Commission, March 5, 2021, No M.10001

EUROPEAN COMMISSION

Decision

MICROSOFT / ZENIMAX

Dear Sir or Madam,

(1) Following a referral pursuant to Article 4(5) of the Merger Regulation, the European Commission received on 29 January 2021 notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Microsoft Corporation (“Microsoft”, USA) intends to acquire sole control of ZeniMax Media Inc. (“ZeniMax”, USA) within the meaning of Article 3(1)(b) of the Merger Regulation (the “Transaction”).4 Microsoft and ZeniMax will together be referred to as the “Parties” and Microsoft will be referred to as the “Notifying Party”.

1. THE PARTIES

(2) Microsoft is a global technology company, which offers products and services to its customers through the following segments: (i) Productivity and Business Processes; (ii) Intelligent Cloud; and (iii) More Personal Computing (“MPC”). As part of the MPC operating segment, Microsoft develops, publishes and distributes games for personal computers (“PCs”), video game consoles and mobile devices. Microsoft also offers the Xbox gaming console and related services, such as the Xbox Live online gaming service and the Xbox Game Pass gaming subscription service.

(3) ZeniMax is a privately held company that develops and publishes games for PCs, consoles and mobile devices. As part of its broad portfolio of games, ZeniMax develops and publishes video game franchises such as “The Elder Scrolls” and “Fallout”.

2. THE OPERATION AND CONCENTRATION

(4) The Transaction will be implemented by means of an Agreement and Plan of Merger (the “APM”) entered into on 19 September 2020 between Microsoft, Vault Merger Sub, Inc. (“Vault”) and ZeniMax. Under the APM, Vault, a newly created Microsoft subsidiary, will be merged with, and into, ZeniMax. Following this merger, Vault will cease to exist, and ZeniMax will be a wholly owned subsidiary of Microsoft.

(5) Following the Transaction, Microsoft will exercise sole control over ZeniMax. The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(6) The Transaction does not have a Union dimension within the meaning of Articles 1(2) or 1(3) of the Merger Regulation, because ZeniMax’s total Union turnover does not exceed EUR 250 million (ZeniMax: [100-150 million], Microsoft: [10.000- 50.000 million]) and ZeniMax’s aggregate turnover is not more than EUR 25 million in each of at least three Member States.

(7) Following the Notifying Party’s reasoned submission pursuant to Article 4(5) of the Merger Regulation that the concentration should be examined by the Commission, the Commission has transmitted this submission to all Member States. No Member State has expressed its disagreement within a period of 15 working days. The Transaction meets the legal requirements set out in Article 4(5) of the Merger Regulation: (i) it is a concentration within the meaning of Article 3 of the Merger Regulation; and (ii) it is capable of being reviewed under the national competition laws of at least three Member States, which are (i) Austria, (ii) Cyprus, and (iii) Germany. The Commission informed the Notifying Party on 18 December 2020 that the case was deemed to have a Union dimension.

4. RELEVANT MARKETS

(8) The Transaction leads to competitively relevant links with regard to the development, publishing, and distribution of video games. Video games are electronic games played by manipulating images on a video display or television screen. Video games are developed for PCs, gaming consoles, and mobile devices (such as smartphones). In particular, the competitively relevant links between the Parties concern the following two levels within the video-gaming value chain:

(a) Game software development and publishing: the development (including design, art, programming, and testing, usually taking place in a development studio) and the making available to the public of a video game. Microsoft and ZeniMax are active in the development and publishing of console games in both physical (discs) and digital form; and

(b) Game distribution: the distribution of games to the public in either physical or digital form, through (i) physical retail (online and “brick-and-mortar” retailers) and (ii) online download/streaming, via digital storefronts5, app stores and subscription services). Microsoft is active in the operation of digital storefronts selling console games in digital form.6

4.1. Game software development and publishing

(9) Game software development and publishing refers to the development (including design, art, programming, and testing, usually in a development studio) and the making available to the public, for sale or free of charge, of a video game. In the present decision, video game software development and publishing will be analysed together (hereafter “video games publishing”).

Relevant product market

4.1.1.1.The Commission’s previous practice

(10) In Activision Blizzard/King, the Commission concluded that there were indications that the market for game software publishing could be segmented by hardware, namely (i) PC games, (ii) console games, and (iii) mobile games.7 The Commission found indications that mobile games in particular constitute a distinct market, given their nature, technical features, different pricing structure, different production costs, and different distribution channels (native mobile games being largely distributed through app stores).8 Overall, however, the Commission argued that the “lines between different platforms are blurring, because games are often released on several platforms, there is substantial substitutability between games”.9

(11) The Commission further considered a segmentation by reference to the type of gamer (e.g., casual, midcore or hardcore10) or genre (e.g., action, adventure, role- playing games, sport strategy, resource management, etc.11). However, the Commission considered that from a supply-side perspective, the same company can create games of many different types. From a demand-side perspective, distinctions between game type or genre were not followed by players and could therefore not be made accurately.12 The Commission reached the same conclusion in Vivendi/Activision, where it noted that “from a demand-side perspective, most gamers appear to buy games across several game genres” and “from a supply-side perspective, publishers appear generally to publish games across multiple genres”.13 Further, the Commission added that a distinction by genre was “subjective”, as there were “games with multi-types of gaming activity inside the same game”.14

(12) The Commission ultimately left the product market definition open.15

4.1.1.2. The Notifying Party’s views

(13) The Notifying Party submits that video games developed for PCs and consoles are increasingly substitutable, while native mobile games remain distinct.16 The Notifying Party argues that games developed for PCs and consoles require greater investment in money, time, and resources (i.e., marketing).17 Moreover, the Notifying Party submits that the difference between games for PCs and consoles will continue to diminish, as the majority of games published by the Parties and other independent game publishers are launched for both PCs and consoles. Lastly, the Notifying Party argues that the introduction of subscription services will continue to erode the differences between games published for PCs and consoles.18

(14) The Notifying Party also argues that a distinction by game type or genre would not properly reflect the dynamics of the industry. It indicates that distinctions by genre or type are not followed by players, and therefore cannot be accurately made. In the Notifying Party’s view, most players buy games across several game genres (as well as multiple games within the same genre) and a significant number of players would switch to other genres of games in response to a significant price rise. In addition, from a supply-side perspective, a publishing studio can create many different types of games. Lastly, the Notifying Party submits that it is inherently difficult to classify games into discrete genres and types.19

(15) The Notifying Party argues that the exact scope of the relevant product market can be left open, given that the Transaction would not raise concerns as to its compatibility with the internal market under any of the plausible alternative market definitions assessed for the purpose of this decision.20

4.1.1.3. The Commission’s assessment

(16) The results of the market investigation are inconclusive regarding a possible segmentation of the video game publishing product market by platform (PC, console, and mobile). In particular, the market investigation produced no clear support for segmenting the relevant market according to the three platforms or for considering mobile games as distinct from games published for PCs and consoles.21

(17) In light of these results, the exact market delineation can be left open. For the purpose of the present decision, video games publishing (i) for PCs, (ii) for consoles, and (iii) for mobile devices, as well as (iv) for a broader market for video games publishing regardless of the platform will be considered to constitute four potential relevant product markets.

(18) The results of the market investigation are also inconclusive regarding a possible distinction between different genres of video games. Amongst video game publishers and distributors (including both physical and digital distributors), there is no clear majority supporting either a segmentation according to genres or supporting that, despite different genres, one single relevant product market exists.22

(19) Therefore, for the purpose of this decision, the exact definition of the relevant product market will be left open. The effects of the Transaction will be assessed both under the assumption that video game genres23 may constitute possible distinct market segments, or that they form one overall video games publishing market.

(20) Further, the results of the market investigation are inconclusive regarding a possible segmentation of publishing by game type.24 Therefore, for the purpose of this decision, the exact definition of the relevant product market will be left open. The effects of the Transaction will be assessed under the assumption that the video game types identified by the Notifying Party (AAA, casual, stand-alone, browser, free-to- play, freemium, and social network25) may constitute potential distinct market segments, or that they form one overall video games publishing market.

(21) In any event, the exact delineation of the relevant product market can be left open for the purpose of this decision, as the Transaction does not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of the plausible product market definitions considered.

Relevant geographic market

4.1.2.1. The Commission’s previous practice

(22) As regards the geographic scope of any of the plausible product market definitions considered in section 4.1.1.3, in previous decisions, the Commission has considered the market to be at least EEA-wide, if not worldwide, but ultimately left the geographic market definition open.26

4.1.2.2. The Notifying Party’s views

(23) The Notifying Party submits that the relevant markets are at least EEA-wide, if not worldwide, since (i) there are no material price differences across the EEA, (ii) the same publishers compete across the EEA, and (iii) digital distribution channels are available across all EEA jurisdictions.27

(24) The Notifying Party argues that the exact scope of the relevant geographic markets can be left open, given that the Transaction would not raise concerns as to its compatibility with the internal market under any of the plausible market definitions assessed for the purpose of this decision.28

4.1.2.3. The Commission’s assessment

(25) The market investigation has confirmed that the geographic scope of any of the plausible product market definitions considered in section 4.1.1.3 is at least EEA- wide, possibly worldwide.

(26) A majority of distributors consider that the overall market for video games publishing should be worldwide in scope because, in particular, there are no significant price differences, and many publishers typically produce one version of a video game for distribution worldwide. This is confirmed by a majority of publishers who indicated that they develop video games for distribution in all geographies, which are then (possibly) localised for specific regions.29 However, only a minority of game publishers responded that the relevant geographic market should be worldwide. These diverging views between publishers and distributors also remain if the replies are broken down by platform (mobile games, PC games, and console games).30

(27) On this basis, the Commission considers that, for the purpose of this decision, it is appropriate to consider both an EEA-wide relevant geographic scope and a worldwide relevant geographic scope for any of the plausible product market definitions considered in section 4.1.1.3.

(28) In any event, the exact delineation of the relevant geographic market can be left open for the purpose of this decision, as the Transaction would not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of the plausible geographic market definitions considered.

4.2. Game distribution

(29) Game distribution refers to the distribution of games to the public in either physical or digital form. In the case of physical distribution, games are distributed on physical media like cartridges and compact discs, and sold online (e.g., via the Microsoft Store, Apple App Store, and Google Play Store) or in brick-and-mortar stores. In the case of digital distribution, games are distributed through online download and/or streaming, e.g., as concerns Microsoft, accessed via the Microsoft Store (on Windows PCs), Xbox Store (now known as the Microsoft Store, on the Xbox Console), Xbox Game Pass (Ultimate), and Xbox Live.

Relevant product market

4.2.1.1. The Commission’s previous practice

(30) In its decision in the case Vivendi/Activision, the Commission considered a possible relevant product market for physical wholesale game distribution.31

4.2.1.2. The Notifying Party’s views

(31) The Notifying Party considers that the Commission’s decisional practice in relation to video games distribution does not provide clear indications as to the definition of the relevant market. Instead, it relies on the decisional practice in the area of physical and digital distribution of recorded music. The Notifying Party considers that these decisions are instructive for the distribution of video games, because, in their view, game distribution is undergoing the early stages of a transformation similar to that seen in the music and video industries, i.e., a shift from physical sales towards digital distribution, and within digital, from download to streaming.32 On this basis, the Notifying Party submits the following arguments.

(32) The Notifying Party refers to Universal Music Group/EMI Music, Sony/BMG and Access/PLG, explaining that, like for music, physical and digital games distribution could fall into distinct relevant product markets, given the differences in pricing and characteristics.33 The Notifying Party also notes that in Vivendi/Activision, the Commission pointed to the different pricing mechanisms for online games (monthly subscription fees) as opposed to offline games (buy-to-play).34

(33) The Notifying Party further submits that, in contrast to the physical distribution of games, digital distribution provides players with immediate access to games, which cannot be lost or destroyed.35 In terms of characteristics, the Notifying Party also points to the accessibility and storage of physical buy-to-play games (similar to books) as opposed to digital games.36 Lastly, the Notifying Party points to the difference in the supply chain of physical and digital distribution, highlighting that a shorter supply chain for digital distribution, makes the cost of digital distribution lower.37 The Notifying Party concludes that, given the differences in pricing and characteristics, physical and digital distribution fall into two distinct product markets.38

(34) Regarding digital distribution, the Notifying Party submits that digital storefronts and app stores through which PC and console video games are distributed, all fall into the same relevant product market.39 As native mobile games are distributed through mobile application stores, the Notifying Party submits that mobile app stores fall into a distinct relevant product market.40 Lastly, the Notifying Party submits that a segmentation of digital distribution with reference to the payment model (purchase or subscription), or between download and streaming of games is not warranted. 41

(35) Overall, the Notifying Party submits that the distribution of games in physical and digital form could likely fall into two separate product markets, with no further segmentation.42

(36) The Notifying Party argues that, in any case, the exact scope of the relevant product market can be left open, given that the Transaction would not raise concerns as to its compatibility with the internal market under any of the plausible market definitions assessed for the purpose of this decision.43

4.2.1.3. The Commission’s assessment

(37) The market investigation has provided inconclusive results with respect to a possible segmentation of video game distribution by physical and digital distribution.44 While a majority of publishers indicate that a game developer can easily switch between developing video games for physical and digital distribution channels, this is not supported by the distributors’ replies to the market investigation.45

(38) On this basis, the Commission considers that, for the purpose of this decision, it will conduct its competitive assessment on both (i) a potential single distribution market, and (ii) two hypothetically separate markets for physical distribution (online and “brick-and-mortar” retailers) and digital distribution (online download/streaming via digital storefronts, app stores and subscription services).

(39) As regards a possible segmentation of digital distribution by platforms for which games are developed (PC, console, and mobile devices), the market investigation has also provided inconclusive results, as there is no majority amongst neither publishers nor distributors supporting or rejecting such a segmentation.46

(40) On this basis, for the purpose of this decision, the exact definition of the relevant product market will be left open. The effects of the Transaction will therefore be assessed under the assumption that the platforms for which games are developed may constitute potential distinct markets, as well as under the assumption of the existence of an overall distribution market.

(41) As regards a possible segmentation of a hypothetical digital distribution market based on the payment model (upfront payment vs. subscription), the results of the market investigation indicate that such a segmentation is not warranted, in particular because digital payment models to a large extent are interchangeable.47 Similarly, the results of the market investigation do not support segmenting the hypothetical digital distribution market by types of players’ access (download vs. streaming). A large majority of respondents in the market investigation indicated that such a segmentation is not appropriate in particular because different access does not influence the players’ purchasing behaviour and choices.48 On this basis, for the purpose of this decision, the Commission will not distinguish different segments in the digital distribution market, based on the payment model and on the types of access.

(42) In any event, the exact delineation of the relevant product market can be left open for the purpose of this decision, as the Transaction would not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of the plausible product market definitions considered.

Relevant geographic market

4.2.2.1. The Commission’s previous practice

(43) As regards the potential market for physical game distribution, in Vivendi/Activision, the Commission stated that, considering the results of the market investigation in that case, “the markets for wholesale game distribution and logistic services tend to be national in scope”.49

(44) In the market investigation in Activision Blizzard/King (which did not focus on the distribution markets), a respondent indicated that gaming became a worldwide industry with the advent of digital content distribution.50

4.2.2.2. The Notifying Party’s views

(45) In relation to the market for physical game distribution, the Notifying Party submits that, similarly to the Commission’s findings in the music industry in Apple/Shazam,51 the market should be at least national.52

(46) In relation to the market for digital game distribution, the Notifying Party considers that the market is at least EEA-wide, if not worldwide in scope. It argues that there are no material price differences within the EEA, that the same game publishers compete across the EEA, and that the same digital distribution channels are available anywhere in the world without cross-border restrictions.53

(47) In any event, the Notifying Party considers that the exact scope of the geographic market can be left open given that the Transaction would not raise competition concerns under any of the alternative market definitions.54

4.2.2.3.The Commission’s assessment

(48) The market investigation confirmed that the geographic scope of physical and digital game distribution is at least EEA-wide.

(49) Both (i) game publishers and (ii) distributors that participated in the market investigation indicated that the relevant geographic market, including both physical and digital distribution, should be at least EEA-wide in scope. Only a small number of respondents indicated that the relevant geographic market should be national. Distributors even supported defining a possible worldwide market, in particular concerning digital distribution.55

(50) On this basis, the Commission considers that for the purpose of this decision, it is appropriate to consider both an EEA-wide and a worldwide relevant geographic for the overall market for video games distribution, as well as any possible market definitions as outlined in section 4.2.1.3.

(51) In any event, the exact delineation of the relevant geographic market can be left open for the purpose of this decision, as the Transaction would not raise serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any of the plausible geographic market definitions considered.

5. COMPETITIVE ASSESSMENT

5.1. Analytical framework

(52) Article 2 of the Merger Regulation requires the Commission to examine whether notified concentrations are compatible with the internal market, by assessing whether they would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.56

(53) Vertical relationships involve companies operating at different levels of the supply chain. There are two main ways in which vertical mergers may significantly impede effective competition: input foreclosure and customer foreclosure.57

(54) Input foreclosure may raise competition problems only if it concerns an important input for the downstream market, and if the combined entity has a significant degree of market power upstream.58 In assessing the likelihood of an anticompetitive input foreclosure strategy, the Commission examines: (i) whether the combined entity would have the ability to substantially foreclose access to inputs; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on competition downstream.

(55) For a transaction to raise customer foreclosure competition concerns, the combined entity must be an important customer with a significant degree of market power in the downstream market.59 In assessing the likelihood of an anticompetitive customer foreclosure strategy, the Commission examines: (i) whether the combined entity would have the ability to foreclose access to downstream markets by reducing its purchases from upstream rivals; (ii) whether it would have the incentive to do so; and (iii) whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.

5.2. Identification of affected markets

(56) Microsoft and ZeniMax are active in the market(s) for game software publishing for PCs, consoles and mobile devices, across video game genres and types. Further, Microsoft is also active in the market(s) for physical and digital video game distribution for PCs and consoles.60 As set out in paragraph (8) above, and taking into account all plausible product market definitions in sections 4.1.1.3 and 4.2.1.3, the Transaction gives rise to one affected market, namely the operation of digital storefronts selling console games in digital form, where Microsoft is active (see paragraph (59) below).

(57) First, the Transaction does not give rise to any affected conglomerate relationships, given the Parties’ generally limited market shares. Furthermore, ZeniMax is not active in a market “closely related” to the operation of digital storefronts selling console games in digital form, where Microsoft holds a market share in excess of 30%.

(58) Second, the Transaction involves no horizontally affected markets. While both Microsoft and ZeniMax are active as game publishers and licensors of rights for game-related merchandising, the Parties’ combined shares in all markets where both Parties are active are limited, and in any event below 20% under any product and geographic delineation considered.

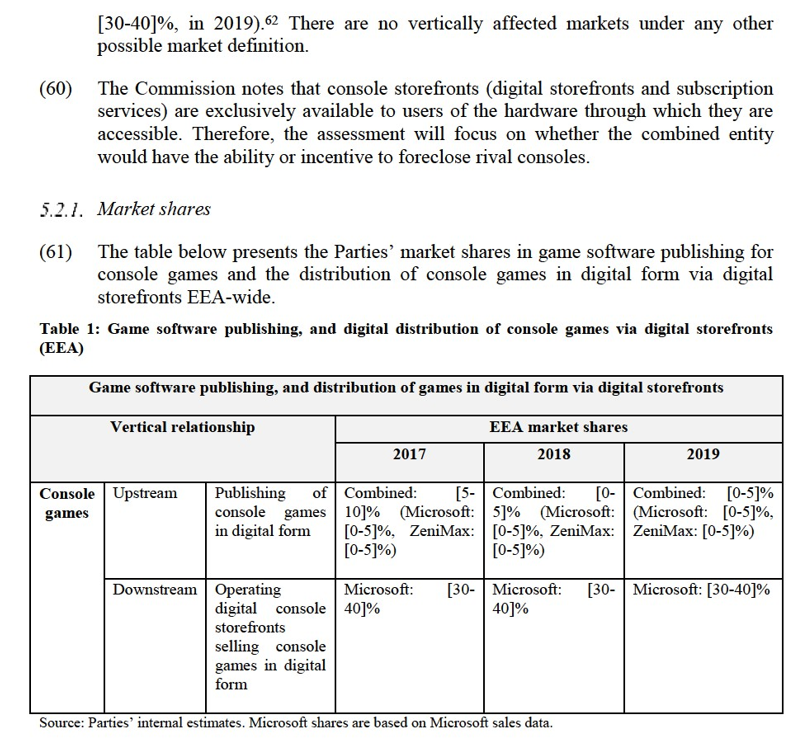

(59) Third, the Transaction gives rise to a vertical relationship, which involves an affected market at the downstream level. The identified vertical relationship consists of: (i) upstream: the publishing of console games in digital form61 in the EEA (Microsoft: [0-5]%, ZeniMax: [0-5]%, in 2019); and (ii) downstream: the operation of digital storefronts selling console games in digital form in the EEA (Microsoft:

digital console video games on its downstream console platform, i.e., the Microsoft and Xbox Store; and (ii) partial foreclosure of rival publishers of console video games through for instance, an increase in distribution fees or a degradation of the terms and conditions under which Microsoft is willing to sell these rival games on its console platform.

5.2.2.1. Ability to engage in customer foreclosure

(A) The Notifying Parties’ views

(64) The Notifying Party submits that post-Transaction, Microsoft will not have the ability to prevent rival game publishers from selling through the Microsoft console- specific digital storefronts.

(65) First, the combined entity’s share of game publishing (however defined) will be very small. At the same time, most prominent new releases of video games are third-party games, and a console needs to offer such games in order to attract gamers. Therefore, Microsoft will need to continue to rely on third-party games to provide the vast majority of its Xbox content.65

(66) Second, the Notifying Party argues that third-party publishers have [console platform’s negotiation with publishers] leverage during negotiations with console platforms. Rival consoles compete intensely to bring newly released games to their consoles first, as doing so makes their console more attractive to players. In addition, the emergence of new gaming platforms from large firms such as Google, Amazon, and Facebook are only increasing the publishers’ negotiating power, as they can look to many other platform providers for more attractive terms.

(67) In particular, the Notifying Party considers that, [forecast of Xbox’s performance]. If Microsoft were to try and restrict access or worsen terms with third-party publishers, these publishers could fully or partially switch to rival consoles, rendering the strategy self-defeating.66

(68) Therefore, the combined entity would not have the ability to foreclose rival game publishers from selling through the Microsoft console-specific storefronts.

(B) The Commission’s assessment

(69) While Microsoft could technically implement a customer foreclosure strategy, the Commission considers that the combined entity will not have the ability to engage in a successful customer foreclosure strategy since there appear to be sufficient economic alternatives in the downstream market for upstream rivals to sell their output.

(70) Market shares indicate that Microsoft, through the Xbox console platform, is an important distributor of console video games in the EEA with [30-40]% (for 2019, see Table 1 above) of the digital console video game distribution market (digital storefronts only). Microsoft’s main competitors in the digital distribution of console video games in the EEA (limited to digital storefronts) are Sony ([50-60]%, in 2019) via the PlayStation console platform and Nintendo ([5-10]%, in 2019) via the Switch console platform.67 However, despite the importance of Microsoft as a distributor of console video games, the Commission concludes that Microsoft would not have the ability to foreclose rival publishers by ceasing to distribute third-party content and exclusively relying on the content of ZeniMax post-transaction or deteriorating the conditions under which Microsoft would distribute third-party console titles.

(71) First, as also addressed in paragraph (93) below, ZeniMax has a very limited market position in the EEA (2019) with regards to the publishing of digital console video games ([0-5]% market share) and the Parties together do not have more than [0-5]% (see Table 1). It will therefore not be possible for Microsoft to exclusively rely on the combination of ZeniMax’s console video game content and its own content for distribution in the EEA.

(72) This was confirmed by several video game publishers and distributors who emphasized the size of the video game publishing market and the strength of Microsoft and ZeniMax’s rival game publishers’ intellectual property, which represents attractive content for game distributors.68

(73) Second, the results of the market investigation indicate that the majority of video game publishers considered that there are other (strong) players to which they could license their content as an alternative to the Parties in the event that Microsoft would cease acquiring their video game content or otherwise degrade the terms on which it acquires their content. Further, publishers confirmed that it is normal business practice to develop games across all possible distribution channels and platforms.69 No respondents considered that there are no alternative licensors for their content.70 [Microsoft’s negotiation strategy with publishers].71 72

(74) Furthermore, the majority of publishers confirmed that the Transaction would not affect their bargaining power in negotiations with Microsoft to sell console games via the Microsoft console platform.73 Only two third-party publishers considered that Microsoft’s bargaining power would increase post-Transaction, however one of these respondents clarified that “the sole acquisition of ZeniMax would be insufficient to tip Microsoft’s bargaining power to levels raising concern.”

(75) Third, as set out in paragraph (119), a material proportion of console video game players multi-home and own multiple consoles or play games on both PC and console74 which further underlines the fact that console video game publishers have multiple distribution options.

(76) Overall, video game publishers that responded to the market investigation have not raised concerns regarding Microsoft ceasing to acquire content from them or otherwise degrading the terms on which it does so. Third parties did not consider that ZeniMax video games were significant enough for a (partial) customer foreclosure strategy to be profitable.75

(77) Therefore, for the reasons set out above, the Commission concludes that the combined entity would not have the ability to foreclose rival console video game publishers by engaging in a total or partial customer foreclosure strategy.

5.2.2.2. Incentive to engage in customer foreclosure

(A) The Notifying Parties’ views

(78) The Notifying Party submits that post-Transaction, Microsoft will not have the incentive to prevent rival game publishers from selling through the Microsoft console-specific digital storefronts.

(79) The Notifying Party argues that it would be self-defeating for any console manufacturer to limit or restrict rival game publishers from selling through Microsoft console-specific digital storefronts. It explains that having a broad range of attractive games is the single most important factor for driving the success of a console, such that any policy undermining the availability of third-party games would be commercially irrational.76

(80) According to the Notifying Party, the imperative to attract third-party content is underlined by the outcome of the last two console generations. [Microsoft’s performance]. Industry experts have also confirmed the correlation between a console’s performance and the amount of attractive gaming content it can offer compared to its rivals.77 Therefore, any strategy restricting third-party publishers’ access to the Xbox would only push publishers to spend less time developing games for the Xbox, and more time developing exclusive content for other devices. This in turn would reduce Xbox’s appeal to players and publishers. Therefore, Microsoft is highly incentivised to continue to rely on third-party games to provide content.78

(81) Therefore, the combined entity would not have the incentive to foreclose rival game publishers from selling through the Microsoft console-specific storefronts.

(B) The Commission’s assessment

(82) The Commission considers that Microsoft would not have the incentive to foreclose access to downstream markets by reducing purchases or purchasing at inferior conditions from upstream competing rivals for the following reasons.

(83) As the Notifying Party argues, rich and differentiated content is key to a console’s ability to attract, engage and retain players.79

(84) Several internal documents and industry reports confirm this premise. A recent IDG Consulting annual whitepaper (2020) thus notes that “[c]ontent in gaming remains the paramount success factor. Without great differentiated content, a game platform cannot survive.”80 The paper further points out that the most popular game titles (such as “GTA V”, “Assasin’s Creed”, “Zelda”, “Final Fantasy”, “Pokemon”, “FIFA”, etc.) also attract a certain amount of brand loyalty, i.e., “these brands exert a significant amount of influence over consumer behaviour and loyalty over time”.81 These top console and PC franchises do not include ZeniMax titles (see also paragraph (104) below). A Microsoft presentation to the Board (2020) further states that, [Xbox’s business strategy].82

(85) The majority of respondents to the market investigation confirmed that Microsoft would not have the incentive to prevent rival publishers from selling through the Microsoft console platform.83 None of the respondents considered that Microsoft would have the incentive to engage in a partial or total customer foreclosure strategy as “[t]here is no interest for Microsoft to restrict access to its platform for third party publishers. Quite the opposite actually”.84

(86) Instead, a large majority of respondents, including rival console platforms Sony and Nintendo, confirmed that holding a broad range of (differentiated) content constitutes one of the drivers of success of a digital distribution channel.85 For instance, a video game distributor explained that “[…] the content is very important for the consumer to decide for a platform or console. The platform with the most and best games (for a reasonable price) will be the market leader”.86

(87) Accordingly, as noted above, the Commission considers that the combined entity will continue to have an incentive to carry a broad range of the most attractive content on its platform.

(88) Therefore, for the reasons set out above, the Commission concludes that the combined entity would not have the incentive to foreclose rival console video game publishers by engaging in a total or partial customer foreclosure strategy.

(C) Impact on effective competition

(89) Given the existence of multiple alternatives to Microsoft, to which video game publishers can supply their content, rival console video game publishers would not likely be deprived of an essential customer, and could still rely on multiple alternative distribution channels.

(90) This conclusion is consistent with the results of the market investigation. The large majority of participants considered that the Transaction’s impact on the publishing market would be neutral. One respondent clarified that “[t]here is a high level of competition in the market for game development and publishing with numerous competitors active on the market. […] [L]arge publishers typically take a broad approach whilst others may be more specialised in the types of games they publish, and many publishers are active across different devices, publishing games, which are interchangeable from the consumer perspective. All games compete for available consumer funds and consumers can readily switch between mobile, PC and console games.”87

(91) In light of the above, the Commission finds that a potential (partial or total) customer foreclosure strategy would not have a material effect on competition in the EEA.

5.2.2.3. Conclusion

(92) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to the compatibility with the internal market under any of the considered alternative product markets for game distribution, either at the EEA- or worldwide levels. Foreclosure of rival console video game distributors by foreclosing access to ZeniMax digital console video games (input foreclosure)

(93) The combined entity’s market share in the upstream market for the publishing of console games in digital form is very limited, amounting to [0-5]% in the EEA in 2019.88 Worldwide, the combined entity’s market share in the overall console game publishing market in the same year is [0-5]%.89 Downstream, the combined entity has a market share of [30-40]% (2019) in the market segment of digital distribution of console video games via digital storefronts in the EEA.

(94) Despite the combined entity’s limited market shares upstream, the Commission notes that ZeniMax, as specified below, publishes some game franchises that are popular among players. The Commission further notes that content plays a prominent role in the video gaming industry. The Commission has therefore assessed the risk of: (i) total foreclosure of rival console video game distributors by foreclosing access to some or all of ZeniMax digital console video games; and (ii) partial foreclosure of rival console video game distributors through a degradation of the terms and conditions under which ZeniMax digital console video games are made available for rival consoles.

5.2.3.1. Ability to engage in input foreclosure

(A) The Notifying Parties’ views

(95) The Notifying Party submits that it is implausible that ZeniMax’s content would enable Microsoft to foreclose rival console storefronts or other rival console distribution channels, as ZeniMax’s content and market share are not significant enough.90

(96) First, the Notifying Party considers that both ZeniMax and Microsoft have a very modest combined market share in the publishing market in the EEA, indicating that the Parties lack the upstream market power to implement a foreclosure strategy.91 In particular, ZeniMax’s market share in the EEA was less than [0-5]% in 2019. The Notifying Party considers that, even if they were to engage in an exclusivity strategy concerning ZeniMax games vis-à-vis other consoles, this would not raise any competition concerns, as ZeniMax’s content is not sufficiently strong to tip downstream markets in favour of Microsoft.

(97) Second, rival consoles (and console storefronts) such as Sony and Nintendo have access to a very large array of popular games.92 Sony and Nintendo also have many blockbuster exclusive console games, some of which rank among the top-selling console games in Europe.93 In this regard, the Notifying Party notes that no ZeniMax games feature among the bestselling console games in Europe in 2018.

(98) Third, the Notifying Party argues that Sony and Nintendo consoles (and their respective storefronts) are differentiated and have stronger market positions than Microsoft’s Xbox, both at EEA and national levels. Moreover, Sony consoles in particular have accumulated significant brand loyalty.

(99) Fourth, the Notifying Party argues that Sony and Nintendo have surpassed Microsoft in the old console generation.94 [Microsoft’s performance].95 The Notifying Party concludes that ZeniMax games, even if exclusively available for the Xbox, could not weaken rival consoles sufficiently to result in foreclosure.96 Therefore, in the Notifying Party’s view, Microsoft would not have the ability to successfully engage in an input foreclosure strategy.

(B) The Commission’s assessment

(100) While Microsoft could have the technical ability to implement an exclusivity strategy with regard to ZeniMax games vis-à-vis rival consoles, the Commission considers that the combined entity will not have the ability to engage in a successful input foreclosure strategy. In this regard, as mentioned above, the Commission has carried out such analysis under both scenarios of total and partial foreclosure.

(101) Console-specific storefronts are available exclusively to users of the respective console, because the console manufacturer runs the storefronts through which players can purchase the related console games. This dynamic was confirmed by a publisher, which indicated that once video game players buy a certain console, they essentially become locked-in to that console’s ecosystem. Exclusive video games could therefore encourage the purchase of the relevant consoles.

(102) ZeniMax publishes popular game franchises (such as “The Elder Scrolls” and “Fallout”), which enjoy recognition by players. However, despite the commercial success of these titles, Microsoft would not have the ability to foreclose rival console distributors by refusing to make ZeniMax games available on rival consoles or degrading the terms under which these games are made available.

(103) First, market shares indicate that ZeniMax’s content represents a very limited position in the upstream market in the EEA, with a lower than [0-5]% share of the digital video games publishing market (2019). Furthermore, the Parties combined represent a market share of [0-5]% (2019) in the EEA (see Table 1). The Commission therefore considers that the combined entity cannot be considered to hold a significant degree of market power in the video games publishing market.

(104) Second, almost all respondents to the market investigation confirmed that, despite the commercial success of a number of ZeniMax games,97 the upstream publishing market is highly competitive.98 The Parties face strong competition from many rival third-party publishers owning well-known game franchises, which represent attractive content for game distributors. These competitors include large developers such as Electronic Arts (“Fifa”, “Need for Speed”), Nintendo (“Super Mario”, “Zelda”), Activision Blizzard (“Call of Duty”), Take Two (“GTA V”) and Ubisoft (“Assasin’s Creed”). For instance, 2018 data shows that no ZeniMax games feature among the 15 bestselling console games in Europe.99

(105) Third, exclusivity strategies are not uncommon and have already been adopted by rival consoles, with video games that performed better than ZeniMax titles.100 Such exclusive games have contributed to drive the success of Nintendo and Sony consoles,101 which have a stronger market position compared to Microsoft’s Xbox.102 In this regard, almost all respondents to the market investigation consider that Microsoft currently holds the least attractive exclusive content compared to Sony and Nintendo consoles.103 Exclusive games might influence the choice of a console especially at the stage of the initial console purchase. However, once the choice has been made, players tend to remain loyal to their console, as also indicated in paragraph (120) below. In this regard, a slight majority of respondents to the market investigation pointed to the presence of some degree of player loyalty to the console brand.104 Publishers generally indicated that players tend to remain loyal to a brand once they choose it. Only a few respondents indicated that players are neutral or not loyal. Therefore, it is unlikely that a significant number of current PlayStation and Nintendo console users would switch to the Xbox console as a result of an exclusivity strategy in relation to ZeniMax’s games. The Commission considers that these reasons further limit the combined entity’s ability to weaken the position of rival console distributors.

(106) Therefore, for the reasons set out above, the Commission concludes that the combined entity would not have the ability to foreclose rival console video game distributors by engaging in a total or partial input foreclosure strategy.

5.2.3.2. Incentive to engage in input foreclosure

(A) The Notifying Parties’ view

(107) The Notifying Party submits that Microsoft has strong incentives to continue making ZeniMax games available for rival consoles (and their related storefronts).105

(108) The Notifying Party explains that the profitability of a strategy to make ZeniMax games exclusive to the Xbox console would depend on a trade-off between: (i) the value of attracting new players to the Xbox ecosystem; and (ii) the lost income from the sale of ZeniMax games for rival consoles (through the related storefronts). In this regard, the Notifying Party forecasts that a significant share of ZeniMax games sales will occur on rival consoles over the life cycle of the newly released console generation.106 Based on such a trade-off, the Notifying Party submits that a hypothetical console exclusivity strategy would be profitable only if it led to an increase in the number of Xbox users [forecast million] over the next five years, corresponding to an increase in Xbox shipments [forecast percentage] above the forecast level.107

(109) In the Notifying Party’s view, it is implausible that Microsoft would achieve such results. Firstly, the Notifying Party considers that such a strategy is likely to be successful if service differentiation is weak and the content at issue is extremely valuable.108 However, rival consoles are significantly differentiated, and have accumulated brand loyalty.

(110) Secondly, a high switching rate by players is implausible due to the considerable switching costs between consoles, and the relative value of ZeniMax games compared to the gaming landscape.109

(111) Thirdly, the Notifying Party considers that the players’ switching rates indicated above are conservative, as they would have to increase further if more realistic switching patterns were taken into account. In particular, the Notifying Party submits that multi-homing across consoles may further reduce the incentives for a foreclosure strategy.110 Players loyal to Nintendo or Sony consoles with a strong desire to play ZeniMax games can respond to a console exclusivity strategy by buying an Xbox to play ZeniMax games, while keeping most of their gaming activity and expenditure on their preferred console.111

(112) In this regard, the Notifying Party submits that cross-platform console ownership reduces the value of an incremental switcher, because players who buy an Xbox as a second console would not bring their entire game purchasing activity to the Xbox. [details about the profit, value and ownership of the Xbox and the profit made from the sale of ZeniMax games].112 113

(113) [Microsoft’s strategy regarding ZeniMax games].114

(114) Therefore, according to the Notifying Party, Microsoft would not have the incentive to cease or limit making ZeniMax games available for purchase on rival consoles.

(B) The Commission’s assessment

(115) The combined entity’s incentive to foreclose rival console game distributors depends on the balance between: (i) the losses from not distributing ZeniMax games broadly on other consoles; and (ii) the higher profits obtained from the increased sales of Xbox consoles (and the related games and services) to new end-users interested in playing ZeniMax games. In light of this trade-off, the Commission concludes that the combined entity would not have the incentive to engage in an input foreclosure strategy by refusing to make ZeniMax games available on rival consoles or degrading the terms under which these games are made available.

(116) The Commission notes that an input foreclosure strategy would only be economically viable if ZeniMax games were able to attract a sufficiently high number of new players to the Xbox console ecosystem, and if Microsoft could profit enough from their game purchasing activity.115 However, such an outcome is unlikely.

(117) First, both the Notifying Party and the market investigation indicate that players may consider switching to another console especially at the launch of a new console generation, an event that occurs approximately every eight years (the current console generation was launched in 2020 and is projected to be discontinued in 2028).116 This is because, in addition to the purchase of a console, players’ subsequent purchasing activities will concern games and related services that are not portable to another console and are exclusively available within that console ecosystem. Therefore, due to these combined costs, players are likely to retain a console throughout its entire life cycle.

(118) In this regard, while a number of the respondents to the market investigation considered that players would switch to another console to enjoy exclusive content,117 such a scenario does not appear probable in the case at hand. While exclusive games are relevant for stimulating demand, high switching rates are unlikely and depend on several additional factors. First, distributors specified that players’ choices are influenced by consoles’ design, services, functionalities and the console brand used by peers. Second, such switching would only occur if particular circumstances are met. For instance, a publisher specified that content must be “extremely high quality […], otherwise players will tend to stick to the console they are used to”. Third, respondents explained that there exists large amounts of significantly differentiated content competing across platforms.

(119) Second, the Commission considers, in line with the Notifying Party’s explanation, that rival console users could also purchase an Xbox as a second console, in addition to the one they already own, in order to play ZeniMax games. As regards console multi-homing, according to an NPD Group survey,118 30.6% of PlayStation 4 console owners also own a Microsoft Xbox 1 and 28.6% also own a Nintendo Switch. In this regard, several respondents to the market investigation confirmed that between 20% and 40% of console owners use more than one console brand.119 As a result, any purchase activity for the Xbox console focused solely on ZeniMax games, as explained in paragraph (112) above, would not likely offset the losses incurred from the sale of the console to the new player.120

(120) Third, more generally, the Commission also notes that Sony and Nintendo consoles are differentiated products, due to the availability of several exclusive games, some of which, as detailed above,121 are highly attractive to players. Rival consoles have built a strong reputation and enjoy a degree of brand loyalty by players, as demonstrated by a Best SEO Companies’ survey.122 Therefore, on top of the considerations set out above, it is implausible that a sufficiently significant number of players would switch to the Xbox driven by the desire to play ZeniMax games, abandoning other ecosystems with a richer game library.123

(121) In addition, respondents to the market investigation confirmed the absence of an incentive for Microsoft to engage in input foreclosure. The majority of respondents indicated that Microsoft would not have the incentive to prevent rival console game distributors from selling ZeniMax games.124

(122) Furthermore, the Commission notes that the above considerations are consistent with the Notifying Party’s declared strategy in relation to the Transaction. [Microsoft’s future strategy regarding ZeniMax games].125 126 127

(123) [Microsoft’s future strategy regarding ZeniMax games].128

(124) Therefore, for the reasons set out above, the Commission concludes that the combined entity would not have the incentive to foreclose rival console video game distributors by engaging in a total or partial input foreclosure strategy.

(C) Impact on effective competition

(125) Even if the combined entity was to engage in a (total or partial) input foreclosure strategy, the Commission considers that such a strategy would not have a material impact on competition in the EEA. Rival consoles would not be deprived of an essential input, and could still rely on a large array of valuable video game content to attract players.

(126) This conclusion is consistent with the results of the market investigation. The majority of distributors considered that the Transaction, in general, would have a neutral impact on their company, and no respondent believed that the impact would be negative.129 The majority of distributors also indicated, more specifically, that the impact of a possible exclusivity strategy with regard to ZeniMax games would be neutral on the distribution market.130

(127) In light of the above, the Commission finds that a potential (partial or total) input foreclosure strategy would not have a material effect on competition in the EEA.

5.2.3.3. Conclusion

(128) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to the compatibility with the internal market with respect to possible input foreclosure practices under all the alternative product markets for game publishing, whether at EEA or at worldwide level.

6. CONCLUSION

(129) For the above reasons, the European Commission has decided not to oppose the notified concentration and to declare it compatible with the internal market and with the functioning of the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement.

1 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (the ‘TFEU’) has introduced certain changes, such as the replacement of ‘Community’ by ‘Union’ and ‘common market’ by ‘internal market’. The terminology of the TFEU will be used throughout this decision.

2 For the purpose of this Decision, although the United Kingdom withdrew from the European Union as of 1 February 2020, according to Article 92 of the Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community (OJ L 29, 31.1.2020, p. 7), the Commission continues to be competent to apply Union law as regards the United Kingdom for administrative procedures which were initiated before the end of the transition period.

3 OJ L 1, 3.1.1994, p. 3 (the ‘EEA Agreement’).

4 Publication in the Official Journal of the European Union No C 40, 5.2.2021, p. 21.

5 Video games, associated content and related services may be distributed through digital storefronts. These storefronts are usually accessible to players at any time and from anywhere as apps and/or websites that offer video games for PCs or console. For example, players using consoles can purchase games through the console-specific storefront (which enables automatic download onto consoles linked to storefront accounts). Microsoft operates the Microsoft Store, an app store on Windows PCs, and the Xbox Store (since late 2017 also rebranded as the Microsoft Store), an Xbox console user-facing storefront, which can be accessed via Xbox consoles or a web browser.

6 ZeniMax also owns and operates a digital storefront, Bethesda net, where it offers ZeniMax PC content for download. However, ZeniMax does not sell third-party games on its digital storefront. Similarly, ZeniMax provides game subscriptions for ZeniMax content, i.e., The Elder Scrolls Online (“ESO”) and Fallout 76, but not for third-party content. In this decision, reference to game distribution means distribution of first- and third-party content unless specified otherwise.

7 Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraph 26.

8 Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraph 20.

9 Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraph 22. The Commission has also considered in its decisions concerning antitrust cases AT.40413 - Focus Home, AT.40414 - Koch Media, AT.40420 – ZeniMax, AT.40422 – Bandai Namco and AT.40424 – Capcom (decisions of 20 January 2021, paragraphs 62-66 and 77-79; a public version of the decision is not yet available) […].

10 Commission decision of 12 February 2016 in case M.7866 – Activision Blizzard/King, Table 1. Casual, midcore and hardcore games describe different types of gamers considered in this case, with increasing differences in terms of difficulty, strategic thinking and time commitment. Casual games include simple game mechanics (i.e., puzzle games), engaging the player in shorter yet more frequent periods of time, with no special skills required. Midcore games are more engaging game concepts, requiring strategic thinking. Hardcore games are very engaging game concepts that retain players, usually requiring prior gaming experience.

11 Commission decision of 12 February 2016 in case M.7866 – Activision Blizzard/King, paragraph 16. Action, adventure, role-playing, sport, strategy, and resource management games describe possible segmentations according to different game genres considered in this case.

12 Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraph 24.

13 Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 23.

14 Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 23.

15 Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraphs 26-27 and Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 25.

16 Form CO, paragraph 189.

17 Form CO, paragraph 191.

18 Form CO, paragraphs 192-193.

19 Form CO, paragraph 194.

20 Form CO, paragraph 200.

21 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 9.

22 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 10.

23 According to the Notifying Party, games may be categorised by genre into strategy, simulation (such as sports, driving, construction, life, and social simulation), action (including fighting and shooter), adventure, role-playing, music and dance. However, genre-based categorisation is bound to be imprecise, due to the blurred nature of genre categories and the subjectivity involved (the Parties and industry experts do not always agree on genre categorisations). For completeness, the Parties do not consider that there are specific “children/kids” genres. See footnote 11.

24 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 11.

25 According to the Notifying Party, games may be categorised by type into AAA, casual, stand-alone and browser games, free-to-play and freemium games, as well as social network games. AAA games are developed by large development studios requiring significant budgets over extended periods. Casual games target a mass audience, are relatively simple, and less costly to develop. Stand-alone games are installed as separate applications on gaming device, and may be played without connecting to the internet. Browser games run directly in the web browser, using standard technologies for interactive multimedia. Free-to-play games are free for the player to acquire, and generally advertising-funded. Freemium games offer basic game-play that is free, but certain aspects of play may require purchases. Social network games use capabilities of social network services, are generally casual games and may be played individually or as multi-player.

26 Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 29 and Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraphs 31-32. In its decisions in the antitrust cases AT.40413 - Focus Home, AT.40414 - Koch Media, AT.40420 – ZeniMax, AT.40422 – Bandai Namco and AT.40424 – Capcom (decisions of 20 January 2021, paragraphs 7-76 and 77; published public version of the decision is not yet available) […].

27 Form CO, paragraph 199.

28 Form CO, paragraph 200.

29 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 14-14.1.

30 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 13.

31 Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraphs 39-40. The Commission has also considered the aspect of PC video game distribution in its decisions concerning antitrust cases AT.40413 - Focus Home, AT.40414 - Koch Media, AT.40420 – ZeniMax, AT.40422 – Bandai Namco, and AT.40424 – Capcom (decisions of 20 January 2021, paragraphs 67-71; a published public version of the decision is not yet available). […].

32 Form CO, paragraph 232.

33 Form CO, paragraph 234. Commission decision of 3 October 2007 in case M.3333 - Sony/BMG, recital 27, Commission decision of 21 September 2012 in case M.6458 - Universal Music Group/EMI Music, recital 128 and Commission decision of 14 May 2013 in case M.6884 - Access/PLG, paragraph 13.

34 Form CO, paragraph 243. Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 12.

35 Form CO, paragraph 258.

36 Form CO, paragraph 260.

37 Form CO, paragraph 261.

38 Form CO, paragraph 257

39 Form CO, paragraph 264.

40 Form CO, paragraph 266.

41 Form CO, paragraphs 273 and 284.

42 Form CO, paragraph 257.

43 Form CO, paragraph 287.

44 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 15.

45 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 16.

46 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 17.

47 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 18-18.1.

48 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 19-19.1.

49 Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 42.

50 Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraph 30. In its decisions concerning antitrust cases AT.40413 - Focus Home, AT.40414 - Koch Media, AT.40420 – ZeniMax, AT.40422 – Bandai Namco, and AT.40424 – Capcom (decisions of 20 January 2021, paragraphs 72-79; a public version of the decision is not yet available) […].

51 Commission decision of 6 September 2018 in case M.8788 - Apple/Shazam, paragraph 19.

52 Form CO, paragraph 285.

53 Form CO, paragraph 286.

54 Form CO, paragraph 287.

55 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 21.

56 With regard to the application of the Merger Regulation in the EEA, see Annex XIV to the EEA Agreement.

57 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Merger Guidelines"), OJ C 265, 18.10.2008.

58 Non-Horizontal Merger Guidelines, paragraphs 34-35.

59 Non-Horizontal Merger Guidelines, paragraph 58.

60 For ZeniMax’s distribution activities, see footnote 6 above.

61 Although we consider that there may be a wider video game publishing market regardless of whether these games are in digital or physical form (see paragraph (21) above), the present competitive assessment will focus on digital games given that physical games are irrelevant for the identified vertical relationship.

62 Form CO, paragraph 289 and for further detail Annex 10 of the Form CO. Microsoft sales data reports the gross revenue generated by Microsoft’s game publishing business and digital storefronts by country, platform and sales channel.

63 Form CO, Annex 12.

64 Partie’s reply to RFI of 8.2.2021, Table 6.

65 Form CO, paragraph 440.

66 Form CO, paragraph 440.

67 Form CO, Table 32.

68 For example, see also Commission decision of 12 February 2016 in case M.7866 - Activision Blizzard/King, paragraph 53 in which respondents point to “a very large number of publishers capable of developing and marketing games whose success will depend on the quality of their games”.

69 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 30.

70 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 29.

71 Form CO, paragraphs 484-485: for a game developer/publisher to distribute a game on any console, they must negotiate the distribution terms with the relevant console platform. The console platform pays a revenue share to the third-party developer/publishers.

72 Form CO, paragraph 486 and Memorandum of 3.2.2021.

73 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 32.

74 Form CO, paragraph 500, Figure 11 and Q1 – Questionnaire to market participants in the video gaming industry, replies to question 26.

75 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 38.

76 Form CO, paragraph 440.

77 Segmentnext.com, PS4 has officially won this console generation, 26.4.2019.

78 Form CO, paragraph 440.

79 Commission decision of 16 April 2008 in case M.5008 - Vivendi/Activision, paragraph 67.

80 Form CO, Annex 9, IDG Consulting, State of the games industry 2020 Annual White Paper, 13.4. 2020, slide 28.

81 Form CO, Annex 9, IDG Consulting, State of the games industry 2020 Annual White Paper, 13.4. 2020, slide 28.

82 Form CO, Annex 3, Microsoft Presentation to the Board of Microsoft, August 2020, slide 2.

83 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 28.

84 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 28.

85 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 24.

86 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 24.

87 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 38.

88 See Table 1 above.

89 Form CO, Table 13.

90 Form CO, paragraphs 445–455.

91 Form CO, paragraph 452.

92 Form CO, paragraph 381.

93 Form CO, paragraphs 446 – 447. Key Sony exclusives include blockbuster titles such as “God of War, “Spider Man”, “The Last of Us” and “Uncharted”. Key Nintendo exclusives on the other hand include several major game franchises, such as the “Super Mario”, “Zelda” and “Pokèmon” franchises.

94 Form CO, Tables 18 and 20. In 2019, Microsoft’s market share by revenues in the sale of console hardware was [10-20]% and [10-20]% globally and in the EU respectively. In the same year, global market shares of Nintendo and Sony were [30-40]% and [50-60]% respectively, while their EU market shares were [30-40]% and [50-60]% respectively.

95 [Xbox’s performance].

96 Form CO, paragraph 449.

97 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 33.

98 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 22.

99 Form CO, Figure 8.

100 Form CO, Figure 8. PlayStation exclusives “God of War” and “Spider Man” ranked as the 6th and 3rd highest selling games in 2018 respectively. See also paragraph (97) and footnote 93 and above.

101 Form CO, paragraph 440 and Parties’ reply to the RFI 2 of 14.1.2021, question 8. See also PS4 has officially won this console generation, 26.4.2019 (link available here); techradar.com: Nintendo’s Switch success shows that gaming is about more than graphics, 5.3.2018 (link available here); and mynintendonews.com: “15 Nintendo Switch exclusives in the Top 40 this weeks” 11.1.2021 (link available here).

102 See footnote 94 above.

103 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 36.

104 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 27.

105 Form CO, paragraphs 456–466.

106 In Annex 14 to the Form CO, the Parties provided two estimates, one based on previous sales and one based on data provided by IDG Consulting. According to such estimates, Microsoft’s loss from not distributing ZeniMax games for rival consoles would range from [forecast million] over the period 2021 – 2028, corresponding to a percentage of ZeniMax sales on PlayStation and Nintendo Switch [forecast percentage].

107 Form CO, paragraph 463 and Annex 14. The Parties have calculated such switching rate by comparing the projected losses from lost sales of ZeniMax games for Sony and Nintendo’s consoles with the projected gains from new players buying an Xbox to keep playing ZeniMax games.

108 Weeds, Helen: “TV wars: Exclusive content and platform competition in pay TV”, The Economic Journal 126.594 (2016).

109 Form CO, paragraph 463.

110 Form CO, paragraph 464 and Parties’ reply to the RFI 2 of 14.1.2021, question 9.

111 Data provided by Microsoft shows that in the US in 2019, [30-40]% of PlayStation 4 owners and [40- 50]% of Nintendo Switch owners also owned an Xbox One.

112 Parties’ reply to the RFI 2 of 14.1.2021, question 9. In Annex 14 to the Form CO of 29.1.2021, the Parties have provided data showing that the average Consumer Lifetime Value (i.e., the average gross margin that each additional Xbox user is worth to Microsoft over a console’s life cycle) amounts to [USD 50-100]. The value of an additional consumer is the highest when the latter purchases an Xbox console [details about consumer value]. Consequently, the value of an additional Xbox consumer [details about consumer value].

113 Form CO, paragraph 464 and Parties’ reply to the RFI 2 of 14.1.2021, question 9.

114 Form CO, paragraph 465.

115 See paragraph (108) above. The Parties provided the relevant calculations in Annex 14 to the Form CO.

116 Form CO, Figure 4. The life cycle of the last console generation lasted 8 years, whereas older console generations had a longer duration, exceeding ten years. As regards the current generation, Microsoft and Sony expect to discontinue the sale of the respective consoles during the course of 2028, as indicated in Annex 14 to the Form CO, footnote 15.

116 Form CO, Annex 3.

117 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 25.

118 Form CO, paragraph 500, data from NPD Group Presentation, Annual Video Game Presentation, 3 March 2020.

119 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 26.

120 Form CO, paragraph 464 and Parties’ reply to the RFI 2 of 14.1.2021, question 9.

121 See paragraphs (104) and (105) above.

122 Form CO, paragraph 499, Figure 11. The Best SEO Companies’ survey Generational Brand Loyalty, 13.11.2019, shows that approximately 40% of players are loyal users of Sony’s consoles, while approximately 31% of players are loyal to Microsoft’s consoles and 30% to Nintendo’s consoles.

123 gamespot.com, PlayStation 4 command over exclusives leads to promising start for PlayStation 5, 10.12.2020 (link available here). See also paragraph (80) above.

124 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 34.

125 Form CO, paragraphs 7 – 17.

126 Form CO, paragraphs 7–17 and 446.

127 Parties’ reply to the RFI 1 of 6.11.2020, question 1.

128 Form CO, Annex 3.

129 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 37.

130 Q1 – Questionnaire to market participants in the video gaming industry, replies to question 35.