Commission, December 18, 2019, No M.9331

EUROPEAN COMMISSION

Decision

DANAHER / GE HEALTHCARE LIFE SCIENCES BIOPHARMA

Subject: Case M.9331 – DANAHER/GE HEALTHCARE LIFE SCIENCES BIOPHARMA

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

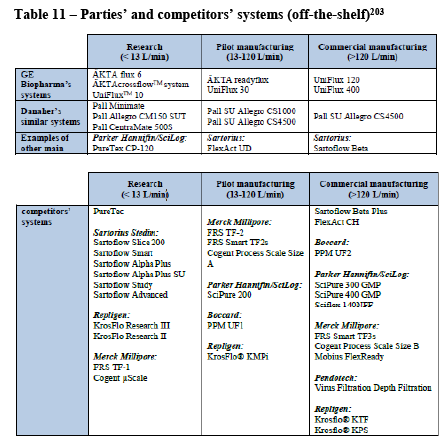

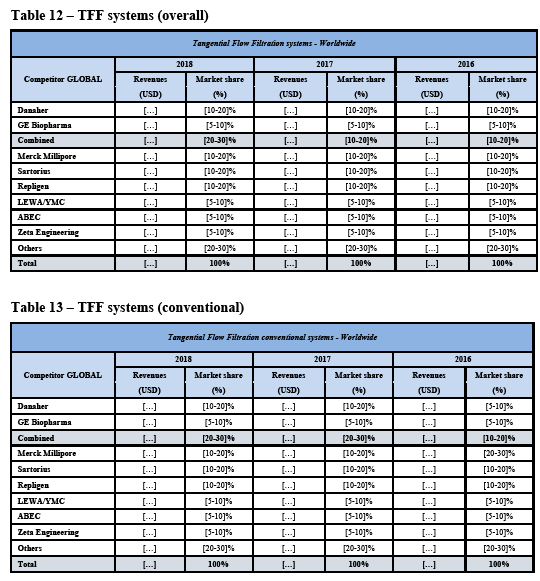

(1) On 29 October 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Danaher Corporation (“Danaher”, United States) acquires sole control of GE Healthcare Life Sciences’ Biopharma Business (“GE Biopharma”, United States), within the meaning of Article 3(1)(b) of the Merger Regulation. (3) Danaher is hereinafter referred to as “the Notifying Party”. Danaher and GE Biopharma are hereinafter collectively referred to as “the Parties”.

1. THE PARTIES, THE OPERATION AND THE CONCENTRATION

(2) Danaher is the ultimate holding company of a group that designs, manufactures and markets professional, medical, industrial and commercial products and services. In the life sciences area, Danaher is primarily active through its wholly-owned subsidiaries Pall Corporation (“Pall”), Molecular Devices, L.L.C (“MolDev”), Leica Microsystems GmbH (“Leica”), Beckmann Coulter, IDBS, Integrated DNA Technologies, Phenomenex, Inc. (“Phenomenex”) and SCIEX.

(3) GE Biopharma is part of General Electric’s (“GE”) Healthcare Life Sciences business unit. GE Biopharma supplies instruments, consumables and software for the research, discovery, process development and manufacturing workflows of biopharmaceutical drugs, such as monoclonal antibodies, vaccines, and cell and gene therapies. GE Biopharma is not organised as a separate stand-alone group of companies, but is held by different legal entities within GE. (4) GE Biopharma comprises all properties, assets, goodwill and rights that relate primarily to the manufacture and distribution of instruments, consumables, and software that support the research, discovery, process development and manufacturing workflows of biopharmaceutical drugs and that are currently owned by GE, either directly or indirectly though GE’s subsidiaries.

(4) On 25 February 2019, Danaher and GE entered into an Equity and Asset Purchase Agreement under which Danaher would acquire GE Biopharma by means of an acquisition of equity interests and assets for USD 21 400 million (EUR 18 100 million) (the “Transaction”). Upon completion of the Transaction, Danaher would, either directly or indirectly own all equity interests and all assets belonging to GE Biopharma. Therefore, the Transaction constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

2. UNION DIMENSION

(5) The combined aggregate turnover of the Parties is more than EUR 5 000 million (Danaher: EUR […] million; GE Biopharma: EUR […] million) and the aggregate Union-wide turnover of each of the Parties is more than EUR 250 million (Danaher: EUR […] million; GE Biopharma: EUR […] million). Neither of the Parties achieves more than two-thirds of their Union-wide turnovers within one and the same Member State. The Transaction therefore has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

3. COMMISSION’S APPROACH AND STRUCTURE OF THE COMMISSION’S ASSESSMENT

(6) The Parties’ activities horizontally overlap in the manufacture and sale of various products and services used in the bioprocessing industries. Moreover, there are also some vertical links to be assessed between the Parties respective activities, as well as possible conglomerate effects. In section 4 of this decision, the Commission will firstly introduce the area of biologics and bioprocessing, followed by an assessment of possible horizontal non-coordinated effects in the various relevant markets, which form part of the bioprocessing workflow (section 4.2 to 4.7). Where relevant, the Commission will assess possible non-coordinated vertical effects (sections 4.2.1.2(B), 4.2.2.2(B) and 4.7.2.2) and possible coordinated effects in section 4.8. In section 4.9, the Commission will then assess possible conglomerate effects.

(7) Moreover, the Parties’ activities horizontally overlap in the manufacture and supply of products and services which, while not directly forming part of the bioprocessing workflow, are closely related to this. In section 5, the Commission assesses possible horizontal non-coordinated effects in relation to the Parties’ activities in those other life sciences research segments, as well as possible coordinated effects.

(8) Sections 7 and 8 will be dedicated to the Commission’s assessment of the Commitments offered by the Notifying Party.

4. MARKET DEFINITION AND COMPETITIVE ASSESSMENT CONCERNING THE PARTIES’

ACTIVITIES IN BIOPROCESSING

4.1. Introduction

4.1.1. Biologics and bioprocessing

(9) Bioprocessing is a broad term encompassing the research, development and, mainly, manufacturing of products prepared from or used by biological systems – namely, cells. Those products are known as biopharmaceuticals or biologics. Although cell- derived pharmaceutical products – such as vaccines and blood products – have long been used for therapeutic purposes, in the last two decades a new class of therapeutics has emerged that is based on proteins produced by genetically engineered living cells. New types of biologics include most notably monoclonal antibodies (“mAbs”). mAbs therapies were developed through a series of scientific advances since the 1980s, and currently are the largest product group within biologics. Most recent classes of biologics therapies are cell and gene therapy. In cell therapy, cells (for instance, stem cells) are injected in patients to treat a certain disease. In the gene therapy, faulty genes causing a disease are modified or inactivated. The latter can be performed by harvesting, curing and re-injecting the patient’s own cells, or by administering modified viruses (“viral vectors”) containing the corrected gene(s).

(10) Although biologics are a relatively young class of therapies, their benefits have fuelled rapid growth. One report estimates that the biologics market was valued at approximately USD 255 000 million in 2017 and is expected to more than double by 2026. (5) The development of biologics and in particular mAbs since the 1980s has also led to the emergence and growth of an industrial bioprocessing sector that supplies equipment and consumables to develop and manufacture biologics, which likewise has seen significant expansion. Its five-year expected annual growth rate is almost 9%. (6)

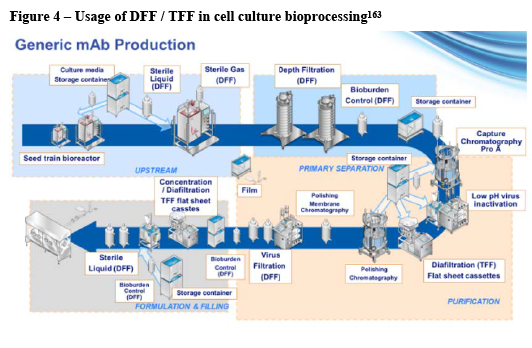

(11) While the manufacturing process of biologics differs somewhat depending on the specific (type of) product, a typical and standardised process such as the one for mAbs begins with cell culture – growing cells within the laboratory – followed by a scale-up process in which the cell culture is grown to the levels required for manufacturing. After sufficient cell growth is achieved, the desired protein must be separated from the cells and the growth media purified. This involves various stages of filtering and clarification, as well as mixing the protein with sterile solutions at the desired level of dilution for administration to the patient. (7)

(12) Bioprocessing can be divided into two broad manufacturing steps: an “upstream” process, during which cells are grown and the biologic target harvested, and a “downstream” process during which the desired drug product is isolated from the cells, purified and ultimately formulated and packaged into a final drug product – typically a filled vial or syringe. (8)

4.1.2.Customer preferences and regulatory constraints

(13) Choices of bioprocessing consumables and hardware are often made at the early stages of the drug development process, based principally on technical considerations. A key feature of the industry is that biologics manufacturers must provide full characterisation of their products for regulatory approval. Such characterisation includes testing of the production process and its control.

(14) In the Union, the European Medicines Agency (“EMA”) is responsible for central evaluation and authorisation of biologics (in EMA terminology, advanced therapy medicinal products or “ATMPs”). In addition to physicochemical testing, biologics require biological testing for full characterisation. Such characterisation combines testing of the active substance and the final medicinal product together with the production process and its control. Thus, the characterised and tested production process, which is designed by the manufacturer of the ATMP, becomes part of the basis for regulatory approval of the ATMP or biologic.

(15) Thus, once regulatory approval to produce a new biologic using a defined manufacturing process has been obtained, and a manufacturer has selected a particular product for a step in this process, it often tries to avoid switching because doing so would require re-characterisation/recertification. It also appears that manufacturers typically do not qualify more than one product for the same use in a given production process, and that they are thus largely locked-in with their suppliers once the product decision has been made.

(16) The Parties explain that it is typical for customers to select hardware and consumables from many different suppliers for a single bioprocessing setup. In light of the replies provided in the course of the market investigation, the Commission finds that customers appear in general to be able to “mix-and-match” equipment from different suppliers. (9)

(17) It should be noted that a significant trend within bioprocessing – especially for commercial production – is the rapidly growing use of recently developed single-use technology (“SUT”) products made of disposable plastic instead of conventional glass or stainless-steel vessels and tubings. SUT provide benefits in terms of lower initial investment cost, ease of use and flexibility, although consumables are more expensive. In particular, it appears that traditional steel hardware requires manufacturers to file with regulators a cleaning protocol, which they need to demonstrate ensures that there is no cross-contamination between product batches produced with the same hardware. Non-SUT also require the actual cleaning of hardware between production campaigns.

(18) Another trend in bioprocessing appears to be that, while traditional biopharma manufacturing occurs through a “batch” process – with the raw materials used to create the biologic being processed as discrete quantities at each stage of manufacturing – there are emergent methods that involve continuous processing at least at certain stages.

4.1.3. Bioprocessing products

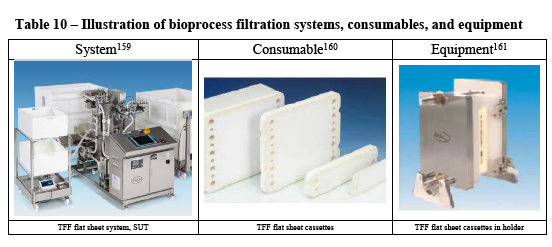

(19) Bioprocessing technologies in manufacturing processes include both hardware and various types of consumables. Bioprocessing hardware includes equipment such as mixers, bioreactors, columns for housing the chromatography process and “skids” or “systems” that manage the flow of fluids being processed. Bioprocessing consumables, which account for the vast majority of sales in the industry, include a large number of products, such as cell culture media, chromatography resins or filters, offered by a broad range of suppliers. (10)

(20) Pursuant to explanation of the Notifying Party, (11) bioprocessing at the upstream level generally involves three types of technologies and related products: bioreactors; filtration equipment; and various mixing and storage instruments.

- Bioreactors are the key element of the upstream manufacturing process. They are vessels in which cells are grown in a controlled environment. Most commonly the cells are suspended in a liquid solution that is stirred or rocked to encourage cell growth.

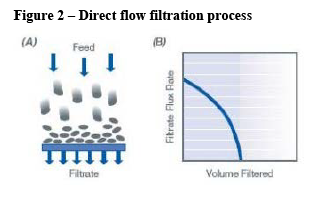

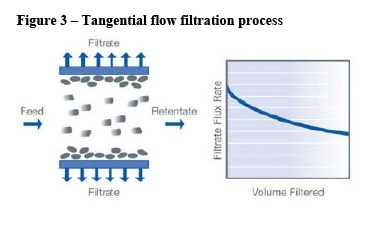

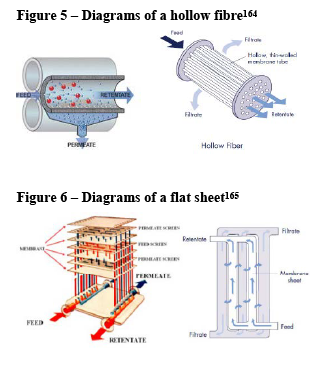

- Filtration solutions are used at various stages of the upstream process to purify and clarify the cell growth solution and ensure its sterility before it is introduced into the bioreactor. The most prevalent type of filtration is direct flow filtration where a mixture flows through the filter. Another type of filtration is tangential flow filtration where the mixture flows alongside the filter.

- Mixers and storage instruments are used to prepare and store cell growth solutions. Mixers can also be used to mix other inputs, such as powders.

(21) Throughout the downstream manufacturing process, various types of equipment are used to separate unwanted (for example cell mass) from wanted (for example proteins) products of the upstream cell production process. The technologies generally fall into two areas:

- Chromatography involves purification technologies that separate desired from undesired elements through chemical processes by running a liquid “mobile phase” through a “stationary phase” of chemically treated resins.

- Filtration typically removes unwanted from wanted elements of the cell growth process through physical separation by running liquids through porous membranes.

(22) The Commission’s assessment of the Parties’ activities in the bioprocessing industry will start with horizontal non-coordinated effects and vertical relationships concerning the upstream process followed by an assessment of the horizontal non- coordinated effects and vertical relationships between the Parties’ activities in the downstream process before moving to possible conglomerate and coordinated effects.

4.2. SUT products

(23) The Parties sell SUT bioreactors, mixers, connectors and bags for use in the upstream bioprocessing steps. The Parties consider each of these functions as different product markets. (12) SUT products have consumable elements made of flexible or semi-rigid plastic. They are intended for one-time use and subsequent disposal, which improves safety and reduce cleaning and sterilisation costs. These consumables are designed to work only with the SUT hardware purchased from a given supplier. SUT products are growing rapidly in bioprocessing.

(24) Bioreactors are vessels that create the appropriate environment through several conditions(13) that enable cell culture growth for the purposes of producing biologics. The hardware part consists of a tank with a motor into which the bag is inserted and an automation and process control system, as well as sensors to control critical operating parameters, such as oxygen, pH, temperature and pressure, and mass flow controllers to regulate the gas flow into the bioreactor. The mixing technology may consist of a rocking platform (rocking bioreactor), a tank (stirred tank bioreactors) or a docking station and equipment to control sensors, mixing or gassing (fixed-bed bioreactor). The consumable part is the disposable plastic assemblies designed for specific hardware systems that contain the cells and cell culture media during cell growth.

(25) SUT mixers are used to perform process steps such as preparing media and buffers, as well as virus inactivation. They are only used for mixing purposes. Most mixers consist of a sterile bag assembly containing a magnetically driven impeller supported by plastic or stainless-steel hardware.

(26) SUT connectors allow to manage fluid between separate fluid pathways in the bioprocessing industry. SUT connectors have largely replaced traditional tube welding (that is joining two pieces of thermoplastic tubing by using high heat), as they provide a faster and easier solution. While it is not possible to use one supplier’s connector on one end with another supplier’s connector on the other end, they can be connected to the SUT system of a different supplier.

(27) SUT bioprocess bags are used for the collection, storage, transport and feed-in of biopharmaceutical liquids in bioproduction processes.

(28) The vast majority of customers and competitors (14) who expressed an opinion in the market investigation on this point submitted that SUT bioreactors, SUT mixers and SUT connectors may be distinguished from each other based on their functions. As some market respondents stated: (15) “they all have different functions which have different performance requirements, thereby making their classifications distinct”, “each product has its own use and can be use independently from each other. None can be replaced by another one” or “these products play different roles in bioprocessing and should therefore be distinguished from each other”.

(29) In light of these considerations as well as all evidence available to it, the Commission will assess the different SUT product categories separately.

4.2.1. SUT bioreactors

4.2.1.1. Market definition

(A) Product market definition

(A.i) Notifying Party’s arguments

(30) The Notifying Party submitted that (i) SUT rocking bioreactors; (ii) SUT stirred tank bioreactors; and (iii) SUT fixed-bed bioreactors belong to separate product markets. (16) The Notifying Party provides a number of arguments in this regard:

(a) Rocking and stirred tank bioreactors would most commonly be used in suspension cell culture. Rocking and stirred tank bioreactors would be used at different stages of the bioprocess workflow (17): whereas rocking bioreactors may be used as a seed train bioreactor for the stirred tank, (18) stirred tank bioreactors are generally used for larger scale operations, such as development and production.

(b) Fixed-bed bioreactors would represent a niche that can only be used for adherent cell culture. (19) The Notifying Party submits that the cases where either fixed-bed bioreactors or microcarriers in stirred tank bioreactors can be used interchangeably to grow adherent cells are limited to small-scale R&D activities (20) and to instances where customers are interested in what the cell produces rather than in the cells themselves. (21) While fixed-bed bioreactors are not well suited for very large-scale cell culture, stirred tanks in combination with microcarriers may be used for large-scale production of vaccines. (22)

(31) The Notifying Party submits that there is generally no substitution between SUT fermenters (vessels that used for the growth of microorganisms in non-mammalian microbial fermentation applications) and SUT bioreactors and therefore excludes the former from its proposed assessment. (23)

(32) The Notifying Party considers that it is not necessary to distinguish between different sizes of SUT bioreactors because the size of the product is determined by the application it is used in and all suppliers generally offer a range of sizes and volumes to address these needs. (24)

(33) The Notifying Party submits that markets should not be further segmented by types of customers because the majority of the SUT products are sold to bioprocessing with only a small part being sold to academia customers. (25)

(34) The Notifying Party considers that it is not necessary to define a separate product market for the hardware (tanks and skids) used to hold and control the consumable part of SUT bioreactors. (26) In this regard, the Notifying Party submits that the hardware and consumable parts are initially sold together as an SUT bioreactors and that a given supplier’s SUT bioreactor generally cannot be used with consumable SUT bioreactor bags supplied by another supplier. (27)

(A.ii) Commission’s assessment

(35) In a previous decision (28), the Commission left open whether SUT bioreactors, SUT bags, SUT mixers and SUT transfer sets constitute separate product markets or whether they belong to a single SUT product market. The Commission did not differentiate between different types of bioreactors in that decision.

(36) A majority of customers who expressed an opinion in the market investigation on this point submitted that they are not generally able to use SUT rocking bioreactors, SUT stirred tank bioreactors and SUT fixed-bed bioreactors interchangeably or are only able to do so to a limited extent. (29) In this regard, a customer submitted that “[e]ach type of SUT bioreactor have its own specification and range of use. [The respondent] choose the one that best fits the cultivation constrains imposed by the research project objectives. On very seldom occasion (once in 6 years), [the respondent] has hesitated between stirred tank and rocking bioreactor”. (30) “[Stirred tank and rocking bioreactors] are used at different steps in the manufacturing process and are not interchangeable”.

(37) Some customers referred to the size of the batch and the individual steps of the bioprocessing workflow as factors limiting the interchangeability between different types of SUT bioreactors. One customer submitted that “[r]ocking bioreactors are used in early steps to grow cells and are limited to a volume of 200 litres. On the other hand, stirred-tank bioreactors are used in the production phase; they are more advanced in their parameters and technical settings, and may be used with a volume of 1 500 - 2 000 litres. While technically both types of bioreactors could be used for the same purpose of growing cells, stirred-tanks bioreactors are generally too complex for smaller scale where rocking bioreactors can be used”. (31) Another customer stated that “[d]ifferent bioreactors as listed above are best fit depending on the processes that you are running as well as the size of a batch that you need to do. For example, rocking bioreactors will be smaller and not able to handle cultures which are higher titer or require greater O2 control and/or consumption”. Another customer stated that “[these different types of bioreactors] have different functions at different scales and so in general are not interchangeable”. Another customer stated that these are “[u]sed for different volume and steps of the process”.

(38) Other customers referred to the differences between suspension and adherent cell culture. In this regard, one customer stated that “[e]specially fixed-bed and stirred tank are not interchang[e]able for suspension cell cultures”. (32) Another customer expressed that “[e]ach of the type of reactors quoted has a specific purpose in a production system, rocking systems are typically used in preculture applications. Stirred tank reactors are used in for production cultures, and fixed bed cultures are specific in their use with adherent cultures. None of these uses are interchangeable”.

(39) Moreover, none of the competitors who expressed an opinion on this point indicated that customers are generally able to use these three types of SUT bioreactors interchangeably. (33)

(40) In addition, a majority of customers who expressed an opinion in the market investigation on this point submitted that, for the specific purpose of growing adherent cell cultures, they are not generally able to use interchangeably fixed-bed bioreactors and rocking/stirred tank bioreactors in combination with microcarriers. (34) In this regard, a customer stated that “[f]or adherent cells, the Company uses (i) small culturing vessels or plastic pipes at an initial phase; (ii) Danaher’s fixed- bed bioreactors at an intermediate phase; and (iii) stirred-tank bioreactors in combination with microcarriers when a larger commercial-scale is required”. (35)

(41) The Commission notes, based on the information provided by the Notifying Party, that a variety of suppliers offer SUT rocking bioreactors with working volumes between 1-5l and 25-50l and SUT stirred tank bioreactors with working volumes between 1-5l and 2,000l. (36) This has been confirmed by a majority of customers who expressed an opinion in the market investigation on this point, which consider that suppliers of SUT bioreactors have a credible offering of differently sized SUT bioreactors (from 1l to 2,000l) to address different needs. (37) The response is however mixed within competitors. (38)

(42) As to SUT fermenters, over the course of the market investigation, no market participant put forward any arguments in relation to a potential substitutability between SUT fermenters and SUT bioreactors.

(43) For the purposes of this decision and in light of all information available to it, the Commission considers that (i) SUT rocking bioreactors; (ii) SUT stirred tank bioreactors; and (iii) SUT fixed-bed bioreactors constitute separate product markets, given that these three types of SUT bioreactors are mostly used at different stages of the bioprocess workflow and that they generally serve different applications. Moreover, the Commission does not consider necessary to further segment these product markets based on the size of the SUT bioreactor, since suppliers have a credible offering of differently sized bioreactors. The Commission does not consider it necessary to define a market for SUT fermenters as those are not relevant for the assessment of the Transaction.

(B) Geographic market definition

(B.i) Notifying Party’s arguments

(44) The Notifying Party submitted that SUT bioreactors are worldwide and in any event, not narrower than EEA-wide in scope, as these products are manufactured at centralised sites and shipped via regional distribution hubs to customers globally. (39)

(45) Moreover, the Notifying Party submitted that (i) transportation costs are low as a proportion of total costs, representing around […]% of the sales prices of SUT bioreactors; (ii) there are no regulatory differences within the EEA; (iii) custom duties do not affect transportation globally; and (iv) pricing is similar across the EEA. (40)

(B.ii) Commission’s assessment

(46) The market investigation confirmed the Notifying Party’s submission regarding geographic market definition.

(47) In relation to rocking bioreactors, stirred tank bioreactors and fixed-bed bioreactors, the large majority of customers and competitors who expressed an opinion on this point stated that (i) they procure SUT bioreactors at worldwide level; (ii) after-sale services are provided at worldwide level; (iii) prices are comparable at worldwide level; and (iv) the same suppliers are active at worldwide level. (41)

(48) For the purposes of this decision, it can be left open whether the market for SUT rocking bioreactor, SUT stirred tank bioreactor and SUT fixed-bed bioreactors is global or EEA-wide in scope. The Transaction does not give rise to serious doubts as to their compatibility with the internal market or the functioning of the EEA Agreement under any of these plausible geographic market definitions.

4.2.1.2. Competitive assessment

(A) Horizontal overlaps

(49) The Transaction leads to a horizontal overlap between the Parties’ offerings in SUT rocking bioreactors and SUT stirred tank bioreactors.

(50) Danaher also offers its iCELLis SUT fixed-bed bioreactors, where GE is not active. (42) Moreover, GE offers SUT fermenters, while Danaher does not. Given the absence of any horizontal overlap, SUT fixed-bed bioreactors and SUT fermenters will not be discussed further for the purpose of this decision.

(A.i) SUT rocking bioreactors

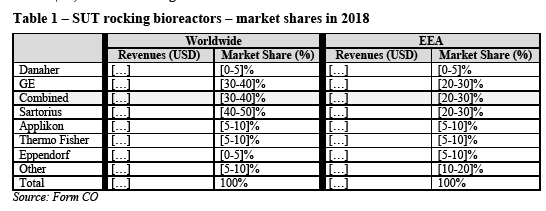

(51) According to the Parties’ estimates set out in Table 1 above, the combined entity would hold a market share of [30-40]% (GE: [30-40]%; Danaher: [0-5]%) in a worldwide market for SUT rocking bioreactors. Following the Transaction, Sartorius will continue being the market leader with a market share of [40-50]%. Danaher would […] add a modest [0-5]% market share, and it is currently a smaller player in SUT rocking bioreactors than Applikon ([5-10]%), Thermo Fisher ([5-10]%) or Eppendorf ([0-5]%). Danaher’s small market share is due to it being a recent entrant in this market with only a small rocking bioreactor limited to 25L.

(52) At the EEA-level, and according to the Parties’ estimates set out in Table 1 above, the combined entity would hold a market share of [20-30]% (GE: [20-30]%; Danaher: [0-5]%) for SUT rocking bioreactors. Following the Transaction, Sartorius will continue being the market leader with a market share of [20-30]%. Danaher would only add a modest [0-5]% market share, and it is currently a smaller player in SUT rocking bioreactors than Applikon ([5-10]%), Thermo Fisher ([5-10]%) or Eppendorf ([5-10]%).

(53) A large majority of customers who expressed an opinion in the market investigation on this point submitted that they would have credible alternative suppliers of SUT rocking bioreactors post-Transaction. (43) In this regard, a customer stated that it “considers there to be sufficient competitors and options in this space. Post- Transaction, [the respondent] is comfortable that it will be able to find sufficient credible alternative suppliers of SUT bioreactors to the merged entity”. This view was unanimously backed by all competitors who expressed an opinion in the market investigation on this point. (44)

(54) Moreover, the results of the market investigation indicated that GE and Danaher would not be close competitors in SUT rocking bioreactors. A clear majority of customers and competitors who expressed an opinion in the market investigation on this point considered that GE is the strongest player and that Sartorius is the second strongest player in this market. (45)

(55) In addition, the replies from the market investigation confirmed the Notifying Party’s argument that GE’s and Sartorius’ strong position is due to the fact that they respectively acquired Wave Biotech LLC in 2007 and Wave Biotech AG in 2008, which resulted from the split of Wave Biotech, the inventor of SUT rocking bioreactors, into two companies. (46) In this regard, a customer elaborated as to GE’s and Sartorius’ relative position in a market for SUT rocking bioreactors: “[t]he rocking bioreactor technology was developed by Wave Biotech over 20 years ago and subsequently acquired by GE. A European based copy of the same technology was purchased by Sartorius. These have been the dominant players in this market place”. (47) This is consistent with the replies from competitors, who stated that “[s]trongest players were first to market with their SUT bioreactors” and that “Thermo has had a long-standing leadership in classical single-use bioreactors”. (48)

(56) A majority of customers and competitors who expressed an opinion in the market investigation on this point does not expect an impact of the Transaction on price, quality, product range, innovation or security of supply. (49)

(57) In light of the considerations in paragraphs (51) to (56) above as well as all evidence available to it, the Commission concludes that, in the worldwide or EEA-wide market for SUT rocking bioreactors, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to horizontal non-coordinated effects given in particular (i) the moderate combined share of the Parties; (ii) the small increment contributed by Danaher, which is a recent entrant to this market, to GE’s position; (iii) the fact that the parties are not close competitors to one another; and (iv) the presence of a strong competitor, Sartorius, matching the combined entity’s market shares.

(A.ii) SUT stirred tank bioreactors

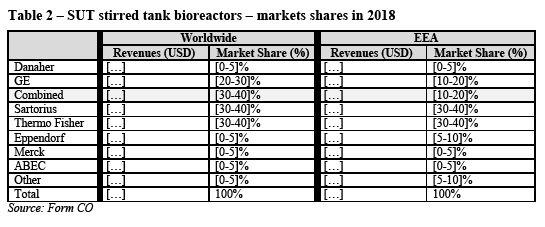

(58) According to the Parties’ estimates set out in Table 2 above, the combined entity would hold a market share of [30-40]% (GE: [20-30]%; Danaher: [0-5]%) in a worldwide market for SUT stirred tank bioreactors. Following the Transaction, Sartorius and Thermo Fisher will remain very similar in size to the combined entity, both with market shares of [30-40]%.

(59) At the EEA-level, and according to the Parties’ estimates set out in Table 2 above, the combined entity would hold a market share of [10-20]% (GE: [10-20]%; Danaher: [0-5]%) for SUT stirred tank bioreactors. Following the Transaction, Sartorius and Thermo Fisher will continue being the market leaders, both with market shares of [30-40]%.

(60) A large majority of customers who expressed an opinion in the market investigation on this point submitted that they would have credible alternative suppliers of SUT stirred tank bioreactors post-Transaction. (50) This view was unanimously backed by all competitors who expressed an opinion in the market investigation on this point. (51)

(61) Moreover, the results of the market investigation indicated that GE and Danaher would not be close competitors in SUT stirred tank bioreactors. Customers who expressed an opinion in the market investigation on this point were divided as to whether GE or Sartorius are the strongest player in SUT stirred tank bioreactors. (52) A majority of competitors and a significant number of customers selected Thermo Fisher as the strongest player in this market. (53) Very similar views on this point were expressed in relation to the second strongest player in SUT stirred tank bioreactors, with customers divided between GE and Sartorius.

(62) A majority of customers and competitors who expressed an opinion in the market investigation on this point does not expect an impact of the Transaction on price, quality, product range, innovation or security of supply. (54)

(63) In light of the considerations in paragraphs (58) to (62) above as well as all evidence available to it, the Commission concludes that, in the worldwide or EEA-wide market for SUT stirred tank bioreactors, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to horizontal non-coordinated effects given in particular (i) the moderate combined share of the Parties; (ii) the small increment contributed by Danaher to GE’s position; (iii) the fact that the Parties are not close competitors to one another; and (iv) the presence of two strong competitors, Sartorius and Thermo Fisher, matching the combined entity’s market shares.

(B) Vertical relationships

(64) The Transaction leads to a vertical link between the upstream supply of direct flow filtration (“DFF”) consumables (described in detail in section 4.5) and the downstream supply of SUT rocking bioreactors and SUT stirred tank bioreactors. DFF consumables are generally used in SUT bioreactors, while tangential flow filtration (“TFF”) hollow fibre consumables are used in SUT bioreactors for perfusion applications. (55)

(65) An internal email of Danaher identified […]. (56) […]. (57)

(66) The Notifying Party explains that “DFF filters used in bioreactors are always chosen by the manufacturer of the bioreactor to ensure that the overall specifications of the bioreactor are met”. (58) While the Notifying Party recognises that, theoretically, DFF filters from other suppliers could be substituted, this would only be possible at the point of manufacture and would be expensive and time consuming, without adding any significant value to the customer. Because of this, the Notifying Party submits that “no bioreactor supplier offers customers the ability to customize the bioreactor bag with their DFF filter of choice because there is no customer demand for this”. (59)

(67) Against this background, the Commission investigated whether the Transaction would lead to non-coordinated vertical effects in the form of input or customer foreclosure.

(68) As regards a possible input foreclosure, the Commission assessed whether post- Transaction, the merged entity could restrict access to its DFF consumables or TFF hollow fibre consumables and thereby foreclose its competitors on the market for SUT bioreactors.

(69) In this regard, the Commission firstly notes that as described in section 4.5, Pall sells DFF consumables and holds a market share of [20-30]% in the EEA and [30-40]% at the worldwide level. In turn, GE is active only […], with a […] market share of [0-5]% in both the EEA and worldwide level. Moreover, there are a number of credible competitors active in DFF consumables (see section 4.5.3.1) so that any attempt by the merged entity to foreclose access to its DFF consumables is likely to be defeated by its competitors in DFF consumables, such as Merck Millipore or Sartorius, who both have a broad portfolio of DFF solutions. (60) Therefore, the Commission considers that the merged entity would not have a sufficiently strong market position in DFF consumables to engage in input foreclosure to the detriment of its competitors.

(70) As regards TFF hollow fibre consumables, the Commission notes that while GE holds a strong position (see paragraph (264) below), […]. Thus, there is no merger- specific change as regards the future market position of the merged entity compared to GE’s current market position in TFF hollow fibre consumables. Against this background, the Commission considers it unlikely that the merged entity would engage in input foreclosure with respect to TFF hollow fibre consumables as a result of the Transaction.

(71) As regards possible customer foreclosure, the Commission assessed whether the merged entity would have the ability to foreclose competing suppliers of DFF or TFF hollow fibre consumables from accessing customers.

(72) In this context, the Commission firstly notes that bioprocessing filtration consumables such as DFF and TFF hollow fibre consumables are not only sold as an input for SUT bioreactors as part of the upstream process, but also on a stand-alone basis or together with hardware used in the downstream process. Thus, even if the merged entity could successfully retro-fit its own consumables into SUT rocking or SUT stirred-tank bioreactors, this would not impact on competitors’ sales of DFF and TFF hollow fibre consumable sales that are unconnected to bioreactors.

(73) Secondly, the Commission notes that the merged entity’s market share in SUT rocking bioreactors would amount to [30-40]% at worldwide level and [20-30]% at EEA level. For SUT stirred tank bioreactors, the merged entity’s market share would amount to [30-40]% and [10-20]% respectively at worldwide and EEA level. This implies that a large part of SUT rocking and stirred tank bioreactors sales would not be affected by a possible retro-fitting strategy of the merged entity.

(74) Thirdly, the Commission considers that any possible customer foreclosure strategy by the merged entity would also be limited by customer preferences. Contrary to the submission by the Notifying Party, a majority of customers who expressed an opinion in the market investigation on this point considers that they typically decide which DFF consumable is included in the SUT bioreactor, with a minority considering that the supplier of SUT bioreactors selects the DFF consumable to be used. (61) In this regard, a customer stated that “[t]ypically, the relevant supplier of the bioreactor would recommend the DFF consumables that it normally offers (usually its own filters) but will always be willing to include a different filter if requested. While their own filter is likely the default, suppliers tend to be flexible following a request”. (62)

(75) Therefore, the Commission considers that the merged entity would also lack the ability to foreclose competing suppliers of DFF and TFF hollow fibre consumables to access respective customers.

(76) In light of the considerations in paragraphs (64) to (75) above as well as all evidence available to it, the Commission concludes that, in the worldwide or EEA-wide market for SUT bioreactors and the worldwide or EEA-wide markets for DFF and TFF hollow fibre consumables, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to vertical non-coordinated effects.

4.2.2. SUT mixers and related IP

(77) SUT mixers are used to perform process steps such as preparing media and other process liquids, (63) as well as virus inactivation. (64) SUT mixers make solutions by mixing various ingredients and cannot be used for adherent or suspension cell culture. (65) Most mixers consist of a sterile bag assembly containing a magnetically driven impeller supported by plastic or stainless-steel hardware. (66)

4.2.2.1. Market definition

(A) Product market definition

(A.i) Notifying Party’s arguments

(78) The Notifying Party submitted that it is not necessary to segment SUT mixers into various categories given that all suppliers offer all types of mixers and can provide a solution based on the user requirement specification of the customer. (67)

(79) The Notifying Party considers that it is not necessary to define a separate product market for the hardware (tanks and skids) used to hold and control the consumable part of SUT mixers. (68) In this regard, the Notifying Party submits that the hardware and consumable parts are initially sold together as an SUT mixer and that a given supplier’s SUT mixer generally cannot be used with consumable SUT mixer bags supplied by another supplier. (69)

(80) The Notifying Party submitted that a further segmentation of the mixer portfolio could nevertheless be made based on the functionality that the mixer provides (that is pH or temperature control), and whether the mixers are locally controlled or connected to the customer’s automation systems. (70) On this basis, it may be possible to identify the following sub-segments: (i) mixers with sensors; (ii) mixers with jackets; (iii) mixers with load cells; and (iv) mixers that are controlled locally or remotely. (71)

(A.ii) Commission’s assessment

(81) In a previous decision, (72) the Commission left open whether SUT bioreactors, SUT bags, SUT mixers and SUT transfer sets constitute separate product markets or whether they belong to a single SUT product market. The Commission did not differentiate between different types of SUT mixers in that decision.

(82) The market investigation in this decision has largely confirmed the Parties’ submissions regarding product market definition.

(83) A majority of customers and competitors who expressed an opinion in the market investigation on this point considered that SUT mixers should not be further segmented according to separate categories based, inter alia, on the different functionality they provide (namely, SUT mixers with sensors, SUT mixers with jackets, SUT mixers with load cells and SUT mixers that are controlled locally or remotely). (73) In this regard, a customer expressed that “[t]he SU mixing is the main functionality and all the others are technical options that end users will request based on the specificities of their processes”. Another customer stated that it “often require[s] an SUT mixer to have sensors, load cells and jackets and be capable of being controlled locally and remotely. [The respondent] does not consider it makes sense to split SUT mixers by such categories given the requirement to mix and match functionality on a machine”. Moreover, a competitor expressed that “[a]ll these variants […] (as well as gas handling) exist and are used at times and not at other times and for various process steps”. This competitor moreover stated that “[i]n general, […] general mixers seems to be a reasonable split”.

(84) Over the course of the pre-notification market investigation, it was put forward that an additional distinction could be made between top-mounted and bottom-mounted impeller mixers

(85) A majority of those customers who expressed an opinion in the market investigation on this point considered that they were generally able to use top-mounted SUT impeller mixers for the same applications as for which bottom-mounted impeller mixers are used. (74) In this regard, a customer expressed that “[t]he only difference between both options is purely operational and [that the] decision would be based on the clean room infrastructure where the SU mixing systems would be installed”. Another customer expressed that, “[i]n practice, [it has] used both top-mounted SUT impellers mi[x]ers and bottom-mounted impeller mixers for the same applications in the past. Ultimately, both function as mixers but with differing entry points. [The respondent] does not consider there to be a substantive difference between the two”. Another customer said that, “when designing a manufacturing process [they] would be able to select either a top- or bottom-mounted impeller mixer regardless of the product”.

(86) Moreover, a majority of competitors who expressed an opinion in the market investigation on this point considered that customers are generally able to use top- mounted impellers for the same applications as for which bottom-mounted impeller mixers are used. (75) In this regard, a competitor expressed that both types of impeller mixers are targeted towards “the same customers and the same applications. Top- mounted impellers have certain advantages, bottom-mounted have other advantages. It depends on the priorities of the customer regarding flexibility, openness, cleaning and other factors”.

(87) For the purposes of this decision, in the light of all evidence available to it, the Commission considers that there is a single relevant market including all types of SUT mixers.

(B) Geographic market definition

(B.i) Notifying Party’s arguments

(88) The Notifying Party submitted that SUT mixers are worldwide and in any event, not narrower than EEA-wide in scope, as these products are manufactured at centralised sites and shipped via regional distribution hubs to customers globally. (76)

(89) Moreover, the Notifying Party submitted that (i) transportation costs are low as a proportion of total costs, representing around […]% of the sales prices of SUT mixers; (ii) there are no regulatory differences within the EEA; (iii) custom duties do not affect transportation globally; and (iv) pricing is similar across the EEA. (77)

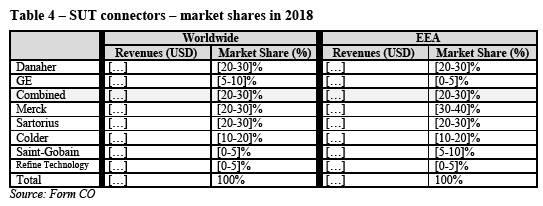

(B.ii) Commission’s assessment

(90) The market investigation confirmed the Notifying Party’s claims regarding geographic market definition.

(91) The large majority of customers and competitors who expressed an opinion on this point stated that (i) they procure SUT mixers at worldwide level; (ii) after-sale services are provided at worldwide level; (iii) prices are comparable at worldwide level; and (iv) the same suppliers are active at worldwide level. (78)

(92) For the purposes of this decision, it can be left open whether the market for SUT mixers is global or EEA-wide in scope. The Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of these plausible geographic market definitions.

4.2.2.2. Competitive assessment

(A) Horizontal overlaps

(93) In SUT mixers, the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement for the following reasons.

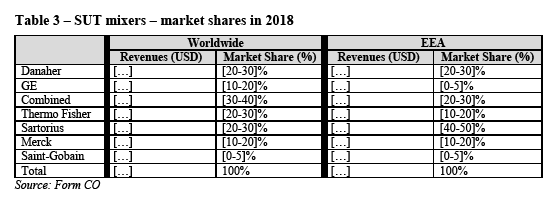

(94) The combined entity will have moderate market shares at both the worldwide and the EEA-levels. As Table 3 shows, the Transaction will combine the current […] and […] players in the worldwide market for SUT mixers and will position the combined entity as the […] player in the market with a market share of [30-40]%. The combined entity will be closely followed by Thermo Fisher and Sartorius, which are roughly similar in size ([20-30]% and [20-30]% respectively). At the EEA-level, Sartorius will continue being the largest player in the market, with a market share of [40-50]%.

(95) A majority of customers and all competitors who expressed an opinion in the market investigation on this point considered there will be credible alternative suppliers of SUT mixers post-Transaction. (79)

(96) A majority of customers and competitors who expressed an opinion in the market investigation on this point considered Sartorius as the closest competitor to Danaher in SUT mixers. (80)

(97) Moreover, a majority of customers and competitors who expressed an opinion on this point did not expect the Transaction to have a negative impact on price, quality, product range, innovation or security of supply. (81)

(98) In light of the considerations in paragraphs (94) to (97) above as well as all evidence available to it, the Commission concludes that, in the worldwide or EEA-wide market for SUT mixers, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to horizontal non-coordinated effects.

(B) Vertical relationships

(99) There is a vertical link between Danaher’s upstream licensing of intellectual property rights […] and the downstream supply of SUT mixers by its competitors.

(100) Danaher [Danaher’s intellectual property rights]. (82)

(101) Currently, [Danaher’s intellectual property rights and license agreements]. (83)

(102) Moreover, [Danaher’s distribution agreements]. (84)

(103) Against this background, the Commission investigated whether the Transaction would lead to non-coordinated vertical effects in the form of input foreclosure. Specifically, the Commission assessed whether post-Transaction, Danaher could restrict access to its intellectual property rights […] and thereby foreclose its competitors on the market for SUT mixers.

(104) In assessing the likelihood of an anticompetitive input foreclosure scenario, the Commission examines, first, whether the merged entity would have, post-merger, the ability to substantially foreclose access to inputs, second, whether it would have the incentive to do so, and third, whether a foreclosure strategy would have a significant detrimental effect on competition downstream. In practice, these factors are often examined together since they are closely intertwined. (85)

(B.i) Ability to foreclose

(105) In light of the fact that Danaher’s intellectual property rights […] are used by many manufacturers of SUT mixers, the Commission has firstly assessed whether Danaher would have the ability to restrict access to those rights.

(106) In this context, the Commission notes that [Danaher’s intellectual property rights]. (86) According to the Notifying Party, [Danaher’s license agreements]. (87)

(107) During the market investigation, all the companies currently licensing these intellectual property rights from Danaher have confirmed that the term of their licence agreements matches the duration of Danaher’s patent protection. (88)

(108) Moreover, the Commission notes that none of the concerned producers of SUT mixers considered that the Transaction or [Danaher’s intellectual property rights] will have an implication on their production of mixers for which they licence IP rights […]. (89)

(109) As the existing licensing agreements cover a sufficient number of operators in the market, the Commission finds that Danaher would not have the ability to restrict access to its intellectual property rights […] post-Transaction.

(B.ii) Incentive to foreclose

(110) As regards a potential incentive for the merged entity to engage in input foreclosure, the Notifying Party submits that [Danaher’s intellectual property rights and license agreements]. (90)

(111) The Commission notes that no competitor currently sourcing components from Danaher to be used in SUT mixers considers it likely that Danaher will restrict access to them post-Transaction. (91) In this regard, a licensee stated that “Danaher is already supplying […] to competitors, the transaction will not change that competitive landscape, or their incentive to restrict access […]”. (92)

(112) In light of this and of the fact that Danaher is bound by the terms of existing licences for the life of the licenced patents, the Commission finds that Danaher would not have the incentive to restrict access to its intellectual property rights […] post- Transaction. In particular, the Transaction will not change the trade-off that Danaher already faces pre-Transaction between the profit that it could lose in the upstream market by engaging in an input foreclosure strategy and the potential profit gain from expanding its sales of SUT mixers downstream.

(B.iii) Impact

(113) Given the absence of the ability or the incentive to foreclose other manufacturers of SUT mixers, the Commission considers that the Transaction will not lead to increased prices in the downstream market thereby significantly impeding effective competition. In particular, the Commission has seen no evidence that a potential anticompetitive foreclosure would increase the cost of downstream competitors in the sale of SUT mixers nor raise the barriers to entry to potential competitors. Moreover, any potential input foreclosure would only affect part of a single market comprising all SUT mixers, as has been defined in paragraph (87) above, [Danaher’s intellectual property rights].

(114) Moreover, the Commission notes that, with the exception of one, all competitors in the downstream market also sell mixers that are not affected by Danaher’s intellectual property rights and would thus be in a position to offer SUT mixers even in the event of restricted access to Danaher’s intellectual property rights. (93)

(B.iv) Conclusion on vertical relationships

(115) In light of the considerations in paragraphs (99) to (114) above as well as all evidence available to it, the Commission concludes that, in the worldwide or EEA- wide market for SUT mixers, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to vertical non-coordinated effects.

4.2.3. SUT connectors

(116) SUT connectors provide reliable sterile connections between separate fluid pathways. They are used throughout single-use bioprocessing. Sterile connectors have largely displaced traditional tube welding as they provide faster and easier solutions to ensure a permanent connection.

(117) In upstream single-use bioprocessing, sterile connectors may be incorporated in SUT bioreactors to enable fluid transfer in or out, pH probe insertion, or sampling. They can also be incorporated in mixer bags to enable fluid transfer in or out of the mixer bag, or for pH/temperature probe insertion during media preparation. Sterile connectors are also key components of transfer sets, which enable the sterile transfer of fluid between unit operations. They can also be a component of an SUT bag, or part of a single-use filtration manifold.

(118) In downstream single-use bioprocessing, sterile connectors are used extensively in transfer sets to enable the sterile transfer of fluid from one bioprocessing unit operation to another. They can also be a component of an SUT bag or incorporated in a mixer, or for pH/temperature probe insertion during buffer preparation. Sterile connectors can also be a component of single-use filtration manifolds or single-use chromatography systems to enable the connection and transfer of fluid from one source through the inline device to another component such as an SUT bag.

(119) It is not possible to use one supplier’s connector on one end with another supplier’s connector on the other end. However, it is possible and common to integrate one supplier’s connectors in another supplier’s single use system according to the specifications of the customer.

4.2.3.1. Market definition

(A) Product market definition

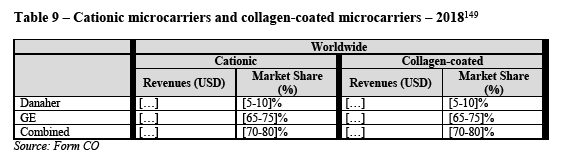

(A.i) Notifying Party’s arguments

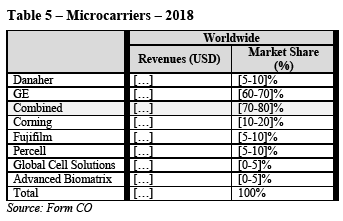

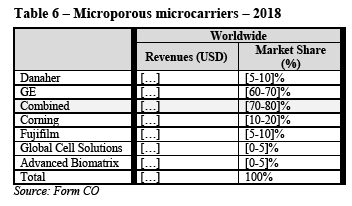

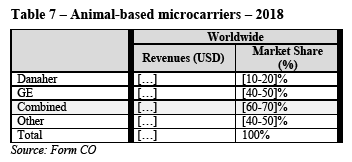

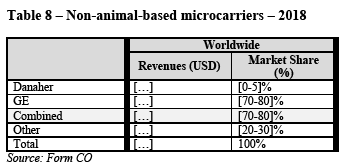

(120) The Notifying Party submits that gendered and genderless connectors (94) compete on the same market, as they both offer the same applications and functionalities and are similar in price. (95)

(121) The Notifying Party submits that aseptic connectors may compete with sterile connectors (96) in applications where sterile connections are not essential, but they generally do not compete where sterile connections are important, such as in the last steps of the downstream bioprocessing workflow, such as in filtration. (97) The Notifying Party submits that sterile and aseptic connectors do not compete with quick connectors (98) as they are intended for different applications. Quick connectors do not allow customers to maintain the cleanliness offered by sterile and aseptic connectors. (99)

(122) The Notifying Party provided market shares on the basis of a relevant product market comprising sterile and aseptic connectors (that is to say excluding quick connectors). (100)

(A.ii) Commission’s assessment

(123) In a previous decision (101), the Commission left open whether SUT bioreactors, SUT bags, SUT mixers and SUT transfer sets constitute separate product markets or whether they belong to a single SUT product market. The Commission did differentiate between different types of SUT connectors in that decision.

(124) In this decision, a wide majority of customers who expressed an opinion in the market investigation on this point indicated that they can replace sterile genderless and sterile gendered SUT connectors as regards price, use applications, technical characteristics and efficiency. (102) In this regard, a customer stated that “[e]ven though users usually prefer genderless connectors (they allow easier designs and better materials management), these should always be interchangeable with gendered ones, provided they are also validated by the drug manufacturer”. Another customer submitted that in its experience, “it is possible to replace a sterile genderless connector with a sterile gendered connector. The two connectors simply differ in their approach to connecting (genderless connectors involves identical connectors and gendered connectors require a female and male component) but otherwise, either can be utilised. Genderless is where the consoles are both identical at the end”.

(125) Moreover, competitors who expressed an opinion in the market investigation on this point have largely supported this view in relation to price, technical characteristics and efficiency. (103) Responses where however mixed in relation to use applications. In this regard, a competitor pointed to certain limitations: “[the respondent] typically chooses between gendered connectors based on application. Genderless connectors are used for more generic, mass quantity production while gendered connectors are used for more customised production. Choice usually lies solely on what makes sense for the given design”.

(126) Competitors who expressed an opinion on this point in response to a request for information submitted that their customers may only replace a sterile connector by an aseptic connector in rare occasions. Some competitors stated that customers may move from connectors that are non-certified for sterile connections (that is aseptic) to those which are certified for this purpose, but not the other way around. (104)

(127) For the purposes of this decision, the Commission considers that the market for SUT connectors comprise both gendered and genderless connectors, as they generally serve the same applications in the bioprocess workflow. Given that the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement in the market for SUT connectors, it can be left open for the purposes of this decision whether SUT aseptic connectors and SUT sterile connectors belong to the same product market.

(B) Geographic market definition

(B.i) Notifying Party’s arguments

(128) The Notifying Party submitted that SUT connectors are worldwide and in any event, not narrower than EEA-wide in scope, as these products are manufactured at centralised sites and shipped via regional distribution hubs to customers globally. (105)

(129) Moreover, the Notifying Party submitted that (i) transportation costs are low as a proportion of total costs, representing around […]% of the sales prices of SUT connectors; (ii) there are no regulatory differences within the EEA; (iii) custom duties do not affect transportation globally; and (iv) pricing is similar across the EEA. (106)

(B.ii) Commission’s assessment

(130) The large majority of customers and competitors who expressed an opinion on this point stated that (i) they procure SUT connectors at worldwide level; (ii) after-sale services are provided at worldwide level; (iii) prices are comparable at worldwide level; and (iv) the same suppliers are active at worldwide level. (107)

(131) For the purposes of this decision, it can be left open whether the market for SUT connectors is global or EEA-wide in scope. The Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of these plausible geographic market definitions.

4.2.3.2. Competitive assessment

(132) The Transaction leads to a horizontal overlap between the Parties’ offerings in SUT connectors. Danaher offers sterile SUT connectors (both gendered and genderless), through different generations of its Kleenpak connectors. GE only offers genderless aseptic SUT connectors, namely its ReadyMate connectors. Should SUT aseptic connectors and SUT sterile connectors be considered to belong to separate product markets, the Transaction would not lead to a horizontal overlap. For this reason, the assessment carried out in this section will be based on a market for overall SUT connectors.

(133) According to the Parties’ estimates set out in Table 4 above, the combined entity would hold a market share of [20-30]% in a worldwide market for SUT connectors. At the EEA-level, the combined entity’s market shares would be of [20-30]%. According to these estimates, Merck would remain the market leader at both the worldwide and EEA levels (with market shares of [20-30]% and [30-40]% respectively), closely followed by Sartorius.

(134) During the market investigation, a number of elements suggested that the Parties’ would hold higher combined market shares in a market for SUT connectors:

(a) First, ordinary course of business documents of Danaher suggest that the combined entity would hold a combined market share of [50-60]% in a worldwide market for SUT connectors in 2015, with GE bringing an increment of [10-20]%. (108) The Notifying Party has explained that the estimates provided in the Form CO are more sophisticated than in this internal document, given that the Form CO is based on customer replies and relies on GE’s actual data. (109)

(b) Second, a number of competitors who expressed an opinion in the market investigation on this point provided estimates of the combined entity’s market shares in SUT connectors, which ranged between [40-50]% and [60-70]% at the worldwide level, with an increment from GE ranging between [10-20]% and [20-30]%. (110)

(135) In view of this discrepancy, the Commission carried out a market reconstruction based on actual sales figures of competitors in order to verify the position of the combined entity in a market encompassing all SUT connectors at the worldwide and EEA levels. (111) The market reconstruction showed that the competitors’ actual sales data was in fact much lower than what had been provided in the Form CO. According to the results of the market reconstruction, the combined entity would hold a market share of [30-40%].

(B) Limited potential entry of new suppliers

(136) A significant majority of customers who expressed an opinion in the market investigation on this point did not expect additional companies to start supplying SUT connectors in the next two to three years. (112) A number of these customers pointed towards the existence of high barriers to entry, as newcomers are required to meet the quality and business requirements of mature pharmaceutical companies. In particular, one customer indicated that “[c]osts and scale of suppliers must be such that new companies coming to the market may not be easy to come by”. (113) The view of competitors in this regard was mixed, with some competitors referring to this market as being “already occupied by clear market leaders, high technical and quality barriers to entry” and that, as such, “[a]ny new entrant would only be able to capture a very small market share”. (114)

(C) Credible alternatives suppliers

(137) A majority of customers and competitors who expressed an opinion in the market investigation on this point considered that, post-Transaction, there will be sufficient credible alternative suppliers of SUT connectors for new production processes prior to obtain regulatory approval of a biopharmaceutical . (115)

(D) Competitors’ expansion of capacity

(138) Several competitors that responded to a Commission’s request for information indicated that they currently have spare capacity for SUT connectors. (116) Moreover, some of these competitors submitted that they would be able to increase their output of SUT connectors without incurring into additional high costs (117) and that they have also plans for expanding their total capacity for SUT connectors in the coming year. (118)

(139) Moreover, one of these competitors indicated that a “significant increase in the price of the SUT competitor connectors” or “SUT competitor connector supply or quality issues” would trigger an expansion in capacity. (119) An additional number of competitors referred in general to an increase in the demand for SUT connectors as a triggering factor for an expansion in total capacity. (120)

(E) Closeness of competition

(140) The Notifying Party submitted that, while GE markets its SUT connectors as aseptic, Danaher offers only sterile certified SUT connectors. According to the Notifying Party, the difference in quality derived from the SUT connectors being aseptic or sterile is reflected in the sharp differences in the price of the Parties’ SUT connectors. (121)

(141) The views of competitors who expressed an opinion on this point in response to a Commission request for information support this argument. The respondents submitted that their customers are only able to replace a sterile connector by an aseptic connector in rare occasions: some customers may move from aseptic SUT connectors to certified sterile SUT connectors, but not the other way around. (122)

(142) Moreover, the Notifying Party submitted that […]. (123)

Figure 1 – Overview of the main suppliers’ offering of SUT connectors (2000-2025)

[…]

Source: Form CO, Annex DHR 580

(143) In this regard, the Commission notes (as illustrated in Figure 1 above) that GE’s SUT connectors (ReadyMate) have been present in the market since before 2010. In turn, […]. Figure 1 above shows that the main competitors to the combined entity have recently introduced new models.

(144) This appears consistent with the […]. (124)

(F) Conclusion

(145) While the Commission notes the discrepancy in market shares and also the responses of customers and competitors regarding the limited scope for potential entry of new suppliers in SUT connectors, further elements lead to the conclusion that the Transaction will not give rise to serious doubts, namely (i) the existence of credible alternative suppliers in the market; (ii) the fact that competitors currently have spare capacity and are able to increase output without incurring into additional high costs; and (iii) the fact that the Parties’ are not close competitors to one another.

(146) In light of the considerations in paragraphs (132) to (145) above as well as all evidence available to it, the Commission concludes that, in the worldwide or EEA- wide market for SUT connectors, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to horizontal non-coordinated effects.

4.3. Cell culture media and sera

(147) Cell culture bioprocessing typically requires growing different types of cells. Nutrients are provided to cultivated cells in the form of media, sera and other reagents such as growth factors and hormones, which are consumables used in cell culture. Cell culture media are water-based liquids, while sera are liquid blood-based animal products.

(148) The Parties’ activities overlap in all three areas, namely cell culture media, cell culture sera and other process liquids but the Transaction gives rise to affected markets only in cell culture sera.

4.3.1. Product market definition

4.3.1.1. Commission’s precedents

(149) The Commission has examined cell culture sera in the past and, while the precise market definition was left opened, it considered that the market for cell culture sera could be segmented based on the customer groups, the type of animal the blood originates from, and the geographic origin of the blood provided. (125)

4.3.1.2. Notifying Party’s views

(150) In line with Commission’s precedents, (126) the Notifying Party considers cell culture sera as a separate market within the overall cell culture segment. The Notifying Party further submits that cell culture sera could likely be segmented based on customer type, type of animal the blood originates from, and geographic origin of the blood provided. However, the precise product market definition was left open, since there would not be any competitive concerns under any such market definition.

4.3.1.3. Commission’s assessment

(151) The majority of customers and competitors who expressed an opinion on this point considered that the Commission’s past definitions for the relevant market in cell culture sera are still pertinent. (127)

(152) Therefore, for the purpose of this case, it can be left open whether there are relevant markets based on the different segmentations like the customer type, the type of animal that the blood originates from, or the geographic origin of the blood provided, as the transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of these plausible product market definitions (128). Considering the overlaps in the Parties’ activities, for the purpose of this decision, the Commission will carry out its competitive assessment only with regard to (i) overall cell culture sera; and

(ii) Ultroser G serum substitute product markets.

4.3.2. Geographic market definition

4.3.2.1. Commission’s precedents

(153) In previous decisions, the Commission considered the geographic market for cell culture sera to be worldwide or at least EEA-wide in scope. (129)

4.3.2.2. Notifying Party’s views

(154) In line with past Commission previous definitions, the Notifying Party considers the geographic market for cell culture sera to be worldwide or at least EEA-wide in scope.

4.3.2.3. Commission’s assessment

(155) The majority of customers and competitors who expressed an opinion on this point tend to confirm the cell culture sera market to be worldwide. This is mainly due to comparable prices at a worldwide level, the fact that the same suppliers of sera are active at a worldwide level and that customers procure sera at a worldwide level. (130)

(156) In any event, for the purpose of this decision, the Commission considers that the precise geographic market definition can be left open, as this would not change the outcome of the competitive assessment.

4.3.3. Competitive assessment

(157) Danaher sources various media from Fujifilm and Stemcell Technologies and resells it for research stages of cell culture, under the under the MolDev brand. Also, Danaher offers a serum substitute (Ultroser G serum substitute) that can replace fetal calf serum (FCS) for small-scale experiments and diagnostic applications and reagents, buffers and solutions that are not used in cell culture. The serum is not suited for bioproduction, human, or animal use.

(158) GE Biopharma, under the HyClone product line, offers various cell culture consumables, for example media, (131) sera, and other supplements, buffers and process liquids. GE Biopharma cell culture media and sera are predominantly used in the manufacturing stage of cell culture and, thus, supplied in high volumes.

(159) The Parties’ activities overlap in the overall sera market and in the possible market for Ultroser G serum substitute and fetal calf serum. The Transaction would lead to affected markets in the possible markets for overall cell culture sera and Ultroser G serum substitute at a worldwide level. However, in none of the possible affected markets, the Transaction raises serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement for the following reasons.

(160) First, according to the Parties’ estimates, in all affected markets, the combined market shares are […] ([20-30]%), with a […] increment from Danaher which is [0-5]%. The […] increment would not lead to a substantial change of the competitive structure of the market in any of the possible affected markets.

(161) Second, the combined entity will face several well-established suppliers post- Transaction, such as Thermo Fisher, Merck Millipore, Corning and other smaller ones.

(162) Third, the majority of customers and competitors who expressed an opinion in the market investigation on this point did not expect that the Transaction would have a negative impact in relation to cell culture sera regarding any of the following parameters: price, quality, innovation, security of supply and product range. (132)

(163) In light of the considerations in paragraphs (157) to (162) above as well as all evidence available to it, the Commission considers that, in the worldwide or EEA- wide market for cell culture sera and Ultroser G serum substitute, the Transaction will not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement due to horizontal non-coordinated effects under any plausible market definition.

4.4. Microcarriers

(164) Microcarriers are consumables used in cell culture bioprocessing. They provide a surface for the anchorage of adherent cells to attach and grow in cell culture vessels and bioreactors for adherent cell culture.

(165) Microcarriers consist of two parts: the core or matrix and the surface.

(166) The core or matrix of microcarriers can be of different porosity. Accordingly, microcarriers can be described as either microporous with pore sizes up to around 20 µm or as macroporous with pore diameters from around 20 µm up to around 400 µm. In a microporous structure, cells cannot enter the pores and thus grow in monolayers on the surface of the microcarrier. In a macroporous structure, cells can access the pores and grow inside the microcarrier in multilayers. As a general matter, microporous microcarriers may be used when the cell itself is the target product (for instance, in the manufacturing of stem cells), whereas macroporous microcarriers are mainly used when the cell secretes the target product (for instance, in the manufacturing of certain protein or viruses for vaccine manufacturing).

(167) The core material of microcarriers can be for example plastic (polystyrene), cotton (cellulose), protein (for example gelatin), or sugar (polysaccharide). The surface of microcarriers can be untreated or coated with proteins (collagen, recombinant proteins or synthetic peptides). The coating material is either animal-free or contains animal product (for example porcine collagen). Moreover, microcarriers can bear a positive charge (cationic) or different chemistries.

4.4.1. Market definition

(168) There are no precedents of the Commission concerning the product or geographic market definition in microcarriers.

4.4.1.1. Product market definition

(A) Notifying Party’s arguments

(169) The Notifying Party submits that microcarriers constitute a single overall product market. (133) Within this overall product market, the Notifying Party considers that microcarriers can be differentiated between microporous and macroporous structures. (134)

(170) Moreover, the Notifying Party considers that a distinction may be drawn between microcarriers using animal-free components and microcarriers with animal-based components. (135) Whereas some microcarrier customers are sensitive to the risk associated with animal component consumables, animal-free consumables do not raise the same concerns.

(171) Finally, the Notifying Party submits that industry reports may categorise microcarriers based on surface coating or surface modification, distinguishing untreated microcarriers, cationic microcarriers, collagen-coated microcarriers and protein-coated microcarriers (other than collagen). The Notifying Party submits that these attributes are not mutually exclusive and that they do not provide a meaningful basis for separate relevant product market definitions.

(B) Commission’s assessment

(172) A wide majority of customers who expressed an opinion in the market investigation on this point submitted that they cannot or they can only to a limited extent use microporous and macroporous microcarriers for the same applications. (136) Likewise, no competitor has indicated during the market investigation that its customers are able to use both types of microcarriers for the same applications. (137)

(173) A wide majority of customers who expressed an opinion in the market investigation on this point were not able, or only able to a limited extent, to use animal-free and animal-based microcarriers for the same applications. (138) In this regard, a customer indicated that “[a]nimal component-free microcarriers are generally regarded as preferable in the pharmaceutical manufacturing setting and we would never replace animal-free with animal-based microcarriers” (non-confidential). A large majority of competitors who expressed an opinion on this point took the same view. (139)

(174) A slight majority of customers who expressed an opinion on this point and a wide majority of competitors who expressed an opinion on this point considered that it is not possible to substitute between cationic microcarriers and collagen-coated microcarriers taking into consideration use applications, technical characteristics and efficiency. (140) In this regard, one competitor stated that “[w]hile for performance testing purposes Sartorius cannot substitute between cationic microcarriers and collagen-coated microcarriers this may well not be the case for other applications”. While a majority of competitors who expressed an opinion on this point considered that it is possible to substitute between cationic microcarriers and collagen-coated microcarriers with regard to their price, the Commission takes the view that the limited substitutability in relation to use applications, technical characteristics and efficiency would suggest that these constitute separate product segments.