Commission, August 17, 2020, No M.9711

EUROPEAN COMMISSION

Decision

ALLIANCE HEALTHCARE DEUTSCHLAND / GEHE PHARMA HANDEL

Subject: Case M.9711 – Alliance Healthcare Deutschland AG / GEHE Pharma Handel GmbH

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 10 July 2020, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Alliance Healthcare Deutschland AG (“Alliance”, Germany) acquires sole control of Gehe Pharma Handel GmbH, Gehe Immobilien GmbH & Co. KG and Gehe Immobilien Verwaltungs-GmbH (together “Gehe” or the “Target”, Germany) (the “Transaction”).3 (Alliance is designated hereinafter as the 'Notifying Party' and together with Gehe as the 'Parties'.)

1. THE PARTIES

(2) Alliance is a full-line pharmaceutical wholesaler in Germany, distributing the full range of prescription pharmaceuticals (“Rx”), over-the-counter medicines (“OTC”) and other products to retail pharmacies in the whole of Germany. To that end, Alliance operates 24 wholesale depots across the country. Alliance is solely controlled by the US pharma retail and wholesale company Walgreens Boots Alliance Inc. (“WBA”). To a minor extent, Alliance is engaged in activities related to pharma-wholesaling, namely (i) the sale of own label products to pharmacies,4 (ii) the provision of logistics services to pharmaceutical manufacturers, and (iii) the provision of data services to manufacturers, wholesalers, pharmacies and other players in the pharmaceutical industry.

(3) Gehe is a full-line pharmaceutical wholesaler in Germany, distributing the full range of Rx, OTC and other products to retail pharmacies in the whole of Germany.5 It operates 18 wholesale depots across the country. Gehe is currently solely controlled by the US pharma wholesale company McKesson Corporation (“McKesson”). To a minor extent, Gehe also sells own label products to pharmacies, as further explained in footnote 4.

2. THE OPERATION

(4) On 11 December 2019, Alliance entered into an agreement with McKesson Europe AG, a subsidiary of McKesson, according to which all shares of Gehe will be acquired by Alliance in exchange for a non-controlling minority stake of 30% of the equity in Alliance. Alliance therefore acquires sole control over Gehe. Consequently, the Transaction gives rise to a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million6 (WBA EUR 115 890 million and Gehe EUR […] million). Each of them has an EU-wide turnover in excess of EUR 250 million (WBA EUR […] million, Gehe EUR […] million), but they do not each achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State.7 The notified operation therefore has an EU dimension within the meaning of Article 1(2) of the Merger Regulation.

4. COMPETITIVE ASSESSMENT

4.1. Market definitions

4.1.1. Product market definition: Wholesale of pharmaceutical products

(6) Pharmaceutical wholesaling comprises the delivery of pharmaceutical products to customers such as pharmacies, and potentially hospitals or doctors, but not to end- customers. Therefore, pharmaceutical wholesalers constitute the link between the manufacturer of pharmaceutical products and professional customers who further sell or use these products. Typically, pharmaceutical wholesalers operate one or a network of depots from where they deliver to customers.

4.1.1.1. Past decisional practice

(7) In previous decisions, the Commission has concluded that pharmaceutical wholesaling by full-liners would form a separate product market from pharmaceutical wholesaling by short-liners.8 Full-line wholesalers aim at supplying customers with the full complement of pharmaceutical products, whereas short-line wholesalers only offer part of the product range. Specifically with respect to Germany, the Commission has concluded on two occasions that pharmaceutical full- line wholesaling was a distinct product market from pharmaceutical short-line wholesaling.9 In other cases concerning countries other than Germany, however, the Commission considered full-liners and short-liners to be potential segments of pharmaceutical wholesaling, and left the exact product market definition open.10

(8) In some cases, the Commission has specifically discussed whether direct deliveries by manufacturers of pharmaceutical products11 may belong to the same product market as pharmaceutical wholesaling. In M.2573 – A&C / Grossfarma, the Commission noted that full-line wholesaling “can be distinguished from the direct distribution of products by manufacturers to pharmacists”, but did not conclude on a product market definition.12 In M.6044 – Alliance Boots / Andrae-Noris Zahn, and with respect to Germany, however, the Commission concluded that activities of full- line wholesalers “are to be distinguished from the direct distribution of products by manufacturers to pharmacists”.13 In other decisions, the Commission did not specifically discuss direct deliveries, but referred consistently to a product market of pharmaceutical wholesaling14 or full-line wholesaling.15

(9) Furthermore, the Commission has considered a further sub-segmentation of pharmaceutical wholesaling according to different product groups. Specifically, the Commission considered possible segmentation between prescription medicine (“Rx”) and over-the-counter products (“OTC”); originator, generic and parallel import medicine; and whether the medicine may be sold in retail pharmacies under the supervision of a pharmacist only, or also in other outlets such as supermarkets.16 Ultimately, the product market definition was left open regarding all potential segments according to product groups as mentioned above.

(10) Finally, the Commission has considered a potential segmentation of pharmaceutical wholesaling according to customer groups, namely between (i) retail pharmacies, (ii) doctors and (iii) hospitals.17 Ultimately, also the product market definition was left open regarding all potential segments according to customer groups.18

4.1.1.2. The Notifying Party’s view

(11) The Notifying Party submits that direct sales from pharmaceutical manufacturers to retail pharmacies should be considered to form part of the same relevant product market as the market for pharmaceutical wholesaling, as pharmacies would use direct deliveries as an alternative source of supply. Even though the depth of assortment and frequency of delivery would differ between deliveries by wholesalers and manufacturers, both would compete for orders of pharmacies.19

(12) The Notifying Party does not argue that short-liners should form part of the same product marked as full-line pharmaceutical wholesalers.20 The Notifying Party further states that the market should not be further delineated by product groups such as Rx, OTC and others, as the conditions of competition would not differ between these groups.21 Finally, the Notifying Party argues that no segmentation according to customer groups was needed, as deliveries to hospitals would only account for less than [CONFIDENTIAL] of the total turnover of the Parties.22

4.1.1.3. The Commission’s assessment

(13) The Commission notes that in past decisional practice, and specifically regarding Germany, it has defined a product market for full-line pharmaceutical wholesaling separate from direct deliveries by manufacturers and deliveries by short-liners, as discussed under Section 4.1.1.1.

(14) The Commission notes that, in the market investigation, competitors indeed tended to consider direct deliveries to be part of the same product market as pharmaceutical wholesalers.23 Indeed, the Notifying Party provides that direct deliveries account for around 17% in terms of value of all deliveries of pharmaceutical products to pharmacies.24 This figure was broadly confirmed in the market investigation.25

(15) However, from the perspective of the customer, there are clear reasons why direct deliveries do not form part of the same product market as pharmaceutical wholesaling. In the market investigation, around 80% of all pharmacies stated that they would receive three or more deliveries per day by their main pharmaceutical wholesaler.26 The rationale behind this high number of daily deliveries is that, under German law, pharmacies may not substitute Rx medicines with a product with the same active ingredient.27 Therefore, pharmacies rely on having short-term access to the full product range of Rx products. However, pharmacies can only store around 5,000 different pharmaceuticals at a time, while wholesalers store around 40,000 Rx products in their depots.28 Therefore, a pharmacy relies on a pharmaceutical wholesaler in order to be in a position to provide a customer reliably and on short notice with the medicine as prescribed by the doctor. As one pharmacists explained: “It is logistically not feasible to receive the needed pharmaceutical products within a sufficiently short timeframe from manufacturers”. Furthermore, “having a large number of pharmaceutical products in stock is not reasonable, as the prescribed medicines change”.29 In general, pharmacies pointed to limited storage space, additional administrative efforts, for instance due to increasing accounting efforts, longer times of delivery and the existence of minimum order volumes that would limit the scope for pharmacies to order directly from manufacturers.30 Consequently, pharmacies predominantly stated that they would not be in a position to source a higher share of products directly from manufacturers.31

(16) For similar reasons as stated above in the context of direct deliveries by manufacturers, the Commission considers that there is no reason to deviate from past decisional practice to regard pharmaceutical full-line wholesaling as separate from pharmaceutical short-line wholesaling. A majority of competitors argued that short- liners would be part of the same product market as full-liners, as they would generally both compete for orders by pharmacies.32 However, with regard to customers, similar arguments apply as laid out in paragraph (15) in the context of direct deliveries. Because of regulatory requirements, pharmacies depend on having short-term access to the whole product range, which is a service only a full-line pharmaceutical wholesaler can reliably provide. This was confirmed in the market investigation, as reliability and the number of products available where named by pharmacies as very important criteria when choosing a pharmaceutical wholesaler.33 Therefore, the Commission sees no reason to deviate from past decisional practice with respect to Germany in the present case.

(17) With respect to a potential segmentation according to product groups, the Commission has no reason to further segment the market for example into the deliveries of Rx, OTC and other products. In the market investigation, a majority of competitors stated that they would generally deliver all types of products to all customers. The remaining competitors submitted that it would be rare that a customer would not source all three types of products.34 The Notifying Party has submitted market shares also separated for Rx, OTC and other pharmaceutical products.35 The Commission notes that market shares of the Parties would not change materially if the market for pharmaceutical wholesaling was further segmented into these product groups.

(18) Similarly, the Commission has no reason to further segment the market according to customer groups like pharmacies, hospitals or doctors. In the market investigation, one competitor stated that doctors usually would not source from pharmaceutical wholesalers due to national regulation.36 In general, feedback from competitors suggests that customer groups other than pharmacies account only for a negligible part of the turnover of pharmaceutical wholesalers.37 This is in line with the Notifying Party’s statement that Alliance and Gehe would only generate less than [CONFIDENTIAL] of their turnover from sales to hospitals. Consequently, the Commission notes that a segmentation between customer groups would not change the competitive assessment, as competition between the Parties and their competitors basically only concerns deliveries to pharmacies.

(19) In light of the foregoing, the Commission considers full-line pharmaceutical wholesaling excluding direct deliveries from manufactures as the relevant product market for the assessment of the competitive impact of the Transaction.

4.1.2. Geographic market definition

4.1.2.1. Past decisional practice

(20) The Commission has consistently considered pharmaceutical wholesaling to be national or regional in scope, but ultimately left the definition open between a national or regional geographic market.38 In M.7935 – McKesson Deutschland / Belmedis / Cophana / Espafarmed / Alphar Partners / Sofiadis, the Commission noted that the geographic market for full-line pharmaceutical wholesaling “might be subnational due to the emphasis placed by customers on the frequency and speed of delivery, and the resulting need for wholesalers to compete on a sub-national basis and to have depots at regional level”.39

(21) With respect to Germany, the Commission left the geographic market definition open between a national or sub-national scope.40 In M.5433 – Sanacorp / V.D. Linde, the Commission further specified that a potential regional market for Germany may be defined according to federal states or following the approach by the German Federal Cartel office, considering a catchment area around each depot of 2 hours and 14 minutes driving time (which is calculated as 2.5 hours of driving time minus eight to ten stops at pharmacies of two minutes each).41 The exact geographic market definition was left open.

(22) Regarding the Netherlands, the Commission has previously pointed at past practice of defining a national or sub-national market for pharmaceutical wholesaling, but left the market definition open.42

4.1.2.2. The Notifying Party’s view

(23) The Notifying Party does not take a specific view as to whether the market should be defined to be national or sub-national.43

4.1.2.3. The Commission’s assessment

(24) The Commission notes that the competitive situation may differ significantly between Member States, due to geography and the impact of the respective national legislation.44 With respect to Germany, the market investigation suggests that the market for pharmaceutical wholesaling is sub-national in scope. As described above in more detail, the clear majority of pharmacies receive three or more daily deliveries from their main wholesaler.45 It is apparent that providing three or more deliveries per day requires a local presence by the respective wholesaler, given the size of Germany that excludes multiple daily deliveries from only one central location of the wholesaler. In fact, the Parties and their main competitors each operate a network of depots across Germany to address exactly this need of a local presence.46 Therefore, the Commission considers that there are strong arguments for assessing competition between pharmaceutical wholesalers on sub-national level.

(25) Regarding the scope of sub-national markets, the Commission does not consider that a segmentation by federal states would accurately reflect competition between pharmaceutical wholesalers. In fact, the 16 German federal states differ greatly both in geographic size and in population.47 Moreover, the Commission is not aware of any regulatory requirements that would prevent pharmaceutical wholesalers to sell across federal states.48 The Commission therefore considers that a geographic segmentation according to German federal states would not allow to accurately assess the actual competitive strengths of the Parties in pharmaceutical pharma wholesaling in Germany.

(26) The market investigation rather suggests that the approach of defining the geographic market of a catchment area of 2 hours 14 minutes driving time around each depot, as applied by the German Federal Cartel Office in past decisions, is the more appropriate approach to assess competition in German pharmaceutical wholesaling. First, pharmacies confirmed that they would generally receive at least three deliveries per day from their main wholesalers.49 The driving time of 2 hours 14 minutes from a depot to a pharmacy was calculated exactly to address this practice.50 Second, although the Commission notes that a fixed driving time can only be a proxy for the actual market, data provided by the Parties show that 2 hours 14 minutes driving time reflects the competitive reality well. Gehe, for instance, provided data for customer pharmacies located furthest away from each of their 18 depots. For [CONFIDENTIAL] depots, the maximum driving time was shorter than 2 hours 14 minutes, while for all others, it was longer51, which suggest that a driving time of 2 hours 14 minutes may indeed be close to the average practise in German pharmaceutical wholesaling.

(27) From the above, the Commission considers that applying a geographic scope of 2 hours 14 minutes of driving time, in line with the practice of the German Federal Cartel Office, around the depots of pharmaceutical wholesalers to be the most appropriate approach for Germany. Therefore, this market definition is considered as the relevant geographical market relating to Germany in this decision.

(28) The Commission notes that in other Member States, a different geographic market definition may be appropriate due to different national regulatory requirements and geography. In line with past decisional practice, as discussed in paragraphs (20) to (22) of this Decision, the Commission therefore considers the geographic scope of pharmaceutical wholesaling for the Netherlands to be national or sub-national, but leaves the ultimate geographic market definition open, as no competition concerns arise under any plausible geographic market definition.

4.2. Competitive assessment

4.2.1.Affected markets

(29) The Transaction gives rise to the following horizontally-affected markets:

(a) Regional markets for full-line pharmaceutical wholesaling in Germany: According to the regional market definition of catchment areas around each depot of the Parties of 2 hours and 14 minutes driving time the following horizontally-affected markets were identified:

Regional markets around the depots of Gehe in Germany:

Berlin, Bonn, Delmenhorst, Dresden, Duisburg, Günzburg, Halle, Hamburg, Kaiserslautern, Kassel, Landshut, Magdeburg, Nürnberg, Porta Westfalica, Rostock, Stuttgart, Unna and Weiterstadt;

Regional markets around the depots of Alliance:

Allgäu, Bayreuth, Berlin, Bochum, Bremen, Dresden, Frankfurt, Freiburg, Harsum, Itzehoe, Kassel, Köln, Leipzig, Ludwigshafen, Meerane, München, Nürnberg, Osnabrück, Regensburg, Rostock, Saarbrücken, Singen, Stuttgart and Würzburg;

(b) Pharmaceutical wholesaling in the Netherlands.52

4.2.2. Horizontal effects

(30) Article 2 of the Merger Regulation requires the Commission to examine whether notified concentrations are compatible with the internal market, by assessing whether they would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(31) The Commission Guidelines on the assessment of horizontal mergers under the Merger Regulation (the "Horizontal Merger Guidelines") distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non- coordinated effects and coordinated effects.

(32) Non-coordinated effects may significantly impede effective competition by eliminating the competitive constraint imposed by each merging party on the other, as a result of which the merged entity would have increased market power without resorting to coordinated behaviour.

(33) The Horizontal Merger Guidelines list a number of factors53 which may influence whether or not significant non-coordinated effects are likely to result from a merger, such as the large market shares of the merging firms, the fact that the merging firms are close competitors, the limited possibilities for customers to switch suppliers, or the fact that the merger would eliminate an important competitive force. Not all of these factors need to be present for significant non-coordinated effects to be likely. The list of factors, each of which is not necessarily decisive in its own right, is also not an exhaustive list.

(34) According to the Horizontal Merger Guidelines, in some markets the structure may be such that firms would consider it possible, economically rational, and hence preferable, to adopt on a sustainable basis a course of action on the market aimed at selling at increased prices. A merger in a concentrated market may significantly impede effective competition, through the creation or the strengthening of a collective dominant position, because it increases the likelihood that firms are able to coordinate their behaviour in this way and raise prices, even without entering into an agreement or resorting to a concerted practice within the meaning of Article 101 TFEU. A merger may also make coordination easier, more stable or more effective for firms, that were already coordinating before the merger, either by making the coordination more robust or by permitting firms to coordinate on even higher prices.54

(35) However, the Commission considers that coordinated effects seem unlikely in the present case for the following reasons and are thus not be further addressed in this Decision. In particular, wholesalers will unlikely reach a common understanding, given their need to reach high capacity utilization. They also have no ability to monitor compliance or punish deviations across the various catchment areas in which they supply pharmacies and which cover the whole of Germany with its approximately 19,000 retail pharmacies. Moreover, post-Transaction there will be five full-line wholesalers active in each German region, with different structures and business models that create diverse competitive incentives. The Transaction does not increase the level of concentration to a point where coordination is likely to occur. Wholesalers also negotiate rebates in confidential bilateral discussions with their individual customers leading to a large variety of net wholesale pharmaceutical prices.55 Furthermore, if full-line wholesalers tried to raise net prices, pharmacies could make use of other wholesalers, in particular because of the widespread practice of multi-sourcing among pharmacies.

4.2.2.1. Full-line pharmaceutical wholesaling in catchment areas in Germany

(A) Market characteristics

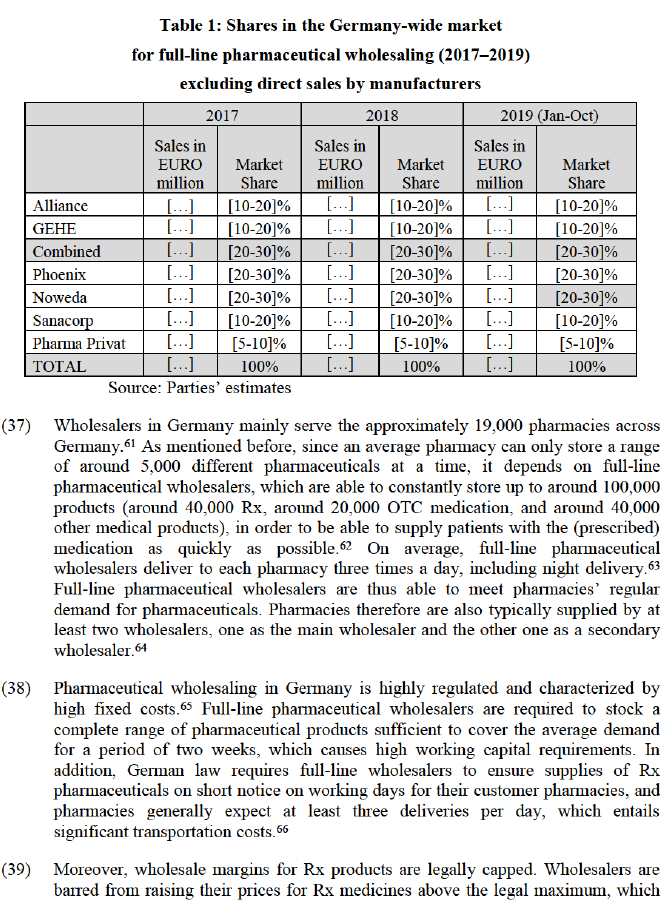

(36) Full-line pharmaceutical wholesaling across Germany is mainly provided by the Parties and five competitors: Phoenix, Noweda, Sanacorp, Pharma Privat and AEP.56 Like the Parties, Phoenix, Noweda and Sanacorp have a distribution network of depots across the country. Phoenix and Noweda have 20 distribution facilities each, Sanacorp 17.57 On a national level, the Parties would have a combined market share of [20-30]% with an increment of [10-20]% by Gehe.58 This is comparable to Phoenix’ market position with a market share of [20-30]%, closely followed by Noveda with a market share of [20-30]% and Sanacorp still with a sizeable position of [10-20]%, as displayed in Table 1 below.59 Pharma Privat is a network of eight owner-managed full-line pharmaceutical wholesalers in Germany operating under the Pharma Privat brand that operate nationwide from twelve different locations. In contrast to these competitors, AEP does not offer multiple deliveries per day to pharmacies. Instead, it limits its services to a single overnight delivery per day from a central depot in Alzenau, near Frankfurt am Main. With these limitations in mind, AEP nevertheless is an alternative supplier as it supplies the full range of products of a full-line pharmaceutical wholesaler.60 In addition to full-line wholesalers that cover the entire German territory, there are several regional players, such a Max Jenne Arzneimittel-Großhandlung KG and Hageda-Stumpf GmbH & Co. KG.

account for over 80% of their turnover.67 Since 2012, the regulatory margin has been set at EUR 0.70 per package plus 3.15% on the manufacturer’s sales price for Rx products. However, the latter margin is capped at EUR 37.80 per box of pharmaceuticals. Pharmaceuticals priced above EUR 1,200 therefore do not earn higher margins for the wholesalers.68 Achieving a high utilization rate of their depots and delivery infrastructure is a way to recoup fixed costs.69 Therefore, tools like granted rebates can be important to attract new customers and thus increase profitability as stated by the Notifying Party.70

(B) The Notifying Party’s position

(40) According to the Notifying Party, the Transaction will not significantly impede effective competition in Germany or any regional market as a result of horizontal non-coordinated effects for the following reasons.71

(41) First, the Notifying Party submits that the full-line pharmaceutical wholesaling market in Germany is highly regulated with legally capped margins. These capped margins together with high fixed costs have led to intense competition between wholesalers to reach effective capacity utilization of depots and delivery infrastructure.72

(42) Furthermore, the Notifying Party argues that the combined entity will have modest combined market shares at national and regional level.73 Depending on the market definition, the Parties’ combined market share will be between around [20-30]% (including direct sales) or [20-30]% (excluding direct sales) on a national level. Combined shares at regional level under the 2h 14 min catchment area range from [10-20]% to [30-40]% (including direct sales) and just over [20-30]% to just over [40-50]% (excluding direct sales).74 However, the Parties submit that these market shares overstate the real impact of the Transaction, as post-Transaction the Parties’ common customers will shift at least some volumes to other suppliers in order to maintain dual-sourcing.75 The Parties also note that higher market shares are not indicative of higher market power [CONFIDENTIAL].76

(43) The Notifying Party also points out that the combined entity will face several strong competitors post-Transaction to whom customers can switch suppliers easily and quickly. According to the Notifying Party, there will remain five players able to offer full line wholesale services across Germany: the merged entity plus Noweda, Phoenix, Sanacorp, and the Pharma Privat network.77 The combined entity will face additional competitive pressure from direct sales by manufacturers as well as from the wholesaler AEP that serves pharmacies in Germany using overnight delivery from a central depot.78

(44) Concerning their customer relationship, the Notifying Party explains, that customers are largely individual pharmacies and pharmacy buying groups and that in both of these groups customers have significant buyer power. Individual pharmacies in Germany would be price-sensitive and can negotiate significant rebates from wholesalers because they can quickly and without additional cost shift purchasing volumes. This is because (1) they dual-source from full-liners and (2) buy some products directly from manufacturers.79 Moreover, pharmacies would be often supported by specialized pharmacy consultants, like ABAKUS (www.aba-kus.com), ApoSanitas KG (www.aposanitas.de), and Vitaplus AG (www.vitaplus-ag.de), that have a good insight into the market and are aware of the best conditions available.80 Additionally, pharmacy buying groups acquire buyer power by pooling large purchasing volumes into annual agreements for which wholesalers are willing to offer even higher discounts.81

(45) Moreover, the Notifying Party indicates that the Parties are not particularly close competitors. They point out, that from the customer perspective, full-line wholesalers provide largely interchangeable products, even if they try to differentiate their service offerings. Nothing in their offering or geographic coverage makes the Parties particularly close competitors. When the Parties lose business, their customers switch to [CONFIDENTIAL].82

(C) The Commission’s assessment

(46) The market investigation particularly involved questionnaires sent to competitors with a national and regional focus and questionnaires sent to pharmacies as customers of the Parties in their respective 2 hours 14 minutes driving distance around the regional depots of the Parties. The questionnaire for the pharmacies focused on the regional impact of the Transaction, whereas the questionnaire for competitors also took a wider view on the Transaction into consideration, that also sheds light on the consequences for the various regional markets. Therefore, in the following, general outcomes of the market investigation that are of importance for all of the various regional markets are presented first. In a second step, outcomes for individual regional markets are presented in more detail.

(47) During the market investigation, competitors to the Parties acknowledged that the Transaction will lead to increased market power of the Parties, which is in line with the fact that the merged entity would become one of the leading full-line wholesalers at national level. However, the effects of this change in the market structure were generally regarded as neutral, at times even positive for competition.83

(48) In fact, several competitors viewed the Transaction as an opportunity to attract additional customers and increase their market presence, as those pharmacies who currently source from both Parties, would look for alternative suppliers post- Transaction in line with the general market feature of multi-sourcing amongst pharmacies.84

(49) As regards the degree of closeness of competition between the Parties, feedback from competitors was somewhat mixed. A minority of competitors regard the Parties as close competitors, and an equal number of competitors regard the Parties not as close competitors or answered that they do not know.85 Moreover, the majority of pharmacies stated that switching suppliers is always possible with either no significant efforts or with limited efforts.86

(50) As regards pharmacies’ possibilities to switch suppliers, competitors generally take the view that there are only low barriers to switching a supplier. This is explained by the fact that there are standardized order systems in place that make switching easy.87 However, the Commission notes that pharmacies rarely switch between wholesalers. According to the market investigation among pharmacies, the overwhelming majority switched their wholesaler only once or not at all in the last 5 years. However, as the market investigation among pharmacies also revealed, they typically multi-source from two wholesalers and can thus switch orders.88

(51) The overwhelming majority of competitors is of the opinion that wholesalers face substantial buyer power, thereby supporting the view expressed by the Notifying Party. The overwhelming majority of competitors are also of the opinion that pharmacies have high or rather high bargaining power regarding supply conditions like frequency of deliveries or rebates granted. Only one competitor is of the opinion that pharmacies have low bargaining power.89 Another competitor states that full- line pharmaceutical wholesalers need a high capacity utilization in order to recoup their costs, given the low margins in the market, which would put pharmacies in a favourable bargaining position.90

(52) Moreover, the market investigation revealed that barriers to enter the market for full- line wholesaling of pharmaceuticals are regarded as high, both for new entrants to the market and for existing market participants that want to expand their physical infrastructure (i.e. deploy a new depot at a location where they are not yet present).91 Nonetheless, expanding their current business in all regions of Germany without setting up new depots is possible for the majority of competitors.

(53) Barriers to enter the market for potential competitors currently not active as wholesaler in the German market are regarded as very high or rather high by the majority of respondents. As explanation competitors state that pharmaceutical wholesaling is very capital intensive combined with low margins. Only one competitor is of the opinion that barriers are neither high nor low.92 Furthermore, respondents to the market investigation pointed to high regulatory burdens that have to be born by full-line wholesalers.93 These concern the licence to offer pharmaceutical wholesaling services in Germany and special licences for dealing with particular substances, like narcotics.94 One competitor also explains that entry barriers are due to network effects imposed by the logistics of the business.

(54) The picture is similar for existing competitors. Asked about the ease for active wholesalers of expanding services into a new region, for example with setting up a new depot, the overwhelming majority of competitors is of the opinion that this would entail very high or high efforts. Only one competitor regards the efforts of expanding into a new region as rather low.95 Again, competitors explain their view with the business’ high capital intensity and high investments. The one competitor who expects the efforts to be rather low, explains that a new depot would not necessarily be required for expansion.96 This is consistent with the competitors’ answer to the question whether they have enough capacity or could require enough capacity to supply additional customers with three deliveries per day. Some competitors state that this is possible in all regions in Germany, to varying degrees.97

(55) The responding competitors regard themselves as competing with direct deliveries by pharmaceutical manufacturers and the overwhelming majority expects their share to rise in the future.98 The competitors mention that manufacturers compete explicitly for products with high margins, which leaves them supplying low-margin products. This in turn impacts their business model that is based on a mixed calculation of high- and low-margin products and leads to an increase in competition among the full-line wholesalers to compensate the foregone turnover. While the Commission does not consider that direct deliveries by pharmaceutical manufacturers fall in the relevant market of full-line pharmaceutical wholesaling, it acknowledged that those direct deliveries may constitute to some extent out-of- market constraints.

(56) An assessment of competitors’ expectations for individual competition parameters revealed no substantial competition concerns. No competitor expects prices to rise as a result of the Transaction. To the contrary, the majority of competitors expects prices to fall, or discounts to increase as a result of the Transaction. One competitor expects constant prices because of the already high level of discounts granted to pharmacies for supplied products.99

(57) Concerning the service level for customers, the majority of replying competitors expect a lessening of the service level, while a minority expects a constant service level.100 With respect to supply reliability, all respondents replying to that question expect no change.101 Regarding the frequency of deliveries, two respondents expect a declining frequency, while one expects no change.102 When asked about the availability of products, all replying competitors expect no change to the current situation.103

(58) When asked about the expected effects of the Transaction on the respondents’ own companies, the investigation also revealed no substantiated concerns. One competitor stated to expect negative effects, one neutral effects and one did not know. However, the negative respondent argued, that negative effects will result from higher discounts granted by wholesalers to pharmacies as a result of the Transaction.104 Thus, the Commission considers that these claimed negative effects are rather positive for competition.

(59) With respect to regional competition in Germany, the majority of the Parties’ competitors is of the opinion that they face similar competition across regions in Germany.105 One competitor was of the opinion that there are regional differences, but mainly attributed them to population density, the rural situation of some regions and regional capacities. 106 Accordingly, wholesalers are not of the opinion that margins differ across regions 107.

(C.i) Local markets with a market share exceeding 35%

(60) The Commission considers that the various affected regional markets can be subdivided according to competitive effects of the Transaction. The Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to any of the regional markets mentioned under(29)(a), due to horizontal non-coordinated effects, as explained in more detail below.

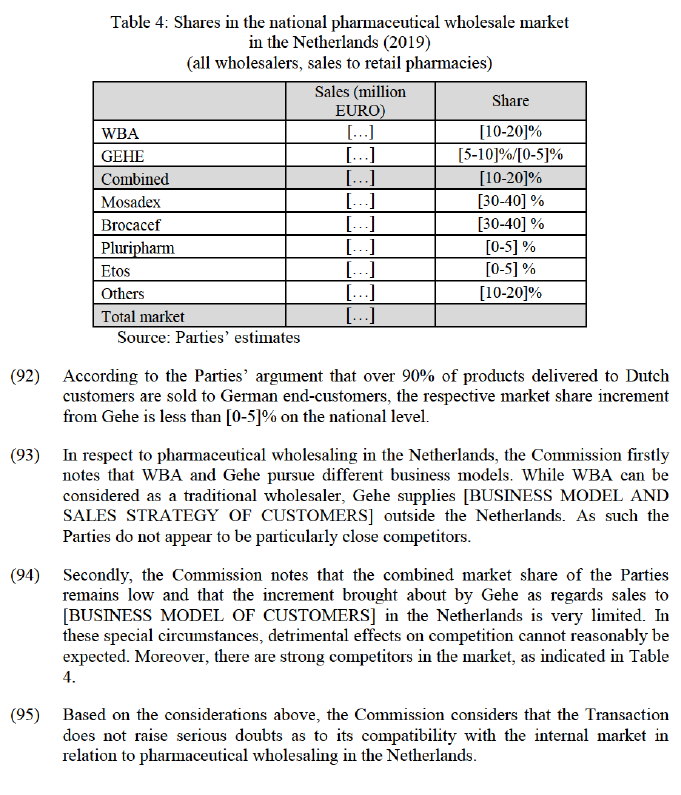

(61) However, the markets of Hamburg/Itzehoe, Rostock and Berlin exhibit higher combined market shares of the Parties than the other regional markets. Combined market shares exceed 35% in these markets and thus come relatively near to [30- 40]%. In the past, the Commission has considered mergers resulting in firms holding market shares between 40% and 50%, and in some cases below 40%, to lead to the creation or the strengthening of a dominant position. The Commission’s assessment of the respective markets will therefore be presented separately, and in more detail below. Regional market shares as presented in the below analysis are based on full- line pharmaceutical wholesaling excluding direct sales by manufacturers. With respect to the market definition as discussed above this approach can be regarded as the narrowest plausible market.

(C.i.a) Hamburg / Itzehoe

(62) The Transaction would give rise to affected markets for pharmaceutical wholesaling in the Hamburg and Itzehoe regions,108 where Alliance has a depot in Itzehoe and Gehe in Hamburg. In the Hamburg region of 2 hours 14 minutes around the depot of Gehe, the Parties have a combined market share of [30-40]% in 2019. The increment stemming from Gehe is [20-30]%. In the Itzehoe region of 2 hours 14 minutes around the depot of Alliance, the Parties have a combined market share of [40-50]% in 2019. The increment stemming from Gehe is [20-30]%.109

(63) In the region of Itzehoe post-Transaction, the merged entity would continue to face competition from Phoenix with a market share of [10-20]%, Noweda with [5-10]%, Sanacorp with [20-30]% and Pharma Privat with [10-20]%. In the region of Hamburg post-transaction the merged entity will face competition from Phoenix with [20-30]% market share, Noweda with [10-20]%, Sanacorp with [10-20]% and Pharma Privat with [5-10]%.110

(64) The presence of competing suppliers is also reflected in the responses to the market investigation. Pharmacies located in the catchment areas around Hamburg and Itzehoe indicated that a number of alternative suppliers will be available to them. On average pharmacies in the Hamburg region consider 3.4 competitors of the Parties to be available for supplying them with pharmaceuticals under usual market conditions.111 In the Itzehoe region, the respective number is 3.3.112 The market investigation also revealed that among the respondents’ suppliers, all national wholesalers except for AEP are listed, and thus in particular the strong competitors Noweda, Sanacorp and Phoenix.113 Moreover, these three competitors have their own depots in Hamburg each. Sanacorp even has two depots in the region, one in Hamburg and one in Bad Segeberg, which is approximately 1 hour driving time from Hamburg. Taking into account that some competitors acknowledged to be in a position to expand their customer base also in the Hamburg/Itzehoe region, as explained above in para. (52), pharmacies seem to have strong alternatives at their disposal.

(65) Asked for the expected impact of the transaction, the majority of responding pharmacies in the Hamburg and the Itzehoe regions expect a negative or rather negative impact.114 The Commission notes that while some pharmacies expressed concern that the Transaction will lead to less choice of suppliers which generally could lead to a declining service level, higher prices and a deterioration of supply quality, when asked explicitly about the expected effects for the frequency of deliveries and their costs, only half of the respondents in the Itzehoe region expect negative consequences for frequency of deliveries, whereas only a minority of the respondents in the Hamburg region expects negative consequences in that respect. Concerning consequences for their costs, also only a minority of respondents in the Itzehoe and Hamburg regions expect a negative impact.115

(66) As discussed above, pharmacies also source from pharmaceutical manufacturers directly. Although the Commission does not consider such direct deliveries as being part of the relevant product market, such deliveries can pose an alternative source with respect to certain products, as also stated by the Parties and their competitors.116 The Commission’s market investigation therefore also enquired whether and to what extent pharmacies source their products directly from manufacturers. The market investigation revealed that, compared to the German-wide average, a significant number of pharmacies in the Hamburg and Itzehoe regions source a substantial share of their products directly from manufacturers and state that they are in a position to increase the share directly sourced even further. This holds true for customers of both Parties.117 Therefore, there is competitive pressure from direct deliveries that can to some extent provide an alternative source for pharmacies.

(67) Moreover, the Commission notes a number of pro-competitive market characteristics as explained in paragraphs 46 to 59 and 62 to 66. First, for pharmacies, barriers to switching wholesalers are generally low. Moreover, pharmacies already have existing business activities with different wholesalers, as multi-sourcing is common practice in the market. Second, pharmacies exercise a certain degree of buyer power towards wholesalers, as competition between pharma wholesalers is generally high. Third, parties are not described as particularly close competitors, and services provided by wholesalers active in the market are generally comparable. Fourth, even though direct deliveries do not form part of the same product market as pharmaceutical wholesaling, deliveries by manufacturers to pharmacies exercise a certain competitive constraint on pharma wholesalers.

(68) Based on the considerations above, taking into account the view of pharmacies and competitors, and in particular the sufficient number of remaining competitors in the two regions, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to full-line pharmaceutical wholesaling excluding direct sales by manufacturers in the Hamburg / Itzehoe regions.

(C.i.b) Rostock

(69) The Transaction would give rise to affected markets for pharmaceutical wholesaling in the area of Rostock, where both Parties have depots. In the catchment area of 2 hours 14 minutes around the depot of Gehe, the Parties have a combined market share of [30-40]% in 2019. The increment provided by the Gehe is [20-30]%. In the catchment area of 2 hours 14 minutes around the depot of Alliance, the Parties have a combined market share of [30-40]% in 2019. The increment provided by Gehe is [20-30]%.118

(70) Post-transaction, the merged entity would continue to face competition from Phoenix with a market share of [20-30]% in the catchment area around Gehe`s depot in this region, [10-20]% of Noweda, [10-20]% of Sanacorp and [5-10]% of Pharma Privat. In the catchment area around Alliance`s depot the market shares are almost equally distributed with Sanacorp having only [10-20]%.119

(71) This is reflected in feedback from pharmacies, as well as from remaining wholesalers, when asked for the availability of wholesalers in these regions. On average customer pharmacies of Alliance in the Rostock region consider approximately 2.2 competitors of the Parties available for supplying them with pharmaceuticals to usual market conditions.120 For customers of Gehe in the Rostock region the respective number is 1.8.121 When compared to the nationwide average of the market investigation of 2.9,122 these numbers look weaker for the Rostock region. However, when explicitly asked for their ability to deliver to the Rostock region, and their ability to expand their offer in that area to address potential demand, four additional competitors currently active in the German pharmaceutical wholesaling market confirmed that they also currently deliver to customers in the Rostock region, and would be in a position to serve more customers or increase the number of daily deliveries in case of increasing demand.123 Moreover, it has to be pointed out, that Sanacorp has its own depot in this region and is regarded as being available to usual market conditions by the overwhelming majority of the Parties` customers in that region. Therefore, a number of competitors are either already present in the markets of the Rostock region or are willing to expand into these markets.

(72) The Commission considers that it is against this background that somewhat more negative views, which pharmacies in the Rostock region expressed in the course of the market investigation have to be assessed. Asked for the expected impact of the Transaction across the Parties’ two catchment areas, the majority of the responding pharmacies took a negative view on the Transaction.124 However, when asked explicitly about the expected effects on the frequency of deliveries and their costs, only a minority of respondents of the Parties’ customers expect negative consequences of the Transaction with regard to the frequency of deliveries or their costs.125

(73) As discussed above pharmacies also source from pharmaceutical manufacturers directly. Although the Commission does not consider such direct deliveries as being part of the relevant product market, such deliveries can pose an alternative source with respect to certain products, as also stated by the Parties and their competitors.126 The Commission’s market investigation therefore also enquired whether and to what extent pharmacies source their products directly from manufacturers. The market investigation revealed that compared to the German-wide average a significant number of pharmacies source a substantial share of their products directly from manufacturers and state that they are in a position to increase the share directly sourced even further. This holds true for customers of both Parties.127 Therefore, there is competitive pressure from direct deliveries, that can to some extent pose an alternative source for pharmacies.

(74) Moreover, the Commission notes a number of pro-competitive market characteristics as explained in paragraphs 46 to 59 and 69 to 73. First, for pharmacies, barriers to switching wholesalers are generally low. Moreover, pharmacies already have existing business activities with different wholesalers, as multi-sourcing is common practice in the market. Second, pharmacies exercise a certain degree of buyer power towards wholesalers, as competition between pharma wholesalers is generally high. Third, parties are not described as particularly close competitors, and services provided by wholesalers active in the market are generally comparable. Fourth, even though direct deliveries do not form part of the same product market as pharmaceutical wholesaling, deliveries by manufacturers to pharmacies exercise a certain competitive constraint on pharma wholesalers.

(75) Based on the considerations above, taking into account the view of pharmacies and competitors, and in particular the sufficient number of remaining competitors in the two regions, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to full-line pharmaceutical wholesaling excluding direct sales by manufacturers in the Rostock region.

(C.i.c) Berlin

(76) The Transaction would give rise to affected markets for pharmaceutical wholesaling in the area of Berlin, where both Parties have depots. In the catchment area of 2 hours 14 minutes around the depot of Gehe, the Parties have a combined market share of [30-40]% in 2019. The increment provided by Gehe is [10-20]%. In the catchment area of 2 hours 14 minutes around the depot of Alliance the Parties have a combined market share of [30-40]% in 2019. The increment provided by the Gehe is [10-20]%.128

(77) Post-transaction, the merged entity would continue to face competition from Phoenix with a market share of [20-30]% in the Berlin region, Noweda with [20-30]%, Sanacorp with [10-20]% and Pharma Privat with [5-10]% in both catchment areas around the depots of Gehe and Alliance.129

(78) The presence of a sufficient number of credible alternative suppliers is also reflected in the feedback of pharmacies. On average, customer pharmacies of Alliance in the Berlin region consider 3.4 competitors of the Parties available for supplying them with pharmaceuticals to usual market conditions.130 For customers of Gehe in the Berlin region the respective number is 3.1.131 The market investigation also revealed that among the respondents’ suppliers, all of the nationally active wholesalers but AEP remain, including the strong competitors Noweda, Sanacorp and Phoenix. Moreover, these three competitors each have their own depots in the Berlin region. Taking into account, that some competitors also acknowledged to be in a position to expand their customer base in that region, as explained above in para. (52), pharmacies seem to have strong alternatives at their disposal.

(79) Asked for the expected impact of the Transaction, several of responding pharmacies expect negative or rather negative effects.132 When asked explicitly about the expected effects on the frequency of deliveries and their costs, roughly half of the respondents expect negative consequences of the Transaction for the Berlin region.133

(80) As discussed above pharmacies also source from pharmaceutical manufacturers directly. Although the Commission does not consider such direct deliveries as being part of the relevant product market, such deliveries can pose an alternative source with respect to certain products, as also stated by the Parties and their competitors.134 The Commission’s market investigation therefore also enquired whether and to what extent pharmacies source their products directly from manufacturers. The market investigation revealed that compared to the German-wide average a significant number of pharmacies source a substantial share of their products directly from manufacturers and state that they are in a position to increase the share directly sourced even further. This holds true for customers of both Parties.135 Therefore, there is competitive pressure from direct deliveries, that can to some extent pose an alternative source for pharmacies.

(81) Moreover, the Commission notes a number of pro-competitive market characteristics as explained in paragraphs 46 to 59 and 76 to 80. First, for pharmacies, barriers to switching wholesalers are generally low. Moreover, pharmacies already have existing business activities with different wholesalers, as multi-sourcing is common practice in the market. Second, pharmacies exercise a certain degree of buyer power towards wholesalers, as competition between pharma wholesalers is generally high. Third, parties are not described as particularly close competitors, and services provided by wholesalers active in the market are generally comparable. Fourth, even though direct deliveries do not form part of the same product market as pharmaceutical wholesaling, deliveries by manufacturers to pharmacies exercise a certain competitive constraint on pharma wholesalers.

(82) Based on the considerations above, taking into account the view of pharmacies and competitors, and in particular the sufficient number of remaining competitors in the Berlin region, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to full-line pharmaceutical wholesaling excluding direct sales by manufacturers in the Berlin region.

(C.ii) Local markets with a combined market share below 35%

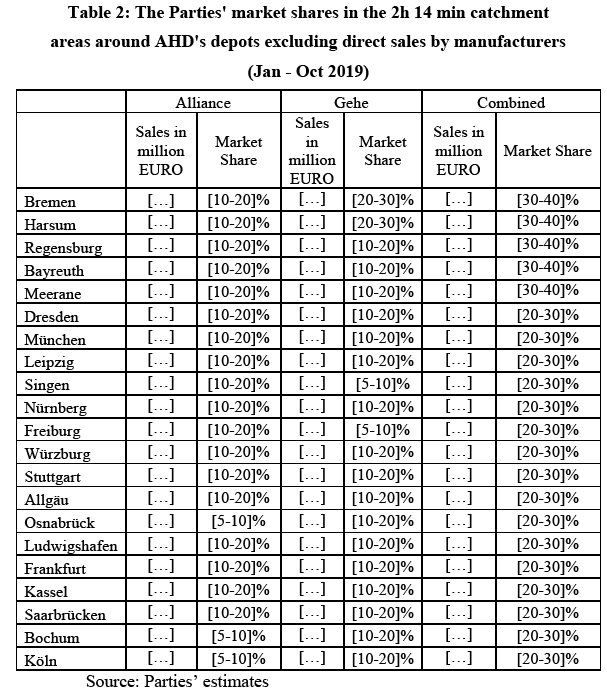

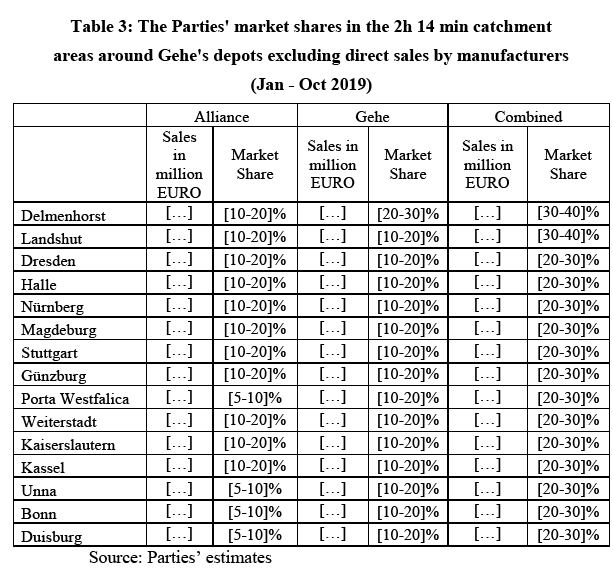

(83) As explained in para (60) the Transaction leads to additional affected regional markets in Germany with combined market shares below [30-40]%. The tables below present the Parties market shares in these markets.

(84) In a large number of these markets, the combined market shares of the Parties post- Transaction remain even below 25%, the level under which concentrations are presumed to not impede effective competition.136 For regional markets around Alliance’s depots, these are the markets of, Osnabrück, Ludwigshafen, Frankfurt, Kassel, Saarbrücken, Bochum and Köln137. For regional markets around Gehe’s depots, these are Weiterstadt, Kaiserslautern, Kassel, Unna, Bonn and Duisburg. For a large number of other markets, market shares exceed [20-30]%, but remain on a moderate level below [30-40]%. Also for these regions, the structure of the market indicates that no competition concerns arise as a result of the Transaction. This assessment is further substantiated by the results of the market investigation.

(85) First, the Commission notes that in all areas mentioned in Tables 2 and 3, the three main competitors Noweda, Sanacorp and Phoenix have a significant presence. Phoenix has market shares138 in excess of 20% in all but two139 local markets listed in Table 2 and 3. In the majority of these areas, Phoenix’ market shares are even above 25%. In all but one140 of the markets listed in Tables 2 and 3, Noweda has market shares exceeding 10%. In the majority of the areas, Noweda’s market shares are even above 20%. Sanacorp has market shares in excess of 10% in all markets as listed in Tables 2 and 3. In most of the markets, Sanacorp’s market shares are even above 15%. Therefore, in all local markets, the merged entity faces significant competition from at least three full-line wholesalers. In addition, Pharma Privat is active on most of these regional markets, with market shares ranging between [0- 5]% and [10-20]%.141

(86) Second, with respect to the market investigation, the Commission notes that pharmacies indeed see the Transaction with scepticism even in markets where the merged entity would have moderate market shares. For the regions around the Gehe depots concerns in Kassel, Landshut, Magdeburg, Nürnberg and Stuttgart, a majority of respondents stated the Transaction would have a rather negative or negative effect. The same statement was made by a majority of respondents around Alliance’s depots in Allgäu, Bayreuth, Bochum, Dresden, Frankfurt, Ludwigshafen, Regensburg and Saarbrücken.142 However, the market investigation confirmed the presence of signification competition to the merged entity in all areas as listed in Tables 2 and 3, as already suggested by the market shares. In the market investigation, pharmacies where asked about the number of pharmaceutical wholesalers other than the Parties that would be available to supply to usual market conditions. For all but two markets143, the average number of available alternative wholesalers indicated by pharmacies is above 2.5, which means that customers consider on average to have more than two alternatives to choose from.144

(87) Finally, the Commission notes a number of pro-competitive market characteristics explained in section 4.2.3.1 (A) of this Decision that also apply to the regional markets as listed in Tables 2 and 3. First, for pharmacies, barriers to switching wholesalers are generally low. Moreover, pharmacies already have existing business activities with different wholesalers, as multi-sourcing is common practice in the market. Second, pharmacies exercise a certain degree of buyer power towards wholesalers, as competition between pharma wholesalers is generally high. Third, parties are not described as particularly close competitors, and services provided by wholesalers active in the market are generally comparable. Fourth, even though direct deliveries do not form part of the same product market as pharmaceutical wholesaling, deliveries by manufacturers to pharmacies exercise a certain competitive constraint on pharma wholesalers.

(88) Based on the considerations above the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to full-line pharmaceutical wholesaling excluding direct sales by manufacturers in the regions as presented in Table 2 and Table 3.

4.2.2.2. Pharmaceutical wholesaling in the Netherlands

(89) In the Netherlands, WBA is active as a full-line wholesaler and generated turnover of EUR […] million in 2019 with retail pharmacies. Gehe is also active in the Netherlands, generating a turnover of EUR […] million in 2019 with wholesale pharmaceutical supplies, but has a very special business model. In fact, Gehe [NUMBER AND BUSINESS MODEL OF CUSTOMERS].

(A) The Notifying Party’s view

(90) The Notifying Party is of the opinion that the Transaction will not have any appreciable impact on competition in the Netherlands and that it should not lead to any truly affected markets in the Netherlands.145 To support this argument, the Notifying Party mainly puts forward that Gehe is only supplying [NUMBER AND BUSINESS MODEL OF CUSTOMERS] in the Netherlands, [BUSINESS MODEL OF CUSTOMERS; SHARE OF PRODUCTS SOLD OUTSIDE OF THE NETHERLANDS].146 Taking this into account, the Parties argue that Gehe is not a significant competitor on the national pharmaceutical wholesaling market in the Netherlands.

(B) The Commission’s assessment

(91) The Parties’ combined market share on a national pharmaceutical wholesale market in the Netherlands lies between [10-20]% and [20-30]%, depending on whether Gehe’s sales to its customers that are sold to end-customers in Germany are taken into account.147 If these are not regarded as being part of the relevant market, the combined market share only amounts to [10-20]%. The following table presents the respective market shares on the national level.

5. CONCLUSION

(96) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

3 Publication in the Official Journal of the European Union No C 235, 17.7.2020, p. 6.

4 The Commission notes that both Parties sell to a limited extent own label products. With respect to Alliance, these include diagnostic products like blood pressure monitors, pregnancy tests or thermometers, orthopaedic bandages, incontinence products and well-being products such as earplugs. Concerning Gehe, these own-label products include nutrition preparations like vitamins, diagnostic products like pregnancy tests, blood pressure monitors or thermometers, skin care products incontinence products, sun protection products as well as products such as masks or gloves. These sales will not be further considered in this decision, for the following reasons:

1. The relevance of the own-label business is negligible in the context of the Transaction. Own label products accounted for [0-5]% of Alliance’s total revenue in 2019, and for [0-5]% of Gehe’s total revenue in 2019. Moreover, products as sold by the Parties are generally not only available in pharmacies, but also in drugstores and supermarkets.

2. Horizontal overlaps, to the extent that they arise in the different product categories remain modest, with combined market share below 5 % in the German market for the vast majority of products sold to pharmacies and below 10 % for urine tests (incl. ovulation and pregnancy tests) sold to pharmacies in Germany. Regarding the latter it has to be pointed out that these products are also sold in drug stores and supermarkets. Therefore, market shares can be expected to be lower (See Form CO para 6.76).

3. No vertical effects regarding the own-label business occur due to the Transaction. At the upstream level, combined market shares remain below 30%. Thus, input foreclosure can be excluded. Likewise, customer foreclosure concerns appear unlikely given that the Parties’ combined market share in pharmaceutical wholesaling remains below 30% at national level and only surpasses 30% on certain regional markets.

4. No concerns were raised during the market investigation concerning own-label products. None of the responding pharma-wholesaling companies considered the Transaction to have an effect in the context of the Parties’ sale of own-label products. One competitor stated, inter alia with respect to the sale of own label products: “Since those markets do not have any particular relevance, the concentration will not have a particular relevance [on these markets].” (original: “Da diese Märkte keine besondere Bedeutung haben, kann der Zusammenschluss auch keine besonderen Auswirkungen haben.”)

5 Gehe has limited export sales of pharmaceutical products to wholesalers in Norway and the UK, where WBA is active as a wholesaler. The Parties characterize these sales as merely driven [CONFIDENTIAL]. These activities are to be distinguished from pharmaceutical wholesaling in Germany, where Gehe operates various local depots and supplies pharmacies typically three times a day. In 2019 Gehe had a market share of [0-5]% with a generated turnover of EUR […] in a national pharmaceutical market in Norway, and a market share of [0-5]% with a turnover of EUR […] million in a national pharmaceutical market in the UK (of which only EUR […] million was generated with sales to external wholesalers, as the remainder of this turnover was mostly generated with sales for clinical studies). Since these activities are very limited and since no competition concerns can reasonably be expected, these markets will not be further considered in this decision. See Form CO, para 6.61 et seqq.

6 Turnover calculated in accordance with Article 5 of the Merger Regulation.

7 See Form CO, para. 4.6.

8 M.7935 - McKesson Deutschland / Belmedis / Cophana / Espafarmed / Alphar Partners / Sofiadis, para. 16.

9 M.5433 - Sanacorp / V.D. Linde, para. 8; M.6044 – Alliance Boots / Andrae-Noris Zahn, para.14.

10 M.7494 – Brocacef / Mediq Netherlands, para. 15; M.7818 - McKesson / UDG Healthcare, paras.15 et seqq; M.4301 Alliance Boots / Cardinal Health, para. 14.

11 Direct deliveries typically concern only specific products of the respective manufacturer, and therefore not the whole product range of pharmaceutical products.

12 M.2573 – A&C / Grossfarma, para.12

13 M.6044 – Alliance Boots / Andrae-Noris Zahn, para.14.

14 M.7818 - McKesson / UDG Healthcare.

15 M.7935 - McKesson Deutschland / Belmedis / Cophana / Espafarmed / Alphar Partners / Sofiadis, para 16; M.5433 - Sanacorp / V.D. Linde, para. 8.

16 M.7818 - McKesson / UDG Healthcare, para. 15; M.7494 – Brocacef / Mediq Netherlands, para. 15; M.4301 – Alliance Boots / Cardinal Health, para. 15.

17 M.7818 - McKesson / UDG Healthcare, para. 15; M.7494 – Brocacef / Mediq Netherlands, para. 15; M.4301 – Alliance Boots / Cardinal Health, para. 16.

18 Specifically with respect to the Netherlands, the Commission has pointed at a possible segmentation of the pharmaceutical wholesaling market according to the categories of wholesalers, products and customers, as discussed in paragraphs 7 to 10 of this Decision, but left the product market definition open; see M.7494 – Brocacef / Mediq Netherlands, para. 15.

19 See Form CO, para. 6.9.

20 See Form CO, para. 6.3.

21 See Form CO, para. 6.10.

22 See Form CO, para. 6.11.

23 See response to Questionnaire Q1, question 8.

24 See Form CO, para. 6.5.

25 See responses to Quetionnaires Q2 – Q43, question 8.

26 See responses to Questionnaires Q2 – Q43, question 4.

27 See Form CO, para. 6.4.

28 See Form CO, para. 6.4.

29 See response to Questionnaire Q4, question 8.1.1.

30 See responses to Questionnaires Q2 – Q43, question 8.1.1.

31 See responses to Questionnaires Q2 – Q43, question 8.1.

32 See response to Questionnaire Q1, question 7.

33 See response to Questionnaires Q2 - Q43, question 11.

34 See response to Questionnaire Q1, question

35 Form CO, Annex 3.2

36 See response to Q1, question 9.1.

37 See response to Q1, question 9; assessment based on non-confidential information provided by four competitors.

38 M.7935 - McKesson Deutschland / Belmedis / Cophana / Espafarmed / Alphar Partners / Sofiadis, para 18; M.7818 - McKesson / UDG Healthcare, para. 24; M.7494 – Brocacef / Mediq Netherlands, para. 18.

39 M.7935 - McKesson Deutschland / Belmedis / Cophana / Espafarmed / Alphar Partners / Sofiadis, para 18.

40 M.6044 – Alliance Boots / Andrae-Noris Zahn, para.15, 16.

41 M.5433 - Sanacorp / V.D. Linde, para. 9.

42 M.7494 – Brocacef / Mediq Netherlands, para. 18.

43 See Form CO, para. 6.31.

44 As described in paragraph 18 of this Decision regarding Germany.

45 See responses to Questionnaires Q2 – Q43, question 4.

46 Alliance operates 24 depots across Germany, while Gehe has 18 depots; see Form CO, sections 1.4. and 1.5.

47 The federal state of Bavaria, for instance, is of a size of 70 000 square kilometres, while the smallest state, Bremen, only is of the size of 420 square kilometres.

48 In fact, those sales are common practice. Alliance, for example operates a depot in Itzehoe, which is located in the federal state of Schleswig-Holstein. However, [CONFIDENTIAL] of customers that receive deliveries from that depot are located in the city of Hamburg, belonging to the federal state of Hamburg. Alliance’s depot in the federal state of Bremen, in turn, supplies a customer base of which [CONFIDENTIAL] are located outside of Bremen; see list of customer contact details of Alliance and Gehe, supplied by the Notifying Party on 21 April 2020.

49 See Form CO, para 6.4; reply to question 11 of Questionnaire Q1.

50 The Federal Cartel office considered that 2.5 hours of driving time was the maximum to provide pharmacies with three deliveries per day. If a route comprises stops at eight pharmacies, and each stop would take 2 minutes, this would result in a catchment area of 2 hours 14 minutes of driving time; see Form CO, section 6.30.

51 See Form CO, Annex 13.

52 For the purpose of this decision there is no need to assess the competitive effects on a narrower market definition, as explained under section 4.2.2.2(B) of this decision and in footnote 147.

53 Horizontal Merger Guidelines, paras 24 et seqq.

54 Horizontal Merger Guidelines, paras 39 et seqq.

55 See Form CO, para 7.4.

56 See Form CO, para 7.3.

57 See Form CO, para 7.32, 7.34 and 7.38.

58 Here and in the following market shares are estimated by value.

59 See Form CO, para 7.16. Market shares are based on a Germany-wide market for pharmaceutical wholesaling excluding direct sales by manufacturers in 2019.

60 According to the Parties` estimates AEP has a market share of [0-5] %. This is not mentioned in Table 1, since this estimate is not based on the data provided by IQVIA, formerly known as IMS Health, which provided the data for the other market participants, but not for AEP. See Form CO, para 6.45.

61 See ABDA - Bundesvereinigung Deutscher Apothekerverbände e. V. (2020). DIE APOTHEKE - ZAHLEN, DATEN, FAKTEN 2020, p. 13.

62 See Form CO, para 6.4.

63 See Form CO, para 6.4; reply to question 11 of Questionnaire Q1.

64 See reply to question 2 of Questionnaires Q2 to Q43.

65 See Form CO para 7.6 et seqq., reply to question 14 of Questionnaire Q1.

66 See para 52 b) subpara 2 and 3 Arzneimittelgesetz AMG: reply to Q 8.1 of Questionnaire Q1.

67 See Form CO, para 7.8.

68 See Form CO, para 7.9. EUR 37.80 are the result of 3.15% of EUR 1,200. Thus margins are not higher, even if the products are priced above EUR 1,200.

69 See Form CO, para 7.13.

70 See Form CO, para 7.13 et seq.; reply to question 18.1 of Questionnaire Q1.

71 See Form CO, para 7.2 of section 7. I

72 See Form CO, para 7.1 of section 7. I; para 7.5 et seq. 73 See Form CO, para 7.3 of section 7. I; para 7.15 et seq. 74 See Form CO, para 7.3 and para 7.19 et seq.

75 See Form CO, para 7.3

76 See Form CO, para 7.3 and para 7.26 et seq.

77 See Form CO, para 7.30 et seq.

78 See Form CO, para 7.3; para 7.46; para 7.50 et seq.

79 See Form CO, para 7.3; para 7.54 et seq.

80 See Form CO, para 7.3.

81 See Form CO, para 7.3.

82 See Form CO, para 7.3 and para 7.72.

83 See reply to question 27 and 27.1 of Questionnaire Q1.

84 See minutes of calls with competitors, DocID 2020/046436.

85 See reply to question 21 of Questionnaire Q1.

86 See reply to question 10 of Questionnaires Q2 to Q43.

87 See reply to question 18.1 of Questionnaire Q1.

88 See reply to question 2 of Questionnaires Q2 to Q43.

89 See reply to question 18 of Questionnaire Q1.

90 See reply to question 18.1 of Questionnaire Q1.

91 See reply to question 14 to 15 of Questionnaire Q1.

92 See reply to question 14 of Questionnaire Q1.

93 See reply to question 14.1 of Questionnaire Q1.

94 See reply to question 14.1 of Questionnaire Q1.

95 See reply to question 15 of Questionnaire Q1.

96 See reply to question 15.1 of Questionnaire Q1.

97 See reply to question 16.1 of Questionnaire Q1.

98 See reply to question 24 and 24.1 of Questionnaire Q1.

99 See reply to question 27.1 of Questionnaire Q1.

100 See reply to question 27.1 of Questionnaire Q1.

101 See reply to question 27.1 of Questionnaire Q1. One competitor does not provide an answer.

102 See reply to question 27.1 of Questionnaire Q1. One competitor does not provide an answer. 103 See reply to question 27.1 of Questionnaire Q1. One competitor does not provide an answer. 104 See reply to question 28 of Questionnaire Q1.

105 See reply to question 19 of Questionnaire Q1.

106 See reply to question 19 and 19.1 of Questionnaire Q1.

107 See reply to question 20 and 20.1 of Questionnaire Q1.

108 For the purposes of this decision, the catchment areas are analyzed separately with respect to the market shares. However, some of the arguments put forward in the market investigation are valid for both Parties’ catchment areas, and thus are discussed for both areas together.

109 See Form CO, para 7.20. The market share is calculated on the basis of January to Oct. 2019.

110 See Form CO, Annex 15 Regional Assessment, para 3.2: Annex RFI 1 Q3.1. Source: Parties’ estimates on the basis of January to Oct. 2019.

111 See reply to question 12 of Questionnaire Q33.

112 See reply to question 12 of Questionnaire Q11.

113 reply to question 3 of Questionnaire Q11 and Questionnaire Q33.

114 See reply to question 13 of Questionnaire Q11; reply to question 13 of Questionnaire Q33.

115 See reply to question 14 of Questionnaire Q11 and Q33.

116 See above para (55).

117 See reply to question 8 of Questionnaire Q33; reply to question 8.1 of Questionnaire Q33; reply to question 8 of Questionnaire Q11; reply to question 8.1 of Questionnaire Q11.

118 See Form CO, para 7.20. The market share is calculated on the basis of January to Oct. 2019.

119 See Form CO, Annex 15 Regional Assessment, para 4.2: Annex RFI 1 Q3.1. Source: Parties’ estimates on the basis of January to Oct. 2019.

120 See reply to question 12 of Questionnaire Q21.

121 See reply to question 12 of Questionnaire Q40. For Gehe customers in the Rostock region it has to be mentioned, that only five pharmacies replied to the market investigation. From Alliance customers in the Rostock region 57 the Commission received 57 replies.

122 See replies to question 12 of Questionnaires Q2 to Q43.

123 See replies to email questionnaires to competitors of 24 July 2020.

124 See reply to question 13 of Questionnaire Q21 and Q40.

125 See reply to question 14 of Questionnaire Q21 and Q40.

126 See above para (55).

127 See reply to question 8 of Questionnaire Q40; reply to question 8.1 of Questionnaire Q40; reply to question 8 of Questionnaire Q21; reply to question 8.1 of Questionnaire Q21.

128 See Form CO, para 7.20. The market share is calculated on the basis of January to Oct. 2019.

129See Form CO, Annex 15 Regional Assessment, para 5.2 Source: Parties’ estimates on the basis of January to Oct. 2019.

130 See reply to question 12 of Questionnaire Q4.

131 See reply to question 12 of Questionnaire Q26.

132 See reply to question 13 of Questionnaire Q4; reply to question 13 of Questionnaire Q26.

133 See reply to question 14 of Questionnaires Q4 and Q26.

134 See above para (55).

135 See reply to question 8 of Questionnaire Q26; reply to question 8.1 of Questionnaire Q26; reply to question 8 of Questionnaire Q4; reply to question 8.1 of Questionnaire Q4.

136 See Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings, OJ C 031, of 05/02/2004 (the “Horizontal Merger Guidelines”), para. 18.

137 In the market investigation no pharmacy from the Köln area replied to the Commission’s questionnaire.

Therefore, if not explicitly stated, the Köln region is not part of the further assessment.

138 All market shares in this paragraph are for 2019.

139 In the catchment area around Alliance’s depots in Stuttgart and Würzburg, Phoenix’ market shares are [10- 20]% and [10-20]% respectively.

140 In the catchment area around Alliance’s depot in Singen, Noweda’s market share is [5-10]%.

141 See Annex RFI1 Q. 3.1.

142 See reply to question 13 of Questionnaire Q2, Q3, Q5 – Q10, Q12 – Q20, Q22 – Q25, Q27 – Q32, Q34 – Q39, Q41 – Q43.

143 For Kaiserslautern and Porta Westfalica, the figure was below 2,5, but still well above 2 alternative wholesalers.

144 See reply to question 12 of Q2, Q3, Q5 – Q10, Q12 – Q20, Q22 – Q25, Q27 – Q32, Q34 – Q39, Q41 –Q43

145 See Form CO, para 6.52.

146 See Form CO, para 6.55.

147 It has to be noted, that the market shares cited here do not distinguish between full-line and short-line wholesaling. The Parties explain, that there are no data available for a short-line wholesaling market. The Parties also explain that to their knowledge, there is no separate market for short-line wholesaling in the Netherlands and that here are no specialist short-line wholesalers in the Dutch market. See Form CO para 6.58. The Commission notes, that for these reasons, the market figures presented in table 4 are the closest estimate of full-line pharmaceutical wholesaling in the Netherlands.