Commission, February 19, 2021, No M.9945

EUROPEAN COMMISSION

Decision

SIEMENS HEALTHINEERS / VARIAN MEDICAL SYSTEMS

Subject: Case M.9945 – Siemens Healthineers / Varian Medical Systems Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 2 and Article 57 of the Agreement on the European Economic Area3

Dear Sir or Madam,

(1) On 23 December 2020, the Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation, by which Siemens AG (“Siemens”, Germany), through its subsidiary Siemens Healthineers AG (“Siemens Healthineers”, […]* Germany), intends to acquire within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of Varian Medical Systems, Inc. (“Varian”, USA).4 Siemens is referred […]** with Varian as the “Parties”.

1. THE PARTIES AND THE OPERATION

(2) Siemens is a technology group headquartered in Munich (Germany), which is active worldwide and focuses on various areas including medical technology and digital healthcare services. Its subsidiary, Siemens Healthineers provides healthcare solutions and services worldwide under three business segments: (i) Imaging; (ii) Laboratory Diagnostics; and (iii) Advanced Therapies.

(3) Varian is a public corporation headquartered in Palo Alto (USA) and listed on the New York Stock Exchange. Varian is a global provider of medical devices and software solutions for treating cancer and other medical conditions with radiotherapy and other advanced treatments.

(4) On 2 August 2020, the Parties entered into an Agreement and Plan of Merger pursuant to which Siemens will acquire 100% of the shares in Varian (the “Transaction”). Siemens will thus acquire sole control of the whole of Varian. The Transaction is therefore a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million5 (Siemens: EUR […]; Varian: EUR […]). Each of them has an EU-wide turnover in excess of EUR 250 million (Siemens: EUR […]; Varian: EUR […]), but none of the Parties achieved more than two-thirds of its aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

3. GENERAL INTRODUCTION

(6) Siemens and Varian are both active in the provision of medical solutions to healthcare providers. Although the Transaction does not give rise to horizontal overlaps, the following activities of the Parties are closely related:

· Siemens provides imaging solutions, which are primarily used to diagnose a wide variety of medical conditions but can also be used to support the planning and delivery of oncology treatments, such as radiotherapy planning. The relevant imaging solutions are the following: computed tomography (“CT”) scanners, magnetic resonance (“MRI”) scanners, positron emission tomography CT (“PET/CT”) scanners.

· Varian supplies radiotherapy solutions used to plan and deliver radiotherapy treatments, including linear accelerators (“Linacs”), proton therapy equipment, brachytherapy equipment, motion management devices, as well as oncology software (such as oncology information system (“OIS”) and treatment planning software (“TPS”)).6

(7) Radiotherapy is an oncology treatment that uses radiation to extinguish cancer cells, shrink tumours and provide palliative treatment for cancer symptoms such as pain. The treatment algorithm for cancer patients receiving radiotherapy treatment involves a scanner to diagnose whether a tumour is cancerous. If so, the patient and the oncologist will discuss and decide the best treatment options, which may include radiotherapy. In such a case, a radiation oncologist will perform a radiotherapy simulation with a scanner (most often a CT scanner specifically equipped for radiotherapy, “CT simulator”). The simulation images are used to plan the radiotherapy, in particular (i) to contour the tumour and organs at risk (in order to ensure that the radiation beam hits the tumour without harming the surrounding healthy tissues); and (ii) to calculate the relevant radiation dose. On this basis, the TPS constructs a treatment plan to be executed by the radiotherapy equipment (most often Linacs). The above images/data are transferred to the OIS, which ensures the workflow between the various equipment and solutions needed for radiotherapy simulation, planning and delivery.

(8) It follows that Siemens’ imaging solutions (used for radiotherapy simulation) and Varian’s radiotherapy solutions are part of an integrated ecosystem and, thus, closely related, giving rise to conglomerate links.7

4. MARKET DEFINITION

4.1. Product Market Definitions

4.1.1. Imaging Solutions

(9) Imaging equipment is employed to create visual representations of the interior of the human body, which can be used for a variety of diagnostic and treatment purposes across multiple medical disciplines (including notably radiotherapy).8 Siemens supplies imaging equipment based on different technologies, including in particular:

- CT scanners. CT is a non-invasive procedure that uses X-rays to create detailed pictures, or scans, of areas inside the body;

- MRI scanners. MRI is a non-invasive procedure that uses a magnetic field and computer-generated radio waves to create images of areas inside the body. MRI does not use X-rays and therefore does not produce ionizing radiation;

- PET/CT scanners. PET imaging uses radioactive substances to visualize and measure metabolic processes in the body. During a PET exam, a radioactive tracer is injected into the patient’s blood. PET/CT scanners combine PET and CT technology in one single unit equipment and acquire sequential images from both in the same session, which are combined into a single superimposed image.

(A) The Commission’s precedents

(10) In past decisions, the Commission concluded that a segmentation by imaging modality – i.e. CT, MRI and PET/CT in the present case – was appropriate, while it left open whether further segmentations within imaging modalities (e.g. by product range or by end-use) were necessary.9

(11) More specifically, in relation to CT-scanners, the Commission considered possible segmentations between (i) single-slice or multi-slice, and/or (ii) low, mid, and high- end, but left the market definition open in the absence of competition concerns.10

(12) Likewise, for MRI scanners, the Commission considered segmenting the market between (i) open MRI scanners, using non-cylindrical magnets and are open vertically or horizontally, and closed MRI scanners, using cylindrical magnets that surround the patient who is placed in a gantry,11 and/or (ii) low, mid, and high-end MRI scanners12 but ultimately left the market definition open.

(13) Furthermore, the Commission assessed but ultimately left open whether nuclear imaging equipment should be further segmented according to type, in Gamma Cameras and PET scanners.13

(B) The Notifying Party’s view Segmentation by imaging modality

(14) In line with the Commission’s decisional practice, the Notifying Party submits that CT scanners, MRI scanners and PET/CT scanners (together referred as “Scanners”) constitute distinct product markets. As detailed below, it also argues that these markets should not be further segmented.

Segmentation by end-use

(15) As regards a potential segmentation by end-use, the Notifying Party argues that it is not relevant to define markets limited to CT scanners, MRI scanner and PET/CT scanners used for radiotherapy simulation (i.e. so-called “CT simulators”, “MRI simulators” and “PET/CT simulators”, together referred as “Simulators”). In particular, the Notifying Party claims that, from a demand-side perspective, Scanners and Simulators are fully substitutable and equally capable of performing radiotherapy simulation. According to the Notifying Party, Simulators are standard Scanners with certain characteristics and additional features, which for the most part are not intrinsic to the Scanner itself and which customers can procure separately from the Scanner equipment (including from third-party suppliers). Moreover, the Notifying Party argues that [commercial strategy]. From the supply-side perspective, the Notifying Party submits that (i) all suppliers of imaging equipment offer a broad portfolio of Scanners for all clinical uses, including radiotherapy; and (ii) Simulators are [information on Simulators’ manufacturing process] and do not require significant additional manufacturing steps or specific know-how.14

Other possible segmentations

(16) The Notifying Party also contests the relevance of the other potential segmentations envisaged by the Commission in the past, arguing that (i) all Scanners can be used for all or most clinical applications regardless of whether there are low-, mid-, or high-end; (ii) in the case of CT scanners, the distinction between single- or multi- slice is no longer appropriate, since the former are no longer considered “state of the art” and that all CT scanners sold today are multi-slice; and (iii) in the case of MRI scanners, the distinction between open and closed is not appropriate as it does not impact the end-use application of the Scanner per se.15

(C) The Commission’s assessment Segmentation by imaging modality

(17) The results of the market investigation confirmed that CT scanners, MRI scanners and PET/CT scanners constitute distinct product markets. Customers and competitors generally consider that different Scanners cannot be used interchangeably for the same medical procedure,16 revealing limited demand-side substitutability. For instance, a competitor stressed the fact that CT scanners, MRI scanners and PET/CT scanners are “used for different medical purposes”, rely on a “different technology” and have “different price”,17 while a customer indicated that “the different scanners have different intended use and technical feature.”18 The above conclusion is also corroborated by the market data provided by the Notifying Party, which show that market conditions for CT, MRI and PET/CT scanners are not homogeneous, each type of Scanners being characterised by (i) different prices19 and (ii) different competitive landscape.20

Segmentation by end-use

(18) As regards the existence of a potential segment for imaging equipment used for radiotherapy simulation, the market investigation provided mixed results.

(19) First, contrary to the Notifying Party’s claims, the market investigation provided indications that a distinction between Scanners and Simulators could be appropriate due to limited demand-side substitutability. Indeed, the vast majority of respondents consider that, for radiotherapy simulation, the use of Simulators is more efficient and convenient than the use of standard Scanners, explaining that Simulators are “optimized for radiotherapy planning”.21 In particular, respondents stressed that the size of the bore, which is an intrinsic feature of the Simulator itself that cannot be procured separately is critical in radiotherapy simulation: “in extremis the CT scanners can be used for radiotherapy planning, however the difference in bore size restricts the procedure considerably”.22 That said, several market participants also indicated that Scanners could be used for radiotherapy simulation, provided that additional features or “extra options” are installed on them.23

(20) Second, most respondents to the market investigation indicated that the supply conditions for Scanners and Simulators are not the same, stressing in particular a difference in terms of pricing.24 This is also corroborated by the EEA/UK market share estimates provided by the Notifying Party, which vary significantly for the supply of CT scanners and CT simulators.25 In particular, Siemens’ market share in CT simulators in the EEA/UK, over the 2017-2019 period, is more than [20-30] percentage points higher than its market share for the supply of CT scanners ([60- 70]% vs. [40-50]%). Moreover, the feedback received from the market investigation revealed that the number of credible and competitive suppliers is more limited for CT simulators than for CT scanners. Indeed, market participants generally consider that Canon is not competitive for the supply of CT simulators, whereas it is perceived as a competitive player for the supply of CT scanners.26 That being said, the vast majority of competitors also indicated that all companies manufacturing standard CT scanners have the capabilities to manufacture CT simulators.27

(21) Third, the Commission notes that Siemens’ internal documents support the existence of distinct market segments for Simulators.28 In particular, these documents illustrate that [commercial strategy])29.

(22) In any event, for the purpose of this Decision, the question of whether CT simulators, MRI simulators and PET/CT simulators constitute distinct market segments can be left open, as it has no impact on the Commission’s competitive assessment of the Transaction.

Other possible segmentations

(23) As regards other possible segmentations, the Commission notes that the elements in the file show that the markets for CT scanners, MRI scanners and PET/CT scanners are differentiated markets, where low- and high-end Scanners may not be fully substitutable. However, the results of the market investigation did not provide indications that a segmentation between low-, mid-, and high-end Scanners, as well as the other alternative segmentations envisaged in the past decisional practice (see Section 4.1.1(A) above) would be relevant in the present case.

(D) Conclusion

(24) Based on the results of the market investigation, for the purpose of this Decision, the Commission concludes that (i) CT scanners, MRI scanners and PET/CT scanners constitute distinct product markets and that (ii) it can be left open whether the above products markets should further segmented according to their end-use, as these alternative market delineations do not affect the Commission’s conclusion regarding the compatibility of the Transaction with the internal market.

4.1.2. Radiotherapy solutions

4.1.2.1. Radiotherapy equipment

(25) Radiotherapy uses radiation to kill cancer cells, shrink tumours and provide palliative treatment for cancer symptoms such as pain. Radiotherapy is one of the main therapies for treating cancer. It is used alone or in combination with other cancer therapies such as surgery, chemotherapy, immunotherapy or interventional oncology.

(A) The Commission’s precedents

(26) The Commission has not previously examined the markets for radiotherapy equipment.

(B) The Notifying Party’s view

(27) In the absence of Commission precedents, the Notifying Party submits that there are four types of equipment used to deliver radiotherapy treatment, based on the position and radiation source, which each constitute separate product markets:30

(i) External beam radiotherapy (“EBRT”), which involves radiation being directed at the tumour from outside the body. EBRT can be delivered with:

· Linear accelerators (“Linacs”), which use high energy X-rays (photons) to destroy the cancerous cells. Linacs are the most common form of radiotherapy and are used to treat most types of cancer; and

· Proton therapy, which uses protons instead of X-rays to destroy cancerous cells and it is used when there are great risks associated with damage to healthy tissue (e.g. in paediatric cancers) as it allows the delivery of radiation in a more targeted way with fewer side-effects. Proton therapy involves significant capital investments and its operation requires dedicated facilities (there are only around 20 proton therapy centres in Europe);

(ii) Brachytherapy, which uses a radiation source located inside the body and is, thus, unlike ERBT, an invasive treatment procedure. Brachytherapy is mainly used to treat certain types of cancer (e.g. cervical, breast, skin); and

(iii) Systemic radioisotope therapy, which involves radioactive materials administered by infusion or orally. Since Varian is not active in systemic radiation therapy, this Decision will not discuss this radiotherapy equipment further.

(28) The Notifying Party claims that a further segmentation is not warranted as within each type of radiotherapy equipment, the various models are merely the result of technological and scientific advancements.31

(C) The Commission’s assessment

(29) The results of the market investigation and the evidence available in the Commission’s file support the Notifying Party’s arguments.

(30) First, respondents to the market investigation confirmed that (i) Linacs, (ii) proton therapy equipment and (iii) brachytherapy equipment cannot be used interchangeably for the same medical procedures, revealing limited demand-side substitutability.32 In that respect, a customer explained that, “each type of treatment (external [EBRT], proton [therapy], brachy[therapy]) requires suitable equipment which cannot be interchangeable”,33 whilst another indicated that the use of the various equipment differs “because of their special inherent physics in dose application and their natural behaviour in human tissue (dose distribution)”.34 Some respondents however indicated that Linacs and proton therapy share some applications (as both equipment are considered EBRT techniques) whereas proton therapy uses newer technology and is significantly more expensive.35

(31) Second, the market data provided by the Parties show that market conditions for Linacs, proton therapy and brachytherapy are not homogeneous, each type of radiotherapy equipment being characterised by (i) different prices36 and (ii) different competitive landscape.37

(32) Third, the Commission notes that Siemens’ internal documents,38 as well as independent industry reports39 support the existence of distinct markets for each type of radiotherapy equipment.

(33) Finally, the results of the market investigation did not provide any indication that a further segmentation of the Linacs, proton therapy and brachytherapy was warranted.

(D) Conclusion

(34) Based on the above, the Commission considers that, for the purpose of this Decision, Linacs, brachytherapy and proton therapy constitute separate product markets, without the need for a further segmentation.

4.1.2.2. Oncology Software

(35) In the field of radiotherapy, Varian offers two main types of oncology software,40 including:

- Treatment planning software (“TPS”), which allows physicians to plan how the radiotherapy equipment will be used to deliver the treatment;

- Oncology information software (“OIS”), which is a software solution providing a single portal to facilitate management of the profile and treatment of cancer patients. It integrates information about a patient’s diagnosis and therapy from the range of healthcare professionals and equipment involved in the patient’s oncology treatment.

(A) The Commission’s precedents

(36) There is no Commission precedent analysing the markets for oncology software. However, in previous cases assessing software solutions, the Commission considered that software can be segmented based on (i) their functionality, (ii) the sector concerned, and (iii) their end-use.41 With respect to healthcare software more specifically, the Commission also considered a potential segmentation by module (i.e Hospital Information System or “HIS”, Electronic Medical Record or “EMR”, etc.), leaving the exact product market definition open.42

(B) The Notifying Party’s view TPS

(37) The Notifying Party, referring to precedents at national level,43 submits that TPS for EBRT constitute a distinct product market which should not be further segmented between Linacs and proton therapy as EBRT TPS is designed for external radiation delivery, irrespective of whether that is proton based (i.e. proton therapy) or X-ray based (i.e. Linacs). In that respect, the Notifying Party notes that Varian offers the same software platform for both Linacs and proton therapy.44 The Notifying Party also claims that brachytherapy equipment and TPS for brachytherapy are part of the same market on the basis that Varian does not sell TPS for brachytherapy as a stand- alone product.45 Ultimately, the Notifying Party considers that the product market definition can be left open.

OIS

(38) The Notifying Party submits that OIS has specific features that are not necessarily the same as the ones in other healthcare software. However, it also considers that OIS present complementary features to EMR or HIS and that suppliers of EMR and HIS could easily enter the OIS market with limited investment in capital and time. Due to this supply-side substitutability, the Notifying Party concludes that HIS, EMR and OIS should be viewed as being part of the same market.46

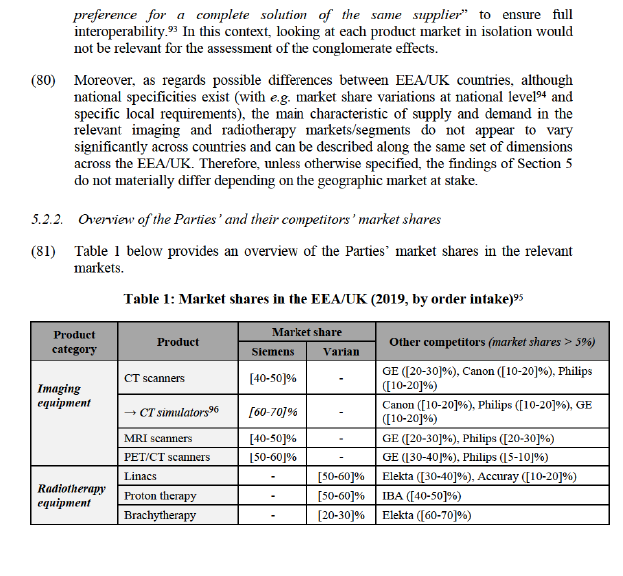

(C) The Commission’s assessment TPS

(39) The results of the market investigation confirmed the Notifying Party’s claim that TPS constitute a distinct product market from other healthcare software.47 Indeed, a majority of respondents indicated that, while TPS share some functionalities with other software solutions (e.g. contouring), TPS is not substitutable with other software solutions as it presents a specific set of functionalities that remain its sole remit, such as dose calculation for the planning of radiotherapy.48

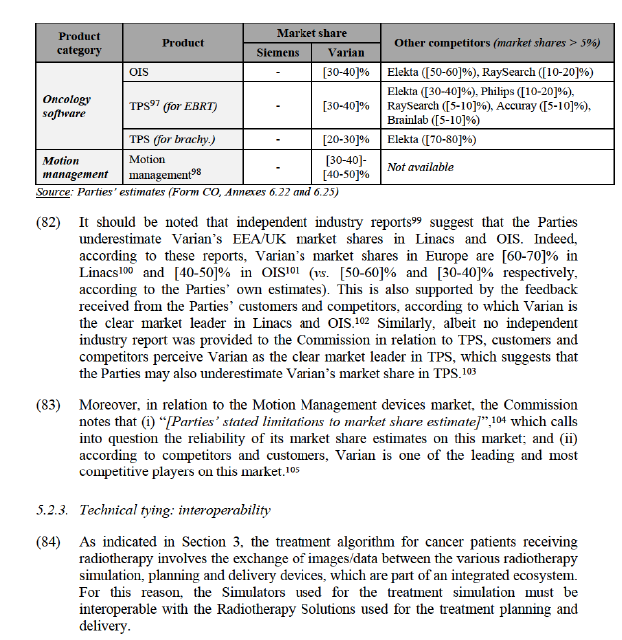

(40) The market investigation also provided indications that TPS for EBRT and TPS for brachytherapy constitute separate product markets, as the supply conditions for these two software are different.49 In that respect, one customer indicated that “some suppliers are more focused on brachytherapy and others on EBRT” while another one added that “complexity, pricing [and] suppliers are different”.50 This is also corroborated by the market share data provided by the Parties, which reveal that in the EEA/UK the competitive landscape in TPS for brachytherapy is characterised by a quasi-duopoly between Elekta and Varian, which is not the case in TPS for EBRT (see Table 1 below). However, the results of the market investigation do not allow the Commission to determine whether TPS for brachytherapy should be part of the overall product market for brachytherapy equipment.

(41) Based on the above considerations, the Commission concludes that, for the purpose of this Decision (i) TPS constitute a separate product market, and that (ii) it can be left open whether the market for TPS should be further segmented between TPS for brachytherapy and TPS for EBRT, as these alternative market delineations do not affect the Commission’s conclusion regarding the compatibility of the Transaction with the internal market.

OIS

(42) The results of the market investigation did not support the Notifying Party’s view and provided clear indications that OIS constitute a distinct market from other healthcare software.

(43) The vast majority of customers responding to the market investigation indicated that OIS cannot be replaced by other software solutions,51 “because of the complex radiotherapy workflow and specific functionality, integration with TPS and delivery systems, […] transferring the functionality of the OIS to the HIS is extremely difficult, certainly in a large hospital facility”.52 While customers who responded to the market investigation acknowledged that OIS share some features with other healthcare software such as HIS and EMT, they also confirmed that “OIS has crucial features that the HIS/EMR/PACS does NOT have”.53 Suppliers also confirmed the differing functionalities and purposes of these products and did not raise any suggestion that there is strong supply side substitutability between the products.54

(44) In addition, whilst the majority of customers who responded to the market investigation explained that they typically procure OIS together with other radiotherapy solutions,55 the results of the market investigation and evidence in the Commission’s file also show that the competitive dynamics for OIS differ from other radiotherapy solutions’. This is notably illustrated by the fact that the competitive landscape for the supply of OIS in the EEA/UK differ from the supply of other radiotherapy solutions, in terms notably of the identity of the suppliers56 and market share estimates.57

(45) Based on the above, the Commission considers that, for the purpose of this Decision, OIS constitute a distinct product market, with no need for further segmentation.

(D) Conclusion

(46) Based on the results of the market investigation, for the purpose of this Decision, the Commission concludes that (i) OIS and TPS constitute separate product markets and that (ii) it can be left open whether the market for TPS should be further segmented between TPS for brachytherapy and TPS for EBRT, as these alternative market delineations do not affect the Commission’s conclusion regarding the compatibility of the Transaction with the internal market.

4.1.2.3. Motion Management Devices

(47) Motion management devices track and manage a patient’s motion (e.g. respiration, movements) during the radiotherapy simulation and treatment (“Motion Management devices”). Motion Management devices are used either (i) with imaging equipment (such as CT simulators) while the image is acquired during radiotherapy simulation (“Imaging Motion Management devices”) or (ii) with radiotherapy equipment (such as Linacs) while the radiotherapy treatment is delivered (“Treatment Motion Management devices”). Motion Management devices have an interface, composed of a hardware and a software, whose intended purpose is to connect the former with the relevant imaging or radiotherapy equipment.

(48) During the radiotherapy simulation, the Imaging Motion Management device tracks the patient’s motion and breathing patterns. The obtained data are then used by the Treatment Motion Management device (combined with the radiotherapy equipment), so that those same motions and patterns can be accounted for during the delivery of the radiotherapy treatment to avoid distortions of the target volume and incorrect positional and volumetric information.58

(A) The Commission’s precedents

(49) The Commission has not previously examined the market for Motion Management devices.

(B) The Notifying Party’s view

(50) The Notifying Party did not expressly provide its view on the scope of the relevant product market for the production and supply of Motion Management devices. However, in the Form CO, Siemens (i) makes a distinction between Imaging and Treatment Motion Management devices59 and (ii) stresses that Imaging and Treatment Motion Management devices do not need to be purchased from the same supplier.60

(C) The Commission’s assessment

(51) The results of the Commission’s market investigation provide indications that Motion Management devices constitute a distinct product market. In particular, the investigation revealed that the main suppliers for Motion Management devices are not identical to the suppliers of other radiotherapy and imaging solutions.61 For instance, respondents to the market investigation identified that the main suppliers for motion management devices (apart from Varian and Elekta) are VisionRT, Brainlab, Anzai, Dyn’R and C-Rad (among others),62 none of which is a radiotherapy or medical imaging solutions supplier.

(52) However, the elements in the file do not allow the Commission to conclude whether the market should be further segmented between Imaging and Treatment Motion Management devices.

(D) Conclusion

(53) Based on the above considerations, the Commission concludes that, for the purpose of this Decision: (i) Motion Management devices constitute a separate product market, and that (ii) it can be left open whether the market should be further segmented between Imaging and Treatment Motion Management devices, as it does not affect the Commission’s conclusion regarding the compatibility of the Transaction with the internal market.

4.2. Geographic Market Definition

4.2.1. Imaging solutions, radiotherapy equipment and Motion Management devices

(A) The Commission’s precedents

(54) In previous cases, the Commission has assessed the relevant geographic markets for all types of imaging solutions both at an EEA/UK-wide and national level, while leaving the precise geographic scope open in the absence of competition concerns.63

(55) As explained above, the Commission has not examined in the past the geographic market definition in relation to either radiotherapy equipment or Motion Management devices. That said, in past decisions related to other types of medical devices, the Commission has generally considered that the markets for medical devices are national in scope, in particular in view of the national regulatory and reimbursement schemes.64

(B) The Notifying Party’s view

(56) The Notifying Party submits that the scope of the relevant geographic markets for imaging solutions and radiotherapy equipment should be at least EEA/UK-wide for the following reasons. First, suppliers are active globally, delivering their solutions worldwide and across the EEA/UK, bearing relatively low transportation costs compared to the value of the equipment.65 Second, to be marketed in the EEA/UK, imaging solutions, radiotherapy equipment and Motion Management devices must be certified to conform to the essential requirements of the EU Medical Devices Directive66 and must obtain a CE-mark.67 Third, Siemens argues that procurement rules are, to some extent, harmonized at EEA/UK level,68 which render the supply relatively homogenous across the EEA/UK.69 However, it also acknowledges the existence of national specificities, such as procurement procedures and reimbursement policies. The Notifying Party concludes that the precise geographic scope of the above product markets can be left open.70

(C) The Commission’s assessment

(57) The Commission’s market investigation provided mixed results as regards the geographic scope of the relevant markets for (i) imaging solutions (namely CT, MRI and PET/CT scanners), (ii) radiotherapy equipment (namely Linacs, brachytherapy equipment and proton therapy equipment) and (iii) Motion Management devices, and their potential sub-segments.

(58) On the demand-side, the investigation yielded mixed results. Customers and competitors confirmed that the procurement of the above products is to some extent harmonised at EEA/UK level with the application of the EU rules on public procurement,71 but also stressed the existence of local specificities at national level, in terms of public procurement procedures and practices, as well as reimbursement policies.72

(59) On the supply-side, the market investigation confirmed that the main suppliers are active across the EEA/UK and more generally at global level.73 This is illustrated by the fact that, regardless of their location, customers identified suppliers active worldwide as the largest credible players in each of the relevant markets.74 While it was noted that customers may require maintenance and repair services for medical devices at the local level, in practice major suppliers’ (or their distributors’) engineers are present throughout the EEA/UK so as to meet this demand.75

(60) Finally, the Commission also notes that the Parties’ internal documents assess market conditions both at national and EEA/UK level (if not worldwide level).76

(61) The above provides indications that, despite the existence of national specificities, from a supply-side perspective, the Parties compete to some extent with their rivals at a broader geographic level (at least at EEA/UK level).

(D) Conclusion

(62) Based on the results of the market investigation, for the purpose of this Decision, the Commission concludes that the geographic scope of the imaging solutions, radiotherapy equipment and motion management devices markets can be left open (between national or at least EEA/UK-wide) as the exact geographic scope of the markets does not affect the Commission’s conclusions regarding the compatibility of the Transaction with the internal market.

4.2.2. Oncology Software

(A) The Commission’s precedents scope of the market for healthcare software solutions to be either national or EEA/UK wide, leaving the

(63) In past decisions, the Commission considered the geographic exact scope open.77 However, there is no Commission precedent analysing the markets for oncology software, including TPS and OIS.

(B) The Notifying Party’s view

(64) In relation to TPS, the Notifying Party considers that the same arguments as the ones raised for radiotherapy equipment apply (see recitals (56)-(56) above).78 Thus, the Notifying Party considers that the market should be defined as being EEA/UK-wide in scope but ultimately concludes that it can be left open.

(65) Similarly, with respect to OIS, the Notifying Party considers the geographic scope of the market to be at least EEA/UK-wide, if not worldwide in scope. This is because the main suppliers are active globally, and the same software products are homogenous and available at worldwide level. However, the Notifying Party submits that in some instances, interfaces might have to be translated into the local language.79

(C) The Commission’s assessment

(66) The results of the market investigation and the evidence in the Commission’s file did not provide any indications that the Commission should depart from its decisional practice regarding healthcare software in the present case. In particular, the results of the market investigation were the same for OIS and TPS as for imaging solutions, radiotherapy equipment and Motion Management devices, confirming that: (i) EU procurement rules apply, (ii) there are some variations at national level in procurement and reimbursement rules and practices, (iii) the main and most credible suppliers are the same across the EEA/UK.80

(D) Conclusion

(67) Based on the results of the market investigation, for the purpose of this Decision, the Commission concludes that the geographic scope of the OIS and TPS markets can be left open (between national or at least EEA/UK-wide) as the exact geographic scope of the markets do not affect the Commission’s conclusions regarding the compatibility of the Transaction with the internal market.

5. COMPETITIVE ASSESSMENT

5.1. Framework of analysis - Assessment of conglomerate non-coordinated effects

(68) Article 2 of the Merger Regulation provides that the Commission has to appraise concentrations with a view to establishing whether or not they are compatible with the internal market. For that purpose, the Commission must assess, pursuant to Article 2(2) and (3), whether or not a concentration would significantly impede effective competition, in particular as a result of the creation or strengthening of a dominant position in the common market or a substantial part of it.

(69) In this Decision, the Commission’s assessment focuses on conglomerate non- coordinated effects due to the combination of the Parties’ complementary equipment in the imaging and radiotherapy space.

(70) Conglomerate mergers consist of mergers between companies that are active in closely related markets, for instance suppliers of complementary products or of products which belong to a range of products that is generally purchased by the same set of customers for the same end use.81

(71) Pursuant to the Non-Horizontal Merger Guidelines, in most circumstances, conglomerate mergers do not lead to any competition problems.82 However, foreclosure effects may arise when the combination of products in related markets may confer on the merged entity the ability and incentive to leverage a strong market position from one market to another closely related market by means of tying or bundling or other exclusionary practices.83

(72) The Non-Horizontal Merger Guidelines distinguish between bundling, which usually refers to the way products are offered and priced by the merged entity and tying, which usually refers to situations where customers that purchase one good (the tying good) are required to also purchase another good from the producer (the tied good).84

(73) Within bundling practices, a distinction is also made between pure bundling and mixed bundling. In the case of pure bundling the products are only sold jointly in fixed proportions. With mixed bundling the products are also available separately, but the sum of the stand-alone prices is higher than the bundled price.85

(74) Tying can take place on a technical or contractual basis. For instance, technical tying occurs when the tying product is designed in such a way that it only works with the tied product (and not with the alternatives offered by competitors).86

(75) The main concern in the context of conglomerate mergers is that of foreclosure. The combination of products in related markets may confer on the merged entity the ability and incentive to leverage a strong market position from one market to another by means of tying or bundling or other exclusionary practices. While tying and bundling have often no anticompetitive consequences, in certain circumstances such practices may lead to a reduction in actual or potential competitors' ability or incentive to compete. This may reduce the competitive pressure on the merged entity allowing it to increase prices or deteriorate supply conditions in other ways. 87

(76) In assessing the likelihood of such a scenario, the Commission examines, first, whether the merged firm would have the ability to foreclose its rivals,88 second, whether it would have the economic incentive to do so89 and, third, whether a foreclosure strategy would have a significant detrimental effect on competition, thus causing harm to consumers.90 In practice, these factors are often examined together as they are closely intertwined.

5.2. Assessment of the conglomerate non-coordinated effect of the Transaction

5.2.1. Introduction

(77) The elements in the Commission’s file show that the combination of the Parties’ activities could potentially result in technical tying (through the degradation of interoperability with third-party products) and commercial bundling91 between the following products:

(i) Siemens’ imaging solutions used for radiotherapy simulation, i.e. CT simulators, MRI simulators and PET/CT simulators (together referred as Simulators), on the one side; and

(ii) Varian’s radiotherapy solutions, i.e. radiotherapy equipment (namely Linacs, brachytherapy equipment and proton therapy equipment), OIS, TPS and Imaging Motion Management (together referred as “Radiotherapy Solutions”), on the other side.

(78) The remainder of this Decision will assess whether the two above-mentioned practices could result in the foreclosure of the Parties’ rivals in the relevant markets.

(79) As a preliminary remark, it should be noted that, unless otherwise specified, the findings set out in Section 5.2.3 (on technical tying) and Section 5.2.4 (on commercial bundling) of this Decision and, in particular, the results of the market investigation92 do not materially differ depending on the type of Simulators and the type of Radiotherapy Solutions. This is mainly due to the fact that all the various equipment and solutions used for radiotherapy simulation, planning and treatment are part of an integrated ecosystem and, therefore, highly intertwined. This is particularly true for Radiotherapy Solutions, for which customers may “have ax

(85) In this context, during the market investigation, several competitors of both Parties proactively approached the Commission expressing strong concerns about the Transaction in relation to a potential risk of technical tying between Siemens’ Simulators and Varian’s Radiotherapy Solutions. More specifically, they argue that, post-Transaction, the Parties will have the ability and incentive to foreclose their rivals by degrading the interoperability (i) between Siemens’ Simulators and third parties’ Radiotherapy Solutions; and (ii) between Varian’s Radiotherapy Solutions and third parties’ Simulators.

(A) The Notifying Party’s view

(86) The Notifying Party contests the above, arguing that, post-Transaction, the combined entity would have no ability and no incentive to implement a technical tying strategy. The Notifying Party’s main arguments are detailed below.106

(87) First, the Notifying Party claims that Siemens and Varian do not have a sufficient degree of market power to foreclose competitors since, in each of the relevant imaging and radiotherapy markets, the Parties face (i) vigorous competition from several strong players and (ii) sophisticated customers, with countervailing power, relying on open tender processes.

(88) Second, the Notifying Party argues that the existence of a de facto industry-wide and non-proprietary standard, named Digital Imaging and Communications in Medicine (“DICOM”), including its radiotherapy extension (“DICOM RT”), prevents the degradation of interoperability. More specifically, the Notifying Party states that (i) DICOM is sufficient to ensure full interoperability between imaging and radiotherapy solutions,107 with no need for specific data formats/interfaces108 or cooperation between vendors; and (ii) compliance with DICOM is a commercial obligation as it is requested by customers who favour open ecosystems allowing them to source products from different vendors to ensure the best possible treatment for patients.

(89) Third, Siemens submits that moving away from DICOM would not be profitable as it would entail significant losses and costs outweighing any potential gains, including notably (i) substantial sales losses (customers, which have a strong preference for DICOM-compliant solutions, would likely switch to alternative suppliers); in particular, the Notifying Party notes that removing interoperability at the prospect of gaining market share on the Imaging Motion Management market would put at risk the sales of CT simulators, [pricing information]; (ii) reputational damage for Siemens beyond the radiotherapy segment; and (iii) material investments to develop and roll out an alternative non-DICOM standard.

(90) Fourth, the Notifying Party claims that abandoning DICOM would have no adverse impact on competition and would not result in the foreclosure of competitors. On the contrary, according to it, such a strategy would make the Parties’ products commercially unsaleable, which would only alienate customers and benefit competitors.

(91) Moreover, the Notifying Party argues that (i) with respect to Simulators, the degradation of interoperability would not materially reduce the sales prospects of Siemens’ competitors as it would only affect their sales of Simulators, which account for a minor share of the overall sales of Scanners; and (ii) with respect to Motion Management devices, only a small portion of the EEA/UK demand for the latter is used with Siemens’ Simulators, which means that the degradation of interoperability with Siemens’ Simulators would only affect the sales of Varian’s Motion Management rivals to a limited extent.

(B) The Commission’s assessment

(92) In the remainder of this Section, the Commission assesses the risk of technical tying between Siemens’ Simulators and Varian’s Radiotherapy Solutions, through the degradation of interoperability with third-party products.

Ability to foreclose

(93) For the reasons set out below, the Commission finds that, post-Transaction, the Parties would have the ability to foreclose their rivals by degrading the interoperability between the above-mentioned products.

(94) First, contrary to the Notifying Party’s claim, the market structure and the evidence in the Commission’s file show that Siemens and Varian have a significant degree of market power:109

a. The Parties are the clear market leaders on their respective markets, with very substantial market shares, close to or above [50-60]% in most of the relevant imaging and radiotherapy markets/market segments at EEA/UK level (in 2019).110 In particular:

− Imaging markets: Siemens has a market share of [60-70]% in CT simulators, which are by far the most prevalent imaging equipment used for radiotherapy simulation and, thus, the most relevant imaging equipment for the assessment of the conglomerate effects of the Transaction. On the broader CT scanner market, Siemens’ market share is lower but remain very significant ([40-50]%). With respect to other types of Scanners, Siemens’ market shares are close to or above [50-60]%, i.e. [40-50]% in MRI scanners and [50-60]% in PET/CT scanners;111 In line with the above, customers and competitors generally perceive Siemens as the leading player in imaging equipment (overall) and CT simulators.112 The Commission also notes that internal documents of Siemens emphasise […];113

− Radiotherapy markets: As regards radiotherapy equipment, Varian has a market share of up to [60-70]% in Linacs114 (which are by far the most common form of radiotherapy), as well as a market share of [50-60]% in Proton therapy. In the brachytherapy market, despite a more moderate market share ([20-30]%), Varian is a very important supplier as it is one of the only two players active in this market (which is characterised by a duopoly). In line with the above, both customers and competitors perceive Varian as the “undisputed” leading player in radiotherapy equipment (overall), as well as in Linacs.115

As regards oncology software, Varian’s market share is close to [40-50]% ([40-50]% according to an independent industry report)116 in OIS (which is central to ensure the workflow between the various solutions used for radiotherapy simulation, planning and treatment and which directly interfaces with Simulators).117 In TPS, Varian’s market share estimates are more moderate (between [20-30]% and [30-40]% depending on the segment), however the Commission notes that (i) Varian is one of the only two players in TPS for brachytherapy and the second largest player in TPS for EBRT (with a market share very close to the market leader) and (ii) the feedback received from customers and competitors, according to which Varian is the clear market leader in TPS (as well as in OIS) suggests that the Parties underestimate Varian’s market share in TPS.118

As regards Motion Management devices, according to the Parties, Varian has a market share of [30-40]-[40-50]%. However, the Commission notes (i) according to the Form CO, “[Parties’ stated limitations to market share estimates]”,119 which calls into question the reliability of the Parties’ market share estimate on this market; and (ii) according to competitors and customers, Varian is one of the leading and most competitive players on this market.120

According to well-established case law, very large market shares above 50% may in themselves be evidence of the existence of a dominant position.121 In

these markets is difficult, a long and expensive process. The main difficulties in switching from one radiotherapy supplier to another are (i) the need to train staff in order to be able to use the new equipment, (ii) the high costs involved, (iii) potential loss of patient data and (iv) lack of interoperability/compatibility between the solutions of different suppliers.126 Consequently, only a minority of customers switched Linac, OIS and/or TPS suppliers in the past 10 years.127

(95) Second, the Parties have a large pool of common customers128 since all radiotherapy customers must procure both Simulators and Radiotherapy Solutions, which are closely interconnected. This is illustrated by the fact that, in 2012, the Parties entered into a strategic global partnership (called “EnVision”) including sales and marketing cooperation. In this respect, the Parties’ internal documents [strategy information relating to the EnVision partnership].129 Similarly, another internal document reads: [strategy information relating to the EnVision partnership].130 In line with the above, internal presentations of Siemens assessing the impact of the Transaction reveal that Siemens expects the Transaction to [strategy information].131 Moreover, the Commission notes that technical tying would allow the combined entity to tie imaging and radiotherapy products purchased separately and, thus, to “overcome the fact that only a small share of customers procures their Linacs and CT scanners at the same time” (as opposed to commercial tying and bundling – see Section 5.2.4 below).132

(96) Third, customers confirmed that interoperability between Simulators and Radiotherapy Solutions, in particular between Simulators and OIS/TPS, is very important, considering it “crucial”/“vital”/“essential” for the entire radiotherapy process to ensure “efficient and safe operations” with a “good workflow”.133 The Parties’ internal documents also stress that […].134

(97) Fourth, the results of the market investigation support the Notifying Party’s claims that the DICOM standard (i) facilitates the exchange of images/data between Simulators and Radiotherapy Solutions; and (ii) is widely adopted (despite the absence of regulatory obligation to adhere to it), which is explained by the fact that customers request it.135 However, the Commission also found that:

a. DICOM does not in itself guarantee full interoperability. A large majority of competitors and a material number of customers confirmed it, explaining that DICOM suffers limitations.136 In particular, several respondent stressed that DICOM covers only the least common denominator and is slow to adapt to new features and functionalities, which are often subject to specific formats (such as “private image tags”) and proprietary extensions to DICOM. The above is corroborated by (i) the DICOM Standards Committee, which states that the DICOM standard “facilitates interoperability of systems claiming conformance in a multi-vendor environment, but does not, by itself, guarantee interoperability” (emphasis added),137 and (ii) the Parties’ internal documents illustrating Siemens […].138

b. DICOM’s implementation requires active and voluntary collaboration between OEMs, which was confirmed by the vast majority of competitors139 and corroborated by the Parties’ internal documents.140 According to competitors, the collaboration required to ensure interoperability between Simulators and Radiotherapy Solutions is material and consists mainly in exchange of technical information (e.g. specific file format details) and joint testing.141 This bilateral collaboration takes place primarily during the development process but also, to a more limited extent, on the ground at the customers’ sites.142

c. Interoperability between DICOM-compliant solutions can be compromised. In particular, most competitors confirmed that interoperability could be hindered

(i) when the relevant solutions do not properly implement the DICOM standard or implement different versions of it (e.g. by failing to quickly incorporate new elements of the standard, such as new DICOM objects/tags, that are created as part of new technological advancements) or (ii) when a vendor does not disclose to other vendors (or delays the disclosure of) relevant information (e.g. private image tags used by the solution).143 For example, a competitor stated that “minor differences in the interpretation and implementation of [DICOM] are common and can make data exchanges challenging”.144 Another respondent explained that “vendors must be aware of any changes to DICOM tags with enough advanced notice to make any required changes to their own product” and that it could “be quite difficult to get a sample data sets of DICOM RT files including all tags from the vendors” since “these are not made publicly available”.145

(98) The above DICOM limitations and the need for active cooperation between vendors are also supported by the fact that [confidential information about the EnVision partnership].146 In fact, internal documents reveal that Varian’s main goal [confidential information about the EnVision partnership].147

(99) Fifth, Imaging Motion Management devices require a direct interface with Simulators, whose development, implementation and validation involve cooperation between the manufacturers. This is notably illustrated by the fact that, under the EnVision partnership, [confidential information about the EnVision partnership].148[…].

(100) Sixth, the market investigation also revealed that a significant number of market participants consider that, post-Transaction, the Parties would be able to degrade the interoperability between Simulators and Radiotherapy Solutions.149

(101) Finally, the Commission considers that the Parties’ rivals would be unable to deploy effective counter-strategies,150 given (i) Siemens’ and Varian’s leadership and potential dominance in the relevant markets, (ii) the absence of other integrated players providing both Simulators and Radiotherapy Solutions and (iii) the fact that respondents to the market investigation were unable to identify any effective workaround mechanisms or solutions whereby they could circumvent an attempt by the Parties to degrade interoperability.151

Incentive to foreclose

(102) Based on the evidence available in the file and the results of the market investigation, the Commission considers that, post-Transaction, the Parties would have incentives to foreclose their rivals by degrading the interoperability between the above-mentioned products for the following reasons.

(103) First, the argumentation raised by the Notifying Party to show that technical tying would not be profitable rely on the key assumption that degrading interoperability between Simulators and Radiotherapy Solutions would require the combined entity to “move away from DICOM”, which would entail significant losses of sales and costs.152 However, as explained in the previous Section, this underlying assumption is contradicted by the results of the market investigation, which revealed that the combined entity would have the ability to hinder the interoperability between their products and third-party products while remaining DICOM-compliant. For example, the Parties could, at no or limited cost, reserve certain new functionalities of Siemens’ Simulators for cases where Siemens’ Simulators are used in combination with Varian’s Radiotherapy Solutions simply by e.g. refusing to disclose technical information (such as private image tags used by Siemens’ Simulators) to Varian’s competitors. More broadly, the Parties could refuse to cooperate in providing technical information and support necessary to enable suppliers to understand and account for its particular implementation of the standard (which respondents suggest is to a degree open to interpretation).153

(104) Second, as explained above, the relevant radiotherapy markets are characterised by high barriers to switch suppliers.154 The customers’ limited ability to switch suppliers of Radiotherapy Solutions (such as OIS and Linacs) would de facto limit the risk of sales losses for Parties. Indeed, the degradation of the interoperability between the Parties’ and their competitors’ Simulators and Radiotherapy Solutions would not put at risk the Parties’ sales of Radiotherapy Solutions. This is all the more true considering that Radiotherapy Solutions, and in particular Linacs, drive the customers’ procurement decisions notably because they are much more expensive and may raise additional non-merger specific interoperability issues.155

(105) Similarly, the Notifying Party’s claim according to which degrading interoperability between Siemens’ Simulators and third-party Imaging Motion Management devices at the prospect of gaining market share on the Imaging Motion Management market would put at risk sales of a significantly more profitable product (CT simulator) is not consistent with the fact that […].156

(106) Lastly, the market investigation revealed that a significant number of competitors believe that, post-Transaction, the Parties would find it profitable to degrade the interoperability between Simulators and Radiotherapy Solutions (including Imaging Motion Management devices).157 According to them, such technical tying would allow the combined entity to leverage Varian’s leadership in the radiotherapy space to further gain market shares in Siemens’ imaging markets (and vice versa). In support of their claim, many of them indicated that, already pre-Transaction, Varian adopts similar practices to limit or delay the interoperability between its radiotherapy solutions and other competing products (e.g. between Varian’s Linac and Elekta’s OIS).158 This is also corroborated by some customers, who explained that “Varian has a history where OIS/TPS is not "speaking" as good as possible with third-party devices” and that “already today the Varian environment is considered to be relatively closed and not very well suited for a true multi-vendor approach”.159 In accordance with the Non-Horizontal Merger Guidelines,160 the Commission considers that the above suggests that a strategy consisting in degrading interoperability in the field of radiotherapy may be profitable, which would incentivise the new entity is implement such strategy post-Transaction.

Impact on competition

(107) Based on the evidence available in the file and the results of the market investigation, the Commission considers that the degradation of interoperability between the above-mentioned products would have a significant detrimental effect on competition, thus causing harm to patients.

(108) First, the market investigation stressed the importance of interoperability for the entire radiotherapy process and revealed that if a vendor of imaging or radiotherapy solutions ceases to collaborate with other vendors, interoperability limitations would arise with “severe consequences” for customers and patients. In particular, (i) customers could lose workflow efficiencies and functionalities (including “critical” ones); (ii) new features could become “useless”. Competitors also emphasized that workaround solutions would be difficult (“technically close to impossible”) and would lead to “additional costs”, “complexity” and “safety issues”.161

(109) Second, given (i) Siemens’ and Varian’s very high market shares – close to or above [50-60]% in most of the relevant imaging and radiotherapy markets/segments (up to [60-70]% in CT simulators and Linacs) at EEA/UK level (in 2019)162 – and (ii) the absence of other integrated players, the degradation of the interoperability between the Parties’ products and their competitors’ would likely significantly reduce their rivals’ sales prospects in the relevant markets/segments and, thus, lead to a reduction in their ability or incentive to compete and innovate with the new entity on these markets/segments.

(110) As regards the Notifying Party’s claim that the degradation of interoperability would only affect the sales of Simulators, which account for a minor share of the overall sales of Scanners, the elements in the Commission’s file show that (i) a technical tying strategy would have the ability to significantly affect the rivals’ sales of CT simulators and that (ii) CT simulators and scanners are differentiated products, which may constitute distinct market segments. A significant reduction of the rivals’ sales prospects for CT simulators may reduce their incentive to compete and innovate in this potential market segment, which would be detrimental for both customers and patients.

(111) As regards the Notifying Party’s claim that only a small portion of the EEA/UK demand for Motion Management devices would be affected by foreclosure resulting from the merger, the Commission notes that:

− Knowing that [Parties’ stated limitations to market share estimates], the Parties’ computation of the total addressable demand for Imaging Motion Management devices that could be foreclosed appears highly uncertain and unreliable;163

− Most of the CT simulators sold by Siemens with an interface for Imaging Motion Management (i.e. […]% worldwide and […]% in the EEA/UK) are used in combination with Imaging Motion Management devices marketed by Varian’s rivals164 which, given Siemens’ market share in the EEA/UK CT simulator segment ([60-70]%), suggest that a sufficiently large fraction of the market output would be affected by foreclosure resulting from the Transaction; and

− Assuming that the Parties’ computation of the addressable demand for Imaging Motion Management devices is reliable (which as previously explained is doubtful), the new entity would still be in a position to foreclose more than [40- 50]% of the addressable demand in the EEA/UK,165 which is substantial enough to raise concerns.

(112) Third, many competitors actively complained and confirmed that the degradation of the interoperability between the Parties’ and their competitors’ Simulators and Radiotherapy Solutions would significantly affect competition on the relevant markets/segment.166

(113) In contrast, only a (material) minority of customers raised concerns about a risk of degradation of interoperability167 and that most of them consider that DICOM is sufficient to ensure full interoperability.168 However, it should be noted that customers may not be not fully aware of the collaboration required between imaging and radiotherapy vendors to ensure full interoperability. Indeed, as already indicated, the market investigation revealed that this cooperation takes place primarily during the development process, i.e. upstream of the onsite installation of the equipment, without involving customers.169 Therefore, customers experience the result collaboration to ensure interoperability, rather than the collaboration effort itself.

(114) Fourth, the Commission observes that, pre-Transaction, the countervailing buyer power of the customers does not prevent Varian from limiting or delaying the interoperability between its Radiotherapy Solutions and other competing products,170 which suggests that customers do not have sufficient countervailing buyer power to defeat similar practices implemented by the new entity post-Transaction.

(115) Lastly, the Commission notes that the degradation of interoperability between the Parties’ and their competitors’ Simulators and Radiotherapy Solutions would not bring any efficiencies.171

(C) Conclusion

(116) In view of the above considerations, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market by providing the new proposed entity with the ability and incentive to foreclose its rivals by degrading the interoperability between (i) Siemens’ Simulators and third parties’ Radiotherapy Solutions; and (ii) Varian’s Radiotherapy Solutions and third parties’ Simulators.

5.2.4. Commercial bundling172

(117) The Transaction leads to conglomerate links between Siemens’ Simulators and Varian’s Radiotherapy Solutions (including Imaging Motion Management Devices), which could result in the implementation of commercial bundling between the above-mentioned products.

(A) The Notifying Party’s view

(118) The Notifying Party argues that, post-Transaction, the combined entity would have no ability and no incentive to foreclose competitors through the implementation of commercial bundling strategy. The Notifying Party’s main arguments are detailed below.

(119) First, the Notifying Party submits that the combined entity will not have the ability to (a) leverage its position in Simulators to foreclose Varian’s Radiotherapy Solution rivals (including Imaging Motion Management rivals), or (b) leverage its position in Radiotherapy Solutions (including Imaging Motion Management Devices) to foreclose Siemens’ Simulators rivals. The Notifying Party claims that, despite their relatively high market shares (see Table 1 above), Siemens and Varian face sizeable and credible alternatives in the relevant markets for Simulators (e.g. GE, Philips and Canon) and Radiotherapy Solutions (e.g. Elekta, IBA, Accuray, VisionRT, C-Rad, Brainlab). In addition, the Notifying Party submits that Simulators and Radiotherapy Solutions are rarely procured together in a single tender so that the combined entity will have limited opportunities to bundle these products, notably due to the different lifespans of the equipment concerned, the public tender procedure rules applicable across the EEA/UK, and customers’ preferences for certain equipment.173

(120) Second, the Notifying Party argues that the combined entity will lack the incentive to engage in a bundling strategy. It points out that, to persuade customers to purchase a bundled offer, the combined entity would have to offer steep bundle discounts (e.g. to compensate for the premature renewal of equipment or to overcome customers’ preference) with no real prospects of recuperating the lost margins. The Notifying Party claims that the lack of incentive of the combined entity to engage in any bundling strategy in the future is highlighted by the fact that, pre-Transaction, (i) Varian does not [commercial strategy], (ii) Siemens does not [commercial strategy], and (iii) even when Siemens was active in the supply of Radiotherapy Solutions (i.e. Linacs)174 it [commercial strategy].175

(121) Third, the Notifying Party is of the view that, in any event, any bundling strategy would not have any detrimental effect on the market since, without changing customers’ procurement behaviour, a bundling strategy would affect only a minor part of the demand for Simulators and Radiotherapy Solutions176 and this is unlikely to change significantly post-Transaction given that Simulators and Radiotherapy Solutions have different average lifespans. Moreover, competitors can implement timely and effective counter-strategies to defeat any attempted foreclosure by granting discounts on their products or by partnering up and offering competing bundles.177

(122) Finally, the Notifying Party submits that the Transaction will result in efficiencies for customers resulting in lower prices and availability of innovative new products in a faster and more effective way.178

(B) The Commission’s assessment

(123) In the remainder of this Section, the Commission assesses whether the commercial bundling between Siemens’ Simulators and Varian’s Radiotherapy Solutions (including Imaging Motion Management Devices) could result in the foreclosure of the Parties’ rivals.

Ability to foreclose

(124) As explained below, the Commission finds that, despite their significant degree of market power in the relevant markets/segments,179 the Parties would not have the ability to foreclose their rivals by bundling commercially Siemens’ Simulators and Varian’s Radiotherapy Solutions (including Imaging Motion Management Devices).

(125) First, the market investigation generally supported the Notifying Party’s claim that, for the reasons set out below, radiotherapy customers typically procure Simulators and Radiotherapy Solutions separately, which considerably limits the Parties’ opportunities to bundle the above products:

a. The pool of common customers procuring Simulators and Radiotherapy Solutions at the same time is limited.180 As rightly pointed out by the Notifying Party, commercial bundling can only apply to products purchased at the same time (contrary to technical tying).181 It follows that any potential ability of the combined entity to offer a bundle would be limited to the share of customers that purchase the relevant Simulators at the same time as the Radiotherapy Solution. Yet, the results of the market investigation confirmed that radiotherapy equipment is rarely procured at the same time as imaging equipment, and vice versa due to the products’ different life cycles. In that respect, one customer noted that “typically CT and linac replacements are planned years ahead and have their own lifespans, so if it would go to the same year, procurement bundle would be an option” while another one explained that since hospitals “require business continuity and redundancy, [they] tend to treat radiotherapy imaging equipment separate from linac”.182

b. The market investigation confirmed that most Simulators and Radiotherapy Solutions are procured as part of public procurement processes.183 Thus, the vast majority of Simulators and Radiotherapy Solutions sold in the EEA/UK is subject to the EU rules on public procurement ([…]% in the case of Siemens’ imaging solutions),184 whereby it is the customer that determines its requirements and the scope of the tenders. Although respondents to the market investigation recognised that public procurement rules do not prevent customers from purchasing Simulators and Radiotherapy Solutions in a bundle (with the exception of a few EEA/UK countries, such as France),185 in practice, the guiding principle under public procurement rules is to tender by individual product lots to ensure an even competitive field for all suppliers.186 In that respect, one customer indicated that “for competitive reasons and respect of the equality between providers it is impossible to bundle because actually only SIEMENS and Varian could do so [post-Transaction]”187 and another one explained that “supplier[s] of imaging equipment and radiotherapy equipment are not [the] same, it’s more easy to dissociated both tenders”.188 In other words, customers would “not risk not to get the best (price and quality) imaging equipment and best radiotherapy equipment”.189

c. The Parties’ sales data corroborate the claim that opportunities to commercially bundle Simulators and Radiotherapy Solutions are limited. In particular, Siemens’ sales data show that less than […]% of Siemens’ CT and MRI scanners are procured with Radiotherapy Solutions in a single tender.190 Moreover, in 2019 in the EEA/UK, only […] Siemens’ CT simulators were sold to radiation oncology department that also purchased a Varian’s Linac that year (representing only around […]% of Siemens’ total sales of CT simulators in the EEA/UK).191 Taking into consideration the Parties’ high EEA/UK market shares in CT simulators ([60-70]%) and Linac ([60-70]%),192 which are by far the most prominent equipment used for radiotherapy simulation and treatment delivery, the above objective […]% figure support the Notifying Party’s claim that Simulators and Radiotherapy Solutions are typically not procured together.193

Regarding specifically Imaging Motion Management Devices, the results of the market investigation suggest that these products tend to be purchased together with Simulators more often than other Radiotherapy Solutions.194 However, the sale data provided by the Parties reveal that only […]% of Varian’s Imaging Motion Management Devices are sold to imaging solutions suppliers (namely […]) – who may sell these products together with Simulators195 – the remaining […]% being sold by Varian directly to customers. The above means that, already today, while customers have the opportunity to procure Varian’s Imaging Motion Management Devices from imaging solutions suppliers ([…]), the vast majority of customers choose to procure Varian’s Imaging Motion Management Devices on a standalone basis (at least around […]% of Varian’s EEA/UK sales of Imaging Motion Management Devices).196 According to some market participants, this is due to the fact that “customers have their own preferences regarding e.g. motion management devices”.197

(126) Second, the evidence in the Commission’s file show that the combined entity’s rivals would have the ability and incentive to deploy counterstrategies to react to a bundling offer of the combined entity,198 by partnering to offer competing bundles or lowering their price for standalone products. In that respect, there are already established relationships between suppliers of radiotherapy equipment and imaging equipment199 and new ones could be implemented post-Transaction, for instance between Elekta and Siemens’ competitors.Such a possibility of increased collaboration with imaging players was already made public by Elekta.200 Alternatively, the level of margins generated by manufacturers of Simulators and Radiotherapy Solutions in the EEA/UK should enable them to grant substantial discounts on their equipment, while remaining profitable.201 This is notably illustrated by the Parties’ margin data in the relevant markets in the EEA/UK in 2019: for instance, Siemens achieves a gross margin of around […]% in imaging equipment (between […]% and […]% depending on the type of Scanners), whereas Varian’s gross margin reaches […]% in Linacs, […]% in TPS, […]% in OIS and up to […]% in Brachytherapy.202 In this respect, one customer explained that “if a 3rd party can offer a comparable product at a lower cost, or additional features which are not yet available from Siemens or Varian, then we would look very closely at them and potentially choose them if it is felt that this is the direction we need to go”.203

Incentive to foreclose

(127) Based on the evidence available in the file and the results of the market investigation, the Commission cannot exclude that the Parties would have incentives to commercially bundle their Simulators and Radiotherapy Solutions (to the extent possible given the limited opportunities).204 However, even if the Parties had incentives to engage in a commercial bundling strategy, for the reasons set out in the previous section, the Commission considers that such strategy would unlikely result in the foreclosure of competitors.

Impact on competition

(128) Based on the evidence available in the file and the results of the market investigation, the Commission considers that the adoption of a bundling strategy by the new entity is unlikely to have a significant detrimental effect on competition in the relevant imaging and radiotherapy markets for the following reasons.

(129) First, although some competitors complained about the risk of commercial bundling resulting from the Transaction,205 the Commission recalls that the reduction in sales by competitors is not it itself a problem and raises concerns only if this reduction is significant enough.206 In this respect, as explained above,207 the evidence in the Commission’s file suggest that the Parties’ opportunities to bundle their Simulators and Radiotherapy Solutions will be rather limited since these are typically procured separately. It follows that, despite the high market shares of Siemens and Varian in the relevant markets/segments, the implementation of a bundling strategy by the combined entity is unlikely to reduce significantly the sales prospects of the Parties’ rivals in the relevant imaging and radiotherapy markets/segments and a fortiori to reduce their ability to compete on these markets/segments. The above elements suggest that the Parties would not have the ability to successfully leverage any potential strength in any of the relevant imaging solutions and/or radiotherapy solutions markets. Any hypothetical bundling strategy of the combined entity is therefore unlikely to result in foreclosure of Siemens’ or Varian’s rivals.

(130) Second, the Commission notes that customers responding to the market investigation did not raise concerns as to the risk of a bundling strategy or its potential impact on their business or on the market.208 On the contrary, many of them stress that such commercial bundling could bring efficiencies (lower prices)209 and more generally expect the Transaction to result in innovation benefits for customers. For example, one customer pointed out that the Transaction could lead to “increased product development”210 while another customer expect the production of “new features in the Siemens/Varian portfolio that will benefit patients”.211 Overall, the Transaction could be expected “to have its main impact on pushing the technological innovation”,212 which will ultimately benefit “oncology patients within the EU”.213

(C) Conclusion

(131) In light of the above and the evidence available to the Commission, and in view of the outcome of the market investigation, the Commission considers that the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market on the relevant imaging and radiotherapy markets as a result of commercial bundling practices.214

6. PROPOSED REMEDIES

(132) In order to render the Transaction compatible with the internal market, the Notifying Party submitted a set of commitments under Article 6(2) of the Merger Regulation on 29 January 2021 (the “First Commitments”). The Commission market tested the First Commitments on 1 February 2021 in order to assess whether they were sufficient and suitable to remedy the serious doubts identified at Section in Section 5.2.3 above. Following the feedback received from market test, amended commitments were submitted on 12 February 2021 (the “Final Commitments”). The Final Commitments are annexed to this Decision and form an integral part thereof.

6.1. Framework for the assessment of the commitments

(133) Where a concentration raises serious doubts as regards its compatibility with the internal market, the merging parties may undertake to modify the concentration to remove the grounds for the serious doubts identified by the Commission. Pursuant to Article 6(2) of the Merger Regulation, where the Commission finds that, following modification by the undertakings concerned, a notified concentration no longer raises serious doubts, it shall declare the concentration compatible with the internal market pursuant to Article 6(1)(b) of the Merger Regulation.

(134) As set out in the Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the “Remedies Notice”)215, the commitments have to eliminate the competition concerns entirely, and have to be comprehensive and effective from all points of view.216

(135) In assessing whether commitments will maintain effective competition, the Commission considers all relevant factors, including the type, scale and scope of the proposed commitments, with reference to the structure and particular characteristics of the market in which the transaction is likely to significantly impede effective competition, including the position of the parties and other participants on the market.217

(136) In order for the commitments to comply with those principles, they must be capable of being implemented effectively within a short period of time. Concerning the form of acceptable commitments, the Merger Regulation gives discretion to the Commission as long as the commitments meet the requisite standard.