Commission, January 15, 2020, No M.9502

EUROPEAN COMMISSION

Decision

SYNTHOMER / OMNOVA SOLUTIONS

Subject: Case M.9502 – SYNTHOMER/OMNOVA SOLUTIONS

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 15 November 2019, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 and following a referral pursuant to Article 4(5) of the Merger Regulation by which Synthomer plc (“Synthomer”, UK) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of Omnova Solutions, Inc. (“Omnova”, US) (the “Transaction”).3 Synthomer is referred to as the “Notifying Party” and, together with Omnova, the “Parties”.

1. THE PARTIES

(2) Synthomer develops and manufactures specialty chemicals for use in a variety of applications. Its activities are mainly concentrated in Europe, with [60-70]% of Synthomer's 2018 worldwide turnover generated in the EEA and sixteen of its production facilities located in the EEA (with one in the United States, two in Middle East/Africa and six in Asia).

(3) Omnova develops and manufactures specialty chemicals and thermoplastic films for a variety of applications. Omnova’s activities are predominantly based in North America, with eight of its thirteen production facilities located in the United States. In contrast, its EEA business is smaller, with [10-20]% of its 2018 worldwide turnover generated in the EEA and two plants in the EEA (at Le Havre (France) and Lisbon (Portugal)).

2. THE CONCENTRATION

(4) On 3 July 2019, Synthomer and Omnova entered into an agreement pursuant to which Synthomer agreed to acquire sole control of Omnova by purchase of its entire issued and to be issued share capital.

(5) The Transaction is therefore a concentration within the meaning of Article 3(1)(b) of the EU Merger Regulation.

3. SCOPE OF COMMISSION REVIEW

(6) The Transaction does not have a Union dimension within the meaning of Article 1 of the Merger Regulation as it does not meet the thresholds of Article 1(2) or Article 1(3).

(7) However, on 6 September 2019, the Notifying Party informed the Commission by means of a reasoned submission that the concentration would be notifiable in five Member States and would fulfill a number of further criteria for its referral to the Commission.4 In particular, the affected markets have a geographic scope that is wider than national (EEA-wide or worldwide) and a referral to the Commission would avoid multiple national filings, thereby increasing administrative efficiency. On that basis, under Article 4(5) of the Merger Regulation, the Notifying Party requested the Commission to examine the Transaction.

(8) The Commission agrees that the referral request meets the legal criteria set out in Article 4(5) of the Merger Regulation in that the Transaction is capable of being reviewed under the national merger control laws of at least three Member States, namely Austria, Germany, Portugal, Spain and the United Kingdom. In addition, none of the Member States competent to examine the Transaction under the respective national laws expressed their disagreement within 15 working days of receiving the reasoned submission.

(9) Therefore, the concentration falls under the scope of review of the Commission pursuant to Article 4(5) of the Merger Regulation.

4. COMPETITIVE ASSESSMENT

4.1. Analytical framework

(10) Under Articles 2(2) and 2(3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(11) A merger can entail vertical effects. As illustrated below, in the present case the vertical links arising from the Transaction are negligible and accordingly are unlikely to give rise to possible impediments of effective competition in the internal market or in a substantial part of it. More frequently, a merger can entail horizontal effects. In this respect, in addition to the creation or strengthening of a dominant position, the Commission Guidelines on the assessment of horizontal mergers under the Merger Regulation (“the Horizontal Merger Guidelines”)5 distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely (a) by eliminating important competitive constraints on one or more firms, which consequently would have increased market power, without resorting to coordinated behaviour (non-coordinated effects); and (b) by changing the nature of competition in such a way that firms that previously were not coordinating their behaviour are now significantly more likely to coordinate and raise prices or otherwise harm effective competition. A merger may also make coordination easier, more stable or more effective for firms which were coordinating prior to the merger (coordinated effects).6

(12) As illustrated below, the horizontal overlaps created by the Transaction with respect to certain affected markets are significant and may give rise to concerns as to a possible creation or strengthening of a dominant position so that effective competition in the internal market or in a substantial part of it may be significantly impeded because of the Transaction. Accordingly, this decision will analyse whether the Transaction is likely to raise serious doubts as to its compatibility with the internal market by the creation of non-coordinated effects in those markets on which the Parties’ activities lead to horizontal overlaps.

4.2. Overview of affected markets

(13) Synthomer and Omnova manufacture and supply speciality chemicals. Specialty chemicals are value-added products manufactured using polymerisation and other reactive processes to transform commodity raw materials into polymers and other complex chemical outputs that are used as an ingredient by customers who formulate finished products for the healthcare, consumer goods, construction and other sectors.

(14) The Parties’ activities horizontally overlap with respect to certain types of synthetic latex polymers (also referred to as “latex dispersions”). Latex dispersions are produced through the polymerization of one or more monomers and are mainly used as binders in the production of materials such as paper, carpets, adhesives, textiles and paints. More specifically, the Transaction leads to horizontally affected markets in:

(a) Vinyl pyridine latex (“VP Latex”);

(b) Carboxylated nitrile butadiene latex (“XNBR”);

(c) Carboxylated styrene butadiene latex (“XSBR”);

(d) Styrene acrylic (“SA”); and

(e) High solids styrene butadiene (“HS-SB”).

(15) Each of these horizontally affected markets will be addressed in turn. There are only very limited vertical links arising from the Transaction, which are not analysed in detail as they do not give rise to competition concerns.7

4.3. Vinyl pyridine latex (VP Latex)

4.3.1. Market definition

(16) VP Latex is an aqueous polymer used in heavy duty rubber goods, primarily tyres, to promote the adhesion between reinforcing cords or fabric and rubber compounds. The most common use of VP Latex is in the tyre cord application, whereby nylon or polyester yarns are dipped or coated in VP Latex before being embedded in a tyre to reinforce it against high pressure and temperatures. Both Parties are active in the production and sale of VP Latex, primarily for the tyre cord application.

4.3.1.1. Product market definition

Commission’s precedents

(17) In Bayer/Hüls, the Commission identified a separate product market for VP Latex.8 Since then, the Commission has consistently defined product markets for synthetic latex products according to the type of latex dispersion (i.e. chemical composition) and also by application.9 The Commission has previously also found that synthetic latex products should not be further divided into submarkets according to the grade qualities of the latex dispersions.10

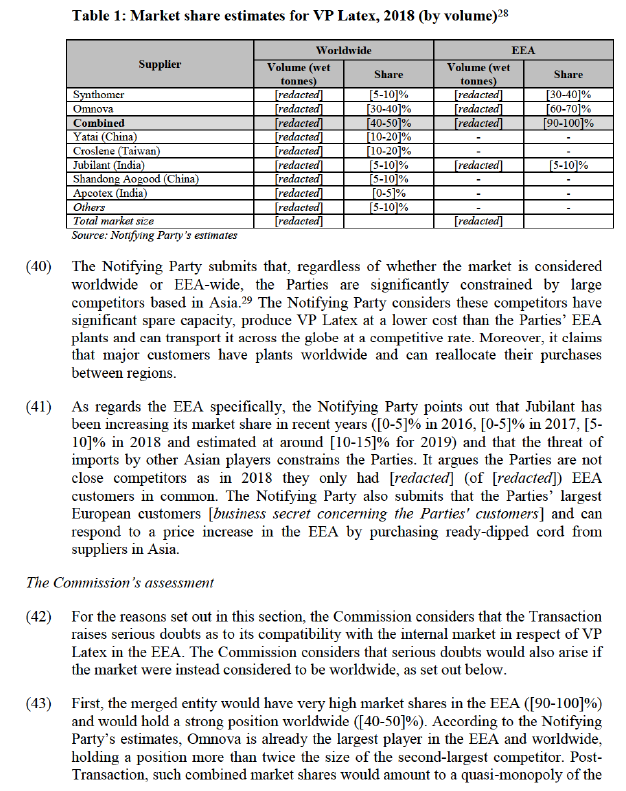

The Notifying Party’s view

(18) The Notifying Party argues that VP Latex forms a separate product market and that it is not necessary to segment the market for VP Latex by application or by grade (i.e. VP Latex with high and low vinyl pyridine content).11

(19) First, the Notifying Party notes that VP Latex is used primarily for the tyre cord application, but it is also used in the production of mechanical rubber goods. These applications should in its view not be considered distinct markets. From a demand perspective, the same grades of VP Latex are used across tyre cord and mechanical rubber goods. From a supply perspective, the same producers sell, or can sell, into all applications. Moreover, the Notifying Party argues that the competitive dynamics for VP Latex are driven by the tyre cord application given that the vast majority (around 85%) of VP Latex sales in the EEA and worldwide are for tyre cords.

(20) Second, the Notifying Party argues that there is substitution between VP Latexes with a high (typically ~15%) and low (typically ~10%) vinyl pyridine content. The Notifying Party acknowledges that demand-side substitution may be limited given that customers typically require a specific vinyl pyridine content to provide the adhesive performance required. However, it argues that there is a high degree of supply-side substitutability, as the only difference between high and low content VP Latex is the proportion of vinyl pyridine used in the formulation. Accordingly, both Parties produce both high and low content VP Latex [business secret regarding the production processes of the Parties]. No time or special steps are required to switch from producing one to the other; it is a change in recipe rather than process.

The Commission’s assessment

(21) The majority of respondents to the Commission’s market investigation confirmed that VP Latex should be considered a separate product market from other synthetic latexes. Customers generally did not consider that VP Latex could be substituted with other latexes, with some noting that other latex products do not have the same adhesion qualities as VP Latex. Even some of those customers that thought switching between VP Latex and other latex products might be possible highlighted that switching between them would require a material and time-consuming change in the formulation that customers use to manufacture the end-products.12 Competitors’ responses were inconclusive as to the degree of supply-side substitution between VP Latex and other synthetic latex products.13

(22) While the market investigation did not provide evidence that a segmentation by application was necessary, it nonetheless revealed that customers typically purchase a specific grade of VP Latex to be incorporated in the finished products they manufacture.14 Most customers that responded to the market investigation considered that switching between grades of VP Latex was challenging. In particular, customers noted that switching would require a change in the formulation used, may impact the adhesion performance of the end product, and would require testing and approvals by end-customers.15

(23) On the other hand, the market investigation clearly confirmed that there is supply- side substitution between VP Latex grades. All suppliers that responded indicated that they can and do switch production between VP Latex with high and low vinyl pyridine content on the same production line with limited effort.16

(24) For the reasons set out above, the Commission considers that, for the purposes of this decision, VP Latex constitutes a distinct product market from other synthetic latex products, without the need for further segmentation.

4.3.1.2. Geographic market definition

Commission’s precedents

(25) The Commission has previously considered the relevant geographic market for all types of synthetic latex products (including VP Latex specifically) to be EEA- wide.17 In particular, the Commission pointed to differences in price levels between continents and the fact that the flow of supply between continents was not significant.

The Notifying Party’s view

(26) The Notifying Party argues that the competitive conditions have changed since the Commission’s decision in Bayer/Hüls and that the relevant market for VP Latex is worldwide.18

(27) First, the Notifying Party argues that the costs of shipping VP Latex overseas are low and that there are no regulatory barriers to selling in the EEA. For example, the Notifying Party estimates that the cost of shipping from a plant in India to a customer in the EEA is around [0-5]% of the average final sales price in the EEA and that the cost of shipping from France to Shanghai is around [0-5]% of the average final sales price in the EEA.

(28) Second, the Notifying Party considers that trade flows have increased since the Commission’s decision in Bayer/Hüls. It points out that Omnova and Synthomer ship a significant proportion of their EEA VP Latex production to customers outside of the EEA ([70-80]% and [30-40]% respectively), while some Asian manufacturers (e.g. Jubilant of India) have begun selling into the EEA. The Notifying Party also explains that all sales to the US are imports given that there are no VP Latex plants in the US; [business secret regarding Omnova's sales and production strategies].

(29) Third, the Notifying Party submits that many VP Latex customers (such as tyre cord dippers or tyre manufacturers) are multinational companies with factories worldwide. It argues that these customers negotiate supply agreements comparing terms and conditions on a worldwide basis, frequently adjust pricing, and can and do arbitrage across the globe as they can gradually shift their purchases and production across regions.

(30) Finally, it argues that VP Latex is also imported into the EEA indirectly in the form of finished (already-dipped) tyre cord. The Notifying Party estimates that [confidential information regarding the Notifying Party's internal analysis/estimate regarding the percentage of the total VP Latex demand in the EEA that VP Latex imported through finished tyre cord represents].

The Commission’s assessment

(31) The results of the market investigation did not confirm the view of the Notifying Party, but rather pointed to the existence of an EEA-wide market for VP Latex.

(32) First, while the Parties may export VP Latex outside the EEA, their sales into the EEA are very limited. Moreover, imports of VP Latex in the EEA are limited. Very few EEA end-customers responding to the market investigation indicated that they source VP Latex from suppliers outside the EEA, in line with the Notifying Party’s estimate that imports account for a small proportion of sales in the EEA (around or less than 10% in 2018, see Table 1 below).19 Moreover, those respondents who do procure VP Latex from outside the EEA confirmed that they do not rely on non-EEA suppliers as their primary supplier, procuring only a small part of their needs from them (typically 10-15%).20

(33) Second, the majority of EEA end-customers indicated that it was important for their supplier’s factory to be close to their production plants to manage costs, lead time and business continuity.21 This is supported by the fact that respondents typically require just-in-time delivery or hold stock to cover their short-term needs.22

(34) Third, a clear majority of EEA end-customers indicated that there were barriers to procuring VP Latex from other regions, in particular long delivery periods, sizeable transport costs, concerns around ensuring the security of supply, as well as the risk that the product may be damaged in transit.23 Suppliers responding to the market investigation agreed and identified similar barriers. In particular, transport costs were identified as a key barrier to shipping across regions.24

(35) Fourth, customers were generally sceptical or unsure about the credibility of Asian suppliers as an alternative in the EEA, with a number of customers raising substantial concerns around security of supply, lead time, transport costs and quality.25

(36) Finally, there is no strong evidence that a hypothetical small but significant and non- transitory increase in price in the EEA would be unprofitable due to the constraint from suppliers outside Europe. EEA end-customers responding to the market investigation were split on whether they would consider importing from outside the EEA in the event of such an increase.26 In practice, for the reasons set out in the previous recitals, only limited switching seems likely. Moreover, certain suppliers who responded noted that a hypothetical 5-10% increase in price in the EEA may not be sufficient to offset the high cost of transporting VP Latex from Asia to Europe.27

(37) In light of the above, the Commission considers that, for the case at hand, the relevant geographic market for VP Latex is EEA-wide. Nevertheless, the Commission considers that the assessment of the Transaction would not change even if the relevant geographic market were considered to be worldwide.

4.3.2. Competitive assessment

(38) Both Parties supply VP Latex in the EEA and worldwide. Synthomer produces VP Latex at its plant in Marl (Germany) and Omnova is active through its plants in Le Havre (France) and Caojing (China). The Parties are the only VP Latex manufacturers with production plants in the EEA.

The Notifying Party’s view

(39) The Notifying Party’s estimates of the Parties’ and their largest competitors’ market shares worldwide and in the EEA are as follows.

Parties in the market for the supply of VP Latex in the EEA, corresponding to the creation or strengthening of a dominant position. The market investigation confirmed these estimates – virtually all customers identified either Omnova or Synthomer as the largest supplier in the EEA and most identified one of the Parties as the largest player worldwide.30

(44) Second, the Transaction would eliminate an important competitive force as the Parties are close competitors. Other than Omnova, Synthomer is the only supplier of VP Latex with manufacturing capability in the EEA. The market investigation showed that customers and competitors consistently identify Synthomer and Omnova as each other’s closest competitor in the EEA and worldwide. Respondents cited the grades offered, quality of products, pricing and their location as reasons why the Parties are close competitors.31

(45) Third, other than Synthomer, there is only a limited constraint on Omnova in the EEA. As outlined above in recital 35, while Asian suppliers do sell to some customers in the EEA, the market investigation did not support the Notifying Party’s arguments that they pose a strong constraint on the Parties. Indeed, Asian suppliers responding to the market investigation consider that they are only “rarely” or “sometimes” able to win business from or against the Parties in the EEA.32 Most EEA end-customers confirmed that they did not have suppliers other than Synthomer or Omnova qualified and that in the last three years they had not considered sourcing VP Latex from any suppliers other than Synthomer or Omnova to meet their EEA demand.33 Moreover, there was limited evidence in customers’ responses that dipped cord could act as a constraint on the merged entity, and few customers were aware of VP Latex suppliers who had recently entered or were intending to enter the market for VP Latex in the EEA.34

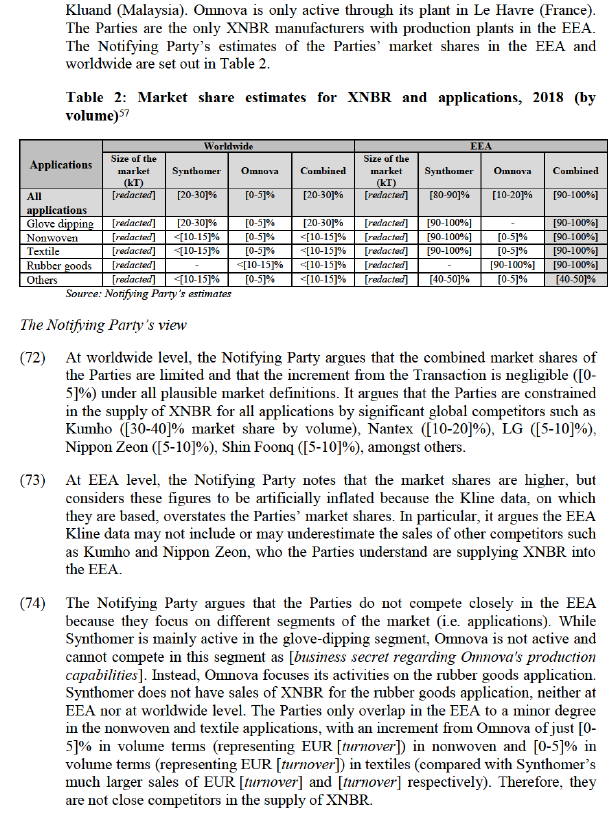

(46) Finally, and consistent with all of the above, the results of the market investigation showed that customers were concerned about the impact of the Transaction, in particular in the EEA. The vast majority of EEA end-customers confirmed that it is important to be able to source VP Latex from more than one production plant (and supplier), to ensure the security of supply and competitiveness of suppliers’ offers.35 Accordingly, the majority of EEA end-customers were concerned that there would not be sufficient choice of suppliers in the EEA post-Transaction and expected the Transaction to result in price increases in the EEA.36 Worldwide, while customers considered that there would be a sufficient number of suppliers, most respondents that expressed a view considered that price increases were likely.37 Moreover, a number of EEA end-customers were concerned that the Transaction would endanger their security of supply, as there would not be any EEA-based alternative to the merged entity and few (if any) credible alternatives for customers requiring VP Latex for their plants in the EEA.38

(47) In light of the above, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market as regards the market for VP Latex in the EEA (and would also do so if the relevant geographic market were instead considered to be worldwide).

4.4. Carboxylated nitrile butadiene latex (XNBR)

4.4.1. Market definition

(48) XNBR is an aqueous emulsion polymer of acrylonitrile-butadiene, stabilized with antioxydants. It is mainly used in the production of rubber gloves, but also in other applications such as the binding of nonwoven fabrics and the production of textile and rubber goods. Its good resistance to other chemicals (such as water, oils, fats, greases, alcohols as well as various solvents), and high abrasion and tear resistance make it commonly used in applications requiring the material to perform its elastomeric function in the presence of chemical agents.

(49) Glove dipping39 represents 96% of all XNBR consumption worldwide, with customers mainly located in South-East Asia. However, the glove-dipping application only represents 25% of the XNBR consumption in the EEA.

(50) XNBR’s chemical composition is distinct from non-carboxylated nitrile butadiene latex (“NBR Latex”) as well as nitrile butadiene rubber (“NBR Solid”), because the manufacturing processes of these two products do not involve a carboxylation step.

4.4.1.1. Product market definition

Commission’s precedents

(51) In Bayer/Hüls, the Commission referred specifically to nitrile butadiene latex but did not consider the product market definition in any depth and did not set out whether it was referring to NBR (non-carboxylated) latex or XNBR (carboxylated) latex.40 However, in the context of XSBR (discussed in section 4.5) the Commission has drawn a distinction between carboxylated and non-carboxylated products.41

(52) Moreover, in previous cases, the Commission has consistently defined product markets according to the type of latex dispersion (i.e. chemical composition) and also by application.42 The Commission found that there was no need to further divide the markets according to the grade qualities of the latex dispersions.43

The Notifying Party’s view

(53) The Notifying Party submits that XNBR is distinct from NBR Latex, because as specialty products with different chemical properties they address different specific customer needs with no demand-side substitutability between them.44

(54) In addition, the Notifying Party argues that there is very little supply-side substitutability between these two products, because the production of NBR Latex requires specific know-how that not all XNBR manufacturers possess. Illustratively, [business secret regarding production process and business strategy of Notifying Party].

(55) For the same reason, the Notifying Party also submits that XNBR is distinct from NBR Solid (which consists of coagulated, dried and ground NBR Latex).

(56) In addition, the Notifying Party considers that there is only limited substitutability between the different applications of XNBR (glove-dipping, rubber goods, nonwovens, textile and others). It claims that demand-side substitutability is limited as each customer/application requires specific properties. It explains that there is some supply-side substitutability (as all XNBR grades are made on technically similar equipment and are produced by tweaking the inputs and process),45 but that this supply-side substitutability can only be effective to the extent that a supplier has developed the grades that are needed to fit the specific requirements of customers for different applications.46

The Commission’s assessment

(57) The results of the market investigation confirmed that the vast majority of customers do not consider XNBR to be substitutable with any other types of latex dispersion.47 In particular, none of the customers that considered potential substitutability between XNBR and other types of latex dispersions identified NBR as a substitute for XNBR.

(58) The market investigation also brought some indication that a segmentation by application could be relevant in the case of XNBR. In particular, the majority of customers do not consider that any type of XNBR can be used for the production of the end-products they manufacture.48

(59) Finally, as regards a potential segmentation of the market by grade, the market investigation did not bring to light any indication that would contradict the Commission's earlier practice not to further segment the market for XNBR according to the grade qualities.

(60) In view of the above, the distinction between XNBR for different applications appears relevant. However, for assessing the Transaction, the exact scope of the product market definition can be left open since the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any of the two above-mentioned alternative market definitions (XNBR as a single product or sub- segmented by applications, namely: glove dipping, textile, non-woven, rubber goods and others).

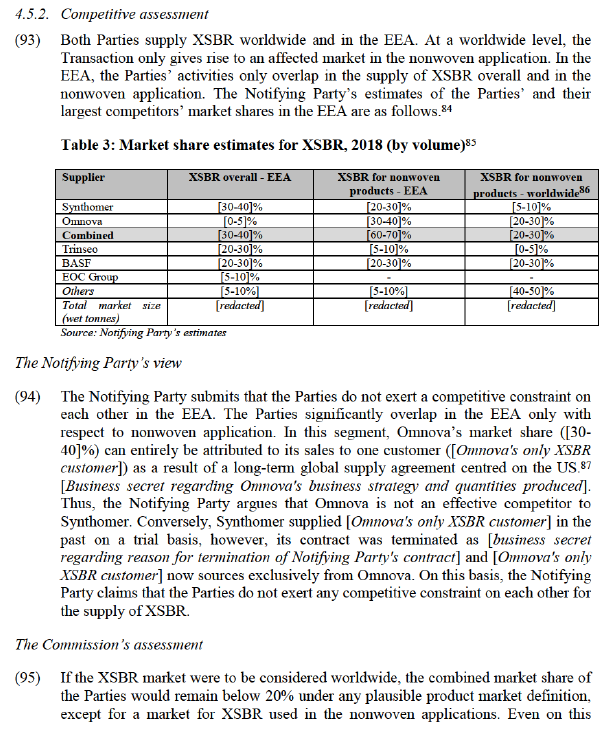

4.4.1.2. Geographic market definition

Commission’s precedents

(61) The Commission has previously considered the relevant geographic market for all types of synthetic latex products (and more specifically for nitrile butadiene latex) to be EEA-wide.49

The Notifying Party’s view

(62) The Notifying Party argues that the relevant market for XNBR is worldwide since the costs of shipping XNBR Latex overseas are low, the shelf life of XNBR (6-12 months according to the Notifying Party) makes it suitable for worldwide shipment, there are no regulatory barriers to selling in the EEA, and the market addresses global customers, mainly in the glove-dipping segment, with sophisticated buying processes, who have the ability to source worldwide.50

(63) Moreover, Omnova and Synthomer ship significant volumes of XNBR produced at their EEA plants to customers based outside the EEA ([10-20]% and more than [60- 70]%, respectively). They are also aware that EEA customers purchase (or have purchased) imported XNBR for niche applications from various Asian (Japanese, Korean and Indian) suppliers.

(64) The Notifying Party also emphasises that the EEA market for XNBR is very small (EUR 14 million, representing around 1% of worldwide sales). It argues that this is because major customers (and the glove-dipping industry generally, which accounts for the vast majority of XNBR sales) are mainly located in Asia and that these customers source globally. This explains the low level of imports of XNBR into the EEA. The Notifying Party further argues that the apparent low interest of non-EEA suppliers for selling into the EEA might also be a result of the moderate price levels for XNBR in the EEA, as the threat of imports acts as a disciplining factor within the EEA.

The Commission’s assessment

(65) The market investigation confirmed that the geographic market is likely to be EEA- wide, but also provided indications that the market could be wider in scope. While EEA customers currently procure limited quantities of XNBR from outside the EEA,51 the majority of them indicated they would consider procuring XNBR from outside the EEA in the event of a hypothetical small but significant and non- transitory increase in price in the EEA.52 Some customers explained that they are price sensitive, so they might instead turn to suppliers in China, Japan, India, Russia, Brazil or the US.53

(66) However, other aspects of the market investigation pointed towards a narrower, EEA-wide relevant geographic market.

(67) First, most XNBR customers that responded to the market investigation consider it important to be supplied by a production plant close to their plants, because transportation costs, lead-time, security of supply and the shelf-life of XNBR (estimated by customers to be 6 months) typically dictate where they procure from.54

(68) Second, most customers indicated that there are barriers to procuring XNBR across regions. Transport costs, long delivery periods, import/export tariffs and security of supply were mentioned among such barriers. Regulatory barriers (REACH compliance) as well as the product’s technical characteristics (temperature variations can affect the quality of XNBR) were also listed among the reasons why EEA customers cannot easily procure from outside the EEA.55

(69) Moreover, most customers that responded to the market investigation were sceptical or unsure about whether Asian suppliers are a credible alternative for the supply of XNBR in the EEA.56

(70) In any event, for the purposes of assessing the Transaction, the exact scope of the geographic market definition can be left open since under all above-mentioned plausible alternative geographic market definitions, (worldwide or EEA-wide), the conclusion of the Commission as to the compatibility of the Transaction with the internal market will remain unchanged.

4.4.2. Competitive assessment

(71) Both Parties supply XNBR in the EEA and worldwide. Synthomer produces XNBR at its plants in Langelsheim (Germany), Filago (Italy), Pasir Gudang (Malaysia) and

(75) Accordingly, the Notifying Party submits that Omnova only exerts a very limited competitive constraint on Synthomer for XNBR in the EEA. It explains that the Parties have next to no XNBR customers in common in the EEA – only [redacted] customers in 2018 out of the Parties’ combined total of more than [redacted] customers in the EEA.58 Indeed, the Notifying Party explains that [business secret regarding Omnova's business strategy]. The Notifying Party adds that Omnova’s capacity for the manufacture of XNBR at its Le Havre plant is much smaller than Synthomer’s capacity and therefore Omnova cannot exert a meaningful constraint on Synthomer at EEA level.59 The Notifying Party claims that the fact that Omnova is not mentioned among Synthomer’s competitors for XNBR in Synthomer’s internal documents supports this view.

(76) Finally, the Notifying Party claims that, for these applications, Synthomer is constrained in the EEA by significant non-EEA XNBR manufacturers. In particular, in the textiles application, Synthomer has lost a customer to the South Korean chemical manufacturer Kumho in 2019 – the volumes lost to Kumho are twice as big as Omnova’s total sales in the textile segment in the EEA in 2018. The Notifying Party argues that other major global players such as Nantex, LG Chem, Shin Foong, Bangkok Synthetics, Apcotex, Jubilant and Emerald are currently selling or are well- placed to sell to customers in the EEA, taking advantage of low production costs and low transportation costs and use local distributors to sell their products into the EEA.

The Commission’s assessment

(77) As can be seen from Table 2, under all plausible product market definitions at worldwide level, the Parties’ market shares would remain limited (<[20-30]%) with a negligible increment of [0-5]% and a HHI increment of <[redacted]. The market investigation supported the Notifying Party’s argument that a number of competitors will remain at worldwide level post-Transaction.60 Therefore, the Commission considers that the Transaction does not raise competition concerns in relation to XNBR (whether or not segmented by application) at worldwide level.

(78) At EEA level, the market investigation confirmed the Notifying Party’s claim that Synthomer and Omnova only exert a limited competitive constraint on each other, for the following reasons.

(79) First, the market investigation revealed that multi-sourcing is not an important factor for XNBR customers. Most customers do not consider it important to source XNBR from more than one supplier, and hardly any respondents have more than one supplier qualified for the supply of this product.61 The very few respondents who do procure from more than one supplier source over 90% of their needs from one single supplier, only using the other supplier as a back-up.62 A number of EEA customers indicated that the volumes they procure are too low to justify multi-sourcing.63

(80) Second, the results of the market investigation confirmed that the Parties are not close competitors and that they only pose a limited constraint on each other in the EEA. When asked to identify the closest alternatives to Synthomer’s products in the EEA, the majority of customers that responded explained that there were no close alternatives or that they were not aware of any, and that the same is true in relation to Omnova’s products.64 This is in line with the Notifying Party’s submissions regarding the very different focus of the Parties’ XNBR activities in the EEA (i.e. only a minimal overlap by application) and the lack of substitutability across XNBR for different applications. Accordingly, customers generally did not express strong views regarding the impact of the Transaction on the availability of a sufficient number of suppliers or on prices in the EEA.65 Only two customers considered that the Transaction may lead to a lack of choice of suppliers for XNBR customers in the EEA. However, both of these customers confirmed that they could turn to several suppliers based outside the EEA as an alternative to the merged entity.66

(81) Third, it appears that non-EEA XNBR manufacturers do constrain the Parties to some extent. The majority of EEA end-customers stated that they would consider procuring XNBR from outside the EEA in the event of a hypothetical small but significant and non-transitory increase in price in the EEA.67 A number of global competitors have sufficient capacity and are well-placed to supply XNBR to the EEA. In particular, Kumho, the largest player worldwide, is already selling in the EEA via a European distributor and has won significant business from Synthomer in the EEA.68 Moreover, Nippon Zeon until recently (2016) produced XNBR in the UK and now supplies EEA customers from Japan,69 as well as having offices, warehouses and distributors in Europe.

(82) In light of the limited increment, the evidence of scarce actual competition between the Parties, as well as the lack of concerns expressed in the course of the market investigation, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market on the market for XNBR or any of its potential sub-segments at either EEA or worldwide level.

4.5. Carboxylated styrene butadiene latex (XSBR)

4.5.1. Market definition

(83) XSBR is an aqueous emulsion polymer of styrene and butadiene used predominantly in the paper and carpet-backing industries.

4.5.1.1. Product market

Commission’s precedents

(84) In previous cases, the Commission identified a separate product market for XSBR,70 and considered narrower segments by application.71 In these previous cases, the Commission based its assessment on XSBR used for paper applications as the narrowest plausible market definition, but did not specifically define separate XSBR product markets by application as those concentrations did not give rise to serious doubts with regards to XSBR regardless of the product market definition used.72 The Commission also considered a further sub-segmentation within applications by grade qualities, but has in the past concluded against doing so.73 Finally, the Commission has previously considered whether SA and XSBR should be considered to form one market, but has concluded against it.74

The Notifying Party’s view

(85) The Notifying Party considers that XSBR should not be sub-segmented by application, because the product is the same across many applications and there is strong supply-side substitutability between XSBR products for different applications.75

(86) The Notifying Party further argues that XSBR can be substitutable or face constraints from other products with different chemical compositions (such as SA) or even other non-chemical technologies (such as thermal or mechanical bonding for XSBR in the non-woven application). It therefore submits that XSBR and SA, on the one hand, and XSBR and non-chemical bonding technologies for nonwovens, on the other, may comprise plausible product markets, while noting that, in any event, the precise definition of the relevant product market can be left open.

The Commission’s assessment

(87) The market investigation provided indications that an overall market for XSBR would be appropriate, without the need for further segmentation.76 As regards segmentation by application, the market investigation supported the claim that there is a strong supply-side substitutability between different grades and applications of XSBR. XSBR of different grades and applications are produced using the same manufacturing process, technology, equipment and production lines, with limited time required to switch.77 The market investigation was overall inconclusive on demand-side substitutability for XSBR across different applications.78

(88) However, the market investigation did not support the Notifying Party’s claim that XSBR faces constraints from other products with different chemical compositions (such as SA) or even other non-chemical technologies. The majority of customers that responded to the market investigation consider that other latex dispersions (including SA) could not be used as a substitute for XSBR.79 Similarly, the market investigation did not reveal strong supply-side substitutability between XSBR and SA.80

(89) In any event, for the purposes of assessing the Transaction the exact scope of the product market definition can be left open since the Transaction does not give rise to serious doubts as to its compatibility with the internal market under any of the two above-mentioned alternative market definitions (XSBR as a single product or sub- segmented by applications).

4.5.1.2. Geographic market

Commission’s precedents

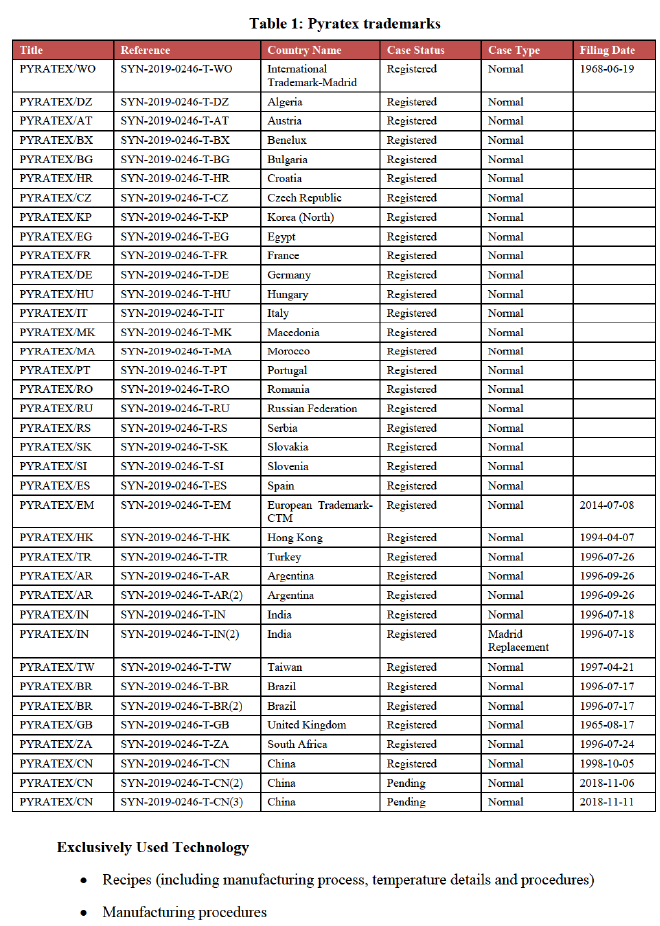

(90) The Commission has previously considered the relevant geographic market for all types of synthetic latex products to be EEA-wide.81

The Notifying Party’s view

(91) The Notifying Party submits that there have not been any significant changes in the geographic market for XSBR since the Commission’s decision in BASF/CIBA and that the relevant geographic market for XSBR is EEA-wide.82

The Commission’s assessment

(92) The market investigation did not provide the Commission with strong reasons to depart from its previous practice.83 Therefore, the Commission considers that, for the case at hand, the relevant geographic market for XSBR is EEA-wide. Nevertheless, the appropriate geographic market definition can be left open, given that the Transaction would not raise serious doubts regarding the market for XSBR regardless of whether the market is considered EEA-wide or worldwide.

narrow segmentation the Parties market shares would be less than [30-40]% (Synthomer: [5-10]%, Omnova [20-30]%). The HHI post-Transaction will remain below [redacted], with a HHI increment below [redacted]. A number of competitors will compete with the merged entity, including BASF, Mallard Creek and Trinseo. Therefore, under a worldwide geographic market definition, the Transaction would not be likely to raise competition concerns irrespective of the product market definition considered.

(96) On the overall market for the supply of XSBR (all applications) in the EEA, the Parties would continue to face competition from a number of strong XSBR suppliers. Moreover, the increment from the Transaction would remain marginal ([0- 5]%) with a HHI increment of <[redacted]. Therefore, the Commission considers that the Transaction does not raise competition concerns in relation to the overall XSBR market in the EEA.

(97) If the market is segmented by application, the Parties significantly overlap only in the market for XSBR for nonwoven applications in the EEA. The market investigation confirmed the Notifying Party’s claim that Synthomer and Omnova are not close competitors. Most notably, it confirmed that Omnova is considered to be of limited importance in the EEA with [business secret regarding Omnova's production facilities], and it only supplies one customer, as a result of [business secret regarding Omnova's business strategy]. In any event, it is likely that post- Transaction a sufficient number of competitors will exercise competitive constraints on the merged entity in the market for XSBR for nonwoven applications in the EEA.88 The market investigation also confirmed that Synthomer is not a credible competitor to Omnova for the sole customer that Omnova supplies in the EEA.89

(98) In light of the above, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market on the market for XSBR or any of its potential sub-segments at either EEA or worldwide level.

4.6. Styrene acrylic (SA)

4.6.1. Market definition

(99) SA is a copolymer of styrene monomers with acrylic acid esters. It is mainly used in paints and coatings, as well as paper, and is also used in printing inks, floor polishes, adhesives (for ceramic tile, laminating, and cold sealing), sealants and caulks, cement additives, mortar mixes, self-levelling floor screeds, concrete roof tile and fibrocement coatings, flexible roofing membranes, elastomeric crack-bridging wall coatings, and nonwoven fabric applications.

4.6.1.1. Product market

Commission’s precedents

(100) The Commission has previously identified a separate product market for SA,90 and considered narrower segments by application, notably the paper application.91 In these previous cases, the Commission based its assessment on SA used for paper applications as the narrowest plausible market definition, but did not specifically define separate product markets by application.92 The Commission also considered a further sub-segmentation within applications by grade qualities, but concluded against doing so.93 Finally, the Commission previously considered whether SA and XSBR are part of the same market, but concluded against it.94

The Notifying Party’s view

(101) The Notifying Party agrees with the previous assessment of the Commission and provided market share data on the basis of all plausible market definitions (on the basis of an overall market for SA, a segmentation by application and a market encompassing both XSBR and SA).95

The Commission’s assessment

(102) The results of the market investigation clearly indicate that SA is not substitutable with other types of latex dispersion (including XSBR).96 As regards a segmentation by application, while the majority of customers consider that such segmentation is not necessary,97 some of them indicate that they could not use another type of SA for the manufacture of their end-products. On the supply-side, all competitors that expressed a view use the same manufacturing equipment to produce different grades of SA, thus suggesting strong supply-side substitutability across different applications.98

(103) In any event, the Commission considers that, for the purpose of the present case, the exact scope of the product market definition for SA can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market, regardless of the product market definition (i.e. an overall market for SA or a segmentation by application).

4.6.1.2. Geographic market

Commission’s precedents

(104) The Commission has previously considered the relevant geographic market for SA to be EEA-wide.99

Notifying Party’s view

(105) The Notifying Party agrees with the previous assessment of the Commission.100

The Commission’s assessment

(106) The market investigation did not provide any indications suggesting that the Commission should depart from its past decisional practice.101

(107) In any event, the Commission considers that, for the purpose of the present case, the exact scope of the geographic market definition for SA and its sub-segments can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market, regardless of the geographic market definition (i.e. EEA or worldwide).

4.6.2. Competitive assessment

(108) Both Parties are active in the production of SA and sell it into the paints and coatings, nonwoven and construction applications, amongst others.

(109) The Transaction does not give rise to any affected SA market at worldwide level under any plausible product market definition. At EEA level, the Transaction does not give rise to an affected market if the relevant product market is considered to be SA for all applications, and only gives rise to one horizontally affected market, namely the market for the supply of SA for paints and coatings in the EEA, when considering SA by applications.

(110) According to the Notifying Party’s estimates, in this market the Parties had a combined market share of [20-30]% in volume in 2018, with a limited increment of [0-5]% from Omnova and a HHI increment of <[redacted].102 On this market, the merged entity would continue to face competition from a number of strong competitors, such as BASF ([20-30]%) and Dow Chemical ([10-20]%), as well as other smaller players.

(111) More generally, the results of the market investigation confirmed that the Parties are not particularly close competitors for the supply of SA,103 both in terms of geographic coverage and in terms of product offering,104 even within the paints and coatings application. The majority of market participants responding to the market investigation did not identify Omnova within the top five suppliers of SA for paints and coatings in the EEA.105

(112) Finally, the vast majority of customers who responded to the market investigation confirmed that they will continue to have a number of alternative suppliers from which to procure SA post-Transaction.106

(113) In light of the above, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the supply of SA under any plausible definition, including in the supply of SA for paints and coatings in the EEA.

4.7. High solids styrene butadiene (HS-SB)

4.7.1. Market definition

(114) HS-SB is a type of emulsion-polymerised latex. It is primarily used for carpet backing and moulded foam products (such as mattresses and pillows), but it can also be used in other applications, including footwear (insoles), adhesives and sealants, construction, tyres, glove dipping, and other rubber goods (e.g. conveyor belts).

4.7.1.1. Product market

Commission's precedents

(115) The Commission has not previously analysed the market for HS-SB. However, in previous cases involving synthetic latexes, the Commission has consistently defined product markets according to the type of latex dispersion (i.e. chemical composition) and also by application.107 The Commission also found that synthetic latexes should not be further segmented according to the grade qualities of the latex dispersions.108

The Notifying Party's view

(116) The Notifying Party claims that the relevant product market is the overall market for HS-SB, without the need for any further segmentation.109

The Commission's assessment

(117) The market investigation generally confirmed the Party’s view. Most customers consider that HS-SB is not substitutable with other types of latex dispersions, and that no further segmentation (e.g. by application or grades) is needed.110 On the supply-side, competitors that responded to the market investigation generally use the same manufacturing equipment to produce different grades of HS-SB, thus suggesting strong supply-side substitutability across different HS-SB grades and applications.111

(118) In any event, the Commission considers that, for the purpose of the present case, the exact scope of the product market definition for HS-SB can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market, regardless of the product market definition (i.e. overall market for HS-SB or segmentation by application or grade).

4.7.1.2. Geographic market

Commission's precedents

(119) The Commission has not previously analysed the market for HS-SB. However, the Commission has previously considered the relevant geographic market for all types of synthetic latex products to be EEA-wide.112

The Notifying Party's view

(120) In accordance with the general approach of the Commission with respect to synthetic latex products, the Notifying Party submits that the market for HS-SB should be defined as EEA-wide.113

The Commission's assessment

(121) The market investigation confirmed that the geographic market is likely to be EEA- wide, but also provided indications that the market could be wider in scope. While the majority of EEA customers that responded to the market investigation indicated that they do not consider suppliers based outside the EEA to be a credible alternative source of supply of HS-SB for their EEA-facilities,114 a number of EEA customers do purchase HS-SB from suppliers with production plants outside the EEA for their European needs.115

(122) In any event, the Commission considers that, for the purpose of the present case, the exact scope of the geographic market definition for HS-SB can be left open, since the Transaction does not raise serious doubts as to its compatibility with the internal market, regardless of the geographic market definition (i.e. EEA or worldwide).

4.7.2. Competitive assessment

(123) The Transaction gives rise to horizontally affected markets at EEA-level and worldwide. The Notifying Party estimates that the Parties’ combined market share in the supply of HS-SB in the EEA is [40-50]%, with an increment from Omnova of less than [0-5]%. At worldwide level, their combined market share is [20-30]%, with an increment from Omnova of less than [0-5]%. At both worldwide and EEA level, the HHI increment from the Transaction remains below [redacted].

(124) Omnova’s activities are negligible and do not appear to constrain Synthomer. While Synthomer produces and sells HS-SB for various applications, Omnova [business secret regarding Omnova's supply sources, quantities produced and sales and business strategy]. In 2018, Omnova had limited sales of EUR [turnover] to [number of HS-SB customers Omnova sold to] EEA customers and only had sales of EUR [turnover] worldwide (out of total worldwide sales of HS-SB of EUR [redacted] million).116

(125) The results of the market investigation confirmed that the Parties are not close competitors, that Omnova is a minor player and that other suppliers will remain active in the EEA and worldwide (such as Versalis, Synthos and Goodyear).117

(126) In light of the above, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the market for HS-SB, regardless of whether the market is considered EEA-wide or worldwide or segmented by application.

5. COMMITMENTS

5.1. Framework for the assessment of the Commitments

(127) Where a concentration raises serious doubts as regards its compatibility with the internal market, the parties may undertake to modify the concentration to remove the grounds for the serious doubts identified by the Commission. Pursuant to Article 6(2) of the Merger Regulation, where the Commission finds that, following modification by the undertakings concerned, a notified concentration no longer raises serious doubts, it shall declare the concentration compatible with the internal market pursuant to Article 6(1)(b) of the Merger Regulation.

(128) As set out in the Commission’s Remedies Notice,118 the commitments have to eliminate the competition concerns entirely, and have to be comprehensive and effective from all points of view.119

(129) In assessing whether commitments will maintain effective competition, the Commission considers all relevant factors, including the type, scale and scope of the proposed commitments, with reference to the structure and particular characteristics of the market in which the transaction is likely to significantly impede effective competition, including the position of the parties and other participants on the market.120

(130) In order for the commitments to comply with those principles, they must be capable of being implemented effectively within a short period of time. Concerning the form of acceptable commitments, the Merger Regulation gives discretion to the Commission as long as the commitments meet the requisite standard. Structural commitments will meet the conditions set out above only in so far as the Commission is able to conclude with the requisite degree of certainty, at the time of its decision, that it will be possible to implement them, and that it will be likely that the new commercial structures resulting from them will be sufficiently workable and lasting to ensure that serious doubts are removed.121 Divestiture commitments are normally the best way to eliminate competition concerns resulting from horizontal overlaps.

5.2. Proposed Commitments

(131) In order to render the concentration compatible with the internal market, the Notifying Party submitted a set of commitments under Article 6(2) of the Merger Regulation on 13 December 2019 (the “Initial Commitments”), described below.

(132) The Commission market tested the Initial Commitments to assess whether they are sufficient and suitable to remedy the serious doubts identified in Section 4.3 of this Decision. The feedback received during the market test confirmed that the Initial Commitments could in principle remedy the serious doubts identified by the Commission, but subject to modifications so as to address a number of specific issues described below in recitals 143 - 156. In order to address these issues, the Notifying Party submitted revised commitments under Article 6(2) of the Merger Regulation on 14 January 2020 (the “Final Commitments”).

5.2.1. Description of the Initial Commitments

(133) In order to render the Transaction compatible with the internal market, the Notifying Party submitted commitments consisting of the divestiture of Synthomer’s global VP Latex business, which is currently operated from its plant in Marl (Germany) and sold under the Pyratex brand (the “Divestment Business”) to a suitable purchaser (the “Purchaser”).

(134) The Initial Commitments would be implemented through a carve-out of the Divestment Business from Synthomer's plant in Marl (Germany).

(135) The Divestment Business includes assets necessary to manufacture and sell VP Latex. In particular, the Divestment Business includes the following main intangible and tangible assets:

(a) all tangible manufacturing assets that are exclusively or primarily used by the Divestment Business;

(b) all intangible assets (including intellectual property rights, know-how, recipes and other information) which are exclusively or primarily used by the Divestment Business (including the Pyratex brand), and the benefit of licenses to other relevant intangible assets currently used by Synthomer (or necessary) to manufacture, sell and use VP Latex but which are otherwise not exclusively or primarily used by the Divestment Business;

(c) all raw materials, stocks, works in progress, and semi-finished and finished goods relating exclusively to the Divestment Business (and agreed levels of other raw materials needed to operate the business when the sale of the Divestment Business is closed in line with the Purchaser’s requirements);

(d) all licences, permits and authorisations issued by any governmental organisation for the benefit of the Divestment Business;

(e) all contracts, commitments and customer orders of the Divestment Business;

(f) all customer, credit and other records of the Divestment Business;

(g) any other tangible or intangible assets which the purchaser may reasonably require to successfully complete the transfer of the Divestment Business to an alternative production location; and

(h) the personnel needed to run the Divestment Business, namely (i) an employee with product/applications knowledge and customer technical service knowledge for VP Latex, (ii) an employee with manufacturing/operations know-how for VP Latex, and (iii) a sales and marketing/commercial product manager for VP Latex, including the Hold Separate Manager.

(136) Furthermore, with the aim of ensuring a smooth transfer of the Divestment Business, the Notifying Party committed to offer a number of transitional supply arrangements to the Purchaser during the integration process to enable the Divestment Business to maintain and grow its sales of VP Latex as well as to facilitate this integration. To this end, the Notifying Party will enter into two transitional agreements (together, the “Transitional Agreements”):

(a) a “Transitional Toll Manufacturing Agreement”, under which the Notifying Party will continue to manufacture VP Latex at its Marl plant for the Purchaser on a tolling basis [cost basis of Transitional Toll Manufacturing Agreement], for a period of up to up to [duration of Transitional Toll Manufacturing Agreement] after the sale of the Divestment Business,

(b) a “Transitional Services Agreement”, under which the Notifying Party will provide sales and marketing, technical, logistical, procurement and product/manufacturing support to the purchaser ([cost basis of Transitional Services Agreement]) for a period of up to [duration of Transitional Services Agreement] (depending on the service) from the sale of the Divestment Business.

(137) Each of the Transitional Agreements may be extended for up to [extended duration of Transitional Agreements] if needed (depending on the service). The Purchaser will be required to use best efforts to complete the transition to its own manufacturing as soon as possible.

(138) In addition to the standard purchaser requirements contained in the Commission’s template for divestiture remedies, the Initial Commitments provide that the Purchaser must (i) have the proven capability and incentive to sell VP Latex directly or indirectly, (ii) have the proven knowledge of the relevant chemistry, and (iii) demonstrate on the basis of its technical and business plan its ability and incentive to establish manufacturing lines for VP Latex (or to integrate it into an existing production line) in the EEA in a timely and economic way and continue the production of VP Latex in the long run.

(139) The Initial Commitments also provide that the Notifying Party should enter into related commitments, inter alia regarding the separation of the Divestment Business from its retained businesses, the preservation of the viability, marketability and competitiveness of the Divestment Business, including the appointment of a monitoring trustee and, if necessary, a divestiture trustee.

(140) Finally, the Initial Commitments provide for a so-called “upfront buyer provision” pursuant to which the Transaction cannot be implemented before the Notifying Party has entered into a final binding sale and purchase agreement for the sale of the Divestment Business and the Commission has approved the Purchaser and the terms of sale.

(141) The Notifying Party argues that the Initial Commitments would eliminate the Commission’s serious doubts in relation to the supply of VP Latex in the EEA (and indeed worldwide). In particular, the Notifying Party is of the view that:

(a) the Initial Commitments would remove the overlap between the Parties in VP Latex as Synthomer would divest its worldwide VP Latex business;

(b) the Divestment Business is a distinct business that includes the necessary assets and personnel to ensure its viability and competitiveness on a lasting basis in the hands of a suitable purchaser, where it will provide effective competition in the supply of VP Latex in the EEA and worldwide; and

(c) the Transitional Agreements will ensure customers’ continued access to VP Latex and the efficient transfer of the Divestment Business to the Purchaser.

5.2.2. Assessment of the Initial Commitments

(142) The Commission launched its market test of the Initial Commitments and sought to assess the scope and effectiveness of the Commitments, the viability and attractiveness of the Divestment Business, and the appropriateness of the purchaser suitability criteria.

5.2.2.1. Suitability of the Initial Commitments to remove serious doubts

(143) As explained in Section 4.3 above, the Commission considers the Transaction raises serious doubts as to its compatibility with the internal market as regards the overlap between the Parties’ activities in the market for VP Latex.

(144) The Initial Commitments would remove the entire overlap between the Parties in the EEA ([volume]kt, EUR [value]) and worldwide ([volume]kt, EUR [value]), thus rendering the combined entity’s market share equal to Omnova’s market share pre- Transaction, at both EEA ([60-70]%) and worldwide level ([30-40]%).

(145) In addition, by requiring a sale to a purchaser with the ability and incentive to establish manufacturing lines for VP Latex (or integrate them) and sell the product in the EEA, the Initial Commitments would address the concern expressed by customers that post-Transaction there would only remain one supplier of VP Latex in the EEA. The divestment would ensure that there is a credible alternative supplier close to customers’ European production facilities.

(146) The market test of the Initial Commitments confirmed their suitability. The majority of competitors consider that the Initial Commitments would create a credible player in the market for VP Latex in the EEA and worldwide and that a suitable purchaser should be able to recover the investment in setting up a manufacturing line for VP Latex (via the Divestment Business) from the supply of VP Latex in a timely manner.122 Respondents expect customers to have the incentive to procure VP Latex from the Divestment Business.123

(147) The suitability of the Initial Commitments was also supported by customers’ responses, in particular as the majority of customers that responded indicated that they would consider qualifying the Purchaser of the Divestment Business as a supplier of VP Latex, and expected this qualification to be significantly easier than qualifying another new supplier they had not used in the past.124

(148) In light of the above, the Commission considers that the Initial Commitments proposed by the Notifying Party are suitable to address the serious doubts that the Transaction would otherwise give rise to.

5.2.2.2. Viability and competitiveness of the Divestment Business

(149) The Commission considers that the Divestment Business is viable and competitive. The Divestment Business achieved sales of EUR [turnover] worldwide in 2018, from more than [number of customers] customers located in 21 countries. The Notifying Party submits that the Divestment Business is profitable with a profit margin of [redacted]% in 2017 and [redacted]% in 2018.

(150) The market investigation confirmed that it is feasible to transfer a VP Latex production line as envisaged in the Initial Commitments and that the opportunity would be attractive for a suitable purchaser.125 The majority of respondents also consider that the Divestment Business contains the necessary assets, personnel and contracts for a suitable purchaser to effectively set up a VP Latex production line and compete effectively with the merged entity in the long run.126

(151) In addition, most respondents confirmed that the Transitional Agreements proposed by the Notifying Party are adequate to ensure a smooth transfer of the Divestment Business.127 However, the results of the market test also indicated that, depending on the need for and length of customers’ requalification processes, the duration of the Transitional Agreements envisaged in the Initial Commitments may not be sufficient to ensure the viability of the Divestment Business.

(152) In light of the above, the Commission considers that the Initial Commitments are adequate to ensure the viability and competitiveness of the Divestment Business if it is acquired by a suitable purchaser, but that the Initial Commitments should be amended to provide for the possibility of an additional extension of the Transitional Agreements.

5.2.2.3. Marketability, purchaser criteria and buyers

(153) As outlined in recital 138 above, the Initial Commitments proposed by the Notifying Party required that the Purchaser have knowledge of the relevant chemistry and prove its ability and incentive to establish manufacturing lines for VP Latex in the EEA and to sell VP Latex directly or via distributors, as well as to have the expertise and incentive to maintain and develop the Divestment Business as a viable and active competitive force.

(154) The majority of respondents to the market investigation confirmed that these criteria were appropriate and that no further requirements are needed.128 There was one exception – the majority of customers considered that it is important for the Purchaser to have an integrated sales network in the EEA. This is necessary to ensure the reliability of the supply chain, facilitate an efficient transition to the new Purchaser, and to reflect the current practice of the largest customers for a technical product such as VP Latex.

(155) The majority of competitors that responded to the market test considered the Divestment Business to be an attractive asset, likely to appeal to suitable purchasers. Indeed, a few respondents expressed interest in acquiring the Divestment Business.129

(156) In light of the above, the Commission considers that the Divestment Business is perceived as a marketable business, but that the purchaser criteria in the Initial Commitments should be amended to require that the Purchaser have an integrated sales network in the EEA.

5.2.3. Description and assessment of the Final Commitments

(157) In response to the Commission's feedback regarding the outcome of the market test and its preliminary assessment, the Notifying Party submitted the Final Commitments on 14 January 2020.

(158) The Final Commitments remove the possibility of a buyer having only an indirect capability to sell VP Latex in the EEA (i.e. via distributors), while preserving the remainder of the elements constituting the Initial Commitments. In the Final Commitments, the Purchaser must have the proven capability and incentive to sell VP Latex via an efficient and integrated sales network in the EEA, which may be demonstrated by having such an existing capability for products similar to VP Latex.

(159) In addition, the Final Commitments provide for a possibility for the Purchaser to require an additional [duration of extended Transitional Agreements] extension of the Transitional Agreements [cost basis of extended Transitional Agreements].130

(160) The Commission deems the Final Commitments are sufficient to eliminate the serious doubts as to the compatibility of the concentration with the internal market.

5.2.4. Conclusion on the Final Commitments

(161) For the reasons outlined above, and in view of the results of the market test, the Commission considers the Final Commitments to be sufficient in scope and suitable to eliminate the serious doubts as to the compatibility of the Transaction with the internal market in relation to VP Latex.

6. CONDITIONS AND OBLIGATIONS

(162) Under the first sentence of the second subparagraph of Article 6(2) of the Merger Regulation, the Commission may attach to its decision conditions and obligations intended to ensure that the undertakings concerned comply with the commitments they have entered into vis-à-vis the Commission with a view to rendering a notified concentration compatible with the internal market.

(163) The achievement of the measure that gives rise to the structural change of the market is a condition, whereas the implementing steps which are necessary to achieve this result are generally obligations on the Parties. Where a condition is not fulfilled, the Commission’s decision declaring the concentration compatible with the internal market no longer stands. Where the undertakings concerned commit a breach of an obligation, the Commission may revoke the clearance decision in accordance with Article 8(6) of the Merger Regulation. The undertakings concerned may also be subject to fines and periodic penalty payments under Articles 14(2) and 15(1) of the Merger Regulation.

(164) In accordance with the distinction described above, the decision in this case is conditioned on the full compliance with the requirements set out in Section B of the Final Commitments (including the Schedule), which constitute conditions. The remaining requirements set out in the other Sections of the Final Commitments constitute obligations on the Parties.

(165) The full text of the Final Commitments is annexed to this decision and forms an integral part thereof.

7. CONCLUSION

(166) For the above reasons, the Commission has decided not to oppose the notified operation as modified by the Final Commitments and to declare it compatible with the internal market and with the functioning of the EEA Agreement, subject to full compliance with the conditions in section B (including the Schedule) of the commitments annexed to the present decision and with the obligations contained in the other sections of the said commitments. This decision is adopted in application of Article 6(1)(b) in conjunction with Article 6(2) of the Merger Regulation and Article 57 of the EEA Agreement.

CASE No. COMP/M. 9502

SYNTHOMER / OMNOVA SOLUTIONS

COMMITMENTS TO THE EUROPEAN COMMISSION

14 January 2020

Pursuant to Article 6(2) of Council Regulation (EC) No 139/2004 (the “Merger Regulation”), Synthomer plc ("Synthomer" or the “Notifying Party”) hereby enters into the following Commitments (the “Commitments”) vis-à-vis the European Commission (the “Commission”) with a view to rendering the acquisition by Synthomer of Omnova Solutions, Inc. ("Omnova") (the “Concentration”) compatible with the internal market and the functioning of the EEA Agreement.

This text shall be interpreted in light of the Commission’s decision pursuant to Article 6(1)(b) of the Merger Regulation to declare the Concentration compatible with the internal market and the functioning of the EEA Agreement (the “Decision”), in the general framework of European Union law, in particular in light of the Merger Regulation, and by reference to the Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the “Remedies Notice”).

SECTION A. DEFINITIONS

1. For the purpose of the Commitments, the following terms shall have the following meaning:

Affiliated Undertakings: undertakings controlled by the Parties and/or by the ultimate parents of the Parties, whereby the notion of control shall be interpreted pursuant to Article 3 of the Merger Regulation and in light of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings (the "Consolidated Jurisdictional Notice").

Agreements: the Transitional Toll Manufacturing Agreement and the Transitional Services Agreement.

Assets: the assets that contribute to the current operation or are necessary to ensure the viability and competitiveness of the Divestment Business as indicated in Section B, paragraph 8 and described more in detail in the Schedule at paragraph 3.

Best Efforts: Best effort obligations shall be interpreted in light of the Commission's decision pursuant to Article 6(1)(b) of the Merger Regulation to declare the Concentration compatible with the internal market and the functioning of the EEA Agreement, the Merger Regulation and the general principles of EU law. Any interpretation that may be given to this term under the law of other jurisdictions is not relevant solely for the purpose of interpreting and/or implementing the Commitments.

Closing: the transfer of the legal title to the Divestment Business to the Purchaser.

Closing Period: the period of […] from the approval of the Purchaser and the terms of sale by the Commission.

Confidential Information: any business secrets, know-how, commercial information, or any other information of a proprietary nature that is not in the public domain.

Conflict of Interest: any conflict of interest that impairs the Trustee's objectivity and independence in discharging its duties under the Commitments.

Divestment Business: the business or businesses as defined in Section B and in the Schedule which the Notifying Party commits to divest.

Divestiture Trustee: one or more natural or legal person(s) who is/are approved by the Commission and appointed by Synthomer and who has/have received from Synthomer the exclusive Trustee Mandate to sell the Divestment Business to a Purchaser at no minimum price.

Effective Date: the date of adoption of the Decision.

Fast-Track Dispute Resolution Procedure: shall have the meaning given to that term in paragraph 49.

First Divestiture Period: the period of […] from the Effective Date.

Hold Separate Manager: the person appointed by Synthomer for the Divestment Business to manage the day-to-day business under the supervision of the Monitoring Trustee.

Key Personnel: all personnel necessary to maintain the viability and competitiveness of the Divestment Business, as listed in the Schedule, including the Hold Separate Manager.

Monitoring Trustee: one or more natural or legal person(s) who is/are approved by the Commission and appointed by Synthomer, and who has/have the duty to monitor Synthomer's compliance with the conditions and obligations attached to the Decision.

Omnova: Omnova Solutions, Inc., an Ohio corporation.

Parties: the Notifying Party/Notifying Parties and the undertaking that is the target of the concentration.

Purchaser: the entity approved by the Commission as acquirer of the Divestment Business in accordance with the criteria set out in Section D.

Purchaser Criteria: the criteria laid down in paragraph 22 of these Commitments that the Purchaser must fulfil in order to be approved by the Commission.

Retained Business: The businesses of Synthomer and Omnova other than the Divestment Business.

Schedule: the schedule to these Commitments describing more in detail the Divestment Business.

Synthomer: Synthomer plc, a public limited company incorporated under the laws of England and Wales, with its registered office at Temple Fields, Harlow, Essex, CM20 2BH and registered with the Company Register at Companies House under number 00098381.

Transitional Services Agreement: shall have the meaning given to that term in paragraph 9.

Transitional Toll Manufacturing Agreement: shall have the meaning given to that term in paragraph 10.

Trustee(s): the Monitoring Trustee and/or the Divestiture Trustee as the case may be.

Trustee Divestiture Period: the period of […] from the end of the First Divestiture Period.

VP Latex: vinyl pyridine latex.

VP Latex Business: Synthomer's VP Latex business as defined in Section B and the Schedule, which Synthomer commits to divest.

VP Latex Products: all of Synthomer's VP Latex products, including Pyratex 221, Pyratex 240, Pyratex 241.

SECTION B: THE COMMITMENT TO DIVEST AND THE DIVESTMENT BUSINESS

Commitment to divest

2. In order to maintain effective competition, Synthomer commits to divest, or procure the divestiture of, the Divestment Business by the end of the Trustee Divestiture Period as a going concern to a purchaser and on terms of sale approved by the Commission in accordance with the procedure described in paragraph 23 of these Commitments.

3. To carry out the divestiture, Synthomer commits to find a purchaser and to enter into a final binding sale and purchase agreement for the sale of the Divestment Business within the First Divestiture Period. If Synthomer has not entered into such an agreement at the end of the First Divestiture Period, Synthomer shall grant the Divestiture Trustee an exclusive mandate to sell the Divestment Business in accordance with the procedure described in paragraph 36 in the Trustee Divestiture Period.

4. The proposed Concentration shall not be implemented before Synthomer or the Divestiture Trustee has entered into a final binding sale and purchase agreement for the sale of the Divestment Business and the Commission has approved the Purchaser and the terms of sale in accordance with paragraph 23.

5. Synthomer shall be deemed to have complied with this commitment if:

5.1 by the end of the Trustee Divestiture Period, Synthomer or the Divestiture Trustee has entered into a final binding sale and purchase agreement and the Commission approves the proposed purchaser and the terms of sale as being consistent with the Commitments in accordance with the procedure described in paragraph 23; and

5.2 the Closing of the sale of the Divestment Business to the Purchaser takes place within the Closing Period.