Commission, July 6, 2020, No M.9716

EUROPEAN COMMISSION

Decision

AMS / OSRAM

Subject: Case M.9716 – AMS/OSRAM

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 29 May 2020, the European Commission received notification of a concentration pursuant to Article 4 of the Merger Regulation resulting from a proposed transaction whereby ams AG (‘AMS’, Austria) intends to acquire sole control, within the meaning of Article 3(1)(b) of the Merger Regulation, of the whole of OSRAM Licht AG (‘OSRAM’, Germany)3. AMS is referred to hereinafter as the ‘Notifying Party’ and together with OSRAM as the ‘Parties’. The undertaking that would result from the proposed transaction is referred to as the ‘merged entity’.

1. THE PARTIES

(2) AMS is an Austrian undertaking active in the supply of sensor solutions worldwide and focused on the development and manufacturing of high-performance sensors, sensor integrated circuits, related algorithms and software. AMS’ business activities are divided into three key areas: (i) optical-, (ii) imaging-, and (iii) audio sensor solutions.

(3) OSRAM is a German undertaking active in lighting technology in the area of automotive and specialty lighting, light management systems and lighting solutions. OSRAM’s business activities are divided into three main business units: (i) optical semiconductors, (ii) automotive lighting, and (iii) non-automotive lamps, electronic components and systems.

2. THE CONCENTRATION

(4) On 7 November 2019, ams Offer GmbH, an AMS wholly owned subsidiary, made a public offer to acquire all shares of OSRAM (the ‘Transaction’). The initial offer period expired on 5 December 2019. The offer was subject to a [over 50]% minimum acceptance threshold and customary closing conditions, including merger control clearance. Such acceptance threshold was achieved by 5 December 2019, after which AMS extended the offer for an additional acceptance period, which ended on 24 December 2019.4 Upon completion of the Transaction, AMS will hold [over 50%] of the voting rights of and sole control over OSRAM. Conversely, post- Transaction, no other shareholders or shareholder-approved board members of OSRAM (different from AMS) will have any direct or indirect veto rights that concern decisions which are essential for the strategic commercial behaviour or business policy of OSRAM.

(5) It follows that the Transaction would result in a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(6) The Transaction does not have a Union dimension within the meaning of Article 1 of the Merger Regulation. With regard to Article 1(2), AMS’ turnover does not amount to more than EUR 250 million in the Union. With regard to Article 1(3), the Parties’ aggregate turnover amounts to more than EUR 100 million in only one Member State, i.e. Germany.

(7) However, on 29 January 2020, AMS submitted a request for a referral to the Commission pursuant to Article 4(5) of the Merger Regulation (‘Form RS’). The request fulfilled the two conditions set out in Article 4(5) of the Merger Regulation in that (i) it referred to a concentration within the meaning of Article 3 of the Merger Regulation that (ii) had to be notified in at least three Member States. In addition, the Transaction fulfilled a number of further criteria set out in the Commission’s Notice on Case Referral.5 In this regard, since the case extended over territories reaching beyond national boundaries, as the markets involved were larger than national as per the Commission’s previous decisions;6 and since the case required investigative efforts in several countries as well as appropriate enforcement powers, the Commission concluded it was in the best position to review the Transaction.

(8) The Form RS was transmitted to all EU Member States and none of them expressed their disagreement to the request for referral. The Transaction is therefore deemed to have a Union dimension.

4. INTRODUCTION TO SEMICONDUCTORS AND OPTICAL SEMICONDUCTORS

(9) The Transaction brings together AMS’ and OSRAM’s development, manufacture and supply of semiconductor products, including ancillary software. The Parties’ activities overlap in the development, manufacture and supply of certain optical semiconductors.

(10) Semiconductors are key components of electronic devices such as diodes, transistors and other electronic components. Devices containing semiconductors include mobile phones, computers, domestic appliances, cars, medical equipment, identification systems, large-scale industry electronics and aerospace equipment. Semiconductors are rarely bought directly by end-consumers. Instead, they are mainly bought by original equipment manufacturers (‘OEMs’) active in different sectors.7

(11) A semiconductor has an electrical conductivity value that is situated between insulators and conductors. Its conductivity changes based on various factors, including heat, light, electric current or electromagnetic fields. The ability to change conductivity based on environmental factors makes semiconductors suitable to control electronic signals (reversing, amplifying) inside of electronic devices.8

(12) Leading market analysts split the semiconductor market into four segments, namely (i) integrated circuits (‘ICs’); (ii) discretes; (iii) optical semiconductors; and (iv) sensors and actuators.9

(13) ICs are semiconductor devices composed of diodes, transistors and other electronic components, combined with conductive interconnect material, which controls the current and voltage of electricity running through it. Nowadays, ICs are particularly complex and compact. ICs currently used in electronic devices are called “microchips” or “chips” and can contain several billion transistors along with diodes and other electronic components. Figure 1 depicts an example of ICs.

(14) Discretes are physically standalone packaged semiconductors specified to perform an elementary electronic function, which are not divisible into separate components functional in themselves. Discretes typically include a single semiconductor such as a diode or transistor and are practically the opposite of an IC, which has many devices on a single piece of semiconductor (see Figure 2). In practice, discretes are designed for high power and high frequency, which require special use and packaging.

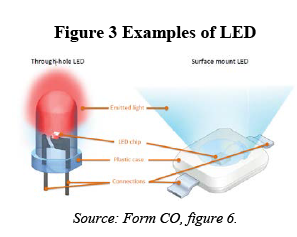

(15) Optical semiconductors can be broadly divided into two major groups: (i) optical semiconductors transforming electricity into light (light-emitting devices); and(ii) optical semiconductors transforming light into electricity (light-receiving devices).10 Among the light-emitting devices are laser diodes and LED. Figure 3 depicts an example of LED meant to be mounted through a hole (left-hand side) and an example of LED meant to be mounted on a surface (right-hand side).

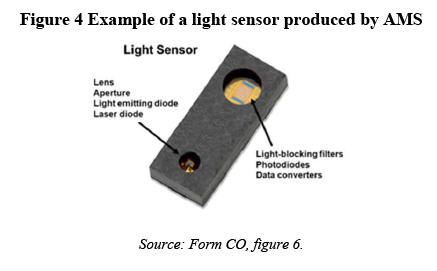

(16) Light-receiving devices such as image sensors and light sensors generally output electric signals in response to a change of light. Figure 4 depicts a particular light sensor produced by AMS where a light source is used for measuring the proximity of certain objects by measuring the time employed by the light source to travel to that object and back to the sensor itself. Often and more generally, light sensors are stand alone devices, i.e. they do not require an emitter, and they measure ambient light or ambient colour.

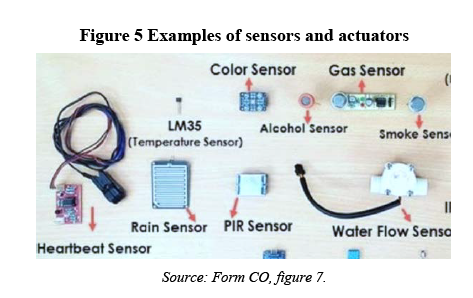

(17) Sensors and actuators are technical components used to help detect signals in a real-world environment and transmit those to embedded processing applications.11 Sensors are specifically designed to measure externalities like quantity of heat, temperature, humidity, pressure, sound field parameters, acceleration, pH value, ionic strength, electrochemical potential and/or the material composition of its surroundings. A sensor always works together with other electronic devices, which translate and then process the information measured by the sensor. Actuators use electronic signals to influence the real world by performing a certain action.

(18) Manufacturing semiconductors, and more specifically optical semiconductors, entails complex manufacturing steps and processes. Once semiconductors are manufactured, they generally require assembly and packaging before they can be integrated by a customer such as a smartphone manufacturer or automotive OEM. For example, various semiconductor devices are assembled into a single camera module, which can then be further integrated into a tablet or into a smartphone. Optical assembly and packaging of such devices, e.g. to form a camera module, can either be handled by dedicated optical packaging and assembly houses, semiconductor manufacturers, or in-house by large customers which typically have these capabilities in-house.12

5. PRODUCT MARKET DEFINITION

5.1. Introduction

(19) The Transaction gives rise to horizontal overlaps with respect to the development, manufacture and supply of certain optical semiconductors and, in particular, of certain light sensors and laser diodes.

(20) The Transaction gives also rise to vertical links between AMS’ provision of micro packaging and assembly services for complete light sensor and illuminator solutions for mobile phones and OSRAM’s supplies of LED and laser diodes.

5.2. The Notifying Party’s view

(21) The Notifying Party considers that semiconductors should be distinguished between:

(i) ICs; (ii) discretes; (iii) optical semiconductors; and (iv) sensors and actuators. In addition, the Notifying Party considers appropriate to further segment optical semiconductors (where the Parties’ activities overlap) by the industrial sector where they are employed, namely (i) commercial and consumer optical semiconductors; and (ii) communications infrared (‘IR’) optical semiconductors. To the Notifying Party’s view such a distinction is deemed necessary because the industry dynamics between these two segments appear to be fundamentally different.13

(22) The Notifying Party is also of the view that commercial and consumer optical semiconductors could be further distinguished by functionality, namely (i) LED; (ii) laser diodes (e.g. vertical cavity surface emitting laser (‘VCSEL’), edge emitting laser (‘EEL’), which the Notifying Party considers to be part of the same product market); (iii) couplers; (iv) light sensors (e.g. proximity sensors, ambient light sensors, colour sensors, spectral sensors, which the Notifying Party considers to be part of the same product market); and (v) image sensors. According to the Notifying Party, devices of each category provide for different functionalities and therefore from a demand-side perspective they are not interchangeable for a specific end-use application.14

(23) According to the Notifying Party, narrower segmentations are not necessary. In this respect, while the Notifying Party considers that there is limited demand-side substitutability for optical semiconductors belonging to narrower markets (for example, in the case of laser diodes, VCSEL and EEL) because products belonging to narrower segmentations are used for (different) specific functions, a considerable supply-side substitutability exists. The Notifying Party is of the view that most optical semiconductors manufacturers have capabilities across, and therefore offer a wide portfolio of different types of light sensors and laser diodes, which confers supply-side substitutability within the same category.15 According to the Notifying Party, the same generally holds true for different types of LEDs, e.g. LEDs with different wavelengths (visible, infrared and ultraviolet), which are not substitutable from a demand-side perspective but which many suppliers offer in their different types.16

(24) With regard to assembly and packaging services for sensor solutions, the Notifying Party submits that a distinct market is to be analysed only where players move from the assembly and packaging of own single component products, to the assembly and packaging of solutions that include components from other suppliers next to the own components or exclusively.17

(25) According to the Notifying Party, it might be plausible to further segment the provision of assembly and packaging services for sensor solutions between micro- packaging and module making. The Notifying Party argues that the technology and capabilities required for semiconductors that are only millimetres in size are very different from bigger modules such as phone cameras, which are much larger in size and contain several different components.18

5.3. The Commission’s precedents

(26) In a number of previous decisions, the Commission considered that optical semiconductors belong to product markets that are separate from other semiconductors product markets. Consistently with the Notifying Party’s view, the Commission has in the past made a clear distinction between (i) ICs; (ii) discretes; (iii) optical semiconductors; and (iv) sensors and actuators. Within these categories (but not specifically for optical semiconductors because no previous decision deals particularly with them), the Commission has also distinguished a number of narrower separate product markets by functionality and by end application.19

(27) In terms of applications, the Commission has considered in the past at least six major applications for semiconductor devices: communications, consumer, computer, military, industrial and automotive. The products designed for each of these applications have been found to be not interchangeable and therefore belonging to separate product markets. 20

(28) Within different applications, the Commission has also previously distinguished between groups or categories according to the functions the semiconductors are designed to fulfil or the types of electronic equipment they will be inserted in (e.g. within the market for communications applications, the Commission has considered that a distinction can be drawn between wireline and wireless applications).21

(29) With respect to optical semiconductors, the Commission has defined them as “devices that have either luminescent or light-receiving functionalities. Luminescent devices include LED and laser diodes, while light-receiving devices include solar cells and photo-detectors”.22 However, since none of the past decisions concerned specifically optical semiconductors, the Commission has never considered further segmentations of these specific products.

(30) The Commission has not dealt with packaging/assembly services for (optical) semiconductors in previous decisions.

5.4. The Commission’s assessment

(31) The market investigation has widely confirmed the Commission’s past practice and the Notifying Party’s view according to which ICs, discretes, optical semiconductors, and sensors and actuators are part of separate product markets.23

(32) With respect to the Notifying Party’s proposed distinction between commercial and consumer optical semiconductors and communications IR optical semiconductors (supplied to data communication providers operating fibre glass, etc.) the majority of the market participants that responded to the market investigation (in particular, most customers in consumer electronics) agreed with the proposed distinction.24 However, one competitor of the Parties indicated that ‘while the customers and their specific product requirements may differ between "commercial and consumer optical semiconductors" and "communications IR optical semiconductors", there is significant overlap in manufacturing and product development or R&D capabilities and fixed costs in these markets’.25

(33) The majority of the market participants that expressed a view in the market investigation also agrees with the Notifying Party’s view that, from a demand-side perspective, LEDs, laser diodes, couplers, light sensors and image sensors present limited demand-side substitutability in terms of, for example, product characteristics, applications and prices, and therefore they belong to separate product markets.26

(34) One market participant, after having provided for a detailed explanation as to why it considers that there is an important lack of demand-side substitutability for the different categories of semiconductors considered, also underlined the lack of supply-side substitutability by stating that “[s]hifting production from one to the other would require substations (sic) R&D effort”.27

(35) This view is echoed by a large majority of the Parties’ competitors that not only confirmed the lack of demand-side substitutability, but also pointed at a lack of supply-side substitutability as they consider that the production and supply of LEDs, laser diodes, couplers, light sensors and image sensors entail significantly different features, expertise and costs.28

(36) Since the Transaction does not raise competition concerns irrespectively of the exact product market definition, the question of whether LEDs, laser diodes, couplers, light sensors and image sensors are considered separate product markets within optical semiconductors can be left open. Nonetheless, as the Parties’ activities overlap in the development and/or the manufacture and supply of certain light sensors and laser diodes, Sections 5.4.1 and 5.4.2 assess in more detail the plausible product market definitions for the specific overlapping products.

(37) In addition, Sections 5.4.3 and 5.4.4 also discuss two plausible product markets where the Transaction leads to a vertical relationship between the Parties, i.e. optical packaging and assembly services and LEDs.

5.4.1. Light sensors

(38) Light sensors can cover a wide range of applications and end-uses. Internal documents of the Parties and industry reports suggest that light sensors for different applications such as automotive or consumer electronics present distinct characteristics in terms of technical specifications, prices and access to customers.29

(39) Most of the Parties’ customers that expressed a view during the market investigation suggested that, from a demand-side perspective, light sensors for automotive applications and those for consumer electronics cannot be substituted by one another and therefore they belong to separate product markets.30 From a supply-side perspective, most of the competitors that replied to this question, indicated that the production and supply of light sensors for consumer electronics and other light sensors (e.g. for the automotive industry) entail significantly different features, expertise and costs.31

(40) Within light sensors, the Parties’ activities overlap in the supply of biosensors for consumer electronics32 and mobile 3D (VCSEL-based) flood illuminators. 33

(41) Biosensors are light sensing solutions used to monitor and measure heart rate and blood pressure. Conventional blood pressure measurement can be invasive or non- invasive. While only a licensed medic can apply invasive methods, non-invasive methods can be used directly by the patient. As such, the non-invasive method allows consumers to monitor and measure heart rate and blood pressure through a biosensing solution for private purposes, as for example during sportive activities.

(42) Devices that include biosensors in the mobile and consumer segment today are (i) wristbands, (ii) smart watches, and (iii) mobile phones.

(43) Biosensing can be achieved with different solutions. Typical solutions consist of a light-emitting device (LED or laser diode), a (light-receiving) photodiode and an application-specific IC or an analogue front-end IC that powers the light source and translates the photodiode’s signal into sensor data, which is then shared with the application processor of the device.

(44) According to the Notifying Party, the Parties currently do not compete directly for specific biosensing designs or technologies, as their product offerings for such solutions are complementary. [Parties’ product offerings and customers]. Therefore, the Parties’ product offerings would be complementary.34

(45) The results of the market investigation are not conclusive as to whether customers and competitors consider that biosensors for consumer electronics constitute a product market which is separate from other biosensors and whether they consider that biosensors for consumer electronics based on different technologies (discrete components versus ICs) belong to separate product markets.35 However, since the Transaction does neither raise competition concerns in the supply of biosensors for consumer electronics, where the activities of the Parties overlap, nor in the narrowest-plausible markets based on different technologies, where the activities of the Parties do not overlap, it can be left open whether these products are part of a wider market for light sensors.

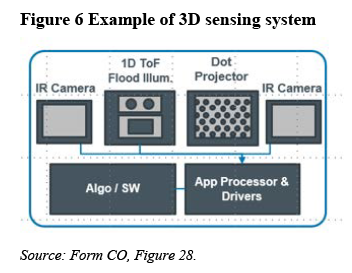

(46) 3D flood illuminators for mobile applications are modules used in certain smartphones for the purpose of “sensing” real world objects through a three- dimensional reconstruction. A light (proximity) sensor detects the relevant object (e.g. a face) and switches the 3D flood illuminator on, which subsequently shines infrared light using a (VCSEL) laser diode. The 3D flood illuminator is itself part of the 3D sensing system present in certain smartphones.

(47) A 3D flood illuminator (integrated in a proper 3D sensing system) placed at the front side of a smart phone would be typically used for functionalities such as face unlock, morphed emojis or gesture control.36 When the 3D flood illuminator and its system are placed at the back face of the mobile, they would typically provide functionalities as for example camera enhancement or augmented/virtual reality.

(48) The results of the market investigation are not conclusive as to whether customers and competitors consider that mobile 3D flood illuminators constitute a separate product market or if they are part of a wider product market for light sensors from demand- and supply-side perspectives.37 However, since the Transaction does not raise competition concerns in the narrowest-plausible market for 3D flood illuminators for mobile applications, it can be left open whether these products are part of a wider market for light sensors.

(49) In conclusion, the market investigation suggests that light sensors likely belong to a product market that is separate from other optical semiconductors. Moreover, light sensors developed and sold for different end-uses (e.g. consumer electronics, automotive, etc.) appear to have very limited demand- and supply- side substitutability, and therefore they likely belong to separate product markets. Further segmentations by functionality, e.g. biosensors for consumer electronics and mobile 3D flood illuminators, would be possible in principle, but the market investigation did not provide for a clear indication in this respect. Ultimately, the definition of the relevant product market for the assessment of light sensors can be left open as the Transaction does not lead to any competition concerns irrespective of whether light sensors are considered a distinct product market or a part of a wider market for optical semiconductors, or whether biosensors for consumer electronics (and segmentations by technology therein) or mobile 3D flood illuminators are considered as separate product markets.38

(50) Accordingly, since the Parties’ activities overlap in biosensors for consumer electronics and mobile 3D (VCSEL-based) flood illuminators, the competitive assessment in Section 7.2 deals with for optical semiconductors overall, light sensors overall, biosensors for consumer electronics and mobile 3D (VCSEL-based) flood illuminators.

5.4.2. Laser diodes

(51) Laser diodes are light-emitting devices used in many different devices (including light sensors) and applications, including for instance the automotive and consumer electronics, for which the activities of the Parties overlap. Laser diodes include VCSEL, EEL and other technologies.

(52) Most of the Parties’ customers that expressed a view during the market investigation suggested that, from a demand-side perspective, laser diodes for automotive applications and those for consumer electronics cannot be substituted by one another and therefore they belong to separate product markets.39 The results of the market investigation are however not conclusive as to whether, from a supply-side perspective, the production and supply of laser diodes for automotive applications and those for consumer electronics entail significantly different features, expertise and costs.40

(53) Regarding the supply of laser diodes, the Parties’ current overlapping activities are very limited and relate solely to VCSEL for different final applications.41 Within VCSEL, [information about the Parties’ business strategy]. For this reason, and in view of the importance of this fast evolving technology, this section discusses the product market definition for laser diodes (VCSEL, EEL) for LiDAR.

(54) LiDAR is a technology that uses light in the form of a pulsed laser for measuring variable distances. In the automotive sector, LiDAR has started to be developed since 2017 for Advanced Driver Assistance Systems (‘ADAS’) in vehicles such as emergency braking, pedestrian detection and collision avoidance. LiDAR is one out of different (competing) sensing systems for ADAS, which will become relevant in autonomous driving in the mid- to longer-term future.

(55) Overall, the development of ADAS can be segmented into five main phases, starting with manual driving (level 0), where the driver does everything and up to full automation (level 5) where a driver is no longer needed. Between these two points, different development levels exist which require different functionalities to allow for the automation of interim steps, such as speed limit observation, autonomous highway driving, etc. LiDAR solutions become relevant from ADAS level 3 upwards.42

(56) The key components of LiDAR systems are the laser and the receiver. Regarding the laser component, two main types of laser diodes can be used for its manufacturing, namely EEL, where the laser light propagates in a direction along the wafer surface of the semiconductor chip and is reflected or coupled out at a cleaved edge; and VCSEL, where the light propagates in the direction perpendicular to the semiconductor wafer surface.

(57) Generally, EELs are more powerful and therefore can travel greater distances, whereas VCSELs have a very narrow laser beam that enables very accurately directed sensing but are much less powerful and therefore cannot cover long distances.

(58) [Information about the Parties’ business strategy].

(59) The results of the market investigation are not conclusive as to whether market participants consider that, from a demand-side perspective, EELs and VCSELs (for LiDAR systems) belong to separate product markets.43 One competitor indicated that ‘EEL and VCSELs for Lidar have similar technical specifications, applications and pricing’.44 However, one customer indicated that ‘EEL and VCSEL have different geometry, temperature behaviour and power’.45 Another customer explained that ‘[EELs] provide a much higher power level per aperture (…) whereas VCSEL can provide a much better addressability of multiple single apertures’.46 From a supply- side perspective, the results of the market investigation are not conclusive either as to whether the production and supply of VCSELs and EELs entail significantly different features, expertise and costs so that VCSELs and EELs belong to different product markets.47

(60) In conclusion, the market investigation suggests that laser diodes likely belong to a product market that is separate from other optical semiconductors. A further distinction by technology, i.e. VCSEL and EEL, also appears to be widely supported by customers and suppliers due to the limited demand-side and supply-side substitutability. Moreover, laser diodes developed and sold for different end-uses (e.g. consumer electronics, automotive, etc.) appear to have very limited demand- side substitutability, although from a supply-side perspective, it is not clear whether they belong to separate product markets. A narrower segmentation for laser diodes for LiDAR and further segmentations thereof (VCSEL versus EEL) would be possible in principle, but the market investigation did not provide for a clear indication in this respect. However, since sales of VCSEL for LiDAR are very limited and expected to remain so at least for the next 5 years, a distinction between VCSEL and EEL for LiDAR is not deemed necessary for the purpose of the present decision. Ultimately, since the Transaction does not raise competition concerns in any of the market definitions for laser diodes set out above, the precise product market definition can be left open.

(61) Accordingly, since the Parties’ activities overlap in VCSEL for consumer electronics, and potentially in LiDAR, the competitive assessment in Section 7.2 is conducted for optical semiconductors overall, laser diodes, VCSEL, and laser diodes for LiDAR.

5.4.3. Assembly and packaging services for sensor solutions

(62) Manufacturers of sensor solutions assemble and pack single components to produce the final product. For this, they can use their own and/or other suppliers’ components. During the market investigation, competitors were asked whether the provision of micro-packaging and assembly services for light sensor solutions and other optical assembly and packaging services entail significantly different features, expertise and costs, as suggested by the Notifying Party. However, whereas it would appear that there is some common know-how, the replies obtained were very limited and not conclusive.48 Ultimately, the definition of the relevant product market for the provision of assembly and packaging services for sensor solutions for mobile phones can be left open, as the Transaction does not raise competition concerns irrespectively of the product market definition.

5.4.4. LEDs

(63) An LED is a small single light-emitting diode that comprises a semiconductor chip and its housing. It emits light when electric current passes through it. The colour of the light is determined by the energy required for electrons to cross the band gap of the semiconductor, ranging from violet to red and white.

(64) The market investigation suggests that LEDs likely belong to a product market that is separate from other optical semiconductors.49 Moreover, the supply of LEDs can be further segmented between (a) visible and invisible LEDs (the latter potentially sub-divided by IR and UV); (b) automotive and general lightning; (c) by light colour; and (d) by power output.

(65) Ultimately, since the Transaction does not raise competition concerns in the narrowest-plausible market within LEDs, it can be left open if these products are part of a wider market for LEDs.

5.4.5. Conclusion on product market definition

(66) The Commission concludes that ICs, discretes, optical semiconductors, and sensors and actuators are part of separate product markets. However, as the Transaction does not raise competition concerns irrespectively of the exact product market definition, the question of whether light sensors, laser diodes and LEDs constitute separate product markets within optical semiconductors can be left open. Likewise, whether further segmentations of the product categories where the activities of the Parties overlap or give rise to a vertical relationship (biosensors for consumer electronics, mobile 3D flood illuminators, VCSELs for LiDAR, visible LEDs, invisible IR LEDs, invisible UV LEDs, automotive LEDs, general lighting LEDs, LEDs of different colours, LEDs of different outputs) are appropriate can be left open.

(67) Moreover, the definition of the relevant product market for the provision of assembly and packaging services for sensor solutions can be left open, as the Transaction does not raise competition concerns irrespectively of the product market definition.

6. GEOGRAPHIC MARKET DEFINITION

6.1. The Notifying Party’s view

(68) The Notifying Party considers that the demand and supply of optical semiconductors, including potentially narrower product markets, are worldwide in scope.50

(69) According to the Notifying Party, the investments required for research and development, as well as for manufacturing, requires sales to be very large, and therefore global in nature. Manufacturers of optical semiconductors typically manufacture their products in a few manufacturing plants (often located in Southeast Asia), and ship them at global level. This practice is facilitated by well-accepted international technical standards, low transportation costs and the absence of significant import taxes and duties. In support of its claim for a global geographic scope, the Notifying Party observes that all the major market reports collect and report global market data. In addition, the Notifying Party submits that the Parties’ sales strategies [information about the Parties’ business strategy].51

6.2. The Commission’s precedents

(70) In past decisions, the Commission has consistently considered the geographic scope of semiconductor markets, including optical semiconductors, to be at least EEA- wide, if not worldwide in scope.

(71) In M.2820 – STMicroelectronics/Alcatel Microelectronics, the Commission considered that the market for semiconductors in general is worldwide in scope.

(72) In M.2439 – Hitachi/STMicroelectronics/SuperH/JV, M.4751 – STM/Intel/JV, and M.5173 – STM/NXP/JV the Commission acknowledged that the market for semiconductors in general has the connotation of worldwide market, but it ultimately left open the question as if it should be considered EEA-wide or worldwide in scope.

(73) In M.7585 – NXP Semiconductors/Freescale Semiconductor, where optical semiconductors are explicitly mentioned as a particular type of semiconductors, the Commission concluded that that there are strong indications in support of a worldwide market geographic scope, but it ultimately left the precise geographic market definition open.

(74) In M.7686 – Avago/Broadcom, the Commission considered that the market for semiconductors, which optical semiconductors are considered part of, is worldwide in scope and assessed potential competition concerns accordingly.

6.3. The Commission’s assessment

(75) The market investigation confirms the Commission’s findings in previous cases that the market for optical semiconductors is at least EEA-wide in scope, with important global characteristics.

(76) A large majority of the Parties’ customers and competitors that replied to the market investigation considers that competitive conditions for light sensors (prices, delivery time, active suppliers, etc.) are generally the same on a worldwide level.52 Most customers indicated that the selection of their suppliers of light sensors is typically independent of their location.53 In addition, most competitors indicated that their customers of light sensors are typically located in regions of the world that might be different from the region where the sensors are manufactured.54 Moreover, most customers and competitors that replied to the market investigation consider that transport cost has little or no impact on imports and exports of light sensors as they can be cost-effectively transported from/to different regions of the world.55

(77) Similarly, a large majority of the Parties’ customers and competitors that replied to the market investigation consider that competitive conditions for laser diodes (prices, delivery time, active suppliers, etc.) are generally the same on a worldwide level.56 Most customers indicated that the selection of their suppliers of laser diodes is typically independent of their location.57 In addition, most competitors indicated that their customers of laser diodes are typically located in regions of the world that might be different from the region where the sensors are manufactured.58 Moreover, most customers and competitors that replied to the market investigation consider that transport cost has little or no impact on imports and exports of laser diodes as they can be cost-effectively transported from/to different regions of the world.59

(78) Therefore, consistently with precedent Commission’s cases, and supported by the market investigation in the present case, the geographic scope of the market for optical semiconductors and of its plausible narrower segments appear to have important worldwide connotations and therefore can be considered at least EEA- wide in scope and most likely worldwide. However, the precise scope can be left open because the Transaction does not raise competition concerns irrespectively of the precise geographic market definition.

7. COMPETITIVE ASSESSMENT

7.1. Legal framework of the assessment

(79) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position. In this respect, a merger can entail horizontal and/or non-horizontal effects.

(80) Horizontal effects are those deriving from a concentration where the undertakings concerned are actual or potential competitors of each other in one or more of the relevant markets concerned. The Commission appraises horizontal effects in accordance with the Horizontal Merger Guidelines.60

(81) According to paragraph 26 of the Horizontal Merger Guidelines, a number of factors need to be assessed, and a non-exhaustive list of relevant factors that might lead to a significant impediment to effective competitions are explained in paragraphs 27-38. Accordingly, Sections 7.2.1 to 7.2.6 of the present decision assess, respectively, market shares and HHI, closeness of competition between the Parties, important dynamics of the markets where the Parties’ activities overlap, the alternatives to the Parties and barriers to entry, buyer power of the Parties’ customers, and the impact that the main market participants expect from the Transaction. Based on all these factors considered together, conclusions on horizontal non-coordinated effects are drawn in Section 7.2.7.

(82) As regards non-horizontal effects, the Commission Non-Horizontal Merger Guidelines61 distinguish between the effects of vertical mergers, which involve companies operating at different levels of the supply chain, and of conglomerate mergers, which involve companies that are active in closely related markets.

(83) According to paragraph 23 of the Non-Horizontal Merger Guidelines, non-horizontal mergers pose no threat to effective competition unless the merged entity has a significant degree of market power in at least one of the markets concerned. Section 7.3 assesses whether post-Transaction the merged entity would have sufficient market power to raise vertical or conglomerate competition concerns.

(84) The Horizontal Merger Guidelines and the Non-Horizontal Merger Guidelines distinguish between two main ways in which mergers may significantly impede competition, namely non-coordinated or coordinated effects. The present Section 7 assesses successively whether the Transaction is likely to raise horizontal, vertical or conglomerate non-coordinated effects on the markets examined in Sections 5 and 6.

7.2. Horizontal non-coordinated effects

7.2.1. The Parties have low to moderate combined market shares under any plausible market definition

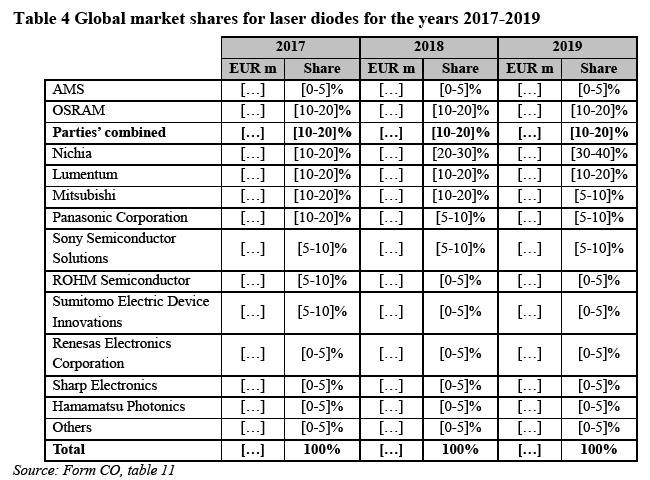

(85) The Notifying Party provided market shares estimates for both EEA-wide and global geographic markets in the supply of the overlapping products. Since most data available from third parties or from the Parties’ internal intelligence concern global sales, estimates of EEA market shares are limited to those of the Parties and do not include their competitors.

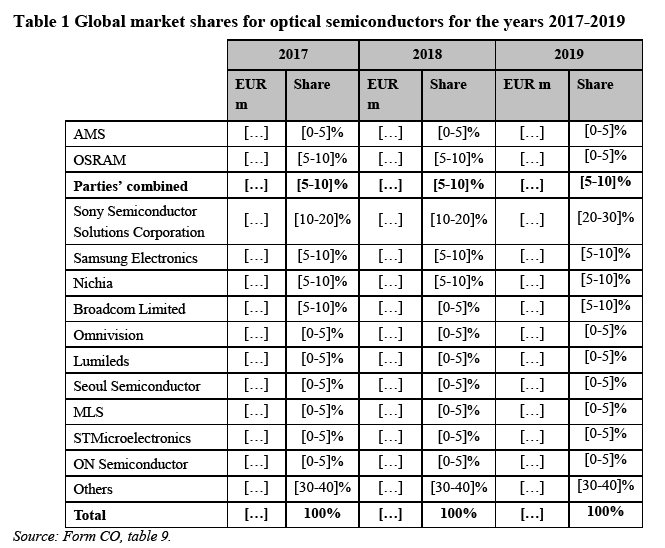

(86) With respect to the supply of optical semiconductors overall, Table 1 below reports the Notifying Party’s estimates of the Parties’ and their competitors’ global market shares for the years 2017-2019. The table shows that for the period 2017-2019, the Parties’ combined market share was well below 20%, and specifically, it was [5-10]% in 2017, [5-10]% in 2018 and [5-10]% in 2019. The table also shows that post-Transaction, the merged entity would continue to compete with a number of global competitors. These global competitors include, for example, Sony Semiconductors, which in 2019 had a global market share of [20-30]% in the supply of optical semiconductors, Samsung Electronics (with a market share of [5-10]% in 2019), Nichia (with a market share of [5-10]% in 2019), and Broadcom (with a market share of [5-10]% in 2019).

(87) In a hypothetical EEA-wide market, the Notifying Party estimates that AMS’ market share for optical semiconductors in 2019 would remain [5-10]%, while OSRAM’s market share would be [20-30]%,62 leading to a combined market share below [30-40] %. As explained in paragraph (85), the Notifying Party [information about the Parties’ business strategy].

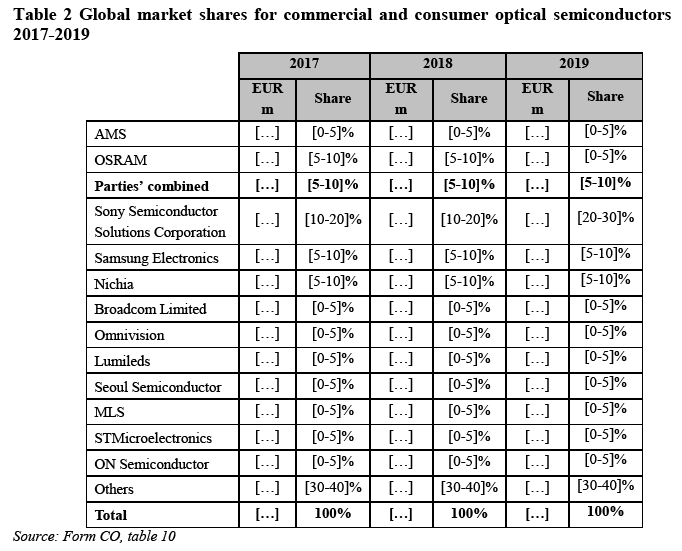

(88) The Notifying Party provided market shares for the supply of optical semiconductors according to its proposed distinction of the intended field of use, namely communications IR optical semiconductors, and commercial and consumer optical semiconductors. Since the activities of the Parties do not overlap in communications IR optical semiconductors, the Notifying Party provided only market shares concerning commercial and consumer optical semiconductors, which, as shown in Table 2, do not materially differ from those concerning optical semiconductors overall.

(89) As the Notifying Party explains, total sales of commercial and consumer optical semiconductors (EUR […] in 2019) are very similar to those of optical semi- conductors overall (EUR […] in 2019) and the Parties are only active in relation to commercial and consumer optical semiconductors (and therefore their sales in commercial and consumer optical semiconductors also represent their sales in optical semiconductors overall). This explains why market shares for commercial and consumer optical semiconductors do not exhibit material differences with those for optical semiconductors overall.

(90) With respect to a potential EEA-wide market definition, the Notifying Party’s estimate of the market shares for commercial and consumer optical semiconductors are the same as those for optical semiconductors overall, i.e. [5-10]%, for AMS and about [20-30]% for OSRAM, which lead to a

(91) Due to the immaterial difference in sales between optical semiconductors overall and commercial and consumer optical semiconductors, this distinction is not further considered in the competitive assessment.

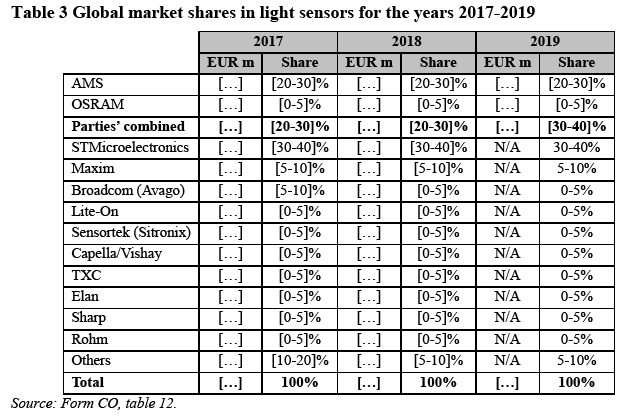

(92) With respect to light sensors, Table 3 reports the Notifying Party’s estimates of the Parties’ and their competitors’ global market shares for the years 2017-2019. Since the Notifying Party was not able to estimate the sales of a number of its competitors for the year 2019, market shares of these competitors are estimated in ranges.

(93) The Parties’ combined market share for the supply of light sensors in 2019 is estimated at [30-40]%, with an increment brought by OSRAM of [0-5]%. While the exact market share of the merged entity’s main competitor (STMicroelectronics) in 2019 cannot be estimated, the Notifying Party provides a range of 30-40%, which suggests that the merged entity would be of a similar size of its largest competitor. Table 3 also shows that there are a number of competitors of the same size of OSRAM or even larger active in the market for light sensors.

(94) Considering the market shares of the year 2018, which have been estimated in a more precise way, and not as ranges, the HHI before and after the Transaction are, respectively, […] and […], and therefore the HHI variation after the Transaction (also referred to as the delta) is 130. According the Horizontal Merger Guidelines, “[t]he Commission is unlikely to identify horizontal competition concerns in […] a merger with a post-merger HHI above 2 000 and a delta below 150”.64

(95) With respect to a potential EEA-wide scope of the market for light sensors, in 2019 AMS generated about EUR […] from the sales of light sensors in the EEA, which is estimated to represent a market share below 10%.65 In the same year, OSRAM’s sales of light sensors in the EEA were EUR […], corresponding to a market share [5-10]%.66 Therefore, the Parties’ combined market share for light sensors in the EEA is estimated to be below 20%.

(96) Within light sensors, the Notifying Party provided also market shares concerning the supply of biosensors for consumer electronics and mobile 3D flood illuminators.

(97) With respect to biosensors, the Parties overlap only regarding consumer electronics. [Information about the Parties’ business strategy].67

(98) The Parties’ combined global market share in the supply of biosensors for consumer electronics in 2020 is estimated to be [30-40]% (AMS: [0-5]% and OSRAM [30-40]%) with an estimated total market volume of EUR […]. As the Notifying Party was not able to provide market shares for biosensors only, the above figures also reflect sales of different biosensor components, whereas the market size refers to biosensors for consumer electronics excluding components. Therefore the Parties’ sales appear to be to a large extent overestimated.

(99) When the Parties’ sales of biosensor components are considered, most of the merged entity’s sales would be from OSRAM’s sales of [information about the Parties’ sales]. In contrast, AMS’ sales [information about the Parties’ sales], and represent only [0-5]% of the overall biosensor for consumer electronics sales in 2020 in value. Therefore, at worst, the Transaction would lead to a small increase of the market shares.

(100) After the Transaction, Maxim would remain the largest competitor of the merged entity in biosensors for consumer electronics with an estimated global market share of [30-40]%. The second largest competitor would be Broadcom with [10-20]% market share. Other competitors with smaller market shares, such as ADI and TI (each with market shares estimated at [5-10]%) would also compete with the merged entity in the supply of biosensors for consumer electronics.

(101) As explained in Section 7.2.3, the markets for optical semiconductors, and in particular the one for biosensors, are growing considerably (the market size of biosensors for consumer electronics is expected to increase from EUR […] in 2020 to EUR […] by 2025) and is fast evolving thus market shares are expected to change rapidly from year to year. Therefore, in order to assess if the market shares of the Parties are expected to grow in the future, the Notifying Party provided forecasts for the year 2025. The Notifying Party estimates that by 2025 the merged entity’s market share would decrease to [20-30]%, at par with Maxim. In addition, by 2025 TI is expected to grow substantially, i.e. to [10-20]%, thus increasing its competitive constrain to the merged entity.

(102) According to the Notifying Party, the changes in market shares from 2020 to 2025 will occur due more competition in discrete photodiodes ([information about the Parties’ business strategy]), and a market preference for integrated solutions ([information about the Parties’ business strategy]).

(103) With respect to 3D flood illuminators for mobile applications, [information about the Parties’ business strategy], therefore only global market shares are provided. Due to the lack of industry reports regarding in particular 3D flood illuminators for mobile applications, market shares estimates are prepared by the Notifying Party based on the best of its knowledge. The Notifying Party considers that in the years 2019 and 2020 no appreciable changes occurred in terms of sales and market shares, and therefore its estimates for the years 2019 and 2020 are identical.

(104) The Parties’ combined market share in the supply 3D flood illuminators for mobile applications amounts to [10-20]% globally and each of the Parties have similar market shares before the Transaction (i.e. about [5-10]%). In addition, after the Transaction, the merged entity’s market share will be well smaller than that of its largest competitor, Trumpf/Philips, which has a market share of [60-70]%.68

(105) With respect to laser diodes, Table 4 reports the Notifying Party’s estimates of the Parties’ and its competitors’ worldwide market shares for the years 2017-2019. The Parties’ combined market share in 2019 is [10-20]% with an increment of [0-5]%. After the Transaction, the merged entity’s largest competitor would remain Nichia with sales about three times larger than the merged entity’s. Lumentum, with [10-20]% market shares worldwide would remain the second largest suppliers of laser diodes, while the merged entity would have sales of similar order of magnitude of other competitors such as Mitsubishi, Panasonic Corporation and Sony Semiconductor Solutions.

(106) With respect to a potential EEA-wide scope of the market for laser diodes, the Transaction would not lead to any overlap between the activities of the Parties [information about the Parties’ business strategy].69

(107) Within laser diodes, the Notifying Party has provided market share information for the supply of laser diodes for LiDAR, [information about the Parties’ business strategy].70 The Notifying Party estimates that [information about the Parties’ business strategy] the combined worldwide market share of the Parties in laser diodes for LiDAR may reach c. [20-30]%.71 The Notifying Party expects that at least Hamamatsu, Excelitas, II-VI/Finisar, Lumentum, Trumpf/Philips, and Trilumina will be able to secure market positions that are (at least) comparable to the combined market position of the merged entity. In general, for laser diodes for LiDAR, according to the Notifying Party, future EEA market shares will be similar to global market shares due to the strong global position of European automotive manufacturers and Tier-1 suppliers.72

(108) Regarding VCSEL only, the Notifying Party estimates that in 2019 AMS will have a market share of [0-5]% and OSRAM of [0-5]%, the combined market share being [5-10]%.73 However, an industry report upon on which the Parties rely in their ordinary course of business,74 indicates higher market shares for AMS and potentially for OSRAM. Nevertheless, as explained below, the Parties’ combined market share would in any event remain below 30%.

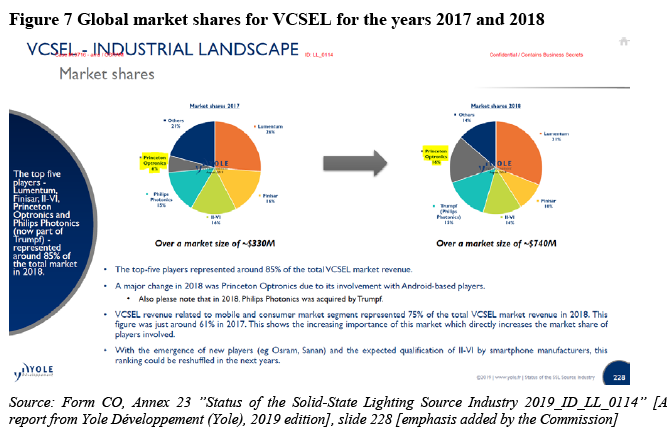

(109) According to such industry report, in 2017 Princeton Optronics (now part of AMS) had a global market share of [5-10]%, which grew to [10-20]% in 2018 (Figure 7). OSRAM is not mentioned as a major supplier and therefore its market shares are not stated explicitly in the report. Instead, the report estimates the market share of all the other VCSEL at 14%. Therefore, even assuming that OSRAM accounted for a large part of the market share allocated to “others” suppliers, the Parties’ combined market share would still remain below 30%.

(110) In conclusion, the market investigation has shown that the Parties’ combined market share in VCSEL is below 30%.

7.2.2. In most of the plausible product markets, the Parties do not appear to compete closely

(111) The Horizontal Merger Guidelines explain that “[p]roducts may be differentiated within a relevant market such that some products are closer substitutes than others. The higher the degree of substitutability between the merging firms' products, the more likely it is that the merging firms will raise prices significantly”.75

(112) As explained in Section 5, the market for optical semiconductors appears to be highly differentiated in a number of products with specific end-uses and functionalities, and many of them could potentially constitute separate product markets. Therefore, the present section assesses if the Parties compete closely in the plausible markets considered in Section 5.4.

(113) As explained in Section 7.2.1, for each plausible product market definition, the merged entity’s market shares are either small or the increments brought about by the Transaction appear to be limited. This is consistent with the fact that, as shown below, the Parties either do not compete closely or that competitors taken together (but often also individually) have higher market shares than the merged entity in the relevant markets.

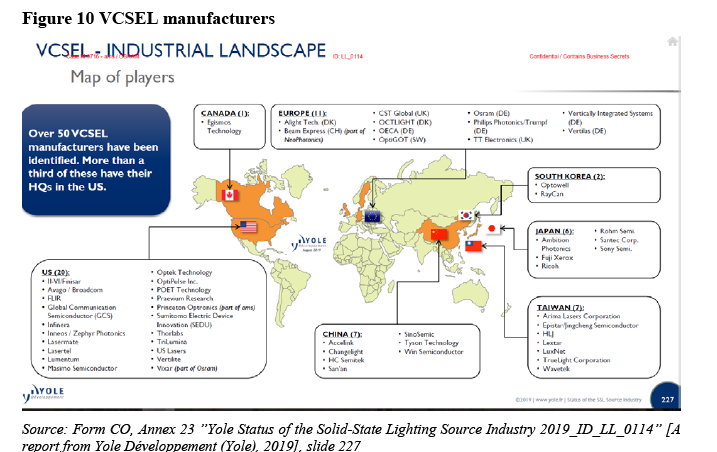

(114) First, the Parties’ products are based on technologies that are to a large extent complementary.

(115) As an OSRAM’s customer active in automotive explains, “OSRAM is the global leader and the only European supplier of LED for automotive applications [and a] close competitor to OSRAM is the Japanese Nichia”, whereas “AMS is strong in sensors, including optical sensors, which are to large extent sold to Apple for manufacturing smartphones”.76

(116) A competitor of the Parties further explained that while it regards AMS as one of its main competitors in light receiving optical semiconductors (as for example light sensors and image sensors), it does not regard OSRAM as a strong competitor because it is mainly active in light emitting optical semiconductors (as for example LEDs): “[…] OSRAM is primarily a lighting company, with activities in proximity light sensors (where AMS is also present) but with a limited market position”. With respect to the combination of the Parties’ products, the same market participant explained that “[b]y acquiring OSRAM, AMS will reinforce its overall position and may generate synergies in segments such as, e.g., under-display solutions (i.e., perfect screens for smartphones or watches) and biosensors (for applications such as vital signs monitoring and spectrometry)”.77

(117) For the limited products for which the activities of the Parties do overlap, there is also a high degree of technology complementarity.

(118) With respect to laser diodes, OSRAM realises [information about the Parties’ revenues] with EEL laser diodes and […] with VCSEL. AMS sells [information about the Parties’ business strategy]. However, while competition between the Parties in VCSEL appears to be limited (one automotive customer stated that “[a]s Osram only recently stated activities on VCSEL there is only minor competition yet”78), from a technology point of view, the Parties’ VCSEL products appear to have similar technical characteristics, as some market participants recognised during the market investigation.79

(119) As explained in Section 5.4.2, [information about the Parties’ business strategy]. In this respect, one could envisage a competition between the Parties in developing new products leading to future competition for the sales of similar products. However, there is currently a high degree of uncertainty regarding the LiDAR market uptake and therefore it is uncertain how the market conditions will be once LiDAR products are deployed. Therefore, the results of the market investigation do not support a conclusion that the Parties will in the future compete closely for the manufacture and sales of LiDAR solutions in the future.

(120) With respect to light sensors, both the Parties sell biosensors for consumer electronics and 3D flood illuminators for mobile applications.

(121) Regarding biosensors for consumer electronics, while OSRAM provides solutions and components [information about the Parties’ business strategy], AMS produces biosensors and components [information about the Parties’ business strategy].

(122) Figure 8, which shows an AMS’ internal document produced in its ordinary course of business, corroborates that [information from internal documents].

Figure 8 […]

[…]

Source: Form CO, Annex 29, Appendix 003, slide 6.

(123) Second, the Parties focus on different customers: while AMS’ activities are focused on optical semiconductors for consumer electronics, OSRAM has a strong focus on automotive applications.

(124) A tier 1 supplier of automotive OEMs, which is considering AMS, among others, as a potential supplier of laser diodes for LiDAR, explained that the complementarity of the Parties in terms of customer focus would lead to a positive impact of the Transaction on the market. More specifically, this market participant explained that “[…] if AMS loses its main customer after the lifetime of its smartphones agreements (i.e. this can happen every 1-2 years), significant financial troubles might occur in the middle of the lifetime of the supply agreement for automotive products that the Company needs to deliver to its customers. In this respect, the acquisition of OSRAM by AMS would have a positive impact because AMS would be able to diversify its risks by relying on a larger number of customers active in different markets”.80

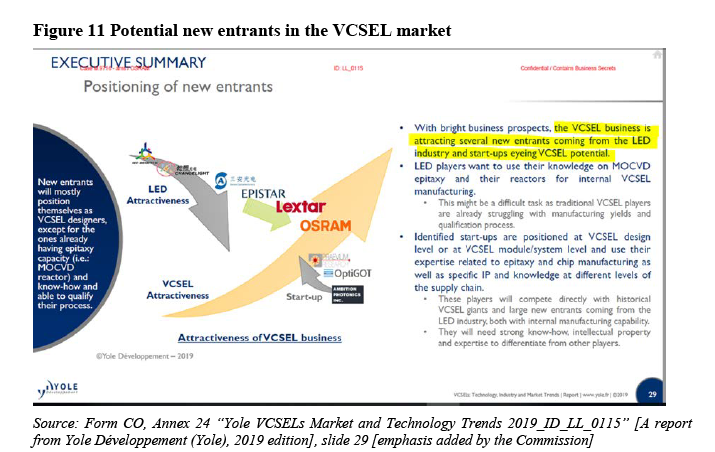

(125) [Information from internal documents].

Figure 9 […]

[…]

Source: Form CO, Appendix 014 (ID_LL_0020), slide 4 [emphasis added by the Commission]

(126) Third, the Parties appear to have a different geographic focus. In 2019, while OSRAM realised […] in the EEA (that is, EUR […] in the EEA, compared to a worldwide turnover of EUR […]), AMS realised only […]% of its turnover in the EEA (that is, EUR […]in the EEA, compared to a worldwide turnover of EUR […]).81

(127) Fourth, a majority of the market participants that expressed a view during the market investigation does not consider the Parties as close competitors and instead consider that AMS and OSRAM offer complementary or different products in terms of technical specifications, price, and quality. This view regards specifically: light sensors overall, light sensors for consumer electronics, biosensors, 3D flood illuminators for mobile, laser diodes overall, and laser diodes for LiDAR.82

(128) A number of market participants consider that the Parties offer similar products with respect to 3D flood illuminators for mobile world-facing applications. However, for the reasons explained in Sections 7.2.1 and 7.2.3 to 7.2.6, the Transaction does not raise competition concerns with respect to the 3D flood illuminators for mobile offered by the Parties.

(129) Therefore, the Parties cannot be regarded as close competitors neither in the overall market for optical semiconductors nor in most plausible narrower product markets, the possible exception being in VCSEL and 3D floor illuminators, for which, to some extent, the Parties appear to compete relatively closely.83 However, notwithstanding this competition between the Parties, the Transaction does not raise competition concerns for the reasons explained in Sections 7.2.1 and 7.2.3 to 7.2.7.

7.2.3. Fast evolving products and market dynamics do not allow the Parties to acquire market power

(130) Optical semiconductors, and, as such, both light sensors and laser diodes are fast evolving products and each product released by suppliers would typically become obsolete within a relatively short period of time. Therefore, for the reasons explained below, the Parties have limited or no possibility to acquire market power vis-à-vis their suppliers.

(131) First, a large majority of the market participants that expressed a view during the market investigation does not consider that either light sensors or laser diodes are part of a mature market where no major changes are expected.84 On the contrary, a majority of the market participants either expects market changes in the near future, or consider products and technologies still under development and therefore the markets as a “future market[s]”.85

(132) A customer of the Parties, which describes itself as a “distributor of electronic components of all varieties, including light sensors and laser diodes from different manufacturers”, and therefore with a wide view of different optical semiconductor products, explained that “our industry is very dynamic and therefore always evolving. More often they drive or enable future markets”.86

(133) Another customer, which is active in the automotive sector, explained that while the technologies themselves are well-established, there is an “increasing automation in particular of transport [that] will create a large number of new applications”. The same market participant explains that this is the reason for the market evolution.87

(134) Another customer of the Parties, which is a supplier of automotive OEMs, further explains how the market deployment of laser diodes and light sensors evolved in the automotive sector and that important cost reductions are to be expected due to a large scale employment of these products: “The market of Automotive HMI [which uses light sensors] is slowly evolving as market has initially been established for premium cars later on evolving towards intermediate cars. 3D TOF (time of flight) and Lidar markets are nascent in Automotive and there is an important pressure from car manufacturers to obtain price reduction from their part suppliers […] to give to the latters access to large volumes. As such, the technologies have to evolve in order to drastically cut their development and manufacturing costs. Since light sensors and laser diodes are important parts of the bill of materials (BOM) of part suppliers […] they are subject to such cost pressure”.88

(135) Second, laser diodes and light sensors are subject to a relatively short replacement cycle, which ultimately drives innovation in developing new or improved products.

(136) A market participant which is globally active in manufacturing and selling consumer electronics explained that “[t]o the best of our knowledge and understanding, the average lifespan (and replacement cycle) of consumer electronics including mobile devices is relatively shorter than those of other products, which means that the replacement cycle of the light sensors incorporated in the consumer electronics is also relatively short. Shorter lifespan and replacement cycle seem to cause somehow fast evolution in the product and technology, thus making the market dynamic”.89

(137) The same market participant also explained that “[c]onsumer electronics including Smartphones, smart watches, and smart wristbands are quickly evolving, and this also leads to fast evolution in the light sensors technology, which is essential to support many functions provided through the consumer electronics (e.g., health, fitness tracking, and air quality monitoring)”.90

(138) For automotive applications, replacement cycles can be expected to be longer because automotive vehicle models are typically sold for about 4 to 6 years, compared to, for example, smartphones that can be sold for about 2-3 years. However, with respect to light sensors, a market participant active in the automotive sector explained that the innovation cycle remains relatively short. While the production for a given product is expected to last for 4 to 6 years plus 10 years of maintenance, the frequency of introduction of new light sensors to new vehicle models is about 2 to 3 years, and for some light sensors this can be as short as 1 to 2 years.91

(139) Therefore, while manufacturers continue the production of light sensors for up to 10 years, they need to continue innovate in order to introduce to the market new products every 1 to 3 years.

(140) Third, with respect to VCSEL in particular, which is an area where the Parties offer and develop similar products, the market appears to be evolving at important rate.

(141) A large majority of the automotive customers that expressed a view during the market investigation consider that VCSEL for LiDAR applications belong to a future market where products and technologies are still under development.92 One market participant active in consumer electronics, when commenting about the evolution of the various optical semiconductor markets, identified in particular VCSEL as an area dynamic changes are expected and stated that “[f]or VCSELs there is most dynamics present, in particular for the higher power arrays”.93

(142) As Figure 7 shows, the overall market size of VCSEL more than doubled from the year 2017 to 2018, i.e. in this period it changed from USD […] to USD […]. Another slide of the same document shows that the VCSEL market is expected to substantially grow from 2018 to 2024, more specifically the related compound annual grow rate (‘CAGR’) in this period is estimated to be [30-40]%.94

(143) Figure 7 also shows how volatile market shares can be from one year to the next. For example, Prince Optronics (which now belongs to AMS) increased its market share from [5-10]% to [10-20]%, while Finisar’s market shares, for example, in the same period went from [10-20]% to [10-20]%. A note in the same slide of the report states that [information from an industry report].

(144) In this respect, any of the 50 companies identified in Figure 10 might potentially erode market shares of the Parties in the near future.

(145) In conclusion, all the evidence in the file suggests that the fast evolving products and market dynamics do not allow the Parties to acquire market power in the potential markets for laser diodes, light sensors, biosensors for consumer electronics, mobile 3D flood illuminators and VCSELs for LiDAR.

7.2.4. A number of capable competitors offer viable alternatives to the Parties and barriers to entry do not seem to prevent new market entrants

(146) A large number of market participants are active in the manufacture and supply of optical semiconductors. The small combined market share of the Parties, and the large number of competitors shown in Table 1 well illustrates that the Parties face strong competition from a number of optical semiconductor manufacturers.

(147) However, since not all manufacturers supply the same types of optical semiconductors, the present section assesses the various alternatives to the Parties, for the plausible product markets defined in Section 5.4

(148) With respect to light sensors, the Parties’ competitors include STMicroelectronics (Switzerland, with a global market share of 30-40%), Maxim (US, with a global market share of 5-10%) and Broadcom (US, with a global market share of 0-5%) among others. With respect to biosensors for consumer electronics ADI (US, with a global market share of 5-10%), TI (US, with a global market share of 5-10%), Broadcom (with a global market share of [10-20]%), Maxim (with a global market share of [30-40]%) and various Asian suppliers (e.g. Pixart, Parton, and Epicore) compete with the Parties. With regard to 3D flood illuminators for mobile, the Parties compete mainly with Trumpf/Philips, which has a global market share of [60-70]%, and to a lesser extent with Lumentum, and II-VI/Finisar.

(149) With respect to laser diodes, the Parties’ competitors include Nichia (Japan, with a global market share of [30-40]%), Lumentum (US, with a global market share of [10-20]%), Mitsubishi Electronics Corporation (Japan, with a global market share of [5-10]%) and Panasonic Corporation (Japan, with a global market share of [5-10]%) among others. In automotive LiDAR a number of suppliers are active, including suppliers of laser diode such as Lumentum, Trumpf/Philips (Germany), II-VI/Finisar (US) and Hamamatsu (Japan), which AMS expects to be able to secure market positions comparable to the combined market position of AMS/OSRAM.95

(150) These suppliers exercise important competitive constraints on the Parties for the following reasons.

(151) First, a majority of the Parties’ competitors that expressed a view during the market investigation consider that the markets for optical semiconductors are either “very competitive” or “somehow competitive i.e. the number of suppliers or potential suppliers is similar to other markets which [they] consider relatively competitive”.96

(152) When asked to rate the Parties’ competitors, a large majority of the Parties’ customers that expressed a view during the market investigation considered that for both laser diodes overall and light sensors overall, the Parties’ competitors either are numerous and strong or exist even if not all of them are as strong as the Parties.97

(153) This opinion appears to be equally shared by both automotive and consumer electronic customers, even if for consumer electronics customers appear to be even less concerned than automotive customers.

(154) When the question was asked for specific products, in some cases, the perception of the existence of a large number of competitors decreased. This is the case for example, of VCSEL. While an automotive customer stated that after the Transaction “[t]here is still a sufficient number of potential suppliers left”,98 some customers consider that the number of valid suppliers is somehow limited. However, as explained in the next paragraphs, due to the potential market entrance of new suppliers this does not seem to be a concern for most customers.

(155) Second, for the limited cases where there are less suppliers available on the market, the Parties’ customers do not appear to be concerned about barriers to entry and are confident that new suppliers might enter the market.

(156) As a tier-1 automotive supplier explained, “[t]echnical requirements for a given system with 3D TOF or laser diodes are generally so high that a maximum of three suppliers can reach the required performance. Sometimes, it is even limited to one or two suppliers. In the case of VCSEL, a part supplier such as [name of the Company] may even have to assist (through training, audit, sometimes financial support) its suplier to allow it to reach technical expectancies from the Automotive market.”99 This view suggests that barriers to entry do not preclude new suppliers to enter the market, especially because certain customers might facilitate their market entrance.

(157) Several customers of the Parties that replied to the market investigation observed suppliers of laser diodes and light sensors entering the market in the last 5 years, and expects new entrants in the next 3 years.100 The observation of new market entrants appears to be slightly lower for automotive end uses, where more stringent requirements related to safety aspects exist and therefore more time is needed for a new supplier to enter the market. However, as one of the Parties’ customers observed “[d]ue to the preparation for autonomous driving a huge number of start-ups are on the way to developing into an automotive supplier company”.

(158) Regarding VCSEL, for which market participants seem to consider that less competitors are present on the market, an industry report upon which the Parties rely in their ordinary course of business explains that the VCSEL business attracts a number of new entrants from neighbouring markets, and more in particular from the LED market, but also start-ups are willing to enter this market (Figure 11).

(159) Regarding 3D flood illuminators for mobile applications, which both the Parties manufacture and sell, an internal document of AMS produced in its ordinary course of business illustrates the competitive landscape for the entire level of its supply chain (Figure 12). AMS considers that [information from ams’ internal documents].

(160) [Information from ams’ internal documents].

Figure 12 […]

[…]

Source: Form CO, Annex 29 “003_ID_LL_0093”, slide 10

(161) The merged entity will continue to face competition from a number of credible competitors and potential new entrants, including (i) laser diode suppliers which may expand into the down-stream assembly of complete illuminator modules (e.g. leading VCSEL-suppliers Lumentum, II-VI/Finisar, Trumpf/Philips); (ii) contract manufacturers (‘CM’)101 that source the relevant input components from laser diode suppliers (e.g. Sunny Optical); and (iii) Asian optical solution providers with own in-house capacities for optical components (e.g. Himax).

(162) Third, in case of a hypothetical price increase of either laser diodes or light sensors, a large majority of the Parties’ customers indicated that they would not pay for the price increase and instead they would switch to other suppliers offering similar products.102

(163) In conclusion, it appears that a number of capable competitors offer viable alternatives to the Parties and barriers to entry do not seem to prevent new market entrants. Therefore the merged entity would not have sufficient market power for increasing prices after the Transaction.

7.2.5. The customers of the Parties have a certain degree of countervailing buyer power and price re-negotiations typically lead to price reductions

(164) The present section demonstrates that for a number of reasons, the customers of the Parties have a certain degree of countervailing buyer power and price re-negotiations typically lead to price reductions.

(165) First, due to the relatively short replacement cycles of optical semiconductors, the Parties’ customers are not subject to lock-in effects and therefore they can switch to other suppliers in case of price increase.

(166) Both consumer electronic OEMs and automotive tier-1 suppliers typically select their suppliers during the design phase of their products, and once the suppliers are selected they prefer not to change them during the production phase.103 However, during this period, which is 2 to 3 years for consumer electronics and 4 to 6 years for automotive customers (see Section 7.2.3), the Parties’ customers are not subject to any type of lock-in effect for two main reasons.

(167) In the first place, and particularly for consumer electronics OEMs, the replacement cycle of optical semiconductors is relatively short and a hypothetical price increase would give its benefits for a short period of time. In contrast, attempting to increase price might result in not being selected for the next consumer electronic model (say, for example, a smartphone or a smart watch).

(168) In the second place, both consumer electronics OEMs and automotive tier-1 suppliers develop different products in parallel and therefore the Parties are considered as potential suppliers far more frequently than once in the replacement cycle of optical semiconductors. Therefore, any attempt of the Parties to exert market power vis-à-vis a certain customer would be subject to retaliation for any other upcoming product that such a customer is developing. For instance, consumer electronic products such as smartphones are typically introduced every 2 to 3 years. Considering that a smartphone OEM would typically supply a portfolio of smartphones, it would select suppliers of optical semiconductors much more frequently than every 2 to 3 years.

(169) In the automotive sector, new models are introduced less frequently than in consumer electronics. However, as explained in paragraph (138), new light sensors for new vehicle models, for example, are expected about every 2 to 3 years, and for some this can be as short as 1 to 2 years.

(170) Therefore, while in principle it could be possible to lock-in their customers for the entire production period of a certain final product, in practice the Parties attempt to sell their products to each of their customers on a frequent regular basis and therefore they do not have enough market power to raise prices during the production phase of a certain final product.

(171) Second, in the markets where the Parties sell their overlapping products, a limited number of powerful buyers are typically present. Due to the fundamental differences in market structures between automotive and consumer electronics, these are analysed separately.

(172) With respect to automotive customers, as explained in Section 5.4, the Parties do not have any overlapping activities with respect to sales to automotive customers, [information about the Parties’ product development].

(173) The Notifying Party submits that potential tier-1 automotive suppliers that [information about the Parties’ business strategy].104

(174) These companies are large in size (and often much large than the Parties) and rely on sophisticated purchasing practices and dedicated purchasing departments and therefore they would be able to exert some level of buyer power on the merged entity.

(175) With respect to customers active in consumer electronics, the Parties typically sell their products directly to consumer electronic OEMs, which are typically large multinational companies active on a global level such as for example [information about customers]. These companies are large in size (and often much large than the Parties) and rely on sophisticated purchasing practices and dedicated purchasing departments and therefore they would be able to exert some level of buyer power on the merged entity.

(176) In addition, each of these consumer electronics OEMs would typically purchase from the Parties a large amount of products, which in some cases represent a large share of each of the Parties’ revenues.105 Losing any of these customers, and in particular the largest ones, would result in a major loss of revenues for the Parties. For this reason, consumer electronics OEMs enjoy some level of buyer power vis-à- vis the Parties.

(177) This is particularly the case because, as explained in Section 7.2.3, consumer electronic OEMs would typically change the type or the model of the optical semiconductors they use (and therefore, potentially, their suppliers) every 2 to 3 years, and they also produce different products in parallel, and therefore a potential retaliation due to an attempted price increase would affect the Parties in the short term.

(178) Third, with respect to of 3D flood illuminators for mobile, consumer electronics OEMs generally engage at different levels of integration, which poses a constraint on suppliers of pre-assembled modules.

(179) Whilst some customers procure optical components (such as VCSEL) and rely on own or third-party optical assembly capabilities to create the relevant modules and 3D systems, others procure modules such as flood illuminators or even entire 3D systems including the relevant software. In this regard, the Parties only compete for the supply of [information about the Parties’ business strategy].106