Commission, February 11, 2019, No M.9094

EUROPEAN COMMISSION

Decision

AMCOR / BEMIS

Subject: Case M.9094 – Amcor / Bemis

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 12 December 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Amcor Limited (“Amcor”, Australia) will acquire, within the meaning of Article 3(1)(b) of the Merger Regulation, control of the whole of Bemis Company, Inc. (“Bemis”, U.S.A.) (“the proposed Transaction”). (3) Amcor and Bemis are designated hereinafter as “the Parties”.

1. THE PARTIES

(2) Amcor is an Australian-based supplier of a broad range of packaging solutions: rigid and flexible packaging products for the food, beverage, medical, pharmaceutical, personal care and other consumer goods sectors globally.

(3) Bemis is a US-based supplier of flexible and rigid plastic packaging for the food, consumer products, medical and other sectors worldwide.

2. THE CONCENTRATION

(4) The proposed Transaction consists of the acquisition of Bemis by Amcor. Pursuant to a Transaction Agreement dated 6 August 2018 by and among Amcor, Arctic Jersey Limited (“New Holdco”), Arctic Corp. (“Merger Sub”), and Bemis, Amcor and Bemis will combine into New Holdco, a newly created holding company incorporated in Jersey.

(5) The proposed Transaction will be effected via (i) a scheme of arrangement under Australian law, whereby each outstanding share of Amcor will be exchanged for one share of New Holdco and (ii) a merger, wherein Merger Sub, a wholly owned subsidiary of New Holdco, will merge with and into Bemis, with Bemis surviving as a wholly owned subsidiary of New Holdco.

(6) The proposed Transaction therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(7) The concerned undertakings have a combined aggregate world-wide turnover of more than EUR 2 500 million (4) (Amcor: 7 822 million, Bemis 3 581 million) and a combined aggregate turnover in excess of EUR 100 million in three Member States, namely [Member States listed]. At least two of the undertakings concerned have a turnover in excess of EUR 25 million in these three Member States.

(8) The notified operation therefore has an EU dimension pursuant to Article 1(3) of the Merger Regulation.

4. PROCEDURE

(9) For its assessment of the proposed Transaction, the Commission has made use of the available means of investigation pursuant to Article 11 of the Merger Regulation. In particular, the Commission sent extensive questionnaires to a large number of competitors and customers active in flexible packaging for food products and medical use (“the market investigation”).

(10) In reaction to complaints received from some market respondents who highlighted potential adverse effects of the proposed Transaction on competition in certain allegedly affected markets, the Commission conducted additional phone calls.

(11) The Commission also analysed internal documents originating from Amcor and Bemis including internal strategy documents for integration plans after the Transaction. Finally, the Commission has market tested the remedies offered by the Parties as described in Section 7.2 of the present decision (“the proposed Commitments”) by forwarding questionnaires to competitors and customers.

5. MARKET DEFINITION

5.1.Relevant product markets

5.1.1. The flexible packaging sector

(12) The proposed Transaction concerns the sector of manufacture and supply of flexible packaging (EEA market size of EUR 12.5 billion). The Parties' activities horizontally overlap in flexible packaging solutions in the EEA and, more in particular, in flexible packaging (i) for food products and (ii) for medical use.

(13) In previous decisions, the Commission described the production of flexible packaging as the manufacture, supply and conversion of plastic and cellulose films, aluminium foils and papers into reels of packaging to be used for primary retail food packaging and labelling and certain other non-food sectors. (5)

(14) In previous decisions, the Commission has already investigated the flexible packaging market. Previously, the Commission has found that the market for flexible packaging could be segmented by distinguishing the end-use of the packaging, as follows: (i) food, (ii) medical supplies, (iii) pharmaceuticals, (iv) household products, and (v) other non-food. (6)

(15) The Parties submit that there should be a single overall product market for all flexible packaging, with no sub-segmentations, for a number of reasons. (7) The Parties namely submitted the following reasons.

(a) There would be strong supply-side substitutability between packaging solutions across a wide range of applications and end-uses. The same materials, machines and processes could be used to manufacture flexible packaging for any segment. The production process would involve the use of machinery, raw materials and technologies that are well established and widely available. Therefore, most competitors would be able to and do cater for several end-use applications.

(b) From a demand-side perspective, there would be strong competitive interaction between materials and formats for a same end use, as customers would have a wide range of possible materials (or mix of materials), shapes, sizes, formats and other characteristics to choose from, and many of these could be used interchangeably for the same end use or application. (8)

(16) Account taken of its prior practice and following the results of its market investigation, the Commission considers that in the present case the market definition proposed by the Parties is too broad. In this case, the market investigation has pointed to similar distinctions of the relevant product markets as resulting from the previous Commission decisions, including possible further sub- segmentations based on a distinction according to end-use that would render the different formats and types of flexible packaging not interchangeable for the customers. That conclusion is also confirmed by the existence of numerous significant overlaps within the Parties within the markets for (i) flexible packaging for food products and (ii) flexible packaging for medical use that is appropriate for the Commission to assess in its competitive analysis.

(17) It follows that the Commission should start assessing the proposed Transaction by distinguishing (i) flexible packaging for food products and (ii) flexible packaging for medical use.

5.1.2. Flexible packaging for food applications

(18) In previous Commission’s decisions, the market for the supply of flexible packaging for food applications has been considered as a separate market. (9)

(19) In previous decisions, the Commission considered even narrower markets within flexible packaging for food, namely for (i)dairy, (ii) beverages,(iii) confectionery, (iv) fresh, (v) dried, (vi) frozen and (vii) pet food. (10)

(20) The Commission also considered an alternative sub-segmentation by type of food (11), namely flexible packaging for (i) confectionary; (ii) fresh and processed meat, fish and poultry; (iii) cheese and dairy; (iv) tea, ground coffee and beans;(v) frozen food and ice cream; (vi) crisps, snacks and nuts; (vii) dried and dehydrated foods and cereals; (viii) bread, biscuits and cakes; and (ix) fresh fruits and vegetables.

(21) Within flexible packaging for cheese and dairy, the Commission has previously considered the existence of potentially narrower segments comprising: (i) yoghurt banderols and (ii) flexible packaging for non-sliced white moulded cheese, noting that these technically challenging niche areas may not represent separate product markets. (12) Likewise, a precedent investigated cheese foil specifically while recognising that this narrow segment covering only one specific product cannot be considered as a market in itself. (13)

(22) However, in such prior decisions the Commission ultimately left the market definition open.

(23) The Parties maintain that the relevant product market is the overall market for flexible packaging. However, in addition to suggest analysing the market for flexible packaging for food products, the Parties have also suggested an analysis, within this market and within the segments for flexible packaging for cheese and dairy, as potential sub markets for the packaging of (i) soft cheese, (ii) processed cheese and (iii) hard cheese.

(24) The Parties also considered, at the Commission’s request, an alternative segmentation by other flexible food packaging types: (i) roll-stock flexible packaging for food applications and (ii) pre-made flexible packaging for food applications, (iii) skin films, (iv) labels, (v) laminates, (vi) forming films, (vii) skin and shrink bags, (viii) skin lidding and forming films, (ix) lidding films, (x) standard pouches, (xi) retortable pouches, (xii) microwavable pouches, (xiii) vacuum pouches, (xiv) stand-up pouches, (xv) wrappers, (xvi) flexible packaging for the food service channel, (xvii) food consumer channel.

(25) The market investigation conducted by the Commission in the present case has demonstrated that the market definition proposed by the Parties is too broad. It has pointed to a similar relevant product market as per the one indicated in previous Commission’s decisions, based on a distinction according to end-use. This confirmed the existence of a separate market for flexible packaging for food products.

(26) The results of the market investigation did not confirm that supply-side substitution would be effective and immediate. The majority of flexible packaging competitors that expressed an opinion in the market investigation is specialised in particular end-use application segments (14) and believes that the flexible packaging market could be sub-divided according to end-use segments. (15) These flexible packaging competitors have indicated as main reasons to regard the market for food as a separate market: regulatory and customer requirements, available production technologies, manufacturing processes, know-how, patents and availability of raw materials. Moreover, they consider that switching to flexible packaging for food from another end-use is not easy and could take one to two years to achieve all necessary certification and customer validation requirements. (16) Furthermore, customers have different requirements for food flexible packaging in comparison to medical flexible packaging, for example certifications, flexible lead times, shelf-life requirements and safety regulations. (17) The results of the market investigation indicate that the competitive conditions differ between end-use application segments. Profit margins tend to be higher in the medical flexible packaging segment than in the segment for food flexible packaging. (18)

(27) The market investigation did not allow to conclude on the existence of narrower sub-segments within the market for flexible packaging for food products. The majority the market respondents indicate that the five main flexible packaging markets based on end-industry, amongst which the market for flexible packaging for food products, should not be further sub-divided into distinct relevant markets based on further demand particularities and customer needs. (19)

(28) According to the majority of suppliers of flexible packaging for food products that expressed an opinion in the market investigation, not all flexible packaging for different sub-segments can be produced on the same machinery, as raw materials, technology and production processes vary for different kinds of packaging. (20)

(29) For the purposes of this decision, on the basis of the evidence before it, and having regard to its decisional practice, the Commission considers that the market for flexible packaging for food applications is the relevant product market in this case.

(30) However, the possible sub-segmentation of the market for flexible packaging for food applications can be left open, since the proposed Transaction will not give rise to any serious doubts under any plausible market definition, under any possible narrower segmentation within the market for flexible packaging for food products.

5.1.3. Flexible packaging for medical applications

(31) In a previous Commission’s decision, the market for flexible packaging for medical use has been considered as a separate relevant product market. (21) However, no prior Commission’s decisions assessed flexible packaging for medical use in more detail.

(32) The market investigation overwhelmingly confirmed that the product market for flexible packaging for the medical use is separate from other end uses such as food packaging.

(33) The market investigation pointed to a number specificities that clearly differentiate the packaging for medical applications from other segments: Products need to have specific barrier properties in order to ensure and also maintain a sterile barrier. Often a device is sterilised already in the package and needs to remain sterile while being in the package. Technical characteristics of the packaging are strictly defined and suppliers must comply with these consistently and to high standards. The packaging must conform with regulations and with standards specific to medical packaging in general. (22) In parallel, both the suppliers and all their individual products must undergo lengthy qualification and validation procedures with customers, which can take years to complete. (23) In this respect, some similarities were noted with flexible packaging for pharmaceutical use; however there, regulatory requirements and validations appear to be even more challenging. As the Allied Development Report acknowledges “These regulatory requirements accentuate the special expertise needed to participate in the medical packaging business”. (24)

(34) For the above reasons, packaging designed and used for other applications, such as food, can only to a very limited extent exercise competitive constraint on packaging for medical applications. Contrary to the Parties’ view, the investigation found little evidence for demand side substitution between packaging for medical and other end uses.

(35) Market participants reported that profit margins are also significantly higher in packaging for medical use than for food, providing an additional indication that conditions of competition in the two segments could be different.

(36) Confirming the Parties’ argument on supply side substitutability, market participants agreed that many raw materials, production equipment and types of packaging are common across end-use segments. There are also a number of competitors that are active across end use applications, catering for the medical and also for the food segment for instance. However, at the same time, a large number of suppliers is specialised on or within one end-use application, and respondents shared the view that switching production into the medical segment was very difficult. None of the respondents could not give evidence of entry in the past five years. (25)

(37) For the purposes of this decision, on the basis of the evidence before it, and having regard to its decisional practice, the Commission conclusively considers that the market for flexible packaging for medical applications is a distinct relevant product market in this case.

5.1.3.1 Possible narrower product market segmentation within the market for the supply of flexible packaging for medical applications

(38) While the market investigation in the present case confirmed that the market for the supply of flexible packaging for medical applications is the relevant product market in this case, it has also suggested that, for the purposes of the competitive assessment of the proposed Transaction, the Commission should take account of distinguishing possible narrower segments within that market, for the following reasons.

(39) First, the Parties themselves employ different segmentations and as indicated by the Parties’ internal documents, they track their sales and competitive positions on the basis of often narrow sub-segments. Such sub-segmentations are [description of segmentations employed by the Parties].

(40) Second, third party independent reports, such as the Allied Development Report, analyse the market for flexible packaging for medical use along end-use sub- segments in the first place and also by materials.

(41) Concerning the inferences that can be derived from possible sub-segmentations of the market for the supply of flexible packaging for medical applications, the respondents to the market investigation gave mixed responses, as illustrated in detail below.

5.1.3.2 Segmentation by end-use

(42) Strategy documents submitted by Amcor employ a segmentation by [description of segmentations employed by Amcor].

(43) A segmentation by end-use is also employed by third party independent industry reports, such as the Allied Development Report, which both market participants and the Parties confirmed as a commonly accepted information source for market intelligence. This third party report tracks the market, products and competitors along the following end use categories: Catheters, Drapes, Electro-mechanical devices, Gloves, Injection Systems, Minimally Invasive Devices, Orthopaedic Devices, Sutures, Tubing, Wound-care, In-hospital use, Kits, other.

(44) Most respondents to the market investigation considered that a segmentation by end-use did not result in separate product markets. Many saw flexible packaging suppliers active across several end-use segments, as there can be also cross cutting synergies and materials can also be used for different end uses. Correspondingly, all competitors replying to the market investigation confirmed being active in more than one end-use application. (26)

(45) Furthermore, it was also noted that the end-use segments themselves were highly differentiated and could be further broken down: “Within end use applications there is as much product variation as between end use applications." (27) This observation resonates with Parties’ argument (28) that within the end use of monitoring devices, where the Parties displayed a significant share ([40-50]%), Amcor and Bemis are not close competitors as they make different products; Amcor produces high barrier aluminium foil for moisture sensitive devices, which Bemis cannot make. This also suggest a narrower segmentation than the end-use subsegments.

(46) Most respondents also agreed that competitors have their specific strengths, which leads to different competitive positions in different segments, and know- hows, often within the segments, focussing on a specific technology.

(47) Internal documents of the Parties (29) [description of documents submitted by the Parties].

(48) For the purposes of the present decision, the Commission considers that it is not necessary to conclude on whether the end-use sub-segments constitute distinct product markets, as serious doubts arise in the supply of flexible packaging for medical use under any possible narrower segmentation by end-use within the market of flexible packaging for medical applications

5.1.3.3 Segmentation by material

(49) Both Amcor and Bemis rely in their ordinary course of business on [description of Parties’ business strategy and segmentations employed by the Parties].

(50) A number of competitors segment the market by type of material, whereas there is no single competitor that specialises in one material only. Competitors, when reporting on their activities and products they manufacture, they generally confirmed employing several materials. (30) Pre-made products are often composed of more than one material. Customers confirmed demand-side substitutability of materials at the packaging design phase. (31) At the same time, when asked to identify competitors’ strengths, they segment the market and rank the competitors spontaneously according to material. (32)

(51) Materials can also be combined through co-extrusion or lamination techniques in order to improve the mechanical, barrier and sealability properties of a packaging material. A variety of those is widely used in flexible packaging. Lamination can involve films, paper, aluminium being joined together using a bonding agent into material composed of two to several layers. Materials can come coated and uncoated and their properties will be different accordingly.

(52) The Allied Development Report also analyses the market along the main materials and segments the market into polymers (including monolayer and coextruded films, sheets and foils), high barrier materials (mainly aluminium foil), non-wovens, paper and other. It specifically addresses Tyvek, a type of non- woven material.

(53) During the market investigation, a number of respondents argued that in their view the material Tyvek, in particular in a coated form, constituted a distinct product market as it was not substitutable with other materials for their applications. Tyvek is a type of non-woven, which is manufactured by DuPont and is appreciated for its unique porosity, strength and barrier properties: it is a breathable material allowing for in package sterilisation under all sterilisation methods, and compared with medical grade papers it is stronger, more tear and puncture resistant and peels clean, for ideal package opening. (33) It is a relatively expensive product compared with medical grade papers (34) and is mainly used to package high-value medical devices such as orthopaedics, cardiovascular or minimally invasive devices for instance.

(54) In the Parties’ view (35) Tyvek and specifically coated Tyvek does not constitute a distinct product market as there is no end-use application or packaging product where Tyvek – (or coated Tyvek) is the only available solution, it is only one of the many materials, they claim. They explain that for example coated paper is also breathable allowing for in package sterilisation and can be strong at the same time. Uncoated Tyvek can also a substitute in their view, as coating, which is there to facilitate the clean peel aspect of the package, can be substituted by adding peel film, a technology that has developed in the past 10 years. They claim that there is ample evidence of customers switching away from coated Tyvek. They also submit that the relatively high price of Tyvek and its single source being DuPont motivates customers to move away from Tyvek in general.

(55) The investigation indeed found some substitutability of coated Tyvek, mainly with uncoated Tyvek, as asserted by the Parties. (36) However, a set of customers argued that for their quality requirements such a substitution would not be feasible, as it necessarily resulted in some loss of package quality, which was in cases not admissible. (37) They also explained that their customers, medical and health care professionals, hospitals, were conservative and would resist most change in an already proven packaging, which could even lead to losing the customer.

(56) Market participants indicated that there were attempts by industry to develop competing materials and competitors confirmed that these were already some on the market, (38) however, these have not yet come close to the penetration rate of Tyvek.

(57) Although there are favourable tendencies, on the basis of the evidence at hand, it cannot be ascertained that coated Tyvek would be instantly substitutable or would become within two years substitutable with other materials.

(58) For the purposes of the present decision, the Commission considers that it is not necessary to conclude on whether coated Tyvek or any other material used for flexible packaging for medical use constitutes a distinct product market, as serious doubts arise in the supply of flexible packaging for medical use under any possible narrower segmentation by material within the market of flexible packaging for medical applications.

5.1.3.4 Segmentation by type of packaging

(59) The Parties also analyse their business on the basis of [description of Parties’ business strategy and segmentations employed by the Parties]. (39)

(60) As in the case of materials, there is no single competitor that specialises in only one of the formats - with the exception of rollstock. At the same time, only few of the competitors manufacture all formats. (40)

5.1.3.5 Conclusion

(61) In conclusion, the market investigation pointed to a highly differentiated product market and did not give a conclusive answer as to whether the market for flexible packaging for medical use should be further sub-segmented of into narrower product markets.

(62) On the basis of the evidence before it, the Commission considers that for the purposes of the present decision the exact market definition can be left open as serious doubts arise in the market for the supply of flexible packaging for medical use under any possible narrower segmentation.

5.2. Relevant geographic markets

5.2.1. Overall market for the supply of flexible packaging

(63) In previous decisions, the Commission considered the geographic scope of the overall flexible packaging market, generally and in relation to the segments identified above, to be at least EEA-wide. (41)

(64) The Parties submit that the relevant geographic market for the overall market for flexible packaging is the EEA. (42)

(65) The Commission considers, in the light of the market investigation, that the relevant geographic market for the overall market for flexible packaging would be the EEA. However, given the results of the market investigation, which confirm that the overall market for flexible packaging is not the relevant product market, the Commission will assess the proposed Transaction on the distinct markets for flexible packaging for food and medical applications.

5.2.2. Flexible packaging for food applications

(66) The Parties submit that the relevant geographic market for the overall market for flexible packaging for food is the EEA . (43)

(67) In previous decisions, the Commission considered the geographic scope of the overall flexible packaging market, generally and in relation to the segments identified above, to be at least EEA-wide. (44)

(68) The market investigation conducted in the present case seems to confirm the existence of an at least EEA-wide market for flexible packaging for food. Market respondents confirm that also in case of food applications, there are no significant barriers within the EEA, due to a harmonized regulatory basis, while import duties, regulatory regimes and additional transport costs create barriers for imports from outside the EEA into the EEA. (45)

(69) In addition, the price differences between the EEA and third countries are higher than the price differences between various EEA-countries. (46) Customers of food flexible packaging mainly source on an EEA-level and consider transportation costs and lead times significant factors that are taken in consideration for the choice of their suppliers. (47)

(70) On the basis of the evidence before it, and having regard to its decisional practice, the Commission considers that the relevant geographic market for flexible packaging for food applications is EEA wide in scope.

5.2.3. Flexible packaging for medical applications

(71) In previous decisions, the Commission considered the geographic scope of the overall flexible packaging market, generally and in relation to the segments, including the medical, to be at least EEA-wide. (48)

(72) The Parties submit that the relevant geographic market for the overall market for flexible packaging is the EEA. (49)

(73) Evidence from the market investigation seems to confirm the existence of an at least EEA-wide market for flexible packaging for medical applications.

(74) Most competitors (50) responding to the market investigation have their logistic organised on an either national or EEA-wide basis. Only a minority reported having global logistics. Correspondingly, competitors responding to the questionnaire achieved the majority of their revenues in the EEA. (51)

(75) The market investigation confirmed the EEA specific regulations and import duties constitute barriers to trade, limiting imports of packaging into the EEA. (52) On the other hand, respondents saw no barriers to trade within the EEA.

(76) Third party industry report by PCI (53) estimates that imports of flexible packaging products into Europe (54) are under 5%. This figure may though be higher in case of medical applications as, often these are higher value and more specialised products and do not require just-in-time delivery.

(77) At the same time, some leading customers claim to be sourcing globally from global players such as Amcor. As one competitor puts it “Global Players normally have globally operating suppliers, which allows to benefit from accumulated volumes and differentiated specifications / regulatory compliance." (55) The PCI report explains in this context that “As multinational brand owners expanded around the world, they have sourced their packaging requirements locally for their local packing operations.” (56) One competitor responding to the market investigation confirms: “Interestingly, the bigger the customer is, the more regionally the customer appears to source." (57)

(78) Conversely, the vast majority customers admitted preferring local suppliers whenever available. They did not exclude sourcing globally, if economically sensible.

(79) Customers who source from overseas (58) often quoted legacy reasons for doing, which was also impacted by the difficulty and cost of switching suppliers and the customized nature of the products. However, these examples seem to be sporadic.

(80) Two thirds (59) of responding competitors see their customers sourcing not wider than EEA wide. [Description of Bemis customer relationships]. (60)

(81) On the basis of the evidence before it, and having regard to its decisional practice, the Commission considers that the relevant geographic market for flexible packaging for medical use is EEA wide in scope.

6. COMPETITIVE ASSESSMENT

6.1. Flexible packaging for food applications

6.1.1. The Parties’ arguments

(82) The Parties submit that on the overall food sub-segment, the Parties' activities do not lead to an affected market ([10-20]% combined: Amcor [5-10]%, Bemis [0-5]%).

(83) The Parties submit that in flexible packaging for food, their activities overlap only with regard to meat and fish, and cheese, as Bemis is practically only active in meat and fish, and cheese, whereas Amcor is active in all segments. In meat and fish, their combined market share is [5-10]%, with a small increment of [0-5]% from Bemis.

(84) As regards flexible packaging for cheese, their combined market share is [10-20]%, with an increment of less than [0-5]% from Bemis. In narrower possible sub segments, such as soft, processed and hard cheese packaging, the only overlap would be in hard cheese, which leads to a [10-20]% combined market share ([5-10]% for Amcor and [5-10]% for Bemis).

(85) The Parties submitted, at the Commission’s request, data for other possible segmentation, i.e. for flexible food packaging types, namely:

(a) roll-stock flexible packaging for food applications and pre-made flexible packaging for food applications (combined market share below 20%),

(b) skin films (combined market share below 20%),

(c) labels (combined market share below 20%),

(d) laminates (combined share below 20%),

(e) forming films (combined market share below 20%),

(f) skin and shrink bags (no overlap),

(g) skin lidding and forming films (no overlap),

(h) lidding films (combined market share below 20%),

(i) standard pouches, (no overlap),

(j) retortable pouches, (no overlap),

(k) microwavable pouches, (no overlap),

(l) vacuum pouches, (no overlap),

(m) stand-up pouches, (no overlap),

(n) wrappers, (combined market share below 20%),

(o) flexible packaging for the food service channel and food consumer channel (combined market share below 20%).

(86) In addition to their limited combined market shares, the Parties submit a number of arguments to support their claim that the proposed Transaction does not give rise to competition concerns. According to the Parties:

(a) A large number of competitors are active in the food sector specifically, such as Constantia, Wipak, Südpack, Huhtamäki, Clondalkin and Cryovac. The Parties submit that competition from countries outside Europe, such as Turkey and Ukraine, is increasing (e.g. from Korozo, Propak, Iskak and Ukrplastic).

(b) Suppliers from other segments have expanded into food applications, for instance Flexopack in Poland.

(c) The Parties are both dependent on a small number of customers in the cheese segment: Amcor's and Bemis' top ten customers account for […]% and […]% of their sales respectively.

(d) [The way in which business between suppliers and customers is typically conducted, example provided].

(e) [Description of documents submitted by the Parties].

(f) Food packaging standard compliance is straightforward and all competitors will comply with these standards.

6.1.2.The Commission’s assessment

(87) The Commission’s market investigation broadly confirmed the above submissions by the Parties:

(a) The market investigation showed that a large number of competitors is active in the market for food flexible packaging, with as closest competitors Wipak, Südpack, Coveris, Mondi and Constantia. (61)

(b) The market respondents have confirmed that there is fierce competition in the food flexible packaging market, especially for commodity products. (62)

(c) The market is characterised by tenders that are carried out mostly yearly or every two to three years. Therefore, contracts usually have a duration of one year up to maximum three years. (63)

(d) Customers often multisource from various suppliers of flexible packaging used for the same kind of end products. (64) The overwhelming majority of customers sources from more than 5 to 25 suppliers of flexible packaging. (65)

(e) Price is an important factor in determining the choice of suppliers of flexible packaging suppliers. The majority of customers of suppliers of food flexible packaging would switch to another supplier in case of a price increase by 5-10% of its current supplier. (66) The market investigation has also confirmed that customers effectively regularly switch suppliers. (67)

(f) Despite the fact that entry in the food segment is difficult to realise considering regulatory requirements, customer validation requirements, need for specific technology and know-how, expansion by competitors of flexible packaging into the food sector cannot be ruled out if profits would be higher than the costs. (68)

(g) The market investigation confirms that not many market respondents view the Parties as competing closely in the market for flexible packaging for food. (69)

(h) Finally, the majority of market respondents does not consider that the Transaction would give rise to significant negative effects on overall competition. (70)

(88) For the reasons mentioned above and on the basis of the evidence before it, the Commission therefore concludes that the proposed Transaction does not raise serious doubts with respect to the market for the flexible packaging for food.

6.2. Flexible packaging for medical applications in the EEA

6.2.1.The Parties’ arguments

6.2.1.1 Overall market for flexible packaging for medical applications

(89) According to the market shares provided by the Parties on an overall market for flexible packaging for medical use, the proposed transaction would not lead to affected markets; The Parties submit that their overall market share remains below 20% (more specifically, [10-20]%). The Parties submit that according to their estimates, the total EEA market for flexible packaging for medical use is ca. EUR 1 billion, on which the Parties sales are EUR [100-200] million combined. They admit, however, that in the absence of third party independent reports on the EEA market size and the Parties’ limited access to information on the competitors’ market shares and their activities on such a fragmented market, their estimates relied on unverified expert advice from Allied Development and on Amcor and Bemis’ subjective views.

(90) In any event, the Parties argue that in the market of flexible packaging for medical use:

(a) There would be a large number of competitors active in flexible packaging for medical applications, such as Oliver, Wipak, Nelipak, VP, Billerud, Sterimed, Sealed Air (Cryovac), Coveris, Südpack, Mondi, Neenah, Westfield, Encaplast, Bolsaplast, Constantia, Berry Global, Flextrus; Huhtamaki, Früh Verpackungstechnik, Microtek Medical, Molnlyke, Printpack, Rollprint and Safta. In addition, the Parties contend that products such as bags and pouches are imported into the EEA from suppliers in China, South Korea and the Middle East. The Parties claim that their combined market shares amount to [10-20]% combined ([10-20]% for Amcor and [5-10]% for Bemis). Based on the Parties’ market reconstruction (71), the main competitors’ EEA market shares are the following: [5-10]% for Wipak, [5-10]% for Nelipak, [5-10]% for Oliver, [0-5]% for Coveris, [0-5]% for Sealed Air, [0-5]% for TEchnoflex, [0-5]% for Renolit and [40-50]% of the market is made up of a large number of suppliers.

(b) The market for medical flexible packaging would not contain significant barriers to entry. This is because: (i) medical packaging is produced using the same processes, raw materials, and equipment as packaging for many other end-uses, (ii) legal and regulatory requirements are minimal (iii) the medical segment is growing, and (iv) there is ample evidence that customers can readily sponsor entry.

(c) Customers such as [third party customer names] would exercise significant purchasing power and would be constantly looking at ways to reduce the purchase price for packaging. Customers are often present across multiple segments and typically secure cost-out reductions across applications and can sponsor entry into flexible packaging of different medical end-uses.

(d) In addition customers could multi-source between different suppliers and would typically have multiple suppliers qualified for sourcing purposes, making it even easier to readily switch volumes.

(e) Switching to an already qualified supplier could be achieved in a matter of weeks. In the event that a new supplier needs to be qualified, qualification can be accomplished in less than 6-12 months for both food and medical.

(f) Suppliers of flexible packaging for medical use also face competition from raw material suppliers e.g. Sterimed and Billeurd that also supply medical device manufacturers.

(g) Flexible packaging suppliers would generally face significant cost pressure from larger and powerful suppliers of raw materials, such as DowDuPont, Henkel and Exxon.

(h) The medical segment is growing, attracting new entry and expansion by current flexible packaging manufacturers and there are several examples of sponsored entry (e.g. Stryker sponsored Placon, who developed a new type of packaging for orthopaedic devices that found use in other applications too, such as wound care and monitoring devices.)

(i) Moreover, customers could engage in disintermediation by diminishing the role of packaging manufacturers such as the Parties, purchase form, fill and seal equipment that enables them to purchase rollstock and manufacture the packaging in-house.

(91) The Parties submit a win-loss analysis (72), according to which Amcor lost a significant amount of contracts to competitors other than Bemis, and only […]% of Amcor’s lost revenues were captured by Bemis. Also in terms of wins, Amcor has won the most contacts from [name of competitor] and not from Bemis. Among all observations, […]% of revenues were won by Bemis.

6.2.1.2 The Parties’ proposed competitive assessment relative to possible market sub- segments

(92) The Parties argue that should certain sub-segmentations be retained, there would still be noticeable competitive interactions between the sub-segments, since competitors typically supply a range of products and materials, and can readily expand and/or move across different product categories and/or end-use applications. Also customers typically have many formats/types of packaging and materials to choose from, such as for example flat pouches and base webs in wound care.

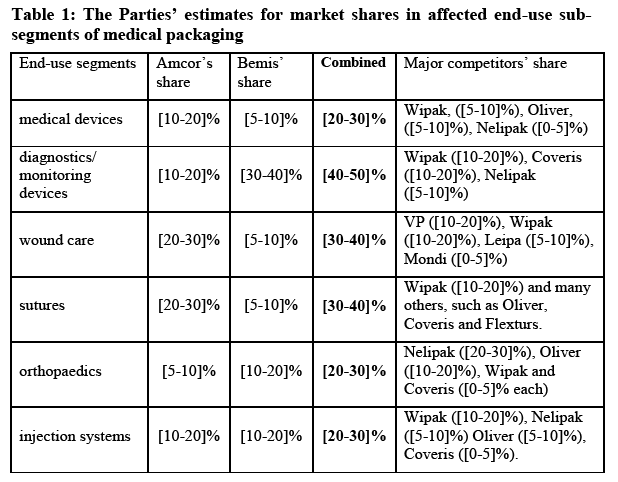

(93) The Parties submit that in any event, even if the following sub-segmentations of flexible packaging for medical use were followed, affected markets would only arise in some of the segments, namely: (i) pre-made pouches and bags, (ii) pre- made lids, (iii) medical grade non-wovens and papers, (iv) flexible packaging for medical devices, (v) diagnostics/monitoring devices, (vi) wound care, (vii) sutures, (viii) injection systems and (ix) orthopaedics, according to the market shares provided by the Parties. The Parties’ position as to the competitive assessment of such possible sub-segmentations of the market for flexible packaging for medical use is further described below.

6.2.1.3 The Parties’ proposed competitive assessment relative to a possible segmentation by end use of packaging

(94) The Parties stress that they do not agree with a sub-segmentation per end use [details of Parties’ business monitoring]. (73) However, they claim that although Amcor and Bemis are active through a wide range of end use applications and their overlaps would nevertheless limited. Their activities do not overlap in fluids, in-hospital, minimally invasive devices, gloves, drapes and electromechanically devices. They maintain that in most end uses where their activities overlap, the increments would be low and combined shares remained below 20%.

(95) This alternative sub-segmentation by end use would result in potentially affected markets for diagnostics/monitoring devices, wound care, sutures, injection systems and orthopaedics.

(96) In addition, the Parties submit that, in diagnostics, they are not close competitors within this segment, [example of why this is the case]. They argue that in woundcare, additional competitive constraint is also exerted by paper manufacturers such as Sterimed and Billerud. And in sutures, the Parties submit that they are not close competitors within this segment [example of why this is the case]. For orthopaedics, the parties claim that various packaging types are used, including pouches, die-cut lids and trays and customers can and do choose between different packaging options both in terms of formats and materials. Similarly for injection systems; a wide range of packaging types, including uncoated paper, lids and flowrap are used and customers can and do switch between packaging formats and materials.

6.2.1.4 The Parties’ proposed competitive assessment relative to a possible segmentation by type of packaging

(97) In order to analyse flexible packaging for medical use per type of packaging the Parties distinguish rollstock from pre-made products, which latter they further divide into bags and pouches, trays and lids (die-cut lids and labels).

(98) According to the Parties, a differentiation rollstock and pre-made products within flexible packaging for medical use does not lead to affected markets with market shares of [10-20]% and [20-30]% respectively.

(99) The parties argue that with respect to lids, they are not close competitors that bags and pouches can often be used as an alternative to lids and trays and that both, pouches and bags and lidding are used across a variety of end use applications.

6.2.1.5 The Parties’ proposed competitive assessment relative to a possible segmentation by material

(100) The Parties address medical grade non-wovens and papers, laminates and flow wraps and films, and stress that it is difficult to provide accurate shares per material as materials can be used on their own but also in combination with others in different types of converted products. However, they estimate that the Parties’ combined share in medical papers and non-wovens together could amount to ca. [20-30]% (Amcor [10-20]%, Bemis [10-20]%) and add that Oliver ([10-20]% share), Wipak ([10-20]% share), Nelipak ([0-5]% share) and Sterimed ([0-5]% share) are also competing with the Parties among others.

(101) In laminates, they estimate their share at below 20% and in flow wraps Bemis is not active. (75) As concerns films, the Parties see their shares below 20% with a [0-5%] increment from Bemis. (76)

(102) As concerns coated Tyvek, the Parties argue (77) that Amcor’s presence is minimal, with sales of only ca. EUR […] million, including rollstock and pre-made products out of coated Tyvek in the EEA. Alternative suppliers, Oliver and Rollprint in the US are also able to coat Tyvek and shipping the coated Tyvek based products from the US is not unprecedented, and the Parties believe that this is the strategy that for instance Oliver follows.

(103) As concerns uncoated Tyvek, which is the majority of Amcor’s sales in the EEA, there are a large number of competitors including Wipak, Oliver, Sterimed, Coveris, Nelipak, VP, Encaplast, Südpack, Medipack, Westfield, Riverside, Bischoff & Klein, and Inpak.

(104) The Parties add that Tyvek has a very low penetration level in Europe (when compared with the US), Europe being much more focused on the use of paper for medical flexible packaging (with many of the large paper manufacturers being based in Europe).

6.2.2.The Commission’s competitive assessment

6.2.2.1 Assessment relative to the overall market for flexible packaging for medical use

(105) The Commission’s competitive assessment of the overall market for flexible packaging for medical use lead to identify a number of concerns, based on the following considerations.

(a) Potentially much higher market shares

(106) In response to the Parties’ position that the competitive assessment of the overall market for flexible packaging for medical applications should not give rise to concerns, the Commission considers that its investigation provided indications that the Parties’ combined market share are likely to be considerably higher than estimated by them. Accordingly the Parties allegation’ that the proposed Transaction would not create competition concerns is unsubstantiated from this point of view. Several elements support this conclusion, as follows.

(107) First, several internal documents (78) of both Parties indicate that the market for flexible packaging for medical applications could have a significantly lower total size and would thus entail higher overall market share for Parties’ than estimated. [Description of market size figures contained in documents submitted by the Parties].

(108) Second, although competitors responding to the market investigation admitted that there is no publicly available figure, and that the market shares are therefore difficult to estimate objectively, they estimated a total market size between EUR 500 and 800 million on average for the EEA. Consequently, the Commission considers that there is evidence that the Parties’ combined market share is higher than the [10-20]% submitted and it could be as high as [40-50]% on an EEA market for flexible packaging for medical use.

(109) Third, some respondents to the market investigation, when estimating the Parties’ position, alleged that the Parties combined could constitute up to 50% of the market for flexible packaging for medical use.

(b) The Parties being close competitors

(110) Beyond their combined overall position, the investigation also found that Amcor and Bemis are close competitors. Competitors and customers responding to the market investigation saw Amcor as being the number one in the medical segment, and Bemis following on in the second or third place, together with Wipak. (79) The Commission argues from this that irrespective of the sizes of the respective market shares in the market of flexible packages for medical applications, the Parties are close competitors and accordingly their overlaps in this market should be attentively scrutinised.

(111) The above finding is even more relevant if the Commission considers the Parties’ respective market shares broken by end use segments; in all the sub-segments analysed by the Commission, namely orthopaedic devices, injection systems, wound care, sutures and diagnostics, Amcor and Bemis are among the top two, three or four competitors.

(112) Internal documents of the Parties corroborate the same findings. [Description of the competitive assessment contained in documents submitted by the Parties]. (80)

(113) Also indicative of the Parties’ closeness is that out of the 12 identified sub- segments by end-use, Amcor and Bemis overlap and lead as per the market shares (as estimated by the Parties) in eight of them.

(114) Even if the market investigation did not allow unequivocally concluding on the existence of narrower sub-segments within the market for medical packaging, the precise delineation of which was left open for the purposes of the present decision, it is clear that relevant considerations can be inferred as to the competitive closeness of the Parties on the highly differentiated markets, concerned. In that context, the fact that the Parties are often each other’s largest competitors in the segments where they overlap (namely diagnostics, injection systems, tubing and wound care and sutures among the affected sub-segments and possibly also on others, such as catheters which were not identified by the Parties as affected) is a strong indication that they are overall close competitors in the market for flexible packaging for medical applications.

(115) The Commission found that the Parties are the only manufacturers to have a nearly complete portfolio in flexible packaging products for medical use, while other competitors are only active in some types of packaging and sub-segments. Customers clearly see the Parties as alternative suppliers for a broad range of products. (81)

(116) Respondents also stressed that the Parties are the only market players that have a significant level of vertical integration into film extrusion and would therefore enjoy a competitive advantage over competitors. (82) Bemis internal documents also acknowledge [description of documents submitted by the Parties]. (83)

(117) As concerns the Parties’ submission on win-loss analysis showing the Parties not being the closest competitors, [explanation of the Commission’s interpretation of the parties’ win loss analysis]. (84)

(118) Overall, the win-loss analysis provided evidence in favour and also against the Parties. However, given the wealth of evidence at hand that points to the closeness of competition between the Parties, the Commission does not find the Parties’ submission to be persuasive enough to challenge the conclusion that the Parties are close competitors.

(c) Parties asymmetrically much larger than their competitors

(119) The Commission observes that although the market investigation confirmed the presence of a large number of competitors active in flexible packaging for medical use, the structure of the market is characterised by a considerable asymmetry towards the current largest operators which includes the Parties, and is strongly skewed towards them: According to the figures provided by the Parties, Amcor and Bemis are individually and together by far the largest players. Combined, they are three times larger than the third competitor, and five times larger than the fourth, whereas there is a long tail of small suppliers. The Commission further notes that a significant number of small competitors expressed concerns about the transaction. (85) Moreover, some customers have indicated that, since already pre-transaction, Amcor showed signs of holding a significant market power and they feared that its market power would only increase –with the acquisition of Bemis. (86)

(120) Therefore, the Commission has doubts as to whether the remaining large number of small competitors would be able to increase their capacity to the extent to counteract any attempt of the merged entity to increase prices for its products.

(121) The Commission also considers that the market investigation did not confirm that imports from China constitute a significant competitive force that could significantly alter the current bias in favour of the Parties in the market of flexible packaging for medical applications. (87)

(122) Finally, the Commission also notes that as it appears from the market investigation, a large number of competitors (88) expressed concerns about the proposed Transaction.

(d) Difficulty of customers to switch suppliers

(123) The Commission found that due to lengthy and costly product validation and supplier qualification requirements in the medical packaging segment, customers do not switch easily from one supplier to another. Validation of a new packaging solution for a product in the medical segment was reported to take some time between one and three years, (89) and could cost hundreds of thousand of euros. (90) Contrary to the Parties’ assertion that a significant part of the medical packaging business was commoditised, customers explained during the market that packaging products are often custom made for the specific end product and fine- tuned to work on the customers’ equipment. The more customised the packaging product, the longer the validation times and cost and the more difficult to change specifications. (91) Therefore, customers on many of these customised products single source and have long-term contracts (three to five years), (92) where they would be hesitant to switch supplier. (93) A competitor notes: "in health and medical packaging, the lead times of the customer validation processes does not allow the customer base to shift between suppliers without 1-2 year transition process. This is a clear barrier to enter - or for customers to change suppliers easily." (94)

(124) Therefore, the Commission considers that customers are often faced with significant switching costs and would not be in a position to change suppliers easily shall the merged entity attempt to increase its prices.

(e) High barriers to entry

(125) The Commission finds that the market investigation did not confirm the Parties’ arguments on low barriers to entry. (95) Respondents to the market investigation agreed that barriers to entry into the flexible packaging for medical use were particularly high and reported of the existence of several: The initial investment was considered to be significant, first, into the machinery. Condition for viability was mentioned the need to achieve scale and high output volumes and a strong balance sheet to bridge the long validation times before cash flow can be generated. These all were considered to represent high barriers to entry. Furthermore, access to know how and technology, and specialised staff were all considered significant barriers. Reputation was also frequently mentioned as critical for acquiring customers, which had to be developed over several years. (96) A customer notes: “High capital costs. Understanding and implementing systems to comply with medical requirements like traceability, lot control, quality system requirements, documentations and procedures- could be a huge undertaking. Qualification and validation is slow resulting in late return on investment.” (97) Another mentioned: “Reputation, competence and size is critical and lack of that can be an obstacle.” (98) The majority of the competitors stated that they could not expand between sub-segments even. (99)

(126) The Commission also finds that although the medical segment is an above average growing market, respondents could not name any new entrants in the market of flexible packaging for medical applications in the past five years (100) and did not expect any new entry in the near future, confirming the finding of high barrier to entry.

(f) Reduced countervailing buyer power and customers concerned

(127) The Commission considers that the market investigation did not confirm that Parties’ argument that customers would change supplier even in the event of certain price increases. Only two customers indicated they could help a supplier build up capability. (101)

(128) The Commission took note that the customers in the medical segment do not always multi-source. (102) They explained that multi-sourcing is typical for more commoditised packaging products, whereas the more complex and customised products need length validations. The cost of this often does not justify the qualification of two suppliers for the very same product. (103)

(129) During the market investigation, over half of responding customers, including large multinational customers, (104) expressed concerns about the transaction held that the transaction could negatively affect competition, prices and innovation on the market for flexible packaging for medical use.

(130) It follows for the Commission that countervailing buyer power among customers for flexible packaging for medical use is likely insufficient to offset potential adverse effects of the merger.

(g) The Commission’s competitive assessment as to the potential sub-segments

(131) Although the Commission does not find it necessary to take a definitive position on the possibility of further segmenting the market for the supply of flexible packaging for medical applications, it finds it relevant for its competitive assessment the finding that the Parties’ combined market shares in certain segments would be particularly high.

(132) In addition, the Commission considers that this approach is the more relevant as the market investigation revealed the existence of higher shares of the Parties across a number of sub-segments than what the Parties submitted.

(133) As concerns sub-segments according to end use applications, [description of significantly higher market share figures contained in documents submitted by the Parties] (105).

(134) On a similar note, following a sub-segmentation by type of packaging [description of significantly higher market share figures contained in documents submitted by the Parties] (106) [description of market share figures contained in documents submitted by the Parties] (107).

(135) [Description of high market share figures for segment not addressed by the Parties but contained in documents submitted by the Parties].

(136) [Description of high market share figures for segment not addressed by the Parties but contained in documents submitted by the Parties].

(137) The market investigation largely confirmed this figure and revealed that coating Tyvek is highly technical and requires significant and also proprietary know-how. According to market participants, only three competitors are capable of coating this material, which are Amcor, Bemis and Oliver. Therefore, the Transaction would reduce the number of suppliers of coated Tyvek from three to two.

(138) As concerns the Parties’ position in laminates, a customer, which did not express concerns during the investigation, very late in the process (108) indicated that the Parties’ combined market share in a product category engineered multi-layered films, could be as high as 90% and submitted that for these products they consider the market to be worldwide. Engineered multi-layer films, as explained by the customers are complex films, often consisting of up to seven layers, which are blown or extruded.

(139) [Description of information contained in documents submitted by the Parties] Bemis’ presence in films is marginal, it reported to the Commission sales of EUR […] million of film rollstock (109). [description of information contained in documents submitted by the Parties] (110).

(140) This seems to indicate that the horizontal overlap in “engineered multi-layer films” as evoked by the complainant is very limited.

(141) In line with this, Bemis confirms that its presence in the EEA is limited to more standard films (111), which is also mirrored by the statements in the internal document referenced above: [description of information contained in documents submitted by the Parties].

(142) The Parties’ internal documents indicate [description of information contained in documents submitted by the Parties].

6.2.2.2 Conclusion

(143) In summary, irrespective of whether the sub-segmentation per end-use application or material or type of packaging can be considered relevant product markets, the Commission considers, on the basis of the results of the market investigation conducted, that after the proposed Transaction the Parties would consolidate their already significant market positions in certain sub-segments as well as in the overall market for the supply of flexible packaging for medical use in the EEA. That finding is also corroborated by the market investigation showing evidence that the Parties are close competitors in the overall market for flexible packaging for medical use in the EEA and are market leaders as the two largest vertically- integrated players with a complete portfolio of flexible packaging products, with the nearest competitors being three to five times smaller than the merged entity post-Transaction. The Commission also finds that that there are large barriers to entry into market and that customers face high switching costs.

(144) Based on the evidence before it, the Commission accordingly concludes that the proposed Transaction would significantly increase the competitive power of the Parties and eliminate an important competitive force on the market for flexible packaging for medical use in the EEA.

(145) Therefore, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market as regards its impact on competition on the market for flexible packaging for medical use in the EEA.

7. REMEDIES

7.1. Framework for the assessment of the commitments proposed

(146) The following principles from the Remedies Notice (112) apply where parties to a concentration choose to offer commitments in order to modify a concentration. Such modifications, described as remedies, have as their object to eliminate the competition concerns identified by the Commission.

(147) It is the responsibility of the Commission to show that a concentration would significantly impede effective competition. It is then for the Parties to the concentration to put forward commitments.

(148) Under the Merger regulation, the Commission assesses the compatibility of a concentration with the internal market on the basis of its effect on the structure of competition. Where a concentration raises competition concerns in that it could significantly impede effective competition, in particular as a result of the creation or strengthening of a dominant position, the parties may seek to modify the concentration in order to resolve the competition concerns and thereby gain clearance of their merger (113).

(149) The Commission only has power to accept commitments that are capable of rendering the concentration compatible with the internal market in that they will prevent a significant impediment to effective competition in all relevant markets where competition concerns were identified (114). To that end, the commitments have to eliminate the competition concerns entirely (115) and have to be comprehensive and effective from all points of view (116).

(150) In assessing whether proposed commitments are likely to eliminate its competition concerns, the Commission considers all relevant factors including inter alia the type, scale and scope of the commitments, judged by reference to the structure and particular characteristics of the market in which those concerns arise, including the position of the parties and other participants on the market (117). Moreover, commitments must be capable of being implemented effectively within a short period of time (118).

(151) Where a proposed concentration threatens to significantly impede effective competition the most effective way to maintain effective competition, apart from prohibition, is to create the conditions for the emergence of a new competitive entity or for the strengthening of existing competitors via divestiture by the merging parties (119).

(152) The divested activities must consist of a viable and competitive business that, if operated by a suitable purchaser (hereinafter referred to as “the Purchaser”), can compete effectively with the merged entity on a lasting basis and that is divested as a going concern. The business must include all the assets which contribute to its current operation or which are necessary to ensure its viability and competitiveness and all personnel which are currently employed or which are necessary to ensure the business' viability and competitiveness (120).

(153) Personnel and assets which are currently shared between the business to be divested and other businesses of the Parties, but which contribute to the operation of the business or which are necessary to ensure its viability and competitiveness, must also be included. Otherwise, the viability and competitiveness of the business to be divested would be endangered. Therefore, the divested business must contain the personnel providing essential functions for the business such as, for instance, group R&D and information technology staff even where such personnel are currently employed by another business unit of the parties —at least in a sufficient proportion to meet the on-going needs of the divested business (121).

(154) Normally, a viable business is a business that can operate on a stand-alone-basis, which means independently of the merging parties as regards the supply of input materials or other forms of cooperation other than during a transitory period (122).

(155) The intended effect of the divestiture will only be achieved if and once the business is transferred to a suitable Purchaser in whose hands it will become an active competitive force in the market. The potential of a business to attract a suitable Purchaser is an important element already of the Commission's assessment of the appropriateness of the proposed commitment. In order to ensure that the business is divested to a suitable Purchaser, the commitments must include criteria to define the suitability of potential Purchasers. This will allow the Commission to conclude that the divestiture of the business to such a Purchaser will likely remove the competition concerns identified (123).

(156) In Phase I, commitments offered by the Parties can only be accepted where the competition problem is readily identifiable and can easily be remedied. The competition problem therefore needs to be so straightforward and the remedies so clear-cut that it is not necessary to enter into an in-depth investigation and that the commitments are sufficient to clearly rule out serious doubts within the meaning of Article 6(1)(c) of the Merger Regulation. Where the assessment confirms that the proposed commitments remove the grounds for serious doubts on this basis, the Commission clears the merger in Phase I.

7.2. Commitments submitted by the Parties

(157) In order to render the concentration compatible with the internal market, the Parties have proposed modifying the notified concentration by entering into the following commitments (hereinafter also referred to as "the Divestment Business").

(158) Pursuant to Article 8(2) of the Merger Regulation, the Notifying Parties initially submitted commitments on 21 January 2019 ("the Initial Commitments"). The Commission subject such commitments to a market test. The market test indicated that the Initial Commitments needed improved to fully eliminate the concerns raised by the proposed Transaction.

(159) In order to address the issues raised in the market test, the Notifying Parties submitted a final set of commitments on 31 January 2019 ("the Final Commitments"). The Final Commitments were subject to an additional market test. The latter market test received a positive response from the vast majority of market test respondents.

(160) The Initial Commitments proposed by Amcor and Bemis consist of the divestment of almost the entirety of Bemis’ flexible packaging business for medical use in the EEA, which included the following:

(a) The divestment of two Bemis plants: The Derry plant in Northern Ireland, UK and the Clara plant, in Ireland, wholly owned by Bemis Healthcare Packaging Limited;

(b) All tangible assets located at the two sites, including all machinery and equipment;

(c) All know-how currently used by the Divestment Business and all IP necessary for its operation;

(d) All licences, permits and authorisations associated with the production of flexible packaging (including medical flexible packaging) at each of sites contained within the Divestment Business;

(e) All contracts, agreements and leases including: (i) a contract for warehousing services near to the Derry plant and (ii) all the customers of the Derry and Clara plants, including […] supply contracts that involve the Derry and Clara plants;

(f) All personnel currently employed by the Divestment Business, including sales, marketing, finance, R&D;

(g) Key personnel, [description of personnel].

(h) Transitional agreements for up to two years following the closing of the Transaction on (i) any central services provided by the Bemis Groups (such as IT and Global Business Services support) and (ii) all raw materials and inputs currently supplied to the Divestment Business by retained Bemis plants on the same terms and conditions currently enjoyed by the Divestment Business.

(161) As to the transitional supply agreements the Parties submitted that the supplied products from the remaining Bemis plants i.e. films and laminates, are to […]% standard films, (i.e. commodity level films), for which there are several alternative suppliers in the EEA, such as Bischof&Klein, Huhtamaki, Wipak; Coveris, Encaplast, Sealed Air, Stermied among others. Therefore, the Parties consider that switching supplier could be done be easily.

(162) As to the non-standard films (i.e. customised films) supplied by Bemis’ remaining plants, the Parties note that [details of inter-company supply]. The Parties consider that at least four alternative suppliers could be capable of manufacturing the same firm, which are Huhtamaki, Danapak, Constantia and EK Pack.

(163) The Parties consider that the proposed transitional agreement, based on which these products will be supplied on current unchanged terms to the Divestment Business provide a sufficient timeline for the Divestment Business to find and for the customers to validate a new supplier.

(164) Bemis considers that it can additionally facilitate the transition process by [details of how Bemis can facilitate the transition process]. (124)

(165) The Parties are confident that there will be numerous candidate Purchasers interested in the Divestment Business. To date, they have received expressions of interest from a number of potential purchasers, that all have expressed interest in attending management presentations. (125)

(166) In addition the Parties entered into related commitments inter alia regarding the separation of the divested businesses from their retained businesses, the preservation of the viability, marketability and competitiveness of the divested businesses, including the appointment of a monitoring trustee and, if necessary, a divestiture trustee.

7.3. The Commission’s market test

(167) With their Initial Commitments, the Parties have essentially proposed to divest almost the entire Bemis’ business in flexible packaging for medical use in the EEA (126). Considering that the Commission has serious doubts concerning the whole overlap for flexible packaging for medical use created by the transaction in the EEA, the scope of the divestment is in principle suitable to remove its competition concerns.

(168) This is confirmed by the results of the market test, where the majority of respondents consider the Initial Commitments as suitable to effectively remove competition concerns raised by the Transaction in flexible packaging for medical use (127).

7.3.1. Viability and competitiveness of the Divestment Business as per the Initial Commitments

(169) The Commission considers that the Divestment Business, as a stand-alone business including all the essential assets, functions and personnel is viable and competitive, with the exception of the transitional supply for raw materials from Bemis plants described below.

(170) From a financial perspective, the Divestment Business has been operating profitably in the past three years, [description of sales and profitability].

(171) The market test resulted in the majority of respondents agreeing that the Divestment Business would be viable and competitive both immediately as well as in the next five years (128)

(172) The market investigation revealed, however, that the transitional supply for raw materials from Bemis’ remaining plants were crucial for business continuity and the way the Initial Commitments were structured in this respect could jeopardise the viability and competitiveness of the Divestment Business. (129)

(173) Respondents noted that the transition period of two years is in most instances not sufficient to find, test and validate a new supplier for a new raw material. Therefore, the transition period should be significantly longer. At the same time many were concerned that a long transitional supply agreement created long term dependencies for the Divestment Business on a competitor; which could again unfavourably affect its competitiveness.

(174) A number of respondents suggested that the Purchaser should have its own extruded film and laminated film manufacturing capability whereas a set of respondents saw it necessary to directly integrate the film supply into the Divestment Business, in order to replicate the capacity and capability that the Bemis medical flexible packaging business originally, had before the Transaction. This would minimise transition time and risk.

7.3.2. Suitability of the Purchaser

(175) The market test respondents stressed that existing presence and expertise of the potential Purchaser in flexible packaging for medical use or for broader health care applications would be necessary for ensuring the viability and competitiveness of the Divestment Business (130). They also noted that the existing presence of the Purchaser in the EEA and a familiarity with the EEA market; customers and qualification standards and procedures, would also be desirable.

(176) Several respondents already active in flexible packaging for medical use in the EEA have expressed interest in purchasing the Divestment Business. (131)

(177) The Parties took into account certain concerns expressed by the market respondents and on 31 January 2019 submitted Final Commitments that improve the Initial Commitments referred to in paragraph and accordingly replace such Initial Commitments. In particular, to address the said concerns expressed by the market respondents, the Parties added to the Initial Commitments the commitment to divest an additional plant located in Elsham, UK, (132) which manufactures extruded and laminated film […] that are supplied to the Derry plant. (133)

(178) Moreover, the Parties committed to the further transitional arrangements, including: (i) for a period of up to two years from Closing, on external warehousing for the Elsham plant. In addition, (ii) at the Purchaser’s election, a commitment to extend the length of the transitional supply arrangements [details of possible extension of supply arrangements].

(179) The Parties committed to a further Purchaser criterion to ensure that the potential Purchaser has sufficient experience in flexible packaging for healthcare applications or other relevant expertise.

(180) The Parties committed to divest all tangible assets located at Elsham, including machinery and equipment.

(181) The Parties committed to divest all other IP (to the extent any) that is used and connected to the Elsham plant.

(182) The Parties committed to exit from all contracts, agreements and leases including all the customers of the Elsham plants, including a small number of supply contracts that involve the Elsham plant.

(183) The Parties committed to attach to the Divestment Business all personnel currently employed by the Elsham plant. There are, however, no sales staff attached to the Elsham plant, as it is currently supported by the Bemis Europe sales and marketing team, which focusses on flexible food packaging. However, to provide continued sales and customer service support to the Elsham plant, the parties will transfer [details of personnel that will transfer]. The Elsham plant does not have on-site IT personnel, and also receives centralised support from Bemis, including support from the Derry and Clara plants. The Elsham plant [details of activities not carried out at Elsham]. The Elsham plant, which has a financial controller on-site, will also require additional resources. (134)

(184) The Parties committed to attach to the Divestment Business all key personnel, that consist of [details of personnel] for the Elsham plant for site management.

7.4. Commission Assessment

(185) The Commission considers that the Final Commitments set aside the serious doubts raised by the proposed Transaction because they remove the entire overlap between the Parties in flexible packaging for medical use in the EEA, the market in which serious doubts were raised.

(186) The Commission also finds that the modifications contained in the Final Commitments and described at paragraph (176) above address the outstanding issues, that were identified in the course of the market test, related to the viability and competitiveness of the Divestment Businesses. In particular, the Commission considers that the Final Commitments will: