Commission, December 21, 2017, No M.8425

EUROPEAN COMMISSION

Decision

SAFRAN / ZODIAC AEROSPACE

Subject: Case M.8425 - SAFRAN / ZODIAC

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 16 November 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Safran S.A. ("Safran", France) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of Zodiac Aerospace S.A. ("Zodiac", France). (3) Safran is designated hereinafter as the "Notifying Party" and together with Zodiac as the "Parties".

1. THE PARTIES

(2) Safran is active worldwide in the aerospace and defence industries. Safran's aerospace propulsion business includes the development and manufacture of aircraft engines, helicopter turbine engines and space engines. Safran also supplies other aircraft equipment including landing systems, wheels and brakes, nacelles, electrical systems and wiring systems.

(3) Zodiac is active in the aerospace industry in the development and manufacture of aircraft equipment and on-board systems, as well as solutions for space applications. Its product offering includes aircraft seats, cabin interiors and various equipment including safety, electrical, control and water and waste systems.

2. THE CONCENTRATION

(4) On 24 May 2017, the Parties entered into a binding Business and Combination Agreement setting out the terms of the acquisition by Safran of sole control over Zodiac (hereinafter the "Transaction" or the "Proposed Concentration"). The Transaction consists of a public tender offer by Safran for Zodiac's shares, with (i) a primary cash offer targeting 100% of Zodiac's shares, and (ii) a subsidiary exchange offer targeting a maximum of 31.4% of Zodiac’s shares, offering to Zodiac’s shareholders Safran preferred shares that would bear the same rights as ordinary shares but would not be transferable and would convert into ordinary shares three years after their issuance upon completion of the tender offer.

(5) Completion of the tender offer will be subject to reaching (i) the mandatory overall acceptance threshold of 50% of Zodiac’s share capital or voting rights, and (ii) a voluntary overall acceptance threshold of two-thirds of the exercisable voting rights of Zodiac, which may be waived by Safran.

(6) Prior to the Transaction, no shareholder controls Zodiac within the meaning of Article 3 of the Merger Regulation. (4) Upon completion of the Tender Offer, Safran will be Zodiac's majority shareholder and […]. Safran will appoint a majority of the members of Zodiac's supervisory board, and a new executive board composed of members selected by Safran.

(7) The Transaction therefore amounts to an acquisition by Safran of sole control over Zodiac within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(8) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million [Safran: EUR 17 753.6 million, Zodiac: EUR 5

208.2 million] (5). Each of them has an EU-wide turnover in excess of EUR 250 million [Safran: EUR […], Zodiac: EUR […] million], but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The Proposed Concentration therefore has an EU dimension.

4. OVERVIEW OF THE AIRCRAFT MANUFACTURING INDUSTRY

(9) As a matter of general introduction, this section summarises the Commission's understanding of the basic features of the aircraft manufacturing industry, as explained mainly by the Notifying Party in the Form CO, and introduces terms and concepts used in the remainder of the decision.

4.1. Types of aircraft

(10) For the purpose of the merger control assessment of the Proposed Concentration, three types of aircraft are relevant: (i) commercial aircraft, (ii) military aircraft, and (iii) helicopters. (6)

(11) The commercial aircraft category includes large commercial aircraft, regional aircraft and business/corporate jets.

a. Large commercial aircraft are generally equipped with over 100 seats, can cover a range of more than 2,000 nautical miles and cost over USD 35 million. A distinction can be drawn between (i) wide-body aircrafts equipped with 200-850 seats and carrying passengers over more than 4,000 nautical miles distances, and (ii) narrow-body aircrafts equipped with 100-200 seats and carrying passengers over 2,000-4,000 nautical miles distances.

b. Regional aircraft are generally equipped with 30 to 90 seats and can cover a range of less than 2,000 nautical miles. Regional aircrafts are comprised of (i) large regional aircraft which can transport 70-90 passengers and (ii) small regional aircraft which can transport 30-50 passengers.

c. Business/corporate aircraft/jets are aircrafts designed for corporate activities and typically cost between USD 3 million and more than USD 50 million.

(12) The military aircraft category comprises aircrafts designed for military activities, be it combat aircraft or non-combat aircraft – i.e. designed for search and rescue, reconnaissance, transport, observation and training.

(13) Helicopters include normal and transport rotorcrafts propelled by turbine engines used for civil or military applications. (7)

4.2. Supply chain

(14) The supply chain in the aerospace industry mainly comprises two types of suppliers: Tier-1 and Tier-2 (and Tier-3 as the case may be). Tier-1 suppliers generally have integration capabilities and provide whole systems and equipment. Tier-2 suppliers tend to be active at an upstream stage, supplying components and sub-components which are later integrated into the systems/equipment by either the aircraft manufacturer or the Tier-1 supplier (or third-parties system integrators).

(15) On the demand side, different types of customers purchase systems and equipment depending on the type of aircraft considered.

a. Large commercial aircraft: depending on the system/equipment considered, purchasers are either (i) aircraft manufacturers (also known as "airframers") with significant integration capabilities or (ii) end-users – inter alia airlines, lessors and national governments – who sometimes directly purchase certain equipment and systems from the Tier-1 supplier.

b. Regional aircraft/corporate jets: systems and equipment are usually purchased by aircraft manufacturers who then resell the whole aircraft to end-users.

c. Military aircraft and helicopters: systems and equipment are usually purchased by aircraft and helicopter manufacturers, in some cases also the Ministry of Defence depending on the equipment or system considered. Helicopter/military aircraft manufacturers will in any case provide the integration of main systems and equipment.

4.3. Procurement process

(16) In most cases, customers in the aircraft manufacturing industry source systems and equipment by means of competitive tender offers, often for the duration of the aircraft programme in question. The structure of the tender process can vary according to the aircraft type, customer involved or platform in question.

4.3.1. Large commercial aircraft

(17) Aircraft manufacturers of large commercial aircraft can either source products through build-to-print or build-to-specification ("build-to-spec") processes. The build-to-print process requires the supplier to manufacture equipment, systems and components to the exact specifications provided by the customer. The build- to-specification process, on the other hand, allows the supplier to use its own design and manufacturing skills.

(18) Additionally, a distinction needs to be drawn between buyer-furnished equipment ("BFE") and supplier-furnished-equipment ("SFE"). BFE are purchased by end- users (e.g. airlines), whereas SFE are purchased by the aircraft manufacturer before the sale of the aircraft to the end-user.

(19) With respect to SFE, suppliers for the different systems and equipment of an aircraft platform are selected through a competitive tender process. When launching a new aircraft platform, the aircraft manufacturers first issue Requests for Information ("RFI") to several prospective bidders in order to identify a preliminary list of potential suppliers for the systems/equipment/part that it will not manufacture in-house. The aircraft manufacturers then typically issue Requests for Proposals ("RFP") in order to "down-select" a limited number of final candidates who will submit "Best and Final Offers" on the basis of which final negotiations and selection will be conducted.

(20) Tenders for BFE products typically occur at a later stage of the procurement process, around two years before the delivery of the aircraft.

4.3.2. Regional aircraft/corporate jets

(21) Contrary to the procurement process for large commercial aircraft (which can be based either SFE or BFE), most equipment and systems for regional aircraft/business jets are sold on an SFE basis. The purchasers are therefore in most cases the aircraft manufacturers and not end-customers.

4.3.3. Military aircraft

(22) The procurement process for equipment and systems for military aircraft follows a specific pattern. Due to the low volume of aircraft and to the complexity of the integrated systems, the procurement process requires close cooperation between the airframer, the system supplier and the National Procurement Authority acting on behalf of the end-users.

4.3.4. Helicopters

(23) The procurement of systems and equipment for helicopters is usually organized by the helicopter manufacturer, though certain parts can also be sourced directly by Ministries of Defence for military helicopters (e.g. engines). For helicopters, purchases take place by means of a tender process or through a negotiated procedure.

5. PRODUCT MARKET DEFINITION

(24) Both Safran and Zodiac are active in the production and supply of aircraft equipment on a worldwide basis. Although their respective product portfolios are complementary to a large extent, there are some horizontal overlaps between the Parties' activities.

(25) Zodiac (and Safran to a lesser extent) also produces and supplies components that can be used as input for aircraft equipment and systems produced by Safran (and Zodiac to a lesser extent). As a result, there are also vertical links between the Parties' activities.

(26) In addition, Safran and Zodiac are both active on the aftermarket in relation to their own products and supply parts to other aftermarket service providers.

(27) The present section examines market definition for all products in relation to which the Parties' activities overlap horizontally, are vertically related or could potentially be regarded as complementary to one another.

5.1. Electrical systems

(28) The aircraft electrical systems include all electrical units and components that generate, control, convert and supply electrical power on an aircraft. According to the Notifying Party, and as apparent from Commission precedents, (8) the main elements of the aircraft electrical energy chain comprise the generation system and the distribution system. (9) They are typically combined with conversion devices, which convert the electrical power from one voltage to another or from AC to DC current, and together form the conversion system of the aircraft. (10) In addition, the aircraft electrical systems include batteries used to support ground operations and cope with failures in generation. (11)

5.1.1. Electrical generation systems

5.1.1.1. Introduction

(29) The electrical generation system is used to generate electrical power for various equipment and devices used on aircraft by converting mechanical energy into electrical energy by a process of electromagnetic induction. Overall, there are three types of generators: main generators, auxiliary power unit ("APU") generators and emergency power unit ("EPU") generators.

(30) The main power generator is the principal electrical power source of the aircraft during normal flight conditions and produces electricity driven by the engines of the aircraft. In practice, power is generated by using the engines to drive a gearbox, which in turn drives the electrical generators. (12) The main power generator is located near the engine, in the nacelle. In the basic configuration of an aircraft, each engine drives one or two main power generator(s), so that, for example, twin-engine aircraft generally carry two or four main power generators. The power rating of generators can vary from around 5kVA to over 250kVA, and different sizes of generators tend to be used in different types of aircraft. (13)

(31) The main power generator can be based on either AC or DC technology. AC technology is used mainly in large commercial aircraft, which have greater power needs (generally more than 15kVA) and longer power lines, but also some large helicopters and military aircraft. AC main power generators can be either based on constant frequency or on variable frequency.

(32) DC main power generators are generally found in smaller aircraft with lower power requirements and are mostly low voltage (i.e. 28V). Low voltage DC generators are typically used on regional aircraft, business jets and helicopters, where limited flight time and less electrical power is needed. High-voltage DC generators (i.e. 270V) are used on a very small number of military fighter aircraft. (14) The Notifying Party believes that high voltage DC generators may in the future become an alternative for power generation in large commercial aircraft. However, these generators are based on a complex technology and raise safety issues.

(33) The APU generator provides electrical power to the aircraft’s systems and devices while the engines are shut down, mainly when the aircraft is on the ground. During flight, APU generators are not normally operated continuously but can be available in emergency situations (in case of engine failure, to provide back-up electrical power and compressed air to help main engine restarting). As for main power generators, APU generators are based on either AC or DC technology (depending on the technology on which the main generation is based), whereas they naturally run at (or close to) a constant speed.

(34) Large aircraft also carry an EPU generator, a device that generates additional or alternative low-output electric power in case of failure of the main and auxiliary power systems (when all engine power is lost) to maintain essential flight and landing systems. The EPU is normally located in the aircraft ventral or nose section and based on a different (and simpler) technology than main and auxiliary power generators, such as Ram air turbines (“RATs”) that generate electricity by using the air flowing around the aircraft. Since only Safran is active in the supply of EPU generators and the Transaction does not give rise to vertical relations involving EPU generators, they are not discussed specifically in the remainder of this decision.

5.1.1.2. Main power generators

(35) In UTC/Goodrich, (15) the Commission concluded that main power generators, APU generators and EPU generators constitute separate product markets. The Commission also found that main power generators based on AC and DC technology constitute separate product markets.

(36) Within AC main generators, the Commission found that AC main generators based on constant frequency ("Main AC CF") and AC main generators based on variable frequency ("Main AC VF") constitute different product markets. (16)

(37) Within DC main generators, the Commission defined separate product markets for high-voltage DC systems (i.e. 270V) ("Main DC HV") and low-voltage DC systems (i.e. 28V) ("Main DC LV").

(38) In that decision, the Commission considered an alternative delineation within main power generators based on the size of the aircraft served, the main categories of aircraft being large commercial aircraft, regional commercial aircraft and corporate jets. This segmentation was ultimately left open.

(39) The Notifying Party submits that, in the present case, the exact market definition can be left open since no competition concern arises under any alternative product market definition.

(40) The market investigation conducted in the present case confirmed that main generators, APU generators and EPU generators constitute distinct product markets. In effect, all competitors and all customers (airframers) responding to the market investigation indicated that they consider this segmentation appropriate. (17)

(41) Similarly, the market investigation confirmed the Commission' decisional practice regarding the appropriateness of a further segmentation of main power generators between Main AC CF, Main AC VF, Main DC LV and Main DC HV. All suppliers who responded to the market investigation considered appropriate to segment main generators according to AC/DC, CF/VF and LV/HV categories, per the Commission's previous practice, since these differ in terms of manufacturing cost, technical characteristics, sales price and usage. (18) Likewise, a majority of customers (airframers) responding to the market investigation indicated that these various types of main generators differ in terms of function/usage, technical characteristics and price. (19)

(42) As regards a possible sub-segmentation of Main AC CF, Main AC VF, Main DC LV and Main DC HV by type of aircraft, the market investigation was not conclusive. A number of competitors responding to the market investigation indicated that such further segmentation would be inappropriate, notably because the choice of a given technology is generally dictated by the size of the aircraft so that a further segmentation by size of aircraft would be redundant. However, the opposite opinion was expressed in similar proportion. For example, a respondent indicated that "[s]olutions are very similar between very light business jets and helicopters, solutions are different between military jet and commercial aircraft", while another explained that "[i]t is the specific technical / performance requirements of the machine, not the aircraft type that matter." (20)

(43) In contrast, a majority of customers (airframers) considered inappropriate to further segment main generators per type of aircraft. (21) In any event, the Commission considers that the exact market definition in this regard can be left open for the purpose of this decision since the Transaction does not raise serious doubts as to its compatibility with the internal market whether or not main generators are further segmented by type of aircraft.

(44) The market investigation also elicited isolated comments suggesting further segmentations between brush and brushless, as well as oil cooled and air cooled generators. (22) When presented with these possible segmentations, the Notifying Party replied as follows:

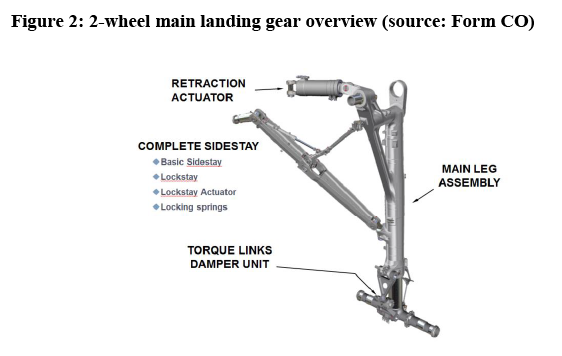

a. As regards Main AC VF: more than 90% of AC VF main generators are oil cooled and all the main AC VF suppliers (UTAS, GE, Honeywell and Thales, as well as Safran) supply oil cooled main generators;

b. Air cooled main generators are essentially Main DC LV (to the exception of the few Main AC VF). When looking at the market for Main DC LV, all are air cooled;

c. Nearly all of the Main DC LV for aircraft currently in service are brush. The brushless technology has been introduced only recently and is used on a few programmes, most of which are still at development stage. According to the Notifying Party, all major DC LV main generator suppliers – such as Skurka, Astronics, Meggitt, Ametek and Thales, as well as Zodiac – are developing DC brushless technology, (23)

(45) The Commission considers that no further segmentation is appropriate based on the type of cooling or the brush/brushless technology on the Main DC LV and Main AC VF markets for the following reasons.

(46) On the Main DC LV market, all generators are air cooled and, therefore, a segmentation based on the type of cooling would not alter the competitive assessment. Furthermore, given that the large majority of Main DC LV generators are brush, a sub-segmentation of the market for Main DC LV based on brush technology would substantially overlap with the delineation of the market for Main DC LV.

(47) On the Main AC VF market, the great majority of generators are oil cooled. Therefore, a sub-segmentation of the market for Main AC VF based on oil cooled technology would substantially overlap with the delineation of the market for Main AC VF.

(48) Finally, the Notifying Party submits that back-up generators are part of the same market as main generators. Back-up generators are used on very few platforms. On the Boeing 777/777X, for example, the main generation system is composed of two generators (one main and one back-up), both driven and installed on the engines. Some helicopters (such as the Boeing CH-47 and the Bell 525) may also have back-up generators. In essence, main and back-up generators contribute to supply the main electrical power of the aircraft during flight, so that there is no interruption in the power transferred to the various loads. The difference between a back-up generator and an EPU generator is that the EPU generator is deployed in case of engine failure and subsequent loss of both the main and the back-up generators.

(49) The outcome of the market investigation supports the Notifying Party's claim, as both the majority of responding customers (airframers) and competitors indicated that they consider inappropriate to segment main and back-up generators. (24) One competitor for example indicated that main and back-up generators are "[…] the same system at the end, the only difference is main generators are designed to operate for long duration at variable load while back-up are to be run when there is an outage to the utility grid or the main source of power in a backup situation". (25) As a result, the Commission considers that back-up generators are part of the same markets as main generators.

(50) In view of the above, the Commission considers it appropriate to define separate product markets for Main AC CF, Main AC VF, Main DC LV and Main DC HV generators. A further segmentation by type of aircraft can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions. In contrast, other sub-segmentations do not appear warranted for the reasons explained above.

5.1.1.3. Auxiliary Power Unit ("APU") generators

(51) APU generators are driven by the APU of the aircraft, a small gas turbine engine located in the aircraft tail section, which is used to start the aircraft's main engines. (26) APU generators provide electrical power to the aircraft systems and devices while the engines are shut down, i.e., mainly when aircrafts are grounded. (27)

(52) According to the Notifying Party, APU generators are either tendered by airframers separately from main generators or as one and the same work package. (28) The Notifying Party also contends that the only relevant segmentation of APU generators is between AC and DC current. (29) Conversely, the distinction between constant and variable frequency is not relevant for APU generators since they run at (or close to) constant speed. (30)

(53) As noted, the market investigation confirmed that the distinction between main generators and APU generators (and EPU generators) is appropriate. (31) Likewise, certain suppliers indicated that a segmentation of APU generators between AC and DC current is required. (32) In contrast, the outcome of the market investigation was inconclusive as to whether APU generators should be further segmented per type of aircraft. Certain suppliers pointed to significant differences across aircraft types, such as commercial aircraft and helicopters, while others emphasized that APU generators are nearly identical for commercial and regional aircrafts. (33) In contrast, a majority of airframers considered that it is not appropriate to split APU generators per type of aircraft, (34) or in any other ways. (35)

(54) In any event, given that the Transaction would not lead to horizontally affected markets under any alternative market definition, the precise market definition can be left open for the purpose of this decision. (36) For this reason and since the Transaction does not either give rise to any vertical relations involving APU generators or materially expands the Parties' product portfolio, they are not further discussed in the present decision.

5.1.2. Electrical distribution systems and components

5.1.2.1. Introduction

(55) The electrical distribution system of an aircraft connects the aircraft's generators to the individual devices and systems powered by electrical energy, during both flight and ground operations. As discussed in section 5.1.3., the electrical distribution system is distinct from the electrical conversion system that converts the electrical power produced by generators from one voltage to another and from AC to DC current.

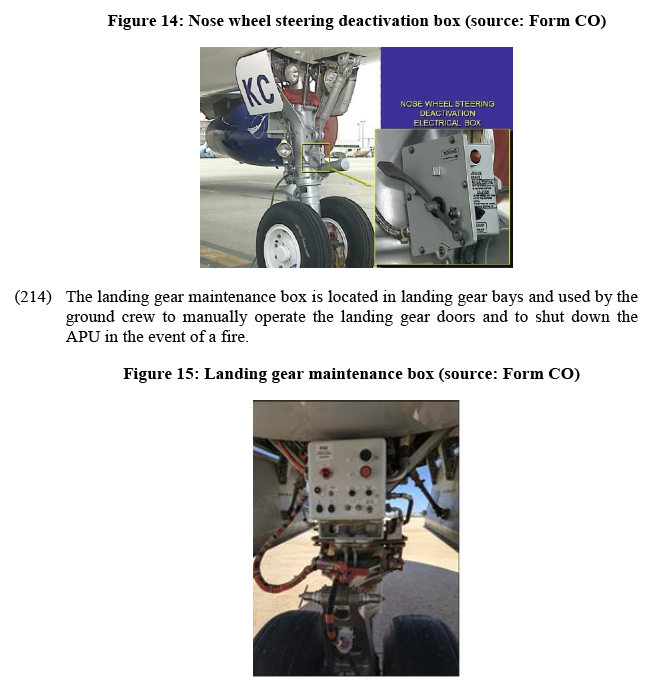

(56) The electrical distribution system of any type of aircraft is divided into a "primary" and a "secondary" system, each of which fulfils different functions within the electrical system. The primary distribution system takes the electrical power from the generators (main generators and APUs) and channels it to (multiple) primary power distribution panels, which are composed of high power switching and circuit protection devices. Electrical power is then allocated to certain high power loads of the aircraft (e.g. the galley) and mainly to the secondary distribution system. The secondary distribution system, through (multiple) secondary power distribution panels, controls and distributes electricity to each individual system or device of the aircraft that requires electrical power. Secondary power distribution panels can be decentralised near key loads and in the cockpit. They are composed of low power switching and circuit protection devices.

(57) Another important function of the electrical distribution system is the protection of the aircraft wiring from electrical overloads and the monitoring of any power surge incident in the distribution circuit. This is achieved by means of circuit protection devices.

(58) The main components that form part of electrical distribution systems include contactors, relays, bus power control units ("BPCUs"), fuses, circuit breakers, remote control circuit breakers ("RCCBs") and Solid State Power Controllers ("SSPC"). They have the purpose of switching, controlling, isolating and protecting the electrical circuits of the aircraft against power surge incidents, short circuits, electrical arc or other electrical failure.

(59) Contactors and relays are electro-mechanical devices which perform the task of switching electrical circuits. Fuses and circuit breakers are devices that mechanically interrupt and isolate a circuit in the event of excessive current. BPCUs are electronic calculators installed in the primary power distribution panels which manage the dispatch of electrical power. SSPC, which combine a circuit breaker and a relay, electronically interrupt and isolate a circuit in the event of excessive current.

5.1.2.2. Electrical distribution systems

(60) The Notifying Party submits that a distinction needs to be made between primary and secondary electrical distribution systems of an aircraft, given that (i) they perform different functions within the aircraft and are often procured in separate procurement packages and from different suppliers, and (ii) the technologies and know-how required to supply them are different (the primary distribution system mainly requires know-how in contactors, electrical system design and fault isolation, while the secondary distribution system mainly requires know-how in SSPC and arc-fault detection).

(61) Conversely, the Notifying Party submits that no further distinction needs to be made within primary and secondary power distribution systems, respectively. In particular, the Notifying Party submits that it is not appropriate to segment distribution systems according to the size or end-use of the aircraft because the technology behind primary and secondary distribution systems is the same regardless of the type of aircraft. The Notifying Party further submits that no distinction between AC and DC technologies is appropriate because: (i) unlike generation systems, distribution systems will generally provide (through conversion devices) both AC and DC depending on the electrical device to which the electrical power is connected, (ii) all suppliers provide both AC and DC distribution systems, and (iii) customers do not issue separate tenders according to the technology used. The Notifying Party considers that the market definition can however be left open since no competition concerns arise under any alternative definition. (37)

(62) The outcome of the market investigation confirms the distinction between the primary and secondary distribution systems, although certain respondents indicated that they are not always sourced separately, as certain airframers procure the entire distribution system as a package from the same supplier. (38) A large majority of respondents to the market investigation also indicated that distribution systems generally provide (through conversion devices) both AC and DC depending on the electrical load to which the power is delivered, and that a distinction between AC and DC technologies is thus not warranted. (39)

(63) As regards a possible segmentation according to type of aircraft, several customers and suppliers indicated that the technological requirements and complexity of distribution systems found on (large and regional) commercial aircraft are different from those of smaller aircraft such as helicopters, business jets or military aircraft. (40) The Notifying Party also acknowledges that the complexity of the primary and secondary distribution systems is dictated by the size of the aircraft, and in particular the number of main generators, of electrical loads (which ranges from 50 in a small aircraft to more than 750 in large commercial aircraft) and the number of electrical networks embedded in the aircraft to power the loads. (41)

(64) Based on the results of the market investigation, the Commission considers that electrical distribution systems can be segmented into primary distribution systems and secondary distribution systems. A distinction can furthermore be made according to the size of the aircraft into electrical distribution systems for large commercial aircraft and smaller aircraft. The exact delineation of the product market can however be left open for the purpose of this decision as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of the alternative market definitions considered.

5.1.2.3. Electrical distribution components

(65) The Notifying Party submits that the relevant product market definition encompasses all aircraft distribution components (contactors, relays, BPCUs, fuses, circuit breakers, RCCBs and SSPC) because they all serve the same purpose of switching, controlling, isolating and protecting the electrical circuits of the aircraft, they do not substantially differ in terms of their technical characteristics (even though their rating and voltage varies with the power required by the relevant device) and suppliers generally master the technologies and know-how required for the manufacturing of all electrical distribution components. The Notifying Party further submits that all distribution components are found both in primary distribution panels and secondary distribution panels (although circuit breakers are generally more present in secondary distribution while contactors are generally more present in primary distribution, though not only), and that there is some degree of substitutability between different distribution components: for instance, SSPCs are increasingly replacing circuit breakers and contactors for circuit protection, and RCCBs integrate contactors and circuit breakers to supply power to a dedicated function. (42)

(66) The outcome of the Commission's market investigation was not conclusive as to whether and how the market for distribution components should be segmented. Although a significant number of respondents agreed with the Notifying Party's views, others indicated that not all manufacturers have the know-how to supply all types of distribution components and that certain components, such as contactors, are more specialised and technically complex than others, or that a distinction should be drawn between electronic components like SSCPs and electro-mechanical units such as relays, circuit breakers, RCCB. (43)

(67) In view of certain differences in their functions and manufacturing technology, the Commission finds that each distribution component (contactors, relays, BPCUs, fuses, circuit breakers, RCCBs and SSPCs) can plausibly be considered to constitute a distinct relevant product market. The exact market definition can however be left open for the purpose of this decision as the Transaction does not raise serious doubts as to its compatibility with the internal market under any alternative market definition considered.

5.1.3. Electrical conversion systems

(68) Conversion devices convert the electrical power produced by generators from one voltage to another and from AC to DC current. According to the Notifying Party, conversion devices constitute stand-alone equipment and comprise transformers, transformer-rectifier units ("TRUs" to convert AC into DC), auto transformer-rectifier units ("ATRUs", also to convert AC into DC) and inverters (to convert DC into AC), (44) which was broadly confirmed by the market investigation. (45)

(69) In effect, the market investigation confirmed that conversion devices consist in a distinct electrical system located between the generation and distribution systems and involving a different technology and supplier base than generation and distribution systems. (46) Likewise, the majority of respondents to the market investigation confirmed that conversion systems are generally tendered out separately from generation and distribution systems. (47) Conversely, none of the respondent to the market investigation suggested that conversion devices need to be segmented in any particular way.

(70) As a result, in view of the outcome of the market investigation, the Commission considers it appropriate to define one distinct product market for conversion systems including all conversion devices. In any event, the precise market definition can be left open because even if the different types of conversion devices were considered separately, the Transaction would not lead to horizontally or vertically affected markets. (48) In effect, conversion systems are only relevant for the purpose of assessing the Transaction insofar as they may be considered close complements of generation and distribution systems and as the Transaction will enable Safran to acquire complementary conversion capabilities, thereby expanding its electrical system product portfolio.

5.1.4. Battery systems

(71) According to the Notifying Party, batteries constitute the fourth distinctive part of the electrical system of an aircraft, next to generation, distribution and conversion. (49) In particular, battery systems are used to: (i) provide electrical power on the ground for certain specific operations (maintenance, fuel loading, towing), (ii) provide electrical power in emergency situations when the main generator does not work, and (iii) provide power to the APU. (50) Batteries used in aircrafts currently in service include lead acid batteries and nickel cadmium (NiCd) batteries. (51) Some of the most recent platforms also use low voltage Lithium-ion (li-ion) batteries but that technology is still largely at development stage. (52)

(72) Based on the information submitted by the Notifying Party and obtained as part of the market investigation, the Commission finds it appropriate to define a distinct product market for batteries, irrespective of the underlying technology, given their distinctive function, separate procurement and different supplier base. (53) The exact market definition can however be left open for the purpose of this decision as the Transaction does not give rise to affected markets under any alternative market definition considered. (54) Since the Transaction does not either give rise to any vertical relations involving batteries, they are not further discussed in the present decision.

5.2. Landing gears

(73) The landing gear supports the weight of the aircraft while on the ground and absorbs most of the energy at landing and during take-off, by damping the mechanical shocks caused by the irregularities of the runway. Large commercial aircraft, regional and corporate aircraft generally have two main landing gears located under the wings and one nose landing gear. (55) Only large helicopters have landing gears (two main and one nose landing gears), the smaller ones do not.

(74) The landing gear generally consist of: (i) a leg assembly, composed of a main fitting and a sliding tube; (ii) a retraction actuator; (iii) a sidestay/forestay; (iv) torque links; (v) a boogie beam for main landing gears with four or six wheels; (vi) harnesses; and (vii) hydraulic hose and tube assemblies.

(75) The Notifying Party submits that there is one overall relevant market for landing gears. In particular, it explains that the distinction between main landing gear and nose landing gear or between landing gears for various types of aircraft is not appropriate based on the fact that these use the same technology and basic design, and can be supplied by the same manufacturers. (56) However, the Notifying Party submits that the exact product market definition can be left open as no competition concerns arises under any alternative product market definition. (57)

(76) In a previous decision, (58) the Commission has examined a market encompassing all landing gears, however considering that the landing gear market is divided into two customer segments, civil and military. The market investigation confirmed that there are no significant technological differences between main and nose landing gears (59) and that they are supplied together. (60) With regard to the further segmentation of the market for landing gears according to aircraft types, the market investigation was inconclusive. (61)

(77) In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

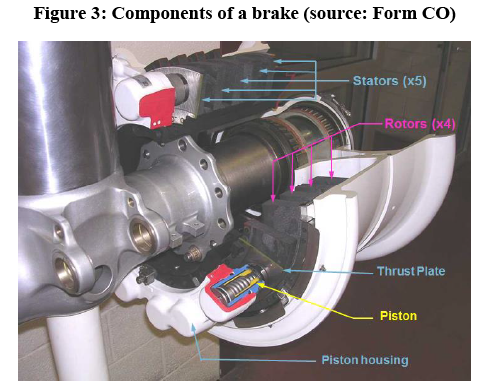

5.3. Brakes and wheels

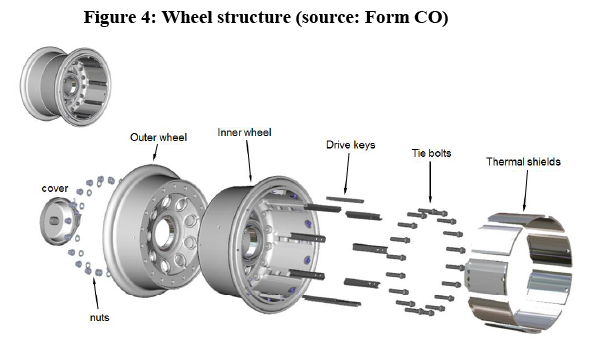

(78) The design of brakes and wheels are linked as the wheel hosts the brake. Brakes and wheels are replaced several times over the lifetime of the aircraft. The brakes are composed of: (i) the stators; (ii) the rotors; (iii) the pistons/actuators; (iv) a thrust plate; and (v) harnesses.

(79) The wheel assembly is mainly composed of two wheel halves: the outer and inner wheel. This structure enables to mount the tyre onto the wheel. Brake rotors are located in the inner wheel.

(80) The Notifying Party submits that brakes and wheels form one relevant product market because airlines purchase brakes and wheels together from one supplier and because brakes and wheels are designed and manufactured simultaneously. (62) Furthermore, the Notifying Party considers that there is no need to distinguish between the various types of aircraft as all suppliers are able to supply all types of aircraft and as the technology is the same. (63) In any event, the Notifying Party is of the view that the exact product market definition can be left open as no competition concerns arises under any alternative product market definition. (64)

(81) The market investigation confirmed that brakes and wheels belong to the same relevant product market. Indeed a large majority of customers responded that they source brakes and wheels together. (65) Although the majority of suppliers stated that they do not design and manufacture brakes and wheels together, (66) the majority of manufacturers confirmed that they are however supplied together to customers. (67)

(82) With regard to the further segmentation according to aircraft types, the market investigation results are inconclusive. The majority of suppliers replied that brakes and wheels for different aircraft types differ significantly from a technical point of view. (68) This is also reinforced by the fact that slightly different ranges of suppliers are active in the different segments. (69) However, the majority of respondents stated that they would be technically capable of supplying brakes and wheels for all types of aircraft, indicating supply-side substitutability. (70)

(83) In this regard, the Commission also notes that the procurement process of brakes and wheels on the different segments differs significantly. Brakes and wheels for large commercial aircraft are purchased by the end-customers, i.e. the airlines after the pre-selection of the suppliers by the airframer. […]. Conversely, the customers of brakes and wheels for other aircraft types are the airframers who are charged at the time of supply.

(84) The exact product market definition can nonetheless be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

5.4. Control systems and equipment

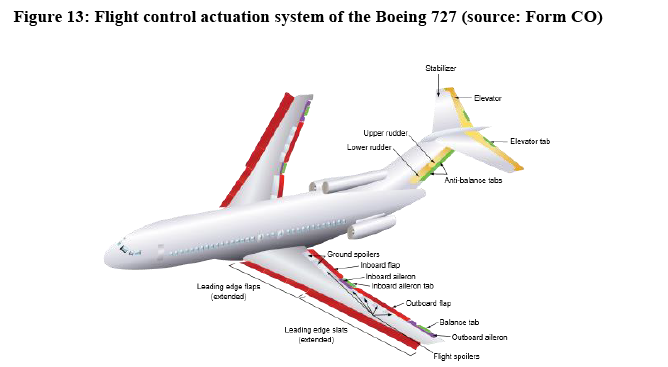

(85) Control systems and equipment command and control various functions of an aircraft through series of components. The customers of control systems and equipment are airframers, which source these products directly from Tier 1 suppliers. For the assessment of the Transaction, three control systems and equipment have to be reviewed, namely the landing gear extension/retraction system, the braking control system and the steering control system. (71)

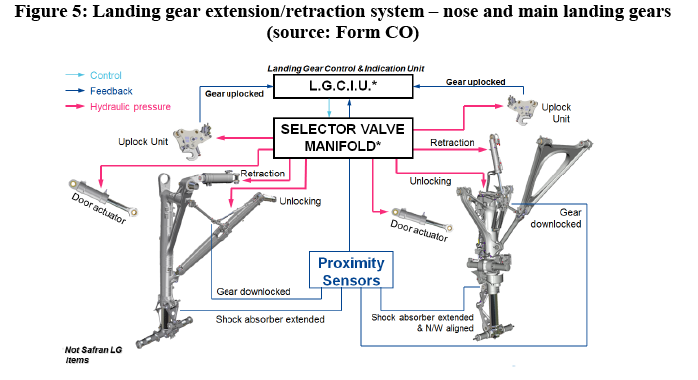

(86) The computer-controlled landing gear extension/retraction system performs successive operations to extend the landing gears before landing and retract them after take-off. It generally consists of: (i) the landing gear control handle lever; (72)

(ii) the landing gear control indication unit ("LGCIU"); (iii) the selector valve;

(iv) solenoid valves (manifold); (v) electromechanical actuators ("EMA") valves;

(vi) the door actuator; (vii) uplock and unlock units and; (viii) sensors.

(87) In normal mode, the power source for landing gear extension/retraction is hydraulic. In case of loss of the main hydraulic circuit, a back-up/emergency mode enables to unlock doors; the landing gears are then extended by gravity.

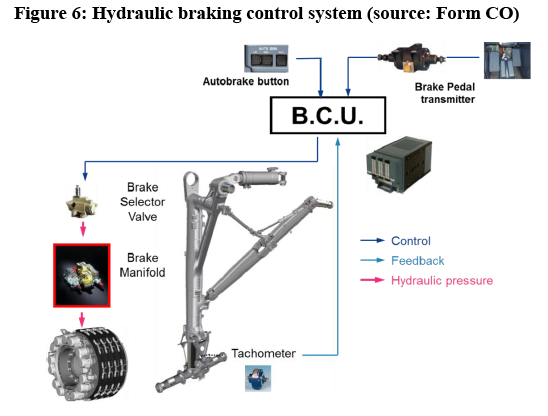

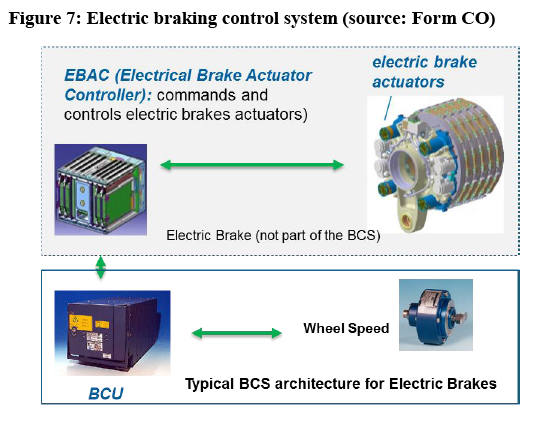

(88) Braking control systems command and control the aircraft's brakes upon pilot's command at landing or taxiing. The braking control system can be either hydraulic (most of existing platforms) or electronic (Boeing 787, Bombardier C- series). Accordingly, the on-board computer (usually called braking control unit – "BCU") controls a hydraulic braking regulation system or directly drives electric brakes.

(89) A hydraulic braking control system generally consist of: (i) pilot controls; (ii) the BCU; (iii) the selector valve; (73) (iv) a braking manifold embedding valves and servo-valves; and (v) tachometers

(90) Electric braking control systems are similar in their design except that the BCU commands another controller usually called electrical brake actuator, which in turn commands the electric brakes themselves. Similarly, tachometers provide wheel speed feedback to the BCU.

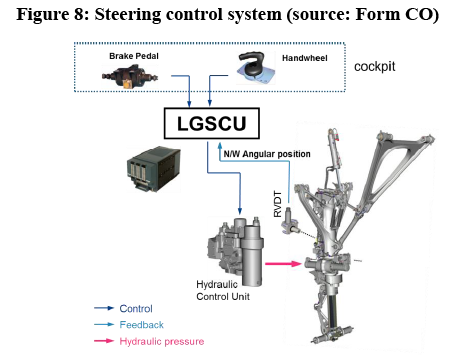

(91) The steering control system controls the position of the nose wheels relative to the aircraft centreline in order to change the direction of the aircraft when on the ground. The computer-controlled steering control system is hydraulically powered. Its major components are: (i) pilot controls; (ii) a landing gear steering control unit ("LGSCU"); (iii) servo-valves (manifold); (iv) position feedback rotary variable differential transformer ("RVDT"); (v) a nose wheel steering deactivation box; and (vi) sensors.

(92) The Notifying Party considers that there are three distinct relevant markets for (i) braking control systems, (ii) landing gear extension/retraction systems and (iii) steering control systems for the following reasons. (74) First, the relevant markets should not include the end-equipment controlled by the systems as they are supplied separately. Second, the components of a specific system are always supplied as a group, therefore the system itself constitutes a relevant product market. (75) Third, a distinction should be made between the different systems as they have different functions (no demand-side substitutability); they are tendered separately and there is limited supply-side substitutability as the systems require different materials and technologies. (76) Finally, the Notifying Party argues that further segmentation according to the types of aircraft would not be appropriate because all suppliers are able to supply all types of aircraft as technologies are identical. (77)

(93) In any event, the Notifying Party is of the view that the exact product market definition can be left open as no competition concerns arises under any alternative product market definition. (78)

(94) The market investigation confirmed that the end-equipment (e.g. landing gears with the landing gear extension/retraction system) is not supplied/sourced together with their control systems (79) and that the different control systems do not belong to the same relevant product market based on the separate procurement (80) and technological differences. (81) The majority of respondents stated that control systems differ significantly across aircraft types (82) and that their company would not be technically able to supply the respective control system for all aircraft types. (83) On the other hand, a competitor argued that this is mostly a question of scale and that there are no major technological differences between control systems for different types of aircraft. (84)

(95) The exact product market definition can nonetheless be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

5.5. Nacelles

5.5.1. Introduction

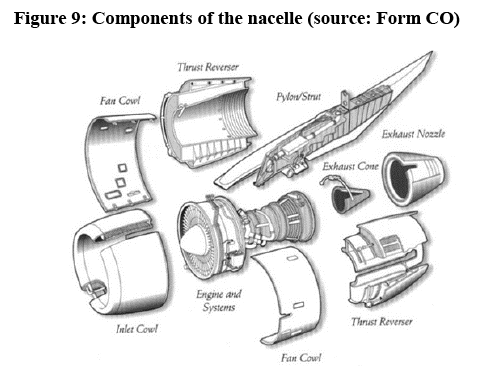

(96) Nacelles are enclosures on the exterior of an aircraft, often attached to the wings, used to house the engine and its components. Large commercial aircraft, regional aircraft, business jets and military aircraft have nacelles. On the contrary, helicopters do not have nacelles. The main functions of the nacelle are to contribute to the performance of the propulsion system, to ensure the best aerodynamics and to participate in the braking of the aircraft. It also helps reduce engine noise, and incorporates safety components to protect the aircraft from the engine heat.

(97) The nacelle contains the engine and its accessories. The exterior of a nacelle is covered with a cowling that can be opened to access the engine and components inside. A cowling is designed to provide a smooth airflow over the nacelle and to protect the engine from damage. Nacelles are complex pieces of equipment, with different components that must be assembled and integrated with the engine into the aircraft. Nacelles in large commercial aircraft are comprised of four main components and related systems: the air inlet, the exhaust (85), the thrust reverser and fan cowl doors. Nacelles in the other types of aircraft do not have an exhaust.

(98) The air inlet (also called nose cowl) is used to provide the air flow to the engine fan. It also attenuates the engine fan noise forward. The air inlet typically includes a pneumatic anti-icing system. It prevents or eliminates ice that may form in flight on the inlet cowl lip. Hot air from the engine compressor is used to heat the inlet cowl lip with a controlled flow.

(99) Fan cowl doors are large doors on both sides of the nacelle that can be opened to access the engine and components inside.

(100) The thrust reverser is located next to the engine and helps the aircraft slow down on the ground by reversing the air flow so as to produce a retarding backward force. To do so, the thrust reverser obstructs the primary air flow, so that the aircraft engine’s exhaust is directed forward rather than backwards. The thrust reverser is the most important component of the nacelle in terms of mass and cost, representing more than half the value of the nacelle. There are three types of thrust reversers: thrust reversers with cascades, thrust reversers with doors and target thrust reversers.

(101) The thrust reverser comprises two main parts: a fixed structure and a transcowl structure that is a mobile part. The thrust reverser functions with an actuation system (“TRAS”) that is needed to move the transcowl structure.

(102) The exhaust expels the secondary air flow from the engine. The exhaust provides the extra thrust force required for all flight conditions and is composed of exhaust nozzle and of the front plug and the rear plug.

5.5.2. Nacelles

(103) In UTC/Goodrich, (86) the Commission regarded nacelles as forming part of a separate product market. Particularly, in that decision the Commission investigated whether it was appropriate to further segment the market for nacelles according to the size and type of aircraft served (i.e. large commercial aircrafts or regional aircrafts). In that case the market definition was ultimately left open, however the market investigation gave indications that such a segmentation would have likely been inappropriate due to supply-side substitution considerations.

(104) The Notifying Party agrees with the above market definition.

(105) The market investigation broadly confirmed the views of the Notifying Party. The vast majority of customers responding to the market investigation in fact indicated that they do not consider appropriate to segment the market for nacelles by type of aircraft. As one respondent explained "some differences depending on engine temp and position but the technology is the same"., (87) From the supply side, the market investigation yielded largely inconclusive results, however it appears that there is a certain degree of supply-side substitutability between nacelles for different types of aircraft. In fact a number of players, typically the largest ones, indicated that they are able to supply nacelles for all the different types of aircrafts. (88)

(106) In light of the above, the Commission considers that nacelles may constitute a separate product market and that a further segmentation according to type of aircraft may not be entirely appropriate. In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

5.5.3. Nacelles components – Thrust reversers

(107) In past decisions, (89) the Commission identified separate product markets for each of the main components of the nacelle, i.e. thrust reversers, air inlets, exhaust and fan cowl doors.

(108) As the only overlap between the Parties' activities arises from the vertical relationship between the nacelle sub-components (such as thrust reverser cascades, scoops, flexible metal hoses and wiring systems) supplied by Zodiac on the one hand and thrust reversers supplied by Safran on the other hand, only thrust reversers will be further discussed below.

(109) The Notifying Party agrees with the Commission's approach that each component of the nacelles constitutes a separate product market and further claims that a segmentation according to the type of thrust reverser (i.e., thrust reversers with cascades, thrust reversers with doors and target thrust reversers) is inappropriate.

(110) The Commission takes the view that the segmentation of the market for thrust reversers based on their type is not appropriate. Although some customers (airframers) responding to the market investigation in fact indicated that this segmentation may be appropriate from a demand perspective in terms of technical characteristics and price, (90) there is broad supply-side substitutability as the majority of suppliers indicated that they are able to manufacture all types of thrust reversers. (91)

(111) The need to further sub-segment the market for thrust reversers according to aircraft types can be left open for the purpose of this decision since the Transaction does not raise serious doubts as to its compatibility with the internal market under any alternative market definition considered.

5.5.4. Nacelles sub-components

(112) Zodiac supplies a number of sub-components that are used in the manufacturing of nacelles and nacelle components and systems. In particular, these are: (i) thrust reverser cascades; (ii) scoops for thrust reversers; (iii) flexible metal hoses; (iv) wiring systems; (v) high-temperature/high-pressure ducting assemblies; and (vi) utility actuators.

(113) The market definition concerning wiring systems is discussed in section 5.9. The relevant market for utility actuators is discussed in section 5.10.6 below.

(114) For the remaining components, the Notifying Party claims that each constitutes a distinct product market and that no further segmentation is appropriate.

(115) The market investigation broadly supported the Notifying Party's claims, and particularly:

a. With respect to high-temperature/high-pressure ducting assemblies the majority of competitors responding to the market investigation indicated that there is no difference between the ones used in nacelles (de-icing ducting) and high-temperature/high-pressure ducting assemblies used elsewhere on an aircraft. This was also the supported by the responses of the customers (air framers);

b. As regards thrust reverser cascades and scoops for thrust reversers there appear to be a degree of supply-side substitution as suppliers are able to manufacture all types of thrust reverser cascades and scoops for thrust reversers. (92)

(116) In light of the above, the Commission concludes that each of thrust reverser cascades, scoops for thrust reversers, flexible metal hoses and high- temperature/high-pressure ducting assemblies constitute a separate product market and that a further segmentation is not appropriate.

5.6. Engines

5.6.1. Introduction

(117) All aircraft and helicopter engines are differentiated products which are designed and manufactured for a specific aircraft platform. Engines must meet specific requirements imposed by the aircraft or helicopter manufacturer (or as the case may be by the national government), in particular in terms of thrust, mass, range, altitude, etc. depending on the type of missions of the aircraft or helicopter.

(118) The basic principle of a jet engine is identical to any and all engines that extract energy from chemical fuel. The four main steps for any internal combustion engine are: (i) intake of air; (ii) compression of the air; (iii) combustion, where fuel is injected and burned to convert the stored energy; (iv) expansion and exhaust, where the converted energy is put to use.

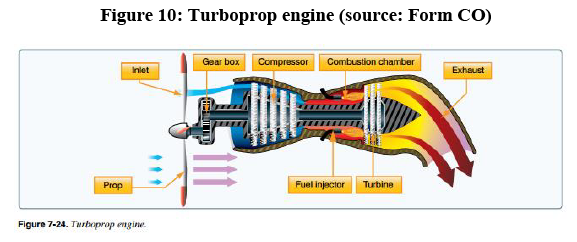

(119) There are three types of engines: turboprop, turbofan and turboshaft engines, which have different architectures but are all equipped with turbomachinery (which can take many forms, such as fans, compressors, turbines and propellers):

a. turboprop engines have two main parts: the core engine and the propeller. The core is similar to a basic turbojet engine, except that instead of expanding all the air through the nozzle to produce thrust, the latter is provided by an external propeller. Turboprop engines are most efficient at speeds between 250 and 400 mph and altitudes between 18,000 and 30,000 feet. They also perform well at the slow airspeeds required for take-off and landing and are fuel efficient. The turboprop provides the benefits of high-thrust and low-fuel consumption for aircraft designed for short distances. Because propellers become less efficient as the speed of the aircraft increases, turboprop engines are usually deployed on regional aircraft (which fly at low speed over short distances) and military carriers and surveillance aircraft (which transport heavy charges at low speed).

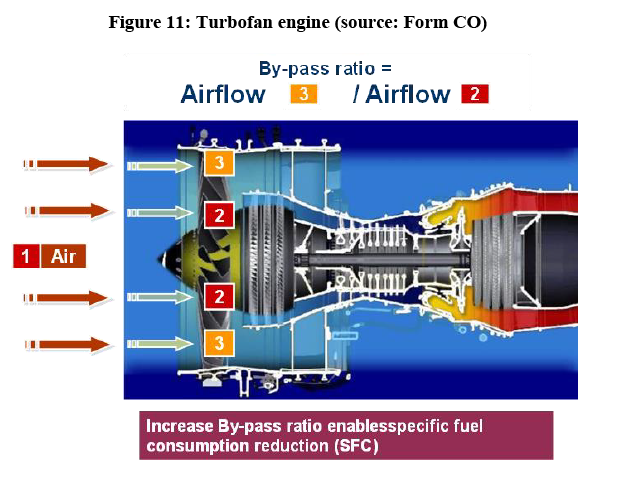

b. turbofan engines are the most modern variation of the basic turbojet engine and were developed to combine some of the best features of the turbojet and the turboprop engines. Turbofan engines are composed of the core engine (gas turbine), achieving mechanical energy from combustion, and a fan which uses the mechanical energy from the low pressure gas turbine to accelerate air rearwards. In contrast to the above mentioned turboprop engines where all the air that enters the front of the engine passes through the turbine, in turbofan engines only part of the air passes through the turbine. The remaining part (the by-pass flow) bypasses or goes around the core of the engine and directly exit through the exhaust nozzle.

Therefore, a turbofan gets some of its thrust from the core and some of its thrust from the fan. More particularly, in military turbofan engines, most of the thrust is coming from the core flow (low by-pass ratio); in commercial engines, most of the thrust is coming from the fan (high by- pass ratio). The increase of the by-pass ratio (approximately 10 for recently developed large commercial engines) enables to reduce engine fuel consumption, but this benefit is impacted by the increase of propulsion system’s weight. This is the reason why light-weight materials are required.

Turbofan engines are deployed on all types of commercial aircraft (large commercial aircraft, regional aircraft and corporate jets) and increasingly on military aircraft.

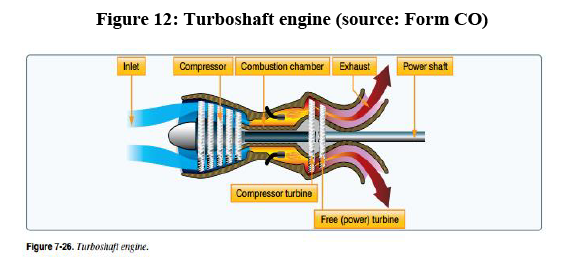

c. In turboshaft engines most of the energy produced by the expanding gases is used to drive a power turbine rather than produce thrust. The principle is similar to a turboprop engine but a large shaft is attached to the back of the turbine. The shaft powers the rotor blade transmission and the latter consequently transfers rotation from the shaft to the rotor blade. Turboshaft engines are deployed on helicopters and on vertical take-off and landing (VTOL) aircraft.

(120) In addition to main engines, Auxiliary Power Units ("APU") may also power the aircraft and some helicopters (depending on their size) while the plane is on the ground, during normal flight conditions or in case of in-flight emergency. APUs are small gas turbines that sit in a plane's tail section. The APU is started by a battery or a hydraulic accumulator. APUs do not provide propulsion but power (electrical, pneumatic, hydraulic, depending on the design of the aircraft) to start the main engine. While the plane is on the ground, APUs may also be used to provide airflow to the cabin, to operate hydraulic equipment (flight controls or flaps) and to provide electrical power. APUs are supplied by engine manufacturers directly to aircraft manufacturers.

(121) Engines are made up of different components, including:

a. Front bearing compartments, which are chambers which enclose the bearings that support the rotating parts of the engine – such as shafts – and provide mechanical interface between the engine and the aircraft engine support structure as well as their lubrication and cooling;

b. Oil systems, which serves several functions such as lubricating and cooling the bearings; and,

c. Mechanical power transmission systems, which is a mechanism that transmits the power developed by the engine to the accessories and equipment of the aircraft. From a material perspective, it is a gearbox, connected to the engine, to which is connected the equipment (such as oil pump, starter, fuel pump, electric drive generator), identified on the basis of the aircraft manufacturer’s needs.

(122) Safran manufactures and sells engines and components. Zodiac is not active in these markets but is a supplier of some of the sub-components used in the manufacturing process. Particularly, Zodiac manufactures: (i) engine oil seals; (ii) check valves; (iii) electrical and mechanical oil debris detectors/collectors; (iv) couplings and seals; (v) air valve actuators; (vi) fuel servo-valves; (vii) ducting assemblies and flexible hoses; (viii) acoustic panels; (ix) scoops for engines; (x) harnesses; (xi) sensors; and, (xii) small sub-components.

5.6.2. Engines

(123) In the past, the Commission left open the question of whether separate product markets should be defined for turbofan, turboprop and turboshaft engines. (93) In earlier decisions, the Commission assessed aircraft turbofan engines depending on the "mission profile" of the aircraft (that is to say, the purpose for which the aircraft is purchased, determined by reference to the aircraft's seating capacity, flying range, price and operational cost) on which the engine is deployed, i.e.: turbofan engines for large commercial aircraft (wide and narrow body); turbofan engines for regional aircraft; and turbofan engines for corporate jets. This distinction was not further discussed in later cases.

(124) The Notifying Party considers that the exact market definition can be left open as whatever the exact market definition eventually retained, the Transaction will not raise any competitive concerns.

(125) The Commission considers that a segmentation of the product market by type of engine (i.e. between turbofan, turboprop and turboshaft engines) could be considered as appropriate. This is because customers (airframers) indicated that they do not regard the different types of engines as substitutable. Although there is a significant degree of supply side substitutability as all the aircraft engines manufacture can and do manufacture all types of engines, there is no need to conclude on the precise market definition as the Transaction will not raise competition concerns irrespective of the precise definition retained.

(126) As regards a further segmentation by mission profile, the Notifying Party claims that is inappropriate as only turbofan engines are to be found across all "mission profiles". Turboshaft engines are in fact only deployed on helicopters and the technologies used are very similar across all types of helicopter, whereas turboprop engines are mainly intended for regional and military aircraft.

(127) The market investigation was largely inconclusive as regards the appropriateness of a segmentation based on "mission profiles". In any event the Commission considers that there is no need to analyse this further segmentation as the Transaction will not raise competition concerns irrespective of the precise market definition retained.

(128) In light of the above, the Commission considers that each individual type of engine may likely constitute a separate product market. In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions..

5.6.3. APUs

(129) In previous decisions, the Commission has identified different types of APUs depending on the shaft power of the APU or depending on the type of aircraft concerned. (94)

(130) The Notifying Party submits that APUs should not be further segmented. From a supply perspective, several APUs suppliers are able to manufacture most types of APUs for most type of aircraft and helicopters.

(131) The market investigation gave clear indications that APUs should be considered as forming part of a separate market. The results of the market investigation regarding to the appropriateness of further segmenting that market were however inconclusive.

(132) In particular, the number of competitors indicating that segmentations are relevant according to type of APU (i.e APU with an output below 550hp, APUs with an output between 550 and 1100 hp and APU with a power output above 110hp) or type of aircraft on which it will be installed and the number of those indicating the opposite is the same. A customer (airframer) responding to the market investigation indicated that segmenting by "specific power applications and by propulsion type is appropriate" and that "the APUs are considered scaled/sized for different specific aircraft requirements, although the fundamental engineering/design technology remains similar".

(133) The market investigation however indicated that there is a significant degree of supply-side substitutability as the majority of APU suppliers indicate that, albeit not currently manufacturing all types of APU, they are capable of doing so.

(134) Given that under no alternative market definition would the Transaction lead to affected markets, the market definition can be left open for the purposes of this decision. For the same reason, APUs are not further discussed in the present decision. (95)

5.6.4. Front bearing compartments

(135) The Commission has not considered a market for front bearing compartments in its previous decisions.

(136) The Notifying Party submits that there is supply-side substitutability on the basis of the functionality of the products and the suppliers' capabilities across the applications and, therefore, the product market for front bearing compartments should not be further delineated.

(137) The Commission understands that types of front bearing compartments have basically the same utility and features. Particularly ball/roller bearings' function is to convey the mechanical loads generated by the rotoric parts to the static parts of the turbomachine engine. These bearings are installed onto bearing supports which are arranged as a self-standing module which is called the "bearing compartment". The bearings need lubrication and cooling oil, as delivered by the lubrication units. The bearing compartment therefore also includes a sealing function in order to contain the cooling oil flow within the compartment and avoid oil migration to inappropriate engine areas.

(138) In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

5.6.5. Lubrication units

(139) The Commission has not in the past considered a market for lubrication units.

(140) The Notifying Party submits that there is supply substitutability on the basis of the functionality of the products and the suppliers' capabilities across the applications and, therefore, the product market for lubrication units should not be further segmented.

(141) According to the Notifying Party, all types of lubrication units have the same utility, features and basic functioning and all suppliers are capable of manufacturing lubrication units for all sorts of engines.

(142) Lubrication units work as follows: on turbomachine engines, a suitable flow of plain oil is required to provide adequate lubrication and cooling to engine components such as bearings and gears. This is achieved by positive displacement supply pumps (i.e. volumetric pumps). As the plain oil passes through these components, it is heated and becomes contaminated by debris and entraps a certain quantity of air. It is therefore necessary to process this oil, prior to its injection back into the components, through cooling, filtration and de- aeration operations. This process is achieved by positive displacement scavenge pumps. A lubrication unit is the self-standing module which includes both supply and scavenge pumps. Most of the time, the lubrication unit also features a filtration unit that removes debris from contaminated oil.

(143) The results of the market investigation were largely inconclusive; however some indications support the Notifying Party's claims. The majority of competitors responding to the market investigation in fact indicated that lubrication units for different kind of aircraft do differ, (96) however they further indicated the underlying know-how required to design them and produce them is the same, regardless of the aircraft they will be installed on. One competitor explained that "for gas turbine engines, regardless of the aircraft type, the lubrication unit know-how does not significantly vary". (97)

(144) In light of the above, the Commission considers that it is plausible to consider that the market for lubrication units should not be further segmented. In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

5.6.6. Mechanical power transmission systems

(145) A mechanical power transmission system is a mechanism that transmits the power developed by the engine to the accessories and equipment of the aircraft. From a material perspective, it is a gearbox, connected to the engine, to which the equipment is connected (such as oil pump, starter, fuel pump, electric drive generator), identified on the basis of the aircraft manufacturer’s needs.

(146) Mechanical power transmission systems include: (i) accessory dive train ("ADT") for aircraft and helicopter engines; (ii) reduction gearbox ("RGB") for aircraft and helicopter engines; (iii) propeller gearbox ("PGB") for turboprop aircraft; and (iv) helicopter transmissions: main gearbox ("MGB") and transfer gearbox ("TGB").

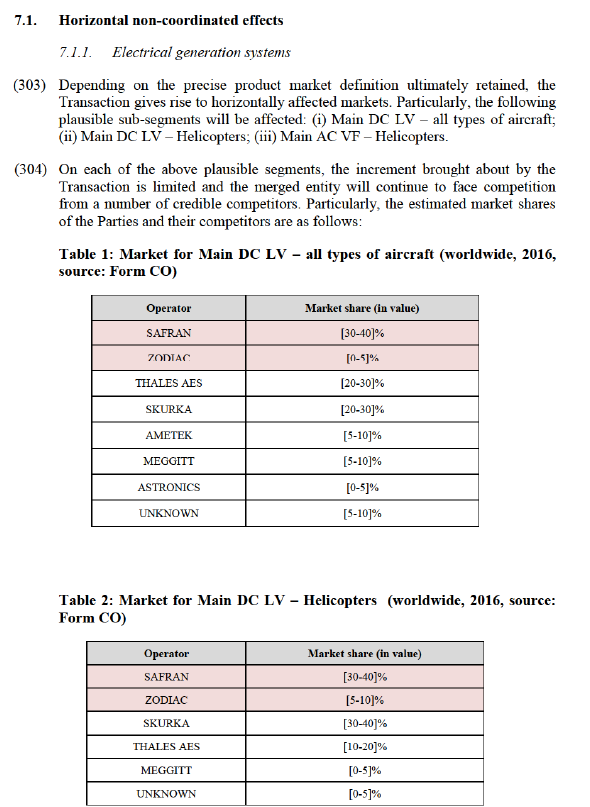

(147) Most of mechanical power transmission systems developed and produced by Safran Transmission Systems are ADTs. The ADT performs two main functions. First, during start-up, the ADT system transmits torque from a starter to the engine, setting it in motion. Second, during normal operation, the ADT system collects power from the engine via the shaft and distributes it to the gearbox mounted accessories as applicable (pumps and generators) necessary for the engine and / or aircraft supply needs. The power is transferred via a pair of bevel gears known as the IGB. The power is then delivered, via the RDS, to a second set of bevel gears located in the TGB and fed to the AGB. The AGB is an arrangement of gearlines and shafts, installed on bearings and integrated into low weight casings. At the end of the transmission process described above, the AGB provides power to various airplane equipment – such as electric generator or lubrication unit - directly installed on it.

(148) To a lesser extent, Safran also manufactures RGBs, which are a variation of ADTs and enables speed variation between the engine and the equipment or accessories that need to be powered. It can reduce or accelerate the speed before transmitting it to the aircraft equipment.

(149) In a past decision, (98) the Commission has considered mechanical power transmission systems but finally left the precise market definition open.

(150) The Notifying Party submits that there is one product market for all the mechanical power transmission systems mainly on the basis of the functionality of the products and the suppliers’ capabilities across the various transmission systems. Particularly, the Notifying Party submits that there is supply substitutability on the basis of the functionality of the products and the suppliers’ capabilities across the applications and because all mechanical power transmission systems use the same basic technology and design principle.

(151) The market investigation was largely inconclusive concerning the demand-side substitutability between the different types of mechanical power transmission systems. However, the market investigation gave indications partially contradicting the Notifying Party's views concerning the supply substitutability of the various mechanical power transmission systems.

(152) Competitors indicated that the supply-side substitutability is not as strong as indicated by the Notifying Party: only a very limited number of respondents currently supply the entire portfolio of mechanical power transmission systems and a very limited number of suppliers indicated that it would be able to start producing those mechanical power transmission systems which are currently not manufacturing. (99)

(153) In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions..

5.6.7. Engine sub-components

(154) There is a wide range of engine sub-components of various characteristics and functions.

(155) Safran purchases sub-components from third party suppliers, and then integrates them into its engines or its engine components and systems. Zodiac Aerospace supplies sub-components that are used in the manufacturing and assembly of Safran’s engines, engine components and engine systems.

5.6.7.1. Acoustic panels

(156) Acoustic panels contribute to the engine noise reduction. They are made in carbon or glass according to the using environment specificities. Some are installed in fan cases of aircraft engines and others in thrust reversers.

5.6.7.2. Scoops for engines

(157) Scoops are composite parts for engines that can be placed in aircraft engines to drive the air inside the engine.

5.6.7.3. Air valves actuators

(158) Air-valve actuators form part of the fuel system of the engine and convert an electrical signal into mechanical movement (open/close) of an air valve.

(159) With regards to the products under (a), (b) and (c) above, the market investigation was not entirely conclusive as regards the appropriateness to further segment the market for acoustic panels. However a number of respondents indicated that they consider any further segmentation inappropriate. (100)

5.6.7.4. Electrical motors

(160) Electrical motors are devices that convert electrical energy into mechanical energy. The electrical motors supplied by Zodiac to Safran are used to start the APU.

(161) The market investigation suggests that a further segmentation of electrical motors could be inappropriate. The vast majority of competitors responding to the market investigation indicated that they not consider that electrical motors are different depending on the type or size of aircraft they will be installed on, or on the application for which they are used (civil, military or helicopter). (101)

(162) Competitors responding to the market investigation also largely indicated that they are capable of manufacturing electrical starter motors for all types and sizes of aircrafts, as well as for all types of applications. (102)

(163) In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions.

5.6.7.5. Electrical and mechanical oil debris detectors and collectors

(164) Oil debris collectors and detectors permit rapid and frequent checking for the presence of ferrous metal in the oil system and are therefore used as a warning in case of detection of ferrous particles. In lubrication systems, they capture debris generated by the wear of transmissions, gearboxes, bearings, gears etc. Usually located in a gearbox or reservoir drain plug location, the magnetic chip collector captures and retains metallic particles for later removal and off-line analysis. The chip collector and chip detectors can also be line-mounted, closer to the potential failure point for detecting a failure.

(165) The Notifying Party claims that oil debris detectors and oil debris collector form part of the same product market.

(166) The market investigation was largely inconclusive with regards to the Parties' claim that debris collectors and debris detector should form part of the same market. However, a number of competitors indicated that any segmentation of those products is inappropriate.

(167) In any event, the exact product market definition in this regard can be left open for the purpose of this decision since the Transaction does not lead to serious doubts as to its compatibility with the internal market under any of the alternative definitions..

5.6.7.6. Small sub-components

(168) Zodiac also supplies a number of small sub-components which are inputs to engines, APUs and engine components. For the analysis of the market definition of these subcomponents, please refer to section 5.10.3 of this decision.

5.7. Environmental control systems

5.7.1. Introduction

(169) The environmental control system ("ECS") of an aircraft provides air supply, thermal control and cabin pressurisation for the crew and passengers. The ECS encompasses bleed air systems, air conditioning systems, cabin pressurisation systems, as well as ice and rain protection systems.

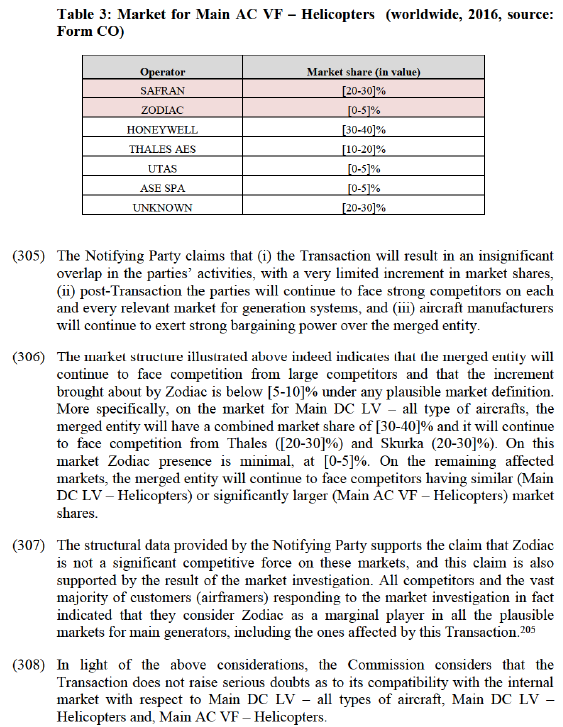

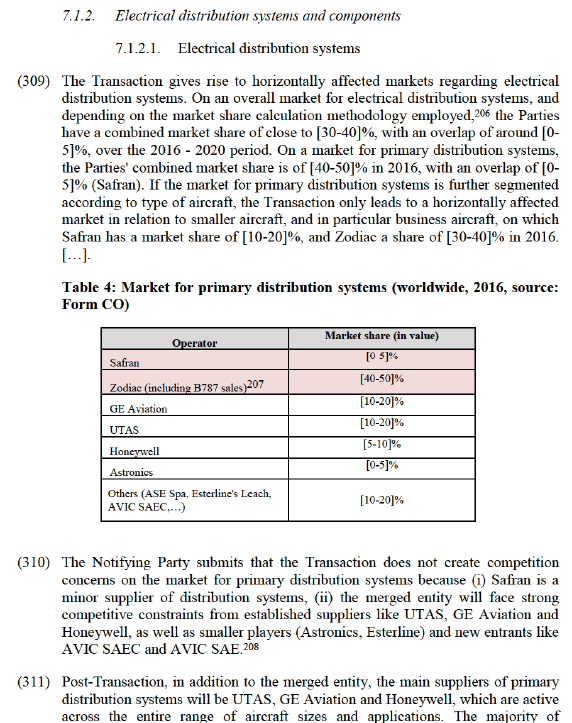

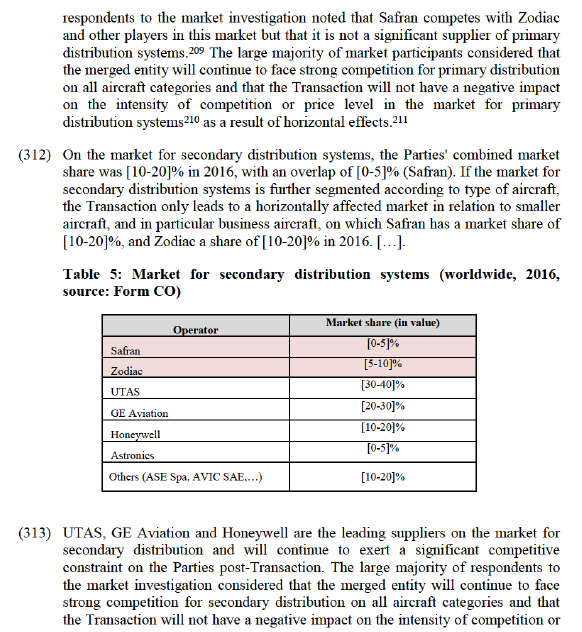

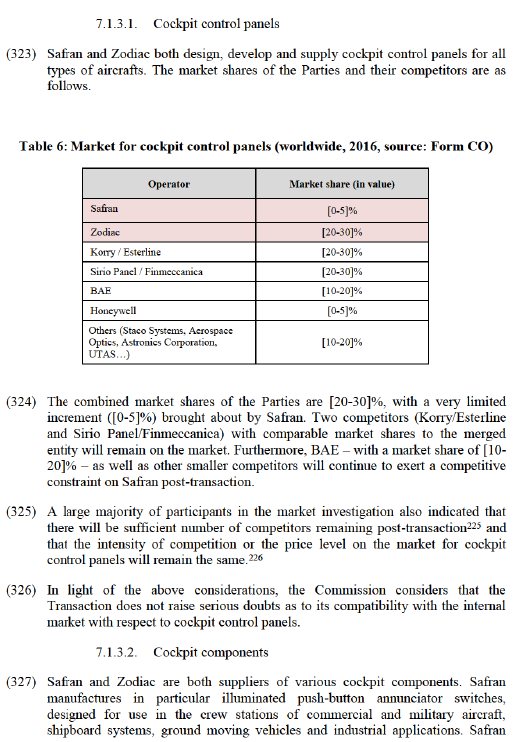

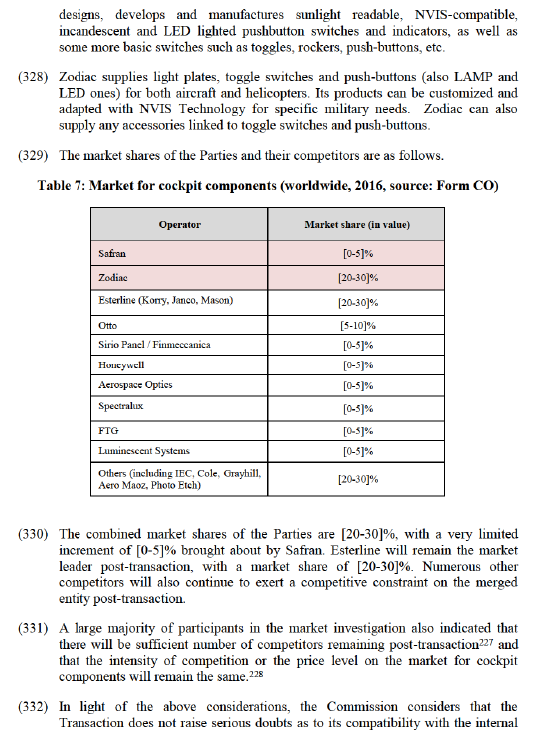

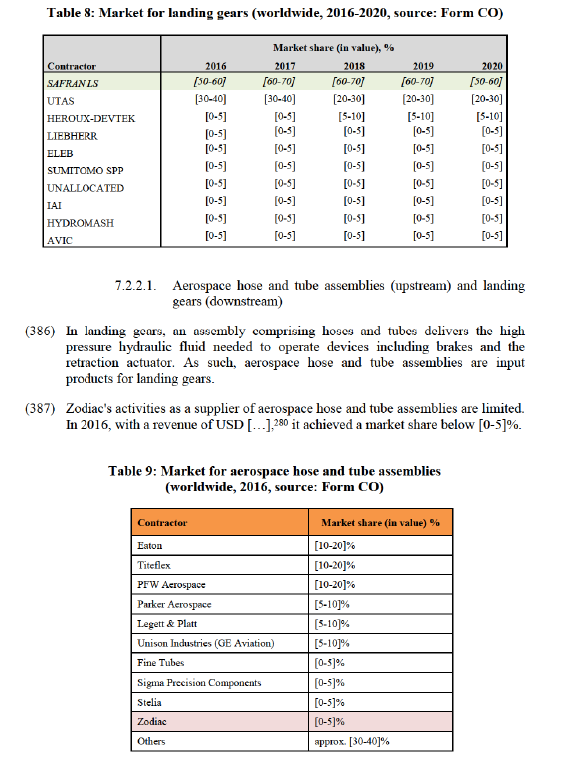

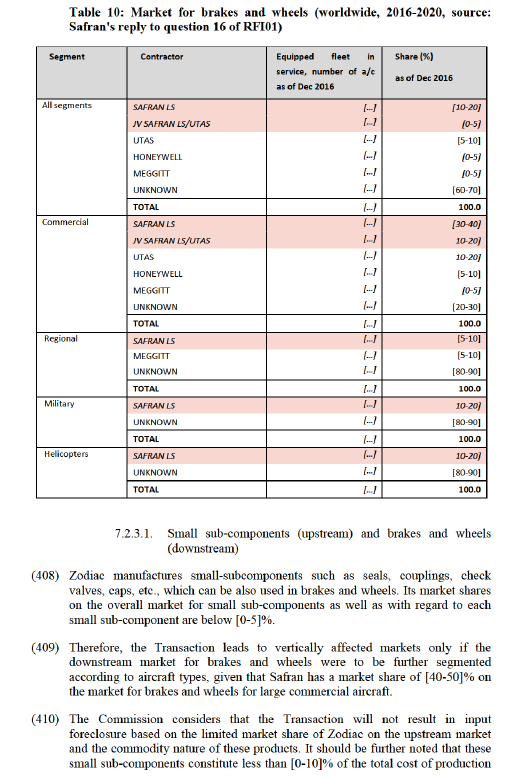

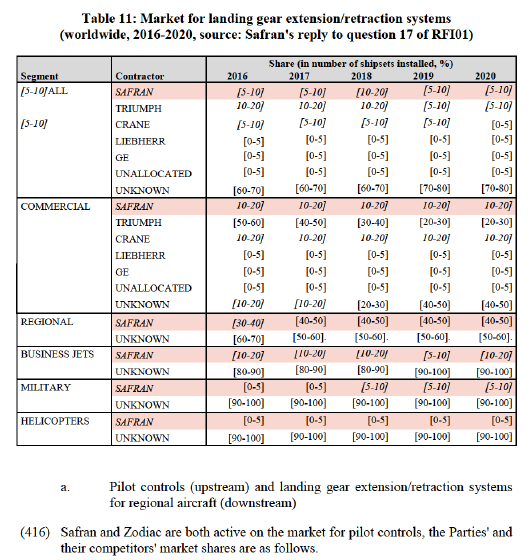

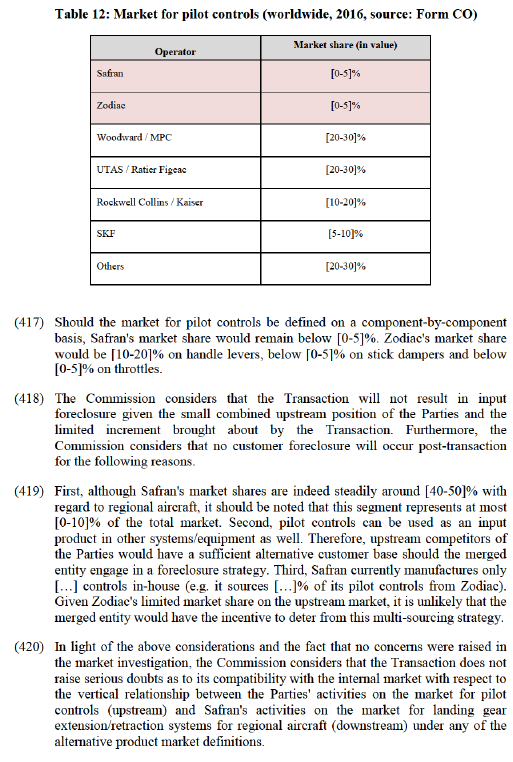

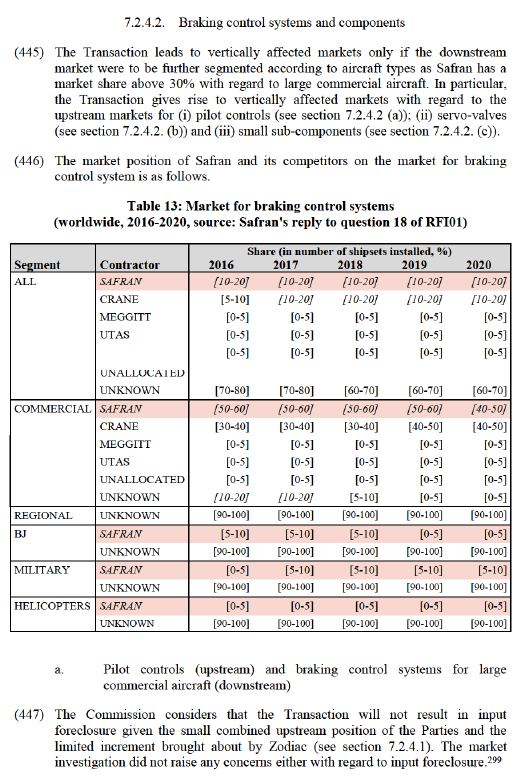

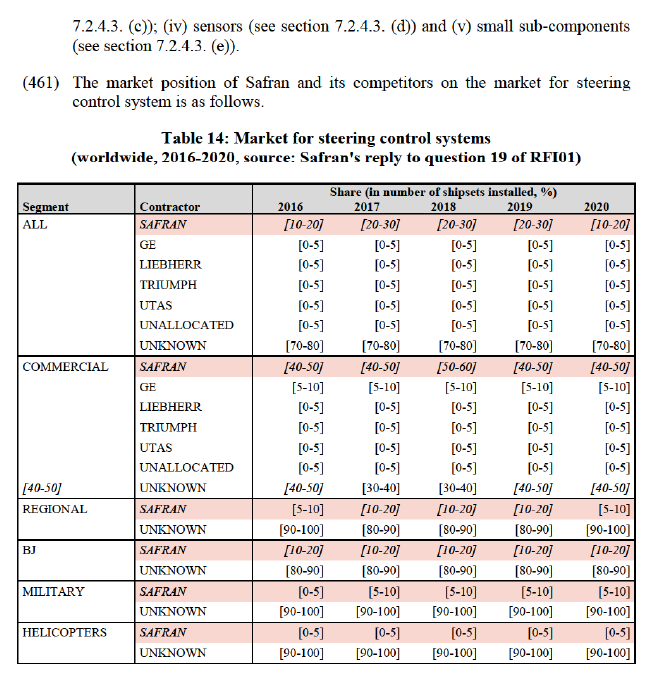

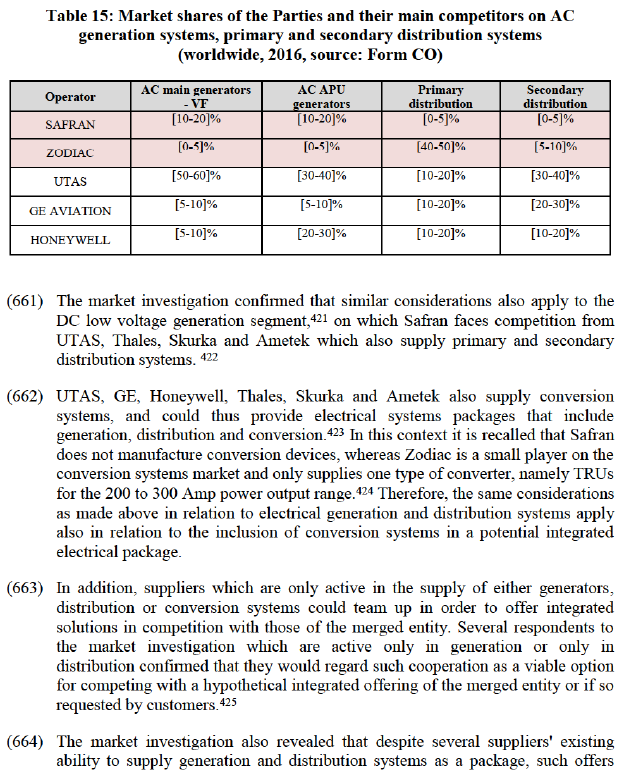

(170) Bleed air systems are comprised of components that control compressed bleed air from the main engine or APU, cool it by using outside air, and deliver it to other downstream systems such as cabin air conditioning, cabin pressurisation, fuel tank and hydraulic reservoir pressurisation, engine start. Air conditioning and cabin pressurisation systems supply and maintain the air in the pressurised fuselage compartments at the correct pressure, temperature and freshness for passenger comfort and equipment cooling, and also provide air for ventilation functions in the unpressurised fuselage bays. Ice and rain protection systems have the role of preventing and removing rain and ice from critical surfaces of the aircraft.