Commission, April 12, 2021, No M.10163

EUROPEAN COMMISSION

Decision

United Internet/Morgan Stanley/Tele Columbus

(1) On 3 March 2021, the European Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043, by which United Internet AG (“United Internet”, Germany) and Morgan Stanley (USA) will indirectly acquire within the meaning of Article 3(1)(b) joint control of Tele Columbus AG (“Tele Columbus”, Germany). This operation is hereafter referred to as the “Transaction”. United Internet and Morgan Stanley are referred to as the “Notifying Parties”. United Internet, Morgan Stanley and Tele Columbus are collectively referred to as the “Parties”

1. THE PARTIES

(2) United Internet is a provider of telecommunications and Internet services for consumers, small and home offices as well as small-to-medium-sized companies, active mostly in Germany.

(3) Morgan Stanley is a global financial services firm providing a wide range of investment banking, securities, wealth management and investment management services. […].

(4) Tele Columbus is an independent broadband cable network operator active in the fields of multimedia and telecommunications with broadband cable network infrastructures mainly located in Germany.

2. THE OPERATION AND CONCENTRATION

(5) On 21 December 2020, United Internet, through its subsidiary United Internet Investments Holding AG & Co. KG, and Morgan Stanley, through its subsidiary Canterbury Holding B.V. (“Canterbury Holding”)4, entered into a Shareholders’ Agreement and a Transaction Agreement pertaining to the acquisition of joint control of Tele Columbus via a public takeover offer (“the Offer”). The Offer was made by Kublai GmbH (“Kublai”), an indirect subsidiary of Morgan Stanley, commenced on 1 February 2021 and is subject to a minimum acceptance rate of 50% plus one share of all outstanding Tele Columbus shares.

(6) Pre-Transaction, United Internet holds a non-controlling share of approximately 29.9% of Tele Columbus’ share capital. Following the Transaction, United Internet will sell its shares in Tele Columbus to Hilbert Management GmbH (“Hilbert Management”), an indirect subsidiary of Morgan Stanley, and, simultaneously, will acquire shares in Kublai from Hilbert Management, with an economic value corresponding to its previous shareholding in Tele Columbus. The shareholding of United Internet in Kublai is dependent on the precise outcome of the Offer. However, based on the Shareholders Agreement, it will not exceed 50% minus one share in Kublai.

(7) On 1 March 2021, United Internet exercised its right under the Transaction Agreement to declare its intended level of (indirect) shareholding in Kublai within the range of […]% and […]%, regardless of the result of the Offer and thereby confirmed it shall be […]%.

(8) Accordingly, United Internet will (indirectly) hold no less than […]%, but in any event less than 50%, of the shares in Tele Columbus.

(9) Despite the unequal shareholding, Morgan Stanley and United Internet will acquire indirect joint control of Tele Columbus, for the following reasons.

(10) According to paragraph 65 of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings, joint control may exist even where there is no equality between the two parent companies in votes or in representation in decision-making bodies or where there are more than two parent companies. This is the case where minority shareholders have additional rights which allow them to veto decisions which are essential for the strategic commercial behaviour of the joint venture.

(11) The evidence as regards the decision-making bodies is inconclusive and does not allow to find joint control. At the level of Kublai, an Advisory Board will be set up as a forum for shareholders to discuss all matters regarding Kublai and Tele Columbus and to coordinate the exercise of voting and shareholders’ rights of Kublai in the General Meeting of Tele Columbus.5 In particular, the Advisory Board shall be responsible for material decisions regarding […], except for certain reserved matters and decisions regarding the business plan of Tele Columbus. Morgan Stanley and United Internet will be entitled to appoint […]. Moreover, Morgan Stanley will be entitled […], while United Internet […]. However, […].

(12) In addition, Kublai shall be managed by -[…].6 The managing directors […]. However […].7

(13) At the level of Tele Columbus, Kublai shall cast its votes in the General Meeting in accordance with the instructions set forth in the duly resolved resolution by Kublai’s Advisory Board.8 In addition, both Morgan Stanley and United Internet will be entitled […].9 Moreover, Morgan Stanley will be entitled[…], while United Internet will have the right […].10 However, the parties agreed that in the event that the […].11 Finally, as regards […], Morgan Stanley and United Internet intend to follow a joint approach, with United Internet having the right to ultimately […].12

(14) However, both Morgan Stanley and United Internet will enjoy veto rights regarding Tele Columbus’ business plan and other strategic decisions pertaining to Tele Columbus, including investments over EUR […] million and company transactions (such as indebtedness) over EUR […] million.

(15) With regard to the business plan, the Notifying Parties have agreed that they will update the business plan (including the budget) […].13 The Notifying Parties have agreed that, […].14 Finally, the Notifying Parties have agreed that […].15

(16) The Notifying Parties have agreed […]. The agreed upon business plan includes […].

(17) In addition to their veto rights with respect to the business plan, irrespective of their exact shareholdings in Tele Columbus, the Notifying Parties will have veto rights regarding any major investments that are not extraordinarily high and constitute an essential feature of the industry.16

(18) On balance, the Commission considers that, due to the veto rights both United Internet and Morgan Stanley will enjoy with respect to the detailed business plan of Tele Columbus as well as the veto rights regarding major investments including those not extraordinarly high, the Notifying Parties will acquire joint control of Tele Columbus.

(19) Therefore, as a result of the Transaction, United Internet and Morgan Stanley will jointly control Tele Columbus within the meaning of Article 3(1)(b) of the Merger Regulation

3. EU DIMENSION

(20) The undertakings concerned have a combined aggregate worldwide turnover of more than EUR 5 000 million (EUR […] million). Each of United Internet, Morgan Stanley and Tele Columbus have an EU-wide turnover of more than EUR 250 million (United Internet: EUR […] million, Morgan Stanley: EUR […] million and Tele Columbus: EUR […] million).

(21) While United Internet and Tele Columbus achieve more than two thirds of their respective EU-wide turnover in Germany, Morgan Stanley does not.

(22) Therefore, the Transaction has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

4. RELEVANT MARKETS

4.1. Introduction

(23) United Internet and Tele Columbus are active in a number of telecommunications and TV markets in Germany, while Morgan Stanley is not active in any relevant market in Germany. While the activities of United Internet and Tele Columbus overlap in a number of markets17, they do not lead to any horizontally affected market. The only vertical relationships between the activities of United Internet and Tele Columbus that lead to affected markets are those between the upstream market for wholesale call termination on fixed networks and the downstream markets for retail fixed and mobile telecommunications services, respectively.

(24) Additionally, Tele Columbus is currently upgrading its hybrid fibre coaxial (“HFC”) network by replacing the coaxial parts with fibre (both fibre-to-the-building (“FTTB”) and fibre-to-the-home (“FTTH”)). The network enables fast internet connections of up to several hundred megabits per second under DOCSIS 3.0 or DOCSIS 3.1 internet transmission standard. In this context, it will start offering wholesale broadband access post-Transaction. This will result in a potential vertical relationship with the downstream market for the retail supply of internet access services, in which United Internet is active. However, given Tele Columbus’ limited footprint in Germany18 and United Internet’s and Tele Columbus’ modest combined market share on the downstream market19, this potential vertical relationship would not lead to any affected markets in the foreseeable future. 20

4.2. Wholesale call termination on fixed networks

(25) Call termination is the service provided by a network operator on the supply side to other network operators on the demand side, whereby a call originating in a demand side operator’s network is delivered to a user in the supply side operator’s network. This service is required by every originating operator, as it is necessary for its customers to be able to communicate with the customers of other networks. Call termination is therefore a wholesale service that is resold or used as an input for the provision of downstream retail fixed and mobile telephony services.

4.2.1. Product market definition

(26) In previous decisions, the Commission has identified relevant markets for the provision of wholesale call termination on fixed and mobile networks. The Commission further considered that there is no substitute for call termination on individual networks as the operator transmitting the call can reach the intended recipient only through the operator of the network to which that recipient is connected. Therefore, each individual network, either fixed or mobile, constitutes a separate market.21

(27) The Notifying Parties do not object to the Commission’s decisional practice according to which the relevant product market is the market for wholesale call termination services on fixed networks.

(28) For the purpose of the present decision, the Commission considers that, as regards wholesale call termination services on fixed networks, termination on each individual fixed network constitutes a separate product market.

4.2.2. Geographic market definition

(29) In previous decisions, the Commission has found that the market for wholesale call termination services on fixed networks is national in scope, considering that the geographic scope of each wholesale market for call termination should correspond to the dimensions of the operator’s network, which is limited to national borders due to regulatory barriers.22

(30) The Notifying Parties do not object to the Commission’s decisions according to which the market for wholesale call termination services on fixed networks is national.

(31) The Commission observes that nothing in the present case indicates that the market should be defined differently in the present case – in particular, considering that the geographic scope of each wholesale market for fixed call termination corresponds to the dimension of each operator’s network which, due to regulatory barriers, is limited to the national territory within which it operates. Consequently, for the purpose of the present decision, and in line with its previous decisional practice the Commission considers that the market for wholesale fixed call termination services is national in scope.

4.3. Retail supply of fixed telecommunications services

(32) Fixed telephony services comprise the provision of connection services at a fixed location or access to the public telephone network, for the purpose of making and/or receiving calls and related services.

4.3.1. Product market definition

(33) In previous decisions, the Commission considered whether a distinction should be made between (i) regional/national and international calls as well as between

(ii) residential and non-residential customers, but ultimately left the exact product market definition open.23 The Commission however considered that managed Voice over Internet Protocol (“VoIP”) services and fixed voice services provided through fixed lines are interchangeable and therefore belong to the same market.24 The Notifying Parties consider this product market definition as plausible.

(34) For the purpose of the present decision, the Commission considers that the exact product market definition in relation to the provision of retail supply of fixed telecommunications services (whether an overall market for fixed telecommunication services would be considered or whether the market would be segmented between regional/national and international calls or between residential and non-residential customers) can be left open as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any such product market definition.

4.3.2. Geographic market definition

(35) As regards the geographic scope of the retail supply of fixed telecommunications services, in previous decisions, the Commission has considered that the geographic scope is national.25 This reflects the continuing importance of the role of national regulation in the telecommunications sector, the supply of upstream wholesale services on a national basis, as well as the fact that the pricing policies of telecommunications providers are predominantly national.26

(36) The Notifying Parties considers the market to be national in scope, based on the Commission's precedents.

(37) The Commission observes that nothing in the present case indicates that the market should be defined differently in the present case– in particular taking into account the importance of national regulation in the telecommunications sector and the fact that the upstream wholesale services are provided on a national basis. Consequently, for the purpose of the present decision and in line with its previous decisional practice, the Commission considers that the market for the supply of fixed telecommunications services is national in scope.

4.4. Retail supply of mobile telecommunications services

(38) Mobile telecommunications services to end customers include services for national and international voice calls, SMS (including MMS and other messages), mobile internet with data services, access to content via the mobile network and retail international roaming services.

4.4.1. Product market definition

(39) In previous decisions, the Commission has not further segmented the overall retail mobile market based on the type of service (voice calls, SMS, MMS, mobile Internet data services), or the type of network technology. The Commission has considered possible segments of the overall retail market for mobile telecommunication services by distinguishing between pre-paid and post-paid services and between private customers and business customers, concluding that these did not constitute separate product markets but were rather market segments within an overall retail market.27

(40) The Notifying Parties do not object to the Commission’s previous decisional practice, i.e., as the overall retail market for the mobile telecommunication services without further segmentation.

(41) For the purpose of the present decision, the Commission considers that the exact product market definition in relation to the provision of retail mobile telecommunications services (whether there is an overall market for retail mobile communication services or whether this market should be segmented between pre-paid and post-paid or between private and business customers) can be left open as the Transaction does not give rise to serious doubts as to its compatibility with the internal market or the functioning of the EEA Agreement under any such product market definition.

4.4.2. Geographic market definition

(42) In previous decisions, the Commission has consistently found the market for retail mobile communication services to be national in scope.28

(43) The Notifying Parties do not object that the market should be considered national in scope in line with previous Commission decisions.

(44) The Commission observes that nothing in the present case indicates that the market should be defined differently in the present case – in particular considering that licences to mobile operators are granted on a national basis. Consequently, for the purpose of the present decision and in line with its previous decisional practice, the Commission considers the market for retail mobile telecommunications services to be national in scope.

5. COMPETITIVE ASSESSMENT

5.1. Analytical framework

(45) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(46) In this respect, a merger may entail horizontal and/or non-horizontal effects. Horizontal effects are those deriving from a concentration where the undertakings concerned are actual or potential competitors of each other in one or more of the relevant markets concerned. Non-horizontal effects are those deriving from a concentration where the undertakings concerned are active on different relevant markets.

(47) With regard to non-horizontal mergers, two broad types can be distinguished: vertical and conglomerate mergers. Vertical mergers involve companies operating at different supply chain levels.

(48) The Commission appraises horizontal effects in accordance with the guidance set out in the Horizontal Merger Guidelines29 while non-horizontal effects are appraised in accordance with the guidance set out in the Non-Horizontal Merger Guidelines.30

(49) A merger between companies which operate at different levels of the supply chain may significantly impede effective competition if such merger gives rise to foreclosure.31 Foreclosure occurs where actual or potential competitors' access to supplies or markets is hampered or eliminated as a result of the merger, thereby reducing those companies’ ability and/or incentive to compete.32 Such foreclosure may discourage entry or expansion of competitors or encourage their exit.33

(50) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure. Input foreclosure occurs where the merger is likely to raise the costs of downstream competitors by restricting their access to an important input. Customer foreclosure occurs where the merger is likely to foreclose upstream competitors by restricting their access to a sufficient customer base.34

(51) Pursuant to the Non-Horizontal Merger Guidelines, input foreclosure arises where, post-merger, the new entity would be likely to restrict access to the products or services that it would have otherwise supplied absent the merger, thereby raising its downstream rivals’ costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger.35

(52) For input foreclosure to be a concern, the merged entity should have a significant degree of market power in the upstream market. Only when the merged entity has such a significant degree of market power, can it be expected that it will significantly influence the conditions of competition in the upstream market and thus, possibly, the prices and supply conditions in the downstream market.36

(53) In assessing the likelihood of an anticompetitive input foreclosure scenario, the Commission examines, first, whether the merged entity would have, post-merger, the ability to substantially foreclose access to inputs, second, whether it would have the incentive to do so, and third, whether a foreclosure strategy would have a significant detrimental effect on competition downstream.37 The three criteria are cumulative.38

(54) Pursuant to the Non-Horizontal Merger Guidelines, customer foreclosure may occur when a supplier integrates with an important customer in the downstream market and because of this downstream presence, the merged entity may foreclose access to a sufficient customer base to its actual or potential rivals in the upstream market (the input market) and reduce their ability or incentive to compete, which in turn, may raise downstream rivals’ costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger. This may allow the merged entity profitably to establish higher prices on the downstream market.39

(55) For customer foreclosure to be a concern, a vertical merger must involve a company which is an important customer with a significant degree of market power in the downstream market. If, on the contrary, there is a sufficiently large customer base, at present or in the future, that is likely to turn to independent suppliers, the Commission is unlikely to raise competition concerns on that ground.40

(56) In assessing the likelihood of an anticompetitive customer foreclosure scenario, the Commission examines, first, whether the merged entity would have the ability to foreclose access to downstream markets by reducing its purchases from its upstream rivals, second, whether it would have the incentive to reduce its purchases upstream, and third, whether a foreclosure strategy would have a significant detrimental effect on consumers in the downstream market.41

5.2. Identification of affected markets

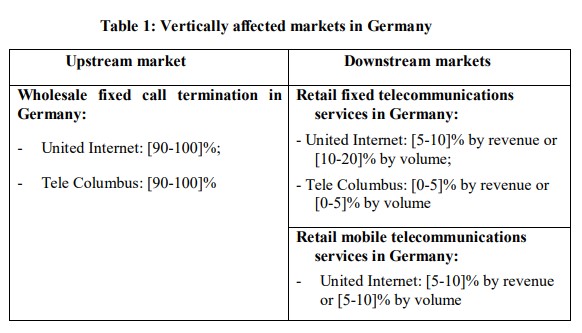

(57) The Transaction gives rise to the following vertically affected markets:

a. the upstream market for wholesale call termination services on fixed networks in connection to the downstream market for retail supply of fixed telecommunications services, and

b. the upstream market for wholesale call termination services on fixed networks and the downstream market for retail supply of mobile telecommunications services.

(58) Call termination services are wholesale services provided by network operators that allows users of different networks to communicate with each other. The market for wholesale termination of calls on fixed networks is therefore vertically related to the retail markets for fixed and mobile telephony services with the following respective market shares.

(59) As regards the upstream market for wholesale call termination services on fixed networks, by definition, each network operator holds a market share of 100% on the calls terminating on their own respective networks.42

(60) The German downstream retail market for fixed telephony services is characterised by the presence of the incumbents Deutsche Telekom and Vodafone with respectively [40-50]% and [20-30]% of the market based on subscriptions as of end 2019. Tele Columbus and United Internet’s activities on that market are limited at a combined share of [10-20]% with a market share increment brought about by the Transaction of [0-5]%.43 Moreover, the combined market shares of United Internet and Tele Columbus remain below 20% even under the narrowest plausible market segmentation of the retail market for fixed telephony services (as discussed above under paragraph (34)).

(61) The German downstream retail market for mobile telephony services is characterised by the presence of the market leaders Deutsche Telekom, Vodafone and Telefonica with respectively [30-40]%, [20-30]% and [10-20]% of the market based on revenues as of end 2019. United Internet had a market share of [5-10]% based on revenues in 2019, while Tele Columbus exited the market in January 2020.44

(62) The Commission considers that the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the vertical links between the upstream market for wholesale fixed call termination services and the downstream markets for retail supply of fixed telephony services and retail supply of mobile telecommunication services, for the following reasons.

5.3. Input foreclosure

5.3.1. Notifying Parties’ arguments

(63) The Notifying Parties consider that the Transaction is unlikely to raise any vertical input foreclosure effects with regard to wholesale call termination on fixed networks and the downstream retail supply of fixed and mobile telecommunication services.

(64) The Notifying Parties argue that it cannot materialize to the extent that the provision of wholesale call termination services on fixed networks in Germany is subject to ex- ante regulation by the German telecommunications regulator (Bundesnetzagentur or “BNetzA”) and that, thereby, the regulator warrants that access to call termination is granted on reasonable and non-discriminatory conditions.45 Therefore, the Notifying Parties argue that United Internet and Tele Columbus will not have any ability to restrict or limit access to call termination on fixed networks.

(65) Irrespective of the regulatory obligations, the Notifying Parties further argue that United Internet and Tele Columbus would not have any incentive to foreclose access to their fixed networks with respect to call termination vis-à-vis downstream competitors (e.g., Deutsche Telekom or Vodafone) as it would deprive their own retail customers of the ability to be called by customers from other (significantly larger) networks and, rather, give them the opportunity to switch to other suppliers. Such a practice would harm United Internet and Tele Columbus’ own market positions by significantly degrading the attractiveness of their telecommunication services.

5.3.2. Commission’s assessment

5.3.2.1. Ability to engage in input foreclosure

(66) The Commission considers that the Parties will not have the ability to engage in input foreclosure by restricting access to their respective upstream call termination networks to the downstream rivals and thereby discriminate against them or otherwise degrade terms and conditions for the provision of wholesale fixed call termination services in Germany.

(67) The Commission notes that there are regulatory obligations applying to the wholesale fixed call termination markets in Germany based on decisions of the BNetzA. Those regulatory obligations include access to specific network facilities, transparency (including publication of draft interconnection agreements on the network operator’s website), non-discrimination and price control. Furthermore, as established by Article 75 of the European Electronic Communications Code, on 21 December 2020 the Commission adopted a delegated act setting the Eurorates (a single Union-wide mobile and a single Union-wide fixed termination rate). That means that as soon as the rates set out by the Delegated Regulation will be applicable to the termination services included in its scope (which is expected by mid-2021 depending on when the regulation enters into force), the termination rates currently imposed by the German regulator will no longer apply.

5.3.2.2. Incentive to engage in input foreclosure

(68) The Commission notes that the three conditions for the vertical input foreclosure scenario being cumulative, the absence of the ability to foreclose would be sufficient to rule out any such strategy. The Commission nevertheless assesses for completentess the existence of an incentive to foreclose.

(69) Pursuant to the Horizontal Merger Guidelines46 as well as by its previous decision practice47, the Commission notes that joint control prevents foreclosure strategies that do not benefit all jointly controlling shareholders. While United Internet may have an incentive to engage in input foreclosure practices vis-à-vis downstream retail fixed or mobile competitors48 by not giving them wholesale access to the Parties’ respective fixed telephony networks, the Commission considers that Morgan Stanley’s own incentive to maximize their financial return will prevent United Internet from giving itself any potential benefit in the downstream markets given that it has no shareholding in United Internet.49

(70) In addition, in view of the limited relative importance the Parties at wholesale fixed call termination services level in Germany when compared to the major network providers (i.e., Deutsche Telekom and Vodafone), the Commission considers that the Parties will not have an incentive to discriminate against or otherwise degrade the terms and conditions for the provision of such services to their retail fixed or mobile competitors to the extent that those are, in large part, the same as the upstream network providers and the Parties would stand losing much more if any of those competitors were to retaliate and cut off the Parties from their respective upstream networks as, in such situations, the Parties would no longer be able to connect their own retail customers to the (much) wider networks of their competitors and thereby significantly limit the commercial and operational attractiveness of their own retail fixed telephony and mobile telecommunication services.

(71) For the reasons set out above, the Commission concludes that the Parties would not have the incentive to foreclosure rival operators by engaging in input foreclosure practices.

5.3.2.3. Impact on effective competition

(72) The Commission considers that due to the lack of ability and incentive, it is not necessary to conclude whether any input foreclosure strategy would have a negative impact on effective competition, the three criteria being cumulative.

(73) Finally, the Commission notes that the majority of the respondents to the market investigation did not raise any concerns related to input foreclosure issues arising from the Transaction in the market for wholesale fixed call termination services on the one hand, and the retail supply of fixed telephony services or the retail mobile telecommunication services on the other hand.50

5.3.2.4. Conclusion

(74) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to the compatibility with the internal market with respect to possible input foreclosure practices on the markets for the retail supply of fixed telephony services on the one hand and mobile telecommunication services on the other hand in Germany.

5.4. Customer foreclosure

5.4.1. Notifying Parties’ arguments

(75) The Notifying Parties submit that, given the market shares of United Internet and Tele Columbus even under the narrowerst plausible downstream markets definitions discussed above under paragraphs (34) and (41) are well below 30%, any customer foreclosure tactics would not have any effect on competition.

5.4.2. Commission’s assessment

5.4.2.1. Ability to engage in customer foreclosure

(76) The Commission considers that the Parties will not have the ability to implement customer foreclosure tactics at the expense of their competitors on the upstream market for fixed call termination services.

(77) Indeed, in view of the limited market share of United Internet and Tele Columbus on the retail market for fixed telephony and the limited market share of United Internet on the retail market for mobile telecommunications services51, the Commission considers that the Parties will not have the ability to implement customer foreclosure tactics that would result in raising the costs of their rivals on the downstream markets as the upstream network providers will always remain with a large enough customer base outside the Parties to sell their services to.

5.4.2.2. Incentive to engage in customer foreclosure

(78) The Commission notes that the three conditions for the vertical customer foreclosure scenario being cumulative, the absence of the ability to foreclose would be sufficient to rule out any such strategy. The Commission nevertheless assesses for completentess the existence of an incentive to foreclose.

(79) The Commission considers that the Parties do not have the incentive to engage in customer foreclosure as any such attempt would be counter-productive and harmful (hence unprofitable) to the Parties should the competitors they would be trying to harm decide to retaliate in the same way. Indeed, such retaliation would be likely more harmful for the Parties than any potential profit from their own foreclosing strategy given the the much larger size of the networks of their respective competitors.

(80) The need of the Parties to rely on their competitors’ networks to connect their own retail customers to whatever number these customers may be calling outside the Parties’ own networks results in the lack of incentive for the Parties to consider any customer foreclosure tactic.

5.4.2.3. Impact on effective competition

(81) The Commission considers that due to the lack of ability and incentive, it is not needed to assess whether any foreclosure strategy would have a negative impact on effective competition, the three criteria being cumulative.

(82) The Commission further notes that the majority of the respondents to the market investigation did not raise any concerns related to customer foreclosure issues arising from the Transaction in the market for wholesale fixed call termination services on the one hand, and the retail supply of fixed telephony services or the retail mobile telecommunication services on the other hand.52

5.4.2.4. Conclusion

(83) In light of the above, the Commission concludes that the Transaction does not raise serious doubts as to the compatibility with the internal market with respect to possible customer foreclosure practices on the markets for the retail supply of fixed telephony services on the one hand and mobile telecommunication services on the other hand in Germany.

6. CONCLUSION

(84) For the above reasons, the European Commission has decided not to oppose the notified operation and to declare it compatible with the internal market and with the EEA Agreement. This decision is adopted in application of Article 6(1)(b) of the Merger Regulation and Article 57 of the EEA Agreement. For the Commission (Signed) Margrethe VESTAGER Executive Vice-President

NOTES

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’).

4 On 15 January 2021, Hilbert Management GmbH, a wholly-owned subsidiary of Canterbury Holding, replaced the latter for the purposes of the Transaction Agreement.

5 Section 6.7 of the Shareholders’ Agreement.

6 Section 6.2 of the Shareholders’ Agreement.

7 Section 6.6 of the Shareholders’ Agreement.

8 Section 7.3 of the Shareholders’ Agreement.

9 Section 7.3 of the Shareholders’ Agreement.

10 Section 7.6 of the Shareholders’ Agreement.

11 Section 7.7 of the Shareholders’ Agreement.

12 Sections 7.11 and 6.1 of the Shareholders’ Agreement.

13 Section 3.2 of the Shareholders’ Agreement.

14 Section 3.5 of the Shareholders’ Agreement.

15 Sections 6.25(k) and 6.30(f)(xi) of the Shareholders’ Agreement.

16 Sections 6.25 (g) and (i) and 6.30(f)(vii) and (ix) of the Shareholders’ Agreement.

For instance, given the total amount of investment with regard to the Fiber Champion Strategy, which involves investments of up to EUR 2.0 billion within the next 10 years, any material indebtedness with a maximum threshold of EUR […] million is considered as extraordinarily high. In view of future investments under the Fibre Champion Strategy, the Parties expect this threshold to be exceeded regularly. Furthermore, telecommunication networks are key infrastructure where the investment policy of a company plays a significant role. Especially in view of the necessity to upgrade existing networks and roll-out new fibre networks, significant investments are an essential industry feature and of utmost importance for each market participant to be an effective competitor, […]. The investment decisions, which require the consent of all shareholders and shall not be carried out without such consent, go beyond the mere protection of the financial interests of the minority shareholder and equally contribute to both Morgan Stanley and United Internet having the ability to influence the overall strategic business policy of Tele Columbus.

17 The markets for retail supply of fixed telephony services, retail supply of fixed internet access services, retail business connectivity services; retail supply of TV services, retail supply of TV signal transmission to single-dwelling units, the potential market for retail supply of multiple play services, wholesale termination and hosting of calls to non-geographic numbers; wholesale leased lines, wholesale acquisition of TV channels and colocation services.

18 In particular, Tele Columbus United expects to achieve a market share of below [0-5]% on the upstream market for wholesale broadband access, and a market share of well below 30% on the potential segment for wholesale broadband access based on layer 3-bitstream.

19 On the downstream market for the retail supply of fixed internet access services, United Internet’s market share in 2019 was of [10-20]% by revenues and [10-20]% by volume, while Tele Columbus had a market share of [0-5]% by revenues and [0-5]% by volume. Therefore, under all plausible segmentations, United Internet’s and Tele Columbus‘ individual and combined market share on the downstream market remains well below 30%.

20 The Commission considers that in any event, the Transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to the vertical link between the upstream market for wholesale broadband access and the downstream market(s) for the supply of internet access services, for the following reasons. With regard to input foreclosure, the Commission considers that Tele Columbus would not have the ability to foreclose United Internet’s downstream competitors, due to its limited footprint and the resulting low market share of below [0-5]%. In addition, the Parties would have no incentive to engage in input foreclosure, in particular due to the diverging interests of the two parents United Internet and Morgan Stanley. Moreover, the Notifying Parties have publicly confirmed that the business rationale of their investment in Tele Columbus is to benefit from the roll-out of Tele Columbus fiber network in Germany and, in particular, the fact that it will be based on an “open access” strategy with the view to maximise the number of users connected to that network (see the Public Takeover Announcement by Kublai GmbH, p. 34)). Finally, any input foreclosure strategy would have no likely impact on competition in the downstream market, due to Tele Columbus’ limited footprint and the fact that downstream competitors can rely on their respective nation-wide networks.

With regard to customer foreclosure, the Commission considers that the Parties will not have the ability to foreclose upstream providers of wholesale broadband access, given United Internet’s low market share of below 20% in the market for internet access services. Additionally, United Internet has no incentive to solely rely on wholesale broadband access from Tele Columbus, given Tele Columbus’ limited footprint and United Internet’s necessity to supply customers nation-wide. Therefore, the Commission considers that any customer foreclosure strategy would have no impact on competition in the market for wholesale broadband access.

21 Commission decision of 27 November 2018 in case M.8792 – T-Mobile NL/Tele2 NL, paragraph 259; Commission decision of 15 July 2019 in case M.9370 – Telenor/DNA; Commission decision of 27 July 2018 in case M.8883 – PPF/Telenor Target Companies; Commission decision of 12 December 2012 in case M.6497 – Hutchison 3G Austria/Orange Austria, paragraph 68.

22 Commission decision of 27 November 2018 in case M.8792 – T-Mobile NL/Tele2 NL, paragraph 263; Commission decision of 15 July 2019 in case M.9370 – Telenor/DNA, paragraph 81; Commission decision of 27 July 2018 in case M.8883 – PPF/Telenor Target Companies, paragraph 35; Commission decision of 3 August 2016 in case M.7978 – Vodafone/Liberty Global/Dutch JV, paragraph 210

23 Commission decision of 07 September 2005 in case M.3914 – Tele2/Versatel, paragraph 10; Commission decision of 29 June 2010 in case M.5532 – Carphone Warehouse/Tiscali UK, paragraphs 35 and 39; Commission decision of 9 January 2010 in case M.5730 – Telefónica/Hansenet Telekommunikation, paragraphs. 16 and 17.

24 Commission decision of 03 August 2016 in case M.7978 – Vodafone/Liberty Global/Dutch JV, paragraph 40; Commission decision of 04 February 2016 in case M.7637 – Liberty Global/BASE Belgium, paragraph 64.

25 Commission decision of 27 November 2018 in case M.8792 – T-Mobile NL/Tele2 NL, paragraph 271; Commission decision of 15 July 2019 in case M.9370 – Telenor/DNA; Commission decision of 27 July 2018 in case M.8883 – PPF/Telenor Target Companies; Commission decision of 3 August 2016 in case M.7978 – Vodafone/Liberty Global/Dutch JV, paragraph 40; Commission decision of 4 February 2016 in case M.7637 – Liberty Global/BASE Belgium, paragraph 64.

26 Commission decision of 27 November 2018 in case M.8792 – T-Mobile NL/Tele2 NL, paragraph 274; Commission decision of 15 July 2019 in case M.9370 – Telenor/DNA; Commission decision of 27 July 2018 in case M.8883 – PPF/Telenor Target Companies, paragraph 22; Commission decision of 3 August 2016 in case M.7978, Vodafone/Liberty Global/Dutch JV, paragraph 40; Commission decision of 4 February 2016 in case M.7637 – Liberty Global/BASE Belgium, paragraph 73.

27 Commission decision of 15 July 2019 in case M.9370 – Telenor/DNA, paragraphs 40-42; Commission decision of 27 July 2018 in case M.8883 – PPF/Telenor Target Companies, paragraphs 12-13; Commission decision of 27 November 2018 in case M.8792 – T-Mobile NL/Tele2 NL, paragraphs 157-160; Commission decision of 4 April 2007 in Case M.4591 – Weather Investments/Hellas Telecommunications, paragraph 10.

28 Commission decision of 18 July 2019 in case M.8864 – Vodafone/Certain Liberty Global Assets, paragraph 67; Commission decision of 15 July 2019 in case M.9370 – Telenor/DNA, paragraphs 44-46; Commission decision of 27 July 2018 in case M.8883 – PPF/Telenor Target Companies, paragraphs 15-16; Commission decision of 27 November 2018 in case M.8792 – T-Mobile NL/Tele2 NL.

29 Guidelines on the assessment of horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Horizontal Merger Guidelines"), OJ C 31, 05.02.2004.

30 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Merger Guidelines"), OJ C 265, 18.10.2008.

31 Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings ("Non-Horizontal Merger Guidelines"), OJ C 265, 18.10.2008, p. 11, paragraphs. 17-18.

32 Non-Horizontal Guidelines, paragraph 18.

33 Non-Horizontal Guidelines, paragraph 29.

34 Non-Horizontal Guidelines, paragraph 30.

35 Non-Horizontal Guidelines, paragraph 31.

36 Non-Horizontal Guidelines, paragraph 35.

37 Non-Horizontal Guidelines, paragraph 32.

38 Judgements of the General Court of 23 May 2019, Case KPN v Commission, T‑370/17, ECLI:EU:T:2019:354, paragraph 119 and of 27 January 2021, Case KPN v Commission, T-691/18, ECLI:EU:T:2021:43, paragraph 112.

39 See Non-Horizontal Guidelines, paragraph 58.

40 See Non-Horizontal Guidelines, paragraph 61.

41 See Non-Horizontal Guidelines, paragraph 59.

42 As confirmed in Commission decision of 18 July 2019 in case M.8864, Vodafone/Certain Liberty Global Assets, paragraph 1584.

43 Form CO, paragraph 206 (based on data from United Internet, Tele Columbus, the BNetzA and publicly available information).

44 Form CO, paragraph 222 (based on data from United Internet, Tele Columbus, the BNetzA and publicly available information).

45 Form CO, paragraph 228.

46 European Commission, Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings, 2008/C 265/07, paragraph 45, footnote 6.

47 Commission decision dated 6 February 2012 in case M.6411 – Avent/Maxam, paragraph 84; Commission decision dated 4 April 2007 in case M.4403 – Thales/Finmeccanica/Alcatel Alenia Space & Telespazio, paragraphs 121 and 268.

48 United Internet has a share of maximum [10-20]% of the market for the retail supply of fixed telephony services (where Tele Columbus has a share of maximum [0-5]%) and [5-10]% of the market for the retail supply of mobile telecommunication services (where Tele Columbus is no longer active).

49 In addition, the Commission notes that Tele Columbus has a share of only [0-5]% in the downstream market for the retail supply of fixed telephony services. It is unclear how this could affect Morgan Stanley’s incentives to engage in input foreclosure.

50 See replies to questionnaire Q1 to Telecom Competitors, questions 4.1, 4.2. and 4.4.

51 And in any event significantly below the thresholds of 30% under which the Commission tradionally considers that there will be no possible vertical effect from a transaction.

52 See replies to questionnaire Q1 to Telecom Competitors, questions 4.1, 4.2. and 4.4.