Commission, September 21, 2020, No M.9883

EUROPEAN COMMISSION

Decision

INEOS / BP CHEMICALS BUSINESS

Subject: Case M.9883 – INEOS / BP CHEMICALS BUSINESS

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 17 August 2020, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the INEOS group (“INEOS”, UK) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the chemicals business of BP plc (“BP’s chemicals business”, UK), (the “Transaction”)3. INEOS is referred to as the “Notifying Party” and, together with BP’s chemicals business, the “Parties”.

1. THE PARTIES

(2) INEOS is a global manufacturer of petrochemicals, specialty chemicals and oil products. Through its business division INEOS Oxide, it is active in the production and sale of acetate esters including ethyl acetate, butyl acetate and isopropyl acetate. Through other business divisions, INEOS is active in the production and sale of products derived from oil and gas, including benzene, products downstream of benzene and acrylonitrile.

(3) BP’s chemicals business comprises (i) BP’s acetyls business, namely its activities in acetic acid; certain products that require acetic acid as an input, namely acetic anhydride, ethyl acetate (“EtAc”), butyl acetate (“BuAc”), and vinyl acetate monomer (“VAM”); and methanol; (ii) BP’s aromatics business, namely its activities in paraxylene (“PX) and purified terephthalic acid (“PTA”), as well as related production of benzene, meta xylene and gasoline blended components; and

(iii) related technology licensing and catalysts businesses, and BP’s interests in green technologies Infinia, Virent and Tricoya.

2. THE OPERATION AND THE CONCENTRATION

(4) On 29 June 2020, INEOS and BP plc entered into a sale and purchase agreement (“SPA”), which was amended and restated on 3 July 2020. The amended and restated SPA provides that INEOS will acquire the shares of the relevant legal entities comprising BP’s chemicals business. Following completion of the Transaction, INEOS will thus acquire sole control of BP’s chemicals business. The Transaction is therefore a concentration within the meaning of Article 3(1)(b) of the EU Merger Regulation.

3. EU DIMENSION

(5) The combined aggregate worldwide turnover of the Parties exceeded EUR 5 000 million in 2019 (INEOS: EUR […] million; BP’s chemicals business: EUR […] million) and the aggregate Union-wide turnover of each of the Parties is more than EUR 250 million (INEOS: EUR […] million; BP’s chemicals business: EUR […] million). Not each of the Parties achieved more than two-thirds of their Union-wide turnover within one and the same Member State. The Transaction therefore has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

4. MARKET DEFINITIONS

4.1. Introduction – Activities of the Parties

(6) BP’s acetyls business comprises its activities in acetic acid; certain products that require acetic acid as an input, namely acetic anhydride, EtAc, BuAc and VAM; and methanol, which is an input for the production of acetic acid. BP’s aromatics business comprises its activities in PX, PTA, as well as related production of benzene, metaxylene and gasoline blended components.

(7) INEOS’ business in petrochemicals, speciality chemicals and oil products comprises a number of business divisions, including for (i) acetate esters, including EtAc and BuAc; (ii) acrylonitrile; (iii) products derived from oil and gas, namely ethylene, propylene, butadiene, polyolefins and benzene; (iv) phenol; (v) styrene; (vi) isophthalic acid, trimellitic anhydride and maleic anhydride; and (vii) chlor alkali, vinyls, and organic chlorine derivatives.4

4.2. Acetic Acid

(8) Acetic acid is an intermediate chemical product used in the production of various other chemicals, and is used globally in many diverse applications. It is a globally traded, bulk commodity product, which is sold in varying concentrations, for which there are over 60 producers worldwide. Pure acetic acid is a colourless, corrosive, flammable liquid that has an ability to react with alcohols and amines to produce esters and amides. It can also react with alkenes to produce acetate esters (such as EtAc, BuAc and isopropyl acetate “IPAC”).

4.2.1. Product market definition

4.2.1.1. Commission precedents

(9) The Commission has previously considered that acetic acid constitutes a separate product market.5

4.2.1.2. The Notifying Party’s view

(10) The Notifying Party agrees with this view. 6

4.2.1.3. Results of the market investigation and conclusion

(11) Replies from both customers7 and competitors8 clearly indicate that acetic acid is not substitutable by any other product and should form a distinct product market. Furthermore, a majority of both customers9 and competitors10 indicates that no further segmentation is needed.

(12) In light of the above, the Commission considers that the relevant product market for acetic acid is a separate market without any further sub-segmentations.

4.2.2. Geographic market definition

4.2.2.1. Commission precedents

(13) The Commission previously found (as a result of a Phase II investigation) that the geographic market for acetic acid was worldwide in scope.11

4.2.2.2. The Notifying Party’s view

(14) The Notifying Party agrees with this precedent, and further submits that the market conditions have since evolved in the direction of an even greater globalisation of the acetic acid market.12

(15) The Notifying Party’s main arguments are that (i) imports of acetic acid now satisfy [60-70]% of EEA demand (imports satisfied only 20% of the Western European demand at the time of a previous Commission Decision13); (ii) there are no barriers to trade acetic acid globally, such as transport costs, import duties or national regulations, in line with the Commission’s past findings; (iii) there is significant over-capacity at a global level, and exports from North America and Northeast Asia into the EEA are expected to increase still further over the next five years; and (iv) previous unplanned outages of acetic acid in the EEA have led to an increase in imports, as occurred in particular in 2010 – 2011 due to a force majeure event at BP’s chemicals business’ acetic acid facility in Hull.

4.2.2.3. Results of the market investigation and conclusion

(16) Both customers14 and competitors15 consider the market for acetic acid to be worldwide. In their replies customers16 and competitors17 for acetic acid confirm the arguments of the Notifying Party, outlined in paragraph (15).

(17) In light of the above, the Commission considers that the relevant geographic market for acetic acid is world-wide.

4.3. Butyl Acetate (“BuAc”)

(18) BuAc is a solvent used in the coatings, leather, paper and chemical processing industries, as well as an extraction solvent in the manufacture of certain antibiotics and in the recovery of phenol from waste liquors.

4.3.1. Product market definition

4.3.1.1. Commission precedents

(19) In the past,18 the Commission found that the market for BuAc should be subdivided into its isomers (same chemical formula but different chemical structures) which are isobutyl acetate (“iso-BuAc”) and n-butyl acetate (“n-BuAc”). Specifically for n- BuAc, the Commission also examined the possibility to sub-segment the market by purity grade, between normal grade n-BuAc with a purity of 99.0% and high purity grade n-BuAc with a purity of at least 99.5%, but ultimately left this question open.19

4.3.1.2. The Notifying Party’s view

(20) The Notifying Party submits20 that iso-BuAc and n-BuAc form part of the same market, because on the supply-side, switching production between these two products is very easy and can be done in a matter of hours for producers equipped with the proper manufacturing equipment. For a producer not yet able to manufacture both products, additional equipment for the production of both isomers would only require a limited investment, around EUR [500 000 - 1.5 million]. From the demand-side, the Notifying Party claims that n-BuAc and iso-BuAc are, to some extent, interchangeable, as they are mainly used by the same industries and for the same purposes, but still acknowledges that there are a number of specific iso-BuAc applications that cannot use n-BuAc.

(21) As regards a potential segmentation of n-BuAc by purity grade, the Notifying Party explains that it was considered in case M.7858 – INEOS / Celanese assets because at that time, [differentiating between purity grades was more common than it is today]. The Notifying Party therefore submits that the segmentation of n-BuAc by purity grade is no longer relevant.

(22) Finally, the Notifying Party underlines that in the context of the assessment of a vertical relationship with acetic acid (upstream), the precise scope of the relevant downstream product market can be left open because all potential segmentations of the market for BuAc require acetic acid for their manufacture in identical amounts, proportions and quality.

4.3.1.3. Results of the market investigation and conclusion

(23) Producers of BuAc overwhelmingly support the view that iso-BuAc and n-BuAc form two distinct product markets. 21

(24) The market investigation was inconclusive as to the substitutability between normal grade n-BuAc with a purity of 99.0% and high purity grade n-BuAc with a purity of at least 99.5%22. While confirming that production of different purity grades within n-BuAc does not require different volumes or qualities of acetic acid, 23 and therefore that acetic acid does not represent a different proportion of the overall manufacturing costs for different purity grades within n-BuAc,24 the market investigation clearly showed 25 that BuAc producers consider that switching between producing the two purity grades costs considerable time and effort and constitutes a major strategic decision.

(25) Replies to the market investigation confirm the argument of the Notifying Party that the production of iso-BuAc does not require different volumes or qualities of acetic acid compared to the production of n-BuAc26 and therefore that acetic acid does not represent a different proportion of the overall manufacturing costs for iso-BuAc compared to n-BuAc.27

(26) In light of the above, the Commission considers that each of n-BuAc and iso-BuAc constitutes a separate product market. Regarding a possible sub-segmentation of n- BuAc by purity level, the question can be left open, since under any possible product market definition (n-BuAc overall, normal grade n-BuAc with a purity of 99.0% and high purity grade n-BuAc with a purity of at least 99.5%), the Transaction does not give rise to serious doubts as to its compatibility with the internal market.

4.3.2. Geographic market definition

4.3.2.1. Commission precedents

(27) In the past,28 the Commission found indications that the geographic market for the various types of BuAc was EEA-wide, but has ultimately left the precise scope of the market open.

4.3.2.2. The Notifying Party’s view

(28) The Notifying Party agrees with this view.29

4.3.2.3. Result of the market investigation and conclusion

(29) The market investigation was not conclusive on whether the market for BuAc is worldwide or a regional market encompassing the EEA and Turkey (“EEA + Turkey”). 30

(30) In light of the above, the Commission considers that the question of whether the relevant geographic market for BuAc is worldwide, the EEA + Turkey, or the EEA can be left open, since the Transaction does not give rise to serious doubts as to its compatibility with the internal market, under any of these three possible geographic market definitions.

4.4. Acrylonitrile (“ACN”)

(31) ACN is an intermediate chemical building block used in the production of a variety of downstream products, including acrylic fibre, engineering thermoplastic resins, adiponitrile, acrylamide and acrylonitrile butadiene rubber.

4.4.1. Product market definition

4.4.1.1. Commission precedents

(32) In the past, the Commission found that ACN was a distinct product market,31 without considering the potential existence of any further sub-segmentations.

4.4.1.2. The Notifying Party’s view

(33) The Notifying Party agrees with the view that ACN is a distinct product market, but argues that any further segmentation of the product market can be left open, as the Proposed Transaction does not lead to any significant impediment to effective competition in the ACN market on any plausible basis.32

4.4.1.3. Result of the market investigation and conclusion

(34) All ACN respondents state that ACN is a distinct product market that should not be further segmented.33

(35) In light of the above, the Commission considers that the relevant product market for ACN is a separate market without any further sub-segmentations.

4.4.2. Geographic market definition

4.4.2.1. Commission precedents

(36) In the past, the Commission considered that the relevant geographic market for ACN could be worldwide, EEA wide and EEA wide + Turkey, but ultimately left the exact scope of the geographic market open.34

4.4.2.2. The Notifying Party’s view

(37) The Notifying Party submits that the relevant geographic market for ACN is global, and cannot be narrower than EEA + Turkey.35 The Notifying Party argues that ACN is easily transportable, despite its hazardous nature, which is evidenced by the fact that INEOS’ ACN plant in Green Lake, USA, exports […]% of its production to Asia, Europe, Mexico and South America. The Notifying Party also explains that the transportation costs for ACN are low, representing 5% – 10% of the delivery price, and that there are high levels of imports of ACN into the EEA, due to the historic surplus situation in Asia and the USA. Finally, the Notifying Party notes that while the general tariff on ACN from third countries stands at 6,5%, ACN currently falls within an autonomous tariff quota system (in the EU, such quotas can be opened in some economic sectors in order to stimulate competition inside the EU. They are normally granted to raw materials, semi-finished goods or components not available in the EU in sufficient quantities36), whose latest amendment provides for 60kt of ACN per annum (representing around [5-10]% of the total EEA + Turkey consumption) to be imported from third countries tariff-free.

(38) In support of the fact that the ACN market cannot be narrower than EEA + Turkey, the Notifying Party explains (i) that ACN is included within the free movement requirements for certain goods as part of the EU-Turkey Customs Union, (ii) that exports of ACN to Turkey represented 53% of the ACN exported from the EEA in 2019, (iii) that Turkey is the leading national consumer of ACN within the EEA+ Turkey area, and its total annual demand is not met by local production, and (iv) that Turkey is home to Aksa, the leading producer of acrylic fibre in the EEA + Turkey area, which is the principal downstream application for ACN, representing approximately […]% of total use of ACN worldwide.

4.4.2.3. Results of the market investigation and conclusion

(39) Respondents in the market investigation unanimously consider the market for ACN to be worldwide.37

(40) In any event, the Commission considers that the question of whether the relevant geographic market for ACN is worldwide, EEA + Turkey, or EEA can be left open, since the Transaction does not give rise to serious doubts as to its compatibility with the internal market, under any of these three possible geographic market definitions.

4.5. Vinyl acetate monomer (“VAM”)

(41) VAM is a commodity chemical derived from acetic acid. Among other uses it serves as an input for the manufacture of S-PVC co-polymers.38

4.5.1. Product market definition

4.5.1.1. Commission precedents

(42) The Commission has previously found VAM to constitute a separate product market that should not be further segmented. 39

4.5.1.2. The Notifying Party’s view

(43) INEOS agrees with this product market definition.

4.5.1.3. Conclusion

(44) The Commission considers that the relevant product market for VAM is a separate market without any further sub-segmentations.

4.5.2. Geographic market definition

4.5.2.1. Commission precedents

(45) The Commission has previously found that the relevant geographic market for VAM is world-wide in scope. 40

4.5.2.2. The Notifying Party’s view

(46) INEOS agrees with this geographic market definition.

4.5.2.3. Conclusion

(47) The Commission considers that the relevant geographic market for VAM is world- wide

4.6. S-PVC co-polymers

(48) S-PVC co-polymers, are the result of the polymerization of a molecule of PVC with another monomer (a co-monomer), such as VAM. 41

4.6.1. Product market definition

4.6.1.1. Commission precedents

(49) The Commission has previously considered S-PVC co-polymers as part of its investigation into the relevant market for commodity S-PVC, finding that S-PVC co- polymers are not part of the commodity S-PVC market. 42

4.6.1.2. The Notifying Party’s view

(50) INEOS submits that S-PVC co-polymers should be considered to comprise a separate product market from other types of S-PVC. 43

4.6.1.3. Conclusion

(51) The Commission considers, for the purposes of this Decision, that the relevant product market for S-PVC co-polymers is a separate market.

4.6.2. Geographic market definition

4.6.2.1. Commission precedents

(52) The Commission has not specifically previously considered the geographic market for S-PVC co-polymers. However, the Commission has considered the geographic market for commodity S-PVC, finding that the relevant geographic scope was North West Europe (“NWE”), wider Western Europe or the EEA. 44

4.6.2.2. The Notifying Party’s view

(53) INEOS considers that appropriate geographic market for S-PVC co-polymers is at least EEA-wide, although the precise geographic market can be left open in this case, as no competition concerns arise under any definition.

4.6.2.3. Conclusion

(54) The Commission considers that the question of whether the relevant geographic market for S-PVC co-polymers is NWE, Western Europe, or EEA, can be left open, since the Transaction does not give rise to serious doubts as to its compatibility with the internal market, under any of these three possible geographic market definitions.

5. ASSESSMENT

5.1. Overview of affected markets

(55) The Transaction does not give rise to horizontally affected markets.45 The Parties noticeably overlap with respect to the manufacture of EtAc and n-BuAc, but the Parties’ combined market shares at worldwide level remain well below the 20% threshold for horizontally affected markets.46

(56) For EtAc, combined market shares would remain at around [5-10]% of sales both on a value and volume basis at worldwide level.47

(57) Concerning n-BuAc (overall and high purity grade), the Notifying Party argues that market shares do not differ materially between them. 48. The combined market shares both in value and in volume would be around [5-10]% for a worldwide market definition. Under an EEA + Turkey and an EEA geographic market definition, only INEOS is active since BP’s chemical business is only active in n-BuAc (overall and high purity grade) through a JV with Yaraco in China, […]49. Therefore, the horizontal overlaps for (an overall and high purity grade) n-BuAc will not be further discussed in the present decision.

(58) Several vertical relationships arise as a result of the transaction.50 Those between (i) the production of acetic acid by BP’s chemicals business (upstream) and the production of n-BuAc51, EtAc52, isopropyl acetate (“IPAC”),53 purified isophthalic acid (“PIA”)54 and trimellitic anhydride (“TMA”)55 by INEOS (downstream), (ii) the production of metaxylene by BP’s chemicals business (upstream)56 and the production of PIA by INEOS (downstream) and (iii) Lotte BP Chemical Co.’s (“Lotte” Korea) vinyl acetate monomer (“VAM”) activities upstream (in which BP’s chemicals business has a [...]% interest)57 and INEOS’ downstream activities in S- PVC co-polymers58 do not give rise to vertically affected markets. Therefore, all of these vertical relationships will not be further discussed in the present decision.

(59) The Transaction gives rise to the following vertically affected markets,59 namely between (i) the production of acetic acid by BP’s chemicals business (upstream) and the production of iso-BuAc (by INEOS) (downstream) and (ii) the production of acetic acid by BP’s chemicals business (upstream) and the production of ACN by INEOS (downstream). Both links are affected only due to downstream market shares as upstream market shares remain below 30%.

(60) Finally, given INEOS’ plan to build a new plant in the UK to produce VAM, in the future60, the Transaction might give rise to a potential horizontal overlap (in the market for the manufacture of VAM world-wide), as well as to two additional potential vertical relationships (between acetic acid upstream and VAM downstream, as well as between VAM upstream and INEOS’ downstream activities in S-PVC co- polymers).

(61) Currently, INEOS does not produce VAM, and only BP’s chemicals business does so, through a JV in Korea. BP’s chemicals business currently has a market share of less than [0-5]% at worldwide level). If INEOS’ plant becomes operational,61 which is expected by 2022, it would represent less than [0-5]% capacity share in the supply of VAM in the world-wide market (in proportion of the total production capacity in 2019).

(62) The Notifying Party argues that these potential horizontal and vertical relationships are not merger-specific since INEOS’ public announcement that it planned to build a new VAM plant preceded discussion of the proposed Transaction by two and a half years; and its public announcement that it had chosen Hull (the same city where BP’s chemicals business has its acetic acid production plant) as the site of the new VAM plant preceded discussion of the proposed Transaction by over one year. However, the validity of such an argument in the context of the current assessment appears debatable.

(63) As regards the potential horizontal relationship arising from an entry of INEOS in the VAM worldwide market the Commission notes that the combined market share of the Parties on a capacity basis would be around [5-10]%.

(64) As regards the potential vertical relationship between acetic acid (upstream) and the combined activities of BP’s chemicals business and INEOS for VAM (downstream), the Commission notes that BP’s chemicals business’ market shares upstream in the worldwide market for the manufacture of acetic acid in 2019 are [10-20]% by value, [20-30]% by volume and [10-20]% by capacity.

(65) As regards the potential vertical relationship between the combined activities of BP’s chemicals business and INEOS for VAM (upstream) and INEOS’ downstream activities in S-PVC co-polymers (downstream), the Commission notes that INEOS’ market shares in the downstream S-PVC co-polymers markets are [20-30]% in NWE, [20-30]% in Western Europe, and [20-30]% in the EEA.

(66) Finally, INEOS, not being yet present on the VAM market, currently has no VAM customers. Therefore, at present there are no potential purchasers of VAM from INEOS for the manufacture of S-PVC co-polymers which could post-transaction be foreclosed in the context of a potential input foreclosure strategy.

(67) As a result, these potential horizontal and vertical relationships that would arise from building the VAM plant in the UK will not be further discussed in the present decision since they would not lead to either horizontally or vertically affected markets.

5.2. Framework of the competitive assessment of vertical links

(68) The Commission’s Guidelines on the assessment of non-horizontal mergers under the Merger Regulation (the "Non-Horizontal Merger Guidelines") distinguish between two main ways in which vertical mergers may significantly impede effective competition, namely input foreclosure and customer foreclosure.62

(69) For a merger to raise input foreclosure competition concerns, the merged entity must have a significant degree of market power upstream.63 In assessing the likelihood of an anticompetitive input foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to substantially foreclose access to inputs; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on competition downstream.64

(70) For a merger to raise customer foreclosure competition concerns, the merged entity must be an important customer with a significant degree of market power in the downstream market.65 In assessing the likelihood of an anticompetitive customer foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to foreclose access to downstream markets by reducing its purchases from its upstream rivals; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.66

5.3. Vertical relationship between the production of acetic acid by BP’s chemicals business (upstream) and the production of iso-BuAc by INEOS (downstream).

5.3.1. Market structure

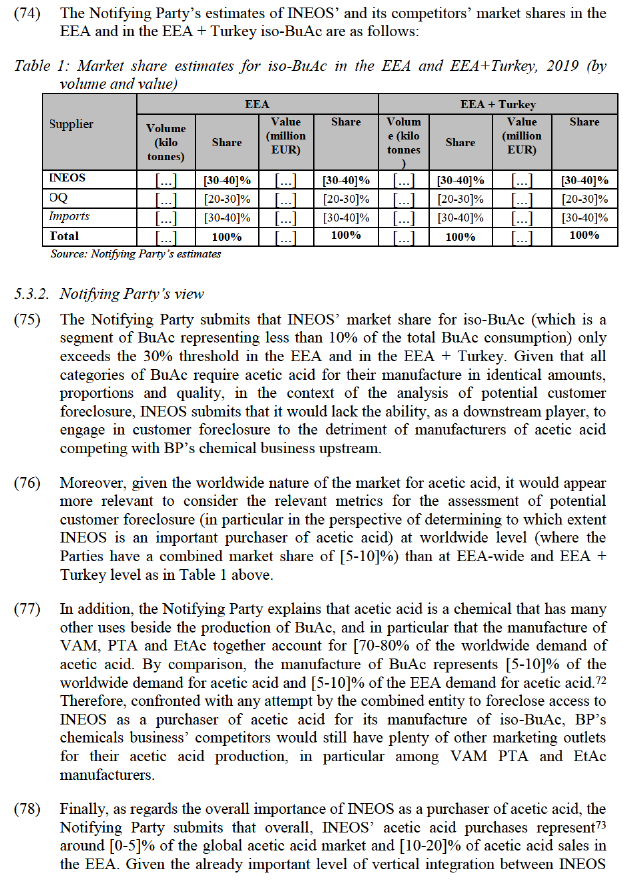

(71) This vertical link is affected downstream only because INEOS’ market shares in the sales of iso-BuAc in the EEA + Turkey and EEA are above 30%, namely [30-40]% and [30-40]% respectively (both on a value and on a volume basis). On a worldwide basis, INEOS’ market share is just below [10-20]% on a value and on a volume basis. 67

(72) On the upstream market, only BP’s chemicals business manufactures acetic acid. BP’s chemicals business’ market shares upstream in the worldwide market for the manufacture of acetic acid68 in 2019 69 are [10-20]% by value, [20-30]% by volume and [10-20]% by capacity.70

(73) For both geographic market definitions, EEA + Turkey and EEA, INEOS is the market leader in the supply of iso-BuAc, while OQ71 is second and the remainder of demand is covered by imports. The Notifying Party submits that importers of iso- BuAc in the EEA + Turkey and the EEA include Dow US, Eastman U, Oxea US, Dmitrievsky Chemical Russia, Eurochem Russia, Jiangyin Baichuan China and Shandong Yanco China.

and BP with respect to acetic acid,74 excluding INEOS’ acetic purchases that are already made from BP’s chemicals business, INEOS’s acetic acid purchases only represents [0-5]% of the sales of acetic acid in the EEA made by acetic acid producers other than BP’s chemicals business. As such, INEOS therefore does not appear to be an important purchaser of acetic acid overall (while BP’s chemicals business does not procure acetic acid on the merchant market).

(79) All these elements would tend to indicate that the combined entity would lack the ability to engage in a potential customer foreclosure strategy aiming at restricting access to other acetic acid manufacturers to INEOS as a purchaser of acetic acid.

(80) The Notifying Party does not bring forward any argument regarding the combined entity’s incentive to engage in a potential customer foreclosure strategy or the potential effects of such a customer foreclosure.

5.3.3. The Commission’s assessment

(81) As regards a potential customer foreclosure strategy (under an EEA + Turkey, or EEA market definition), the Commission firstly notes that the Notifying Party’s market shares for iso-BuAc, are [30-40]% and [30-40]% respectively (both on a value and on a volume basis). Its main EEA based competitor has an approximately [20-30]% market share under all scenarios, while the rest is covered by imports.

(82) The Commission also notes that there are many different downstream uses of acetic acid, apart from the manufacture of BuAc (see paragraph (77)) and that the Notifying Party’s purchases of acetic acid, for all uses, are low (see paragraph (78)).

(83) Additionally, the Commission recalls that the geographic scope of the acetic acid market is worldwide. Consequently, manufacturers of acetic acid can sell to customers worldwide and are not limited to European customers.

(84) It is therefore highly unlikely that INEOS would be able to run a successful customer foreclosure, by stopping, post-transaction, to purchase acetic acid from its current suppliers. This was confirmed by a vast majority 75 of competitors in acetic acid, who consider that post Transaction there would be still a sufficient number of customers available for acetic acid, even if the merged entity would stop purchasing from them.

(85) Moreover, half of the competitors indicate that the merged entity would not have any incentive to no longer purchase acetic acid from them.76 The Commission takes note that a number of dissenting replies suggest that the aim of the merged entity would be to internalise in its own upstream division production of the acetic acid volumes it needs, which would change the merged entity’s purchasing strategy for acetic acid on the market.77

(86) However, the majority of competitors do not foresee any impact on the market for acetic acid as a result of the Transaction, neither on price, quality, choice for customers or product innovation. 78

(87) In light of the above, the Commission considers that the Transaction does not give rise to serious doubts based on costumer foreclosure.

(88) As regards a potential input foreclosure strategy, the Commission notes that several customers of acetic acid responding to the market investigation, albeit only a minority, submit that there would not be a sufficient number of suppliers for acetic acid if the merged entity would stop selling to them.79 Half of all acetic acid customers expect an increase in prices of acetic acid as a result of the Transaction, while the other half does not consider the Transaction to have an impact on prices.80 However, a clear majority of acetic acid customers do not consider that the merged entity would have an incentive to stop supplying them with acetic acid.81 In this context, the Commission notes that especially downstream competitors in the market of BuAc seem to be critical of the Transaction.

(89) The Commission recalls that the market investigation clearly indicates that acetic acid is a worldwide market, in line with Commission’s past practice and the fact that the majority of acetic acid sold in the EEA is indeed imported from third countries. 82 It is recalled that on the global acetic acid market the combined market shares of the Parties do not exceed [20-30]%83. The Commission considers that this low market share level does not appear to give the merged entity the ability to engage in input foreclosure of acetic acid to the detriment of its downstream competitors.

(90) Account has also to be taken of the fact that even if the merged entity would source the entirety of its demand for acetic acid captively, it would still have free capacities of at least […] of all its acetic acid production capacity. This suggest that the merged entity would have an economic incentive to continue supplying acetic acid to the merchant market. This is supported by the fact that a clear majority of acetic acid customers do not consider that the merged entity would have an incentive to engage in input foreclosure.

(91) As regards specifically concerns expressed by downstream competitors in the production of BuAc, according to data submitted by the Notifying Party, demand of acetic acid for overall BuAc production in the EEA accounts only for around [5- 10]% of all worldwide sales of acetic acid ([5-10]% in the EEA)84.

(92) Moreover, replies to the market investigation confirmed the argument of the Notifying Party that the production of iso-BuAc does not require different volumes or qualities of acetic acid compared to the production of n-BuAc85 and therefore that acetic acid does not represent a different proportion of the overall manufacturing costs for iso-BuAc compared to n-BuAc.86 It is therefore doubtful that the merged entity can successfully foreclose its downstream iso-BuAc competitors by preventing them to gain sufficient access to acetic acid volumes.

(93) Moreover, account has to be taken of the fact that iso-BuAc production represents a very small proportion of the total production for BuAc.

(94) Moreover, downstream competitors, including those for BuAc, do not only rely on supplies of the merged entity, as they already multisource.87 Finally, the Commission notes the Notifying Party’s argument concerning the presence of traders of acetic acid (such as Helm or Cellmark) that would have the ability to sell […] of acetic acid per year.88 This represents more than the double of the volume of acetic acid BP’s chemicals business currently sells from its production facility in Hull to the three biggest BuAc competitors of INEOS in the EEA, which would make it difficult for a vertically integrated merged entity to selectively target any acetic acid input foreclosure strategy to specific downstream (BuAc) competitors. In light of the above, taking account of the results on the market investigation and of all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the vertical link between acetic acid (upstream) and iso-BuAc (downstream).

5.4. Vertical relationship between the production of acetic acid by BP’s chemicals business (upstream) and the production of acrylonitrile (“ACN”) by INEOS (downstream).

5.4.1. Market structure

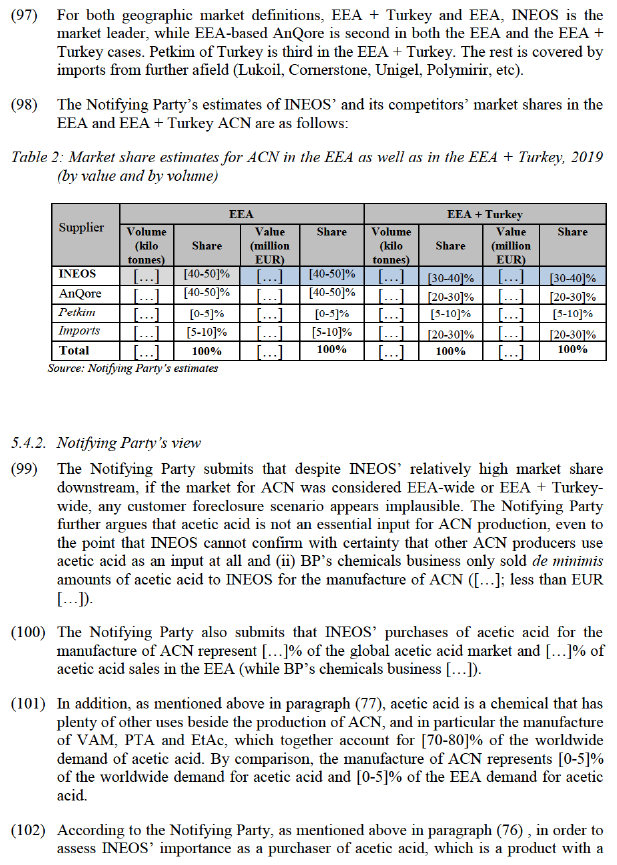

(95) This vertical link is affected downstream only because INEOS’ market shares in the sales of ACN in the EEA + Turkey and EEA are above 30%, namely just below [40- 50]% and around [40-50]% respectively (both on a value and on a volume basis) On a worldwide basis, INEOS’ market share is just below [10-20]% on a value and on a volume basis.89

(96) On the upstream, only BP’s chemicals business manufactures acetic acid. BP’s chemicals business’ market shares upstream in the worldwide market for the manufacture of acetic acid90 in 2019 91 are [10-20]% by value, [20-30]% by volume and [10-20]% by capacity.

worldwide geographic scope, INEOS’ market shares downstream at worldwide level would probably constitute a better proxy, for the purpose of assessing potential customer foreclosure.

(103) More generally, as mentioned above in paragraph (78), the Notifying Party submits that an even better proxy for INEOS’ importance as a purchaser of acetic acid is the proportion of overall acetic acid sales that INEOS’ purchases for all downstream applications represent. These represent 92 only [0-5]% of the global acetic acid market and [10-20]% of acetic acid sales in the EEA ([0-5]% of the sales of acetic acid in the EEA excluding INEOS’ purchases that are already made from BP’s chemicals business).

(104) All these elements would tend to indicate that the combined entity would lack the ability to engage in a potential customer foreclosure strategy aiming at restricting access to other acetic acid manufacturers to INEOS as a purchaser of acetic acid.

(105) The Notifying Party does not bring forward any argument regarding the combined entity’s incentive to engage in a potential customer foreclosure strategy or the potential effects of such a customer foreclosure, given the very hypothetical nature of such a customer foreclosure scenario (mainly due to the current absence of potential customers of BP’s chemicals business active in ACN that the combined entity could foreclose).

5.4.3. The Commission’s assessment

(106) As regards a potential customer foreclosure strategy (under an EEA + Turkey, or EEA market definition), the Commission firstly notes that the Notifying Party’s market shares for ACN, are around [40-50]% and [40-50]% respectively (both on a value and on a volume basis). Its main EEA based competitor has a market share of [20-30]% in the EEA + Turkey and of [40-50]% in the EEA, while the rest is covered by a Turkish producer and imports from further afield.

(107) The Commission also notes that there are other downstream uses of acetic acid, apart from the manufacture of ACN (see paragraph (77)) and that the Notifying Party’s purchases of acetic acid, for all uses, are low (see paragraph (78)).

(108) Additionally, the Commission recalls that the scope of the acetic acid market is worldwide. Consequently, manufacturers of acetic acid can sell to customers worldwide and are not limited to European customers.

(109) It is therefore highly unlikely that INEOS would be able to run a successful customer foreclosure strategy, by stopping, post-transaction to purchase acetic acid from its current suppliers. This was confirmed by a vast majority 93 of competitors in acetic acid who consider that post Transaction there would be still a sufficient number of customers available for acetic acid, even if the merged entity would stop purchasing from them.

(110) Moreover, half of the competitors indicate that the merged entity would not have any incentive to no longer purchase acetic acid from them.94 The Commission takes note that a number of dissenting replies suggest that the aim of the merged entity would be to internalise in its own upstream division production of the acetic acid volumes it needs, which would change the merged entity’s purchasing strategy for acetic acid on the market.95

(111) However, the majority of competitors do not foresee any impact on the market for acetic acid as a result of the Transaction, neither on price, quality, choice for customers or product innovation. 96

(112) As regards a potential input foreclosure strategy, the Commission notes that there were no indications of concern about input foreclosure for ACN.

(113) In light of the above, taking account of the results on the market investigation and of all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the vertical link between acetic acid (upstream) and ACN (downstream).

5.5. General conclusion on vertical effects

(114) In the light of the considerations in paragraphs (68) to (113) the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market due to vertical effects.

6. CONCLUSION

(115) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

3 Publication in the Official Journal of the European Union No C 280, 25/08/2020, p. 18.

4 Products of special relevance to the assessment of the case are presented in sections 4.2, 4.3, 4.4 as well as

5.1 of this Decision.

5 See Case M.3625 Blackstone / Acetex.

6 See Form CO paragraph 6.62.

7 See replies to question 11, Q1 – Questionnaire to acetic acid customers.

8 See replies to question 6, Q2 – Questionnaire to acetic acid competitors.

9 See replies to question 12, Q1 – Questionnaire to acetic acid customers.

10 See replies to question 7 Q2 – Questionnaire to acetic acid competitors.

11 See Case M.3625 – Blackstone / Acetex.

12 See Form CO paragraphs 6.4 – 6.82.

13 See Case M.3625 Blackstone / Acetex.

14 See replies to question 22, Q1 – Questionnaire to acetic acid customers.

15 See replies to question 8, Q2 – Questionnaire to acetic acid competitors.

16 See replies to question 22.1, Q1 – Questionnaire to acetic acid customers (“Acetic Acid can be shipped and purchased globally”, “About 60 % of European demand is imported from the USA.”, “Deliveries have global character, production units are located in Far East, USA, Middle East and Europe (Hull – BP Installation). Some non European producers have constantly product n their tanks in ARA for distribution of Acetic Acid in Europe.”, “acetic acid can be traded globally”, “Acetic acid is produced at scale and transport costs are reasonable in bulk, so a global market is appropriate. Imports from US and China into Europe can be competitive”.

17 See replies to question 8.1, Q2 – Questionnaire to acetic acid competitors (“AA market is worldwide with production facilities existing in North America, Europe, China (China is the main place where global production capacities exist)”, “Acetic acid is transported all over the world with limited logistics costs and correlated worldwide pricing. There is no geographic barrier to shipping acid all over the world and many producers all over the world make acid that is used in different regions.”, “Acetic acid is transported all over the world”, “Acetic acid is a commodity that is traded globally.”.

18 See case M.7858 – INEOS / Celanese assets

19 See case M.7858 – INEOS / Celanese assets

20 See Form CO paragraphs 6.30 – 6.34.

21 See replies to question 13, Q1 – Questionnaire to acetic acid customers.

22 See replies to question 15, Q1 – Questionnaire to acetic acid customers.

23 See replies to question 6, Q1 – Questionnaire to acetic acid customers.

24 See replies to question 8, Q1 – Questionnaire to acetic acid customers.

25 See replies to question 15, Q1 – Questionnaire to acetic acid customers.

26 See replies to question 5, Q1 – Questionnaire to acetic acid customers.

27 See replies to question 7, Q1 – Questionnaire to acetic acid customers.

28 See Case M.7858 INEOS / Celanese assets.

29 See Form CO paragraphs 6.35 – 6.37.

30 See replies to questions 22 and 22.1, Q1 – Questionnaire to acetic acid customers.

31 See Cases M.5238 INEOS / BASF assets and M.7614 – CVC Capital Partners / Royal DM (Fibre Intermediates and Composite Resins).

32 See Form CO paragraph 6.110.

33 See replies to questions 20 & 21, Q1 – Questionnaire to acetic acid customers.

34 See Cases M.5238 INEOS / BASF assets and M.7614 – CVC Capital Partners / Royal DM (Fibre Intermediates and Composite Resins).

35 See Form CO paragraphs 6.113 – 6.114.

36 See https://ec.europa.eu/taxation_customs/business/calculation-customs-duties/what-is-common-customs- tariff/tariff-quotas_en#heading_1

37 See replies to questions 22 and 22.1 Q1 – Questionnaire to acetic acid customers.

38 The potential vertical relationships between acetic acid and VAM as well as VAM and S-PVC co- polymers are discussed in paragraphs (60)-(66).

39 Case M.3625 Blackstone / Acetex.

40 Case M.3625 Blackstone / Acetex.

41 The potential vertical relationships between acetic acid and VAM as well as VAM and S-PVC co- polymers are discussed in paragraphs (60)-(66).

42 See Case M.6905 INEOS / Solvay / JV.

43 See Form CO paragraph 6.150.

44 See Case M.6905 INEOS / Solvay / JV.

45 See Form CO paragraphs 6.11 and 6.13 – 6.57.

46 In past decisional practice, the Commission has considered the geographic market definition for EtAc to be worldwide (see M.3625 – Blackstone / Acetex, para. 149). In the market investigation of the present case, all respondents that produce or source EtAc confirmed that the geographic market for EtAc is worldwide in scope (see replies to question 22, Q1 – Questionnaire to acetic acid customers). The Notifying Party submits that [60-70]% of all sales of EtAc in the EEA in 2019 were imports from outside the EEA (see Form CO, para. 6.20).

47 Yaraco, a JV of BP’s chemical business […], See Annex 2 Form CO and Reply of the Notifying Party to RFI 5, of 09.09.2020.

48 See Annex 2 Form CO and Reply of the Notifying Party to RFI 5, of 09.09.2020.

49 See Form CO paragraph 6.40.

50 See Form CO paragraphs 6.11 and 6.58 – 6.176.

51 INEOS’ market shares in volume and value under both an EEA and an EEA + Turkey geographic market definition are [20-30]% and [20-30]% respectively.

52 The combined market share of the Parties, under a worldwide geographic market definition, which is in line with Commission precedents and the results of the market investigation is around [5-10]%, both in volume and in value terms.

53 INEOS’ market shares in volume and value under an EEA geographic market definition, which is the narrowest in line with Commission precedents, are [20-30]%.

54 INEOS’ market shares in volume and value under an EEA geographic market definition, which is the narrowest in line with Commission precedents, are [5-10]%.

55 INEOS’ market shares in volume and value under a worldwide and an EEA geographic market definition, are below [20-30]%.

56 BP’s chemicals business […]. Its worldwide market share is below [30-40]%.

57 Lotte’s market shares in volume and value under a worldwide geographic market definition, which is in line with Commission precedents are below [5-10]%.

58 INEOS’ market shares in volume and value under an EEA, a Western Europe and a Northern Western Europe geographic market definition, which are the only plausible in line with Commission precedents are below [20-30]%.

59 See Form CO paragraph 6.174.

60 The target date for operations is 2022 ([…]).

61 The Notifying Party submits that the building of this plant is […].

62 OJ L 24, 29.1.2004, p. 1.

63 Non-horizontal Merger Guidelines, paragraph 35.

64 Non-horizontal Merger Guidelines, paragraph 32.

65 Non-horizontal Merger Guidelines, paragraph 61.

66 Non-horizontal Merger Guidelines, paragraph 59.

67 It is recalled that the Parties’ combined market share for n-BuAc on a worldwide basis is around [5-10]% on a value and on a volume basis, see paragraph (55). INEOS’ market share in n-BuAc and high purity n- BuAc under the EEA + Turkey and EEA geographic market definitions are below 30% both on value and on volume. [...].

68 See Annex 3 Form CO.

69 These market shares are obtaining by adding to BP’s chemicals business worldwide market share the market shares of all the JVs where it has shareholding interests in. Lower market shares would be obtained if the market shares of the JVs were allocated to BP’s chemicals business in proportion of the level of equity share it holds in each of them on global level.

70 As regards BP’s chemicals business’ capacity share in acetic acid worldwide in 2019, it amounts to [5- 10]% (including the capacity of the BBPA JV with Petronas in Malaysia […]) and [10-20]% including the capacities of all the JVs [...].

71 Formerly known as Oxea.

72 See Form CO table 6.3 and paragraph 2.1. Reply to RFI 4, of 02.09.2020.

73 See Form CO paragraph 7.32 and 7.33.

74 This already important level of integration between the Parties before the Transaction results from the fact that INEOS has manufacturing facilities located in Hull, United Kingdom, the same place where BP has its main manufacturing plant for acetic acid, so that INEOS already purchases [70-80]% of its overall needs for acetic acid from BP’s chemicals business.

75 See replies to question 9, Q2 – Questionnaire to acetic acid competitors.

76 See replies to question 10, Q2 – Questionnaire to acetic acid competitors.

77 See replies to question 10.1, Q2 – Questionnaire to acetic acid competitors “The transaction may affect the parties' purchasing strategy for acetic acid” ; “INEOS, once it is backwards integrated into BP's acid will no longer purchase the acid that it currently buys from us”.

78 See replies to questions 11 & 12, Q2 – Questionnaire to acetic acid competitors

79 See replies to question 23, Q1 – Questionnaire to acetic acid customers.

80 See replies to question 25 – Questionnaire to acetic acid customers.

81 See replies to question 24 – Questionnaire to acetic acid customers.

82 See paragraph (16) above.

83 Main competitors on a global market for acetic acid in 2019 where Celanese ([10-20]% market share, volume based), Sopo Chemical ([5-10]%), Yankuang ([5-10]%) and Chang Chun ([5-10]%).

84 See Form CO table 6.3.

85 See replies to question 5, Q1 – Questionnaire to acetic acid customers.

86 See replies to question 7, Q1 – Questionnaire to acetic acid customers.

87 See replies to question 10 – Questionnaire to acetic acid customers.

88 See the Notifying Party’s reply to RFI 4, of 2.9.2020.

89 See Annex 2 Form CO and Reply of the Notifying Party to RFI 5, of 09.09.2020.

90 See Annex 3 Form CO.

91 These market shares are obtaining by adding to BP's chemicals business worldwide market share the market shares of all the TVs where it has shareholding interests in. Lower market shares would be obtained if the market shares of the JVs were allocated to BP's chemicals business in proportion of the level of equity share it holds in each of them on a global level.

92 See Form CO paragraphs 7.32 and 7.33.

93 See replies to question 9, Q2 – Questionnaire to acetic acid competitors.

94 See replies to question 10, Q2 – Questionnaire to acetic acid competitors.

95 See replies to question 10.1, Q2 – Questionnaire to acetic acid competitors “The transaction may affect the parties' purchasing strategy for acetic acid” ; “INEOS, once it is backwards integrated into BP's acid will no longer purchase the acid that it currently buys from us”.

96 See replies to questions 11 & 12, Q2 – Questionnaire to acetic acid competitors