Commission, November 14, 2018, No M.8915

EUROPEAN COMMISSION

Decision

DS SMITH / EUROPAC

Subject: Case M.8915 – DS Smith / Europac

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 24 September 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which DS Smith plc ("DSS") will acquire sole control over Papeles y Cartones de Europa, S.A. (Europac Group) ("Europac") by way of purchase of shares (the "Transaction")3. DSS is designated hereinafter as the "Notifying Party" and together with Europac as the "Parties".

1. THE PARTIES

(2) DSS is active mainly in the manufacture and sale of corrugated packaging in the EEA, and plastic packaging worldwide. DSS also collects used paper and corrugated cardboard, to produce recycled paper for corrugated packaging. DSS' corrugated packaging activities are spread across the EEA.

(3) Europac is a paper and packaging company. It is primarily active in the manufacture and sale of paper, corrugated board and corrugated packaging. Its activities are based in France, Spain and Portugal, and for its production of paper and corrugated board, it also has forestry operations in those countries.

2. THE CONCENTRATION

(4) The Transaction consists of the acquisition by DSS of the entire issued share capital of Europac, with the exception of one plant in Bretagne ("the Caradec plant"). Post-Transaction, DSS will therefore exercise sole control over Europac.

(5) In 2012, the Commission conditionally cleared the acquisition by DSS of SCA (M.6512 - DSS/SCA Packaging). One of the conditions for clearance in that case was the divestiture of the Caradec plant. Following the conditional clearance, DSS sold the Caradec plant to Europac. DSS is, as a result of the commitments in that case, bound by a 10-year non-reacquisition clause preventing it from acquiring the Caradec plant. For this reason, [Details regarding the sale of the Caradec plant].

3. EU DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (DSS: EUR 6 521.9 million; Europac: EUR 856.8 million).4 Each of them has an EU-wide turnover in excess of EUR 250 million (DSS: EUR 5 300 million;5 Europac: EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same

Member State. The Transaction therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. MARKET DEFINITION

(7) DSS and Europac are both vertically integrated companies active in the collection and supply of recovered paper, manufacture and supply of corrugated case materials ("CCM"), manufacture and supply of corrugated sheets, and manufacture and supply of corrugated cases.

4.1.Collection of recovered paper

(8) Waste paper is collected from waste generators (i.e. supermarkets, industrial businesses, etc.) and is either used internally by the collector or sold to third parties. In respect of supply of recovered paper, only this latter activity on the merchant market is considered in this decision.

4.1.1. Product market definition Commission's decision-making practice

(9) The Commission has previously defined separate product markets for the collection and the supply of recovered paper.6

(10) The Commission has previously considered that the market for the collection of recovered paper may be further segmented according to the quality of paper collected.7

The Notifying Party's view

(11) The Notifying Party defines a separate relevant market for the collection of recovered paper. It submits that the further sub-segmentation of this market based on the different paper grades is not appropriate because market players are active across all grades and waste generators of different types of paper do not require specialised services.8

The Commission's assessment

(12) The market investigation did not elicit anything that would contradict the Commission's earlier findings of defining a separate relevant product market for the collection of recovered paper. In any event, for the purpose of this decision, the exact scope of the product market definition and thus the question whether this market should be further sub-segmented based on the different market grades can be left open, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market with regard to the collection of recovered paper even on the basis of this narrowest plausible product market definition.

4.1.2. Geographic market definition Commission's decision-making practice

(13) The Commission has previously assessed the market for the collection of recovered paper on both an EEA-wide and a national basis.9

The Notifying Party's view

(14) The Notifying Party does not contest those market definitions and submits that the competitive assessment of the Transaction would not lead to competition concerns even when based on the narrower – national – market definition.10

The Commission's assessment

(15) The market investigation did not bring to light any indication that would contradict the Commission's earlier findings. The Commission considers that in any case, for the purpose of this decision, the exact scope of the geographic market definition can be left open, as the Transaction does not give rise to serious doubts with regard to the collection of recovered paper even when based on the narrowest plausible – national – geographic market definition.

4.2.Supply of recovered paper

(16) Following the collection, recovered paper is processed at a facility where it is sorted into recyclable and non-recyclable materials. The recyclable paper is sorted into grades and then inspected before either being used captively or sold to third party paper mills. Only this latter market-facing activity is considered in this decision.

4.2.1. Product market definition Commission's decision-making practice

(17) The Commission has previously defined separate product markets for the collection and the supply of recovered paper.11

(18) The Commission has also previously considered that the market for the supply of recovered paper may be further segmented according to the quality of paper collected as qualities of paper do not have the same use and the same price.12

The Notifying Party's view

(19) The Notifying Party does not contest the Commission's decisional practice to the extent that it defined a separate relevant market for the supply of recovered paper. However, it submits that the further sub-segmentation of this market based on the different paper grades is not appropriate because the supply of recovered paper of any grade requires exactly the same equipment and know-how and therefore market players are active across all grades and all grades are used to some extent in the manufacturing of corrugated case materials.13

The Commission's assessment

(20) The market investigation did not elicit anything that would contradict the Commission's earlier findings of defining a separate relevant product market for the supply of recovered paper. In any event, for the purpose of this decision, the exact scope of the product market definition and thus the question whether this market should be further sub-segmented based on the different paper grades can be left open, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market with regard to the supply of recovered paper even on the basis of this narrowest plausible product market definition.

4.2.2. Geographic market definition Commission's decision-making practice

(21) The Commission has previously assessed the markets for the supply of recovered paper on both an EEA-wide and a national basis, whilst leaving the market definition open.14

The Notifying Party's view

(22) The Notifying Party considers that the market for the supply of recovered paper cannot rationally be narrower than EEA-wide based on the current trading patterns.15

The Commission's assessment

(23) The Commission considers that for the purpose of this decision, the exact scope of the geographic market definition can be left open, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market with regard to the supply of recovered paper even on the basis of the narrowest plausible – national – geographic market definition.

4.3. Manufacture and supply of corrugated case materials

(24) Corrugated case materials refer to a portfolio of products which are the main inputs for the manufacturing of corrugated packaging. CCM includes both liners, forming the flat outer layers of corrugated packaging, and fluting, which is the rippled middle layer of corrugated packaging providing rigidity, bulkiness and strength.

(25) Both liners and fluting can be made from virgin wood fibres or from recycled fibres, as well as from a mix of the two. Liners produced from virgin wood fibres are called "kraftliners"; while "testliners" are made from recycled fibres.

(26) Fluting from virgin wood fibres can be (i) Nordic semi-chemical fluting ("NSCF") containing (almost) exclusively Nordic birch tree fibres and (ii) semi- chemical fluting ("SCF") containing a large proportion (around 70-80%) of virgin wood fibres, as well as recycled fibres (around 20-30%).

(27) Recycled fluting can be (i) high performance ("HP") recycled fluting, made out of 100% recycled fibres but the performance of which is improved by the addition of starch and other chemicals; and (ii) standard recycled fluting made out of 100% recycled fibres, also known as "Wellenstoff".16

4.3.1. Product market definition Commission's decision-making practice

(28) In previous decisions, the Commission has considered a separate product market for CCM,17 and within CCM it has identified separate relevant markets for fluting and liners.18 Furthermore, the Commission considered but ultimately left open, whether the market for liners should be further sub-segmented between kraftliner and testliner,19 and whether the market for fluting should be further sub- segmented by different types of fluting.20

The Notifying Party's view

(29) The Notifying Party submits that the relevant product market encompasses all CCM based on strong supply- and demand-side substitutability.

(30) First, the Notifying Party argues that in the EEA, [80-90]% of the recycled CCM mills produce both liners and fluting (representing [90-100]% of recycled CCM production). It does, however, admit that the production of virgin wood fibre CCM requires different machinery.21

(31) Second, the Notifying Party claims that while there is generally a performance difference between kraft- and testliners, (i) sheet feeders and box plants (i.e. plants that manufacture corrugated sheets and corrugated cases) can and do switch between the two; (ii) paper type is only one element that determines the performance of the end-product; and (iii) the performance level of recycled CCM is constantly improving due to technology improvements.

(32) Finally, it also submits that dual-use paper grades are available, which can be used as both fluting and liner.22

The Commission's assessment

(33) The Commission notes that it has analysed the market for the manufacture and supply of CCM in a very recent decision,23 concluding that liners and fluting constitute separate relevant product markets. Furthermore, in that same decision the Commission considered the potential further sub-segmentation of the fluting market by the various types of fluting. Based on this, the Commission focused its market investigation in the present case on the market for liners which was not analysed in the Mondi/Powerflute decision.

(34) The market investigation results suggest that there is limited supply-side substitutability with regard to virgin wood fibre and recycled CCM. Indeed, the majority of competitors indicated that it is not possible to switch production on the same production lines between kraftliner and any recycled CCM product.24 However, the majority of the competitors also submitted that such switching is possible between testliners and recycled fluting products.25 This finding is in fact in line with the Notifying Party's first argument set out in paragraph 30 above.

(35) From a demand-side perspective, the majority of respondents indicated that it uses kraftliners and testliners interchangeably.26 However, many market participants noted that there are certain applications for which kraftliner must be used due to legal requirements or technical requirements (e.g. humidity or temperature resistance).27 This is in line with the findings made in the Mondi/Powerflute case for fluting.

(36) For the purpose of this decision, the Commission considers that flutings and liners constitute separate markets as per the Mondi/Powerflute decision. As regards each of flutings and liners, the exact scope of the product market definition and thus the question whether the various fluting and liner products constitute separate relevant product markets can be left open, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market with regard to the manufacture and supply of CCM even on the basis of the narrowest plausible product market definition.

4.3.2. Geographic market definition Commission's decision-making practice

(37) In previous cases the Commission has considered the market for the manufacture and supply of CCM, as well as its sub-segments to be at least EEA-wide in scope.28

The Notifying Party's view

(38) The Notifying Party does not contest the Commission's decisional practice and submits that the CCM market is at least EEA-wide in scope.29

The Commission's assessment

(39) The market investigation results support the previously retained geographic market definition. The majority of both competitors and customers indicated with regard to all CCM products that the market is at least EEA-wide in scope.30

(40) Furthermore, with regard to kraftliners, the market investigation in the present case suggests that the market might even be global in scope. Indeed, the majority of the competitors and customers who replied explained that they supply/source kraftliner globally31 and the majority of competitors who replied indicated that roughly 10-20% of the total volumes sold in the EEA come from imports.32

(41) The Commission considers that for the purpose of this decision, the exact scope of the geographic market definition can be left open, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market with regard to the manufacture and supply of CCM even if it is considered on a narrower basis, i.e. on a market that is at least EEA-wide in scope.

4.4.Manufacture and supply of corrugated sheets

(42) Corrugated sheets ("sheets") are made from CCM, and comprise an upper and lower layer of liner, and a middle layer of fluting. Sheets are produced at two different types of production facilities, (i) sheet feeders, which are plants dedicated exclusively to the conversion of CCM into sheets, that are then supplied to sheet plants for conversion into corrugated cases, or (ii) integrated plants, or so-called box plants, which convert CCM into sheets and then convert the sheets into corrugated cases at the same production site. Whilst integrated plants are designed to sell cases, they can also sell sheets to sheet plants, though usually sheet feeders are more efficient at producing sheets.

4.4.1. Product market definition Commission's decision-making practice

(43) In previous decisions, the European Commission has considered a product market comprising all types of sheets. It has also further considered distinct markets for "conventional" sheets and "heavy duty" sheets, the latter comprising either (i) only triple wall sheets, or (ii) triple wall and double wall sheets insofar as the sheets contain at least one A flute (i.e. AA, BA and CA board) and weighs more than a given threshold (ranging between 300 and 1000 g/sqm).33

The Notifying Party's view34

(44) The Notifying Party submits that the relevant product market encompasses all types of sheets, and that it would not be appropriate to define separate markets for conventional and heavy duty sheets respectively as any cut-off would be arbitrary.

(45) To that end, the Notifying Party claims that on the demand side, there is an innumerable variety of sheets available that form a continuum of solutions, from single through triple wall and with various combinations of fluting. There is no specific cut-off for "heavy duty"; a product's characteristics and performance are delivered via a combination of paper content, flute type and/or flute combination and sheet construction. In addition, the balance between the costs and strength of a sheet also influences a customer's choice for either "conventional" or "heavy duty" products.

(46) On the supply side, all solutions – with some limited exceptions – can be produced using the same machines, and limited additional technology and investment is needed to be able to produce "heavy duty" sheets. More concretely, for the production of double or triple wall sheets, a corrugator with respectively two or three single-facers is required, and upgrading a double-wall corrugator to be able to produce triple wall sheets would cost EUR […].

The Commission's assessment

(47) The market investigation in the present case confirms the Notifying Party’s claim that no specific cut-off for heavy duty sheets exists. Indeed, the majority of respondents is unaware of an industry standard used for distinguishing conventional and heavy-duty sheets, and only a minority indicates that its company itself distinguishes between conventional and heavy duty sheets. Between those that do indicate that a standard is applied in the industry, some refer to the number of walls being determinative, some to the weight and some to both, however no consistent replies were provided as to the exact design or weight rendering a sheet "heavy duty".35

(48) Furthermore, on the demand-side, respondents indicated that sheet customers generally tend to provide the exact technical specifications of the product that they wish to procure, although some customers also indicate their requirements in terms of performance, and leave the designing to the supplier.36

(49) As regards the supply-side, there appear to be a number of sheet producers that manufacture heavy duty sheets, although various sheet suppliers also indicated that they are not active as regards heavy duty sheets, and in particular with regard to triple wall sheets as special equipment is needed for this and adapting a conventional corrugator to accommodate triple wall sheets is difficult.37

(50) In view of the above, the results of the market investigation point to a continuum of different sheet solutions, though there also appear to be limits, especially on the supply-side, to the substitutability of conventional and heavy duty sheets.

(51) In any case, the exact scope of the product market definition can be left open as heavy duty sheets only represent around […]% of the Parties' production of sheets in 2017 and less than 15% of the total market for the manufacture and supply of sheets in France, Spain and Portugal, therefore the assessment does not hinge on whether heavy duty sheets are considered separately or not. For the purpose of this decision, the Commission has analysed the Transaction on the basis of the narrowest plausible markets, comprising on the one hand conventional sheets and on the other heavy duty sheets.

4.4.2. Geographic market definition Commission's decision-making practice

(52) The Commission has in previous decisions analysed the effects of transactions both at (i) national level, and (ii) with regard to a 300-400 km radius around the production sites concerned.38 The Commission has also considered that heavy duty sheets can be transported further than conventional sheets.39 The exact scope of the geographic market definition was consistently left open for sheets, both conventional and heavy duty sheets.40

The Notifying Party's view41

(53) The Notifying Party submits that the market for both conventional and heavy duty sheets is at least national and that a local level assessment is arbitrary. According to the Notifying Party, sheets are supplied at distances significantly over 400 km and across borders. Also, transport costs are very low42 and, regardless of the fact that manufacturers will rationally try to maximise margins by supplying as close to their plant as possible, various DSS plants sell part of their sheets further than 400 km away.43 In addition, the service expected by customers does not require a local presence.

The Commission's assessment

(54) The results of the market investigation did not confirm the view of the Notifying Party, but rather point to the existence of 400 km radii within which the vast majority of customers sources sheets.

(55) Almost all respondents indicated that the distance between a sheet supplier’s production facility and customer’s plant is (very) important, and a majority, both of suppliers and customers, indicated that sheets are sourced within a radius around a production plant.44 When it comes to the concrete distance that is considered acceptable, a majority indicated a distance of 400 km or less, mainly for reasons of transport costs, delivery time and flexibility.45

(56) It has to be noted that some respondents indicated that heavy duty sheets have a wider transport radius, as these are higher value products with slightly lower relative transport costs.46

(57) In view of the above and for the purpose of this decision, the Commission considers the geographic scope to be local, comprising a radius of 400 km, and will assess the Transaction on the basis of such a radius.47 For heavy duty sheets specifically, it will take into account the fact that heavy duty sheets might have a wider transport radius.

4.5.Manufacture and supply of corrugated cases

(58) The conversion of sheets into corrugated cases ("cases") for sale to end-customers involves printing, slotting and/or die-cutting, folding and gluing and/or stitching. Cases are produced either by (i) converter plants, or sheet plants, which convert sheets supplied by sheet feeders or box plants into cases for sale to end- customers, or (ii) integrated plants (so-called box plants) that – as mentioned before - convert CCM into sheets and then convert the sheets into cases at the same production site.

4.5.1. Product market definition Commission's decision-making practice

(59) In previous decisions, the Commission has considered a separate product market for cases, with potential sub-segmentations for conventional, heavy duty and litho-laminated cases.48

The Notifying Party's view49

(60) The Notifying Party claims that it is not appropriate to segment conventional and heavy duty cases, and that there is a market comprising all types of cases.

(61) The Notifying Party submits in that context that, from a demand-side perspective, there is a continuum of capabilities of case characteristics, which can be assessed against a wide range of criteria, including reliability in stacking, structural quality, resistance to pressure and tearing, resistance to puncture by a sharp object, moisture resistance, susceptibility to vibration etc., and whereby the type of sheet used, which is in itself a combination of paper content, flute type and/or flute combination and sheet construction, is just one factor which influences the performance of a given case, with the design of the case also having a significant impact.

(62) From a supply-side point of view, the equipment and know-how also for the production of heavy duty cases is readily available. Although the conversion of triple wall may need some additional – but readily available and cheap – equipment, the conversion of double wall sheet into double wall case requires the same equipment and process of printing, slotting, die-cutting and gluing as is used for the conversion of conventional sheet into conventional case.

The Commission's assessment

(63) As for sheets, the market investigation in the present case suggests that no generally accepted standard exists for distinguishing conventional and heavy duty cases in the industry. The majority of customers for cases that responded are unaware of an industry standard used for distinguishing conventional and heavy duty cases, and only a minority of the case suppliers that responded indicated that a standard is used.50 In addition, the majority of respondents, both case suppliers and customers, and also respondents that did indicate that a standard is used in the industry, indicated that they do not distinguish between conventional and heavy duty cases themselves.51 Of those companies who do distinguish, none indicated the same standard of distinction.52

(64) As regards the demand-side, the market investigation indicated that customers generally provide their suppliers either with technical specifications such as design, weight and type of paper to be used, or with requirements in terms of performance such as resistance to humidity and printability, all depending on the customer concerned and on whether the product being sourced is new or has been sourced before.53 As to the possibility for customers to switch between conventional and heavy duty cases, the market investigation indicated that from an economic point of view switching from conventional to heavy duty cases would not be appropriate unless needed.54

(65) As regards the supply-side, as for sheets, there appear to be several case suppliers that manufacture both conventional and heavy duty cases, although also here respondents indicated a need for special equipment.55

(66) Hence, as for sheets, the market investigation appears to support to a certain extent the existence of a continuum of different case solutions, nevertheless also revealing limits to the substitutability, especially on the supply-side.

(67) In any case, the exact scope of the product market definition can be left open as heavy duty cases only represent less than […]% of the Parties' production of cases and less than [5-10]% of the total market for the manufacture and supply of cases in 2017 in each of France, Spain and Portugal, so that the assessment would not significantly differ irrespective of whether heavy duty cases are considered part of the same market as conventional cases. For the purpose of this decision, the Commission has analysed the Transaction on the basis of the narrowest plausible markets, for conventional cases on the one hand, and heavy duty cases on the other.

4.5.2. Geographic market definition Commission's decision-making practice

(68) For conventional cases, the Commission previously considered the geographic market to (i) be national, or (ii) comprise a 200-300 km radius around the production facilities concerned. As regards heavy duty cases, the Commission has in the past considered the geographic market to be national in scope.

The Notifying Party's view56

(69) The Notifying Party claims the geographic market for both conventional and heavy-duty cases to be at least national, and that any local level assessment is arbitrary. To that end, the Notifying Party submits that while production facilities aim to maximise their local sales to reduce the impact of transportation costs, they will also always look to make as many sales at as high a margin as possible and will thus also make marginal sales further afield.57 Additionally, transport costs are low, around […]% of the costs of production for conventional cases, and […]% for heavy duty cases.

The Commission's assessment

(70) The results of the market investigation did not confirm the view of the Notifying Party, but indicated that the relevant geographic scope of the market for cases comprises a radius of 300km.

(71) A large majority of case suppliers that responded to the market investigation indicated that they supply to customers within a certain radius, and a large majority of both customers and suppliers consider the distance between a supplier's production facility and customer's plant to be (very) important.58

(72) Furthermore, the vast majority of suppliers indicated that they supply cases within a radius of 300 km or less, and a large majority of customers that responded indicated that 80% of their supplies for cases is sourced within a radius of 300 km, and even a considerable majority indicated that 90% of their supplies for cases is sourced within this radius.59

(73) Although some respondents indicated that heavy duty cases can be transported further, the market investigation results from suppliers are mixed with regard to the exact maximum distance that is acceptable.60 The majority of the case customers that responded indicated that the maximum distance they consider acceptable for the supply of heavy duty cases is between 300-500 km.61

(74) In view of the above and for the purpose of this decision, the Commission considers the geographic scope to be local, comprising a radius of 300 km, and will assess the Transaction on the basis of such a radius.62 For heavy duty cases specifically, it will take into account the fact that these might have a wider transport radius.

5. COMPETITIVE ASSESSMENT

5.1.Horizontal non-coordinated effects

5.1.1.Collection of recovered paper Introduction

(75) Both DSS and Europac are active on the market for the collection of recovered paper, achieving a market share of [5-10]% and [0-5]% respectively on an EEA-wide basis.63 64 Should the market be defined narrower, as national in scope, the Parties' activities overlap only to a very limited extent in Spain, where DSS does not collect recovered paper but has a trading office (with […] full-time employee).65 The market shares of the Parties and therefore the increment brought about by the Transaction would not significantly differ, even if the market for the collection of recovered paper were to be further sub-segmented on the basis of the different paper grades.66

The Notifying Party's view

(76) The Notifying Party submits that in view of the low market shares and the very limited increment brought about by Europac, the Transaction is unlikely to raise competition concerns.67

The Commission's assessment

(77) The Transaction does not give rise to affected markets even on the basis of the narrowest plausible product and geographic market definition.

(78) Based on the limited combined market shares of the Parties, the limited increment brought about by Europac, as well as the lack of concerns expressed in the market investigation, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the collection of recovered paper even on the basis of the narrowest plausible product and geographic market definition.

5.1.2. Supply of recovered paper Introduction

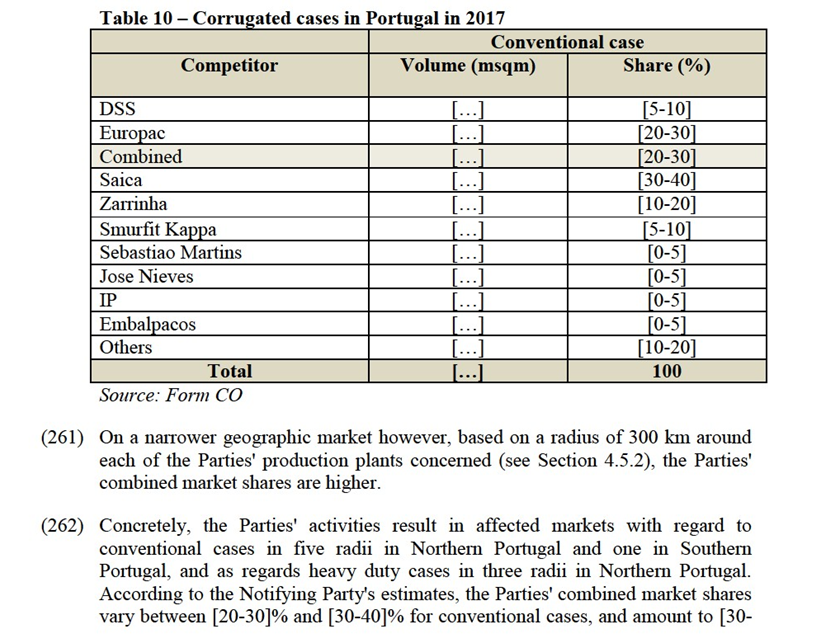

(79) On an EEA-wide level, DSS achieves a market share of [5-10]% on the market for the supply of recovered paper, while Europac's activities are very limited, amounting to a market share of less than [0-5]% in 2017.68 69 Should the market be defined as national in scope, the Parties' activities overlap in Spain (combined market share of less than [0-5]%) and in Portugal (combined market share of [30- 40]% with an increment of less than [0-5]% brought about by DSS).70

(80) The market shares of the Parties would not significantly differ, even if the market for the supply of recovered paper were to be further sub-segmented on the basis of the different paper grades.71

The Notifying Party's view

(81) The Notifying Party submits that in view of the limited combined market shares on an EEA-wide level, as well as the insignificant increment brought about by the Transaction, it is unlikely to lead to competition concerns. 72

The Commission's assessment

(82) The Transaction leads to a horizontally affected market only if the market for the supply of recovered paper is considered as national in scope. However, while Europac has a market share of [30-40]% in Portugal, the increment brought about by DSS is de minimis (less than [0-5]%).73

(83) The market investigation suggests that the Transaction would not negatively affect the competitiveness of the market for the supply of recovered paper.

(84) As for the availability of recovered paper, a competitor of the Parties, itself sourcing recovered paper from the merchant market, explained that "[t]here is no difficulty in sourcing recycled paper today. More and more paper is recycled in a proper way. The reduction in exports to China furthermore leaves more availability for European paper mills."74 Indeed, the large majority of the respondents to the questionnaire indicated that the Transaction would not have an impact on the available volumes.75

(85) Furthermore, the majority of the Parties' customers which replied to the questionnaire indicated that they would have sufficient alternative suppliers should the Parties stop supplying them or supply them at significantly worse conditions post-transaction.76

(86) Although some unsubstantiated concerns were raised with regard to the impact of the Transaction on the respondent's sourcing of recovered paper in the market investigation,77 the majority of respondents indicated that the intensity of competition will either increase or remain the same, and the price level will either decrease or remain the same.78

The Commission's assessment

(92) The Commission notes that the Transaction does not lead to any horizontally affected markets, even on the basis of the narrowest plausible product and geographic market definitions set out in Section 4.3 above.

(93) In the market investigation, the majority of the competitors and customers replied that the Transaction will not have a negative impact on the intensity of competition, the price level or the volumes available.82

(94) Based on the limited combined market shares of the Parties and the market investigation results, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to horizontal non-coordinated effects regarding the manufacture and supply of case materials under any plausible product and geographic market definition set out above.

5.1.4. Manufacture and supply of corrugated sheets Introduction

(95) The Parties' activities overlap in the manufacture and supply of sheets, and on a national level the Transaction gives rise to affected markets in relation to the potential sub-segments for conventional sheets in Spain and Portugal.83

(96) On a local level, taking the 400km radii around each of the Party's production plants, the Transaction results in affected markets in the potential sub-segments for conventional sheets in France, Spain and Portugal, and heavy duty sheets in Spain.

5.1.4.1.Introduction

Manufacture and supply of corrugated sheets – France

(97) In France, the Parties' activities overlap in relation to the manufacture and supply of sheets, but do not result in any affected markets on a national level. However, at local level the Transaction results in affected markets with regard to conventional sheets in Eastern France, in the local markets comprising the 400 km radii around (i) DSS Kunheim and (ii) DSS Velin, as well as in South Eastern France in the local markets comprising 400 km radii around (iii) DSS Dauphine and (iv) Europac La Rochette.

The Notifying Party's view84

(98) With regard to conventional sheets in France, the Notifying Party submits that the Transaction will not result in any competition concerns with regard to the market for conventional sheets, or any of its sub-segments, for the reasons below.

(99) First, the Parties' combined market shares, as well as the increment brought about by the Transaction, are limited even on a local basis, and there are several strong competitors remaining in the market. The radial size of 400 km is in any case arbitrary as transport costs are low and sheets travel further than this distance.

(100) Second, sheets are a relatively commoditised product, and customers can switch suppliers of sheets quickly and easily. Supply contracts are short, and sheet customers multi-source and are able to exert buyer power with regular tenders.

(101) Third, barriers to expansion are relatively low in terms of costs and time.

(102) Fourth, there is overall spare capacity in the market, and all competitors could quickly and easily increase output by adding overtime or increasing shifts.85 In addition, operators of box plants that currently only produce sheets for internal use could easily start making merchant sales, either from existing capacity or as part of a new investment in sheet capacity.

The Commission's assessment

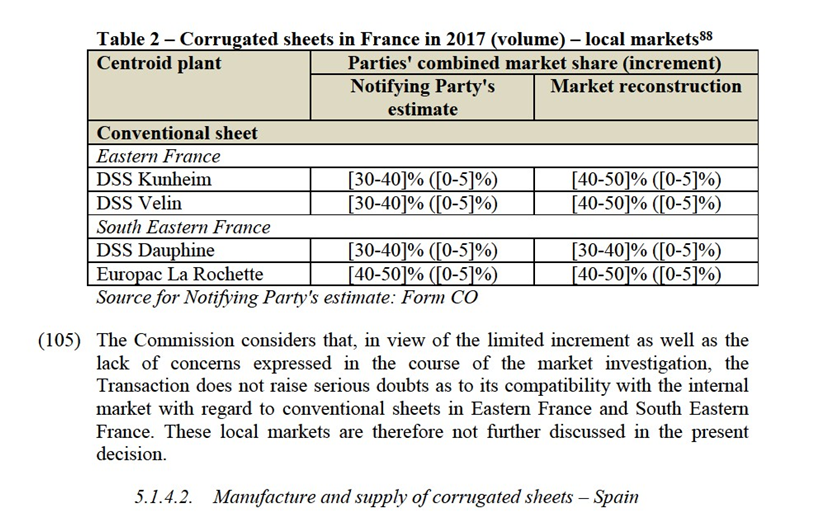

(103) On a national level, the Parties' combined market share does not result in any affected markets, neither with regard to conventional sheets nor in relation to heavy duty sheets.86 At the local level, based on radii of 400 km around the Parties' production facilities concerned (see Section 4.4.2), the Parties' activities result in affected markets in Eastern France and South Eastern France.

(104) The Notifying Party provided market share estimates for all the local markets where the Parties' combined market shares exceed 20%. The Commission conducted a market reconstruction based on the Parties', as well as their main competitors' external sales volume data in 2017.87 The results of the Commission's market reconstruction are also presented below.

majority of production in Portugal is sold to customers located in Portugal, not Northern Spain. Indeed, the total volume of exports from Portugal, inter alia (but not only) to (the whole of) Spain, equals only [a relatively limited proportion]% of the Parties' production of sheets in Portugal. Excluding the Parties' production from their plants located in Portugal reduces the Parties' combined market share to only [5-10]%, with an increment of [0-5]%.

(121) Second, a number of competitor plants are located just outside of the 400 km radius, including production facilities of Saica and Smurfit Kappa, that could and do conduct sales of sheets to customers located within the radius of 400 km around Europac Dueñas. Indeed, expanding the 400 km radius by 50 km introduces 20 additional plants, reducing the market share of the Parties to [20- 30]%.

(122) Third, the responses to the market investigation indicated that although some smaller local customers select their suppliers on the basis of bilateral negotiations, many customers multi-source and organise tenders, organised on a local (i.e. plant-by-plant), national or pan-European level also depending on their size and geographic footprint.94 In this context, none of the respondents indicated that they would lack sufficient alternative suppliers post-Transaction in Northern Spain.95

(123) Fourth, respondents to the market investigation considered that production can relatively easily and quickly be increased by 10% through overtime. This would reduce the Parties' market share, to [30-40]% within a 400 km radius (and [5- 10]% within a 300 km radius).96

(124) Lastly, in the course of the market investigation no concerns were raised in relation to Northern Spain.

(125) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the local markets for conventional sheets in Northern Spain.

Eastern Spain – Conventional corrugated sheets

(126) As regards the radii around DSS Andorra and Europac Alcolea, the Commission considers that in view of the moderate combined market shares (i.e. less than 30%), in combination with the limited concerns that were raised by respondents during the market investigation and the presence of multiple competitors such as Grupo Petit, Saica, International Paper, Mora y Goma SA and Ondulados Carme SA, the Transaction is unlikely to raise serious doubts in relation to conventional sheets in the radii around DSS Andorra and Europac Alcolea.

(127) As regards the other affected radii in Eastern Spain, the Parties have moderate combined market shares of [30-40]-[30-40]% around the plants of DSS Dicesa, DSS Flak and Europac Torrelavit, with increments of [10-20]-[10-20]% brought about by Europac.97 The market reconstruction largely confirms these market share data.

(128) The Commission considers that the Transaction does not raise serious doubts with regard to conventional sheets in Eastern Spain for the reasons set out below.98

(129) First, there are a large number of competitors located just outside the 400 km radius. Indeed, expanding the radius to 500 km, adds more than 20 third party plants in total, including multiple plants of International Paper and Grupo Petit, bringing down the Parties' combined market share below 30%.99 These plants are able to sell to many customers located within the radii around the Parties plants in Eastern Spain.

(130) Second, 4 of the 8 sheet feeders operating in Spain are located more closely to DSS Dicesa and DSS Flak than Europac's Alcolea,100 which is a box plant.

(131) Third, the market investigation indicated that customers organise tenders to fulfil their demand and multi-source. The Commission notes that post-Transaction, multiple competitors will remain, such as Saica and Smurfit Kappa but also numerous smaller competitors. These competitors represent together a volume that is higher than the combined entity. As such, the customers' ability to organise tenders and multi-source will not be jeopardised.

(132) Fourth, the respondents to the market investigation considered that production can relatively easily and quickly be increased by 10% through overtime.101 This would reduce the Parties' combined market share in each of the radii concerned with two percentage points.

(133) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the local markets for conventional sheets in Eastern Spain.

North Western Spain – Conventional corrugated sheets

(134) In North Western Spain, the Parties' combined market shares vary between [40- 50]% around the plants of DSS La Coruña and DSS Pontevedra, with an increment of [10-20]% brought about by Europac. The Commission's market reconstruction shows a much higher combined market share of [50-60]% with an increment of [20-30]-[20-30]%.

(135) Nevertheless, the Commission considers that the Transaction does not raise serious doubts with regard to conventional sheets in North Western Spain, for the reasons set out below.102

(136) Concretely, the local market shares most likely do not at all give a true representation of the competitive pressure exerted by Europac, and thus likely by the combined entity, in North Western Spain.

(137) First, Europac does not operate any plants in North Western Spain. The overlap for sheets results entirely from three of the four Europac plants located in Portugal (Europac Oporto, Europac Ovar and Europac Leiria) and Europac Dueñas located in Northern Spain.

(138) Second, Europac has in the past not exerted a significant competitive constraint in North Western Spain. It has only competed for very few tenders of sheet customers in North Western Spain, namely […] tenders during the last three years, […]. […]. As such, the Parties do not appear to be close competitors for customers located in North Western Spain.103

(139) Third, Europac's overall sales of conventional sheets to customers located in North Western Spain are very limited; they amounted to a total of […] msqm in 2017. According to the Parties' estimates, this represents only around [a limited proportion]% of demand in North Western Spain.

(140) In addition, the market investigation indicated that customers organise tenders to fulfil their demand and multi-source. The Commission notes that post- Transaction, multiple competitors will remain, such as Zarrinha and Smurfit Kappa but also numerous smaller competitors. In view of the likely significant overestimation of the Parties' market position, the sales of these competitors most probably represent together a volume that is higher than the combined entity in North Western Spain. As such, the customers' ability to organise tenders and multi-source will not be jeopardised.

(141) Finally, respondents to the market investigation considered that a sheet supplier can relatively easily and quickly be increase its production by 10%, through overtime.104

(142) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to conventional sheets on the relevant local markets in North Western Spain.

(143) Irrespective of the above, the Commission notes that the remedies proposed by the Notifying Party, as described in Section 6 below, will in any case also significantly reduce the Parties' combined local market shares in North Western Spain, with more than 10 percentage points.

Eastern Spain – Heavy duty corrugated sheets

(144) As regards heavy duty sheets in Eastern Spain, the Commission considers that in view of the moderate market shares (i.e. less than 30%), in combination with the limited concerns that were raised by respondents during the market investigation, and the presence of multiple competitors such as Smurfit Kappa, International Paper, Cartonajes Font, Grupo Rivas and Ondulados Carme SA, the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to heavy duty sheet in Eastern Spain.105

Conclusion – Corrugated sheets in Spain

(145) In view of all the above, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the manufacture and supply of conventional or heavy duty sheets in Spain or any local market within Spain.

5.1.4.3. Introduction

Manufacture and supply of corrugated sheets – Portugal

(146) In Portugal, the Parties' activities overlap with regard to the manufacture and supply of sheets, and the Transaction leads to affected markets as regards the conventional sheet market in Portugal.

(147) In particular, the Transaction will result in an affected market for conventional sheets at national level, as well as at local level, in Northern Portugal in the local markets comprising the radii of 400 km around (i) DSS Esmoriz, (ii) Europac Guilhabreu, (iii) Europac Ovar and (iv) Europac Leiria, and in Southern Portugal in the local market comprising the radius of 400 km around Europac Rio de Mouro.

The Notifying Party's view106

(148) The Notifying Party considers that the Transaction does not raise competition concerns with regard to the market for conventional sheets in Portugal, nor any potential sub-segments, for the following reasons.107

(149) First, according to the Notifying Party, the 2017 market shares are not entirely representative since the market for the manufacture and supply of sheets has changed substantially during 2018. In particular, Saica opened a new sheet feeder in March 2018 in Marinha Grande. This investment has already had an impact on the market, […].

(150) With Saica having made a large investment, the Notifying Party expects Saica to maximise its sales to third parties to recover its fixed costs. The Notifying Party estimates that this sheet feeder, that is currently still ramping up, will have a capacity of […] msqm of which […] msqm would be available for sale on the merchant market - which amounts to […] of the total merchant sheet market in Portugal. Already by the end of 2018, the Notifying Party expects this sheet feeder to be selling an additional […] msqm of conventional sheets on the market in Portugal. This alone would, based on the Notifying Party's estimates of all competitors' sales on the merchant market in Portugal, reduce the Parties' combined market share from [40-50]% to [30-40]%.

(151) Second, post-Transaction, a large number of competitors would remain in Portugal for these customers to source from, including Zarrinha, Saica, Smurfit Kappa, ECC and Sebastiao Martins. Further to this, the radial size of 400 km is in any case arbitrary as transport costs are low and sheets travel further than this distance.

(152) Third, sheets are a relatively commoditised product, and customers can switch suppliers of sheets quickly and easily.

(153) Fourth, customers multi-source and are able to exert countervailing buyer power with regular tenders and requests for price reductions.

(154) Fifth, barriers to expansion are relatively low in terms of costs and time.

(155) Sixth, as regards capacity the Notifying Party submits that on the one hand there is overall spare capacity in the market, and on the other hand that all competitors could quickly and easily increase output by adding overtime or increasing shifts.

(156) As such, the Parties estimate that the spare capacity of Saica's Marinha Grande sheet feeder together with that of another sheet feeder located in Portugal, of ECC's Feiria, is alone larger than the total current volumes of conventional sheets sold by the Parties. Concretely, the Notifying Party estimates this total spare capacity to be around […] msqm, whereas the Parties' sales of conventional sheets in 2017 amounted to […] msqm. This scenario does not even take into account the spare capacity that the Notifying Party believes exists in all Portuguese box plants.

(157) In respect of the capacity arguments made, on 17 October 2018, the Notifying Party provided an additional submission which sets out its market share estimates based on the assumption that each competitor increases its production of conventional sheets by 10%, explaining that in such a scenario the combined market share in Portugal decreases [5-10] percentage points if no sales are attributed to Saica's Marinha Grande sheet feeder, and [5-10] percentage points if Saica were to sell only [5-10]% of its total production capacity in Marinha Grande to third parties.

(158) Finally, the Notifying Party submits that there are significant imports into Portugal with potential imports in particular from Spain also exerting competitive

increased vertical integration (i.e. for sheets to be used for the production of Saica's own cases).113 The resulting impact of that investment on the market is therefore significantly different from the understanding and estimations by the Notifying Party.

(167) In addition, the Parties allege that at least five strong competitors with significant spare capacities (i.e. Zarrinha, Smurfit Kappa, Saica, ECC and Sebastiao Martins) would remain in the relevant markets.

(168) The market investigation showed however that the possibility to increase production, also at these sites, may be limited. Indeed, the majority of the respondents, as well as of the major competitors in Portugal, considered that it is difficult to increase production by more than 10%. Whilst it is possible to increase production by 10% by working overtime, in order to increase production by more than 10% a weekend shift or extra shift during weekdays may be needed. For further production increases, new equipment may be required according to some respondents.114 Presuming that all major competitors would increase their production by 10%, this would however only have a limited impact on the Parties' combined market share. Based on the Commission's market reconstruction, the Parties' combined market share would reduce from [40-50]% to [40-50]% were each competitor to increase its production by [10-20]%. The Commission also computed the Parties' combined market share based on the presumption that all competitors would increase their production by 10% and that Saica would sell 7% of its total Marinha Grande production capacity to the merchant market. In such case, the combined market share of the Parties would not decrease to [30-40]% as estimated by the Notifying Party, but only to [40-50]%.

(169) In addition, several concerns were raised during the course of the market investigation, by customers as well as competitors. In particular, a majority indicated that the intensity of competition would decrease in Portugal post- Transaction, with several respondents pointing to the Transaction creating a duopolistic market structure in Portugal. In this regard, the Commission notes that the combined entity together with its biggest competitor Zarrinha would represent according to the Notifying Party's estimates [60-70]%, and according to the Commission's market reconstruction up to [60-70]%115, of the market for sales of sheets to customers in Portugal.

(170) The arguments of the Notifying Party that customers multi-source and can switch suppliers quickly, and that competitors can increase capacity easily, are not sufficient to counter the significant position of the merged entity. The results of the Commission's market reconstruction show that all smaller competitors together represent a volume that is much lower than DSS alone, even if they were to increase their production by 10%. Further, no structural capacity expansions are foreseen by sheets suppliers in Portugal.116

(171) The market investigation also did not confirm the Notifying Party's argument that box plant operators that produce sheets for internal use could easily start making merchant sales, since cases are more complex products, with more added value.117 As such, they are more profitable than sheets. This is apparent also from the margin data provided by the Parties for sheets in Portugal.

(172) In view of the above, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market with regard to the local relevant markets for conventional sheets in Northern and Southern Portugal.

5.1.5. Manufacture and supply of corrugated cases

(173) As regards the manufacture and supply of cases, the Parties activities overlap, and on a national level the Transaction gives rise to affected markets in relation to the potential sub-segment for conventional cases in France and Portugal and the potential sub-segment for heavy duty cases in France.118 There is no overlap between the Parties' activities with regard to litho-laminated cases, as Europac is not active in this segment.119

(174) On a local level, taking a 300 km radius around each of the Parties' production plants, the Transaction results in affected markets with regard to the potential sub- segments for both conventional and heavy duty cases in France, Spain and Portugal.

5.1.5.1. Manufacture and supply of corrugated cases - France

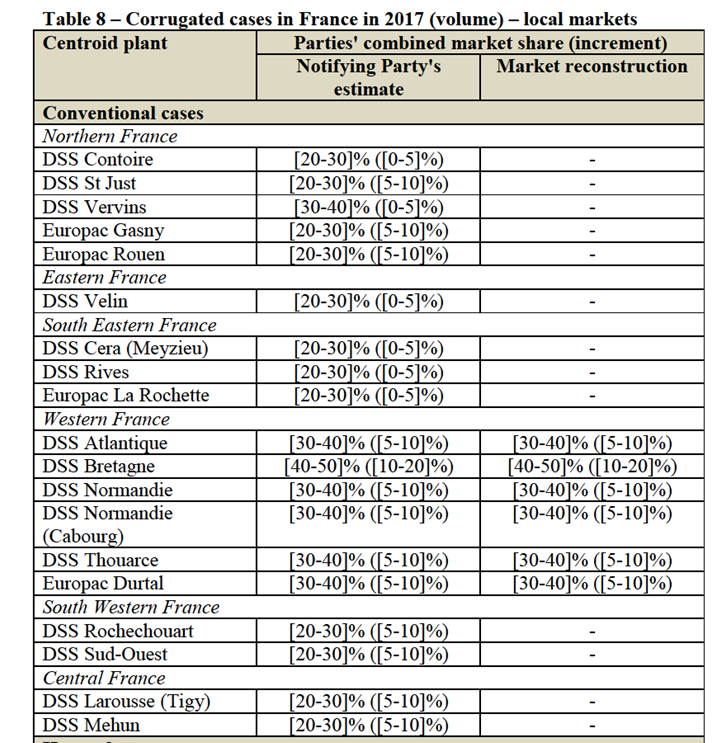

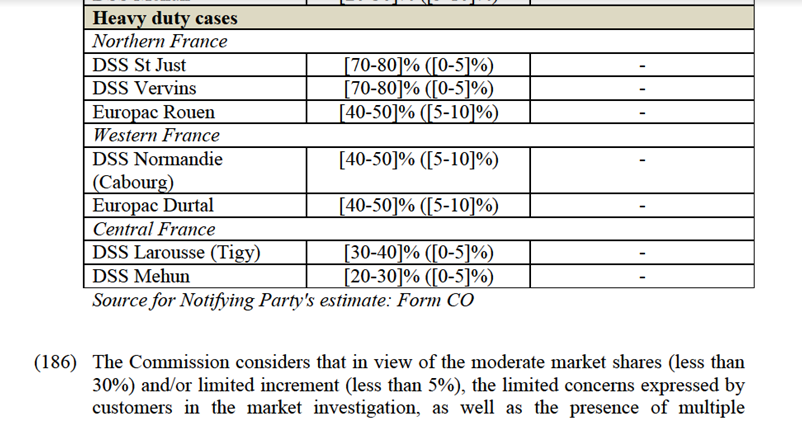

(175) The Parties' activities overlap with regard to the manufacture and supply of cases in France. On a national level the Transaction leads to affected markets as regards the potential sub-markets for each of conventional and heavy duty cases.

(176) At the local level, as regards conventional cases, the Transaction results in 5 affected markets in Northern France,120 1 affected market in Eastern France,121 3 affected markets in South Eastern France,122 6 affected markets in Western France,123 2 affected markets in South Western France124 and 2 affected markets in Central France.125 With regard to heavy duty cases, the Transaction leads to 3 affected markets in Northern France,126 2 affected markets in Western France127 and 2 affected markets in Central France.128

The Notifying Party's view

(177) The Notifying Party submits that the Transaction does not raise competition concerns with regard to cases or any of its sub-segments in France for the following reasons.

(178) First, the combined market shares, as well as the increment brought about by Europac are limited on a national level and there are strong competitors remaining present on the market such as Smurfit Kappa, Saica, International Paper, Rossmann and VPK.

(179) Second, barriers to expansion are low as evidenced by recent investments, by competitors of the Parties in their French plants.

(180) Third, the Notifying Party considers that there is currently spare capacity and competitors could easily and quickly increase output by, for example, increasing the number of production shifts or by adding overtime.

(181) Finally, it argues that case customers are able to exert countervailing buyer power, as a result of tendering and ad-hoc requests for price reductions. […].129

(182) The Notifying Party further submits that no competition concerns arise from the Transaction even if the market for corrugated cases, as well as its sub-segments, were to be defined as local in scope. In its local market analysis,130 the Notifying Party bases itself on local market conditions, by considering the market structure, pricing, available third party capacity, closeness of the Parties and potential constraints from outside the local market.131

The Commission's assessment

(183) At national level, the Parties' combined market share is [20-30]% with regard to each of conventional and heavy duty corrugated cases. The increment brought about by Europac is limited, not exceeding [0-5]%.

competitors,134 the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market with regard to conventional cases in Northern, Eastern, South Eastern, South Western and Central France and with regard to heavy duty cases in Central France. These regions and local markets are therefore not further discussed in the present decision.

Western France – Conventional corrugated cases

(187) The Parties achieve a relatively high market share – varying between [30-40]-[40- 50]%135 – in all six local markets in Western France, when defined as a 300 km radius around each of their six production plants in Western France. The increment brought about by the Transaction varies between [5-10]-[10-20]%.

The Notifying Party's view

(188) The Notifying Party submits that no significant impediment of effective competition arises in relation to the supply of conventional cases in any of the local markets.

(189) First, the Notifying Party argues that there are many strong competitors remaining in all local areas, providing a range of alternative suppliers, as well as a sufficient competitive constraint on the merged entity.

(190) Second, the Notifying Party argues that competitor plants can easily and cheaply increase production in response to a hypothetical rise in the price of cases.

(191) Third, the Notifying Party submits that the radial size of 300 km is arbitrary as conventional cases travel further than this distance and as it excludes competitors’ plants just outside of the radius, which may exert important competitive constraint on the Parties.

(192) Finally, it argues that the Parties are not particularly close competitors in these local markets.136

(193) With regard to Brittany in particular, the Notifying Party submitted additional arguments in its Supplementary submission on 17 October 2018.

(194) First, it reinforces its argument that analysing the market on the basis of radii of 200km or 300km around DSS Bretagne – based on Commission's precedents – does not provide an accurate picture of the Brittany region.

(195) Second, the Notifying Party submits that there are a number of strong competitors in the radius around DSS Bretagne and considers that Europac is very rarely one of the geographically closest suppliers to the customers of DSS Bretagne. It further argues that in substantially all cases, the competitor plants closest to the customer produce sufficient conventional cases to cover the amounts the customer currently purchases from DSS Bretagne. It is therefore not plausible that customers in the region would not be able to secure at least three independent competitive bids post-Transaction.

(196) Third, the Notifying Party claims that the Parties rarely compete with another in this local market.

(197) Finally, the Notifying Party argues that customer orders in this local market tend to be relatively modestly-sized, therefore even small competitors can compete for the vast majority of conventional case opportunities in the local area, ensuring a sufficient number of alternative suppliers.

The Commission's assessment

(198) The Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market with regard to the manufacture and supply of conventional cases in Western France, and in particular in Brittany,137 for the following reasons.

(199) First, the Commission notes that the Parties' combined market shares are relatively high in all local markets, varying between [30-40]-[40-50]%. The Parties achieve the highest combined market share in Brittany, in the local market around DSS Bretagne.

(200) Second, in the market investigation, customers raised various concerns with regard to the conventional cases market in Western France, pointing out that further supply-side concentration resulting from the Transaction would reduce the number of alternative suppliers and lead to price increases.

(201) In particular in Brittany, 78% of the customers responding to the questionnaire indicated that they expect a price increase as a result of the Transaction, 67% replied that the Transaction would have a negative impact on their company and the market in general, and that the intensity of competition will decrease due to the Transaction. Furthermore, 44% of the respondents in the region expressed that they would not have sufficient alternative suppliers should the Parties stop supplying them or supply them at significantly worse conditions.138

(202) Third, although various other competing suppliers are active in Western France, DSS and its largest competitor, Smurfit Kappa, already before the Transaction – and without taking into account the Caradec plant139 -– appear to control more than half of the merchant market in all local areas with a combined market share between [50-60] and [70-80]%. Therefore, the Transaction would increase the combined market share of the two largest suppliers to [60-70]-[80-90]%.

(203) In this regard, the Commission notes that although the Notifying Party submitted, at least with regard to the customers of the DSS Bretagne plant,140 that there are indeed multiple third party plants present in the region and located closer than the Europac Durtal plant to the customers analysed, this analysis is not determinative. This is beacuse these smaller competitors – representing altogether a lower production volume than Europac Durtal alone – would not be able to replace the competitive constraint exerted by Europac pre-transaction. This remains the case even if customer orders tend to be small as claimed by the Notifying Party.141

(204) Fourth, the market investigation did not confirm the Notifying Party's claim that production can be easily increased in the region. Indeed, no structural capacity expansion is foreseen by the competitors in the region,142 and a capacity expansion of more than 10% is seen as difficult.143 The majority of market participants responding to the market questionnaires also do not expect any new suppliers entering the case market in France.144

(205) In any event, even a hypothetical 10% increase in third party merchant sales by all competitors of the Parties would only result in a limited decrease of the combined market shares of the Parties (varying between [30-40]-[40-50]% in the six local markets).

(206) Fifth and as to the Parties’ criticism of the applicable radii-based market definition, the market investigation did not support the Notifying Party's view that customers can source cases from more than 300km (see Section 4.5.2). In any event, adding an additional 100km to the radii would still result in the Parties achieving significant combined market shares in the six local areas ([20-30]-[40- 50]%).

(207) Sixth, due to the highly concentrated supply-side level of the market and the relatively small size of the majority of customers, it is unlikely that buyer power emanating from tenders and multi-sourcing can sufficiently counterbalance price increases induced by the merged entity.

(208) Finally, the Notifying Party asserts that the Europac Durtal plant has not in the past exerted a significant competitive constraint on the DSS plants in the Brittany region […]. However, this is not indicative with regard to its (potential) competitive strength in the future, […].145

(209) Whilst no customer has indicated that its demand is currently supplied by both DSS Bretagne and Europac Durtal,146 the market investigation results indicate that Europac Durtal exerts a competitive constraint on DSS in Brittany. In this regard, the Commission has investigated whether customers located in Brittany147 have seen Europac Durtal in past tenders or would consider it as a viable option to supply from it. The competitive interaction between DSS and the Europac Durtal plant in Brittany is confirmed by the fact that the customers responding to the market investigation indicated for the majority (77%)148 of their plants located in Brittany that Europac Durtal is a current supplier, past supplier, past tender participant or alternative supplier.149

(210) Therefore, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market with regard to the manufacture and supply of conventional cases in Western France, and in particular in Brittany.

Western France – Heavy duty corrugated cases

(211) The Parties also produce heavy duty cases in Western France, leading to two affected local markets, when defined as radii of 300 km around DSS Normandie (Cabourg) and the Europac Durtal plant.

(212) The Commission however considers that the Transaction does not raise serious doubts with regard to heavy duty cases in Western France for the following reasons.

(213) First, the increment is limited ([5-10]-[5-10]%), brought about by the Europac Rouen plant in Western France, with a production of […] msqm (representing less than […]% of its total production).

(214) Second, the market investigation confirmed that heavy duty cases travel farther than conventional cases (see Section 4.5.2). Indeed, the majority of the customers replying to the questionnaire indicated that the maximum distance they consider acceptable for the supply of heavy duty cases is between 300-500km.150 Such further expansion of the geographic scope of the market decreases the Parties' combined market shares and/or the increment in the affected local areas.

(215) With regard to the local market around DSS Normandie (Cabourg), the Parties' combined market share drops to [30-40]% (with an increment of [5-10]%) in a radius of 400km. With regard to the radius around Europac Durtal, the combined market share decreases to [20-30]% in a radius of 400 km, with an increment of [0-5]%, and to [20-30]% in a radius of 500km, with an increment of [0-5]%.

(216) Third, and as detailed in Section 4.5.1, the market investigation suggests that a sliding scale of substitution exists between the different case products and thus no sharp delineation can be made for heavy duty cases. In view of the significantly lower market shares of the Parties in the same geographic area with regard to conventional cases, which to some extent are substitutable with certain heavy duty products, it can be concluded that the market share of the Parties on the strictly defined heavy duty segment overestimates their market power.

(217) Finally, no concerns were raised in the market investigation with regard to heavy duty cases in Western France.

(218) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to heavy duty cases in Western France.

Northern France – Heavy duty corrugated cases

(219) While the Parties' combined market shares are moderate with regard to conventional cases in Northern France, they achieve high market shares with regard to heavy duty cases, varying between [40-50]-[70-80]% in the three affected markets.

(220) The Commission however considers that the Transaction does not raise serious doubts with regard to heavy duty cases in Northern France for the following reasons.

(221) First, the increment brought about by Europac is limited, [0-5]-[5-10]% in each local market. Indeed, the only Europac plant producing heavy duty cases in Northern France is Europac Rouen, with a production of […] msqm (representing less than […]% of its total production).

(222) Second, the market investigation confirmed that heavy duty cases travel farther than conventional cases (see Section 4.5.2). Indeed, the majority of the customers replying to the questionnaire indicated that the maximum distance they consider acceptable for the supply of heavy duty cases is between 300-500km.151 Such further expansion of the geographic scope of the market decreases the Parties' combined market shares and/or the increment in all three affected local areas.

(223) With regard to the local market around DSS St Just, the Parties' combined market share drops to [50-60]% (with an increment of [0-5]%) in a radius of 400km, and to [20-30]% (with an increment of [0-5]%) in a radius of 500km. With regard to the radius around DSS Vervins, the combined market share decreases to [30-40]% in a radius of 400 km (with an increment of [0-5]%), and to [20-30]% in a radius of 500km (with an increment of only [0-5]%). Finally, as regards the local market around Europac Rouen, while the combined market share increases to [60-70]% with a 400km radius, the increment brought about by Europac is very limited, only [0-5]%. As for a radius of 500km, the Parties' combined market share decreases to [40-50]%, with an increment of only [0-5]%.

(224) Third, and as detailed in Section 4.5.1, the market investigation suggests that a sliding scale of substitution exists between the different case products and thus no sharp delineation can be made for heavy duty cases. In view of the significantly lower market shares of the Parties in the same geographic area with regard to conventional cases, which to some extent are substitutable with certain heavy duty products, it can be concluded that the market share of the Parties on the strictly defined heavy duty segment overestimates their competitive power.

(225) Finally, no concerns were raised in the market investigation with regard to heavy duty cases in Northern France.

(226) Therefore, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to heavy duty cases in Northern France.

Conclusion - France

(227) Given the strong position of the merged entity, the high concentration levels of the market, as well as customer concerns, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market with regard to the manufacture and supply of conventional cases in Western France and in particular in the Brittany region. However, the Transaction does not raise serious doubts in other regions of France for either conventional or heavy duty cases.

5.1.5.2. Manufacture and supply of corrugated cases – Spain

(228) In Spain, the Parties' activities overlap with regard to the manufacture and supply of cases, although the Transaction does not result in any affected markets on a national level.152 Nevertheless, at the local level the Transaction results in affected markets with regard to conventional cases in Western Spain, in the 300 km radii around (i) DSS La Coruña, (ii) DSS Pontevedra and (iii) Europac Cartonajes Asturiana, and with regard to heavy duty cases in North Western Spain and Eastern Spain, in the 300 km radii around (iv) DSS Tecnicarton Vigo and (v) DSS Tecnicarton Almussafes (Valencia) respectively.

The Notifying Party's view153

(229) The Notifying Party submits that the Transaction does not raise competition concerns with regard to cases, or any of its sub-segments, in Spain for the following reasons.

(230) First, the Parties' combined market shares, as well as the increment brought about by the Transaction, are limited and strong competitors will remain on the market in Spain, in additional to regional and local players, so that customers will continue to have a range of alternative suppliers. Also, in any direction there are always third party plants in between DSS Pontevedra and Europac's plants, so that the Parties are geographically not particularly close competitors in this radius.

(231) Second, the Notifying Party considers that there is overall spare capacity, and competitors could easily and quickly increase their production in response to a hypothetical rise in prices of cases, inter alia through overtime, increasing the number of shifts or adding a weekend shift.

(232) Third, customers multi-source, and are able to exert buyer power through regular tenders and requests for price reductions.

(233) Fourth, barriers to expansion are relatively low in terms of costs and time.

(240) First, the market share of [30-40]% is also due to the inclusion of the Parties' production facilities in Portugal, which all produce conventional case. As all exports from Portugal, inter alia to Spain, equal only roughly […]% of the Parties' total production of cases in Portugal, the Parties' combined market share does not give a true representation of the competitive pressure exercised by the Parties on each other in respect of customers located in Western Spain.

(241) Second, as regards the 300 km radius, it should be noted that (i) DSS Pontevedra made […]% of its sales to customers located outside of this radius, and that (ii) there is a number of third party plants located just outside the 300 km radius, including production facilities operated by Saica and Hinojosa, which could and potentially do supply cases within the radius.

(242) Third, the market investigation indicated that customers organise tenders to fulfil their demand and multi-source. The Commission notes that post-Transaction, multiple competitors will remain, such as Saica and Smurfit Kappa but also numerous smaller competitors. These competitors represent together a volume that is higher than the combined entity. As such, the customers' ability to organise tenders and multi-source will not be jeopardised.

(243) Fourth, the respondents to the market investigation considered that production can relatively quickly be increased by 10%, through overtime.154 Such a hypothetical increase in production by all competitors would reduce the Parties' combined market share with two percentage points.

(244) In view of the above, the Commission considers that the Transaction does not raise serious doubts as regards its compatibility with the internal market with regard to conventional cases in Western Spain.

North Western Spain – Heavy duty corrugated cases

(245) In the 300 km radius around DSS Tecnicarton Vigo, the Parties' combined market share is [30-40]%, with an increment brought about by the Transaction of [5- 10]%.

(246) The Commission considers nevertheless that the Transaction does not raise competition concerns with regard to heavy duty cases in the 300 km radius around DSS Tecnicarton Vigo, for the reasons set out below.

(247) First, DSS' market share is limited ([5-10]%), and equals a production of heavy duty cases of only […] msqm. Of this […] msqm, part is generated by DSS's production facility in Portugal, DSS Tecnicarton Agueda. In addition, Europac's market share is fully generated by its production facilities in Portugal; Europac does not have any production facilities of heavy duty cases in North Western Spain.

(248) Second, and as detailed in Section 4.5.1, the market investigation suggests that a sliding scale of substitution exists between the different case products and thus no sharp delineation can be made for heavy duty cases. Therefore, it can be concluded that the combined market share of the Parties on the strictly defined heavy duty segment would overestimate their market power.

(249) Third, the market investigation confirmed that heavy duty cases travel further than conventional cases (see Section 4.5.2). Indeed, the majority of the customers replying to the questionnaire indicated that the maximum distance they consider acceptable for the supply of heavy duty cases is between 300-500 km.155 Such further expansion of the geographic scope of the market decreases the Parties' combined market shares and/or the increment in the affected local areas – to [10- 20]% with a [5-10]% increment at 500 km, as there is a number of additional competitor plants (including Zarrinha, Embalpacos, Jose Neves and Cartocerm Lda.) located outside of the 300 km radius but within 500 km of Tecnicarton Vigo.

(250) Fourth, DSS Tecnicarton Vigo and Europac are not each other's closest competitors because unlike Europac, Tecnicarton Vigo is not focused on corrugated packaging but rather on designing and producing tailor-made multi- material solutions for its customers, using materials such as plastic, metal, foam and paper with corrugated packaging only being produced incidentally, as evidenced by the fact that the two facilities together produce only […] msqm.

(251) Finally, no concerns were raised in the market investigation with regard to heavy duty cases in North Western Spain.

(252) In view of the above, the Commission considers that the Transaction does not raise serious doubts as regards its compatibility with the internal market with regard to heavy duty cases in North Western Spain.

Eastern Spain – Heavy duty corrugated cases