Commission, April 22, 2020, No M.9517

EUROPEAN COMMISSION

Decision

MYLAN / UPJOHN

Subject: Case M.9517 – Mylan/Upjohn

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 28 February 2020, the European Commission (the “Commission”) received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Mylan N.V. (“Mylan”, the Netherlands) and Upjohn, a business division of Pfizer Inc. (“Pfizer”, the United States of America) intend to merge (the “Transaction”).3 Mylan and Upjohn are designated hereinafter as the “Notifying Parties” or “Parties” to the Transaction.

1. THE PARTIES

(2) Mylan is a publicly listed global pharmaceutical company, which develops, licenses, manufactures, markets, and distributes (i) generic, (ii) branded generic and (iii) specialty pharmaceuticals. Mylan offers a broad product portfolio of medicines, including more than 1 500 products (generics, branded generics, prescription, and non-prescription). Mylan has a vertically integrated global supply chain that includes over 40 manufacturing facilities.

(3) Upjohn is a global business division of Pfizer. It operates a portfolio of 20 off-patent branded and generic molecules under 21 brands in five therapeutic areas: (i) cardiovascular, (ii) central nervous system/psychiatry, (iii) pain/neurology, (iv) urology, and (v) ophthalmology. In addition, Upjohn includes the generic business of Greenstone LLC, a generic business exclusively active in the United States of America.

2. THE OPERATION

(4) On 29 July 2019, the Parties and Pfizer entered into a business combination agreement pursuant to which the businesses of the Parties will be combined. The Transaction will take place in three steps.(a) First, Pfizer will contribute and transfer Upjohn’s assets and liabilities to Spinco, a special-purpose vehicle wholly owned by Pfizer.(b) Second, Pfizer will distribute Spinco’s common stock to its stockholders.4(c) Third, Spinco and Mylan will combine, by a merger or an asset sale, resulting in the transfer of Mylan’s assets and liabilities to Spinco.

(5) Upon completion of the Transaction, the merged entity (comprising Upjohn and Mylan) will be wholly owned by Spinco, which will be renamed “Viatris”. Former Mylan shareholders will hold 43% and Pfizer’s shareholders will hold 57% of Viatris. None of the individual shareholders of Mylan or Pfizer will exercise control over Viatris, which will be an independent undertaking.

(6) The Transaction therefore constitutes a merger between Mylan and Upjohn within the meaning of Article 3(1)(a) of the Merger Regulation.

3. UNION DIMENSION

(7) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million (Mylan: EUR 9 551 million; Upjohn: EUR 10 582 million).5 Each of them has a Union-wide turnover in excess of EUR 250 million (Mylan: EUR […] million; Upjohn: EUR […] million), but each does not achieve more than two- thirds of its aggregate Union-wide turnover within one and the same Member State. The notified operation therefore has a Union dimension.

4. OVERVIEW OF THE OVERLAPS AND VERTICAL RELATIONSHIPS

(8) The Transaction will combine one of the top five generic suppliers in the EEA6 (Mylan) with an originator,7 whose products were the first launched on the market for a specific molecule but that have lost exclusivity following patent expiries (Upjohn).

(9) The Transaction gives rise to horizontally affected markets in the supply of finished dose pharmaceuticals (“FDPs”), which are assessed in Section 5 of this Decision.8

(10) In addition, the Transaction leads to vertically affected markets for (i) the supply of active pharmaceutical ingredients (“APIs”), upstream, and the supply of FDPs, downstream, and (ii) the outlicensing of rights to FDPs, upstream and the supply of FDPs, downstream. These vertical links are respectively assessed in Sections 6 (regarding the supply of APIs) and 7 (regarding the outlicensing of rights to FDPs) of this Decision.9

5. FINISHED DOSE PHARMACEUTICALS

(11) FDPs are pharmaceutical products that have undergone all stages of production (including packaging in the final container and labelling). They are the final pharmaceutical products received by pharmacies and other healthcare professionals, and ready to use by patients.

(12) Both Parties supply genericized FDPs in the EEA, but have a slightly different business focus. While Mylan offers mostly unbranded generics (among its offering of more than 1 500 FDPs), Upjohn is an originator supplier, whose portfolio comprises 21 brands based on 20 molecules that were the first launched on the market for a specific molecule but most of which lost exclusivity following patent expiry more than five years ago.

5.1. Market definition

5.1.1. Product market definition

5.1.1.1. Product market definition in the pharmaceutical sector

(13) FDPs may be subdivided into therapeutic classes by reference to the Anatomical Therapeutic Classification (“ATC”), devised by the European Pharmaceutical Marketing Research Association (“EphMRA”) and maintained by EphMRA and IQVIA, formerly known as Intercontinental Medical Statistics (“IMS”).

(14) The ATC system is a hierarchical and coded four-level system, which classifies medicinal products according to their indication, therapeutic use, composition, and mode of action. In the first and broadest level (ATC1), medicinal products are divided into the 16 anatomical main groups. The second level (ATC2) is either a pharmacological or a therapeutic group. The third level (ATC3) further groups medicinal products by their specific therapeutic indications. Finally, the ATC4 level is generally the most detailed one (not available for all ATC3 classes) and refers for instance to the mode of action or any other subdivision of the relevant products.

(15) When defining relevant markets in past decisions dealing with FDPs, the Commission often referred to the third level (ATC3) as the starting point for defining the relevant product market.10 However, in a number of cases, the Commission found that the ATC3 level classification did not yield the appropriate market definition within the meaning of the Commission Notice on the Definition of the Relevant Market.11

(16) In decisions involving genericized FDP markets, the Commission generally defined the relevant product market at the level of the relevant molecule (i.e. based on the same active pharmaceutical ingredient) or group of molecules (for instance all benzodiazepines or all anticholinergics)12 that are considered interchangeable.13

(17) In previous decisions, the Commission found that, at molecule level, the originator (i.e. the first product that was launched on the market for a specific molecule) and generics (i.e. products that were launched after the originator’s loss of exclusivity)14 generally form part of the same market. This is because generics are versions of originator medicines, which are specifically designed to compete with those medicines and normally represent the closest substitute to them.15

(18) The Commission has acknowledged in previous decisions that additional segmentations may also apply.16 FDPs may be differentiated not only by their active ingredient(s), but also by galenic form and route of administration, which may limit their substitutability. The Commission also considered separate markets for FDPs, which can be dispensed only against a prescription and those which can be sold over the counter (or "OTC").17

5.1.1.2. The Notifying Parties' views

(19) The Notifying Parties did not provide any indications that the Commission should depart from the more recent approach to define the product market for genericized FDPs at the level of molecules within the same ATC3 class, and considered all alternative market definitions (at ATC3, ATC4, and multi-molecule levels, based on galenic form, as well as between prescription and OTC products) in line with applicable precedents.18

5.1.1.3. The Commission's assessment

(20) For the purpose of this Decision, the Commission considers that the relevant product markets for FDPs should be defined at molecule level.

(21) In the present case, the responses to the market investigation suggest that, for the molecules involved in this case, different genericized molecules, including from the same ATC3 class, do not form part of the same product market, in particular since they are not interchangeable for patients and pharmacies,19 and their price-setting modalities differ.20 Relatedly, respondents to the market investigation also indicated that certain genericized molecules belonging to wider groups of molecules with the same or similar mode of actions, such benzodiazepines, are generally not interchangeable.21 However, with regard to anticholinergics specifically, while the majority of respondents also consider that different molecules generally do not form part of the same product market, 22 the Commission notes that the answers received in the market investigation to this question were mixed regarding the Lithuanian market.23 These elements indicate that, with the possible exception of anticholinergics,24 the molecules offered by the Parties and analysed in the present case each form a separate product market.

(22) Respondents to the market investigation also took the view that, for the same genericized molecule, originator and generics form part of the same market, as they are generally perceived as substitutes to each other and interchangeable.25 This indicates that, concerning the products offered by the Parties and therefore analysed in the present case, products based on the same molecule(s) that fall within the same therapeutic indication (namely within a same ATC3 class) belong to the same product market.

(23) The market investigation was inconclusive regarding whether products with different galenic forms are substitutable.26 A large majority of responding pharmacies indicated that different form factors might not be interchangeable to treat the same symptoms or illness, especially for nervous system treatments,27 while an overwhelming majority of competitors consider that different galenic forms do compete with each other.28 The Commission notes that the Commission’s assessment does not significantly differ in the present case should the relevant product markets be sub-segmented at the galenic form level or comprise all galenic forms. Moreover, no additional Group 1(+) or 2 markets arise from the Transaction if the relevant product markets were defined based on different galenic forms, except where this is explicitly mentioned in Section 5, and in none of those cases the competitive assessment changes. Therefore, the question of whether the relevant molecule markets should be further segmented based on the galenic form of FDPs can be left open, as it has no impact on the competitive assessment of the Transaction.

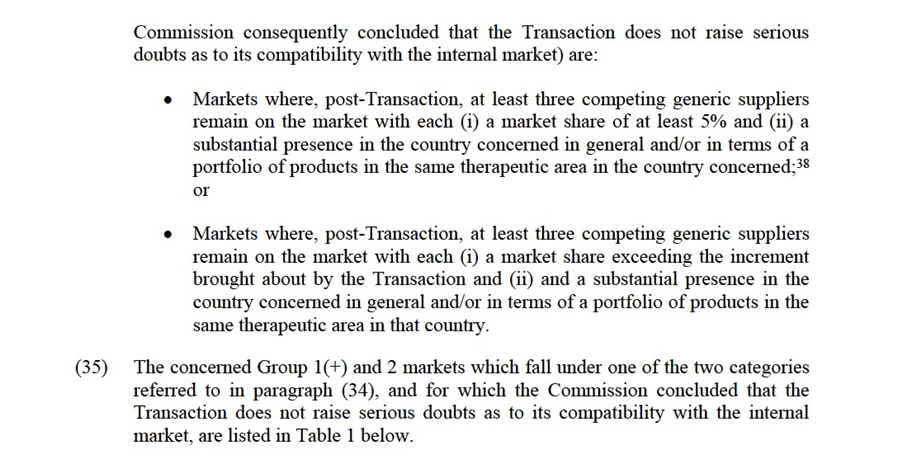

(24) In summary, based on the results of the market investigation and any other evidence available to it, the Commission has no reason to depart from its decisional precedents in the area of genericized FDPs (see paras. 15 to 18 above), and concludes that the relevant product markets should be defined at molecule level, while the question of the sub-segmentation based on the galenic form can be left open.

5.1.2. Geographic market definition

(25) The Commission has consistently defined the geographic markets for FDPs as being national in scope.29

(26) The Notifying Parties, in line with the Commission’s decisional practice, provided market share data at national level for FDP overlaps.

(27) The market investigation in this case confirmed the national dimension of the markets for FDPs, in particular in view of the differing national regulatory and reimbursement schemes, and the fact that competition between pharmaceutical suppliers still predominantly takes place at a national level.30

(28) Therefore, for the purpose of this Decision, the Commission considers that the geographic scope of all relevant FDP product markets is national.

5.2. Methodology for the identification and the assessment of affected markets

(29) In line with Commission precedents,31 the Notifying Parties primarily used sales data of pharmaceutical products compiled by IQVIA to identify the affected markets that the Transaction gives rise to.32

(30) In addition, given a large number of affected markets in pharmaceutical mergers (involving numerous product and geographic markets), the Commission has applied a system of filters aimed at determining the group of markets where concerns are most likely and on which it focuses its analysis. In line with Commission precedents in the pharmaceutical sector,33 affected markets can be classified in four categories- Group 1, where the Parties' combined market share exceeds 35% and the increment exceeds 1%;- Group 1+, where either (i) the combined market share is below 35% (but above 20%), and only one other competitor remains on the market, or where(ii) the combined market share exceeds 35% and the increment is below 1%, but the party with the small increment is a recent entrant.34- Group 2, where the Parties' combined market share exceeds 35% but the increment is below 1%; and- Group 3, where the Parties' combined market share is between 20% and 35%.

(31) The Commission has analysed all markets affected by the Transaction. Regarding Group 1(+) markets (comprising Group 1 and Group 1+ markets), the Commission assessed the markets under the narrowest plausible market definition, namely at the molecule level (with potential sub-segmentation by galenic form where relevant). Depending on the results of the market investigation on the scope of the relevant market in relation to these molecules, the Commission also assessed these markets at "multi-molecule" level (namely a combination of potentially interchangeable molecules within the same ATC4 or ATC3 class).

(32) The Commission's assessment focused primarily on volume-based market shares. As generics are in general less expensive than the originator drugs, the competitive interactions between Mylan (and other generic players) and Upjohn, are more accurately reflected in volume-based market shares. In addition, the products concerned by the Transaction have typically been genericised over five years ago, thus mitigating any first-mover advantage that a specific generic player may have in particular on pricing. Under these circumstances, the competitive pressure that generics exert on the originator largely depends on the volumes that they can divert from the originator, and the competitive position of each company is therefore better captured with volume market shares. However, the Commission also reviewed the value-based market shares of the Parties and their competitors for the affected markets. In the present case, the combined value-based market share of the Parties is generally higher than their volume-based combined market share, as the former originator product of Upjohn is generally sold at a higher price point than its generic competitors. In any event, the Commission notes that the competitive assessment does not differ substantially when considering value market shares for any affected market, in particular because the number of competitors and their ability to exert a credible competitive pressure on the merged entity does not change.

5.3. Competitive assessment

(33) In line with precedents,35 Group 3 markets are not discussed individually in this Decision.36 The Commission assessed the competitive situation in these markets by considering the combined market shares of the Parties and their competitors over the last three years, other factors including the presence of competitors with a significant presence in the generics markets, the date of patent expiry, the recent evolution of prices, the level of complexity of the Parties’ products,37 the Parties’ pipeline products, as well as the results of the market investigation. The Commission reached the conclusion that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the Group 3 markets arising from the Transaction, due to the limited market shares of the Parties and the presence of significant competitors remaining on the market post-Transaction that will likely sufficiently constrain the merged entity.

(34) The Commission has assessed all Group 1(+) and 2 markets individually, but does not discuss individually in this Decision the Group 1(+) and 2 markets which fall within one of the two following sets of criteria. These markets (for which the

(36) In these markets, the Parties' combined market share generally remains below [50- 60]%,39 under any plausible market definition.40 In this case, which involves a merger between an originator and a generic company, high market shares alone do not equate to market power. Genericised FDPs are typically heavily regulated, which limit the opportunity to engage in price increases and favours the entry of new and lower cost generic players. In addition, Mylan, as a generic player, competes more closely with other generic players. If a sufficient number of credible competitors remain in the market, combining the market shares of Mylan and Upjohn thus does not automatically translate into increased market power.

(37) Moreover, the overwhelming majority of respondents to the market investigation considered that the Transaction would have a neutral or positive impact on these markets.

(38) In light of the foregoing, the Commission finds that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the markets listed in Table 1.

(39) In the following, the Commission individually assesses all Group 1(+) and Group 2 markets, which do not fall under one of the two categories referred to in paragraph (34). For the reasons detailed in paragraph (32) above, the Commission relied as a starting point on volume-based market shares to assess the competitive dynamics of the affected markets. However, as noted above, the Commission considered the value market shares for the markets affected by the Transaction and notes that the competitive assessment does not differ substantially when considering value market shares for any affected market.

Commission’s assessment

(47) The combined market share of the Parties at molecule level amounts to nearly [40- 50]% in 2018. In addition, only one significant competitor would remain post- Transaction, namely Zentiva with a volume-based market share of [40-50]% in 2018 and hence, the combined entity would face limited competitive constraints post- Transaction.

(48) Moreover, if the market was further segmented based on galenic form, the Parties are the only two manufacturers supplying extended release tablets of doxazosin in Czechia. Therefore, the Transaction would lead to a monopoly if a market segmented by galenic form at molecule level were considered.

Conclusion

(49) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market due to its likely horizontal non-coordinated effects (i) in the market for doxazosin in Czechia given the high combined market share post-Transaction and the reduced number of significant competitors in the market, as well as (ii) in a possible market for extended release tablets of doxazosin in Czechia given that no competitor would remain on this possible market.

(b) Doxazosin in France

(50) Both Parties supply doxazosin (ATC3 class C2A) in France. This molecule is genericized in France since 2009. While Upjohn markets doxazosin under the brand name Zoxan, Mylan supplies an unbranded version of doxazosin.

Market shares

(51) A Group 1 market arises at the molecule level for doxazosin in France.44

(52) The volume market shares of the Parties and their competitors for the supply of doxazosin in France are provided below in Table 3.

Notifying Parties’ views

(63) The Parties did not submit any views in relation to this market. To expedite the clearance of the Transaction, the Parties offered to divest Mylan’s eplerenone product in Belgium to a suitable purchaser.47

Commission’s assessment

(64) The combined market share of the Parties is [90-100]% at molecule level, with a significant increment from Upjohn (of [20-30]% based on 2018 figures). As a result, no competitor would remain post-Transaction and the Transaction would therefore lead to a monopoly for the supply of eplerenone in Belgium.

(65) The market investigation did not provide any elements to dispel the serious doubts arising from the fact that the merged entity would have a monopoly on the market post-Transaction and there would be no competitor present.

Conclusion

(66) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market as regards the supply of eplerenone in Belgium due to its likely horizontal non-coordinated effects in the market for eplerenone in Belgium given the high combined market share and the fact that no competitors will remain on the market post-Transaction.

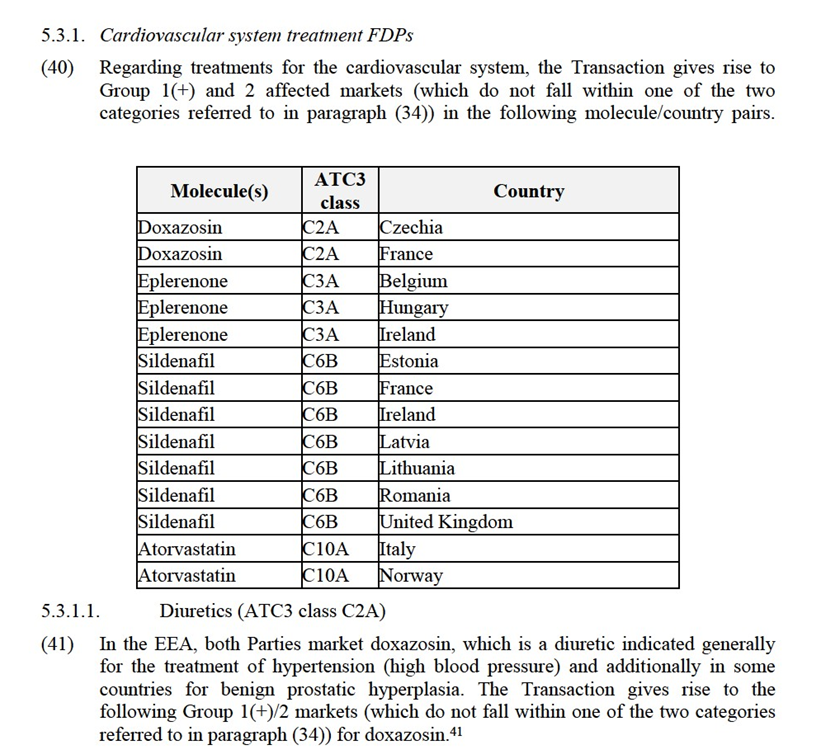

(b) Eplerenone in Hungary

(67) Both Parties supply eplerenone (ATC3 class C3A) in Hungary. This molecule is genericized in Hungary since 2010. In this country, while Upjohn markets eplerenone under the brand name Inspra, Mylan sells an unbranded version of eplerenone.

Market shares

(68) The Transaction gives rise to a Group 1 market at the molecule level for eplerenone in Hungary.

Commission’s assessment

(72) Structurally, the Transaction leads to an important change in the market. Post- Transaction, the merged entity’s market share would be very high (reaching [80- 90]% based on 2018 figures) with a material increment from Mylan (of [5-10]% based on 2018 figures). Such market shares may in themselves be indicative of a dominant position of the merged entity post-Transaction.49

(73) In addition, the market investigation conducted by the Commission does not fully support the Notifying Parties’ arguments.50

(74) First, the Transaction will result in a reduction in the number of players from four to three. Between the two other players active in the supply of eplerenone in Hungary, only one competitor has a significant presence in Hungary overall and in diuretics (ATC2 class C3) more specifically, namely Krka, which is a recent entrant with a market share remaining below [0-5]% in 2018. Alvogen, the only other supplier of eplerenone in Hungary, has consistently had a higher market share than Mylan in the last 3 years. However, this player does not have a strong presence in Hungary in general, nor in the therapeutic area (ATC2 level). As a result, the constraints exercised by competitors on the merged entity for the supply of eplerenone in Hungary are likely to remain limited post-Transaction.

(75) Second, the Parties’ claim that generics/unbranded products do not compete closely with originators/branded products was not supported by the market investigation. Replies to the market investigation were inconclusive as to whether originator and generic products are considered interchangeable.51 In addition, the Hungarian national authority states that pharmacies have incentives to substitute originator products with generics.52

(76) In addition, wholesalers in Hungary indicated that they carry both the originator and generic versions of genericized molecule, and try to offer as many generics as possible,53 evidencing as well the importance of a sufficient number of generic suppliers to maintain effective competition.

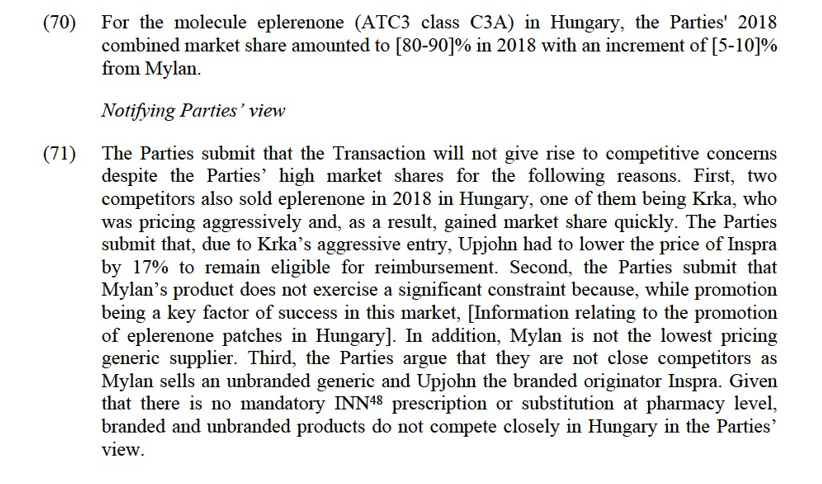

(86) Mylan’s limited increment and the constraints exercised by competitors suggest that the Transaction will not alter significantly the structure of the market for the supply of eplerenone in Ireland. This was confirmed by the market investigation. The majority of respondents consider that the Transaction will not have a negative impact on the market for eplerenone in Ireland, either on prices or on product availability.57

(87) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the eplerenone market in Ireland.

Conclusion

(88) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of eplerenone in Ireland.

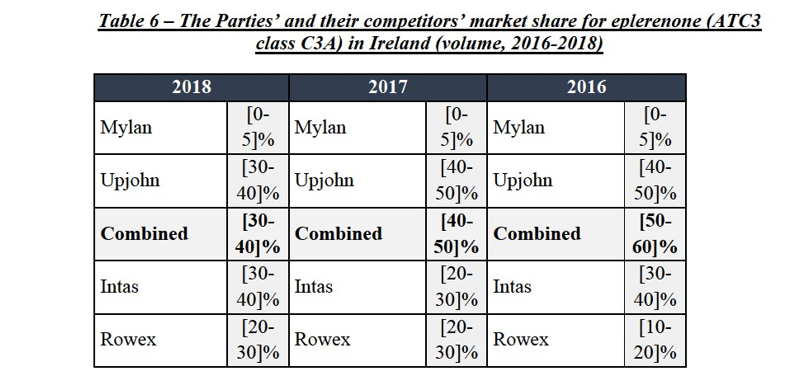

5.3.1.3. Pulmonary arterial hypertension (ATC3 class C6B)

(89) In the EEA, both Parties market sildenafil, which is a so-called PDE-5 inhibitor. This molecule is used to treat pulmonary arterial hypertension (“PAH”) and is indicated for the prevention of cardiovascular disease in adults and for the treatment of hyperlipidemia. The Transaction gives rise to the following Group 1(+)/2 markets (which do not fall within one of the two categories referred to in paragraph (34)) for sildenafil (PAH).

(a) Sildenafil in Estonia

(90) Both Parties supply sildenafil for the treatment of PAH (ATC3 class C6B) in Estonia.58

(91) This molecule is genericized in Estonia since 2015 for the treatment of PAH. Both Parties market a branded version of sildenafil for the treatment of PAH in Estonia. While Upjohn markets sildenafil (C6B) under the brand name Revatio, Mylan markets this product under the name Mysildecard.

Market shares

(92) The Transaction gives rise to a Group 1+ market at the molecule level for the supply of sildenafil (C6B) in Estonia.

Notifying Parties’ views

(103) The Parties did not submit any views in relation to this market. To expedite the clearance of the Transaction, the Parties offered to divest Mylan’s sildenafil product (C6B) in France to a suitable purchaser.60

Commission’s assessment

(104) Structurally, for the supply of sildenafil (C6B) in France, the combined market share of the Parties is extremely high (namely [90-100]%). Besides the Parties, no other competitor is active for the supply of sildenafil (C6B) in France and thus no competitor would remain post-Transaction on the market. Therefore, the Transaction would lead to a monopoly for the supply of sildenafil (C6B) in France.

(105) The market investigation did not provide any elements to dispel the serious doubts arising from the fact that the merged entity would have a monopoly on the market post-Transaction and there would be no competitor present.

Conclusion

(106) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market as regards the supply of sildenafil for the treatment of PAH (ATC3 class C6B) in France, due to its horizontal non-coordinated effects in the market for sildenafil in France given the high combined market share and the fact that no competitors will remain in the market post-Transaction.

(c) Sildenafil in Ireland

(107) Both Parties supply sildenafil (ATC3 class C6B) in Ireland for the treatment of PAH. This molecule is genericized in Ireland since 2015 for the treatment of PAH. In this country, both Parties market a branded version of sildenafil (C6B) under the brand names Revatio concerning Upjohn and Mysildecard concerning Mylan.

Market shares

(108) The Transaction gives rise to a Group 1+ market at the molecule level for sildenafil (C6B) in Ireland.

[5-10]% and [5-10]% respectively) and have a strong presence in the therapeutic area as well (namely a market share of [5-10]% and [5-10]% respectively at ATC2 level in Ireland).

(114) In addition, the results of the market investigation indicate that there will remain a sufficient number of suppliers of sildenafil (C6B) in Ireland. All responding Irish wholesalers indicated that a sufficient number of suppliers of sildenafil (C6B) would remain in the market post-Transaction.61

(115) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction regarding the supply of sildenafil (C6B) in Ireland.

Conclusion

(116) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of sildenafil for the treatment of PAH (C6B) in Ireland.

(d) Sildenafil in Latvia

(117) Both Parties supply sildenafil (ATC3 class C6B) in Latvia for the treatment of PAH. This molecule is genericized in Latvia since 2015 for this therapeutic indication. Both Parties market a branded version of sildenafil for the treatment of PAH in Latvia. While Upjohn markets sildenafil (C6B) under the brand name Revatio, Mylan markets this product under the name Mysildecard.

Market shares

(118) The Transaction gives rise to a Group 1 market at the molecule level for the supply of sildenafil (C6B) in Latvia.

(119) The volume market shares of the Parties and their competitors for the supply of sildenafil in Latvia are provided below in Table 10

Commission’s assessment

(130) Structurally, the combined market share of the Parties is very high at molecule level ([90-100]% in 2018), with a significant market share from Upjohn ([90-100 ]% in 2018), and Mylan’s increment is small (below [0-5]% in 2018). Mylan is, however, a recent entrant, which started supplying sildenafil for PAH in Lithuania in 2017. In addition, only two competitors are active in the supply of this product in Lithuania, namely Teva and Intas, one of which (Intas) does not rank among the top 10 suppliers of generics in Lithuania. As a result, the Transaction would reduce the number of players from four to three. These elements are indicative of a likely dominant position of Upjohn pre-Transaction, which would be further strengthened by the Transaction.

(131) The market investigation did not provide any elements to dispel the serious doubts arising from the fact that Upjohn would likely have a dominant position pre- Transaction, which would be further strengthened by the Transaction and that the merged entity would only face limited competition post-Transaction.

Conclusion

(132) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market as regards the supply of sildenafil in Lithuania for the treatment of PAH (ATC3 class C6B), due to its likely horizontal non-coordinated effects, in particular given the high combined market share and the limited number of significant suppliers.

(f) Sildenafil in Romania

(133) Both Parties supply sildenafil (ATC3 class C6B) in Romania for the treatment of PAH. This molecule is genericized in Romania since 2015 for this therapeutic indication. Both Parties market a branded version of sildenafil for the treatment of PAH in Romania. While Upjohn markets sildenafil (C6B) under the brand name Revatio, Mylan markets this product under the name Mysildecard.

Market shares

(134) The Transaction gives rise to a Group 1 market at the molecule level for the supply of sildenafil in Romania.

(135) The volume market shares of the Parties and their competitors for the supply of sildenafil in Romania are provided below in Table 12.

Notifying Parties’ views

(145) The Parties did not submit any views in relation to this market. To expedite the clearance of the Transaction, the Parties offered to divest Mylan’s sildenafil product (C6B) in the United Kingdom to a suitable purchaser.66

Commission’s assessment

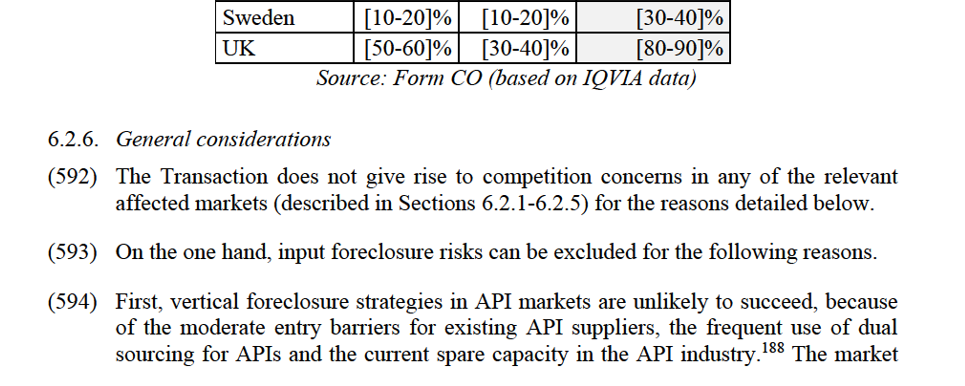

(146) Structurally, the combined market share of the Parties is very high at molecule level ([80-90]% in 2018), with a significant market share from Upjohn ([50-60]% in 2018), and Mylan’s increment is also high (namely [30-40]% in 2018). These elements are indicative of a likely dominant position of Upjohn pre-Transaction, which would be further strengthened by the Transaction.

(147) The market investigation did not provide any elements to dispel the serious doubts arising from the fact Upjohn would likely have a dominant position pre-Transaction, which would be further strengthened by the Transaction and that the merged entity would only face limited competition post-Transaction. To the contrary, three wholesalers based in the United Kingdom believe that, for the supply of sildenafil, the Transaction will have a negative impact on prices or product availability in the United Kingdom.67

Conclusion

(148) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market as regards the supply of sildenafil in the United Kingdom for the treatment of PAH (ATC3 class C6B), due to horizontal non-coordinated effects, in particular given the high combined market share and the limited number of significant suppliers.

5.3.1.4. Cholesterol and Triglyceride preparations (ATC3 class C10A)

(149) In the EEA, both Parties market atorvastatin, which is a molecule indicated for the prevention of cardiovascular disease in adults and for the treatment of hyperlipidemia. The Transaction gives rise to the following Group 1(+)/2 markets (which do not fall within one of the two categories referred to in paragraph (34)) for atorvastatin.

(a) Atorvastatin in Italy

(150) Both Parties supply atorvastatin (ATC3 class C10A) in Italy. This molecule is genericized in Italy since 2012. In this country, Upjohn markets a branded version of

Commission’s assessment

(155) Structurally, the Parties’ combined market share is high, but remained below [50- 60]% in the past three years. Mylan’s increment amounted to [5-10]% in 2018, and remained below [10-20]% in 2016 and 2017.

(156) In addition, a high number of players, namely nineteen, will remain active in the supply of atorvastatin in Italy post-Transaction. Importantly, two of the Parties’ competitors, Menarini and Teva, have a significant presence in this market. Menarini and Teva’s market share exceeded [5-10]% in the past three years ([20-30]% and [5- 10]% respectively in 2018). In addition, both Menarini and Teva have a significant presence at the level of the ATC1 class to which atorvastatin belongs.68 An additional player, Doc Generici, which ranks among the top 10 suppliers of generics in Italy, is also active in the supply of atorvastatin in Italy, although with a market share slightly below [5-10]% ([0-5]% in 2018, but with a small increase in the past three years). These competing suppliers will thus likely be able to constrain the merged entity post-Transaction. This was confirmed by the market investigation. The Italy-based customers that responded to the market investigation indicated that there would be no material change in terms of having a sufficient number of suppliers post-Transaction for this molecule.69

(157) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the atorvastatin market in Italy. None of the respondents to the market investigation considers that the Transaction will have a negative impact on the market, either on prices or on product availability.70

Conclusion

(158) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of atorvastatin in Italy.

(b) Atorvastatin in Norway

(159) Both Parties supply atorvastatin (ATC3 class C10A) in Norway. This molecule is genericized in Norway since 2002. In this country, while Upjohn markets a branded

Commission’s assessment

(175) Post-Transaction, the Parties will face competition from a number of established generic manufacturers, with a significant market presence in Austria (Sanofi is among the top 10 competitors in generics in Austria), with a significant presence in urinary incontinence products (Montavit has a market share of [5-10]% at ATC2 level), as well as Astellas Pharma (market share of [10-20]% in anticholinergics). Furthermore, Upjohn faces competition from two additional competitors (namely Intas with a market share of [5-10]% and Easypharm Generika with a market share of [5-10]%) at the molecule level (tolterodine).

(176) Furthermore, the market investigation confirmed the argument of the Parties that the Parties’ products are not close substitutes, as the Parties do not market the same genericized molecule.72.

(177) In addition, the results of the market investigation indicate that there will remain a sufficient number of suppliers of anticholinergics in Austria. All responding Austrian wholesalers indicated that a sufficient number of suppliers of anticholinergics would remain on the market post-Transaction.73

(178) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the anticholinergics market in Austria.

Conclusion

(179) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of anticholinergics in Austria.

(b) Anticholinergic agents in Lithuania

(180) The Transaction does not give rise to Group 1(+) or 2 market at molecule level for the treatment of urinary incontinence (ATC3 G4D) in Lithuania. However, the Transaction gives rise to a Group 1 market if the relevant market were defined at the multi-molecule level for the supply of anticholinergics in Lithuania.

(181) With regard to anticholinergics in Lithuania, Upjohn sells the molecule tolterodine, under the brand name Detrusitol, while Mylan markets a branded version of oxybutynin, under the brand name Driptane.

respectively [30-40]% and [10-20]%). Respondents to the market investigation based in Lithuania indicated that these two companies are among the ten leading suppliers of generics in Lithuania.74 This indicates that Zentiva and Teva could exert constraints on the behaviour of the merged entity, including in terms of pricing.

(187) Second, the market investigation confirmed the argument of the Parties that the Parties’ products are not close substitutes, as the Parties do not market the same genericized molecule.75

(188) In addition, the results of the market investigation indicate that there will remain a sufficient number of suppliers of anticholinergics in Lithuania. All responding Lithuanian wholesalers indicated that a sufficient number of suppliers of anticholinergics would remain on the market post-Transaction.76

(189) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the anticholinergics market in Lithuania.

Conclusion

(190) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of anticholinergics in Lithuania.

5.3.3. Musculoskeletal system treatment FDPs

(191) Regarding treatments for the musculoskeletal system, the Transaction also gives rise to a Group 1 affected market (which does not fall within one of the two categories referred to in paragraph (34)) in the market for the supply of celecoxib in Italy.

(192) In the EEA, both Parties market celecoxib, which is a molecule indicated for the treatment of musculoskeletal inflammation. A Group 1 affected market arises in Italy.

(193) Both Parties supply celecoxib (ATC3 class M1A) in Italy. This molecule is genericized in Italy since 2014. In this country, Upjohn sells both an unbranded and a branded version (Celebrex) of celecoxib, and Mylan supplies an unbranded version of celecoxib.

(199) Second, a sufficient number of competitors remain in the market post-Transaction. 11 generic suppliers of celecoxib will remain active post-Transaction, five of which had market shares exceeding the increment contributed by Mylan, namely: S.F. Group ([5-10]%), Teva ([5-10]%), Doc Generici ([0-5]%), Novartis ([0-5]%) and Stada ([0-5]%). Importantly, these five suppliers have a significant presence in Italy in the generic space. These five suppliers will thus likely be able to constrain the merged entity post-Transaction. Another six competitors offer the same molecule. Therefore, a sufficient number of competitors will remain in the market post- Transaction. This was confirmed by the market investigation. Indeed, Italian-based wholesalers indicated unanimously that they would have a sufficient number of suppliers post-Transaction for this molecule.77

(200) In addition, the presence of five suppliers with market shares larger than Mylan suggests that the Transaction will not alter significantly the structure of supply and will not lead to a negative impact in terms of product availability or frequency of price reductions. This was confirmed by the market investigation. Respondents to the market investigation unanimously confirmed that the Transaction would not have a negative impact on the market for celecoxib in Italy, either on prices or on product availability.78

(201) Third, the market investigation did not indicate that the Transaction could meaningfully alter the competitive dynamics in the market. S.F. Group, the second largest supplier of celecoxib in Italy following Upjohn (in terms of market shares), is the only competing supplier besides Upjohn offering branded celecoxib in Italy. All other suppliers, including Mylan, offer undifferentiated generic products.79

(202) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the celecoxib market in Italy.

Conclusion

(203) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of celecoxib in Italy.

competitive constraint, as they can enter or re-enter the market very easily from neighbouring countries.

Commission’s assessment

(211) The market investigation conducted by the Commission does not fully support the Notifying Parties' arguments.

(212) First, the combined market share of the Parties is very high ([70-80]%) with a very significant increment brought by Mylan ([20-30]%). The Parties were the two largest suppliers of Eletriptan in Denmark in 2018. The combined market share of [70-80]% may in itself be evidence of a dominant position of the merged entity post-Transaction.80

(213) Moreover, only one competitor with a significant presence would remain in the market post-Transaction, namely Orifarm, a parallel importer81 of Upjohn’s eletriptan product with a [20-30]% market share. Although market shares fluctuate significantly in Denmark, only three suppliers have gained market shares above 10% in the last three years, showing clearly that the Parties are among the top three suppliers of eletriptan in Denmark.

(214) While the market investigation confirms the Notifying Parties' claims that barriers to entry are not particularly high in Denmark, the Commission was not able to confirm entry plans for this market in Denmark before 2023.82 Moreover, the market investigation was inconclusive as to whether parallel importers are effective competitors. While the views of competitors are mixed, the retailer responding to the market investigation does not consider parallel importers as effective competitors.83

(215) Second, the Commission observes that while the tenders system in Denmark fosters competition, it is important to have a sufficient number of credible suppliers participating in such tenders in order to keep downward pressure on prices and to ensure product availability. The Transaction would reduce the number of suppliers who have achieved market shares above [10-20]% in the last years from three to two. Moreover, over the period between 2016 and 2018, only one additional supplier achieved market shares above [5-10]% and only in 2016.

(216) Moreover, wholesalers in Denmark indicated that they carry both the originator and generic versions, and try to offer as many generics as possible,84 evidencing as well

Orion, one of the largest pharmaceutical suppliers in Finland, obtained a marketing authorization for eletriptan in October 2018. Second, the Parties submit that the main reason for the limited generic uptake in this segment is Upjohn’s decision to price Relpax (eletriptan) within the price corridor applied under the Finnish generic substitution policy. Upjohn’s strategy to price within it generally limits the incentive for patients to switch to a generic. In Finland, pharmacies may dispense not just the lowest priced generic alternative for a prescribed medicinal product, but all products priced within the acceptable price range (referred to as the "price corridor"). In many instances where the originator prices within the price corridor, which is what Upjohn does for Relpax, patients tend to prefer the originator product and pharmacies tend to dispense it.

Commission’s assessment

(223) The market investigation conducted by the Commission does not validate the Notifying Parties' arguments.

(224) First, the combined market shares of the Parties are very high ([90-100]%). Although the increment is very limited, only one additional supplier (Orifarm) achieved sales of eletriptan in Finland in 2018.

(225) Orifarm is a parallel importer of Upjohn’s own eletriptan, Relpax, and does not offer a generic version of eletriptan. Therefore, the Transaction would remove from the market the only generic supplier of eletriptan in 2018. Even if Orion were to enter the market, as suggested by the Parties, the number of generic competitors would remain very limited.

(226) Second, despite the decision of some suppliers to price their originator drugs within the price corridor, it is important to have generic suppliers to maintain price competition. The vast majority of competitors who responded to the market investigation indicated that generics exert a competitive constraint on originators in Finland.85 Removing the only generic eletriptan player would limit the competitive constraint exerted on Upjohn's Relpax, the only other molecule sold in Finland.

Conclusion

(227) In view of the above considerations and taking account of the results of the market investigation and all of the evidence available to it, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for eletriptan in Finland, in particular given the high combined market shares of the Parties and the limited number of suppliers.

market post-Transaction. Among those, both Novartis ([0-5]%) and Stada ([0-5]%) achieve market shares higher than Mylan.

(270) However, the Parties submitted remedies for Luxembourg for pregabalin and explained that, for the purpose of marketing pregabalin, [Information relating to the promotion and distribution of pregabalin in Luxembourg]. Therefore, to expedite the clearance of the Transaction, the Parties offered to divest Mylan’s pregabalin product in Belgium and Luxembourg to a suitable purchaser. 93

Commission’s assessment

(271) The combined market shares of the Parties are very high ([90-100]% in 2018), with an increment brought by Mylan of [0-5]% on top of Upjohn’s significant market share ([80-90]% in 2018). Moreover, only two competitors with market shares above the increment would remain in the market. No competitor achieves market shares above [5-10]%. These elements are indicative of a likely dominant position of Upjohn pre-Transaction that would be further strengthened by the Transaction.

(272) The market investigation did not provide enough elements to dispel the serious doubts arising from the fact that Upjohn likely has a dominant position pre- Transaction, which would be strengthened by the Transaction, and given that the merged entity would only face limited competition.

Conclusion

(273) In view of the above considerations and taking account of the results of the market investigation and all of the evidence available to it, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market due to its likely horizontal non-coordinated effects in the market for pregabalin in Belgium, in particular given the high combined market share and the limited number of significant suppliers.

(b) Pregabalin in Czechia

(274) Both Parties supply pregabalin (ATC3 class N3A) in Czechia. This molecule is genericized in Czechia since 2014. In this country, while Upjohn sells a branded version (Lyrica) of pregabalin, Mylan supplies an unbranded version of pregabalin.

Commission’s assessment

(279) The market investigation conducted by the Commission does not fully support the Notifying Parties' arguments.

(280) First, the combined market share of the Parties is high ([50-60]%) with a significant increment brought by Mylan ([5-10]%). Although, Upjohn has lost market shares over the last three years, it remains the clear market leader. The increment brought by Mylan would lead to market shares above [50-60]%.

(281) Second, while a large number of competitors are active in the market, only two competitors with a significant presence would remain in the market post- Transaction, namely Krka with a [10-20]% market share and Novartis with a [5- 10]% market share. All the other competitors would have markets shares below [5- 10]% and below the increment created by the Transaction.

(282) Regardless of the fact that the regulatory framework would constrain potential price increases, it cannot be excluded that the removal of one of the few significant competitors to Upjohn would lead to less frequent price decreases or less product availability.

(283) The market investigation did not provide any elements to dispel the serious doubts arising from the fact that the merged entity would have a strong position on the market post Transaction and only face limited competition.

Conclusion

(284) In view of the above, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for pregabalin in Czechia, in particular given the high combined market shares and the limited number of significant suppliers.

(c) Pregabalin in Greece

(285) Both Parties supply pregabalin (ATC3 class N3A) in Greece. This molecule is genericized in Greece since 2014. In this country, while Upjohn sells a branded version (Lyrica) of pregabalin, Mylan supplies an unbranded version of pregabalin.

Commission’s assessment

(290) First, the Commission notes that Mylan contributes a limited increment of [0-5]% for the supply of pregabalin in Greece. The Parties' combined market share therefore primarily reflects the market position of Upjohn.

(291) Second, a sufficient number of competitors would remain in the market post- Transaction. Six generic suppliers of pregabalin will remain active post-Transaction in addition to the Parties, four of which with market shares exceeding the increment contributed by Mylan, namely: Novartis ([0-5]%), Teva ([0-5]%), Medochemie ([0- 5]%) and Elpen ([0-5]%). Another two competitors offer the same molecule and two additional suppliers have entered in 2019. Therefore, a sufficient number of competitors remain in the market post-Transaction. This was confirmed by the market investigation. Indeed, wholesalers active in Greece unanimously indicated that they would have a sufficient number of suppliers for this molecule post-Transaction.96

(292) In addition, the presence of four suppliers with market shares larger than Mylan suggests that the Transaction will not alter significantly the structure of supply and will not lead to a negative impact in terms of product availability or frequency of price reductions. This was confirmed by the market investigation.97

(293) Respondents to the market investigation generally consider that the Transaction will not have a negative impact on the market for pregabalin in Greece.98

Conclusion

(294) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of pregabalin in Greece.

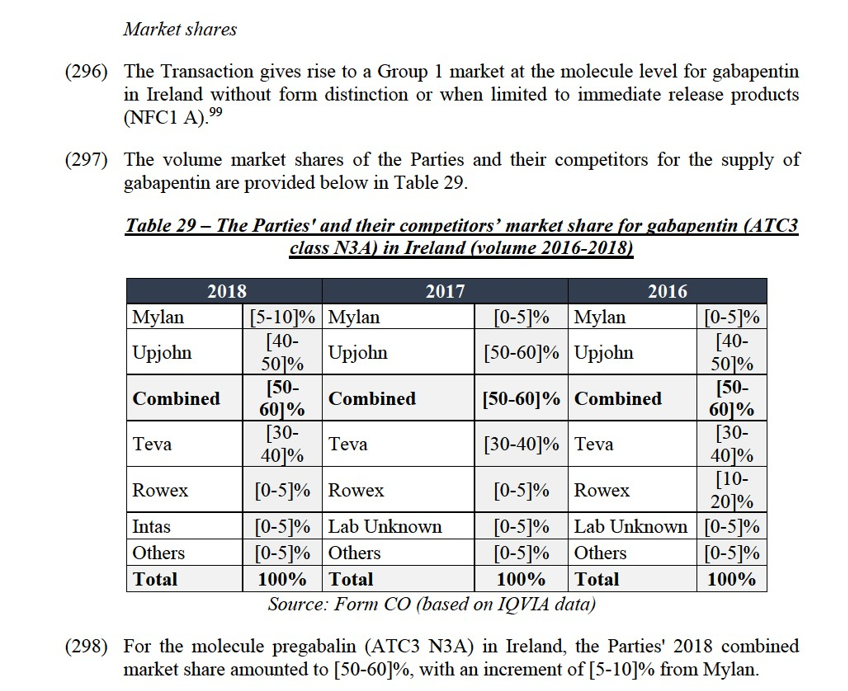

(d) Gabapentin in Ireland

(295) Both Parties supply gabapentin (ATC3 class N3A) in Ireland. This molecule is genericized in Ireland since 1999. In this country, while Upjohn sells a branded version (Neurontin) of gabapentin, Mylan supplies an unbranded version of gabapentin.

recently become substitutable at pharmacy level and that consequently Upjohn would face more competition from generic players, and that given the number of remaining suppliers the Transaction cannot have a negative impact on product availability. Finally, the Notifying Parties submit that the merged entity will be constrained in its pricing behaviour by the regulatory framework in Ireland.

Commission’s assessment

(301) The market investigation conducted by the Commission does not fully support the Notifying Parties' arguments.

(302) First, the combined market share of the Parties is high ([50-60]%) with a material increment brought by Mylan ([5-10]%). The increment brought by Mylan would lead to market shares above [50-60]%. Market shares for the first two months of 2020 are still not sufficiently meaningful, as the period of two months is too short to be indicative of the market position of the Parties. In any event, market shares do not change significantly ([40-50]% combined for the first two months of 2020) and there is only one competitor with a market share above [5-10]% or the increment, namely Teva.

(303) Second, while four competitors are active in the market, only one competitor with a significant presence would remain in the market post-Transaction, namely Teva with a [30-40]% market share. All the other competitors would have markets shares below [5-10]% and below the increment created by the Transaction.

(304) Third, as recognized by the Notifying Parties and confirmed by the market investigation,100 gabapentin is substitutable at pharmacy level. This increases competition between the originator and generics. Mylan is the second largest generic supplier of gabapentin in Ireland and thus it is well positioned to compete closely with Upjohn to gain market shares.

(305) Fourth, respondents to the market investigation indicate that the Transaction would likely have a negative impact, in particular on product availability.101

Conclusion

(306) In view of the above, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for gabapentin in Ireland, in particular given the high combined market shares of the Parties and the limited number of significant suppliers.

Notifying Parties' view

(311) The Parties submit that the Transaction does not give rise to competition concerns regarding the supply of pregabalin in Italy because (i) a sufficient number of suppliers (namely 16) will remain in the market post-Transaction, (ii) Upjohn lost significant market share since generic entry in 2015 (-[30-40]% in volume) and (iii) the merged entity will post-Transaction be constrained in its pricing behaviour by the regulatory framework.

Commission’s assessment

(312) First, a sufficient number of competitors remain in the market post-Transaction. 16 generic suppliers of pregabalin will remain active post-Transaction, three of which have market shares exceeding the increment contributed by Mylan and above [5- 10]%, namely: Teva ([10-20]%), Doc Generici ([5-10]%) and Novartis ([5-10]%). Importantly, these three suppliers also have a significant presence in in Italy in the generic space. Another 13 competitors offer the same molecule. Therefore, a sufficient number of competitors remain in the market post-Transaction which will be able to exert a meaningful competitive constraint for the supply of pregabalin in Italy. This was confirmed by the market investigation. Indeed, Italian-based wholesalers indicated unanimously that they would have a sufficient number of suppliers post-Transaction for this molecule.102

(313) In addition, the presence of three suppliers with market shares larger than Mylan suggests that the Transaction will not alter significantly the structure of supply and will not lead to a negative impact in terms of product availability or frequency of price reductions. This was confirmed by the market investigation. Respondents to the market investigation unanimously confirmed that the Transaction would not have a negative impact on the market for pregabalin in Italy, either on prices or on product availability.103

(314) Second, Upjohn has lost market shares very rapidly in the last years ([20-30] percentage points between 2016 and 2018), since the loss of exclusivity for pregabalin in Italy in 2014, while the market shares of Mylan have grown modestly ([0-5] percentage points between 2016 and 2018). Other suppliers such as Teva or Novartis have gained market shares faster than Mylan. Suppliers such as Stada or Ecupharma have also gained market shares in the last three years. This suggests that other suppliers compete more closely with Upjohn than Mylan and exert a competitive pressure on Upjohn.

(333) The market investigation indicated that parallel importers sell branded products and do not price at generic level.106 Wholesalers also indicated that parallel importers are less reliable suppliers.107 Therefore, they do not exert a strong competition constraint on originator products.

(334) Third, the Commission was not able to verify the entry plans of other suppliers before 2023 in the pregabalin market in Norway.108 The Transaction would eliminate Mylan as the only potential competitor for a generic product in Norway.

(335) Finally, the Commission does not find that it is appropriate to consider as the most likely counterfactual scenario a lack of entry by Mylan in the market. [information about Mylan’s commercialization of pregabalin in Norway].

Conclusion

(336) In view of the above, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for pregabalin in Norway given the removal of the only potential generic competitor.

5.3.4.3. Antipsychotics (ATC3 class N5A)

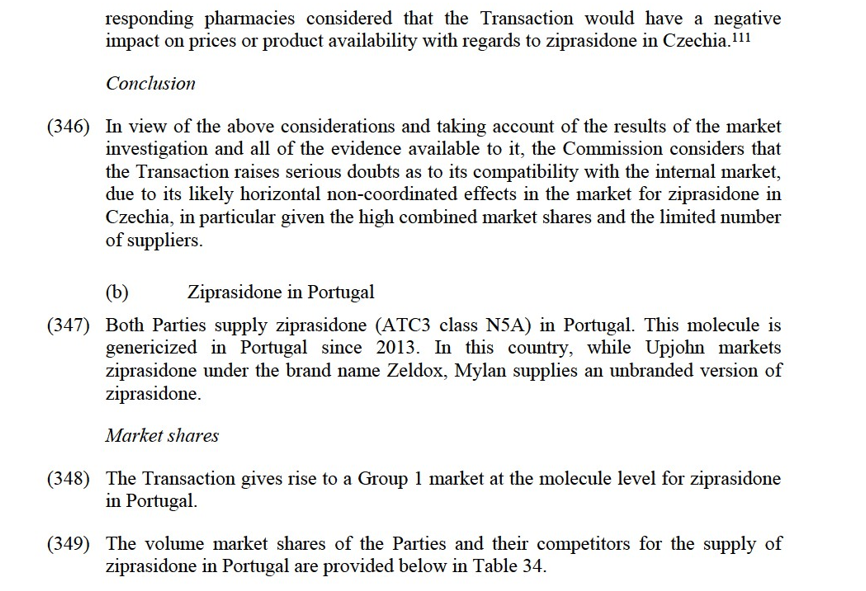

(337) In the EEA, both Parties market ziprasidone, a molecule indicated for the treatment of mental disorders including schizophrenia and mania. The Transaction gives rise to the following Group 1(+)/2 affected markets (which do not fall within one of the two categories referred to in paragraph (33)) for ziprasidone.

(a) Ziprasidone in Czechia

(338) Both Parties supply ziprasidone (ATC3 class N5A) in Czechia. This molecule is genericized in Czechia since 2013. In this country, while Upjohn markets ziprasidone under the brand name Zeldox, Mylan supplies an unbranded version of ziprasidone.

Market shares

(339) The Transaction gives rise to a Group 1 market at the molecule level for ziprasidone in Czechia.109

(350) For the molecule ziprasidone (ATC3 class N5A) in Portugal, the Parties' combined market share amounted to [40-50]% in 2018, with an increment of [10-20]% from Upjohn.

Notifying Parties' view

(351) The Parties submit that competition concerns can be excluded for the supply of ziprasidone (ATC3 class N5A) in Portugal, in particular due to the actual and potential competitors on the market (including holders of dormant market authorisations), the lack of closeness of competition between the Parties, and constraints due to the applicable regulatory framework which would limit the possibility to increase prices.

Commission’s assessment

(352) The combined market shares of the Parties would remain below [40-50]% post- Transaction. The increment is brought about by Upjohn, evidencing the largely genericized nature of the ziprasidone market in Portugal.

(353) Post-Transaction, at least two other significant generic players will remain on the market, namely Stada and Aurobindo, with market shares of [20-30]% and [20-30]% respectively. In addition, the responding Portuguese national health authorities indicate that entry in the market is easy, and in particular, that generic companies holding dormant marketing authorisations are credible entrants which could enter within a short period.112

(354) The market investigation also indicates that, in Portugal, generics compete with originators primarily on prices. However, the market investigation also indicates that Mylan is perceived as not being a particularly price-aggressive player by some pharmacies and wholesalers. Respondents note in particular [Information relating to the commercialization of ziprasidone in Portugal].113

(355) In addition, virtually all responding wholesalers indicated that a sufficient number of suppliers of ziprasidone would remain on the market post Transaction.114

(356) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the ziprasidone market in Portugal.

(361) For the molecule ziprasidone (ATC3 class N5A) in Spain, the Parties' combined market share amounted to [80-90]% in 2018, with an increment of [0-5]% from Mylan.

Notifying Parties’ view

(362) The Parties submit that competition concerns can be excluded for the supply of ziprasidone (ATC3 class N5A) in Spain, in particular due to the limited increment brought about by Mylan, the number of competitors remaining on the market, the lack of closeness of competition between the Parties, and constraints due to the applicable regulatory framework, which would limit the possibility to increase prices.

Commission’s assessment

(363) The Commission notes that the increment brought about by Mylan (less than [0-5]%) is particularly limited. The merged entity’s significant market share thus mainly reflects Upjohn’s position and is largely not merger-specific.

(364) Importantly, substitutability between originators and generics for ziprasidone may be limited in Spain. In the area of anti-psychotics, such as ziprasidone, doctors would normally not switch a patient’s prescription when one specific product is found to be effective, as switching can be counterproductive or even lead to side effects. Responding Spanish pharmacies confirmed that for antipsychotics, pharmacies would not switch a patient’s prescription from a branded product to a generic, while they generally have the ability to do convert prescription towards generics under the applicable rules.116 This situation may explain the relative stability of Upjohn’s market share over the years.

(365) In addition, responding pharmacies and wholesalers do not consider Mylan’s ziprasidone as a must-have product, i.e. a product that they need to have in stock to meet patients' demand, in Spain.117

(366) Competitors to the Parties, with a more significant footprint than Mylan will remain on the market post-Transaction. At least three players, including large generic companies such as Krka (with a [5-10]% market share) and Stada ([0-5]%), as well as Infarco ([0-5]%), which have a market share exceeding the increment ([0-5]%), will remain active on the market.

(367) Furthermore, virtually all responding wholesalers also indicated that a sufficient number of suppliers of ziprasidone would remain on the market post Transaction.118

(368) Finally, the results of the market investigation did not reveal any substantiated concerns as regards the impact of the Transaction in the ziprasidone market in Spain.

Conclusion

(369) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of ziprasidone in Spain.

5.3.4.4.Tranquilisers (ATC3 class N5C)

(370) In the EEA, both Parties market alprazolam, a molecule indicated for the treatment of anxiety, panic disorders, alcohol withdrawal syndrome, depression, and anxiety.

(371) Alprazolam belongs to the category of benzodiazepines, which are molecules affecting a key neurotransmitter, effectively slowing nerve impulses throughout the body. While Mylan markets other benzodiazepines (including for instance oxazepam, lorazepam, bromazepam, hydroxyzine and buspirone), Upjohn only markets alprazolam.

(372) The Transaction gives rise to the following Group 1(+)/2 markets (which do not fall within one of the two categories referred to in paragraph (34)) for alprazolam.119

(a) Alprazolam in Greece

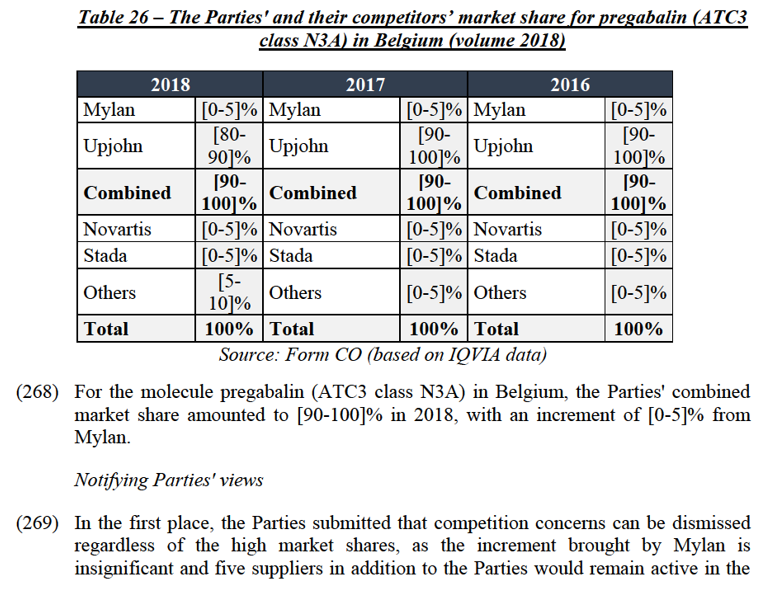

(373) Both Parties supply alprazolam (ATC3 class N5C) in Greece. This molecule is genericized in Greece for at least 20 years. In this country, while Upjohn markets alprazolam under the brand name Xanax, Mylan supplies an unbranded version of alprazolam.

Market shares

(374) The Transaction gives rise to a Group 2 market at the molecule level for alprazolam in Greece.

(381) First, Upjohn’s Xanax is by far the primary alprazolam product sold in Greece, and only faces limited competition to date. Most respondents, including virtually all responding pharmacies/hospitals and a majority of wholesalers consider Upjohn’s products including Xanax as a must-have.120 In addition, […].

(382) Competition from all third parties, including Mylan, is important to guarantee supply of alprazolam to Greek patients and hospitals. Pfizer suffered out of stock situations for alprazolam in Greece over the last three years.121 In addition, supply is further limited due to parallel exports from Greece.122 As a result, product availability from smaller players, including Mylan, is likely to be particularly critical for patients and health systems.

(383) Only one player, namely Adelco, would remain active in the market post- Transaction with a market share of [0-5]%. Adelco and Mylan hold a similar market share for the supply of alprazolam in Greece. Contrary to Mylan, Adelco is not among the top 10 generic players in Greece. Adelco thus presumably exerts a similar or lesser level of competitive constraint on Upjohn pre-Transaction than Mylan.

(384) Regardless of any price increase, the removal of one of only two competitors to Upjohn’s Xanax could potentially lead to less frequent price decreases or less product availability.

(385) A majority of responding customers expect a negative impact of the Transaction on prices and/or product availability, in relation to the supply of alprazolam in Greece.123 One customer notes for instance that “"Xanax of Pfizer & alprazolame (sic) of Mylan cover almost [90-100]% of patient needs”.124

(386) Lastly, documents provided by the Parties [[Information relating to Mylan’s commercial activities in Greece]. As a result, it is not clear that the correct counterfactual scenario, absent the Transaction, would be [[Information relating to Mylan’s commercial activities in Greece].

Conclusion

(387) In view of the above considerations and taking account of the results of the market investigation and all of the evidence available to it, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for alprazolam in

Commission’s assessment

(393) The Parties’ combined market shares are very high, exceeding [80-90]%, with a significant increment, approaching [20-30]%, from Upjohn, on top of Mylan’s significant market share ([50-60]% in 2018) These elements are indicative of a likely dominant position of Mylan pre-Transaction, which would be further strengthened by the Transaction.

(394) On such market, the Parties only face one competitor, namely Krka. As a result, the Transaction essentially amounts to a reduction in the number of players active on the market from three to two.

(395) Furthermore, when looking only at oral solid immediate release alprazolam products (NFC1 class A) in Iceland, the situation is even more problematic, as Mylan's market share would be [80-90]% and Upjohn's [10-20]%. On this market, the merger would essentially amount to a merger to monopoly.

(396) The market investigation did not provide any elements to dispel the serious doubts arising from the fact that Mylan likely has a dominant position pre-Transaction, which would be further strengthened by the Transaction, and given that the merged entity would only face limited competition post-Transaction.

Conclusion

(397) In view of the above considerations and taking account of the results of the market investigation and all of the evidence available to it, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for alprazolam in Iceland, in particular given the high combined market shares and the limited number of suppliers.

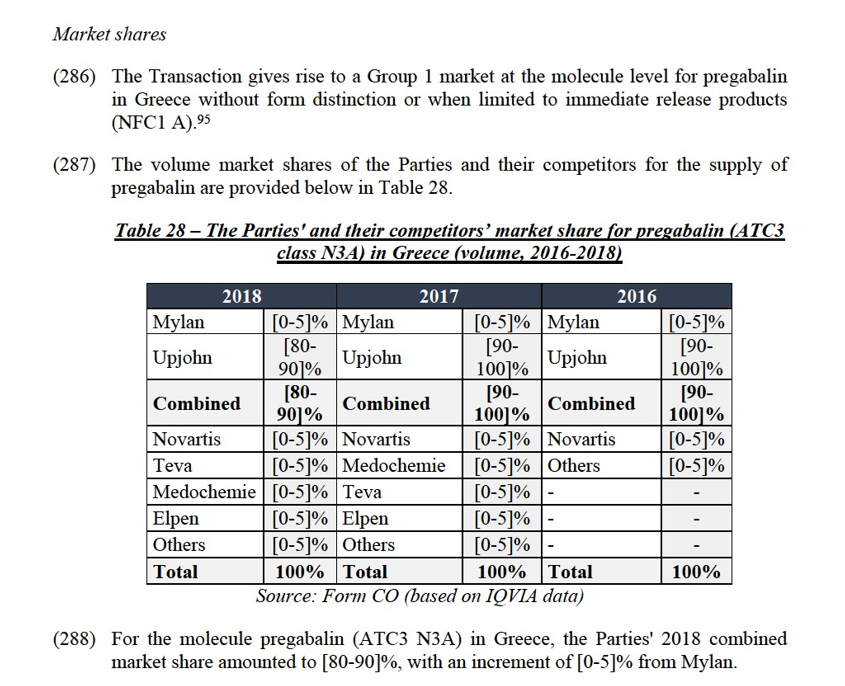

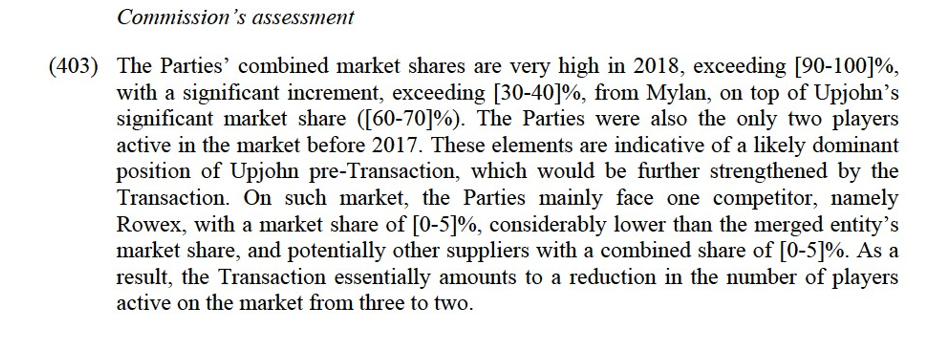

(c) Alprazolam in Ireland

(398) Both Parties supply alprazolam (ATC3 class N5C) in Ireland. This molecule is genericized in Ireland since at least 20 years. In this country, Upjohn markets alprazolam under the brand name Xanax, Mylan markets alprazolam under the brand name Gerax.

Market shares

(399) The Transaction gives rise to a Group 1 market at the molecule level for alprazolam in Ireland.

(404) The market investigation did not provide any elements to dispel the serious doubts arising from the fact that Upjohn likely has a dominant position pre-Transaction, which would be further strengthened by the Transaction, and given that the merged entity would only face limited competition post-Transaction. In fact, half of responding customers (pharmacies and wholesalers) considered that the Transaction would have a negative impact on prices or product availability with regards to alprazolam in Ireland.128

Conclusion

(405) In view of the above considerations and taking account of the results of the market investigation and all of the evidence available to it, the Commission concludes considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for alprazolam in Ireland, in particular given the high combined market shares and the limited number of significant suppliers.

(d) Alprazolam in Italy

(406) Both Parties supply alprazolam (ATC3 class N5C) in Italy. This molecule is genericized in Italy since at least 20 years. In this country, while Upjohn markets alprazolam under the brand name Xanax, Mylan supplies both an unbranded version of alprazolam and a branded version, under the brand name Frontal.

Market shares

(407) The Transaction gives rise to a Group 1 market at the molecule level for alprazolam in Italy.129

(408) The volume market shares of the Parties and their competitors for the supply of alprazolam in Italy are provided below in Table 39.

share ([60-70]%). These elements are indicative of a likely dominant position of Upjohn pre-Transaction, which would be further strengthened by the Transaction. In addition, the market investigation conducted by the Commission does not fully support the Notifying Parties’ arguments.

(413) First, the market investigation indicates that generic penetration remains quite low for alprazolam in Italy (below one third of the total market).130 This is confirmed by Upjohn’s consistently high market shares over the last three years, in spite of Xanax’s loss of exclusivity occurring over 20 years ago.

(414) A majority of responding Italian customers (pharmacies and wholesalers) consider that the price of generic products in Italy generally affects the price level of originators. For instance, prices of originators would likely decrease if all generic players reduced their prices by 5-10%.131 Respondents to the market investigation also took specifically the view that the price of generic alprazolam constrains the pricing of Upjohn’s Xanax.132

(415) Second, Mylan exerts a competitive constraint on Upjohn. The market investigation confirms that brand loyalty is very high in Italy and is a key parameter of competition in the supply of pharmaceutical products in Italy.133 However, as mentioned in paragraph [414], generic alprazolam exerts a competitive constraint on Xanax, in particular in terms of pricing. As a result, removing the largest provider of generic alprazolam is likely to strengthen Xanax’s already strong market position.

(416) Third, independently from any kind of product differentiation, Mylan can be set apart from other generic players on the alprazolam market in Italy. Mylan is the largest generic player in the alprazolam market, with a market share nearly three times as large as the second generic player, Stada, whose market shares does not exceed [5-10]%. One responding competitor even considers the Parties to be close competitors in Italy because they both have high market shares.134 The respondents to the market investigation indicate that companies with low market shares (that is to say below 5%) do not exert a strong competitive constraint on an originator.135 Combined, all other generic suppliers besides Stada have a market share lower than Mylan’s. As a result, Mylan is among one of the only two generic players able to exert an effective competitive constraint on Upjohn’s Xanax.

(417) In addition, part of Mylan’s sales (accounting for around [0-5]% of the sales in the Italian alprazolam market) result from the sale of its branded product Frontal, [Information concerning alprazolam in Italy].136 This product is priced at a premium, closer to Upjohn’s than Mylan’s unbranded generic alprazolam.

(418) Lastly, alprazolam is not a reimbursed product in Italy. It belongs to the so-called “class C” of pharmaceutical products. The pricing of class C products, such as alprazolam is set freely by the manufacturers, and can be increased every odd year, in line with anticipated inflation, under the monitoring of the Italian public health authorities. Information provided by the Notifying Parties shows that both Upjohn, Mylan, as well as other generic suppliers have used this possibility in 2017 and 2019.

(419) In addition to potential price increases, the Transaction could potentially lead to less frequent price reductions, as a result of the more limited competitive interactions between Xanax and generic alprazolam.

Conclusion

(420) In view of the above considerations and taking account of the results of the market investigation and all of the evidence available to it, the Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, due to its likely horizontal non-coordinated effects in the market for alprazolam in Italy, in particular given the high combined market shares and the limited number of significant suppliers.

(e) Alprazolam in Poland

(421) Both Parties supply alprazolam (ATC3 class N5C) in Poland. This molecule is genericized in Poland since at least 20 years. In this country, while Upjohn markets alprazolam under the brand name Xanax, Mylan supplies an unbranded version of alprazolam.

Market shares

(422) The Transaction gives rise to a Group 1 market at the molecule level for alprazolam in Poland.137

(427) Post-Transaction, the Parties will face competition from a number of established generic purchasers, with a significant market presence, including Orion (with a [10- 20]% market share), Servier ([10-20]%), Krka ([10-20]%), and Delfarma ([5-10]%), all with market shares exceeding [5-10]% and even exceeding [10-20]% for the former three.

(428) In addition, virtually all responding Polish wholesalers indicated that a sufficient number of suppliers of alprazolam would remain on the market post-Transaction.138

Conclusion

(429) In view of the above considerations, taking into account the market investigation and all the evidence available to it, the Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the supply of alprazolam in Poland.(f) Alprazolam in Portugal

(430) Both Parties supply alprazolam (ATC3 class N5C) in Portugal. This molecule is genericized in Portugal since at least 20 years. In this country, while Upjohn markets alprazolam under the brand name Xanax, Mylan supplies an unbranded version of alprazolam.

Market shares

(431) The Transaction gives rise to a Group 1 market at the molecule level for alprazolam in Portugal.139

(432) The volume market shares of the Parties and their competitors for the supply of alprazolam in Portugal are provided below in Table 41.

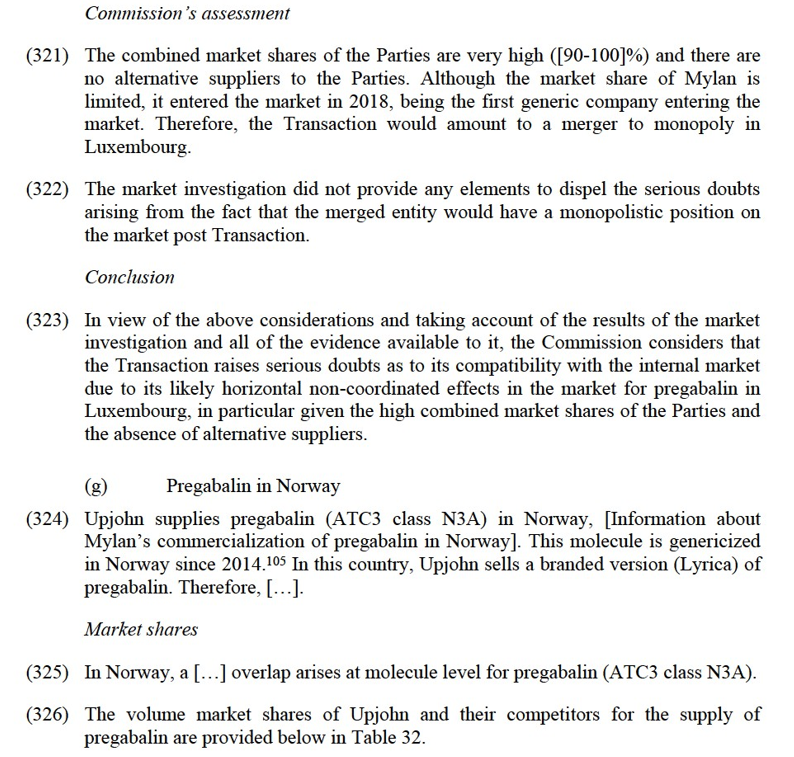

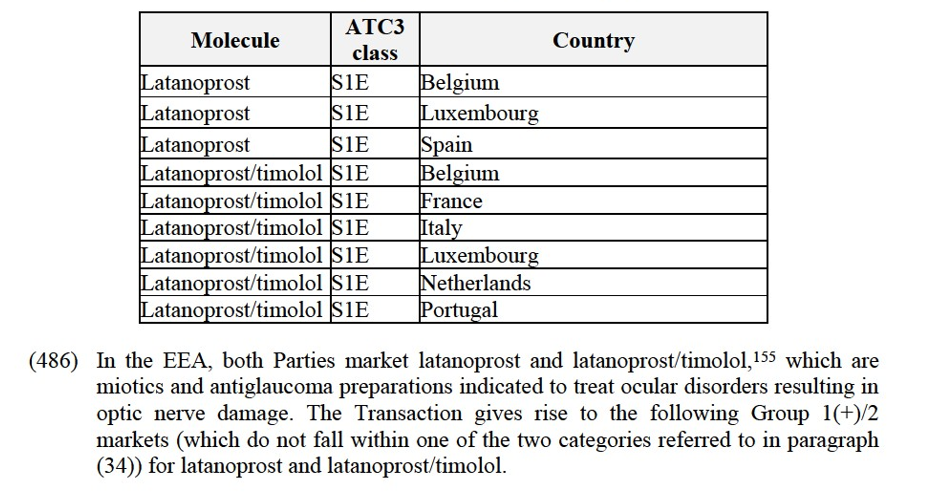

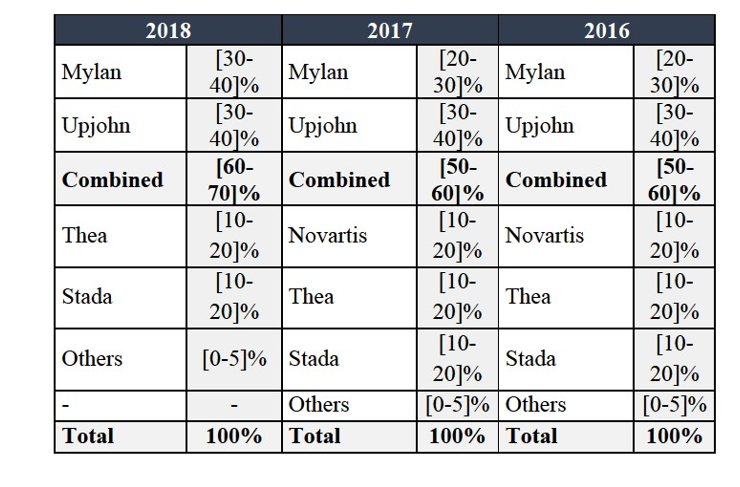

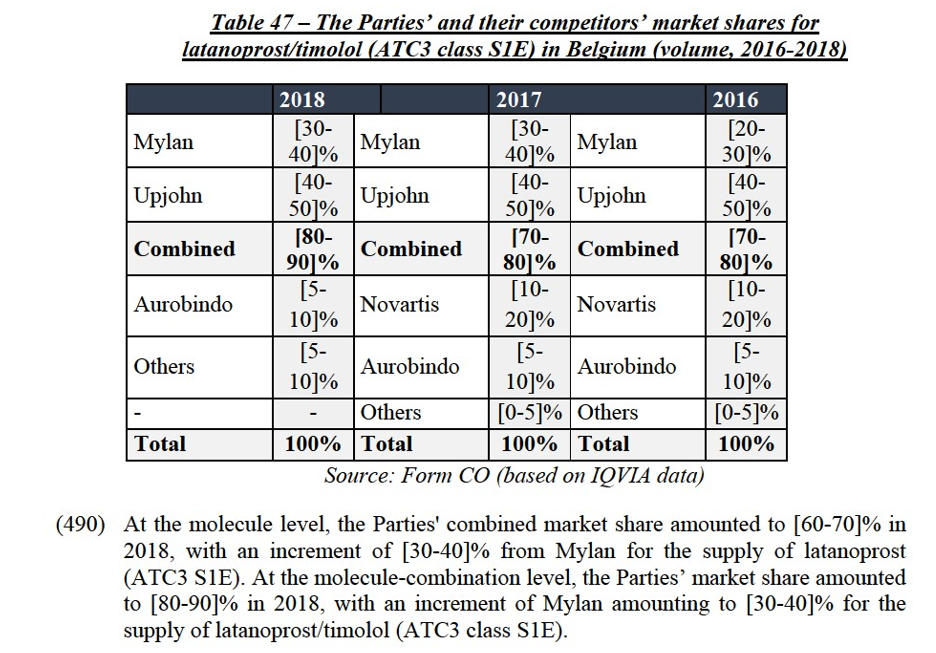

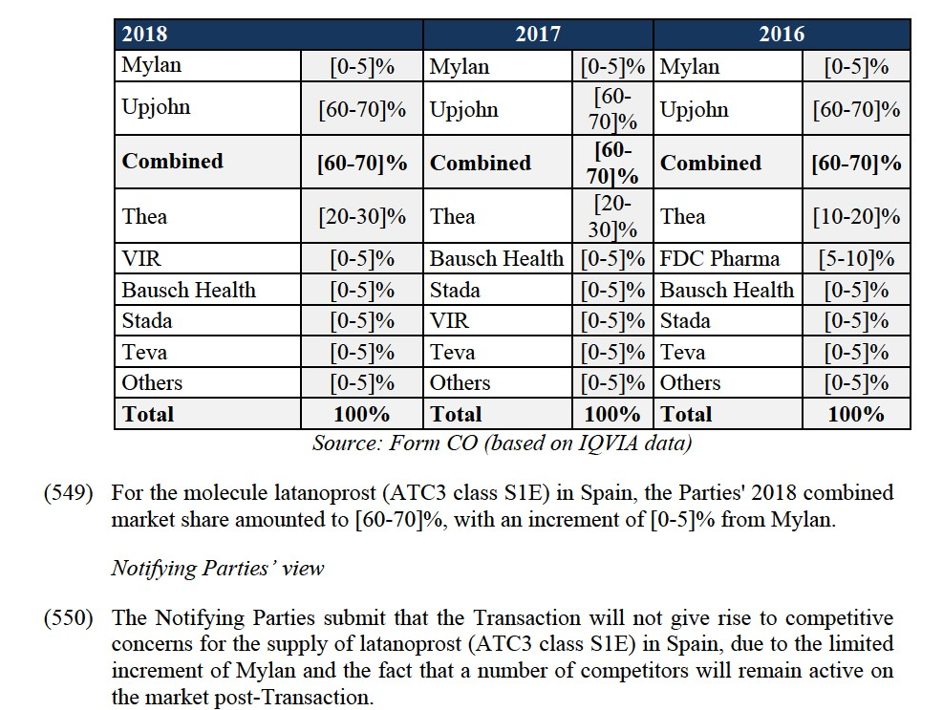

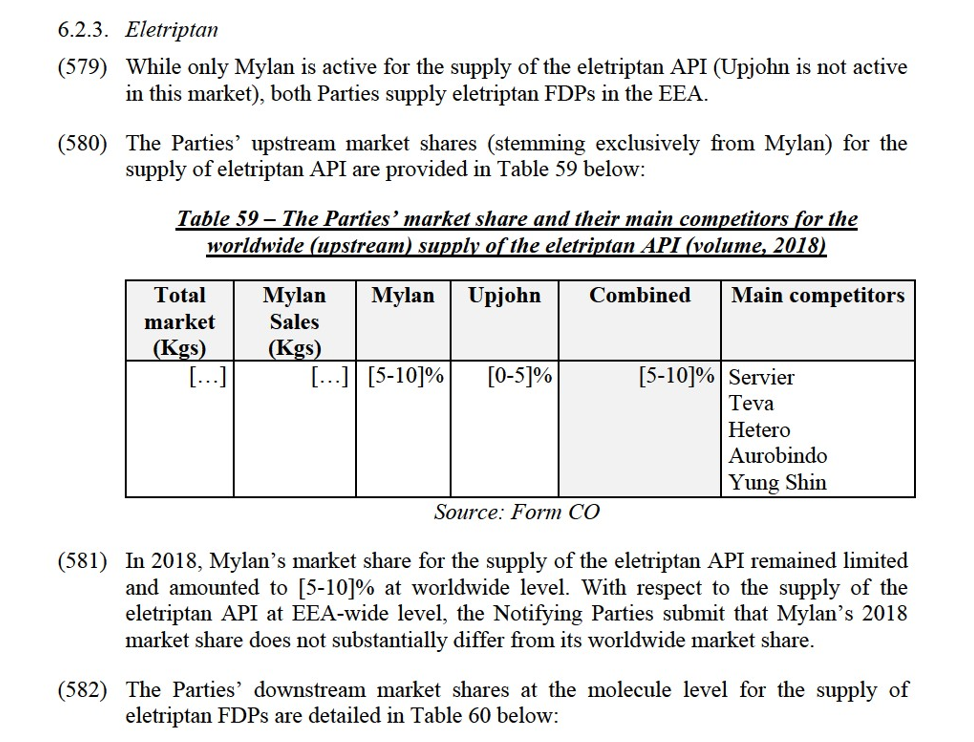

Commission’s assessment