Commission, September 17, 2019, No M.8870

EUROPEAN COMMISSION

Decision

E.ON / INNOGY

COMMISSION DECISION of 17.9.2019

declaring a concentration to be compatible with the internal market and the EEA agreement

Case M.8870 – E.ON/Innogy

(Only the English text is authentic) THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof,

Having regard to Council Regulation (EC) No 139/2004 of 20.1.2004 on the control of concentrations between undertakings1, and in particular Article 8(2) thereof,

Having regard to the Commission's decision of 7 March 2019 to initiate proceedings in this case, Having regard to the opinion of the Advisory Committee on Concentrations,

Having regard to the final report of the Hearing Officer in this case, Whereas:

1. INTRODUCTION

(1) On 31 January 2019, the European Commission received notification of an intended concentration, pursuant to Article 4 of the Regulation (EC) No 139/2004 (‘the Merger Regulation’), by which E.ON SE ("E.ON", Germany) would acquire, within the meaning of Article 3(1)(b) of the Merger Regulation, sole control over the distribution and consumer solutions business and certain electricity generation assets of Innogy SE ("Innogy", Germany) (“the Concentration”).

(2) The proposed acquisition consists of two steps. As a first step, E.ON would acquire the whole of Innogy. As a second step, E.ON would carve-out the majority of Innogy’s renewable electricity generation business, its gas storage business and its minority participation in Kärntner Energieholding Beteiligungs GmbH and would transfer those assets (“Re-Transfer-Assets”) back to RWE AG (“RWE”), the current sole owner of Innogy.

(3) E.ON is sometimes hereinafter referred to in this Decision as "The Notifying Party" and together with Innogy as "the Parties".

2. THE PARTIES

(4) E.ON is an energy company active across the supply chain, including generation, wholesale supply, transmission, distribution, retail supply and energy-related activities (such as metering, e-mobility, etc.). E.ON is active in several Member States, including Denmark, Czechia, Germany, Hungary, Italy, Poland, Romania, Slovakia, Sweden, United Kingdom.

(5) Innogy, a majority-owned subsidiary of RWE, is an energy company active across the supply chain, including generation, distribution, retail supply and energy-related activities such as metering, e-mobility, etc.. Innogy is active in several Member States, including Belgium, Czechia, Croatia, France, Germany, Hungary, Italy, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, the Netherlands, and the United Kingdom.

3. THE CONCENTRATION

(6) The Concentration consists in the acquisition of sole control of Innogy by E.ON. The Concentration is to be accomplished by way of a purchase of shares. The Concentration is part of an extensive asset swap between E.ON and RWE as the result of which E.ON will be primarily active in the operation of electricity and gas distribution networks as well as retail supply in various European countries. RWE will focus on the generation and wholesale activities. E.ON and RWE entered into a definitive agreement on 12 March 2018.

(7) E.ON would acquire the energy distribution network and customer solutions operations of RWE’s subsidiary, Innogy, as well as certain minor electricity generation assets, mainly combined heat and power (CHP) plants held by Innogy (“the Reverse Carve-Out Assets”). RWE would acquire most of E.ON’s electricity generation business from renewable energy sources and minority stakes in two already RWE-operated nuclear power plants. In addition, RWE would retain (a) Innogy’s renewable generation assets (with the exception the Reverse Carve-Out Assets), (b) Innogy’s 49% stake in Kärntner Energieholding Beteiligungs GmbH and (c) eleven gas storage facilities operated by Innogy in Germany and Czechia (all these assets together make up the Re-Transfer-Assets). RWE would also acquire a pure financial minority shareholding in E.ON. The acquisition of the E.ON Assets by RWE was cleared by the Commission by decision of 26 February 2019, COMP/M.8871 – RWE/E.ON Transfer Assets.

(8) The two parts of the asset swap give rise two separate concentrations.2 This Decision concerns the concentration that would arise from E.ON´s acquisition of control of Innogy.

(9) The Concentration falls within the definition of a concentration as defined in Article 3(1)(b) of the Merger Regulation.

4. UNION DIMENSION

(10) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (E.ON: EUR […]; Innogy: EUR […]).3 Each of them has an EU-wide turnover in excess of EUR 250 million (E.ON: EUR […]; Innogy: EUR […]), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.4

5. THE PROCEDURE

(11) On 31 January 2019, the Commission received formal notification of the Concentration pursuant to Article 4 of the Merger Regulation.

(12) During the Phase I market investigation the Commission reached out to a large number of market participants (customers of the Parties and competitors), by requesting information through e-Questionnaires, telephone calls and written requests for information pursuant to Article 11 of the Merger Regulation.

(13) In addition, the Commission also sent numerous written requests for information to the Parties and reviewed internal documents of the Parties submitted at this stage.

(14) On 22 February 2019, the Commission informed the Parties of the serious doubts arising from the preliminary assessment of the Concentration during a "State of Play" meeting.

(15) On 7 March 2019, the Commission found that the Concentration raised serious doubts as to its compatibility with the internal market and the EEA Agreement and adopted a decision to initiate proceedings pursuant to Article 6(1)(c) of the Merger Regulation (the "Article 6(1)(c) decision").

(16) On 8 March 2019, the Commission provided a number of key documents to the Notifying Party. Additional key documents were provided by the Commission to the Notifying Party on 12 March 2019. The Notifying Party submitted its written response to the Article 6(1)(c) decision on 20 March 2019 (the “Response to the Article 6(1)(c) decision”).

(17) On 25 March 2019, at a State of Play meeting, the Commission provided the Parties with the opportunity to discuss the main issues raised in their Response to the Article 6(1)(c) decision, and indicated the matters on which it planned to focus its further investigative efforts during the Phase II investigation. During the Phase II investigation, the Commission sent numerous further requests for information to the Parties.

(18) On 25 March 2019, the Commission adopted a decision pursuant to Article 11(3) of the Merger Regulation suspending the merger review time limit for initiating proceedings and for decisions due to the failure of the Parties to provide certain requested documents. The suspension lasted from 22 March 2019 until 11 April 2019, when the requested documents were provided.

(19) On 29 March 2019, the Commission adopted a decision pursuant to Article 11(3) of the Merger Regulation suspending the merger review time limit for initiating proceedings and for decisions due to the failure of the Parties to provide certain requested documents. The suspension lasted from 26 March 2019 until 11 April 2019, when the requested documents were provided.

(20) On 30 April 2019, the Commission adopted a decision pursuant to Article 11(3) of the Merger Regulation suspending the merger review time limit for initiating proceedings and for decisions due to the failure of the Parties to provide certain requested documents. The suspension lasted from 29 April 2019 until 8 May 2019, when the requested documents were provided.

(21) The Commission also held several calls with market participants, and sent requests for information in the form of questionnaires. The Commission also sent request for information in the form of a EU Survey to small company customers in the retail markets of electricity, gas and heating electricity in Germany, the retail markets of electricity and gas in Czechia, and the retail electricity markets in Hungary and Slovakia.

(22) The Parties indicated in the early days of the Phase II investigation, and in particular during the State of Play meeting held on 25 March 2019, that they would be interested in obtaining feedback from the market investigation as soon as possible after the Commission had obtained results from the investigation. In the spirit of providing the Parties with an opportunity to remedy any preliminary competition concerns prior to adopting a Statement of Objections, following the results of the Phase II market investigation a State of Play meeting was held on 27 May 2019. During the meeting, the Commission informed the Parties of the preliminary results of the Phase II market investigation and the scope of the preliminary concerns of the Commission.

(23) On 7 June 2019, the merger review time period was extended by 20 working days by the Commission with the agreement of the Notifying Party pursuant to Article 10(3) of the Merger Regulation.

(24) In order to address the preliminary competition concerns identified by the Commission at the State of Play meeting held on 27 May 2019, E.ON submitted commitments on 20 June 2019. The Commission launched a market test of those commitments on 21 June 2019.

(25) E.ON submitted final commitments on 3 July 2019.

(26) The meeting of the Advisory Committee took place on 20 August 2019 and issued a favourable opinion on the draft Decision on the same day.

6. THE ACTIVITIES OF THE PARTIES

(27) The Proposed Concentration leads to significant overlaps in the following countries5:

(28) In Germany, both E.ON and Innogy are active in the generation and wholesale supply of electricity, in the distribution of electricity and gas, in transformer services and management/maintenance of substations, in the sales of materials, in the retail supply of electricity and gas, in energy consulting, in the sale of miscellaneous materials, in drinking water supply and related services, in the district heating supply, in metering (heat, water, electricity and gas), in wholesale and retail telecommunication services, in the provision of street lighting, in e-mobility services, in photovoltaic (“PV”) systems, in the sale and installation of smart home products and services and in demand side response and flexibility services.

(29) In Czechia, both E.ON and Innogy are active in the generation and wholesale supply of electricity, in the wholesale supply of gas (downstream), in the distribution of gas, in the retail supply of electricity and gas, in heat generation (including district heating and heat and electricity cogeneration units), in the maintenance and repair of technology equipment in the energy sector, in e-mobility services, in the sale of motor fuels, in PV systems, in home insurance services, in energy consulting and auditing, in street lighting and other lighting services, in heating/refrigeration systems and facilities, in and home assistance services.

(30) In Hungary, both E.ON and Innogy are active in the generation and wholesale supply of electricity, in the distribution of electricity, in the retail supply of electricity and gas, in the provision of street lighting and other lighting services, in transformers, in services provided to other networks, in gas pressure regulators, in e-mobility services, in photovoltaic (“PV”) systems, in energy auditing and in the sales of materials.

(31) In Slovakia, both E.ON and Innogy are active in the generation and wholesale supply of electricity, in the wholesale supply of gas (downstream), in the distribution of electricity, in the retail supply of electricity and gas, in the leasing of dark fibre lines, in e-mobility services, in the management and maintenance of substations, in PV systems, smart homes, in energy consulting, in lighting solutions and in insurance.

(32) In the United Kingdom, both E.ON and Innogy are active in the generation and wholesale supply of electricity, in the retail supply of electricity and gas, in e- mobility services, in the provision of metering services, in energy consulting, and in demand-side response and flexibility services.

7. GERMANY

(33) In Germany, both E.ON and Innogy are active in the generation and wholesale supply of electricity, in the distribution of electricity and gas, in transformer services and management/maintenance of substations,6 in the sale of materials, in the retail supply of electricity and gas, in energy consulting,7 in the sale of miscellaneous materials,8 in drinking water supply and related services,9 in the district heating supply, in metering (heat, water, electricity and gas), in wholesale and retail telecommunication services,10 in the provision of street lighting,11 in e-mobility services, in PV systems,12 in the sale and installation of smart home products and services,13 and in demand side response and flexibility services14.15

7.1. Market Definition

(34) The main purpose of market definition, both concerning the relevant product and the relevant geographic market, in the Commission´s assessment of mergers is to identify in a systematic way the immediate competitive constraints facing the merged entity.16 The relevant product market comprises all those products and/or services which are regarded as interchangeable or substitutable by the consumer, by reason of the products' characteristics, their prices and their intended use.17 The relevant geographic market comprises the area in which the undertakings concerned are involved in the supply and demand of products or services, in which the conditions of competition are sufficiently homogeneous and which can be distinguished from neighbouring areas because the conditions of competition are appreciably different in those areas.18 Such a product and geographic market definition makes it possible inter alia to calculate market shares and concentration levels, which provide useful first indications of the market structure and of the competitive importance of both the merging parties and their competitors.19

7.1.1. Generation and wholesale supply of electricity

(35) The Commission has a consolidated case practice of defining the market for the generation and wholesale supply of electricity as encompassing the trading of the generated electricity on the wholesale market within a certain geographic market, including electricity that is physically imported into that this geographic market via interconnectors and irrespective of the source of generated electricity (e.g. wind or nuclear).20 In the past the Commission has also considered a segmentation between wholesale supply on the one hand and balancing and ancillary services21 on the other hand.22 The Commission notes that the German Bundeskartellamt (Federal Cartel Office or “FCO”) has typically considered a separate market for renewables-based generation that benefits from public subsidies under the German Renewable Energies Act (Erneuerbare Energien Gesetz or “EEG”).23 The Commission considers, however, that the market definition can ultimately be left open in this case as no competition concerns would arise even if a separate market were defined for balancing and ancillary services or separate markets were defined for conventional generation (including renewables not covered by the EEG-scheme) on the one hand and renewable generation covered by the EEG-scheme.

(36) The Commission has generally defined the geographic market for the generation and wholesale supply of electricity as national in scope,24 but has also recognised in some instances that the presence of a sufficiently large interconnection capacity between Member States may justify broadening the geographic scope of the market.25 This could also be the case if two Member States belong to the same bidding area. For the purpose of this Decision, however, the question whether, with respect to Germany, the geographic market for the generation and wholesale supply of electricity should be defined as wider than the German territory due to the interconnection and existence of a common bidding zone with Luxembourg can ultimately be left open as no competition concerns would arise even if the geographic market were limited to Germany alone.

(37) A geographic market for the generation and wholesale supply of electricity in Germany would not be affected by the Concentration, as the combined market share of the Parties post-merger would amount to less than [5-10]% with an increment, as a result of the merger, of no more than [0-5]%26 ([…] by renewable generation assets).27 When the phase-out of nuclear power is taken into account, E.ON’s market share will be (gradually and) significantly reduced to less than [0-5]%, due to the decommissioning of the three nuclear power stations currently operated by E.ON (Grohnde and Brokdorf in 2021 and Isar 2 in 2022).28

(38) Even if a separate market for balancing power and ancillary services were to be considered, the combined market share of the Parties post-merger would remain well below 20%. In view of the above, the Commission considers that the national German market for the generation and wholesale supply of electricity would therefore not be affected by the Concentration.

7.1.2. Distribution of electricity [Electricity networks]

(39) Electricity is transported via the transmission network for long distances and via networks with lower voltage level networks at regional and local level. Networks are connected with each other and different voltage levels are connected through transformers.29

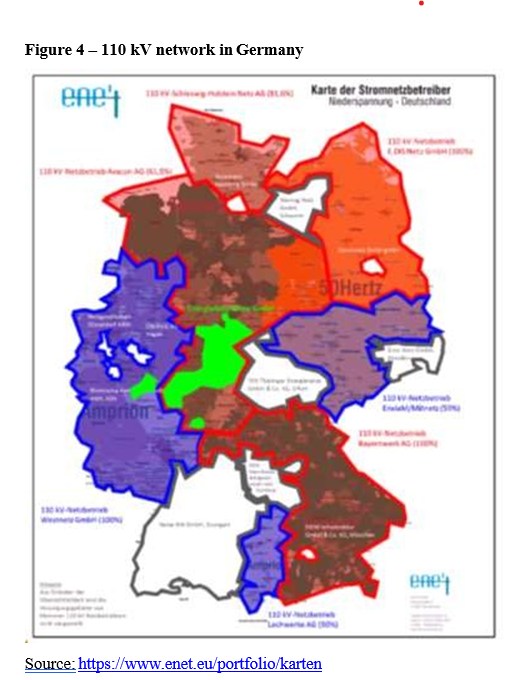

(40) In Germany, the electricity grid is divided into four voltage levels, i.e. the (i) extra- high (220-380 kV), (ii) high (72.5-125 kV), (iii) medium (1-72.5 kV) and (iv) low (< 1 kV). The high, medium and low voltage grids (“lower voltage networks”) are operated by approximately 890 Distribution System Operators (“DSOs”). The extra high voltage transmission grid is operated by four electricity Transmission System Operators (“TSOs”). Each TSO operates a separate transmission system, and each TSO covers part of Germany.30 Neither E.ON nor Innogy is active as a TSO.31

7.1.2.1. Product and geographic market definition

The Commission's decisional practice

(41) In previous decisions, the Commission has identified two separate markets for the transportation of electricity: transmission and distribution.32

(42) In relation to distribution networks, the Commission has found the operation and management of lower voltage (distribution) networks to be a relevant product market.33

(43) The Commission has previously considered the relevant geographic market for the operation of electricity distribution networks to be limited to the geographic area of the network in question (grid wide scope), with each grid constituting a relevant geographic market.34

The Notifying Party's view

(44) The Notifying Party agrees with the Commission’s previous decisional practice as regards the product definition and the geographic scope of the market for electricity distribution via lower voltage networks operated by DSOs.35

The Commission's assessment

(45) No evidence gathered by the Commission in the course of the market investigation in this case provided any indication to suggest that the Commission's past decisional practice is not appropriate in this case.

7.1.2.2. Conclusion on market definition

(46) For the purposes of this Decision, electricity distribution via lower voltage networks operated by DSOs is regarded as a distinct product market with the region covered by each such network operated by DSOs (“DSO area”) in Germany constituting a separate relevant market.

7.1.3. Retail supply of electricity

7.1.3.1. Background

(47) For historical reasons, prior to the liberalisation of the energy market in Germany in 1998 when the Energy Industry Act (Gesetz über die Elektrizitäts- und Gasversorgung, "EnWG") entered into force, the German market for electricity was characterised by a large number of energy suppliers, mostly Stadtwerke active at local level only. In 1958, when the German Act against Restraints of Competition (Gesetz gegen Wettbewerbsbeschränkungen) entered into force in Germany, territorial protection clauses in the electricity sector were exempted from the general cartel prohibition and as a result, many households in Germany had been served only by one local supplier for years. With the liberalisation, customers started moving away from their historical supplier and switching to alternative providers.

(48) Nonetheless, energy markets have traditionally witnessed considerable customer inertia (especially for households and small businesses) and despite the availability of more competitive offers, a significant proportion of customers stayed with the historical supplier. This "incumbency effect" is common to many or even most of the European retail energy markets (see also recital (59)) and it is still very apparent in Germany, too, where local incumbents still account for a considerable part of the demand in their own area (approximately 70%).

(49) From a competition perspective, due to this inertia, some customers will stick to their historical supplier largely irrespective of the offers of alternative suppliers. In other terms, customers’ inertia may produce monopoly-like situations where, for those customers who are ‘disengaged’, the historical incumbents face little competition from alternative suppliers. On this group of customers, structural changes in the market (e.g. mergers involving the historical incumbent and/or other players) are likely to have only a limited or no immediate material impact.

(50) The customer inertia issue is particularly pronounced for customers who are still supplied under basic (‘default’) supply contracts (see recital (49)). Despite material price differences between basic supply contracts and special contracts, a considerable portion of customers does not engage in searching or switching supplier and remain with the more expensive basic supply tariffs offered by the incumbent. While the percentage is steadily decreasing, still about 28% of all household customers were supplied under basic supply tariffs in 2017 (in 2016: approximately 31%; in 2012: approximately 37%; in 2007: approximately 59%).36

(51) In Germany, the law establishes that there can only be one basic supplier per area and which company shall act as basic supplier has to be determined every three years by the relevant DSO.37 Basic supply is subject to specific regulation. There is a legal obligation on the basic supplier to conclude basic supply contracts and the basic supplier can only terminate a basic supply contract in exceptional circumstances.38 Basic suppliers also have the legal obligation to pass on decreases in statutory provisions (i.e. taxes, concession fees, surcharges and levies except network charges) and face limitations on price increases (in that profit margin increases are not allowed).39 Further, a different regulatory regime applies to basic supply, e.g. basic supply contracts do not require an express agreement entered into by the basic supplier and a household customer (de jure contract) and basic supply contracts can be terminated at any time by the customer with a notice period of only two weeks.40

7.1.3.2. Product market definition

The Commission's decisional practice

(52) In previous cases, the Commission has defined the relevant market for retail supply of electricity in Germany as a separate market. The Commission has further distinguished further between (i) individually metered (15 or 30 minutes intervals) large industrial customers (“large/industrial customers”); and (ii) small commercial and household customers that are not individually metered, without any further sub- division.41

(53) While the Commission has not in the past taken any firm view as to whether special contracts and basic supply tariffs are in separate markets, recently (2015) in the case COMP/M.7778 – Vattenfall/ENGIE/GASAG, it assessed the impact of the merger on the entirety of the SLP (standard load profile) customers (including basic supply and special contracts) as well as on special contract customers only (both also at the national level).42

(54) The FCO's decisional practice, similarly to the Commission, distinguishes between RLM (load measured) and SLP customers (i.e. households and small commercial customers). However, for the latter customer group, the FCO distinguishes further in SLP customers under (i) basic supply; (ii) special contracts and (iii) heating electricity contracts.43 The FCO (as well as the competition authorities of Federal States) has been consistently adopting this market definition since 2009 in competition cases and sector inquiries44 and it also forms the framework under which the FCO and the FNA assess the electricity markets in their annual joint monitoring reports on the energy markets.

The Notifying Party's view

(55) The Notifying Party submits that the product market definition could ultimately be left open but it nonetheless considers that a distinction between basic supply and special contract customers would no longer be appropriate45 because, since the FCO´s decision in 200946, the share of basic supply customers has been steadily decreasing with customers progressively switching to special contracts. In the ten years period from 2007 to 2016, the percentage of customers on a basic supply contract has halved, from 61% to 31%, a fact that, according to the Notifying Party, is evidence of the pressure on basic suppliers “stemming from price competition in the liberalised retail markets”.47

The Commission's assessment

(56) In this case, and in line with the FCO`s precedents, the Commission considers that the retail supply of electricity to households and small commercial customers (“household customers”)48 should be segmented (i) between electricity for heating purposes (“heating electricity”) and electricity for other purposes (“regular electricity”) and (ii) within regular electricity, between basic supply contracts and special contracts.

(57) The reasons for distinguishing between regular electricity and heating electricity is further discussed in Section 7.1.4. The distinction between basic supply contracts and special supply contracts is further discussed in this Section.

(58) First, the Commission notes that there still exists a significant price gap between basic supply tariffs and special contract tariffs. In their joint annual Monitoring Report on the energy markets, the FNA/FCO indicate that special contract tariffs are consistently cheaper than basic supply tariffs.49 The FNA/FCO estimate that the net price (i.e. the price net of the non-controllable costs, such as, for instance, network charges and taxes) for special contracts with a supplier other than the basic supplier is approximately 30% to 50% cheaper than the net basic supply tariff and 20% to 40% cheaper than the average net price for special contracts charged by the basic supplier.50 The Notifying Party itself estimates that “Basic Supply tariffs of E.ON are on average […] more expensive than […] Special Contract tariffs in electricity”.51 This is also confirmed by the respondents to the Commission’s investigation, many of whom indicated that basic supply and special contract tariffs differed by more than 5-10%.52

(59) Despite the significant saving they could make if they switched to a special contract, about a quarter of customers are still on basic supply contracts. In the Commission’s view, this is largely explained by customer inertia. Customers’ lack of engagement with the choice of energy supplier has historically been a major obstacle, which has slowed down the effects of the liberalisation and deprived customers of the advantages/benefits (in terms of lower prices, greater variety, etc.) of competition. A recent report by ACER53 found that consumer inertia, deriving from the lack of consumer interest in the market and from consumer loyalty to existing suppliers, is a key determinant of the low switching rates in European energy retail markets. The perceived smallness if the monetary gain that could result frol switching, the lack of trust in new suppliers, the perceived complexity of the switching process and the level of satisfaction with their current supplier were identified as the factors that were most influential in inhibiting consumer switching behaviour. The switching process may be perceived by customers as too complex or too burdensome relative to the benefit that switching could bring. The report argued that a number of cognitive biases (social proof, status quo and loss-aversion bias) explain, at least to some extent, why customers stick to their historical supplier despite the availability of cheaper offers.

(60) Many competitors responding to the Commission’s questionnaire also noted that basic supply and special contract supply do not always necessarily follow a similar dynamic.54 First, basic suppliers have the legal obligation to pass on decreases in statutory charges (i.e. taxes, concession fees, surcharges and levies and other than network charges) and they are subject to limits on price increases (in the sense that margin increases are not allowed). Second, price fluctuation in the the wholesale markets can only be reflected to a limited extent in the retail prices of basic supply. Third, while a number of respondents indicated that a 5-10% increase in the price of basic supply contracts available on the market offers could trigger an increase in the level of switching from basic supply offers to special contracts, the majority of the competitors who responded to the Commission’s investigation55 (almost 70%) considered that the increase in switching would probably be small or negligible.56 In this vein, one competitor noted that “Basic supply is not challenged by active competition and therefore not price sensitive.”57

(61) Finally, the distinction between basic supply tariffs and special contract tariffs is also evident from the fact that the Parties adopt different pricing and price adjustment policies for the two types of tariff.58

(62) The Commission therefore considers that basic supply tariffs are not materially constrained by special contract tariffs, and as a result the two types of contract constitute two separate relevant product markets.

7.1.3.3. Geographic market definition

The Commission's decisional practice

(63) The Commission has typically defined the geographic markets for the retail supply of electricity to end-customers as national in scope.59 For Germany, however, in COMP/M.5496- Vattenfall/Nuon Energy the Commission also considered the possibility of a narrower geographic market definition (at distribution network level) for the retail supply of electricity to small (i.e. non-load measured) customers, also a narrower definition (at the distribution network level) although it ultimately left the market definition open in that case.60

(64) Since 2009, the retail electricity supply market in Germany has significantly evolved and the geographic scope of competition has become increasingly broad. Although this trends towards nationwide competition had not yet fully materialised by the time of the COMP/M.5496 investigation, it was nonetheless already in existence in 2009 and was expected to lead ultimately to a broader geographic market: “competition in Germany is progressively expanding and that this could likely lead to broadening the geographic scope of the market for retail supply of electricity to small customers in the future”.61

(65) This trend has been already reflected to some extent in the more recent practice of the Commission. In 2015, in COMP/M.7778 – Vattenfall/ENGIE/GASAG of 2015, while the geographic market definition was left open, the Commission also considered national market shares for the retail supply of electricity to household customers in general and for special contract customers only.62

The FCO's decisional practice

(66) In its recent cases the FCO has consistently considered that the market for special contracts to be national in scope, whereas it has considered the market for basic supply tariffs to have an inherently local dimension and to be restricted to the geographic scope ofthe network area, in which, under Section 36(2) EnWG, the supplier acts as basic supplier.63

(67) In its decision B8-107/09 - Integra/Thüga taken at the end of 2009, the FCO introduced the distinction between basic supply and special contract customers and defined the market for speciatl contract customers as national in scope. The FCO noted in particular in that decision that the competitive conditions for special contract customers had changed compared with the situation when previous decisions has been taken. This was because spectial contract customers now had a wide choice of electricity suppliers offering special contracts in any area of Germany. Market conditions had also changed from the perspective of the electricity supplier since electricity suppliers now orientated themselves more and more outside their own incumbency areas and offered electricity also in other network areas (stating that in 2008, 31 companies were active in more than 300 network areas). These companies included in particular also energy utilities without regional ties, but that position themselves strategically as nationwide energy suppliers.64

The Notifying Party's view

(68) The Notifying Party agrees with the geographic market definition adopted by the FCO for separate product markets (i.e. basic supply and special contracts).65

The Commission's assessment

(69) The Commission considers that the reasoning whereby the Commission still considered a narrower geographic market (albeit already stating that “competition in Germany is progressively expanding and that this could likely lead to broadening the geographic scope of the market for retail supply of electricity to small customers in the future”)66 in COMP/M.5496 of June 2009 no longer reflects market reality. Rather, the market investigation shows that the market definition adopted by the FCO is more appropriate.

(70) For large/industrial customers, in line with Commission’s precedents, the Commission considers that the geographic market is national.

(71) As discussed above, the Commissions considers that basic supply and special contracts are separate product markets.

(72) The market for customers under basic supply is local because for each local area, only one company is entitled to serve basic supply customers and there cannot be competition between basic suppliers active in different areas.

(73) While there are local elements of competition, the Commission considers that on balance the market for special contracts is national in scope with local elements of competition.

(74) First, the Commission notes that the trend of an increasing number of suppliers active across multiple areas, which the FCO observed in its 2009 decision (see recital (67) above), has continued. Compared to 2008 where ‘only’ 31 companies were active in more than 300 network areas, in 2017 there were 88 companies active in more than 500 (of approximately 900) network areas and 61 companies active in 251-500 network areas.67 In 89% of the network areas, more than 50 suppliers were active, whilst in 2007 this was true for only less than 25% of the network areas.68

(75) Second, suppliers tend to pursue similar sales strategies across areas. In response to the Commission’s investigation, the majority of the competitors indicated that they do not significantly differentiate their sales strategy by areas in terms of sales channel used, size of sales force or type and intensity of advertising.69 One competitor noted that it does not see “big local differences in the B2C segment.Competition is rather uniform across Germany...”.70

(76) Third, national pricing has become common. Of the suppliers responding to the Commission’s investigation, 65% either have the same net-price across the country71 or have in general the same net price across the country but may occasionally differentiate between areas.72

(77) Fourth, there is considerable supply-side substitution as expansion across local areas appears to be relatively easy and common.

(78) The Notifying Party estimates that 60% of switches take place via price-comparison websites73 (which would be more for the internet in total, including homepages) and the importance of this channel is likely to increase further going forward. As a consequence, companies need limited physical infrastructure to offer retail of electricity and can easily serve customers across multiple areas.

(79) Suppliers (incl. small Stadtwerke/local players) regularly try to expand and drive competition outside their own ‘original’ area. For example, one competitor said that “In recent years, [it] won a considerable amount of private customers outside its home market.”74 Another indicated that, while it has traditionally focused on a region in Southern Bavaria, it has expanded into “Bavaria and in the South of Germany.”75 In the last 2-3 years the Commission estimates that on average two new players entered any given local area (post-code) and have quickly gained non-negligible shares of supply.76

(80) There are currently well over 1000 players in Germany and the average number of suppliers per area increased from 46 in 2008 to 124 in 2017.77 The majority of suppliers (even small ones) are active at least at DSO-area level (on average about 12 municipalities each) up to even Federal State level (on average approximately 700 municipalities each).78

(81) Some competitors argued that the retail supply of electricity is local in scope in view of the fact that net prices charged by the Parties (and other competitors) vary locally and that suppliers typically charge higher margins in areas where they are basic supplier.79 The Commission has carefully considered the analysis submitted by these companies (hereafter, the “Pricing Analysis”)80 but maintained its view that the geographic market is nationwide.

(82) The Commission preliminary notes that the incumbents typically charge the highest price for the basic supply tariff81 but, as discussed above, the Commission considers that basic supply is not part of the same relevant market as special contracts and that the geographic market for basic supply is local in scope.

(83) On the other hand, pricing analyses show that the local basic supplier can typically charge substantially higher prices also to their special contract customers82, i.e. customers which have a special contract with the legal entity that has basic supplier status (as it has the highest share of customers in the local area)83.

(84) One important thing to notice is that the Pricing Analysis submitted by the competitors (and referred to in recital (81)) treats different subsidiaries of the Parties as independent entities. For example, the analysis only considers contracts branded “Innogy” as tariffs of Innogy, whereas contracts of other Innogy’s subsidiaries (e.g., “eprimo”) are considered as contracts of separate entities. This can have an important effect on the results, if e.g. margins or pricing strategies are analysed in a region where one group company is the basic supplier, and only the margins or prices of that entity in that region are taken into account, not the ones of the other group companies. The complainants themselves acknowledge in their analysis that the Parties have different price strategies by brand, e.g. they note that E Wie Einfach acts far more eratically than E.ON, sometimes pricing higher, sometimes lower than E.ON,84 and that for some brands they do not flex the prices locally: for example, in relation to eprimo’s pricing strategy these third parties notes that “the behaviour shown by eprimo, Innogy discount subsidiary, did not differ in regard to the basic supply area (of E.ON).” 85

(85) The Commission considers the relatively high price for special contract that the local basic suppliers can charge (see recital (83)) is due to the incumbency advantage. Special contract customers who are addressed by these relatively expensive offers are likely to be customers who have showed some signs/willingness of engaging but were not able to take full advantage of the competitive offers available on the market. The outcome of the Commission’s short Phase II questionnaire to SME and micro- business customers in Germany provides support to these findings:86 of those customers who have changed contract without changing supplier (which include customers who moved from basic supply to special contract with the incumbent), 20- 25% did not look around/compare offers before selecting the new contract. And even among those who changed contract, almost 40% admitted that, absent any offer from their incumbent supplier, they would have stayed with the same supplier.87 This suggests that a significant number of customers under special contracts are not receptive to the existing price differences and stick to their incumbent supplier irrespective of substantially cheaper offers that are available on the market. This is further supported by the FCO’s findings in the Integra/Thüga decision according to which small customers is heterogeneous in terms of price sensitivity. This heterogeneity is illustrated in particular by the fact that customers who in the past have already switched the electricity supplier, tend to switch suppliers more readily than customers who have always been with the established electricity suppliers.88

(86) In the Commission’s view, most of the special contract customers who are with the basic supplier’s most expensive tariffs are in many respects similar to basic supplier customers: this segment of the demand is characterised by considerable demand stickiness (due to, e.g., inertia or loyalty to the local incumbent or municipal utility, etc.) as despite the availability of cheaper offers these customers stay with the local incumbent.89 For this reason the local element of competition is more pronounced for these customers compared to the other customers under special contracts for whom, as discussed above, the national dimension of competition prevails. This is also confirmed by the pricing analysis that shows that for the more contestable customers, the Parties – outside special contracts with their basic supply entity - tend to price as (and sometimes) more competitively than other suppliers even in their own incumbency areas.

(87) It is worth noting that the complainants do not dispute that the market is competitive, rather, to the contrary, they state that the “German electricity sales market for end customers is subject to a high-level of competition. In addition to E.ON and Innogy and their respective group of companies, a large number of competitors is active in each of the examined supply areas”.90 Also, importantly, third parties are mostly concerned that “over time a profitable and sustainable operation is, however, only possible for those companies who that are basic suppliers”91 because they can compensate the “low competitive prices by profits generated from their large base of customers (in basic supply) and the grid business”92. This suggests that the local incumbent may only have market power vis-a-vis default/basic supply customers and customers having a special contract with the basic supplier but faces strong competition for the more engaged customers which further points to a broader-in- scope market.

(88) The highly competitive offers available to those customers who are engaged and are willing to switch the supplier are further illustrated by the analysis carried out by the Commission which shows that there is no systematic link between margins for this customer group and the incumbent’s share of supply at local level. The Commission has analysed the tariffs that the Parties charged to newly acquired customers93 and plotted against the incumbent share of supply in local areas (e.g. E.ON in its DSO areas). For example, the following graph shows E.ON’s margin on the ‘OptimalStrom’94 tariff and the entire E.ON group share of supply in local areas95.96

Figure 2 - E.ON’s margin on the “OptimalStrom” tariff and the entire E.ON group share of supply in local areas

[analysis of margins of an E.ON-tariff]

Source: Commission’s analysis on the Parties’ data

(89) The lack of a systematic link between margins and shares of supply as regards the group of customers who do not have a special contract with the basic supplier suggests that the current competition and threat of entry constrains local incumbents at least with regard to that customer group (see recital (289) below for further discussion on the analysis undertaken by the Commission).

(90) In light of the above, the Commission concludes that, for the purposes of this Decision, the retail supply of regular electricity to household customers under special contracts is national, although there are local elements of competition. Even if (quod non) the market were to be defined as local in scope, in the competitive assessment the Commission has also considered the effects of the Concentration on a local level and concluded that even on a local basis the Concentration does not raise competition concerns.

7.1.3.4. Conclusion on market definition

(91) For the purposes of this Decision, the market for retail supply of electricity to large industrial customers will be regarded as national in scope. The retail supply of regular electricity to household under basic supply will be regarded as a separate product market and the market will be regarded as local in scope, restricted to the relevant basic supply area. The retail supply of regular electricity to household under special contracts will be regarded as a separate product market and the market will be regarded as national in scope with local elements.

7.1.4. Retail supply of heating electricity

7.1.4.1. Product market definition

(92) One of the main differences between regular electricity and heating electricity is the customer’s different pattern of consumption. While heating electricity is supplied for the purpose of room heating – mainly through two technologies: electric night storage heaters (Nachtspeicheröfen) or electric heat pumps (Wärmepumpen) – regular electricity is supplied for the operation of household appliances and lamps.

(93) Regular and heating electricity are typically metered through separate metering systems compared to regular electricity. If a customer uses heating electricity, he either has a single “two-tariff” meter for both regular and heating electricity tariffs that can switch between the two tariffs, or he has two separate meters, one for heating electricity and one for regular electricity. In the Notifying Party's view, “single meter customers” are rather the exception and account for only approximately [20-30]% of the Notifying Party's overall customer portfolio in heating electricity. For customers, the use of double meters provides more flexibility as they can choose between different electricity suppliers for each metering system.97

(94) For the reasons explained below in recitals (95) to (110), the Commission considers that the retail supply of electricity for heating purposes ("heating electricity") constitutes a separate product market, distinct from electricity used for other purposes ("regular electricity").

The Commission's decisional practice

(95) The Commission has not previously considered or assessed the retail supply of heating electricity.

The FCO's decisional practice

(96) The FCO has previously assessed the retail supply of heating electricity in several decisions and a sector inquiry into heating electricity and has concluded that heating electricity constitutes distinct market, separate from regular electricity.98 It has based its findings mainly on the following arguments.

(97) First, heating electricity customers have a different demand profile than regular electricity customers both across days and within the same day. Since heating electricity is used for heating purposes, the consumption varies depending on the outside temperature and is typically high on days when the outside temperature is low. Also, the times at which heating electricity and regular electricity are typically consumed are different. In fact, heating electricity can be consumed particularly at off-peak hours thanks to the interruptible consumption devices (i.e. in mainly heating technology).99

(98) Second, prices for heating electricity supply tend to be lower than prices for regular electricity. The reason is essentially twofold: (i) heating electricity is subject to lower network charges and fees,100 and (ii) heating systems, especially night-storage technologies, consume electricity in particular in off-peak hours, when the wholesale price of electricity is typically lower than in peak hours.

The Notifying Party’s view

(99) The Notifying Party submits that a distinction by electricity purpose (regular vs heating) is not warranted and that the arguments, whereby the FCO identified a separate market for heating electricity in 2009,101 no longer reflect today’s competitive conditions.

(100) The Notifying Party submits that night storage heaters are no longer installed in new buildings and are increasingly replaced by more efficient technologies, in particular heat pumps.102 Heat pumps, unlike night-storage heating, do not require charging cycles and thus can be operated also at daytime. The Notifying Party expects that dedicated heating electricity tariffs will gradually disappear and be substituted by regular electricity tariffs which are equally suitable for the operation of heat pumps as consumption levels with heat pumps are more comparable to regular electricity and will no longer justify different tariffs.103 All suppliers offering regular electricity will eventually be able to compete for customers’ demand for electricity that is used for heating purposes.104

The Commission’s assessment

(101) The Commission considers that a distinction between heating electricity and regular electricity is appropriate.

(102) First, the market investigation has confirmed that load profiles for heating electricity are still significantly different from the customer load profile for regular electricity (75% of the respondents to the market investigation indicated that the load profiles of regular electricity customers and heating electricity customers differ).105

(103) Second, in respect of the Notifying Party's argument that (i) night storage heaters are increasingly replaced by more efficient technologies, in particular by more efficient heat pumps and (ii) as a result, the load profile for electricity for heat pumps will not considerably differ from the standard load profile for regular electricity so that special heating electricity tariffs will disappear, the Commission notes that the replacement of night storage heaters by other technologies is slow. While the number of night storage heaters is being reduced over time, the shift towards new technologies appears to take place gradually. According to the Notifying Party,2.4 million night storage heaters were in operation in 2000 in Germany and 1.6 million of these devices were still used in 2017.106 Thus, in seventeen years the number of night storage heaters has been reduced by only 33%.

(104) Third, the large majority (87%) of the competitors responding to the market investigation indicated that they offer different commercial conditions for the retail supply of heating electricity compared to regular electricity.107 The main reasons for this include the different demand profiles and metering systems, the necessity for consumers to have a controllable consumption/interruptible load device, the different load profiles determined by the DSO, as well as the lower network charges and concession fees applied to heating electricity.108

(105) Fourth, the investigation also confirmed that there still exists a significant price gap between heating and regular electricity (typically heating electricity is considerably cheaper than regular electricity, i.a. due to lower network charges and concession fees). In this vein, the majority of competitors indicated that there are different price levels for consumers of heating electricity with regards to consumers of regular electricity.109 In addition, heating electricity (for night storage heaters, which still account for more than two-thirds of all interruptible consumption devices)110 is predominantly consumed when electricity can be procured for off-peak times when electricity is typically cheaper to procure on the wholesale market than at peak times. Consequently, heating electricity suppliers can also benefit from lower procurement costs.111 Overall, as a consequence, the Commission considers that heating customers would unlikely consider regular electricity as a viable alternative because switching to regular electricity would entail significant additional costs.

(106) Fifth, there are indications that margins for heating electricity are typically higher than margins for regular electricity, which suggests the competitive landscape between regular and heating electricity differs. In this vein, one competitor explains that “margins on the market for heating electricity are twice as much as the margins on the market for regular electricity because competition is less intense”.112 As explained in recitals (104) and (105), the market investigation indicated that the competitive conditions in the two markets (heating and regular electricity) are not homogenous. The identity and relative strength of the suppliers differ: there are much fewer suppliers offering heating electricity than regular electricity and some suppliers who are particularly active and effective competitors for regular electricity have a much weaker presence in heating electricity.113

(107) Sixth, the Commission has also considered whether heating and regular electricity could be considered as part of the same relevant market on the basis of supply-side arguments. However, for the reasons explained in recitals (318) to (325) below, there are significant barriers for a new supplier to enter the heating electricity market or for local suppliers to extend their activities across regions and therefore suppliers active in regular electricity would not be able to start offering heating electricity quickly and without significant costs. Barriers to entry are considerably higher for heating than for regular electricity. Barriers to entry relate to managing different load profiles, which vary by customers and network areas, specific know-how, different procurement, difficulties to identify heating customers or higher risk in the procurement of electricity. Each network area has a different load profile, different network charges and different concession fees. These differences require considerable extra work to assess tariffs for each area compared to regular electricity if a supplier intends to be active at supra-regional or national scope. Offering a standardised product is therefore much more difficult for heating electricity, also in view of a generally smaller potential customer base and the difficulty to identify these customers. Also procurement (purchasing and prognosis of temperature- dependent demand) and IT-systems (for processing and billing) place higher demands on potential suppliers with regard to know-how and necessary investments. Therefore, heating and regular electricity cannot be considered as substitutable products from a supply-side perspective. In this vein, a competitor explains “although the German Federal Cartel Office has done some important work on leveling the playing field, the supply of electricity for heating purposes is still a very demanding business with lots of barriers to entry. Not every local DSO does offer the necessary information when using the business processes for electricity (GPKE) and in general the business processes lack some detail. Furthermore, there are still conflicting views on how the network fees and concession fees have to be determined in regard to the relevant uses cases, e.g. heat pump and night storage heaters. As a result, a supplier faces uncertainty if he has calculated the tariffs correctly. A supplier faces more than 870 DSO areas in Germany and thus has to deal with up to 870 conflicting views on appropriate concession fees for electricty for heating.”114 Therefore, heating and regular electricity cannot be considered as substitutable product from a supply side perspective.

(108) Seventh, not all suppliers who are active in the provision of regular electricity offer heating electricity and vice versa.115 There are much fewer competitors in heating electricity, as discounters, a significant competitive force in regular electricity, are not active in this market and small municipal utilities (“Stadtwerke”) and other local suppliers have limited presence in this market (including a more limited geographical reach, see also recital (317)).

(109) Finally, most competitors internally differentiate between regular and heating electricity, including the Parties. Significant differences relate also to marketing strategies, invoicing, investment in IT systems, logistic or sales structure, which are more demanding for the supply of heating electricity. For example, a competitor considers that “there are a lot of differences in calculating the tariffs”116. In the same vein, another competitor considers that “the complexity in processing and billing is higher”117. Another competitor submits that “a retailer would need a capable legal department and a well trained customer service due to a high number of special situations/problem cases. Whereas the usual number of problem cases is around 3 -5% in the retail market (supply to households and SMEs), we see 50 - 60% of problem cases in the supply of electricity for heating purposes”.118

(110) In view of the above and for the purposes of this Decision, the retail supply of heating electricity to household customers in Germany will be regarded as a separate product market.

7.1.4.2. Geographic market definition

The Commission’s and FCO´s decisional practice

(111) As indicated above, the Commission has not previously considered the supply of heating electricity in Germany.

(112) The FCO has, in respect of heating electricity, considered regional markets based on the “established supply areas” of the respective incumbent supplier. In its sector inquiry on heating electricity in 2010119 and in the case B8-94/11 – RWE/SW Unna, the FCO considered that the market for supplying Standard Low Profile (SLP) customers with heating power is defined regionally. The delimitation takes place according to the established supply area of the electricity distribution undertaking offering heating electricity, i.e. practically according to the network area of the network operator connected to the undertaking concerned, in which the distributor has the position of the basic supplier120 within the meaning of Section 36 EnWG and offers heating power. In this case, these markets were defined as corresponding to the grid areas of SWU and RWE. This same market definition was used again in inter alia B4-80/17 – EnBW/MVV.121

(113) The FCO found that the competitive conditions between local incumbent areas are fundamentally different, with very high local market shares and customers only having very limited options to switch supplier as basically only the local basic supplier of regular electricity122 offered heating electricity within a network area and there were hardly competitors present.123

The Notifying Party’s view

(114) As regards electricity for heating purposes, the Notifying Party submits that, if a separate market were to be considered, it would be appropriate to define local markets (limited to the respective network areas), mainly because (i) a very large proportion (around 90%) of customers are still being supplied by the local incumbent supplier, (ii) load profiles differ locally and this limits the extent of any supply-side substitution (as it creates a challenge for retail suppliers to expand their offering quickly in other areas) and (iii) prices differ significantly from regular electricity prices due to the significant rebates on network charges and concession fees, which differ by area to area.124

The Commission’s assessment

(115) The Commission considers that for the purposes of this Decision, the exact geographic market definition for the retail supply of heating electricity to household customers in Germany can be left open, as the Commission considers that the Concentration significantly impedes effective competition irrespective of whether the market is considered to be national in scope with local elements of competition or local at the network area level.

(116) On the one hand, some elements point towards a national market: first, whilst the FCO has traditionally defined the market for heating electricity as regional, there are signs that the market is moving towards a national market in a similar manner that has happened to the competitive supply of regular electricity, although this trend is less pronounced and progressing more slowly. According to the FNA/FCO monitoring report 2018, “there has been a steady increase in switching activity among electric heating customers, albeit at a low level, following many years with hardly any customers switching. This increase in the switching rate indicates a higher degree of competition. Yet at the same time, the switching rates are still far below those for household electricity and non-household customers. ”.125

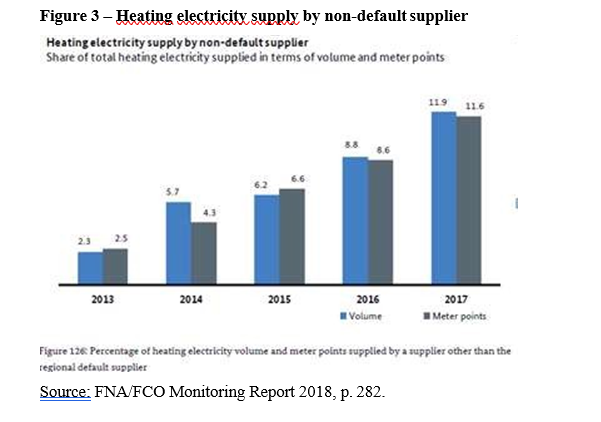

(117) The Commission also notes that, according the 2018 monitoring report “There is a steady increase in the share of electricity provided for heating purposes and electric heating meter points provided by a supplier other than the local default supplier, now standing at around 12%”126. As shown in the graph below, the demand of heating customers captured by suppliers other than the local incumbent has increased by more than 5 times in the last four years (from 2.3% to 11.9%). This suggests, similarly to regular electricity, that the market for heating electricity is becoming increasingly competitive (although more slowly than regular electricity ) and the role of the local incumbent has been eroding over time.

(118) Second, a number of suppliers are active on a supra-regional or even national level, offering heating electricity across Germany127 and almost half of the respondents indicated that they offer similar commercial conditions in all the areas where they operate and do not differentiate by local area.128 Most importantly, the largest suppliers, which are the main drivers of competition for the engaged customers in the retail supply of heating electricity as explained in Section 7.2.3 (e.g. the Parties and EnBW), are active across the country or at least have a supra-regional focus.

(119) On the other hand, some elements support a local market definition. First, the majority of the respondents to the questionnaire are only active in certain areas and not across Germany129 and some competitors face barriers to expanding beyond their traditional region. For example, one competitor considers that “[p]roviding electricity for heating purposes outside our traditional area of […] would require extra marketing efforts for product (tariff) design, promotion and implementation (additional meter). Given this substantial effort in combination with the rather small number of potential clients, we have decided for the time being to not sell this product beyond the […] region”130. This is in contrast with the same competitor´s strategy in the supply of regular electricity, where it states that it is active in regular electricity supply across Germany and uniformly present across the country (not targeting some specific areas).131 This highlights the difference in entry barriers between heating electricity and regular electricity.

7.1.4.3. Conclusion on market definition

(120) For the purposes of this Decision, the Commission is of the view that the exact geographic market definition for the retail supply of heating electricity to household customers in Germany can be left open, as the Commission considers that the Concentration significantly impedes effective competition irrespective of whether the market is considered to be national in scope with local elements of competition or local at the network area level.

7.1.5. Distribution of gas [Gas networks]

(121) Gas transmission is the transport of natural gas through a network, which mainly contains high pressure pipelines, with a view to its delivery to (intermediate) customers for distribution. Gas distribution is the transport of natural gas through local or regional pipeline networks with a view its delivery to customers, but not including supply.132

(122) The transmission system is operated by gas Transmission System Operators (“TSOs”) which in Germany includes 16 supra-regional gas TSOs. Innogy does not currently operate a gas TSO.133 The distribution system is operated by approximately 718 gas DSOs.134

7.1.5.1. Product and geographic market definition

The Commission's decisional practice

(123) In previous Decisions, the Commission has generally distinguished between (i) gas transmission (via high pressure systems) and (ii) gas distribution (via medium/low pressure systems).135

(124) In previous Decisions, the Commission found that the geographic market for gas distribution networks is regional within the limits of the area covered by the respective grid, inter alia because the DSO operates a natural monopoly with a market share of 100%.136

The Notifying Party's view

(125) The Notifying Party concurs with the Commission’s decisional practice as regards the product definition and the geographic scope of the market for lower pressure gas distribution networks operated by DSOs.

The Commission's assessment

(126) The Commission did not receive any indication suggesting that the Commission's decisional practice is no longer appropriate.

(127) For the purposes of this Decision, lower pressure (low and medium) gas distribution networks operated by DSOs will be regarded as a separate product market with a geographic scope in line with the gas distribution network regions, such that the region for each gas distribution network constitutes a distinct relevant geographic market.

7.1.5.2. Conclusion on market definition

(128) For the purposes of this Decision, lower pressure (low and medium) gas distribution networks operated by DSOs will be regarded as a separate product market and the market will be regarded sub-national in scope in line with the electricity distribution network regions, such that the region for each electricity distribution network constitutes a distinct relevant geographic market.

7.1.6. Retail supply of gas

(129) The Commission considers, based on its assessment, that the structure and functioning of the market for the retail supply of gas is very similar to the market for the retail supply of electricity.137

7.1.6.1. Product market definition

The Commission's decisional practice

(130) In previous decisions concerning Germany, the Commission defined a separate market for retail supply of gas, considering a further segmentation of that market into: (i) the supply of gas to large customers (potentially divided into industrial customers and gas-fired power plants) and (ii) the supply of gas to small customers (commercial customers and households).138

(131) The FCO followed a similar distinction into (i) load metered customers (Kunden mit registrierender Leistungsmessung, "LM-customers", i.e. large/industrial customers); and (ii) non-load metered or standard load profile customers (nicht- leistungsgemessene oder Standardlastprofil-Kunden, "NLM-customers", i.e. small commercial and household customers). In addition, the FCO since 2014 has further separated the NLM-customers segment into (i) basic supply customers and (ii) special contract customers.139

The Notifying Party's view

(132) The Notifying Party considers it appropriate to distinguish between large/industrial customers on the one hand and small commercial/household on the other, but does not consider it appropriate to distinguish between large/industrial customers and power plants, nor to make a distinction between basic-supply140 and special contract Customers.141

The Commission's assessment

(133) In line with the Commissions' precedents and the Notifying Party's submission, the Commission considers it appropriate for the purposes of this Decision to distinguish between (i) small commercial/household customers (“household customers”)142 and large industrial customers143. However, with respect household customers, the Commission considers that a further distinction should be made also between (i) basic supply and (ii) special contracts, in line with the FCO´s findings. The same or similar issues regarding the distinction between basic supply tariffs and special contracts that apply to retail of regular electricity apply to also the retail supply of gas.144

7.1.6.2. Geographic market definition

The Commission's decisional practice

(134) In previous decisions the Commission considered that the market for the retail supply of gas to households and SMEs can be national, regional or local (restricted to the distribution network area) in scope depending on the market characteristics.145

(135) For the market for the retail supply of gas to large/industrial customers, the Commission previously indicated that can be national or regional in scope as well, but ultimately left it open.146 In the market investigation carried out in Case COMP/M.6910 – Gazprom/Wintershall/Target Companies, however, the large majority of competitors and customers active on the upstream and downstream wholesale gas supply markets as well as the competitors and customers active on the retail gas supply market considered the geographic scope of the retail gas supply market to at least encompass the entire German territory.147

(136) In 2014, deviating from its previous decisional practice148, the FCO investigated in depth and concluded that for the supply of LM-customers and for the supply of NLM-customers under special contracts, that there is no longer a need to consider regional supply markets as market penetration by various suppliers across different supply areas on a national level had increased considerably. The FCO therefore considered the relevant markets for the retail supply of gas to LM-customers and NLM-customers under special contracts to be national, the market for the retail supply of gas to NLM customers under basic supply as local, the relevant DSO-area for which the supplier is the basic supplier. 149

The Notifying Party's view

(137) The Notifying Party submits that the geographic market for the retail supply of gas to large/industrial customers as well as for a market for retail supply to small commercial/household customers is national in scope.150 However, the Notifying Party submits that a potential market for retail supply of gas to basic supply customer would be local in scope (the respective basic supply area).151

The Commission's assessment

(138) For the market for retail supply of gas to large/industrial customers the Commission considers it, in line with the Parties and FCO’s precedents, to be national in scope. The market investigation showed that the majority of respondents price in general the same across the country but occasionally differ between areas and only the minority stated that their net prices differ by area for all or the majority of products. Many respondents elaborated, that for large/industrial customers, prices differ per customer as customer specific offers are made.152 Also, the majority of respondents indicated that their sales strategy does not differ by area.153

(139) Concerning household customers, the market investigation conducted by the Commission suggests that the market definition adopted by the FCO is appropriate.

(140) The market for basic supply for gas is, like in electricity, local. For each local area, only one company is legally entitled to serve basic supply customers and there cannot be competition between basic suppliers active in different areas.

(141) While there are local elements of competition, the Commission considers that on balance the market for special contracts is national in scope with local elements of competition.

(142) First, there are around 1,000 gas suppliers in Germany.154 The FCO notes that in 2017, more than 50 gas suppliers operate essentially across the entire nation (in 93% of the network areas) and more than 100 gas suppliers are operating in 40% of network areas. On average, gas consumers in Germany can choose between almost 120 suppliers in their network area. The average number of suppliers per area has steadily increased in recent years. In 2010 in the majority of the of the network areas (62%) there were less than 30 suppliers available to customers.155

(143) Second, the majority of respondents price in general the same across the country but occasionally differ between areas also for household customers and only the minority stated that their net prices differ by area for all or the majority of products.156 Second, the majority of respondents indicated that their sales strategy does not differ by area.157 Third, the Parties’ internal documents showed also for gas under special contracts that the Parties monitor activities of competitors throughout Germany without focusing on specific regions or competitors, as competitive developments in gas and electricity are internally monitored and assessed similarly by the Parties (see recital (337)). Fifth, there is considerable supply-side substitution and the Commission did not identify significant barriers to entry or expansion.158

(144) Similarly to electricity, the special contract tariffs of the basic supplier are typically higher than the special contract tariffs offered by other suppliers.159 In the Commission’s view this is due to an incumbency advantage that the basic supplier enjoy thanks to some demand stickness caused among other things by, e.g., customer inertia or loyalty to the histotrical incumbent, etc.. Most of the special contract customers who are with the basic supplier’s most expensive tariffs are in many respects similar to basic supplier customers in the sense that the local element of competition is more pronounced, the local incumbent has a degree of pricing power vis-à-vis these customers and the merger does not affect this. However, for the more contestable customers, those who look around and actively choose their supplier on the basis of the offers available on the market, the Parties – outside special contracts with their basic supply entity - tend to price as competitively as other suppliers even in their own incumbency areas.

(145) As with electricity, the competitive offers available to those gas customers who are engaged and willing to switch supplier is further proved by the Commission’s analysis which shows that there is no systematic link between the tariffs that the Parties charged to newly acquired customers (and therefore most likely targeted to customers who are engaged)160 and the incumbent’s share of supply at local level. This suggests that the current competition and threat of entry constrains local incumbents at least with regard to the group of customers who are engaged/more contestable, and this in turn points to a national market.

(146) In light of the above, the Commission concludes that, for the purposes of this Decision, the retail supply of gas to household customers under special contracts is national, although there are local elements of competition. Even if (quod non) the market were to be defined as local in scope, in the competitive assessment the Commission has also considered the effects of the Concentration on a local level and concluded that even on a local basis the Concentration does not raise competition concerns.

7.1.6.3. Conclusion on market definition

(147) For the purposes of this Decision, the retail supply of gas to household customers under basic supply will be regarded as a separate product market and the market will be regarded local in scope, restricted to the relevant basic supply area. The retail supply of gas to households customers under special contracts will be regarded as a separate product market and the market will be regarded national in scope.

7.1.7. Metering

(148) Metering relates to the measurement of consumed electricity, gas, water or heat for the purposes of invoicing and providing transparency/optimisation of consumption.

(149) There are differences within the metering sector in Germany between electricity/gas and district heating/water metering.

(150) For district heating and water metering, according to the regulatory framework, customers cannot choose their metering service provider and the metering services are supplied by their network operator.

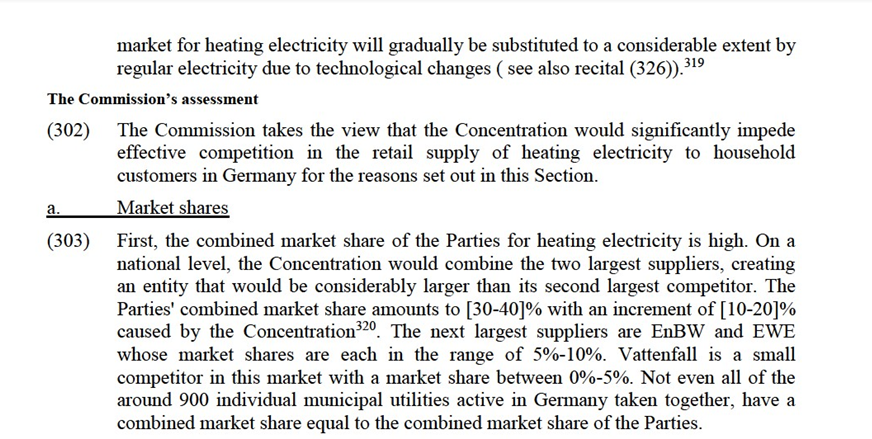

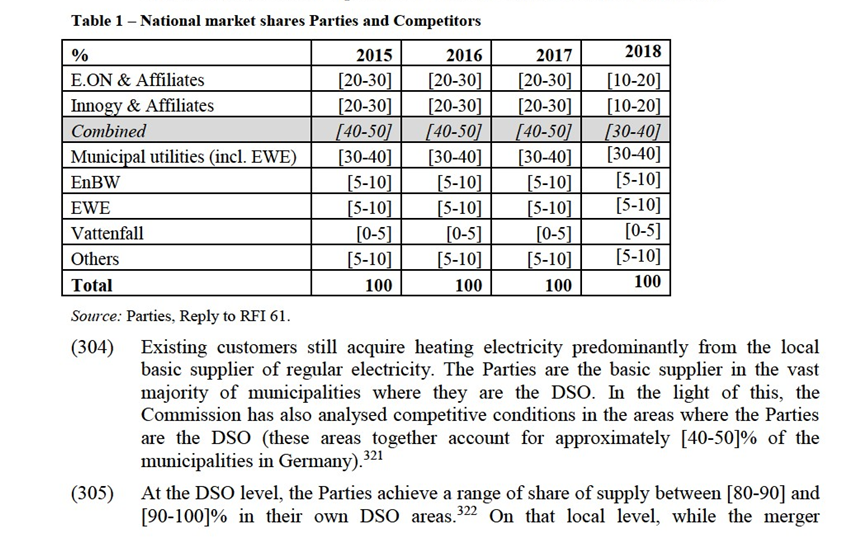

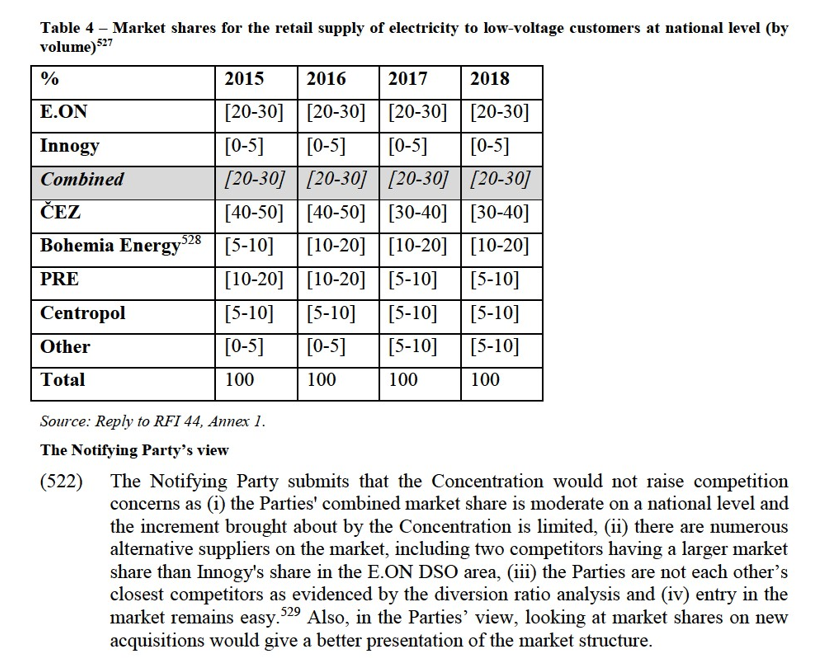

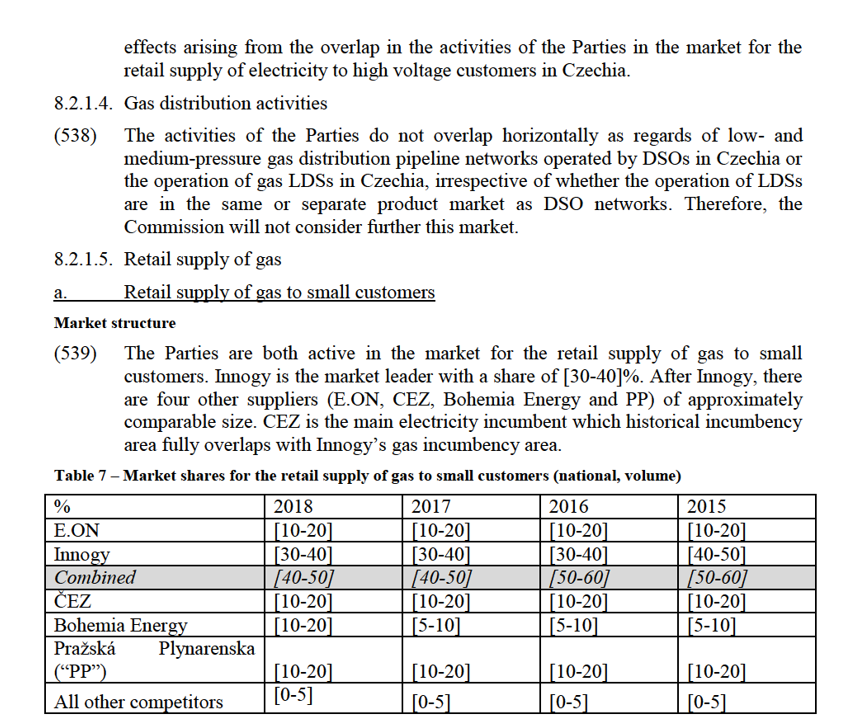

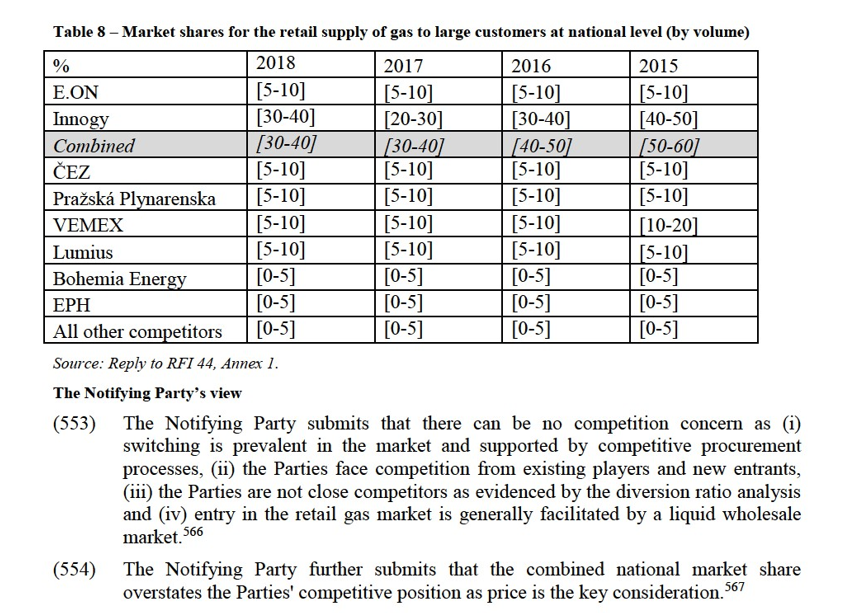

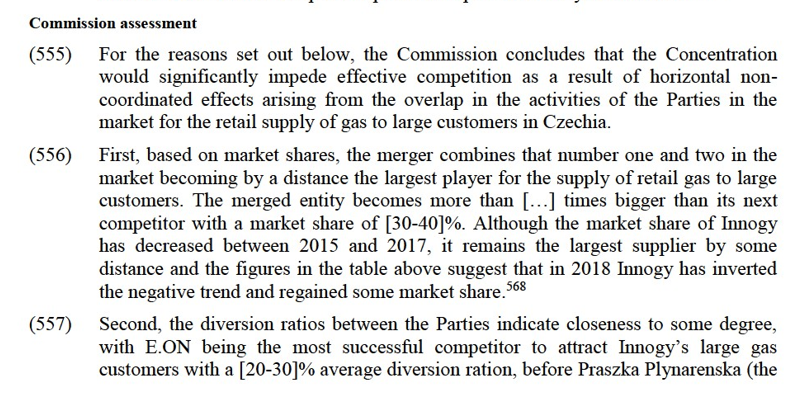

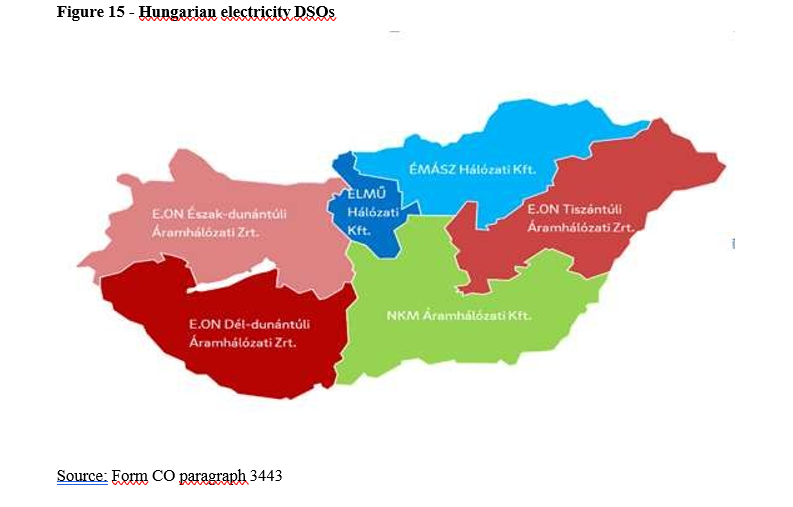

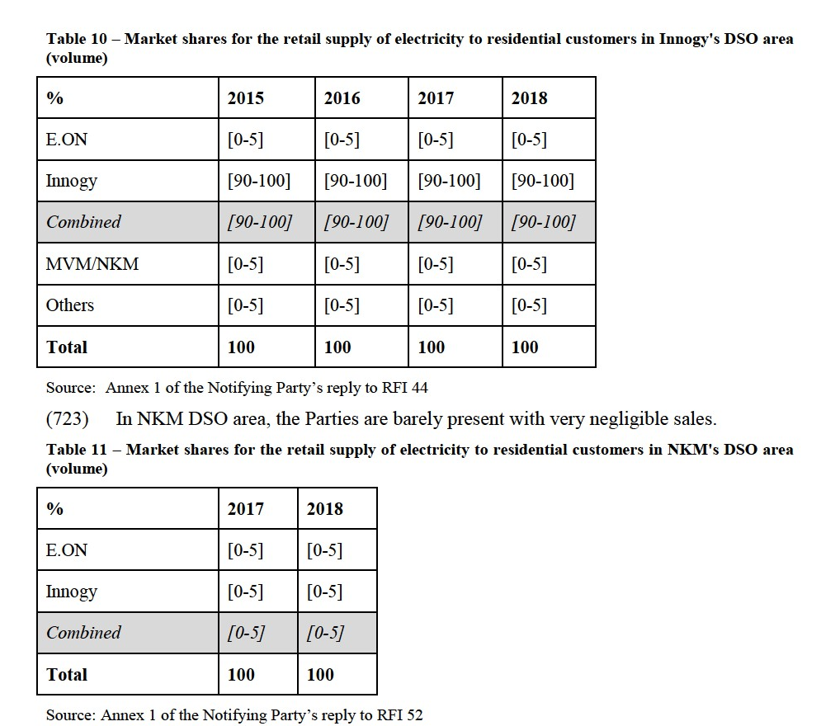

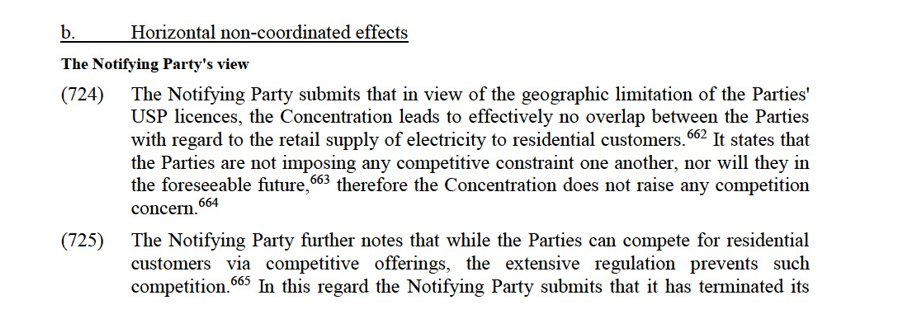

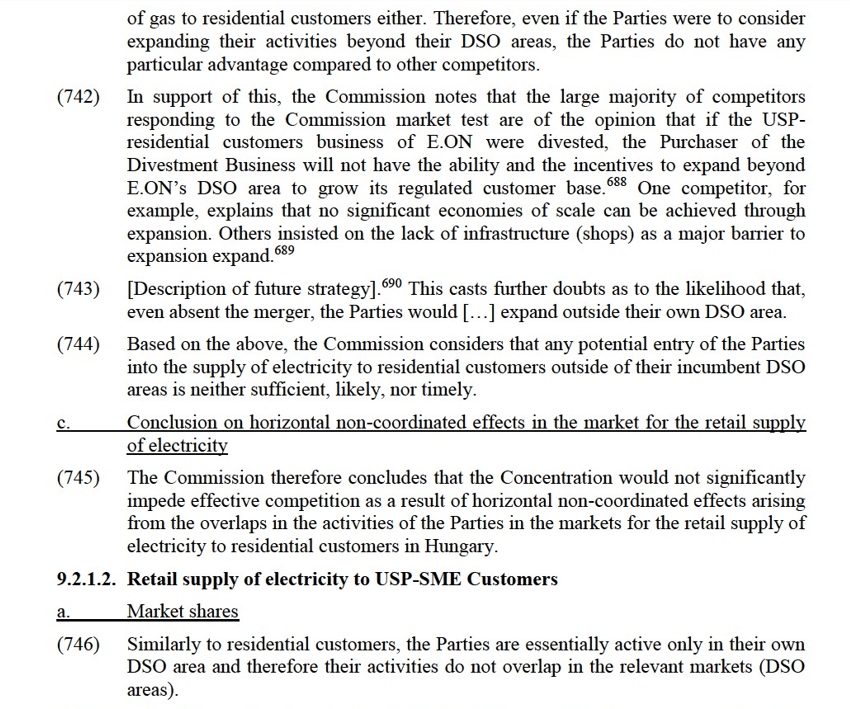

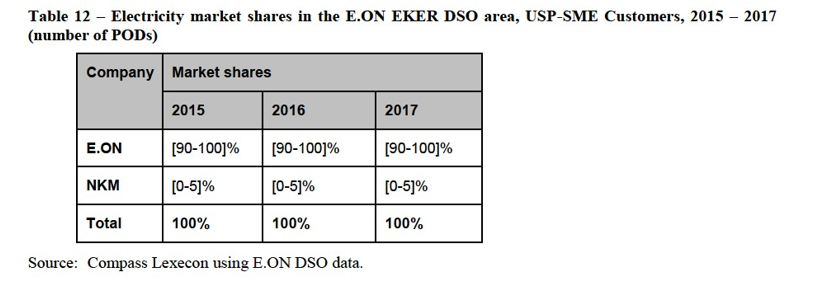

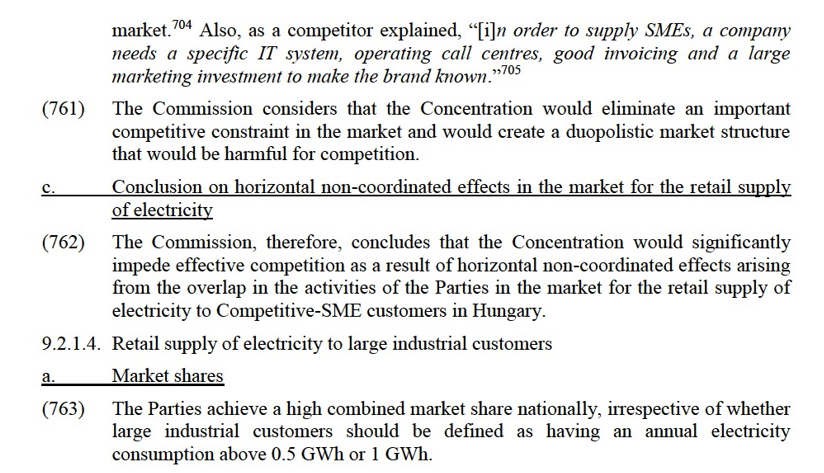

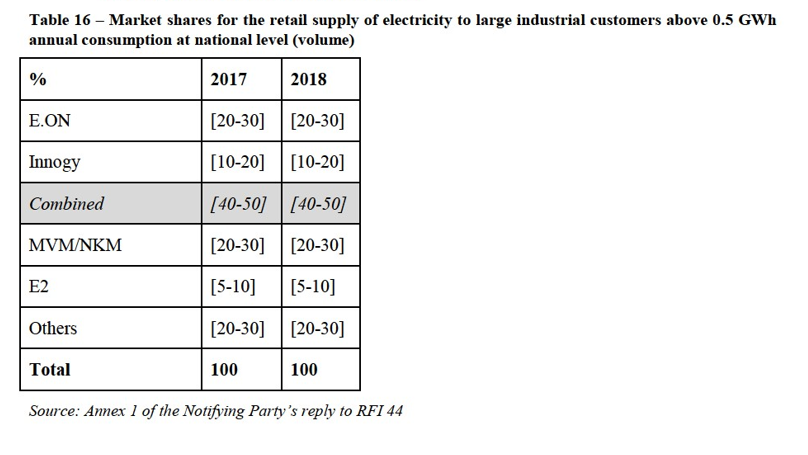

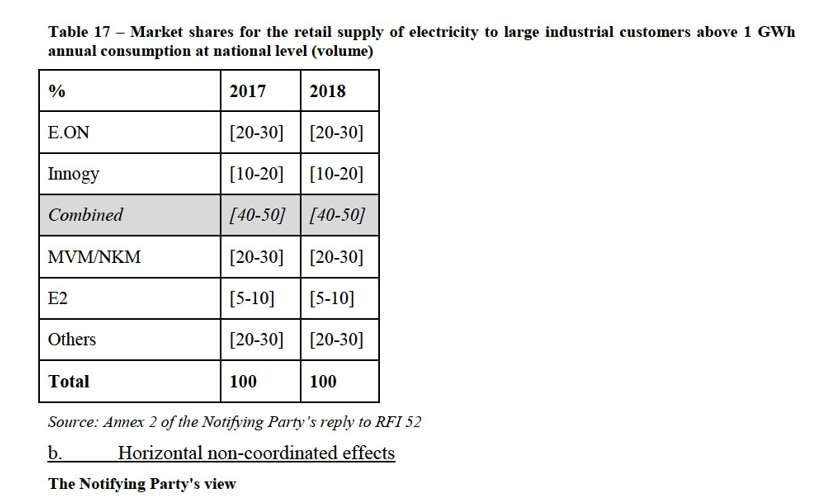

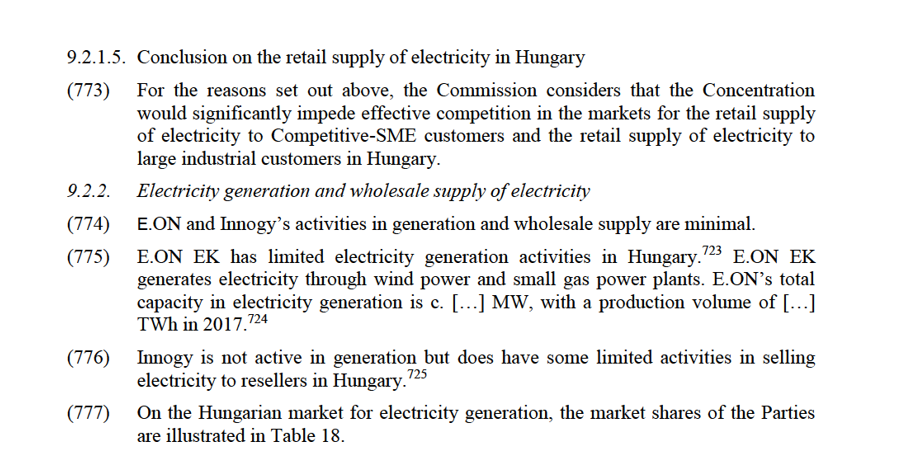

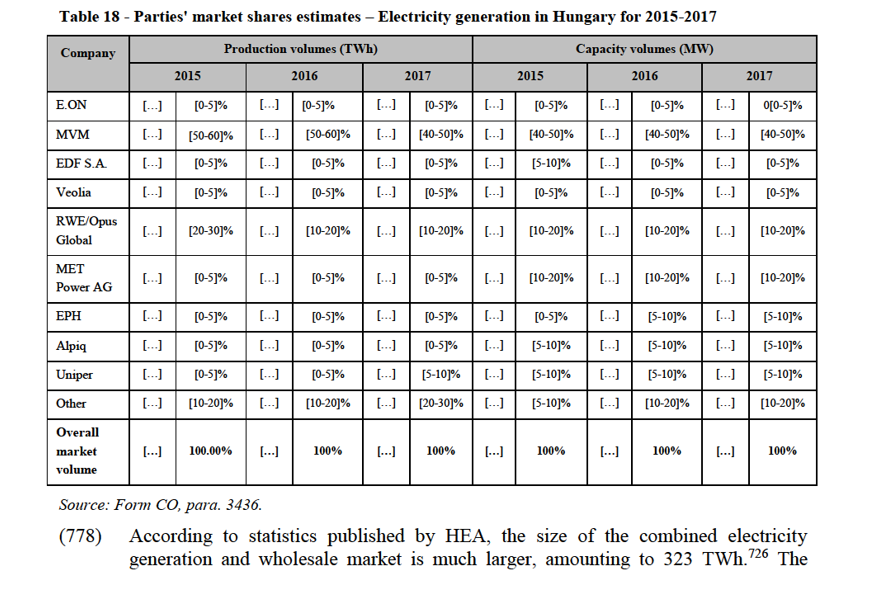

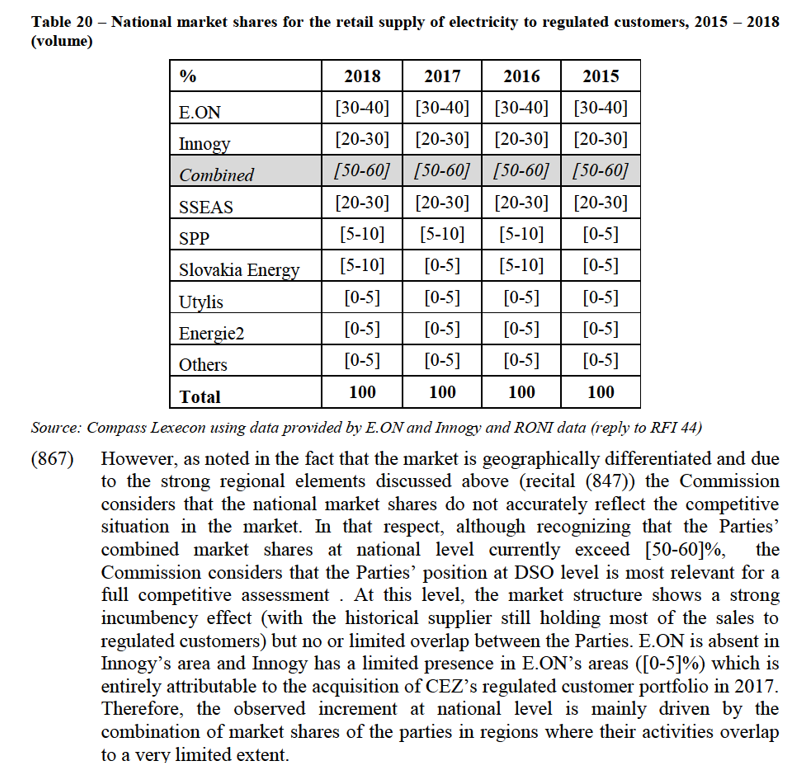

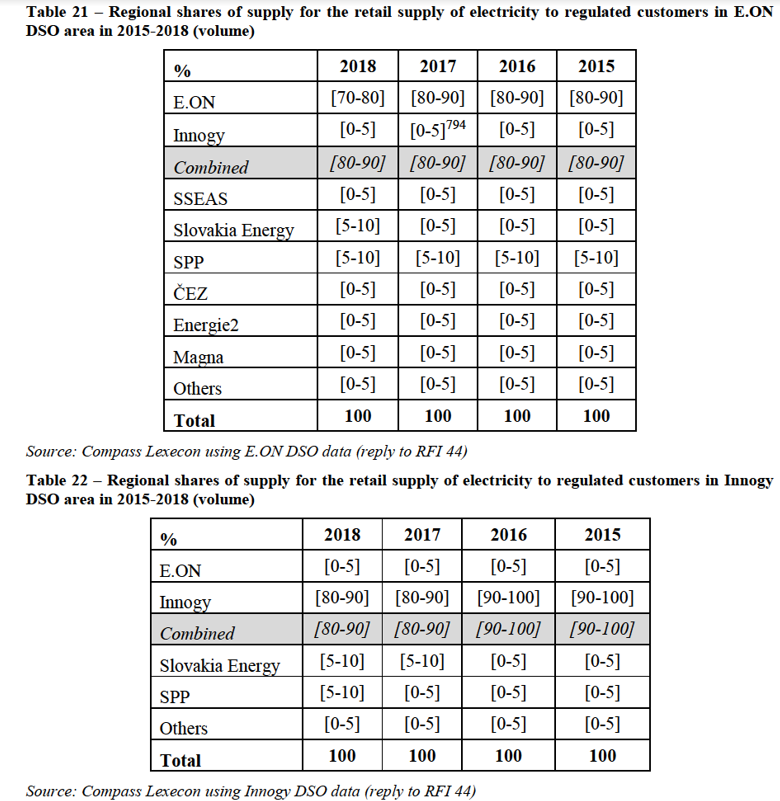

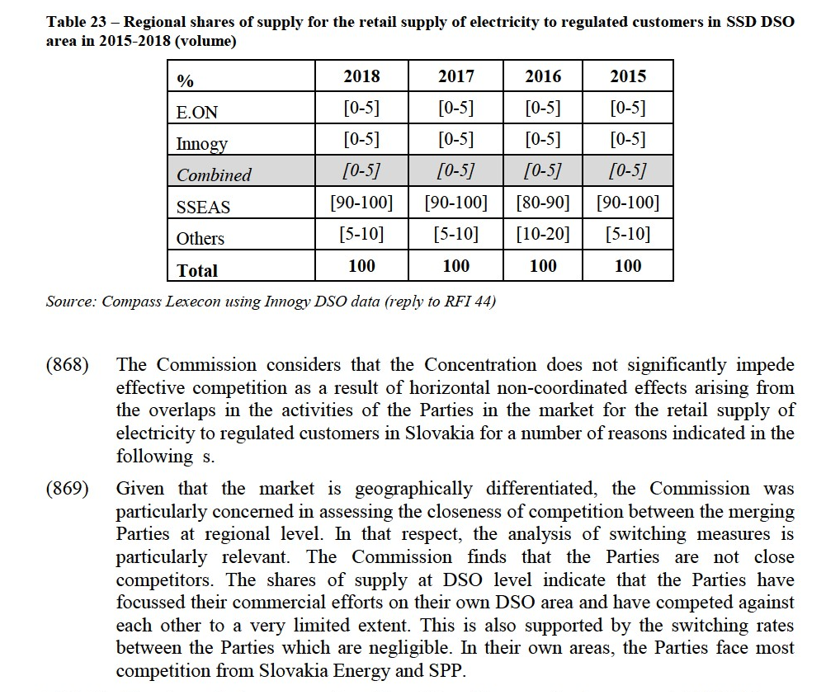

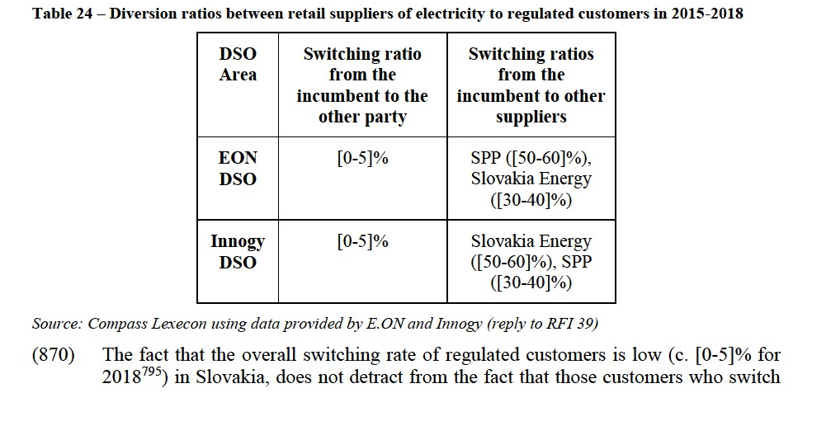

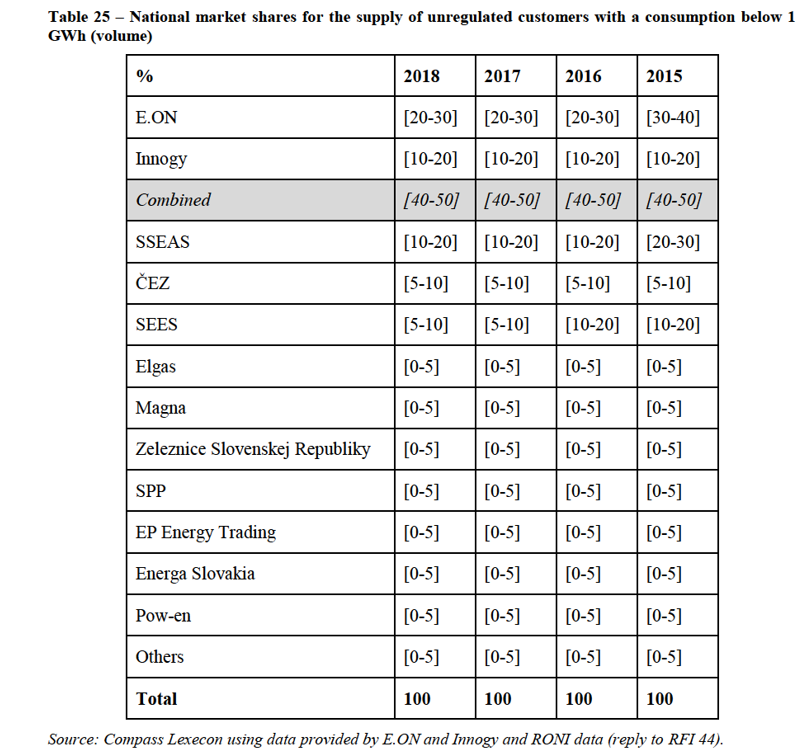

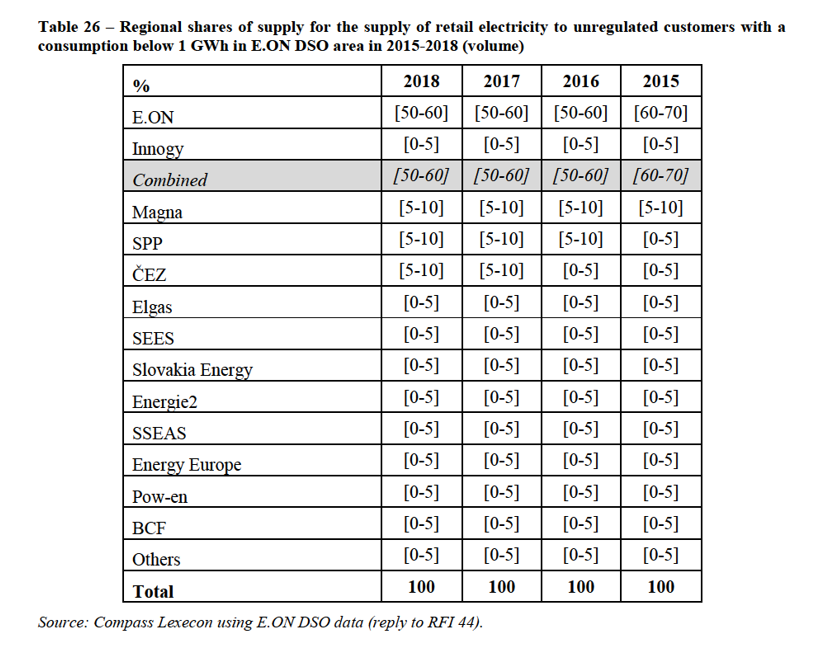

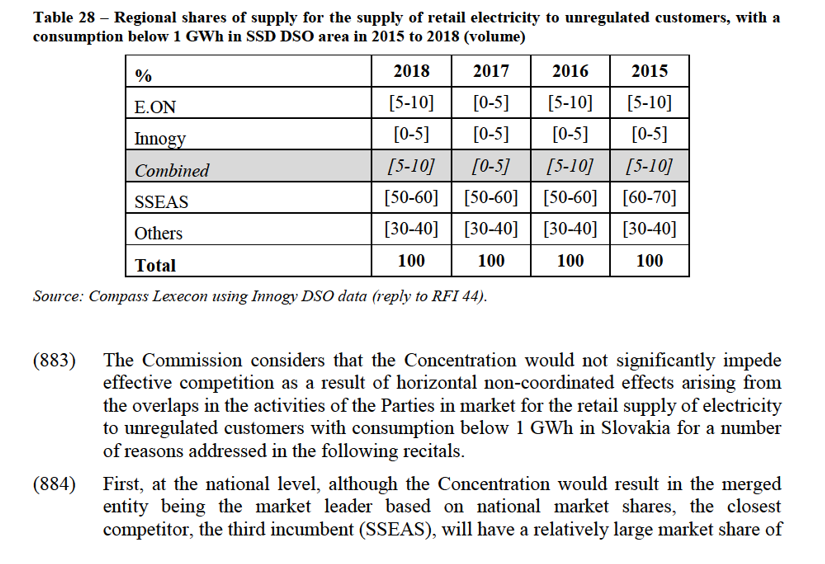

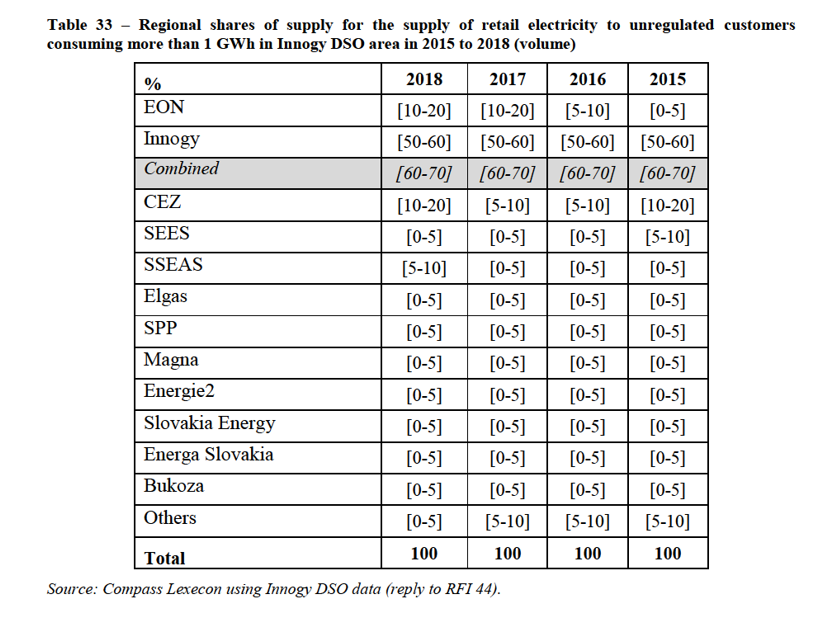

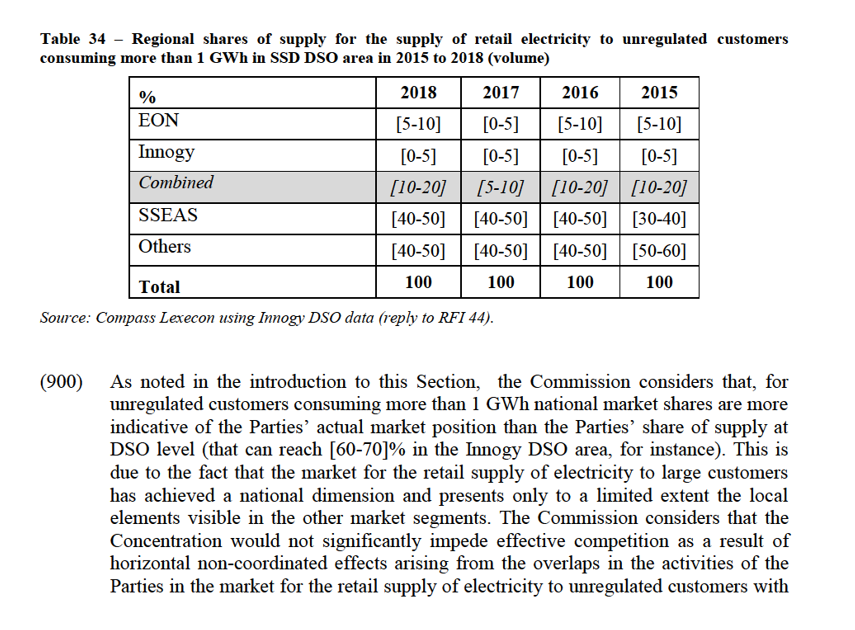

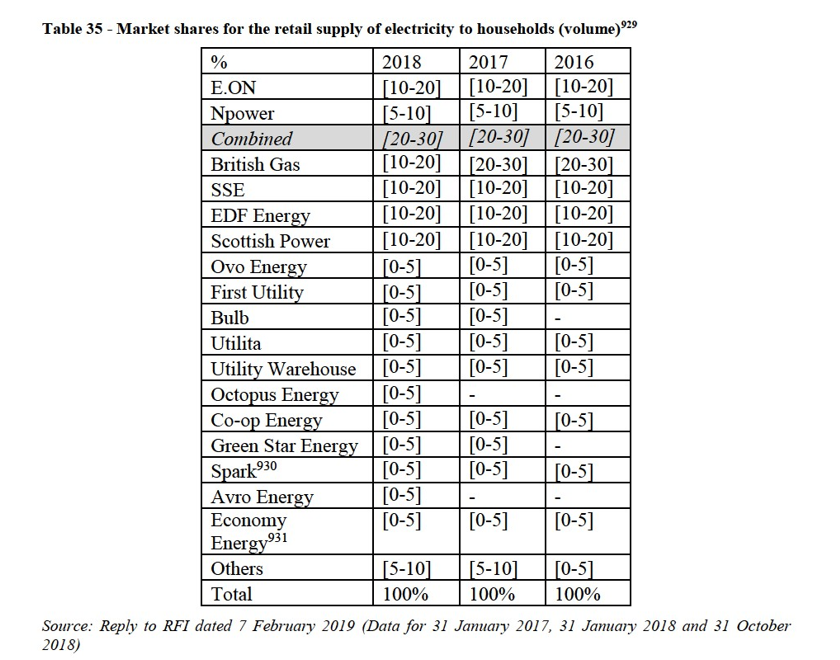

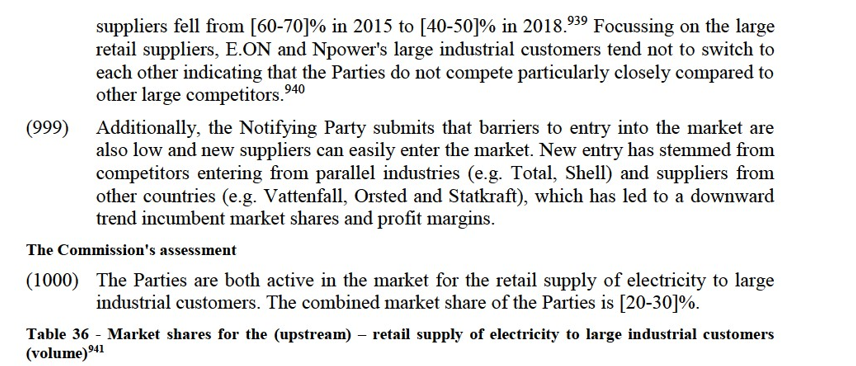

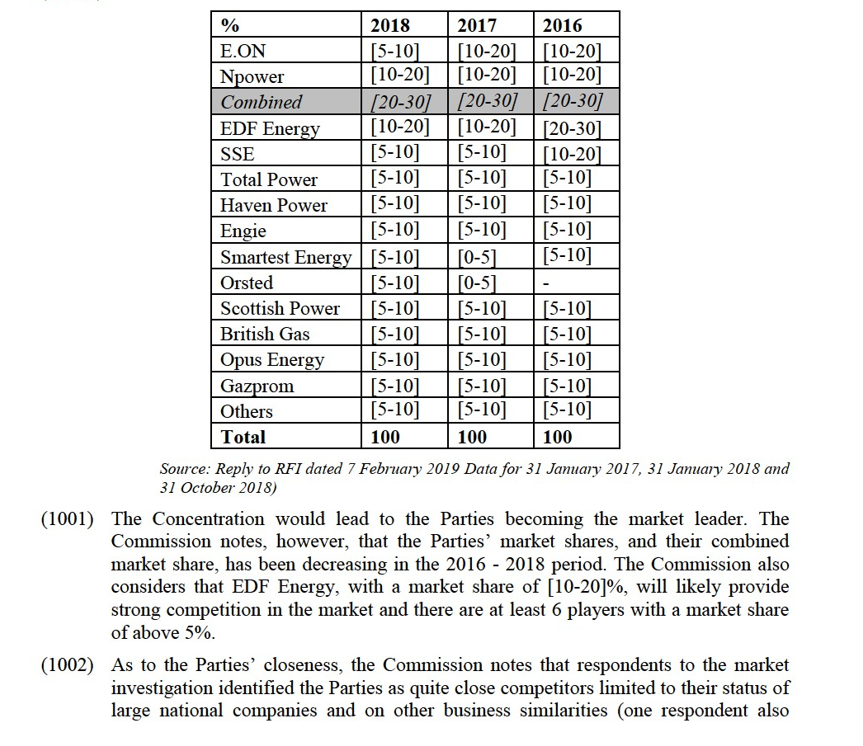

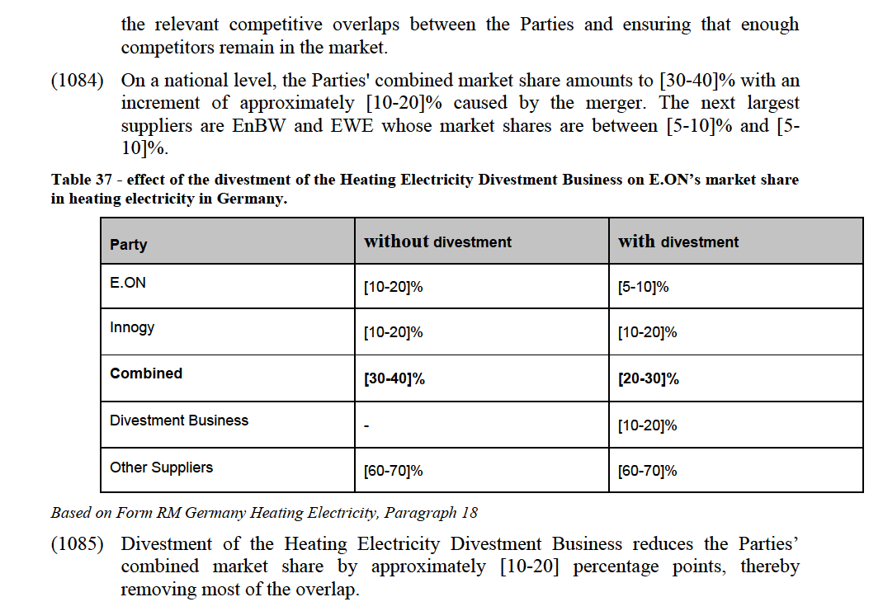

(151) For electricity and gas, prior to 2005, metering point operation was the responsibility of the respective DSO in its network area and a de jure monopoly. In 2005, the legislator allowed third-parties the operation of electricity and gas metering points and introduced competition.161 The DSO was still responsible for the operation of the metering points in the respective network area (as the existing metering point operator, “eMPO”); however, customers were given the choice to switch to a third party. In 2016, a new regulatory framework was introduced, the Metering Point Operation Act (Messstellenbetriebsgesetz, “MPO Act”) in which network and metering point operation were unbundled. For the operation of electricity and gas meters, two new market roles were defined : the “normally responsible metering point operator” (“nMPO”, predominantly the eMPO/DSO)162 on the one hand and the “competitive metering point operator” (“cMPO”) on the other. However, to date, cMPOs still exercise only fringe competition on e/nMPOs in the respective network areas of the latter.