Commission, May 30, 2018, No M.7000

EUROPEAN COMMISSION

Decision

LIBERTY GLOBAL / ZIGGO

Subject: Case M.7000 – LIBERTY GLOBAL / ZIGGO

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

1. INTRODUCTION

(1) On 14 March 2014, the European Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the "Merger Regulation") by which Liberty Global plc (''Liberty Global", the United Kingdom, also the "Notifying Party"), acquired within the meaning of Article 3(1)(b) of the Merger Regulation sole control over Ziggo N.V. ("Ziggo", the Netherlands) by way of a public bid ("the Transaction") in order to form an entity which would take over the parties' respective activities in the Netherlands ("NewZiggo").

(2) On 10 October 2014, the Commission declared the Transaction compatible with the internal market subject to the fulfilment of certain conditions (the "Conditional Clearance Decision" or "the 2014 Decision").

(3) By judgment of 26 October 2017 (the "Judgment"), the General Court annulled the Commission's Conditional Clearance Decision on the ground that the Commission failed to state the reasons of its finding that the proposed merger would not lead to vertical anti-competitive effects on the possible market for Premium pay TV sports channels.3 The General Court found, in fact, that the Conditional Clearance Decision did not contain any analysis of the impact of the downstream structural changes, with the joining together of Liberty Global’s and Ziggo’s respective distribution platforms, on the relevant market in question. In addition, the Court argued, when discussing the ability and incentive of Liberty Global to engage in foreclosure of Sport1, the Commission should also have assessed the respective market positions and competitive relationships of Fox Sports and Sport1.4

(4) In order to comply with the Judgment, the Commission is undertaking a re- assessment of the entire Transaction, including all affected markets, under current market conditions as stipulated by the text of Article 10(5) of the Merger Regulation.

(5) On 4 April 2018, Liberty Global and Vodafone (the "Notifying Parties") submitted to the Commission a supplement Form CO providing information on the Transaction, on its effect on competition and on the changes in market conditions occurred since the Conditional Clearance Decision (the "Supplement Form CO").

(6) Since the Conditional Clearance Decision, Liberty Global and Vodafone have combined their telecommunications businesses in the Netherlands in VodafoneZiggo. This subsequent transaction was conditionally cleared by the Commission on 3 August 20165 and was completed on 31 December 2016. As of that date, the target (which had become part of NewZiggo), was contributed by Liberty Global to VodafoneZiggo and is now indirectly jointly controlled by Liberty Global and Vodafone.

2. THE PARTIES

(7) Liberty Global owns and operates cable networks and some mobile networks worldwide and offers television, broadband internet, mobile and telephony services as well as mobile services.

(8) At the time of the Conditional Clearance Decision, Liberty Global owned a regional cable network in the Netherlands under the brand UPC. This was then merged with the Ziggo business into NewZiggo. Today, Liberty Global is active in the Netherlands via its joint venture with Vodafone – VodafoneZiggo - into which the NewZiggo entity was contributed.

(9) The Conditional Clearance Decision found that John Malone, a United States citizen, is the largest shareholder (albeit a minority shareholder) of Liberty Global.6 He also held significant minority shareholdings in Liberty Interactive Corporation ("LIC"), Liberty Media Corporation ("LMC") and Discovery Communications, Inc. ("Discovery"). John Malone also held the positions of Chairman of the respective boards of Liberty Global, LIC and LMC, as well as of director of Discovery. None of LIC, LMC or Discovery was found to be part of Liberty Global. Discovery was found to be active in the wholesale supply of TV channels, including in the Netherlands, and had recently acquired Eurosport SAS ("Eurosport").7

(10) The issue of whether John Malone controls Liberty Global, LIC or LMC was left open in the Conditional Clearance Decision given that the outcome of the competitive assessment was considered not to change whether or not John Malone controlled those companies.8

(11) Today, John Malone still holds significant minority shareholdings in Liberty Global, LMC, Discovery and LIC (which was renamed Qurate Retail, Inc. ("Qurate Retail") as of March 2018). In addition, John Malone today holds significant minority shareholdings in GCI Liberty, Inc ("GCI") and Liberty Broadband Corporation ("Liberty Broadband").9

(12) The Commission has assessed whether the exercise of voting rights or powers related to corporate offices enables John Malone to exercise either de jure or de facto control on, in particular, LMC and Discovery. The purpose of the assessment is to verify whether Liberty Global and LMC (with its Formula 1 broadcasting rights owned as of January 2017) may be subject to the control of the same individual, so that Liberty Global may be considered active in the supply of sports broadcasting rights in the Netherlands. The same analysis has been carried out in relation to Discovery, which controls the sports channel Eurosport.

(13) In this respect, the Commission has requested and examined all relevant information concerning the corporate governance of the companies in which Mr John Malone owns voting rights and/or holds corporate offices.

(14) Mr John Malone holds, with his spouse and trusts, 28% of the voting rights in Liberty Global. Voter turnout percentages at the shareholders meeting of the company have been [...] in the years 2017, 2016 and 2015 respectively. Therefore, Mr Malone has less than 50% of the voting rights in the shareholders meeting. His voting shares allow him to block the approval of special resolutions that require a pass majority of 75% (and do not concern strategic commercial decisions), but do not allow Mr Malone to either pass or block the approval of ordinary resolutions that concern strategic commercial decisions.

(15) Based on information publicly available and information provided by the Notifying Parties, GCI, Qurate Retail and Liberty Broadband, where Mr Malone has minority shareholdings too, carry out business activities unrelated to the Netherlands.10

(16) With respect to LMC, where Mr Malone holds a minority shareholding of 47.7%, the Notifying Parties have not been able to provide updated voter presence data for the shareholders meeting. In any event, for completeness, the Commission will undertake an "even if" assessment of the hypothetical situation that John Malone de facto controls both Liberty Global and LMC in which case there would be indirect control between Liberty Global’s activities and Formula 1.11

(17) With respect to Discovery, in the decision Liberty Global/Discovery/All3Media,12 the Commission concluded that, based on the information available at the time, no single shareholder (including Mr John Malone) had the ability to exercise sole or joint control over Discovery. The Commission has found no evidence that the situation has changed since the adoption of that decision.13 Moreover, according to the most recent SEC disclosure from Discovery, John Malone currently holds a 28.5% interest in Discovery, which is slightly less than what he held at the time of the aforementioned decision.14

(18) In addition to the mentioned minority (although in some cases significant) shareholdings, the Commission has also taken into consideration the minority shareholdings of other natural and legal persons. It observes, in that respect, that certain members of Liberty Global's Board of Directors own shares in various companies (such as Liberty Global itself, LMC, Qurate Retail) in which Mr Malone is a shareholder. The same applies to investment funds and financial institutions, whose names recur in the shareholders' lists of the same companies. With specific respect to Liberty Global, the Commission notes that Mr John Malone is the chairman of the company's Board of Directors and, in the last ten years, has been one of the two members of the company's Executive Committee, to which the Board of Directors delegates some of its executive powers.

(19) At the same time, however, Mr Malone is not able, solely relying on his voting rights and corporate powers, to unilaterally appoint directors (whose appointment is based on the designation of a specific committee subject to the approval of the shareholders meeting)

(20) Based on the above considerations, the Commission concludes that there is not sufficient evidence that Mr John Malone is capable of exercising either de jure or de facto control over Liberty Global. In relation to his role in the companies in question, the Commission adds that, even if any form of "significant influence" (which is not "decisive influence") of Mr Malone over any of the companies at hand existed, it is a mere minority shareholding and there is no proof of a causal link between the business behaviour of each (otherwise independent) undertaking and the aforementioned minority shareholdings.

(21) Vodafone is the holding company of a group primarily involved in the operation of mobile telecommunications networks and the provision of mobile telecommunications services, such as mobile voice, messaging and data services.

(22) VodafoneZiggo is a provider of telecommunication services in the Netherlands. It was established on 31 December 2016 as a joint venture in which Liberty Global and Vodafone combined their respective telecommunication activities in the Netherlands. VodafoneZiggo operates a cable network under the Ziggo brand, which covers approx. 90% of households in the Netherlands. In addition, VodafoneZiggo provides retail mobile telecommunications services and mobile wholesale access and call origination services, under the Vodafone and the Hollandse Nieuwe brands, as one of the four mobile network operators (MNOs) active in the Dutch market. It provides digital and analogue cable video, broadband internet, and digital telephony services to 3,978,600 customers as of December 31, 2016. VodafoneZiggo has approx. 4.97 million mobile customers as of 30 September, 2017. In addition to its core cable and mobile operations, VodafoneZiggo has limited broadcasting activities in the form of (i) a suite of Pay TV sports channels, Ziggo Sport Totaal ("ZST") (which until 11 November 2015, was called Sport1) and (ii) a basic package TV channel, Ziggo Sport ("ZSB", launched on 11 November 2015).

(23) The target, Ziggo, was established on 1 February 2007 and has operated under the Ziggo brand since May 2008. At the time of the Conditional Clearance Decision, Ziggo owned and operated a cable network that span more than half of the Netherlands, including the third and fourth biggest cities, Den Haag and Utrecht. Ziggo's cable network did not overlap with that of UPC. In 2013, Ziggo provided digital and analogue cable video, broadband internet, mobile telephony and digital telephony (VoIP) services.

(24) Liberty Global’s UPC, Ziggo, NewZiggo or VodafoneZiggo have never been under any regulated access obligations in the Netherlands and has never granted access to its cable network on a commercial basis.

(25) For the purpose of this decision, Liberty Global and Vodafone are referred to as the "Notifying Parties". Liberty Global, Vodafone and VodafoneZiggo are together referred to as the "Parties".

3. THE OPERATION AND THE CONCENTRATION

(26) The concentration, which was notified on 14 March 2014, consisted of the acquisition of sole control over Ziggo by Liberty Global, which operated a non-overlapping regional cable network in the Netherlands under the brand UPC. For this purpose, in particular, Liberty Global would launch a public bid for the remaining shares in Ziggo that it did not already own. If the bid would be successful, Liberty Global would have a controlling interest in Ziggo.

(27) This therefore constituted a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

(28) At the time of the 2014 notification the intention to launch a public bid had been publicly announced. After receiving approval by the relevant securities markets authorities and clearance by the Commission on 10 October 2014, the tender offer was successfully completed on 21 November 2014.

4. EU DIMENSION

(29) The Transaction had an EU dimension at the time of the 2014 notification. The undertakings concerned at the time had a combined aggregate worldwide turnover of more than EUR 5 000 million in 2012 (Liberty Global: EUR 13 082 million; Ziggo: EUR 1 537 million). They each had a combined aggregate EU-wide turnover of more than EUR 250 million in 2012 (Liberty Global: EUR 11 260 million; Ziggo: EUR 1 537 million). While Ziggo achieved more than two-thirds of its aggregate EU-wide turnover in the Netherlands, Liberty Global did not. The Transaction therefore had a Union dimension. The Transaction may be considered to be of an EU dimension also today. Based on 2016 data, the Parties have a combined aggregate world-wide turnover of more than EUR 5 000 million15 (Liberty Global: EUR 18 076 million; Vodafone: EUR 47 631 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Liberty Global: EUR 14 371 million; Vodafone: EUR 34 516 million), while neither achieved two-thirds of its aggregate EU- wide turnover within one and the same Member State.

(30) The Transaction therefore has an EU dimension.

5. RELEVANT MARKETS

(31) The Transaction gave rise to certain horizontal overlaps and vertical relationships between UPC’s and Ziggo’s activities in a number of relevant markets along the value chain for the distribution of audio visual TV content and the provision of telecommunication services (fixed and mobile telephony and broadband Internet) in the Netherlands.

5.1. Television services

(32) As regards the TV-related markets where the Parties are active, with respect to the licensing and distribution of content and channels, the Commission has in previous decisions made a distinction between the following markets:

§ Licensing and acquisition of broadcasting rights for TV content;

§ Wholesale supply and acquisition of TV channels; and

§ Retail supply of TV services.

(33) With reference to the abovementioned TV-related markets, it is possible to identify several levels of activity in the product chain.

(34) Upstream, in the audio-visual chain, there are the holders of broadcasting rights for audio-visual content such as (i) films, (ii) sport events and (iii) other content (such as TV series and documentaries).16

(35) At the second level, the broadcasting rights are licensed to: (i) broadcasters which then incorporate them into linear TV channels; or (ii) content platform operators which retail the content to end users on a (non-linear) VOD/PPV basis. Licenses for sports broadcasting rights are typically granted through tenders on an exclusive basis for a specific geography and for a limited period.

(36) At the third level, TV channel suppliers (such as ZST or Fox Sports) license their channels to providers of retail TV services for incorporation into broader TV channel bouquets that are in turn sold to viewers. Some TV channel suppliers (such as ZST) are vertically-integrated as they own a technical platform and/or are active as retail Pay TV operators. They broadcast their own channels together with third party channels via their own platform. Other TV channel suppliers (such as Fox Sports) are not vertically-integrated and depend on platform operators or retail pay-TV operators to broadcast their channels.

(37) FTA channels are mainly financed by advertising and sometimes, public funds. Pay-TV channels are primarily financed by subscription fees paid by viewers; other sources of finance are carriage fees paid by retail operators and advertising.

(38) At the final stage of the product chain, retail TV providers offer a TV subscription to end-users, which typically consist of a selection of packages combining a number of TV channels (different operators may package channels differently). In addition, certain TV channels may also be distributed on a standalone basis, either as an "add-on" to a traditional TV subscription or via an OTT service.

(39) In addition, these TV propositions may be offered standalone or as part of bundles with other fixed services (internet, telephony) and/or in combination with services via a mobile network ("mobile services") (known as "multi- play" bundles).

5.1.1. Licensing and acquisition of broadcasting rights for TV content

(40) Audio visual TV content comprises "entertainment products", such as films, sports, and TV programmes that can be broadcast via TV.17 The broadcasting rights generally belong to the creators of the content. These rights owners, which constitute the supply side of this market, license them to broadcasters for linear broadcasting, as part of TV channels, or to platform operators for non-linear distribution through pay-per-view ("PPV") or video-on-demand ("VOD"). Those broadcasters and content platform operators, together, comprise the demand side of this market.

(41) In previous decisions, the Commission has divided the market for the licensing and acquisition of individual content in the following manner: (i) Pay TV versus Free-To-Air ("FTA") TV,18 (ii) linear versus non-linear broadcast,19 (iii) by exhibition window, that is to say subscription VOD ("SVOD"), transactional VOD ("TVOD"),20 PPV, first Pay TV window,second Pay TV window,21 and FTA, (iv) by content type, that is to say films, sports, other content.

(42) As regards content type, the Commission has further distinguished between:(i) exclusive rights to premium films, (ii) rights to football events that are played regularly throughout every year (for example national league matches, national cup, UEFA Cup and UEFA Champions League), (iii) rights to football events that are played more intermittently, every four years, for example the FIFA World Cup and European Championship of Nations, and(iv) exclusive rights to other sport events,22 and by type of supplier in respect of films, that is to say major Hollywood studios/smaller suppliers.23

5.1.1.1. Product market definition

The Notifying Party's views in 2014

(43) In the 2014 notification, the Notifying Party submitted that the exact definition of the market could be left open as the proposed concentration would not lead to a significant impediment to effective competition on any potential submarket.

(44) With respect to specific market sub-segments, in particular, the Notifying Party indicated that no distinction should be made between linear and non- linear broadcasting. The Notifying Party considered that, from a demand side perspective, providers of linear TV services were facing increasing competition from over-the-top ("OTT") players, that is to say operators providing audio visual services over the Internet, providing non-linear services. According to the Notifying Party there was also a high degree of supply side substitutability between the rights for linear and non-linear broadcast and those rights were often negotiated together and covered by a single agreement.

(45) The Notifying Party also indicated a certain degree of demand-side and supply-side substitutability between the broadcasting rights for the different exhibition windows, including SVOD and TVOD, pointing out that TV channels and VOD services often offered a mix of first Pay TV window, second Pay TV window and library content. In addition, the Notifying Party considered that substitutability also existed on the supply side, with some content right owners creating second Pay TV windows in response to the increased demand for exclusive windows created by the emergence of OTT providers thus blurring the distinction between the different exhibition windows.

(46) As to the distinction between various type of content (sports, films and other content), The Notifying Party submitted that a single market existed for all individual content due to the high degree of supply-side substitutability. The Notifying Party argued that it was not always possible to make a strict distinction between the different content segments as TV products are highly differentiated and a given product could be aimed at various types of target audience.

Commission's assessment and conclusions in 2014

(47) In its assessment, the Commission noted that the market investigation confirmed the traditional distinction between FTA and Pay TV content. At the same time, as the Dutch market was essentially a Pay TV market with only three FTA channels, the Commission concluded that the distinction between FTA and Pay TV was of little relevance and the definition could be left open, because the assessment of the Transaction would remain the same, whether the licensing and acquisition of broadcasting rights for FTA TV and Pay TV were considered to belong to the same product market or to two separate markets.

(48) In relation to the distinction between linear and non-linear broadcasting, the Commission noted that the information gathered during the market investigation, and in particular the differences in the pricing models and the licensing conditions, suggested the existence of separate markets for licensing and acquisition of broadcasting rights for (i) linear broadcasting and (ii) non- linear broadcasting. In any event, since the Transaction did not raise competition concerns under any possible market segmentation, the Commission considered that the exact scope of the relevant product markets could be left open in that respect.

(49) In relation to the market definition according to broadcasting windows, the Commission found that, given the different conditions for the acquisition of rights for each exhibition window, and the limited instances in which a window could be replaced by another, there were indications that a different market for each exhibition window could be distinguished.

(50) As regards VOD, the market investigation indicated a clear distinction between SVOD and TVOD, mostly due to the fact that both types of VOD services had different business models, different pricing conditions, and fell into separate and distinct viewing windows. Those differences in business models and pricing conditions suggested that SVOD and TVOD could constitute two separate product markets.

(51) Since the Transaction did not raise competition concerns under any possible market segmentation, the Commission left open the question whether licensing and acquisition of broadcasting rights for each exhibition window, including for SVOD and for TVOD, belonged to the same or to separate markets.

(52) As to a possible differentiation based on the type of content (sport, films, other content), the investigation revealed absence of interchangeability between the various types of content, different target audiences and the differences in licensing agreements as elements suggesting that the acquisition of rights for films could be distinguished from the acquisition of rights for sport events and from the acquisition of rights for other types of content.

(53) Since, in any event, the Transaction did not raise competition concerns under any possible market segmentation, the Commission left open the exact scope of the relevant product market.

(54) The Commission also assessed the existence of possible separate markets for premium and non-premium content both in sports and in film right licensing. The market investigation revealed differences in price and ability to attract viewers (e.g. films with high box office success and popular sports, such as Formula 1, Uefa Champions League and Fifa World Cup) and suggested the existence of a distinction between the acquisition of rights for premium content and the acquisition of rights for non-premium content. In any event, the Commission considered that for the purposes of the decision, the question whether broadcasting rights for premium and for non-premium content constituted different markets could be left open.

(55) As regards a differentiation between United States and non-United States film productions, responses to the market investigation differed and it was unclear whether a differentiation between United States and non-United States films should indeed be made. However, this question was left open, since the Transaction did not raise competition concerns whether or not a differentiation was made between United States and non-United States film productions.

(56) The Commission also considered, based on its investigation, that the differences in pricing, production model and terms of acquisition of broadcasting rights for Dutch-language content (film and series) and other content did not seem to justify the delineation of a separate product market for Dutch-language content. In any event, the Commission concluded that even if a separate market for acquisition of Dutch-language content were to exist, the final commitments proposed by the Notifying Party would also address all possible concerns related to the acquisition of premium Dutch-language content.

(57) Based on the previous considerations, the Commission left open the exact definition of the relevant product market in the Conditional Clearance Decision.

The Notifying Parties' views in their Supplementary Notification

(58) With respect to the possible segmentation between Pay TV and FTA services, the Notifying Parties submit in the Supplement Form CO that there is no clear distinction between Pay TV and FTA services from Dutch consumers' perspective given that there are only three FTA channels (NPO 1, 2 and 3) broadcast via unencrypted terrestrial TV signals in a limited standard definition quality, while all other TV channels are available only through a Pay TV subscription.

(59) As to the difference between linear and non-linear broadcasting, in the Supplement Form CO, the Notifying Parties indicate, as a key development in the broadcasting and television markets since 2014, the ongoing shift of the relative amount of time consumers spend watching linear television via "traditional" technologies versus accessing the internet and watching content on demand. More specifically, they submit that the growth of the offer of non- linear services, which was identified in 2014, has been very significant, with the penetration of Netflix in the Netherlands (with 2.6 million subscribers in 2017) being a key example.24

(60) The Notifying Parties further argue that, from a demand side perspective, linear TV services are to a very considerable extent substitutable with non- linear TV services. This is evidenced by the growth of non-linear services at the expense of linear services (in terms of viewing time). Several OTT players have successfully entered the market (e.g. NLZiet, Videoland, and Netflix) offering consumers a readily available, cost effective possibility to obtain high quality content. Actual competition in the acquisition of premium content is for instance exerted by players such as Netflix, which managed to secure exclusive deals for certain content with Disney and Sony. In the case of Netflix, that means that it secures linear rights together with the VOD rights, while it is of course only interested in the latter. Furthermore, they add, an increasing number of content creators are offering their content directly to consumers. An example is Netflix (with e.g. House of Cards), which creates its own content and broadcasts this directly to consumers via its OTT platform. This exerts even further competitive pressure on traditional linear services. Moreover, even though the terms under which linear and non-linear rights are licensed may differ to some extent, these rights are usually negotiated together and covered by a single agreement.

(61) In the Supplement Form CO, the Notifying Parties submit that, given the increased competitive pressure that non-linear services exert on linear services, this potential segmentation is no longer appropriate. This is further evidenced by the fact that, for the main types of content, the contractual structure for acquiring rights covers/typically involves both linear and non- linear distribution.

(62) In relation to sports, the Notifying Parties note that VodafoneZiggo's negotiations for sports rights are generally focussed on linear rights as from a commercial perspective the value of the rights is almost exclusively based on the linear content provided and non-linear rights are perceived as an add-on since non-linear sports broadcasting is in practice of little importance. Where rights-holders do make non-linear rights available, however, these are generally included in the same agreement.

(63) The Notifying Parties also note that they purchase sport rights separately for the Ziggo GO app (both linear and non-linear exhibition) due to the high level of technical details this app requires. In addition, after the divestiture of Film1, VodafoneZiggo focuses on the purchase of film rights for SVOD distribution and agreements for such rights may also include rights for linear distribution ([...]).

(64) As to a market definition based on exhibition windows, the Notifying Parties maintain the position they had in 2014 and submit that a degree of substitutability exists between these distribution modes on the demand and supply side of the market.

(65) As to a possible market segmentation based on the type of content (such as between sports, films and other TV content) the Notifying Parties argue that it is not always possible to apply a strict distinction between certain types of content.

(66) On a market distinction based on the language of the content, the Notifying Parties submit that indeed, the differences in market conditions are not such as to justify a separate market for Dutch-language content. The negotiation position of a content provider depends for a large part on the commercial success of the content, rather than the language of such content.

(67) In general, the Notifying Parties conclude, a single market exists for all individual content types due to the high degree of supply substitutability and because individual rights can be sold for use in different products or channels without any modification.

(68) As to a possible market segmentation based on the nature of the content supplier (such as Hollywood studios or small content producers), the Notifying Parties consider that no strict segmentation between “major” Hollywood studios and smaller suppliers can be made, particularly since the negotiation position of the relevant content supplier will depend mainly on the commercial success of the film that is being sold, rather than on the nature of the supplier.

(69) Concluding on the relevant product market for broadcasting rights on TV content, the Notifying Parties still consider that the possible segmentations of the market as discussed above can be left open, as the Transaction has not led and does not lead to any competition concerns on even the narrowest conceivable market.

Commission's assessment

(70) The results of the market investigation confirm the Notifying Parties' view in relation to the large penetration of Pay TV in the Dutch market. The market investigation also confirms that a distinction between basic Pay TV and Premium Pay TV would be more appropriate in the Netherlands than a distinction between FTA and Pay TV.25 This market structure impacts the market for content, making a distinction of content licenced for FTA or Pay TV broadcasting irrelevant.

(71) In light of the limited significance of FTA TV in the Netherlands, since essentially, the Dutch TV market is a Pay TV market, the assessment of the Transaction would remain the same whether the licensing and acquisition of broadcasting rights for FTA TV and Pay TV are considered to belong to the same product market or to two separate markets. As a consequence, the Commission considers that the market definition can be left open for the purpose of this decision.

(72) As to the possible distinction between linear and non-linear content, the market investigation indicates that, on the demand side, content rights for the two distribution modes are not substitutable and, in some cases, are used as complementary offers by TV broadcasters.26 At the same time, non-linear is increasingly constraining linear broadcasting, with viewers replacing linear broadcasting with a selection of their preferred non-linear content ("cord cutting"). On the supply side there is a degree of elasticity, as linear and non- linear rights for content are licensed together.27 In any event, the Commission considers that, for the purposes of this decision, the question as to whether there exists a distinct market for linear and non-linear content can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point.

(73) As to the distinction between different types of content, the market investigation confirms the fundamental distinction, emerged already in the 2014 market investigation, between (i) sport, (ii) film; and (iii) other content.28 The market investigation includes indications that the distinction between popular films and popular TV series is fading, as also the latter can be considered premium content.29 The results of the market investigation indicate that US productions and non-US productions may not be considered alternatives.30

(74) Within these content types, the replies of TV retailers to the market investigation indicate the existence of premium and non-premium content.31 The qualification of content as premium or not, however, seems to depend not solely on the nature of the content, but also on contingent circumstances (for instance the emergence of a national champion or talent in the case of sports).

(75) The Commission considers that the differences in price and ability to attract viewers suggest the existence of a distinction between the acquisition of rights for premium content and the acquisition of rights for non- premium content. In any event, the Commission considers that, for the purposes of this decision, the question as to whether broadcasting rights for premium and for non-premium content (and, within premium films, US and non-US productions) can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point.

(76) In the above respect, some complainants and third interested parties have indicated that certain sports events (such as the Formula 1 World championship, the English Premier League, the Spanish La Liga and the Eredivisie football league) are to be considered "essential" competitive factors, so important for the business that, in order to realise a level playing field, all competitors should have access to them.

(77) The Commission, however, considers that an essential factor is an input that forces out of the market (or prevents market entry of) those which do not have it. In the case at hand, the sport contents mentioned can attract viewers and generate revenues, but having access to them is not a requirement to continue to operate on the market for the wholesale supply of TV channels or of retail supply of Pay TV services. Operators in the Pay TV value chain (TV channels providers and retail Pay TV providers), in fact, still have the possibility to differentiate themselves by investing in alternative content which can be (or become over time) equally or more attractive for viewers and subscribers. The replies to the market investigation point to a number of premium sports events (some traditionally considered premium, others considered premium due to contingent circumstances, such as the presence of a Dutch athlete) that are substitutable among themselves.32 The Commission therefore, considers that the narrowest plausible markets are those for broadcasting rights for premium and non-premium content, without any possible further distinction.

(78) For films, the market investigation has also indicated that, from the demand side, a difference exists between various broadcasting windows for films and, within VOD, between SVOD and TVOD. The replies to the market investigation, however, indicate a certain degree of supply side substitutability in offering various content.33 In any event, the Commission considers that, for the purposes of this decision, the question as to whether the VOD market should be further segmented in SVOD and TVOD can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point.34

Overall conclusion

(79) In light of the above, the Commission concludes that the relevant product markets for the purpose of this decision are the markets for licensing and acquisition of TV broadcasting rights in relation to (i) sports content, (ii) movies and series, and (iii) other content. The question as to whether these markets should be further segmented based on content for FTA or Pay TV, linear or non-linear broadcasting, premium or non-premium quality and broadcasting window can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point.

5.1.1.2. Geographic market definition

(80) At the time of the 2014 notification, the Notifying Party did not take a position on the geographic scope of the market but referred to the SFR/Télé 2 France case,35 where the Commission had found that the market was national in scope.

(81) The Commission has previously considered that the market for the licensing/acquisition of broadcasting rights for audio visual TV content is either national in scope or potentially comprises a broader linguistically homogeneous area.36

(82) The Dutch Authority for Consumers and Markets (ACM) (previously the Nederlandse Mededingingsautoriteit (NMa)) concluded in its decision in UPC-Canal+37 that, since licenses for exclusive rights to premium film content are limited to the Netherlands, the market is national in scope. In its later decisions in cases Sanoma-SBS38 and RTL NL-Radio 538,39 the ACM (NMa) stated that the geographic scope of the market for the licensing and acquisition of content is national in scope or relates to a linguistically homogeneous area. However, in each case, it ultimately left the question open, as the geographic market definition did not impact on the competitive assessment.

(83) The vast majority of respondents to the 2014 market investigation considered that the geographic scope of the market for licensing and acquisition of broadcasting rights in general, but also broken down by film, sport and other content is national.

(84) As regards the geographic scope of a potential market for the licensing and acquisition of broadcasting rights for Dutch-language audio visual content, around half of the respondents to the 2014 second phase market investigation that replied to the relevant question considered that the geographic scope of such a market should cover the Netherlands only (excluding Dutch-speaking Flanders). Some respondents highlighted the fact that Dutch-language content produced in the Netherlands in general did not have the same commercial success in Flanders and vice versa. The other half of the respondents stated that the geographic market should naturally comprise both the Netherlands and Flanders because of their linguistic homogeneity. That being said, the rights for the Netherlands and Flanders were still licensed and acquired separately and, as mentioned by one respondent, not all purchasers of broadcasting rights for Dutch-language content would even be interested in acquiring the rights for both the Netherlands and Flanders. This latter point was indeed confirmed by the fact that the majority of respondents confirmed that the scope of the licensing contracts concluded for Dutch-language audio visual content encompass the Netherlands only.

(85) In that regard, in 2014, the Commission noted that all of the relevant supply agreements covering (i) VOD rights, (ii) first and second window Pay TV rights, (iii) TVOD, as well as (iv) SVOD rights at the time in force between the Notifying Party and suppliers of individual audio visual content [reference to supply agreements between the Parties and suppliers of audio-visual content]. Similarly, all such supply agreements in force between Ziggo and suppliers of individual audio visual content [reference to supply agreements between the Parties and suppliers of audio-visual content].

(86) Based on the above elements the Commission considered in the Conditional Clearance Decision that the relevant markets for the licensing and acquisition of broadcasting rights were national in scope.

(87) In the Supplement Form CO, the Notifying Parties submit the market has a national dimension [reference to the geographic scope of supply agreements between the Parties and suppliers of audio-visual content]. Furthermore, they indicate that significant differences exist in Dutch language individual content produced for Dutch target audiences on the one hand and Flanders target audiences on the other hand. Although there is a degree of co-productions, most of the Dutch language series and programmes are targeted at either Dutch or Flemish audiences, but not both. The Notifying Parties therefore consider that there is no separate geographic market that covers both Dutch and Flemish individual content.

(88) The market investigation undertaken for the reassessment indicated that broadcasting rights for sport events are generally sold on a country-by-country basis. With some exceptions, linked to the fact that the broadcaster purchasing content is active in multiple countries, film broadcasting rights are also licensed on a national basis.40

(89) Therefore, for the purposes of this decision, the Commission concludes that the relevant geographic market is national.

5.1.1.3. Affected market

(90) In 2014, as regards the acquisition of content, the Notifying Party could not rule out that the merged entity's market share would exceed 20% in the hypothetical market for the acquisition of film content and, in particular, the markets for the acquisition of first Pay TV window film content and TVOD film content. As such, those markets were considered to be affected for the purposes of that decision.

(91) Today, the Notifying Parties submit that the combined market share of Liberty Global and Ziggo in the market for the acquisition of all content to be broadcast in linear and VOD mode was [5-10]% in 2013 and that the estimated market share of VodafoneZiggo in the same market in 2017 is [5- 10]%.41

(92) As indicated in paragraph (63) as a consequence of the divestiture of the Film1 channel, VodafoneZiggo only purchases rights for movies and series for non-linear, mainly SVOD, broadcasting. The Notifying Parties submit they are no longer active in the purchase of linear content rights, which may only still be licensed to VodafoneZiggo as a part of SVOD agreements.42 Therefore, the hypothetical market for movies and series broadcast in linear mode is not an affected market.

(93) As to the acquisition of VOD rights only for movies and series (thus excluding sports), the Notifying Parties indicate that, while, in 2013, Liberty Global and Ziggo held a combined market share of [20-30]%, in 2017 the estimated market share of VodafoneZiggo in the same market is [5-10]%. Therefore, the market for movies and series broadcast in non-linear/VOD mode is not an affected market.

(94) If the market for non-linear broadcasting rights for movies and series is split between SVOD and TVOD, the 2017 market share of the Parties amounts to less than 20% in SVOD, while the Notifying Parties cannot exclude that the market share of VodafoneZiggo in TVOD exceeds 20%. The market for non- linear broadcasting rights for movies and series for TVOD distribution, therefore, is considered an affected marked.

(95) The Notifying Parties indicate that the expenditure for other broadcasting rights excluding sports (that is, documentaries, concert broadcasts, etc.) is negligible.

(96) As to the acquisition of sport content (where non-linear rights, according to the Notifying Parties, are generally included in the linear rights) the estimated market share of VodafoneZiggo is [10-20]% in 2017, while the combined market share of Liberty Global and Ziggo was [5-10]% in 2014. The market therefore is not horizontally affected.

(97) In a hypothetical scenario where Mr. John Malone were considered to de facto control both Liberty Global (and thereby jointly control VodafoneZiggo) and LMC (and thereby Formula 1), Liberty Global would be then active in the supply (or licensing) of content rights for broadcasting in the Netherlands. The Notifying Parties have therefore submitted the estimated market shares of Formula 1 in the hypothetical relevant markets. On the hypothetical market segment for supply of broadcasting rights for all premium and non-premium sports content rights in the Netherlands, the market share of Formula 1 would be 1.2%. Taking into account sports content supplied for premium sports channels, Formula 1’s estimated market share would still be limited to approx. 2.2%. Formula 1's estimated market share would be even smaller (0.3%) in the market for the supply of all content for Pay TV and for linear and non- linear distribution. Therefore, the Commission concludes that, even if Mr John Malone were to be considered as de facto controlling both Liberty Global and LMC and, thus, the Parties were to be considered active in the market for the supply of sports content (and various sub-segments), this market would not be either horizontally or vertically affected.

(98) In the light of the figures and estimates provided by the Notifying Parties in the Supplement Form CO and subsequent submissions, the Commission concludes that the market for the acquisition of non-linear broadcasting rights for movies and series for TVOD distribution is an affected market.

5.1.2. Wholesale supply and acquisition of TV channels

(99) TV channels suppliers acquire or produce individual audio visual content and package it into TV channels. These TV channels are then broadcast to end users via different distribution infrastructures, for example cable, satellite, Internet, and mobile, either on a FTA basis or on a Pay TV basis, individually or as part of so-called "channel bouquets". Hence, the supply side of that market comprises TV channel suppliers. Its demand side comprises providers of retail TV services, which either limit themselves to "carrying" the TV channels and making them available to end users, or also act as channel aggregators, which also "package" TV channels.

5.1.2.1. Product market definition

The Notifying Party's views in 2014

(100) In the 2014 notification, the Notifying Party submitted that there was a separate wholesale market for the supply and acquisition of TV channels. Within the Netherlands, the traditional distinction between FTA and Pay TV channels appeared increasingly blurred and a more appropriate distinction could be made between Basic Pay TV channels, including FTA channels and ordinary commercial channels available in standard bundles, and Premium Pay TV channels. The latter market could be split into two broad segments, namely Premium Pay TV sports channels (carrying high-value sport rights) and Premium Pay TV film channels (featuring blockbuster films or series).

(101) The Notifying Party also indicated that a strict distinction between general interest and thematic Pay TV channels could not be made as a wide range of highly differentiated channels was available: although certain channels may not be always substitutable, depending on the content offered by the channel and viewers' preferences, channels in both segments overlapped in target audience and type of content.

(102) As regards a possible segmentation according to distribution infrastructure, the Notifying Party argued that distribution via satellite or Direct to Home (DTH) exerted a similar competitive constraint on the Parties as other distribution infrastructures such as Internet Protocol TV ("IPTV"), fibre and vDSL (very high bit-rate Digital Subscriber Line) in line with previous decisions of the Commission.

Commission's assessment and conclusions in 2014

(103) In light of the limited significance of FTA TV in the Netherlands (essentially, the Dutch TV market is a Pay TV market), the assessment of the Transaction would remain the same whether FTA TV channels and Pay TV channels are regarded as belonging to the same product market or to two separate markets. Therefore, for the purpose of the decision, the Commission decided to leave the exact market definition open.

(104) In light of the differences in content offering, pricing conditions and size of the audience attracted between Basic and Premium Pay TV channels, and for the purposes of the decision, the Commission considered that Basic Pay TV channels and Premium Pay TV channels belonged to separate product markets with the latter being possibly further segmented between Premium Pay TV film channels and Premium Pay TV sports channels. In any event, the Commission left open the question whether the market for Premium Pay TV channels could be further segmented into areas of interest as the assessment of the Transaction would have remained the same. The Commission also left open the question whether all general interest Pay TV channels and all thematic Pay TV channels belonged to separate product markets, as the assessment of the Transaction would have remained the same.

(105) As to a possible market segmentation based on distribution infrastructure, the market investigation at the time indicated interchangeability of the different infrastructures. Therefore, also in consideration of its precedents on this issue,the Commission considered that at least cable, IPTV over DSL, fiber and possibly Satellite (DTH) were part of the same product market.

The Notifying Parties' views in their Supplementary Notification

(106) In the Supplement Form CO, the Notifying Parties refer to the Commission's precedents in defining the Dutch market for the wholesale supply and acquisition of TV channels. They agree with the distinction between Basic Pay TV channels and Premium Pay TV channels and indicate that Premium Pay TV sport channels were either being offered in the Basic Pay TV tier or increasingly subject to competition by Basic Pay TV sports channels.

(107) The Notifying Parties indicate that, even if there may be some competitive interaction between Premium Pay TV sports channels and Basic Pay TV sports channels, the exact market definition can be left open, since also on the more narrow segment for Premium Pay TV sports channels the Transaction has not led and will not lead to a significant impediment of effective competition.

(108) They refer to the fact that, until now, the Commission has left open the exact definition of the market and whether Premium Pay TV channels could be further segmented into areas of interest such as movies and/or sports. The Notifying Parties submit that also in this case the question whether Premium Pay TV channels should be further segmented into sports and film channels can be left open as the Transaction has not and does not lead to any competition concerns even on the narrowest markets.

(109) The Notifying Parties also submit that it can be left open whether all general interest Pay TV channels and all thematic Pay TV channels belong to separate product markets, as current market conditions demonstrate that the Transaction has not and does not lead to any competition concerns even on the narrowest markets.

(110) To conclude, the Notifying Parties submit that the exact definition of the relevant product market can be left open as the Transaction has not and does not lead to any competition concerns on even the narrowest market.

Commission's assessment

(111) The market investigation has confirmed that the Netherlands is essentially a Pay TV market.43 Therefore, the difference between FTA and Pay TV channels has a reduced relevance and the question as to whether they belong to separate markets can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point.

(112) The market investigation has confirmed the distinction between Basic and Premium Pay TV channels44 and between Premium Pay TV film channels and Premium Pay TV sports channels.45 With respect to sports channels, the market investigation has indicated that Premium Pay TV sports channels cannot be replaced by other (that is, non-sport) premium and/or thematic channels.46 For the same reasons indicated in section 5.1.1.1, the Commission rejects the argument that the market can be further segmented in order to include certain "essential" channels alone. The fact that these channels can attract subscribers and generate revenue does not mean that there are no alternatives for them and that retail TV providers cannot differentiate their offers otherwise.47 In any event, in section 6.3 the Commission carries out an assessment of the risk of foreclosure in relation to the channel ZST.

(113) A change in business model (Fox Sports has, since August 2016, shifted from a revenue-sharing model to a flat fee model with minimum guaranteed)48 and the availability of premium content for channels distributed in the Basic Pay TV tier (ZSB)49 seems to blur the distinction between Basic and Premium Pay TV sport channels to some extent.50 However, the Commission considers that those changes in business model and in market positioning are not the effect of reduced differences between the two categories of channels, but rather the effect of the greater attractiveness of the Premium Pay TV sports channels (and of their content) and the related intention of the broadcasters to draw higher profits by offering them to a wider audience at a marginally lower rate. The Commission therefore considers that Basic Pay TV channels and Premium Pay TV channels belong to separate product markets.51

(114) As to a possible market segmentation based on distribution infrastructure, the market investigation revealed that cable and IPTV through DSL or fibre appear as interchangeable technical solutions, as they both allow TV distribution and interactivity. On the other hand, satellite (DTH) and digital terrestrial television (DTT) appear to be slightly less valid alternatives.52 In any event, based on the results of the market investigation and on its own precedents, the Commission considers that at least cable, IPTV over DSL, fiber and possibly satellite (DTH) are part of the same product market.

Overall conclusion

(115) Based on the above considerations, therefore, the Commission considers that the market can be segmented in (i) Basic and Premium Pay TV channels, and, within the latter, between (ii) Premium Pay TV film channels and Premium Pay TV sports channels. The Commission also considers that at least cable, IPTV over DSL, fiber and possibly satellite (DTH) are part of the same product market. The question as to whether a distinction FTA vis-à-vis Pay exist can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point.

5.1.2.2. Geographic market definition

(116) In their notification of 2014, the Notifying Party submitted that the geographic market was national in scope.

(117) In a number of previous decisions, the Commission considered that the market for the wholesale supply and acquisition of TV channels was national in scope, or at most covering a single linguistically homogeneous area.53 The exact geographic scope of the market was however ultimately left open.

(118) Based on the results of the market investigation and on other evidence available, the Commission concluded that the markets for the wholesale supply and acquisition of TV channels were national in scope.

(119) In the Supplement Form CO, the Notifying Parties submit that the geographic market in the present case is likely to comprise the Netherlands given the way the carriage agreements are concluded. Moreover, the Notifying Parties consider that generally, agreements in place for the acquisition of TV channels [reference to the geographic scope of supply agreements between the Parties and suppliers of audio-visual content]. As such, the Notifying Parties consider that no subnational or regional market for the acquisition of TV channels exists.

(120) The market investigation confirms that the geographic scope of the wholesale market for the supply and acquisition of Pay TV channels mainly consists of the territory of the Netherlands.54

(121) Therefore, the Commission concludes for the purpose of this decision that the relevant market is national in scope.

5.1.2.3. Affected market

(122) The divestiture of the Premium Pay TV film channel Film1, offered as a remedy by the Notifying Party and approved with the Conditional Clearance Decision has addressed the horizontal and vertical concerns the Commission had raised in the wholesale market for the supply and acquisition of Premium Pay TV film channels (supply side). Since that divestiture and the dissolution of the HBO NL joint venture, VodafoneZiggo is no longer active on the wholesale market for Premium Pay TV film channels (supply side).55

(123) Notwithstanding this, however, the Commission will still carry out56 the assessment of the possible vertical concerns in relation to the HBO content, now distributed by VodafoneZiggo through the Movies&Series VOD service.

(124) The OTT remedies offered by the Notifying Party and accepted by the Commission in the Conditional Clearance Decision addressed the concern of the increased buyer power of the entity resulting from the merger.

(125) In the Supplement Form CO,57 the Notifying Parties estimate at [50-60]% the market share of VodafoneZiggo in the acquisition of Basic Pay TV channels, of Premium Pay TV film channels and of Premium Pay TV sports channels. The markets for the acquisition of Basic Pay TV channels, Premium Pay TV film channels and Premium Pay TV sports channels are therefore horizontally affected markets. These are also vertically affected markets, as VodafoneZiggo has a 53% market share on the downstream market for the retail supply of Pay TV services.

(126) In the Supplement Form CO, in relation to the supply side of the wholesale market for the acquisition and supply of Premium Pay TV sports channels, the Notifying Parties argue that ZSB is not a premium channel and that the market share of VodafoneZiggo in the wholesale supply of Premium Pay TV channels (where VodafoneZiggo only supplies ZST) is [10-20]%. In terms of subscribers at retail level, the penetration of ZST is just [5-10]% ([5-10]%, when disregarding subscribers on VodafoneZiggo's platform).Therefore, this is not a horizontally affected market.

5.1.3. Retail provision of TV services.

(127) In the market for the retail provision of TV services, the suppliers of linear and non-linear (mainly VOD) TV services serve end customers who wish to purchase such services.

5.1.3.1. Product market definition

The Notifying Party's views in 2014

(128) In the 2014 notification, the Notifying Party claimed that the retail market for FTA TV services did not exist in the Netherlands. Instead, the Notifying Party considered it appropriate to distinguish between the retail provision of Basic Pay TV channels and Premium Pay TV channels. As regards linear Pay TV services and non-linear services, the Notifying Party's view was that those should be considered to belong to the same product market given the competitive constraints which VOD services exercised on linear Pay TV services. As regards a possible distinction between the different distribution technologies for the provision of retail TV services, the Notifying Party recalled the different Commission and ACM (OPTA and NMa) precedents where no distinction between distribution technologies had been made.

Commission's assessment and conclusion in 2014

(129) In consideration of the limited offer of FTA channels in the Netherlands and given the fact that the assessment of the Transaction would remain the same whether FTA TV services and Pay TV services were considered to belong to the same product market or to two separate markets, the Commission considered that the market definition in that respect could be left open.

(130) In relation to the difference between linear and non-linear retail TV services, the Commission noted that the market investigation had highlighted a number of differences between the two distribution modes. In any event, the Commission considered that the exact scope of the relevant market for Pay TV services could be left open in that regard, as the Transaction did not raise competition concerns on the market for the retail provision of Pay TV services under any alternative product market definition considered.

(131) Taking into account the responses to the market investigation, and in particular considering the demand-side substitutability between retail Pay TV services provided through the different distribution technologies such as cable, DSL, Fibre-to-the-Home (FttH) and possibly DTH satellite, the Commission considered that the provision of retail Pay TV services through those different distribution technologies belonged to the same product market.

The Notifying Parties' views in their Supplementary Notification

(132) In the Supplement to the Form CO, the Notifying Parties argue that, in relation to the Dutch market, a distinction between Basic Pay TV channels and Premium Pay TV channels is most appropriate.

(133) With respect to the distinction between linear and non-linear technology, the Notifying Parties are of the view that a distinction between linear and non- linear Pay TV services is disappearing and is no longer appropriate, given the growing competitive constraint that VOD services exert on linear TV services and the continuing convergence between traditional linear Pay TV services and OTT services. They also refer to research conducted by Telecompaper, indicating that Dutch households spend approximately 38% of their daily viewing on linear TV channels and the remainder on VOD services (either TVOD, SVOD or other OTT services). The Telecompaper research also indicated that an increasing number of households had access to a Smart TV which could be used for streaming SVOD (e.g. Netflix) services.

(134) However, the Notifying Parties conclude that, given that the Transaction has not raised and does not raise any competition concerns, the market definition can be left open.

Commission's assessment

(135) The market investigation has confirmed that the Dutch market has a very limited offer of FTA TV services, which makes the distinction between Basic Pay TV and Premium Pay TV more appropriate.58 The market investigation also indicated that some differences persist between linear and non-linear broadcasting, which are seen more as complements than as substitutes. Although the two distributions mode tend to converge and overlap, PPV/TVOD and OTT/SVOD do not yet seem as viable alternatives to Pay TV in case of switching.59

(136) As to different distribution technologies, the market investigation indicates that switching appears possible from cable to IPTV over fibre or DSL, much less to satellite (DTH) and terrestrial (DTT) technologies.60

(137) Based on the foregoing, the Commission considers that the question as to whether the TV retail market may be segmented in FTA TV and Pay TV, can be left open, as the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market irrespective of the conclusion on this point. For the same reason, it can also be left open the question whether there is a distinction between linear and non-linear distribution. As to the different distribution technologies, the Commission considers that they are all part of the same product market.

5.1.3.2. Geographic market definition

(138) In the notification of 2014, the Notifying Party did not take a view on the exact geographic scope of the market. Based on the results of the market investigation, and considering that following the Transaction the merged entity would have had almost national coverage, the Commission considered that the relevant market was national in scope.

(139) In the Supplement Form CO, the Notifying Parties submit that the question of geographic market definition is not of decisive importance for the assessment of competition in the market for the retail supply of TV services. However, for the purpose of the Supplement, the Notifying Parties provide data for a national market.

(140) The market investigation indicates that the market for retail supply of TV services is national in scope.61 The Commission, therefore, considers that the relevant market is national in scope.

5.1.3.3. Affected market

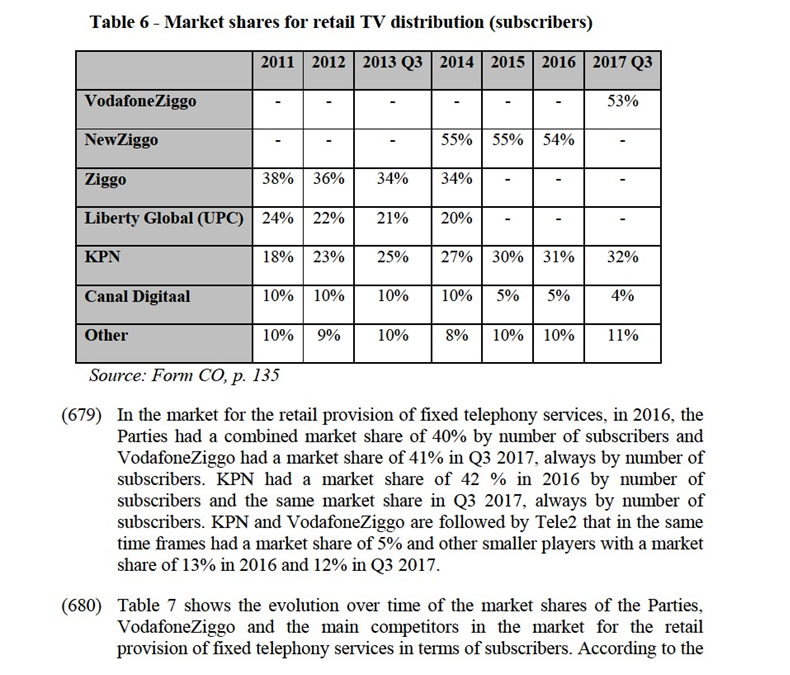

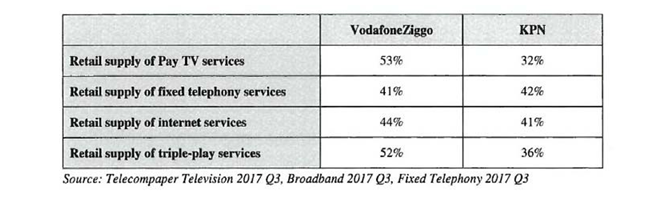

(141) The retail market for the provision of Pay TV services is an affected market considering that, as of Q3 2017, VodafoneZiggo holds a market share of 53% for services provided in linear mode (55% after the combination of Liberty Global/UPC's and Ziggo's networks) and of [20-30]% for VOD services.

5.2. Fixed telephony and Internet services

(142) The Parties provide fixed telephony and fixed Internet services in the Netherlands. In particular, they provide services on the following markets:

§ fixed telephony/voice at retail level;

§ call termination on fixed networks at wholesale level;

§ fixed Internet access at retail level;

§ fixed Internet access at wholesale level;

§ business communication services; and

§ carrier services at wholesale level.

5.2.1. Fixed telephony/voice at retail level

5.2.1.1. Product market definition

(143) In the downstream market for the retail provision of fixed telephony and voice services, operators provide fixed voice services to end customers. Both Parties are active on this market offering fixed voice services bundled together with fixed broadband Internet access and TV.

The Notifying Party's view in 2014

(144) In the 2014 notification, the Notifying Party submitted that a product market existed for the retail provision of fixed telephony services, but that the definition of its exact scope and in particular whether it should be further segmented could be left open, as it would not significantly affect the competition assessment.

Commission's assessment and conclusion in 2014

(145) In its assessment, the Commission considered that the exact scope of the product market definition, and specifically, whether fixed line and VoIP telephony services belonged to the same product market, and whether there was a separate market for residential and non-residential customers, could be left open as the Transaction did not raise competitive concerns under any alternative product market definition considered.

The Notifying Parties' view in their Supplementary Notification

(146) In the Supplement Form CO, the Notifying Parties submit that the exact scope of the relevant product market can be left open as no competition concerns have arisen or will arise on any plausible market segment.

Commission's assessment

(147) The market investigation confirmed the Commission existing definition of the market (including VOIP) in 2014. According to some respondents, additional fixed services (such as for business customers and for international calls) should also be included in the same market.62 In any event, the Commission considers that the exact scope of the product market may be left open for the purposes of this Decision.

5.2.1.2. Geographic market definition

(148) In the 2014 notification, the Notifying Party did not take any view on the geographic scope of the market. Consistently with its previous practice and with the results of the market investigation, the Commission considered that the market for the retail provision of fixed telephony services was national in scope.

(149) In the Supplement Form CO, the Notifying Parties submit that no definite position has to be taken on the exact geographic scope of this market. However, in line with the previous approaches taken by the Commission and the ACM, the Notifying Parties will provide data for the smallest possible segment (a national market).

(150) The market investigation carried out by the Commission confirms that the market is national in scope.63 The Commission, therefore, considers the market to be national in scope.

5.2.1.3. Affected market

(151) In the Conditional Clearance Decision, the Commission assessed all the retail markets jointly. The Commission noted that all retail services, such as fixed telephony, were provided by Liberty Global and Ziggo in the respective, non- overlapping footprints in the Netherlands. Therefore, no customer switching could take place between Liberty Global and Ziggo. Nonetheless, the Commission still considered whether Liberty Global and Ziggo took each other's actions into account before taking commercial decisions. The Commission found that there was insufficient evidence pointing to the risk of non-coordinated effects as a consequence of the elimination of an indirect constraint between Liberty Global and Ziggo.

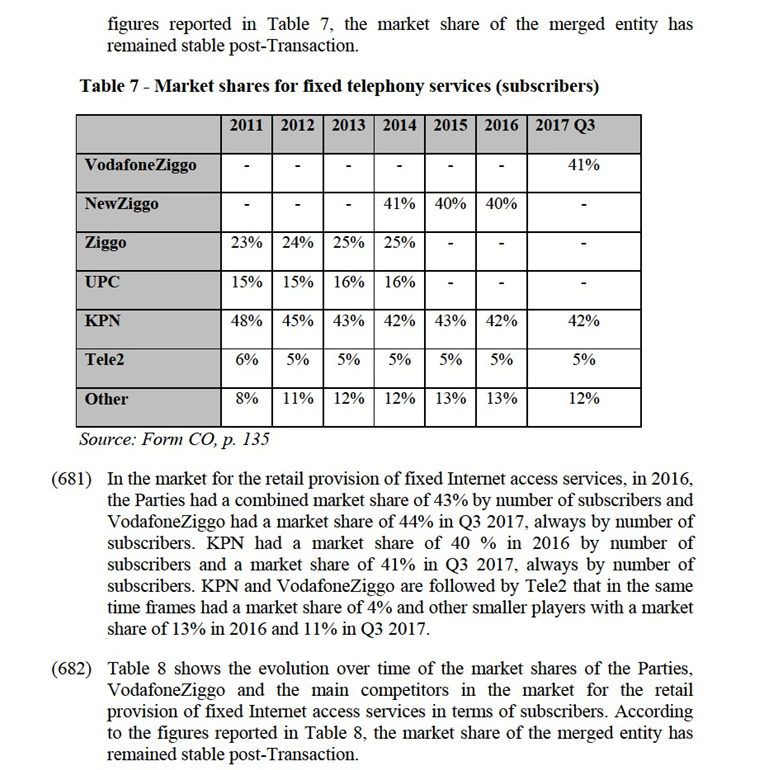

(152) Under current market conditions (Q3 2017), VodafoneZiggo holds a market share of 41% in the retail market for fixed telephony services, which is therefore an affected market. The market is also technically a vertically affected market, due to its connection to the wholesale market for call termination on fixed network, where each operator holds by definition a 100% market share.

5.2.2. Call termination on fixed networks at wholesale level

(153) Call termination is a service provided by telephony operator B to telephony operator A, whereby a call originating on operator A's network is delivered to a user of B's network. This essentially allows users of different networks to communicate with each other.

5.2.2.1. Product market definition

(154) In the Supplement Form CO, the Notifying Parties recall that, in previous cases, the Commission found that there are no substitutes for call termination on each individual fixed network, since the operator transmitting the outgoing call can reach the intended recipient only through the operator of the network to which that recipient subscribed. Each individual fixed network therefore constitutes a separate market for call termination and each network operator has, by definition, a 100% market share on that market.

(155) The ACM has taken a similar view as the Commission and the Notifying Parties therefore submit that the relevant product market is the wholesale market for call termination on each individual fixed network.

(156) In view of the above, the Commission considers that each individual fixed network constitutes a separate market for call termination.

5.2.2.2. Geographic market definition

(157) As to the geographic scope of the relevant market, the Notifying Parties submit in the Supplement Form CO that the market is national in scope, due to regulatory reasons, namely the fact that the geographic scope of regulatory licenses do not extend beyond the territory of a Member State. The Commission shares such view.

5.2.2.3. Affected market

(158) The Commission concluded in its Conditional Clearance Decision that the concentration could have no impact on the market, as each network constituted a market on its own. For that reason, wholesale call termination on fixed networks was not discussed further in the Commission's Conditional Clearance Decision.

(159) For the purposes of the re-assessment of the Transaction, the Commission considers this reasoning still holds, because Liberty Global and Ziggo provide call termination services each in its own footprint with a market share of 100% and the Transaction does not thus bring about any horizontal overlap. The Commission, therefore, has granted a waiver to the Notifying Parties, in relation to the wholesale market for call termination on fixed network.

(160) The market for call termination on fixed network at wholesale level is also vertically related to the retail market for fixed telephony services. In this regard, the Commission notes that the markets of wholesale call termination services on fixed networks in the Netherlands are subject to ex-ante regulation by the ACM. The Commission therefore considers that the Transaction does not give rise to serious doubts as to the compatibility with the internal market and has granted a waiver to this vertical relation as well.

5.2.3. Fixed Internet access at retail level

5.2.3.1. Product market definition

(161) As regards the retail provision of fixed Internet access services, retail operators provide fixed Internet services to end customers.

The Notifying Party's views in 2014

(162) The Notifying Party submitted that both Parties' activities should be qualified as provision of broadband Internet access and that the nature of access services requested by large corporate customers was materially different from the services provided to residential and small businesses. The Notifying Party also claimed that mobile broadband Internet accessible at retail level via 4G technology in the Netherlands exercised at least to a certain extent competitive constraint on fixed Internet access services.

Commission's assessment and conclusion in 2014

(163) In light of a large majority of responses indicating that the distinction between the different infrastructures, that is to say DSL, cable and fibre, was not appropriate, the Commission considered that there was no reason to divide the relevant market according to those different infrastructures. However, the Commission considered that a distinction between the market for mobile Internet and the market for fixed broadband Internet was justified. As regards the question whether fixed broadband Internet access services to residential and small business customers on one hand and large business customers on the other should be considered to belong to separate markets, the Commission left the question open given that the Transaction did not raise competition concerns whether those customer groups were considered together or separately.

The Notifying Parties' views in their Supplementary Notification

(164) In the Supplement Form CO, the Notifying Parties submit that the relevant product market is the market for retail internet access without it being necessary to define any hypothetical sub-segments. The Notifying Parties indicate that, from a demand-side perspective, the various internet offerings with various speeds are clear substitutes. There is also significant supply-side substitution in respect of internet offerings with various speeds, as confirmed by the ACM. The Notifying Parties submit that because of these demand-side and supply-side substitutability considerations, it is neither necessary nor appropriate to define separate markets based on download speed. Referring to the results of the 2014 market investigation, the Notifying Parties also submit that the retail market for fixed internet services should not be segmented according to distribution technology (i.e. DSL, cable or fibre) either. The Notifying Parties submit that also the question as to whether the market should be segmented by customer type can be left open by the Commission.

Commission's assessment

(165) The market investigation has confirmed that different technologies (cable, fibre, DSL) for the provision of retail fixed internet access are part of the same market.64 It has also indicated that mobile and fixed internet access are not substitutable65 and that residential business and small business customers belong to a separate product market from that for large business customers.66

(166) The Commission considers therefore that the relevant market for internet access at retail level includes all different technologies, while distinctions exist between mobile and fixed internet access and between residential business and small business customers, on the one hand, and large business customers, on the other.

5.2.3.2. Geographic market definition

(167) In the 2014 notification, the Notifying Party did not express a view on the geographic scope of the relevant market. Based on the results of the market investigation, the Commission considered that the relevant market was national in scope.

(168) In the Supplement Form CO, in line with the Commission’s and ACM’s previous decision practice, the Notifying Parties consider that the retail market for fixed internet access is national in scope.

(169) Based on the results of the market investigation,67 the Commission takes the position that the relevant market is national in scope.

5.2.3.3. Affected market

(170) Information provided by the Notifying Parties in the Supplement Form CO indicates that VodafoneZiggo holds (as at Q3 2017) a market share of 44% on the retail market for Internet access. Therefore the market shall be considered an affected market for the purposes of this decision.

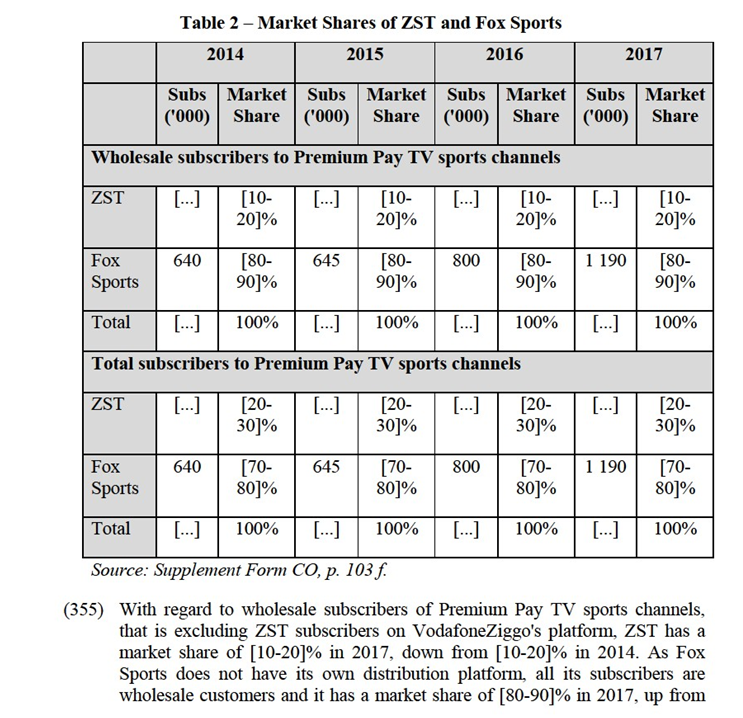

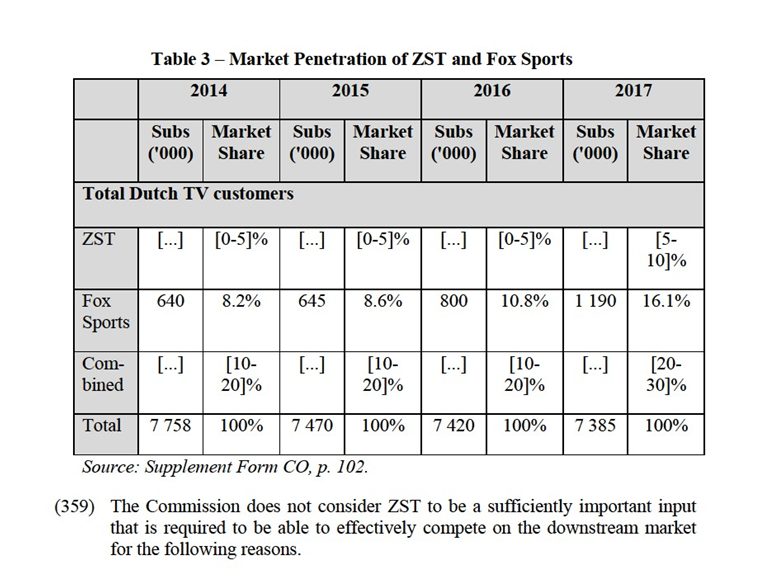

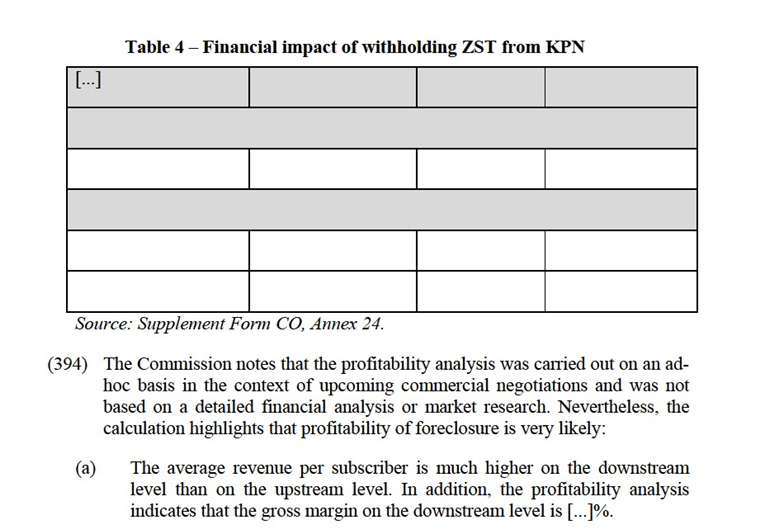

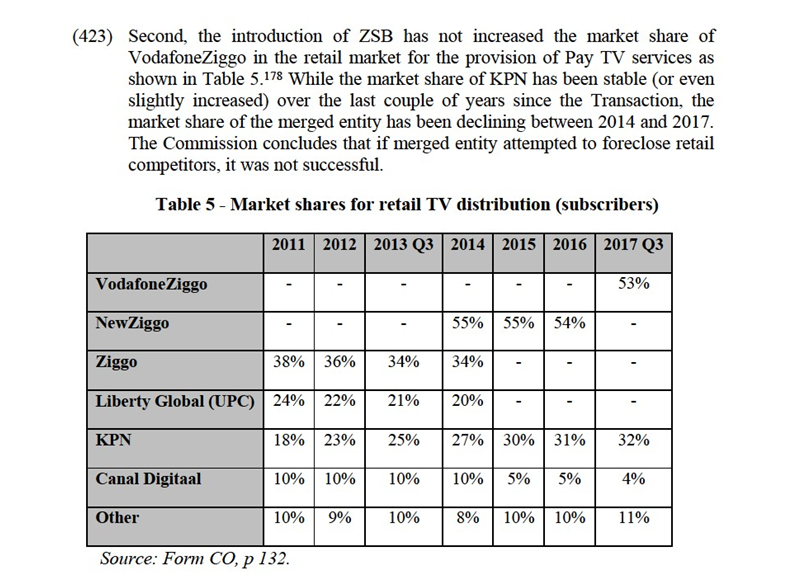

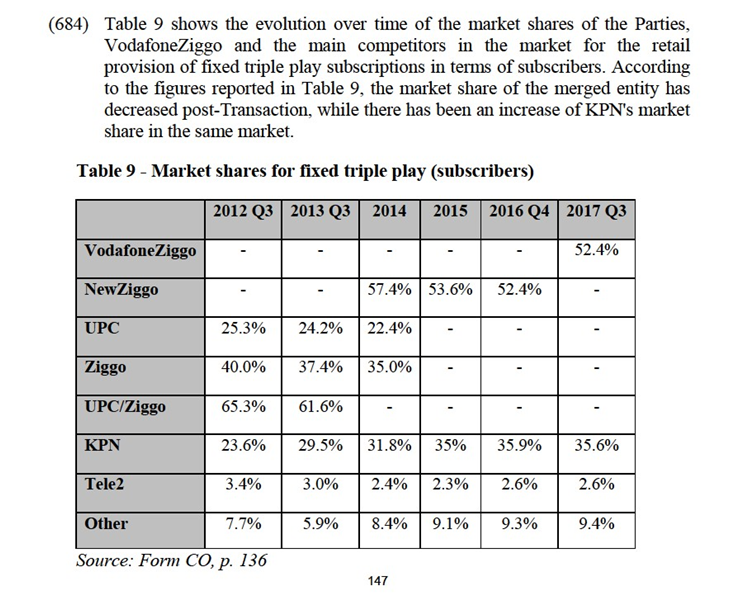

5.2.4. Fixed Internet access at wholesale level