Commission, March 25, 2021, No M.9952

EUROPEAN COMMISSION

Decision

PKN ORLEN/PGNiG

Subject: Case M.9952 — PKN Orlen/PGNiG

Commission decision following a reasoned submission pursuant to Article 4(4) of Regulation No 139/20041 for referral of the case to Poland and Article 57 of the Agreement on the European Economic Area2.

Date of filing: 19.02.2021

Legal deadline for response of Member States: 12.03.2021

Legal deadline for the Commission decision under Article 4(4): 26.03.2021

Dear Sir or Madam,

1. INTRODUCTION

(1) The transaction in question involves the acquisition by PKN Orlen (‘Orlen’) of the whole of Polskie Górnictwo Naftowe i Gazownictwo (‘PGNiG’) (together referred to as the ‘Parties’) by way of purchase of shares pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the ‘Transaction’).3

(2) On 19.02.2021, the Commission received by means of a Reasoned Submission a referral request pursuant to Article 4(4) of the Council Regulation (EC) No 139/2004 (‘Merger Regulation’) with respect to the Transaction cited above. The parties request the Transaction to be examined in its entirety by the competent authorities of Poland.

(3) According to Article 4(4) of the Merger Regulation, where a certain concentration has a Union dimension and before a formal notification has been made to the Commission, the parties to a transaction may request that their transaction be referred in whole or in part from the Commission to the Member State where the concentration may significantly affect competition and which present all the characteristics of a distinct market.

(4) A copy of this Reasoned Submission was transmitted to all Member States on 19.02.2021.

(5) On 24.02.2021, the Polish Competition Authority (Urząd Ochrony Konkurencji i Konsumentów – ‘UOKiK’) as the competent authority of Poland informed the Commission that Poland agrees with the proposed referral.

2. THE PARTIES AND THE TRANSACTION

(6) PKN Orlen is active across the supply chain for refined oil products in Poland, Austria, Czechia, Estonia, Latvia, Lithuania, Germany and Slovakia. Orlen’s activities cover all fuel products typically processed at an oil refinery and it has a network of retail fuel stations across Poland. Orlen also produces a range of petrochemical products at its refineries in Poland and Czech Republic. Finally, it is active in the electricity and gas markets.

(7) Polskie Górnictwo Naftowe i Gazownictwo is the main supplier of natural gas in Poland, at both wholesale and retail levels, and it is also the owner of all existing gas storage facilities in Poland. It has limited activities in the supply of natural gas in Lithuania, Germany, the Netherlands, Austria, Great Britain and Ukraine. PGNiG is also active in the electricity supply chain in Poland and to a limited extent in the supply of certain refined oil products.

3. THE OPERATION AND CONCENTRATION

(8) The Transaction involves the proposed acquisition by Orlen of PGNiG (together referred to as the ‘Parties’) by way of purchase of shares, pursuant to Article 4 of Council Regulation (EC) No 139/2004. The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

4. EU DIMENSION

(9) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million (Orlen: EUR 35 568, PGNiG: EUR 9 777 million) and two of the undertakings have an EU-wide turnover of more than EUR 250 million (Orlen: EUR […] million, PGNiG: EUR […] million). The Parties do not each achieve more than two-thirds of their aggregate Union- wide turnover in one and the same Member State. The Transaction therefore has a Union dimension within the meaning of Article 1(2) of the Merger Regulation.

5. ASSESSMENT

(10) For the reasons set out below, the Transaction meets the legal requirements set out in Article 4(4) of the Merger Regulation. The Transaction is a concentration within the meaning of Article 3 of the Merger Regulation, it has an EU dimension (see above) and it may significantly affect competition in a market or markets,4 and the market(s) in question are within a Member State and present all the characteristics of a distinct market(s).5

(11) The Transaction gives rise to a number of horizontally and vertically affected markets, which can be grouped as follows:

a) Electricity (and heat)-related markets (giving rise to both horizontal and vertical overlaps);

b) Gas-related markets (giving rise to both horizontal and vertical overlaps);

c) Fuel-related markets (primarily giving rise to vertical overlaps);

d) Industrial gas-related markets (primarily giving rise to vertical overlaps);

e) Chemicals-related (primarily giving rise to vertical overlaps);

f) Petrochemicals-related markets (primarily giving rise to vertical overlaps);

g) Refined petroleum products-related markets (primarily giving rise to vertical overlaps).

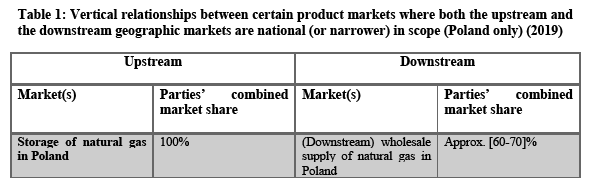

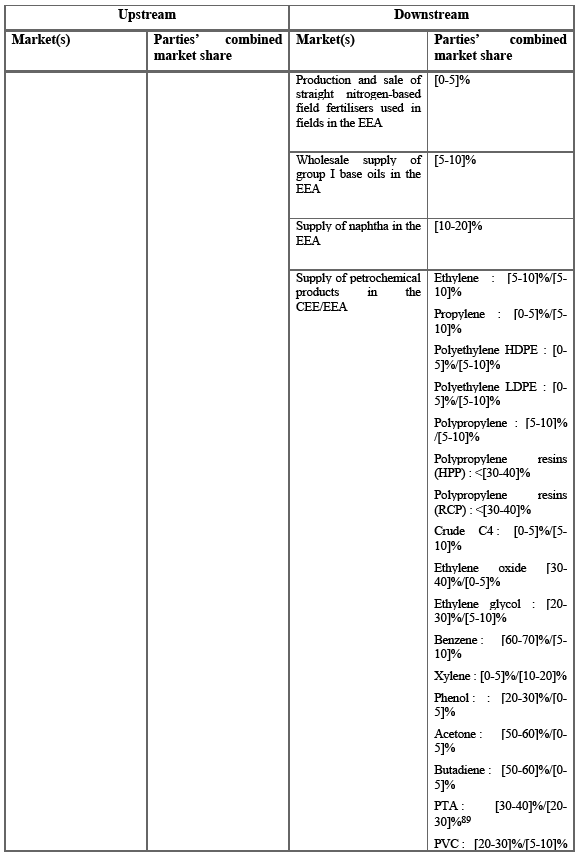

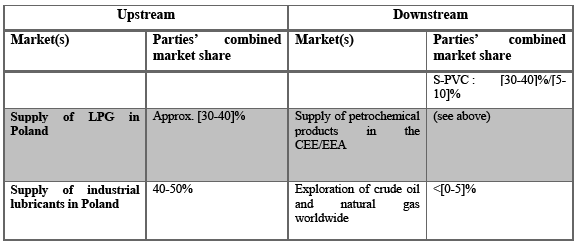

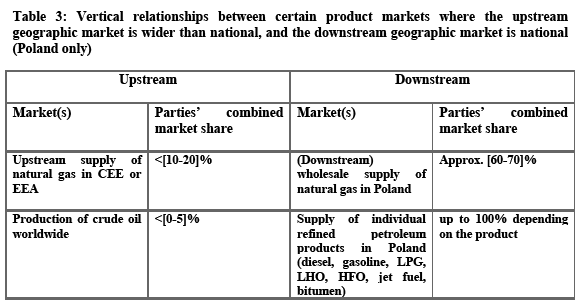

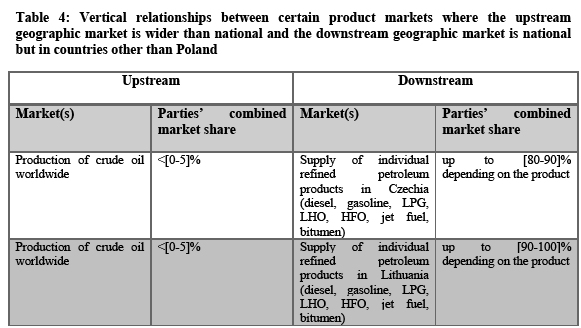

(12) A comprehensive list of the vertically affected markets is provided in Tables 1 to 4 below. The next section briefly discusses the relevant market definition of the affected markets.

5.1. Relevant markets – product and geographic market definition

1.1.1. Electricity (and heat) – related markets

(13) Both Parties produce electricity and heat in Poland.

(14) Generation and wholesale supply of electricity: in previous decisions the Commission has defined the generation and wholesale supply of electricity as a separate product market whose geographic scope was in general national.6

(15) Retail supply of electricity: in previous decisions the Commission has considered that the retail supply of electricity which can be further segmented depending on the type of customer.7 In previous decisions relating to Poland, the Commission considered that a distinction can be made between (i) retail supply to customers from Group G (households), and (ii) retail supply to customers outside Group G (i.e. non-household customers).8 The Commission has defined the geographic market as national in scope.9

(16) Distribution of electricity: in previous decisions the Commission has established that each local distribution network constitutes a separate market and the geographic scope to be local and limited to the relevant distribution network. The network operator is monopolist on its grid as distribution networks cannot be economically replicated.10

(17) Supply of white certificates: in Poland there are different types of electricity certificates: green certificates (to support electricity from renewable sources), blue certificates (to support electricity generated from agricultural biogas) and white certificates (to support energy efficiency measures).11 In previous decisions the Commission has considered that electricity certificates constitute a separate market from other tradable certificates.12 While it has not in the past assessed whether different types of electricity certificates constitute separate markets, for the purpose of this decision the Commission considers conservatively that white certificates are a distinct market from green and blue certificates. The Commission considers this market to be national in scope as white certificates are related to the Polish-specific legal regime implementing the Energy Efficiency Directive (2012/72/EU).13

(18) Supply of district heat: in previous decisions, the Commission considered a separate product market for the supply of district heat and the geographic scope to be local and limited to the relevant district heating network.14 The companies active in the supply of district heating are generally considered as monopolists on their network.

5.1.2. Gas related-markets

(19) Both Parties are active in the upstream exploration, production and import of natural gas, and PGNiG is the leading importer of natural gas into Poland.

(20) Exploration of gas and crude oil: in previous decisions, the Commission has identified one product market including both the exploration of crude oil and the exploration of natural gas as it is not possible from the outset to determine whether the exploration will result in finding crude oil or natural gas. This market has been considered as worldwide in scope.15

(21) (Upstream) wholesale supply of gas: in previous decisions the Commission has defined a distinct product market for the upstream wholesale supply of natural gas where gas producers tend to sell large volumes of gas to (national) downstream wholesalers.16 Different geographic market definitions have been considered in previous cases, from national to regional or EEA- wide.17 For the purpose of this decision, the geographic market definition can be left open as the conclusions as to whether the transaction meets the requirements for a referral under Art. 4(4) of the Merger Regulation would remain unaltered under any plausible market definition.

(22) (Downstream) wholesale supply of gas: in previous decisions the Commission has defined a distinct product market for the downstream wholesale supply of natural gas, as comprising the activity whereby wholesalers procure gas from producers for resale to other wholesalers or downstream distributors.18 The geographic scope of the market has been generally considered as national in scope.19

(23) Retail supply of gas: in previous decisions, the Commission has identified a distinct product market for the retail supply of gas which could be further segmented into: (i) retail supply to gas-fired electricity plants, (ii) retail supply to large industrial customers, (iii) retail supply to small businesses, and (iv) retail supply to households.20 The Commission has generally held that the geographic scope of retail markets was national in scope.21

(24) Distribution of gas: as with the distribution of electricity, in previous decisions the Commission has established that each local distribution network constitutes a separate market and the geographic scope to be local and limited to the relevant distribution network. The network operator is monopolist on its grid as distribution networks cannot be economically replicated.22

(25) Storage of gas: in previous decisions the Commission has defined gas storage as constituting a separate relevant product market, generally national in scope.23 24

5.1.3. Fuel-related markets

(26) Both Parties produce and sell crude oil. Orlen’s main activity is the refining of crude oil into fuels and other products derived from crude oil, such as bitumen.

(27) Production of oil: in previous decisions the Commission identified a separate market for production and sale of crude oil which has been typically considered as world-wide in scope.25

(28) Wholesale supply of fuels: these include (i) gasoline, (ii) diesel, (iii) liquefied petroleum gas (‘LPG’), (iv) light heating oil (‘LHO’), (v) light heating oil (‘HFO’), (vi) jet fuel. In previous decisions, the Commission has considered that the wholesale supply of each of these fuels constitutes a separate product market and each of these markets is national in scope.26 27

(29) Supply of bitumen: in previous decisions, the Commission has considered that the supply of bitumen is a separate market which should be further segmented by (i) standard bitumen, (ii) modified bitumen, and (iii) industrial

bitumen. The relevant geographic market for (all types of) bitumen has been considered as national in scope.28

5.1.4. Industrial gases related markets

(30) Industrial gases comprise all the gases and mixtures of gases provided by gas suppliers for various industry and research applications. The most commonly used industrial gases are, among others, oxygen, nitrogen, hydrogen, argon, carbon dioxide, acetylene, carbon monoxide and helium as well as mixtures thereof, such as the so-called syngas, which is a mixture of hydrogen and nitrogen.

(31) Both Parties are active on the nitrogen market. Orlen is also active in the market for carbon dioxide.

(32) In its previous decisions the Commission has taken the view that different individual industrial gases are generally not interchangeable because of their different chemical and physical properties, that there is no substitutability either from the demand or the supply side, and that therefore each gas constitutes a separate relevant product market.29 In particular, the Commission has identified separate product markets for nitrogen and carbon dioxide.30 The Commission also considered that the various modes of distribution (tonnage, small on site-plant, bulk, and cylinder) give rise to distinct product markets.31 With respect to nitrogen, the Commission considered that the relevant modes of supply were tonnage, small on-site plants, bulk and cylinder. The relevant modes of supply for carbon dioxide were considered to be tonnage, bulk, cylinders (excluding dry ice), and dry ice.32

(33) The Commission has considered that the relevant geographic market for each industrial gas depended on the mode of supply.33 The Commission considered that the relevant market was:

a) EEA-wide for supply through small on-site plants, and tonnage;

b) Either national or EEA-wide for nitrogen and carbon dioxide supplied in cylinders and bulk.

(34) The Commission will assess the referral request for the nitrogen and carbon dioxide markets (distinguishing between tonnage, bulk and cylinder) on the basis that markets would be either national or EEA.

5.1.5. Ammonia and fertiliser markets

(35) Natural gas may be regarded as an input for production of certain chemical products, including fertilisers. Natural gas is rich in methane, therefore it is used in technological processes for the production of ammonia and fertilisers.

(36) Orlen purchases natural gas from PGNiG, and uses it as an input for the production of ammonia, most of which is used captively as an intermediate for the production of fertilisers by Orlen.

(37) Supply of ammonia: in previous decisions the Commission has considered that the supply of ammonia constitutes a separate market which could possibly be further segmented between anhydrous ammonia and aqueous ammonia.34 The Commission has further considered that a distinction could be drawn between anhydrous ammonia for industrial purposes and anhydrous ammonia for fertilisers.35 For the purpose of this decision the Commission considers that the market definition can be left open as its conclusions would be identical under all plausible market definitions. The Commission has previously left open the question whether ammonia markets are national in scope or broader, regional or EEA-wide than national.36 The Commission will assess the referral request on the basis that markets for the supply of ammonia are either national, regional (Central and Eastern Europe, ‘CEE’) or EEA-wide in scope.37

(38) Supply of fertilizers: in its previous decisions the Commission has drawn a distinction between fertilizers in single nutrient form (‘straight nitrogen’) or in a complex form which may contain any combination of nitrogen, phosphorus and potassium.38 The Commission has also previously considered but ultimately left open whether (i) field fertilizers39 are distinct from specialty fertilizers and (ii) different types of straight nitrogen-based fertilizers (e.g., urea, ammonia and UAN) constitute separate product markets. For the purpose of this decision, the precise market definition can be left open, as the Parties are only active in the supply of straight nitrogen- based field fertilisers used in fields. In previous decisions concerning nitrogen fertilizers, the Commission found that the relevant geographic market is at least EEA-wide.40

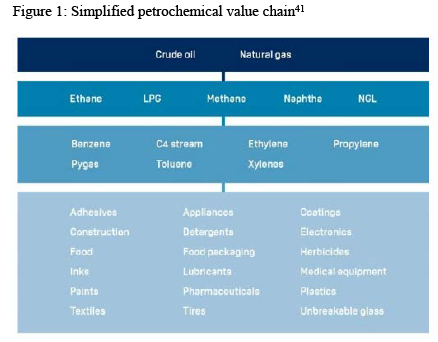

5.1.6. Petrochemicals-related markets

(39) Petrochemicals are a group of chemicals (as distinct from fuels) derived from various hydrocarbon feedstock and used for a broad range of commercial purposes. In the petrochemical value chain one can distinguish basic

products, which are obtained directly from processing of hydrocarbon input, from more advanced, specialized petrochemicals, that are obtained further down the value chain, in technological processes which involve using basic petrochemicals as an input for production.

(40) Orlen is active in the production of numerous petrochemicals, for which natural gas is either a direct or an indirect input, depending on the level of the value chain. Orlen sources natural gas from PGNiG.

(41) The Notifying Party has identified various other chemical product markets relevant for the assessment of the referral request. These are naphtha, ethylene, propylene, crude C4, polyethylene, polypropylene, ethylene oxide, ethylene glycol, benzene, xylene, phenol, acetone, butadiene, PTA, and PVC.

a) Supply of naphtha: in previous decisions, the Commission has considered that naphtha constitutes a separate product market given its chemical characteristics, uses and prices.42 The Commission has previously considered the market for naphtha to be EEA-wide.43

b) Ethylene: in previous decisions the Commission has considered ethylene to form a distinct product market.44 It has not previously reached a conclusion on the relevant geographic market definition, and considered it as being either limited to the territory which could be supplied by using a pipeline network, national, regional or EEA- wide.45 The Commission will assess the referral request on the basis of a national, CEE-wide, or EEA-wide market.

c) Polyethylene: in previous decisions the Commission has considered that polyethylene can be segmented into high density polyethylene (‘HDPE’), low density polyethylene (‘LDPE’) or linear low density polyethylene (‘LLDPE’), leaving the precise market definition open.46 The Commission has previously considered that the geographic scope of the market is at least Western Europe, leaving the market definition open.47 The Commission will assess the referral request on the basis of a CEE-wide, or EEA-wide market.

d) Polypropylene: in previous decisions the Commission has considered polypropylene as a separate market which can be further segmented between polypropylene resins on the one hand and polypropylene compounds on the other hand. Among polypropylene resins, the Commission has also distinguished between (i) homopolymers (‘HPP’) (ii) random copolymers (‘RCP’), and (iii) impact (block) copolymers.48 However, the final definition was left open. In its previous decisions the Commission has considered that the geographic scope of the market is at least Western Europe, leaving the market definition open.49 The Commission will assess the referral request on the basis of a CEE-wide, or EEA-wide market.

e) PVC: in previous decisions the Commission has accepted a distinction between suspension PVC (‘S-PVC’) and emulsion PVC (‘E-PVC’).50 The Commission further segmented the market for the production of S-PVC into three separate product markets:

(i) commodity S-PVC; (ii) specialty S-PVC; and (iii) extender S-PVC. The Commission considered a possible further segmentation of E-PVC into (i) Paste E-PVC and (ii) specialty emulsion thermoplastic application E-PVC (‘specialty E-PVC’). The Parties are only active in the production of commodity suspension PVC (‘S-PVC’). The Commission previously considered that PVC markets might be North-Western Europe wide or EEA-wide, leaving the precise market definition open.51 The Commission will assess the referral request on the basis of a CEE-wide, or EEA-wide market.

f) Others: in previous decisions the Commission has further identified distinct product markets for propylene,52 crude C4,53 ethylene oxide,54 ethylene glycol,55 benzene,56 xylene,57 phenol,58 acetone,59 butadiene60 and PTA.61 The Commission has previously considered either Western Europe or EEA-wide markets (leaving the precise market definition open) for propylene,62 crude C4,63 ethylene oxide,64 ethylene glycol,65 benzene,66 xylene,67 phenol,68 acetone,69 butadiene,70 and PTA.71 The Commission will assess the referral request on the basis of a CEE-wide, or EEA-wide market.

5.1.7. Refined petroleum products-related markets (base oils and industrial lubricants)

(42) Refined petroleum products are the outputs of a crude oil refinery. A typical refinery produces a wide variety of different products from every barrel of crude oil that it processes. Typical petroleum products obtained in the refinery include various fuels and fuel oils, base oils and bitumen. Natural gas is used as an input in refinery production, for heating and for the generation of hydrogen, which is itself used for the purification of products and the conversion of heavy residues to lighter products.

(43) Orlen and its subsidiaries are active across many different markets for refined petroleum products, and it sources natural gas from PGNiG.

(44) Supply of Group I base oils: in its previous decisions the Commission has considered the supply of API72 Group I base oil as a separate market which is EEA-wide in scope.73

(45) Supply of industrial lubricants: in previous decisions the Commission has considered that the supply of industrial lubricants constitutes a separate market from the supply of automotive lubricants.74 The Commission has also considered whether the market for the supply of lubricants should be further segmented along other dimensions, (e.g. the end-use application) but

ultimately left the market definition open.75 The market for the supply of industrial lubricants has been generally considered as national in scope.76

5.2. Assessment of the referral request

1.2.1. Legal requirements

(46) According to the Commission Notice on Case Referral in respect of concentrations (the ‘Commission Notice on Case Referrals’),77 in order for a referral to be made by the Commission to one or more Member States pursuant to Article 4(4) of the Merger Regulation, the following two legal requirements must be fulfilled:

a) there must be indications that the concentration may significantly affect competition in a market or markets,78 and

b) the market(s) in question must be within a Member State and present all the characteristics of a distinct market.79

5.2.2. Horizontally-affected markets

(47) With regard to the first requirement, taking into account all the plausible product market definitions discussed in Section 5.1 above, the Transaction gives rise to the following horizontally affected markets: (i) the downstream wholesale supply of natural gas in Poland (the Parties’ combined market share is approximately [60-70]%), (ii) the retail supply of natural gas in Poland (the Parties’ combined market share exceeds [70-80]%), (iii) the supply of LPG in Poland (the Parties’ combined market share is approximately [30-40]%), and (iv) the supply of white certificates in Poland (the Parties’ combined market share is approximately [30-40]%).80 81

(48) With regard to the second requirement, the Commission considers that all the horizontally affected markets are national in scope and are all related to Poland.82

(49) Therefore, as far as the horizontally affected markets are concerned, the legal requirements set forth in Article 4(4) of the Merger Regulation are met.

5.2.3. Vertically affected markets

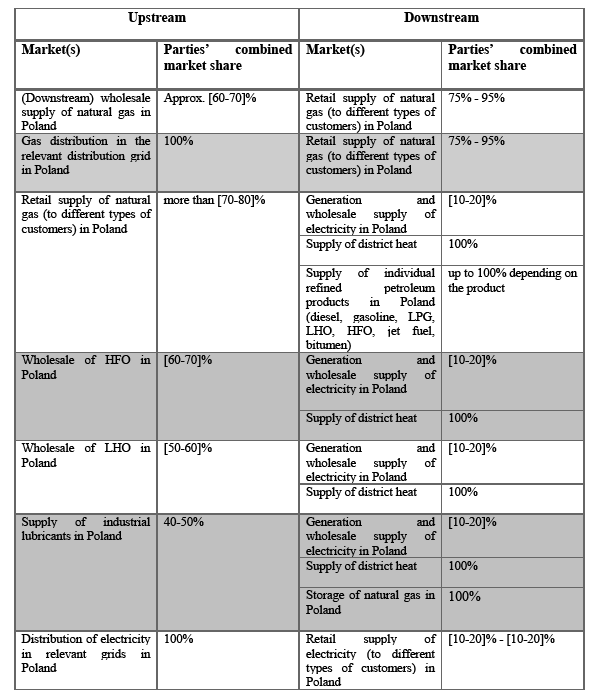

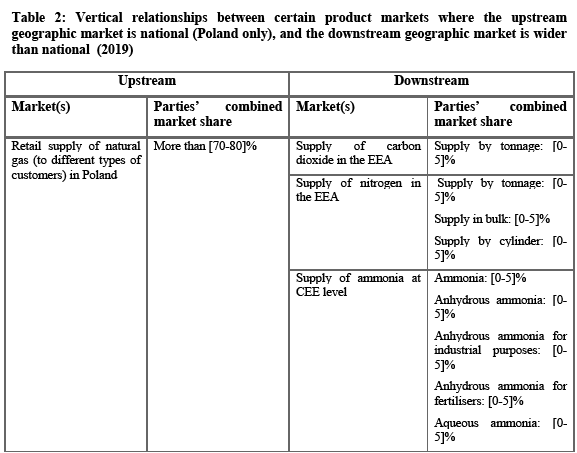

(50) With regard to the first requirement, taking into account all the plausible product market definitions discussed in Section 5.1 above, the Transaction also gives rise to several vertically affected markets which can be grouped as follows:

a) Vertical relationships where both the upstream and the downstream markets are national in scope (and the affected vertical links arise in Poland only).83

b) Vertical relationships where the upstream market is national (Poland only), and the downstream market is wider than national.84

c) Vertical relationships where the upstream market is wider than national, and the downstream market is national (Poland only).85

d) Vertical relationships where the upstream market is wider than national and the downstream market is national but in countries other than Poland.86

5.2.3.1. Vertical relationships between certain product markets where both the upstream and the downstream markets are national (or narrower) in scope (Poland only)

(51) The following table shows the full list of vertical relationships where both the upstream and the downstream geographic markets are national or narrower in scope (and the affected vertical links arise on the territory of Poland only).

(52) The Parties are both active at the upstream and downstream level in the markets identified below. PGNiG however is primarily active in markets for the supply of natural gas and electricity and heat, while Orlen is primarily active in markets for the supply of refined petroleum products (though it is also active in the supply of electricity and heat).

(53) These vertically affected product markets all have a national or narrower geographic scope and are all related to Poland. Therefore, the requirements of Article 4(4) of the Merger Regulation are met in relation to these markets.

5.2.3.2. Vertical relationships between certain product markets where the upstream geographic market is national (Poland only), and the downstream geographic market is wider than national.87

(54) These primarily include instances where the retail supply of gas (upstream) is an input for the production of several chemical products (downstream) including, for example: ammonia, fertilizers, petrochemical products (such as, ethylene, propylene, etc.) and naphtha.

(55) The following table shows the full list of vertical relationships where the upstream geographic market is national or narrower in scope and the downstream geographic market is broader than national.88

(56) PGNiG is primarily active at the upstream level, where it supplies natural gas, whereas Orlen is primarily active at the downstream level, in the production of industrial gases, chemicals and petrochemicals.

(57) In the vertical links listed in the table above, the Parties tend to have a large position in the upstream product markets (which are national in scope) – with the exception of LPG where although the market is technically affected, the Parties’ combined share is moderate. However, their position in many of the downstream markets (which can be wider than national or EEA-wide in scope) generally tends to be limited (typically below 20% and often below 10% or even 5% on a geographic market defined as EEA-wide in scope).90 Therefore, even under the assumption that the downstream markets which rely on natural gas as an input have a broader-than-national scope, the effects of the Transaction would be negligible outside Poland.

(58) Considering the Parties’ position in the upstream market, the most plausible theory of harm would appear to be that Orlen could adopt an input foreclosure strategy. However, the transaction is unlikely to materially increase the risk of such a strategy arising.

(59) First, input foreclosure would be a concern only if the Parties’ competitors in the downstream markets purchased gas in Poland where the merged entity would hold a strong position post-merger. However, the Parties’ main competitors in the downstream markets are typically active in a number of Member States and would not be dependent on Polish gas suppliers.91 Even when the Parties have a sizeable share of supply in the CEE (for example, in acetone ([50-60]%), butadiene ([60-70]%) ethylene oxide ([30-40]%), benzene ([60-70]%), S-PVC ([30-40]%)), Orlen is the only producer of these petrochemical products based in Poland (apart from benzene).92 Therefore, Orlen competes with producers from other countries (where PGNiG has no presence at the retail level) which source natural gas from their suppliers outside Poland.

(60) Second, the Parties’ relatively small market shares in most of the downstream markets discussed above suggest that their ability to recapture the volume lost by any competitors who would potentially be foreclosed would likely be limited and therefore their incentive to engage in input foreclosure would be limited too.

(61)The Transaction could theoretically also give rise to customer foreclosure concerns for gas suppliers as the Parties would have a sizeable share of supply in the CEE in some of the downstream markets (for example, acetone, butadiene or benzene). However, such concern appears unlikely because the gas used for the production of these petrochemical products represent a limited portion of the total gas demand in the CEE and because Orlen already pre-merger sources [the vast majority] of its demand for gas from PGNiG.93

(62) In view of the above, the Commission considers that the Proposed Concentration is unlikely to significantly affect competition on the vertical links listed in Table 2 outside Poland.

5.2.3.3. Vertical relationships between certain product markets where the upstream geographic market is wider than national, and the downstream geographic market is national (Poland only).94

(63) These include primarily instances where the upstream market for the production of natural gas and oil is vertically linked with the wholesale supply of gas and refined petroleum products.

(64) The following table shows the full list of vertical relationships where the upstream market is wider than national and the downstream market is national (Poland). Both Parties are active upstream and downstream on these markets, PGNiG is primarily active in the natural gas markets and Orlen primarily in the oil and fuel markets.

(65) The Parties have a large position in the downstream product markets (which are national in scope). However, their position in the upstream product markets (which can be wider than national in scope) tends to be limited (typically below 20%), and therefore even under the assumption that the upstream markets - which use the downstream wholesale supply of natural gas in Poland and the supply of refined petroleum products to Poland as routes to market their product - have a broader-than-national scope, the effects of the Transaction would be negligible outside Poland.

(66) Considering the Parties’ position in the upstream markets, the only plausible theory of harm would appear to be that Orlen could adopt a customer foreclosure strategy. However, the Transaction is unlikely to materially increase the risk of such a strategy to arise as (i) the Parties’ competitors upstream would continue to have access to the demand of customers located in countries other than Poland, even if the Parties were to stop sourcing from third parties in Poland post-merger;95 and (ii) the merger marginally increases the Parties’ position in the downstream markets96 which means that its ability to customer foreclose remains largely unaltered.

5.2.3.4. Vertical relationships between certain product markets where the upstream geographic market is wider than national and the downstream geographic market is national but in countries other than Poland.97

(67) These include two vertical links where the production of oil is linked with the production of refined petroleum products in Czechia and Lithuania. Both Parties are active in the production of crude oil upstream, while only Orlen is active in the downstream markets for the supply of individual refined petroleum products.

(68) In these vertical links, the Parties have a large position in the downstream markets (which are national in scope) in Czechia and Lithuania but their position in the upstream market (which is worldwide in scope) tends to be limited. As with the vertical links described in Section 5.2.3.2, the only plausible theory of harm would appear to be a customer foreclosure strategy by Orlen. However, for the reasons set out in paragraph (66), the Commission considers that customer foreclosure is unlikely to arise in these markets and therefore the effects of the Transaction would be negligible out of Poland.98

5.2.4. Conclusion on the affected markets

(69) For the reasons set out above, the Commission considers that the Proposed Concentration may significantly affect competition in markets located exclusively in Poland, which all present the characteristics of distinct markets.

5.2.5. Additional factors

(70) In addition to the verification of the legal requirements, point 19 of the Notice provides that it should also be considered whether referral of the case is appropriate, and in particular ‘whether the competition authority or authorities to which they are contemplating requesting the referral of the case is the most appropriate authority for dealing with the case’.

(71) Moreover, point 21 of the Notice provides that ‘The extent to which a concentration with a Community dimension which, despite having a potentially significant impact on competition in a nation-wide market, nonetheless potentially engenders substantial cross-border effects (e.g. because the effects of the concentration in one geographic market may have significant repercussions in geographic markets in other Member States, or because it may involve potential foreclosure effects and consequent fragmentation of the common market), may be an appropriate candidate for referral will depend on the specific circumstances of the case. As both the Commission and Member States may be equally well equipped or be in an equally good position to deal with such cases, a considerable margin of discretion should be retained in deciding whether or not to refer such cases.’

(72) In addition, point 23 of the Notice states that ‘Consideration should also, to the extent possible, be given to whether the NCA(s) to which referral of the case is contemplated may possess specific expertise concerning local markets, or be examining, or about to examine, another transaction in the sector concerned’.

(73) Both points 21 and 23 appear to apply to this case. First, as explained above (see Section 5.3.1), the effects of the transaction are likely to be confined to Poland and UOKiK is thus well place to review the transaction. Second, UOKiK has previous experience in assessing competition in the affected markets as it examined several concentrations99 and competition-related conducts100 in the energy sector in recent years.

(74) According to point 20 of the Referral Notice, ‘concentrations with a Community dimension which are likely to affect competition in markets that have a national or narrower than national scope, and the effects of which are likely to be confined to, or have their main economic impact in, a single Member State are the most appropriate candidate cases for referral to that Member State’. As set out in Section 5.3.1 above, this applies to the present case. The impact of the case would occur only in Poland and referral is made to Poland only, therefore ‘the benefit of a “one-stop-shop”’ is preserved.

5.2.6. Conclusion on referral

(75) On the basis of the information provided by the parties in the Reasoned Submission, the case meets the legal requirements set out in Article 4(4) of the Merger Regulation in that the concentration may significantly affect competition in markets within a Member State which present all the characteristics of a distinct market.

(76) Moreover, UOKiK can be considered to possess the necessary expertise concerning the local markets in question.

6. CONCLUSION

(77) For the above reasons, and given that Poland has expressed its agreement, the Commission has decided to refer the transaction in its entirety to be examined by the Polish Competition Authority. This decision is adopted in application of Article 4(4) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (‘TFEU’) has introduced certain changes, such as the replacement of ‘Community’ by ‘Union’ and ‘common market’ by ‘internal market’. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the ‘EEA Agreement’).

3 Orlen intends to take control over PGNiG by way of a public takeover bid. However, the precise structure of the Transaction has not been finalised.

4 Further developed in point 17 of the Commission Notice on Case Referrals.

5 Further developed in point 18 of the Commission Notice on Case Referrals.

6 COMP/M.8871 RWE/E.ON Assets; COMP/M.8860 Fortum / Uniper; COMP/M.5979 KGHM / Tauron Wytwarzanie / JV; COMP/M.6540 Dong Energy Borkumriffgrund I Holdco / Boston Holding / Borkum Riffgrund I Offshore Windpark.

7 COMP/M.8870 E.ON/Innogy.

8 COMP/M.5979 – KGHM/Tauron Wytwarzanie/JV.

9 COMP/M.8870 E.ON/Innogy.

10 COMP/M.8870 E.ON/Innogy.

11 Under the Polish legislation implementing the Energy Efficiency Directive (2012/72/EU), white certificates are granted to projects aiming to improve energy efficiency (świadectwa efektywności energetycznej). The national legislation envisages that some entities (mostly enterprises in the energy markets) are under the obligation to carry out activities to improve energy efficiency for final customers. This obligation can also be met by buying energy efficiency/white certificates from third parties.

12 COMP/M.8660 – Fortum/Uniper.

13 This approach is in line with the Commission’s reasoning in COMP/M.8860 – Fortum/Uniper.

14 COMP/M.8860 – Fortum/Uniper; COMP/M.5793 – DALKIA CZ/NWR ENERGY, and COMP/M.4238

– E.ON/PRAZSKÁ/PLYNÁRENSKÁ.

15 COMP/IV/M.1532, BP Amoco/Arco, and Case M.4934 Kazmunaigaz/Rompetrol.

16 M.5585 Centrica/ Venture Production, M.5220 ENI/Distrigaz.

17 M.6801 Rosneft/TNK-BP, M.4545 Statoil/Hydro.

18 M.6984 EPH / Stredoslovenska Energetika.

19 M.3868 DONG/Elsam/Energi E2.

20 See, for instance, M.8358 – Macquarie/National Grid/Gas Distribution Business of National Grid, and M.7936 – Petrol/Geoplin.

21 COMP/M.5740 - Gazprom / A2A / JV; COMP/M.6068 - ENI/ ACEGASAPS/ JV; COMP/M.3230 -

Statoil / BP / Sonatrach / In Salah JV.

22 COMP/M.8870 E.ON/Innogy.

23 COMP/M.5549 EDF / Segebel, of 12 November 2009; COMP/M.3696 E.ON / MOL, of 21 December 2005; COMP/M.3410 Total / Gaz de France, of 8 October 2004. IV/M.1383 Exxon/Mobil, para 261.

24 COMP/M.3669 E.ON/MOL.

25 COMP/M.4934 – Kazmunaigaz/Rompetrol.

26 M.9014 – PKN Orlen / Lotos.

27 The Commission has in the past considered that the market for the wholesale supply of LPG could also be supra-national or EEA-wide in scope. In a hypothetical regional/supra/national market including Central and Eastern European countries the merger would result in an affected market. However, this would not give rise to concerns in this hypothetical market as the Parties’ combined share would be below [20-30]%, with one of the Parties having only a [0-5]% share. Therefore, with regard to LPG, the Transaction is only liable to give rise to competition concerns if the market is national in scope as the Parties have a combined share of approximately [30-40]% (see paragraph (47)).

28 M.9014 – PKN Orlen / Lotos.

29 M.8480 –Praxair / Linde, para 91.

30 Ibid.

31 M.8480 –Ibid.

32 Ibid.

33 M.8480 –Praxair / Linde, para 105.

34 M.8674 – BASF/Solvay’s Polyamide Business, paras 31-36.

35 M.7784 – CF Industries Holdings / OCI Business, para 18.

36 M.7784 – CF Industries Holdings / OCI Business, paras 36-39.

37 CEE is defined as including Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Hungary, Slovenia, Croatia, Romania and Bulgaria.

38 M.7784 – CF Industries Holdings / OCI Business, para 21-26.

39 A distinction can be made between ‘field’ and ‘specialty’ application. Field fertilizers, such as urea, ammonium nitrate (AN) and calcium ammonium nitrate (CAN), are spread on a field and diluted progressively by rain or irrigation water. Specialty fertilizers, such as urea ammonium nitrate solution (UAN), are fully water-soluble fertilizers that are manufactured to a high degree of purity.

40 M.7784 – CF Industries Holdings / OCI Business, paras 40-42.

41 Form RS, para 337.

42 M.4208 – Petroplus/European Petroleum Holdings, paras 9-10.

43 M.4208 – Petroplus/European Petroleum Holdings, para 10.

44 M.6905 – Ineos/Solvay/JV, paras 423-424.

45 M.6905 – Ineos/Solvay/JV, paras 425-427.

46 M.4744 – Ineos / Borealis, paras 10-12.

47 M.4744 – Ineos / Borealis, para 17.

48 M.8877 - Lyondellbasell Industries / A Schulman, paras 9-14.

49 M.4744 – Ineos / Borealis, para 17.

50 M.6881 – Strategic Value Partners/Kloeckner Holdings, paras 29-36.

51 M.6218 – Ineos/Tessenderlo Group S-PVC Assets, paras 20-26.

52 M.6905 – Ineos/Solvay/JV, paras 430-433.

53 M.4744 – Ineos / Borealis, paras 15-17.

54 M.4094 – Ineos/BP Dormagen, para 31.

55 M.4094 – Ineos/BP Dormagen, paras 52-56.

56 M.4737 – Sabic/GE Plastics, para 19.

57 M.4426 – Sabic/Huntsman Petrochemicals UK, para 30.

58 M.6171 – IPIC/CEPSA, paras 8-12.

59 M.6171 – IPIC/CEPSA, paras 13-15.

60 M.8674 – BASF/Solvay's EP and P&I Business, paras 23-27.

61 M.7918 – Indorama Netherlands/Guadarranque Polyester, paras 21-25.

62 M.6905 – Ineos/Solvay/JV, paras 432-433.

63 M.4744 – Ineos / Borealis, para 17.

64 M.4094 – Ineos/BP Dormagen, paras 47-51.

65 M.4426 – Sabic/Huntsman Petrochemicals UK, para 39.

66 M.4737 – Sabic/GE Plastics, para 21.

67 M.4426 – Sabic/Huntsman Petrochemicals UK, para 39.

68 M.6171 – IPIC/CEPSA, paras 16-20.

69 M.6171 – IPIC/CEPSA, paras 21-24.

70 M.8674 – BASF/Solvay’s EP and P&I Business, paras 28-30.

71 M.7918 – Indorama Netherlands/Guadarranque Polyester, paras 26-28.

72 The American Petroleum Institute (‘API’) has created a classification of base stocks that is widely used in the oil industry as a reference for base oils. This classification divides base stocks into five groups (‘API Groups’), depending on the specific physical characteristics of the oil. API Groups I, II and III are paraffinic oils while API Groups IV and V are naphthenic.

73 M.9014 – PKN Orlen / Lotos (not yet published).

74 M.9014 – PKN Orlen / Lotos (not yet published).

75 M.9014 – PKN Orlen / Lotos (not yet published).

76 M.9014 – PKN Orlen / Lotos (not yet published).

77 OJ L 24, 29.1.2004, p. 1.

78 Further developed in point 17 of the Commission Notice on Case Referrals.

79 Further developed in point 18 of the Commission Notice on Case Referrals.

80 Under the Polish legislation implementing the Energy Efficiency Directive (2012/72/EU), white certificates are granted to projects aiming to improve energy efficiency (świadectwa efektywności energetycznej). The national legislation envisages that some entities (mostly enterprises in the energy markets) are under the obligation to carry out activities to improve energy efficiency for final customers. This obligation can also be met by buying energy efficiency/white certificates from third parties.

81 There is no other markets (even considering all plausible product and geographic definitions) that would be affected by the Transaction.

82 The Commission notes that the Proposed Transaction would also lead to affected markets in a hypothetical regional/supra-national market including CEE countries for the wholesale supply of LPG. However, for the reasons set out in footnote 27, the Commission considers that the existence of such an affected market does not prevent the Proposed Transaction from being referred to Poland, as the legal conditions set forth by Article 4(4) of the Merger Regulation are met.

83 See Table 289 of the Form RS.

84 See Table 287 of the Form RS.

85 See Table 286 of the Form RS.

86 See Table 288 of the Form RS.

87 See Table 287 of the Form RS.

88 For some of the downstream markets the geographic dimension can plausibly be defined as national. As the Parties are mostly active in Poland, the vertical links would materially arise in Poland only and therefore, as for the vertical links listed in Table 1, UOKiK would be well placed to assess the impact of the Transaction on those links. For this reason, Table 2 below only shows the Parties’ market shares for those markets which can plausibly be defined as broader than national.

89 2018 data.

90 The below paragraphs discuss the likely competitive impact of the transaction in those downstream markets where the Parties would have a sizeable market share in the CEE.

91 In its past decisions, the Commission considered that the existence of such vertically affected relationships (between upstream national markets and downstream markets wider than national) was not necessarily an impediment for referral to a national competition authority (see, for example, M.8971 - INA/PPD/Petrokemija).

92 Form Co, para 1609. Benzene is also produced in Poland by Petrochemia Blachownia, part of the Agrofert group. However, this production plant does not rely on natural gas as an input. While Orlen produces benzene as derivative of pygas (obtained through cracking of naphtha), Petrochemia Blachownia relies on production from coke oven light oil, which is obtained from coal.

93 Therefore, even if Orlen were to source internally 100% of its gas demand post-merger, this would not materially reduce the gas demand accessible to the Parties’ competitors in the upstream market (i.e. the market for the retail supply of gas).

94 See Table 286 of the Form RS.

95 In its past decisions, the Commission considered that the existence of such vertically affected relationships (between upstream wider than national markets and downstream national markets) was not necessarily an impediment for referral to a national competition authority (see, for example, M.6683 - PKN ORLEN/PETROLOT).

96 PGNiG has a share of approximately [0-5]% in the downstream wholesale supply of natural gas in Poland and it is not active in the refinery petroleum products listed in the table, with the exception of the wholesale supply of LPG on which, in any case, the Parties have a moderate combined market share in Poland (approximately [30-40]%).

97 See Table 288 of the Form RS.

98 Even if the Parties account for most of the sales of diesel, gasoline, LPG, LHO, HFO, jet fuel and bitumen in Poland, Czechia and Lithuania, their crude oil requirements represent a limited portion of the global demand for crude oil. Producers of crude oil are active worldwide and would have access to the demand of customers located in all countries other than Poland, Czechia and Lithuania, even if the Parties were to stop sourcing from third parties in these three countries post-merger.

99 See Table 284 and Table 287, Form RS.

100 See Table 285, Table 286 and Table 287, Form RS.