EC, August 26, 2020, No M.9299

COMMISSION OF THE EUROPEAN COMMUNITIES

Decision

DISCOVERY / POLSAT / JV

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union (the "TFEU")1,

Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof,

Having regard to Council Regulation (EC) No. 139/2004 of 20.1.2004 on the control of concentrations between undertakings2 (the "Merger Regulation"), and in particular Article 9(3) thereof,

Having regard to the notification made by Discovery Communications Europe Limited and Cyfrowy Polsat S.A. on 7 July 2020, pursuant to article 4 of the said Regulation,

Having regard to the request of the President of the Office of Competition and Consumer Protection of Poland (Urzędu Ochrony Konkurencji I Konsumentów (“the UOKiK”)) of 27 July 2020 and received by the Commission on 27 July 2020 (the “Referral Request”),

Whereas:

(1) On 7 July 2020 the Commission received notification of a proposed concentration by which Discovery Communications Europe Limited (“Discovery”, UK) belonging to Discovery, Inc. (“Discovery Group”, US), and Cyfrowy Polsat S.A. (“Polsat”, Poland), controlled by Zygmunt Solorz, acquire, within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation, joint control of a newly created company constituting a joint venture (the “JV”, Poland) (the “Transaction”).

(2) Discovery and Polsat are collectively referred to as the “Notifying Parties” or the “Parents”. Discovery, Polsat and the JV are jointly referred to as the “Parties”.

(3) The UOKiK received a copy of the notification on 8 July 2020.

(4) By its Referral Request, Poland via the UOKiK requested the referral to its competition authority of the proposed concentration with a view to assessing it under national competition law, pursuant to Article 9(2)(a) of the Merger Regulation.

1. THE PARTIES

(5) Discovery is a media company belonging to the Discovery Group, which produces free-to-air (“FTA”) and pay-TV channels and provides TV content across multiple distribution platforms. Discovery's portfolio in the EEA includes: (i) non-fiction TV channels through its global brands (such as Discovery and Animal Planet); (ii) sports entertainment channels through Eurosport; and (iii) Scripps Networks Interactive Inc., which includes a controlling interest in TVN, a Polish media company which broadcasts a range of TV channels. Discovery’s activities in Poland include the retail Over-the-Top ("OTT") audio-visual (“AV”) services “Player”, “Eurosport Player” and “TVN24Go” and TVN Media, an advertising sales house.

(6) Polsat is a Polish media company ultimately controlled by Mr. Zygmunt Solorz. Polsat produces and broadcasts FTA and pay TV channels. It provides retail AV services through satellite, IPTV3 (via Netia S.A., “Netia”) and OTT (“Ipla” and “Eleven Sports”). Polsat offers fixed telecommunication and mobile telecommunication services under its Netia and Plus (via Polkomtel sp z. o. o., “Polkomtel”) brands. Polsat is active in the advertising market as well as advertising intermediation.

(7) The JV will operate an OTT video-on-demand (“VOD”) service in Poland.4 The new service will include local productions supplied by Discovery and Polsat, acquired TV content and new Polish series commissioned specifically by the new entity. The JV platform may also distribute the TV channels of the Parents and other third parties.

(8) [Confidential information relating to the implementation of the JV].

(9) Discovery and Polsat will [Confidential information relating to the JV’s activities]5 6.

2. THE OPERATION AND THE CONCENTRATION

(10) On 25 October 2019, Discovery and Polsat entered into a Joint Venture Agreement (“JVA”) to form, develop and operate a fully functioning and independent joint venture over a number of years by making available, licencing or transferring to the JV certain funding, content, rights, technology and other assets.

2.1. Joint control

(11) Discovery and Polsat will each hold 50% of the shares in the JV. They will each appoint [an equal number of the] members of the management board and the same number of supervisory board members.7 All decisions of the management board are determined by a simple majority except in relation to certain matters for which decisions must be taken unanimously by all management board members in office.8 In general, all decisions of the supervisory board on all matters to be determined by the board must be decided unanimously.9

(12) Accordingly, all matters10 addressed by each of the governing bodies of the JV (i.e. the shareholders’ meeting, the management board and the supervisory board) will require the consent of both Discovery and Polsat (or members of those bodies appointed by the respective Parents).

(13) Therefore, as a result of the Transaction, Discovery and Polsat will jointly control the JV within the meaning of Article 3(1)(b) of the Merger Regulation.

2.2. Full-functionality

(14) The JV will be fully functional.

(15) First, the JV will employ its own management dedicated to its day-to-day operations.11 The JV will also have access to sufficient resources, including finance, staff and tangible and intangible assets that will enable it to operate independently on the market for the retail supply of AV services, performing the functions normally carried out by undertakings operating on the same market.12

(16) Second, the JV is intended to operate as an autonomous entity and will have its own, independent access to and presence on the market for the supply of AV (OTT) services.13 Its activities will not be limited to the distribution or sale of its Parents' products, as the JV will supply its own OTT offering to end customers, as a fully independent company with its own personnel. In addition, the JV has negotiated and/or will negotiate agreements with its Parents (e.g. wholesale agreements for the supply of content and channels) on an arm’s length basis, reflecting the normal market conditions it practices with third parties.14

(17) Third, the JV will not only purchase from and/or supply to its Parents. It will have direct contractual relationships with third party licensors and will not be reliant on its parents for licensing relationships. It will also commission original productions from TV production studios and source additional and new SVOD licenses to content mainly from third party content providers.15

(18) Finally, the JV is intended to operate on a lasting basis. The JV will operate for [Confidential information relating to the JV’s activities].16

(19) Therefore, the Transaction will lead to the creation of a full-function joint venture within the meaning of Article 3(4) of the Merger Regulation.

3. EU DIMENSION

(20) The Parties concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million (Discovery: EUR 10 379 million; Polsat: EUR […]). Each of them has a Union-wide turnover in excess of 250 million (Discovery: […]; Polsat: […]). While Polsat generates more than 2/3 of its total EU turnover in Poland, Discovery Group does not.

(21) Therefore, the Transaction has an EU dimension pursuant to Article 1(2) of the Merger Regulation.

4. ASSESSMENT UNDER ARTICLE 9(3) OF THE MERGER REGULATION

4.1. Introduction

(22) By its Referral Request of 27 July 2020, the UOKiK, on behalf of Poland, requests a referral of the Transaction with a view to assessing the effects of the Transaction in Poland under national competition law, pursuant to Article 9(2)(a) of the Merger Regulation.

(23) According to Article 9(3) of the Merger Regulation, the Commission may refer the whole or part of the case to the competent authorities of the Member State concerned with a view to applying the Member State’s national competition law if, following a request for referral by that Member State pursuant to Article 9(2) of the Merger Regulation, the Commission considers that the Transaction threatens to significantly affect competition in a market within that Member State, which presents all the characteristics of a distinct market.

(24) When the criteria laid down in Article 9(2)(a) are met, the Commission will assess whether it is appropriate to refer a given case to a national competition authority. The Commission retains a margin of discretion in deciding whether to refer a case or not17. In exercising such discretion, the Commission will take into account the need to ensure effective protection of competition in all markets affected by the Transaction18. The Commission exercises that discretion taking into account the criteria set out in the case law and the Referral Notice.19

(25) In the following sections, it will be examined whether the criteria of Article 9(2)(a) of the Merger Regulation are fulfilled (Sections 4.2 - 4.5), the remedies submitted by the Notifying Parties will be described (Section 4.6) and then, it will be examined whether it would be appropriate to refer the present case to Poland (Section 4.7).

(26) In its assessment of the Referral Request, the Commission takes into account the arguments it received from the Polish authorities and the Notifying Parties.

4.2. The criteria of Article 9(2)(a) of the Merger Regulation

(27) In order for a referral request to be issued by a Member State, one procedural and two substantive conditions must be fulfilled pursuant to Article 9(2)(a) of the Merger Regulation.

(28) As to the procedural condition, the referral request must be made within 15 working days from the date on which the notification of a concentration before the Commission is received by that Member State. In this regard, the Commission notes that Poland, via the UOKiK, received a copy of the notification of the Transaction on 8 July 2020. The Referral Request was made by letter received by the Commission on 27 July 2020. Therefore, the Referral Request was made within 15 working days following the receipt by Poland of the notification of the Transaction and, consequently, within the deadline provided for in Article 9(2) of the Merger Regulation.

(29) As to the substantive conditions, first, in assessing a referral request made pursuant to Article 9(2)(a) of the Merger Regulation, the Commission is required to determine whether there is a market within the Member State concerned which is affected by the notified concentration and presents all the characteristics of a distinct market. According to Article 9(3) of the Merger Regulation and the case law of the General Court20, the Commission has to evaluate this on the basis of a definition of the market for the relevant product or services and a definition of the geographical reference market. Second, the Commission is required to verify whether the Transaction threatens to significantly affect competition in that market. Finally, Article 9(7) of the Merger Regulation gives further indications as to which area the geographically relevant market shall consist of, and which elements the Commission must take particular account of when assessing that issue. These conditions are assessed in turn in the following sections.

4.3. Markets within Poland which present all the characteristics of distinct markets

4.3.1. The UOKiK’s submission

(30) In its Referral Request, the UOKiK considers that the Transaction threatens to significantly affect competition in the following markets within Poland presenting all the characteristics of distinct market:

– The production and licensing of AV content (supply and demand side),

– The wholesale supply of TV channels (supply and demand side),

– The retail supply of AV services, and

– The sale of offline and online advertising space (supply and demand side).

(31) With regard to these markets, the UOKiK considers that the geographic scope can be defined at national level, or narrower, in line with the Commission’s practice.21

4.3.2. The Notifying Parties’ view

(32) First, in the Form CO, for the production and licensing of AV content, the Notifying Parties consider that the exact definition of the geographic markets can be left open, their scope potentially being broader than national.22

(33) Further, the Notifying Parties have provided market information in line with the UOKiK’s assessment of the relevant geographic markets for the wholesale supply of TV channels, the retail supply of AV services, where they find that markets are

national at most, considering, however, that the exact definition of the geographic markets can be left open.23

(34) Finally, the Notifying Parties agree with previous Commission decisions and share the UOKiK’s assessment of the relevant geographic market for the sale of advertising space, which were found to be national, although the Notifying Parties consider that the exact definition of the geographic markets can be left open. 24

(35) Second, in its Response to the UOKiK’s Referral Request, the Notifying Parties confirm that they generally agree with the definition of the product markets as put forward by the UOKiK (except in respect of the sub-segments of the market for the wholesale supply of TV-channels)25 but note (as above) that some of the geographic markets have previously been defined by the Commission as broader than national in scope.26

(36) Further, the Notifying Parties note that the JV is intended to be active not just in Poland, but that in the future, its operations are intended to expand outside Poland. As a result, the effect of the JV on the TV retail market would not be limited to a distinct geographic market of only Poland.27

4.3.3. Commission’s assessment

(37) The Transaction concerns all three levels of the AV value chain, namely:

– The production and licensing of AV content, where Discovery and Polsat, independently, and the JV will be active mainly on the demand side of the market;

– The wholesale supply of TV channels where Discovery and Polsat will remain independently active, while the JV will only be active on the demand side of the market; and

– The retail supply of AV services where the JV will be active and Discovery and Polsat will remain independently active through their other distribution platforms.

(38) In addition, the Transaction concerns:

– The market for the sale of advertising space where both Discovery and Polsat are independently active (offline and online) and where the JV will be active in the sale of online advertising space; and

– The markets for fixed telecommunication services (fixed telephony, fixed internet access) and mobile telecommunication services where only Polsat is active and which could be bundled with the JV’s AV services (potentially in a separate market for multiple play services).

4.3.3.1. The AV value chain

(39) In previous cases, the Commission set out the different levels of the AV value chain as follows: (i) the (upstream) markets for the production and the licensing of AV content, (ii) the (intermediate) market for the wholesale supply of TV channels, and (iii) the (downstream) market for the retail supply of AV services.28

(40) The market investigation confirmed that this three-layer classification with regard to the chain of supply of AV content is still applicable today.29

4.3.3.2. Production and licensing of AV content

Product market definition

Previous Commission decisions

(41) This part of the value chain concerns on the one hand, the production of new AV content. The supply side of the market comprises TV production companies while the demand side comprises companies (TV broadcasters or content platform operators) that commission the production of AV content or hire TV production services.

(42) On the other hand, this part of the value chain concerns the licensing of (i) broadcasting rights relating to pre-existing AV content, which is made available ‘off- the-shelf’ by the rights holder, and (ii) broadcasting rights for sports events. The broadcasting rights can belong to either (or a combination of) the rights holder to the TV format, the production company that produced the content, the company that commissioned the production of the content, or a third party distributor to which the rights were licensed by the original owner. Rights holders license rights to TV broadcasters, or content platform operators, which retail the content to end-users on a non-linear basis (e.g., SVOD service providers).

(43) The Commission has consistently considered that the production of AV content should be distinguished from the licensing of broadcasting rights for AV content.30 The Commission has also found the product market for the production of TV content to be limited to non-captive TV production, thereby excluding content produced by TV broadcasters for use on their own channels.31

(44) In addition, in its 2015 case Liberty Global/Corelio/W&W/De Vijver Media, the Commission considered that the market for the production of TV content and the market for licensing of broadcasting rights to TV content could be further segmented depending on the type of TV content (that is films, sports or other) or exhibition window (namely SVOD, transaction-based VOD (“TVOD”), Pay Per View (“PPV”), Fist pay TV window, Second pay TV window, FTA), but ultimately left those possible segmentations open.32 In subsequent cases, the Commission either did not consider further segmentations or left open the question whether the market for the production of AV content should be further segmented. In particular, the question was left open whether the market for production of general entertainment TV content should be further segmented: (i) by genre; (ii) between scripted and non-scripted content; and (iii) between commissioned TV production or TV production for-hire.33 Similarly, the question whether the market for licensing AV content could be further sub-divided by distinguishing premium and non-premium content, or scripted and non-scripted content was left open.34

The Notifying Parties’ views

(45) The Notifying Parties submit that the Transaction should be assessed on the two separate markets for (i) production and supply of commissioned TV content; and (ii) licensing of broadcasting rights for pre-produced TV content (available ‘off-the- shelf’) and that any further segmentation would not be appropriate.35

Commission’s assessment

(46) A majority of respondents to the market investigation consider that (i) the production and supply/acquisition of commissioned TV content, whereby the producer delivers tailor-made content to its customers; and (ii) the licensing of broadcasting rights whereby pre-produced AV content is made available off-the-shelf by the rights- holder to downstream operators are two distinct product markets.36

(47) In addition, in relation to the product market for the production of AV content, the results of the market investigation provided no reason to depart from the Commission’s approach according to which the market is limited to non-captive AV production. Further, a majority of respondents to the market investigation consider that the market for the production of AV content needs to be subdivided by content type or into scripted and non-scripted AV content.37 The replies were inconclusive as to whether a segmentation by exhibition window would be appropriate.38 Lastly, the results of the market investigation provided no reason to depart from the Commission’s approach of considering a further segmentation between commissioned TV production or TV production for-hire.

(48) Further, in relation to the product market for the licensing of AV content, most of the providers of AV content consider that the market for the licencing of broadcasting rights for pre-produced AV content could be subdivided by content type, in particular: (i) films; (ii) sports; and (iii) other AV content (i.e. all non-sport, non-film content). Furthermore, potential sub-segments within these content types should be considered including, in particular, the sub-division of “film content” into (a) US and

(b) non-US films and the subdivision of "other AV content" into (a) scripted AV content and (b) unscripted AV content.39 Most providers of retail AV services further consider that these segmentations may be appropriate, however few respondents indicate that a segmentation of sports content should be subdivided by sport discipline.40

(49) Most of the respondents consider that the market for the licensing of broadcasting rights for pre-produced AV content could be segmented by exhibition windows: (i) subscription video on demand ("SVOD"); (ii) transactional video on demand ("TVOD"); (iii) pay-per-view ("PPV"); (iv) first pay TV window; (v) second pay TV window; and (vi) free-to-air ("FTA").41

(50) In light of the above, the Commission considers that, for the purpose of this decision and without prejudice to further investigation by the UOKiK, a relevant market for the non-captive production of AV content and a market for the licensing of broadcasting rights for pre-produced AV content has to be considered, while it can be left open whether this relevant product marked needs to be further sub-segmented, as it would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

Previous Commission decisions

(51) In previous cases, the Commission considered that the question whether the geographic scope of the market for the production of TV content and the market for the licensing of broadcasting rights for TV content was national or regional could be left open.42

The Notifying Parties’ views

(52) The Notifying Parties submit that it may be possible to define the relevant geographic markets more broadly than national or regional. In relation to the market for licensing of AV content, the Notifying Parties consider that this market should encompass all licensing irrespective of its origin and that, therefore, from the production side, no distinctions on the basis of country of origin should be made. Regardless, the Notifying Parties submit that it is not necessary for the Commission to reach a conclusion, as the Transaction will not raise any competition concern under any possible market segmentation.43

Commission’s assessment

(53) According to a majority of respondents to the market investigation, the geographic scope of agreements for the licensing of broadcasting rights for AV content is national.44

(54) In light of the above, for the purpose of this Decision and without prejudice to further investigation by the UOKiK, the Commission concludes that the relevant geographic market for the non-captive production of AV content and the market for licensing of broadcasting rights for pre-produced AV content, and all its possible sub-segments, is national in scope.

4.3.3.3. Wholesale supply of TV channels

Product market definition

(55) TV broadcasters package the AV content and broadcasting rights for AV content that they have produced in-house or acquired into linear TV channels, which are supplied to retail suppliers of AV services, and then broadcast to end users either on a FTA basis or on a pay TV basis. Ancillary services, such as catch-up TV, have gradually been associated to TV channels in order to complement the TV offering and enhance the viewer experience of traditional linear TV channels.

Previous Commission decisions

(56) In its past decisional practice, the Commission identified a wholesale market for the supply of TV channels. Within that market, in certain decisions, the Commission further identified two separate product markets for (i) FTA TV channels, and (ii) pay TV channels.45 The Commission further stated that within the pay TV channels market, there could be different segments for (i) basic pay TV channels; and (ii) premium pay TV channels,46 for which end customers pay a premium in addition to their basic subscription fee.

(57) In other decisions, the Commission concluded that at the level of the wholesale supply of TV channels there were two separate product markets, one consisting of the wholesale supply of premium pay TV channels and one consisting of the wholesale supply of FTA and basic pay TV channels.47 In its decision of 24 February 2015 in case M.7194 – Liberty Global/Corelio/W&W/De Vijver Media, the Commission has considered that, given that (i) FTA channels were mostly supplied together with basic pay TV channels, and (ii) the competitive assessment would remain the same even if FTA channels were regarded as belonging to a separate product market from that of basic pay TV, it was not necessary to make a distinction between FTA and basic pay TV channels on the market for wholesale supply of TV channels in that case.

(58) In addition, in previous decisions including its recent decision of 12 November 2019 in case M.9064 – Telia Company/Bonnier Broadcasting Holding (hereafter Telia/Bonnier), the Commission considered that there was no need to draw a distinction between linear TV channels and their ancillary services, which are licensed by TV broadcasters to TV distributors along with, or in addition to those linear TV channels.48

(59) Further, in previous decisions, the Commission examined a number of other potential additional segmentations, including genre or thematic content (such as sports, films, general entertainment, news, youth, and others), and ultimately left the market definition open in these regards.49

(60) Last, in Telia/Bonnier, the Commission considered that the market for wholesale supply of TV channels, and any other possible segmentation, should not be further segmented according to the type of infrastructure used for the delivery to the viewer (cable, satellite, terrestrial TV and IPTV).50

The Notifying Parties’ views

(61) The Notifying Parties submit that the relevant markets for the wholesale supply of TV channels may be separated between FTA and pay-TV channels, and with the further distinction between basic pay-TV and premium pay-TV channels, but no further distinction based on genre, between linear channels and non-linear services, or between the different means of transmission. Regardless, the Notifying Parties submit that it is not necessary for the Commission to reach a conclusion, as the Transaction will not raise any competition concern under any possible market segmentation.51

Commission’s assessment

(62) Most of the providers of AV content consider that FTA TV and pay TV channels form separate relevant product markets. This result of the market investigation is in line with the Commission’s past decisional practice.52

(63) Within pay TV channels, the Commission has previously further distinguished between the markets for basic pay TV channels (that are part of the basic cable or IPTV subscription) and premium pay TV channels (for which end customers have to pay a premium in addition to their basic subscription fee).53 However, during the market investigation, providers of retail AV services provided a mixed reply. In particular, several respondents consider that a segmentation in FTA and pay channels is not appropriate since broadcasters bundle FTA and pay channels into the same package when negotiating with retail providers of AV services.54

(64) With reference to a segmentation by genre, most of the respondents consider that thematic pay-TV channels of a given genre (such as TVN Turbo) constitute a complement to thematic pay-TV channels of a different genre (such as Polsat News).55 In particular, respondents indicate that sports channels should be regarded as complementary in respect to other TV channels.56

(65) Most respondents consider that ancillary services (e.g., TVE, catch-up, PVR, etc.) have gradually been associated to TV channels in order to complement the TV offering and enhance the viewer experience of traditional linear channels.57 In particular, in the Polish market most of the providers of retail AV services provide both linear and non-linear services with the latter offered either as ancillary rights to linear distribution or as standalone OTT services.58

(66) Most of the respondents consider that the market for the wholesale supply of TV channels should not be further segmented according to the distribution forms (e.g. cable, IPTV, satellite, terrestrial, or OTT).59

(67) In light of the above, the Commission considers that, for the purpose of this Decision and without prejudice to further investigation by the UOKiK, the relevant product market is the market for the wholesale supply of TV channels, including their ancillary services and covering all types of infrastructure. The question whether this product market can be further segmented (i) by genre, (ii) by distribution technology, or between (iii) FTA and pay TV channels, and in turn whether pay TV channels can be further segmented between basic pay and premium pay TV channels, or (iv) FTA and basic pay TV channels on the one hand, and premium pay TV channels on the other hand could be left open as it would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

Previous Commission decisions

(68) In its decisional practice, the Commission has considered that the market for wholesale supply of TV channels could be national,60 sub-national61 or could correspond to a linguistically homogeneous area broader than national.62 In Telia/Bonnier, the Commission concluded that the market was national in scope.63

The Notifying Parties’ views

(69) The Notifying Parties submit that, in the present case, the relevant geographic market for the wholesale supply of TV channels is national in scope and corresponds to Poland. The Notifying Parties however submit that it is not necessary for the Commission to reach a conclusion, as the Transaction will not raise any competition concern under any possible market segmentation.64

Commission’s assessment

(70) According to a majority of the respondents to the market investigation, the geographic scope for the wholesale supply of TV channels is national in scope.65

(71) In light of the above, for the purpose of this Decision and without prejudice to further investigation by the UOKiK, the Commission concludes that the relevant geographic market for the wholesale supply of TV channels, including all its possible sub- segments, is national in scope.

4.3.3.4. Retail supply of AV services

Product market definition

(72) Retail providers of AV services offer packages of linear AV services and/or non- linear AV services to end customers. Such linear and non-linear AV services can be augmented with ancillary services, such as catch-up TV or TV everywhere. Retail AV services can be delivered to end-users though a number of technical means including cable, satellite, IPTV and OTT.

Previous Commission decisions

(73) In its past decisional practice, the Commission considered the retail supply of FTA TV and pay TV as separate markets, but ultimately left open the product market definition.66 The Commission also considered whether pay TV could be segmented further according to: (i) linear vs non-linear pay TV services;67 (ii) premium vs basic pay TV services.68 However, the Commission left open the market definition with regard to each of these potential sub-segments.

(74) In addition, the Commission considered a possible segmentation of the market for the retail supply of AV services according to distribution technology (for example, cable, OTT, satellite, IPTV or terrestrial). In its decisions of 12 November 2019 in Telia/Bonnier, and of 30 May 2018 in case M.7000 – Liberty Global/Ziggo, the Commission considered that all the different distribution technologies were part of the same product market,69 while leaving the exact product market definition open in a number of other decisions.70

The Notifying Parties’ views

(75) The Notifying Parties submit that the Transaction should be assessed on the basis of an overall market for the retail supply of AV services including both linear and non- linear services.

(76) The only material distinction that they consider justified is between (i) advertising funded services (market comprising both FTA linear and AVOD non-linear services); and (ii) subscription funded services (market comprising linear pay-TV and Paid VOD services). The Notifying Parties however submit that it is not necessary for the Commission to reach a conclusion as to the precise product market definition, as the Transaction will not raise any competition concern under any possible market segmentation.71

Commission’s assessment

(77) The information gathered during the market investigation indicated that the distinction between the retail supply of FTA AV services on the one hand, and the retail supply of pay AV services on the other hand, remains valid today.72

(78) As regards a further segmentation of the market for retail supply of AV services between the retail supply of (i) basic and (ii) premium AV services73 or a segmentation between the retail supply of (i) premium film and series AV services and (ii) other premium sport AV services74 several respondents considered such a segmentation not appropriate.

(79) The results of the market investigation are inconclusive as to whether these markets should be further segmented on the basis of linear vs non-linear pay TV services.75 Furthermore, respondents provided a mixed view on whether they consider a segmentation between non-linear services based on international content, such as Netflix or Amazon, and TV channels appropriate.76

(80) The market investigation was also inconclusive as to whether non-linear services such as those offered by Ipla and Player should be considered as a different segment to linear channels as they serve different audiences and satisfy different consumption habits.77

(81) As regards distribution technologies, a majority of respondents to the market investigation considered that end customers perceive the distribution forms (e.g. cable, IPTV, satellite, terrestrial or OTT) through which they access AV content in Poland as different segments to each other.78

(82) In light of the above, the Commission considers that, for the purpose of this decision and without prejudice to further investigation by the UOKiK, the relevant product market at retail level is to be considered the market for the retail supply of AV services encompassing all distribution technologies. Moreover, the Commission considers that, in any case, the question can be left open whether the retail supply of AV services should be further segmented between (i) FTA and pay AV services, as well as the question whether in turn the retail supply of pay AV services should be segmented according to (ii) linear and non-linear pay AV services, and (iii) premium and basic pay AV services, as this would not change the outcome of the Commission’s evaluation evaluation of the Referral Request.

Geographic market definition

Previous Commission decisions

(83) In previous decisions, the Commission considered that the market for the retail provision of AV services is either national, or limited to the geographic coverage of a supplier's cable network.79 In Telia/Bonnier, the Commission concluded that the market was national in scope.80

The Notifying Parties’ views

(84) The Notifying Parties submit that the market for the retail supply of AV services is national in scope. The Notifying Parties however submit that it is not necessary for the Commission to reach a conclusion, as the Transaction will not raise any competition concern under any possible market segmentation. 81

Commission’s assessment

(85) The results of the market investigation indicated that it is still relevant to consider that the relevant geographic market for the retail supply of AV services is national.82

(86) In light of the above, for the purpose of this Decision and without prejudice to further investigation by the UOKiK, the Commission concludes that the relevant geographic market for retail supply of AV services, and all its possible sub-segments, is national in scope.

4.3.3.5. Sale of advertising space

Product market definition

Previous Commission decisions

(87) The Commission has previously drawn a distinction between online and offline advertising, due to each channel's specificity and different pricing mechanisms.83 Within offline advertising, the Commission has previously considered that the sale of advertising space in national TV broadcasting constitutes a separate market from other means such as newspapers.84 Within online advertising, the Commission has previously segmented between search and non-search advertising and considered a possible further sub-segmentation (i) including and excluding social media85 and (ii) between video advertising and other forms of online advertising.86

The Notifying Parties’ views

(88) The Notifying Parties generally agree with the Commission's view that online and offline advertising constitute separate markets even though they note that, given the uptake of OTT services, it may no longer be appropriate to consider TV advertising exclusively as a segment of offline advertising.87

(89) The Notifying Parties agree with the Commission that within the online advertising market search and non-search advertising are likely to constitute separate markets. The Notifying Parties however submit that it is not necessary for the Commission to reach a conclusion, as the Transaction will not raise any competition concern under any possible market segmentation.88

Commission’s assessment

(90) The market investigation in the present case did not provide any indication that the Commission should depart from its findings in previous cases. The majority of respondents responding to this question indicated that these findings (distinction of online vs. offline advertising and segmentation of advertising market by media channel, such as newspapers, radio, TV, internet) are still accurate in Poland today.89

(91) In light of the above, the Commission concludes that, for the purpose of this Decision and without prejudice to further investigation by the UOKiK, the market for offline TV advertising and the market for online advertising constitute separate markets. The Commission also concludes that the question whether the market for online advertising can be divided between search and non-search advertising, including a possible further sub-segmentation (i) including and excluding social media and (ii) between video advertising and other forms of online advertising can be left open, since this would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

Previous Commission decisions

(92) The Commission previously considered that the geographic markets for (i) offline TV advertising, and (ii) online advertising is either national or regional.90

The Notifying Parties’ views

(93) The Notifying Parties submit that the geographical scope of the markets at stake is national and thus constitutes Poland. The Notifying Parties however submit that it is not necessary for the Commission to reach a conclusion, as the Transaction will not raise any competition concern under any possible market segmentation.91

Commission’s assessment

(94) A majority of respondents indicated that the geographic market for advertising space is national.92

(95) In light of the above, for the purpose of this Decision and without prejudice to further investigation by the UOKiK, the Commission concludes that the relevant geographic market for offline TV advertising and the market for online advertising, and all its possible sub-segments, are national in scope.

4.3.3.6. Telecommunication services

(96) In relation to the markets for the retail supply of telecommunication services, the Notifying Parties have not provided any views as to the relevant product or geographic market definition. Therefore, the below section will only set out previous Commission decisions and the Commission’s assessment.

Retail supply of fixed telephony services

Product market definition

(97) Fixed telephony services to end customers comprise the provision of subscriptions enabling access to public telephone networks at a fixed location for the purpose of making and/or receiving calls and related services.93

(98) In previous decisions, the Commission considered whether a distinction between local/national and international calls as well as between residential and non- residential customers should be drawn, based on the distinctions in the Commission Recommendation 2003/311/EC,94 but ultimately left the exact product market definition open.95

(99) More recently, the Commission also considered that managed Voice over Internet Protocol (“VoIP”) services96 and traditional telephony are interchangeable and therefore belong to the same market. In recent decisions, the Commission considered that an overall retail market for fixed telephony services exists, which includes VoIP services.97

(100) The Commission considers that, for the purposes of this decision and without prejudice to further investigation by the UOKiK, the exact product market definition with regard to the market for the retail supply of fixed telephony services can be left open, since this would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

(101) In previous decisions, the Commission concluded that the retail market for the provision of fixed telephony services was national in scope.98 This is due to the continuing importance of national regulation in the telecommunications sector, the supply of upstream wholesale services that work on a national basis, and the fact that the pricing policies of telecommunications providers are predominantly national.99 In Liberty Global/BASE Belgium and MEIF 6 Fiber/KCOM Group, the Commission assessed the possibility for the scope of the market for the retail provision of fixed telephony services to be narrower than national.100 More recently in Vodafone/Certain Liberty Global Assets, the Commission considered that the scope of the market for the retail provision of fixed telephony services was national.101

(102) In light of the foregoing, the Commission considers that, for the purposes of this decision and without prejudice to further investigation by the UOKiK, the relevant market for the retail supply of fixed telephony services is national in scope.

Retail supply of fixed internet access services

Product market definition

(103) In recent cases, the Commission considered but ultimately left open possible segmentations according to (i) product type (distinguishing narrowband, broadband, and dedicated access), and (ii) distribution technology (distinguishing xDSL, fibre, cable). Moreover, the Commission acknowledged that the retail market for fixed internet access services should not be divided according to download speed.102

(104) The Commission also considered, but ultimately left open, possible segmentations as to customer type, distinguishing between residential and small business customers, on the one hand, and larger business and public authorities, on the other hand.103

(105) With regard to a possible segmentation of the market for the retail provision of fixed internet access services according to product and customer type or according to distribution technology (that is to say, xDSL, cable or fibre), the results of the market investigation provide no reason to depart from the Commission’s approach in previous cases.

(106) In light of the foregoing, the Commission does not depart from its previous assessment, and concludes, for the purposes of this Decision and without prejudice to further investigation by the UOKiK, that the exact scope of the product market definition in relation to the provision of retail fixed internet access services can be left open, since this would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

(107) In its previous decisions, the Commission concluded that the retail market for the provision of fixed internet services was national in scope.104

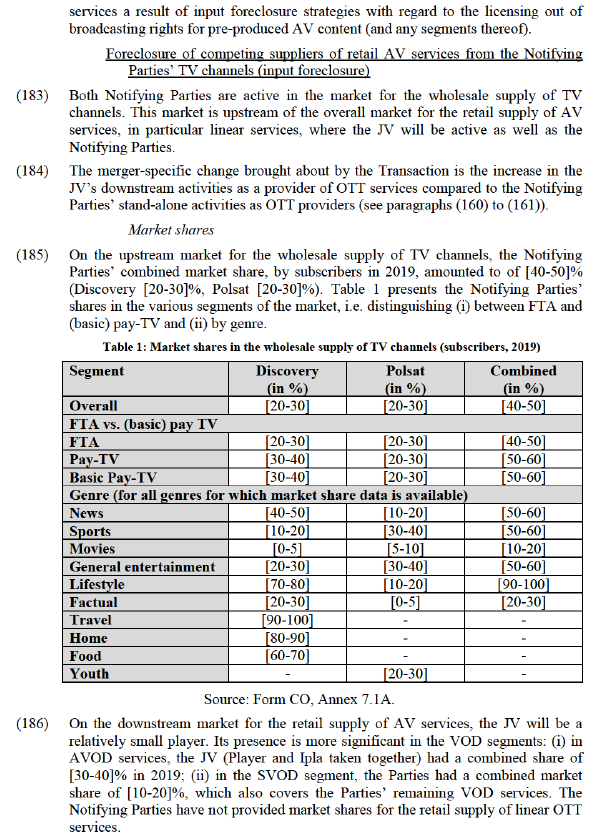

(108) The market investigation did not provide any indication that the Commission should depart from its findings in previous cases, according to which the geographic market should be national.

(109) In light of the foregoing, the Commission concludes that, for the purpose of this decision and without prejudice to further investigation by the UOKiK, the relevant market for the provision of fixed internet services is national in scope.

Retail supply of mobile telecommunication services

Product market definition

(110) The Commission has previously considered that there is an overall retail market for mobile telecommunications services constituting a separate market from retail fixed telecommunication services.105 The Commission did not further segment the overall retail mobile market based on the type of service (voice calls, SMS, MMS, mobile internet data services), or the type of network technology (for example, 2G/3G/4G). The Commission considered distinctions within the overall retail market for mobile telecommunication services between pre-paid or post-paid services and private customers or business customers, concluding that these did not constitute separate product markets but represent rather market segments within an overall retail market.106

(111) In light of the foregoing, the Commission does not depart from its previous assessment, and concludes, for the purposes of this Decision and without prejudice to further investigation by the UOKiK, that the exact scope of the product market definition in relation to the provision of retail mobile telecommunications services can be left open, since this would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

(112) In its previous decisions, the Commission concluded that the retail market for the provision of mobile telecommunications services was national in scope.107

(113) In light of the foregoing, the Commission concludes that, for the purpose of this decision and without prejudice to further investigation by the UOKiK, the relevant market for the retail provision of mobile telecommunications services is national in scope.

Retail supply of multiple play services

Product market definition

(114) In previous decisions, the Commission has considered but ultimately left open the question as to whether there exist one or more multiple play markets, which are distinct from each of the underlying individual telecommunication services.108 Moreover, in previous decisions, the Commission has noted that, due to different services, delivered over different infrastructures (fixed for dual play and triple play or fixed and mobile for quadruple play), that are included in the different multiple play bundles, instead of one possible market for multiple play, there could be several possible multiple play markets: a market for fixed bundles (dual play, and triple play) and another separate market for fixed-mobile convergence bundles. The Commission has also noted that the possibility for several mobile subscriptions to be included in a quadruple play bundle further complicates the picture.109

(115) In light of the foregoing, the Commission concludes that, for the purpose of this decision and without prejudice to further investigation by the UOKiK, the question as to whether there exist one or more multiple play markets which are distinct from each of the underlying individual telecommunications services can be left open, since this would not change the outcome of the Commission’s evaluation of the Referral Request.

Geographic market definition

(116) In previous decisions, the Commission considered that the geographic scope of any possible retail market for multiple play services would be national since the components of the multiple play offers are offered individually at a national level, and the bundling of the services would not change the geographic scope of the components.110

(117) In light of the foregoing, the Commission concludes that, for the purpose of this decision and without prejudice to further investigation by the UOKiK, any possible market for the retail supply of multiple play services would be national in scope.

4.3.4. Conclusion on the first substantive condition

(118) In addition to the Commission’s findings set out above (Section 4.3.3), the Commission notes that at this stage, the JV’s services will only be offered in Poland. In the Form CO, the Parties have not indicated any relevant or affected markets outside Poland. The JV’s activities will, at least in the foreseeable future, be restricted to the Polish territory.111

(119) In light of the above, the Commission considers that the markets identified in the Referral Request (Section 4.3.1) present the characteristics of distinct markets in Poland, as required under Article 9(2)(a) of the Merger Regulation, also in light of Article 9(7) thereof.

4.4. Markets within Poland in which the Transaction threatens to significantly affect competition

4.4.1. The UOKiK’s submission

(120) In its Referral Request, the UOKiK submits that the Transaction threatens to significantly affect competition in Poland as a result of the following:

– Horizontal: the UOKiK claims that the Transaction will have an adverse effect on the markets for the production and licensing of AV content, the wholesale supply of TV channels and the retail supply of AV services. In this respect, the UOKiK stressed the high market shares of the Parties in these markets;

– Vertical: the UOKiK considers that anticompetitive vertical concerns arise in respect of the Notifying Parties' activities in the wholesale supply of TV channels on the one hand and the JV's acquisition of TV channels for its retail AV services on the other hand, and the Notifying Parties' sale of offline advertising space on the one hand and the JV's acquisition of such advertising services to promote its retail AV services on the other hand;

– Coordination: the UOKiK further notes the risk of coordination between the Notifying Parties and the JV in the market for the sale of advertising space, given the level of the Notifying Parties' market shares in this market. In this respect, the UOKiK stresses the market power of the Notifying Parties, which may lead to coordinated effects as a result of the Notifying Parties cooperating on markets outside of the JV to promote and disseminate their services to the detriment of competitors.

(121) In light of the above, the UOKiK prima facie considers that the Transaction is likely to have significant effects in the Polish market.

4.4.2. The Notifying Parties’ view

(122) The Notifying Parties disputes the UOKiK’s findings in its Referral Request.

(123) First, in relation to the UOKiK’s horizontal concerns112, the Notifying Parties submit that these must be rejected for the following reasons:

– The Transaction is limited to the consolidation of the Notifying Parties’ OTT businesses only, which does not result in a horizontally affected market for the retail supply of AV services. The Notifying Parties stress the low market shares of the JV and each of the Notifying Parties in this respect;

– The JV’s intended licensing of content from third parties is yet to be determined, with a prospective yearly budget of just […]. Therefore, the extent of any overlap between the Notifying Parties and the JV in this market is uncertain. Consequently, the Notifying Parties submit that such prospective behaviour combined with the Notifying Parties’ market share cannot result in a potential competition concern;

– Finally, the Notifying Parties submit that there is no further horizontally affected market in the remaining markets the UOKiK identified given that the Notifying Parties’ activities on these markets are not being consolidated as part of the Transaction. This relates to all upstream activities in respect of content production and acquisition, wholesale or retail supply of TV channels, acquisition of TV channels and offline TV advertising.

(124) Second, in relation to the UOKiK’s vertical concerns113, the Notifying Parties submit that:

– The Notifying Parties’ activities as wholesale suppliers of TV channels will continue to be operated as independent businesses post-Transaction. Further, the Notifying Parties stress that their individual market shares on this market are below 30%, and their combined market share is irrelevant in the absence of consolidation. [Confidential information relating to the JV’s activities];

– The Notifying Parties also reject the UOKiK’s sub-segmentation by genre of the market for the wholesale supply of TV channels, whereby the Parties market shares do exceed 30%. They submit that this is not in line with the Commission’s previous market definition practice, namely to leave open whether the market for wholesale supply of TV channels should be segmented further;

– Finally, the Notifying Parties’ activities in the offline advertising market will also continue to be operated as independent businesses post-Transaction. They also note that they do not have sufficient market power in the upstream market for the supply of offline TV advertising in order for any vertical competition concerns to arise.

(125) Third, in relation to the UOKiK’s coordination concerns,114 the Notifying Parties submit that:

– In relation to offline advertising, the Notifying Parties and the JV could not coordinate. Any potential agreements for the JV to purchase offline advertising airtime would be entered into on an arms-length basis. Further, the JV could still purchase such airtime from a third party. In any case, the JV will represent less than [0-5]% of the purchasing market for offline advertising in Poland;

– Finally, more generally, the Notifying Parties emphasize that the Transaction will not lead to any coordination between them, due to the nature of the relevant markets and the Parties disparate activities therein – the complete lack of homogeneity between products and the difference in the Parties’ geographic focus (global versus local player), lack of transparency over input costs and multiple complex revenue streams.

4.4.3. Commission’s assessment

(126) As explained in paragraphs (7) to (9), the JV will be active in the retail supply of AV services with its OTT platform in Poland.

(127) In order to provide content for its OTT platform, the JV will acquire AV content from the Notifying Parties as well as from third parties. The JV will also commission the production of original content and license broadcasting rights for pre-produced AV content. Furthermore, the JV will acquire linear TV channels (and the associated ancillary services) from the Notifying Parties and third parties.115

(128) In the following sections, the Commission discusses all horizontal and non- horizontal relationships between the Parties, which give rise to affected markets, and carries out a preliminary assessment as to whether the Transaction threatens to significantly affect competition in these affected markets.

4.4.3.1. Horizontal assessment

Horizontal non-coordinated effects in the production of AV content and licensing of broadcasting rights for pre-produced AV content (demand side)

(129) The Notifying Parties’ activities and those of the JV overlap on the demand side of the markets for the production and licensing of AV content, i.e. on the markets for the acquisition of commissioned AV content and broadcasting rights for pre- produced AV content.

Market shares

(130) On an overall market for the acquisition of commissioned AV content, the Parties’ combined market share, by revenues in 2019, amounted to [50-60]% (Discovery: [20-30]%, Polsat: [20-30]%, JV estimate116: [0-5]%). The market shares remain broadly consistent on potential narrower segments of the market such as scripted, premium or Polish content.

(131) On an overall market for the acquisition of broadcasting rights for pre-produced AV content (excluding sports rights), the Parties’ combined market share, by revenues in 2019, amounted to [30-40]% (Discovery: [10-20]%, Polsat: [10-20]%, JV: [0-5]%). In the segment for the acquisition of sport rights, the Parties had a combined market share of [40-50]% (Discovery: [5-10]%, Polsat: [30-40]%, JV: [0-5]%), however, [Confidential information relating to the JV’s activities].

The Notifying Parties’ views

(132) The Notifying Parties submit that the Transaction does not raise horizontal competition concerns in the markets for the acquisition of commissioned AV content and broadcasting rights for pre-produced AV content on the basis of any plausible market definition.117

(133) First, the Notifying Parties explain that they will remain independent TV wholesalers and would therefore keep the same incentive to compete aggressively against one another in order to secure the best content. Second, they also submit that the JV would be marginally active in these markets with a spending of […] for commissioned content and […] for pre-produced content. Third, the Notifying Parties consider that the Parties’ market shares would likely further decrease due to increasing demand from international OTT players. Fourth, several other large customers would continue to be active in the market.

Commission’s assessment

(134) The Commission preliminarily considers that horizontal effects in the markets for the acquisition of commissioned AV content and broadcasting rights for pre-produced AV content are unlikely.

(135) First, as put forward by the Notifying Parties, both Discovery and Polsat will continue to be active as independent purchasers of AV content production services and as independent licensees of individual AV content post-Transaction.

(136) Second, the JV will be a new additional purchaser of AV content production and a new licensee of individual AV content. Based on the 2019 market size, it will only represent [0-5]% of the demand (by value) in the market for the production of Polish- language AV content and [0-5]% of the demand (by value) in the market for the licensing of Polish-language AV content in Poland. Therefore, the merger specific change brought about by the Transaction will be limited.

(137) Third, the majority of content providers responding to the market investigation did not indicate that the Transaction would significantly increase the bargaining power of the Parties vis-à-vis providers of commissioned content118 or providers of pre- produced content.119

(138) Fourth, the Commission notes that significant alternative purchasers and licensors will remain active on the demand side of the market, including TVP, Canal+, TV Puls as well as global OTT platforms such as Amazon Prime, HBO Go and Netflix.

Conclusion

(139) Therefore, at this stage, based on its preliminary analysis and without prejudice to further investigation by the UOKiK, the Commission considers that the Transaction would not threaten to significantly affect competition with respect to the markets for the acquisition of commissioned AV content and broadcasting rights for pre- produced AV content (and any segments thereof).

Horizontal non-coordinated effects in the wholesale supply of TV channels (demand side)

(140) The Notifying Parties’ activities and those of the JV will overlap on the demand side of the market for the supply of TV channels, i.e., on the market for the acquisition of TV channels.

Market shares

(141) On the overall market for the acquisition of TV channels, Polsat had a [10-20]% market share by subscribers in 2019 while Discovery had a market share of below [0- 5]%. Discovery does not currently acquire TV channels for incorporation into its retail TV offering other than the acquisition of one single third-party general entertainment/lifestyle pay-TV channel. In some narrower segments, Polsat’s market share was above 20%, notably it was [20-30]% in the acquisition of pay-TV channels and [20-30]% in the acquisition of basic pay-TV channels.

(142) The Notifying Parties submit that the JV may acquire the Parents’ and certain third parties’ TV channels to be streamed on its OTT platform, however, these activities would be limited.

The Notifying Parties’ views

(143) The Notifying Parties submit that the Transaction does not raise horizontal competition concerns in the market for the acquisition of TV channels on the basis of any plausible market definition.120

(144) First, the Parents would continue to operate their activities in the acquisition of TV channels independently. Second, Discovery would have marginal activities in the acquisition of TV channels. Third, the JV would only have marginal activities in the acquisition of TV channels.

Commission’s assessment

(145) The Commission preliminarily considers that horizontal effects in the markets for the acquisition of TV channels are unlikely.

(146) First, both Discovery and Polsat will continue to be active as independent purchasers of TV channels post-Transaction.

(147) Second, given the JV’s limited foreseen activities in the acquisition of TV channels, the merger-specific change brought about by the Transaction will be limited.

(148) Third, there are many other purchasers of TV channels, including Canal+ (second largest DTH operator as well as OTT operator), Orange as well as cable operators such as Vectra and UPC.

(149) Finally, no concerns with regard to the market for the acquisition of TV channels were raised in the market investigation.121

Conclusion

(150) Therefore, at this stage, based on its preliminary analysis and without prejudice to further investigation by the UOKiK, the Commission considers that the Transaction would not threaten to significantly affect competition with respect to the market for the acquisition of TV channels (and any segments thereof).

Horizontal non-coordinated effects in the retail supply of AV services

(151) The Notifying Parties and the JV’s activities overlap in the market for the retail supply of AV services.

(152) Discovery’s Player and Polsat’s Ipla platforms will be replaced with the JV’s OTT platform. [Details regarding business plan].

Market shares

(153) The Notifying Parties were not able to provide market shares fully in line with the Commission’s market definition. For instance, the Notifying Parties did not provide market shares in the overall retail supply of AV services nor for all plausible segments. Nevertheless, the Commission considers that the submitted market shares provide a good overview on the Parties’ activities in retail supply of AV services.

(154) The Notifying Parties submit that the market for the retail supply of AV services should be segmented according to whether AV services are (i) funded by advertising, including linear (FTA channels) and non-linear services (AVOD), or (ii) funded by subscriptions, including linear (pay-TV channels) and non-linear services (VOD).

(155) In the advertising-funded market segment, the Parties’ combined market share, based on average monthly real users in 2019, amounted to [40-50]% (Discovery[20- 30]%122, Polsat: [20-30]%, JV estimate123: [0-5]% (Player: [0-5]%, Ipla: [0-5]%)). In the narrower segment for the retail supply of AVOD services (i.e., advertising funded non-linear OTT services), the JV had a combined share of [30-40]% (Player: [20- 30]%, Ipla: [10-20]%).124 The Notifying Parties have not provided market shares for the retail supply of linear advertising funded OTT services.

(156) In the subscription-based segment, the Parties’ combined market share, by subscribers in 2019, amounted to [30-40]% (Discovery: [0-5]%, Polsat: [20-30]%, JV estimate: [0-5]%125). In the narrower market segment for the retail provision of SVOD services (i.e. subscription-based non-linear OTT services), the Parties hold a combined market share of [10-20]% (Discovery SVOD: [5-10]%, Polsat SVOD: [0- 5]%, no separate share available for the JV). The Parties’ SVOD share mainly represents Player and Ipla, but also includes their sports players, which will not be contributed to the JV, but will be offered as an add-on to the JV, as well as Discovery’s TVN24Go. The Parties’ market shares in value terms do not differ significantly. The Notifying Parties have not provided market shares for the retail supply of linear subscription-based OTT services.

The Notifying Parties’ views

(157) The Notifying Parties submit that the Transaction does not raise horizontal competition concerns in the market for the retail supply of AV services on the basis of any plausible definition of the relevant product and geographic markets for the reasons set out below.126

(158) First, the assessment would be the same for all potential segments of the market for the retail supply of AV services as the JV will in any case have a limited market share. Second, international OTT platforms, such as Netflix and HBO, which are the most frequently viewed OTT platforms in Poland, have a very strong market position. Third, Canal+ has recently announced the launch of its own OTT service in the Polish market providing access to general entertainment, kids, sport and film channels in Poland. Fourth, there would be other strong local competitors active on the Polish market. Wirtualna Polska and Onet run AVOD businesses in Poland and Wirtualna Polska would have achieved a significant position on the Polish VOD market.

Commission’s assessment

(159) Within the overall market for the retail supply of AV services, the Commission considers that Player and Ipla are close competitors in light of (i) the same distribution technology (OTT) and (ii) the similar type of content (focus on local productions). This was also confirmed by the results of the market investigation. The vast majority of AV distributors identified Player as Ipla’s closest competitor and Ipla as Player’s closest competitor.127

(160) The Commission expects that the Transaction will likely allow the Parties to significantly increase the JV’s subscriber base once the JV’s platform aggregates both Parents’ content and channels. The Notifying Parties have not been able to provide up-to-date projections128 as regards the expected viewer and subscriber evolution of the JV but the Notifying Parties’ submissions confirm that they have similar expectations, as they consider that:

– “The JV will generate significant added value in comparison to the products currently offered by each of the Parents”129,

– “The JV will create the unique destination for wide aggregation of free and pay content, offering consumers convenience resulting from easy access to a wide variety of content (previously offered on a few platforms) on one platform.”130,

– [Details regarding commercial strategy]131, and

– [Details regarding commercial strategy ]132.

(161) Market participants that responded to the market investigation confirmed the Parties’ assessment, for instance stating that “the cooperation of Polsat and Discovery regarding JV will lead to a situation in which there will be established the platform combining today's potential of the Player and Ipla” and that “after the transaction it will be difficult to find a player on the Polish market who will be able to match them both in terms of content and market share”.133

(162) Nevertheless, with regard to the retail supply of AV services, the Commission’s preliminary analysis, based on the available market share information at this stage, is that horizontal effects are unlikely.134

(163) With regard to the advertisement-funded market segment (FTA and AVOD), the Commission notes that the JV’s market share will be very limited ([0-5]%). Even in the narrower segment for the supply of AVOD services, the JV’s market share will only be slightly above 30% ([30-40]%), down from [30-40]% in 2017.

(164) Several AVOD alternatives to the JV’s platform will exercise a competitive constraint on the JV:

– Onet ([20-30]%): a press publisher owning vod.pl, a VOD service providing a wide range of content ([Details regarding commercial strategy]),

– TVP ([10-20]%): the Polish national broadcaster which offers a range of linear TV channels as well as non-linear VOD services on its OTT platform,

– CDA ([10-20]%): a video website,

– WP Pilot ([10-20]%): an OTT linear AV services provider,

– TV Puls: a Polish broadcaster with a VOD offering, and

– Canal+: which launched a new OTT service in May 2020. Canal+’s service, MyCanal, will offer a variety of content including Canal+ channels, third party channels and paid content, including Polish content.

(165) Similarly, with regard to the subscription-based segment (pay-TV and SVOD), the Commission notes the JV’s market share in the overall subscription-based segment will be limited ([0-5]%). In the narrower segment for the supply of SVOD services, the JV’s market share will amount to c. [10-20]%. Several alternative SVOD platforms will exercise a competitive constraint on the JV:

– Netflix ([30-40]%): the most frequently viewed OTT platform in Poland, which entered the market with minimal Polish content, but has gained a significant position and has started commissioning Polish content,

– HBO Go ([10-20]%): the second most frequently viewed OTT platform in Poland. HBO also commissions its own Polish content,

– CDA ([10-20]%): a video website, and

– WP Pilot, TVP, TV Puls and Canal+ (mentioned above), which also offer SVOD services. In particular, Canal+’s paid content will include several packages, including Kids, Fun and Info, Film and Sports packages.

(166) The Commission notes, however, that the constraint exerted by international OTT platforms such as Netflix and HBO Go may be limited as these platforms are mainly focussed on international rather than Polish content. Therefore, international OTT platforms may represent a complement rather than a substitute to the JV’s services.

(167) Given the JV’s current limited market position and the number of alternative platforms, the Commission considers that horizontal effects are unlikely even if the JV increases its downstream footprint in the future.

Conclusion

(168) Therefore, at this stage, based on its preliminary analysis and without prejudice to further investigation by the UOKiK, the Commission considers that the Transaction would not threaten to significantly affect competition with respect to the market for the retail supply of AV services (and any segments thereof).

4.4.3.2. Vertical and conglomerate assessment

Foreclosure of competing suppliers of retail AV services from the Notifying Parties’ AV content (input foreclosure)135

(169) Both Notifying Parties are active in the market for the licensing out of broadcasting rights for pre-produced AV content. This market is upstream of the market for the retail supply of AV services, in particular VOD services, where the JV will be active as well as the Notifying Parties.136

(170) The merger-specific change brought about by the Transaction is the increase in the JV’s downstream activities as a provider of OTT services compared to the Notifying Parties’ stand-alone activities as OTT providers (see paragraphs (160) to (161)).

Market shares

(171) On the upstream market for the licensing out of broadcasting rights for pre-produced AV content, the Notifying Parties’ combined market share, by revenues in 2019, amounted to of [0-5]% (Discovery: [0-5]%, Polsat: [0-5]%). The Notifying Parties’ market shares were slightly higher in some narrower segments of the market, however, they remain well below 30%: other content (TV series) [0-5]% (Discovery [0-5]%, Polsat [0-5]%), scripted content [0-5]% (Discovery [0-5]%, Polsat [0-5]%) and Polish content [10-20]% (Discovery [0-5]%, Polsat [0-5]%). In addition, the Notifying Parties license in sports rights from leagues and other rights holders and sometimes sub-license out certain of these rights to other broadcasters. In this segment, their combined market share was [10-20]% (Discovery [0-5]%, Polsat 10.6%).

(172) On the downstream market for the retail supply of AV services, the JV will be a relatively small player. Its presence is more significant in the VOD segments: (i) in AVOD services, the JV (Player and Ipla taken together) had a combined share of [30-40]% in 2019; (ii) in the SVOD segment, the Parties had a combined market share of [10-20]%, which also covers the Parties’ remaining VOD services.

The Notifying Parties’ views

(173) The Notifying Parties submit that the Transaction will not give rise to any vertical competition concerns, including input foreclosure concerns, on the basis of any plausible market definition, for several reasons: (i) there will be no change to supply on the upstream market; (ii) the Notifying Parties do not have market power on the upstream market; (iii) access to the Parents' AV content does not constitute an essential input in order to provide retail AV services; and (iv) other VOD players are investing heavily in content, including Polish content.137

(174) The Notifying Parties also argue that the JV could be a potential new entrant into the market for the licensing out of broadcasting rights for pre-produced content as the JV will develop its own productions (i.e., OTT dedicated TV series) which may be further licensed to third parties should the JV management choose to engage in this activity.

Commission’s assessment

(175) The vast majority of AV distributors responding to the market investigation indicated that the Notifying Parties would have the ability and incentive to worsen the terms and conditions at which they license pre-produced AV content and that competitors would not have effective counterstrategies.138

(176) The Commission notes that the JVA includes a clause [Confidential – details regarding commercial strategy].139

(177) Nevertheless, the Commission preliminarily considers that vertical effects as a result of input foreclosure strategies by the Parties with regard to access to the Notifying Parties’ AV content are unlikely as the Notifying Parties do not have ability to foreclose competing OTT distributors by withholding their AV content.

(178) First, the Notifying Parties’ market shares do not reflect a position of market power on any plausible market for the supply of broadcasting rights for pre-produced content, including with regard to the Polish content (combined market share of [10- 20]%).

(179) Second, neither Discovery (via TVN) nor Polsat have licensed their own Polish TV content to competing standalone OTT VOD platforms. The results of the market investigation confirmed that most market participants currently do not license the Notifying Parties’ AV content for their OTT VOD platforms. The few respondents that do license AV content from the Notifying Parties indicated doing so only to a very limited extent.140

(180) Third, there is no indication in the Commission’s file that Discovery and Polsat would have licensed out their Polish AV content to competing standalone OTT VOD platforms absent the Transaction.

(181) Fourth, OTT VOD platforms that currently do not access the Notifying Parties’ AV content successfully compete on the market without relying on the Notifying Parties’ AV content (see paragraphs (164) and (165)).

Conclusion

(182) Therefore, at this stage, based on its preliminary analysis and without prejudice to further investigation by the UOKiK, the Commission considers that the Transaction would not threaten to significantly affect competition in the retail supply of AV

The Notifying Parties’ views

(187) The Notifying Parties submit that the Transaction will not give rise to any vertical competition concerns on the basis of any plausible market definition.141

(188) The Notifying Parties argue that Discovery and Polsat will not have the ability to engage in a foreclosure strategy and the Transaction will not increase their ability to do so. First, the Notifying Parties’ market power would be limited since they will each remain independently active in the wholesale supply of TV channels in Poland and neither of them has a market share above 30%. Second, according to the Notifying Parties, linear TV channels would not be an important input for the distribution of AV content via OTT as shown by the success of VOD-only platforms such as Netflix. Third, Discovery and Polsat’s most popular FTA channels would be subject to must-offer obligations.

(189) The Notifying Parties submit that Discovery and Polsat will not have the incentive to engage in a foreclosure strategy and the Transaction will not increase this incentive. Each of Discovery and Polsat are already vertically integrated and the JV is only expected to result in a limited increase of their presence on the downstream market for the retail supply of AV services.

(190) Finally, the Notifying Parties argue that a potential foreclosure strategy would have no effect on competition since, already before the Transaction, Polsat does not licence out OTT rights to its channels and Discovery only licences these rights to a limited extent.

Commission’s assessment

(191) The Commission preliminarily considers that the Notifying Parties could hinder the JV’s OTT competitors’ access to Discovery’s and Polsat’s TV channels. These TV channels constitute important inputs which, absent the Transaction, would likely have been licensed out, at least to some additional players, for OTT distribution. If such foreclosure were to materialise, the JV would become the sole channel aggregator distributing over the internet, eliminating potential competition between different OTT channel aggregators.

As regards ability

(192) The Commission preliminarily considers that the Notifying Parties will have the ability to foreclose competing OTT platforms by withholding or degrading access to the Notifying Parties’ TV channels, for several reasons.