Commission, January 18, 2019, No M.8674

EUROPEAN COMMISSION

Decision

BASF/Solvay's Polyamide Business

COMMISSION DECISION of 18.1.2019

declaring a concentration to be compatible with the internal market and the EEA Agreement

(Case M.8674 BASF/Solvay's Polyamide Business)

(Only the English text is authentic)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof,

Having regard to Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings1, and in particular Article 8(2) thereof,

Having regard to the Commission's Decision of 26 June 2018 to initiate proceedings in this case, Having regard to the opinion of the Advisory Committee on Concentrations2,

Having regard to the final report of the Hearing Officer in this case3, Whereas:

1. INTRODUCTION

(1) On 22 May 2018, the European Commission ("Commission") received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the “Merger Regulation”) by which BASF SE (“BASF”, Germany) intends to acquire sole control of Solvay S.A. (“Solvay”, Belgium)’s worldwide polyamide business (“the Business”) within the meaning of Article 3(1)(b) of the Merger Regulation (“the Transaction”).4 BASF is referred to in this Decision as “the Notifying Party” while BASF and the Business are collectively referred to as “the Parties" and the undertaking that would result from the Transaction is referred to as “the Merged Entity".

2. THE PARTIES AND THE CONCENTRATION

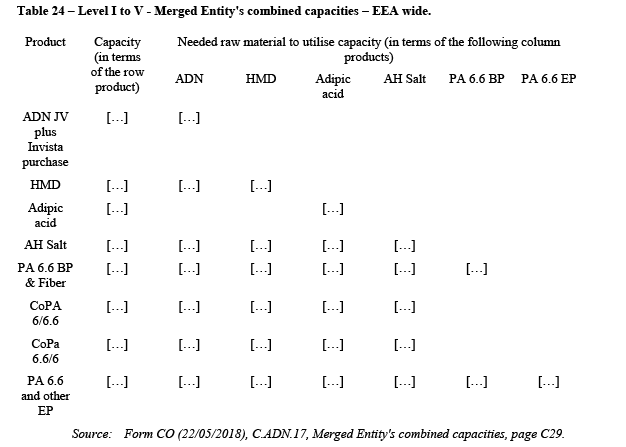

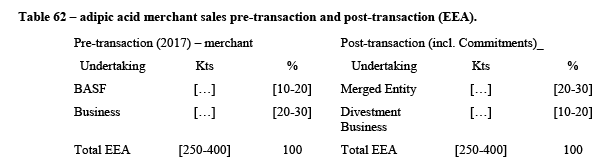

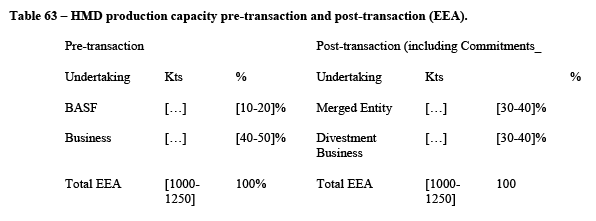

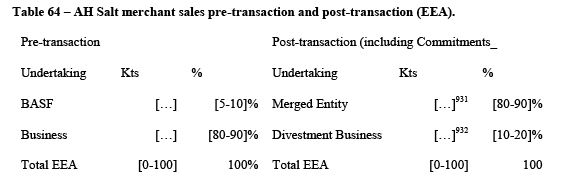

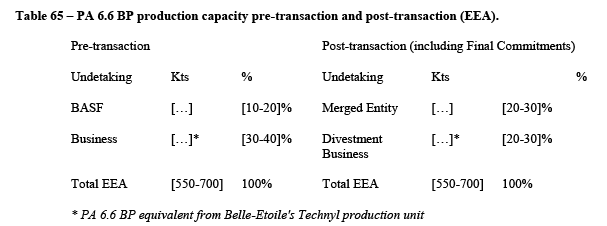

(2) BASF is a diversified company headquartered in Ludwigshafen, Germany, active in chemicals, performance products, functional materials & solutions, agricultural solutions and oil & gas. BASF is active in the polyamide value chain in the production of hexamethylenediamine (“HMD”), adipic acid,5 Hexamethylenediamine adipate Salt (“AH Salt”), PA 6.6 polyamide base polymer (“PA 6.6 BP”), co-polyamide 6/6.6 and polyamide engineering plastic (“PA 6.6 EP”).

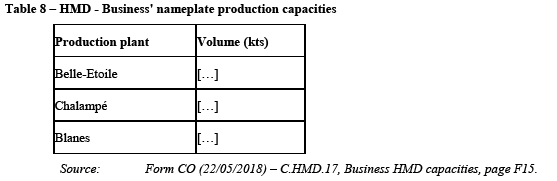

(3) The Business consists of Solvay’s worldwide polyamide activities (with the exception of certain assets located in Paulinia and Santo André, Brazil), with production facilities located in the EEA (France, Poland, Spain and Germany), the Americas (Brazil, Mexico), and Asia (South Korea, China and India), as well as sales and research organisations, e.g., in Italy, the United States of America and Japan. As a whole, the Business is active in the production of adiponitrile (“ADN”), HMD, adipic acid, AH Salt, PA 6.6 BP, PA 6.6 EP and PA 6.6 Performance Fibres. Thus, the Business does include Solvay’s 50% stake in Butachimie, Société en Nom Collectif (“Butachimie”, France), a 50/50 joint venture with INVISTA Equities, LLC (“Invista”, United States of America) active in the production of ADN and HMD.

(4) As a result of the Transaction, BASF would acquire sole control of the Business, primarily by means of share transfers of existing Solvay affiliates. The Transaction would therefore result in a concentration within the meaning of Article 3(1) of the Merger Regulation.

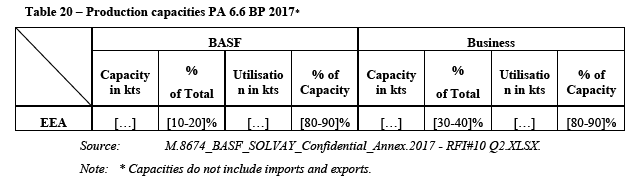

3. UNION DIMENSION

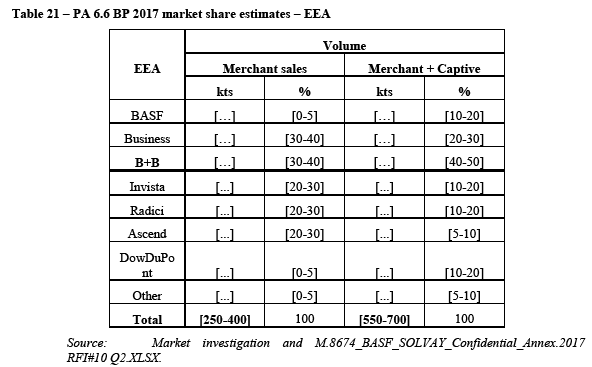

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (EUR 58 886 million in 2016). Each of them has Union-wide turnover in excess of EUR 250 million (BASF: EUR […] million in 2016; Business: EUR […] million in 2016). They do not achieve more than two- thirds of their respective aggregate Union-wide turnovers within one and the same Member State. The notified operation therefore has a Union dimension within the meaning of Article 1(2) of the Merger Regulation.

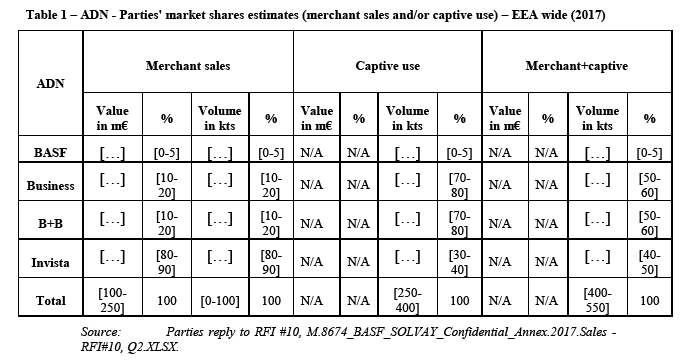

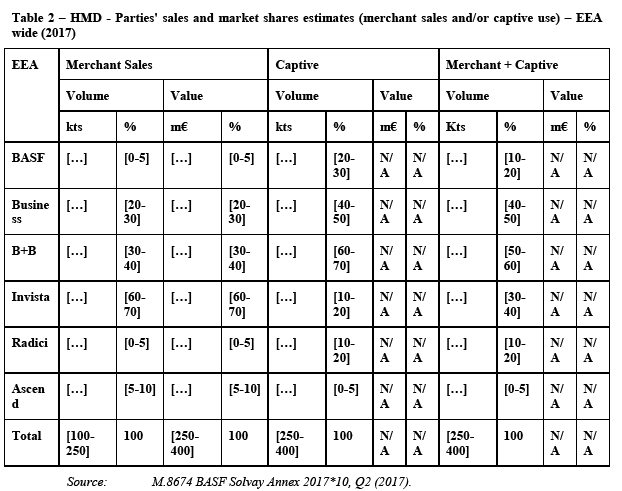

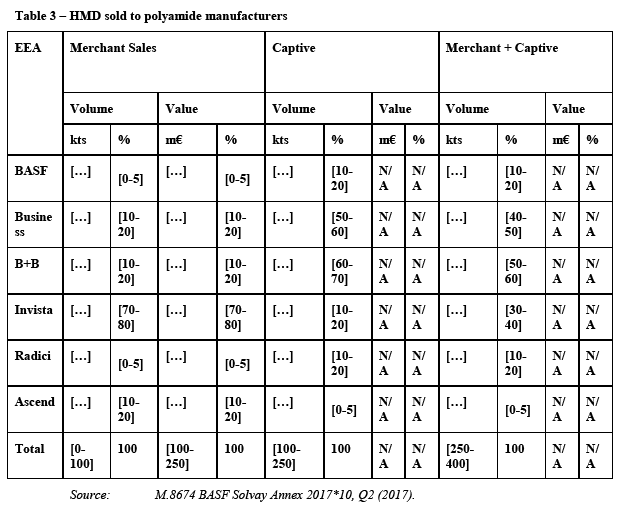

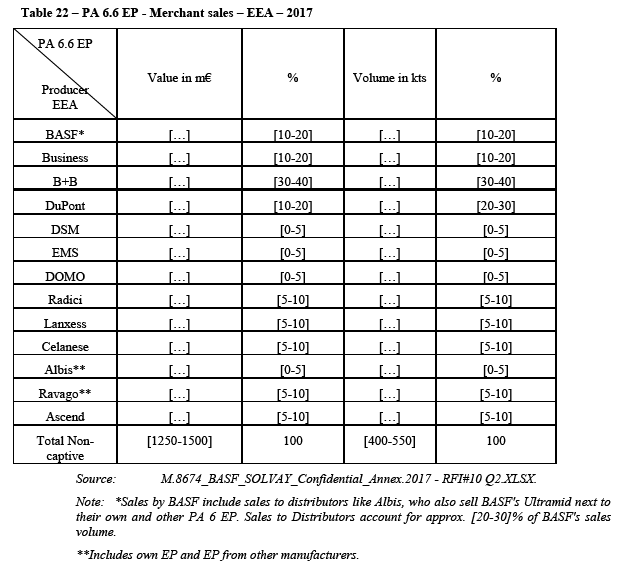

4. THE PROCEDURE

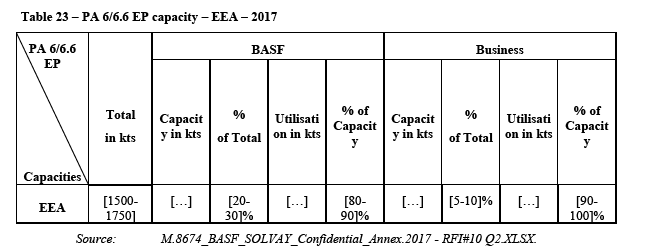

(6) After a preliminary examination of the notification and based on the Phase I market investigation, on 26 June 2018, the Commission decided to initiate proceedings under Article 6(1)(c) of the Merger Regulation (the "Article 6(1)(c) Decision"). In the Article 6(1)(c) Decision, the Commission concluded that the Transaction raised serious doubts as to its compatibility with the internal market and with the functioning of the EEA Agreement in relation to (i) EEA-wide markets for: ADN, HMD, adipic acid, AH salt, PA 6.6 BP, and PA 6.6 EP based on horizontal non- coordinated effects; and (ii) EEA-wide markets for ADN, HMD, adipic acid, AH aalt and PA 6.6 BP due to likely vertical input foreclosure effects.

(7) On 9 July 2018, the Notifying Party submitted its response to the Article 6(1)(c) Decision (the "Response to the Article 6(1)(c) Decision" or "Response"), in which it challenged aspects of the Commission's assessment as set out in the Article 6(1)(c) Decision.

(8) On 12 July 2018, a formal State of Play meeting took place between the Commission and the Parties.

(9) On 7 August 2018, the Commission adopted a decision pursuant to Article 11(3) of the Merger Regulation, following Solvay's failure to provide complete information in response to an information request ("RFI 8") from the Commission ("the Article 11(3) Decision of 7 August 2018"). That Decision suspended the time limits referred to in the first subparagraph of Article 10(3) of Regulation (EC) 139/2004. Solvay responded to RFI 8 on 28 August 2018.

(10) On 19 July 2018, the Commission adopted a decision pursuant to Article 11(3) of the Merger Regulation, following BASF's failure to provide complete information in response to an information request ("RFI 7") from the Commission ("the Article 11(3) Decision of 19 July 2018"). That Decision suspended the time limits referred to in the first subparagraph of Article 10(3) of Regulation (EC) 139/2004. BASF responded to RFI 7 on until 30 August 2018 and the suspension expired at the end of that day.

(11) Based on a Phase II investigation which supplemented the findings of the Phase I investigation, a State of Play meeting between the Commission and the Parties took place on 20 September 2018.

(12) During that meeting, the Commission informed the Parties of its preliminary conclusion that the Transaction would likely lead to a significant impediment of effective competition as a result of horizontal non-coordinated effects in the EEA markets ADN, HMD, adipic acid, AH aalt, PA 6.6 BP and PA 6.6 EP, as well as of vertical input foreclosure effects in the EEA markets for ADN, HMD, adipic acid, AH Salt and PA 6.6 BP and vertically related markets.

(13) On 25 September 2018 and 10 October 2018, two separate extensions of the time limit for adopting a final decision (of ten working days each) were granted under Article 10(3) second subparagraph, third sentence of the Merger Regulation in order to allow the Parties to present commitments to the Commission.

(14) In order to address the competition concerns identified by the Commission, of which the Parties were informed in the course of the procedure, the Parties formally submitted a set of commitments to the Commission (the "Initial Commitments") on 15 October 2018. The Initial Commitments were market tested by the Commission on 16 October 2018.

(15) The results of the market test identified risks on the viability and competitiveness of the business which the Notifying Party committed to divest (the “Divestment Business”) as foreseen in the Initial Commitments. The Commission informed the Parties of the outcome of the market test on 24 October 2018.

(16) Taking into account the market test results, the Parties submitted revised commitments to the Commission on 31 October 2018, which include several improvements to the Initial Commitments. Eventually, the Parties submitted a final set of commitments to the Commission on 11 December 2018 ("the Final Commitments").

(17) The Advisory Committee discussed a draft of this Decision on 17 December 2018 and issued a favourable opinion.6

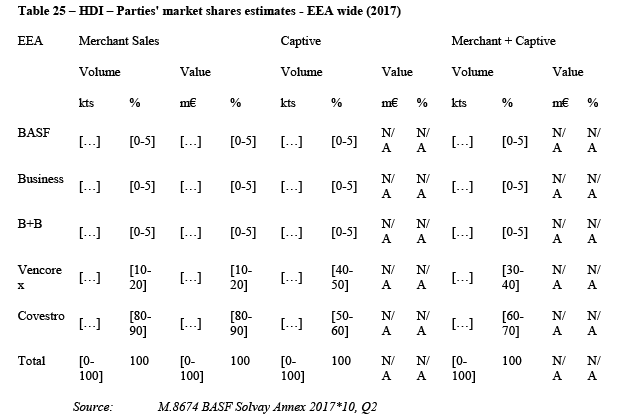

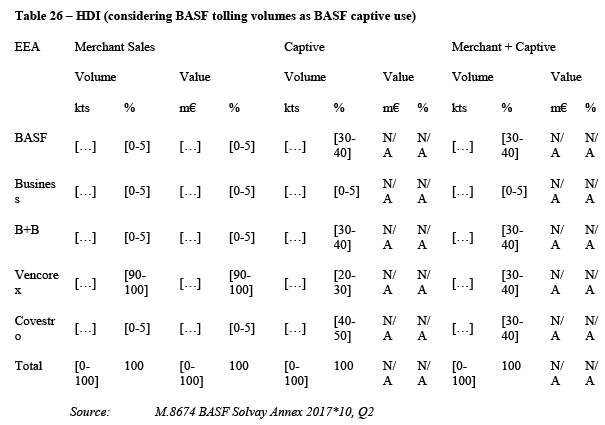

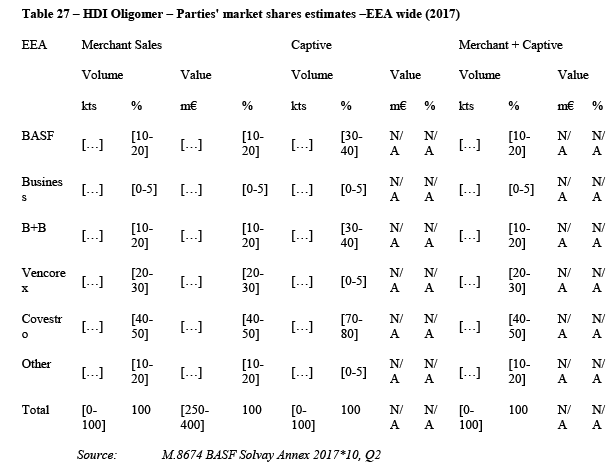

5. RELEVANT MARKETS

(18) The Transaction leads to horizontal overlaps at all levels of the polyamide value chain namely for ADN, HMD, AH Salt, adipic acid, PA 6.6 BP, PA6 3D printing powders and PA 6.6. EP. The Transaction also generates vertical relationship along all the polyamide value chain and, outside the polyamide value, between HMD and hexamethlyene diisocynate ("HDI") derivatives. This Decision therefore focuses on the horizontal overlaps and the vertical links at all levels of the polyamide value chain and, outside the polyamide value chain, on the vertical links between HMD and HDI derivatives.

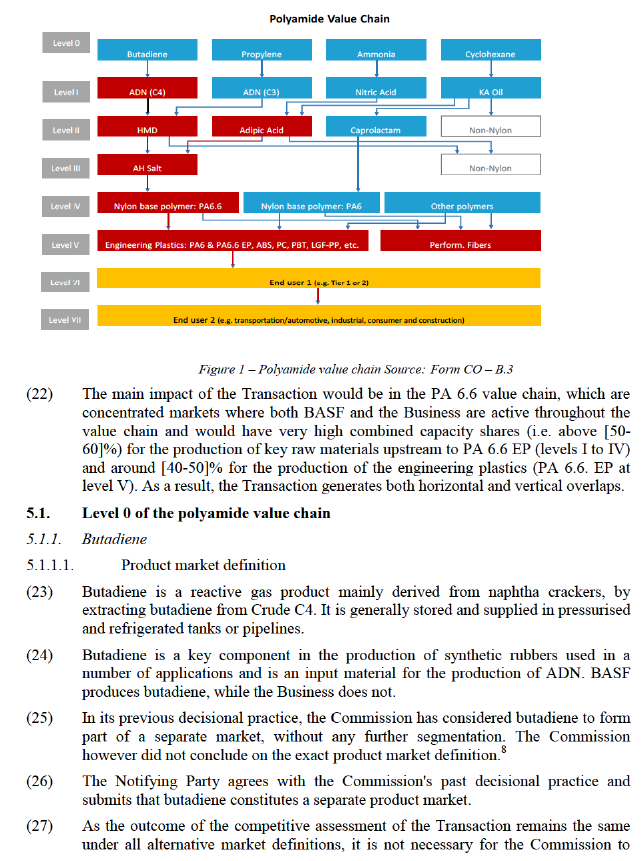

(19) The main nexus of the Transaction are nylon products ("PA 6" and "PA 6.6", where PA stands for polyamide).7 PA 6 and PA 6.6 are produced from oil derivatives through a number of chemical and physical reactions, illustrated in Figure 1. The production process results in PA 6 BP and PA 6.6 BP, which are then compounded into PA 6 EP and PA 6.6 EP or transformed into performance fibres.

(20) PA 6 EP and PA 6.6 EP are used in a wide number of end use applications in the automotive, electronics, construction, clothing and food industries. They are found for example in automobiles, electrical and electronic appliances, windows frames, film for food packaging. PA 6 Performance Fibres and PA 6.6 Performance Fibres are used among other for carpets and clothing applications.

(21) As illustrated in Figure 1, the polyamide value chain is composed of eight levels (0 to VII), and the Transaction affects Level I to V. In red are indicated the steps of the value chain for PA 6.6 EP where the Business is active.

conclude on the exact product market definition. For the purposes of this Decision, butadiene will be regarded as a separate product market.

5.1.1.2. Geographic market definition

(28) The Commission has previously considered the geographic scope for butadiene to be at least "Western Europe +", which is composed of Western Europe, Poland and the Czech Republic. The precise geographic market definition was however ultimately left open.9

(29) The Notifying Party argues that there are strong arguments for a global market definition. In particular, it notes that Western Europe is a net exporter of butadiene and that North America is a net importer of butadiene, which advocates for a global market.

(30) As the outcome of the competitive assessment of the Transaction remains the same under all alternative market definitions, it is not necessary for the Commission to conclude on the exact product market definition.

5.1.2. Ammonia

5.1.2.1. Product market definition

(31) Ammonia is manufactured by reacting nitrogen from the air with hydrogen in the presence of a catalyst at high temperature and high pressure. At room temperature and ambient pressure ammonia is gaseous. It can be refrigerated or compressed and thus stored as a liquid. Ammonia can be diluted in demineralised water, typically at approximately 25% of ammonia and approximately 75% of water. In distinction to “anhydrous ammonia” (not diluted in water) the product diluted in water is named “aqueous ammonia”. Ammonia is used as an input material for the production of nitrogen-based fertilisers and for other industrial applications.

(32) BASF produces anhydrous ammonia and aqueous ammonia, while the Business does not produce ammonia, but rather sources it from market players including BASF.

(33) In past decisions, the Commission considered that anhydrous ammonia is part of product market, distinct from all other chemicals.10

(34) The Notifying Party concurs with the Commission’s decisional practice as regards anhydrous ammonia, however does not take a position as regards aqueous ammonia.

(35) The market investigation indicated that anhydrous ammonia likely forms part of a separate product market. As regards a plausible sub-segmentation of that market by end application (i.e. industrial applications and fertiliser production), the market investigation was largely inconclusive. It however gave some indications that both from a supply and demand side perspective there might be a certain degree of substitutability between the various applications.11

(36) As the outcome of the competitive assessment of the Transaction remains the same under all alternative market definitions, it is not necessary for the Commission to conclude on the exact product market definition.

5.1.2.2. Geographic market definition

(37) For anhydrous ammonia, the Commission has in the past found that, whilst the possible market for the supply of large quantities (to the fertiliser industry for example) is global in scope as the product is shipped worldwide in large vessels, the geographic scope of the possible market for anhydrous ammonia for smaller industrial customers covered a territory smaller than the EEA. In a previous case, the Commission considered North Western Europe (consisting of France, Germany, Denmark, Belgium, the Netherlands and Luxembourg) as the relevant geographical market due to the intense transportation infrastructure in that area.

(38) The Notifying Party does not take a position regarding the geographic scope of the market, but claims at the precise definition can be left open.

(39) The market investigation broadly supported the conclusions of the Commission' previous decisional practice. On the demand side, the majority of customers responding to the market investigation indicated that they source anhydrous ammonia within the EEA, and a significant proportion thereof indicated that they source only from nearby regions, and don’t consider the entirety of the EEA.

(40) On the supply side, none of the responding competitors indicated that there is any import of anhydrous ammonia from outside the EEA.

(41) Based on the assessment in recitals 31 to 41, the Commission concludes that the geographic scope of the market for ammonia is at most EEA wide and most likely narrower. However, as the outcome of the competitive assessment of the Transaction remains the same under all alternative market definitions, it is not necessary for the Commission to conclude on the exact product market definition.

5.2. Level I of the polyamide value chain

5.2.1. ADN

5.2.1.1. Introduction

(42) Adiponitrile ("ADN") is an aliphatic diamine consisting of 6 Carbon atoms. It can be manufactured following two commercially established routes: the C4 route (with primary feedstock butadiene) and the C3 route (with primary feedstock propylene). The only producer of ADN in the EEA is Butachimie, the joint venture between Solvay and Invista which uses the C4 route.

(43) The only commercial use of ADN is for the production of Hexamethylene Diamine ("HMD") within the polyamide value chain.

5.2.1.2. Product market definition

5.2.1.3. The Commission precedents

(44) The Commission has not previously analysed the market for ADN.

5.2.1.4. The Notifying Party's view

(45) The Notifying Party submits that ADN constitutes a distinct product market (without any further segmentation) due to its sole use for the production of HMD, the absence of substitutes for that purpose, and given that there are no individual product specifications within ADN.

(46) In the Response to the 6(1)(c) Decision, the Notifying Party provides further arguments and claims that ADN C3 and ADN C4 are perfect substitutes from the demand side. First, the Notifying Party claims that while C3 ADN may be less pure, having higher water content than ADN C4, HMD production would ultimately be unaffected from a product quality point of view by using ADN C3. According to the Notifying Party, this applies in particular to […], […].

(47) Second, the Notifying Party further explains that in its understanding the HMD produced by […] is used […].

(48) Third, the Notifying Party claims that HMD producers' choice of input (i.e. ADN C3 or ADN C4) mainly depends on raw material costs. To illustrate this point, the Notifying Party provides evidence that, while ADN C4 usually has a cost advantage over ADN C3, the price difference may be and is subject to changes.

(49) Fourth, the Notifying Party claims that switching from using ADN C3 and ADN C4 is easy and only requires that the HMD process parameters in the synthesis and purification steps need to be adapted. […].

5.2.1.5. The Commission's assessment

(50) The market investigation carried out by the Commission during in Phase I provided strong indications that ADN C3 and ADN C4 belong to separate product markets.

(51) From the demand-side, respondents to the market investigation indicated that they can only use one type of ADN in their production process (in the EEA, that is ADN C4) because the production assets are designed to use ADN derived from a specific feedstock (propylene or butadiene). Any switch in feedstock would require significant investments. Respondents also indicated that ADN C4 is preferred over ADN C3 because has a higher purity and is available in the EEA, while ADN C3 is not.12

(52) The investigation carried by the Commission in Phase II, contrary to the Notifying Party's claim in the Response to the 6(1)(c) Decision, further supported these findings.

(53) First, with regards to the Notifying Party's claim that ADN C3 and ADN C4 are technically substitutable, the information provided by BASF13 does not support this finding. The Notifying Party in fact indicates that switching between ADN C3 and ADN C4 is possible, but such a switch cannot be made seamlessly and in a short period of time without causing at least some disruption to the HMD production process. […]. The Commission understands that these costs are additional to […] indicated in the Response to the 6(1)(c) Decisions necessary to then perform the switch from ADN C3 to ADN C4 itself. The Commission also understand that these costs, in direct investment, time and production disruption, would occur each time that a company producing HMD were to switch between ADN C3 and ADN C4, or vice versa.

(54) In its Response to the 6(1)(c) Decision, the Notifying Party further explains that HMD producers choice of raw material depends upon the cost, and that the alleged perfect substitutability of the two type of ADN would allow for an almost immediate switch. The Notifying Party however did not provide any evidence supporting this statement, but rather provided information pointing towards the opposite conclusion:

(a) First, notwithstanding the change in price differential between ADN C3 and ADN C4, the Notifying Party […];

(b) Second, the Notifying Party explains that switching from ADN C4 to ADN C3 without needing to renegotiate the feedstock supply contracts is possible only for a marginal proportion of the HMD production. […].

(55) In its reply to the request for information number 10, the Notifying Party further claims that it considers multiple switching between using ADN C3 and ADN C4 as a viable business model to react to price fluctuation of either type of ADN. […] Switching from using ADN C4 to ADN C3 requires additional time, estimated by the Notifying Party to be 3 to 4 months […].

(56) The Commission takes the view that – contrary to the Notifying Party's claim – it would not be sustainable to switch between ADN C4 and ADN C3 in response to a 5-10% price increase as such a switch would cause disruption to the production process which would make the cost savings less attractive.

(57) The Notifying Party explains that "switching from ADN C4 to ADN C3 possibly leads to an increase of necessary financial expenses as the catalyst consumption in the hydration process […] compared to the use of ADN C4 in the HMD production. The use of ADN C3 leads to additional by-products in the HMD production" […].

(58) The Commission therefore concludes that the additional cost and time required to switch a meaningful proportion of supply from ADN C4 to ADN C3 (and vice-versa) further advocates against substitutability of ADN C3 and ADN C4.

(59) This conclusion is further supported by the information provided by […], which indicated that "(t)he change in the system that would be needed to start using C3 ADN would be huge in terms of costs and time", the magnitude of the investment would be so significant that "together with the logistic difficulties and the higher price of the inputs (ADN from Ascend is more expensive) would force […] out of the market". These significant investment and long time frame are caused by technical barriers to perform such a switch, and more in detail "ADN needs to be hydrogenized and distilled to produce HMD. The condition reactions with the catalysts to hydrogenize the ADN are different depending on the technology used to produce the ADN (C3 vs C4)".14

(60) […] indicated that switching from using ADN C4 to using ADN C3 requires "customer qualification and to modify the facility’s environmental permit".15 Such regulatory requirements pose an administrative burden on HMD producers, further negating the substitutability of ADN C3 and ADN C4.

(61) This is partially contradicted by […], a manufacturer of ADN C3, which stated – though without providing any level of detail – that it can use both ADN C3 and ADN C4 in its production process. The Commission notes, however, that […] utilises ADN C3 and not ADN C4 and therefore […]’s reply may not be material for the purposes of the Commission’s assessment. The production process of ADN C3 generates more by-products than the production process of ADN C4 and, as acknowledged by the Notifying Party in its Response to the 6(1)(c) Decision, ADN C3 is less pure and has a higher content of water than ADN C4. The Commission therefore contends that producers of ADN C3 can switch more easily to ADN C4 than ADN C4 producers can switch to ADN C3.

(62) With reference to the Notifying Party's argument that the water content of HMD is irrelevant for the production of AH Salt, the Commission observes that this is not relevant in the assessment of substitutability of ADN C3 and ADN C4. According to paragraph 17 of the Commission Notice on the definition of the relevant market for the purposes of Community competition law,16 the relevant test for assessing whether two products belong to the same product market is "whether the parties' customers would switch to readily available substitutes (…)". In order to assess whether two products are substitutable, the Commission must therefore assess the behaviour of the customers of ADN (the producers of HMD) and not of those of HMD (e.g. the producers of AH Salt). Whether the water content of HMD is important for AH Salt manufacturer is therefore not of relevance for this assessment as AH Salt manufacturers are not ADN customers, but rather they purchase HMD.

(63) From the supply-side, the market investigation carried out in the first phase indicated that switching from producing ADN C4 to producing ADN C3 and vice versa is not feasible for both economic and technical reasons. Respondents to the market investigation indicated that both the investment and the time required to perform such a switch would be significant. The switch from ADN C3 to ADN C4 is further

complicated by the fact that access to proprietary intellectual property (“IP”) belonging to Invista is necessary, and Invista is not licensing that IP on the market.17 This finding was not contested by the Notifying Party.

5.2.1.6. Conclusion on product market definition

(64) Based on the assessment in recitals 50 to 63, the Commission concludes that, for the purpose of assessing the Transaction, ADN C4 constitutes a distinct product market.

5.2.1.7. Geographic market definition

5.2.1.8. The Commission precedents

(65) The Commission has not analysed the geographic scope of the market for ADN in the past.

5.2.1.9. The Notifying Party's view

(66) In the Form CO, the Notifying Party argues that the geographic market is global in scope for the following reasons:

(a) ADN is predominantly manufactured in the USA and the EEA and demand in Asia is mainly supplied by imports due to insufficient local capacities;

(b) most global sales are attributed to Invista and the Notifying Party estimates that the ADN market price in 2016 is at most [0-10]% lower in China than in the EEA;

(c) the EEA exports approximately [0-10]% ([…] kts) of its ADN production to either Brazil or Asia. The USA exports approximately [10-20]% ([…] kts) of its ADN production to either Brazil or Asia. China and Brazil import [90- 100]% of their ADN requirements from either the EEA or the USA;

(d) transport costs between the USA and the EEA and between the EEA and Brazil amount to approximately [10-20]% of the overall product value;

(e) in case of production shortfalls in the EEA, additional capacities are shipped from the USA to the EEA within a short timeframe.

(67) In its Response to the 6(1)(c) Decision, the Notifying Party further submits that the existence of significant interregional trade of ADN in Asia in particular demonstrates the economical transportability of ADN. The Notifying Party claims that the responses to the Phase I market investigation claiming that a business model based on importing ADN is unsustainable are implausible. The fact that HMD / PA 6.6 BP demand in Asia is constantly growing on the basis of ADN imported from the EEA and the USA shows that any technical challenge that may exist can be dealt with easily and in an economical way.

(68) As regards the price of ADN, and absent any available public information, the Notifying Party restates in the Response to the 6(1)(c) Decision that it assumes that the ADN market price in 2016 is at most [10-20]% lower in China than that in the EEA. In the Response to the 6(1)(c) Decision, the Notifying Party further claims that the lower ADN price in China makes transportation of ADN economically viable.

(69) Finally, the Notifying Party claims that the increased value chain complexity in sourcing ADN from outside the EEA is not an impediment. According to the Notifying Party, effective demand planning is manageable for ADN customers and the very fact that significant amounts of ADN are traded interregionally shows that such demand planning is possible.

5.2.1.10. The Commission's assessment

(70) The market investigation carried out during the first phase strongly contradicted the Notifying Party's views, and gave indications pointing towards an EEA-wide market. It emerged that there are both technical and economic consideration that limit the transportability of ADN.

(71) The investigation in Phase II further strengthened the initial finding of an EEA-wide market.

(72) As regards the Notifying Party's claim that the existence of interregional trade is evidence of a worldwide market, the Commission disagrees In the Commission’s view, the Notifying Party focuses almost exclusively on trade flows to China as evidence of a broader geographic market yet there is no ADN production in China, thereby forcing Chinese suppliers to resort to import. As Chinese customers do not have any alternative to importing ADN, it makes no sense to consider it as a proof that the market is worldwide. The situation for Brazil is the same as for China.

(73) The Notifying Party also stated that it […], referencing an EEA-wide market. Information obtained by the Commission in the course of the market investigation further confirms the absence of any material trade flow of ADN into the EEA. To the contrary, the result of the market investigation indicates that ADN is only exported from the EEA to Asia and South America.18

(74) With regard to the Notifying Party claim that ADN can be technically transported, the Commission observes that it never argued that transporting ADN is impossible, but rather that doing so is not a sustainable business model and therefore customers would not resort to imports in response to a 5-10% price increase. In the words of […], an indirect customer, imports “may be acceptable short term and for small volumes to ensure the continued supply in response to a force majeure event, but they are unsustainable over a mid- to long-term, i.e. as a business model.”19 Contrary to the Notifying Party's claim, this finding strongly supports the determination of an EEA-wide market: in a shortage situation, the alternative to importing from outside the EEA is to shut down production, and it is only under these extreme conditions that EEA customers would source from outside the EEA. Conversely, no respondent to the market investigation indicated that it has or would import ADN from outside the EEA in response to a price increase. 20

(75) This is further supported by the information provided by […] in the course of the Phase II market investigation, which explained that "on cost point of view, obviously, the transport from overseas country compared with the one from Chalampé (F) is completely different and uncompetitive", this is because "the more realistic way to transport ADN from US to […] plant is in ISO Container, notoriously more expensive compared with transport via Train, as […] normally does from Chalampé. The cost composition is made by, the fulfilment of every ISO, the inland movement from Decatur (Alabama) to the nearest port (typically, Savannah port in Georgia), the trans-oceanic shipment to Genoa port (Italy), the inland transport to […] Plant in Novara (Italy)". […] further specifies that "In a normal market situation (historically speaking) the magnitude of the transport cost from North America, even considering an ideal price parity of the material on FCA basis, lead to compromise any marginality or, even more, to create losses".21

(76) The Phase I market investigation also indicated that import tariffs are significant, at 6.5% for ADN, and further point towards an EEA-wide market. This was confirmed by the Phase II market investigation.

(77) The Phase I market investigation also indicated that long delivery times for imported ADN also create additional costs and complexity in the supply chain. This conclusion was supported by the Phase II market investigation. For example, […] explained that, in addition to the increased costs and complexity, "The main constrain in […] supply chain, in case of regular ADN import from North America would consist in a pure additional action, which would consist in the control and in the management of the blend, at the right rate, of the two kinds of material. That it means new storage equipment, mixers, checks and analysis, plus another kind of transport (ISO’S vs Train) to be managed". 22

(78) Finally, with reference to the alleged [10-20]% difference between the price of ADN in the EEA and the price of ADN in China mentioned in recital (67(b)), the Commission firstly observes that – as acknowledged by the Notifying Party itself – there is no publicly available data to support this statement. Secondly, to the extent it is relevant, this information rather advocates in favour of the fact that the conditions of competition, at least in terms of price, differ in different regions of the world, thus excluding a worldwide market for ADN.

5.2.1.11. Conclusion on geographic market definition

(79) Based on the assessment in recitals (70) to (78), the Commission concludes that the market for the supply of ADN C4 is EEA-wide in scope.

5.2.1.12. Conclusion on the market definition for ADN

(80) In conclusion, the Commission will carry out its competitive assessment on a market for ADN C4 defined as EEA-wide in scope.

5.2.2. Nitric acid

5.2.2.1. Introduction

(81) Nitric acid is an aqueous solution of hydrogen nitrate. Nitric acid is used predominantly in the fertiliser industry (approximately 80% of the total nitric acid consumption). In the area of polyamide (approximately 3% of the total nitric acid consumption), it serves as raw material for the production of adipic acid (Level II) when processed with KA Oil.

(82) Nitric acid has numerous other uses in the chemical industry, such as metal treatment, cleaning, adhesives, as intermediate, in the production of polyurethanes, of dyestuff and explosives and also of adipic acid.

(83) Nitric acid is supplied in several concentrations: weak nitric acid (concentration between 54% and 65%), azeotropic nitric acid (68% concentration) and concentrated nitric acid (concentration of 98% to 99%).

(84) Both BASF and the Business produce nitric acid mainly for their captive demand, however part of the production is also sold on the merchant market.

5.2.2.2. Product market definition

(85) In a previous decision, the Commission considered that weak nitric acid, azeotropic nitric acid and concentrated nitric acid form part of separate product markets. These findings were due to lack of demand side substitutability, as each type of nitric acid has different applications and prices, and the very limited supply side substitutability.23 The exact product market definition was, however, left open.

(86) The Notifying Party agrees with the Commission's previous decisional practice.24

(87) The results of the market investigation largely confirm the Commission's decisional practice.

(88) On the demand side, customers responding to the market investigation indicated that they purchase only one grade of nitric acid and that switching – albeit technically possible – would require a significant investment. A customer also indicated that normally market participants would not switch between grades.25

(89) On the supply side, producers of nitric acid responding to the market investigation indicated that they generally produce only one grade, mostly for internal consumption. […] explained that the technology required to produce the different grades varies and the investment required to perform the switch between the different technologies is significant.26

(90) As the outcome of the competitive assessment of the Transaction remains the same under all alternative market definitions, it is not necessary for the Commission to conclude on the exact product market definition.

5.2.2.3. Geographic market definition

(91) As regards weak nitric acid the Commission has considered in a previous decision that the geographic market is mainly national or regional, e.g., in the area of North Western Europe (France, Germany, Denmark, Belgium, The Netherlands and Luxembourg). In a more recent decision, the Commission also took into account a possible wider regional geographic market within a radius of 1,000 km around each production plant.27

(92) The Notifying Party, in line with the Commission’s decisional practice, submits that the geographic market is at least 1,000 km around each production plant, and can ultimately be left open.

(93) The results of the market investigation broadly corroborated the Commission’ recent decisional practice. The overwhelming majority of customers responding to the market investigation in fact indicated that they source nitric acid within 1,000 km from their plants. Respondents indicated that this is due both to the high transport cost compared to the overall price of the product and to the logistic complication inherent in the corrosive nature of nitric acid.

(94) As the outcome of the competitive assessment of the Transaction remains the same under all alternative geographic market definitions, it is not necessary for the Commission to conclude on the exact geographic market definition.

5.2.3. KA Oil

5.2.3.1. Introduction

(95) KA Oil is the industry term for the unrefined mixture of cyclohexanone and cyclohexanol (ketone and alcohol) which is produced by the oxidation of cyclohexane. KA Oil can be used directly for the production of adipic acid without further processing.28 For the production of caprolactam, pure cyclohexanone is needed. Such purecyclohexanone can be derived by separating KA Oil into cyclohexanone and cyclohexanol.

(96) The most significant volumes of KA Oil are used for the production of caprolactam (approximately 65%); the remaining volume is mainly used for the production of adipic acid (30%) and solvents (<5%).

5.2.3.2. Product market definition

(97) The Notifying Party submits that KA Oil constitutes a distinct product market, as there are no real substitutes for KA Oil to produce AA, and because individual product specifications are absent. KA Oil in its pure form can be used without further distillation in the production process for AA.

(98) The Commission has not previously analysed the product market for KA Oil.

(99) The Notifying Party is of the opinion that both distilled and undistilled KA Oil belong to the same product market, as the production process of adipic acid in any case involves producing undistilled KA Oil. In some cases, KA Oil will then be distilled into cyclohexanol and cyclohexanone. All KA Oil producers are able to do this, without much added difficulty or cost.

(100) The evidence in the Commission's file has not provided any indication which would suggest that further sub-segmenting the KA Oil market would be appropriate.

(101) As the outcome of the competitive assessment of the Transaction remains the same under all alternative market definitions, it is not necessary for the Commission to conclude on the exact product market definition. However, for the purpose of this Decision, KA Oil will be regarded as a separate product market.

5.2.3.3. Geographic market definition

(102) The Commission has not previously analysed the geographic market for KA Oil.

(103) The Notifying Party submits that the relevant geographic market for KA Oil is worldwide or at least EEA-wide, in particular because transportation costs are low, there are no barriers to trade and imports taxes are not relevant.

(104) The Commission takes the view that it is not necessary to conclude on the exact geographic market definition as the Transaction does not raise competition concerns irrespective of the precise geographic market definition.

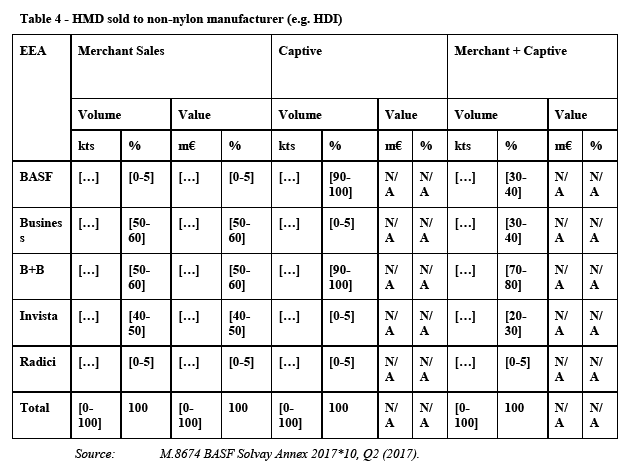

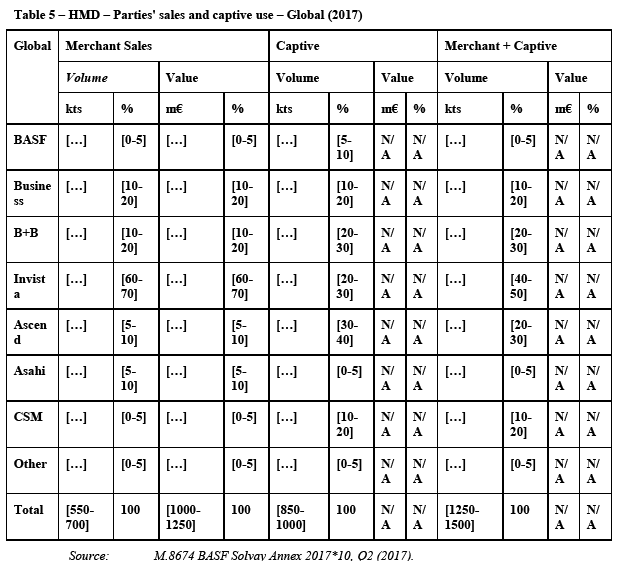

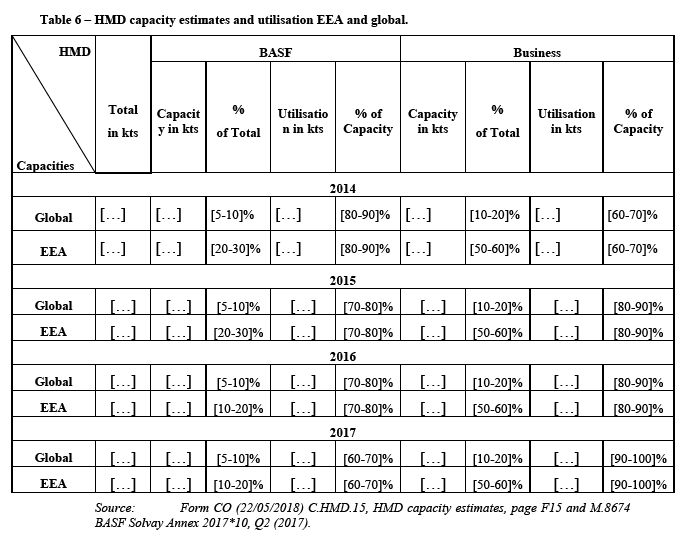

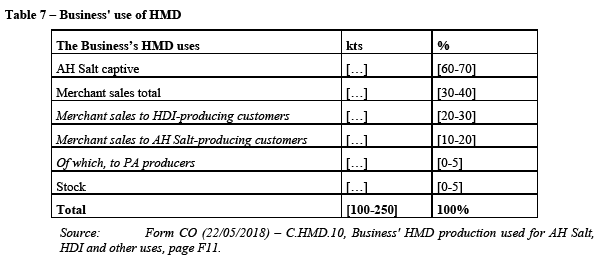

5.3. Level II of the polyamide value chain: HMD

5.3.1. Introduction

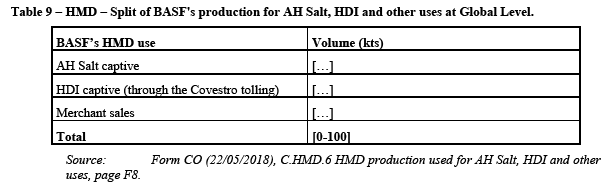

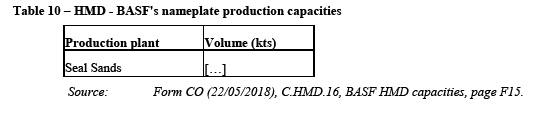

(105) HMD (level II in the polyamide value chain) is, together with adipic acid (also level II), a precursor of AH Salt (level III) which is then polymerised into PA 6.6 BP (level IV). Outside the polyamide value chain, it is also used to produce Hexamethlyene diisocynate ("HDI"), a chemical product that is used for the production of paints and coatings.

(106) HMD is produced through the hydrogenation of ADN (Level I). The hydrogenation of HMD is a two-step process through which ADN is first hydrogenated into a crude product (“crude HMD”) and then purified (“pure HMD”).

(107) HMD is a monomer used, in particular, for the production of different polyamides. The major part of the HMD that is produced globally is consumed in the PA 6.6 BP production (approximately 85%). The remainder is used in a number of different applications including as an intermediate for other polyamides such as PPA, PARA, and PA 6.10, and for coatings and biocides. The most significant non-polyamide application of HMD is the coatings precursor HDI. Further, HMD is used for the production of plastic additives, adhesives, inks, water treatment and construction.

5.3.2. Product market definition

5.3.2.1. The Commission’s precedents

(108) The Commission has previously considered that HMD may form a distinct product market. In Solvay/Rhodia, the Commission carried out a market investigation, which implied no need for a further segmentation of the market for HMD, but ultimately left open the exact product market definition. 29

5.3.2.2. The Notifying Party's view

(109) The Notifying Party agrees with the Commission's past decisional practice and submits that HMD constitutes a separate product market and that no further segmentation is appropriate.

(110) According to the Notifying Party, there are only two types of HMD, i.e. anhydrous HMD (HMD content >99,5%) and less concentrated HMD (typically 98% HMD content or less).

(111) According to the Notifying Party, on the supply-side, all producers in the EEA manufacture anhydrous HMD, and if necessary add water to the product to obtain less concentrated HMD.

(112) In the Response to the 6(1)(c) Decision, the Notifying Party adds that Anhydrous HMD can be easily de-filtered to less concentrated HMD. Such de-filtering technology is easily available and inexpensive. De-filtering is a standard process that does not require special technology and costs for this process are negligible. In practice, water is pumped into a tank with anhydrous HMD, diluting it to the desired degree. In the past, BASF produced [90-100]% HMD from anhydrous HMD using this process.

(113) On the demand-side, HDI producers need anhydrous HMD. AH Salt producers can use both anhydrous and less concentrated HMD (minimum 90% HMD content) but typically source anhydrous HMD given the supply conditions.

(114) BASF produces, sells and uses […]. The Commission understands, based on the information provided in the Form CO that the Business […].

5.3.2.3. The Commission's assessment

(115) The market investigation results indicate that HMD should be considered a separate product market. AH Salt and HDI can only be produced through HMD and there are no alternatives.

(116) With regard to the differentiation between anhydrous HMD (HMD content >99,5%) and less concentrated HMD (typically 98% HMD content) the investigation was inconclusive as to whether they belonged to the same or different product markets.

(117) On the demand-side, most of the customers only source anhydrous HMD, however it is possible to use less concentrated HMD for the production of AH Salt. In contrast, HDI producers can only use anhydrous HMD because “water content specification is a key requirement for the phosgenation process (used for the production of HDI) as water will lead to the formation of highly insoluble amine hydrochloride salts. These compounds lead to many production issues (drop of yields, clogging of filters and equipment ...) as well as safety issues (leakages due to corrosion)”.30

(118) On the supply-side, the market investigation showed that in the EEA both anhydrous HMD and less concentrated HMD are being produced. However, contrary to the Notifying Party's claims, one producer indicated that it is only producing anhydrous HMD and that “to produce different grades it would be necessary to invest in a loading station with tanks”.31

5.3.2.4. Conclusion on product market definition

(119) In the light of the considerations in recitals (105) to (118) , as the outcome of the competitive assessment of the Transaction remains the same and the Final Commitments entered into by the Notifying Party address the Commission’s concerns under all alternative market definitions, irrespective of whether the relevant product market is defined as comprising anhydrous HMD and less concentrated HMD or should be further segmented into these two categories, it is not necessary for the Commission to conclude on the exact product market definition.

5.3.3. Geographic market definition

5.3.3.1. The Commission’s precedents

(120) As regards the geographic market definition the Commission has previously considered the geographic scope of the market for HMD to be at least EEA-wide but ultimately left open the exact market definition.32

5.3.3.2. The Notifying Party's view

(121) The Notifying Party submits that there is significant evidence suggesting that the relevant geographic market for HMD is global in scope. For example, some market players source HMD on a worldwide basis, there […] and there are imports from the USA to the EEA as well as from the USA and the EEA to Turkey, Israel and Asia. The Notifying Party also submits that international trade flows represent [20-30]% of the worldwide sales and transportation costs for HMD are rather low (approximately [10-20]% of the total sales price) supporting a global reach.

(122) In the Response to the 6(1)(c) Decision, the Notifying Party continues to sustain that the HMD market is global in scope and provide further arguments.

(123) First, the Notifying Party submits that transportation costs for HMD are rather low (approx. [10-20]% of the total sales price)33 and that transportation costs for sourcing HMD on a global level amounts to an additional [0-10]% of the overall sales value at most. According to the Notifying Party, the main reason would be that important HMD customers like […] would benefit from convenient locations for the sourcing of imported HMD. The Notifying Party also submits that […] transportation costs would increase only slightly if it stopped sourcing HMD from the Business' production plant in Belle-Etoile (France), irrespective of whether the alternative HMD supply would come from a production site within or outside the EEA.

(124) Second, according to the Notifying Party, there are significant exports from the EEA to other regions of the world, mainly to Asia, thus supporting a global scope of the HMD market.

(125) Third, the Notifying Party points out that the technical requirements for the transportation of HMD into and out of the EEA do not differ from the requirements for the transportation within the EEA.

(126) Fourth, the Notifying Party submits that while the existing swap agreements between HMD producers help to reduce overall costs, the 6(1)(c) Decision errs when denying the economic transportability of HMD by referring to [REFERENCE TO THE BUSINESS’ COMMERCIAL STRATEGY].

(127) Fifth, the Notifying Party claims that long delivery time are easily manageable through demand planning and a consistent procurement organisation. Further, statements of market participants arguing that imports may only be acceptable in the short term in response to a force majeure, show that the delivery time cannot be of relevance for the supply chain because a force majeure event by definition require a fast reaction.

(128) Finally, according to the Notifying Party, regulatory provisions constitute only a negligible barrier to trade.

5.3.3.3. The Commission's assessment

(129) The results of the market investigation in Phase I provided strong indications that the market for HMD is EEA wide in scope. The investigation in Phase II has not provided any element speaking in favour of a global market and has confirmed that the geographic market is EEA in scope.

(130) First, transportation costs and custom tariffs increase significantly the price of HMD imported into the EEA. The Notifying Party submits that HMD custom tariffs are usually 6.5% and the extra costs for freight from outside the EEA would amount to approximately [0-10]% of the total sales price and that these costs are […].34 However, the market investigation shows that transport costs from outside the EEA, in addition to the tariffs, have a very significant impact on the overall cost and are significantly higher than what the Notifying Party claims. Indeed, transport costs are identified as a barrier to trade across regions of the world by some producers and virtually all customers.35 Along this line, […] explains that “sourcing from non-EEA countries is possible but currently uneconomical and has a negative impact on the competitive positioning on the downstream market(s). In particular, the price for transcontinental imports of HMD is significantly higher than for HMD produced locally”.36 Another important customer of HMD, […], adds that “sourcing ADN or HMD from outside Europe is not competitive. Technically it is possible to bring HMD from USA, but it is much more expensive”.37 […] continue explaining that, “the price for HMD increases significantly if it is imported from outside Europe: in addition to high transportation costs relating to hazardous goods, the product needs to be shipped with specific conditions to maintain its integrity (insulated & heated)”38. It adds that “non-European producers do not constitute viable alternatives to Solvay due to significantly increased prices for potential import of HMD from overseas”.39 […] also submits that "transport of HMD is expensive. Transport by sea, e.g., requires ships with specially equipped tanks. Shipping HMD from the US to Europe, e.g., increases the variable costs significantly, e.g. by 15- 20%".40

(131) Second, according to the Notifying Party, imports to the EEA were as follows: […] kts in 2014; […] kts in 2015 and […] kts in 2016. These figures represent a very small part of the total HMD production in the EEA and of the merchant market. For example, in 2016 imports represented less than [0-10]% of the total HMD production in the EEA and less than [0-10]% of the merchant market. This is confirmed by the market investigation in which all respondents confirmed that they purchase HMD to be used in their plants located in the EEA either exclusively or for the vast majority of their needs within the EEA.41 […] explains that imports are done in response to shortages or force majeure events, but not as business model: “imports from outside Europe may be acceptable short term and for small volumes to ensure the continued supply in response to a force majeure event, but they are unsustainable over a mid- to long-term, i.e. as a business model”.42 Another customer, […], adds that “the HMD can be sourced from the USA, but it is much more expensive and supply chain is very complex as product has to be heated”.43

(132) The Notifying Party also provide a number of examples of trade across regions and in particular of exports from the EEA towards Asia. However, the existence of exports from the EEA to other regions does not prove that the geographic market is broader in scope. The rationale of the exports from the EEA to Asia can find their explanation in other factors, like for example the lack of ADN production in Asia or structural shortages of the HMD market. For example, […] explains that "in China, the market for HMD is short, but they have a big capacity in the downstream markets. Therefore, demand of HMD in China is strong. In […] opinion, this can make exports to China attractive for HMD producers".44 The relevant factor in this case is that imports into Europe do not represent a competitive constraint because they represent negligible volumes and because the overwhelming majority of customers consider than importing from outside the EEA is uneconomical as explained in this section.

(133) Third, HMD is difficult to transport over long distances due to certain technical characteristics, as it needs to be heated and insulated from moisture. All customers responding to the market investigation considers that there are technical characteristics of HMD that limit its transportability.45 “HMD's transportation requires careful handling its exposure to moisture and to be kept at temperatures above 40°C, so that it remains liquid, which makes it significantly more complicated and expensive to source from outside Europe”.46 In general, customers consider that the main requirement is to keep temperature constant and avoid exposure to air or light, which is very costly.47 The vast majority of competitors also confirmed in the market investigation that there exist technical characteristics of HMD that limit its transportability.48 For example, […] explains that temperature should be kept constant, that HMD should travel in a nitrogen atmosphere to avoid exposure to oxygen and that special safety handling is required.49 […] adds that "another barrier is the availability of specialized logistics and handling. Special ships and tanks and storage at both loading and receiving ends are required"50.

(134) Moreover, while the Notifying Party claims that the technical requirements for the transportation of HMD into and out of the EEA do not differ from the requirements for the transportation within the EEA, importing from outside the EEA means that the distance is higher and delivery time is longer, making logistics more complicated. Storage time influence HMD final characteristics. […] explains that "during transportation, storage and re-heating process of HMD, side reactions with air or oxygen together with temperature exposure could occur if HMD is improperly stored or exposed for too long. These reactions will damage product characteristics and performance such as color, reactivity…".51 […] continues explaining that "obviously, transportation costs, long delivery periods, as well as risks from transhipments shall be taken into consideration in case of sourcing non negligible volumes on lasting basis from outside the EEA. The technical requirements of HMD transportation has also significant impact on the cost of imported HMD".52 […] submits that for imports from outside the EEA "delivery time [is] almost 6 weeks".53 In the same vein, […] explains that "HMD is costly to transport. It is toxic and corrosive and must be shielded from oxygen and kept under a nitrogen blanket the entire time. It must also be kept above a temperature of 40°C as it otherwise solidifies. For these reasons, the transport of HMD is expensive. Transport by sea, e.g., requires ships with specially equipped tanks. Normally HMD being transported by sea in bulk is diluted with water to depress the freezing point, which adds to the costs as the water is transported as well. Shipping HMD from the US to Europe, increases the variable costs significantly, e.g. by 15-20%."54

(135) Fourth, the existence of swap agreements between HMD producers with facilities in different regions indicates that transport between regions is often not economical. For example, [REFERENCE TO THE BUSINESS’ COMMERCIAL STRATEGY]. Contrary to the Notifying Party view, this argument holds true even if [REFERENCE TO THE BUSINESS’ COMMERCIAL STRATEGY]. As the Notifying Party recognises, the rationale of the existing swap agreements between HMD producers is to "help to reduce overall costs".55 The distance that the HMD needs to travel between the […] and […] is less than the distance that the HMD would have to travel between the […] and […]. Moreover, […].

(136) Finally, while half of the competitors consider that there are no barriers to trade at global level, the other half believe that high transportation costs and long delivery periods are barriers to trade at global level.56 On the customer side, contrary to the Notifying Party's claim that long delivery times are easily manageable, all customers unanimously consider that long delivery periods are important barriers to trading HMD across regions of the world.57 Furthermore, the statements of market participants arguing that imports may only be acceptable for short term in response to a force majeure event do not show that delivery times are irrelevant. These responses from customer show under what conditions EEA customers would source HMD from outside the EEA. That is, only when there is no availability of HMD in the EEA. In a shortage situation, there is no consideration of price differences between regions of the world or logistic difficulties, because the alternative to importing from outside the EEA is to shut down production. It is only under these extreme conditions that EEA customers would source from outside the EEA. It is also important to note that force majeure situations are relatively frequent in this industry and may last up to several months. Under these circumstances, customers accept the significant additional costs and logistical difficulties involved with imports, including longer lead times.

(137) Moreover, all customers responding to the market investigation indicate that transportation costs are barriers to trading HMD across the world. The majority of those customers also consider that tariffs are a barrier to trade, while other customers also mention regulatory barriers. […], a major customer, explains “obviously, transportation costs, long delivery periods, as well as risks from transhipments shall be taken into consideration in case of sourcing non negligible volumes on lasting basis from outside the EEA. The technical requirements of HMD transportation have also significant impact on the cost of imported HMD”.58 Another customer, […], explains that regulatory barriers exist, as HMD must be REACH-registered.59 Although the importance of regulatory barriers should not be overstated, it adds to the numerous and important barriers described in this section.

5.3.3.4. Conclusion on geographic market definition

(138) Based on the assessment in recitals (120) to (137), the Commission concludes that, for the purpose of assessing the Transaction, the market for the supply of HMD is EEA-wide in scope

5.3.4. Conclusion on the market definition for HMD

(139) As the outcome of the competitive assessment of the Transaction remains the same and the Final Commitments entered into by the Notifying Party address the Commission’s concerns under all alternative market definitions, it is not necessary for the Commission to conclude on the exact product market definition for HMD, which is EEA-wide in scope for the purpose of assessing the Transaction.

(140) In conclusion, the Commission will carry out its competitive assessment on a market for HMD defined as EEA-wide in scope.

5.4. Level II of the polyamide value chain: adipic acid

5.4.1. Introduction

(141) Adipic acid is an aliphatic diacid consisting of 6 carbon atoms. The most established commercial production process entails a mixture of cyclohexanol and cyclohexanone (commonly known as KA Oil, and represented at level I in Figure 1). The KA Oil is oxidised with nitric acid (also level I) to generate Adipic acid, via a multistep pathway (i.e., through several production steps), as follows:

(a) Liquid cyclohexane is air-oxidised through a cyclohexyl hydroperoxide intermediate to a cyclohexanone-cyclohexanol mixture;

(b) KA Oil is oxidised to adipic acid by nitric acid in the presence of a catalyst; and

(c) Adipic acid is cleaned from impurities.

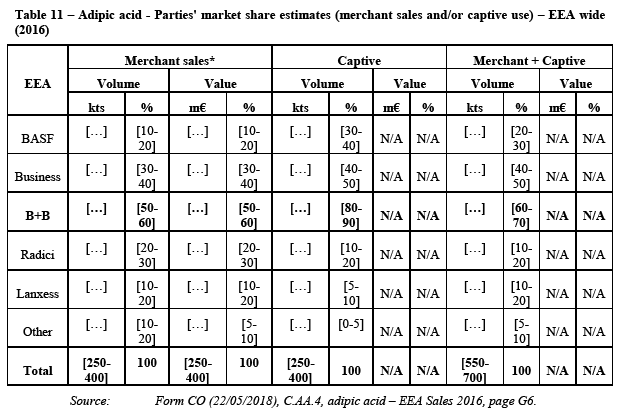

(142) Within the polyamide value chain, adipic acid is mixed with HMD to produce AH Salt (level III), the precursor to PA 6.6 BP (level IV). Outside the polyamide value chain, adipic acid has other equally important applications including polyurethane, flexible foam, plasticisers, polyester TPU thermoplastic and synthetic leather.

5.4.2. Product market definition

5.4.2.1. The Commission’s precedents

(143) In Solvay/Rhodia, the Commission considered that adipic acid may form a distinct product market.60 In that case, the Commission carried out a market investigation in which the respondents did not point to any further segmentation of the product in question. Ultimately, the Commission left the product market definition open.

5.4.2.2. The Notifying Party's view

(144) The Notifying Party agrees with the Commission's past decisional practice and submits that adipic acid constitutes a separate product market and that no further segmentation is warranted.61

5.4.2.3. The Commission's assessment

(145) The outcome of the market investigation indicates that adipic acid should be considered a separate product market, as there is no alternative to produce AH Salt and other products like polyurethane, flexible foam, or plasticisers. Conversely, the market investigation did not reveal a need to segment this market further.

(146) Certain respondents – and the Notifying Party – have occasionally referred to different adipic acid grades. Others have objected that adipic acid is a single commoditised product, though quality levels may vary across producers, notably in relation to imports from China. Thus […] explained that: "Adipic Acid is a commodity product that can vary by quality and colours".62 Likewise, […] indicated that adipic acid "is the same everywhere" but that there can be "quality differences between different market players", pointing in particular to supplies from China.63

(147) Overall, the market investigation has not revealed that adipic acid produced in the EEA could be of such different nature, composition or presentation so as to be suitable for certain applications and not others. Conversely, EEA suppliers can typically accommodate varying customer requirements. Thus, respondents have indicated that "Adipic Acid quality is consistent in Europe",64 and that “European producers of Adipic Acid produce roughly equivalent products. Customers specify the characteristics of Adipic Acid they want and [the producer] provides the product. Once a quality is approved, it does not matter who the actual manufacturer is”.65

5.4.2.4. Conclusion on product market definition

(148) The Commission therefore concludes that, for the purpose of assessing the Transaction, adipic acid constitutes a distinct product market.

5.4.3. Geographic market definition

5.4.3.1. The Commission’s precedents

(149) In terms of geographic market definition, the Commission considered in Solvay/Rhodia that the geographic scope of the market for adipic acid was at least EEA-wide in scope. Respondents to the market investigation in that case indicated that, in principle, they source adipic acid on an EEA or worldwide basis. Ultimately, the Commission left open the precise market definition in that case.66

5.4.3.2. The Notifying Party's view

(150) The Notifying Party originally submitted that the geographic market for adipic acid should be defined as global in scope because, in essence, transportation costs and import duties do not hamper the possibility to trade adipic acid over long distances and thus to procure from suppliers located outside of the EEA, notably in view of the existing price gap between the EEA and China.

(151) In response to the Article 6(1)(c) Decision, the Notifying Party elaborated as follows:67

(a) Adipic acid quality requirements do not constitute an obstacle to imports for the vast majority of EEA customers. Whereas different adipic acid grades (standard and TPU) can be distinguished in relation to Chinese imports, the Notifying Party considers that the majority of EEA customers do not require adipic acid of a specific "better" quality, that the Chinese standard adipic acid quality would be sufficient to cover most of the EEA demand and that the largest Chinese adipic acid producers produce the higher adipic acid grade of a quality comparable to that of EEA producers;

(b) Long distance transportation does not affect the quality of adipic acid to make it an obstacle to imports. In particular, the Notifying Party considers that the solidification of adipic acid resulting from its storage over a long period and its exposure to humidity – known as "caking" – does not constitute a significant impediment to importing adipic acid from outside the EEA due to the possibility of sourcing adipic acid in big bags and to the availability of low-cost "crushing machines" to break up "clumped" adipic acid;

(c) Logistical arrangements required by the importation of adipic acid to the EEA do not constitute a significant limitation to import from China either. Specifically, the Notifying Party contends that the supply of imported adipic acid in big bags rather than bulk is not such as to make imports significantly more difficult or uncompetitive because a majority of European customers take delivery of adipic acid in big bags while the additional costs of processing adipic acid delivered in bags are limited. Moreover, a number of EEA distributors are active in the import of adipic acid and may alleviate the logistical constraints faced by smaller customers;

(d) Transportation costs, tariffs and longer delivery periods do not constitute an obstacle to imports of adipic acid either. In the Notifying Party's view, transportation costs and import tariffs are insignificant in the context of importing adipic acid into the EEA and the REACH registration process does not constitute a real barrier to entry;

(e) Longer delivery time and associated financial risks do not further constitute a significant barrier to imports. In effect, longer lead time between each delivery can be catered for by planning additional storage or compensated by procuring on the European spot market, whereas the financial risks due to price variations are low given the significant price gap between the European and Chinese adipic acid market;

(f) Chinese adipic acid capacity is sufficient to supply a large part of the entire EEA market and Chinese suppliers have a significant cost advantage over EEA producers. According to the Notifying Party, significant adipic acid spare capacity is available in China and capacity will continue to rise, whereas Chinese suppliers will adjust to the enforcement of environmental legislations in order to address temporary shutdowns. Moreover, the price gap between EEA and Chinese adipicacid remains material due to the significant cost advantage of Chinese over European suppliers;

(g) EEA customers can – and already do – rely on non-EEA suppliers for a very significant proportion of their adipic acid needs. The fact that a large number of EEA customers are procuring adipic acid from Chinese producers and that imports have increased significantly in recent years show that Chinese supply is clearly an alternative to domestic EEA production, thereby putting pressure on EEA prices. In effect, adipic acid imports from China increased because the price of imports became relatively cheaper than the price of adipic acid produced in the EEA. Moreover, the price of the adipic acid produced in the EEA and the price of Chinese imports of adipic acid are positively correlated and the correlation increases if the EEA prices are lagged, thus suggesting that EEA prices are influenced by Chinese import prices; and

(h) The Parties' customers often use Chinese producers of adipic acid as a credible threat in negotiations. In that regard, the Notifying Party provides anecdotal evidence of correspondences with customers over the 2012-2018 period allegedly […].

5.4.3.3. The Commission's assessment

(152) The outcome of the market investigation in Phase II does not concur with the Notifying Party's claims but rather supports the view that the market for adipic acid is EEA-wide in scope. In the Article 6(1)(c) Decision, the Commission acknowledged that the evidence available back then was inconclusive and that it would continue investigating the appropriate scope of the adipic acid market for the purpose of assessing the impact of the Transaction. While market participants continue to share different views, an overall assessment of the evidence obtained over the course of the in-depth investigation points more clearly in favour of an EEA-wide market.

(153) At the outset, in line with the Notice on the definition of relevant market,68 the Commission notes that, according to the Notifying Party, the overall demand (merchant + captive) for sdipic scid in the EEA amounted to approx. […] kts in 2016, of which imports represented approx. [0-10]% ([…] kts, the lowest import level since 2011).69 Imports have increased significantly in 2017, reaching approx. [10-20]% of the total demand of […] kts ([…] kts, the highest import level since 2011).70

(154) While imports from the United States have dropped significantly in 2016 (to approx. […] kts from […] kts in 2015 and up to […] kts in 2013), imports from China have increased to approx. […] kts in 2017, compared to approx. […] kts in 2016 and […] kts in 2015. Overall, it appears to be a commonly held view among market participants,71 including the Notifying Party,72 that Chinese imports to the EEA have replaced imports from the USA over the past couple of years due to certain plant closures in North America.73

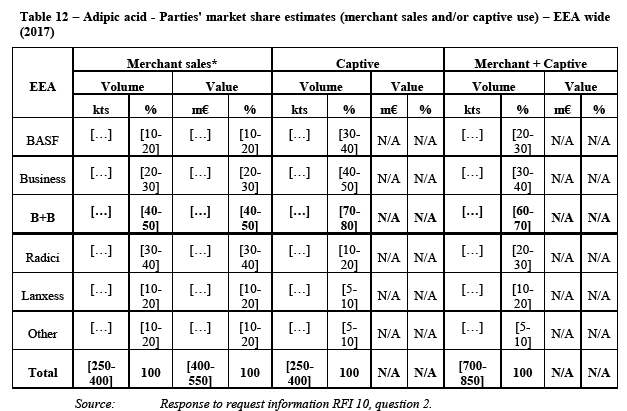

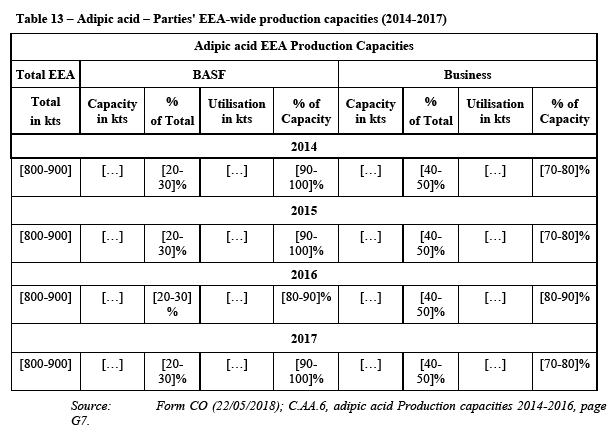

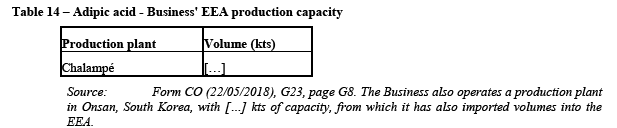

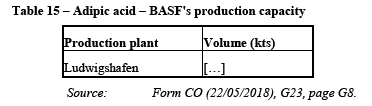

(155) If, as claimed by the Notifying Party,74 imports of adipic acid for the purposes of the merchant market are primarily derived from China, these represented approx. [0- 10]% of EEA merchant sales in 2016 and [10-20]% in 2017. In contrast, the Parties accounted for more than [50-60]% of EEA merchant sales and [60-70]% of total EEA demand (merchant + captive), based on 2016 data.75 Altogether, EEA producers including the Parties, Radici and Lanxess Deutschland GmbH ("Lanxess", Germany), account for more than [90-100]% of total EEA demand.

(156) Imports from outside the EEA therefore represent a relatively moderate proportion of total EEA demand or merchant sales, even though they increased in 2017, thus questioning the reality of a global market. The Commission notes that the median adipic acid import volume between 2011 and 2017 was around […] kts/year, representing approx. [0-10]% of the 2017 EEA demand.

(157) In line with the Notice on the definition of relevant market, the reasons behind the market shares figures need to be explored based on an analysis of demand characteristics, to establish whether companies in different areas (primarily China) do indeed constitute a real alternative source of supply for consumers, and possibly an analysis of supply factors, to assess the impediments in developing sales throughout the whole alleged geographic market.76 While doing so, the Commission also addresses the Notifying Party's arguments.

5.4.3.3(A) Demand-side considerations

(158) As noted in the Article 6(1)(c) Decision, a significant number of customers are sourcing adipic acid from China, but these typically represent only a small percentage of the required amount.77 The Phase II investigation confirmed that those EEA customers sourcing adipic acid from China to feed their downstream manufacturing processes tend to import limited volumes, in line with the overall share of Chinese imports into the EEA, though variations apply depending on the applications for which adipicacid is used and the design of the customer's manufacturing processes. 78 Importantly, various limitations to a wider reliance on Chinese imports appear to remain in the opinion of EEA customers.

(a) Quality issues remain a source of concern for EEA customers

(159) The market investigation in Phase II confirmed the conclusions of the Article 6(1)(c) Decision in that a number of EEA customers, including very large ones,79 continue to view the quality of adipic acid supplies from China as being either inferior to that available from EEA producers, or as being of inconsistent quality across suppliers.80

(160) Admittedly, the quality concern may not be of equal magnitude across all industries. Thus, using adipic acid from China appears particularly problematic (and even "not an option"81) for food contact goods due to hygiene specifications but also for polymer (bioplastic) production, due to purity issues.82 Generally, quality development has been mentioned as an important requirement for a greater acceptance of Chinese imports,83 for "Chinese quality hasn't been improved enough yet".84

(161) Traders tend to be more positive about the quality of the material that they procure from China on behalf of certain EEA customers.85 However, they also concede that "[s]ome Chinese producers are not in line with the European producers' requirements".86 Likewise, the quality required by EEA customers is sometimes available only from a particular production line (e.g., Huafon's third production line).87 Moreover, the Chinese material appears to frequently require repacking and sometimes reprocessing to improve the physical appearance of the product.88

(162) Thus, notwithstanding possible improvements over the recent past,89 the quality of Chinese supplies appears to be an issue for a number of EEA customers and, combined with other considerations spelled out in this section continues to affect demand dynamics differently than vis-à-vis EEA producers.

(b) The "caking" issue and the unavailability of imports in bulk remain an important constraint for a number of EEA customers

(163) The fact that adipic acid is hygroscopic in nature and solidifies in block when transported over long distances by cargo, appears to be well known within the industry. Likewise, respondents to the in-depth investigation (including traders) concur to the effect that "clumped" adipic acid cannot be used as such in production lines, i.e., is "inoperable".90 Since that phenomenon derives from the physical characteristics of adipic acid, it is not clear how it could be alleviated in the short to medium term.91

(164) The Notifying Party argues that "it is in fact easy to break up the clumped AA with a simple crusher, to revert to a powder form AA".92 Admittedly, the impact of the caking issue may be more or less significant depending on the industrial equipment of the customer. Still, additional cost to crush caked adipic acid has been estimated between [5-10]% of the purchase price,93 which is not negligible and does affect the competitiveness of Chinese imports.

(165) Likewise, respondents to the market investigation are unanimous that Chinese material is not available in bulk.94 This constraint may also affect certain customers more than others. For example, […] explains that it can purchase both packaged and bulk quantities, which ensure greater flexibility, including in procuring from overseas.95 However, this is a significant limitation for other customers operating silo storage tanks from which the material goes directly into production. For these customers, the procurement of adipic acid in bags rather than bulk would entail efficiency losses and labour cost increases, while also raising safety concerns.96

(166) The procurement of adipic acid from China therefore faces significant physical constraints limiting the availability or attractiveness of Chinese supplies, at least for a category of customers, including large customers. As a corollary, these limitations, combined with other factors, also affect the constraints that Chinese imports can exercise on domestic EEA producers.

(c) Longer delivery periods and associated financial risks also limit the competitiveness of Chinese imports

(167) The investigation in Phase II has confirmed the findings of the Article 6(1)(c) Decision to the effect that importing from China entails longer and inconsistent delivery times, translating in greater financial risks and working capital requirements (due to the necessary adjustment of stocks and storage needs).97 In turn, the outcome of the market investigation in Phase II does not support the Notifying Party's views to the effect that price differentials between European and Chinese adipic acid would naturally mitigate financial risks, and that so would the possibility of outsourcing risks to traders and/or turning to the EEA spot market in case of shortage.

(168) In response to the market investigation, both large customers and traders have insisted on the volatility of Chinese adipic acid prices. Thus, according to […], that volatility of Chinese prices is significant, and significantly greater than that of EEA prices, whereas the delivery time differs between two months for Chinese supplies and one week from EEA deliveries.98 While generally more positive about the availability of Chinese supplies, […] also highlighted the risks arising from the longer supply chain when resorting to imports from outside Europe.99 This is consistent with […] earlier explanation that “Adipic Acid is traded on monthly basis. From one month to another the price difference can be very high (for example in 2017 we have seen changes of 25% and more within a month) depending on raw material price developments and product availability. Imports e.g. from Asia take around 6-8 weeks by sea transport. The European market could completely different at the time of product arrival”.100

(169) Interestingly, trader […] confirmed that the long transit time for adipic acid from China is a main disadvantage and has a material impact on the price risk for imported product. To become comparable to EEA supplies, according to […], Chinese suppliers would need to offer pricing based on delivery date in the EEA not shipment date from China, thus illustrating the significance of the risks in question and resulting lack of homogeneity in supply conditions.101 Likewise, […] explained that hedging is not a viable option as the derivative market for adipic acid is not well developed.102

(170) Overall, the significance of the financial risks associated with the long delivery time should also be considered against the narrowing down and possible reversal of the price gap between EEA and Chinese supplies in recent years, as discussed in the present section. For the sake of completeness, the Commission also notes that emergency supplies from China (Huafon) have occasionally taken place by train in recent times, thus shortening the delivery time to 18 days, but that these remain exceptional and are thus not representative of normal supply conditions.103

(d) Security of supply considerations significantly limit the attractiveness of Chinese imports

(171) In addition to confirming considerations already spelled out in the Article 6(1)(c) Decision, the in-depth market investigation has elicited additional concerns, especially in relation to the security of Chinese supplies as a result of recent disruptions resulting from regulatory enforcement.

(172) Based on the results of the market investigation, the Commission considers that the so-called "Blue Sky" policy has led to the tightening of the enforcement of environmental standards in China over the past couple of years, leading to the closure of certain production facilities, even if on a temporary basis (winter). These developments appear to have profoundly affected the perceived reliability of Chinese supplies in the eyes of EEA customers.

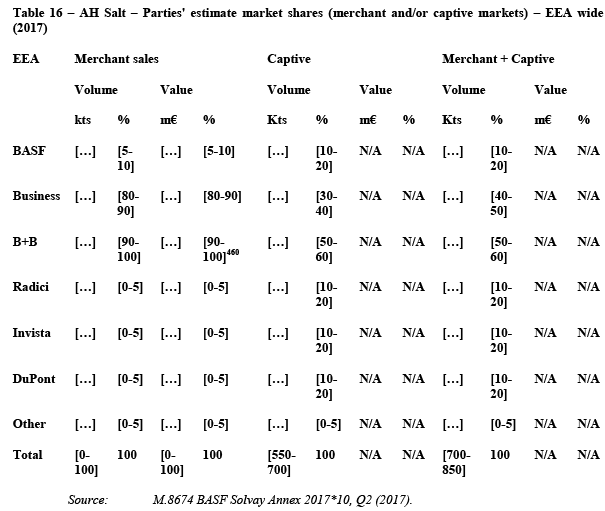

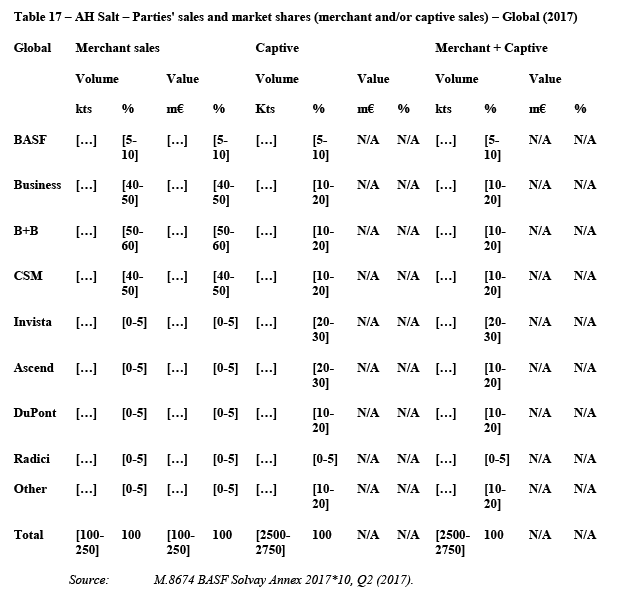

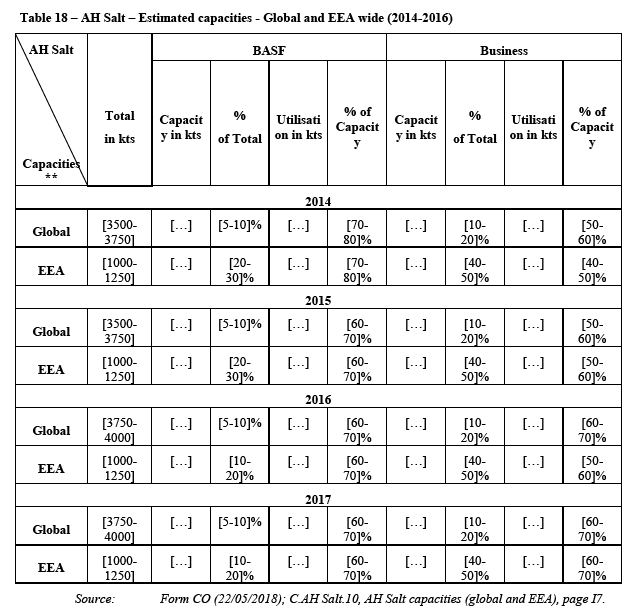

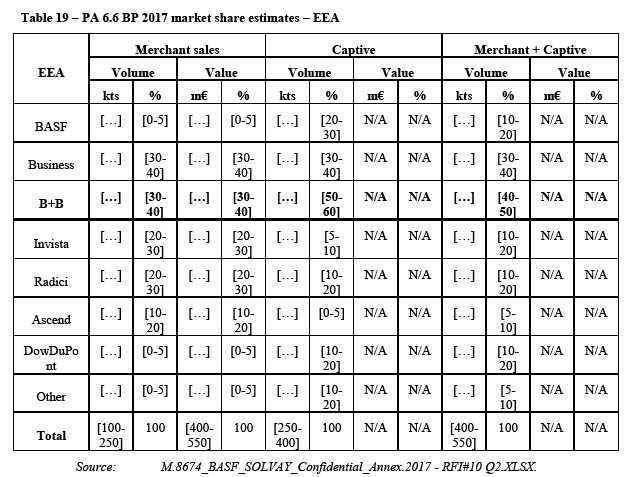

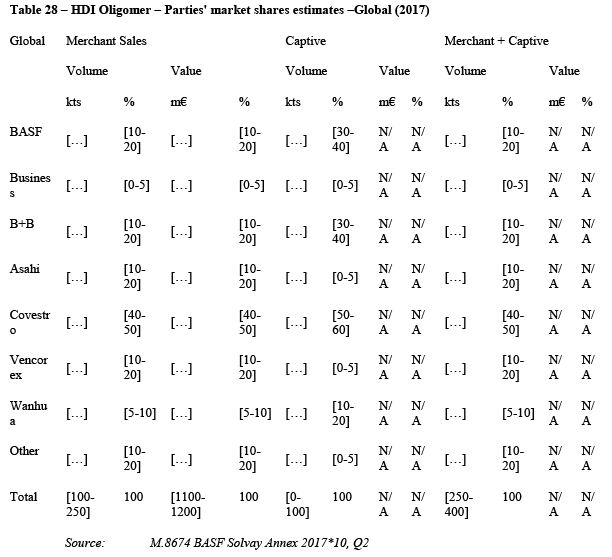

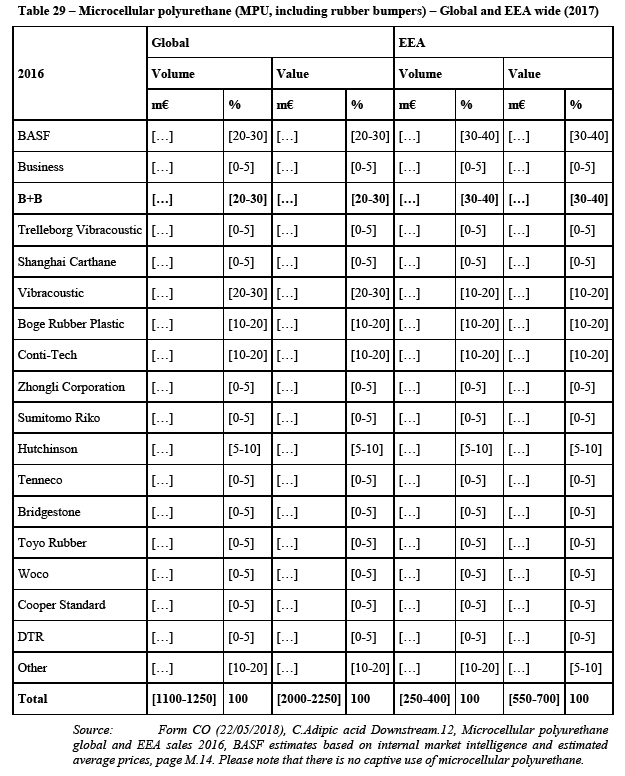

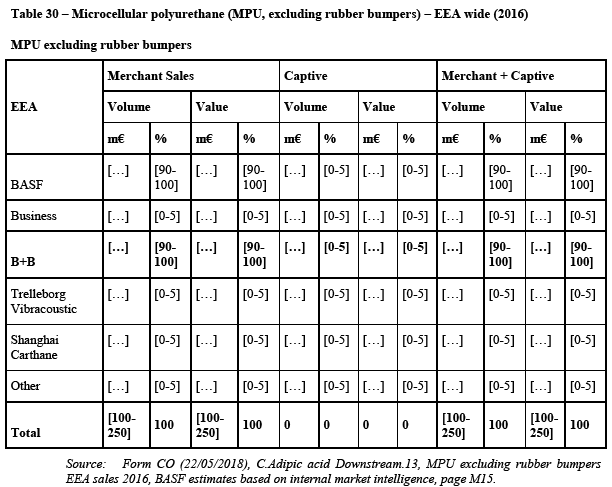

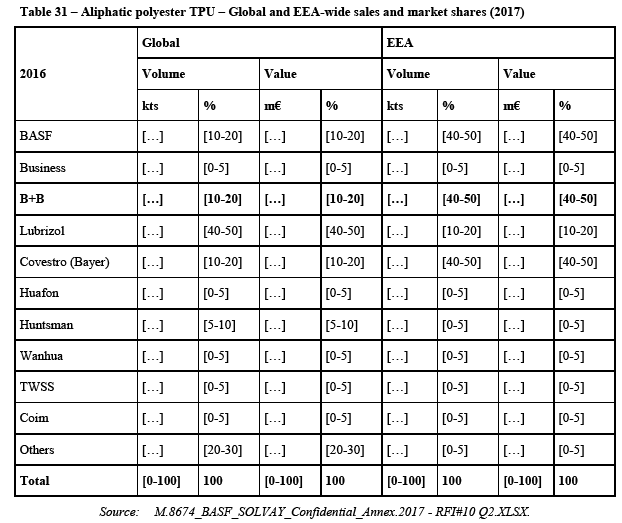

(173) Thus, according to […], "the Chinese supply is unreliable, since not available year round. Importing AA from China is therefore not a reliable option for the long- term".104 Likewise, […] highlights the "low supply reliability [of Chinese producers] due to unpredictable plant shutdowns in China because of environmental reasons or natural gas shortage".105 […] equally underlines that "with the recent local environment constraints in China, regular and consistent deliveries are not even guaranteed any longer which makes sourcing from China even less viable due to the ensuing security of supply issues" or, put otherwise, "due to safety, environmental or other local regulations, the supply reliability from China is very poor in the light of a number of unplanned shutdowns or significant reduction on plant output and their corresponding impact on the security of the supply".106 […] is also "concerned that the reliability of Adipic Acid supply from Chinese producers is significantly lower than from European producers (mainly driven by regulatory decisions)"; in turn, according to […], "supply reliability could generate a very big financial impact".107