Commission, December 7, 2020, No M.9827

EUROPEAN COMMISSION

Decision

INTERNATIONAL FLAVORS & FRAGRANCES / NUTRITION & BIOSCIENCES

Subject: Case M.9827 - INTERNATIONAL FLAVORS & FRAGRANCES / NUTRITION & BIOSCIENCES

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 30 October 2020, the European Commission received notification of a concentration pursuant to Article 4 of Council Regulation (EC) 139/2004 (‘the Merger Regulation’) which would result from a proposed transaction by which International Flavors & Fragrances Inc (‘IFF’, USA) intends to acquire control, within the meaning of Article 3(1)(b) of that Regulation, of the whole Nutrition & Biosciences business (‘N&B’, USA) owned by DuPont de Nemours, Inc. (“DuPont”) by way of purchase of shares (‘the Transaction’).3 In this Decision, IFF and N&B are referred to as ‘the Parties’. The undertaking that would result from the Transaction is referred to as ‘the merged entity’.

1. THE PARTIES

(2) IFF (the United States) is a public company based in New York, listed on the New York Stock Exchange, the Tel Aviv Stock Exchange and Euronext Paris. It is active worldwide in the development, production and supply of flavours and fragrances used in consumer goods industries, such as food and beverage, personal care, and home care industries.

(3) N&B, headquartered in Delaware (the United States), is a business unit of DuPont. It is active worldwide in the development, production and supply of food and industrial ingredients and additives, including (i) natural and plant-based specialty ingredients (e.g. proteins, emulsifiers, sweeteners), (ii) solutions for health and bioscience applications (e.g. probiotics, fibres, cultures, enzymes, microbial control), functional cellulosic polymers and seaweed derived excipients for pharma and dietary supplements.

2. THE TRANSACTION

(4) The Transaction is to be achieved by means of the implementation of a separation and distribution agreement and a merger agreement, both signed on 15 December 2019, by which IFF is to acquire 100% of the outstanding equity of a new company (SpinCo) to which DuPont will transfer its N&B business, in the so-called Reverse Morris Trust transaction.4 IFF will therefore acquire sole control of the N&B business.

(5) The Transaction would henceforth result in a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(6) The Parties have a combined aggregate world-wide turnover of more than EUR 5 000 million (IFF EUR 4 662 million; N&B EUR 5 667 million). The aggregate Union-wide turnover of each of the Parties is more than EUR 250 million (IFF EUR […]; N&B EUR […]) and neither of the Parties achieves more than two- thirds of their aggregate Union-wide turnover within one and the same Member State. Therefore, the notified concentration has a Union dimension within the meaning of Article 1(3) of the Merger Regulation.

4. RELEVANT MARKETS

(7) The Parties’ activities overlap horizontally in the supply of cultures and plant-based proteins. There are also a limited number of vertical links between the Parties’ activities in relation to locust bean gum, microcrystalline cellulose (MCC) and emulsifiers. In addition, the Transaction entails the conglomerate integration of two largely complementary product portfolios with significant individual market positions involving, in particular, the supply by N&B of functional ingredients such as soy-based proteins, locust bean gum, MCC, enzymes and probiotics for dietary supplements.5

4.1. Cultures

(8) Cultures are living microorganisms, such as bacteria, yeast or mould used in food and beverage manufacturing, animal and plant health, and animal feed. They provide a beneficial impact when used in a production process or included in a final product. Cultures ferment sugars and hence lower the pH value to protect the food, e.g., to extend shelf life and inhibit specific contaminating flora. Food manufacturing Cultures are used as bacterial starters or adjuncts and as protective Cultures in the production process of a variety of products in the food and beverage industry - including meat and dairy - to achieve greater production efficiency and specific product characteristics (such as flavour, texture, consistency, colour, taste), and to preserve perishable foods.

(9) The Parties’ activities only overlap in the manufacturing and supply of Dairy Cultures and Cultures for Meat, as well as in a number of sub-segments. N&B also has limited sales of Cultures for Plant-based food.

4.1.1. Relevant Product Markets

4.1.1.1. The Commission’s decisional practice

(10) The Commission has not previously defined a market for Cultures. In a previous case, the Commission considered a market for dairy cultures in the area of ‘Cultures for food production’, but ultimately left the exact market definition open.6

4.1.1.2. The Parties’ views

(11) The Parties submit that the product market definition with respect to Cultures can be left open, as the Transaction does not give rise to competition concerns irrespective of the exact market definition. In any event, the Parties argue that in any case no distinction should be made between Cultures for Meat and Dairy Cultures. The nParties add that no further distinctions should be defined for Dairy Cultures and Cultures for Meat based, respectively, on type of culture or on type of end product.7

(12) More precisely, the Parties argue with respect to Dairy Cultures that a segmentation between Cultures for Cheese and Fresh Dairy Cultures would not be appropriate. First, the Parties claim that there is considerable supply-side substitutability since both Cultures for Cheese and Fresh Dairy Cultures are typically produced on the same production lines using the same equipment,. Second, the Parties argue that while demand-side substitutability between different types of Dairy Cultures is limited,8 all Dairy Cultures are interchangeable from a supply-side. According to the Parties, with the exception of surface and ripening Cultures, the technology and know-how used for the production of all types of Cultures are very similar and Dairy Culture producers therefore generally offer all variations. The Parties further submit that similar bacterial strains are regularly used for the different types of Dairy Cultures.9

(13) The Parties further explain that if Dairy Cultures were to be further segmented, a distinction could be made between acidifying Cultures and other Cultures such as protective Cultures in Fresh Dairy Cultures and Cultures for Cheese, adjuncts in cheese, surface, and ripening Cultures in cheese, or probiotic Cultures in Fresh Dairy Cultures. Following such a segmentation, the Parties would only overlap in acidifying Cultures.10

(14) Finally, the Parties submit that in any case and in view of the very small market share increment the exact market definition with respect to Dairy Cultures can be left open.11

(15) With respect to Cultures for Meat, the Parties submit that the definition of the relevant product market can also be left open. According to the Parties, a possible distinction could be drawn between acidifying Cultures, surface Cultures and protective Cultures. However, the Parties argue that while demand-side substitutability between these different types of Cultures for Meat is limited, the Parties state that from a supply-side perspective, they are largely interchangeable. The technology and know-how used for production of all types of Cultures are largely similar. While not all suppliers of Cultures for Meat offer all three types of Cultures for Meat, the Parties argue that they could easily expand their portfolio.12

(16) If Cultures for Meat were to be segmented by type of end product, according to the Parties, a distinction between Cultures for Dried and Semi-Dried Sausages (potentially further sub-segmented into Cultures for Northern European ripening-style, Cultures for Southern European ripening-style and Cultures for US ripening-style), Cultures for Dried Cured Ham, Cultures for Cooked Sausages, Cultures for Cooked Ham and other Cultures, in particular for Parboiled / Fresh Sausages could be considered.13

(17) The Parties acknowledge that when considering Cultures for Meat by type of end product, demand-side substitutability would be limited, because different end product production processes require different types of Cultures for Meat. However, according to the Parties, supply-side substitutability is significant, as the technology and know-how used for the production of all types of Cultures for Meat are largely similar (with the exception of surface cultures which require different production assets). While not all suppliers of Cultures for Meat offer Cultures for all end products, the Parties argue that they could easily expand their portfolio.14

(18) Finally, the Parties submit that in any case and in view of the moderate combined market shares of the Parties in such sub-segments, the exact market definition with respect to Cultures for Meat can be left open.15

4.1.1.3. The Commission’s assessment

(19) The outcome of the market investigation provides strong indications that the market for the manufacture and supply of Cultures should be segmented and that in particular the manufacture and supply of Cultures for Meat, Dairy Cultures and Cultures for Plant-based food each constitute a distinct product market.

(20) The majority of respondents to the market investigation consider that Cultures for Meat, Dairy Cultures and Cultures for Plant-based food constitute three separate markets due to their limited substitutability in terms of properties, modes of action, applications and/or price. While the majority of customers answered with ‘I do not know’, the majority of customers expressing their opinion indicated that a consideration of three separate markets is appropriate.16 A majority of competitors also considers this distinction appropriate.17

(21) While one customer indicated that ‘[c]ulture development is a competence that can be applied to several areas of expertise’,18 another customer explained that ‘these are really 3 different markets (dosage of application, technology, people…)’.19 Another customer explained that ‘[t]he respective cultures show other functionalities and other requirements depending on the application’.20 A further customer mentioned that ‘the cultures are mainly distinguished by their different application technology and the need for advice. In part there are also significant differences in regulatory/qualitative requirements […]’.21 While one competitor stated that ‘[s]uppliers of cultures can in principle produce both meat and dairy cultures even though these two cultures are not interchangeable as regards their use in meat and dairy products’,22 it also indicated that in its view, ‘cultures for meat, dairy cultures and cultures for plant-based food constitute three different product segments. While the culture-base may be related with ability to leverage scale and know-how across the product segments, the underlying properties and modes of action of the cultures in the various applications differ’.23

(22) Further, while a majority of customers answered with ‘I do not know’, a majority of customers expressing their opinion do not consider suppliers of Cultures to be able to switch production across Cultures for Meat, Dairy Cultures or Cultures for Plant- based food, within a short period of time and without incurring significant additional costs.24 While one customer explained that ‘[s]witching is possible in case required know-how is available. Process/fermenters are similar’,25 other customers disagree. One customer cautioned and explained that it is ‘[p]ossible, however, with limits of sufficient cleaning. Also particular attention to labels respect such as vegan, halal, kosher etc and image/reputations risks if manufactured within one plant’.26 Another customer stated that ‘in part there are large differences in qualitative requirements […] which have a significant impact on the production’.27

(23) Competitors’ responses to this question are conflicting, with one competitor stating that ‘[i]n general, we consider there to be a high degree of supply-side substitution between said segments, mainly due to the above-mentioned ability to leverage scale and know-how across the various product segments by key suppliers in the market’.28 However, another competitor stated that the ‘[c]ost of requalification is considered to be high’.29

(24) While responses to the market investigation are not conclusive, they suggest a lack of demand-side substitutability and at best limited supply-side substitutability. It therefore appears that a distinction between separate markets for the manufacture and supply of Cultures for Meat, Dairy Cultures and Cultures for Plant-based food could be appropriate.

(25) However, the outcome of the market investigation is less conclusive with respect to whether a further distinction of the markets for the manufacture and supply of Cultures for Meat and Dairy Cultures (where the Parties overlap) either by type of culture or by end product would be appropriate.

(26) With respect to Cultures for Meat, while the majority of customers answered ‘I do not know’, the majority of customers expressing their opinion submit that the technology and know-how used in the production of acidifying, surface and protective Cultures for Meat are similar.30 A customer explained this by referring to the ‘[s]ame type of fermenters and know-how’.31 Another customer indicated that ‘all are produce[d] by fermentation, the way[s] to c[h]aracterize them are quite similar’.32 While competitors’ responses to this question are overall inconclusive, one competitor stated that ‘[b]roadly speaking, the culture-base and related know-how within the mentioned sub-segments of meat cultures are based on the same technology platform’.33

(27) To the question whether a supplier of a certain sub-type of Cultures for Meat (acidifying, surface or protective Cultures) can switch production to another sub-type in the short term and without incurring significant additional costs, responses from customers and competitors are inconclusive. While a customer explained that it thinks ‘a [switch] is difficult’,34 a competitor indicated that the sub-types of Cultures for Meat ‘are based on the same production and technology platforms’.35

(28) As regards the question whether a segmentation of the market for the manufacture and supply of Cultures for Meat by end-product would be appropriate, responses from customers and competitors are inconclusive. In response to the question of whether a supplier of Cultures for Meat can switch production across end applications, e.g. Dried and Semi-Dried Sausages, Dried Cured Ham or Cooked Meat, without incurring significant additional costs, a customer explained that ‘to find a new culture you have a long product development with expensive laboratory costs’.36 A competitor however stated that such Cultures for specific end-products ‘are based on the same production and technology platforms’ and that in its view, ‘cultures for meat constitute an overall market segment’.37

(29) Therefore, while it cannot be excluded that a further distinction of the market for the manufacture and supply of Cultures for Meat may be appropriate, the outcome of the market investigation does not conclusively support such a further distinction.

(30) With respect to Dairy Cultures, while the majority of customers answered ‘I do not know’, the majority of customers expressing their opinion submit that the technology and know-how used in the production of Dairy Culture sub-types such as acidifying, protective for fresh dairy, ripening for cheese and probiotic Cultures for fresh dairy are similar.38 While one customer stated that there are ‘[d]ifferent consumer needs and different manufacturing process[es]’,39 another customer explained that such sub-types utilise the ‘[s]ame basic processes, obviously with specific requirements for each area’ and that the ability to switch from Dairy Culture sub-types ‘depends on generally available knowledge within company and available equipment’.40 Another customer also submitted a nuanced answer, stating that the sub-types of Dairy Cultures utilise the ‘[s]ame type of fermenters, but for other fermentation process[es] and nutrients, specific knowledge [is] necessary’.41 Competitors’ responses to this question are overall inconclusive, yet one competitor stated that ‘[b]roadly speaking, the culture-base and related know-how within the mentioned sub-segments of dairy cultures are based on the same technology platform’42 and another remarked that it ‘[s]uppose[s] an unique technology and know-how is used’.43

(31) When asked whether a supplier of a certain sub-type of Dairy Cultures (acidifying, protective for fresh dairy, ripening for cheese, probiotic Cultures for fresh dairy) can switch production to another sub-type in the short term and without incurring significant additional costs, customers and competitors provide inconclusive responses. One customer stated there are ‘[d]ifferent manufacturing process[es]’.44 Another customer stated that there are ‘specific requirements for each area’ and further that in any case it is important for the manufacturer to pay ‘particular attention to labels […] such as vegan, halal, kosher etc and image/reputations risks if manufactured within one plant’.45 A competitor however pointed out that all these sub-segments of Dairy Cultures ‘are based on the same technology platform’ and that ‘[t]his is confirmed by the fact that all key suppliers in the industry have offerings within all of these sub-types of cultures’.46

(32) Therefore, whereas it cannot be excluded that a more refined product market, leading to a further segmentation of the market for the manufacture and supply of Dairy Cultures, may be appropriate, the outcome of the market investigation does not conclusively support such a further segmentation.

(33) In conclusion, the Commission considers that, for the purposes of this Decision, it is appropriate to assess separately the markets for Dairy Cultures, Cultures for Meat and Cultures for Plant-based food. In any event, the exact scope of product market definition with respect to Cultures can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition.

4.1.2. Relevant Geographic Market

(34) The Commission has not previously defined a geographic market for Cultures.

(35) The Parties submit that the market for Cultures should be defined as worldwide in scope, because suppliers of Cultures have manufacturing plants in all regions of the world and therefore can and do serve their customers on a worldwide basis.47

(36) The outcome of the market investigation on the question whether an EEA or worldwide geographic market definition for Cultures is appropriate, is inconclusive.

(37) Whereas the majority of customers answered ‘I do not know’, the majority of customers expressing their opinion consider the conditions of competition (such as same suppliers, quality and price) to be generally the same in the EEA with respect to Dairy Cultures, Cultures for Meat and Cultures for Plant-based food.48 While one customer states that ‘[w]ithin the area of cultures […] the global players are limited an[d] thereby present in the entire world with more or less equal conditions’,49 another customer submits that from its point of view with respect to dairy cultures, ‘the conditions for healthy competition are given in the EEA’.50

(38) In contrast, while the majority of competitors answered ‘I do not know’, the majority of competitors expressing their opinion consider the conditions of competition to be generally the same worldwide with respect to Dairy Cultures, Cultures for Meat and Cultures for Plant-based food.51

(39) Considering their own procurement of Diary Cultures, Cultures for Meat and Cultures for Plant-based food, whereas a majority of customers answered ‘I do not know’, a majority of customers expressing their opinion indicate the EEA as the relevant geographic scope.52 One customer explicitly stated that it ‘buy[s] Cultures via N&B and manufactured in Europe’.53 While the majority of competitors answered ‘I do not know’, those that provided substantive answers submit that the scope of their company’s sales for Dairy Cultures, Cultures for Meat and Cultures for Plant-based food is worldwide.54 One competitor stated that it ‘operates globally in more than 140 countries’.55

(40) In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to Cultures can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

4.2. Plant-based Proteins

(41) Plant-based Proteins are ingredients derived from plant sources, such as soy, wheat, pea, maize, corn, grains, canola, hemp, mung bean, rice, potato, algae, fungi, etc. They are mainly offered as Isolates, Concentrates, or Textured types, which have each varying percentages of protein content, forms (grain or powder), and technologies applied in the manufacturing process. Plant-based Proteins are used across a variety of applications, including food and beverage, health, infant nutrition, pet food, and animal feed. In the food industry, Plant-based Proteins can be used either as meat substitutes or as an additional bulking agent in meat products to reduce the overall cost.56 Further, Plant-based Protein is often used as an ingredient for Active Nutrition, which includes protein fortified snack bars and protein beverages (such as protein shakes) that are largely used for weight management purposes and as sports and fitness nutrition.

(42) While both the N&B Business and IFF manufacture and sell Plant-based Proteins, in particular Soy-based Proteins, their activities overlap only to a limited extent given IFF’s minor activities in this area. IFF purchases Plant-Based Proteins, including SPI [details on IFF’s purchases and supply sources], for use in its production of Food Inclusions and Systems.

4.2.1. Relevant Product Market

4.2.1.1. The Commission’s decisional practice

(43) The Commission has previously considered a market for protein products obtained from oilseed and other sources which would in particular include soy products. The Commission noted that there is a degree of substitutability with other products, such as milk products, fish products, eggs, peas, but also significant demand and supply- side substitutability with other plant sources such as grains, maize, and corn.57

(44) More recently, the Commission left open whether protein products could also encompass oilseed meals or if a more narrow market for soy protein products including soy meal or maybe just for soy bean meal should be defined.58 The Commission further considered whether each individual soy protein product, namely, soy flour protein, textured soy protein (‘TSP’), soy protein concentrates (‘SPC’), and soy protein isolates (‘SPI’), could form separate segments — while noting that there was a considerable degree of demand-side substitutability between the different types—but ultimately left the product market definition open.59

4.2.1.2. The Parties’ views

(45) The Parties submit that the Plant-based Protein market should not be segmented by the source of the protein, and that, in particular, soy-based proteins should not be considered a separate market product.

(46) From a demand-side perspective, the Parties argue that consumers’ demand for vegetable protein is not specific to soy, that there is considerable interest in novel Plant-based Protein sources, and that food manufacturers often label their products therefore as “plant protein” or “vegetable protein” instead of “soy protein”. Further, they contend that plant protein prices are generally correlated with their protein content and product functionality and not only with the protein source. They submit that most of these Plant-based Proteins are used in a similar technical manner in the same applications as soy protein, such as meat alternatives, processed meats, beverages, nutrition bars, dairy-alternatives, etc. In addition, the Parties contend that pea protein in particular is attracting an increasing demand due to changing consumer preferences and is increasingly used as a source for Plant-based Protein.

(47) From a supply-side perspective, the Parties argue that several large companies are increasingly active in both soy and pea proteins. In addition, they contend that soy protein production facilities can be used for the production of pea proteins.

(48) Further, the Parties submit that segmentation by protein type (isolated, textured, concentrated, flour) would not be appropriate, given the degree of demand-side substitutability between the individual product types.

(49) They contend that this is particularly true for protein concentrates and protein isolates such as SPC, SPI, pea protein concentrates (“PPC”), and pea protein isolates (“PPI”) since these products are applied in a similar fashion and for similar end uses. They argue that, as a result, the majority of SPI sold globally is sold in direct competition with SPC and that therefore, SPC pricing dynamics impact SPI.

(50) Finally, the Parties submit that the Plant-based Proteins market generally should not be divided into segments by application due to the following considerations on demand-side and supply-side substitutability.

(51) From a demand-side perspective, the Parties argue that Plant-based Proteins can be used across several applications. For example, Plant-based Protein concentrates and isolates can be used for meat and meat substitute applications, for snacks and beverages for Active Nutrition, and for other applications such as instant meals, bakery applications, etc.

(52) From a supply-side perspective, the Parties argue that many sophisticated suppliers such as Archer Daniels Midland (“ADM”), Cosucra, and Roquette as well as an increasing number of Chinese suppliers such as Gushen and Goldensea already currently supply protein products across most or all major end applications. In addition, they contend that many competitors in the SPC / SPI segment have the capabilities to upgrade their portfolio and enter additional segments such as Active Nutrition. If one were to consider separate segments based on a distinction by end application, the Parties would consider, mainly because of limited demand-side substitutability, a potential segmentation of the Plant-based Protein market between: (i) animal feed, (ii) meat and meat substitute applications, (iii) Active Nutrition, (iv) bakery, and (v) others.

(53) As regards Plant-based Proteins for Active Nutrition the Parties submit that, for reasons of demand-side and supply-side substitutability they should not be further segmented between products used in beverages and those used in snacks: there is limited difference between the Plant-based Proteins used in beverage applications and snack applications and customers of Plant-based Proteins for Active Nutrition typically buy the same ingredient for use in protein bars and protein shakes.

(54) In any event, the Parties submit that the exact product market definition can be left open on the ground that the Transaction does not give rise to any competitive concerns under any plausible product market definition.

4.2.1.3. The Commission’s assessment

(55) The outcome of the market investigation suggests that the market for the supply of Plant-based Proteins could be segmented by source of Plant-based Protein, by type of Plant-based Protein, and by end application.

(56) As regards the source of Plant-based Protein, overall, a vast majority of respondents expressing an opinion in the market investigation indicated that Plant-based Proteins from soybean constituted a separate market due to limited demand and supply substitutability.

(57) A majority of customers expressing an opinion indicated that Soy-based Proteins are not interchangeable with Plant-based Proteins from other sources in terms of their characteristics, modes of action and intended use.60 The majority of competitors took the same view.61

(58) One customer pointed out in this respect that “[e]ach specific protein source has its specific nutritional profile, functionality as flavor.”62, while another explained that “[t]he interchangeability is pretty much associated with final product application, meaning that proteins from different sources will deliver different product characteristics and characteristics will need to be modified in the rest of the formulation.”63

(59) While one competitor commented that “[s]ome proteins are interchangeable but it depends upon the application and properties required. Each protein has pros and cons.”64, another explained that “[s]oy provides a broad range of functionalities at a competitive price. While functionalities partly have been matched by other plant proteins those usually have a weak point regarding price competitiveness. From a purely technological reason it is therefore difficult to replace soy. Considering additional aspects such as sustainability, labelling there are alternatives to soy.”65

(60) The majority of customers expressing an opinion indicated that suppliers of Plant- based Proteins are not able to switch production between the different plant-protein sources in a limited period of time and without incurring into significant additional costs.66 The majority of competitors took the same view.67

(61) On this point, a customer replied: “Technically Yes but cross contamination (Allergen control) is huge and therefore manufacturing sites are generally specific and only manufacturing sites are generally specific and only manufacture one type in a facility to avoid costly clean downs and testing to ensure no potential for cross contamination.”68, while another commented that “the proteins have different behaviour and thus typically require a fundamentally new recipe development with all associated cost. Plus, prices of different plant-based proteins differ significantly.”69

(62) For its part, a competitor commented: “To the best of my knowledge, suppliers are usually focused on one protein so their equipment is usually set up to process that. In addition, here may be issues with accessing raw materials to process”70, whereas another competitor indicated that “[s]witching between the different proteins within a short time is not feasible. While similar processes are applied significant adjustments need to be made which requires time and money”, while acknowledging that “[a]dapting an existing plant and fully switching to a different raw material is possible. A direct switch may be considered for protein sources that are very closely related (e.g. pea and faba bean)”.71

(63) As regards a segmentation by type of Plant-based Proteins (isolates, concentrates, textured and flour), respondents to the market investigation generally submitted that this was warranted, due to limited demand and supply substitutability.

(64) The majority of customers expressing an opinion stated that different types of Plant-based Proteins are not interchangeable with one another, taking into consideration their intended use.72 The majority of competitors took the same view.73

(65) A customer commented on this issue that “[a]ll the mentioned products have unique properties and functionalities and perform very differently in application.”74, while another explained that “[t]he protein content and purity levels are different between these ingredients and will limit the interchangeability of each.”75

(66) One competitor explained that “[w]hile not fully interchangeable certain replacement of one by the other is possible if the application is adapted accordingly”76, while another commented: “Each protein type has its own specific uses.”77 Another remarked: “In my view, they have different functionality and applications”78.

(67) While a large majority of customers replied that they did not know the answer to this question, the majority of those expressing an opinion indicated that suppliers of Plant-based Proteins are not able to switch production between the different plant- protein sources in a limited period of time and without incurring significant additional costs.79 The majority of competitors took the same view.80

(68) A customer commented on this point: “Set up costs will be significant to change”81. A competitor explained: “Flours and concentrates are generally made together (a dry process). Isolates (a wet process) are made on completely different equipment. Either flours, concentrates or isolates (or combinations) can be used as the feedstock for texturised proteins.”82, while another stated: “It can be expected that the know-how is sufficient to enter a new category. Switching from one to the other is not feasible as different technologies are involved”83.

(69) As regards a segmentation by application of Plant-based Proteins, such as meat substitutes or active nutrition, the replies from respondents to the market investigation generally indicated that this would be warranted.

(70) On the question whether the manufacturing processes and quality and safety requirements differ across the various applications of Plant-based Proteins a majority of customers replied that they did not know the answer, but a majority of those expressing their opinions said that this was the case.84 A majority of competitors took the same view.85

(71) A customer explained: “Cross contamination is a big issue and manufacturers have to go to great length to ensure the product is free from "Contamination". Quality and testing plays a big role. Manufacturing set ups could be similar for multiple raw materials.”86, while another specified: “Quality and safety requirements are different between food, feed and infant nutrition for example.”87 A competitor commented: “Manufacturing process strongly impacts the performance in application. The requirements on manufacturing and quality are stricter for critical applications where technical performance is key or applications which target special target groups”.88

(72) On the question whether a supplier could switch its production to serve a different application in a short period of time and without incurring significant additional costs, the majority of customers replied that they did not know the answer to the question, but themajority of those expressing their opinion said that this was not possible.89 The majority of competitors took the same view.90

(73) A customer explained: “It would never be advised. Food nutrition is and will always have very strict parameters and manufacturing a food ingredient in the same location as animal ingredients would not be or should not be allowed.”91 A competitor commented: “Cost to change from feed protein to food-grade can be very high - potentially a complete re-build.”92 , while another explained “Changing from feed to food production will require significant adaptations to process as well as safety/quality requirements. Active nutrition will therefore be significantly more difficult to target”.93

(74) The results of the market investigation suggest a degree of supply-side substitutability among various applications based on the source of protein. On the question whether each source of Plant-based Protein such as soy or peas can be used in different applications such as meat/meat substitutes, active nutrition, bakery or animal feed, the majority of customers indicated that this was the case.94 A majority of competitors expressing their opinions took the same view.95

(75) A customer indicated that different Plant-based Protein sources may be used for the same application but that Soy-based Proteins are not substitutable by other sources in certain applications: “Soy Based proteins have unique properties both nutritionally and functionally. it is possible that in certain applications they are not interchangeable. But in certain applications they can be substituted.”96, while a competitor commented “It is possible to use the different protein sources in all/most applications. Differences may include taste - which can be helped with flavours / taste modulators.”97

(76) It follows from the above, and in the light of the results of the market investigation, that within the area of Plant-based Proteins it is appropriate to distinguish separate markets for the supply of Plant-based Proteins, segmented by source, type, and application.

(77) In conclusion, the Commission considers that, for the purposes of this Decision, it is appropriate to assess the market for Plant-based Proteins, distinguishing between (i) separate markets for the supply of Plant-based Proteins, segmented by type, in particular Soy-based and Pea-based Isolates and Concentrates; (ii) separate markets for the supply of Soy-based Proteins, segmented by type, in particular SPI, SPC and TSP; and (iii) separate markets for the supply of Plant-based Proteins, segmented by application, in particular meat substitutes and active nutrition, including snacks and beverages. In any event, for the purposes of this Decision, the exact scope of the product market definition with respect to Plant-based Proteins can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition.

4.2.2.Relevant Geographic Market

(78) In previous decisions, the Commission found the market for Plant-based Proteins to be at least EEA-wide in scope. While for certain products transport costs may limit the distance over which they can be transported at economically viable costs, they are traded on international commodity markets and are not subject to trade barriers.98

(79) The Parties submit that these considerations remain valid today and that the markets for Plant-based Protein may be global in scope. In any event, the Parties submit that the exact geographic market definition can be left open as the Transaction does not give rise to any competitive concerns irrespective of the exact market definition.

(80) The outcome of the market investigation on the question whether an EEA or worldwide geographic market definition for Soy-based Proteins is appropriate, is not entirely conclusive, but provides certain indications suggesting a global scope.

(81) As regards the geographic scope in which the conditions of competition (such as suppliers, quality and price) are generally the same with regard to Soy-based Proteins, a majority of customers replied that they did not know the answer to the question. Among the customers who expressed an opinion an equal number considered this to be EEA-wide and to be global.99 Similarly, while a majority of competitors replied that they did not know the answer to the question, an equal number of competitors expressing an opinion considered the geographic scope of Soy-based Proteins markets to be EEA-wide and to be global.100

(82) With regard to Plant-based Protein overall one customer commented: “For all ingredients (with the exception of Plant Proteins) there is competition available on a worldwide basis. For plant based proteins, the suppliers tend to use a regional specific portfolio and pricing strategy”101, while a competitor explained: “Plant protein producers compete on global level with additional smaller local producers in certain areas”102. However, another competitor considered Soy-based Proteins markets to be global in contrast to Plant-based Protein markets in general, deemed more regional: “Most markets are global with the exception of proteins which tend to be more regional. Soy proteins, lecithin are global”.103

(83) As regards their own procurement of Soy-based Protein a majority of customers replied that they did not know, but a majority of those expressing their opinion said that they purchase such ingredients on a global scale.104 Similarly, as regards their own sales of Soy-based Proteins, a majority of competitors replied that they did not know, but a majority of those expressing an opinion stated that they sold those ingredients on a worldwide basis.105 One competitor commented that it “markets plant-based proteins (soy and pea) and lecithin globally”.106

(84) In the light of those responses, the outcome of the market investigation provides certain indications suggesting that a worldwide rather than an EEA-wide geographic market definition is appropriate as regards Soy-based Proteins.

(85) In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to Soy-based Proteins can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

4.3. Gums

(86) Gums are a type of hydrocolloids, which are additives that react with water to form gels, pastes, and emulsions. They are used to impart creaminess, thickness, and viscosity, in a variety of industries including food and beverage and personal care. In particular, Gums are used to improve the texture and / or mouth feel of the end product.

(87) N&B manufactures and sells guar gum, locust bean gum, xanthan gum and gellan gum. IFF does not manufacture any gums but purchases […] locust bean gum [details on IFF’s purchases and supply sources] for application in its Systems and Food Inclusions.

4.3.1. Relevant Product Market

4.3.1.1. The Commission’s decisional practice

(88) The Commission has not previously considered possible market definitions for Gums.

4.3.1.2. The Parties’ views

(89) The Parties submit that all sources of gum should be included in the same market and that a further segmentation of the gum market by different sources is not warranted. In any case, they contend that the exact product market definition for gums can be left open as the Transaction does not give rise to any competitive concerns irrespective of the exact market definition.

(90) From a demand-side perspective, the Parties submit that Gums from different sources serve the same function, i.e., to improve the texture and / or mouth feel of the end product. While there may be certain differences in the price and specific properties of Gums from different sources, they contend that customers can and do substitute Gums from different sources for different applications. They submit that while there are certain niche applications, e.g., non-regurgitation milk for babies where only one source of Gum is used, generally Gums from different sources share the same function. The Parties contend that even in these niche applications, gums may compete with other texturants such as starches and gelatin.

(91) From a supply-side perspective, the Parties contend that suppliers of Gums are typically active in Gums from several sources. They submit that multinational suppliers with diversified portfolios such as the N&B Business, Tate & Lyle and Cargill and even niche players such as LBG Sicilia, Polygal and CPKelco typically supply Gums from various sources.

4.3.1.3. The Commission’s assessment

(92) The outcome of the market investigation suggests that the market for the supply of Gums should be segmented by source of gum, in particular locust bean, and provides some indications that a segmentation by end application, in particular infant nutrition, could be warranted.

(93) As regards the source of gum, a majority of respondents expressing an opinion in the market investigation submitted that gums from locust bean constituted a separate market due to limited demand and supply substitutability.

(94) A majority of customers expressing an opinion indicated that Locust Bean Gums (LBG) are not interchangeable with gums from other sources (e.g. guar gum, xanthan gum and gellan gum) in terms of properties, intended use, mode of action and/or price.107 A majority of competitors considered that Locust Bean Gum is interchangeable, but only with certain other gums.108

(95) One customer pointed out that “[t]he functional characteristics of LBG are very specific, also synergy possibilities with other hydrocolloids are very specific for this product group” 109 while another explained that “LBG is not interchangeable due its specific abilities in the stabilization process of a fruit preparation.”110

(96) A competitor stated: “In certain applications substitution is fully or partially possible”111, while another explained: “The interchange is rarely 1 to 1. It is application dependent. LBG can be replaced by a combination of other gums such as Tara, if customer is willing to adjust their formulation and differences in texture and stability are acceptable.”112

(97) A majority of customers expressing their opinion said that suppliers of hydrocolloids gums are not able to switch production between Gums from different sources (locust bean, guar, xanthan and gellan gums) within a short period of time and without incurring significant additional costs.113 A majority of competitors took the same view.114

(98) A customer replied: “Not necessarily, since extraction process can differ quite a lot – from cleaning, separation to extraction itself. Also feedstocks origination differ, and it’s an advantage to have to production closer to farming area.”115, while another commented that “switching between guar and locust bean gum would be possible to our best knowledge. Others are not possible due to other technology.”116

(99) A competitor commented: “Gums come from different sources. Manufacturing plants and process lines are built and adapted to the specific hydrocolloid you are trying to produce”. 117

(100) On the question whether other texturants such as starches and gelatin can be used instead of Locust Bean Gum for certain applications, the results of the market investigation are inconclusive. There was no majority among customers or competitors expressing their opinion to confirm or reject this possibility, nor to suggest that other substitutes may exist.118

(101) One customer indicated that [starch and gelatin are “very different raw material, which does not give the same outcome of stability/consistency/desired outcome”119, whereas another stated: “When LBG is combined with guar or xanthan gum for gelling properties, it could be replaced by gelatin, for general thickening reasons.The functionality of LBG could be substituted by using certain starches”.120

(102) As regards a further segmentation of Locust Bean Gum by end application, such as infant nutrition, the results of the market investigation generally suggest that this is warranted due to limited demand-side and supply-side substitutability.

(103) A majority of customers expressing their opinion said that the market for Locust Bean Gum should be further segmented by end applications, such as infant nutrition, either because not all Locust Bean Gum can be used for the same application or because suppliers need specific technology and/or know-how and there are different certification processes.121 Among the very few competitors who expressed an opinion, there was no majority to confirm or reject such further segmentation.122

(104) A customer stated: “IFT [infant nutrition] application requires different handling than non IFT”, while another commented: “Suppliers need specific technology and/or know-how and there are different certification processes.”123

(105) A competitor explained: “There is refined lbg on the market as well that is different than crude lbg targeting specific applications (e.g water gels that need clarity); N&B manufacture lbg and refined lbg.”124

(106) In the light of the above considerations and taking account of the results of the market investigation, it is appropriate to distinguish separate markets for the supply of Gums, segmented by source and separate markets for the supply of Locust Bean Gum, segmented by application.

(107) In conclusion, the Commission considers that, for the purposes of this Decision, it is appropriate to assess the market for Gums, distinguishing between separate markets for the supply of Gums, namely: (i) a separate market, segmented by source, in particular for the supply of Locust Bean Gum; and (ii) a separate market for the supply of Locust Bean Gum, segmented by application, in particular for the supply of infant nutrition. In any event, for the purposes of this Decision, the exact scope of the product market definition with respect to Gums can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition.

4.3.2. Relevant Geographic Market

(108) In previous cases where the Commission examined the possible market definition for hydrocolloids, it found that the markets were at least EEA-wide, in some cases worldwide in scope.125

(109) The Parties submit that the relevant geographic market for Hydrocolloids and any potential sub-segments is at least EEA-wide, if not worldwide in scope.

(110) In any event, the Parties submit that the exact product market definition can be left open as the Transaction does not give rise to any competitive concerns irrespective of the exact market definition.

(111) The outcome of the market investigation on the question whether an EEA or worldwide geographic market definition for Locust Bean Gum is appropriate is not entirely conclusive, but provides indications suggesting a global scope.

(112) Asked about the geographic scope in which the conditions of competition (such as same suppliers, quality and price) are generally the same with regard Locust Bean Gum, while the majority of customers replied that they did not know the answer to the question, a majority of customers expressing their opinion considered this to be global.126 Similarly, the majority of competitors replied that they did not know the answer to the question, while the majority of competitors expressing their opinion considered the geographic scope of Locust Bean Gum markets to be global.127

(113) One customer commented on this point: “Within the area of cultures and enzymes the global players are limited and thereby present in the entire world with more or less equal conditions. Locust bean gum and emulsifiers are located in the same manner as cultures and enzymes and are therefore also equal in setup”128.

(114) As regards their own procurement of Locust Bean Gum the majority of customers replied that they did not know, but the vast majority of those expressing their opinion said that they purchase such ingredients on a global scale.129 One customer commented on this point: “LBG, guar gum and enzymes are bought for all global affiliates on all continents”.130

(115) As regards their own sales of Locust Bean Gum, a large majority of competitors replied that they did not know, while a small majority of those expressing an opinion stated that they sold those ingredients on a basis other than global or EEA-wide.131

(116) In the light of the above responses, the Commission considers that the market investigation has provided valid indications suggesting that a worldwide rather than an EEA-wide geographic market definition is appropriate as regards the supply of Locust Bean Gum.

(117) In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to Gums can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

4.4. Microcrystalline Cellulose

4.4.1. Relevant Product Market

(118) Microcrystalline cellulose (‘MCC’), also known as cellulose gel, is manufactured from pure, depolymerized alpha cellulose. The gel is then dried to produce a powder. MCC is used primarily in pharmaceuticals, as an excipient, but also in food applications as a stabilizer, opacifier, to add viscosity and texture. N&B manufactures and sells MCC for both pharmaceutical and food applications. IFF only uses MCC for food applications in the manufacturing of its Functional Ingredient Systems and Flavours.

(119) In a previous decision, the Commission considered that MCC was part of a pharmaceutical excipients market.132 More recently, the Commission considered whether there was a distinct product market for all different kinds of MCC but ultimately left the product market definition open.133

(120) The Parties acknowledge that for food ingredient manufacturers colloidal and non- colloidal are not interchangeable, as the later does perform the function that food ingredient manufacturers look for. Non-colloidal MCC is mainly used in the pharmaceutical applications and/or nutraceuticals.134 Based on supply substitutability reasons, the Parties however submit that there is one single MCC product market comprising both MCC for pharmaceutical and food applications.135

(121) The market investigation results are however not conclusive. While some customers and competitors indicated that it is possible for suppliers to switch production without incurring in significant additional costs and within a limit period of time, others suggested that a switch from food to pharmaceutical applications is more difficult than from pharmaceutical to food applications given the more stringent regulatory requirements regarding MCC for pharmaceutical applications.136 More importantly one customer stressed that “there is more competition in the supply of MCC used in the food industry and prices are lower.”137

(122) In any event, for the purposes of this Decision, the exact scope of product market definition with respect to MCC can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition.

4.4.2. Relevant Geographic Market

(123) In a previous decision, the Commission considered that the pharmaceutical excipients market including MCC was essentially EEA-wide.138 Later, the Commission considered that a MCC product market was at least EEA wide in scope, if not worldwide, but ultimately left the exact geographic definition open.

(124) The Parties submit that the geographic market is worldwide. A small majority of customers and competitors who expressed a view considered also the market to be worldwide in scope. 139 In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to MCC can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

4.5. Emulsifiers

(125) An emulsifier is a substance that prevents the separation of immiscible compounds by increasing the kinetic stability of a mixture. Emulsifiers have the ability to stabilise emulsions, i.e., a mix of hydrophilic (e.g., water) and hydrophobic (e.g., oil) substances. Emulsifiers can be synthetic (e.g. sourced from vegetable oils, sugar alcohols, organic acids and glycerol) or natural. The most common natural Emulsifiers are Lecithin-derived.

(126) N&B manufactures and supplies Lecithin-derived and synthetic Emulsifiers, primarily for food applications. IFF sources Emulsifiers including natural Emulsifiers like Lecithin, but also synthetic Emulsifiers like Distilled Monoglycerides (‘DISMO’) and Diacetyl Tartaric Esters of Monoglycerides (‘DATEM’). IFF only sources food grade Emulsifiers.

4.5.1. Relevant Product Market

4.5.1.1. The Commission’s decisional practice

(127) In a previous decision, the Commission considered synthetic Emulsifiers and Lecithin-derived Emulsifiers to belong to separate product markets.140

(128) With respect to synthetic Emulsifiers, the Commission has in a previous decision considered possible separate product markets for the following types of synthetic Emulsifiers: DATEM, mono-diglycerides and DISMO.141 The product market definition was however ultimately left open.

(129) With respect to Lecithin-derived Emulsifiers, the Commission has in a previous decision considered a distinction between ‘Special’ Fluid Lecithin (destined for specific applications), De-Oiled Lecithin (typically used in food applications (oil and fat spreads, instant products, bakery) and the health and nutrition segments (food additives, sports nutrition)), and Fractioned Lecithin (mainly used for sophisticated non-food applications such as pharmaceuticals, cosmetics, and personal care products). It has further distinguished between genetically modified (‘GM’) and non- GM Lecithin-derived Emulsifiers.142

4.5.1.2. The Parties’ views

(130) Aside of the product market distinction’s discussed in the Commission’s precedent decisions, the Parties explain that with respect to synthetic Emulsifiers a distinction by chemical class could be considered: Esters Emulsifiers (including DATEM), DISMO, Fatty acids Emulsifiers, Other Synthetic Emulsifiers (including mono- diglycerides).143

(131) The Parties submit that the product market definition with respect to Emulsifiers can be left open, as the Transaction does not give rise to competition concerns irrespective of the exact market definition.144

4.5.1.3. The Commission’s assessment

(132) While a majority of customers responding to the market investigation answered with ‘I do not know’, a majority of customers expressing their view consider that synthetic Emulsifiers and Lecithin-derived Emulsifiers belong to separate markets.145 A majority of competitors expressing their opinion also endorse this distinction.146 In this context a customer dissents and states that ‘[b]oth product groups are used in similar applications’.147 However another customer states that in its ‘experience the two category[ies] are different for performance in our application and cannot be interchange[d]’.148 A competitor explains that ‘synthetic emulsifiers and the lecithin- driven emulsifiers have a completely different chemistry (chemical molecule classes) with different functionalities, and thus related production processes and value chains and scope of application are completely different’.149 A further competitor states that ‘[c]ustomers don’t use them interchangeably’.150

(133) With respect to Lecithin-derived Emulsifiers, while majorities of customers and competitors answered with ‘I do not know’, majorities of customers and competitors expressing their opinion consider it appropriate to distinguish between Special Fluid Lecithin, De-Oiled Lecithin and Fractioned Lecithin Emulsifiers.151 A customer in this context submits that ‘[t]hey are indeed used for specific applications as mentioned’.152

(134) With respect to synthetic Emulsifiers, while a majority of respondents answered ‘I do not know’, small majorities of customers and competitors expressing their opinion consider a further distinction by chemical class (e.g. Esters Emulsifiers, DISMO, Fatty acids Emulsifiers) appropriate.153 In this context, one customer states that ‘different type[s] of emulsifiers provide for different functionalities’.154 However, another customer explains that while ‘[t]he products are not interchangeable (different functionalities) [they] are all used in the same and similar market segments’.155

(135) While replies from customers are inconclusive, a majority of competitors expressing their opinion consider that suppliers of a given chemical class of synthetic Emulsifier are not able to switch their production to another chemical class without incurring significant additional costs and to do so in a short period of time.156 In this context one competitor explains that the ‘[p]roduction set-up for different emulsifiers can be very different; e.g. related to corrosiveness of acids used in esterification; distilliation temperatures etc’.157 Another customer states that ‘[i]n many cases the manufacture of these ingredients utilise different equipment and chemistry making it difficult to switch’.158

(136) Therefore, on the basis of the responses to the market investigation, it appears that a distinction between different types of Lecithin-derived remains appropriate and further that a distinction between different chemical classes of synthetic Emulsifiers is likely appropriate.

(137) In any event, for the purposes of this Decision, the exact scope of product market definition with respect to Emulsifiers can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition

4.5.2. Relevant Geographic Market

(138) In previous decisions, discussion synthetic Emulsifiers, the Commission found the geographic market to be at least EEA-wide.159 With respect to GM ‘Special’ Fluid Lecithin Emulsifiers and GM De-Oiled Lecithin Emulsifiers, the Commission considered a worldwide market, while with respect to non-GM ‘Special’ Fluid Lecithin Emulsifiers and non-GM De-Oiled Lecithin Emulsifiers it considered an EEA-wide market.160

(139) While the Commission has not previously considered a geographic market for Fractioned Lecithin, the Parties submit that it should similarly be at least EEA-wide if not worldwide in scope. In any event, the Parties submit that the geographic market definition with respect to Emulsifiers can be left open, as the Transaction does not give rise to competition concerns irrespective of the exact market definition.161

(140) The outcome of the market investigation on the question whether an EEA or worldwide geographic market definition for Emulsifiers is appropriate, is inconclusive.

(141) While a large majority of customers answered ‘I do not know’, the majority of customers expressing their opinion submit that for synthetic Emulsifiers and for Lecithin-derived Emulsifiers the geographic area where conditions of competition are generally the same is worldwide. While a large majority of competitors answered ‘I do not know’, a majority of competitors expressing their opinion considers the conditions for competition to be generally the same in the EEA for synthetic Emulsifiers and worldwide for Lecithin-derived Emulsifiers.162

(142) Considering the scope of their own procurement of synthetic and Lecithin-derived Emulsifiers, while a majority of customers answered ‘I do not know’, a majority of customers expressing their opinion consider it to be worldwide. Those competitors providing substantive answers also consider their sales to have a worldwide scope.163

(143) Therefore, on the basis of the responses to the market investigation, it appears that a worldwide geographic market definition with respect to Emulsifiers may be most appropriate.

(144) In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to Emulsifiers can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

4.6. Enzymes

4.6.1. Relevant Product Market

(145) Enzymes are biological catalysts that regulate the rate at which chemical reactions proceed in living organisms. They can be used as ingredients and as processing aids in a variety of applications.

(146) The Parties submit that Industrial Enzymes and naturally extracted enzymes (known as Specialty Enzymes) belong to different product markets. According to the Parties, these two types of enzymes are used by different types of customers: Industrial Enzymes are used as ingredients and/or processing aids in the home and personal care, food, beverage and animal feed industries; whereas Specialty Enzymes are used in human health supplements. Unlike Industrial Enzymes, Specialty Enzymes have effects during (and after) the consumption of the finished product to which they are added. Generally, Specialty Enzymes are also sold at higher prices.164

(147) The Parties have also considered a segmentation of the Industrial Enzymes by end application into industrial, food and beverage, home and personal care, and animal nutrition applications. According to the Parties, while the same enzyme backbone might be broadly applicable across a number of industries, the format of the enzyme needs to be tailored to the needs of the relevant industry. In addition, different regulatory and registration requirements apply depending on the end application. The Parties however underlined that Industrial Enzymes suppliers are generally active across several end applications, can leverage on their knowledge in one industry to another and the equipment required is broadly the same across the different end applications.165

(148) The Parties also submitted that a further segmentation of the Industrial Enzymes for food applications market is not warranted. According to the Parties, Enzymes for food applications generally interchangeable and there is a significant supply-side substitutability as already today suppliers are active across the various end applications: bakery, bakery, dairy, brewing, carbohydrate processing, fish processing, meat and culinary processing.166

(149) In the market investigation, a majority of customers and competitors who expressed a view considered that indeed Industrial and Specialty Enzymes belong to separate markets.167 A majority of respondents also agreed with the segmentation of Industrial Enzymes by end application168 but, as the Parties, they said that no further segmentation is warranted, either because they considered the Enzymes in the food industry to be interchangeable, either because they considered that suppliers can easily switch between the production of the different subtypes, or both.169

(150) In any event, for the purposes of this Decision, the exact scope of product market definition with respect to Enzymes can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition.

4.6.2. Relevant Geographic Market

(151) The Parties submit that the relevant geographic market for Enzymes (including for each of the Industrial and Speciality Enzyme markets) is at least EEA-wide if not worldwide in scope as raw materials are generally readily available, transportation costs are low, and there are no trade barriers except for product registration requirements for supplement ingredients, food, and feed enzymes.170

(152) The market investigation results were not conclusive, while a small majority of customers who expressed a view considered the geographic market to be EEA wide in scope, in particular for industrial enzymes for feed, a small majority of competitors who expressed a view considered the geographic market to be worldwide.171

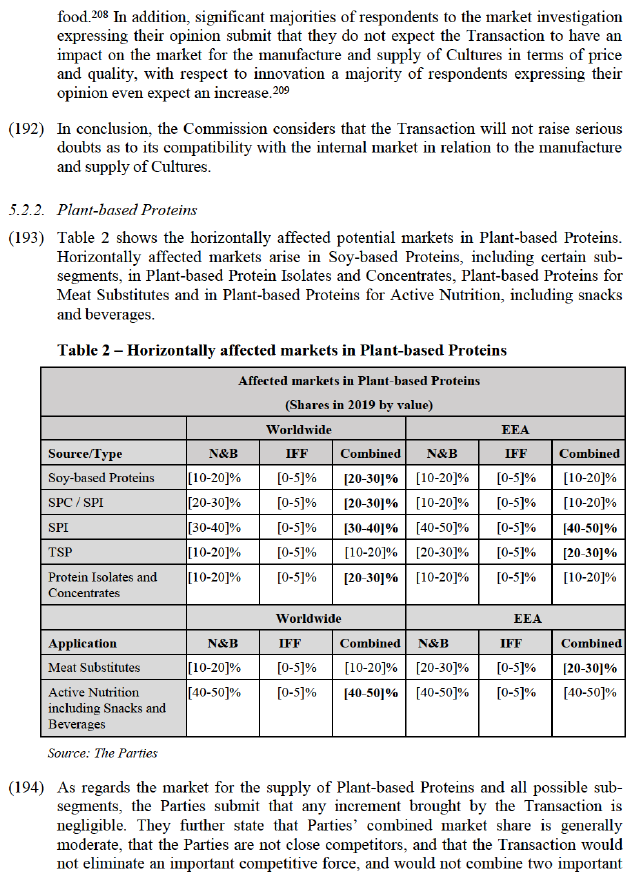

(153) In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to Enzymes can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

4.7. Probiotics

4.7.1. Relevant Product Market

(154) Probiotics are live beneficial bacteria that are naturally created by the process of fermentation in foods like yogurt, sauerkraut, miso soup, kimchi, and others. Probiotics are consumed for their health benefits, especially gut health. Probiotics are sold as nutritional dietary supplement products. They are also used as active pharmaceutical ingredients and as functional ingredients in food and beverage products.

(155) The Parties submit there is a high demand-side and supply-side substitutability between Probiotics used in dietary supplements and in food and beverages applications, and therefore the relevant product market should include all probiotics used in human health. N&B argues that it sells the same Probiotics to both food and dietary supplement manufacturers. Probiotics for both these application have the same sources and follow the same development and formulation processes. Moreover, according to the Parties, for the end customer there is no significant difference with respect to the desired health effect between intake of probiotics from food and/or beverages compared to dietary supplements. From the supply-side perspective, the Parties submit that the manufacturing assets are the same and there are a few differences in the regulatory requirements.172

(156) The results of the market investigation were however not conclusive. Whereas a majority of competitors who expressed a view consider that Probiotics used by dietary supplement and food and beverage manufacturers are the same, customers were divided on whether or not these two products are interchangeable, although a small majority of customers considered that suppliers can easily change production from one to another use without incurring into significant costs.173

(157) In any event, for the purposes of this Decision, the exact scope of product market definition with respect to Probiotics can be left open, since the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative product market definition.

4.7.2. Relevant Geographic Market

(158) The Parties submit that the geographic market should be worldwide in scope. According to the Parties, manufacturers of probiotics supply customers worldwide, they do not need a local presence, transportation costs do not represent a significant fraction of overall costs, and there are no relevant trade barriers.174

(159) The market investigation results also point out for a worldwide scope, in particular as regards the Probiotics for use in dietary supplements.175

(160) In any event, for the purposes of this Decision, the exact scope of the geographic market definition with respect to Probiotics can be left open, as the Transaction would not raise serious doubts as to its compatibility with the internal market under any plausible alternative geographic market definition.

5. COMPETITIVE ASSESSMENT

5.1. Legal Framework

(161) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position. Depending on the position of the Parties in the supply chain, a concentration may entail horizontal and/or non-horizontal effects.

(162) Horizontal effects arise when the parties to a concentration are actual or potential competitors in one or more of the relevant markets concerned. The Commission appraises horizontal effects in accordance with the guidance set out in the Horizontal Merger Guidelines.176

(163) Non-horizontal effects arise when the parties to a concentration operate in different levels of the supply chain in certain relevant markets (vertical effects) or when the Parties operate in closely related markets (conglomerate effects). The Commission appraises non-horizontal effects in accordance with the guidance set out in the Non-Horizontal Merger Guidelines.177

(164) Both Horizontal and Non-Horizontal Merger Guidelines distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non-coordinated and coordinated effects.

(165) In horizontal mergers, non-coordinated effects may significantly impede effective competition by eliminating the competitive constraint imposed by each merger party on the other, as a result of which the merged entity would have increased market power, without resorting to coordinated behaviour. In that regard, the Horizontal Merger Guidelines consider not only the direct loss of competition between the merging firms, but also the reduction in competitive pressure on non-merging firms in the same market that could be brought about by the merger.178

(166) The Horizontal Merger Guidelines list a number of factors which may influence whether or not significant non-coordinated effects are likely to result from a merger, such as the large market shares of the merging firms, the fact that the merging firms are close competitors, the limited possibilities for customers to switch suppliers or the fact that the merger would eliminate an important competitive force.179 Furthermore, in accordance with the Horizontal Merger Guidelines, a merger with a potential competitor can also have horizontal anti-competitive effects where the potential competitor constrains the behaviour of firms active in the market.180 Not all these factors need to be present for significant non-coordinated effects to be likely. The list of factors is also not an exhaustive list.

(167) In non-horizontal mergers, non-coordinated affects may arise when the concentration gives rise to foreclosure. In vertical mergers, foreclosure can take the form of input foreclosure, where the merger is likely to raise costs of downstream rivals by restricting their access to an important input; and/or of customer foreclosure, where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base.181

(168) In addition, the Non-Horizontal Merger Guidelines also state that a concentration may entail conglomerate effects. Conglomerate effects may arise in a concentration where the undertakings involved are active on closely related markets and may also lead to the foreclosure of rivals, by allowing the merged entity to leverage a strong market position from one market to another by means of tying, bundling or other exclusionary practice.182

(169) In accordance with the above legal framework, the Commission has carried out an extensive competitive assessment of the Transaction in order to assess whether the Transaction would impede effective competition within the internal market on accounts of:

(a) possible horizontal non-coordinated effects in the relevant markets for the manufacture and supply of Cultures and Plant-based Proteins;

(b) possible vertical non-coordinated effects in the relevant markets for the supply of Locust Bean Gum, Plant-based Proteins for Active Nutrition, SPI, MCC for Food Applications, Synthetic Emulsifiers overall, Ester Emulsifiers, DISMO, Fatty Acid Emulsifiers, Other Synthetic Emulsifiers, De-Oiled Lecithin Emulsifiers overall, GM De-Oiled Lecithin, and Non-GM De-Oiled Lecithin, in particular by assessing the likelihood of foreclosure scenarios and, in particular, whether the merged entity would have the (i) ability and (ii) the economic incentive to foreclose its rivals, as well as (iii) whether such foreclosure strategy would have a detrimental effect on competition, causing harm to consumers183; and

(c) possible conglomerate effects in closely related markets.

5.2. Horizontal non-coordinated effects

(170) Affected markets arise due to the horizontal overlap between the Parties’ activities in the manufacture and sale of Cultures and Plant-based Proteins.184

5.2.1. Cultures

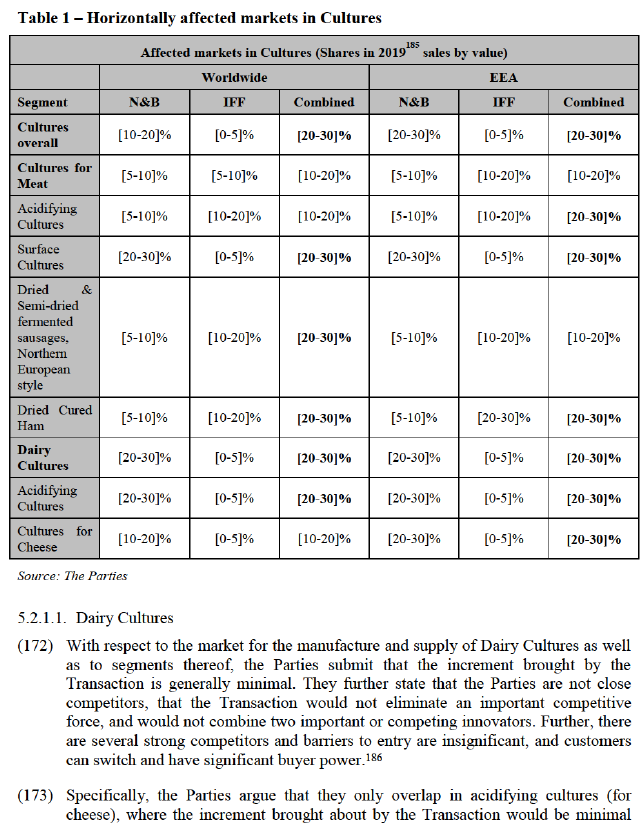

(171) The Parties only overlap in the manufacture and supply of Dairy Cultures and Cultures for Meat. Therefore, horizontally affected markets with respect to Cultures only arise in Dairy Cultures and Cultures for Meat, as well as in certain sub-segments thereof. […]. Table 1 shows the horizontally affected markets in Cultures.

(around [0-5]%). While N&B has considerable activities in Dairy Cultures and considers itself a significant innovator in that market, IFF is not a relevant player in Dairy Cultures [details on IFF’s activities and production process]. Finally, there are a number of strong competitors in Dairy Cultures overall as well as in the segment of acidifying Cultures – most prominently the market leader Chr. Hansen.187

(174) The market investigation largely confirms the arguments brought forward by the Parties. While N&B is named by many customers and competitors responding to the market investigation as an important supplier of Dairy Cultures, IFF is only named by two customers and no competitors.188 None of the replying customers or competitors consider N&B and IFF to be among the top five of each other’s closest competitors in Dairy Cultures.189 Further, customers and competitors generally consider manufacturers such as N&B, Chr. Hansen, CSK and DSM to be the most capable in Dairy Cultures when considering parameters such as quality, R&D capabilities or portfolio. IFF by contrast is not ascribed any capabilities by the majority of respondents.190

(175) All customers expressing their opinion consider that the Transaction will not have an impact on their company with respect to the procurement of Dairy Cultures.191 While the majority of competitors answered ‘I do not know’, a large majority of competitors expressing their opinion also do not consider the Transaction to have an impact on their company with respect to the supply of Dairy Cultures.192 Overall, no customer or competitor expressed a substantiated concern with respect to the market for the manufacture and supply of Dairy Cultures, or a segment thereof (in particular acidifying Cultures or Cultures for Cheese).

(176) It follows from the foregoing that irrespective of whether an EEA or worldwide market is considered, and whether Dairy Cultures overall or segments such as acidifying Cultures or Cultures for Cheese are considered, the Transaction would lead to the combination of a well-established supplier (N&B) with another supplier with only a very minor market presence and limited capabilities (IFF).

(177) In the light of the above considerations, and, in particular, in the light of the moderate combined market share and the very small increment brought about by the Transaction (around [0-5]% by IFF) and taking account of the results of the market investigation, the Commission considers that the horizontal overlap brought about by the Transaction in the manufacture and supply of Dairy Cultures overall, acidifying Cultures and Cultures for Cheese is not such as to raise serious doubts as to its compatibility with the internal market.

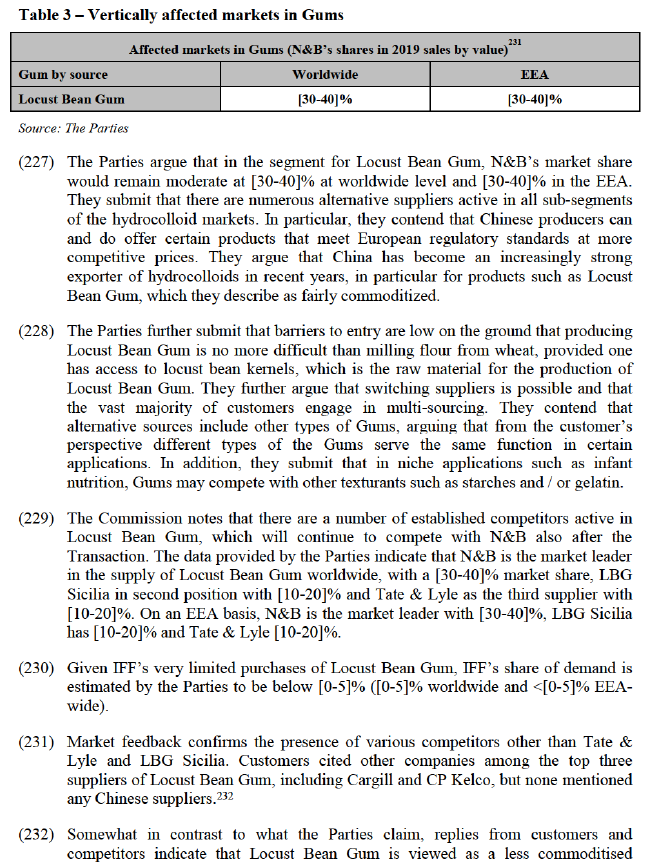

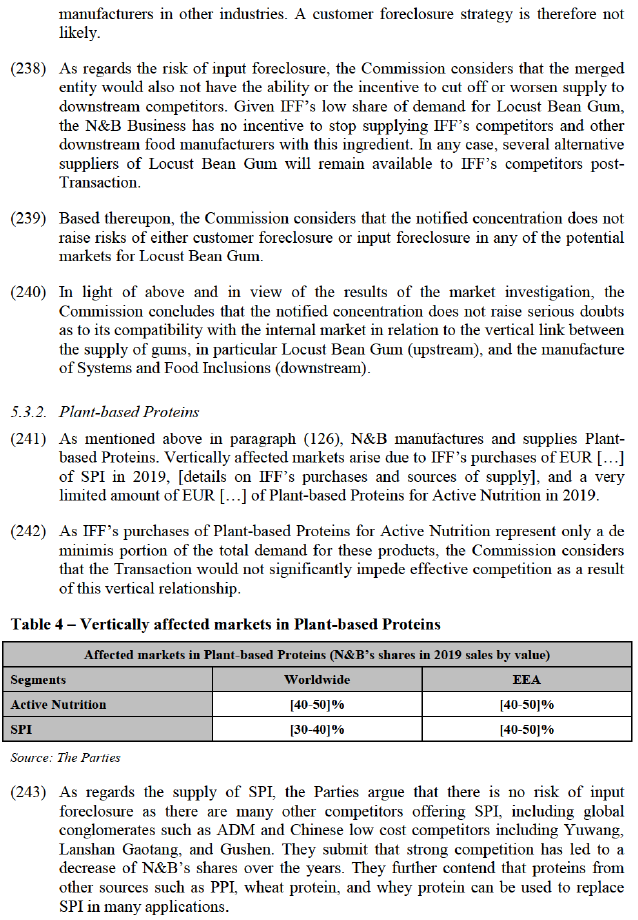

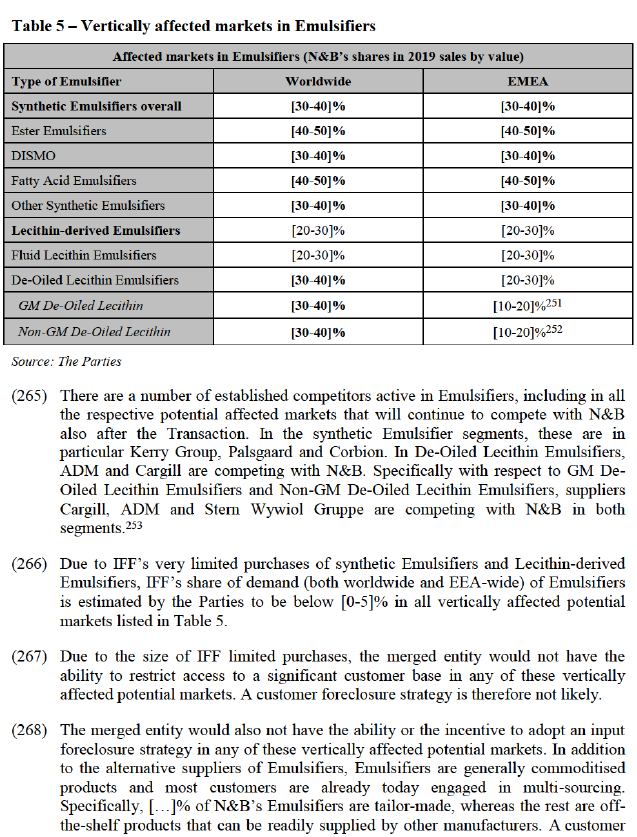

5.2.1.2. Cultures for Meat