Commission, February 12, 2019, No M.8964

EUROPEAN COMMISSION

Decision

DELTA / AIR FRANCE-KLM / VIRGIN GROUP / VIRGIN ATLANTIC

Subject: Case M.8964 - DELTA / AIR FRANCE-KLM / VIRGIN GROUP / VIRGIN ATLANTIC

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 08 January 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Air France-KLM S.A. (“AFKL”, France), Delta Air Lines, Inc. (“Delta”, the United States of America) and Virgin Group (the British Virgin Islands) acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of the whole of Virgin Atlantic Limited (“VAL”, the United Kingdom) by way of purchase of shares (“the Transaction”). (3) AFKL, Delta, Virgin Group and VAL are designated hereinafter as the “Parties”.

1. THE PARTIES

(2) AFKL is a French company and is the holding company of Société Air France (“AF”), the French national carrier airline, and Koninklijke Luchtvaart Maatschappij N.V. (“KL”), the Dutch national carrier airline. (4) AFKL provides passenger air transport services, cargo air transport services and maintenance, repair and overhaul services (“MRO”). In 2017, AFKL carried 99 million passengers to 314 destinations in 116 countries with a fleet of 537 aircraft in operation.

(3) Delta is an international airline with headquarters in the United States. Delta provides passenger air transport services and cargo air transport services, using belly space on its passenger aircraft, as well as MRO services. Delta carries approximately 180 million passengers a year to more than 300 destinations in over 50 countries with a fleet of more than 800 aircraft.

(4) Virgin Group is the holding company of a group of companies, including VAL, active in a wide range of products and services worldwide. The Virgin Group holding company, Virgin Group Holdings Limited, is wholly-owned by Sir Richard Branson.

(5) VAL is the holding company of Virgin Atlantic Airways Limited (“Virgin Atlantic”) and Virgin Holidays Limited (“Virgin Holidays”). Virgin Atlantic is an international airline with headquarters in the United Kingdom (“UK”), providing passenger air transport services and cargo air transport services, using belly space on its passenger aircraft, as well as MRO services. Virgin Atlantic flies to 34 destinations worldwide. Virgin Holidays is a UK tour operator which supplies and distributes package holidays and ancillary products.

Pre-existing corporate and commercial relationships between the parties

(6) Delta is a shareholder of both AFKL and VAL, and the Parties have existing alliance and joint venture relationships:

- AF and Delta were founding members of the SkyTeam alliance in 2001. Since 2004 (shortly after the merger of AF and KL), KL has also been a full member of the SkyTeam alliance.

- AFKL and Delta are also members of SkyTeam Cargo, a global airline cargo alliance, started in 2000.

- Delta, AF, KL and Alitalia Compagnia Aerea Italiana S.P.A. (“Alitalia”) are parties to the TATL Joint Venture, a metal neutral joint venture arrangement covering various routes between Europe and North America, and other geographic regions. (5)

- Delta and Virgin Atlantic are parties to the Delta-Virgin Atlantic Joint Venture, a metal neutral joint venture arrangement covering non-stop routes between the UK and North America. (6)

- Delta, AF, KL, Alitalia and Virgin Atlantic are also parties to a coordination agreement dated 8 April 2013 (the “5-Way Coordination Agreement”), pursuant to which these parties established a framework for coordination of commercial activities covering city pair routings between the UK and North America. (7)

2. THE CONCENTRATION

(7) The Transaction concerns the proposed acquisition by AFKL of a 31% joint- controlling interest in VAL. In addition, the Parties intend to implement a (new) transatlantic joint venture agreement (“JVA”) (8) between AFKL, AF, KL, Delta and Virgin Atlantic and the Enhanced Strategic Cooperation Agreement (“ESCA”) described in the ESCA memorandum of understanding (“ESCA MOU”) (9) between Virgin Atlantic, AFKL, AF and KL.

AFKL entering as a new shareholder

(8) Pre-Transaction, Virgin Group and Delta respectively own 51% and 49% of the shares in VAL and have joint control over VAL. (10)

(9) Pursuant to a Sale and Purchase Agreement (“SPA”) (11), executed on 15 May 2018, AFKL will acquire a 31% equity interest in VAL from Virgin Group.

(10) Post-Transaction, AFKL will therefore own 31%, Virgin Group 20% and Delta 49% of the shares in VAL.

Implementation of a transatlantic joint venture agreement and the ESCA MOU

(11) Pursuant to the JVA between AFKL, AF, KL, Delta and Virgin Atlantic, the Parties intend to establish a new transatlantic joint venture agreement combining (i) [details of cooperation arrangement] (12) and (ii) the metal neutral joint venture arrangement between Delta and Virgin Atlantic (the “Delta-Virgin Atlantic Joint Venture” (13)). This expanded joint venture will cover the Parties [details on potential parties to new transatlantic joint venture agreement] (14) [further details on the joint venture agreement].

(12) In addition to the JVA, Virgin Atlantic, AFKL, AF and KL have concluded an ESCA MOU which regulates how AFKL and Virgin Atlantic intend to organise and implement bilateral cooperation on certain routes between Europe (including the UK) and the rest of the world (excluding North America). (15)

Scope of this Decision

(13) This Decision only assesses the impact on competition resulting from the acquisition by AFKL of a joint-controlling interest in VAL. The Commission does not assess the impact on competition resulting from the pre-existing relationships between AFKL and Delta as these have been assessed in the Commission’s Decision in case AT.39964 – Air France/KLM/Alitalia/Delta. (16) In that respect, the Parties have notified the Transaction based on the assumption that the TATL Joint Venture and Delta-Virgin Atlantic Joint Venture are in place. However, this decision is without prejudice to the application of Article 101 TFEU to any existing or envisaged agreement between the Parties, including without limitation the TATL Joint Venture, the DL-VS Joint Venture, the JVA and the 5-Way Coordination Agreement.

Joint control

(14) The Board of Directors of VAL will consist of [details about composition of the Board of Directors]. (17) [Details about appointment of the Chairman]. (18) [Further details about appointment of the Chairman]. [Details about appointment of executive director]. (19)

(15) [Details about voting mechanism] (20); [further details about voting mechanism]. (21)

(16) The approval of strategic business plans, annual budgets, borrowings beyond the current annual budget, capital expenditure beyond the current annual budget, and any material contract not authorised by the current annual budget (each a “Special Matter”), will be subject to a special approval process, [details about voting mechanism and veto rights]. (22) [Further details about voting mechanism and veto rights].

(17) In addition, each of Delta, AFKL and Virgin Group has a veto right over [details about veto rights]. (23)

(18) Besides, for the sake of completeness, the Shareholders Agreement provides that, upon implementation of the JVA, which is conditional upon all necessary regulatory approvals having been obtained, (24) [details about veto rights]. (25)

(19) According to paragraphs 62 and 69 of the Consolidated Jurisdictional Notice, the power to co-determine the structure of the senior management, such as the members of the board and the power to block actions which determine the strategic commercial behaviour of an undertaking, usually confers upon the holder the power to exercise decisive influence on the commercial policy of an undertaking.

(20) As a result, post-Transaction, Delta, AFKL and Virgin Group will jointly control VAL and its subsidiaries (notably Virgin Atlantic and Virgin Holidays). (26)

Full-functionality

(21) VAL has sufficient own staff, financial resources and dedicated management for its operation and for the management of its portfolio and business interests. Furthermore, VAL will not be limited to exercising a specific function for its parents as it will continue to have a market presence. It also does not have significant sale or purchase relationships with its parents. Finally, VAL is intended to operate on a lasting basis. Therefore, VAL is a full-functional joint venture.

3. EU DIMENSION

(22) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million (27) (AFKL: EUR 25 781 million, Delta: EUR 36 499 million, Virgin Group: EUR […] and VAL: EUR 3 038 million). Each of them has an EU-wide turnover in excess of EUR 250 million (AFKL: EUR […], Delta: EUR: […], Virgin Group: EUR […] and VAL: EUR […]), and they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. (28) The notified operation therefore has an EU dimension.

4. RELEVANT PRODUCT AND GEOGRAPHIC MARKETS

(23) The Parties' activities overlap in (i) passenger air transport services (29), (ii) cargo air transport services and (iii) maintenance, repair and overhaul (“MRO”) services.

4.1. Identification of the relevant markets in respect of air transport services of passengers

4.1.1. Relevance of the O&D approach

(24) In respect of air transport services of passengers, the Commission has, in its prior decision practice related to air transport, defined the relevant markets for scheduled passenger air transport services on the basis of two approaches: (i) the "point of origin/point of destination" ("O&D") city-pair approach, where the target was an active air carrier; (30) and (ii) the "airport-by-airport" approach, when the target included an important slot portfolio. (31)

(25) Under the O&D approach, every combination of an airport or city of origin to an airport or city of destination is defined as a distinct market. Such a market definition reflects the demand-side perspective whereby passengers consider all possible alternatives of travelling from a city of origin to a city of destination, which they do not consider substitutable for a different city pair. The effects of a transaction on competition are thus assessed for each O&D separately.

4.1.2. Relevance of the airport-by-airport approach

(26) Under the airport-by-airport approach, every airport (or substitutable airports) is defined as a distinct market. Such a market definition has notably been adopted to assess the risks of foreclosure entailed by the concentration of slots at certain airports in the hands of a single undertaking. (32) Under this approach, the effects of a transaction on competition are thus assessed for all O&Ds taken together to or from an airport (or substitutable airports).

4.1.2.1. Introduction

Slots as an input for air transport services

(27) By virtue of the Slot Regulation, (33) slots, i.e. the permission to land and take-off at a specific date and time at congested airports, are essential for airlines' operations. Indeed, only air carriers holding slots are entitled to get access to the airport infrastructure services delivered by airport managers and, consequently, to operate routes to or from those airports.

(28) The Commission has, in its prior decision practice, highlighted that the lack of access to slots constitutes a significant barrier to entry or expansion at Europe's busiest airports, such as London Heathrow airport. (34)

(29) The Commission has also insisted, in the framework of its airport policy, that "slots are a rare resource" and "access to such resources is of crucial importance for the provision of air transport services and for the maintenance of effective competition." (35)

(30) In addition, the Slot Regulation recalls that, with the increase of air traffic, there is a continuously growing demand for capacity at congested airports. (36) Therefore, the lack of available slots has become a prominent feature of the EU airline industry and is expected to become an even more critical issue for air carriers in the near future.

Rules for the allocation of slots

(31) In the context of the imbalance between demand and supply of airport capacity, the Slot Regulation defines the rules for the allocation of slots at EU airports. It aims to ensure that, where airport capacity is scarce, the latter is used in the fullest and most efficient way and slots are distributed in an equitable, non- discriminatory and transparent way.

(32) Under the Slot Regulation, the general principle regarding slot allocation is that an air carrier having operated its particular slots for at least 80% during the summer or winter scheduling period is entitled to the same slots in the equivalent scheduling period of the following year (the "grandfather rights"). (37) Conversely, slots which are not sufficiently used by air carriers (below 80%) are reallocated to other air carriers (the "use it or lose it" rule).

(33) The Slot Regulation also provides for the setting up of "pools" containing newly- created time slots, unused slots and slots which have been given up by a carrier or have otherwise become available (e.g. via the “use it or lose it” rule). 50% of the slots from the slot pool shall first be offered to new entrants. The other 50% of the slots from the slot pool shall be placed at the disposal of other applicant airlines (incumbent airlines). If applications by new entrants amount to less than 50% of the capacity made available through slots from the pool, this remaining capacity shall also be placed at the other applicants' disposal. (38)

(34) Under the Slot Regulation, slots cannot be traded. They may however be exchanged or transferred between airlines in certain specified circumstances and subject to the explicit confirmation from the coordinator under the Slot Regulation. (39)

4.1.2.2. Parties’ views

(35) The Parties do not object to the airport-by-airport approach but submit that the Transaction does not make any material change to the position of any of the Parties at any EEA airport. (40)

4.1.2.3. Commission’s assessment

(36) According to the Explanatory Memorandum for the Commission Proposal for a Regulation of the European Parliament and of the Council on common rules for the allocation of slots at European Union airports, (41) "the emergence of a strong competitor at a given airport requires it to build up a sustainable slot portfolio to allow it to compete effectively with the dominant carrier (usually the “home” carrier)."

(37) In this context, in a number of prior decisions related to transactions entailing the transfer of slots at certain airports, the Commission has considered the effects of the transaction on the operation of passenger air transport services at a given airport in terms of the slot portfolio held by a carrier at the airport, without distinguishing between the specific routes served to or from that airport. (42) Under this approach, the Commission assesses how the transaction strengthens the merged entity's position at certain airports and the potential effects thereof on the merged entity’s ability and incentive to foreclose other air carriers from accessing the relevant airports. Foreclosing access to airports may in turn foreclose those other air carriers from operating routes from/to the relevant airports. (43)

(38) AFKL’s major hubs are Amsterdam and Paris-Charles de Gaulle airports, (44) where Delta holds a negligible amount of slots. (45) Delta’s slots at these airports are all used for existing TATL Joint Venture services. Virgin Atlantic does not hold any slot (and historic rights thereto) at Amsterdam or Paris-Charles de Gaulle airports, nor at any EEA airport outside the United Kingdom. (46) Therefore, the Transaction will not have any impact on any of the Parties’ slot portfolio at any EEA airport outside the United Kingdom. (47)

(39) In the United Kingdom, Delta/Virgin Atlantic hold slots (and historic rights thereto) at London Heathrow, London Gatwick and Manchester airports in both IATA Seasons. AFKL also holds slots at London Heathrow and Manchester airports in both IATA Seasons. The Parties’ slot portfolios thus overlap at London Heathrow and Manchester airports. (48)

(40) Therefore, in view of the above, the Commission considers it appropriate, for the purpose of this Decision, to apply the analytical framework designed to address the risk of foreclosure from access to airport infrastructure services potentially resulting from the acquisition of joint control over Virgin Atlantic, at airports where the slot portfolio of Virgin Atlantic/Delta and AFKL overlap in Winter 2018/2019 and Summer 2019 IATA Seasons, namely London Heathrow and Manchester airports.

4.1.3. Relevance of the market for air transport services to tour operators

(41) Carriers, both charter and scheduled airlines, may sell seats (or entire flights) to tour operators, which then integrate the flights into package holidays or resell seats only to end customers.

(42) In prior decisions, the Commission has regarded the wholesale supply of airline seats to tour operators as a distinct market from the supply of scheduled air transport services to end customers. (49) Indeed, from a demand-side perspective, tour operators have different requirements from those of individual passengers (for example, purchase of large seat packages in advance from the start of the season, negotiation of rebates, taking into account passengers’ needs in terms of flight times). In Ryanair/Aer Lingus III, the Commission stated that “competitive conditions in this market [the supply of seats to tour operators] are manifestly different, since tour operators have different requirements from those of individual customers (for example, buying of large seat packages, negotiation of rebates, taking into account of customers' needs in terms of flight times).” (50)

4.1.3.1. Parties’ views

(43) The Parties stated that the distinction between retail and wholesale supply of airline seats to tour operators is not meaningful for the competitive assessment of specific routes in the case at hand. (51)

4.1.3.2. Commission’s assessment

(44) The Commission considers that, for the purpose of assessing the horizontal effects of the Transaction, the supply of airline seats to tour operators only constitutes a meaningful market on routes where either AFKL or Virgin (52) are active to a significant extent. (53) Indeed, in the absence of any (material) overlap, the market for the supply of airline seats to tour operators cannot be considered as meaningful for the purpose of the Transaction. (54)

(45) Therefore, for the purpose of the Transaction, a competitive assessment of the effects of the Transaction on the market for the supply of airline seats to tour operators could be meaningful only on the London – Shanghai route. (55) Nevertheless, the Commission notes that competitive features on the London – Shanghai route are similar as regards both the supply of scheduled air transport services to end customers and the supply of airline seats to tour operators. (56) In particular, the Commission notes that the main competitors of the Parties in the supply of air transport services to end customers are also active on the supply of seats to tour operators. For instance, the established carrier China Eastern operated a daily direct flight on the London – Shanghai route in Summer 2017 and six weekly frequencies in Winter 2017/2018 IATA Season. (57) While the Parties do not have access to third party data for the market for the supply of seats to tour operators, they estimate that their market shares (58) and the increment brought about by the Transaction are moderate under any plausible market definition, as in the market for supply of air transport services to end customers. (59)

(46) In view of the moderate market shares and increments and the presence of established carriers offering direct flights on the markets for the supply of airline seats to (i) tour operators and (ii) end customers, the Commission considers that, for the purpose of this Decision, it is not necessary to further assess the effects of the Transaction on the market for the supply of airline seats to tour operators with regard to the London – Shanghai route.

(47) In any event, the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market with respect to the supply of airline seats to tour operators, under any plausible market definition.

4.1.4. Conclusion on the relevant market in respect of passenger air transport services

(48) In the present case, the target is an active air carrier and the Parties’ slot holding overlap at London Heathrow and Manchester airports. In its prior decisional practice, the Commission noted that London Heathrow is an airport where barriers to entry are high due to the scarcity of slots. (60) Therefore, the relevant market for scheduled passenger air transport services will be defined under both the O&D approach and the airport-by-airport approach.

(49) For the purpose of this Decision, the Commission considers that it is not necessary to further assess the effects of the Transaction on the market for the supply of airline seats to tour operators.

4.2. Definition of the relevant markets

4.2.1. O&D approach - Air transport services of passengers

4.2.1.1. Distinction between groups of passengers

The Parties’ views

(50) The Parties note that in previous cases the Commission has considered that a distinction may be drawn between (i) time sensitive (“TS” or premium) passengers and (ii) non-time sensitive (“NTS” or non-premium) passengers, while ultimately leaving the market definition open in many instances. The Parties do not object to this distinction. Consistent with the Commission’s previous approach, the Parties have considered that (i) restricted economy class passengers were NTS passengers and (ii) all first class, business class and premium economy class passengers, as well as economy class passengers with the most flexible economy tickets were TS passengers. (61)

Commission’s assessment

(51) The Commission has in its decisional practice (mostly concerning network carriers) considered distinguishing, for a given O&D route, between (i) time sensitive ("TS" or premium) passengers who tend to travel for business purposes, require significant flexibility for their tickets and are willing to pay higher prices for this flexibility, and (ii) non-time sensitive ("NTS" or non- premium) passengers who travel predominantly for leisure purposes, do not require flexibility with their booking and are more price-sensitive than the first category. (62)

(52) In its recent decisional practice relating to long-haul flights, the Commission has considered that it may be relevant to distinguish between TS and NTS passengers, although ultimately leaving the question open. (63)

(53) The outcome of the market investigation is inconclusive, as to whether the distinction between TS and NTS passengers is relevant for the purpose of the Transaction. (64) While some competitors, travel agents and corporate customers indicated that the distinction was relevant for the assessment of the Transaction, other respondents to the market investigation considered that the distinction between TS and NTS passengers has become increasingly blurred, as some business travellers increasingly travel on economy fares, whereas leisure travellers might choose a “premium” cabin to secure a seat on a high-demand flight. (65)

Conclusion

(54) In light of the above, the Commission concludes that the question whether it is necessary to distinguish between TS and NTS passengers can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition. The Commission will consider the relevance of the distinction between TS and NTS passengers in the route-by-route analysis where relevant.

4.2.1.2. Distinction between direct and indirect flights (66)

The Parties’ views

(55) The Parties submit that on the overlap routes passengers consider indirect flights as an equivalent alternative to direct flights. In that regard, the Parties’ booking data show that some passengers do choose one-stop flights, although those indirect flights are more than 150 minutes longer in duration than non-stop flights. (67) Therefore, the Parties consider that one-stop flights may impose a competitive constraint on non-stop flights and that the extent to which one-stop flights are substitutable for non-stop flights is apparent from the booking data for a certain route.. The Parties have submitted market shares for all non- stop/one-stop and one-stop/one-stop overlap routes.

Commission’s assessment

(56) On a given O&D pair, passengers can travel either by way of a direct flight between the point of origin and the point of destination or by way of an "indirect" flight on the same O&D pair via an intermediate destination. (68)

(57) The level of substitutability of indirect flights to direct flights largely depends on the duration of the flight. As a general rule, the longer the flight, the higher the likelihood that indirect flights exert a competitive constraint on direct flights. (69)

(58) The Transaction does not give rise to any short/medium-haul overlap routes, because Virgin Atlantic does not operate any short/medium-haul services. (70) Therefore, the question of the substitutability of direct and indirect flights is only needs to be addressed for long-haul services.

(59) In prior decisions, the Commission has considered that with respect to long-haul routes (more than 6 hours flight duration), indirect flights constitute a competitive alternative to direct services under certain conditions (for example if they are marketed as connecting flights on the O&D pair in the computer reservation systems). (71)

(60) A majority of competitors having expressed their views confirmed that one-stop services could constitute competitive alternatives to non-stop services as identified above. (72) The majority of travel agencies stated that, on each of the relevant routes for the purpose of this decision, they sell tickets to both direct and indirect flights to their customers. The majority of corporate customers having expressed a view stated that they buy tickets for both direct and indirect flights on the affected direct/indirect overlap routes. (73) Travel agents and corporate agents having expressed a view specifically mentioned that the following criteria can lead passengers to choose one-stop flights over non-stop flights: the price, the total travel duration (including stopover times), the schedules and the number of frequencies. (74)

Conclusion

(61) The Transaction does not give rise to direct/direct overlap routes. (75) If direct and indirect flights were to be considered as two separate markets, the direct/indirect overlap routes would not be affected overlap routes as a result of the Transaction. For the purpose of this Decision, the Commission will consider that direct and indirect flights are part of the same market and assess the effects of the Transaction on direct/indirect overlap routes. Nevertheless, the conclusion on whether or not direct and indirect flights belong to the same market can be left open as the Transaction would not raise serious doubts as to its compatibility with the internal market under either of these alternative market definitions.

4.2.1.3. Distinction between charter flights and scheduled flights

The Parties’ views

(62) The Parties submit that they face significant competition from charter companies selling so-called “dry seats” (seats only without other services) on a number of routes, especially in respect of sunshine/leisure destinations in the Caribbean (such as Cuba and Jamaica) served by Virgin Atlantic. (76)

(63) In the Parties’ views, charter flights offering “dry seats” and scheduled flights are substitutable and are therefore part of the same relevant product market. (77)

Commission’s assessment

(64) The Commission has previously considered that charter flights, as opposed to scheduled flights, are usually defined as air transport services that take place outside normal schedules, normally through a hiring arrangement with a particular customer (in particular a tour operator). Charter companies often fly to destinations where no scheduled airline is active and usually operate on a seasonal basis with a relatively low frequency of flights, in response to the requirements of tour operators (for example, once a week on Saturday, only during the summer or only during the ski season). (78)

(65) The Commission has also considered that charter companies do not traditionally sell tickets directly to passengers. They sell seats on their aircraft to tour operators, which include the flight in a holiday package. As such, the flight (air transport) is part of a package holiday, the price of which includes flights, accommodation and other services. However, charter companies sell to some extent "dry seats" directly to passengers. (79)

(66) The Commission has previously held that most of the services offered by charter companies (package holiday sales, seat sales to tour operators) are not in the same market as scheduled point-to-point air passenger transport services. (80) However, as regards charter carriers selling dry seats and scheduled point-to- point air passenger transport services, the Commission has left open whether they are part of the same relevant product market and has considered the relevance of dry seats offered by charter companies in its competitive assessment. (81)

(67) The Parties submit that charter carriers are not represented in the market data they submitted. (82) The Commission notes that the market data submitted by the Parties includes on some routes the airlines Thomas Cook/Condor and TUI, which are integrated into a tour operating company.

Conclusion

(68) In light of the above, the Commission considers that the question of whether dry seats are part of the same market as scheduled air transport services can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition. The Commission will consider the relevance of the dry seats sold by charter airlines in the route- by-route analysis where relevant.

4.2.1.4. Airport substitutability

Analytical framework

(69) When defining the relevant O&D markets for passenger air transport services, the Commission has previously found that flights to or from airports with sufficiently overlapping catchment areas can be considered as substitutes in the eyes of passengers (particularly if the airports serve the same main city). In order to correctly capture the competitive constraint that flights to or from two different airports exert on each other, a detailed analysis taking into consideration the specific characteristics of the relevant airports is necessary. (83)

(70) The evidence used to characterise airport substitutability includes inter alia a comparison of actual distances and travelling times to the indicative benchmark of 100 km/1 hour driving time, (84) the outcome of the market investigation (views of the competitors and other market participants), and the competitors’ practices in terms of monitoring of competition.

(71) In the present case, taking account of the relevant routes where the Parties’ activities overlap, the question of airport substitutability arises for the routes to or from the following cities: Shanghai, Lyon, Paris, Düsseldorf, Milan, London, Manchester, New York, Orlando and San Francisco

(72) Nevertheless, for the purpose of this Decision, the question of airport substitutability is not relevant for Shanghai, Lyon, Düsseldorf, Manchester, Orlando and San Francisco. (85)

Assessment of airport substitutability

a) Paris

(73) Paris has two main airports, namely Charles de Gaulle (CDG) and Orly (ORY).

(74) In its prior decision practice, the Commission has considered ORY and CDG as substitutable airports, but ultimately left the question open. (86)

(75) For the purposes of the O&D assessment of the Transaction, the question of airport substitutability is relevant for the following routes: Paris – San-Francisco and Paris – Boston.

(76) On the Paris – San Francisco route, AFKL/Delta operates direct services and markets an indirect service to/from CDG. VAL only operates indirect services to/from CDG while Frenchbee operates a direct service to/from ORY. (87)

(77) On the Paris – Boston route, AFKL/Delta operates direct services and markets an indirect service to/from CDG. VAL only operates indirect services to/from CDG. (88)

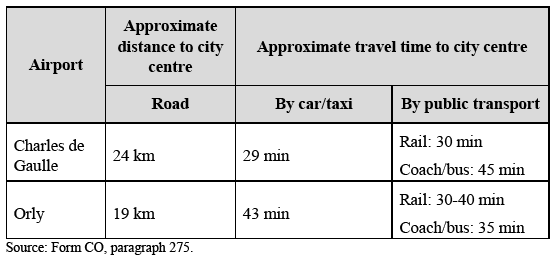

(78) The travel distances and times between Charles de Gaulle and Orly airports and the centre of Paris are summarised below:

(79) Both competitors and corporate customers and travel agents having expressed a view gave mixed replies as to whether passengers consider CDG and ORY as substitutable. (89) The majority of competitors having expressed a view do monitor air carriers flying on the Paris – San Francisco and Paris - Boston routes to/from CDG or ORY. (90) The outcome of the market investigation is therefore inconclusive.

(80) In any case, for the purpose of this Decision, the question of whether the relevant market consists of Charles de Gaulle, or of Charles de Gaulle and Orly, can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under either plausible market definition.

b) Milan

(81) Milan has three airports, namely Malpensa (MXP), Linate (LIN) and Bergamo (BGY). In light of the fact that mostly domestic and short/medium-haul flights are operated from Bergamo, the latter will therefore not be included in the airport substitutability analysis.

(82) In its prior decision practice, the Commission has considered Malpensa and Linate as substitutable, but the market definition was ultimately left open. (91)

(83) For the purposes of the O&D assessment of the Transaction, the question of airport substitutability is relevant for the routes: Milan – Los Angeles and Milan – San Francisco.

(84) With respect to both the Milan – Los Angeles and Milan – San Francisco routes, the Parties operate indirect services to/from MXP and to/from LIN. (92)

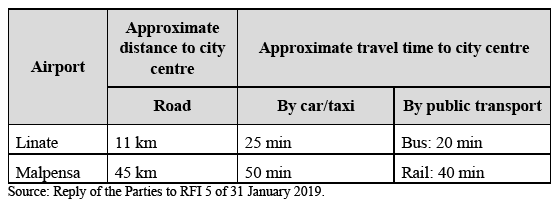

(85) The travel distances and times between Linate and Malpensa airports and the centre of Milan are summarised below:

(86) Both competitors and corporate customers and travel agents having expressed a view gave mixed replies as to whether passengers consider LXP and LIN airports as substitutable. (93) The majority of competitors having expressed a view do monitor air carriers flying on the Milan – Los Angeles and Milan – San Francisco routes to/from MXP or LIN. (94) The outcome of the market investigation is therefore inconclusive.

(87) In any case, for the purpose of this Decision, the question of whether the relevant market consists of Malpensa, or of Malpensa and Linate, can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under either plausible market definition.

c) London

(88) London has six main airports, namely Heathrow (LHR), Gatwick (LGW), City (LCY), Stansted (STN), Luton (LTN) and Southend (SEN). (95)

(89) In its prior decisional practice relating to long-haul services to/from London, the Commission examined the effects of the transaction on a market comprising flights to and from Heathrow only and on a wider market comprising flights to and from LHR, LGW and LCY, but the market definition was ultimately left open. (96)

(90) The Parties consider that there is no reason to deviate from this practice. (97)

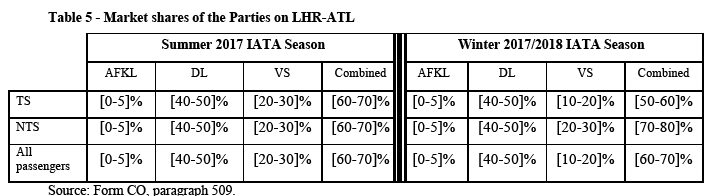

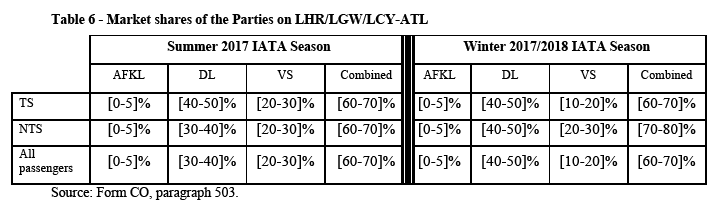

(91) For the purposes of the O&D assessment of the Transaction, the question of airport substitutability is relevant for the following routes: London – Seattle, London – Atlanta, London – Minneapolis, London – Detroit, London – Portland, London – Lagos, London – Shanghai, London – Havana and London – Montego Bay.

(92) On the London – Seattle route, VAL/Delta operates direct and indirect services to/from LHR. AFKL operates indirect services to/from LHR via AMS or CDG. VAL/Delta also operates indirect services to/from LGW while Norwegian operates direct services to/from LGW. (98)

(93) On the London - Atlanta route, VAL/Delta operates direct and indirect services to/from LHR. AFKL operates indirect service to/from LHR via AMS or CDG. VAL/Delta also operates an indirect service to/from LGW. (99)

(94) On the London – Minneapolis route, VAL/Delta operates direct and indirect services to/from LHR. AFKL operates indirect services to/from LHR via AMS or CDG. (100)

(95) On the London – Detroit route, VAL/Delta operates direct and indirect services to/from LHR. AFKL operates indirect services to/from LHR via AMS or CDG. (101)

(96) On the London – Portland route, VAL/Delta operates direct and indirect services to/from LHR. AFKL operates indirect services to/from LHR via AMS or CDG. (102)

(97) On the London – Lagos route, VAL operates direct and indirect services to/from LHR. AFKL operates indirect services to/from LHR and to/from LCY. (103)

(98) On the London – Shanghai route, VAL operates direct services to/from LHR. AFKL operates indirect services to/from LHR and to/from LCY. (104)

(99) On the London – Havana route, VAL operates direct and indirect services to/from LGW. AFKL operates indirect services to/from LHR. (105)

(100) On the London – Montego Bay route, VAL operates direct services to/from LGW while AFKL and VAL/Delta operate indirect services to/from LHR. (106)

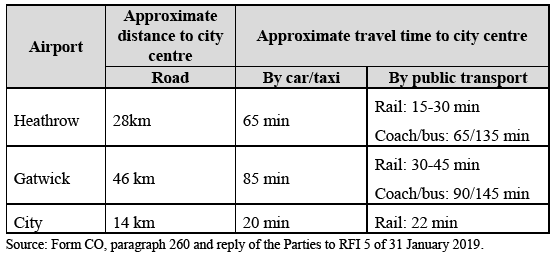

(101) The travel distances and times between Heathrow, Gatwick and City airports and the centre of London are summarised below:

(102) Both competitors and corporate customers and travel agents having expressed a view gave mixed replies as to whether the relevant market consists of flights to/from LHR only, or to/from LHR, LGW and LCY taken together. (107) The majority of competitors having expressed a view do monitor air carriers flying to/from LHR, LGW or LCY on the routes listed in paragraph (91) above. (108) The outcome of the market investigation is therefore inconclusive.

(103) In any case, for the purpose of this Decision, the question of whether the relevant market consists of flights to/from Heathrow only, or to/from Heathrow, Gatwick and City airports, can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under either plausible market definition.

d) New-York

(104) The city of New York is served by three primary airports, namely John F. Kennedy (JFK), Newark Liberty (EWR) and La Guardia (LGA) airports. La Guardia predominantly serves North American destinations and there are no direct flights to and from La Guardia relevant for the assessment of the Transaction. (109) La Guardia will therefore not be included in the airport substitutability analysis.

(105) In its prior decisional practice relating to transatlantic flights to/from New York, the Commission examined the effects of the transaction on a market comprising flights to and from JFK only and a wider market comprising flights to and from JFK and EWR, but the market definition was ultimately left open. (110)

(106) For the purposes of the O&D assessment of the Transaction, the question of airport substitutability is relevant for the following routes: Manchester – New York, Edinburgh – New York, Nice – New York, Dublin – New York, Lyon – New York, Marseille – New York and Hamburg – New York.

(107) On the Manchester – New York route, VAL/Delta operates direct and indirect services to/from JFK and indirect services to/from EWR. AFKL operates indirect services to/from JFK while United Airlines, Lufthansa and Air Canada operate direct services to/from EWR. (111)

(108) On the Edinburgh – New York route, VAL/Delta operates direct and indirect services to/from JFK. AFKL operates indirect services to/from JFK via AMS or CDG while United Airlines, Lufthansa and Air Canada operate direct services to/from EWR. (112)

(109) On the Nice – New York route, AFKL/Delta operates direct and indirect services to/from JFK while VAL operates indirect services to/from JFK. The Parties also operate limited indirect services to/from EWR. (113)

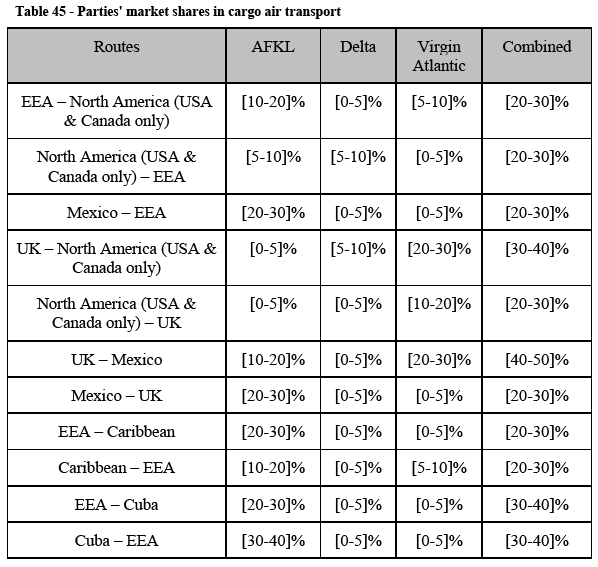

(110) On the Dublin – New York route, AFKL/Delta operates direct and indirect services to/from JFK. VAL operates indirect services to/from JFK and to/from EWR while United Airlines, Lufthansa, Air Canada and Aer Lingus operate direct services to/from EWR. (114)

(111) On the Lyon – New York route, the Parties operate indirect services to/from JFK and to/from EWR. (115)

(112) On the Marseille – New York route, the Parties operate indirect services to/from JFK and to/from EWR. (116)

(113) On the Hamburg – New York route, the Parties operate indirect services to/from JFK and to/from EWR while United Airlines operates a direct service to/from EWR in summer only. (117)

(114) The Parties consider JFK and EWR as substitutable. (118)

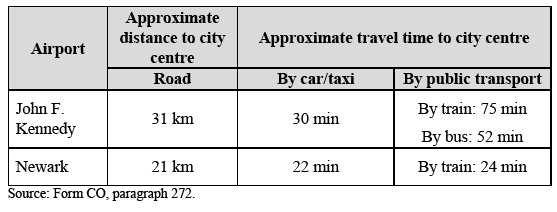

(115) The travel distances and times between these airports and the centre of New York are summarised below:

(116) The outcome of the market investigation is inconclusive. While a majority of competitors having expressed a view consider that JFK and EWR airports are substitutable and monitor air carriers flying on the routes listed in paragraph (106) above to/from JFK or EWR, (119) the corporate customers and travel agents gave mixed replies as to whether passengers consider JFK and EWR as substitutable airports. (120)

(117) In any case, for the purpose of this Decision, the question of whether John F. Kennedy and Newark airports are substitutable can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under either plausible market definition.

e) Orlando

(118) Orlando is served by two airports, namely Orlando International (MCO) and Orlando Sanford International (SFB).

(119) In its prior decisional practice, the Commission found that MCO and SFB can be considered as substitutable from the point of view of passengers, at least with regards to NTS passengers, with regard to the routes London – Orlando and Manchester - Orlando. (121)

(120) For the purpose of the O&D assessment of the Transaction, the question of substitutability of MCO and SFB is relevant for the following routes: Dublin – Orlando and Amsterdam – Orlando.

(121) On the Dublin – Orlando route, the Parties operate indirect services to/from MCO, while Aer Lingus operates direct flights from MCO. (122) With respect to the Amsterdam – Orlando route, the Parties operate from MCO while TUI operated a direct service to/from SFB. (123)

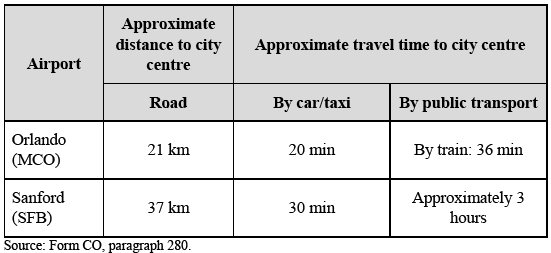

(122) The travel times and distances between these airports and the city centre of Orlando are summarised below:

(123) The outcome of the market investigation is inconclusive. While a majority of competitors having expressed a view consider that Orlando and Sanford airports are substitutable and monitor competitors on the route Amsterdam – Orlando flying to/from MCO or SFB, (124) the corporate customers and travel agents gave mixed replies as to whether passengers consider Orlando and Sanford as substitutable. (125)

(124) In any case, for the purpose of this Decision, the question of whether Orlando and Sanford airports are substitutable can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under either plausible market definition.

Conclusion

(125) For the purpose of this Decision, it is not necessary to decide whether (i) Paris- Charles de Gaulle and Paris Orly airports, (ii) Milan Malpensa and Milan Linate airports, (iii) London Heathrow, Gatwick and City, (iv) John F. Kennedy and Newark, (v) Orlando and Sanford airports are substitutable as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible market definition.

4.2.2. Airport-by-airport approach – Air transport of passengers

(126) As explained in paragraph (40) above, the Commission considers it appropriate to apply the airport-by-airport approach for the purpose of this Decision. The Commission will assess the effect of the Transaction on the Parties’ slot holding in both IATA Seasons at London Heathrow and Manchester airports in relation to the markets for air transport services of passengers to or from the relevant airports and the market for airport infrastructure services provided at the relevant airports.

(127) The Commission will consider below the various possible delineations of these two relevant markets under the airport-by-airport approach.

4.2.2.1. Air transport services of passengers to or from the relevant airports

Relevant product market

(128) In prior decisions, the Commission has not deemed it necessary to consider under the airport-by-airport approach, when all O&Ds to or from an airport are aggregated, the same distinctions as those considered when each O&D market is examined separately (e.g. time sensitive vs. non-time sensitive passengers, direct vs. indirect flights, charter flights vs. scheduled flights, wholesale vs. retail supply of airline seats). (126) On the basis of the information in the file, the Commission considers that there are no grounds for it to deviate from this past practice for the purposes of this Decision.

Relevant geographic market

(129) In prior decisions, the Commission has considered whether the relevant airports were substitutable with other airports in view of their overlapping catchment areas. (127)

(130) In the present case, the substitutability from the point of view of passengers of

(i) London Heathrow, Gatwick, City, Stansted, Luton and Southend airports and

(ii) Manchester, Liverpool and Leeds airports has been considered in section 4.2.1.4. above. (128)

Conclusion

(131) For the purpose of its airport-by-airport assessment of the Transaction in this Decision, the Commission will assess the competitive effects of the Transaction on the markets for the provision of passenger air transport services, encompassing all routes to or from an airport, or to or from substitutable airports.

(132) For the purpose of its airport-by-airport assessment of the Transaction in this Decision, the question of whether the relevant geographic market consists of (i) flights to/from London Heathrow only or Heathrow, Gatwick and City airports and (ii) flights to/from Manchester only or Manchester, Liverpool and Leeds can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under either plausible market definition (see section 5.2. below).

4.2.2.2. Airport infrastructure services

(133) For the purpose of providing passenger air transport services at congested airports, airlines have to source infrastructure services at those airports. As indicated in paragraph (27) above, at congested airports, infrastructure capacity is managed through the allocation of slots, which enable air carriers to fly to and from the airports. Slots are therefore defined, from the point of view of airports, as "a planning tool for rationing capacity at airports where demand for air travel exceeds the available runway and terminal capacity." (129) From the point of view of airlines, the granting of a slot at an airport means that the airline may use the entire range of infrastructure necessary for the operation of a flight at a given time (runway, taxiway, stands and, for passenger flights, terminal infrastructure). This in turn enables the airlines to provide passenger air transport services to and from that airport.

(134) As a consequence, through the Transaction and the combination of slot portfolios, the Parties together obtain a right of access to a higher share of airport infrastructure capacity. The Transaction therefore has an impact on (the demand- side of) the markets for airport infrastructure services at the relevant airports and also on the markets for passenger air transport to and from those airports.

Relevant product market

(135) The Commission has, in its prior decisional practice, delineated a product market for the provision of airport infrastructure services to airlines, which includes the development, maintenance, use and provision of the runway facilities, taxiways and other airport infrastructure. (130)

(136) The Commission has considered sub-dividing the market for airport infrastructure services on the basis of airline customers (i.e. charter operators, scheduled full service carriers and scheduled low cost carriers) and on the basis of the type of flights (i.e. short-haul and long-haul). (131)

(137) However, in prior decisions relating to the transfer of slots at airports, the Commission has not considered it appropriate to further distinguish within the market for airport infrastructure services, considering that slot portfolios give access to all infrastructure services necessary to operate at the airport.

(138) The Commission considers that there is no element in the file that would require deviating from the Commission's past practice for the purposes of this Decision.

Relevant geographic market

(139) In its prior decisional practice, the Commission has, defined the geographic scope of the market for airport infrastructure services as the catchment area of individual airports.

(140) The Commission has also considered additional criteria relevant for assessing airport substitutability in relation to the market for airport infrastructure services, while acknowledging that the airlines' choice of airports ultimately depends on passengers' demand. In addition to the catchment area of a particular airport, the Commission has notably analysed the capacity constraints for slots and facilities, passenger volumes or the positioning of the airport (e.g. a niche airport serving high yield time-sensitive passengers or an airport serving mainly leisure, less time-sensitive passengers). (132)

(141) The Commission has taken account of all the above-mentioned criteria when assessing the geographic scope of the airport infrastructure services markets relevant for the assessment of the effects of transfer of slots. (133)

Substitutability of London Heathrow, Gatwick, City, Stansted, Luton and Southend airports

(142) VAL, AFKL and Delta each hold slots at Heathrow airport. Virgin Atlantic/Delta hold slot at Gatwick, while AFKL holds slot at City. (134) The Transaction therefore gives rise to an overlap between AFKL and Virgin Atlantic/Delta at Heathrow, and on a broader geographic scope comprising at least (i) LHR and (ii) LCY and/or LGW.

(143) The question of the catchment area of London airports is addressed in section 4.2.1.4. above. From the point of view of passengers, the relevant markets consists of flights to/from London Heathrow only or to/from Heathrow, Gatwick and City airports.

(144) As regards capacity constraints, these three airports are coordinated (Level 3) airports.

(145) In 2018, 78 million passengers used Heathrow airport, (135) 46.1 million passengers travelled to/from Gatwick (136) and 4.8 million passengers used City airport. (137)

(146) As regards positioning, Heathrow is the “world’s busiest international airport” and a major international hub for air transport, with more than 81 airlines operating 204 destinations. (138) Gatwick is used by 50 airlines, which provide “a combination of full service, low-cost and charter services” and fly to 230 destinations. (139) While 56% of City airport’s passengers travel for business purpose, 44% are leisure passengers. In that regard, City airport “has developed an attractive mix of airlines and destinations with 11 airline customers […] serving 43 different destinations (11 UK, 34 European and 1 US destination)”. (140)

(147) Considering that Heathrow, City and Gatwick have different positioning and strategy, the Commission concludes that, for the purpose of this Decision, the geographic scope of the market for the provision of airport infrastructure services to airlines is limited to Heathrow airport. (141)

Substitutability of Manchester, Liverpool and Leeds-Bradford airports

(148) Virgin Atlantic/Delta and AFKL hold slots at Manchester airport. The Transaction therefore gives rise to an overlap between Virgin Atlantic/Delta and AFKL’s slot portfolios. […]. (142)

(149) As regards catchment area, Manchester, Liverpool and Leeds airports are each all located within 100 km/1 hour driving time from Manchester city centre.

(150) In previous decisions, the Commission considered that Manchester and Liverpool or Manchester, Liverpool and Leeds airports could belong to the same market in respect of certain short-haul routes. (143)

(151) As regards capacity constraints, Manchester airport is a coordinated (Level 3) airport during both IATA Seasons, while Liverpool and Leeds airports are both schedules facilitated airports (144) (Level 2) (145) during both IATA Seasons.

(152) As regards positioning and passenger volumes, Manchester serves in particular full service carriers. It is used by 70 airlines serving 220 destinations. The number of passengers at Manchester airport reached 59 million in 2018. Leeds and Liverpool are mainly used by low-cost carriers such as Ryanair and easyJet (at Liverpool only). (146) 3.6 million passengers travelled to/from Leeds airport, (147) compared to 5.1 million to/from Liverpool airport. (148)

(153) Considering that (i) only Manchester airport is a coordinated airport, and (ii) Manchester airport has a different positioning and market strategy, the Commission concludes that, for the purpose of this Decision, the geographic scope of the market for the provision of airport infrastructure services to airlines is limited to Manchester airport.

Conclusion

(154) For the purpose of this Decision, the Commission will assess the effects of the Transaction on the market for the provision of airport infrastructure services to airlines.

(155) For the purpose of this Decision, the Commission considers that the geographic scope of the market for airport infrastructures services in London is London Heathrow airport and the geographic scope of airport infrastructure services in Manchester is limited to Manchester airport.

4.2.3. Air transport services of cargo

4.2.3.1. Relevant product market

(156) In prior decisions, the Commission considered a market for air transport of cargo including all kinds of transported goods provided by all types of air cargo carriers, (149) without any further subdivision to be made according to the nature of the goods transported (for example, dangerous or perishable goods) or the type of air cargo carrier. (150)

(157) In fact, the Commission has concluded that four types of air cargo carriers, namely (i) cargo airlines with dedicated freighter planes; (ii) airlines with only belly space cargo capacity on passenger flights; (iii) combination airlines (i.e. airlines with both dedicated freighter airplanes and belly space cargo capacity); and (iv) integrators, compete with each other for business with the same kinds of customers. (151)

(158) Based on the Commission’s prior decisions, the O&D approach to market definition is not appropriate for air cargo transport services because cargo is (i) in principle less time-sensitive than passengers, and (ii) usually transported “behind” and “beyond” the points of origin and destination by trans-modal transport methods and thus can be routed via a higher number of stops than passengers. (152) Consequently, the Commission considers that a wider market for air transport of cargo exists as, unlike passengers, cargo can be transported with a higher number of stopovers and therefore any one-stop route is a substitute for any non-stop route. (153)

(159) In addition, according to the Commission's precedents, cargo transport markets should be assessed on a unidirectional basis, due to differences in demand at each end of the route. (154)

(160) The Parties agree with the Commission's decision-making practice. (155)

(161) Therefore, in line with its prior decisional practice, the Commission will assess the effects of the Transaction on a broader market for air transport of cargo encompassing all types of air cargo carriers and including all kinds of transported goods on a unidirectional basis.

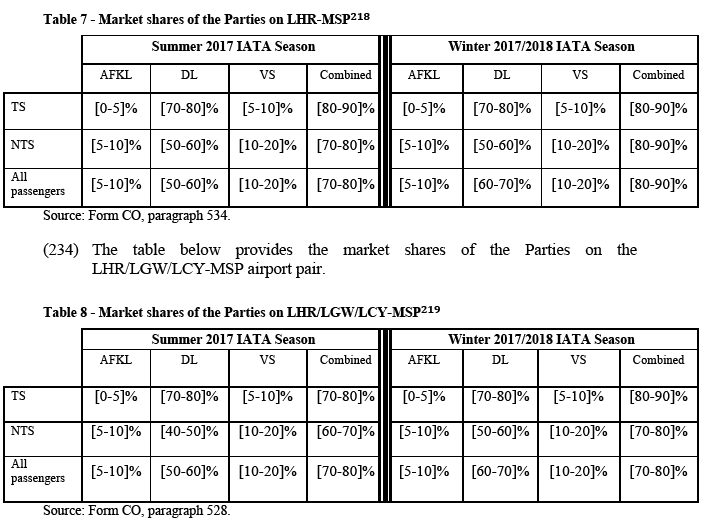

4.2.3.2. Relevant geographic market

(162) In prior decisions, the Commission defined the market in intra-European routes of air cargo transport as European-wide. (156) As regards intercontinental routes, the Commission established that catchment areas at each end of the route broadly correspond to continents where local infrastructure is adequate to allow for onward connections (for example, by road, train, or inland waterways, etc.), such as Europe and North America. As regards continents where local infrastructure is less developed, the relevant catchment area has been considered the country of destination. (157)

(163) The Parties agree with the Commission's previously established geographic definition.

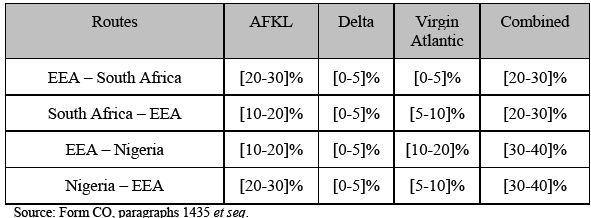

(164) Therefore, in line with its prior decisional practice, the Commission will assess the effects of the Transaction on a continent-to-continent and continent-to-country basis as the case may be. The Transaction gives rise to the following affected cargo flows: EEA - North America (USA & Canada), North America (USA & Canada) - EEA, Mexico - EEA, UK - North America (USA & Canada), North America (USA & Canada) - UK, Mexico - UK, UK - Mexico, EEA - Caribbean, Caribbean - EEA, EEA - Cuba, Cuba - EEA, EEA - South Africa, South Africa - EEA, EEA - Nigeria, Nigeria - EEA.

4.2.4. Maintenance, repair and overhaul (“MRO”) services

4.2.4.1. Relevant product market

(165) In prior decisions, the Commission distinguished four separate segments within the MRO market based on the part of the aircraft to be serviced and the level of service required, namely (i) line maintenance (minor checks carried out on aircraft and performed at the different airports), (ii) heavy maintenance (comprehensive inspection and overhaul of the aircraft, for which the aircraft is taken out of service), (iii) engine maintenance, and (iv) components maintenance (inspection, repair and overhaul of specific aircraft components). (158) The Commission also considered but ultimately left the question open, whether a distinction between commercial and business aviation is appropriate. (159) It moreover noted that line maintenance and heavy maintenance can be further subdivided according to nature and frequency of the checks involved (A, B, C and D-checks). (160)

(166) The Parties submit that the precise scope of the product market definition for MRO can be left open as no serious doubts would arise under any plausible market definition. However, in line with the Commission’s decisional practice, they provided data for each MRO segment and notably for line maintenance services where the Parties’ activities overlap.

(167) In light of the above, the Commission concludes that the precise scope of the product market definition for MRO services can be left open since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible product market definition.

4.2.4.2. Relevant geographic market

(168) In prior decisions, the Commission considered that the geographic scope of the market for heavy maintenance services might be at least EEA-wide, whereas line maintenance services could be local in scope and even limited to the airport where services are provided. (161) Indeed, line maintenance services are usually carried out at the airport of origin or destination, or at the aircraft’s operational base. (162) As regards to engine maintenance services and components maintenance services, the Commission has considered these services to be worldwide in scope. (163)

(169) The Parties submit that the precise scope of the geographic market definition for all MRO segments can be left open.

(170) For the assessment of the Transaction, the Commission concludes that the precise geographic market definition for MRO services can be left open since the Transaction does not raise serious doubts as to its compatibility with the internal market under any plausible geographic market definition.

4.2.4.3. Conclusion

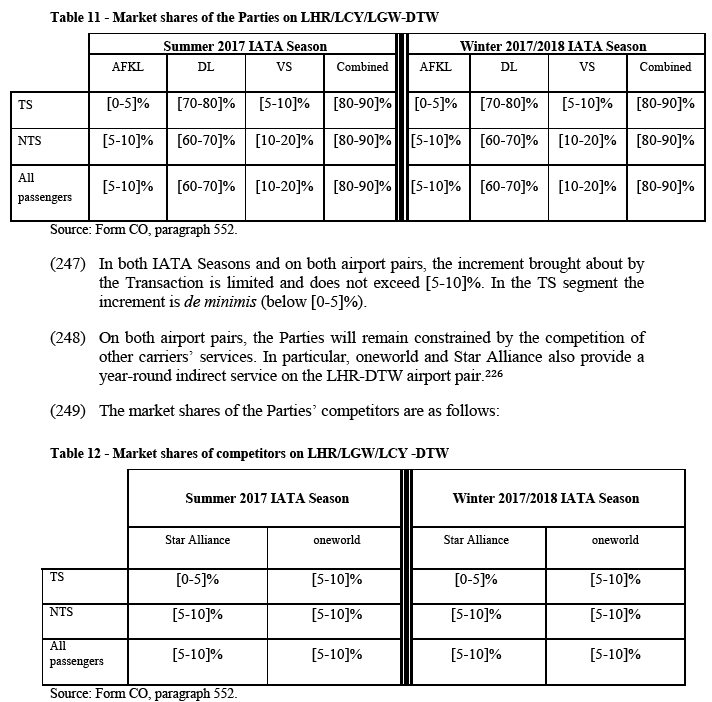

(171) Given that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of MRO services under any plausible market definition, the Commission concludes that the precise product and geographic market definitions can be left open.

5. COMPETITIVE ASSESSMENT

5.1. Passenger air transport services under the O&D approach

5.1.1. Analytical framework

5.1.1.1. Alliances and profit-sharing joint ventures

(172) Air France and Delta were founding members of the SkyTeam alliance in 2001. Since 2004, shortly after the merger of Air France and KLM, KLM has also been a full member of the SkyTeam alliance. (164) Consistent with the Commission’s practice, alliance partners are generally not considered as forming a single economic entity for the purpose of determining affected markets. (165)

(173) Delta, Air France-KLM and Alitalia are parties to a revenue-sharing joint venture (or “metal neutral joint venture”), covering routes between Europe (166) and North America (the “TATL” Joint Venture”). (167)

(174) Delta and Virgin Atlantic are parties to a metal neutral joint venture covering direct routes between the United Kingdom and North America (the “DL-VS Joint Venture”). (168)

(175) Delta, AFKL, Alitalia and Virgin Atlantic are also parties to a Coordination Agreement, covering routes between the United Kingdom and North America. (169) By final order issued on 23 September 2013, the American Department of Transportation granted antitrust immunity with respect to the activities contemplated under the DL-VS Joint Venture and the Coordination Agreement. (170)

(176) Metal neutral joint ventures involve extensive cooperation such as revenue- sharing and joint management of schedules, pricing and capacity. (171)

(177) There are two other metal neutral joint ventures on transatlantic routes, namely (i) the oneworld Transatlantic Joint Business Agreement entered into by American Airlines, British Airways (BA) and Iberia (IB) and Finnair(AY) (“oneworld”) and (ii) the Star Alliance A++ Joint Venture of United (UA), Lufthansa (LH) and Air Canada (AC) (“Star Alliance”).

(178) Consistent with the Commission’s approach, each of the metal neutral joint ventures are treated as a single entity for the purposes of assessing market shares on all relevant routes. (172)

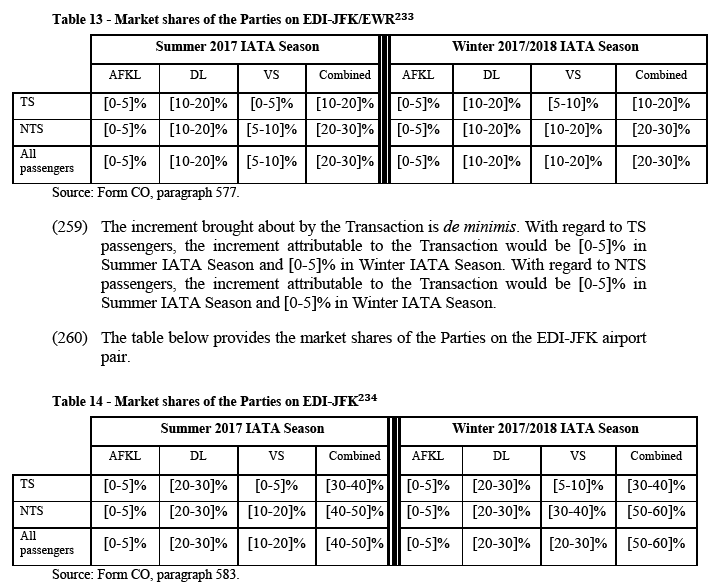

5.1.1.2. Methodology used to calculate market shares

(179) The Commission has previously used Marketing Information Data Tapes (“MIDT”) data (173) and PaxIS PLUS data (174) as appropriate proxies to estimate market shares for air transport of passengers.

(180) The Parties have first submitted data on market size and market shares for each relevant O&D on the basis of MIDT while recognising that MIDT has certain limitations: MIDT data is based on bookings made through the Global Distribution Systems (GDS) and does not capture the direct sales made direct by airline to their customers. (175)

(181) To take account of the increasing number of direct sales, the Commission has asked the Parties in the pre-notification phase to use a data source that captures direct sales by the Parties and their competitors.

(182) The Parties submitted that none of the Parties subscribes to PaxIS PLUS and proposed not to use PaxIS PLUS since PaxIS PLUS [details about usability of PaxIS PLUS in the context of the case at hand]. (176)

(183) Instead of PaxIS Plus, the Parties proposed to use Direct Data Solutions (“DDS”) data, another database developed by IATA. (177) The Parties explained that DDS includes actual bookings data from GDS and ACR data (US country of sale agency settlement data) as well as contributed data from the carriers subscribing to it. IATA would apply an algorithm to estimate volumes for carriers that do not contribute data or do not allow for their contributed data to be published. According to the Parties, DDS is intended to capture all passenger bookings. (178) The Parties submitted data on market size and market shares for each relevant O&D on the basis of DDS for the last two IATA Seasons. (179)

(184) The Parties have also submitted their actual bookings data for the last two IATA Seasons and submit that the DDS data is often similar to the actual sales data in terms of number of bookings. (180)

(185) The Commission is of the view that DDS data are the best proxy to estimate the market shares and are appropriate for the assessment of the affected routes in this case.

5.1.1.3. “Filters”

(186) Consistent with previous Commission practice, (181) the Parties have applied the following filters to exclude likely unproblematic routes from the scope of its investigation (all criteria must have been met in the four last completed IATA Seasons and for all passenger segments for a route to be excluded under the filters): (182)

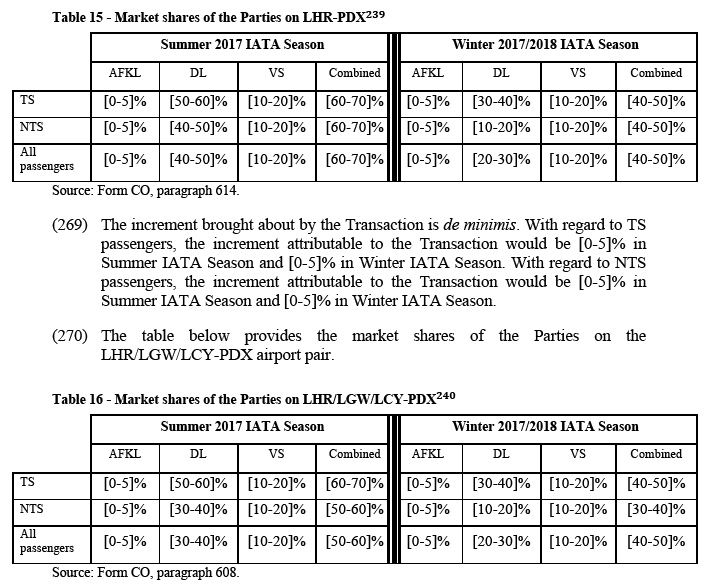

(a) For direct/indirect overlaps:

(i) the Parties’ combined market share was below 25%; or

(ii) one of the Parties had a market share below 2%; (183) or

(iii) short-haul routes where the total share of indirect operations in the relevant market was below 10%; or

(iv) at least one end of the city pair is outside the EU and the total annual traffic was below 30 000 passengers; or

(v) the route was below the HHI thresholds of paragraph 20 of the Horizontal Merger Guidelines. (184)

(b) For indirect/indirect overlaps:

(i) the Parties’ combined market share was below 25%; or

(ii) one of the Parties had a market share below 2%; (185) or

(iii) as regards short-haul routes where the total annual traffic was below 15 000 passengers or as regards long-haul routes where the total annual traffic was below 30 000 passengers; or

(iv) the route was below the HHI thresholds of paragraph 20 of the Horizontal Merger Guidelines.

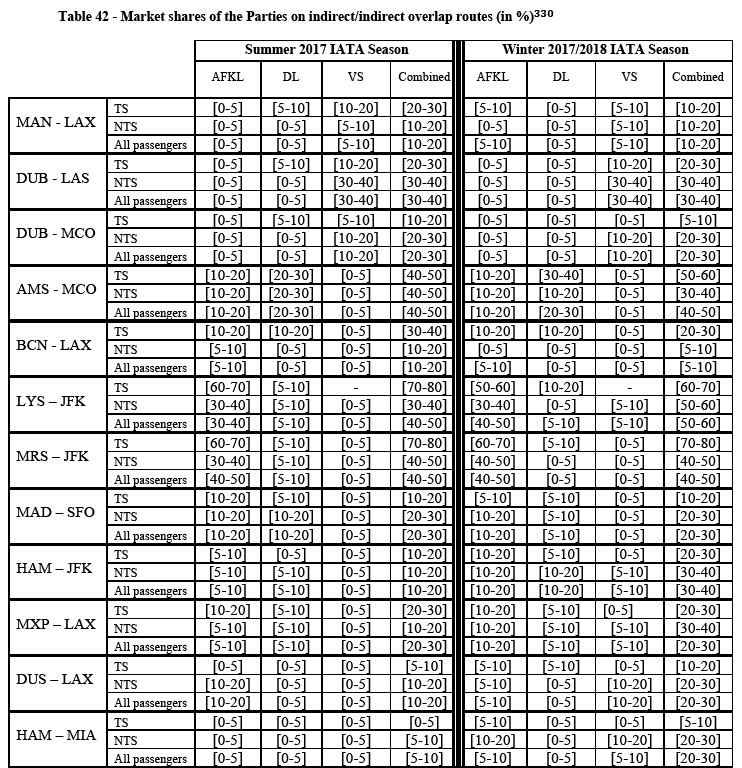

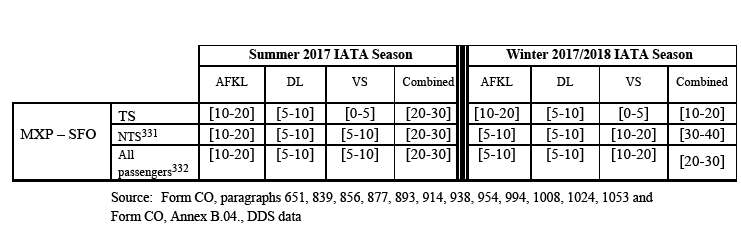

(187) As a result of the above criteria, the Parties submitted that 32 routes (direct/indirect overlaps and indirect/indirect overlaps) would be affected by the Transaction.

5.1.1.4. Closeness of competition

(188) The Transaction gives rise to 19 affected horizontal direct/indirect overlaps. On eight affected routes from the United Kingdom to North America, Virgin Atlantic/Delta operates a direct service, while AFKL operates an indirect service. These routes are: London-Seattle, Manchester-New York, London-Atlanta, London-Minneapolis, London-Detroit, Edinburgh-New York, London-Portland, Manchester-San Francisco. On seven affected routes from Continental Europe/Ireland to North America, AFKL/Delta operates a direct service, while Virgin Atlantic operates an indirect service. These routes are: Amsterdam-Los Angeles, Amsterdam-Miami, Amsterdam-San Francisco, Paris-San Francisco, Paris-Boston, Nice-New York and Dublin-New York. On three affected routes (London-Lagos, London-Shanghai, London-Havana), Virgin Atlantic operates a direct service, while AFKL operates an indirect service and on one affected route, Virgin Atlantic operates a direct service, while AFKL and Delta operate an indirect service (London-Montego Bay).

(189) The Commission will first assess the closeness of competition in general between the Parties on the 19 horizontal direct/indirect overlap routes, before assessing the effects of the Transaction on these routes.

(190) For the reasons explained below, the affected direct/indirect overlap routes will not give rise to competition concerns. If direct and indirect flights were to be considered as two separate markets, there would be no affected overlap routes as a result of the Transaction. Therefore, it is not necessary to reach a conclusion on whether direct and indirect passenger air transport services constitute part of the same market, as it would not change the conclusion of the competitive assessment as already stated in section 4.2.1.2 above.

(191) The Commission has in previous airline cases analysed the closeness of competition between the parties to the concentration. (186) The concept of “closeness of competition” may play an important role in better understanding the competitive constraint exerted by different competitors on each other in differentiated markets such as airline markets. (187) It is therefore relevant to assess whether a) Virgin Atlantic/Delta’s direct service and AFKL’s indirect service on the routes from the United Kingdom to North America, b) AFKL/Delta’s direct service and Virgin Atlantic’s indirect service on the routes from Continental Europe/Ireland to North America and c) Virgin Atlantic’s direct services and AFKL’s and Delta’s indirect services on the routes from London to certain rest of the world-destinations would be considered as close substitutes.

(192) As explained above, the market investigation gave mixed results concerning the question if of whether passengers consider direct flights as an alternative to indirect flights: while the majority of competitors (airlines) considered this to be the case, the views of the responding customers (travel agencies and corporate customers) were mixed. (188)

(193) The majority of customers (travel agencies and corporate customers) stated that they sell tickets to both direct and indirect flights to their customers and that they buy tickets for both direct and indirect flights on the affected direct/indirect overlap routes. (189) However, around 1/3 of the corporate customers responding to the market investigation explained that they generally only buy tickets to direct flights. (190) When asked which criteria would make customers choose an indirect flight over a direct flight, respondents to the Commission’s market investigation identified most frequently the price difference, followed by the schedule of the respective flight and the total travel duration. (191)

(194) The majority of respondents to the market investigation (competitors, travel agents, corporate customers) indicated that none of the Parties are each other’s closest competitor on any of the 19 affected direct/indirect overlap routes. (192) In the majority of cases, British Airways, American Airlines, United Airlines or Lufthansa was identified as either Virgin Atlantic’s, AFKL’s or Delta’s closest competitor.

(195) In the light of the above, the Commission considers that none of the Parties are each other’s close competitor on the 19 direct/indirect overlap routes.

5.1.1.5. Significant competitive pressure from other airlines

(196) The market investigation in previous cases has shown that indirect routes are often modified from one IATA Season to the next and that price increases or reductions of capacity could be countered by competitors who could start operating on these routes more easily than on direct/direct overlap routes which require the deployment of aircraft dedicated to the O&D route. (193) Therefore, in general, any attempt by the Parties to raise prices on routes, where the overlap is between direct/indirect services, would likely be short-lived and ineffective. This was also confirmed by the market investigation. The majority of respondents having expressed a view consider that there will be sufficient competition to prevent the Parties from raising prices on all affected direct/indirect overlap routes. The Commission thus considers that other carriers like the members of the Star Alliance or oneworld would exert significant competitive pressure on the Parties post-Transaction on the affected direct/indirect overlap routes.

5.1.1.6. De minimis increment

(197) In previous cases, the Commission has considered increments up to 5% as low increments on direct/indirect overlap routes. (194) In line with its prior decisional practice, the Commission considers that, also taking into account that other airlines would exert competitive pressure on the Parties post-Transaction, an increment of up to 5% on an affected direct/indirect overlap is de minimis.

5.1.2. Direct/Indirect affected markets between the United Kingdom and North America

(198) As explained in paragraph (178) above, the Commission treats each of the metal neutral joint ventures as a single entity for the purpose of assessing the market shares on all relevant routes. Consistent with the approach, Delta and Virgin Atlantic are treated as a single entity on every route between the United Kingdom and North America.

5.1.2.1. London – Seattle

(199) In Summer 2017 IATA Season, [100.000-200.000] passengers travelled between London Heathrow and Seattle airports and [100.000-200.000] passengers flew between London Heathrow, Gatwick and City and Seattle airports. (195) In Winter 2017/2018 IATA Season, [60.000-80.000] passengers travelled between London Heathrow and Seattle and [80.000-100.000] passengers flew between London Heathrow, Gatwick and City and Seattle airports. (196)

(200) In Summer 2017 and Winter 2017/2018 IATA Seasons, Virgin Atlantic/Delta operated direct services on the LHR-SEA airport pair, while AFKL offered only indirect services on this airport pair via Paris-Charles de Gaulle or Amsterdam airports.

(201) As explained in section 4.2.1.4 above, the Commission will assess the effect of the Transaction on the following airport pairs: LHR-SEA and LHR/LGW/LCY- SEA.

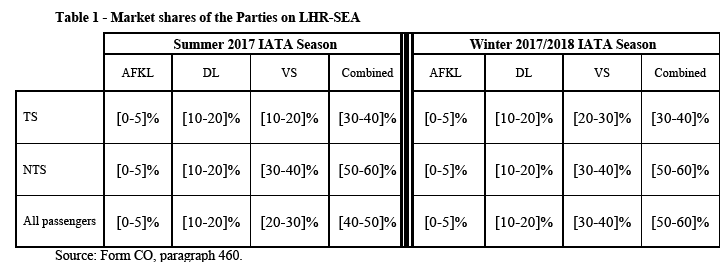

(202) The table below provides the market shares of the Parties on the LHR-SEA airport pair.

(203) The increment brought about by the Transaction is de minimis in both IATA Seasons and under any plausible market definition. With regard to TS passengers, the increment attributable to the Transaction would be [0-5]% in Summer IATA Season and [0-5]% in Winter IATA Season. With regard to NTS passengers, the increment attributable to the Transaction would be [0-5]% in Summer IATA Season and [0-5]% in Winter IATA Season. (197)

(204) The table below provides the market shares of the Parties on the LHR/LGW/LCY-SEA airport pair.

(205) The increment brought about by the Transaction is de minimis in both IATA Seasons and under any plausible market definition. With regard to TS passengers, the increment attributable to the Transaction would be [0-5]% in Summer IATA Season and [0-5]% in Winter IATA Season. With regard to NTS passengers, the increment attributable to the Transaction would be [0-5]% in Summer IATA Season and [0-5]% in Winter IATA Season.

(206) In addition, the Parties will remain constrained by the competition of the year- round direct service of oneworld as well as the daily all-year round indirect service operated by oneworld, Star Alliance and Icelandair on LHR-SEA. (198) In addition, Norwegian operated a direct service on the LGW-SEA airport pair in Summer 2017 IATA Season. (199)

(207) Finally, the majority of respondents to the market investigation having expressed a view considers that there will be sufficient competition on the route to prevent the Parties’ from raising prices on the route post-Transaction. (200)

(208) In light of the above and of all available evidence, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the London – Seattle route under any plausible market definition.

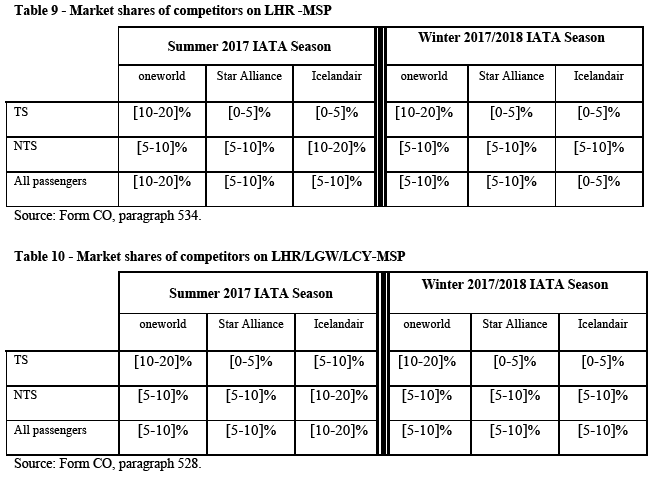

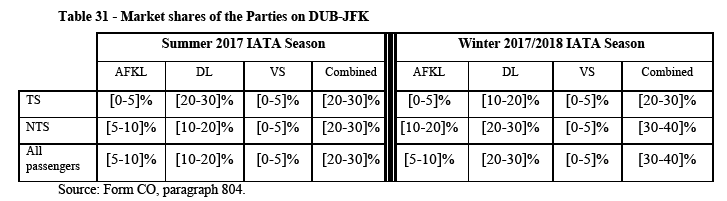

5.1.2.2. Manchester – New York

(209) In Summer 2017 IATA Season, [200.000-300.000] passengers travelled between Manchester and John F. Kennedy airports and [20.000-40.000] passengers flew between Manchester and Newark airports. (201) In Winter 2017/2018 IATA Season, [100.000-200.000] passengers travelled between Manchester and John F. Kennedy airports while [40.000-60.000] passengers travelled between Manchester and Newark airports. (202)

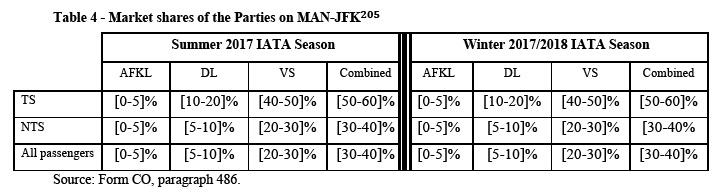

(210) In Summer 2017 and Winter 2017/2018 IATA Seasons, Virgin Atlantic/Delta operated direct services on the MAN-JFK airport pair, while AFKL offered only indirect services on this airport pair via Paris-Charles de Gaulle or Amsterdam airports.

(211) As explained in section 4.2.1.4 above, the Commission will assess the effect of the Transaction on the following airport pairs: MAN-JFK/EWR and MAN-JFK. (203)

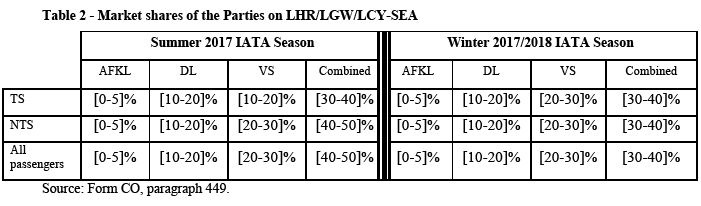

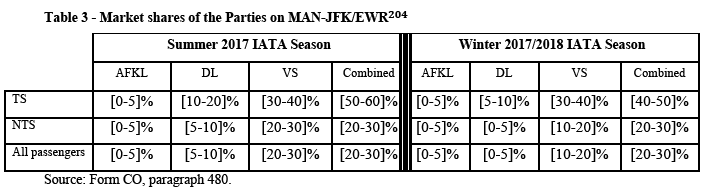

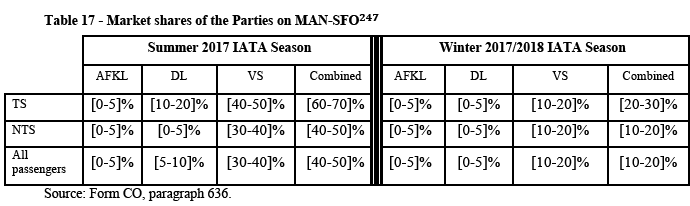

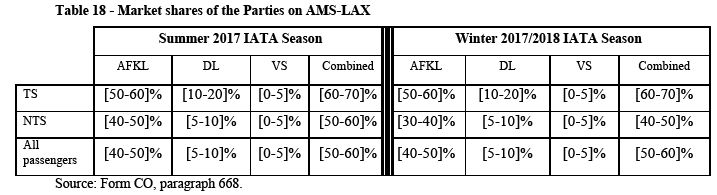

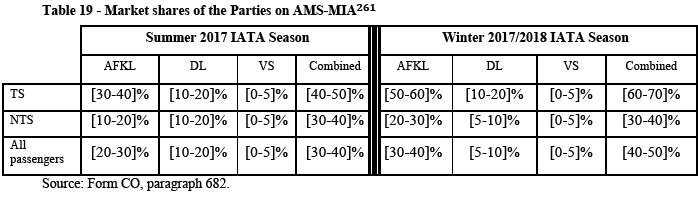

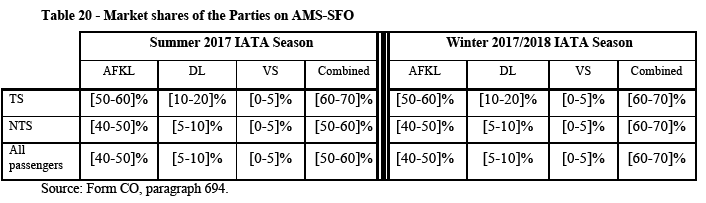

(212) The table below provides the market shares of the Parties on the MAN-JFK/EWR airport pair.

(213) The increment brought about by the Transaction is de minimis in both IATA Seasons and under any plausible market definition. With regard to TS passengers, the increment attributable to the Transaction would be [0-5]% in Summer IATA Season and [0-5]% in Winter IATA Season. With regard to NTS passengers, the increment attributable to the Transaction would be [0-5]% in Summer 2017 IATA Season and [0-5]% in Winter 2017/2018 IATA Season.

(214) The table below provides the market shares of the Parties on the MAN-JFK airport pair.

(215) The increment brought about by the Transaction is de minimis in both IATA Seasons and under any plausible market definition. With regard to TS passengers, the increment attributable to the Transaction would be [0-5]% in Summer IATA Season and [0-5]% in Winter IATA Season. With regard to NTS passengers, the increment attributable to the Transaction would be [0-5]% in Summer 2017 IATA Season and [0-5]% in Winter 2017/2018 IATA Season.

(216) In addition, the Parties will remain constrained by the competition of the daily all- year round direct service operated by Star Alliance on the MAN-EWR airport pair. (206) With respect to indirect flights, oneworld and Star Alliance, Aer Lingus and Icelandair operate on the MAN-JFK and MAN-EWR airport pairs all-year round. (207)

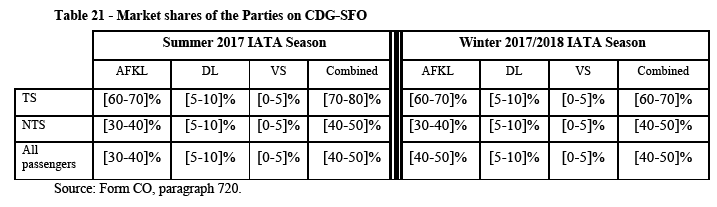

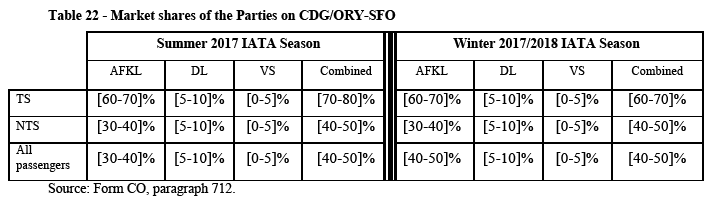

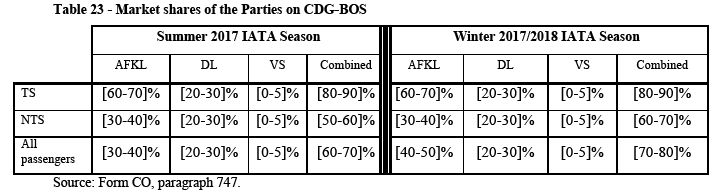

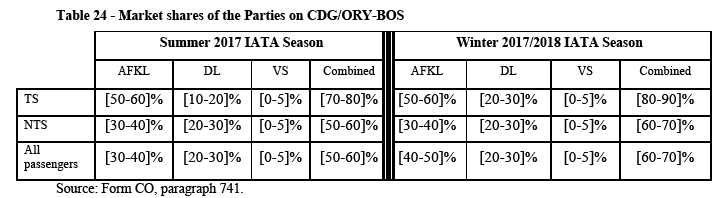

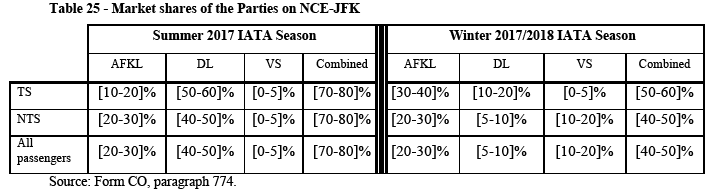

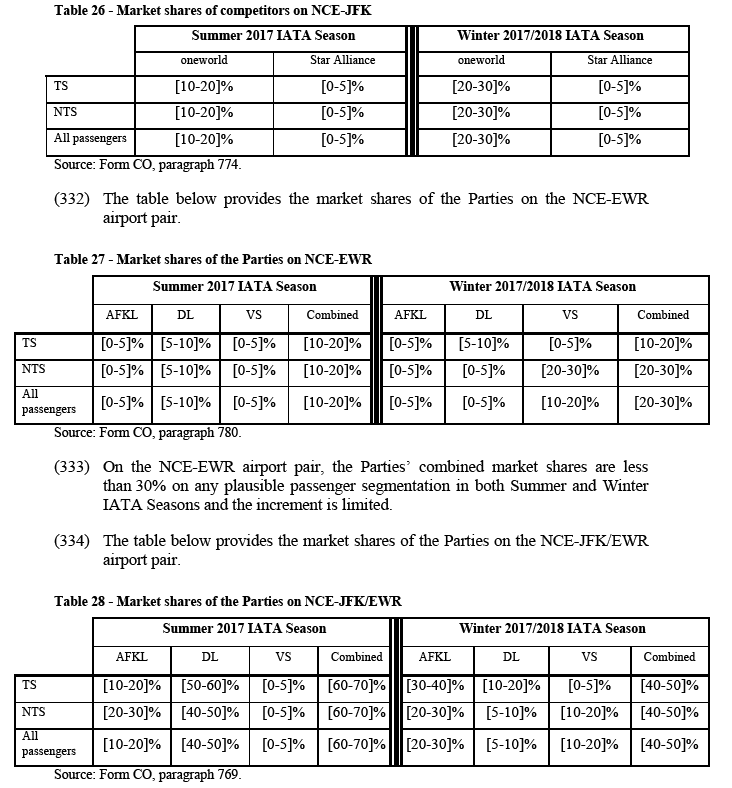

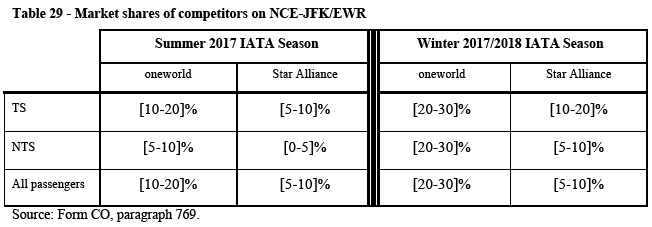

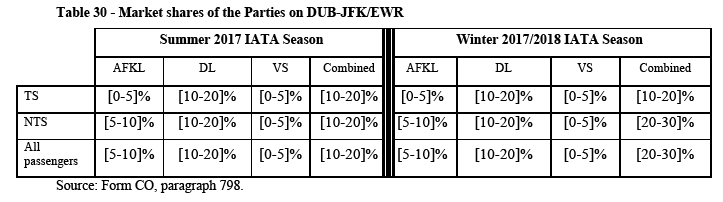

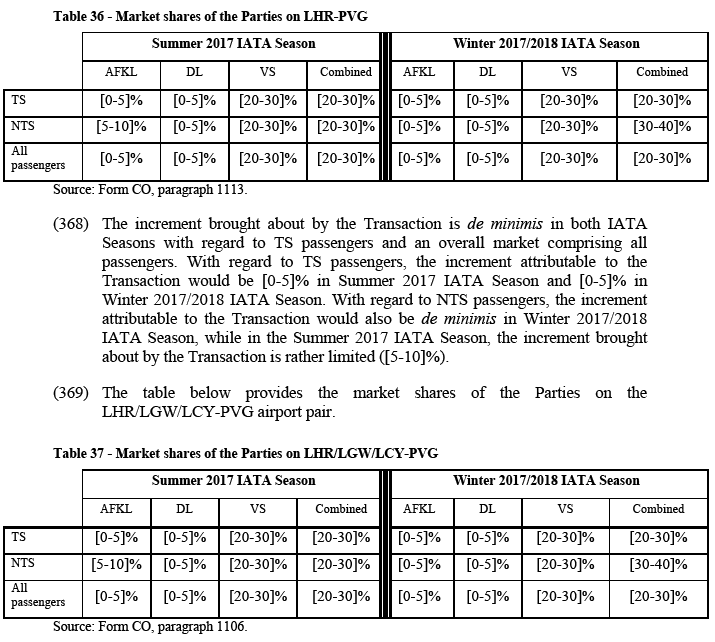

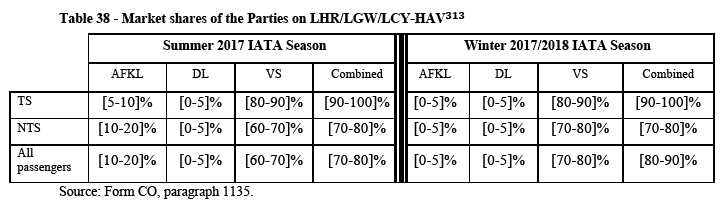

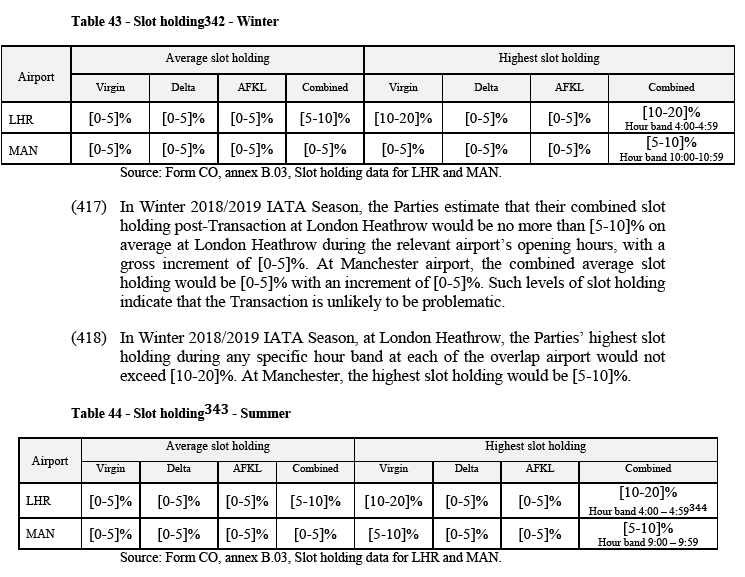

(217) Thomas Cook/Condor also provides three to four weekly direct services all-year round on the MAN-JFK airport pair. (208) The Parties consider that Thomas Cook/Condor exert a meaningful competitive constraint on the Parties post-Transaction, particularly in the non-time-sensitive segment of the market. (209)