Commission, July 7, 2020, No M.9843

EUROPEAN COMMISSION

Decision

COLONY CAPITAL / PSP / NGD

Subject: Case M.9843 – Colony Capital / PSP / NGD

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 2 June 2020, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Colony Capital, Inc., United States (“Colony Capital”) and Public Sector Pension Investment Board, Canada (“PSP”) will, indirectly, acquire joint control of Next Generation Data Limited, United Kingdom (“NGD” or “Target”) within the meaning of Article (3)(1)(b) and 3(4) of the EUMR (the “Transaction”)3. Colony Capital and PSP are designated hereinafter as the “Notifying Parties” or, together with NGD, as the “Parties”.

1. THE PARTIES

(2) Colony Capital is a publicly traded real estate and investment management firm headquartered in the United States. Colony Capital manages a global portfolio composed of, amongst other, investments in digital infrastructure, including macro cell towers, data centres, small cell networks and fibre networks.

(3) PSP is the pension investment manager of the pension plans of the Canadian Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and the Reserve Force. It manages a diversified global portfolio including stocks, bonds and other fixed-income securities as well as investments in private equity, real estate, infrastructure, natural resources and credit investments.

(4) NGD is a private company limited by shares incorporated and existing under the laws of England and Wales. NGD is active in the design, build, operation and ongoing management of data centre solutions in the United Kingdom (“UK”).

(5) Colony Capital controls the subsidiaries Zayo Group Holdings Inc. (“Zayo”) (active in IT outsourcing and retail business connectivity) and Aptum Technologies (“Aptum”)4 (only active in IT outsourcing), which operate in markets that are vertically related to the market for colocation where NGD is active.

2. THE CONCENTRATION

(6) By virtue of the Transaction, each of Colony Capital and PSP will indirectly acquire joint control of NGD within the meaning of Article 3(1)(b) of the EUMR and 3(4).

(7) The acquisition of the Target will occur through a non-full function joint venture company, namely a Cayman Islands exempted limited partnership, F1 Europe JV, LP, which is jointly and indirectly controlled by Colony Capital and PSP.

(8) Colony Capital holds a jointly controlling stake in F1 Europe JV, LP via [Confidential]

(9) PSP holds a jointly controlling stake in F1 Europe JV, LP via [Confidential]. Each of Colony Capital and PSP have joint control through unilateral veto rights over the F1 Europe Reserved Matters (budget, business plan, appointment/removal of the CEO and COO). These rights do not apply to F1 Europe JV, LP only, but also to BidCo, and, post-closing, NGD (as NGD will become an indirect wholly-owned subsidiary of BidCo).

(10) At closing of the Transaction, F1 Europe JV, LP will acquire 100% of shares and sole control in Next Generation Data Infrastructure 1 Limited (the ultimate holding company of NGD Group) through its indirect wholly-owned subsidiary Vantage Data Centers UK BidCo Limited (“BidCo”), a private company limited by shares incorporated and existing under the laws of England and Wales.

(11) In terms of shareholdings after the closing of the Transaction, NGD’s equity will be distributed as follows: (a) [An LP under the sole control of] Colony Capital will indirectly hold approximately a 45.9% equity stake in NGD; (b) PSP [Confidential] will hold approximately a 23% equity stake in NGD [Confidential]; (c) NGD management will hold a non-controlling equity stake in NGD of approximately 8.2%; and (d) the remaining 23% equity stake in NGD will be indirectly held by non- controlling minority investors [Confidential].

(12) NGD has sufficient own staff, financial resources and dedicated management for its operation and for the management of business interests. NGD generated in FY18 almost EUR 33.5 million from the provision of colocation data center services and ancillary services to third party hyperscale and enterprise customers in the UK and post-closing will continue to sell these services to a similar wide range of customers in the UK (and will not rely almost entirely on sales to or purchases from Colony Capital and PSP). NGD has a market presence, does not have significant sale or purchase relationships with its parents and is intended to operate on a lasting basis. Therefore, NGD is and will remain fully functional.

(13) Therefore, the Transaction will result in the acquisition of joint control by Colony Capital and PSP over NGD pursuant to Articles 3(1)(b) and 3(4) of the EUMR.

3. EU DIMENSION

(14) The notified operation has a Union dimension pursuant to Article 1(2) of the Merger Regulation. The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million5 (Combined: [Confidential], Colony Capital: [Confidential], PSP: [Confidential], NGD: EUR 33.45 million). Each of the Notifying Parties has an EU-wide turnover in excess of EUR 250 million; Colony Capital: [Confidential], PSP: [Confidential]). Each of the undertakings concerned does not achieve more than two-thirds of its aggregate Union-wide turnover within one and the same Member State.

4. RELEVANT MARKETS

(15) The Parties are active in a number of markets of the internet connectivity value chain. NGD is active in the design, build, operation and ongoing management of data centre solutions in the UK. In particular, NGD provides carrier-neutral, wholesale colocation space through its data centre located in Newport, South Wales, which encompasses 750,000 sqm of gross space, 18,000 rack capacity over three floors and 72 MW of sellable IT load.6

(16) Colony Capital, through its subsidiary Digital Colony, invests in digital infrastructure such as macro cell towers, data centres, small cells and fibre networks. In fact, Digital Colony controls the following portfolio companies with activities in the colocation data centre services market or in the broader telecommunications market in the EEA: a. Etix Group SA (“Etix”) - On 10 February 2020, Colony Capital and PSP acquired joint control of Etix, a public limited liability company based in Luxembourg. Etix designs and operates data centres, in which it provides colocation services to medium and large companies operating in various industries. Etix has a worldwide network of carrier-neutral data centres located in (a) the EEA (11 data centres located in (i) Liège (Belgium); (ii) les Sables d’Olonne, la Roche-sur-Yon, Nantes and Lille (France); (iii) Asgard, Fitjar and Blönduós (Iceland) and (iv) Jokkmokk (Sweden) as well as a data centre under construction in Frankfurt (Germany)), (b) Africa (two data centres in Morocco and Ghana) and (c) Latin America (one data centre in Colombia). Etix does not operate in the UK. b. Zayo – Since 9 March 2020, Digital Colony has a jointly controlling interest of [Confidential] in Zayo, a global network solutions provider listed on the New York Stock Exchange and headquartered in Boulder, Colorado in the United States. Zayo provides medium and large enterprises in North America and Europe with communications infrastructure services including metro dark fibre, private data networks, wavelength connections, Ethernet, IP connectivity, cloud offerings, colocation services and other high-bandwidth offerings. Zayo’s colocation segment provides carrier-neutral colocation space in the United States, Canada and the EEA.7 Specifically in the UK, Zayo owns and operates a long-haul dark fibre network as well as a metro dark fibre network, with a wide coverage across the UK. Zayo is not active in public cloud services in the UK. Some of its activities, on the other hand, fall under the relevant product markets for retail business connectivity services,8 IT outsourcing (cloud IaaS) and colocation services.9 c. Aptum – the Canada-based Aptum provides essential business-to-business products and services such as colocation, network connectivity, managed hosting, cloud services and managed services through its two-way broadband cable networks in Canada, United States and Europe. Aptum also operates in the business information and communications technology services industry in North America and Europe. Specifically in the UK, Aptum provides the following services: (i) colocation services through its data centre in Portsmouth, which encompasses [Confidential] square feet and an available capacity of [Confidential]; and (ii) IT outsourcing services.10

(17) As explained above, PSP, together with Colony Capital, has joint control of Etix, which is active in the market for colocation services provided by third party data centres in the EEA, Africa and Latin America. Etix, however, is not active in the UK.

4.1. Colocation services provided by third party data centres

(18) Colocation services consist of the building, power, cooling, connectivity and security services provided in data centres (dedicated facilities sometimes purpose-built) in which companies house and operate IT equipment that supports their business (such as servers and data storage).

4.1.1. Product market definition

4.1.1.1. Commission precedents

(19) The Commission has previously11 defined a market for colocation services provided by third party data centres (excluding in-house data centres).12 The Commission considered that it was not appropriate to sub-divide this product market depending on (i) carrier-owned and carrier-neutral data centres, (ii) wholesale and retail data centres, and (iii) type of customer.13

(20) Further, the Commission has briefly touched upon the question whether interconnection services (i.e. connections via physical cable between the IT equipment of a data centre customer and that of another customer of the same data centre) and managed IT services (i.e. simple operations or maintenance tasks on behalf of data centre customers) could constitute separate markets. The Commission noted, in that respect, that interconnection services and managed IT services are part of the services that are typically provided by data centres operators on top of and in addition to colocation services; hence, the Commission considered that it was not necessary to assess the existence of possible separate markets for the provision of these services.14

4.1.1.2. Notifying Parties’ views

(21) The Notifying Parties do not contest the Commission precedents and argue that, insofar as NGD exclusively provides colocation services through its data centre in Newport, South Wales, the relevant product market for its activities is the market for colocation services provided by third party data centres. Colony Capital (via Aptum, Zayo and Etix) and PSP (via Etix) also provide colocation services in the EEA (but not in the UK). In any event, the Notifying Parties add, the precise definition of the product market can be left open in the present case since the Transaction does not give rise to any competition concerns irrespective of how the market is defined.

4.1.1.3. Commission’s assessment

(22) The Commission considers that in the present case the relevant product market is colocation services provided by third party data centres (excluding in-house data centres) as nothing in the case file suggests a need to depart from the Commission’s precedents.

4.1.2. Geographic market definition

4.1.2.1. Commission precedents

(23) The Commission has previously defined the relevant geographic market for colocation services provided by third party data centres as each metropolitan area corresponding to a radius of around 50 km from the centre of the city concerned.15

(24) This is because most customers target very specific metropolitan areas when seeking to source colocation services and, hence, the different metropolitan areas do not appear substitutable from the demand side. In concluding that 50 km from the city centre is the appropriate geographic scope, the Commission took also into consideration the following: (i) the data centre should not be located too far from the city centre to allow the customers’ IT teams to access and install equipment in the data centres; (ii) there is normally a sufficient concentration of network operators in metropolitan areas to allow customers to connect to third parties with low latency; and (iii) the maximum distance between the data centre and the city centre should be 50 km to allow customers to connect through another data centre using Dense Wavelength Division Multiplexing (DWDM).16

4.1.2.2. Notifying Parties’ views

(25) The Notifying Parties submit that the same geographic scope applies to the Transaction. Colony Capital (via Aptum, Zayo and Etix) and PSP (via Etix) are not active in the same metropolitan areas as NGD. Therefore, there are no horizontal overlaps between the activities of the Parties and NGD.

(26) In any event, the Notifying Parties argue that the precise definition of the relevant geographic market can be left open in the present case since the Transaction does not raise any competition concerns under any plausible geographic market definition.

4.1.2.3. Commission’s assessment

(27) The Commission considers that in the present case the relevant geographic market is metropolitan area corresponding to a radius of around 50 km from the city centre as nothing in the case file suggests a need to depart from the Commission’s precedent. In addition, the majority of the respondents to the Commission’s market investigation that gave a view confirmed that they procure colocation services within a 50km radius from the city centre.17

4.1.3. Conclusion

(28) In light of the above, in this Decision the Commission assesses the effects of the Transaction with respect to the market for colocation services provided by third party data centres (excluding in-house data centres) within the metropolitan area corresponding to a radius of around 50km radius from the city centre.

4.2. Retail business connectivity services

(29) Retail business connectivity services consist of fixed telecommunications services that are purchased by large businesses, enterprises and public sector customers to provide data connectivity between multiple sites.

4.2.1. Product market definition

4.2.1.1. Commission precedents

(30) In previous decisions,18 the Commission has considered a separate product market for retail business connectivity services. These services include various offerings such as virtual private network (VPN) technology, capacity services (retail leased lines), dark fibre (fibre connections that are not yet activated) and wavelengths (segmentations of dark fibre that function as separate channels for communication and transfer of data between end points).19

(31) The Commission took into consideration differences between the services provided to residential customers and those provided to B2B customers. Indeed, the Commission noted that large businesses and public sector customers require internet access services based on higher performance in terms of security bandwidth and functionality as well as more complex, flexible and integrated solutions, which are often tailor-made to fit their existing systems. In addition, these customers require specific services such as dedicated internet access, leased lines and VPN technology. However, the precise product market definition was ultimately left open.20

(32) The Commission further considered that the market for retail business connectivity services can be further segmented into: (i) Internet access services; (ii) leased lines (also known as dedicated internet access (DIA)); and (iii) VPN services, but ultimately left the precise product market definition open.21 The Commission also considered retail business connectivity services as one of the markets related to business-to-business (“B2B”) telecommunications services, but ultimately left the precise product market definition open.22

4.2.1.2. Notifying Parties’ view

(33) In the Notifying Parties’ view, the relevant product market is retail business connectivity services. The Notifying Parties argue that in any event the exact market definition can be left open, since the Transaction does not give rise to any competition concerns irrespective of how the market is defined.

4.2.1.3. Commission’s assessment

(34) The Commission considers that in the present case the exact delineation of the relevant product market for the provision of retail business connectivity services can be left open since the proposed transaction does not give rise to competition concerns under any alternative market definition.23

4.2.2. Geographic market definition

4.2.2.1. Commission precedents

(35) In previous decisions, the Commission considered the retail supply of business connectivity services to be national in scope.24 In another decision, when considering the geographic scope for B2B telecommunications services, including business connectivity services, the Commission found that the geographic market was likely to be national in scope (especially from the demand side), but left the geographic market definition open.25

4.2.2.2. Notifying Parties’ view

The Notifying Parties do not contest the Commission’s previous findings and conclude that in any event the precise definition of the relevant geographic market can be left open.

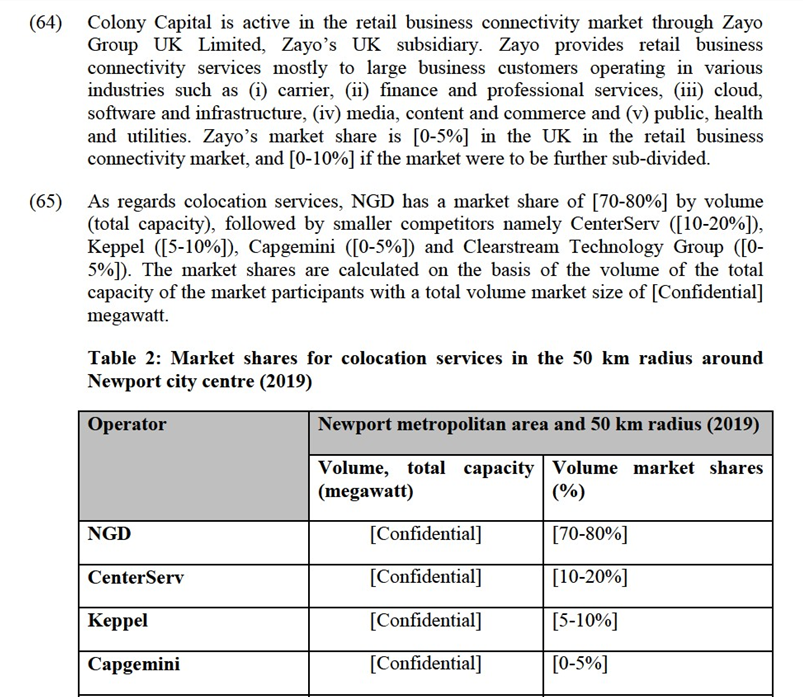

4.2.2.3. Commission’s assessment

(36) The Commission considers that in the present case, the precise geographic market definition can be left open since the Transaction does not give rise to any serious doubts as regards its compatibility with the internal market regardless of whether the market is national or EEA-wide in scope.

4.2.3. Conclusion

(37) For the purpose of this Decision, the precise scope of the market for retail supply of business connectivity services can be left open as the Transaction does not give rise to serious doubts as regards its compatibility with the internal market irrespective of whether there is an overall market for retail supply of business connectivity services, or whether this overall market is segmented on the basis of the type of customer (residential or B2B customers), or segmented into (i) Internet access services; (ii) leased lines (also known as dedicated internet access (DIA)); and (iii) VPN services, or into (i) services provided to residential customers and (ii) those provided to B2B customers, on a national or an EEA wide market.

4.3. IT outsourcing

4.3.1. Product market definition

4.3.1.1. Commission precedents

(38) In previous decisions,26 the Commission has considered a segment of the IT services market that encompasses IT outsourcing, which could be further segmented into (i) public cloud computing services; (ii) Infrastructure as a Service (“IaaS”); (iii) infrastructure outsourcing services (including potential further sub-segments for data centre services, network outsourcing, end-user device outsourcing and help desk outsourcing); and (iv) application outsourcing services. The Commission ultimately left open the market definition.

4.3.1.2. Notifying Parties’ view

(39) In the Notifying Parties’ view, in the present case, Colony Capital (via Aptum and Zayo) offers cloud computing services, IaaS and managed hosting (infrastructure outsourcing services). According to the Notifying Parties, these services fall under the relevant product market for IT outsourcing without further sub-segmentations.

(40) The Notifying Parties argue that in the present case, the precise product market definition can be left open since the Transaction does not give rise to any competition concerns irrespective of how the market is defined.

4.3.1.3. Commission’s assessment

(41) The Commission considers that in the present case the exact delineation of the relevant product market for IT outsourcing can be left open since the proposed transaction does not give rise to competition concerns under any alternative market definition. 27

4.3.2. Geographic market definition

4.3.2.1. Commission precedents

(42) The Commission has previously considered both EEA-wide28 and national29 markets. The Commission’s market investigation showed in those cases that IT solutions are often customised according to language and local business particularities whilst IT service suppliers need to also provide logistics, marketing, sales branches, distribution network and after sales maintenance services at national level.30 However, the Commission ultimately left the relevant geographic market definition open.

4.3.2.2. Notifying Parties’ view

(43) The Notifying Parties submit that the precise definition of the relevant geographic market can be left open in the present case since the Transaction does not raise any competition concerns under any plausible geographic market definition.

4.3.2.3. Commission’s assessment

(44) n the present case, the precise geographic market definition can be left open since the Transaction does not give rise to any serious doubts as regards its compatibility with the internal market regardless of whether the market is national or EEA-wide in scope.31

4.3.3. Conclusion

(45) For the purpose of this Decision, the precise scope of the market for IT outsourcing can be left open as the Transaction does not give rise to serious doubts as regards its compatibility with the internal market irrespective of whether there is an overall market for IT outsourcing or whether the overall market is further segmented into (i) public cloud computing services; (ii) IaaS; (iii) infrastructure outsourcing services (including potential further sub-segments for data centre services, network outsourcing, end-user device outsourcing and help desk outsourcing); and (iv) application outsourcing services.

5. COMPETITIVE ASSESSMENT

5.1. Horizontal overlaps (colocation services)

(46) The Transaction does not give rise to any horizontal overlaps in the catchment area of Newport where NGD is active.

(47) Both Colony Capital and PSP have controlling stakes in companies that offer colocation services through their data centres in the EEA: (i) Colony Capital through Zayo, Aptum and Etix; and (ii) PSP through Etix. However, Etix does not have any data centres in the UK, while Aptum and Zayo operate smaller data centres that are much further than the 50 km, or even 100 km radius around the city centre of Newport (South Wales) where NGD operates its data centre. In fact, Zayo has a single data centre in the UK in Feltham (near London) and Aptum also has a single data centre in the UK in Portsmouth.

(48) The Notifying Parties observe that certain types of customers, such as large enterprise customers or hyperscale customers (e.g. Amazon, Google, Microsoft) might be less sensitive to distance, as they are global players that procure their requirements on a UK or even Western European basis. However, in a UK-wide colocation market, the horizontal overlap that would be triggered would remain well below [0-10%] by value and volume sold (megawatt) on a UK basis with Aptum and Zayo adding a limited share to NGD’s pre-existing share ([5-10%] both for value and volume in 2019).

(49) The majority of the respondents to the market investigation expressed a neutral view on the Transaction with regard to colocation services.32 None of the respondents expressed a negative view or raised concerns regarding the effects of the Transaction on the market for colocation services provided by third party data centres. All of the respondents confirmed that a sufficient number of alternative providers of colocation services will remain post-Transaction.33

(50) In light of the above, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with regard to the market for colocation services.

5.2. Non-horizontal overlaps

(51) Vertical mergers involve companies operating at different levels of the same supply chain. For instance, a vertical merger occurs when a manufacturer of a certain product merges with one of its distributors.

(52) Pursuant to the Commission Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings (the "Non-Horizontal Merger Guidelines"),34 vertical mergers do not entail the loss of direct competition between merging firms in the same relevant market and provide scope for efficiencies.

(53) However, there are circumstances in which vertical mergers may significantly impede effective competition. This is in particular the case if they give rise to foreclosure.35

(54) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure: input foreclosure, where the merger is likely to raise costs of downstream rivals by restricting their access to an important input, and customer foreclosure, where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base.36

(55) Pursuant to the Non-Horizontal Merger Guidelines, input foreclosure arises where, post-merger, the new entity would be likely to restrict access to the products or services that it would have otherwise supplied absent the merger, thereby raising its downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger.37

(56) For input foreclosure to be a concern, the merged entity should have a significant degree of market power in the upstream market. Only when the merged entity has such a significant degree of market power, can it be expected that it will significantly influence the conditions of competition in the upstream market and thus, possibly, the prices and supply conditions in the downstream market.38

(57) Pursuant to the Non-Horizontal Merger Guidelines, customer foreclosure may occur when a supplier integrates with an important customer in the downstream market and because of this downstream presence, the merged entity may foreclose access to a sufficient customer base to its actual or potential rivals in the upstream market (the input market) and reduce their ability or incentive to compete which in turn, may raise downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger. This may allow the merged entity profitably to establish higher prices on the downstream market.39

(58) For customer foreclosure to be a concern, a vertical merger must involve a company which is an important customer with a significant degree of market power in the downstream market. If, on the contrary, there is a sufficiently large customer base, at present or in the future, that is likely to turn to independent suppliers, the Commission is unlikely to raise competition concerns on that ground.40

(59) Three vertically affected markets arise from the potential vertical links between Colony Capital and NGD in the UK:(a) Colocation services (NGD) as a downstream market to IT outsourcing (Zayo, Aptum);(b) Colocation services (NGD) as a downstream market to retail business connectivity (Zayo); and (c) Colocation services (NGD) as an upstream market to IT outsourcing (Zayo, Aptum).

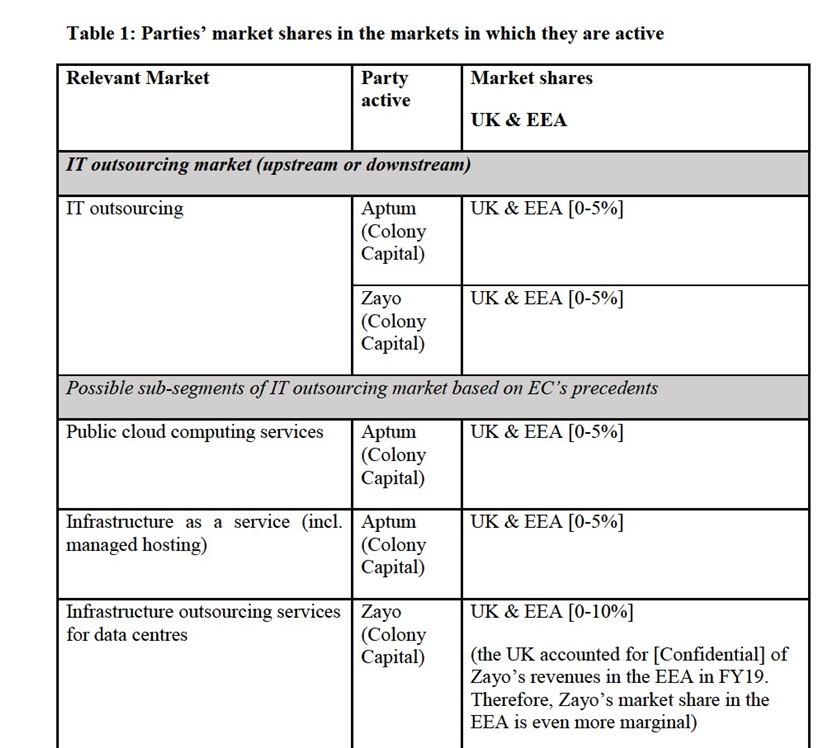

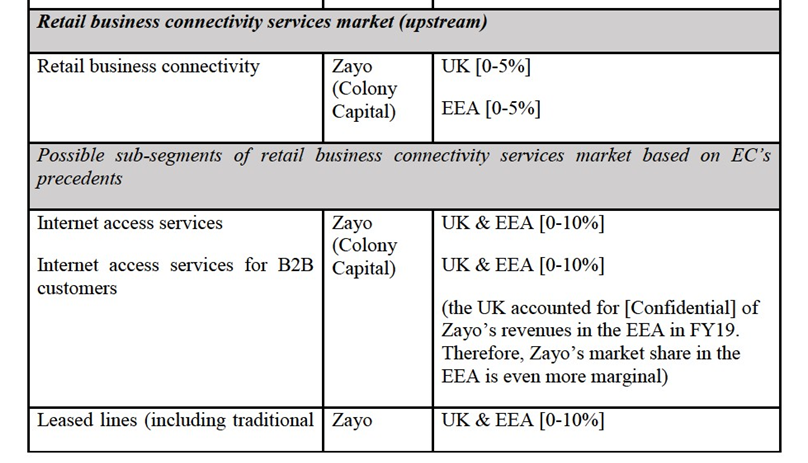

(60) The table below reflects the Parties’ market shares in the markets in which they are active:

Link, Iomart, Node4 and Centerserv and data centre providers with retail/interconnection focus such as Equinix, interxion and Telehouse.

(68) According to the Notifying Parties, NGD can also be constrained by its competitors. This is reflected in the Information Memorandum for the Transaction, which identifies several hyperscale data centre providers as its main competitors in the UK, such as Virtus, Digital Realty, Ark Corsham, Colt and CyrusOne. Even though these providers are located outside the 50km radius from the city centre, it appears that NGD faces competitive constraints by these players on a UK basis. On a UK basis, NGD’s market share is [0-10%] by volume sold and value compared to various strong players such as Equinix and Digital Realty with [30-40%] and [10-20%] market shares by value in FY19 respectively.

5.2.1.2. Commission’s assessment

(69) The Commission considers that the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market as regards the position of NGD in the market for colocation services as a downstream market to IT outsourcing.

(70) As a preliminary point, the Commission notes that NGD’s market share in Newport is mainly created by one single large customer that can easily switch providers. This is [Confidential] which is NGD’s hyperscale customer representing [70-80%] by volume. In their reply to the market investigation, [Confidential] confirmed that there is no shortage of alternatives and that they already have contracts in place with other.41 Therefore, as NGD is largely dependent on one single customer that can easily switch to other providers, the high market share within the Newport metropolitan area is not sufficient in itself to raise foreclosure concerns.

(71) The Commission considers that the combined entity will lack both the ability and the incentive to engage into input foreclosure.

(72) First, as regards the ability to engage into input foreclosure, the Commission notes that in light of their very low market shares shown in Table 1 above, neither Zayo nor Aptum has market power in the upstream market for IT outsourcing as their market shares are very limited under any possible product and geographic market delineation.

(73) Second, the Commission considers that the combined entity will lack the incentive to engage into input foreclosure: because of the low market shares of Aptum and Zayo, the combined entity will not be in a position of generating additional profit by foreclosing NGD’s rivals downstream.

(74) Third, there will remain a large number of competitors in the market for IT outsourcing that could meet the demand in case of input foreclosure strategy by the combined entity.

(75) Fourth, the above points have also been confirmed by market investigation as none of the respondents indicated any concern that could potentially arise from the creation of a vertical link between IT outsourcing on the upstream market and colocation services on the downstream market.42

(76) The Commission considers that the combined entity will lack both the ability and the incentive to engage into customer foreclosure.

(77) First, as regards the ability to engage into customer foreclosure, the Commission notes that in light of their very low market shares shown in Table 1 above, neither Zayo nor Aptum has market power in the upstream market for IT outsourcing as their market shares are very limited under any possible product and geographic market delineation.

(78) Second, data centres represent only a tiny fraction of the total demand for IT outsourcing. Data centres represented less than 5% of Aptum and Zayo’s turnover in the UK and in the EEA.

(79) Third, Zayo’s [Confidential] IT outsourcing customer, [Confidential].

(80) Fourth, NGD’s share of demand for IT outsourcing is [0-5%] on a UK basis.43 Even if NGD decided to switch its sourcing of IT outsourcing to only Aptum and Zayo, the other competing suppliers of IT outsourcing would continue to have a wide range of alternative data centres in the UK to whom they could offer their services.

(81) Fifth, the market investigation confirmed the above findings as all the respondents expressed the view that the Transaction will not have a negative impact on the market for IT outsourcing as a result of its link to the market for colocation services.44

(82) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market as regards the position of NGD in the market for colocation services as a downstream market to IT outsourcing.45

5.2.2. Colocation services as a downstream market to retail business connectivity

5.2.2.1. The Notifying Parties’ views

(83) The Notifying Parties submit that NGD’s [70-80%] market share in Newport does not confer market power to NGD in the Newport metropolitan area.

(84) In the Notifying Parties’ view, as explained in paragraphs (66) – (68) above, NGD is constrained by its customers, in particular the largest ones. NGD can also be constrained by its competitors even if they are located further away than the 50km radius from the city centre.

5.2.2.2. Commission’s assessment

(85) The Commission considers that the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market as regards the position of NGD in the market for colocation services as a downstream market to retail business connectivity services.

(86) As explained in paragraph 70 above, the Commission notes that NGD’s market share in Newport is mainly created by one single large customer that can easily switch providers. This is [Confidential] which is NGD’s hyperscale customer representing [70-80%] by volume. In their reply to the market investigation, [Confidential] confirmed that there is no shortage of alternatives and that they already have contracts in place with others.46 Therefore, as NGD is largely dependent on one single customer that can easily switch to other providers, the high market share within the Newport metropolitan area is not sufficient in itself to raise foreclosure concerns.

(87) The Commission considers that the combined entity will lack both the ability and the incentive to engage into input foreclosure.

(88) First, as regards the ability to engage into input foreclosure, the Commission notes that in light of its very low market shares shown in Table 1 above, Zayo does not have market power in the upstream market for retail business connectivity as its market shares are very limited under any possible product and geographic market delineation.

(89) Second, the Commission considers that the combined entity will lack the incentive to engage into input foreclosure: because of the low market shares of Zayo, the combined entity will not be in a position of generating additional profit by foreclosing NGD’s rivals downstream.

(90) Third, there will remain a large number of competitors in the market for IT outsourcing that could meet the demand in case of input foreclosure strategy by the combined entity.

(91) Fourth, the above points have also been confirmed by market investigation as none of the respondents indicated any concern that could potentially arise from the transaction.47

(92) The Commission considers that the combined entity will lack both the ability and the incentive to engage into customer foreclosure.

(93) First, as regards the ability to engage into customer foreclosure, the Commission notes that in light of their very low market shares shown in Table 1 above, Zayo does not have market power in the upstream market for retail business connectivity services as its market shares are very limited under any possible product and geographic market delineation

(94) Second, as regards the incentive to engage into customer foreclosure, it is noted that data centres represent only a tiny fraction of the total demand for retail business connectivity services. Data centres represented less than 5% of Zayo’s turnover in the UK and in the EEA.

(95) Third, NGD’s share of demand for retail business connectivity services is [0-5%] on a UK basis.48 Even if NGD decided to switch its sourcing of retail business connectivity to Zayo, the other competing suppliers of IT outsourcing would continue to have a wide range of alternative data centres in the UK to whom they could offer their services.

(96) Fourth, the market investigation confirmed the above findings as all the respondents expressed the view that the Transaction will not have a negative impact on the market for retail business connectivity services as a result of its link to the market for colocation services.49

(97) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market as regards the position of NGD in the market for colocation services as a downstream market to retail business connectivity services.50

5.2.3. Colocation services as an upstream market to IT outsourcing

(98) The market for colocation services provided by third party data centres could also be viewed as an upstream market to the market for IT outsourcing to the extent that IT outsourcing service providers need to colocate their IT equipment in third party data centres for the provision of cloud computing or managed hosting services in the UK.

5.2.3.1.The Notifying Parties’ views

(99) The Notifying Parties submit that from the perspective of IT outsourcing providers, all colocation data centres within the UK are substitutable. The geographic limitations that apply to colocation data centres (i.e., geographic market of 50 km radius around the city centre) are not relevant for IT outsourcing providers, as they can source their colocation requirements across multiple locations in the UK or even on an EEA-wide basis (depending on the scope of their backbone network).

5.2.3.2.Commission’s assessment

(100) The Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market as regards the position of NGD in the market for colocation services as an upstream market to IT outsourcing.

(101) The Commission considers that the combined entity will not have the ability nor the incentive to engage into input foreclosure vis-à-vis its IT outsourcing rivals that purchase collocation services.

(102) First, NGD does not have the ability to engage into input foreclosure as it does not have real market power in the market for colocation services. As explained in paragraph 70 above, the Commission notes that NGD’s market share in Newport is mainly created by one single large customer that can easily switch providers. This is [Confidential] which is NGD’s hyperscale customer representing [70-80%] by volume. In their reply to the market investigation, [Confidential] confirmed that there is no shortage of alternatives and that they already have contracts in place with other. Therefore, as NGD is largely dependent on one single customer that can easily switch to other providers, the high market share within the Newport metropolitan area is not sufficient in itself to raise foreclosure concerns.

(103) Second, the Commission considers that the combined entity will also lack the incentive to engage into input foreclosure: the market for IT outsourcing is national or EEA-wide, and not local. The geographic limitations that apply to colocation data centres (i.e., geographic corresponding to a 50 km radius around the city centre) are not relevant for IT outsourcing providers, as they can source their colocation requirements across multiple locations in the UK or even on an EEA-wide basis (depending on the scope of their backbone network).

(104) Third, there will remain numerous other colocation data centre providers in the UK, given that NGD’s share is well below 10% (by value and volume sold) on a UK basis.

(105) Fourth, the market investigation confirmed the above findings as all the respondents expressed the view that the Transaction will not have a negative impact on the market for retail business connectivity services as a result of its link to the market for colocation services.51

(106) The Commission considers that the combined entity will not have the ability nor the incentive to engage into customer foreclosure vis-à-vis its IT outsourcing customers that purchase collocation services.

(107) First, NGD does not have the ability to engage into customer foreclosure as it does not have real market power in the market for colocation services. As explained in paragraph 70 above, the Commission notes that NGD’s market share in Newport is mainly created by one single large customer that can easily switch providers.

(108) Second, the Commission considers that the combined entity would lack the incentive to engage into customer foreclosure given the very small market shares of Zayo and Aptum in the market for IT outsourcing.

(109) Third, even if NGD decided to switch its offering of colocation services excusively to Zayo and Aptum, the customers of NGD would have a very wide range of alternative data centres in the UK from whom they could source colocation services.

(110) Fourth, the market investigation confirmed the above finding as all the respondents expressed the view that the Transaction will not have a negative impact on the market for IT outsourcing as a result of its link to the market for colocation services as an upstream market, and that a large number of alternative colocation services providers would remain post-transaction.52

(111) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market as regards the position of NGD in the market for colocation services as an upstream market to IT outsourcing.53

6. CONCLUSION

(112) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation” or “EUMR”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

3 Publication in the Official Journal of the European Union No C 193, 9.6.2020, p. 32-33.

4 The company was incorporated as Cogeco Peer 1. Inc and was renamed to Aptum Technologies in 2019.

5 Turnover calculated in accordance with Article 5 of the Merger Regulation.

6 NGD further offers its colocation customers in Newport certain complementary ancillary services in the form of a bundle such as (i) NGD cloud gateway, enabling NGD colocation customers to connect to cloud providers without going through the public Internet; (ii) NGD Connect, enabling NGD customers across the NGD Connect network (including Newport, Bristol, Swindon, Slough, Birmingham, Leicester and London) to have a high speed, relatively low one-way latency (1.5ms) broadband access to NGD’s data centre in Newport; and (iii) Broadband re-sale. The total turnover generated through such services is limited to circa [Confidential]. Neither Colony Capital nor PSP provides such services, and no vertical links are created either. Hence, those services are not discussed further in this decision.

7 Zayo owns and operates seven data centres in Brussels (Belgium), Düsseldorf (Germany), Paris, Montpellier and Toulouse (France), Amsterdam (the Netherlands) and London (UK).

8 These are dedicated internet access (DIA), interconnection services, Ethernet services, SONET services, wavelength services and IP transit.

9 Colocation services to enterprise customers through its carrier-neutral data centre located in Feltham, which encompasses [Confidential] square metres, has a capacity of [Confidential] and offers connectivity to six different carriers.

10 These services include (i) standard and complex managed hosting and associated services to manage Aptum’s customers hosting and (ii) cloud services and, in particular, access and migration services to public clouds, such as Microsoft Azure, in exchange for a fee based on the customer’s monthly usage.

11 Case M.8251 Bite/Tele 2/Telia Lietuva/JV and case M.7678 Equinix/Telecity.

12 In case M.7678 Equinix/Telecity, paras. 16-17, the Commission found that third party data centres are not substitutable in terms of product characteristics and price with storing data in-house given in-house data centres require expertise and high investments rendering the customers unable to realise economies of scale assoated with third party data centres.

13 Case M.7678 Equinix/Telecity, paras. 23-24.

14 Case M.7678 Equinix/Telecity, paras. 7-8.

15 Case M.8251 Bite/Tele 2/Telia Lietuva/JV and case M.7678 Equinix/Telecity.

16 Case M.8251 Bite/Tele 2/Telia Lietuva/JV, para. 72 and Case M.7678 Equinix/Telecity, para. 37.

17 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 3.

18 Cases M.8792 T Mobile NL/Tele2 NL, para. 281, M.7421 Jazztel/Orange, para. 42, M.7499 Altice/PT Portugal para.17, M.7109 Deutsche Telekom/GTS, para. 26 and M.6584 Vodafone/Cable & Wireless, paras. 8-9.

19 Case M.8131 Tele2 Sverige/TDC Sverige, para. 37.

20 Cases M.8131 Tele2 Sverige/TDC Sverige, para. 41, M.5730 Telefonica/Hansenet, para. 12, and M.4417 Telecom Italia/AOL German Access Business, paras 19-20.

21 Cases M.7499 Altice/PT Portugal, paras. 54-57, M.7109 Deutsche Telekom/GTS, paras. 26-29, and M.6584 Vodafone/Cable Wireless, para. 9.

22 M.7499 Altice/PT Portugal, paras. 54-57

23 See below, Section 5.2.2.

24 Cases M.6584 Vodafone/Cable Wireless, para. 10, M.5532 Carphone Warehouse/Tiscali UK, paras. 56 and M.7109 Deutsche Telekom/GTS, paras. 30-33.

25 Cases COMP/M.7499 Altice / PT Portugal, paras. 58-62, M. 6921 IBM Italia/UBIS, of 19 June 2013, paragraph 30.

26 Cases M.8180 Verizon/Yahoo, para. 72, M.6921 IBM Italia/UBIS, paras. 14-17, and M.7458 IBM/INF Business of Deutsche Lufthansa, paras, 20-29.

27 See below, Sections 5.2.1 and 5.2.3

28 See below, Sections 5.2.1 and 5.2.3.

29 Case M.8180 Verizon/Yahoo, para. 75, and M.7458 IBM/INF Business of Deutsche Lufthansa, para. 32.

30 Case M.5301 Capgemini/BAS, para. 19.

31 Case M.6921 IBM Italia/Ubis, para. 29.

32 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.1.

33 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.3.

34 OJ C 265, 18.10.2008, p. 6.

35 Non-Horizontal Merger Guidelines, para 18.

36 Non-Horizontal Merger Guidelines, para 30.

37 Non-Horizontal Merger Guidelines, para 31.

38 Non-Horizontal Merger Guidelines, para 35.

39 Non-Horizontal Merger Guidelines, para 58.

40 Non-Horizontal Merger Guidelines, para 61.

41 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.3.1.

42 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.4.

43 As NGD is only present in the UK, its share of demand will be even further diluted on an EEA-wide basis.

44 Replies to Questionnaire Q1 to market participants of 4 June 2020, questions 5.2 and 5.4.

45 This assessment also applies to all plausible market subsegmentations in which the Parties are active, namely: Public cloud computing services, Infrastructure as a service (incl. managed hosting), and Infrastructure outsourcing services for data centres, both on a UK and EEA market (see Table 1).

46 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.3.1.

47 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.4.

48 As NGD is only present in the UK, its share of demand will be even further diluted on an EEA-wide basis.

49 Replies to Questionnaire Q1 to market participants of 4 June 2020, questions 5.2 and 5.4..

50 This assessment also applies to all plausible market sub-segmentations in which the Parties are active, namely: Internet access services and Leased lines (including traditional leased copper and fibre lines, ethernet circuits and dark fibre); services offered to medium and large customers (B2B); or Internet access services offered to B2B customers, and leased lines offered to B2B customers both on a UK and EEA market (see Table 1).

51 Replies to Questionnaire Q1 to market participants of 4 June 2020, questions 5.1 and 5.4..

52 Replies to Questionnaire Q1 to market participants of 4 June 2020, question 5.1, 5.3 and 5.4.

53 This assessment also applies to all plausible market subsegmentations of the market for IT outsourcing in which the Parties are active, namely: Public cloud computing services, Infrastructure as a service (incl. managed hosting), and Infrastructure outsourcing services for data centres, both on a UK and EEA market (see Table 1)