Commission, February 5, 2021, No M.9857

EUROPEAN COMMISSION

Decision

VOLVO / DAIMLER / JV

Subject: Case M.9857 – Volvo/Daimler/JV

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 2 and Article 57 of the Agreement on the European Economic Area3

Dear Sir or Madam,

(1) On 23 December 2020, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the “Merger Regulation”) by which Aktiebolaget Volvo (“Volvo”, Sweden) and Daimler Truck AG, part of the Daimler group (“Daimler”, Germany) acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of Daimler Truck Fuel Cell GmbH (the “JV”, Germany) (the “Transaction”).4 Volvo and Daimler are together referred to as the “Notifying Parties”.

1. THE PARTIES

(2) Volvo is a multinational manufacturing company globally active amongst other things in the manufacture and sale of on- and off-highway trucks, buses, construction equipment and marine, on-highway and industrial engines.

(3) Through its 100% affiliate, Daimler Trucks AG, Daimler is active in the manufacturing and sale of trucks and buses. The Daimler group globally develops, manufactures and distributes automotive products, mainly passenger cars, trucks, vans and buses.

(4) The JV is currently a 100% subsidiary of the Daimler group, incorporated in Germany, in which Daimler has transferred its ongoing fuel cell activities. The JV will be active in the development, production, sales and after sales of fuel cell systems (“FCS”) for heavy-duty trucks and, to a smaller extent, for stationary applications.

2. THE OPERATION

(5) The Notifying Parties entered into an investment Agreement and Shareholder’s Agreement on 2 November 2020, according to which Volvo will obtain joint control of the JV, which is currently wholly owned by Daimler, by acquiring 50% of the JV’s shares.

Joint control

(6) The Notifying Parties will have joint control over the JV, whereby they will each hold (directly or indirectly) 50% of the JV’s shares and have equal shareholder rights.5

(7) […].6

(8) […].

(9) […]. As a result, the Commission considers that the JV will be jointly controlled by the Notifying Parties.

Full-functionality

(10) The JV will be equipped with sufficient resources to operate independently on a lasting basis. The Notifying Parties have committed to provide the necessary financing to the JV, according to the approved business plan.7 Once the JV will enter into production phase, the income it will generate will enable it to operate independently on the market.

(11) The JV will have a management board and management dedicated to its day-to-day business. The JV will also hire its own staff, with the intention to have this staff on its own payroll.8

(12) Until the FCS for heavy duty trucks are fully developed, the JV will ([…]) supply FCS to third-party manufacturers of stationary applications. Therefore, in the short term, the JV will have no captive sales and all sales will be to third-parties.9

(13) Following this development phase, […],10 […].

(14) Once the JV will enter into the mass production phase ([…]), the Notifying Parties expect […]. […].11 Sales to third parties will therefore allow the JV to achieve scale effects and render the operation of the JV economically viable. As a result, the Commission considers that the JV will be full-function.

3. THE CONCENTRATION

(15) The JV will constitute a full-function joint venture, performing on a lasting basis all the functions of an autonomous economic entity, and will be jointly controlled by the Notifying Parties within the meaning of Article 3(1)(b) and 3(4) of the EU Merger Regulation.

4. EU DIMENSION

(16) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million.12 Each of them has an EU-wide turnover in excess of EUR 250 million, but they do not achieve more than two-thirds of their aggregate EU- wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

5. RELEVANT MARKETS

(17) The JV will develop and manufacture FCS for heavy-duty trucks and for stationary applications.13 Although the JV cannot exclude to produce this technology for other vehicles or applications in the future, at present there are no concrete plans for the JV to do so.

(18) Volvo supplies diesel engines to manufacturers of stationary applications. However, even if the manufacture and sale of diesel engines and FCS for stationary applications were considered as part of the same product market, it would not be an affected market as the combined market share in the EEA14 would be [10-20]%. Therefore, this hypothetical horizontal overlap will not be further discussed in this decision.

(19) As concerns the JV’s activity with regard to the development, production and sale of FCS for heavy-duty trucks, the Transaction will lead to one vertical link between the JV’s activities in the sale of FCS (upstream) and the Parties’ activities in the sale of heavy duty trucks (downstream).15

5.1. Manufacture and supply of FCS

5.1.1. Product market definition

(20) The Commission has previously investigated the market for the manufacture and supply of FCS only in case M.9474 Faurecia/Michelin/Symbio/JV.16 In that decision, the Commission considered that the manufacture and supply of FCS constitutes a separate market from combustion and battery electric engines.17 The Commission has considered, but ultimately left open, whether this market should be further segmented according to the different end uses or applications of such FCS (e.g. use as propulsion system for heavy-duty trucks or, more widely in the automotive sector, in stationary applications, in construction equipment etc.).18

(21) The Notifying Parties argue that there is a single market for the development, production and sale of FCS.19 The JV, for instance, […]. According to the Parties, the main differentiating factor between the development of FCS for use in stationary applications in the one hand, and in heavy-duty trucks in the other hand, is the longer testing and validation phases the latter have to undergo. Thus, the Parties argue that there is supply-side substitutability and that therefore the product market for the manufacture and supply of FCS should not be further segmented according to the end use or application of such FCS.

(22) In this regard, the majority of FCS suppliers responding to the market investigation indicated that they supply FCS and components to both automotive and non- automotive sectors.20 Moreover, the majority of suppliers indicated that FCS and components for the automotive sector could be used for other applications.21 Furthermore, the vast majority of respondents to the market investigation confirmed that FCS and components for heavy-duty trucks can in general be used in other types of vehicles. However, several respondents indicated that this would require application-specific modification of the FCS and FCS components, depending on the intended use.22

(23) In light of the above, for the purposes of the present decision, it can be left open whether the market for the manufacture and supply of FCS may be further segmented according to the application in which FCS may be used since the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement, under any plausible product market definition and, in any case, the Parties have no concrete plans to develop and manufacture FCS for purposes different than stationary applications and heavy-duty trucks.

5.1.2. Geographic market definition

(24) The market investigation in case M.9474 Faurecia/Michelin/Symbio/JV23 had suggested that the geographic scope of the market for the manufacture and supply of FCS was worldwide.24 However, it was left open whether the geographic market was worldwide or EEA-wide in scope as it was not necessary to close the market definition for the competitive assessment in that decision.25

(25) The Notifying Parties agree with the view that the geographic scope of the market is wider than the EEA. They expect that there will be worldwide supply and demand for FCS, and point to the fact that undertakings in the EEA are increasingly partnering with undertakings outside the EEA to jointly develop viable FCS technology and increase their ability to sell the product outside their usual geographic markets.26 Furthermore, the Notifying Parties are of the view that cost and time of transportation will not play a significant role in this respect. They expect relative transportation costs to be low and that the difference in transportation time within and outside the EEA will not prevent purchasers from sourcing FCS outside the EEA.27

(26) The Commission considers that there is evidence pointing to the geographic scope of the market being worldwide for the manufacture and supply of FCS for the following reasons.

(27) First, it should be noted that FCS technology is still at an early stage, with further development being needed for wide commercialization of the product. Development of the technology is occurring at a worldwide level, whereas currently the most advanced FCS developers are located outside the EEA.28 Narrowing the geographic market down to the EEA level would leave a number of significant FCS developers, which are located outside the EEA, out of consideration with regard to the development of FCS technology.

(28) Second, while FCS technology is still largely in development phase, undertakings in the EEA are partnering in the development of FCS with undertakings outside the EEA, in order to later expand their customer base outside their usual geographic markets and secure their market position at a worldwide level.29

(29) Third, there is already a number of FCS suppliers which are currently developing the technology and selling some units on a prototype basis, which are active both worldwide and in the EEA.30 In this regard, all the FCS suppliers who replied to the market investigation indicated that they (intend to) supply FCS at worldwide level.31 Moreover, the majority of FCS suppliers submitted that their (prospective) customers (will) purchase FCS and components at worldwide level.32

(30) Finally, the market investigation suggests that transportation costs and time is not a deterring factor for FCS customers to source the product on a worldwide level.33

(31) Despite the results of the market investigation, the Commission considers that it cannot be concluded whether the geographic market is EEA-wide or worldwide because it is a new market subject to uncertainties.

(32) In light of the above, for the purposes of the present decision, the Commission considers that the geographic market is at least EEA-wide and it can be left open whether the geographic market is worldwide or EEA-wide, as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement.

5.2. Manufacture and supply of heavy-duty trucks

5.2.1. Product market definition

(33) Volvo and Daimler manufacture and supply heavy-duty trucks.

(34) In previous cases, the Commission has categorized trucks into three different product markets depending on the truck’s weight. It has thus defined a separate market for the manufacture and supply of heavy-duty trucks, in which it has categorized trucks with a gross weight of more than 16 tonnes, as opposed to light-duty trucks (gross weigh below 5 tonnes) and medium-duty trucks (5-16 tonnes).34

(35) The Notifying Parties agree with the previous decision practice of the Commission.35

(36) The Commission takes the view that its previous decision practice with regard to the categorization of trucks is still relevant.

(37) In this regard, and for the purposes of this decision, the Commission considers that the relevant product market is the market for heavy-duty trucks, comprising trucks of a gross weight of over 16 tonnes.

5.2.2. Geographic market definition

(38) While in Volvo/Scania36 and Volvo/Renault37 the Commission decided that the geographic scope of the heavy truck market was national, the Commission has in other cases subsequently left open the question whether the market is national, regional or EEA wide38.

(39) In Volkswagen/MAN39 the Commission had found that, even though technical requirements appeared to be largely uniform across the EEA, there were a number of elements suggesting that the markets for heavy trucks were probably still national in scope. For instance, prices, rebates and the brand reputation of the different producers still differed per country in various instances, the majority of customers still procured at national level, and the structure of the market in the individual Member States differed considerably.

(40) Although the Notifying Parties argue that there is a number of elements pointing to a regional or EEA-wide market, they ultimately do not oppose the previous decision practice of the Commission.40

(41) In light of the above, for the purposes of this decision, it can be left open whether the market for the manufacture and supply of heavy-duty trucks is national, regional or EEA-wide, as the transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement, even in the case that a national market were to be assumed.

6. COMPETITIVE ASSESSMENT

6.1. Affected markets

(42) The JV will be present in the market for the development, production and sale of FCS with a specific focus on heavy-duty trucks and stationary applications. Currently, the JV has no sales of FCS (as indicated in paragraph 12 above, sales of FCS are expected to materialise in […] when the JV will sell some units of FCS for stationary purposes). Moreover, since this is still an emerging market, the Notifying Parties submit that they cannot provide market shares estimates for the next years.41 Volvo and Daimler will not be present in this market. Therefore, there are no horizontally affected markets.

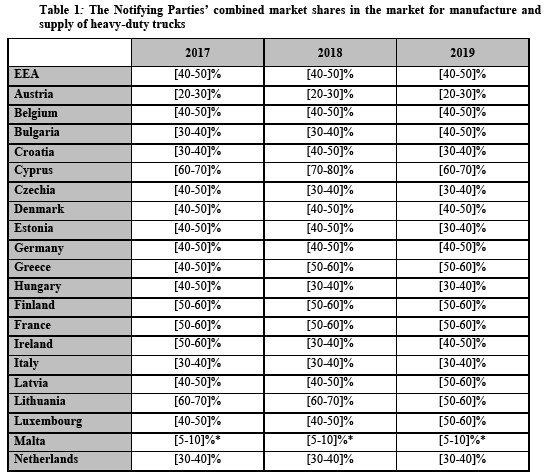

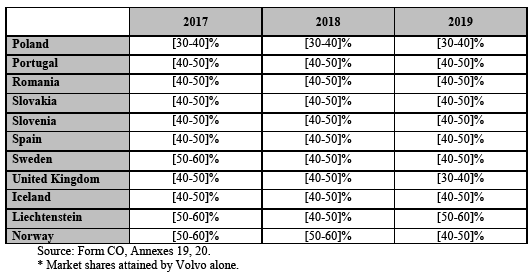

(43) However, Volvo and Daimler are both present in the downstream markets for the manufacture and supply of heavy duty trucks, at EEA and worldwide level.42 Volvo and Daimler’s combined market shares in these markets are set out in Table 1 below.

(44) In view of the Parties’ downstream market shares, the Transaction gives rise to the following vertically affected markets: manufacture and supply of FCS (upstream) and manufacture and supply of heavy-duty trucks (downstream) at EEA level and in each EEA Member State except Austria and Malta (where Volvo and Daimler’s shares in the downstream markets remain below 30%).

6.2. The Notifying Parties’ views

(45) The Notifying Parties submit that the JV will not have either the ability nor the incentive to foreclose Volvo’s and Daimler’s competitors on the market for the manufacture and supply of heavy-duty trucks from access to FCS (input foreclosure). As regards the ability, the Notifying Parties consider, first, that FCS will not be a key input, as there are alternative technologies available for manufacturers (internal combustion engines, methane or gas-based engines or hybrid trucks); and second, that the technology developed by the JV is not essential as there are other players developing FCS which will be also secured by IP rights. As regards incentives, the Notifying Parties argue that the sale of FCS to third parties will allow the JV to achieve economies of scale […] and that it will spur the growth of the market thus stirring public support for investment in charging infrastructure.43

(46) The Notifying Parties also submit that the JV will also not have the ability nor the incentives to foreclose third parties in the market for the development, production and sale of FCS (customer foreclosure). In relation to the ability, the Notifying Parties consider, first, that looking at the market shares today, a customer base accounting for approximately [60-70]% of the EEA-wide market will remain available and would thus constitute potential customers for the JV’s competitors; second, that at worldwide level – where fuel systems manufacturers are expected to operate – this customer base would be even larger; third, that competing manufacturers will have sufficient access to manufacturers of other applications to whom they can sell FCS. As regards the incentive, the Notifying Parties indicate, first, that an increase in prices of fuel systems after having forced competing suppliers out of the market would only incentivise heavy-duty truck manufacturers to switch to alternative solutions, second, that customer foreclosure would frustrate the JV’s interest to foster the belief in the fuel cell technology and investment in the necessary infrastructure, and third, that the JV will supply FCS to Volvo and Daimler on a non-exclusive basis and that both companies will not develop and manufacture cell systems outside the JV.44

6.3. The Commission’s assessment

(47) Vertical non-coordinated effects may principally arise when non-horizontal concentrations give rise to foreclosure.45

6.3.1. Assessment of input foreclosure

(48) Input foreclosure arises where, post-merger, the new entity is likely to raise the costs of downstream rivals by restricting their access to an important input.46 However, as a potential new entrant in the market for the manufacture and sale of FCS expected to supply third parties, the JV currently has a market share of 0% and will be a new source of supply in a nascent market. Therefore, in principle, the JV’s activity in this field will be pro-competitive. If heavy-duty truck manufacturers other than the Parties were to purchase FCS from the JV in the future, this would mean that they would benefit from the existence of an additional source of FCS supply, extending rather than limiting their choice of FCS suppliers.

(49) Moreover, several OEMs and other third parties, including Tier 1 suppliers, are currently engaged in R&D work related to FCS, including for the application in heavy-duty trucks. There is no conclusive evidence that these third parties would be less efficient or likely less successful than the Parties.47 It is therefore not possible to conclude that the Parties could have the ability to foreclose inputs to competitors, let alone have the incentive to do so. Therefore, the Commission considers that the present case does not raise any input foreclosure concerns.48

6.3.2. Assessment of customer foreclosure

(50) The Commission’s investigation therefore focused on potential customer foreclosure concerns, assessed in the following section.

(51) Customer foreclosure may occur where a supplier integrates with an important customer in the downstream market, thereby restricting upstream rivals’ access to a sufficiently large customer base.49 For customer foreclosure to be a concern, a vertical merger must involve an important customer with a significant degree of market power in the downstream market. If, on the contrary, there is a sufficiently large customer base, at present or in the future, that is likely to turn to independent suppliers, the Commission is unlikely to raise competition concerns on that ground.50 Although several respondents to the market investigation expressed their concerns as regards the merged entity’s potential to engage in customer foreclosure behaviour,51 the Commission considers that the Transaction does not raise customer foreclosure concerns for the following reasons.

6.3.2.1. Ability to foreclose upstream rivals

(52) First, FCS is a technology which is only at development stage. Currently, heavy- duty trucks are mostly equipped with combustion engines, with a very small minority of electric heavy-duty trucks.52 The number of fuel cell heavy-duty trucks is even more limited and those are only prototypes. The Notifying Parties do not currently manufacture or supply any fuel cell heavy-duty trucks. As a result, the Notifying Parties could still not be deemed to constitute important customers of FCS within the meaning of the Non-Horizontal Merger Guidelines with a significant degree of market power given its current lack of activity in fuel cell heavy-duty trucks.

(53) The Parties currently do not have contracts with third parties for the supply of FCS. Although it could be assumed that Volvo and Daimler are likely to be purchasers of FCS in the future, the information provided by the Notifying Parties53 and the results of the market investigation indicate that Volvo and Daimler are not expected to become important customers of FCSs in the EEA from third parties in the foreseeable future in a way that would result in any customer foreclosure when they would start predominantly sourcing from the JV.

(54) In any event, as indicated by market participants, the development of a FCS is a complex technological development, which will take years to complete.54 Therefore, at this stage, it is also highly uncertain whether the JV will be successful in the development and production of FCS and thus whether the Notifying Parties will be able to rely to a large extent on the JV. In this regard, the JV has no sales of FCS yet and is expected to develop its presence in the heavy-duty trucks market only gradually as from […]. Therefore, any potential ability to foreclose the market could only be expected to materialise in the long term and only gradually, adding significant uncertainty to any assessment of foreclosure effects. This also provides third party FCS manufacturers with time to adjust to the new competitive environment and improve their offering.

(55) Second, even if FCS were to become a successful technology and the JV were to be successful in developing FCS, the Commission cannot at the present stage determine with a reasonable degree of certainty whether they will have a “significant degree of market power in the downstream market”, as set out by the Non-Horizontal Merger Guidelines. Rather the contrary, as there are currently several collaborations between heavy-duty truck OEMs and FCS developers ongoing, which aim to introduce FCS- powered heavy-duty trucks to the market within the course of the next years.55 In the same context, some FCS suppliers noted that they expect a number of other companies – including some which do not currently manufacture combustion engine heavy duty trucks – to enter the market for the purchase of FCS / FCS components for heavy-duty trucks in the next years.56

(56) Third, even considering the current market shares of Volvo and Daimler in the overall market for the manufacture and supply of heavy-duty trucks as a proxy for the market power that they may have […] in relation to the purchase of FCS for heavy-duty trucks, there are a number of other truck manufacturers active both in the EEA and at national level which account for a substantial proportion of the market. OEMs accounting for approximately [60-70]% of the EEA-wide market of FCS- sourced heavy-duty trucks would remain available as potential customers. Moreover, as explained in section (5.1.1), even if conditions of competition differ between different regions of the world (and so an EEA wide market may be appropriate), manufacturers of FCS are expected to be active globally including areas where the Notifying Parties’ market shares are significantly lower and hence even more potential is still accessible. This is confirmed by the market investigation, where a 100% of the FCS suppliers replied that they (intend to) supply FCS worldwide. Several respondents replied that they already deliver FCS for different use cases to customers located around the world. Another respondent noted that “hydrogen and its utilization in FCSs will be desired globally”.57

(57) Fourth, even if the customer base available represented by manufacturers of FCS- sourced heavy-duty trucks was considered insufficient, competing suppliers of FCS will have sufficient access to manufacturers of other vehicles/applications to whom they can sell their FCS, such as stationary, buses/coaches, marine, railway, ships, aeronautics, construction, etc. in some of which Volvo and Daimler are not even present in the downstream markets. This is evidenced by the fact that (i) a majority of market respondents have confirmed that, with some adaptations, FCS/components for heavy-duty trucks could be used in other types of vehicles and for other non- automotive applications,58 and that (ii) that the vast majority of players are indeed already developing FCS for several applications at the same time.59 Therefore, any hypothetical higher variable production costs that competing upstream firms might encounter due to a limited reduced customer base in FCS-sourced heavy-duty trucks, would be likely to be compensated by potential customers which manufacture other vehicles/applications.

6.3.2.2. Incentive to foreclose upstream rivals

(58) As concerns the JV’s incentive to engage in customer foreclosure, […]. Hence, there is no risk that the JV will have an incentive to reduce its purchases of FCS from competing suppliers, as the Notifying Parties currently do not purchase these FCS for use in their heavy-duty trucks.

(59) Moreover, it is apparent from the Notifying Parties’ submissions that the success of the JV will depend on the general market belief in fuel cell technology and the roll- out of the necessary infrastructure. This objective would be frustrated if the JV foreclosed competing FCS manufacturers. In addition to this, it is very likely that the future of the market for the development, production and sale of FCS will strongly depend on an overall hydrogen infrastructure, including hydrogen refuelling stations within the EEA and outside. Without this infrastructure, possible customers will probably not purchase any FCS (or fuel-cell equipped heavy-duty trucks) as these vehicles would not be able to be used in these countries. To make such infrastructure financially interesting, companies providing such infrastructure will need a strong market penetration with fuel-cell equipped heavy-duty trucks, which is something that the JV will not be able to achieve without other competitors.

(60) In addition, FCS will likely constitute a key aspect of competition between heavy- duty truck OEMs, as it will be an important part of a FCS heavy-duty truck in terms of value and efficiency. As the technology is rapidly developing, the Notifying Parties are likely to need to install appropriate technology in their heavy-duty trucks, whether produced by the JV or by a third party. The success of the JV, like its competitors in the FCS market, is therefore likely to depend much more on its technological skills than on a possible customer base.

(61) Furthermore, although during the market investigation some respondents were concerned that the JV would be the exclusive supplier of Volvo and Daimler, the Notifying Parties have confirmed that the JV will sell its FCS to the Parties on a non- exclusive and arm’s length basis. The Notifying Parties remain open to purchase FCS for incorporation in their heavy-duty trucks from third party FCS suppliers.60

6.3.2.3. Effects on competition

(62) As regards the effects on competition, the results of the market investigation indicate that, in the future, the JV will be an additional credible supplier of FCS whose market activity may rather have neutral or positive effects in terms of market competitiveness.61 One FCS and FCS components supplier indicated in the market investigation that “Due to expected increased sales volume for our FCS components, the serial introduction will become more cost effective and attractive for usage in zero emission vehicles.” Another respondent argued that “A positive effect of the envisaged joint venture will probably be that it can significantly support the development and setting of industry standards. This is very important regarding the further development of new technologies”.62 On a similar note, a third respondent replied that the Transaction “…will accelerate adoption of fuel cell technical by other HD truck OEMs”.63

(63) In conclusion, the Commission considers that the Parties will lack the ability and the incentive to engage in any customer foreclosure strategies with regards to suppliers of FCS competing with the JV, and that any potential foreclosure strategy would not have a significant effect on competition.

6.4. Spill over effects

(64) Although FCS will be a key component for heavy-duty trucks, the Commission considers that the JV is unlikely to lead to spill over effects in the downstream heavy-duty truck manufacturing market as the Parties will not have the incentives to coordinate in this market.64 In the first place, the cost of FCS is expected to represent a relatively limited proportion of the overall final cost of the fuel-cell powered truck (approximately […]%, according to the Parties, which could even be lower as the technology is rolled out).65 In the second place, the manufacture and supply of heavy duty trucks is a differentiated product market in which manufacturers offer heterogeneous products, the (end) prices of which are dependant on many factors, some of which (e.g. technical characteristics of the truck, design, comfort, after-sales service, warranty) are unrelated to the scope of the cooperation while others (discounts to importers and dealers and to final customers) are not even under the control of the manufacturer but depend on the competition structure of the downstream distribution and retail markets. In the third place, the JV neither requires nor incentivises any limitation of the production of Daimler and Volvo and does not in any way limit or conditions the freedom of these two undertakings to freely set their commercial policies. To the contrary, it is to the JV’s interest to increase sales in order to achieve scale effects and thus lower the cost of production, which is key to the market uptake of FCS. In the fourth place, not a single market respondent in the market investigation has pointed out to the risk or likelihood of any collusion or coordination in the downstream market.

(65) In conclusion, the Commission considers that the Transaction is unlikely to lead to anticompetitive coordinated effects between the Notifying Parties.

6.5. Conclusion

(66) The Commission therefore considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement.

7. CONCLUSION

(67) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 For the purposes of this Decision, although the United Kingdom withdrew from the European Union as of 1 February 2020, according to Article 92 of the Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community (OJ L 29, 31.1.2020, p. 7), the Commission continues to be competent to apply Union law as regards the United Kingdom for administrative procedures which were initiated before the end of the transition period.

3 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

4 Publication in the Official Journal of the European Union No C 8, 11.1.2021, p. 16.

5 Form CO, para. 128.

6 Form CO, Annex 02 – Term Sheet, point 9.

7 Form CO, Annex 02 – Term Sheet, point 7, 12.

8 Form CO, paragraph 133.

9 Daimler has already secured a customer contract for the JV with Rolls-Royce and has a further pilot project with Hewlett Packard. The current assumption of the Notifying Parties is that up to […] may be rented out or leased out in 2021 to […].

10 Form CO, paragraph 268.

11 Supra, 7.

12 Turnover calculated in accordance with Article 5 of the Merger Regulation.

13 The use case of stationary applications allows for an earlier market introduction of the FCS compared to heavy-duty trucks, because of the various test phases the FCS will have to undergo, to meet the requirements of regulation in the automotive industry. […]. A first customer contract with Rolls-Royce was secured.

14 For the purposes of this Decision, the EEA is understood to cover the 27 Member States of the European Union (Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden) and the United Kingdom, as well as Iceland, Liechtenstein and Norway. Accordingly, any references made to the EEA in this Decision are meant to also include the United Kingdom (UK).

15 This vertical link will however not materialize before […], when, according to the Notifying Parties’ estimations, the JV will start marketing its FCS to heavy-duty truck manufacturers. There is no horizontal overlap, since Daimler’s activities in FCS development have been transferred to the JV and […].

16 Case M.9474 - Faurecia/Michelin/Symbio/JV of 12.11.2019.

17 Case M.9474 – Faurecia/Michelin/Symbio/JV of 12.11.2019, para. 30.

18 Idem.

19 Form CO, para. 191 – 204.

20 See responses to questionnaire Q1 to FCS suppliers, question 7.

21 See responses to questionnaire Q1 to FCS suppliers, question 8.

22 See responses to questionnaire Q1 to FCS suppliers, question 11, 12.1. Regarding the ease of switching between the assembly and supply process of FCS / FCS components for the automotive sector and other sectors, one respondent indicated that “The adaption of hardware, e.g. housings for [Fuel Cell Control Units], hoses or connectors for sensors and actuators will need a lead time of 6-12 months to develop and validate the necessary changes. Investment of single digit million-€ necessary. The development, change and bugfix of software modules will lead to a time frame of 12-24 months. Investment of double digit million-€ necessary” (see responses to questionnaire Q1 to FCS suppliers, question 9.1.)

23 Case M.9474 - Faurecia/Michelin/Symbio/JV of 12.11.2019.

24 Case M.9474 – Faurecia/Michelin/Symbio/JV, responses to questionnaire Q2 to FCPU and FCS suppliers, questions 9 and 10; respondents indicated that FCS suppliers operate, and FCS customers mainly purchase, at a worldwide level.

25 Idem, para. 33.

26 Form CO, para 221.

27 IdeM.

28 […] Toyota, Hyundai and Weichai/Ballard Power Systems, which are all seated outside the EEA, are considered by many as the current leaders in FCS technology (Form CO, para. 401).

29 For instance, Iveco, an Italy based undertaking, entered into a partnership with Nikola, a US-based undertaking, to jointly develop fuel cell trucks. Similarly, South-Korea based Hyundai partnered with Swiss H2 Energy (Form CO, para. 221).

30 Case M.9474 – Faurecia/Michelin/Symbio/JV, Fn. 23.

31 See responses to questionnaire Q1 to FCS suppliers, question 13.

32 See responses to questionnaire Q1 to FCS suppliers, question 14.

33 See responses to questionnaire Q1 to FCS suppliers, question 17.

34 Case M.6267 – Volkswagen/MAN of 26.09.2010, para. 8 – 14; Case M.5157 – Volkswagen/Scania of 13.06.2008, para. 12.

35 Form CO, para. 163 – 172.

36 Case M.1672 – Volvo/Scania of 15.03.2000, para 31 et seq.

37 Case M.1980 – Volvo/Renault V.I. of 01.09.2000, para. 20 et seq.

38 Case M.6267 – Volkswagen/MAN of 26.09.2010, para 19; Case M.4336 – MAN/Scania of 20.12.2006, para 20 et seq.; Case M.5157 – VW/Scania of 13.06.2008, para 24.

39 Case M.6267 – Volkswagen/MAN of 26.09.2010, para. 18.

40 Form CO, para. 177, 178.

41 Form CO, paragraph 60.

42 Volvo markets its heavy-duty trucks in the EEA under the brands Volvo Trucks and Renault Trucks (it uses the brands UD Trucks, Mack Trucks, Eicher Trucks and Dongfeng Trucks in other regions) and its city buses, inter-city buses, coaches under ther brand Volvo. Daimler sells heavy duty trucks in the EEA under the Mercedes-Benz Trucks brand and its city buses, inter-city buses and coaches under the brands Mercedes-Benz and Setra.

43 Form CO, paragraphs 536 and following.

44 Form CO, paragraphs 554 and following.

45 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings, OJ C 265, 18.10.2008 (“Non-Horizontal Merger Guidelines”), paragraph 18.

46 Non-Horizontal Merger Guidelines, paragraph 30.

47 On the contrary, some FCS suppliers have already secured contracts and cooperation agreements with some heavy truck manufacturers (see Form CO, Annex 14). One FCS supplier noted that some of these players are technologically more advanced, and will be quicker than the JV in introducing FCS for heavy- duty trucks to the market (see minutes of a conference call with a FCS supplier, 19 November 2020).

48 Indeed, for input foreclosure to be a concern, the merged entity must have a significant degree of market power in the upstream market. Non-Horizontal Merger Guidelines, paragraph 5.

49 Non-Horizontal Merger Guidelines, paragraphs 30 and 58.

50 Non-Horizontal Merger Guidelines, paragraph 61.

51 See confidential replies to Questionnaire Q1 to FCS suppliers, question 21.1.

52 Electric heavy-duty trucks represent today a symbolic portion of the market, according to the estimates of an international FCS supplier (around 5 000 globally). The same supplier indicated that, by 2030, electric heavy-duty trucks will represent 20% of all heavy-duty trucks globally. See minutes of a conference call with a FCS supplier, 19 November 2020.

53 […]. See reply to RFI 7.

54 See replies to questionnaire Q1 to FCS suppliers, question 19.2.

55 See Form CO, Annex 14.

56 See confidential replies to questionnaire Q1 to FCS suppliers, question 24.

57 See replies to questionnaire Q1 to FCS suppliers, question 13.1.

58 See replies to Questionnaire Q1 to FCS suppliers, questions 9.

59 See replies to Questionnaire Q1 to FCS suppliers, question 7.

60 See Form CO, para. 565.

61 See replies to Questionnaire Q1 to FCS suppliers, questions 19 and 28.

62 See replies to Questionnaire Q1 to FCS suppliers, question 28.

63 See replies to Questionnaire Q1 to FCS suppliers, question 30.1.

64 The Commission notes that certain minority shareholders are present in both Volvo and Daimler. However, these minority shareholders do not exercise control over any of the Notifying Parties within the meaning Art. 3 (2) of the Merger Regulation.

65 See Form CO, para. 528.