Commission, March 10, 2021, No M.10123

EUROPEAN COMMISSION

Decision

PPG / TIKKURILA

Subject: Case M.10123 – PPG / Tikkurila

Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 03 February 2021, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which PPG Industries, Inc. (“PPG”, USA) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of Tikkurila Oyj (“Tikkurila”, Finland), (the “Transaction”). PPG is referred to as the “Notifying Party” and, together with Tikkurila, as the “Parties”.

1. THE PARTIES AND THE OPERATION

(2) PPG is a publicly listed corporation traded on the New York Stock Exchange. It is active worldwide in the production and sale of coatings and specialty materials.

(3) Tikkurila is a publicly listed entity on the Helsinki Stock Exchange. It is mainly active in the production and sale of decorative coatings and, to a lesser extent, industrial coatings. Tikkurila focuses its activities in Finland, Poland, Sweden and Russia, which account for over 80% of its worldwide turnover.

(4) On 18 December 2020, PPG and Tikkurila entered into an agreement pursuant to which PPG will offer to acquire all of the shares of Tikkurila through a recommended voluntary public offer. Following completion of the Transaction, PPG will thus acquire sole control of Tikkurila. The Transaction is therefore a concentration within the meaning of Article 3(1)(b) of the EU Merger Regulation.

2. EU DIMENSION

(5) The notified operation has a Union dimension pursuant to Article 1(2) of the Merger Regulation, because (i) the undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (PPG: EUR 13 531 million: Tikkurila: EUR 564 million),3 (ii) each of them has a EU-wide turnover in excess of EUR 250 million (PPG: EUR […] million: Tikkurila: EUR […] million) and (iii) none of the undertakings concerned achieves more than two-thirds of its aggregate Union-wide turnover within one and the same Member State.

3. RELEVANT MARKETS

(6) Both Parties are active in the manufacture and wholesale supply of decorative coatings.

(7) The Parties are also active in the retail distribution of decorative coatings through their own retail outlets.

3.1. Market definitions

3.1.1. Manufacture and wholesale supply of decorative coatings

(8) Decorative coatings cover various types of coatings (such as paints, lacquer and varnish) normally used on-site both internally and externally during construction or refurbishment, to protect and decorate surfaces of buildings such as walls, ceilings, doors, window frames and other surfaces. Decorative coatings include both paints and woodcare products.

3.1.1.1. Product market definition

The Commission’s precedents

(9) In previous decisions, the Commission concluded that decorative coatings form part of a distinct product market, separate from industrial coatings.4

(10) In the market for decorative coatings, the Commission further considered distinctions between: (i) decorative paints and woodcare products;5 (ii) water-based and solvent-based decorative coatings;6 and (iii) decorative coatings sold through non-professional resellers (retail segment, which usually consists of Do-It-Yourself outlets) and decorative coatings sold through professional resellers (trade segment).7 Within the segment for decorative coatings sold through the retail segment, the Commission considered a distinction between branded and private label products.8 Ultimately, the Commission left open whether each of these segments and sub- segments would constitute a separate product market.

The Notifying Party’s view

(11) The Notifying Party submits that the relevant product market is the wholesale supply of decorative coatings without any further segmentations. According to the Notifying Party, most suppliers produce all types of decorative coatings (i.e. decorative paints, woodcare products, water-based decorative coatings and solvent- based decorative coatings) and can relatively easily switch production between these products as the raw materials and manufacturing processes are similar. In addition, all types of decorative coatings are deemed interchangeable from a customer’s point of view.

(12) The Notifying Party also submits that the potential segmentation by sales channels is not appropriate in view of the supply-side substitutability, as well as the lack of a clear distinction between retail and trade distribution channels (as all end-users are free to purchase from all resellers).9

The Commission’s assessment

Segmentation between decorative paints and woodcare products

(13) The market investigation provided mixed results as to whether decorative paints and woodcare products constitute distinct product markets.

(14) First, the majority of competitors indicated that suppliers of decorative coatings manufacture both paints and woodcare products,10 and that there are no significant hurdles to switch from paints to woodcare products and vice versa.11 However, a third of the respondents considers that switching production between the two products would involve considerable time and resources and could even be uneconomical.12

(15) Second, while virtually all customers purchase both decorative paints and woodcare products,13 they consider that these products cannot be used interchangeably by end- customers.14 In this respect, one customer indicated that “in general paints and woodcare products are used for different purpose of use. However, it is possible that some consumers use paints as a substitute for woodcare products and vice versa in certain occasions” and another one specified that “[w]hen it comes to paints and woodcare products, our customers buy them for different use”.15

(16) Third, the market investigation did not provide any indication that any further segmentation of the (i) decorative paints and/or (ii) woodcare products segments was warranted.16

(17) In any event, for the purpose of this decision, the question of whether decorative paints and woodcare products constitute distinct markets can be left open, as it has no impact on the Commission’s competitive assessment of the Transaction.

Segmentation between water-based and solvent-based coatings

(18) The results of the market investigation did not support the Notifying Party’s view and provided indications that water-based coatings and solvent-based coatings constitute distinct product markets.

(19) First, whilst the vast majority of competitors indicated that manufacturers of decorative coatings produce both water-based and solvent-based coatings,17 half of them consider that switching production between the two products would involve considerable time and resources or even be uneconomical.18 In that respect, one supplier explained that “it would be quite time and resource consuming to change the production facility from water to solvent based (safety level of machines, air cleaning...)”.19

(20) Second, virtually all retailers (i.e. customers) purchase both water-based and solvent- based coatings.20 The majority of retailers consider however that these products are not purchased interchangeably by end-customers:21 more and more customers (and in particular DIY customers) choose water-based products because these are more environmentally friendly; conversely, some customers appear to keep a preference for solvent-based products based on the perception that these are more efficient.22 In addition, professional painters may in some instances favour solvent-based products because of their faster drying time, meaning that successive layers of paint can be applied faster, which increases the painters’ productivity.23

(21) Third, the market investigation did not provide any indication that any further segmentation of the (i) water-based coatings and/or (ii) solvent-based segments was warranted.24

(22) In any event, for the purpose of this decision, the question of whether water-based and solvent-based coatings constitute distinct product markets can be left open, as it has no impact on the Commission’s competitive assessment of the Transaction.

Segmentation by sales channels

(23) The market investigation provided indications that a segmentation of the market for decorative coatings (and its sub-segments) by sales channels is not appropriate in the present case.

(24) First, virtually all competitors who responded to the market investigation confirmed that they sell their products through both sales channels.25 Conversely, the results of the market investigation confirmed the lack of a clear distinction between retail and trade distribution channels from a customer’s point of view as end-users are increasingly free to purchase from all resellers.26

(25) Second, while the market investigation provided mixed results on whether the price and packaging of decorative coatings sold to professional and non-professional resellers were the same,27 both suppliers and customers recognized that there is no meaningful or only a relatively small difference in terms of quality, and that end- customers are free to choose either category of products.28 One customer indicated that “[a]ll products are usable by both user groups” and another one added that “[t]here are no meaningful differences between professional and consumer products.

In both channels, customers have options to choose from a wide range of paints”.29

(26) In light of the above, the Commission considers that, for the purpose of this decision, the overall market for the manufacture and wholesale supply of decorative coatings and the possible narrower markets (i.e. potential segmentations of the overall market for the manufacture and wholesale supply of decorative coatings, either between (i) decorative paints and (ii) woodcare products; or between (i) water-based decorative coatings and (ii) solvent-based decorative coatings; or between (a) solvent-based products and (b) water-based products within each of (i) paints and (ii) woodcare products) do not need to be further segmented by sales channels.30

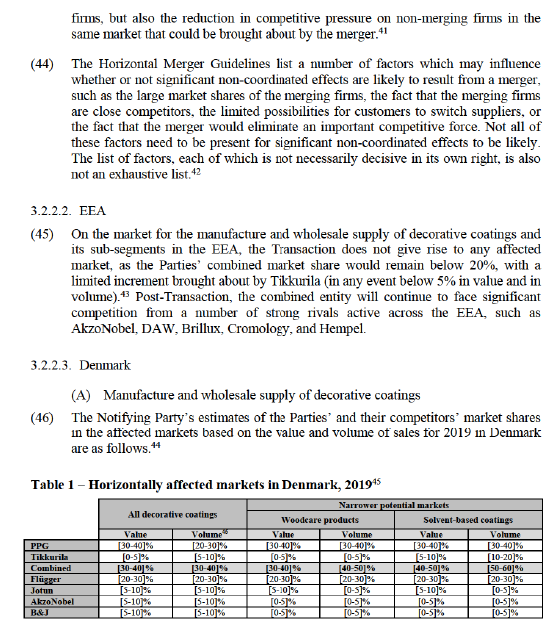

3.1.1.2. Geographic market definition

(27) In previous decisions, the Commission has left open whether the market for decorative coatings (and its sub-segments) is EEA-wide or national.31

(28) The Notifying Party submits that the market for decorative coatings has a national dimension, although the competitive pressure from imports is relevant.

(29) The market investigation was not conclusive as to whether the market for decorative coatings (and its sub-segments) is EEA-wide or national.32

(30) In any event, for the purpose of assessing the Transaction, the exact scope of the geographic market definition can be left open since under all above-mentioned plausible alternative geographic market definitions (EEA-wide or national), the Transaction does not give rise to serious doubts as to its compatibility with the internal market.

3.1.2. Retail distribution of decorative coatings

(31) The market for the retail distribution of decorative coatings is downstream from the market for the manufacture and wholesale supply of decorative coatings, and consists in the sale of decorative coatings to end-users by (specialised or not) shops.

3.1.2.1. Product market definition The Commission’s precedents

(32) The Commission has previously examined the market for the retail of DIY products (including decorative coatings). The Commission considered whether the market should be further segmented between products sold including (i) decorative products, (ii) wall, floor and tile coatings, (iii) tools, (iv) hardware and storage, (v) electricity and lighting, (vi) bathroom equipment, (vii) construction materials, (viii) woodwork and (ix) gardening.33 The Commission also considered a segmentation of the markets between distribution channels including (i) Do-It-Yourself retail shops, (ii) large food retailers, (iii) mono-product specialised shops, and (iv) neighbourhood stores.34 In both instances the Commission ultimately left the market definition open.

The Notifying Party’s view

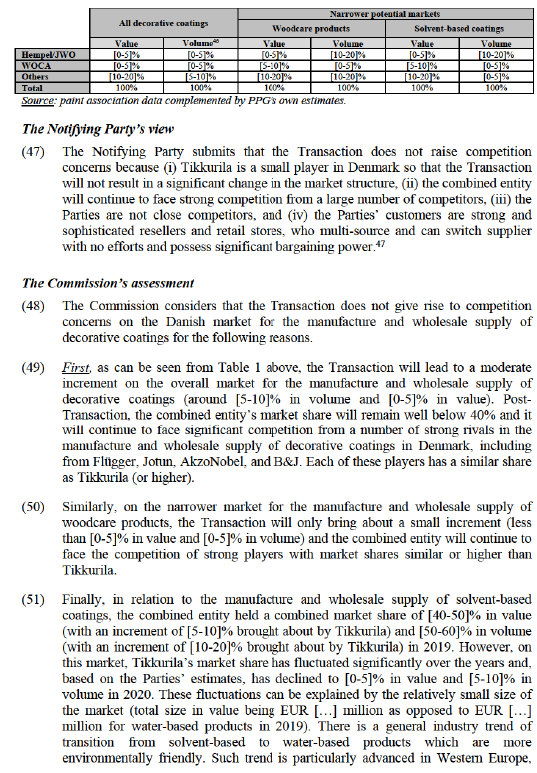

(33) The Notifying Party considers the retail distribution of decorative coatings to be the relevant product market, without the need for any further segmentations.35

The Commission’s assessment

(34) The market investigation did not indicate that the market for the retail distribution of decorative coatings should be further segmented. As a result, for the purposes of assessing the Transaction, the Commission will analyse the retail activities of the Parties on the basis of the narrowest plausible product market, namely the market for the retail distribution of decorative coatings. The Commission therefore considers that, for the purposes of assessing the Transaction, the retail distribution of decorative coatings constitutes a distinct product market, without the need for further segmentations.

3.1.2.2. Geographic market definition The Commission’s precedents

(35) The Commission has previously considered the market for the distribution of decorative, Do-It-Yourself and gardening products to be local in scope (within a 20km radius), while acknowledging the relevance of national market positions and strategies.36

The Notifying Party’s view

(36) The Notifying Party submits that the relevant geographic market for the retail distribution of decorative coatings is national or local (e.g. within a 30-50 km radius from a given store, depending on the country) in scope. The Notifying Party claims that prices do not vary significantly between different localities within the same country, inter alia because wholesalers set uniform prices over a national territory or because of competition from online resellers with such uniform pricing policies.37

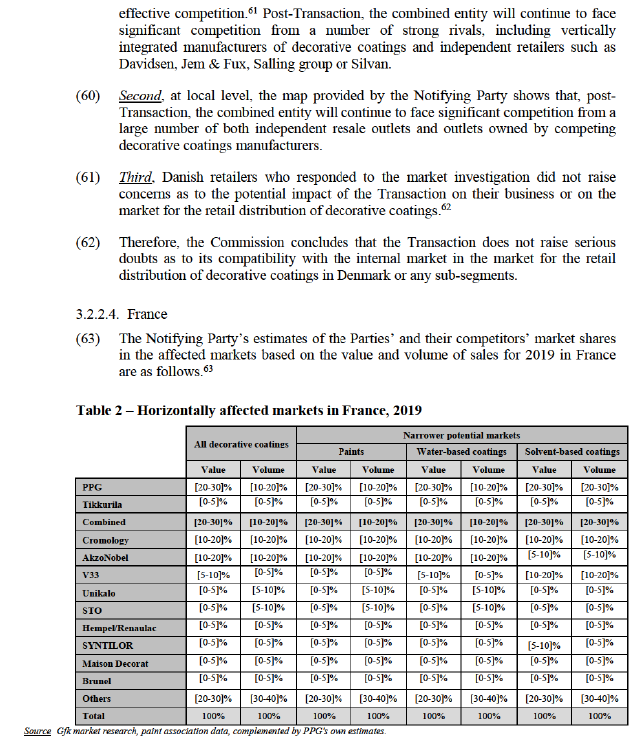

The Commission’s assessment

(37) The market investigation did not provide any indications pointing towards either alternative potential geographic market definition (i.e. national or local) for the resale of decorative coatings to end-users.

(38) In any event, for the purpose of assessing the Transaction, the exact scope of the geographic market definition can be left open since under all above-mentioned plausible alternative geographic market definitions, i.e. whether markets are defined as national, regional or local (including either as a 20km or a 30-50 km radius around stores), the Transaction does not give rise to serious doubts as to its compatibility with the internal market.

3.2. Competitive assessment

3.2.1. Introduction

(39) Based on the Notifying Party’s market share estimates, the Transaction gives rise to horizontally affected markets in (i) the manufacture and wholesale supply of decorative coatings in Denmark, France, Hungary, Latvia, Lithuania, the Netherlands, Poland, Slovakia, and Sweden and (ii) the retail distribution of decorative coatings in Denmark.38, 39

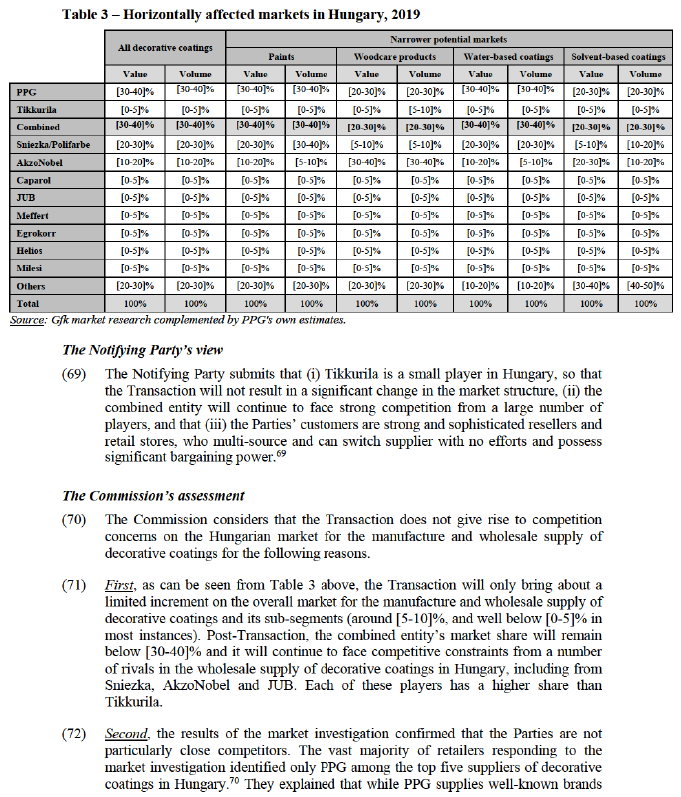

(40) The Transaction also gives rise to vertically affected markets as a result of the vertical link between the activities of the Parties as wholesalers of decorative coatings (upstream) and the retail distribution of decorative coatings to end-users (downstream) in Denmark, Hungary, the Netherlands, Poland, Slovakia, and Sweden.

3.2.2. Horizontal non - coordinated effects

3.2.2.1. Legal framework

(41) Article 2 of the Merger Regulation requires the Commission to examine whether notified concentrations are compatible with the internal market, by assessing whether they would significantly impede effective competition in the internal market or in a substantial part of it.

(42) The Commission Guidelines on the assessment of horizontal mergers under the Merger Regulation (the "Horizontal Merger Guidelines")40 distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non- coordinated effects and coordinated effects.

(43) Non-coordinated effects may significantly impede effective competition by eliminating the competitive constraint imposed by each merging party on the other, as a result of which the merged entity would have increased market power without resorting to coordinated behaviour. According to recital (25) of the Merger Regulation, a significant impediment to effective competition can result from the anticompetitive effects of a concentration even if the merged entity would not have a dominant position on the market concerned. In this regard, the Horizontal Merger Guidelines consider not only the direct loss of competition between the merging

including Denmark.48 On the solvent-based market segment, the combined entity will continue to face strong players such as Flügger, and Hempel, with shares exceeding the Tikkurila’s pre-Transaction, as well as Jotun with a similar share as the Tikkurila ([5-10]% in value and [5-10]% in value), and AkzoNobel, B&J and WOCA.

(52) Second, the results of the market investigation confirmed that the Parties are not particularly close competitors. The vast majority of retailers who replied to the market investigation identified only PPG among the top five suppliers of decorative coatings in Denmark.49 They explained that while PPG supplies well-known brands in the Danish market, Tikkurila is perceived by the Parties’ customers as a very small player (some of them not having heard of the company before).50 Overall, it appears that each of the Parties compete more closely with other suppliers, rather than between themselves, both in relation to decorative coatings and in relation to its sub-segments.51

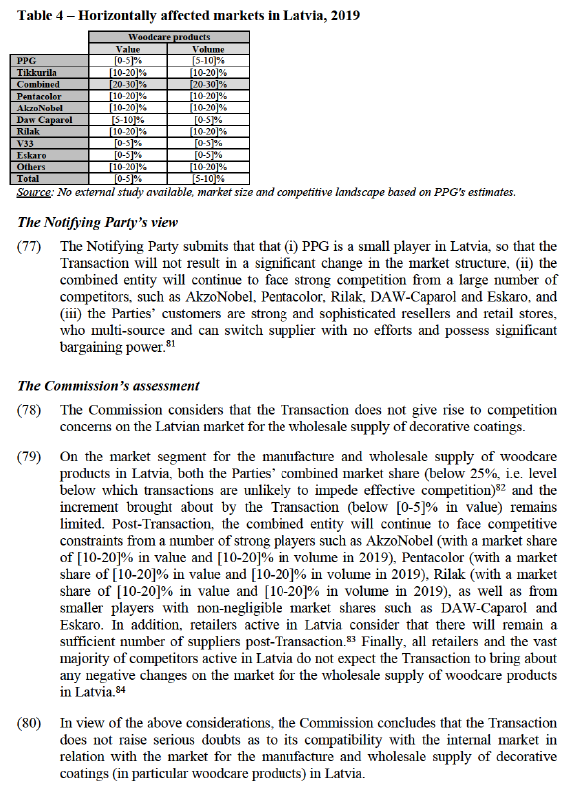

(53) Third, the market investigation revealed that it is relatively easy for retailers to change suppliers since (i) retailers usually have more than one supplier,52 and (ii) contracts have a limited duration of 1-3 years.53 Half of the Danish retailers who responded to the market investigation had switched suppliers over the past 3 years.54 In addition, retailers confirmed that neither PPG nor Tikkurila have products in their portfolio that are not offered by rivals.55 Therefore, there are limited barriers to switching.

(54) Fourth, the vast majority of respondents to the market investigation confirmed that they would continue to have a sufficient number of alternative suppliers from which to procure decorative coatings, including woodcare products and solvent-based coatings in Denmark post-Transaction.56 None of them expects the Transaction to bring about any negative changes on the market.57 This was also confirmed by competitors.58

(55) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the supply of decorative coatings (or any plausible sub-segmentation thereof) in Denmark.

(B) Retail distribution of decorative coatings in Denmark

(56) According to the Notifying Party, PPG and Tikkurila have a combined market share of [20-30]% (PPG: [10-20]% and Tikkurila: [5-10]%)59 in volume in 2019 on the market for the retail distribution of decorative coatings in Denmark. The Notifying Party was not able to provide market shares at local level but provided the below map showing the localities where the Parties’ direct resale outlets overlap. The Notifying Party also confirmed that, based on the Parties’ best estimates, their combined market share for the supply of decorative coatings at retail level (i) at regional level, (ii) in any 20km radius catchment area around each of their store and (iii) in any 30-50km radius catchment area around each of their store would not differ substantially from the Parties’ combined market share for the supply of decorative coatings at retail level in Denmark.

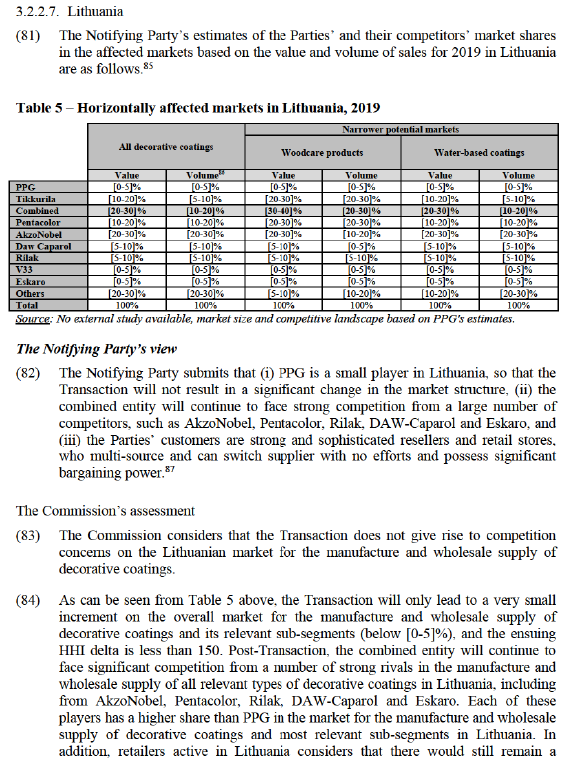

The Notifying Party’s view

(57) The Notifying Party submits that (i) the Parties’ combined market share at national level remains limited and many other players will remain active on the market and that (ii) in the localities where the parties’ direct resale outlets overlap, there are a large number of both independent resale outlets and outlets owned by competing decorative coatings manufacturers.60

The Commission’s assessment

(58) The Commission considers that the Transaction does not give rise to competition concerns on the Danish market for the retail distribution of decorative coatings for the following reasons.

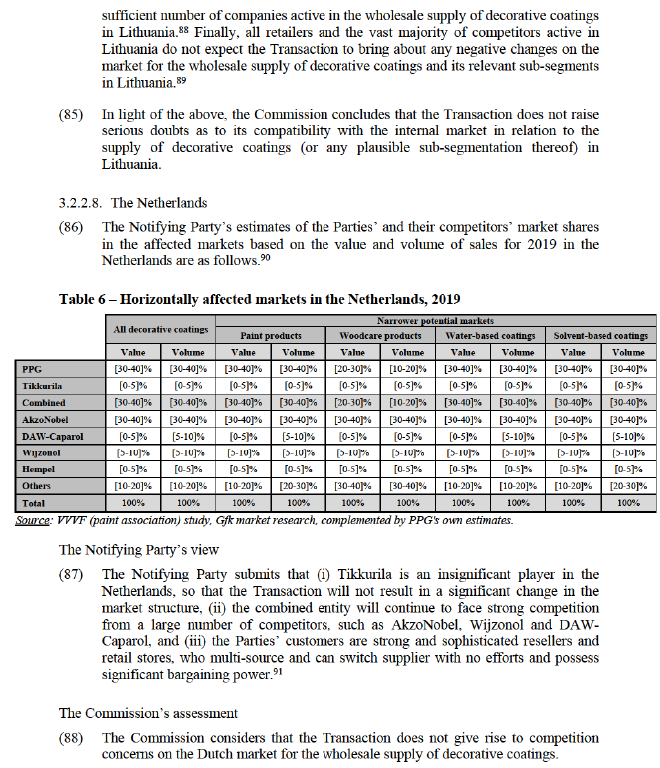

(59) First, at national level, the combined market share of PPG and Tikkurila remains limited (below 25%), a level below which transactions are unlikely to impede

The Notifying Party’s view

(64) The Notifying Party submits that (i) Tikkurila is an insignificant player in France, so that the Transaction will not result in anything but a negligible change in the market structure, (ii) the combined entity will continue to face strong competition from a large number of players, and that (iii) the Parties’ customers are strong and sophisticated resellers and retail stores, who multi-source and can switch supplier with no efforts and possess significant bargaining power.64

The Commission’s assessment

(65) The Commission considers that the Transaction does not give rise to competition concerns on the French market for the manufacture and wholesale supply of decorative coatings.

(66) As can be seen from Table 2 above, the Transaction will only lead to a negligible increment on the market for the manufacture and wholesale supply of decorative coatings and its sub-segments (in any event significantly below [0-5]%) and the ensuing HHI delta is less than 150. Post-Transaction, the combined entity will continue to face significant competition from a number of strong rivals in the manufacture and wholesale supply of decorative coatings and its sub-segments in France, including from Cromology, AkzoNobel, V33, Unikalo, and STO. Each of these players has a market share higher than Tikkurila on the decorative coatings market and all relevant sub-segments in France. In addition, the vast majority of retailers considers that there would still remain a sufficient number of companies active in the wholesale supply of decorative coatings in France.65 None of them expects the Transaction to bring about any negative changes on the market.66 This was also confirmed by competitors.67

(67) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the supply of decorative coatings (or any plausible sub-segmentation thereof) in France.

3.2.2.5. Hungary

(68) The Notifying Party’s estimates of the Parties’ and their competitors’ market shares in the affected markets and sub-segments based on the value and volume of sales for 2019 in Hungary are as follows.68

in the Hungarian market, Tikkurila is not particularly well-known.71 Overall, it appears that each of the Parties compete more closely with other suppliers, rather than between themselves, both in relation to decorative coatings and in relation to its sub-segments.72

(73) Third, the market investigation revealed that it is relatively easy for retailers to change suppliers since (i) retailers usually have more than one supplier,73 and (ii) contracts have a limited duration of 1-3 years.74 In addition, retailers confirmed that neither PPG nor Tikkurila have products in their portfolio that are not offered by rivals.75 Therefore, there are limited barriers to switching.

(74) Fourth, the vast majority of respondents to the market investigation active in Hungary confirmed that they will continue to have a sufficient number of alternative suppliers from which to procure all types of decorative coatings in Hungary post- Transaction.76 None of them expects the Transaction to bring about any negative change on the market.77 This was also confirmed by competitors.78

(75) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the supply of decorative coatings (or any plausible sub-segmentation thereof) in Hungary.

3.2.2.6. Latvia

(76) According to the Notifying Party’s estimates, PPG and Tikkurila have combined market shares of 20% or more only on the market segment for the manufacture and wholesale supply of woodcare product in Latvia. On this market segment, the Parties had a combined market share of [20-30]% in value (PPG: [0-5]% and Tikkurila: [10- 20]%) and [20-30]% in volume (PPG: [5-10]% and Tikkurila: [10-20]%) in 2019.79 The Notifying Party’s estimates of the Parties’ and their competitors’ market shares in woodcare products based on the value and volume of sales for 2019 in Latvia are as follows.80

The Notifying Party’s view

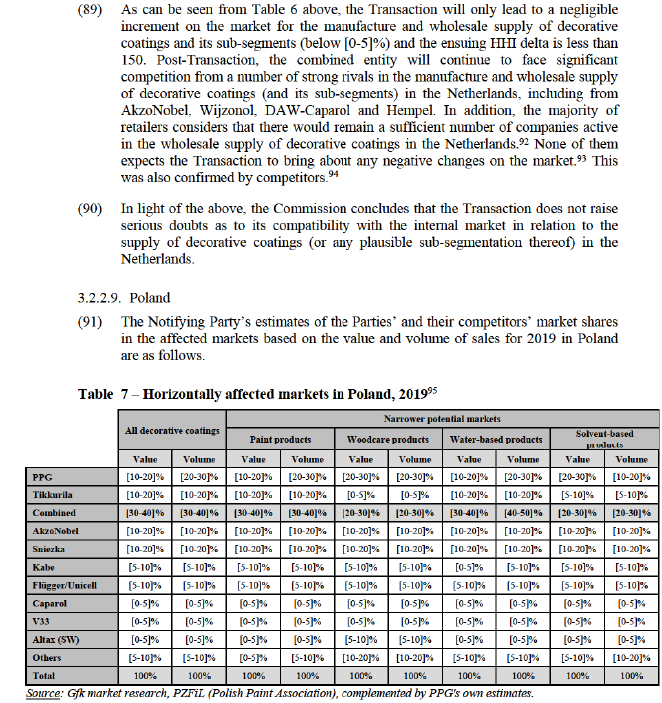

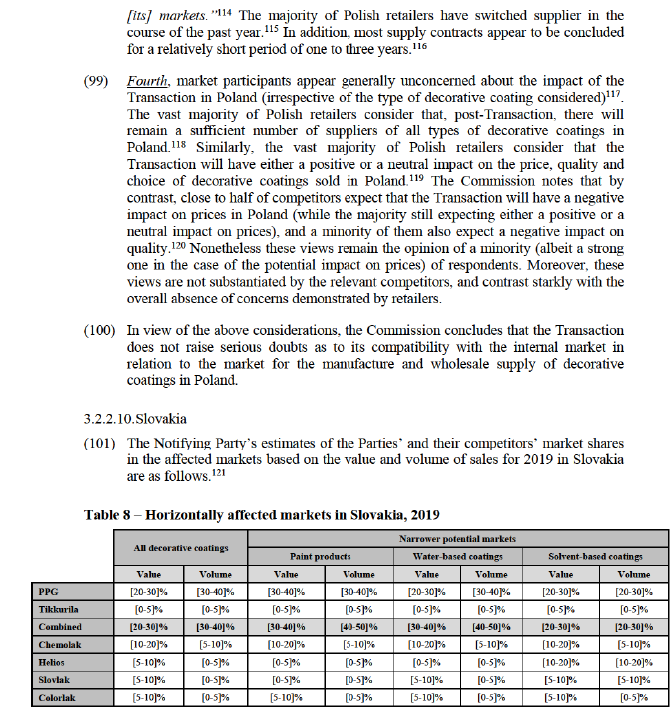

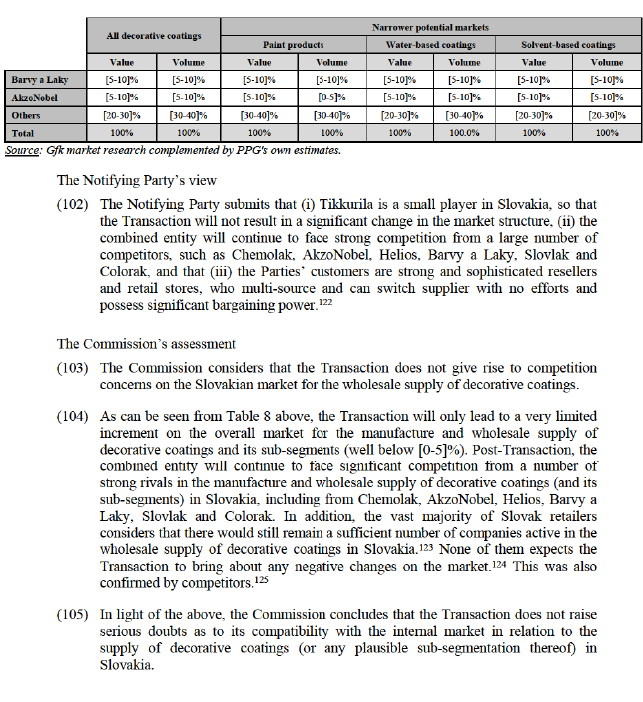

(92) The Notifying Party submits that the Transaction does not raise competition concerns because (i) the combined entity will continue to face strong competition from a large number of competitors with production capacities in Poland, (ii) the Parties are not close competitors as Tikkurila is perceived as a high-quality/high cost supplier on the market, while PPG is instead perceived as supplier of intermediate quality and cost, and (iii) the Parties’ customers are strong and sophisticated resellers and retail stores, who multi-source and can switch supplier with no efforts and possess significant bargaining power.96

The Commission’s assessment

(93) The Commission considers that the Transaction does not give rise to competition concerns on the Polish market for the manufacture and wholesale supply of decorative coatings for the following reasons.

(94) First, as can be seen from Table 7 above, the combined entity will continue to face strong players in the wholesale supply of decorative coatings (and its sub-segments) in Poland, including from AkzoNobel, Sniezka, Kabe, Flügger and Caparol.97 This is in line with the views expressed by respondents to the market investigation active in Poland, one of them explaining that “Poland is a very competitive market with many players.”98

(95) Second, the market investigation confirmed to some extent the Notifying Party’s claim that the Parties do not compete closely on the Polish market. Only around half of Polish retailers place both Parties among the top 5 competitors in Poland.99 Similarly, when asked specifically about each of the Parties’ closest competitors on the Polish market, only around half of retailers consider either PPG to be among Tikkurila’s top 5 competitors (or vice versa) in Poland.100 The difference between the Parties’ offering is highlighted by a customer of the Parties in Poland, in the following terms: “Tikkurila offers adequate price for all the products, high quality, strong brand position, wide range of products, positive existing relatioship [sic] with supplier, manufacturing located in Poland what follows easy acces [sic] to the products. PPG average quality and prices of the products, poor range of products, not existing business relationship, manufacturing located in Poland, insignificant position on the market.”101 The fact that Tikkurila’s brands and products compete in the premium segment of the market, while PPG’s are perceived as brands and products of more intermediate quality and cost is confirmed by another customer of the Parties in Poland: “In Poland, PPG has strong brands (Bondex and Dekoral) which are well-seen both by professional and DIY customers. Drewnochon is also perceived as popular: a mid-quality product at an affordable price. In Poland, Tikkurila and Beckers products (Tikkurila brands) are positioned at a higher (medium/high price) price point than Dekoral (PPG brand) - they are premium products.”102 Retailers confirmed that this analysis would not differ depending on any potential sub-segments within decorative coatings.103

(96) In addition, the vast majority of both retailers and competitors consider that PPG and Tikkurila compete in Poland equally with several other suppliers.104 This view is confirmed by a customer of the Parties in Poland, commenting “in Poland […] both manufacturers compete between themselves as well as with a number of other suppliers.”105 Finally, according to an overwhelming majority of both retailers and competitors, none of PPG or Tikkurila have any particular product not offered by other players or offered by fewer than two other suppliers.106 Again, both retailers and competitors confirmed that their opinion would not differ depending on any potential sub-segments within decorative coatings.107

(97) Third, the market investigation also confirmed to some extent the validity of the Notifying Party’s argument about the sophistication and bargaining power of the Parties’ customers. Half of responding Polish retailers considers that they have equal bargaining power with the strongest suppliers when negotiating their purchases of decorative coatings (irrespective of the type of decorative coating)108. The other half considers that they have either strong or very strong bargaining power, and none of the Polish retailers considers that it has either little or very little bargaining power compared with the strongest suppliers when negotiating their purchases of decorative coatings.109 By contrast, a majority of competitors, including large players, generally consider they have little or very little bargaining power compared to large retailers when negotiating their supply of decorative coatings.110 As an illustration of this bargaining power, a Polish customer of the Parties explains: “My company has a long lasting presence on the local market […] if any new supplier is about to establish in the area, it is known that it rather needs to establish a contract with my company.”111

(98) This element is reinforced by the multi-sourcing strategies put in place by retailers, and their ease to switch suppliers. The vast majority of Polish retailers have more than five different suppliers of decorative coatings.112 A customer of the Parties in Poland mentions “We work in Poland with various supplier for paint coatings (Sniezka, Akzo Nobel, PPG, Tikkurilla, Syntilor, V33 the main one[s])”,113 while another explains that it has “more than 5 suppliers of decorative coatings in all of

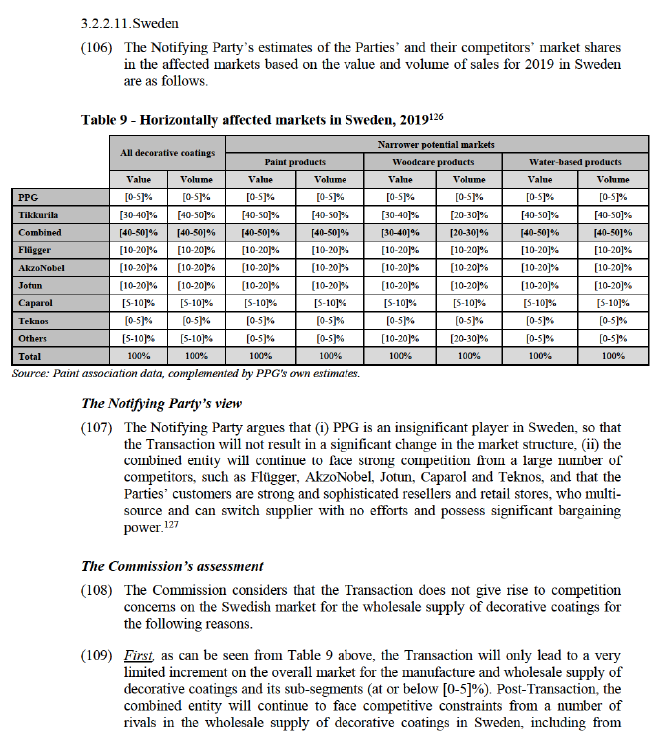

Flügger, AkzoNobel, Jotun, Caparol and Teknos. Each of these players has a higher share than PPG in the market for the wholesale supply of decorative coatings in Sweden.

(110) Second, the results of the market investigation confirmed that the Parties are not particularly close competitors. The majority of retailers responding to the market investigation identified either PPG or Tikkurila among the top five suppliers of decorative coatings in Sweden.128 They explained that while Tikkurila sells well- known brands in the Swedish market, PPG has a limited presence in the country (some retailers are not able to name a brand owned by PPG).129 Overall, it appears that each of the Parties compete more closely with other suppliers, rather than between themselves, both in relation to decorative coatings and in relation to its sub- segments.130

(111) Third, the market investigation revealed that it is relatively easy for retailers to change suppliers since (i) retailers usually have more than one supplier,131 and (ii) contracts have a limited duration of 1-3 years.132 The majority of Swedish retailers who responded to the market investigation had switched suppliers over the past 3 years.133 In addition, retailers confirmed that neither PPG nor Tikkurila have products in their portfolio that are not offered by rivals.134 Therefore, there are limited barriers to switching.

(112) Fourth, all retailers active in Sweden who responded to the market investigation confirmed that they will continue to have a sufficient number of alternative suppliers from which to procure all types of decorative coatings in Sweden post- Transaction.135 None of them expects the Transaction to bring about any negative changes on the market.136

(113) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the supply of decorative coatings (or any plausible sub-segmentation thereof) in Sweden.

3.2.3. Vertical non—coordinated effects

3.2.3.1. Legal framework

(114) The Commission’s Guidelines on the assessment of non-horizontal mergers under the Merger Regulation (the "Non-Horizontal Merger Guidelines") distinguish between two main ways in which vertical mergers may significantly impede effective competition, namely input foreclosure and customer foreclosure.137

(115) For a merger to raise input foreclosure competition concerns, the merged entity must have a significant degree of market power upstream.138 In assessing the likelihood of an anticompetitive input foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to substantially foreclose access to inputs; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on competition downstream.139

(116) For a merger to raise customer foreclosure competition concerns, the merged entity must be an important customer with a significant degree of market power in the downstream market.140 In assessing the likelihood of an anticompetitive customer foreclosure strategy, the Commission has to examine whether (i) the merged entity would have the ability to foreclose access to downstream markets by reducing its purchases from its upstream rivals; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.141

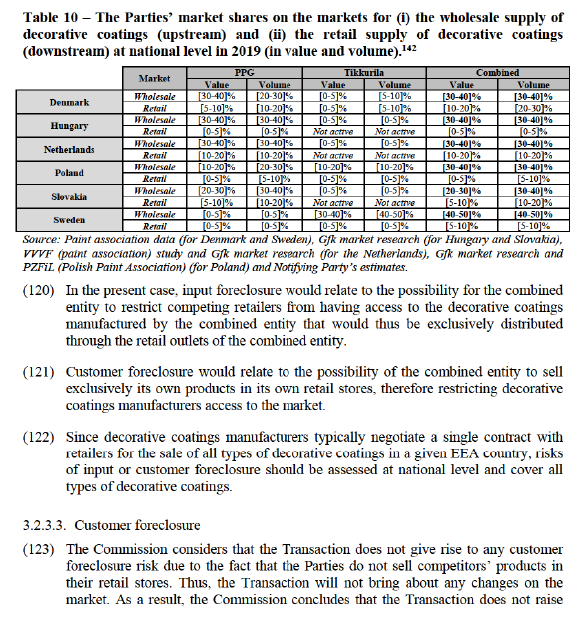

3.2.3.2. Overview of the Parties’ and their competitors’ market shares

(117) Decorative coatings manufacturers supply their products at the wholesale level to retailers (upstream market). Retailers then sell decorative coatings to end-users, through their retail outlets or DIY stores. (downstream market).

(118) Most decorative coatings manufacturers are, at least to a certain extent, vertically integrated at retail level. Depending on the EEA country, the level of integration of the various manufacturers can be very different.

(119) An overview of the vertically affected markets arising from the Transaction is provided in the table below.

serious doubts as to its compatibility with the internal market relative to customer foreclosure risks.

serious doubts as to its compatibility with the internal market relative to customer foreclosure risks.

3.2.3.4. Input foreclosure

The Notifying Party’s views

(124) In relation to Hungary, Netherlands, Poland and Slovakia, the Notifying Party submits that input foreclosure is unlikely to materialize because (i) Tikkurila is not (or barely) active in the retail distribution of decorative coatings to end-users and (ii) PPG is already active at both upstream and downstream level pre-Transaction. As such, the Transaction would not create any shift in PPG’s incentives to engage in potential input foreclosure strategies.143

(125) As regards Denmark and Sweden, the Notifying Party submits that input foreclosure is unlikely to materialize since (i) the Parties’ main competitors upstream are suppliers of decorative coatings which are themselves vertically integrated downstream, (ii) PPG (for Denmark) and Tikkurila (for Sweden) are already today active at both upstream and downstream levels (and not engaging in any input foreclosure practice), (iii) the increment brought by Tikkurila at downstream for Denmark and by PPG for Sweden is too small to create a significant shift in the combined entity’s incentives to engage in potential input foreclosure strategies, and (iv) any foreclosure strategy of independent resale outlets would likely divert the wholesale purchases of these resale outlets towards rival suppliers.144

The Commission’s assessment

(126) The Commission considers that the Transaction would not give rise to any significant input foreclosure for the following reasons.

(127) First, the Commission considers that the combined entity would not have the ability to foreclose its rivals in the downstream market for the retail supply of decorative coatings in Denmark, Hungary, the Netherlands, Poland, Slovakia and Sweden due to the presence of a substantial number of decorative coatings suppliers to which independent resale outlets could turn to. The vast majority of retailers who responded to the market investigation confirmed that there would remain a sufficient number of alternative suppliers they could to turn to if the combined entity decided to stop selling them decorative coatings.145 This is further corroborated by the fact that, as explained in Section 3.2.2 above, the majority of retailers have more than five different suppliers,146 switching suppliers is relatively easy,147 and contracts generally have a limited duration of 1-3 years.148 Over half of the retailers who responded to the market investigation switched suppliers over the past 3 years. Therefore, there are limited barriers to switching and, post-Transaction, a sufficient number of decorative coatings suppliers will remain on the market. In addition, the vast majority of competitors149 and retailers150 confirmed that neither PPG not Tikkurila have a unique type of decorative coatings in their portfolio that could not be offered by rival suppliers.

(128) Second, the Commission considers that the combined entity would not have the incentive to foreclose its downstream rivals in the resale of decorative coatings to end-users in Denmark, Hungary, the Netherlands, Poland, Slovakia and Sweden, by restricting access to its decorative coatings to independent resellers.151 The Commission finds that any foreclosure strategy would likely divert wholesale sales towards rival manufacturers while only leading to marginal benefits at the retail level due to the Parties’ limited market share downstream, and the competition they face in every relevant market. The market investigation indeed confirmed that retailers can easily switch suppliers within a short period of time (and the vast majority has done so in the past), in particular due to the fact that the vast majority of retailers rely on multi-sourcing strategies.152 Retailers usually carry multiple brands from different manufacturers, which allows them to supply and reallocate their respective shares of wallet within a short period of time, should supply conditions from the combined entity deteriorate post-Transaction.

(129) In addition, the Commission notes that the vertical link between the wholesale provision of decorative coatings in Denmark and the resale of decorative coatings to end-users in Denmark is pre-existing, as both Parties are active both upstream and downstream, with a limited increment brought about by Tikkurila (both upstream and downstream). Thus, the Commission considers that the incentives of the combined entity will not change significantly as a result of the Transaction. This is all the more true in Hungary, the Netherlands,Poland and Slovakia, where PPG is strong at both upstream and downstream level and Tikkurila is not or barely active at downstream level.

(130) Similarly, the vertical link between the wholesale provision of decorative coatings in Sweden and the resale of decorative coatings to end-users in Sweden is also pre- existing, as both Parties are active both upstream and downstream, with a limited increment brought about by PPG (both upstream and downstream). Thus, the Commission considers that the incentives of the combined entity will not change significantly as a result of the Transaction.

(131) Third, the Commission considers that any input foreclosure strategy is unlikely to have a significant detrimental impact on competition in the resale of decorative coatings to end-users in Denmark, Hungary, the Netherlands, Poland, Slovakia and Sweden. The Commission notes that retailers responding to the market investigation did not raise concerns as to the risk of a foreclosure strategy or its potential impact on their business or on the market.153

(132) In light of the above, the Commission concludes that the Transaction is unlikely to raise serious doubts as to its compatibility with the internal market in relation to the vertical link between the wholesale supply of decorative coatings and the retail of decorative coatings in Denmark, Hungary, the Netherlands, Poland, Slovakia and Sweden.

4. CONCLUSION

(133) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the “EEA Agreement”).

3 Turnover calculated in accordance with Article 5 of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C 95, 16.4.2008, p. 1).

4 See cases M.8020 – Sherwin-Williams/Valspar, decision of 10 August 2016; M.6270 - Berkshire Hathaway/Lubrizol, decision of 24 August 2011; M.4779 AkzoNobel/ICI, decision of 13 December 2007; and M.4853 PPG/Sigmakalon, decision of 10 December 2007.

5 See case M.1167 – ICI/Williams, decision of 29 April 1998.

6 See case M.8020 – Sherwin-Williams/Valspar, decision of 10 August 2016.

7 See case M.390 – Akzo/Nobel IndustrierCI/Williams, decision of 10 January 1994.

8 See case M.4779 AkzoNobel/ICI, decision of 13 December 2007.

9 Form CO, paragraphs 41-46.

10 Question 6 of questionnaire Q2 to competitors.

11 Question 7 of questionnaire Q2 to competitors.

12 Question 7 of questionnaire Q2 to competitors.

13 Question 3 of questionnaire Q2 to customers.

14 Question 6 of questionnaire Q1 to customers. The Commission notes that wholesalers’ supply strategies are driven by end-customers’ preferences and expectations. For this reason, the preferences of end- customers appear relevant in the context of assessing the market definition at wholesale level.

15 Question 6.1 of questionnaire Q1 to customers.

16 Questions 6.2 and 6.3 of questionnaire Q1 to customers.

17 Question 8 of questionnaire Q2 to competitors.

18 Question 9 of questionnaire Q2 to competitors.

19 Question 7.1 of questionnaire Q2 to competitors.

20 Question 3 of questionnaire Q1 to customers.

21 Question 7 of questionnaire Q1 to customers.

22 Question 7.1 of questionnaire Q1 to customers.

23 Non-confidential minutes of a call with a decorative coatings competitor, dated 20 January 2021.

24 Questions 6.2 and 6.3 of questionnaire Q1 to customers.

25 Question 12 of Q2 to competitors.

26 Question 12.1 of Q2 to competitors.

27 Questions 10.1 and 10.2 of questionnaire Q1 to customers and questions 11.1 and 11.2 of Q2 to competitors.

28 Question 10.3 of questionnaire Q1 to customers and question 11.3 of Q2 to competitors.

29 Question 11.4 of Q2 to competitors.

30 As a consequence, there is no need to assess, for the purpose of this decision, the relevance of a further segmentation between branded products and private labels within the retail segment.

31 See cases M.4779 AkzoNobel/ICI, decision of 13 December 2007; M.4853 PPG/Sigmakalon, decision of 10 December 2007; and M.8020 – Sherwin-Williams/Valspar, decision of 10 August 2016.

32 Questions 11-13 of questionnaire Q1 to customers and questions 13-15 of questionnaire Q2 to competitors.

33 See cases M.2898 Leroy Merlin/Brico, decision of 13 December 2002 and M.2804 - Vendex KBB/Brico Belgium, decision of 17 July 2002. Also see referral cases M.7677 OBI/Baumax certain assets, decision of 4 August 2014 and M.7283 Kingfisher/Mr Bricolage, decision of 11 August 2014.

34 See cases M.2898 Leroy Merlin/Brico, decision of 13 December 2002. Also see referral cases M.7677 OBI/Baumax certain assets, decision of 4 August 2014 and M.7283 Kingfisher/Mr Bricolage, decision of 11 August 2014.

35 Form CO, paragraph 47.

36 See cases M.2898 Leroy Merlin/Brico, decision of 13 December 2002. Also see referral case M.7677

OBI/Baumax certain assets, decision of 4 August 2014.

37 Form CO, paragraph 62.

38 As regards Czechia, given Tikkurila’s negligible amount of sales over the past years on the market for the manufacture and wholesale supply of decorative coatings ([…]) and the fact that, post-Transaction, the Parties will continue to face the competition of strong players, the Commission concludes that the Transaction does not give rise to competition concerns in Czechia.

39 As regards the segmentation of paints and woodcare products by chemical composition, the Notifying Party confirmed that, based on the Parties’ best estimates, the Parties’ combined market shares for the supply of (i) water-based paints, (ii) solvent-based paints, on the one hand, and (iii) water-based woodcare products, and (iv) solvent-based woodcare products, on the other hand, in each of the relevant Member States examined in Section 3.2.2, would not differ substantially from the Parties’ combined market shares for the supply of (i) paints, and (ii) woodcare products respectively in these countries.

40 OJ C 31, 05.02.2004, p. 5.

41 Horizontal Merger Guidelines, paragraphs 24 and 25.

42 Horizontal Merger Guidelines, paragraphs 26-38.

43 At EEA level, the Parties' combined market share on a hypothetical overall market for all decorative coatings would be (10-20]% in value, with a [0-5]% increment from Tikkurila, and [10-20]% in volume, with a (0-5]% increment from Tikkurila. In the potential sub-segments for paints, woodcare products, water-based decorative coatings and/or solvent-based decorative coatings, the Parties' combined market share is at most (10-20]% (for solvent-based products, in volume), and the increment from Tikkurila is at most [5-10]% (for woodcare products, in value).

44 The potential markets for paints and water-based decorative coatings in Denmark are not affected.

45 The market shares of the Parties did not substantially differ in 2017, 2018 and 2020 (based on the Notifying Party's estimates for 2020) on the overall market for decorative coatings and its sub-segment for woodcare products.

46 In litres.

47 Form CO, paragraph 120.

48 Non-confidential minutes of a call with a decorative coatings competitor, dated 20 January 2021.

49 Question 14 of questionnaire Q1 to customers.

50 Questions 15.1 and 15.2 of questionnaire Q1 to customers.

51 Questions 16 and 17.3 of questionnaire Q1 to customers.

52 Question 19 of questionnaire Q1 to customers.

53 Question 20.2 of questionnaire Q1 to customers.

54 Question 20 of questionnaire Q1 to customers.

55 Question 18 of questionnaire Q1 to customers.

56 Question 22 of questionnaire Q1 to customers.

57 Question 24.3 of questionnaire Q1 to customers.

58 Question 21.1 of questionnaire Q2 to competitors.

59 Market shares have been estimated on the basis of the paint association data and have been complemented by PPG's own estimates. Should the market shares be computed based on the Parties’ sales (EUR), the market for the retail distribution of decorative coatings in Denmark would not be affected (PPG: [5-10]% and Tikkurila: [0-5]% in 2019). The market shares of the Parties did not substantially differ in 2017, 2018 and 2020 (based on the Notifying Party’s estimates for 2020).

60 Form CO, paragraph 122.

61 Horizontal Merger Guidelines, para. 18.

62 Question 25 of questionnaire Q1 to customers.

63 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years. The potential market for woodcare products in France is not affected.

64 Form CO, paragraph 129.

65 Question 22 of Q1 to customers.

66 Question 24.4 of Q1 to customers.

67 Question 21.5 of questionnaire Q2 to competitors.

68 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years.

69 From CO, paragraph 133.

70 Question 14 of questionnaire Q1 to customers.

71 Questions 15.1 and 15.2 of questionnaire Q1 to customers.

72 Questions 16 and 17.5 of questionnaire Q1 to customers.

73 Question 19 of questionnaire Q1 to customers.

74 Question 20.2 of questionnaire Q1 to customers.

75 Question 18 of questionnaire Q1 to customers.

76 Question 22 of questionnaire Q1 to customers.

77 Question 24.4 of questionnaire Q1 to customers.

78 Question 21.2 of questionnaire Q2 to competitors.

79 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years.

80 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years.

81 Form Co, paragraph 141.

82 Horizontal Merger Guidelines, para. 18.

83 Question 22 of questionnaire Q1 to customers.

84 Question 24.4 of questionnaire Q1 to customers and question 21.5 of questionnaire Q2 to competitors.

85 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years. The potential markets for paints and solvent-based decorative coatings in Lithuania are not affected.

86 In litres.

87 Form Co, paragraph 145.

88 Question 22 of questionnaire Q1 to customers.

89 Question 24.4 of questionnaire Q1 to customers and question 21.5 of questionnaire Q2 to competitors.

90 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years.

91 Form Co, paragraph 152.

92 Question 22 of Q1 to customers.

93 Question 24.4 of Q1 to customers.

94 Question 21.5 of questionnaire Q2 to competitors.

95 The market shares of the Parties did not substantially differ in 2017, 2018 and 2020 on the overall market for decorative coatings and its sub-segments, except for a general decreasing trend in PPG's shares throughout this period. As a result, the Parties' combined market shares decreased from (30-40]% in value (30-40]% in volume) in 2017 to [30-40]% in value (30-40]% in volume) in 2020. A similar trend applies to all potential sub-segments of the decorative coatings market.

96 Form CO, paragraphs 161-167.

97 In addition, as mentioned in footnote 95 above, these competitors have been responsible, in the course of the past four years, for the progressive decline of PPG’s (and subsequently the Parties’ combined) market shares.

98 Non-confidential minutes of a call with a decorative coatings competitor, dated 20 January 2021. See also the same competitor’s response to question 17.1 of Q2 – Questionnaire to decorative coatings competitors: “Poland is a competitive market with a number of players.”

99 Question 14 of Q1 – Questionnaire to decorative coatings customers.

100 Question 17.2 of Q1 – Questionnaire to decorative coatings customers.

101 Question 13.1 of Q1 – Questionnaire to decorative coatings customers.

102 Question 15.3 of Q1 – Questionnaire to decorative coatings customers.

103 Question 14.1 and 17.6 of Q1 – Questionnaire to decorative coatings customers.

104 Question 16 of Q1 – Questionnaire to decorative coatings customers and question 17 of Q2 – Questionnaire to decorative coatings customers.

105 Question 16.1 of Q1 – Questionnaire to decorative coatings customers.

106 Questions 18 and 18.2 of Q1 – Questionnaire to decorative coatings customers and questions 19 and 19.2 of Q2 – Questionnaire to decorative coatings customers.

107 Question 16.1 of Q1 – Questionnaire to decorative coatings customers and question 17.1 of Q2 – Questionnaire to decorative coatings customers.

108 Question 21.1 of Q1 – Questionnaire to decorative coatings customers.

109 Question 21 of Q1 – Questionnaire to decorative coatings customers.

110 Question 20 of Q2 – Questionnaire to decorative coatings competitors.

111 Question 21.1 of Q1 – Questionnaire to decorative coatings customers.

112 Question 19 of Q1 – Questionnaire to decorative coatings customers.

113 Question 19.1 of Q1 – Questionnaire to decorative coatings customers.

114 Question 19.1 of Q1 - Questionnaire to decorative coatings customers.

115 Question 20 of Q1 - Questionnaire to decorative coatings customers.

116 Question 20.2 of Q1 - Questionnaire to decorative coatings customers.

117 Questions 22.1 and 24.5 of Q1 - Questionnaire to decorative coatings customers.

118 Question 22 of Q1 - Questionnaire to decorative coatings customers.

119 Question 24.1 of Q1 - Questionnaire to decorative coatings customers.

120 Question 21.3 of Q2 - Questionnaire to decorative coatings competitors.

121 The Notifying Party confirmed that these shares did not evolve significantly in the course of the past three years. The potential market for woodcare products in Slovakia is not affected.

122 Form Co, paragraph 177.

123 Question 22 of Q1 to customers.

124 Question 24.4 of Q1 to customers.

125 Question 21.5 of questionnaire Q2 to competitors.

126 The market shares of the Parties did not substantially differ in 2017, 2018 and 2020 (based on the Notifying Party's estimates for 2020) on the overall market for decorative coatings and its sub-segments, except for (i) the year 2020, where, based on the Notifying Parties' estimates, the Parties' market shares were lower than their average level over the period, (ii) woodcare products, where the Parties combined market shares decreased from [40-50]% in value ([30-40]% in volume) in 2017 to [30-40]% in value ([20-30]% in volume) in 2020. The potential market for solvent-based decorative coatings in Sweden is not affected.

127 Form Co, paragraph 183.

128 Question 14 of questionnaire Q1 to customers.

129 Questions 15.1 and 15.2 of questionnaire Q1 to customers.

130 Questions 16 and 17.4 of questionnaire Q1 to customers.

131 Question 19 of questionnaire Q1 to customers.

132 Question 20.2 of questionnaire Q1 to customers.

133 Question 20 of questionnaire Q1 to customers.

134 Question 18 of questionnaire Q1 to customers.

135 Question 22 of questionnaire Q1 to customers.

136 Question 24.2 of questionnaire Q1 to customers.

137 OJ L 24, 29.1.2004, p. 1.

138 Non-horizontal Merger Guidelines, paragraph 35.

139 Non-horizontal Merger Guidelines, paragraph 32.

140 Non-horizontal Merger Guidelines, paragraph 61.

141 Non-horizontal Merger Guidelines, paragraph 59.

142 With respect to the upstream markets, while Table 10 above only lists market shares for the overall market for the wholesale supply of decorative coatings in each relevant country, there may also be affected markets in these countries in the possible narrower markets. These are listed in each relevant section of the analysis of the horizontal non-coordinated effect in Section 3.2.2. With respect to the downstream markets, while Table 10 above only lists market shares at national level in the market for the retail of decorative coatings in each relevant country. The Notifying Party however confirmed that, based on the Parties' best estimates, the Parties' combined market share for the supply of decorative coatings at retail level (i) at regional level, (ii) in any 20km radius catchment area around each of their store and (iii) in any 30-50km radius catchment area around each of their store in each of (a) Denmark, (b) the Netherlands, (c) Poland, (d) Slovakia and (e) Sweden would not differ substantially from the Parties' combined market share for the retail of decorative coatings at national level in each of these countries. By way of exception, as regards Hungary, where PPG has only [...] stores and Tikkurila is not active at retail level, the share estimate at the narrowest level (radius catchment area of 20 km) would be of around [5-10]%. The share estimate would be of less than [0-5]% in a radius catchment area of 30-50 km or at regional level.

143 Form CO, paragraphs 136, 155, and 172.

144 Form CO, paragraphs 124 and 187.

145 Question 23 of questionnaire Q1 to customers.

146 Question 19 of questionnaire Q1 to customers.

147 Question 20 of questionnaire Q1 to customers.

148 Question 20.2 of questionnaire Q1 to customers.

149 Question 19 to questionnaire Q2 to competitors.

150 Question 18 to questionnaire Q1 to customers.

151 As regards Denmark and Sweden, the Parties’ main competitors upstream are suppliers of decorative coatings which are themselves vertically integrated downstream, and only sell their own products in their branded stores. This would be true as well in other countries (Hungary, the Netherlands, Poland and Slovakia); however, the limited importance of branded outlets compared to independent resellers in these countries makes this argument less relevant in the context of input foreclosure scenarios. At any rate, the Commission notes that in all countries considered in this section, input foreclosure could only apply to independent resellers (and not branded outlets).

152 Questions 19 and 20 of Q1 – Questionnaire to decorative coatings customers.

153 Question 25 of questionnaire Q1 to customers.