Commission, December 10, 2019, No M.9421

EUROPEAN COMMISSION

Decision

TRITON / CORENDON

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union (the "TFEU")1,

Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof,

Having regard to Council Regulation (EC) No. 139/2004 of 20.1.2004 on the control of concentrations between undertakings2 (the "Merger Regulation"), and in particular Article 9(3) thereof,

Having regard to the notification made by Triton Group (“Triton” or the “Notifying Party”) on 21 October 2019, pursuant to article 4 of the said Regulation,

Having regard to the request of the Belgian Competition Authority of 12 November 2019, Whereas:

(1) On 21 October 2019, the Commission received notification of a proposed concentration by which Triton acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Corendon Holding B.V. (“Corendon”) by way of purchase of shares (the “Transaction”). Triton and Corendon are collectively referred to as the “Parties”.

(2) The Belgian Competition Authority received a copy of the notification on 21 October 2019.

(3) By letter dated 12 November 2019, Belgium, via the Belgian Competition Authority, requested the referral to its competition authority of the proposed concentration with a view to assessing it under national competition law, pursuant to Article 9(2)(a) of the Merger Regulation.3

1. THE PARTIES

(4) Triton is an investment firm that invests primarily in medium-sized businesses headquartered in Northern Europe, with particular focus on businesses in three core sectors: Business Services, Industrials and Consumer/Health. Triton indirectly owns and controls Sunweb, which it acquired earlier this year.4 Sunweb is a European online tour operator, headquartered in Rotterdam, which provides packaged holidays primarily to sunshine destinations across Europe and the Mediterranean. Sunweb offers package holidays mainly from the Netherlands and Belgium and to a lesser extent also from Denmark, the United Kingdom, Sweden, Germany and France.

(5) Corendon is a leisure services provider based in the Netherlands. It operates as a leisure tour operator via its own website and third party channels (high street travel agencies and online). Corendon provides package holidays to over 40 sun and beach destinations, mostly in the Mediterranean, but also has long haul and winter sun and beach destinations in its offering. Corendon also operates Corendon Dutch Airlines (“CND”), which currently operates three aircraft out of Amsterdam Airport Schiphol.

2. THE CONCENTRATION

(6) On 29 May 2019, the Parties entered into a signing protocol, pursuant to which Sunweb will acquire 100% of the shares in Corendon, after consultation of the applicable Dutch works councils.

(7) Post-Transaction, Corendon will become a wholly-owned subsidiary of Sunweb and therefore an indirectly wholly-owned and solely-controlled portfolio company managed by Triton.

(8) It follows that the proposed concentration constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(9) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million5 in 2018 [Triton: EUR 12 593 million, Corendon: EUR 488 million]. The EU-wide turnover of each of the undertakings concerned is more than EUR 250 million [Triton: EUR […] million, Corendon: EUR […] million]. Not each of the Parties achieves more than two-thirds of their aggregate EU-wide turnover within the same Member State.6

(10) The notified operation therefore has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. THE ARTICLE 9 REFERRAL REQUEST

(11) By letter dated 12 November 2019, the Belgian Competition Authority, on behalf of Belgium, requested the Transaction to be partially referred to the Belgian Competition Authority with a view to assessing the effects of the Transaction in Belgium under national competition law, pursuant to Article 9(2)(a) of the Merger Regulation.7

(12) In its preliminary assessment, the Belgian Competition Authority has identified that the Transaction threatens to significantly affect competition in Belgium in the market for the supply of package holidays, which presents all the characteristics of a distinct market.

(13) The Belgian Competition Authority further submits that it would be the best placed authority to review the effects of the Transaction in Belgium, given that (i) the markets are national in scope, (ii) the Belgian Competition Authority has very recent case experience in a linked market through the Brussels Airlines/Thomas Cook Airlines Belgium merger case8 and the Brussels Airlines/Thomas Cook Belgium antitrust case and (iii) it is not unlikely that the approval of the proposed concentration would be subject to conditions, which will be better monitored by the Belgian Competition Authority, since these conditions will be likely to have a country-specific nature.

5. RELEVANT MARKETS

(14) The Parties’ activities overlap in the supply of package holidays by tour operators. In addition, the Transaction gives rise to a vertical relationship in relation to Corendon’s activities, through Corendon Dutch Airlines, in the supply of airline seats to tour operators (upstream market) and the supply of package holidays by tour operators (downstream market), where both Parties are active. Given that the Transaction mainly relates to the supply of package holidays, the Commission will focus on the market for the supply of package holidays by tour operators and the horizontal overlaps raised by the Transaction for the purpose of this decision.9

5.1. Product market definition – Package holidays supplied by tour operators

5.1.1. Distinction between traditional package holidays, dynamic packages and independent holidays

5.1.1.1. Introduction

(15) Customers may purchase their package holidays with different modalities: (i) traditional package holidays;10 (ii) dynamic packages; and (iii) and independent travel options.

(16) Traditional package holiday suppliers obtain hotel rooms and airline seats under annual block bookings with hotel owners and airlines (and sometimes take a part of the commercial risk of filling these hotel rooms and airline seats). A traditional package holiday supplier offers a package including a flight and a hotel room to customers from this inventory.

(17) A dynamic package includes a flight and hotel booked by a customer in a single transaction, based on the best available flight and hotel option at the time of booking. Dynamic package suppliers do not pre-arrange block bookings of hotel rooms or airline seats, they secure these bookings in real time.

(18) Independent travel options or independent holidays refer to flight and hotel bookings made in separate transactions. Independent travel options are also described as “self- packaged” holidays. This would include “click-through bookings”, where a traveller books a flight from one supplier and is then invited to book a hotel with another supplier (or vice versa).

(19) Both Sunweb and Corendon are traditional package holiday suppliers. However, in order to respond to competition from dynamic package suppliers, they are considering offering some dynamic packages.

(20) For the purpose of this decision and in line with the Commission’s decisional practice,11 traditional package holidays would indifferently be referred to as package holidays or traditional package holidays.

5.1.1.2. The Notifying Party’s views

(21) In the Form CO, the Notifying Party argues that from the customer perspective, there is no difference between dynamic packages and package holidays created by tour operators from pre-acquired content. According to the Parties, traditional and dynamic packages compete directly on value for money, and consumers search, compare and book these travel packages in the same way online.12

(22) The Notifying Party also argues that independent or “self-packaged” travel options are a direct substitute for traditional travel packages. It argues that consumers are able to book individual holiday components online directly with travel services providers (e.g., airlines, hotels and tour operators) or through OTAs, MSS and online marketplaces.13

5.1.1.3. Commission’s assessment

(23) In its decisional practice, the Commission has generally distinguished between package holidays and independent holidays.14 In its most recent precedent, TUI/Transat France,15 the Commission considered, but ultimately left open, whether package holidays constitute a distinct market from independent holidays.

(24) The results of the market investigation are inconclusive as to whether package holidays constitute a distinct market or whether traditional package holidays, dynamic packages and independent holidays belong to the same market for leisure travel services. Some respondents, among them tour operators, have indicated that customers do not notice the difference between traditional and dynamic package holidays.16 Others noted that dynamic packages could not compete with traditional package holidays, in cases where tour operators include in the package items to which they have exclusive access.17 Also, the question whether price differences exist between traditional and dynamic packages and between the former and independent bookings have triggered mixed replies, as prices generally depend on a number of variables and different arrangements at both the provider and customer levels.18 It can, however, be observed that prices between the three types of package holidays differ substantially at times and do not follow each other consistently over the year.

(25) Moreover, the Parties’ internal documents provide support for a distinct market for the supply of traditional package holidays within the potential broader market for leisure travel services. According to a document about market dynamics, […].19 In addition, regarding online travel agents […].20;21

5.1.1.4. Conclusion

(26) In light of the above, the Commission considers that, for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the question whether traditional package holidays constitute a distinct market from dynamic packages and independent holidays can be left open. The criteria of Article 9(2)(a) of the Merger Regulation are met, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for traditional package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

5.1.2. Distinction of package holidays by holiday type

5.1.2.1. Introduction

(27) The Commission has considered in some of its prior decisions in the sector the possibility to further distinguish markets by holiday types, such as “sun and sea” holidays, “beach holidays” (or holidays to “sunshine destinations”), “skiing” and “city breaks”, but ultimately left open the precise scope of this segmentation.22

(28) In its decision in case M.8046 - TUI/Transat France,23 the Commission considered a distinction recognised by the trade union of French tour operators (the Syndicat des entreprises du Tour Operating – SETO), which recognises five different types of package holidays: (i) package holidays à la carte, (ii) tour package holidays, (iii) tour package holidays in clubs, (iv) package holiday stays and (v) group package holidays. However, the Commission concluded that the question whether the market for package holidays should be further segmented by type could be left open.24

(29) Package holidays à la carte are tailor-made packages of holiday products labelled as “à la carte” or “sur mesure” by the tour operator, irrespective of the specific type and scope of the service sold. Tour package holidays (“circuits”) refer to itinerant journeys, which typically include travel, accommodation and guided tours to multiple destinations. Package holidays in clubs (“clubs”) imply the provision of dedicated services in addition to accommodation, such as animation, activities, sports, baby-sitting, etc. by the tour operator. Package holiday stays (“séjours”) are defined as consisting of the provision of travel and accommodation services in a single destination. Stays may also sometimes include additional services or activities, which are not offered directly by the tour operator, but rather by the operator of the hotel. Lastly, group package holidays (“groupes”) are any package holidays sold in the framework of a collective agreement. Group package holidays notably include holiday services to work councils. However, in TUI/Transat France, the Commission concluded that this type of package holidays should not be treated as a distinct product market as this was confirmed by the market investigation conducted then and since it is predominantly a commercial categorisation of package holidays rather than a generic category.25

5.1.2.2. The Notifying Party’s views

(30) In the Form CO,26 the Notifying Party does not contest a possible distinction between package holidays to sunshine destinations, “city breaks” package holidays or wellness package holidays, but argues that the distinction outlined in TUI/Transat France is not generally recognised in the industry outside France, in particular by the Parties, the Dutch Association of Travel Agents and Tour Operators (the “ANVR”) and the Association of Belgian Travel Organisers (the “ABTO”).

(31) The Notifying Party also explains that, if the Parties were to designate their activities as principally falling within one of the holiday types outlined by SETO in the context of the French market, they would say that they offer package holiday stays. Nevertheless, the Notifying Party adds that such package holiday stays are not recognised as a specific holiday type in the Netherlands and Belgium.

(32) Lastly, as the overlap in the present case arises due to the Parties’ activities in the supply of sun and sea holidays, the Notifying Party provided its analysis in relation to the supply of package holidays to sunshine destinations.

5.1.2.3. Commission’s assessment

(33) The market investigation yielded mixed results as to whether tour operators and travel agents segment their package holiday offering by type of holiday.

(34) The main tour operators supplying package holidays in Belgium confirmed that they distinguish their offers by holiday types and offer package holidays to sunshine destinations as distinct products from city breaks or ski trips. For example, TUI confirmed that it segments by “[f]light holidays sun & beach (on which we have different labels such as adults only, family products, small & friendly,..) -Overland: car & Nearby holidays -Ski holidays -Tours -Cruises -Seat Only flight tickets -Sport Holidays -Exclusive VIP holidays -Leisure team parks (for example Disneyland) - Holiday Homes”.27 easyJet Holidays and DER Touristik indicated that within package holidays they distinguish between “[s]un and sea, city breaks, holidays by car, skiing holidays and long haul destinations”.28 In addition, based on the information available on Club Med’s website, it appears that it also offers package holidays to sunshine destinations and ski holidays separately.29 Other tour operators responding to the Commission’s market investigation stated that they do not segment their package holiday offering in Belgium by product type. However, it should be noted that most of these respondents only provide package holidays for stays to sunshine destinations, therefore, any segmentation between package holidays to sunshine destination and package holidays to ski destinations of such tour operators’ offering is irrelevant.

(35) The majority of travel agents responded that they apply a segmentation by holiday types in their offering such as “Sun holidays, city trips, active holidays, ski, long distance, etc.”, or “Flight Holidays, Car Holidays, City Trips, Snow holidays”.30

(36) As a result, overall, it appears that the majority of respondents to the market investigation, especially the tour operators, distinguish between package holidays to sunshine destinations, ski trips package holidays and city breaks package holidays in Belgium. Any further distinction between package holidays à la carte, tour package holiday, package holidays in clubs, package holiday stays would not change the assessment whether to refer to Belgium since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and package holidays to certain destination countries supplied in Belgium. In addition, the Parties’ activities overlap only in the supply of package holiday stays.

(37) Therefore, in line with the Commission’s precedents, the Commission considers that the question whether package holidays can be further segmented by holiday type can be left open, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

5.1.2.4. Conclusion

(38) In light of the above, the Commission considers that, for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the question whether the market for package holidays should be further segmented by type of holidays can be left open. The criteria of Article 9(2)(a) of the Merger Regulation are met, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

5.1.3. Distinction of package holidays by destination

5.1.3.1. Introduction

(39) The Commission considered in its previous decisional practice a further distinction within the market for package holidays between domestic and foreign holidays and, within package holidays to foreign destinations, between short/medium haul and long haul destinations (defined as package holidays involving flights that substantially exceed three hours) but ultimately left the question open.31

(40) The Commission also left open whether the market for package holidays should be segmented by destination country or by group of destination countries.32

5.1.3.2. The Notifying Party’s views

(41) The Notifying Party does not contest the Commission’s decisional practice with respect to the segmentation of the market for package holidays between domestic and foreign holidays and, within package holidays to foreign destinations, between short/medium haul and long haul destinations.33

(42) However, with respect to the plausible segmentation by destination country or by group of destination countries, the Notifying Party submits that the markets for package holidays should not be segmented by individual country of destination. Instead, the potential relevant product market would comprise all short/medium haul sunshine destinations.34

(43) The Notifying Party argues that when choosing an annual summer holiday, customers in Northern Europe, notably in Belgium and the Netherlands, are primarily interested in securing a holiday which they consider to be good value for money – including a hotel with appropriate facilities, food and drink options, a high likelihood of sunny weather, and a mix of other features not determined by the specific destination country.35

(44) In that respect, the Notifying Party considers that the conditions of competition are very similar across all sunshine destinations. According to the Parties, their marketing materials would provide support for this argument: the images representing the hotels offered by the Parties in Bulgaria, Egypt, Greece, Italy, Portugal, Spain and Turkey would present the same key features, namely blue skies, a swimming pool, leisure facilities, bars and restaurants.36

(45) Sunweb and Corendon each observed that the majority of their repeat customers (i.e. customers who purchased more than one package holiday to a sunshine destination) […].37 According to the Notifying Party, this […] would support the argument against a segmentation of package holidays by country of destination.38

(46) Besides, the Notifying Party submits that customers would switch between sunshine destinations in response to geo-political events.39 For instance, the Notifying Party considers that the decrease in the number of tourists in Turkey from the Netherlands in 2015 and 2016 is likely due to the rising political tensions there at the time. This drop in travel to Turkey is likely to have caused switching to other sunshine destinations such as Greece, Portugal and Spain, which saw increases in travellers from the Netherlands in 2017.40

(47) Furthermore, the Notifying Party considers that customers are mostly interested in sunshine, not the specific destination country.41 In that respect, it submits that during the heatwave of Summer 2018, the number of bookings for package holiday to sunshine destinations fell because the excellent weather in Northern Europe deterred many customers from booking trips to sunshine destinations, who instead stayed in their home country. According to the Notifying Party, this provides further support for the view that passengers are very willing to switch between countries for their holidays.42

5.1.3.3. Commission’s assessment

Distinction between package holidays to domestic destinations and package holidays to foreign destinations

(48) The market investigation seems to indicate that package holidays to domestic destinations and package holidays to foreign destinations are not close substitutes.43 In that respect, a tour operator indicated that “Domestic trips are generally without flights given that the Netherlands and Belgium are small countries, and therefore significantly different from foreign packages”.44 However, the substitutability between package holidays to domestic destinations and package holidays to foreign destinations would depend on several factors, including the weather conditions, the budget and personal preferences. For instance, a travel agent indicated that the substitutability between foreign and domestic destinations “depends strongly on the national weather’”45 and a tour operator explained that it “mainly depends on domestic economic conditions. A slow economy results in a higher propensity for domestic travel”.46

(49) The Commission considers that the question whether package holidays to domestic destinations and package holidays to foreign destinations belong to the same product market can be left open, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

Distinction between package holidays to short/medium haul destinations and package holidays to long haul destinations

(50) The market investigation is inconclusive as to whether package holidays to short/medium haul destinations are substitutable with package holidays to long haul destinations. One the one hand, several respondents indicated that the price difference between packages to short/medium haul destinations and packages to long haul destinations is usually significant and would therefore provide support for considering them as not substitutable.47 On the other hand, as indicated by travel agents “depending on the price the customer decides for short/medium or long-haul destination”.48

(51) In line with its previous decisional practice, the Commission considers that the question whether package holidays to short/medium haul destinations and package holidays to long haul destinations belong to the same product market can be left open, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

Distinction of package holidays by destination countries or group of destination countries

(52) From the demand-side, the majority of respondents to the market investigation indicated that the country of destination is one of the five most important factors that influence the decision on destination of a customer of package holidays supplied in Belgium.49 Respondents to the market investigation indicated that for package holidays to certain sunshine destination countries (notably Greece and Portugal), the country itself appears to be one of the three most important factors in the customers’ purchase decision.50 A tour operator indicated that “customers usually have a clear idea of their destination when book, and of their budget. Sometimes, customers are more looking for an experience or for specific activities. Therefore, it is not always easy for a customer to switch its destination choice for another one”.51 In addition, Sunweb’s internal document shows that for package holidays supplied in Belgium, […].

Figure 1 [confidential]

[…]

Source: Form CO, Annex 22A – Triton 5.4 Doc #110 […] , slide 15.

(53) Furthermore, in case of a permanent price increase of 5 to 10% of the package holiday to a given country, the majority of respondents to the market investigation indicated that the majority of customers who initially wanted to travel there would still choose a package holiday to this country of destination, despite the price increase.52 A travel agent noted that “Overall, a client remains faithful to one particular destination and will only explore alternatives once the increase of his holidays reaches 20%”.53

(54) From the supply-side, the majority of tour operators indicated that it is not easy to start offering package holidays to other destination countries swiftly because the entry to a new destination country implies significant costs and risks. In that respect, a tour operator indicated that entering a new destination country involves “to go through a full set of set up tasks until a satisfactory level of service can be provided to customers”. Another tour operator explained that “there is a lot of analysis being done in-house prior to offering new destinations. The reaction of the market is always an uncertain factor. Starting new destinations is going hand in hand with additional costs on several levels”.54

(55) In addition, the Parties55 and the majority of tour operators having responded to the market investigation monitor their competitors’ prices at destination country level and/or at hotel level.56

(56) When asked specifically whether package holidays to sunshine destinations should be segmented by group of countries, respondents to the market investigation did not always delineate the various groups of destination countries in the same way. Some considered that Southern Europe should be distinguished from Northern Africa, while others considered that there should be a distinction between Eastern Mediterranean countries on the one hand and mainland Spain and mainland Portugal on the other hand.57

(57) While, in light of the above, there are indications that destination matters and the country of destination does play an important role for many travellers when booking their holidays, it can be left open whether the market for package holidays should be segmented by destination country or group of countries, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

5.1.3.4. Conclusion

(58) In light of the above, the Commission considers that, for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the question whether the supply of package holidays should be segmented by destination (namely, between domestic or foreign destination; short/medium haul or long haul destination; by country of destination or group of countries of destination) can be left open. The criteria of Article 9(2)(a) of the Merger Regulation are met, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destinations in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

5.1.4. Conclusion on product market definition

(59) In light of the above, the Commission considers that, for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the question whether traditional package holidays constitute a distinct market from dynamic packages and independent holidays can be left open. Within traditional package holidays, the question whether traditional package holidays should be further segmented by holiday type or by destination (namely, between domestic or foreign destination; short/medium haul or long haul destination; by country of destination or group of countries of destination) can be left open. The criteria of Article 9(2)(a) of the Merger Regulation are met, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries (e.g. Turkey) supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 below.

5.2. Geographic market definition – Package holidays supplied by tour operators

5.2.1. Introduction

(60) Given that the Parties’ activities overlap in the supply of package holidays in Belgium and in the Netherlands, the Commission will assess whether a broader geographic market for the supply of package holidays is pertinent, encompassing both the Netherlands and Belgium, as well as airports in neighbouring countries,58 as claimed by the Notifying Party.59

(61) In its previous decisional practice, the Commission has considered that the market for the supply of package holidays in general, as well as its possible segments for foreign package holidays, for short/medium haul package holidays or for package holidays to specific destinations are national in scope.60

(62) In two cases related to the supply of package holidays in Austria and Germany, the Commission left open whether Germany and Austria formed one geographic market, although it found that there were some indications suggesting that competitive conditions in both countries were converging, or whether the relevant geographic market was national.61 The Commission therefore assessed the effects of the transaction in Germany and Austria separately and on a geographic market encompassing both Austria and Germany.62

(63) In a case related to the supply of package holidays in the Netherlands, the relevant geographic market was defined as national.63

5.2.2.The Notifying Party’s views

(64) The Notifying Party argues that the geographic scope of the supply of package holidays is broader than national and encompasses the Netherlands and Belgium taken together, as well as airports in neighbouring countries.64

(65) In particular, the Notifying Party notes that […] Dutch and Belgian passengers frequently use airports outside of their home countries in Belgium, the Netherlands, Germany, France and Luxembourg. This is notably because large numbers of Dutch and Belgian residents live within 100 km of airports in neighbouring countries.65 In particular, when prices are higher during school holidays, customers are more likely to purchase a package holiday with a flight departing from a foreign airport.66

(66) Furthermore, the Notifying Party submits that in 2018, […]% of Corendon customers living in Belgium booked via Corendon’s Dutch website and […]% of Sunweb customers living in Belgium booked via Sunweb’s Dutch website,67 which would support the claim that Belgium is part of a broader geographic market encompassing also the Netherlands. On the other hand, less than […]% of Corendon and Sunweb customers living in the Netherlands booked via Belgium as the country of sale.68

5.2.3.Commission’s assessment

(67) As explained in Section 5.2.1 above, in its decisional practice the Commission has so far always concluded that the geographic scope for package holidays was national, with the notable exception of two cases related to the supply of package holidays in Germany and Austria, in which the Commission left open whether the geographic market could be broader than national. In this case, in line with the Commission’s decisional practice, the results of the market investigation point strongly towards two separate national markets.

(68) From a demand-side perspective, according to the market investigation, the majority of customers purchase package holidays supplied in their country of residence. Belgian residents generally purchase package holidays supplied in Belgium (either via brick and mortar shops, call centres or online). To cater for this demand, tour operators and travel agents that responded to the market investigation and that are active in both Belgium and the Netherlands have dedicated retail channels (e.g. a website with a “.be” or “.nl” domain name as relevant).69 Sunweb and Corendon also have dedicated websites for Belgian and Dutch residents.70

(69) Only a minority of Belgium residents (about 5%) would purchase package holidays supplied in the Netherlands (either via brick and mortar shops, call centres or online).71 The figure of 5% is in line with Sunweb’s actual figure of […]%, but well below the […]% for Corendon. This difference might be explained by the fact that […],72 while […]% of Corendon’s sales in Belgium in 2018 were achieved via travel agents rather than online or via Corendon’s call centres.73 Similarly, Dutch residents generally purchase package holidays supplied in their home country. Only a minority of Dutch residents (about 5%) would purchase package holidays supplied in Belgium.74 This figure of 5% is also in line with the Parties’ figures provided in Section 5.2.2 above. Furthermore, the majority of respondents to the market investigation having expressed a view indicated that the majority of customers living in Belgium and in the Netherlands would continue purchasing package holidays supplied in their residence country in case of a small but significant non-transitory price increase.75

(70) In addition, customer preferences seem to be different in Belgium and in the Netherlands. A tour operator explained that “package holidays are created taking account of national preferences. For instance, for the packages offered [in the] Netherlands, hotels are booked based on the preferences of Dutch customers. In addition, pricing is determined at a national level”.76 Furthermore, Sunweb notes that “the slightly different taste of Belgians for hotels enables a more diversified portfolio on many destinations”.77 In that regard, in an internal document discussing Sunweb’s entry plan in the market for […] Sunweb notes that the […].78 According to a report commissioned by the Notifying Party, there are also distinct customer preferences in terms of purchase channels: [details of customer behaviour] while [details of customer behaviour].79

(71) On the supply side, the Commission notes that the Parties define their source markets on a […] basis […]. More specifically, when defining their entry or expansion strategies, the geographies are defined […]”80 […].81 Consequently, the Parties monitor their competitors on a national basis, in terms of turnover and brand recognition, as shown in the figures below.

Figure 2 [confidential]

[…]

Source: Form CO, Annex 22A– Triton 5.4 Doc #47 […], p.17.

Figure 3 [confidential]

[…]

Source: Form CO, Annex 22A – Triton 5.4 Doc #09 […], p.20.

(72) Furthermore, the Parties […]. For instance, […]. This shows that conditions of competition for package holidays supplied in Belgium are different from the competitive conditions for package holidays supplied in the Netherlands.

Figure 4 [confidential]

[…]

Source: Form CO, Annex 22A – Triton 5.4 Doc #048 […], p. 34.

(73) In addition, Sunweb and Corendon have dedicated personnel for Belgium and for the Netherlands. For instance, Sunweb has local (i.e. national) offices, including local call centres and staff in charge of “local market (language related)”82 while Corendon has […].83

(74) Finally, customers living near and departing from foreign airports do not contradict the finding of separate geographic markets defined on the basis of the point of sale because the mere fact of departing from a foreign airport does not mean that the conditions of competition in Belgium and the Netherlands are sufficiently homogeneous to conclude that they belong to the same geographic market.84

(75) In light of these demand- and supply-side considerations and its decisional practice, the Commission considers that the market for package holidays in Belgium and the market for package holidays in the Netherlands constitute distinct markets.

5.2.4. Conclusion on geographic market definition

(76) In view of the above and in line with its decisional practice, the Commission considers that for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the geographic market for the supply of package holidays is national in scope. Therefore, the market for package holidays supplied in Belgium and its plausible segmentations present all the characteristics of distinct markets, within the meaning of Article 9(2)(a) of the Merger Regulation.

5.3. Conclusion on market definition

(77) The Commission considers that for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the exact product market definition can be left open, since, as explained in Section 6 below, the Transaction threatens to significantly affect competition in the markets for package holidays to all short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets, as explained in Section 5.2 above. In the following section, the Commission will therefore assess the effects of the Transaction on the plausible narrower markets for package holidays to short/medium haul sunshine destinations and package holidays to specific countries of destination.

(78) With respect to the geographic market definition, the Commission considers that for the purpose of this decision and without prejudice to further investigation by the Belgian Competition Authority, the geographic market for the supply of package holidays is national in scope.

6. COMPETITION ASSESSMENT

(79) For the purpose of this decision, the Commission will focus its assessment on the plausible narrower markets, namely the markets for package holidays to short/medium-haul sunshine destinations supplied in Belgium and the markets for package holidays to specific destination countries.85

(80) In the Form CO, the Notifying Party submits that following the Transaction, the Parties will continue to face significant competitive pressure from a large number of competing travel services providers in all market segments. According to the Notifying Party, the merged entity will be constrained by other tour operators, online travel agents as well as independent travel options such as airlines, hotel operators and online market places.86

(81) The Notifying Party also submits that the Transaction is not capable of giving rise to material competition concerns due to a minimal increment in Corendon’s pre- Transaction share of supply.87 On the basis of the Notifying Party’s submission, following the Transaction, the combined share of the Parties on the market for package holidays to all short/medium-haul sunshine destinations supplied in Belgium would remain below 20% and therefore not lead to any affected market.88 Moreover, in the Notifying Party’s view, Sunweb and Corendon are not each other’s closest competitors.89

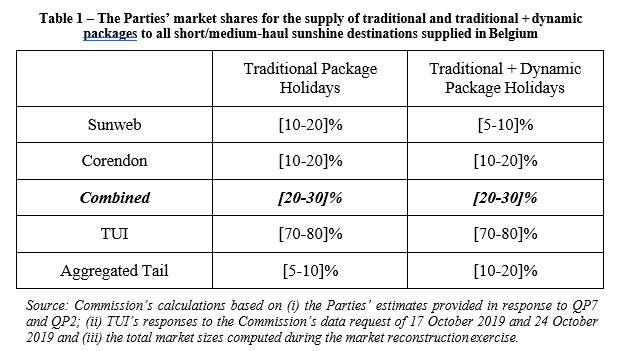

(82) The Notifying Party’s submission, however, has not been corroborated by the evidence collected during the Commission’s preliminary market investigation. First, the results of the Commission’s market reconstruction show that even the broader market definition for the supply of package holidays to all short/medium-haul sunshine destinations supplied in Belgium gives rise to affected markets both on the basis of traditional package holidays only and including dynamic packages (see Table 1 below).

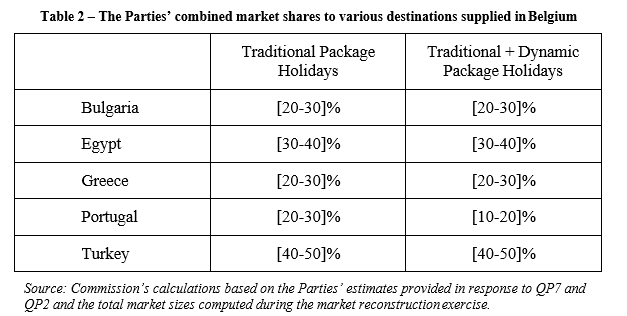

(83) Moreover, as indicated in Table 2 below, on the narrowest plausible markets for traditional package holidays to certain destinations supplied in Belgium, the Transaction will lead to significantly higher combined market shares both on the basis of traditional package holidays only and including dynamic packages. For example, the Parties’ combined market share on the market for traditional package holidays to Turkey as well as traditional and dynamic packages combined would be close to [40-50]%, whereas to Egypt, the combined market share would be approximately [30-40]%. In the Commission’s view, such high combined market share levels indicate that the Transaction may lead to significant effects on competition in Belgium.

(84) Second, the Commission’s market investigation showed that the Parties are close or very close competitors that offer similar type of holiday packages and are both seen as “low cost” tour operators.90 The Parties’ internal documents confirm that both Corendon and Sunweb are close competitors. For example, a document discussing the strategy post-Transaction states that […].91 Moreover, following the Transaction, the only other credible tour operator offering package holidays in Belgium will be TUI,92 which is not seen as the leading low cost supplier in the market place and therefore not as the closest competitor to either Sunweb or Corendon. As shown by the Commission’s market investigation, all the other tour operators on the Belgian market are mostly active in neighbouring countries such as, for example, FTI Germany, DER Touristik, Alltours or LuxairTours, and have very limited package holiday sales in Belgium.93 Therefore, contrary to the Notifying Party’s submission, their presence in Belgium is marginal.94 A limited number of tour operators active in the Belgian market indicates that the merged entity might not be sufficiently constrained following the Transaction.

(85) Third, other concerns arising in connection with the Transaction identified during the market investigation were in relation to the higher concentration on the Belgian market as the Transaction is de facto a 3 to 2 merger.95 Indeed, as shown in Table 1 above, the results of the Commission’s market reconstruction indicate that the Belgian market for the supply of package holidays will in essence be concentrated in the hands of two tour operators: TUI with a market share of [70-80]% and the merged entity with a market share of [20-30]%. Such a high level of market concentration could lead to an increased likelihood of coordination post-Transaction and also to horizontal non-coordinated effects, in particular with regard to specific destinations such as Turkey and Egypt.96 In any case, this potential negative effect on competition in Belgium will require further in-depth investigation.

(86) Last, two thirds of the tour operators responding to the Commission’s market investigation indicated that it is very difficult to enter the Belgian market for the supply of package holidays.97 Some of the market respondents suggested that the Belgian market is “very protectionist[ic]”,98 while others were of the opinion that the presence of two very large players on the Belgian market post-Transaction will result in increased barriers to entry.99

(87) At this stage, the Commission considers that the arguments of the Parties according to which dynamic package providers and smaller tour operators exert a competitive constraint would require further investigation at national level.

(88) Based on its preliminary analysis, the Commission considers that the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and package holidays to certain sunshine destination countries, in particular Turkey and Egypt, supplied in Belgium.

7. ASSESSEMENT UNDER ARTICLE 9(3) OF THE MERGER REGULATION

7.1. The criteria of Article 9(2)(a) of the Merger Regulation

(89) According to Article 9(3) of the Merger Regulation, the Commission may refer the whole or part of the case to the competent authorities of the Member State concerned with a view to applying the Member State’s national competition law if, following a request for referral by that Member State pursuant to Article 9(2) of the Merger Regulation, the Commission considers that the Transaction threatens to significantly affect competition in a market within that Member State, which presents all the characteristics of a distinct market.

(90) Therefore, in order for a referral request to be made to a Member State, one procedural and two substantive conditions must be fulfilled pursuant to Article 9(2)(a) of the Merger Regulation.

(91) Although the Notifying Party considers that the geographic market for the supply of package holidays might be broader than national in scope, it does not seem to contest that the Referral Request meets the procedural condition laid down in Article 9(2)(a) of the Merger Regulation.

(92) As to the procedural condition, the referral request must be made within 15 working days from the date on which the notification of a concentration before the Commission is received by that Member State. In this regard, the Commission notes that Belgium, via the Belgian Competition Authority, received a copy of the notification of the Transaction on 21 October 2019. The Referral Request was made by letter received by the Commission on 12 November 2019. Therefore, the Referral Request was made within 15 working days following the receipt by Belgium of the notification of the Transaction, and, consequently, within the deadline provided for in Article 9(2) of the Merger Regulation.

(93) As to the substantive conditions, first, the requesting Member State is required to demonstrate that, based on a preliminary analysis, there is a real risk that the transaction may have a significant adverse impact on competition, and thus that it deserves scrutiny. Such preliminary indications may be in the nature of prima facie evidence of such a possible significant adverse impact, but would be without prejudice to the outcome of a full investigation.100 Second, the requesting Member State is required to show that the geographic market(s) in which competition is affected by the transaction is (are) national, or narrower than national in scope.101

7.1.1. Markets within Belgium which present all the characteristics of distinct markets

(94) The Belgian Competition Authority considers, in line with the decisional practice of the Commission, that the market for the supply of package holidays is national in scope.

(95) The Belgian Competition Authority’s findings with regard to the geographic scope of the markets for package holidays are consistent with the Commission’s decisional practice and the results of the Commission’s market investigation. Therefore, it can be concluded that the markets for the supply of package holidays in Belgium are distinct from other geographical areas.

(96) In light of the above, the Commission considers that the markets identified in the Referral Request (namely the markets for package holidays supplied in Belgium) present the characteristics of distinct markets in Belgium, as required under Article 9(2)(a) of the Merger Regulation.

7.1.2. Markets within Belgium in which the Transaction threatens to significantly affect competition

(97) The Belgian Competition Authority’s Referral Request is based on the concerns that the Transaction threatens to significantly affect competition in the markets for package holidays to certain destinations supplied in Belgium.

(98) In its Referral Request, the Belgian Competition Authority noted that the Parties are likely to obtain a substantial combined market share post-Transaction, particularly in relation to package holidays to Turkey and package holidays to non-EU destinations.

(99) The Belgian Competition Authority considers that the Transaction is likely to have significant unilateral effects in Belgium, notably since Sunweb and Corendon seem to be close competitors, as they are both seen as “low cost” tour operators, contrary to their competitor TUI. In addition, the Belgian Competition Authority considers that the Parties have not adequately identified in the Form CO the degree of competitive pressure exerted by alternative providers of package holidays.102

(100) Besides, the Belgian Competition Authority considers that there is a risk of coordinated effects after the bankruptcy of Thomas Cook, as the two main tour operators in Belgium post-Transaction would be TUI and the Parties. Therefore, the Belgian Competition Authority considers that potential coordinated effects should be further analysed.

(101) The prima facie competition concerns of the Belgian Competition Authority are consistent with the results of the market investigation of the Commission with respect to the markets for package holidays supplied in Belgium.

(102) In light of the above, following the Commission’s preliminary assessment, the Commission concludes that the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and package holidays to certain sunshine destination countries, in particular Turkey and Egypt, supplied in Belgium, as required under Article 9(2)(a) of the Merger Regulation.

7.1.3. Conclusion

(103) In light of the above, the Commission considers that the legal requirements laid down in Article 9(2)(a) of the Merger Regulation are fulfilled, as the Transaction threatens to significantly affect competition in the markets for package holidays to short/medium haul sunshine destinations supplied in Belgium and for package holidays to certain sunshine destination countries supplied in Belgium, which present all the characteristics of distinct markets.

7.2. The Commission's discretion in deciding whether to refer

(104) Pursuant to Article 9(3) of the Merger Regulation, in the event that the criteria provided for in Article 9(2)(a) are fulfilled with regard to a proposed transaction, the Commission retains a margin of discretion in deciding whether to refer a given case to a national competition authority.103

(105) In its email submission dated 22 November 2019, the Notifying Party explained that it considers that the Commission is better placed to review the Transaction, in essence, for the following reasons:

(a) The Parties consider that it is questionable whether the Transaction gives rise to affected markets that are national in scope. Therefore, the Commission would be best placed to assess the Parties’ submissions, which indicate broader than national scope of the geographic market.

(b) Sunweb and Corendon compete in Belgium and in the Netherlands. A one- stop-shop review by the Commission would therefore be efficient and would ensure consistency of approach.

(c) The Commission has experience in the relevant markets impacted by this case.

(d) The Parties have already invested significant time and resources in the pre- notification and the phase 1 investigation of the filing during the EU level review.104

(106) In the following, the Commission assesses the appropriateness of a referral in the present case in light of the principles set out in the Referral Notice.

(107) According to paragraph 9 of the Referral Notice, “In principle, jurisdiction should only be reattributed to another competition authority in circumstances where the latter is more appropriate for dealing with the merger, having regard to the specific characteristics of the case as well as the tools and expertise available to the authority”. The Referral Notice also states that “particular regard should be had to the likely locus of any impact on competition resulting from the merger” and that “[r]egard may also be had to the implications, in terms of administrative effort, of any contemplated referral”.

(108) Moreover, paragraph 13 of the Referral Notice states that “referral should normally only be made when there is a compelling reason for departing from 'original jurisdiction' over the case in question, particularly at the post-notification stage”.

(109) In contrast to the Notifying Party’s view,105 the Commission considers that there are compelling reasons for departing from original jurisdiction over the present case, by partially referring the Transaction to Belgium.

(110) First, considering that the geographic scope of the relevant markets is likely to be national (see Section 5.2 above), and that the Transaction is likely to significantly threaten competition in those markets, the Belgian Competition Authority is better placed to evaluate any submissions of the Parties in relation to potentially broader markets by way of assessing the behaviour of Belgian consumers (e.g. their ability and willingness to switch between package holidays, dynamic packages and independent travel options), for example, through customer surveys. In addition, if the Parties offer remedies, the Belgian Competition Authority would be better placed to assess the remedies’ submissions, which would likely have a country-specific nature. Besides, contrary to the Notifying Party’s argument in relation to consistency of approach, the Commission considers that referring a part of the case to Belgium does not entail a risk of inconsistency of approach across the internal market, considering that the Belgian and Dutch competent authorities have given indication of their intention to cooperate during their respective investigations.106

(111) As to the third point raised by the Notifying Party in relation to the Commission’s experience in the relevant markets impacted by the case, it should be noted that the Belgian Competition Authority has also gained up-to-date relevant sectorial knowledge when reviewing a merger in linked markets.107

(112) Last, the while the Notifying Party argues that significant resources and time have been spent in pre-notification and phase 1 of this case, this in no way precludes the Commission from its discretion to view the Referral Request favourably, provided that the conditions in Article 9(2)(a) of the Merger Regulation are fulfilled. Besides, at this point of the review of the Transaction, any additional administrative effort of the Parties due to a partial referral would not be disproportionate. The Belgian Competition Authority has already formed a broad picture of the main characteristics of the case and potential competition concerns prior to the filing of its Referral Request. The Belgian Competition Authority indicated that its market investigation could be launched upon the adoption of this referral decision by the Commission.108

(113) In light of the above, the Commission considers that the Belgian Competition Authority is in the best position to investigate the effects of the Transaction in Belgium.

7.3. Conclusion

(114) In light of the above, the Commission considers that (i) the legal requirements to request a referral under Article 9(2)(a) of the Merger Regulation are met and (ii) the competent authorities of Belgium are the most appropriate and best placed to carry out a thorough investigation of the effects of the Transaction in Belgium.

(115) It is therefore appropriate for the Commission to exercise its discretion under Article 9(3) of the Merger Regulation and partially refer the case to Belgium insofar as it concerns Belgium.

8. CONCLUSION

(116) From the above it follows that the conditions to request a referral under Article 9(2)(a) Merger Regulation are met. The Commission also considers that, given the local scope of the market(s) affected by the Transaction, the competent authorities of Belgium are better placed to carry out a thorough investigation of parts of the case, and that it is therefore appropriate for the Commission to exercise its discretion under Article 9(3)(b) Merger Regulation and to partially refer the Transaction to Belgium as regards its effects in Belgium.

(117) On the same date as this decision, the Commission has also adopted a decision on the basis of Article 9(3)(b) of the Merger Regulation pursuant to which the Commission partially referred the notified concentration to the Netherlands as regards its effects in the Netherlands.

HAS ADOPTED THIS DECISION:

Article 1

The notified concentration is referred partially to the competition authority of Belgium, as regards the aspects concerning Belgium, pursuant to Article 9(3)(b) of Council Regulation (EC) No 139/2004.

Article 2

This Decision is addressed to Kingdom of Belgium. Done at Brussels, 10.12.2019

1 OJ C115, 9.8.2008, P.47.

2 OJ L 24, 29.1.2004, p.1. With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision.

3 On 19 November 2019, the Belgian Competition Authority provided additional considerations on the grounds for referral, both documents are further referred to as “the Referral Request”.

4 Case M.9249 - Triton/Sunweb, Commission decision under the simplified procedure of 6 February 2019.

5 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

6 While Corendon achieved more than two thirds of its EU-wide turnover in the Netherlands, Triton does not achieve more than two thirds of its EU-wide turnover in any single member state.

7 By a letter dated 11 November 2019, the Netherlands Authority for Consumers and Markets, on behalf of the Netherlands, requested the Transaction to be partially referred to the Netherlands with a view to

assessing the effects of the Transaction in the Netherlands under national competition law, pursuant to Article 9(2)(a) of the Merger Regulation.

8 Decision of the Belgian Competition Authority BMA-2017-C/C-31 of 11 September 2017 approving the acquisition of assets of Thomas Cook Airlines Belgium by Brussels Airlines.

9 In its decisional practice (see among others, case M.8046 – TUI/Transat France, paragraph 88, M.4600 – TUI/First Choice, paragraph 59, M.4601 – KarstadtQuelle/My Travel, paragraph 44), the Commission considered that the upstream market for the wholesale supply of airline seats to tour operators was national in scope. The market investigation confirmed the Commission’s practice. Therefore, the market for the wholesale supply of airline seats also presents the characteristics of a distinct market in which the Transaction threatens to affect competition, given that the Parties’ shares exceed 30% under some market delineations in the supply of package holidays.

10 The term "package holidays" for the purpose of this decision is distinct from the notion of "package travel" under Directive (EU) 2015/2302 of the European Parliament and of the Council of 25 November 2015 on package travel and linked travel arrangements, amending Regulation (EC) No 2006/2004 and Directive 2011/83/EU of the European Parliament and of the Council and repealing Council Directive 90/314/EEC ("the new Package Travel Directive") and without prejudice to the autonomous interpretation of "package travel" contained therein.

11 Case M.5867, Thomas Cook/Öger Tours; Case M.1524, Airtours/First Choice, paragraph 5 et seq.; Case M.4601, KarstadtQuelle/MyTravel, footnote 63.

12 Form CO, paragraph 246.

13 Form CO, paragraph 292 et seq.

14 Case M.5867, Thomas Cook/Öger Tours, paragraph 10. Other, less recent cases include Case M.1524, Airtours/First Choice, paragraph 43; Case M.4601, KarstadtQuelle/MyTravel, paragraph 28 et seq; Case M.5462, Thomas Cook Group/Gold Metal International, paragraph 9 et seq.

15 Case M.8046 – TUI/Transat France, paragraph 27.

16 See replies to Q1 – Questionnaire to Tour Operators, question 11.1.

17 See replies to Q1 – Questionnaire to Tour Operators, question 11.1, replies of EasyJet Holiday to question 11.1; reply of a travel agent to Q3 – Questionnaire to Travel Agents, question 10.1, “Big Tour operators like Corendon or Sunweb buy hotels or sell them in the market on an exclusive basis. These hotels can only be booked with them. No alternatives”.

18 See replies to Q1 – Questionnaire to Tour Operators, questions 12.1 and 13.1; Q2 – Questionnaire to Online Travel Agents, questions 18 and 19; Q3 – Questionnaire to Travel Agents, questions 11 and 12.

19 Form CO, Annex 22A, Triton 5.4 Doc #30, […] p.119.

20 Form CO, Annex 22A, Triton 5.4 Doc #30, […] p.135.

21 The AVNR is the Dutch Association of Travel Agents and Tour Operators.

22 Case M.4601, KarstadtQuelle/MyTravel, paragraph 25; Case M.4600, TUI/First Choice, paragraph 30; Case M.1524, Airtours/First Choice, paragraph 10.

23 Case M.8046 – TUI/Transat France, paragraph 30 et seq.

24 Case M.8046 – TUI/Transat France, paragraph 39.

25 Case M.8046 – TUI/Transat France, paragraph 31.

26 Form CO, paragraph 344 et seq.

27 See replies to Q1 – Questionnaire to tour operators, questions 14 and 14.1.

28 See replies to Q1 – Questionnaire to tour operators, questions 14 and 14.1.

29 Club Med offers different webpages for “vacances au soleil” and “vancances au ski”. See e.g. https://www.clubmed.be/l/vacances-au-soleil.

30 See replies to Q3 – Questionnaire to travel agents, questions 13 and 13.1.

31 Case M.8046 – TUI/Transat France, paragraph 59.

32 Case M.8046 – TUI/Transat France, paragraph 59.

33 Form CO, paragraphs 349-351.

34 Form CO, paragraph 77.

35 Form CO, paragraph 169.

36 Form CO, paragraphs 174-175.

37 Form CO, paragraph 181 et seq.

38 Form CO, paragraph 186 et seq.

39 Form CO, paragraph 192 et seq.

40 Form CO, paragraph 192-193.

41 Form CO, paragraph 198 et seq.

42 Form CO, paragraphs 201-203.

43 Replies to Q1 – Questionnaire to Tour Operators, question 16; Q2 – Questionnaire to Online Travel Agents, question 22; Q3 – Questionnaire to Travel Agents, question 15.

44 Reply to Q1 – Questionnaire to Tour Operators, question 16.1.

45 Reply to Q3 – Questionnaire to Travel Agents, question 15.1.

46 Reply to Q1 – Questionnaire to Tour Operators, question 16.1.

47 Replies to Q1 – Questionnaire to Tour Operators, question 17; Q2 – Questionnaire to Online Travel Agents, question 25; Q3 – Questionnaire to Travel Agents, question 18.

48 Reply to Q3 – Questionnaire to Travel Agents, question 18.1.

49 Replies to Q1 – Questionnaire to Tour Operators, question 18; Q2 – Questionnaire to Online Travel Agents, question 24; Q3 – Questionnaire to Travel Agents, question 15.

50 Replies to Q1 – Questionnaire to Tour Operators, question 20; Q2 – Questionnaire to Online Travel Agents, question 26; Q3 – Questionnaire to Travel Agents, question 19.

51 See agreed non-confidential minutes of a conference call of 26 August 2019 with a tour operator, paragraph 8.

52 Replies to Q1 – Questionnaire to Tour Operators, question 21; Q2 – Questionnaire to Online Travel Agents, question 27; Q3 – Questionnaire to Travel Agents, question 20.

53 Reply to Q3 – Questionnaire to Travel Agents, question 20.1.

54 Replies to Q1 – Questionnaire to Tour Operators, question 23.

55 See for instance Form CO, Annex 22A, Triton 5.4 Doc #17, […], p.11.

56 Replies to Q1 – Questionnaire to Tour Operators, question 24.

57 Replies to Q1 – Questionnaire to Tour Operators, question 22; Q2 – Questionnaire to Online Travel Agents, question 28; Q3 – Questionnaire to Travel Agents, question 21.

58 Form CO, paragraph 101 et seq.

59 i.e. the Commission will not assess, for the purpose of this decision, the geographic scope of the plausible wider market for leisure travel services, which would comprise package holidays, dynamic packages and independent holidays.

60 See for example cases M.8046 – TUI/Transat France, paragraph 65; M.6704 – REWE Touristik GmbH/Ferid NASR/EXIM Holding SA, paragraph 28; M.5867 – Thomas Cook/Öger Tours, paragraphs 11 and 13; Case No IV/M.1524 – Airtours/First Choice, paragraph 50.

61 Cases M.4600 – TUI/First Choice, paragraph 39; M.1898 – TUI Group/GTT Holding, paragraph 22.

62 See for example M.4600 – TUI/First Choice, paragraph 149 et seq.

63 Case M.4600 – TUI/First Choice, paragraph 38.

64 Form CO, paragraph 101 et seq.

65 Form CO, paragraph 108 et seq.

66 Form CO, paragraph 147 et seq.

67 Form CO, Annex QP2-2 – Belgian residents booking via Dutch website of the Parties.

68 Form CO, Annex QP2-2 – Dutch residents booking via Belgian website.

69 Replies to Q1 – Questionnaire to Tour Operators, question 30; Q2 – Questionnaire to Online Travel Agents, question 34; Q3 – Questionnaire to Travel Agents, question 27.

70 E.g. www.corendon.nl for Dutch residents and www.corendon.be with pages in French and Dutch; www.sunweb.nl for Dutch residents and www.sunweb.be with pages in French and Dutch for Belgian residents.

71 Replies to Q1 – Questionnaire to Tour Operators, question 28; Q2 – Questionnaire to Online Travel Agents, question 31; Q3 – Questionnaire to Travel Agents, question 25.

72 Form CO, Annex QP2-2, footnote 1.

73 Form CO, Annex 22A – Triton 5.4 Doc #9 […], p. 37.

74 Replies to Q1 – Questionnaire to Tour Operators, question 27; Q2 – Questionnaire to Online Travel Agents, question 30; Q3 – Questionnaire to Travel Agents, question 24.

75 Replies to Q1 – Questionnaire to Tour Operators, questions 34-35; Q2 – Questionnaire to Online Travel Agents, question 36-37; Q3 – Questionnaire to Travel Agents, question 29-30.

76 See agreed non-confidential minutes of a conference call of 2 September 2019 with a tour operator, paragraph 4.

77 Form CO, Annex 22A – Triton 5.4 Doc #15 […], p. 22.

78 Form CO, Annex 22A – Triton 5.4 Doc #048 […], p. 57.

79 Form CO, Annex 22A, Triton 5.4 Doc #30 […], p. 123.

80 Form CO, Annex 22A – Triton 5.4 Doc #015 […], p. 16.

81 Form CO, Annex 22A – Triton 5.4 Doc #048 […], p. 54.

82 Form CO, Annex 22A – Triton5.4 Doc #048 […], p. 36.

83 Form CO, Annex 22A – Triton 5.4 Doc #09 […], p. 52.

84 This is without prejudice to the fact that in the competition assessment, the Commission calculated market shares including package holidays with flights departing from foreign airports.

85 As explained in section 5.1 above, at this stage the question whether the relevant product market includes package holidays, dynamic packages and independent holidays requires further investigation.

86 Form CO, paragraphs 403-406, see also Table 7.1

87 Form CO, paragraph 633.

88 On the basis of the Notifying Party’s submission, the combined market share of the Parties (excl. Thomas Cook) for traditional package holidays would be [10-20]%, whereas the combined market share for traditional and dynamic packages would be [5-10]% (excl. Thomas Cook). See Form CO, Table 7.24A and the Parties’ submission in Annex QP7-1.

89 Form CO, paragraphs 633; 702-703.

90 See replies to Q3 – Questionnaire to travel agents, questions 39 and 40.

91 Form CO, Annex 22A – Triton 5.4 Doc #10 […], p. 3.

92 See replies to Q3 – Questionnaire to travel agents, question 40.4.1.

93 FTI Germany, Alltours and DER Touristik are predominantly active in Germany, whereas LuxairTours is predominantly active in Luxembourg.

94 See agreed non-confidential minutes of a conference call with a tour operator of 10 September 2019, paragraph 2; agreed non-confidential minutes of a conference call with a tour operator of 26 August 2019, paragraphs 3-4; tour operators’ replies to Q1 – Questionnaire to tour operators, questions 2 and 4.

95 See replies to Q3 – Questionnaire to travel agents, question 65.1.

96 See Horizontal Merger Guidelines, paragraph 39.

97 See replies to Q1 – Questionnaire to tour operators, question 49.

98 See replies to Q1 – Questionnaire to tour operators, question 49.1.

99 See replies to Q3 – Questionnaire to travel agents, questions 60.1 and 61.1.

100 Commission Notice on Case Referral in respect of concentrations (“Referral Notice”), OJ C 56, 05.03.2005, p. 2, paragraph 35.

101 Referral Notice, paragraph 36.

102 Referral Request, paragraph 47.

103 Referral Notice, paragraph 7.

104 Notifying Party’s submission dated 22 November 2019.

105 Notifying Party’s submission dated 22 November 2019.

106 See email email correspondence between the Belgian Competition Authority and the Commission of 8 November 2019 and 9 November 2019. See also correspondence between the Netherlands Authority for Consumers and Markets and the Commission of 24 October 2019.

107 Decision of the Belgian Competition Authority BMA-2017-C/C-31 of 11 September 2017 approving the acquisition of assets of Thomas Cook Airlines Belgium by Brussels Airlines.

108 Referral Request, paragraph 57.