to vary depending on the specific hour of the day/night similar to the generation and wholesale market. Given the similarities in functioning of the mFRR market with the generation and wholesale market and, in particular, the procurement on a Nordic-wide basis, subject to interconnector congestion, and the observed combination of bidding zones within Sweden and with other Nordic bidding zones, the Commission considers a combination of the four Swedish bidding zones the most distinctive area, with constraints coming from bidding zones of other Nordic countries. Therefore, for the purpose of this decision, the Commission will assess mFRR on a national basis, subject to external constraints from bidding zones outside Sweden.

(97) Regarding FADR and PLR, the information available supports a geographic market definition that is (at most) national as these reserves are procured nationally. (130)

(98) In light of the above, the Commission concludes that, for the purposes of this decision, FCR will be assessed on a national basis (see paragraphs (86) to (87)), aFRR will be assessed on a national basis (see paragraphs (88) to (90)) and mFRR will be assessed on a national basis (see paragraphs (91) to (96)), all taking into account external constraints from bidding zones outside Sweden. The non-hourly reserves, FADR and PLR will each be assessed on a national basis, separately (see paragraph (97)).

4.4. Retail supply of electricity

(99) The retail supply of electricity comprises the sale of electricity to final customers. In the Nordic region, only the Notifying Party is active in this market, namely in Finland, Sweden and Norway.

4.4.1. Product market definition The Notifying Party's view

(100) The Notifying Party submits that the distinction between customer groups identified in some of the Commission's previous decisions might not be appropriate in the Nordics because retailers have unrestricted access to the Nord Pool exchange and there are no regulatory or technical barriers to prevent retailers from selling electricity to different sizes of customers. (131)

(101) In any event however, the Notifying Party submits that the relevant product market definition can be ultimately left open as the Proposed Transaction does not give rise to competition concerns regardless of the market definition retained. (132)

The Commission's assessment

(102) The Commission has previously considered that the retail supply of electricity constitutes a separate product market from the generation and wholesale supply of electricity, and that potential narrower markets can be distinguished based on factors such as different needs and profiles on the demand side and different services and technologies on the supply side. In this regard, separate product markets were defined for the retail supply of electricity to large industrial and commercial customers on the one hand and to household and smaller industrial and commercial customers on the other hand. (133)

(103) The Commission considers that the exact product market definition and the question whether the market for the retail supply of electricity should be further segmented can be left open for the purpose of this decision as the Proposed Transaction does not lead to serious doubts as to its compatibility with the internal market under the narrowest of the alternative definitions.

4.4.2. Geographic market definition The Notifying Party's view

(104) The Notifying Party submits that the Nordic retail electricity markets are developing towards a combined regional market. However, it argues that the relevant product market definition can be ultimately left open as the Proposed Transaction does not give rise to competition concerns regardless of the market definition retained. (134)

The Commission's assessment

(105) The Commission has previously typically defined the retail electricity markets as national in scope.135 However, with regard to the Nordics, it has considered a possible wider, regional market for the retail supply of electricity. (136)

(106) The Commission considers that the exact geographic market definition for the purpose of this decision can be left open as the Proposed Transaction does not lead to serious doubts as to its compatibility with the internal market under the narrowest of the alternative definitions.

4.5. CO2 allowances, renewable electricity certificates and guarantees of origin

(107) Both the Notifying Party and Uniper trade in CO2 allowances (under the EU ETS system), electricity certificates (within the Swedish-Norwegian system) and Guarantees of Origin ("GoOs" under the EU system).

4.5.1. Product market definition The Notifying Party's view

(108) Regarding the trading of CO2 allowances, the Notifying Party submits that, in line with the Commission's precedents, these may form a separate product market (possibly including Certified Emission Reductions). However, it adds that, since the Proposed Transaction does not give rise to competition concerns on any plausible market, it is not necessary to conclude on the precise scope of the product market definition. (137)

(109) Regarding the trading of electricity certificates and GoOs, the Notifying Party submits that: (i) each electricity certificate scheme based on the relevant national legislation may form its own relevant product market; and (ii) the market for GoOs comprises the EU's integrated GoO system (which oversees national GoOs registries and allows for the trading and use of GoOs throughout the EU). Nevertheless, the Notifying Party submits that the Proposed Transaction does not raise competition concerns irrespective of the market definition. (138)

The Commission's assessment

(110) With regard to the trading of CO2 allowances, in previous cases, the Commission has considered them to form a separate market, potentially also including Certified Emission Reductions issued under the global mechanisms set up by the Kyoto Protocol. (139) The Commission considers that the exact product market definition can be left open for the purpose of this decision as the Proposed Transaction does not lead to serious doubts as to its compatibility with the internal market under the narrowest of the alternative definitions.

(111) With regard to electricity certificates and GoOs, the Commission has not investigated these in previous cases.

(112) Electricity certificates are connected to the national public support scheme for the production of renewable electricity in Norway and Sweden. These certificates are granted to the renewable electricity producers and electricity retailers and certain end users under a quota obligation to buy a certain number of certificates. (140) The trading of electricity certificates takes place through bilateral contracts and brokers in the certificate market where the price is determined by supply and demand. Trading is mainly done for spot price and forward contracts that differ mainly in the date of transfer and payment for delivery (141).

(113) GoOs on the other hand are electronic documents with the sole function of providing proof to a final customer that a certain volume of energy was produced from renewable sources. The GoOs are voluntary for market participants. (142)

(114) Given the different rules governing electricity certificates and GoOs, such as the respectively mandatory and voluntary nature of the systems, and the different purpose of the two products, for the purpose of this decision, the Commission considers electricity certificates and GoOs to belong to separate product markets.

(115) In light of the above, the Commission considers for the purposes of this decision that the trading of CO2 allowances, the trading of electricity certificates and the trading of GoOs each constitute a distinct market.

4.5.2. Geographic market definition The Notifying Party's view

(116) Regarding CO2 allowances, the Notifying Party considers, in line with Commission precedents, the geographic market to be EU-wide in scope. (143)

(117) Regarding electricity certificates and GoOs, the Notifying Party considers it likely that: (i) the geographic market for electricity certificates comprises the countries included in each relevant legislative scheme; and (ii) the geographic market for GoO is EU-wide as a result of GoOs being traded within the integrated EU-wide GoO system. (144)

The Commission's assessment

(118) With regard to CO2 allowances, in previous decisions, the Commission has considered the market to be EU-wide in scope. (145) The Commission considers that for the purposes of this decision the market for the trading of CO2 allowances is EU-wide in line with previous Commission practice.

(119) As explained in paragraph (111), the Commission has not investigated electricity certificates and GoOs in the past.

(120) The electricity certificates support scheme of Sweden and Norway has created a common market for electricity certificates between these countries. (146) For the purpose of this decision, the Commission therefore considers the geographic scope of the market to be Norway and Sweden combined.

(121) The GoOs system is based on the EU Renewable Energy Directive (147) and GoOs issued by individual Member States can be traded and used throughout the EU. For the purpose of this decision, the Commission therefore considers the geographic scope of the market to be EU-wide.

4.6. Energy production-related services

(122) Both Fortum and Uniper provide general energy-production related services, as well as specialised services to the nuclear sector.

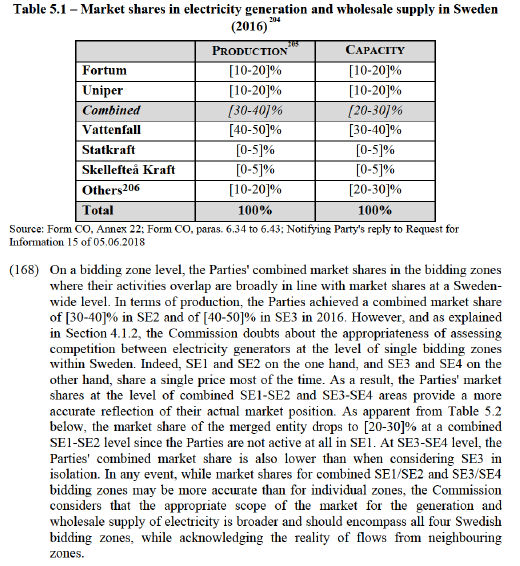

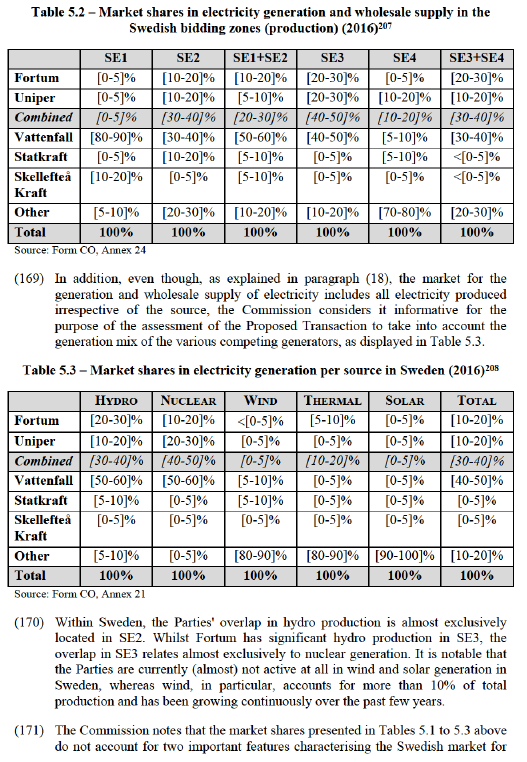

4.6.1. Product market definition The Notifying Party's view

(123) The Notifying Party submits that general electricity production-related services comprise the provision of engineering and consultation services in different phases of the lifecycle of a production plant. It adds that these services do not require a high level of specialisation and therefore can be provided by a broad range of companies. (148)

(124) In line with the Commission's decisional practice, the Notifying Party submits that there may be a separate market for the provision of nuclear services. (149) However, it argues that this should also include the treatment and disposal of radioactive waste and spent nuclear fuel. On the other hand, the Notifying Party considers that the storage of nuclear fuel should constitute a separate market from the nuclear services. (150)

(125) In any event however, the Notifying Party submits that the relevant product market definition can be ultimately left open as the Proposed Transaction does not give rise to competition concerns regardless of the market definition retained. (151)

The Commission's assessment

(126) The Commission has previously not assessed the market for energy production- related services but defined a separate product market for nuclear services in its past decisions. (152) No further sub-segmentation based on the type of services or the technology of the reactor was considered appropriate. (153) Furthermore, the treatment and disposal of radioactive waste and spent nuclear fuel was also considered to be a separate product market. (154)

(127) General energy production-related services comprise of a range of engineering and consulting services in different phases of the lifecycle of a production plant, such as design, operation and maintenance, inspection and consultation services related to power plant systems or services related to power plants' efficiency.

(128) These services are procured by power plant owners or operators in a changing constellation according to the current needs of the production plant. The suppliers of these services, either specialised in the energy sector (such as the Parties) or general technical engineering suppliers (such as Siemens or GE), offer a broad range of services. Based on these demand- and supply-side substitutability considerations, the Commission considers that it is appropriate to define a separate relevant product market for general energy production-related services.

(129) As to whether nuclear services and the treatment and disposal of radioactive waste and spent nuclear fuel constitute separate markets from the market for general energy production-related services, the Commission considers that the exact product market definition can be left open for the purpose of this decision as the Proposed Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

4.6.2. Geographic market definition The Notifying Party's view

(130) The Notifying Party submits that the market for general energy production-related services is global or at least EEA-wide in scope. (155) With regard to nuclear services, and in line with the Commission's decisional practice, it submits that the market is at least EEA-wide, if not global. (156) The Notifying Party argues that the treatment and disposal of radioactive waste and spent nuclear fuel does not constitute a separate product market and is global in scope. (157)

(131) In any event however, the Notifying Party submits that the relevant geographic market definition can be ultimately left open as the Proposed Transaction does not give rise to competition concerns regardless of the market definition retained. (158)

The Commission's assessment

(132) The Commission has in the past not analysed the market for general energy production-related services. With regard to nuclear services, the Commission has previously considered that the market is at least EEA-wide or global in scope. (159) As regards the treatment and disposal of radioactive waste and spent nuclear fuel, the Commission considered in a decision the market to be national in scope. (160)

(133) The Commission considers that the market for general energy production-related services is at least EEA-wide in scope based on the fact that there are no specific legal or commercial requirements restricting the provision of such services within the EEA (161) and that the suppliers of such services, including the Parties, (162) indeed operate on an EEA-wide or global basis. The market investigation has not brought to light any indication that would contradict this finding.

(134) With regard to nuclear services and the treatment and disposal of radioactive waste and spent nuclear fuel, the market investigation has not brought to light any indication that would contradict the Commission's earlier findings as to geographic market definition and therefore those findings are retained for the present decision.

4.7. Trading in natural gas and coal

(135) Uniper is active in the supply of natural gas and coal both at the (downstream) wholesale and retail level in a number of EEA countries. Within the EEA, Fortum procures natural gas and coal as fuel for its power production in Finland, Latvia, Sweden and Poland. In Poland, Fortum also supplies natural gas at retail level, both to industrial customers and households.

4.7.1. Product market definition The Notifying Party's view

(136) As regards the trading of natural gas, the Notifying Party submits that, in line with Commission's precedents, there are separate markets for the wholesale supply of gas and the retail supply of gas. However, since the Proposed Transaction does not give rise to competition concerns on any plausible market, it is not necessary to conclude on the precise scope of the product market definition. (163)

(137) Likewise, as regards coal, the Notifying Party refers to Commission precedents defining a product market for all solid fuels or, alternatively, a separate market for fuel grade petcoke and, separately, a market for other solid fuels. In any case, since the Proposed Transaction does not give rise to competition concerns on any plausible market, it is not necessary to conclude on the precise scope of the product market definition. (164)

The Commission's assessment

(138) Regarding the trading of natural gas, the Commission has in the past considered the existence of separate relevant product markets for: (i) the upstream wholesale supply of gas (comprising the development, production and upstream supply of gas to large importers/wholesalers); (ii) the downstream wholesale supply of gas (comprising the sale by non-integrated wholesalers to other wholesalers or downstream distributors); and (iii) the retail sale of gas. (165) A further segmentation of the market for the retail sale of gas has also been considered, into: (i) the supply of gas to gas-fired power plants; (ii) the supply of gas to large industrial customers; (iii) the supply of gas to small industrial and commercial customers; and (iv) the supply of gas to household customers. (166)

(139) Regarding the trading of coal, the Commission has also previously considered a product market comprising all solid fuels or, alternatively, a separate market for fuel grade petcoke and a separate market for other solid fuels, including coal. (167)

(140) For the purpose of this decision, the precise product market definitions in relation to natural gas and coal can be left open as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation.

4.7.2. Geographic market definition The Notifying Party's view

(141) As regards both natural gas and coal, the Notifying Party agrees with Commission precedents, as summarised below. Nevertheless, since the Proposed Transaction does not give rise to competition concerns on any plausible market, it considers that it is not necessary to conclude on the precise scope of the geographic market definition. (168)

The Commission's assessment

(142) Regarding natural gas, the Commission has in the past considered the geographic scope of the market for the upstream wholesale supply of gas to be EEA-wide or narrower (i.e. regional or national). (169) The market for the downstream wholesale supply of gas has been generally considered to be delineated along existing transport grid areas, thus at national or regional level. (170) As regards the geographic scope of the retail gas markets, the Commission has generally considered these to be national in scope but also regional for specific Member States overall and for the retail supply of gas to household customers. (171)

(143) As regards coal, the Commission has considered the geographic market to be EEA-wide or global in scope, both when all solid fuels are considered together as well as when fuel grade petcoke is considered separately (from coal, notably). (172)

(144) For the purpose of this decision, the precise geographic market definition can be left open as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation.

4.8. District heating

(145) According to Fortum, the Parties only overlap in the supply of district heating in Sweden; Fortum supplies district heating to Stockholm and Uniper supplies district heating to Malmö. According to Uniper, district heating produced in Malmö (via the Öresundskraft power plant) was sold to the district heating network owned by E.ON Varme AB. However, the contract was terminated in March 2016 and since March 2017, Öresundskraft has been in preservation mode and unavailable for district heating production. Uniper confirms that no future district heating production is envisaged at the moment.

4.8.1. Product market definition The Notifying Party's view

(146) The Notifying Party submits that increasing forms of heating source methods, such as geothermal heating, could suggest a wider product market than Commission precedents. However, it adds that, since the Proposed Transaction does not give rise to competition concerns on any plausible market, it is not necessary to conclude on the precise scope of the product market definition. (173)

The Commission's assessment

(147) In previous decisions, the Commission has considered the provision of district heating as a separate relevant product market. (174)

(148) For the purpose of this decision, the precise product market definition can be left open as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation.

4.8.2. Geographic market definition The Notifying Party's view

(149) The Notifying Party does not dispute the Commission's decision-making practice summarised below and submits that since the Proposed Transaction does not give rise to competition concerns on any plausible market, it is not necessary to conclude on the precise scope of the geographic market definition. (175)

The Commission's assessment

(150) In previous decisions, the Commission has defined the relevant geographic market as local and limited to the relevant district heating network. (176)

(151) For the purpose of this decision, the precise product market definition can be left open as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market even on the narrowest plausible segmentation.

5. COMPETITIVE ASSESSMENT

Relevant economic unit as the acquiring undertaking

(152) Pursuant to Article 3(1), Article 5(4) read in conjunction with Recital 22 of the Merger Regulation and the Consolidated Jurisdictional Notice, (177) the Commission has undertaken to assess whether Fortum should be considered to fall under the same controlling undertaking as other Finnish State-owned enterprises ("SOEs") or, conversely, whether it has a power of decision independent from the Finnish State and other Finnish SOEs. In principle, the outcome of that assessment might indeed affect the scope of the substantive assessment of the Proposed Transaction.

(153) The Notifying Party submits that: (i) Fortum is an independent economic unit; (ii) the Finnish State manages its interest in Fortum entirely separately from its investments in other companies; and (iii) Fortum is not subject to any form of coordination with any other company controlled by the Finnish State. (178) In particular, the Notifying Party indicates that no State employee sits on Fortum's Board of Directors, which is responsible for all strategic decisions relating to the commercial policy of the company, including budget, business plan, major investments and the appointment of the senior management. (179) Moreover, in compliance with the Finnish Corporate Governance Code applicable to all publicly traded companies on the Helsinki stock exchange, all members of Fortum's Board of Directors are independent of the company and of its significant shareholders. (180) In practice, members of Fortum's Board of Directors are appointed for a one-year term by the Annual General Meeting ("AGM") of shareholders, by simple majority, upon proposal by the Shareholders' Nomination Board ("SNB"). (181) The SNB is composed of representatives of the three largest shareholders in Fortum and of its President, but decides by unanimity. (182) Overall, the Notifying Party submits that the Finnish State has never objected to a member being appointed to Fortum's Board of Directors as presented to the AGM. (183)

(154) The Commission has investigated the relationship between Fortum and the Finnish State, and together with other Finnish SOEs active in the energy sector, in particular Gasum Corporation (gas supply), Neste Corporation (oil products), Kemijoki Oy (hydropower production) and Vapo Oy (supply of solid fuels, heating and electricity). In doing so, and in line with precedents, (184) the Commission has focused on: (i) Fortum's autonomy from the Finnish State in deciding on its own strategy, business plan and budget; and (ii) the possibility for the Finnish State to coordinate the commercial conduct of Fortum and of other Finnish SOEs active in the energy sector.

(155) As a preliminary observation, the Commission notes that the Finnish State does not have any special rights attached to its shares in Fortum, which all belong to one and the same class and carry the same voting rights. (185)

(156) In relation to Fortum's autonomy, the Commission first notes that the fact that Fortum is a public company listed on Nasdaq Helsinki since 1998 and is therefore subject to the Finnish Corporate Governance Code is in itself not sufficient to establish independence from the Finnish State. However, in analysing Fortum's corporate governance, notably by means of Fortum's publicly available Corporate Governance Statements, (186) the Commission found that Fortum's governance structure goes in fact beyond the independence requirements set forth in the Finnish Corporate Governance Code. In particular, the Finnish Corporate Governance Code does not require that all members of the Board of Directors fulfil the independence requirements, notably towards shareholders, as seems instead to be the case for Fortum. (187) Moreover, the Finnish Corporate Governance Code does not mandate recourse to the SNB mechanism according to which the Finnish State cannot impose the presentation of a particular Board member to the AGM without the consent of representatives of other large shareholders and of the Chair of Fortum's Board of Directors.

(157) Second, a criterion commonly relied upon by the Commission to assess the autonomy of SOEs is the degree of interlocking directorships. In that regard, the Commission has not identified the existence of common members of the Board of Directors across the energy-related Finnish SOEs, as listed above. (188) The only relevant links identified by the Commission relate to the Fortum Board membership of Neste Corporation's CEO and the Kemijoki Board membership of a Fortum executive. However, it appears from publicly available information that Neste Corporation's CEO is only a Board member of Fortum since 2017 and his tenure at Neste Corporation is ending in 2018. Kemijoki is also partly owned by Fortum and its purpose is to produce electricity at cost for its shareholders, thus including Fortum. These links do not therefore seem to be such as to impair the autonomy of Fortum, or to be such as to enable a coordination of the commercial conduct of Fortum with the SOEs in question. (189) For the sake of completeness, the Commission notes that Fortum and Neste share the same three largest shareholders and that the same individuals sit in their respective SNB. However, as noted, these two listed companies do not share any single common member of their Board of Directors.

(158) In terms of (lack of) coordination across Finnish energy-related SOEs, which complements the assessment of Fortum's autonomy, the Commission also notes that it is familiar with the Finnish State's ownership scheme and that in the past it has consistently found that the energy-related SOEs in question acted independently. Thus, in Neste/IVO, the Commission concluded that there was no indication that the commercial conduct of these companies had been coordinated in the past. In contrast, the Commission found that the Finnish State exercised its ownership control only in questions relating to the shareholding of the State (such as sales of shares, listings, etc.). (190) That assessment of the possible coordination of SOEs through the Finnish Primer Minister's Office was revisited and confirmed in subsequent cases. (191) Likewise, in the present case, the Commission has not identified elements pointing to a possible coordination of Finnish energy- related SOEs, thus including Fortum, or to any specific involvement of the Finnish State in the decision-making process relating to the Proposed Transaction. To the contrary, the Finnish government appears to have publicly and repeatedly underlined its unwillingness to intervene in this matter. (192)

(159) Based on the outcome of its investigation, the Commission therefore concludes that Fortum appears to constitute a distinct economic unit with an independent power of decision. Hence, the competitive assessment of the Proposed Transaction can be properly carried out by considering Fortum on a standalone basis.

(160) In any event, the Commission observes that the competitive assessment of the Proposed Transaction would not be materially affected by a combination of the activities of other energy-related Finnish SOEs with the ones of Forum. In particular, the Commission notes that Gasum does not supply natural gas to power plants in Sweden and that Uniper is not engaged in the trading or supply of natural gas in Finland, Sweden or Norway, where Gasum is active. (193) The Commission also understands that Neste Corporation does supply fuel to oil-fired power plants but that Uniper operates only one such plant in the entire Nordic and Baltic area (in Sweden), where Neste's activities concentrate. As noted above, Kemijoki produces in Finland electricity at cost for its shareholders, including Fortum, either for consumption or resale, and is thus not engaged directly in the wholesale supply of electricity. (194) Finally, while Vapo supplies solid fuels for use in bioenergy plants in Finland, Sweden and Estonia, Uniper does not operate any such plants in any Nordic country, or Estonia. In addition, Vapo Oy has very limited electricity generation activities in Sweden (less than 0.1%), where the Parties' own generation activities overlap, and does not supply heat in the Malmö area where Uniper does.

Scope of the competitive assessment

(161) In view of the above considerations pertaining to the scope of the relevant economic unit as the acquiring undertaking, and based on the product and geographic market definitions set forth in Section 4, the Proposed Transaction leads to a number of horizontally affected markets within the areas of: (i) the generation and wholesale supply of electricity; (ii) financial trading; and (iii) ancillary services. (195)

(162) Furthermore, vertically affected markets arise in relation to: (i) the Parties' activities on the market for generation and wholesale supply of electricity (upstream) and Fortum's activities on the market for retail supply of electricity (downstream); (196) and (ii) the Parties' activities on the market(s) for energy production-related services (upstream) (197) and their activities on the market for the generation and wholesale supply of electricity (downstream).

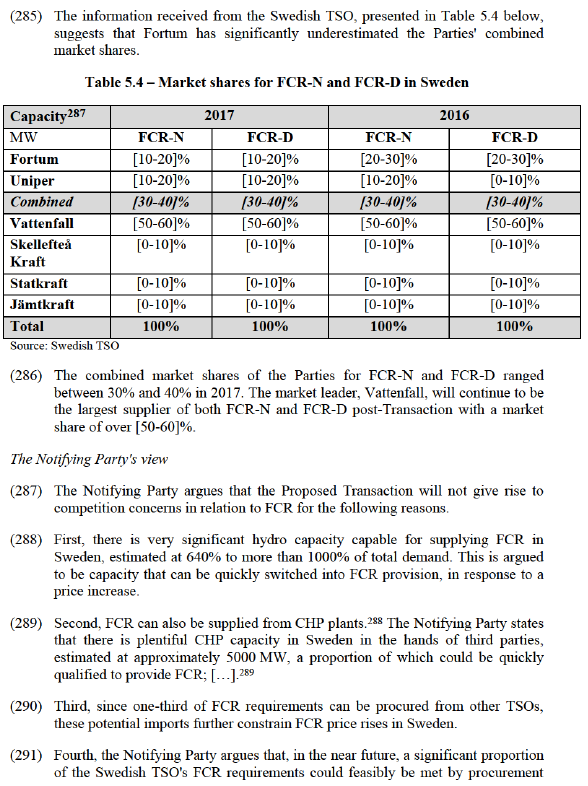

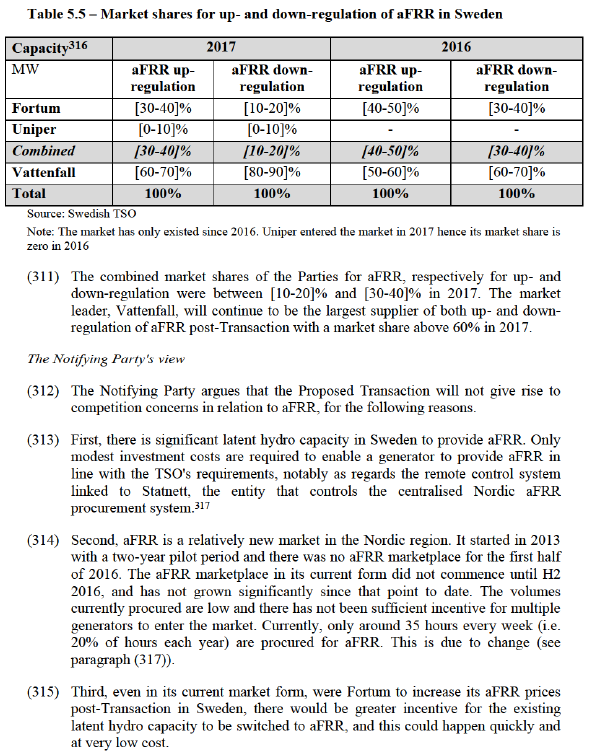

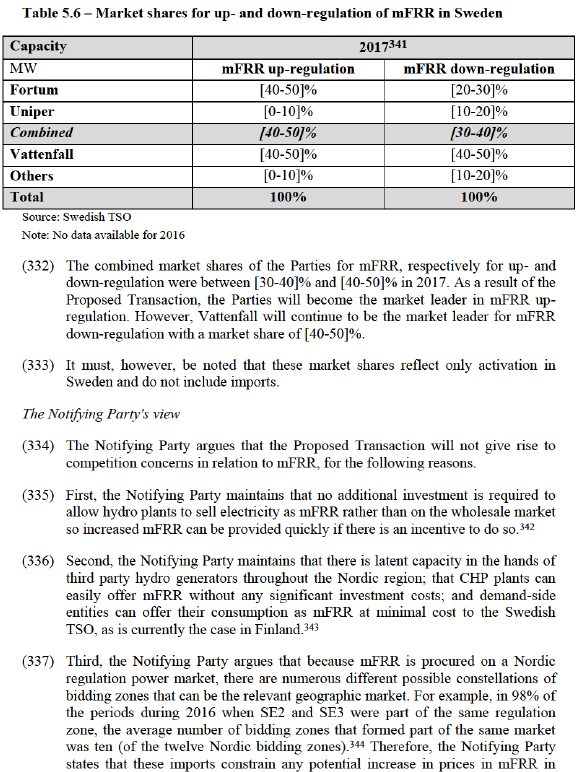

(163) No horizontally or vertically affected markets arise in respect of: (i) CO2 allowances, renewable electricity certificates and guarantees of origin; (ii) trading of natural gas and coal; and (iii) district heating.