Commission, May 12, 2017, No M.8314

EUROPEAN COMMISSION

Decision

BROADCOM / BROCADE

Subject: Case M.8314 – Broadcom / Brocade

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 17 March 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Broadcom Limited ("Broadcom", Singapore) intends to acquire within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of Brocade Communications Systems, Inc. ("Brocade", the United States) by way of a purchase of shares (the "Transaction").3 Broadcom is designated hereinafter as the "Notifying Party", and Broadcom and Brocade are together referred to as the "Parties", while the undertaking resulting from the Transaction is referred to as the "Merged Entity".

1. THE PARTIES AND THE OPERATION

(2) Broadcom, the Notifying Party, is a technology company (with dual headquarters in the US and Singapore) that designs, develops and supplies a broad range of semiconductor devices – also referred to as integrated circuits ("ICs") or chips – for customers in four business segments: (i) wireless communications; (ii) wired infrastructure; (iii) enterprise storage; and (iv) industrial and other. Broadcom is essentially a "fabless" provider of semiconductor devices, as it primarily relies on third-party "fabrication" plants and only has limited in-house manufacturing capabilities.

(3) Brocade, the target company, is a US-based technology company that supplies networking hardware, software, and services, including (i) Fibre Channel ("FC") Storage Area Network ("SAN") products, such as directors, fixed switches, embedded switches as well as network management and monitoring solutions; and (ii) Internet Protocol ("IP") networking products such as IP routers, Ethernet switches, network security, analytics and monitoring, as well as products used to manage application delivery. Brocade's products are used in communications and datacentre infrastructures and applications.

(4) On 2 November 2016, Broadcom and Brocade entered into an Agreement and Plan of Merger pursuant to which Broadcom will acquire all shares in Brocade. The Transaction will thus lead to the acquisition by Broadcom of sole control over Brocade and therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

2. UNION DIMENSION

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million4 (Broadcom: EUR 13 610 million; Brocade: EUR 2 115 million). Each of them has a Union-wide turnover in excess of EUR 250 million (Broadcom: EUR […] million; Brocade: EUR […] million), but they do not achieve more than two-thirds of their aggregate Union-wide turnover within one and the same Member State. The notified operation therefore has a Union dimension within the meaning of Article 1(3) of the Merger Regulation.

3. RELEVANT MARKETS

(6) The Transaction does not give rise to any horizontal overlaps between the Parties' activities. However, it results in a number of vertical and conglomerate relationships in relation to following products.

3.1. Application specific integrated circuits and application specific standard products

(7) Broadcom is active with regard to the supply of both application specific integrated circuits ("ASICs") and application specific standard products ("ASSPs"). Vertical relationships arise as: (i) Broadcom's ASICs can be used as an input for Brocade's FC SAN switches; and (ii) Broadcom's ASICs and ASSPs can be used as inputs for Brocade's IP/Ethernet switches and routers.

3.1.1. Product market definition

3.1.1.1.Introduction

(8) Semiconductors are materials that conduct electricity more easily than insulators (like glass) but less easily than conductors (like copper), which makes them ideal for manipulating electronic signals (reversing, amplifying). Semiconductor materials, most typically silicon, are used in semiconductor devices like microchips and their components (for example, diodes and transistors). Semiconductor devices can be found in virtually every electronic device today; end-products that contain semiconductor devices range from base stations, mobile phones, computers, domestic appliances and cars to medical equipment, identification systems, large-scale industry electronics and aerospace equipment.

3.1.1.2. Past decisional practice

(9) In previous decisions, the Commission has considered dividing the market for semiconductors in a number of different ways.

(10) The Commission has found that semiconductors for different industries are not substitutable, and can be differentiated on the basis of the sector for which they are intended, namely: (i) consumer; (ii) data processing; (iii) automotive; (iv) industrial; (v) military/aerospace; and (vi) communications.5 Further, within the market for communications applications, the Commission has considered that a distinction can be drawn between: (i) wireline applications; and (ii) wireless applications.6

(11) The Commission has found that there are four main categories of semiconductors:(i) integrated circuits (“ICs"), commonly referred to as "chips", or "microchips";(ii) discretes; (iii) optical semiconductors; and (iv) sensors and actuators.7

(12) With regard to ICs, the Commission has found that: (i) digital ICs; and (ii) analogue ICs; should be considered as separate markets.8 Also, with particular regard to digital ICs, the Commission has considered that this market should be sub-divided into three main sub-segments: (i) micro-components; (ii) memory ICs; and (iii) logic ICs.9 In turn, micro-components can be sub-segmented into: (i) microprocessors ("MPUs"); (ii) microcontrollers ("MCU"s); and (iii) digital signal processors ("DSPs").10 MCUs can be further sub-divided according to their technical parameters (i.e. number of bits) and whether they are either general purpose or used for specific application.11

(13) With respect to ICs, a segmentation can be made on the basis of the specific application for which they are intended, namely: (i) custom-made for a specific original equipment manufacturer ("OEM"), known as 'application specific integrated circuits' (ASICs); (ii) off-the-shelf or 'merchant' ICs, which can be purchased in identical form by a number of different customers, referred to as 'application specific standard products (ASSPs); or (iii) 'field programmable gate arrays', which can be configured and re-configured by customers after fabrication to perform desired logic and processing functions.12

(14) Lastly, it is possible to distinguish ASICs and ASSPs according to the device in which they will be implemented,13 for example for: (i) IP/Ethernet switches;14 (ii) IP/Ethernet routers;15 (iii) FC SAN switches.16

3.1.1.3. The Notifying Party's views

(15) The Notifying Party submits that it is not necessary to determine the exact scope of the relevant market for ASICs or ASSPs as the Transaction does not give rise to competition concerns under any possible market definition.

(16) The Notifying Party submits specifically that it is not necessary to further segment the market for wireline communication ASICs according to end device. While ASIC vendors develop chips for a specific customer for a specific end device, there is full supply-side substitutability. In particular, it submits that: (i) ASICs for different types of switches are technically very similar, relying on similar IP blocks, packaging, power consumption; and (ii) there is no difference in the degree of technical complexity between ASICs for different switches. Accordingly, it is possible for all ASIC suppliers to develop and supply ASICs for each of the different types of switch. Equally, the Notifying Party submits that it is not appropriate to distinguish between ASSPs according to end device as there are no ASSP solutions for FC SAN switches, and while ASSPs are available for IP/Ethernet switches and fibre channel over Ethernet ("FCoE") switches, the same chips can be used in both products.

3.1.1.4. The Commission's assessment

(17) First, the results of the market investigation indicate that application specific semiconductors (ASICs/ASSPs) used for wireline communications are not in the same product market as application specific semiconductors used in other product categories, including wireless communications, storage, or automotive.Respondents to the market investigation consider that application specific semiconductors are generally designed to support specific features consistent with the product categories for which they are designed and that there are different protocols and technologies.17

(18) Second, the results of the market investigation indicate that ASICs and ASSPs are not in the same product market. While a number of suppliers consider that there is substitutability between ASICs and ASSPs, from the demand side all of the customers that responded to the market investigation consider that they are not substitutable. This is because of the significantly higher costs involved in developing a custom-made ASIC compared to purchasing ASSPs off the shelf, as well as differing technology and functionalities.18

(19) Third, the results of the market investigation indicate that ASICs for FC SAN switches and ASICs for IP/Ethernet switches are not in the same product market. The vast majority of respondents consider that these different ASICs can be principally distinguished due to differing functionalities.19 Additionally, the majority of respondents consider that ASICs for different switches have different characteristics (size, technology), different design, need different know-how, and have different prices.20

(20) In any event, for the purpose of this decision, the precise product market definition for ASICs and ASSPs can be left open, as the Commission's assessment does not materially change regardless of whether ASICs and ASSPs are considered on the narrowest market definition (that is: (i) ASICs for FC SAN switches; (ii) ASICs for IP/Ethernet switches; (iii) ASICs for IP/Ethernet routers; (iv) ASSPs for IP/Ethernet switches; and (v) ASSPs for IP/Ethernet routers), or more broadly.

3.1.2.Geographic market definition

(21) The Notifying Party submits that it is not necessary to determine the exact scope of the relevant market, because the Transaction does not give rise to competition concerns under any possible geographic market definition.

(22) In previous cases, the Commission concluded that the relevant geographic markets for wireline communication ASICs and ASSPs should be considered worldwide in scope.21

(23) The results of the market investigation confirm that the geographic scope of the markets for wireline communication ASICs and ASSPs is likely to be worldwide. Respondents highlight the facts that price levels are similar across the world, suppliers are active on a worldwide basis, and transport costs are not significant.22

(24) However, for the purpose of this decision, the exact geographic market definition can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is considered to be worldwide, or narrower.

3.2.Fibre Channel Storage Area Networking

(25) Storage Area Networks ("SANs") are a type of high-speed data communication network. SANs connect servers to storage devices such as optical jukeboxes, tape libraries and storage arrays which enable storage devices to be accessed and operated as if they were locally attached to the server. Users of such networks include the financial services industry, governments and telecommunications and media companies.

(26) A number of technologies exist for SAN infrastructures of which fibre channel ("FC") technology is the most prominent, accounting for approximately 70% of the market.23

(27) FC SAN networks contain a number of components including: (i) FC SAN switches, which connect servers and storage devices; and (ii) FC host bus adaptors ("FC HBAs"), which are cards mounted in servers or the storage device24 and connect the host server to a FC SAN switch that determines the device of origin and destination and forwards the data to the intended destination. Both FC SAN switches and FC HBAs perform their main interconnect function through semiconductors. Vendors of FC HBAs and FC SAN switches generally supply their products to OEMs, which in turn supply servers and storage systems to end customers.

(28) Broadcom is active with regard to FC HBAs and Brocade is active with regard to FC SAN switches, which gives rise to a conglomerate relationship. In addition, Broadcom's activities with regard to ASICs give rise to a vertical relationship as they can be used as an input for Brocade's FC SAN switches.

3.2.1.FC SAN switches

3.2.1.1. Product market definition

(29) The Notifying Party submits that it is not necessary to determine the exact scope of the relevant market as the Transaction does not give rise to competition concerns under any possible market definition.

(30) The Notifying Party submits that the basic purpose of FC SAN switches and IP/Ethernet switches is the same but FC SAN switches only provide connectivity to FC devices and cannot switch IP/Ethernet traffic or attach to IP/Ethernet devices. FC has its own protocol and the data in a FC network is transmitted in frames/packets which are different from and incompatible with those used on Ethernet. On the other hand, it submits that there is a long-term trend towards replacement of FC SAN networks (and therefore FC SAN switches) with IP based technologies (and therefore IP/Ethernet switches) as well as other technologies.

(31) The Commission has not previously assessed the relevant product market in relation to FC SAN switches. In relation to switches and routers in general, the Commission has previously considered a distinction between switches and routers and, within switches, a segmentation based on the different protocols and network technologies that they support (for example TDM, ATM, IP/Ethernet, multi service, etc.) which could be applicable to FC technology (see paragraphs (47) to(56) below).

(32) The results of the market investigation support the view that switches25 should be segmented according to the technology/protocol used and thus, FC SAN switches and IP/Ethernet switches should be considered as distinct product markets. These two types of switches have different characteristics, capabilities and require different skill sets within a customer to manage.26

(33) For the purpose of this decision, the Commission will conduct its assessment on the basis of the narrowest possible product market, that is to say the market for FC SAN switches.

3.2.1.2. Geographic market definition

(34) The Notifying Party submits that it is not necessary to determine the exact geographic scope of this market because the Transaction does not give rise to competition concerns under any possible market definition but that the segment for FC SAN switches should be considered as worldwide.

(35) In previous decisions, the Commission has considered that the geographic market for all categories of networking products (including IP/Ethernet switches and routers) to be either EEA-wide or worldwide in scope.27

(36) The results of the market investigation indicate that the market for FC SAN switches is likely to be worldwide. In particular, respondents consider that suppliers operate on a worldwide basis, transport costs are not significant, location is not a factor for supplier selection and price levels are similar across regions.28

(37) However, for the purpose of this decision, the exact geographic market definition can be left open, as the Commission's assessment does not materially change regardless of whether the market is considered to be worldwide or EEA-wide.

3.2.2.FC HBAs

3.2.2.1. Product market definition

(38) The Notifying Party submits that it is not necessary to determine the exact scope of the relevant market as the Transaction does not give rise to competition concerns under any possible market definition but notes that FC HBAs offer connectivity functionalities that cannot be offered by other devices or products that support another technology, such as IP/Ethernet HBAs.

(39) The Commission has not previously defined the relevant product market for FC HBAs although it has undertaken an assessment of the electronic manufacturing services market broken down as far as the product level, including 'storage network HBAs'.29

(40) The results of the market investigation were mixed with regard to whether within the SAN space, the functionalities offered by FC HBAs can be offered by another device supporting another technology or protocol such as for example a converged network adaptor or an iSCSI adaptor. The market investigation indicates that it would not be possible to deploy a non-FC HBA into an existing FC network.30

(41) The majority of respondents did not consider it appropriate to further segment the market for FC HBAs, for example according to speed, interconnection, or generation.31

(42) For the purpose of this decision, the Commission will conduct its assessment on the basis of the narrowest possible product market, that is to say the market for FC HBAs.

3.2.2.2. Geographic market definition

(43) The Notifying Party submits that it is not necessary to determine the exact geographic scope of this market because the Transaction does not give rise to competition concerns under any possible market definition but that the segment for FC SAN switches should be considered as worldwide.

(44) In previous decisions, the Commission has considered that the geographic market for all categories of networking products (including IP/Ethernet switches and routers) to be either EEA-wide or worldwide in scope which could be considered as also applicable to FC HBAs.32

(45) The results of the market investigation indicate that the market for FC HBAs is likely to be worldwide. In particular, respondents consider that suppliers operate on a worldwide basis, transport costs are not significant, location is not a factor for supplier selection and price levels are similar across regions. 33

(46) However, for the purpose of this decision, the exact geographic market definition can be left open, as the Commission's assessment does not materially change regardless of whether the market is considered to be worldwide or EEA-wide.

3.3.IP/Ethernet Networking

(47) IP/Ethernet is one type of network technology. Switches and routers are combination of software and hardware devices, and are essential parts of telecommunication networks. They are the "knots" of a network used to interconnect different parts of a network, notably to route and exchange data packets between the various sub-networks. They analyse information contained in data packets to determine to which sub-network it must be transferred. Although it is not always possible to establish the precise difference between switches and routers in marketing or technical terms, routers are generally larger devices that connect different networks together while switches are generally used within the same network.34

(48) Brocade is active with regard to IP/Ethernet switches and routers. Vertical relationships arise as Broadcom's ASICs and ASSPs can be used as inputs for Brocade's IP/Ethernet switches and routers.

3.3.1.Product market definition

(49) The Notifying Party submits that it is not necessary to determine the exact scope of the relevant market for IP/Ethernet switches and routers because the Transaction does not give rise to competition concerns under any possible market definition, in particular as Broadcom does not supply IP/Ethernet switches or routers. For the purpose of the competitive assessment, the Notifying Party provides information for the following potential markets: (i) IP/Ethernet switches; and (ii) IP/Ethernet routers.

(50) The Commission has previously considered whether there is a product market encompassing both switches and routers, due to the growing multi-functionality and convergence between these products. The Commission found that despite a technological trend towards convergence between the products they still differed in terms of prices and functionalities.

(51) Moreover, it found that switches are generally used for network connectivity within a Local Area Network35 ("LAN") while routers on the other hand are used to interconnect networks across long distances and are used in wide area network ("WAN") connectivity, such as connecting separate LANs or connecting LANs to the internet.36

(52) The results of the market investigation were mixed as to whether network switches and routers should be considered as part of the same market. While the majority consider that they should be in separate markets because of differing functionalities, the increased complexity of routers and the lower cost of switches, many other respondents noted that there were an increasing number of switches that were now enabled with some routing functionality.37

(53) Switches: In previous decisions, the Commission has considered dividing the market for switches in a number of ways but left the exact product market definition open. First, it has considered whether switches should be distinguished based on different technologies, such as: (i) time division mode ("TDM"); (ii) asynchronous transfer mode ("ATM"); (iii) IP/Ethernet; and (iv) multi service.38 Second, whether the network switching equipment sector should be segmented by type of activity (manufacture, distribution and offering of integrated solutions).39 Third, the Commission has also considered a possible segmentation for switches based on customer size.40

(54) The majority of respondents to the market investigation indicated that IP/Ethernet switches should be considered a part of a separate product market to switches based on other protocols and technologies as IP/Ethernet is now the dominant technology.41

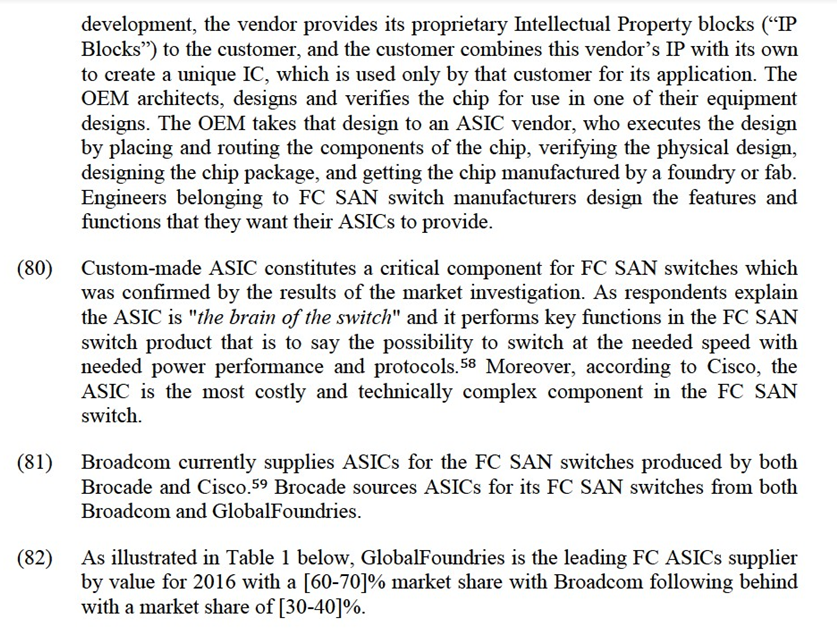

(55) Routers: Similarly to switches, the Commission has considered whether the market could be segmented according to the technology used (TDM, ATM, and IP/Ethernet) or on the basis of the number of users but ultimately left the market definition open.42

(56) In any event, for the purpose of this decision, the exact product market definition for IP/Ethernet switches and routers can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is divided between switches or routers or further sub-divided according to technology, type of activity, or customer size.

3.3.2.Geographic market definition

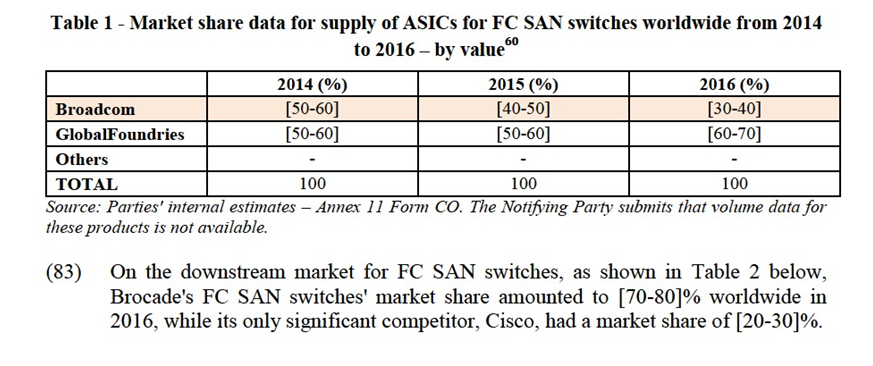

(57) The Notifying Party submits that the market(s) for IP/Ethernet switches and routers should be considered as worldwide but that it is not necessary to determine the exact scope of the relevant market because the Transaction does not give rise to competition concerns under any possible geographic market definition. For the purpose of the competitive assessment, the Parties provide information for IP/Ethernet networking products on a worldwide basis.

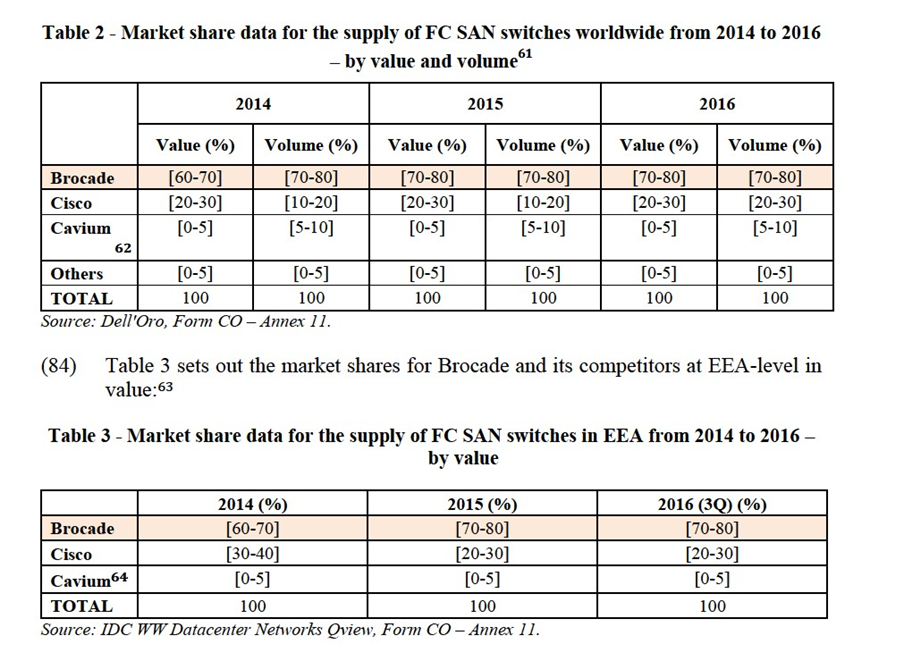

(58) In previous decisions, the Commission has considered that the geographic market for all categories of networking products (including IP/Ethernet switches and routers) to be either EEA-wide or worldwide in scope.43

(59) Respondents to the market investigation unanimously consider the geographic markets for IP/Ethernet switches and routers to be worldwide given the global nature of both supply and demand.44

(60) However, for the purpose of this decision, the exact geographic market definition can be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market regardless of whether the market is considered to be EEA- or worldwide.

4. COMPETITIVE ASSESSMENT

4.1.Analytical framework

(61) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(62) In this respect, a merger may entail horizontal and/or non-horizontal effects. Non- horizontal effects are those deriving from a concentration where the undertakings concerned are active in different relevant markets.

(63) As regards, non-horizontal mergers, two broad types of such mergers can be distinguished: vertical mergers and conglomerate mergers.45 Vertical mergers involve companies operating at different levels of the supply chain.46 Conglomerate mergers are mergers between firms that are in a relationship which is neither horizontal (as competitors in the same relevant market) nor vertical (as suppliers or customers).47

(64) The Commission appraises non-horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Non-Horizontal Merger Guidelines.48

(65) In this particular case, the Transaction does not give rise to any horizontal overlaps between the Parties' activities, but results in a number of vertical and conglomerate relationships. Accordingly, the Commission will only examine whether the Transaction is likely to give rise to non-horizontal effects.

4.2.Vertical assessment

4.2.1.Legal framework

(66) According to the Non-Horizontal Merger Guidelines,49 non-coordinated effects may significantly impede effective competition as a result of a vertical merger if such merger gives rise to foreclosure.

(67) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure. Input foreclosure occurs where the merger is likely to raise the costs of downstream competitors by restricting their access to an important input. Customer foreclosure occurs where the merger is likely to foreclose upstream competitors by restricting their access to a sufficient customer base.

(68) In assessing the likelihood of an anticompetitive foreclosure scenario, the Commission examines, first, whether the merged entity would have, post-merger, the ability to substantially foreclose access to inputs or customers, second, whether it would have the incentive to do so, and third, whether a foreclosure strategy would have a significant detrimental effect on competition.50

(69) As regards ability to foreclose, under the Non-Horizontal Merger Guidelines, input foreclosure may lead to competition problems if the upstream input is important for the downstream product.51 For input foreclosure to be a concern, a vertically integrated merged entity must have a significant degree of market power in the upstream market. It is only in those circumstances that the merged entity can be expected to have significant influence on the conditions of competition in the upstream market and thus, possibly, on prices and supply conditions in the downstream market.52

(70) With respect to incentives to foreclose, paragraph 40 of the Non-Horizontal Merger Guidelines states that the incentive of the merged entity to foreclose depends on the degree to which foreclosure would be profitable. The vertically integrated firm will take into account how its supplies of inputs to competitors downstream will affect not only the profits of its upstream division, but also of its downstream division. Essentially, the merged entity faces a trade-off between the profit lost in the upstream market due to a reduction of input sales to (actual or potential) rivals and the profit gain, in the short or longer term, from expanding sales downstream or, as the case may be, being able to raise prices to consumers.53 Additionally, paragraph 42 of the Non-Horizontal Merger Guidelines indicates that “[t]he incentive for the integrated firm to raise rivals' costs further depends on the extent to which downstream demand is likely to be diverted away from foreclosed rivals and the share of that diverted demand that the downstream division of the integrated firm can capture”.

(71) As regards the effects of input foreclosure, the Non-Horizontal Merger Guidelines explain that such conduct raises competition concerns when it leads to increased prices on the downstream market. First, anticompetitive foreclosure may occur when a vertical merger allows the merging parties to increase the costs of downstream rivals in the market thereby leading to an upward pressure on their sales prices. Second, effective competition may be significantly impeded by raising barriers to entry to potential competitors.54 The Horizontal Merger Guidelines further state that if there remain sufficient credible downstream competitors whose costs are not likely to be raised, for example because they are themselves vertically integrated or they are capable of switching to adequate alternative inputs, competition from those firms may constitute a sufficient constraint on the merged entity and therefore prevent output prices from rising above pre-merger levels.55

(72) Additionally, the Non-Horizontal Merger Guidelines recognise that a vertically integrated entity may gain access to commercially sensitive information on the activities of its upstream or downstream rivals. This may give the vertically integrated entity a competitive advantage to the detriment of consumers. For instance, a vertically integrated entity which is also the supplier of a downstream competitor may obtain critical information regarding the latter’s activities.56

4.2.2. ASICs for FC SAN switches

4.2.2.1. Input foreclosure

(a) The Notifying Party's view

(73) The Notifying Party claims that the Merged Entity will neither have the ability nor the incentive to foreclose access to ASICs for FC SAN switches to competing downstream FC SAN switch suppliers by refusing to supply ASICs or by charging excessive prices for its ASICs.

(74) In particular, as regards the Merged Entity's lack of ability to foreclose, the Notifying Party submits that first, it has no market power on the upstream market for supply of ASICs for FC SAN switches where it faces significant competition from GlobalFoundries, which is a suitable alternative supplier (and is vertically integrated with its own manufacturing capabilities while Broadcom relies on third party foundries TSMC and Amcor for the physical manufacture of ASICs). Second, beside GlobalFoundries there are other ASICs suppliers from which a downstream competitor in FC SAN switches can source ASICs such as Intel, Texas Instruments, STMicroelectronics and eSilicon (some of which similarly to GlobalFoundries are vertically integrated and have their own silicon production facilities ("fabs")). Third, the Notifying Party claims that there is nothing unique in the ASIC design and development services offered by Broadcom and GlobalFoundries does offers the similar services and solutions such as place & route, IP design kits, physical verification, and packaging design.

(75) Furthermore, the Notifying Party claims that the barriers to switch ASICs vendor for FC SAN switches for a new ASIC opportunity are low as there are no additional costs or delays. According to the Notifying Party each new ASIC opportunity is a discrete project with its own specifications, independent from previous projects regardless of the vendor. As regards existing generations of FC SAN switches the Notifying Party submits that the majority of the design and developing work for its only FC SAN ASICs customer besides Brocade, that is Cisco, is already done with Broadcom handling only the manufacturing process.

(76) The Notifying Party also submits that it will not have the incentive to engage in input foreclosure post-Transaction because of the absence of market power upstream by Broadcom and because the Merged Entity would not be able to recoup any lost upstream revenue from ASICs on the downstream switch market as Cisco would source ASICs from an alternative vendor and still effectively compete in the switch market downstream. In addition, the Notifying Party submits that should the Merged Entity engage in input foreclosure it risks losing not only the FC SAN ASICs revenue but also significant revenue from Cisco in other business areas. According to the Notifying Party, Broadcom's total sales to Cisco amount to USD […] annually, of which FC SAN ASICs sales represent less than [0-5]%.57 The Notifying Party therefore submits that it has no incentive to disrupt its business relationship with Cisco and jeopardize the sale of products and solutions other than FC SAN ASICs to Cisco. Finally, the Notifying Party claims that any attempt to engage in input foreclosure would damage also its relationships with storage solution OEMs who would either support other FC SAN switch providers or even promote more actively alternative technological solutions at the expense of FC solutions, which will further accelerate the decline of the FC SAN market.

(77) According to the Notifying Party, in any event any potential input foreclosure strategy will have no effects on competition as Cisco will remain a significant competitor in the downstream market for FC SAN switches as it will have alternatives for FC SAN ASICs supply and storage OEMs with countervailing buyer power will safeguard against any effect on competition downstream.

(b) The Commission's assessment

(78) The core “routing” function of networking equipment including switches and routers is undertaken by the switch ICs, which depending on the network device can be customized ASICs or obtained off-the-shelf ASSPs.

(79) Customized ASICs are manufactured exclusively for a single OEM customer and are based primarily on the customer’s own proprietary design. In an ASIC

industry.66 GlobalFoundries however considers that any possible differences between the fabrication technologies of GlobalFoundries and its ASIC fab competitors is irrelevant for FC ASICS and that GlobalFoundries' fabrication technologies allow it to build FC SAN ASICs as efficiently, and with the same quality as TSMC.67

(88) As to the possibility for ASICs supplier to also offer FC ASICs, Cisco considers eSilicon and STMicroelectronics to be potential alternative FC ASICs suppliers. eSilicon considers itself to be an alternative to Broadcom for the supply of FC ASIC and is acknowledged by GlobalFoundries as being its other main competitor for FC SAN ASICs beside Broadcom.68 The market investigation did not provide any further insight as to the suitability of other ASIC vendors as viable alternatives for the supply of FC ASICs.

(89) In light of the above considerations and based on the results of the market investigation, the Commission considers that, although it appears unclear to what extent ASIC providers such as eSilicon and STMicroelectronics can be considered as alternatives for the supply of FC ASICs, there is at least one viable alternative provider (GlobalFoundries) who can supply FC ASIC to FC SAN switch manufacturers competing with the Merged Entity in the event that post- Transaction the Merged Entity engages in full or partial FC ASIC foreclosure.

(90) As regards possible entry of new FC ASICs suppliers, based on the results of the market investigation, entry barriers appear to be high in view of the considerable entry investment (including in IP) and the likelihood of new entrant in the foreseeable future is rather low. The majority of the respondents to the market investigation consider entry into the market for the supply of FC SAN ASIC to be difficult even for an established wireline communications ASICs provider, which is not currently active in FC SAN ASICs. As one market participant explains, FC SAN ASIC is very unique technology with limited industry expertise in a flat to declining market, so there is little room for growth and a steep learning curve for a firm looking to begin to develop the necessary ASIC design skill and expertise customers expect from their custom supplier.69

(91) The results of the market investigation suggest that switching FC ASICs vendor for new/upcoming generation of FC SAN switches is possible if done prior the launch of the design phase or sufficiently early in the design and development process: "Any ASIC supplier change would have to occur at the architect/design stage to avoid incurring significant switching costs due to the custom nature of the products. The impact from switching significantly increases as you move further into the development cycle". Some respondents estimate the time necessary to switch to 24 months thus making switching feasible two to three years ahead of the new switch product launch.70

(92) In contrast, when it comes to the possibility of switching provider for FC ASICs in existing/current generation of FC SAN switches (for which the design phase has been completed) the majority of the market respondents consider that it is not possible to switch in a timely manner and without incurring significant costs: "Migration from one ASIC solution to another in this industry can take 2 – 3 years. Such a migration is considerable in cost, time and resources required to complete". Further hurdle to switching pointed out by a market participant is that the ASICs from a new provider might be incompatible with the existing product.71

(93) Cisco in particular considers that, while switching of FC ASIC is feasible from a technical point of view, such switching would lead to significant delays in the release to market72 of the products that would rely to the alternative FC ASIC supplier. In relation to the existing/current generations of ASIC Cisco explains that, should it decide to source FC ASIC for its 32 Gbps switches from a different supplier, it would miss most of the expected time period during which it could make significant sales of its 32 GBPS FC SAN switches before the release of the new generation of 64 Gbp FC SAN switches (which Cisco anticipates will take place around 2020).73

(94) In relation to existing FC ASIC the Commission notes that, as supported by the result of the market investigation, switching FC ASIC supplier at such a stage of the ASIC procurement process appears to be quite difficult and costly. However, the design and development phases of the FC ASIC procurement process for Cisco have been already finalised and at present Broadcom is handling, via a third party (TSMC and Amcor), only the physical fabrication of the FC ASIC.

(95) The supply of FC ASIC from Broadcom to Cisco for all existing generations of FC ASIC that Cisco sources from Broadcom is governed by a Master Purchase Agreement between Broadcom and Cisco concluded in 2002 and subsequent Amendments74 (the "2002 MPA and amendments"). Under the 2002 MPA and amendments Cisco [details of contractual provisions].

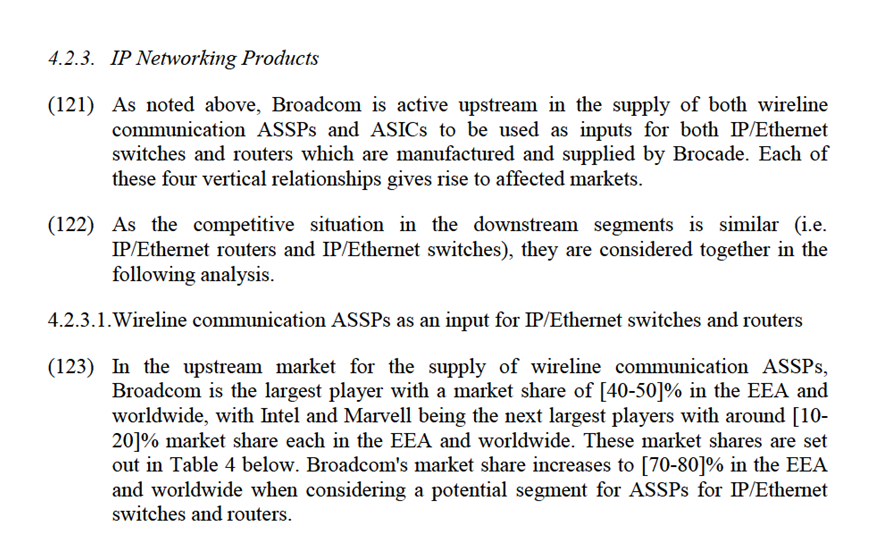

(96) As regards supply of FC ASIC for future/next generation of FC SAN switches (64 Gbps) the Commission notes the following. First, as confirmed by the majority of the market participants, switching to a different FC ASIC supplier before the start of the design process or even sufficiently early in the design and development stage is possible without incurring significant delays or costs. Cisco has just released its latest generation of FC SAN switches (32 Gbps) in April 2017 (one year behind Brocade) but it has not yet selected the supplier for the design and development for the next generation of 64 Gbps switches. Therefore, should Cisco decide to go forward with a next generation of FC SAN switches of 64 Gbps, Cisco is in the position to turn to an alternative FC ASIC supplier in the event that the Merged Entity refuses to develop and supply FC ASIC for future generations of FC SAN switches or were to engage in partial input foreclosure in relation to the next generation of ASICs.

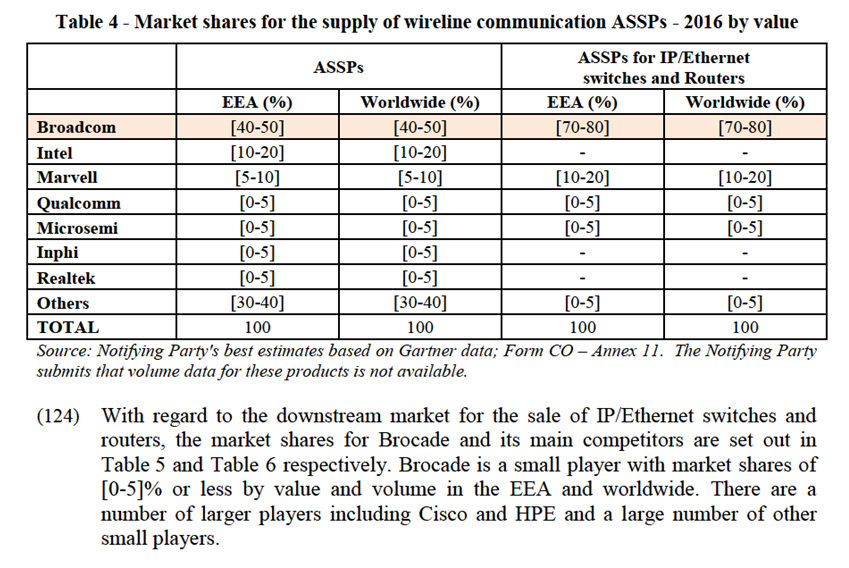

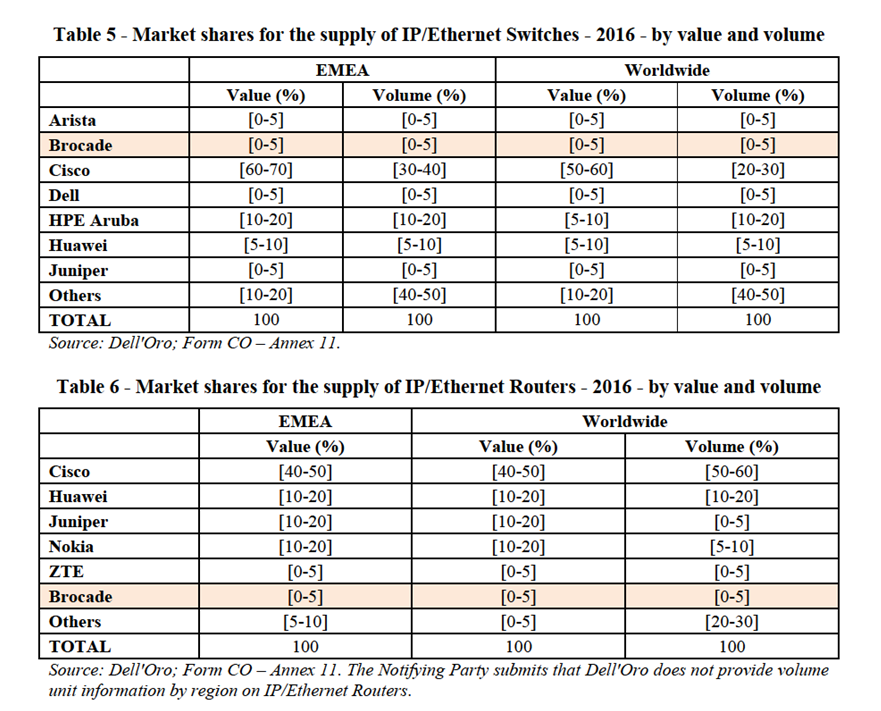

(97) As already explained in paragraphs (86) to (89) above, there is at least one viable alternative FC ASIC vendor, GlobalFoundries, to which Cisco could turn for the design and manufacture of next generation FC ASICs.

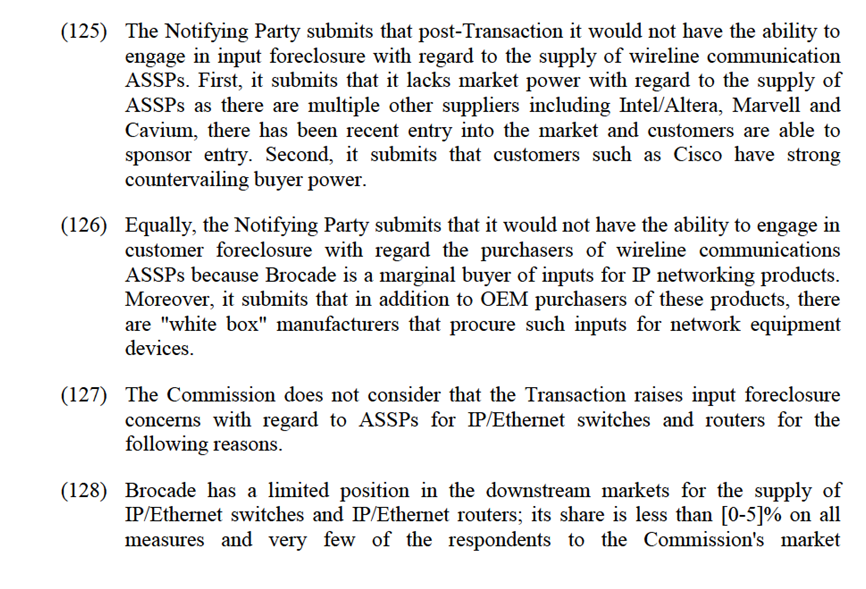

(98) It light of the above considerations and based on the results of the market investigation, the Commission concludes that it is unlikely that the Merged Entity will have the ability to engage in input foreclosure with regard to FC ASICs for both existing and future generations of FC SAN switches.

(99) Concerning the incentive of the Merged Entity to engage in such foreclosure strategy and in particular to what extent such strategy would be profitable, it cannot be excluded that the Merged Entity would be able to recoup downstream the lost revenue from supply to Cisco with FC ASICs upstream. While the revenue from the design and supply of FC ASICs to Cisco amounts to USD […] million for 2016, in view of the magnitude of the revenue of Brocade on the downstream market for FC SAN switches for the same period (USD [1 000 – 1 500] million) and the marginal presence of other FC SAN switch providers (mainly Cavium's legacy products) the Merged Entity would need to divert only a minimal amount of sales from Cisco to be able to offset the foregone revenue from FC ASIC supply.

(100) Notwithstanding the above, the Merged Entity would risk in such a foreclosure scenario losing not only FC SAN revenue from Cisco, but also significant revenue from other products that it is currently supplying to Cisco: in 2016 Cisco for example purchased […]75 for around USD […] from Broadcom (as already mentioned in paragraph (76) above Broadcom's total sales to Cisco amount to USD […] annually). In the presence of a number of alternative Ethernet switch ASSPs and ASICs vendors (see paragraphs (124) and (142) below) to which Cisco can switch the procurement of Ethernet switch ASICs and ASSPs this would represent considerable loss of revenue that the Merged Entity could not recoup so easily from diverting sale of FC SAN switches from Cisco.

(101) The Commission therefore considers that to be a factor limiting any possible incentive the Merged Entity might have to engage in foreclosure in relation to FC ASICs.

(102) As regards the possible effects of input foreclosure towards FC SAN switch providers and Cisco in particular, the Commission notes that post-Transaction, and, in particular, in relation to future generations of FC SAN switches, there will be viable alternatives for Cisco to source FC ASIC which will allow it to continue to compete effectively on the downstream market for switches against the Merged Entity. Moreover, the Commission also notes that FC SAN switch customers do not expect the Transaction to have any effect, be it positive or negative, in relation to ASICs for FC SAN switches.

(103) In light of the evidence available to it and based on the results of the market investigation, the Commission considers that the Merged Entity will not have the ability nor the incentive to engage in input foreclosure due to the presence of GlobalFoundries as a viable alternative supplier of FC SAN ASIC, the possibility for FC SAN switch competitors to switch FC ASIC vendor for next generations of ASIC, the contractual obligations on Broadcom to continue the supply of current generations of ASIC to its customers, as well as the risk of losing significant revenue from its FC ASIC customers in the case of a foreclosure scenario. Therefore, the Commission concludes that the Transaction does not give rise to serious doubts as to its compatibility with the internal market as a result of an input foreclosure strategy by the Merged Entity in relation to FC ASIC.

4.2.2.2. Possible leakage of commercially sensitive information

(104) As explained in paragraph (80) above, as the ASIC used in an FC SAN switch is tailored for each customer and when an FC SAN switch ASIC program is awarded to an FC ASIC vendor such as Broadcom, the customer and the ASIC vendor work very closely together and the ASIC vendor receives IP and confidential information from the switch supplier for the development of the ASIC. The ASIC vendor also has visibility over other commercially sensitive information of the customer such as the switch supplier’s product roadmap, time to market, cost, sales etc.

(105) The results of the market investigation have confirmed that various pieces of sensitive information are exchanged or made visible following the interactions between an FC ASICs vendor and its customer: "ASIC supply relationships involve the need to exchange and license a great deal of IP between customer and supplier. All the reference architecture specification of the ASIC – hardware and firmware e.g. functionality, code etc. will be subject to IP protections and the parties must have the proper licenses and nondisclosure agreements in place to accomplish the design and build of the ASIC."76

(106) In addition, Cisco explains that the FC ASIC vendor has visibility also on the cost structure of the FC SAN switch (the most variable cost of the switch being the ASIC, which makes a sizeable portion of the overall cost), schedules (such as FC SAN switch release dates) and other product information such as technical characteristics, for example size, transistor density, power consumption, input/output pins, etc.77

(107) In this respect, Cisco has raised the concern that post-Transaction Broadcom could misuse such Cisco commercially sensitive information (in relation to the current generations of Cisco FC SAN switches, which are likely to stay on the market for several years, but potentially also for future generations should Cisco decide not to switch ASIC supplier) to favour Brocade, Cisco's main competitor in FC SAN switches.

(108) According to market participants, typically there are safeguards in place to ensure preservation of the confidentiality of the information/IP exchange: confidentiality agreements, licenses and non-disclosure agreements outlining the confidential information to be shared and any use restrictions on the information.78

(109) Similarly, the customer-supplier relationship between Broadcom and Cisco in relation to FC ASICs is subject to a number of confidentiality agreements: (i) a Master Mutual Non-Disclosure Agreement signed in 2000 ("the 2000 Master NDA", (ii) a Master Purchase Agreement from 2002 and Amendments incorporating the 2000 Master NDA by reference, and (iii) a Memorandum of Understanding that lays out in detail several steps that Brocade's ASIC design and development entity must take to protect Cisco’s confidential information from disclosure to anyone who does not have a strict need to know the information in furtherance of Broadcom’s relationship with Cisco (either inside the company or as a third party).

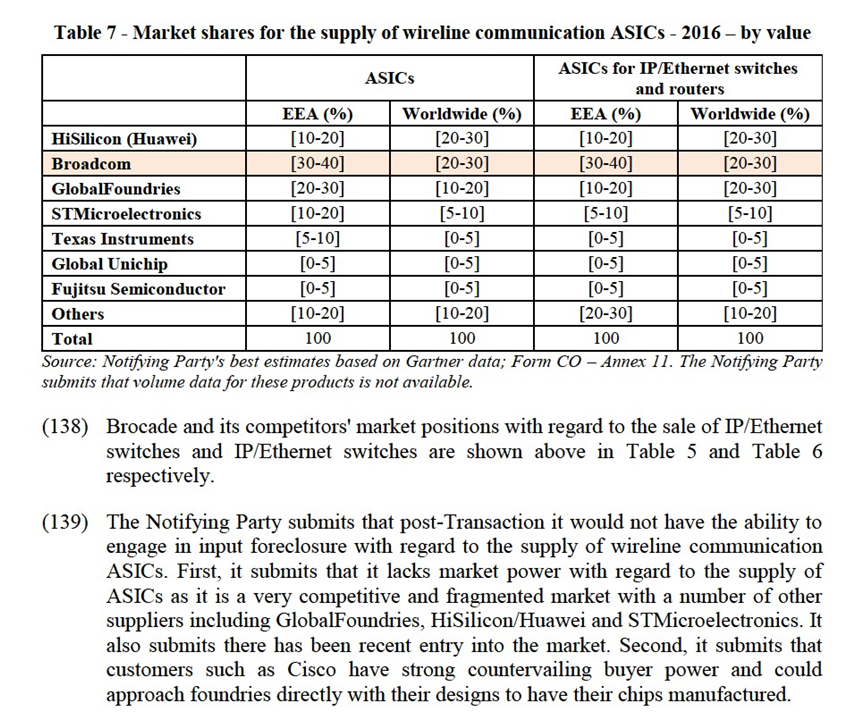

(110) On […], Broadcom entered into a new agreement with Cisco that supplements the confidentiality agreements previously in place between the two companies (the "New Confidentiality Agreement"). The New Confidentiality Agreement contains certain provisions aimed at preventing Cisco's confidential information from being disclosed to Broadcom personnel who is not responsible for developing Cisco's FC SAN switch ASICs. In addition, the New Confidentiality Agreement contains provisions that [details of contractual provisions].

(111) In the case at hand, however, the Commission notes that Cisco would be particularly vulnerable to any potential breach by Broadcom of its confidentiality obligations and that it would be particularly difficult for Cisco to determine whether Broadcom's competitive behaviour in the downstream market for FC SAN switches is a result of the normal course of business or whether its behaviour has been impacted by access to commercially sensitive Cisco information. The Commission further notes that the sanctions on the Merged Entity in the event of a breach of the confidentiality provisions in relation to protection of Cisco's confidential information under the New Confidentiality Agreement and the 2002 MPA do not appear to provide a satisfactory level of deterrence to prevent a potential breach of confidentiality in view of the specific exposure of Cisco, as described in paragraphs (105) to (107) above.

(112) The Commission therefore considers that the contractual provisions currently in place between Broadcom and Cisco are in themselves insufficient to ensure that, post-merger, the Merged Entity does not use any confidential information received from Cisco to the benefit of its downstream FC SAN switches activities. In light of the above considerations and based on the results of the market investigation, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market as a result of the risks of misuse by Broadcom of commercially sensitive information of Cisco exchanged between Cisco and the Merged Entity in the vertically related markets of ASICs for FC SAN switches and for FC SAN switches worldwide.

4.2.2.3. Customer foreclosure

(113) As explained in paragraph (81) above Brocade currently sources FC ASIC from both Broadcom and GlobalFoundries. As post-Transaction the Merged Entity will be vertically integrated, it could reduce the amount of FC ASIC sourced from third parties, that is to say from GlobalFoundries, or source internally the entire quantities of FC ASICs it needs.

(114) The Notifying Party claims that there is no risk of customer foreclosure with regard to upstream suppliers of ASIC for the following reasons: (i) any possible loss (from either partial or full foreclosure of access to Brocade) can to a significant extent be offset by sales to Cisco which has an important share of demand for FC SAN ASICs; (ii) any possible foreclosure in relation to FC SAN ASIC will have only a minimal impact on the overall ASIC business of GlobalFoundries, […].

(115) The Commission considers that a customer foreclosure strategy would be unlikely for the following reasons.

(116) In relation to current generations of FC ASIC the same considerations on barriers to switching outlined in paragraphs (92) to (94) above apply to Brocade. For most generations of its FC SAN switches (including for the most recent generation of switches, Gen6) Brocade sourced […]. Given that Broadcom does not have its own fabrication facilities but relies on third party fabs it appears unlikely that Brocade will try post-Transaction to migrate the manufacturing of FC ASIC for its current generations of FC SAN switches away from GlobalFoundries. Accordingly, GlobalFoundries would still have access to Brocade as a customer for the current generation of FC ASICs, for the next two to three years.

(117) For ASIC for the future generation of 64 Gbps FC SAN switches, […]. Even if Brocade is to source the design, development and production of 64 Gbps FC ASIC internally with Broadcom, GlobalFoundries would still have access to Cisco, as a customer of FC ASICs. Cisco, with a FC SAN switch market share of [20-30]%, would continue to represent a possible non-integrated customer for the FC ASICs of GlobalFoundries.

(118) Neither GlobalFoundries, nor any other market participant raised any customer foreclosure concerns in relation to FC ASICs during the market investigation.

(119) In light of the above considerations and based on the results of the market investigation, the Commission concludes that, even if the Merged Entity eventually decides to source all of its FC ASIC internally and engage in customer foreclosure, it is highly unlikely that such conduct would result in the foreclosure or marginalisation of GlobalFoundries in relation to ASIC manufacturing to such an extent that competition for the provision of FC ASIC would be negatively affected.

4.2.2.4.Conclusion

(120) The Commission concludes that as regards the above outlined vertical relationships, the Transaction raises serious doubts in relation to the effective protection of Cisco's commercially sensitive information. The Commission further concludes that the Transaction is unlikely to raise input or customer foreclosure concerns in relation to the supply of FC ASICs.

investigation consider Brocade to be a top 5 supplier of either IP/Ethernet switches or routers.79 Given this limited market position, it is unlikely that Brocade would benefit in the event that Broadcom stopped selling, increased prices, or otherwise degraded the terms of supply to competing downstream suppliers of IP/Ethernet switches and routers. The Merged Entity therefore would lack the incentive to adopt such a foreclosure strategy as it is unlikely that it would recuperate the revenues lost from withholding or otherwise degrading the supply of ASSPs for IP/Ethernet switches and routers to downstream competitors.

investigation consider Brocade to be a top 5 supplier of either IP/Ethernet switches or routers.79 Given this limited market position, it is unlikely that Brocade would benefit in the event that Broadcom stopped selling, increased prices, or otherwise degraded the terms of supply to competing downstream suppliers of IP/Ethernet switches and routers. The Merged Entity therefore would lack the incentive to adopt such a foreclosure strategy as it is unlikely that it would recuperate the revenues lost from withholding or otherwise degrading the supply of ASSPs for IP/Ethernet switches and routers to downstream competitors.

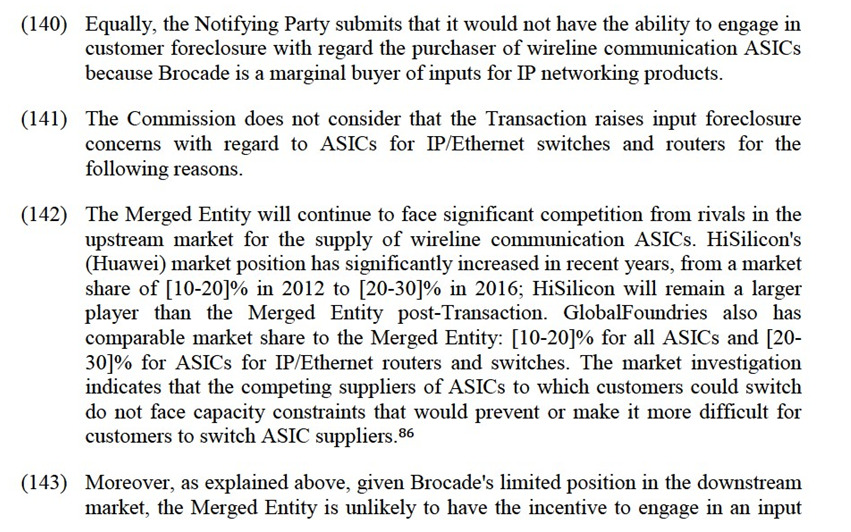

(129) Moreover, the Merged Entity will continue to face competition from rivals in the upstream market for the supply of wireline communication ASSPs which would be in a position to continue supplying ASSPs for IP/Ethernet switches and routers to downstream competitors. In particular, the Merged Entity will continue to face competition from Marvell which is active with regard to ASSPs for IP/Ethernet routers and switches specifically with a market share of [10-20]% at the EEA and worldwide level, as well as other players such as Intel, Qualcomm and Realtek. The market investigation indicates that none of the competing suppliers of ASSPs to which customers could switch face capacity constraints that would prevent, or make it more difficult for, customers to switch suppliers.80 In addition, entry has been seen in the market, for example from XPliant in 2011 (since acquired by Cavium),81 and Barefoot Networks in 2013 which was sponsored by Google and Tencent.

(130) Equally, the Commission does not consider that the Transaction raises concerns of customer foreclosure as Brocade cannot be considered as an important customer in the downstream market for the acquisition of ASSPs. In 2016, Brocade procured approximately USD [0-50] million of wireline communication ASSPs in a market worth USD [5-10] billion82 equating to a market share of [0-5]% (when excluding ODM sales,83 this figure falls to USD [0-50] million). Accordingly, if Brocade were to cease purchasing ASSPs from Broadcom's upstream rivals, these rivals would continue to have sufficient alternatives to which they could sell their output.

(131) Moreover, by revenue, Brocade already sources […]% of its ASSPs for IP/Ethernet switches and routers from Broadcom meaning that the Transaction will not have a significant effect on the situation that currently exists today.

(132) The Commission therefore considers that the Merged Entity would not have the ability or the incentive to adopt a customer foreclosure strategy post-Transaction.

(133) A number of respondents raised concerns regarding the possible impact of the Transaction on the market for IP/Ethernet ASSPs, in particular focusing on a potential reduction in quality of service following the merger or general concerns regarding the degree of consolidation in the industry. The Commission does not consider some of these concerns to be merger specific and moreover, for the reasons set out above, the Commission does not consider that the Merged Entity will have the ability and incentive to implement either an input or customer foreclosure strategy with regard to IP/Ethernet ASSPs.

(134) In light of the above considerations and based on the results of the market investigation, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the supply of ASSPs for IP/Ethernet switches and routers.

(135) In any event, the Commission notes that Broadcom is disposing of Brocade’s IP networking business, which would eliminate this vertical relationship. To this effect, Broadcom has entered into: (i) a binding agreement with ARRIS on 22 February 2017 for the sale of Brocade’s Ruckus Wireless product family and Brocade’s ICX Switch business;84 and (ii) a binding agreement on 29 March 2017 with Extreme Networks for the sale of Brocade’s datacentre switching, routing, and analytics business.85

(136) Both disposals are conditional upon Broadcom acquiring Brocade and have been notified to the antitrust authorities in the US and Germany. The German Federal Cartel Office has already approved both transactions. The US Federal Trade Commission has approved the ARRIS transaction and the Notifying Party expects its approval of the Extreme Networks transaction.

4.2.3.2.Wireline communication ASICs as an input for IP/Ethernet switches and routers

(137) In the upstream market for the supply of wireline communication ASICs, Broadcom is one of the three largest players with a [30-40]% market share in the EEA and [20-30]% worldwide. The other large players are HiSilicon (Huawei) with [10-20]% in the EEA and [20-30]% worldwide and GlobalFoundries with [20-30]% in the EEA and [10-20]% worldwide. Broadcom has similar market shares when considering a potential sub-market of ASICs for IP/Ethernet switches and routers.

foreclosure strategy as it is unlikely that Broadcom would recuperate the revenues it would lose from withholding or otherwise degrading the supply of ASICs to downstream competitors.

(144) Equally, the Commission does not consider that the Transaction raises concerns of customer foreclosure as Brocade cannot be considered as an important customer in the downstream market for the acquisition of ASICs. Brocade procured approximately USD [0-50] million of wireline communication ASICs in 2016 equating to a market share of [0-5]%. Accordingly, if Brocade were to cease purchasing ASSPs from Broadcom's upstream rivals, these rivals would continue to have sufficient alternatives to which they could sell their output. The Commission therefore considers that the Merged Entity would not have the ability or the incentive to adopt a customer foreclosure strategy post-Transaction.

(145) A few respondents to the market investigation raised concerns regarding the possible impact of the Transaction on the market for IP/Ethernet ASICs, in particular focusing on a potential reduction in quality of service following the merger, or general concerns regarding the degree of consolidation in the industry. The Commission does not consider some of these concerns to be merger specific and moreover, for the reasons set out above, the Commission does not consider that the Merged Entity will have the ability and incentive to implement either an input or customer foreclosure strategy with regard to IP/Ethernet ASICs.

(146) In lights of the above considerations and the results of the market investigation, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in this market for the supply of ASICs for IP/Ethernet routers and switches.

(147) In any event, Broadcom intends to divest Brocade’s IP networking business which would eliminate this vertical relationship and has already entered into contractual arrangements with two third-party purchasers which are conditional on Broadcom's acquisition of Brocade as described above at paragraphs (135) - (136).

4.3.Conglomerate assessment

(148) End customers that rely on FC SAN require both FC HBAs and FC SAN switches to build and operate an FC SAN. Similarly, most of the OEMs that supply such end customers purchase both FC SAN switches and FC HBAs.87 Broadcom’s FC HBAs can therefore be considered to be complementary or at least closely related to Brocade’s FC SAN switches within the meaning of paragraph 91 of the Non- Horizontal Guidelines. Accordingly, the Commission will examine whether the Transaction may give rise to conglomerate effects in relation to Brocade's FC SAN switches and Broadcom's FC HBAs.

(149) Section 4.3.1 below summarises the legal framework applicable to conglomerate relationships. Section 4.3.2 sets out the Parties’ and their competitors' market shares in the markets relevant for the conglomerate assessment. Section 4.3.3 identifies the possible practices that could lead to conglomerate effects post- Transaction. Section 4.3.4 examines a possible interoperability degradation strategy aimed at foreclosing competing suppliers of FC HBAs. Section 4.3.5 assesses a possible use of confidential information from competing FC HBA suppliers aimed at favouring the Merged Entity's own position on the FC HBA market. Section 4.3.6 examines a possible mixed bundling strategy aimed at foreclosing competing suppliers of FC HBAs. Section 4.3.7 draws conclusions.

4.3.1. Legal framework

(150) According to the Non-Horizontal Merger Guidelines, in most circumstances, conglomerate mergers do not lead to any competition problems.88

(151) However, foreclosure effects may arise when the combination of products in related markets may confer on the merged entity the ability and incentive to leverage a strong market position from one market to another closely related market by means of tying or bundling or other exclusionary practices. The Non- Horizontal Merger Guidelines distinguish between bundling, which usually refers to the way products are offered and priced by the merged entity89 and tying, usually referring to situations where customers that purchase one good (the tying good) are required to also purchase another good from the producer (the tied good). Tying can take place on a technical or contractual basis. For instance, technical tying occurs when the tying product is designed in such a way that it only works with the tied product (and not with the alternatives offered by competitors). While tying and bundling have often no anticompetitive consequences, in certain circumstances such practices may lead to a reduction in actual or potential competitors' ability or incentive to compete. This may reduce the competitive pressure on the merged entity allowing it to increase prices.90

(152) In assessing the likelihood of such a scenario, the Commission examines, first, whether the merged firm would have the ability to foreclose its rivals,91 second, whether it would have the economic incentive to do so92 and, third, whether a foreclosure strategy would have a significant detrimental effect on competition, thus causing harm to consumers.93 In practice, these factors are often examined together as they are closely intertwined.

4.3.2. Market shares

(153) The market shares for Brocade and its competitors in the supply of FC SAN switches are set out in Table 2 and Table 3 in Section 4.2.2.1 above. Brocade is the market leader, with a worldwide market share of [70-80]% in 2016 (in value). The only notable competitor to Brocade is Cisco, with a worldwide market share of [20-30]% in 2016 (in value). Cavium (previously, QLogic)94 announced in mid-

(158) Regardless of whether or not the Merged Entity would enjoy sufficient market power in FC HBAs,98 it would likely not have the ability and incentive to foreclose competitors in FC SAN switches by degrading the interoperability of its own FC HBAs with competitors' FC SAN switches. As explained in more detail in paragraphs (178) and (180) below, end customers are typically more reluctant to change supplier of FC SAN switches, compared to changing supplier of FC HBAs. As a result, in the event of a hypothetical degradation of interoperability between the Merged Entity's FC HBAs and competing FC SAN switches, those customers that have opted for an FC SAN switch provider competing with the Merged Entity (i.e. Cisco) would be likely to also source FC HBAs from a competing FC HBA supplier (i.e. Cavium), so as to ensure that their FC HBAs interoperate optimally with FC SAN switches of their choice.

(159) In relation to mixed bundling strategies, as further explained in paragraphs (223) to (225), the Merged Entity will likely not have the ability and the incentive to engage in such strategies, due to (i) the asynchronous purchasing patterns for FC HBAs and FC SAN switches and to (ii) the OEMs' ability to unbundle the offer.

(160) In light of the above, given the lack of ability and/or incentive of the Merged Entity to engage in interoperability degradation and/or mixed bundling strategies to the detriment of competing FC SAN switch suppliers, there is no need to examine the effects on competition of such potential strategies.

4.3.4. Interoperability degradation towards competing FC HBAs

(161) In this Section, the Commission assesses the concern that the Merged Entity could leverage its market position from the market for FC SAN switches to the market for FC HBAs by degrading the interoperability of its own FC SAN switches with competitors' FC HBAs. The Commission will examine whether the Merged Entity would have the ability to foreclose competing FC HBA suppliers, whether it would have the economic incentive to do so and whether a foreclosure strategy would have a significant detrimental effect on competition in FC HBAs.

4.3.4.1. Ability to foreclose

(a) The Notifying Party's views

(162) The Notifying Party submits that the Merged Entity would have no ability to foreclose competitors in FC HBAs for a number of reasons.

(163) First, the Notifying Party argues that Brocade does not have market power in FC SAN switches, as Brocade is in reality constrained by several factors. Brocade faces competition from Cisco, which has a market share of approximately [20- 30]%. Moreover, FC is a mature technology which has been losing ground to newer technologies, such as public cloud, IP or Ethernet storage networking solutions, as the speed and stability of those interconnects have improved.

(164) Second, the Notifying Party emphasises that compliance with technical standards is critical for networking equipment, as standards ensure the maintenance of interoperability between devices in a particular network environment. Compliance with these standards means that FC HBAs manufactured by Broadcom must be fully interoperable with other vendors’ FC SAN switches within the SAN infrastructure. According to the Notifying Party, as long as both devices are based on the same standards, the Merged Entity will therefore be unable to degrade the interoperability of other vendors’ FC HBAs with Brocade’s FC SAN switches, as this would result in the product not qualifying under the standard – a major downside in any comparison with competing offers.

(165) Third, the Notifying Party claims that customers have buyer power and would thwart any attempt to engage in foreclosure strategies. Broadcom’s ten largest customers account for around [90-100]% of its sales of FC HBAs and Brocade’s ten largest customers account for more than [90-100]% of its FC SAN switches sales. These customers include OEMs such as […] that have considerable power to force the Merged Entity to ensure interoperability of its FC products with those of other suppliers. The fact that such OEMs are sophisticated market participants was specifically recognized by the Commission in its decision in Avago/Broadcom.99 Moreover, end customers often mix and match products from different FC suppliers, and require that all FC SAN components follow the T11 FC standard to ensure interoperability.

(b) The Commission's assessment

(166) In order to assess the Merged Entity's ability to foreclose competing FC HBA suppliers, this Section will examine, first, the specific practices available to the Merged Entity to degrade interoperability of its FC SAN switches with competing FC HBAs and, second, the likely impact of such practices on competing FC HBA suppliers.

Possible practices to degrade interoperability

(167) Within the FC SAN environment, certain technical standards are in place to ensure that FC SAN switches and FC HBAs can interoperate with each other even if they are supplied by different vendors.100 However, unlike what the Notifying Party seeks to suggest, mere compliance with those standards is not sufficient to ensure optimal interoperability between FC SAN switches and FC HBAs of different vendors. Further cooperation between the FC SAN switches and the FC HBAs vendor is required for this purpose, as largely confirmed by the results of the market investigation.101

(168) In particular, during the development cycle of a new version of FC HBAs with a higher data transmission speed (also called new "generation" of FC HBAs),102 FC HBA vendors test their products to ensure that they will properly function when connected to an FC SAN switch. For this purpose, FC HBA vendors provide early access to their next-generation FC HBA to switch vendors (and vice versa), including access to items such as simulated packets, product plans, logs and traces. This process is referred to as the “qualification” process. According to information provided by the Notifying Party, the design cycle for an FC HBA lasts about two years, and FC HBA vendors begin their qualifying efforts about six months before their products are eventually released on the market.

(169) In addition, after the product release of FC HBAs and once FC HBAs have been sold to the OEM or to the end customer, technical support from the FC SAN switch vendor may be required to solve technical issues such as FC HBA defects ("bugs") that occur at customers' sites. Such cooperation post-product release plays an important role to maintain customer satisfaction.

(170) In light of the above, the main concern that emerged from the market investigation relates to the risk that, post-Transaction, the Merged Entity could reduce the technical cooperation that it provides to competing FC HBA suppliers at different stages of the FC HBA product cycle or take other steps to favour its own FC HBAs by disadvantaging competitors. In particular, the Merged Entity could, first, slow down or obstruct the qualification process of future generations of competing FC HBAs, for example by delaying or failing to transfer the necessary information and equipment to other FC HBA suppliers. This could lead to reduced interoperability of future generations of competing FC HBAs with the Merged Entity's FC SAN switches, reduced product reliability and possibly a delay in product release for competing FC HBAs. Furthermore, the Merged Entity could choose not to provide technical support in a sufficiently timely manner to rectify bugs at the premises of end customers that use competing FC HBAs (whether of current or future generations), thereby negatively affecting customer experience and thus the reputation of competing FC HBA suppliers. In addition, the Merged Entity could seek to favour its own FC HBAs by allowing them to function with new or improved features when interoperating with the Merged Entity's FC SAN switches, while at the same time denying such possibility to competing FC HBAs.

(171) The market investigation has not revealed any particular obstacles to the technical feasibility of any of the practices described above. Accordingly, it can be concluded that the Merged Entity would have the ability to engage in a number of practices that would negatively affect the interoperability between its own FC SAN switches and competing FC HBAs (i.e. essentially, Cavium's FC HBAs), thus putting those FC HBAs at a competitive disadvantage compared to the Merged Entity's FC HBAs.

Likely impact on competing FC HBAs

(172) Whether the reduced interoperability of competing FC HBAs with the Merged Entity's FC SAN switches would effectively lead to foreclosure of competing FC HBA suppliers depends on the extent to which OEM and end customers would abandon competing FC HBAs as a reaction to such reduced interoperability. Relevant factors for the purpose of assessing this question include the existence of a sufficiently large pool of common customers of FC SAN switches and FC HBAs, the customers' propensity to switch FC HBA provider, the extent to which the Merged Entity enjoys market power in FC SAN switches, and the existence of possible counterstrategies available to competing FC HBA suppliers. Each of these factors will be examined below.

(173) Vendors of FC HBAs and FC SAN switches generally supply their products to OEMs, which in turn supply them to end customers as part of their servers and storage offerings. Most of these OEMs (such as IBM, HPE, Dell/EMC, Lenovo, Fujitsu and Huawei) are suppliers of both server and storage systems and, therefore, tend to source both FC SAN switches and FC HBAs in order to offer them to the end customers. Moreover, as mentioned in paragraph (148) above, end customers that rely on FC SAN (such as financial institutions, telecom/media companies and government customers) require both FC HBAs and FC SAN switches to build and operate an FC SAN. As a result, FC SAN switches and FC HBAs are characterised by a large common pool of customers, both at the OEM and at the end customer level, which is an important premise for foreclosure to be a possible concern.103

(174) Regarding the likely reaction of OEMs and end customers to possible interoperability degradation strategies of the Merged Entity, the following can be noted.

(175) Most OEMs typically qualify (i.e. test) and source FC HBAs from the two main FC HBA vendors, Broadcom and Cavium,104 in order to be able to offer both options for sale to their customers. OEMs tend to purchase FC HBAs from vendors when they need them, i.e. on a "just-in-time" basis, usually for the cumulative need for the current quarter.105

(176) Contrary to the claim put forward by the Notifying Party, it cannot be assumed that the OEMs would thwart attempts by the Merged Entity to degrade interoperability. Given that OEMs essentially act as resellers of the FC HBAs to fulfil end customers' demand, they would not necessarily be able or willing to detect and counter interoperability degradation practices to a sufficient degree as to defeat the Merged Entity's strategy. Moreover, as most OEMs are already customers of Broadcom for FC HBAs (given the double-sourcing), in the event that a foreclosure strategy was put in place, they would only need to increase the amount of orders of FC HBAs that they already purchase from Broadcom, without having to enter into a commercial relationship with a new supplier and qualify new products.

(177) Furthermore, regarding the Notifying Party's reference to the Avago/Broadcom decision, it suffices to note that, while that decision did indeed recognise that OEM customers are "sophisticated market participants", it referred specifically to "other options" available to those OEMs in the event of a tying strategy, "including the possible option to start in-house production of certain chips or to support entry".106 In the present case, no evidence of such option has emerged from the market investigation. Quite the contrary, market respondents have indicated that barriers to enter the FC SAN space are significant and they do not expect any new player to enter the market in the next future.107

(178) End customers source FC HBAs and FC SAN switches either in the context of the installations of new (or "greenfield") datacentres (10% of sales), or in connection with replacement or upgrades (90% of sales). Generally, the market investigation suggested that, while some end customers tend to mix-and match FC HBAs from different vendors within the same datacentre, others do not.108 Conversely, it appears that end customers typically do not mix-and-match FC SAN switches of different vendors within the same datacentre.109 More generally, within FC SAN systems, FC SAN switches tend to be the "driving" product when it comes to the interaction between FC SAN switches and FC HBAs. Indeed, compared to FC SAN switches, FC HBAs exhibit a lower degree of product differentiation and are less expensive than FC SAN switches.110

(179) When placing an order for FC HBAs for the purpose of new installations, end customers are essentially free to opt for either of the two FC HBA vendors. As a result, given the predominant role of FC SAN switches over FC HBAs, it is likely that most end customers who have a preference for the Merged Entity's FC SAN switches (for example, due to previous experience) may decide not to opt for Cavium FC HBAs for new installations to avoid the risk of reduced interoperability with their FC SAN switches.

(180) As regards replacement/upgrades of FC HBAs, the market investigation revealed that, from an end customer perspective, switching supplier of FC HBAs tends to be less difficult in terms of costs, time and complexity (e.g. staff training, testing) than switching supplier of FC SAN switches.111 Similarly, internal documents of the Parties confirm that the complexity of replacing FC SAN switches and the risk aversion of end customers […] in FC SAN switches, resulting in end customers being generally reluctant to switching FC SAN switch vendor when replacing/upgrading switches.112 As a result, faced with reduced interoperability between Cavium's FC HBAs and the Merged Entity's FC SAN switches, end customers of those products would likely be inclined to abandon Cavium FC HBAs in favour of the Merged Entity's FC HBAs when undertaking replacements or upgrades.

(181) Whether the migration of end customers away from Cavium FC HBAs to the Merged Entity's FC HBAs (for new installations and replacements/upgrades) would effectively be of such scale as to foreclose Cavium largely depends on the market strength that the Merged Entity enjoys in FC SAN switches.

(182) As set out in Table 2 above, Brocade is by far the leading supplier of FC SAN switches, accounting for [70-80]% of the worldwide market in 2016 (by value). The only FC SAN switch competitor that Brocade faces is Cisco, which accounted for [20-30]% of the worldwide market in 2016 (by value). As explained by the Notifying Party, Brocade has historically been the first mover for each generation of FC SAN switches, leading Cisco by an average of 15-18 months. Not surprisingly, therefore, the results of the market investigation indicate that Brocade's FC SAN switches are regarded as a "must-stock" product by the large majority of OEMs.113 Contrary to the claim of the Notifying Party, it appears, therefore, that Brocade enjoys significant market power in FC SAN switches.114