Commission, January 13, 2021, No M.9564

EUROPEAN COMMISSION

Decision

London Stock Exchange Group / Refinitiv Business

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof,

Having regard to Council Regulation (EC) No 139/2004 of 20.1.2004 on the control of concentrations between undertakings1, and in particular Article 8(2) thereof,

Having regard to the Commission's decision of 22.6.2020 to initiate proceedings in this case,

Having given the undertakings concerned the opportunity to make known their views on the objections raised by the Commission,

Having regard to the opinion of the Advisory Committee on Concentrations,

Having regard to the final report of the Hearing Officer in this case,

Whereas:

1. THE PARTIES AND THE OPERATION

(1) On 13 May 2020 the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the “Merger Regulation”) by which London Stock Exchange Group plc (the “Notifying Party” or “LSEG”, United Kingdom) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of Refinitiv Business (the “Target” or “Refinitiv”, United States) by way of purchase of shares (the “Transaction”).2 LSEG and Refinitiv are designated hereinafter as the “Parties”.

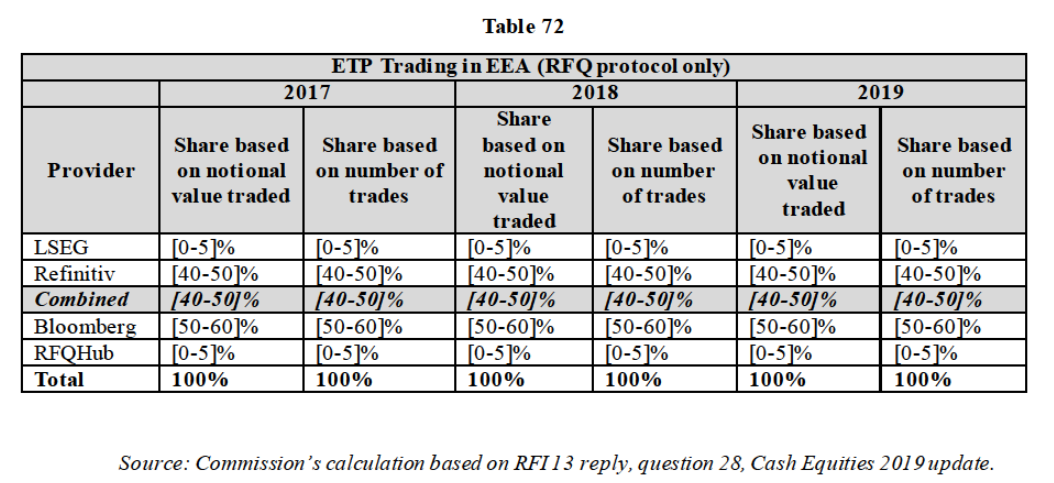

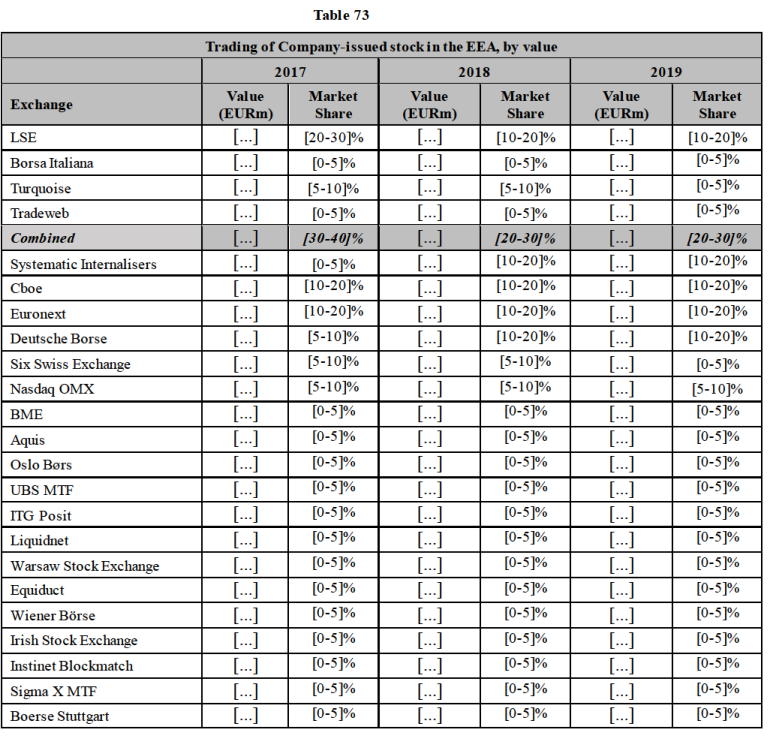

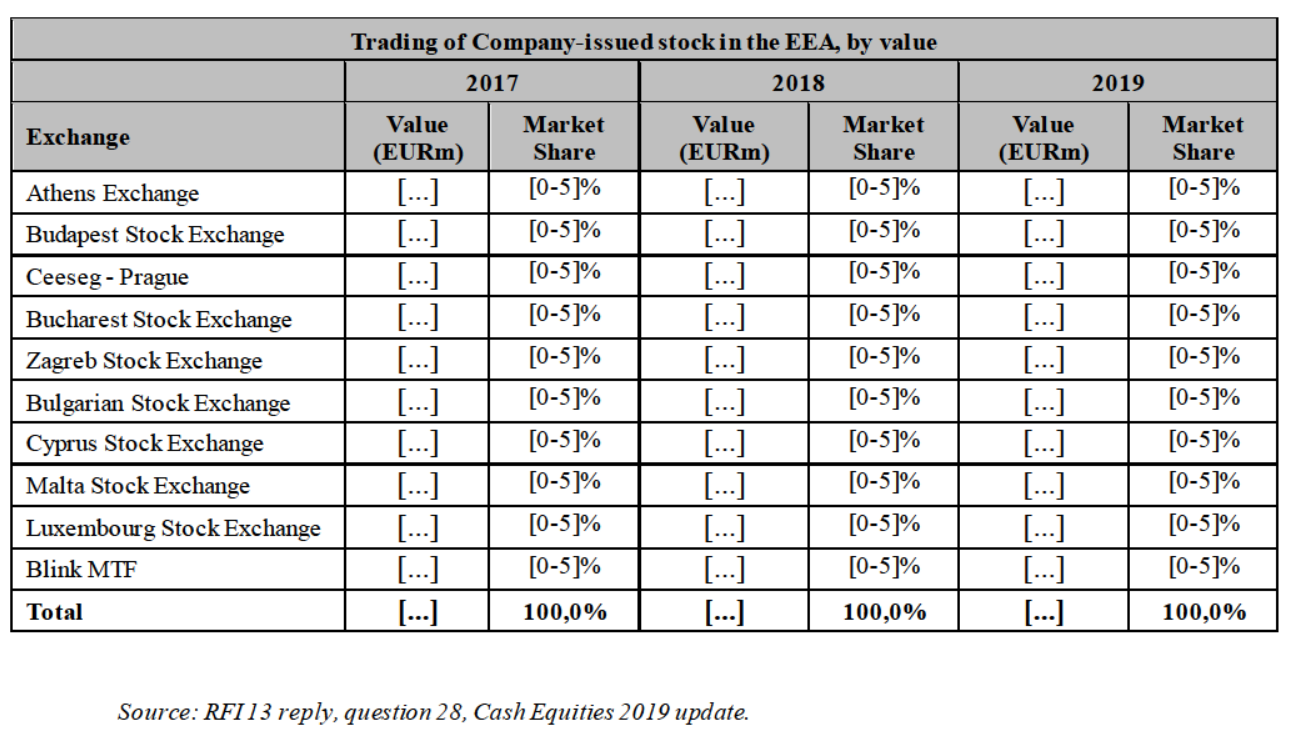

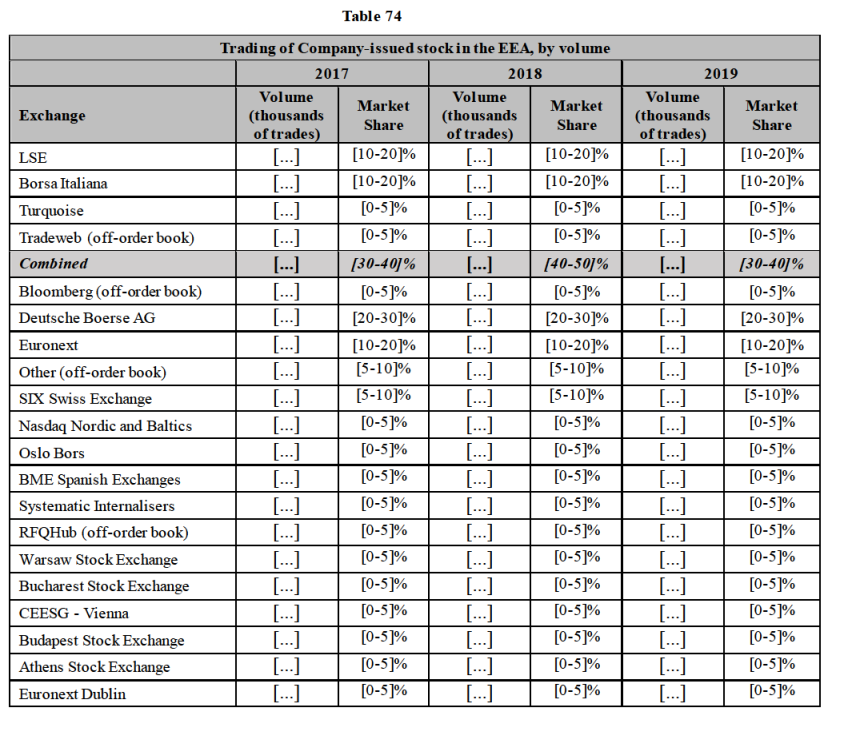

(2) LSEG is an international financial markets infrastructure and data provider. LSEG’s main activities are in (i) capital markets through trading venues (namely, LSE, Borsa Italiana, MTS, Turquoise, and CurveGlobal Limited); (ii) post-trade and risk management; (iii) information services; and (iv) technology services through trading, market surveillance and post-trade systems for organisations and exchanges. In the first two areas, LSEG operates trading venues (LSE, Borsa Italiana, MTS, Turquoise, CurveGlobal) for equities, exchange-traded products (“ETPs”), bonds, interest rate derivatives and equity derivatives, as well as clearing houses (LCH and CC&G) for equities, ETPs, bonds, interest rate derivatives, equity derivatives, credit derivatives and foreign exchange (“FX”) products. In the last two areas, LSEG is in particular active in index provision through FTSE Russell, venue data provision through its aforementioned trading venues, desktop solutions through Mergent, sector classification schemes, and other financial information products such as security identifiers.

(3) Refinitiv is a financial markets infrastructure and data provider. The Target is active in (i) data and analytics provision; (ii) capital markets and workflow solutions; and (iii) risk management services. In the first area, Refinitiv is in particular active in desktop solutions through Eikon, consolidated real-time datafeeds (“CRTDs”) through Elektron, market data platforms (“MDPs”) through Thomson Reuters Enterprise Platform (“TREP”), index provision, sector classification schemes, and venue data provision. In the second area, Refinitiv operates trading venues (Tradeweb, FXall and Matching) for equities, ETPs, bonds, interest rate derivatives, equity derivatives, and FX products.

(4) LSEG will (directly or through wholly owned subsidiaries) in an all-share transaction3 acquire the whole of Refinitiv from Refinitiv Holdings Ltd, which is ultimately controlled by Blackstone Group, Inc. (“Blackstone”).4 In exchange, LSEG will issue shares to (certain subsidiaries of) Refinitiv Holdings Ltd., granting Blackstone a ~29% voting interest in LSEG.5 The Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(5) The Parties had a combined aggregate worldwide turnover of more than EUR 5 000 million in 2019 (LSEG: EUR […]; Refinitiv: EUR […]). Each of them had an aggregate Union-wide turnover in excess of EUR 250 million in 2019 (LSEG: EUR […]; Refinitiv: EUR […]). None of the Parties achieved more than two-thirds of their aggregate Union-wide turnover within one and the same Member State. The notified concentration therefore has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

3. RELEVANT MARKET DEFINITION

3.1. Introduction

3.1.1. Trading and Clearing of Financial Instruments

(6) Financial instruments are assets (e.g. equities or bonds) or contractual agreements between two parties to receive or deliver another financial instrument (e.g. repos or derivatives). They are issued, purchased, and sold in financial markets. The financial instrument value chain includes listing, trading, clearing, and custody/settlement.6

(7) Trading in the context of financial markets describes the expression of a mutual commitment between two parties to enter into an agreement to buy or sell a financial asset.7

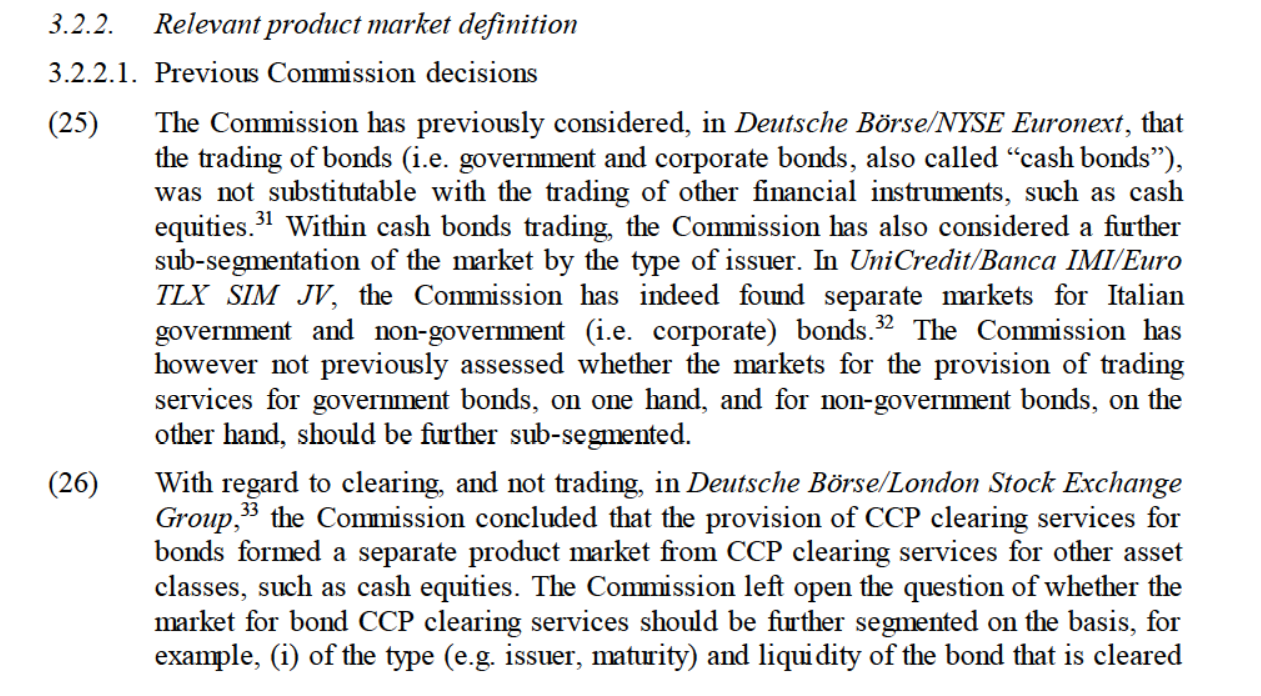

(8) This can occur in various ways: electronically or via voice;8 bilaterally or multilaterally; on venues (on exchanges or “regulated markets” (“RMs”)9, multilateral trading facilities (“MTFs”),10 organised trading facilities, (“OTFs”),11 or outside a venue (i.e. over-the-counter (“OTC”), including through other format such as systematic internalisers (“SIs”).12

(9) The evolution of the main legislative acts13 in the area of trading and clearing of financial assets in the European Economic Area (“EEA”)14 has changed the way in which certain financial assets can be legally traded and cleared by market participants, and how and when trading activity needs to be made public and reported to authorities, as explained below.

(10) In particular, the scope of over-the-counter (“OTC”) trading has evolved with the legislation. Historically, OTC trading generally had the same meaning with respect to all asset classes, namely, it referred to trades executed bilaterally and away from a trading venue. However, the regulatory changes mentioned above gave a different legal meaning to the concept of OTC trading for different asset classes.15

(11) For equities,16 OTC trading refers to trades that take place away from a MiFID II17 regulated trading venue (RM or MTF in this case) and away from an EEA-based SI.18 Listed company-issued equities are in principle subject to the trading obligation (i.e. they need to be traded on an RM, MTF or SI) and as such there is limited OTC trading for these assets. This does not however apply to ETPs, which are not subject to the trading obligation and can be traded OTC.19

(12) For bonds, OTC trading refers to trades that take place away from a MiFID II regulated venue (RM, MTF or OTF in this case). No trading obligation applies to bonds. Bonds traded via a systematic internaliser (“SI”) are considered OTC.

(13) For derivatives, OTC trading refers to all derivatives not traded on an RM. This means that all trades executed on MTFs, OTFs or via an SI are considered OTC.

(14) Clearing refers to all activities occurring between the time of trading (i.e. when a trade has been agreed between the buyer and the seller) and the moment in which commitments are fulfilled, or “settled” (i.e. the seller has delivered the rights to the financial asset to the buyer and the buyer has paid the agreed amount to the seller). The main function of clearing is to insure each party to a trade against non-fulfilment of the commitments agreed to by the other party. This is commonly referred to as insuring “counterparty risk”. Where the clearing service is performed centrally by a third party, this third party is referred to as the central counterparty (“CCP”) or clearing house. In addition to its principal function of managing counterparty risk, the CCP can also perform other ancillary activities such as the registration and verification of the trade and its counterparties and the transmission of the details of the trade to the relevant settlement body.20

(15) Clearing has a different relevance for different asset classes, mainly depending on the time that counterparties are exposed to each other’s non-compliance risk (i.e. until the final obligations related to a traded contract are fulfilled). This time is normally rather limited with respect to cash instruments (i.e. equities and bonds), as the settlement (final delivery and payment) takes place within the next couple of days after the trade is agreed. With respect to derivatives, this time can be long, ranging from a few months to several years, depending on the exact contract terms. The clearing obligations introduced following the financial crisis of 2008 in the EEA cover all derivatives traded on an RM and certain OTC derivatives, including OTC IRDs.21

(16) The rate of cleared OTC IRD trades has grown from ca. 24% in 2009 to 60% in 2018 of the total amount traded (as measured by notional amounts outstanding by counterparty).22

3.1.2. Financial Data Products

(17) Financial data products are products that deliver financial information to the end-customer. This data is sometimes the by-product of the trading or other activities of financial players (e.g. venue data). Often financial data has also undergone aggregation, processing or enrichment (e.g. to produce consolidated content real-time datafeeds or derived content such as security identifiers or indices). Financial data can also be packaged with functionalities and workflow tools to create comprehensive solutions for the end-customer (e.g. desktop solutions).

3.2. Provision of Trading Services for Cash Bonds

(18) Throughout this Decision, the operation of trading platforms or marketplaces, and the related infrastructure for a given financial instrument or category of financial instruments, will be referred to as “the provision of trading services” for this financial instrument or category of financial instruments, or, more simply, and in line with the Commission’s precedents, as “the trading” of this financial instrument or category of financial instruments.

3.2.1. Introduction to the trading and clearing of bonds

(19) Cash bonds are fixed-income securities,23 which are issued by governments (also called “government bonds”) or non-governmental institutions such as corporations (also called “corporate bonds”). In this Decision, European Government Bonds (“EGBs”) refer to bonds issued by the governments of the EEA countries and Switzerland.

(20) As for other financial instruments, the bonds value chain includes listing, trading, clearing, and settlement/custody. Within bonds, the Transaction gives rise to horizontally affected markets (regarding trading services for EGBs and regarding D2C electronic trading services for corporate bonds), and to vertically affected markets regarding the trading and clearing of bonds.24

(21) Bonds are traded on the primary and secondary market. Primary market trading refers to the process of offering bonds as part of a fund-raising round. Subsequent trading of bonds takes place on the secondary market. The Transaction gives rise to horizontally affected markets only in bonds trading on the secondary market (EGB trading services and D2C electronic trading services for corporate bonds).

(22) Bonds, in particular EGB trading (on the secondary market) historically took place on a bilateral basis (e.g. via telephone and hence called “voice trading”. Voice trading is used today to indicate also other channels for bilateral trading, such as messaging). Today, the majority of EGB trades are executed electronically on trading venues. Some venues offer mixed trading models, combining voice features and electronic capabilities.25 In addition, bond trading takes place at two levels: (i) dealer-to-dealer (“D2D”)26 and (ii) dealer-to-client (“D2C”).27 Electronically-traded bonds are usually traded through a central limit order book (“CLOB”) trading protocol28 or a request-for-quote (“RFQ”).29 Moreover, as explained in recital (11) above, bond trading can occur “on venue” (i.e. on an RM, MTF, or OTF for EGBs) or OTC (e.g. through a SI for EGBs), as there is no trading obligation for EGBs and cash bonds in general.

(23) Both Parties are active in bond (government and non-government) trading services through their electronic bond trading venues (operated by MTS Group for LSEG and by Tradeweb for Refinitiv). In addition, LSEG is active in the clearing of cash bonds.

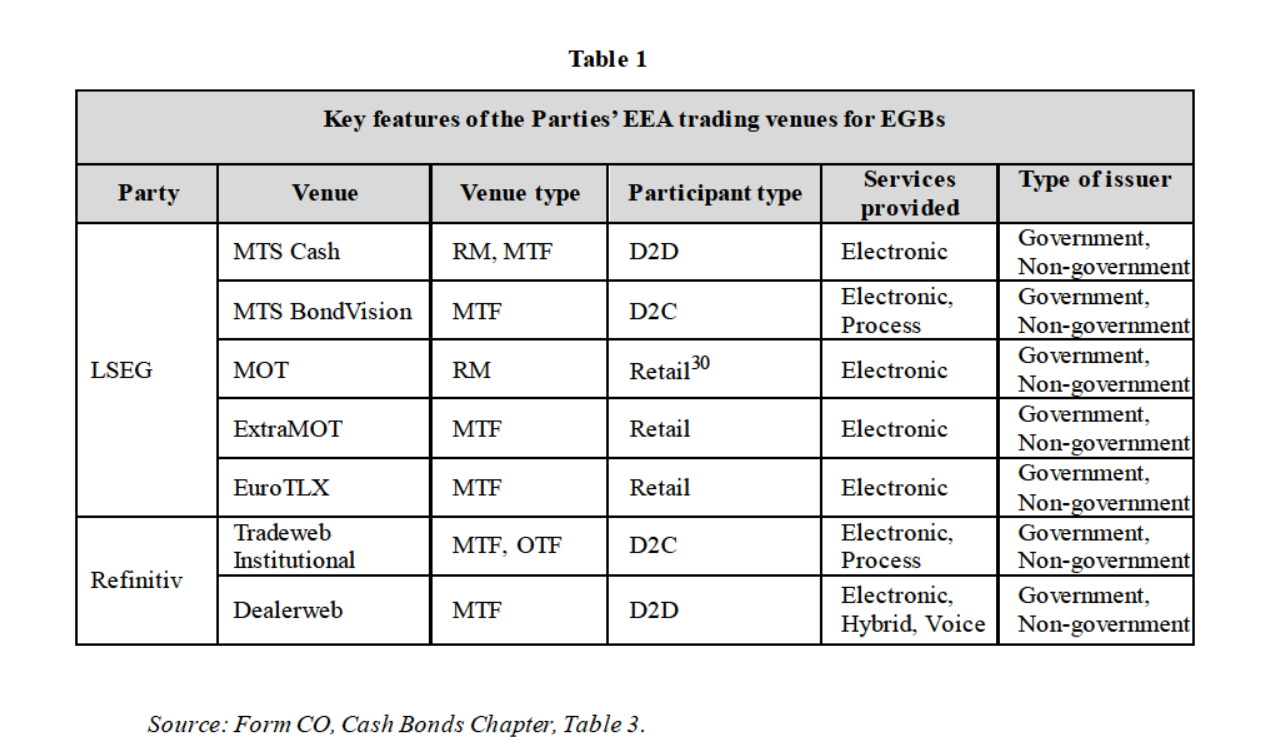

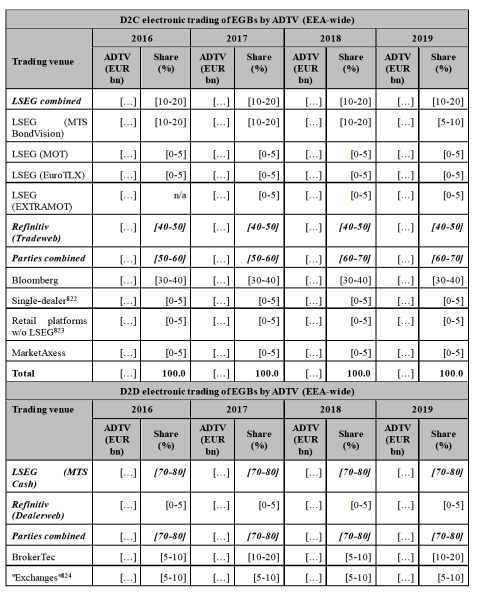

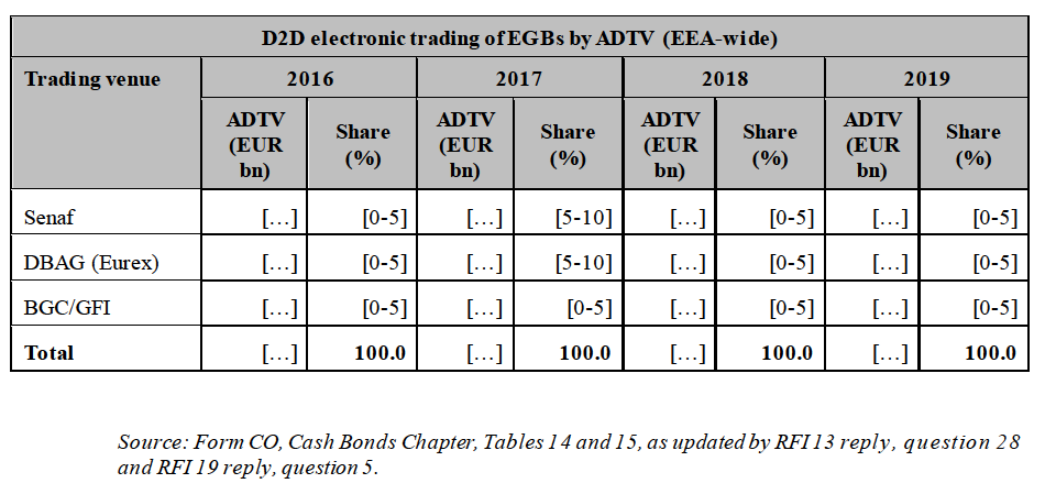

(24) As regards bond trading, the Parties’ activities in the different segments of bond trading are summarised in Table 1 below.

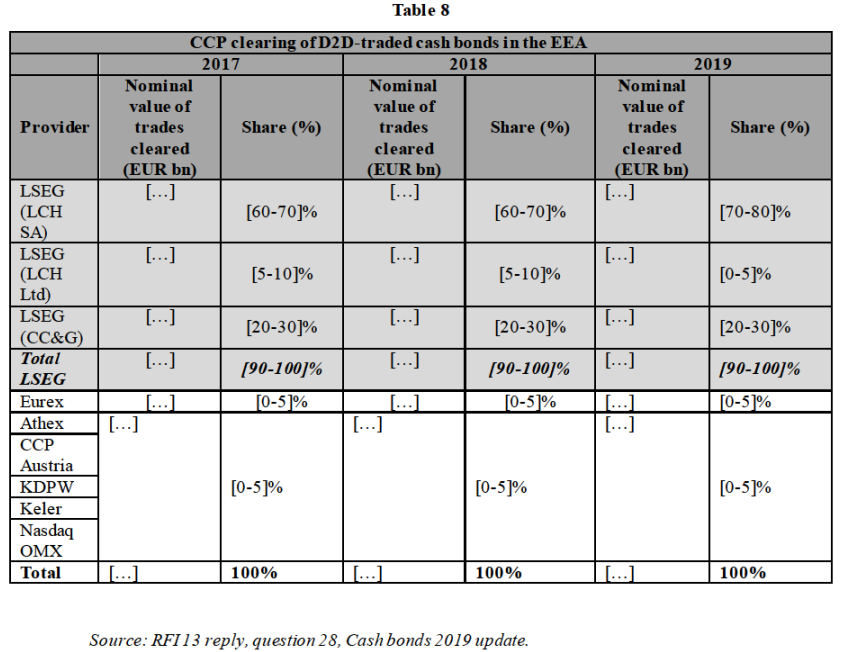

or (ii) of whether the bond that is cleared is traded between dealers (D2D) or dealer-to-client (D2C).34

or (ii) of whether the bond that is cleared is traded between dealers (D2D) or dealer-to-client (D2C).34

3.2.2.2. The Notifying Party’s view

(27) At the outset, it should be noted that the Notifying Party provided its view on the product market definition of bond trading exclusively in the Form CO.35 The Notifying Party did not respond to the Commission’s preliminary views regarding the provision of trading services for cash bonds, including the considerations on market definition, set out in the decision pursuant to Article 6(1)(c) and in the Statement of Objections. Therefore, the Notifying Party did not challenge the Commission’s preliminary view that the provision of trading services for EGBs constitutes a separate product market from the trading of other types of bonds, and that the provision of electronic trading services for EGBs constitutes a separate product market, which is possibly further segmented by trading channel (i.e. between the D2C and the D2D channels).

(28) In the Form CO, the Notifying Party agrees with the Commission’s precedents that the trading of cash bonds is part of a separate product market from the trading of other financial instruments such as cash equities.36 The Notifying Party considers that the relevant product market for cash bond trading is segmented by (i) issuer-type (government bonds versus non-government bonds) and (ii) trading channel (i.e. D2C versus D2D).37

(29) First, the Notifying Party considers it appropriate to segment cash bond trading services by issuer type (i.e. between government and non-government bonds), notably because (i) this distinction is used across the market, including the Celent industry reports,38 (ii) the supply-side substitutability between government and corporate bonds is limited as different players focus on and/or compete in these two product areas, as illustrated by the fact that, e.g., MTS’s presence is strong in government bonds but limited in non-government bonds, while the presence of BGC/GFI’s venues is de minimis in government bonds but material in non-government bonds, (iii) government bonds are subject to quoting requirements and pricing considerations that do not apply to corporate bonds,39 and (iv) from buy-side market participants’ perspective, government and non-government bonds are not generally substitutable in terms of risk exposure as government bonds are deemed as “risk free asset”, unlike non-government bonds. The Notifying Party considers that a further segmentation within trading services for government bonds by issuing state is not appropriate, notably because (i) although government bonds can have various characteristics such as date of maturity, coupon, and nationality of sovereign issuer, these characteristics do not differ systematically across government bonds by state of issuance; and (ii) venues that offer trading of government bonds, such as MTS, BrokerTec and Bloomberg, generally offer trading of all major EGBs.40

(30) Second, the Notifying Party considers it appropriate to segment cash bond trading services by trading channel (i.e. between D2C and D2D trading), notably because: (i) this distinction is used across the market, including in the Celent industry reports, (ii) the D2D channel is a key component of the market, allowing market makers to ensure liquidity for cash bonds (including to manage large and complex orders without shifting or destabilising the market), particularly because cash bonds generally have lower liquidity levels than other asset classes, so that achieving a certain level of liquidity is more challenging than for other asset classes, (iii) D2D trades generally require a higher level of anonymity between the parties to a given transaction than D2C trades, while the buy-side enjoys additional levels of protections under MiFID II,41 which do not apply for D2D trades, (iv) different players focus on and compete in these two channels, as illustrated by LSEG that targets D2D trades via MTS Cash and D2C trades via MTS BondVision, (v) different market participants are active in each of these segments (dealers in D2D and dealers and customers in D2C) and (vi) a number of legal obligations are borne by dealers on D2C trades that do not apply for D2D trades (regarding, e.g. best execution, information disclosure, and assessment of suitability and appropriateness obligations).42

(31) Third, the Notifying Party does not consider it appropriate to segment cash bond trading services by trading method (i.e. between voice and electronic trading) because voice trading imposes a material competitive constraint on electronic trading venues. According to the Notifying Party, this constraint notably comes from the fact that (i) due to the larger number of unique bonds traded (compared to, e.g. cash equities), customers monitor and negotiate bond prices by using both voice and electronic trading methods,43 (ii) the delineation between voice and electronic trading is unclear because most electronic trading venues also offer functionality that allows customers to agree trades by voice (e.g. Bloomberg’s chat functionality),44 (iii) market participants switch and multi-source between electronic and voice trading,45 and (iv) electronic venues set up specific protocols to compete directly with voice trading methods (namely via request for quote (or “RFQ”) protocols).46

(32) Fourth, the Notifying Party considers that the different execution environments47 compete, notably because the different “on venue” environments (i.e. RMs, MTFs, and OTFs) are substitutable among themselves, and compete with OTC trading, notably because market participants’ decision regarding the execution environment is highly fact and situation-specific.48 The Notifying Party emphasizes that (i) customers can trade “on venue” or negotiate a trade bilaterally, as there is no trading obligation for cash bonds, (ii) the ability to source prices and agree trades bilaterally remains central as cash bonds are less standardized, and cash bond trades are generally less frequent and larger in size compared to other financial instruments, (iii) market participants explore options across all execution environments in order to comply with best execution requirements, and (iv) the lines between OTC and "on venue” trading are blurred as (a) venues use RFQ functionalities to mirror OTC trades and (b) large dealer banks allow execution of trades on their own single-dealer platforms (in their capacity of SIs or OTFs) or through third parties’ venues to which they are connected.49

3.2.2.3. The Commission’s assessment

A. The provision of electronic trading services for EGBs

(33) On the basis of the market investigation results and the evidence available to it, the Commission concludes that for the purposes of this Decision the provision of electronic trading services for EGBs forms a separate product market that could potentially be segmented by trading channels (i.e. between the D2D and the D2C channel).

(34) The Commission takes this view for the following reasons.

(35) First, the results of the market investigation confirm the Notifying Party’s view that trading services for EGBs form a separate product market from the trading of other financial instruments, including corporate bonds and government bonds other than EGBs.50 In addition, feedback from the market participants indicates that EGB trading services are largely substitutable, regardless of the country of issuance of the specific EGBs (as described in further details in recitals (36) and (37) below).

(36) From the demand-side perspective, the market investigation indicates that around half of the customers who responded to the relevant questions trade all EGBs.51 Regarding the other half of customers who do not trade all EGBs, these customers explain that they decide not to trade certain EGBs because of general considerations of “trading policy” that are not necessarily related to the product characteristics of specific EGBs. For several customers, such as Danmarks Nationalbank (a buy-side customer), their EGB trading mandate “depend[s] on the credit rating for the respective countries”.52 This means that the list of the EGBs that they can trade is dynamic and fluctuates with credit ratings. In addition, while some customers seem to have lists of countries for which they can or cannot trade bonds, these lists varies according to the customers. By way of example, the buy-side customer Alte Leipziger explains that its company decided to trade “[o]nly EGBs in EUR”,53 while Cassa Sovvenzioni Banca D'Italia, another buy-side customer, says that it does not trade “EGB issued by: Greece, Ireland, Austria, Finland, Netherlands, Belgium, Luxembourg”.54 Consequently, no clear and objective distinction between EGBs by state of issuance can be drawn from a demand-side perspective. Importantly, no such distinction can be drawn at the level of the provision of EGB trading services.

(37) From a supply-side perspective, the vast majority of competitors indicate that they provide trading services for all EGBs (i.e. bonds of all the EEA and Swiss governments).55 The only exceptions reported were marginal: (i) the CME group, a D2D competitor specifies that it offers trading services for all EGBs eligible for central clearing,56 and (ii) BME Clearing S.A.U. informs that it does not offer trading services for Swiss bonds.57 There is therefore a strong degree of supply-side substitutability between the trading services for EGBs.

(38) Second, contrary to the Notifying Party’s view, the result of the market investigation indicates that EGB trading services managed bilaterally via voice (i.e. outside of an electronic trading venue), are not fully substitutable with EGB trading services operated electronically by trading venues.

(39) From a demand-side perspective, the vast majority of sell-side dealers consider that their bilateral voice trading offer does not constrain electronic trading venues’ fee setting.58 These customers explain that voice EGB trading does not exercise an important constraint because voice EGB trading is usually more expensive than electronic EGB trading. By way of example, KBC, a sell-side customer, explains, “[f]ees for electronic trading need to rise considerably before a switch can be considered”,59 and another said “[w]e don't see a clear correlation between voice trading and platform fees”.60

(40) The market investigation also indicates that customers rely much more often on electronic EGB trading than voice EGB trading. Market feedback indicates that voice EGB trading is rather occasional and typically chosen for specific types of trades, namely sensitive (large) trades and/or trades of illiquid bonds.61 Market participants explain that voice can be preferred for these occasional trades as electronic platforms may not provide the necessary liquidity, or an electronic trade might impact the liquidity and/or price of the EGB traded.62

(41) In addition, some customers explain that they do not rely on voice trading at all to trade EGBs. A reason for this choice, or more generally for the customer’s preference to trade EGBs electronically is that electronic trades are perceived by customers as more efficient for reporting purposes and in terms of execution timing. By way of example, Swiss Life AM, a buy-side customer, explains that the main reasons for choosing to trade electronically are, “[f]or compliance reasons in order to prove the best execution and efficiency of execution”,63 and Deutsche Bank AG, another buy-side customer, explains that it prefers electronic trading “for efficient access to market liquidity and best prices. In addition, electronic venues also facilitate automated execution more easily”.64

(42) From a supply-side perspective, the vast majority of providers of EGB trading services also consider that the possibility for customers to trade by voice does not constrain their fee setting.65 Like customers, competitors explain that voice and electronic EGB trading have differentiated prices. For instance, CME Group Inc. explains that trading EGBs via voice is “more expensive than electronic because of associated costs” 66 and MarketAxess Holdings indicates that “voice fees remain higher than electronic fees”.67 Feedback from competitors showed that the pricing features of voice and electronic EGB trading services differ, notably because (i) fees are usually more transparent on electronic platforms than when trading by voice and (ii) most electronic trading platforms charge fees that are not included in a mark-up whereas when trading by voice, fees are often included in the mark-up.68

(43) In addition, most of the providers of EGB trading services are active either in voice trades or in the provision of electronic trading services.69 While some suppliers provide what the Notifying Party calls “hybrid” features,70 suppliers generally offer to execute trades, either electronically on venue, or bilaterally. Moreover, shifts in trading flows between electronic and voice EGB trades seem limited. Some providers of electronic EGB trading services have indicated that they have attracted EGB voice trade flows of liquid securities.71 Similarly, some competitors consider that voice trading could attract electronic flows for less liquid products or large orders.72 However, the flows for which switching is possible appear to be limited. Indeed, voice providers generally indicate that attracting electronic EGB flows is not applicable to their business.73

(44) The market investigation also indicated that services provided by SIs for EGB trading are not fully substitutable with electronic trading venues. By way of example, JP Morgan, a sell-side dealer, explains that it “does not consider itself a trading venue competitor to LSEG or Refinitiv”.74

(45) Based on the above, the market investigation indicates that electronic “on venue” trading services for EGBs are part of a separate product market from EGB trading services operated via voice and SIs. In contrast, the market investigation largely confirms the Notifying Party’s view that all “on venue” EGB trading environments (i.e. RM, MTF, and OTF) compete.

(46) Third, regarding the possible segmentation of the relevant product market based on the trading channel, the Commission notes that D2C trades (i.e. trades between a dealer and a customer) and D2D trades (i.e. trades between dealers) are largely distinct today from a demand-side substitutability perspective. D2D trading services are provided to dealers looking to trade with other dealers while D2C trading services are provided to dealers wishing to trade with a client and vice versa. For this reason, D2D and D2C trades present different characteristics, notably in terms of anonymity of the trading parties (as inter-dealer trades require a higher level of anonymity, which is not necessary in a trade involving a client relationship, as it is the case of D2C trades). D2D venues generally offer CLOB protocols (see Section 3.2.1 above) allowing the parties to a trade to remain anonymous, while D2C venues generally offer RFQ protocols (see Section 3.1.2.1 above) which disclose the identity of the counterparties to each other. In addition, D2C trades are characterised by the customer relationship built between a dealer and its client, and the fact that the client generally chooses the trading channel (although dealers generally bear the trading fees).

(47) From a supply-side substitutability perspective, most of the providers of electronic EGB trading services are active mainly in D2C or in D2D trading services. However, a number of market players offer trading services for both D2C and D2D trading, including the Parties and another competitor (BME).75 In addition, some providers of EGB trading services focusing on D2C trades explained that they do allow trades between dealers (i.e. D2D trades) on their venues.76

(48) A majority of customers explain that they have executed D2D trades on D2C venues in the past 3 years.77 By way of example, Commerzbank AG, a sell-side customer, explains that “D2D/D2C venues have started to provide this service which has been driven by market demand from both the buy & sellside”.78 Banco BPM SpA, another sell-side customer, explains as well that “[t]he differences between D2D and D2C platforms are less huge than in the past; this brings to the possibility in particular of executing orders for customers into D2D platforms too as well as the opposite”.79 UniCredit, a sell-side customer, explains that it does so for “trades on bonds where [they] weren’t liquidity provider”80, and Nomura International plc, still on the sell-side of EGB trading, explains that “[they] do not initiate such trades, however [they] execut[e] D2D trades on D2C venues to provide liquidity to non-EGB market-making desks at other dealers on D2C venues”.81

(49) In the same vein, some providers of EGB trading services consider that this possibility to perform D2D trades on D2C platforms will materially increase in the next 3 years.82 A minority of sell-side customers share this view.83 KBC, a sell-side customer further highlights that it “expect[s] mixed platforms to grow at the expense of pure D2D or D2C platforms”.84 Similarly, another sell-side customer, Banco BPM SA considers that “[t]his is a real possibility” that it will execute more D2D trades on D2C venues in the next 3 years”.85

(50) In addition, some competitors indicate that they lost in the past 3 years, or expect to lose in the next 3 years, a material part of their D2D EGB trading volumes to D2C platforms (or vice versa).86

(51) The Commission also notes that a number of providers of D2C EGB trading services do consider competitors’ D2D fees when setting their own D2C trading fees, and vice versa (i.e. some providers of D2D EGB trading services do consider competitors’ D2C fees to set their own D2D trading fees).87 By way of example, BME Clearing, a competitor, explains that, for setting D2D trading fees, “[w]e compare execution cost all over the different trading venues to make our offer competitive”.88 More generally, Eurex explains that “D2C and D2D venues compete” for cash bonds.89

(52) Consequently, the distinction between electronic D2C and D2D trading is expected to fade in the near future (as it has recently happened in the United States of America).90 Market participants have divergent views as to the likelihood of this convergence process but the market investigation results indicate that the development will likely depend on a number of factors, notably the transparency of the market; and the willingness of market participants (including the combined entity)91 to operate this shift, and possibly converge more. According to a number of market participants, a convergence to an all-to-all trading would not necessarily remove the necessity to adopt different protocols for different participant types.92 Asked whether, and if so why, they expect, in the next 3 years, a convergence of D2C and D2D trading into “all-to-all” trading in the EGB market, Bloomberg, a D2C competitor of the Parties explains, “[i]n fixed income trading, D2D platforms increasingly allow the buy side (liquidity takers) to access “non-traditional liquidity providers”, (e.g. hedge funds); this expansion of D2D platforms towards “clients” blurs the line between the previously distinct D2C and D2D venues. The distinction may disappear over time as markets evolve and liquidity is redistributed.”93 Other competitors expect D2C and D2D EGB trading to converge. In this regard, BME Clearing S.A.U explains that “institutional clients ar[e] becoming more important sources of liquidity to the detriment of pure primary dealers”,94 and MarketAxess explains as well that “the convergence of D2D and D2C trading of European

government bonds is enabled by technology and driven by client demand with the aim to have more market participants trading on the same venue, which in turn increases liquidity”.95

(53) The Commission concludes that the question of the whether the D2C electronic trading of EGB and the D2D electronic trading of EGB form part of two separate product markets can ultimately be left open for the purposes of this Decision because competition concerns arise under all possible market segments. As further evidenced in Section 4.4.1.2 below, the Transaction indeed significantly impedes effective competition be it at the level of EGB D2C electronic trading, or of EGB D2D electronic trading, or of EGB electronic trading overall.

(54) Based on the above and the evidence available to it, the Commission therefore concludes that for the purposes of this Decision the provision of electronic EGB trading services constitutes a separate product market, which may be further segmented by trading channel (namely, between the D2C and the D2D trading channels).

B. The provision of trading services for other bonds than EGBs

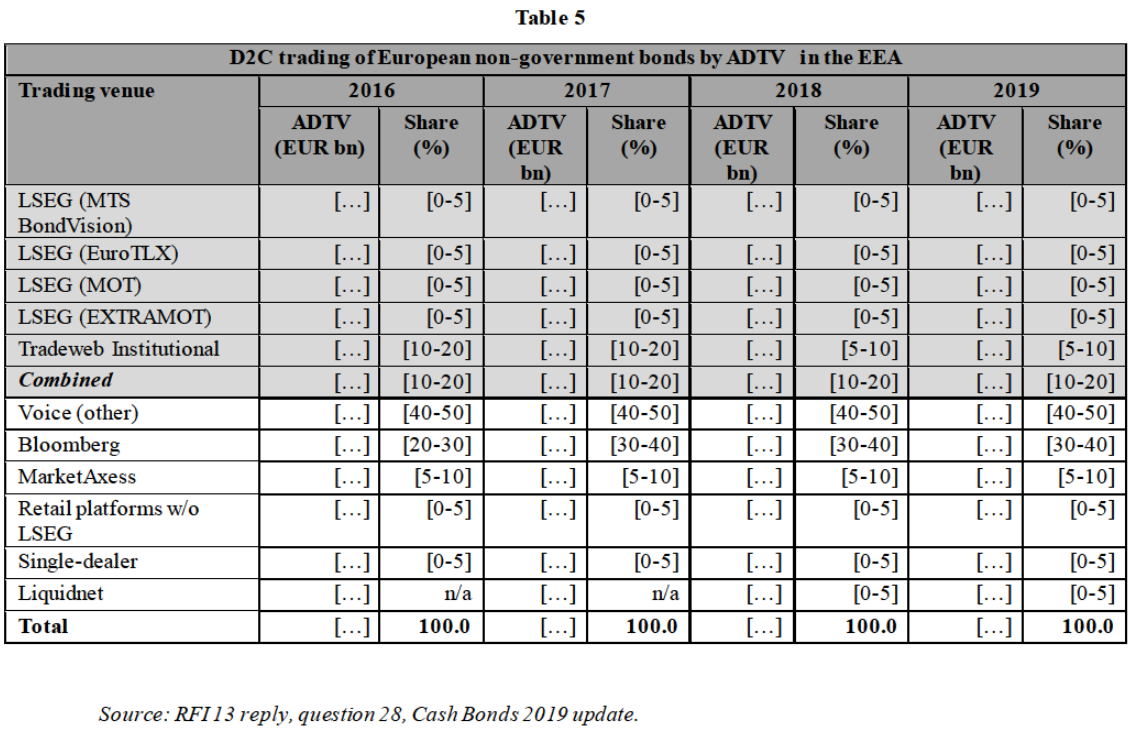

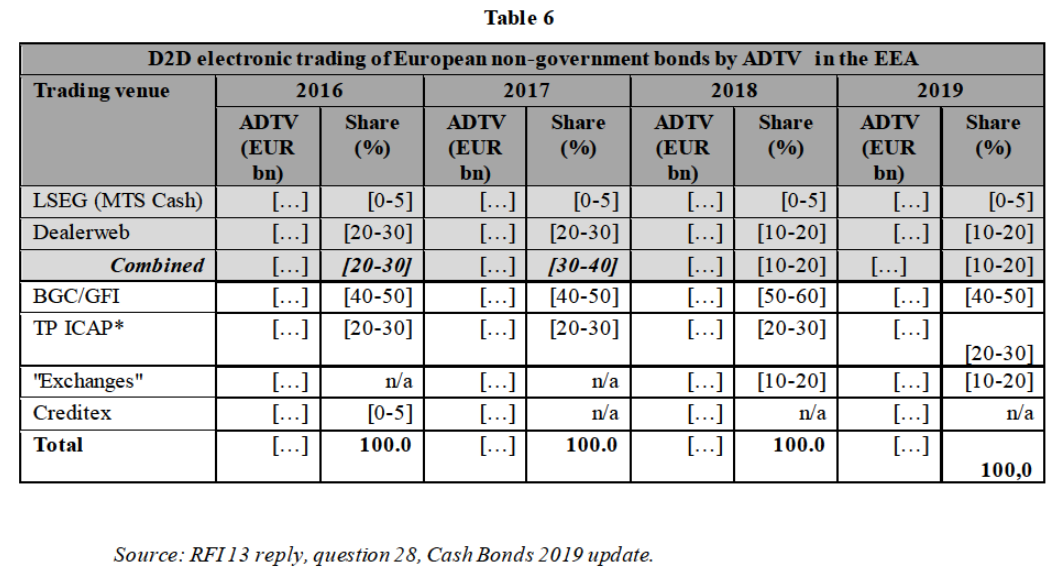

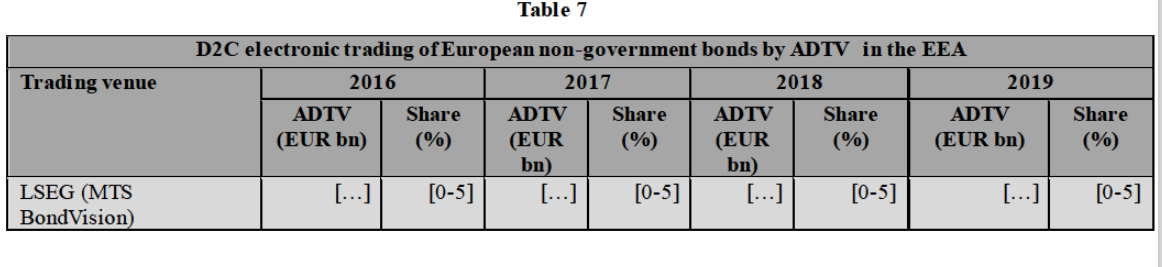

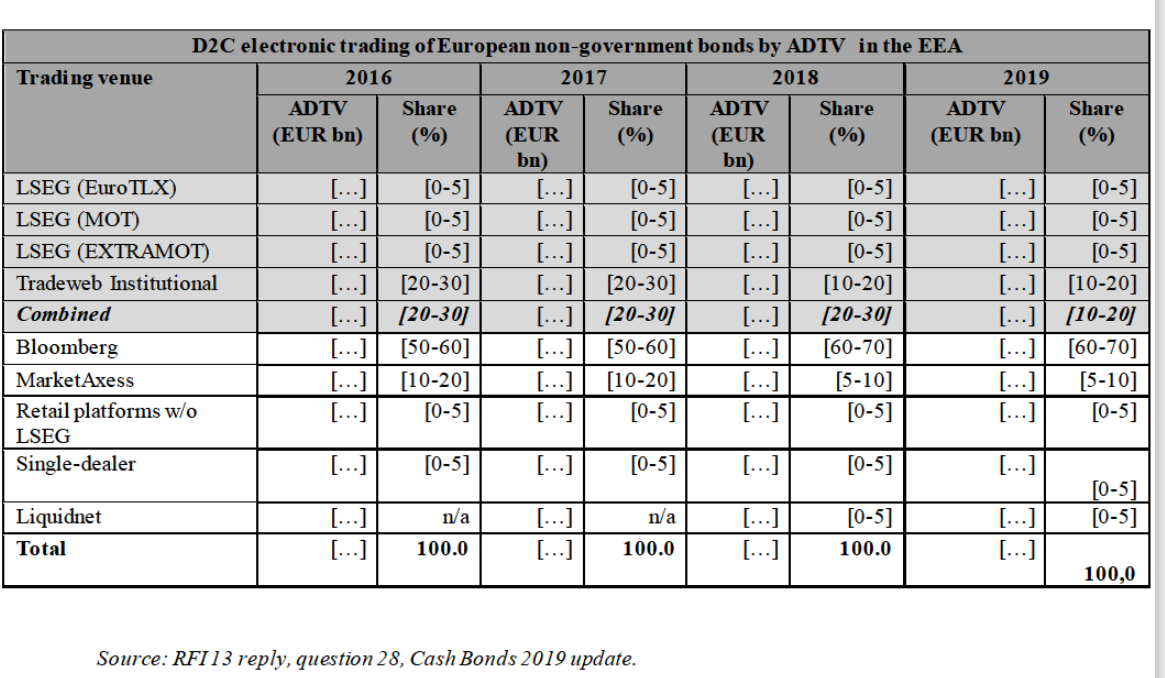

(55) Based on the results of the market investigation and the evidence available to it, the Commission considers that the question of the precise product market definition for the provision of trading services for bonds other than EGBs can be left open for the purposes of this Decision. This is because the Transaction would not result in a significant impediment to effective competition under any of the plausible product market segmentations, namely regardless of whether the market be segmented by (i) issuer-type (i.e. between corporate bonds and government (non-EGB) bonds), (ii) trading channel (i.e. between the D2C and the D2D channels), as claimed by the Notifying Party,96 or by (iii) execution method (i.e. between voice and electronic).

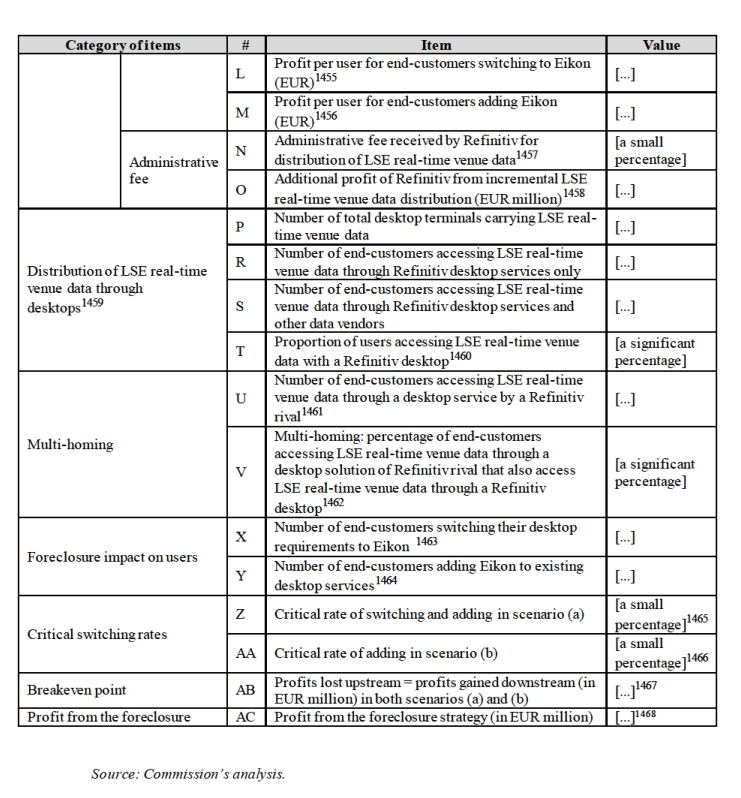

3.2.3. Relevant geographic market definition

3.2.3.1. Previous Commission decisions

(56) The Commission did not previously assess the relevant geographic market for the provision of trading services for bonds specifically.

(57) However, the Commission previously assessed the relevant geographic market for the provision of clearing services for bonds. In Deutsche Börse/NYSE Euronext,97 the Commission considered whether the geographic market for cash bond clearing services could be at least EEA-wide but ultimately left this question open. In Deutsche Börse/London Stock Exchange Group,98 the Commission however considered that the market for cash bond clearing was EEA-wide.

3.2.3.2. The Notifying Party’s view

(58) The Notifying Party considers that the conclusions on the geographic market definition in the above-mentioned Commission’s precedents regarding cash bond clearing are consistent with the Parties’ experience in cash bonds trading, and its potential sub-segments.99 According to the Notifying Party, this is because investors and their intermediaries residing in a specific country also use trading venues in other countries.100 However, the Notifying Party considers that it would ultimately not be necessary for the Commission to reach a definitive view on geographic market definition.101

(59) As mentioned in recital (27) above, the Notifying Party did not respond to the Commission’s preliminary views set out in the decision pursuant to Article 6(1)(c) and in the Statement of Objections regarding the electronic trading of EGBs, and therefore did not provide further comments on, nor challenged, the Commission’s preliminary view that the market for the provision of electronic EGB trading (and its possible D2C and D2D sub) is at least EEA-wide in scope.

3.2.3.3. The Commission’s assessment

A. The provision of electronic trading services for EGBs

(60) On the basis of the market investigation results and the evidence available to it, the Commission considers that the provision of electronic trading services for EGBs is at least EEA-wide in scope.

(61) The Commission takes this view for the following reasons.

(62) First, suppliers and customers of EGB trading services indicate that (i) the vast majority of customers are located in the EEA, although some customers also have trading desks located outside Europe, (ii) providers of EGB trading services are active in the EEA, some with a national footprint and others also outside the EEA, and (iii) suppliers typically set trading fees at EEA level, although global players may set their fees at the worldwide level.102

(63) Second, the Commission considers that the question of whether the geographic scope of electronic EGB trading services is EEA-wide or worldwide can be ultimately left open as it does not affect the Commission’s assessment.103 As indicated in Section 4.4.2 below, indeed, the Commission considers that the Transaction would not result in a significant impediment to effective competition due to horizontal effects regardless of whether the relevant geographic market is EEA-wide or worldwide.

B. The provision of trading services for other bonds than EGBs

(64) Based on the results of the market investigation and the evidence available to it, the Commission considers that the question of the precise geographic market definition for the provision of trading services for bonds other than EGBs can be left open. This is because the Transaction would not result in a significant impediment to effective competition under any of the plausible geographic market segmentation, namely regardless of whether the market for the trading of bonds other than EGBs, and its possible sub-segments (by issuer-type, trading channel, and execution method), is EEA-wide or worldwide.

3.2.4. Conclusion

(65) Based on the above and the evidence available to it, the Commission considers that there is a separate relevant market for the provision of electronic trading services of EGBs, which is possibly further segmented by trading channel (between D2C and D2D) and which is at least EEA-wide in scope. However, the Commission concludes that the question of whether the market for the provision of EGB trading services should be segmented by trading channel and/or should be defined as EEA-wide or global, can be ultimately left open for the purposes of this Decision because the Transaction would significantly impede effective competition due to horizontal concerns regardless of whether or not the market for the electronic provision of EGB trading services should be further segmented by trading channel and/or should be defined as EAA-wide or worldwide.

(66) In addition, based on the above and the evidence available to it, the Commission considers that the provision of trading services for bonds other than EGB is a separate market, which is possibly further segmented by issuer-type (between government bonds and non-governments), trading channel (between D2C and D2D), and execution method (between electronic and voice trading) which is EEA-wide or worldwide. However, the Commission concludes that the question of whether the market for the provision of trading services for non-EGB bonds should be segmented by issuer-type, trading channel, and execution method and/or should be defined as EEA-wide or global, can be ultimately left open for the purposes of this Decision because the Transaction does not significantly impede effective competition under any of these possible market segmentations.

3.3. Provision of Clearing Services for Cash Bonds

3.3.1. Relevant product market definition

3.3.1.1. Previous Commission decisions

(67) The Commission has previously considered the product market definition of the provision of clearing services for cash instruments and cash bonds in Deutsche Börse/NYSE Euronext,104 and Deutsche Börse/London Stock Exchange Group.105

(68) In Deutsche Börse/NYSE Euronext, the Commission considered whether clearing services for cash instruments (comprising securities and bonds) provided by CCPs form a separate product market, but ultimately left this question open.106

(69) In Deutsche Börse/London Stock Exchange Group, the Commission considered that clearing of bonds form a separate product market from CCP clearing of other asset classes,107 and that CCP clearing of bonds and other forms of "risk management" of bonds do not form part of the same market.108 In Deutsche Börse/London Stock Exchange Group, the Commission has further considered whether the product market of CCP cash bond clearing services should be further sub-segmented on the basis of the other potential segmentations, for example the type and liquidity of the bond (for example German government bonds) that is cleared or whether the bond that is cleared is traded D2D and D2C, but ultimately left this question open.109

3.3.1.2. The Notifying Party’s view

(70) The Notifying Party considers that it is not necessary for the Commission to reach a definitive view on the relevant product market for cash bond clearing given that the Transaction would not give rise to any horizontal or non-horizontal competition concerns on any plausible basis, in particular because generally only D2D government bond trades are cleared (in which Tradeweb’s position is very small).110

3.3.1.3. The Commission’s assessment

(71) On the basis of the market investigation results and the evidence available to it, the Commission considers that, for the purposes of this Decision, the provision of clearing services for cash bonds form a separate product market. The Commission further considers that the question of wether this market could be sub-segmented by trading channel (D2D versus D2C), or by type of issuer (e.g. government and non-government bonds) or by liquidity can be ultimately left open for the purposes of this Decision as the Transaction does not significantly impede effective competition (via vertical effects) irrespective of whether such sub-market should apply. The Commission takes this view for the following reasons.

(72) First, the Commission considers that CCP clearing of cash bonds should be analysed separately from CCP clearing of other asset classes such as cash equities.111

(73) The market investigation in this case did not provide any evidence casting doubt on the Commission’s previous findings that, from a demand-side perspective, customers' demand usually relates to the clearing of individual transactions, in this case of individual cash bonds transactions, pointing to the existence of a market limited to CCP clearing of cash bonds.

(74) Similarly, the market investigation in this case did not provide any evidence casting doubt on the Commission’s previous findings that, in relation to supply-side substitutability, certain elements indicate that the degree of supply-side substitutability between CCP clearing of cash bonds and CCP clearing of other asset classes is limited. First, clearing requires specific authorisations per asset class and depends on instrument specific expertise and technology, even if the basic infrastructure would appear to be common across financial instruments. In addition, clearing houses that offer one category of instruments are unlikely to start offering clearing services for another category of instruments within a relatively short time frame and without incurring significant investment costs (including building out workflow, creating or adapting a guarantee fund, devising risk models, purchasing underlying data, adopting or creating new IT systems, establishing connections, etc.). The market investigation also indicated that from a supply-side point of view, due to regulatory approval processes and technological requirements, CCPs active in one asset class need to invest 1-2 years and considerable expense in order to expand into another asset class.112 In addition, in view of the importance of clearing houses from a systemic risk point of view, launching a new clearing service also (and importantly) requires a detailed regulatory review. Obtaining the necessary approvals for a new clearing service (i.e. for a new asset class) therefore cannot be done swiftly.

(75) Second, the Commission considers that the question of whether the provision of cash bond clearing services should be segmented by trading channel and/or issuer type and/or liquidity can be ultimately left open for the purposes of this Decision as the Transaction does not significantly impede effective competition (via vertical effects).

(76) With respect to a potential segmentation by trading channel and/or issuer type, the Commission notes that the market investigation provided no elements that would contradict the Notifying Party’s statement that the vast majority of CCP activity for cash bonds clearing relates to D2D government bond trades (because D2D trades are typically conducted anonymously and dealers cannot identify the other counterparty to the trade to manage risk bilaterally), while D2C bond trades are almost entirely uncleared. In this regard, the Commission notes as well that, with regard to EGBs, the market investigation suggest that the vast majority of buy-side customers do not clear EGBs, but rather prefer to settle EGB trades bilaterally with their counterparty.113 In this context, the wider market for the clearing of bonds is equivalent or very similar to the narrower market for the clearing of D2D government bonds, and the potential segmentations of the bond clearing market by trading channel and/or issuer type appears of little relevance.

(77) Finally, with respect to a potential segmentation of the bond clearing market by liquidity of the bond, the Commission notes that the market investigation provided no elements that would contradict the Notifying Party’s view that such a market segmentation is not of particular relevance. In addition, as a subsidiary element, the Commission observes that as there is no measurement scale for liquidity, it seems difficult from a practical point of view to define clear cut categories encompassing various types of bonds based on their liquidity.

Conclusion

(78) Based on the above and the evidence available to it, the Commission concludes that the provision of CCP clearing services for cash bonds is a separate product market and considers that the question of whether cash bond clearing services should be segmented by trading channel or issuer type can be ultimately left open for the purposes of this Decision because the Transaction does not significantly impede effective competition (due to vertical effects) regardless of the precise market definition (i.e. of whether the market for bond clearing services forms a single market or should be segmented by trading channel or issuer or liquidity type).

3.3.2. Relevant geographic market definition

3.3.2.1. Previous Commission decisions

(79) The Commission has previously considered the geographic market definition of the provision of clearing services for cash instruments and cash bonds in Deutsche Börse/NYSE Euronext, 114 and Deutsche Börse/London Stock Exchange Group.115 In Deutsche Börse/NYSE Euronext, the Commission has considered whether the market of clearing services for cash instruments could be at least EEA-wide but ultimately left the market definition open.116 In Deutsche Börse/London Stock Exchange Group, the Commission concluded that the geographic market for cash bonds clearing services was EEA-wide, including because the market investigation showed that market participants generally purchase clearing services for bonds in the EEA.117

3.3.2.2. The Notifying Party’s view

(80) The Notifying Party considers that it is not necessary for the Commission to reach a definitive view on geographic market definition for the clearing of cash bonds as no (non-horizontal) competition concerns arise on any plausible basis.118

3.3.2.3. The Commission’s assessment

(81) On the basis of the market investigation results and the evidence available to it, and for the reasons detailed below, the Commission considers that, while the geographic market for bonds clearing, and its possible sub-segments by issuer type and liquidity and trading channel is likely EEA-wide, the question of whether the relevant geographic market for the provision of CCP clearing services for bonds is EEA-wide or broader (e.g. worldwide) in scope can be ultimately left open given that the Transaction does not significantly impede effective competition, due to vertical effects (input or customer foreclosure), regardless of whether the geographic market definition is EEA-wide or worldwide.

(82) The market investigation in this case did not yield any evidence that would contradict the Commission’s precedent findings that the geographic scope of the market for bonds clearing services is EEA-wide.

(83) With regard to clearing services in general, including but not limited to cash bonds, the majority of CCPs that responded to the market investigation indicate that they offer clearing services within the EEA and three CCPs (representing 27% of the respondents) indicate that they offer clearing services at worldwide level. In addition, these CCPs active at worldwide or EEA level also set clearing fees at worldwide or EEA-level.119 In terms of the competition constrains as viewed by competitors, a small majority of respondents consider that their CCP competitors are active at worldwide level.120

(84) With regard to EGB clearing, the CCPs that responded to the market investigation indicate that they do not provide clearing services for customers located outside the EEA,121 and that they set prices for EGB clearing at EEA level.122 In addition, when listing the companies that they consider to be the leading CCPs for EGBs, these CCPs listed European-based clearing houses, namely LCH, Eurex, Six, and CC&G.123

(85) Therefore, considering the demand and supply-side substitutability, the Commission considers that the geographic scope of the relevant market for the provision of trading services for bonds, and its possible sub-segments, is at least EEA-wide.

3.3.3. Conclusion

(86) Based on the above and the evidence available to it, the Commission considers that the provision of bond clearing services constitutes a separate product market, which can be segmented between the clearing of D2C and D2D-traded bonds. However, the Commission considers that the question whether the market for the provision of bond clearing services is segmented by trading channel (i.e. between the D2C and the D2D channels), or by issuer or liquidity type, and/or whether its scope is EEA-wide or worldwide, can be ultimately left open for the purposes of this Decision because the Commission’s conclusions that the Transaction does not significantly impede effective competition, due to vertical effects (customer and input foreclosure), would not change regardless of whether the market for the provision of bond clearing services is segmented by trading channel (i.e. between the D2C and the D2D channels), issuer or liquidity type and/or whether or not its scope is EEA-wide or worldwide.

3.4. Provision of Clearing Services for Repos

3.4.1. Relevant product market definition

3.4.1.1. Previous Commission decisions

(87) In Deutsche Börse/LSEG, the Commission analyzed the market for provision of trading and clearing services for repurchase agreements (repos).124 The Commission considered three possible segmentations between (i) general and specific repos, (ii) non-triparty and triparty repos; and (iii) ATS-traded and bilaterally traded (non-ATS) repos.

(88) First, The Commission concluded that ATS-traded repos form a product market which is distinct from the one comprising non-ATS repos.125 Second, the Commission decided that triparty repos and non-triparty repos are not part of the same product market.126

(89) With respect to ATS-traded triparty repos, the Commission noticed that the choice of collateral management is predetermined by where the repos is traded and thus, the Commission considered appropriate to examine these services as a bundle and belonging to the same product market.127 Similarly, the Commission considers that there is a market for bundles comprising ATS trading and CCP clearing for non-triparty repos. However, with respect to non-triparty repos, the Commission has not reached a decisive conclusion.128

(90) The Commission examined separately the markets for (i) ATS traded and CCP cleared non-triparty repos, and (ii) the market for ATS traded and CCP cleared triparty repos.129

3.4.1.2. The Notifying Party’s view

(91) The Notifying Party agrees with the segmentation between ATS traded and non-ATS traded repos.130 The Notifying Party agrees with the distinction between triparty and non-triparty repos.131

(92) Given the negligible presence of both Parties on the markets for non-ATS traded repos, the Notifying Party submits that the Commission does not need to consider further sub-segmentations into the market definition for non-ATS traded repos. According to the Notifying Party, the Parties’ presence in the market would remain limited on any plausible further segmentation of the non-ATS traded repos.132

3.4.1.3. The Commission’s assessment

(93) Based on the market investigation results and the evidence available to it, the Commission considers that the relevant product market is the provision for clearing services for repos, which is segmented between (i) non-triparty and triparty repos and (ii) ATS-traded and bilaterally traded (non-ATS) repos.

3.4.2. Relevant geographic market definition

3.4.2.1. Previous Commission decisions

(94) In Deutsche Börse/London Stock Exchange Group, the Commission considered that the relevant geographic scope of the markets for ATS traded repos is EEA-wide in scope.133

3.4.2.2. The Notifying Party’s view

(95) The Notifying Party agrees with the findings in the Commission’s precedents regarding the geographic market for ATS traded repos.134 The Notifying Party considers that the Commission does not need to reach a view on the geographic scope of the market for non-ATS traded repos, given the limited presence of the Parties in the non-ATS repos trading and clearing.135

3.4.2.3. The Commission’s assessment

(96) Based on the market investigation results and in line with the Notifying Party’s arguments and the previous decisions, the Commission considers that the geographic market for the clearing of repos and its sub-segments thereof is EEA-wide.

3.4.3. Conclusion

(97) In conclusion, the Commission considers that the provision of clearing services for repos forms a relevant product market, which is segmented between (i) non-triparty and triparty repos and (ii) ATS-traded and bilaterally traded (non-ATS) repos and is EEA-wide.

3.5. Provision of Trading Services for Financial derivatives

3.5.1. Introduction to the trading and clearing of derivatives

(98) Financial derivatives136 are bilateral contracts that do not transfer ownership of underlying financial assets but derive their value from such assets. Financial derivatives enable a transfer of risk between two counterparties without needing to invest in the underlying financial assets.

(99) There are different types of financial derivatives, such as equity derivatives, credit default swaps, FX derivatives, and IRDs. In the present case, the Transaction gives rise to vertically affected markets only with regard to IRDs and FX products. For this reason, only these two types of financial derivatives are described below.

Interest-rate derivatives

(100) Interest-rate derivatives, or IRDs, are contracts used to speculate on or hedge against a movement in interest rates, for instance by transforming a floating or variable interest-rate exposure to a fixed interest rate exposure or vice versa, depending on the respective trader’s position/risk to be insured.

(101) The main types of IRD contracts are options, futures/forwards and swaps. Options are contracts between two counterparties under which the option buyer acquires the right (against the payment of a premium), but not the obligation, to buy from, or sell to, the option seller a specific amount of the underlying asset at a specific "strike price" at or before a specified date.137 A future/forward is a contract between two counterparties under which the seller agrees to sell to the buyer a specified amount of the underlying asset (or its cash equivalent) at a specified future date at a price agreed at the time of the conclusion of the contract.138 A swap is an agreement between two counterparties to exchange a sequence of cash flows over a period of time, for example fixed or floating interest rates in the case of interest-rate swaps.139

(102) Options are traded on-exchange as well as OTC, while futures are only traded on-exchange, and forwards and swaps only OTC. Hence, there is a certain overlap of the distinction by type of contract and by execution environment (i.e. exchange-traded vs OTC discussed below).

(103) “On-exchange”-traded IRDs are usually traded through a CLOB trading protocol (see recital (22), in which case they are referred to as exchange-traded IRDs or “ETD IRDs”). In the context of IRDs, OTC can refer to two execution methods: (i) IRDs traded via voice, i.e. bilaterally between two counterparties, for example, in a phone call or chat conversation, or (ii) IRDs traded electronically via an MTF or OTF often via an RFQ trading protocol (see recital (22), above).

(104) The Parties are active in trading and clearing services for derivatives in several asset classes (equity derivatives, credit default swaps, FX derivatives and IRDs. While Refinitiv is active through Tradeweb offering OTC derivative trading services, LSEG offers only exchange-traded derivatives trading through its venues CurveGlobal and IDEM. At the clearing level, Refinitiv is not active. LSEG is active through LCH and Cassa di Compensazione e Garanzia (CC&G) in providing clearing services for both exchange-traded and OTC derivatives in the asset classes mentioned above.

Foreign exchange products

(105) FX products refer to various contracts, which are traded and possibly cleared, for the exchange of currency pairs whose payoff depends on the foreign exchange rate(s) of two (or more) currencies over time. FX products can be used for a number of reasons, e.g., to obtain currency, to provide exposure or hedge against risk with respect to changes in exchange rates over time, or for investment purposes. The most common FX products are spots, swaps, forwards, non-deliverable forwards (NDFs), futures and options.140

(106) FX contracts can be traded either on an exchange or OTC but the majority of FX trading takes place OTC. Most FX products are available for OTC trading; only futures and a small volume of options are traded on exchange; and market demand for exchange-traded FX products is very limited relative to OTC products. According to the Notifying Party, the daily average turnover of FX products traded OTC exceeded EUR 5.7 trillion between April 2016 and April 2019, while only EUR 0.1 trillion was traded on exchange in the same period (i.e. less than 2%).141

(107) With regard to the Parties’ activities in FX products, Refinitiv is active upstream in trading through FXall (for D2C FX trades) and Matching (for D2D FX trades) and LSEG is active downstream in clearing through LCH’s ForexClear (for OTC-traded FX products). As such, the Transaction gives rise to a vertically affected market regarding the trading and clearing of OTC FX products. As neither LSEG nor Refinitiv offers exchange-traded FX products or clearing services for such products, there is no horizontal overlap or non-horizontal relationship between the Parties in relation to exchange-traded FX products.

3.5.2. Provision of trading services for over-the-counter interest-rate derivatives

3.5.2.1. Relevant product market definition

A. Previous Commission decisions

(108) In past decisions, the Commission considered that the provision of trading services for derivative contracts can be distinguished based on underlying asset classes, execution environment, and types of contracts.142

(109) First, regarding the type of underlying variable or asset, the Commission considered that trading services for derivatives can be categorised into trading services for equity derivatives (single stock or index based), interest rate derivatives (“IRDs”), currency derivatives, commodity derivatives, credit derivatives, and foreign exchange (“FX”) derivatives.143 In the present case, the Commission’s investigation focuses on the trading services for IRDs, which is the only type of derivatives where the Transaction raises (vertical) concerns or results in an affected market.

(110) Second, the Commission previously identified separate relevant product markets for the provision of trading services for derivatives on exchanges (i.e. exchange-traded or “ETD” derivatives) and the trading of derivatives over-the-counter (i.e. “OTC” derivatives) in view, in particular, of their different characteristics144 and different applicable legal framework.145 In the present case, the Commission’s investigation focuses on the provision of trading services for OTC IRDs, which is the only execution environment where the Transaction significantly impede effective competition due to vertical effects (customer foreclosure), or results in an affected market.146

(111) Third, the Commission previously segmented the provision of trading services for derivatives according to the types of contracts and considered that trading services for swaps147 are part of a distinct product market from trading services for options148 and futures/forwards,149 although it left open whether trading services for futures and for options comprise separate markets as well.150

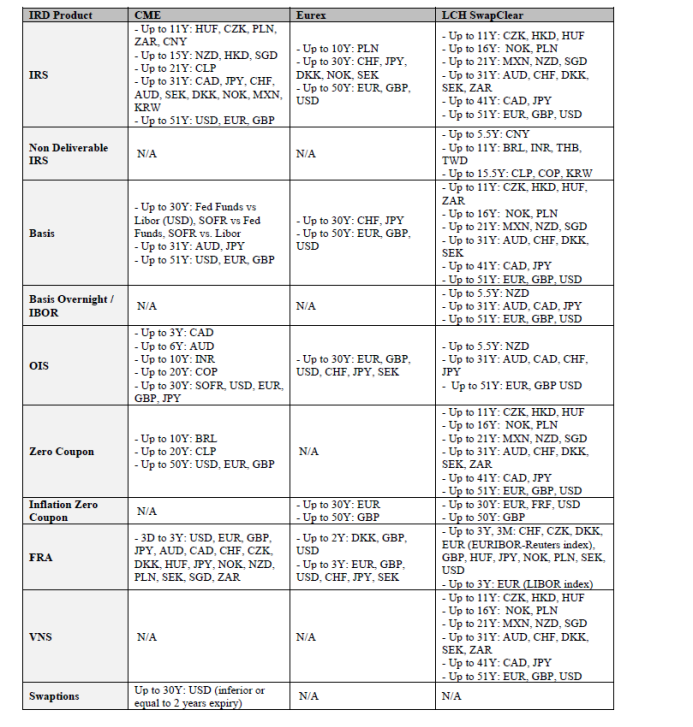

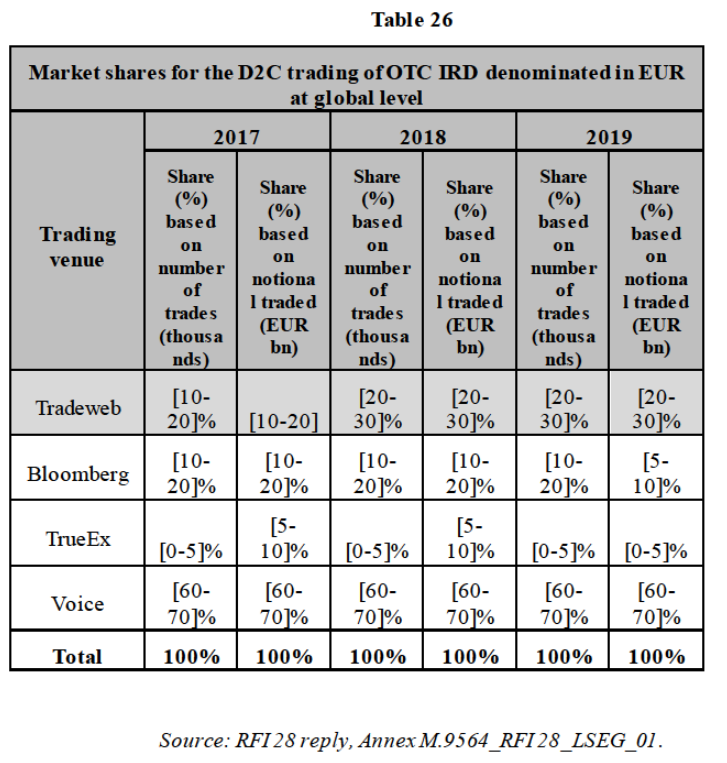

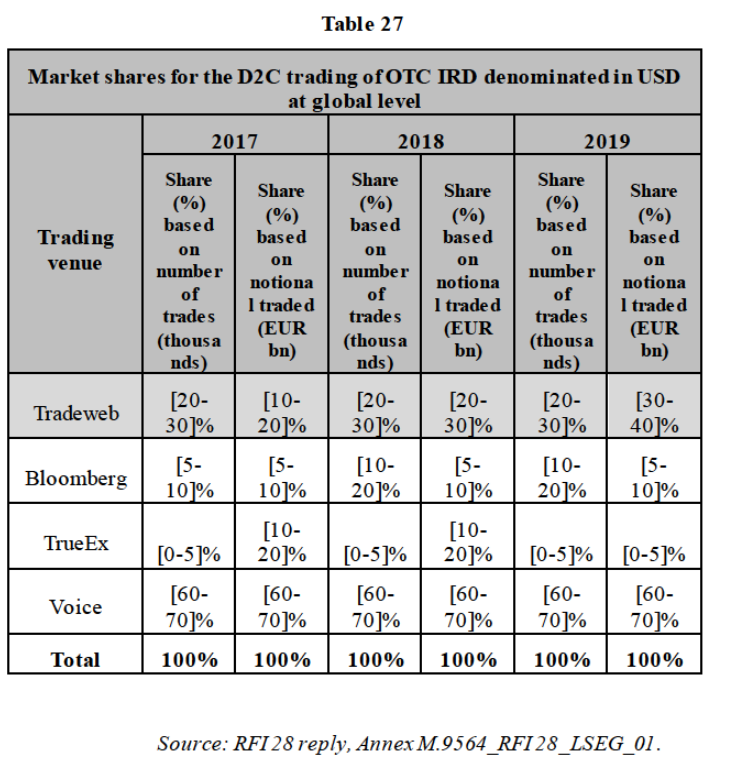

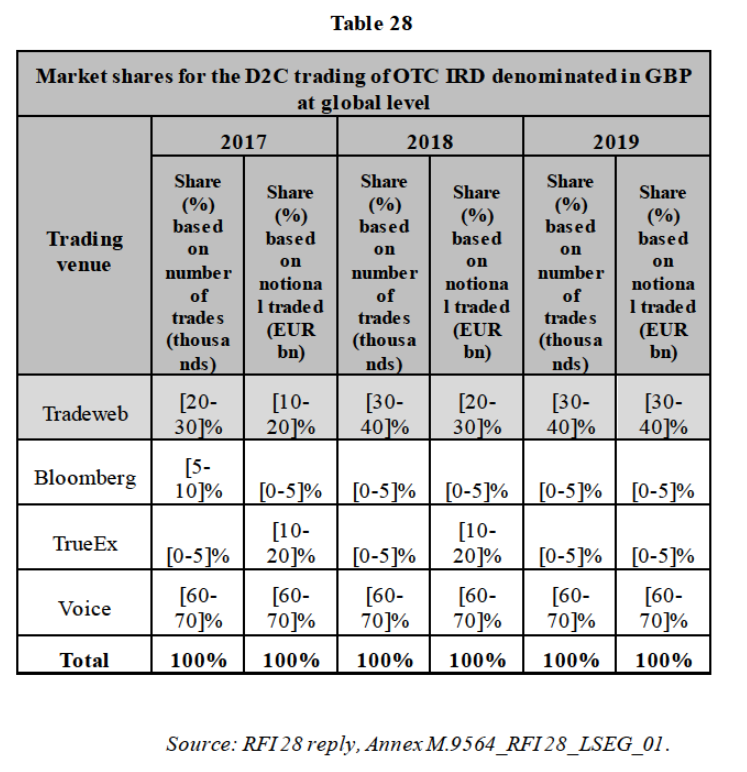

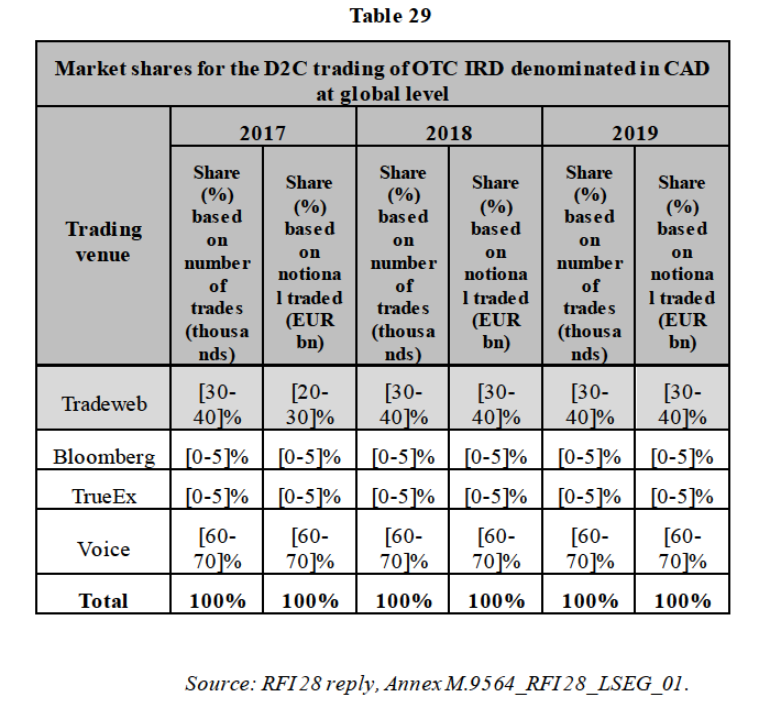

(112) Fourth, the Commission considered in past decisions that, within the provision of trading services for exchange-traded IRDs, currency was a differentiating factor determining separate product markets.151 The Commission did not previously assess this possible sub-segmentation in the context of OTC IRDs specifically.

(113) Lastly, in its prior decisional practice, the Commission has not considered whether the relevant product market for the provision of trading services for IRDs, be it exchange-traded or OTC IRDs, should be further segmented based on the trading channel (D2C and D2D).152

B. The Notifying Party’s view

(114) At the outset, it should be noted that the Notifying Party provided its view on the product market definition of IRD trading exclusively in the Form CO.153 It did not challenge, in its response to the decision pursuant to Article 6(1)(c),154 the Commission’s preliminary view that the provision of OTC IRD trading was a separate product market that could be further sub-segmented by execution environment, trading channel, and type of contract and/or currency traded.155

(115) In the Form CO, the Notifying Party indicates that it considers that the provision of trading services for OTC IRDs forms a separate product market, which can be segmented by trading channel.

(116) First, the Notifying Party indicates that it agrees with the Commission’s previous distinctions based on underlying asset class156 and execution environment.157 It therefore considers that the trading of OTC IRDs constitute a separate product market.

(117) Second, the Notifying Party indicates that, as regards OTC IRD trading services, a further distinction exists between D2D and D2C venues,158 in particular because venues compete with each other in each of these trading channels but not across them.159 It adds that venues are specifically dedicated to either D2C or D2D and, even where some providers (e.g. Tradition’s Trad-X, Tradeweb/Dealerweb) offer trading services in both trading channels, these require distinct and specific functionalities (e.g. D2C venues require pre-trade credit checks).160 The Notifying Party also considers that venues belonging to each trading channel serve a different purpose and attract different customers, in particular because they operate different trading protocols. The D2D venues generally offer CLOB trading services, which provide a more anonymous method of trading, while D2C venues generally offer RFQ functionalities, which do not offer anonymity to the liquidity takers and makers.161

(118) In addition, the Notifying Party explains that, although a venue such as Dealerweb permits buy-side customers to trade on its (D2D) venue, a buy-side would prefer to trade through a D2C platform for the following reasons.162 First, some buy-side customers may lack the necessary expertise to achieve their desired outcome on a D2D venue. In the Notifying Party’s view, because D2D platforms typically offer more standardised products than D2C venues, a buy-side willing to trade a tailor-made OTC IRD trade may have to take positions in a package of more standardised OTC IRD contracts, which would require an analytic expertise that some buy-side customers may lack. Second, buy-side firms would typically want to trade on a fully disclosed basis with their chosen liquidity providers with which they have a long-term relationship (while D2D venues provides anonymity in this regard).

(119) Third, the Notifying Party disagrees with a segmentation of the OTC IRD trading market by type of contract and/or currency.163 It submits that OTC IRD trading venues normally offer trading services for a broad range of products. In addition, customers of IRD trading services use the various types of OTC IRDs for the same purpose, i.e. as bespoke investment products and tailored hedging instruments, in order to transform rate exposure based on their views of the likely development of rates.

(120) Fourth, the Notifying Party indicates that a distinction by regulatory regime (e.g. US SEF, trading obligation under MiFIR164 / no trading obligation under MiFIR) is not appropriate.165 In the Notifying Party’s view, the fact that a market segmentation based on whether customers have a regulatory obligation to trade certain IRDs on an SEF or MTF is not appropriate is evidenced by Tradeweb’s pricing, which is the same for mandated and non-mandated IRDs, and the Notifying Party’s view that an increase of mandated IRD trading prices would result in an increase of non-mandated IRD trading.166 In addition, the Notifying Party considers that market participants themselves do not decide their trading or investment strategy based on whether a particular IRD is subject to the mandatory trading obligation or not (but rather based on their overall hedging and/or investment objectives).167 The Notifying Party further considers that a segmentation of mandated IRDs based on the regulatory authorisation of the venue (e.g. an MTF in the EEA or a SEF in the US) is also not appropriate as mandated IRDs can be traded on a RM, MTF or OTF in Europe or on a SEF in the US, in light of the equivalence granted in this respect.168 The Notifying Party further considers that the Commission does not need to reach a view on segmentations by trading channel or regulatory regime as no concerns arise regardless of those segmentations.

(121) Fifth, regarding the possible segmentation by execution method, between trades executed on an electronic platform or bilaterally, the Notifying Party comments that an electronic only market would be “putative” but that “there are no non-horizontal concerns even on a putative ‘electronic only’ segmentation”.169

(122) The Notifying Party considers that ultimately it is not necessary for the Commission to reach a definitive view on whether the OTC IRD trading market should be further segmented (i.e. by trading channel, type of derivative, or regulatory regime applicable to the trading venue), as no material competition concerns would arise on either basis.

C. The Commission’s assessment

(123) On the basis of the market investigation results and the evidence available to it, and for the reasons explained in this Section, the Commission concludes that the provision of OTC IRD trading services constitute a separate product market, which is segmented by trading channel (i.e. that the provision of trading services for D2C OTC IRD trades constitutes a separate market from the provision of trading services for D2D OTC IRD trades), and is global in scope. However, the Commission concludes that the question of whether the market for the provision of OTC IRD trading services is segmented by (i) trading channel (i.e. D2C versus D2D), (ii) by the execution method (i.e. through an electronic venue versus bilaterally via voice outside of an electronic venue), and/or (iii) by the type of IRD contract and/or currency traded can be ultimately left open for the purposes of this Decision because the Transaction would significantly impeded effective competition due to vertical effects (customer foreclosure) regardless of whether or not the market for the provision of OTC IRD trading services is segmented by trading channel, execution method, and/or type of contract or currency traded.

(124) At the outset, the Commission notes that the results of the market investigation are in line with the Commission’s precedents regarding the segmentation based on underlying asset class and execution environment according to which the trading of OTC IRDs would be a separate market.170 The Commission therefore considers that the provision of trading services for OTC IRDs constitutes a separate product market (e.g. from the provision of trading services for other types of derivatives or from the provision of trading services for exchange-traded derivatives).

Distinction by trading channel

(125) Based on the evidence on file, and for the reasons explained below, the Commission considers that the market for the provision of trading services for OTC IRDs is segmented by trading channel, therefore distinguishing the provision of (i) D2C and of (ii) D2D OTC IRD trading services. The question of whether or not the market for the provision of trading services for OTC IRDs is segmented between the D2C and the D2D channel can however be ultimately left open as the Transaction would significantly impede effective competition due to vertical effects (customer foreclosure) regardless of whether or not the market for the provision of OTC IRD trading services is segmented by trading channel.

(126) First, in order to assess whether a segmentation of the OTC IRD trading market by trading channel is relevant, the Commission assessed the demand-side substitutability between the provision of D2C and D2D trading services. In line with the Commission Notice on the definition of the relevant market, this assessment “entails a determination of the range of products which are viewed as substitutes by the consumer”.171

(127) At the outset, the Commission notes that by definition D2C and D2D trades are not in themselves substitutable for customers given that D2C trades take place between a dealer and its client, while D2D trades occur between two dealers, who do not have a provider/client relationship. As such, there is no demand-side substitutability between these two types of OTC IRD trades. However, the Commission assessed whether the provision of trading services for OTC IRDs in the D2C and D2D channels (e.g. between trading venues focusing on the execution of D2C trades and trading venues focusing on the execution of D2D trades) are substitutable from the perspective of customers. For the reasons explained below, the Commission’s in-depth investigation indicates that, while there is a degree of demand-side substitutability between the D2C and D2D trading channels from the perspective of dealers (i.e. the sell-side), the demand-side substitutability between the D2C and D2 channels is limited from the perspective of customers (i.e. the buy-side).

(128) Firstly, in order to assess the demand-side substitutability from the perspective of clients (i.e., the buy-side), the Commission considered whether customers execute D2C trades on D2D venues. In this regard, only three buy-side customers who responded to the market investigation indicate to have access to some D2D trading venues (this amounts to 10% of the responding customers).172 The vast majority of buy-side customers, namely 77% of them, indicate that as a price taker they do not have access to D2D trading venues.173 This indicates that demand-side substitutability between the D2C and D2D trading channels is very limited from the perspective of the clients (i.e. the buy-side). This is an important element given that, for the D2C trading channel, it is usually the client (i.e. the buy-side) who decides where to trade. In this regard, Rabobank explains: “Clients decide where to trade. Rabobank just follows what client preference”.174 Similarly, BBVA adds: “Our clients decide if they execute a trade electronically or by voice. We don't have the chance of choosing the channel for the D2C activity”.175

(129) Secondly, in order to assess the demand-side substitutability from the perspective of dealers (i.e., the sell-side), the Commission considered whether customers execute D2D trades on D2C venues. The results of the market investigation evidence that D2D trades can occur on D2C venues.176 A majority of sell-side customers indeed indicate that they execute D2D trades on D2C venues: 41% of sell-side customers explain that they do so “frequently” and 36% of them explains that they do so, but “rarely”.177 Rabobank explains for instance that: “We as Rabobank Markets onboard all types of clients in Bloomberg and Tradeweb. We make no split in between D2D or D2C”. 178

(130) More specifically, feedback from the market investigation indicate that D2D trades are executed on D2C venues when a dealer is a small bank, to trade an OTC IRD trade subject to the trading obligation, or when dealers process a trade that was agreed by voice. For instance, Société Générale explains that it executes D2D trades on D2C venues for the following reason: “Regulatory requirement (interbank trades which have to go through D2C venues because subject to the Trading Obligation)”.179 In addition, Lloyds Banking Group Plc indicates that “Market making desks are prohibited from acting as a client on D2C venues in Europe so are prohibited from launching RFQ’s to another market maker. D2C venues are, however, frequently used for confirming voice trades done in the interbank market as “process” trades”.180 J.P. Morgan also explains that “[s]ome smaller dealers are often considered clients”.181 These elements tend to show that there is a certain degree of demand-side substitutability between the D2C and D2D trading channels from the perspective of dealers (i.e. the sell-side) for certain trades, in particular trades subject to the trading obligation and trades with small dealers than they consider as clients).

(131) Thirdly, and subsidiarily, the Commission assessed which market players are considered by customers as closely competing with the Tradeweb and Dealerweb. Customers who responded to the market investigation generally mention D2C trading venues as being close competitors to Tradeweb (a D2C venue) and D2D trading venues as being close competitors to Dealerweb (a D2D venue).182 While taken in isolation this element indicates that venues in each trading channel primarily compete against each other, it is insufficient alone to prove that the D2C and D2D trading channels are not substitutable, and thus do not belong to the same relevant product market.

(132) Second, in order to assess whether a segmentation of the OTC IRD trading market by trading channel is relevant, the Commission assessed the supply-side substitutability between the provision of D2C and D2D trading services. In line with the Commission Notice on the definition of the relevant market, supply-side substitutability assessment “may also be taken into account when defining markets in those situations in which its effects are equivalent to those of demand substitution in terms of effectiveness and immediacy. This means that suppliers are able to switch production to the relevant products and market them in the short term (4) without incurring significant additional costs or risks in response to small and permanent changes in relative prices”.183

(133) Firstly, the Commission assessed whether venues active in OTC IRD trading focus on one of the two trading channels. The results of the market investigation indicate that it is the case: suppliers of OTC IRD trading services generally focus on one trading channel, either the D2C or the D2D. For instance, Tradeweb and Bloomberg focus on the D2C trading channel while BGC, TPICAP, and Dealerweb focus on the D2D trading channel.

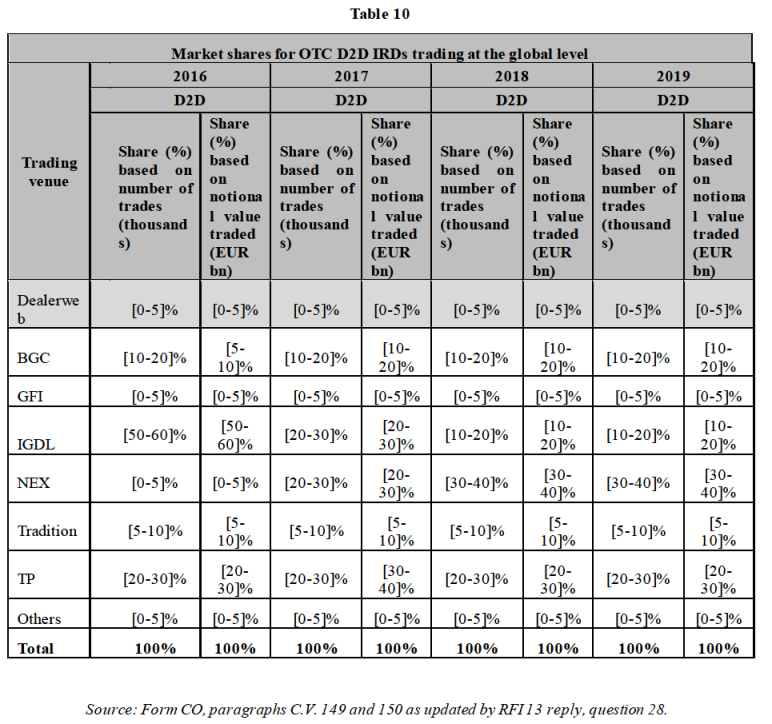

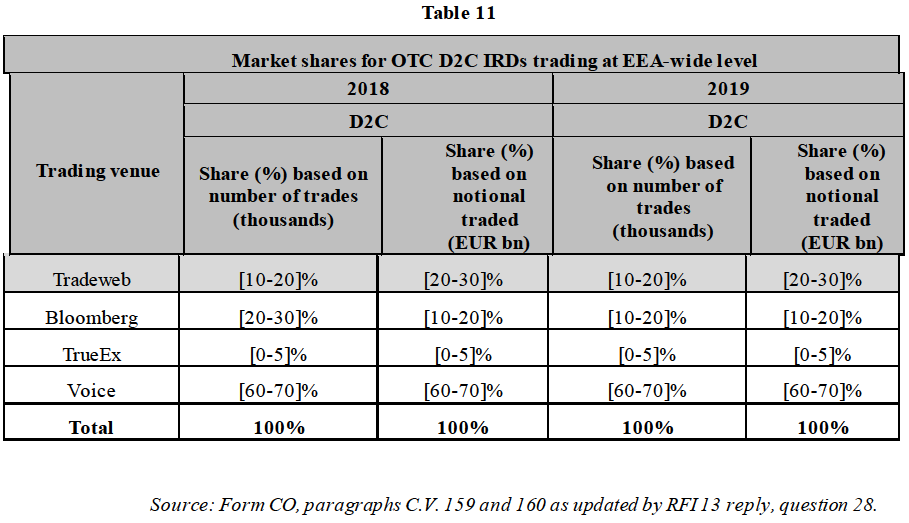

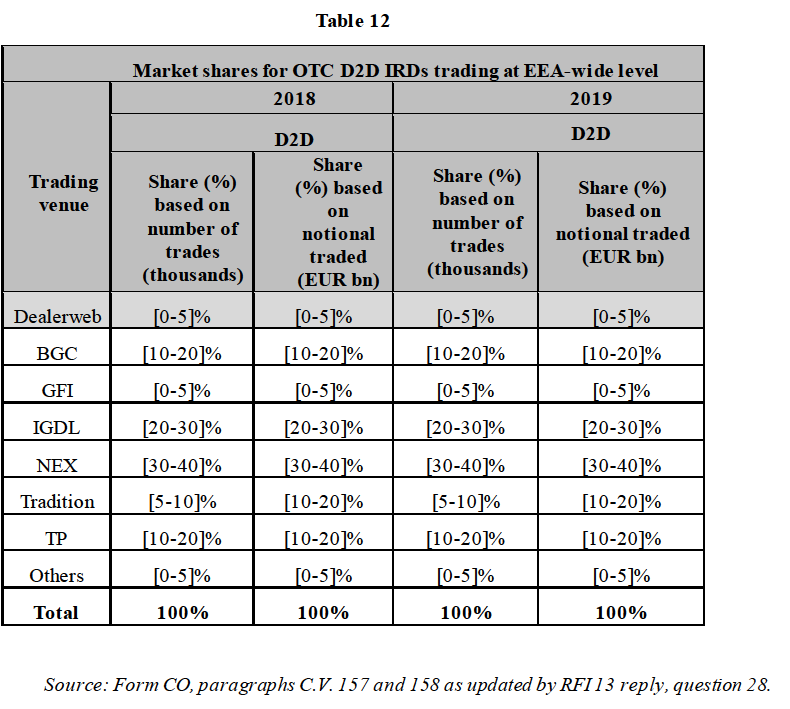

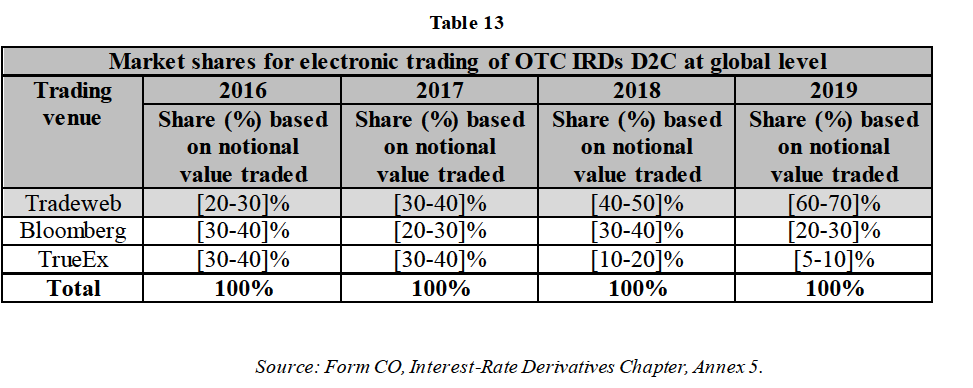

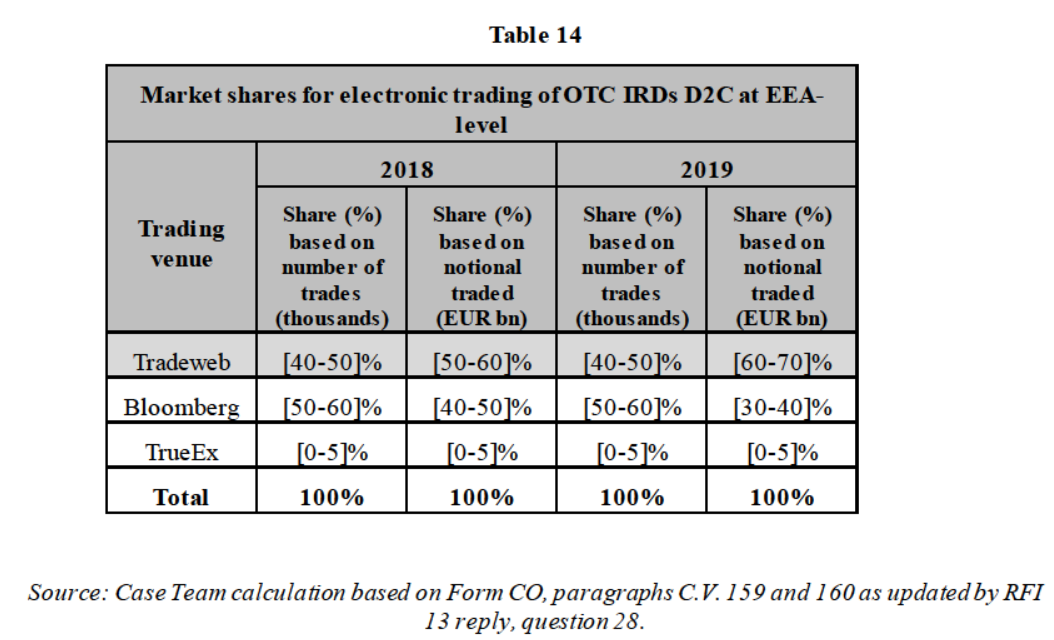

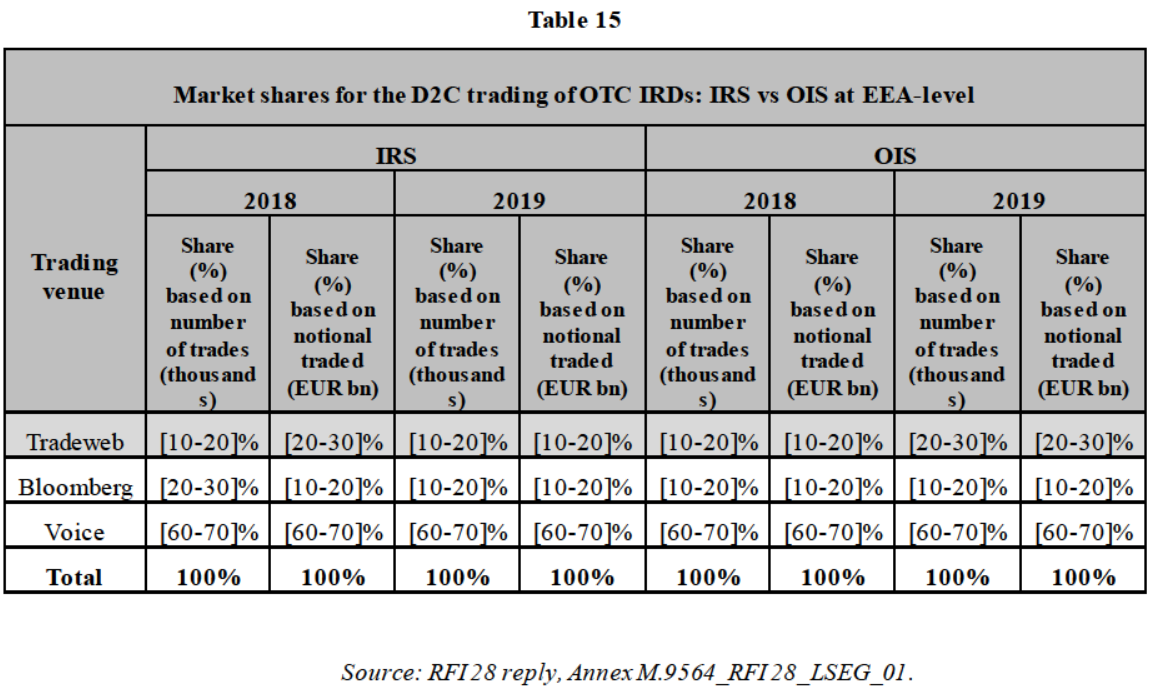

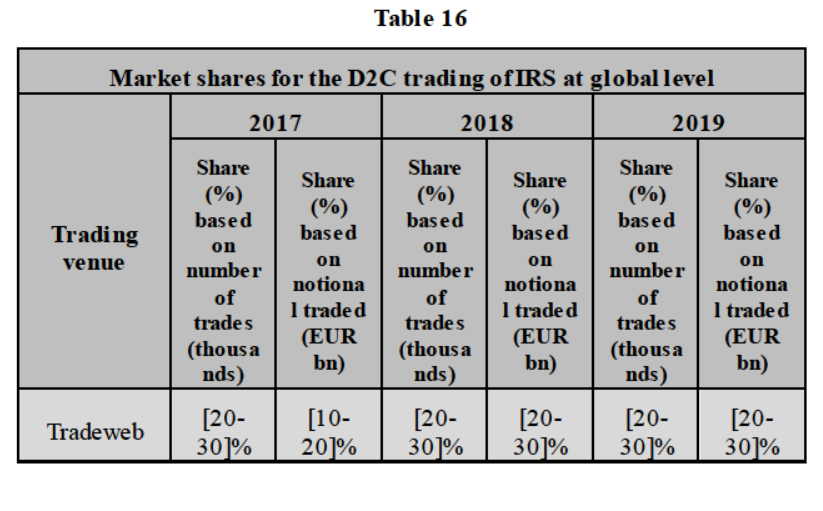

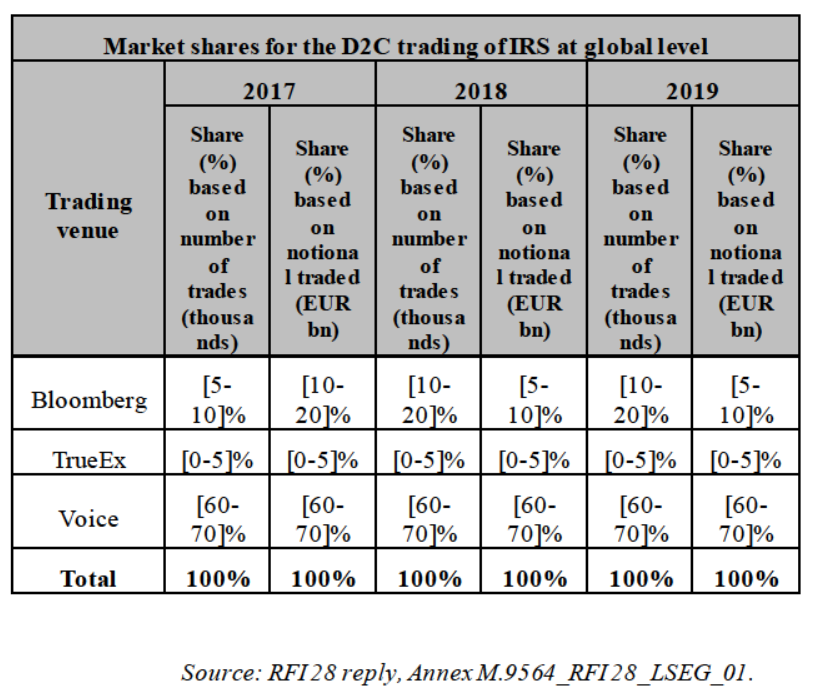

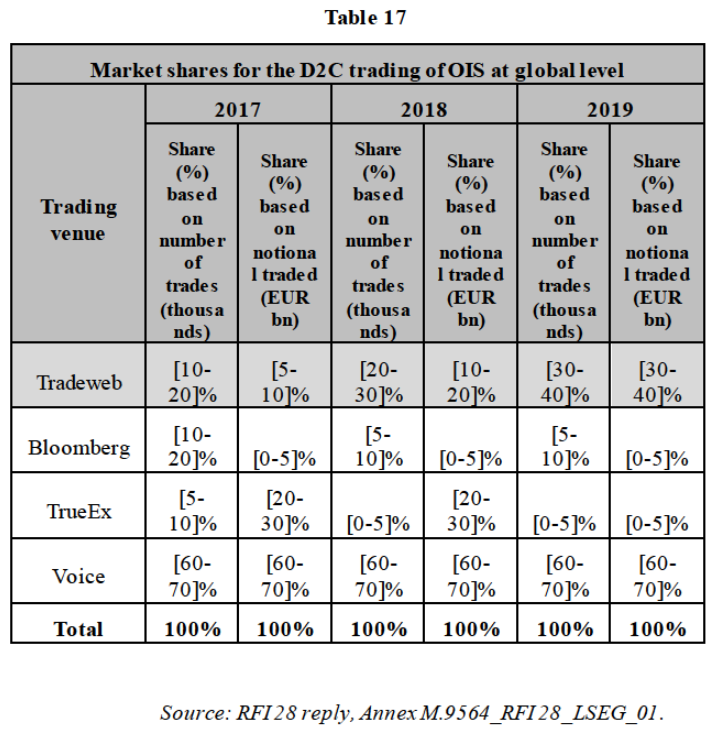

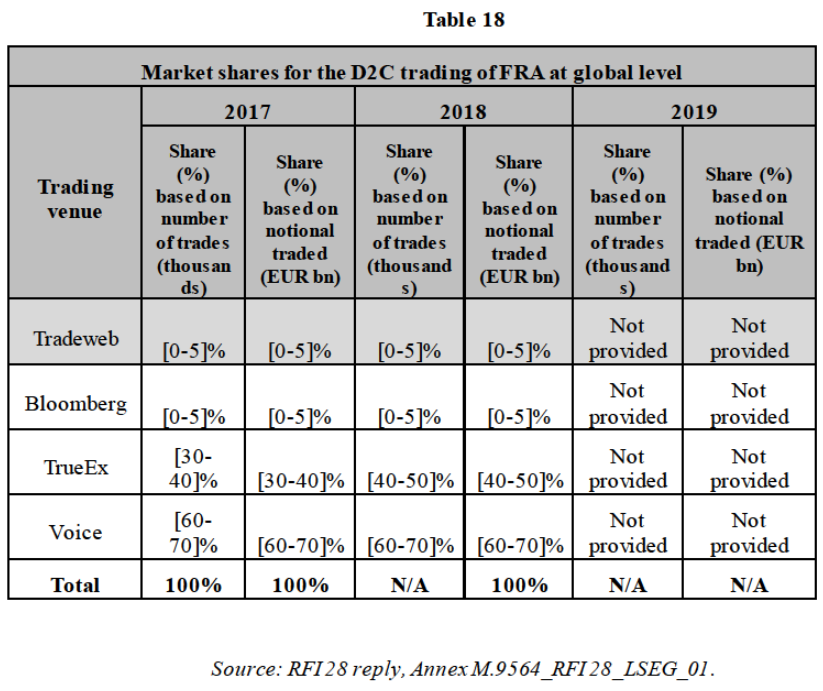

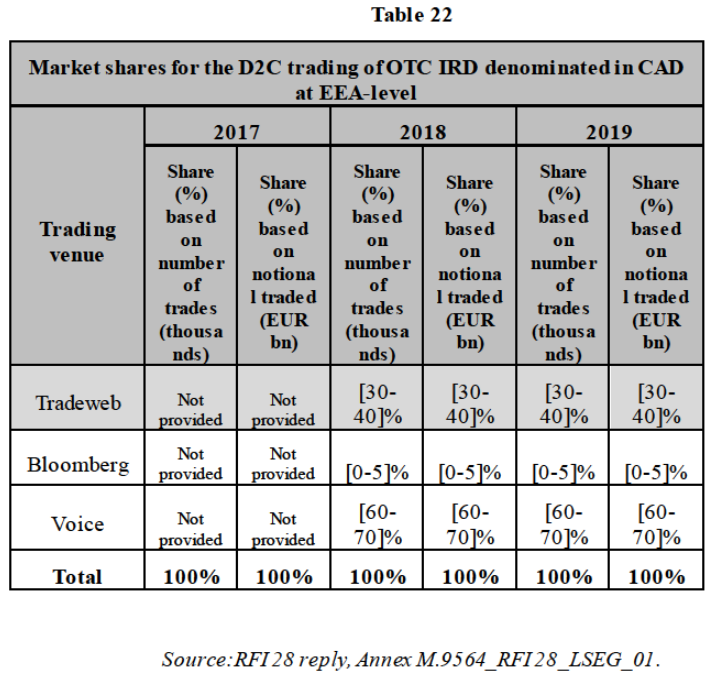

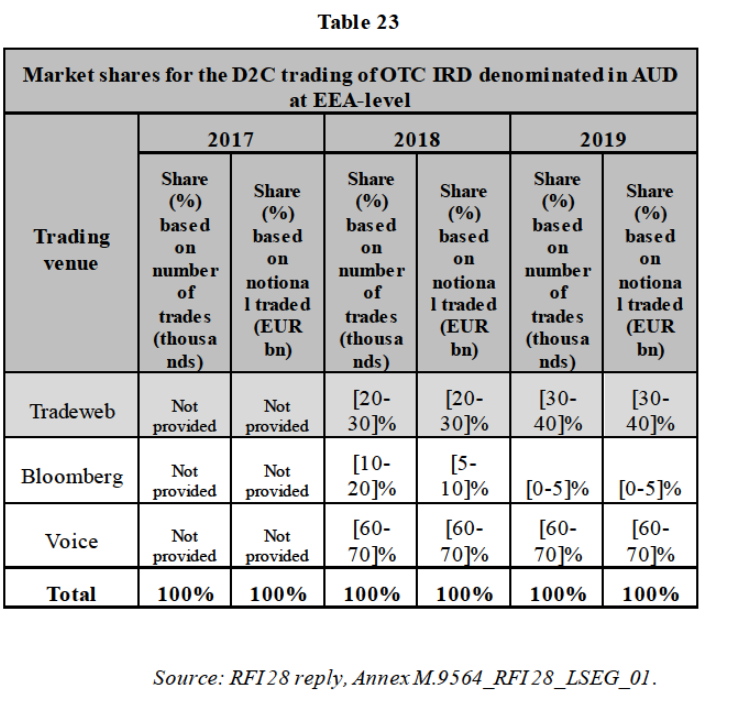

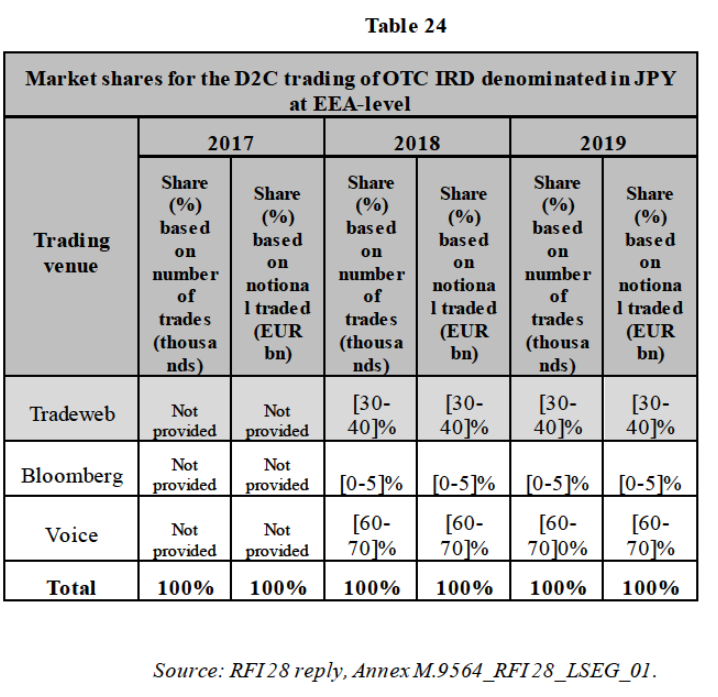

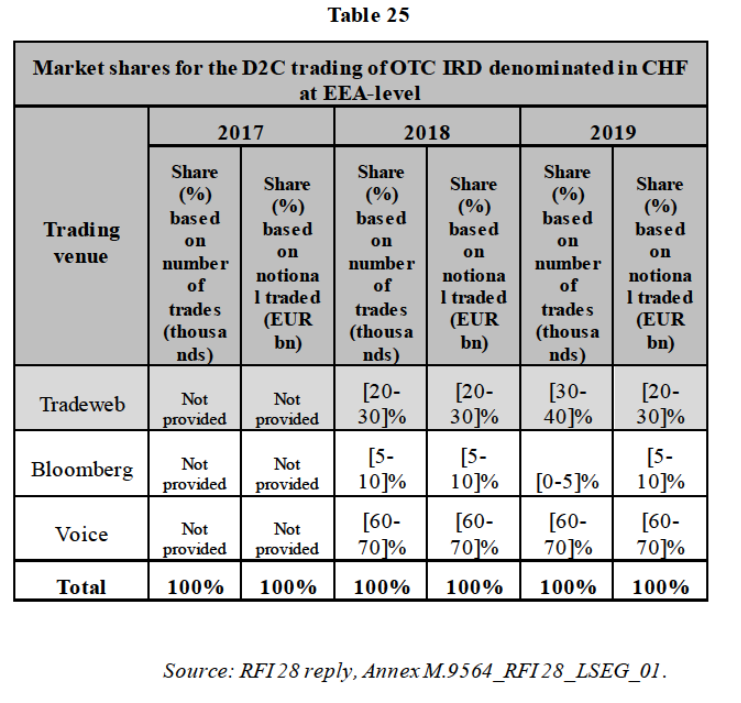

(134) Secondly, the Commission assessed whether trading venues focusing on D2D (so-called “D2D venues”) provide trading services for D2C trades. The Commission notes that it is the case for Tradition’s Trad-X184 and Tradeweb’s Dealerweb,185 which offer their services for both D2C and D2D trades. With regard to Tradition, Trad-X’s offering for D2C trades is a recent market development. While Trad-X has been active in D2D OTC derivatives since 2011, as part of Tradition,186 it has introduced in January 2020 a D2C functionality (CLOB) for D2C trades of OTC IRDs.187 The fact that two so-called “D2D” venues offer D2C trading services shows that there is a degree of supply-side substitutability between the D2C and D2D trading channels, although it is important to note that these two trading venues represent only a small share of the D2D segment (less than [0-5]% based on number of trades (thousands) and less than [0-5]% based on notional value traded according to Table 11). The recent expansion of Trad-X to D2C trades is also an element taken into account by the Commission. However, this element is not sufficiently probative, in particular as it does not provide an indication of the cost (in time and money) that a so-called D2D trading venue would incur in order to start providing D2C OTC IRD services and to obtain a sufficient liquidity.

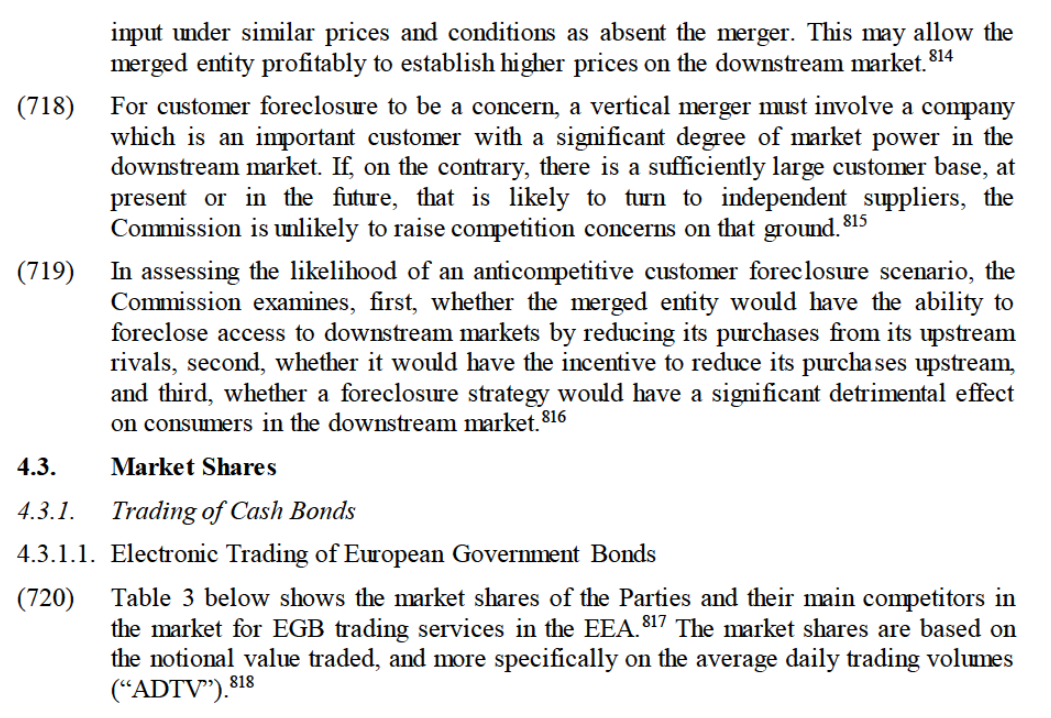

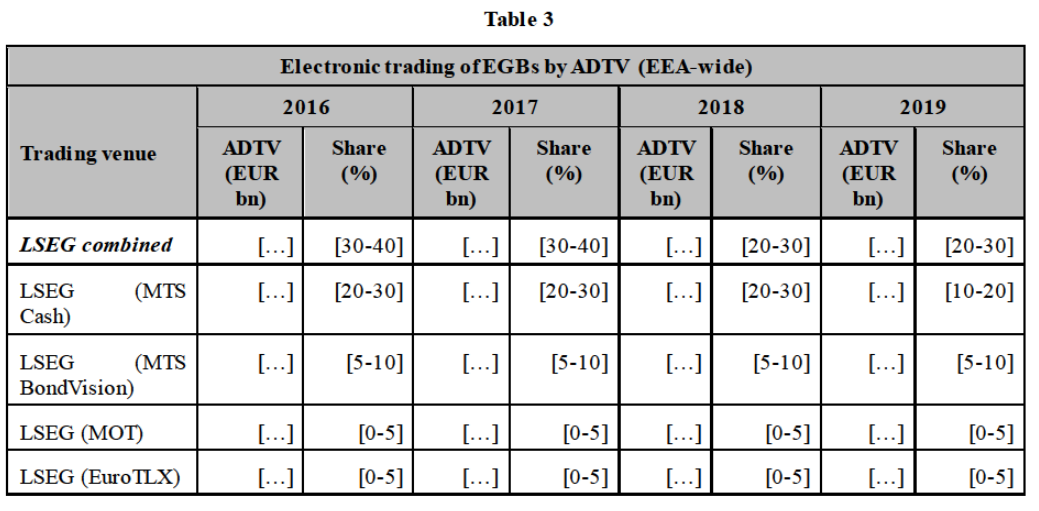

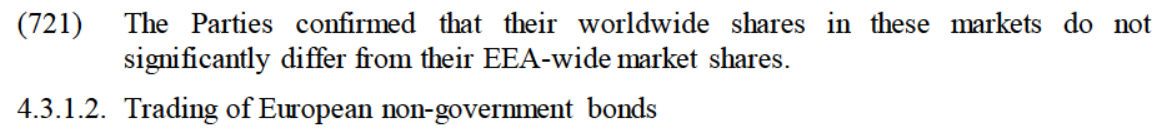

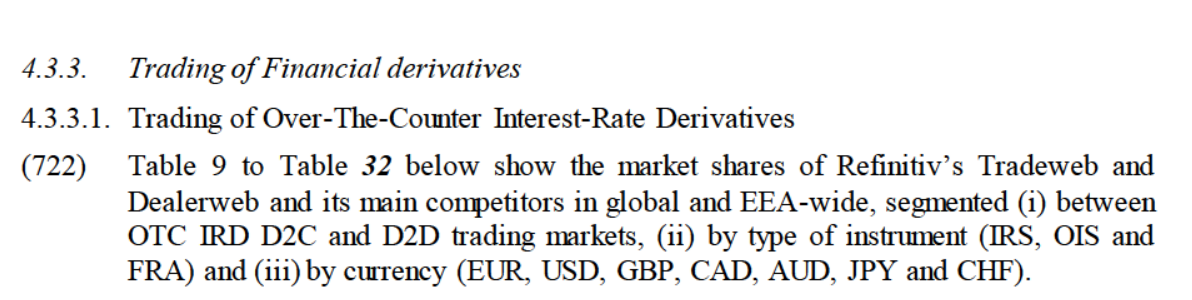

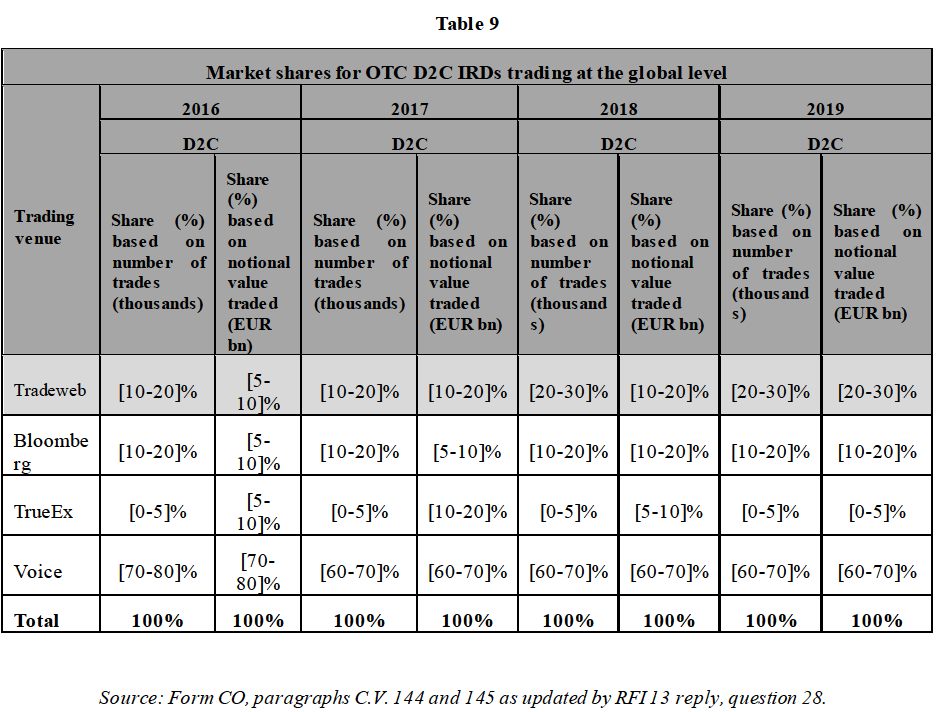

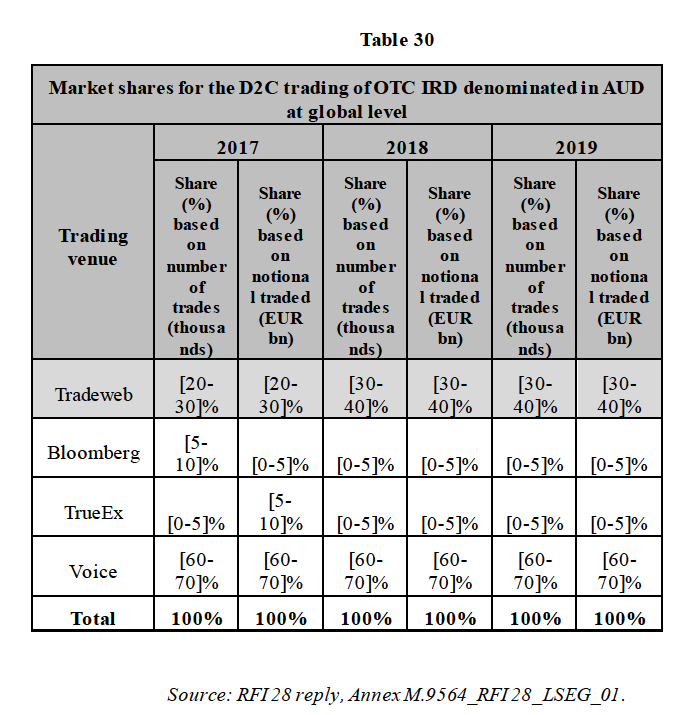

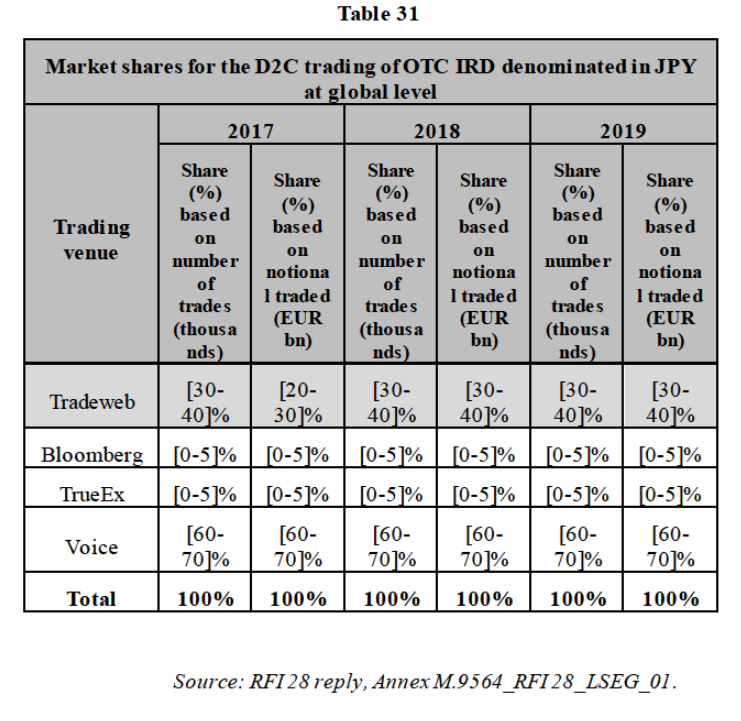

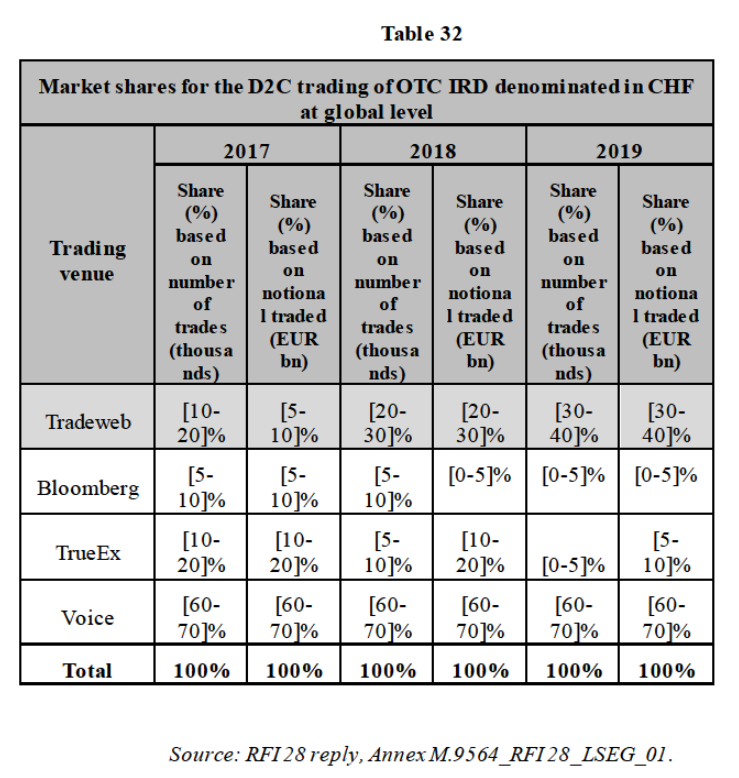

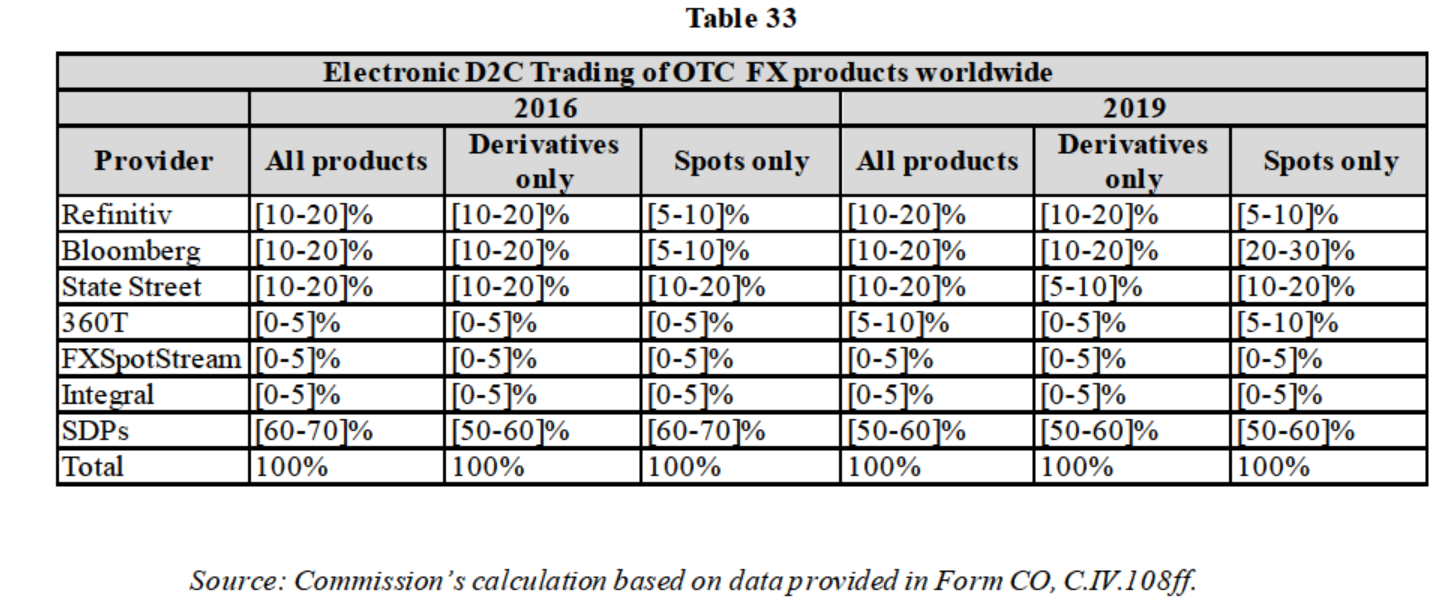

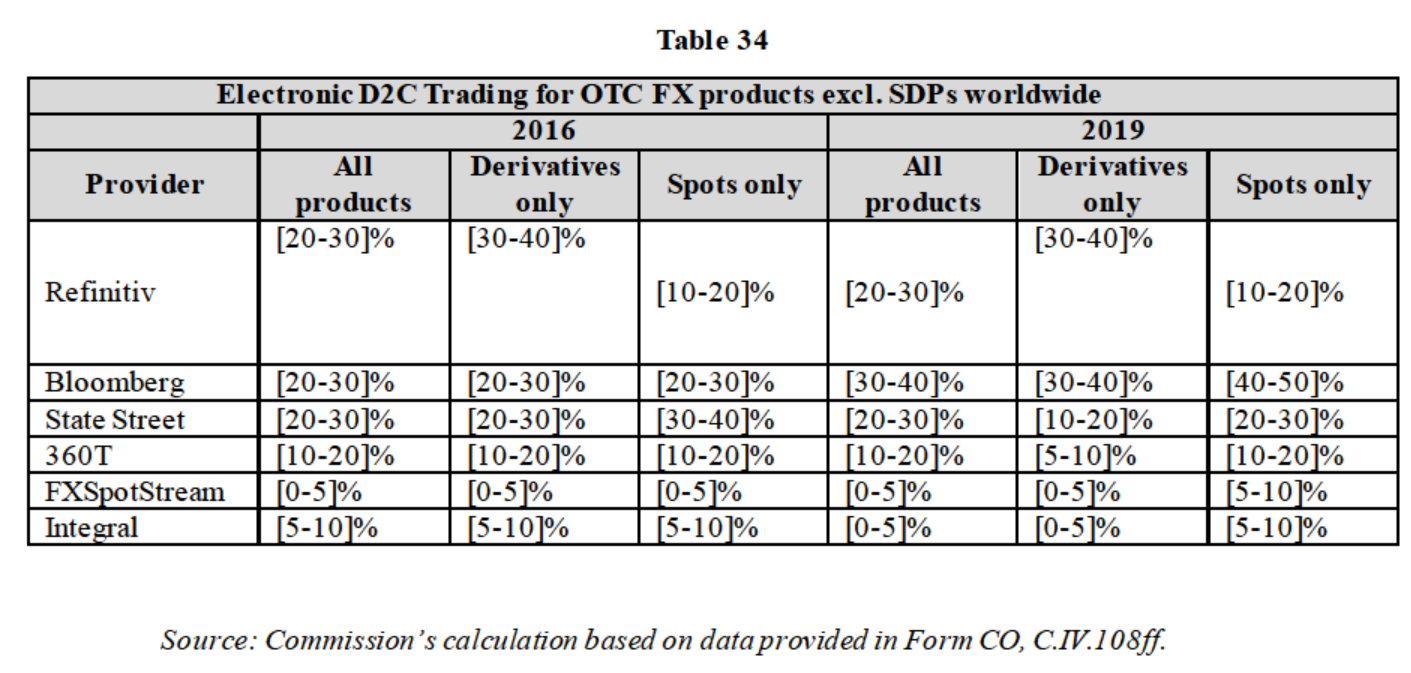

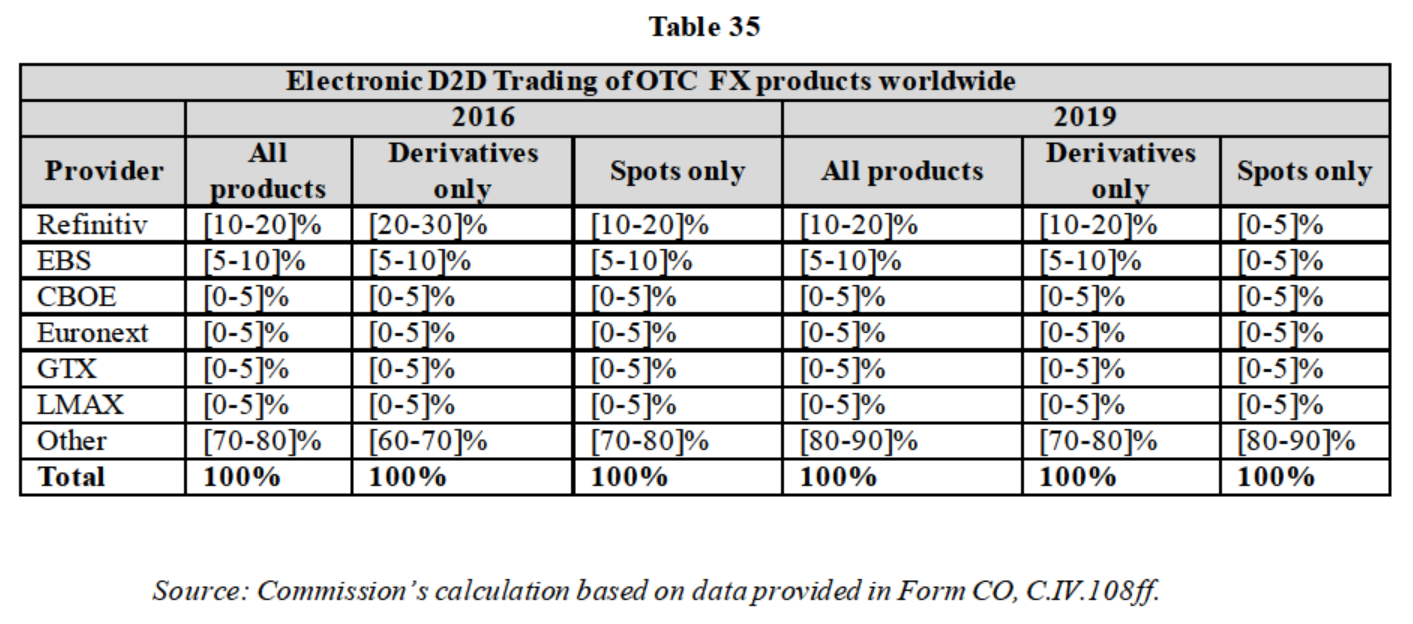

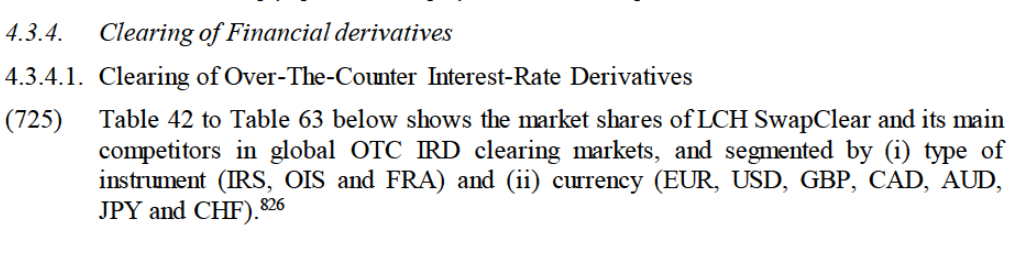

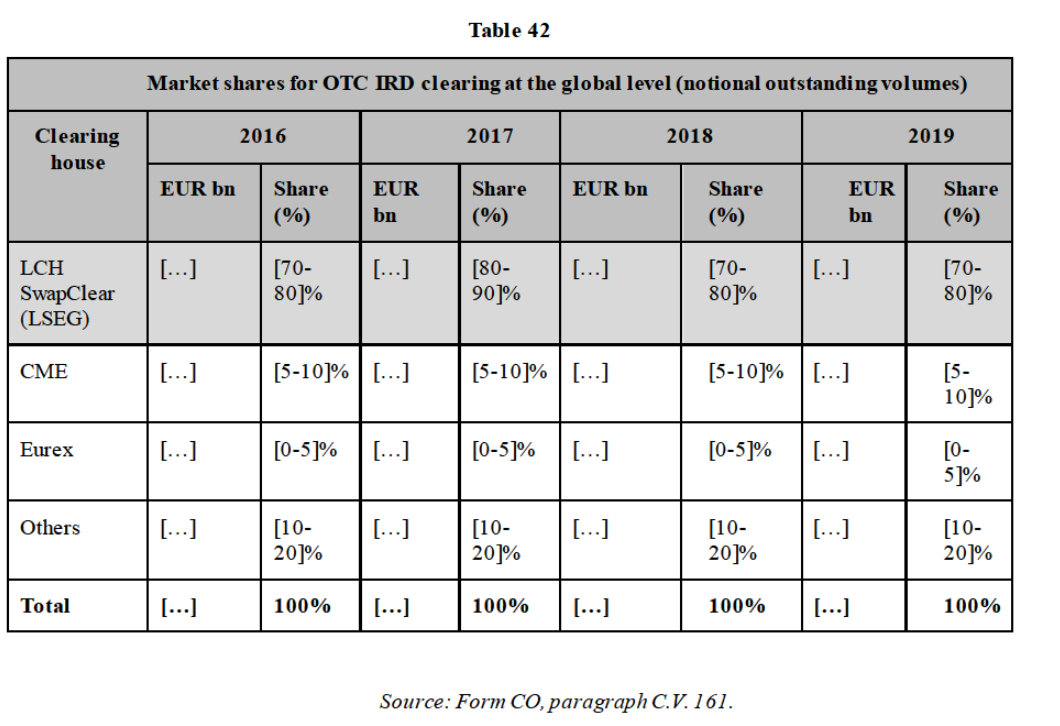

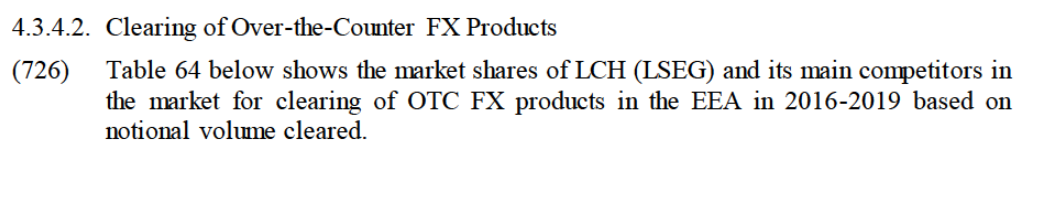

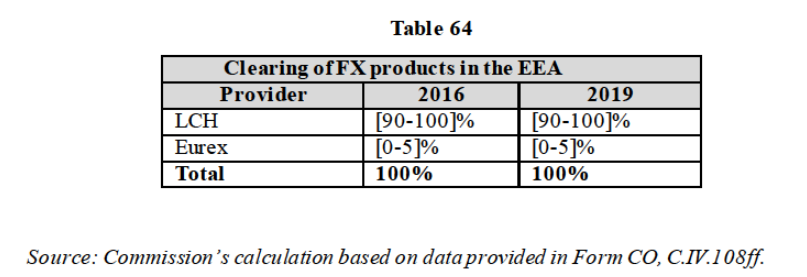

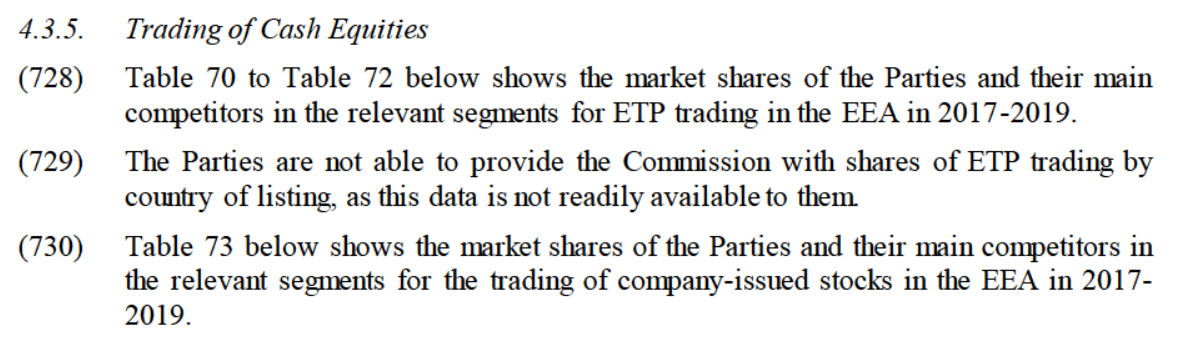

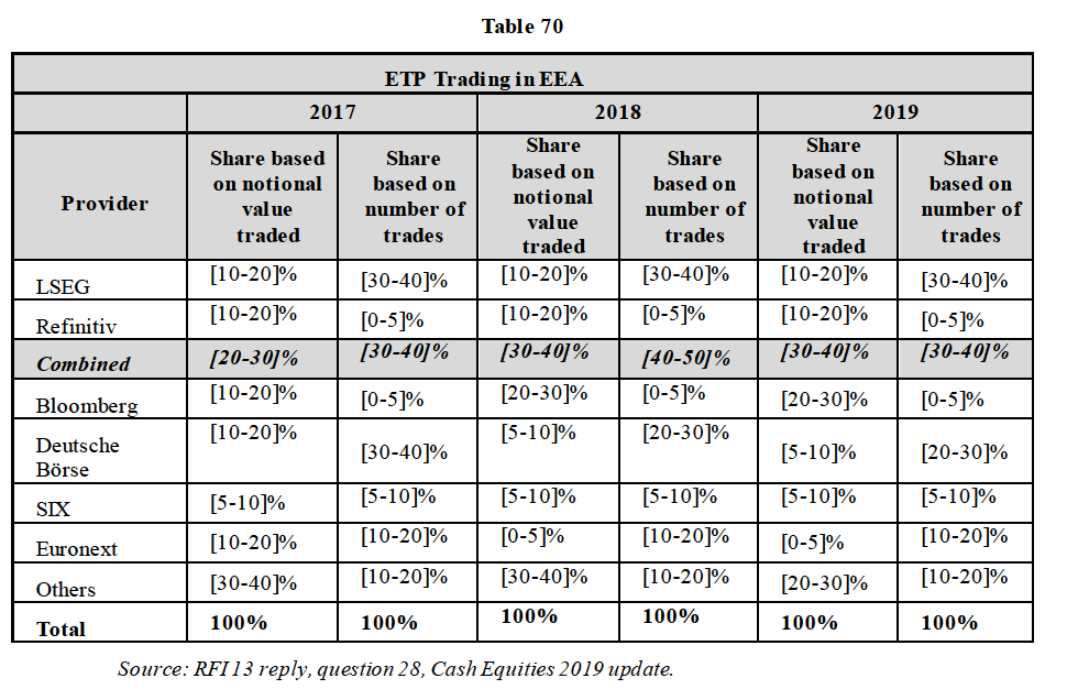

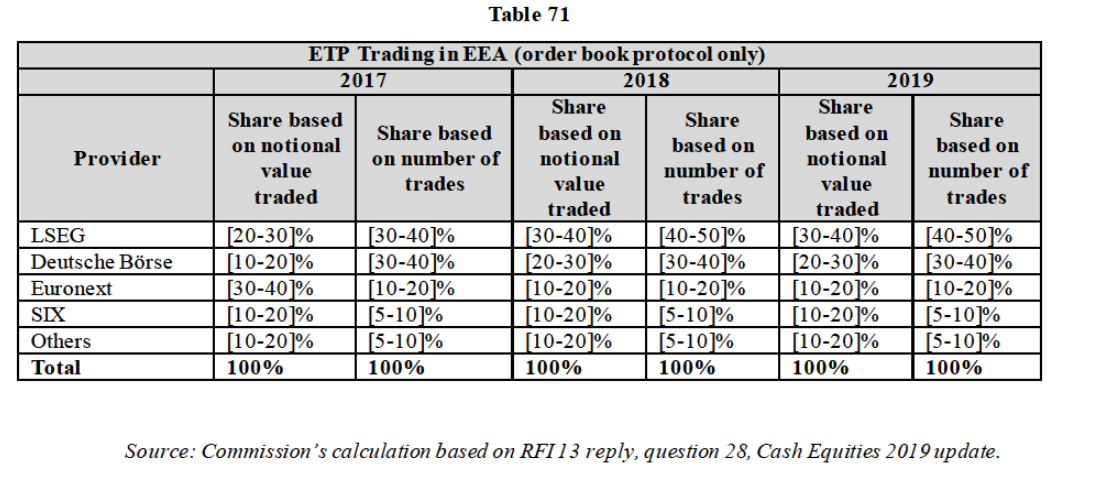

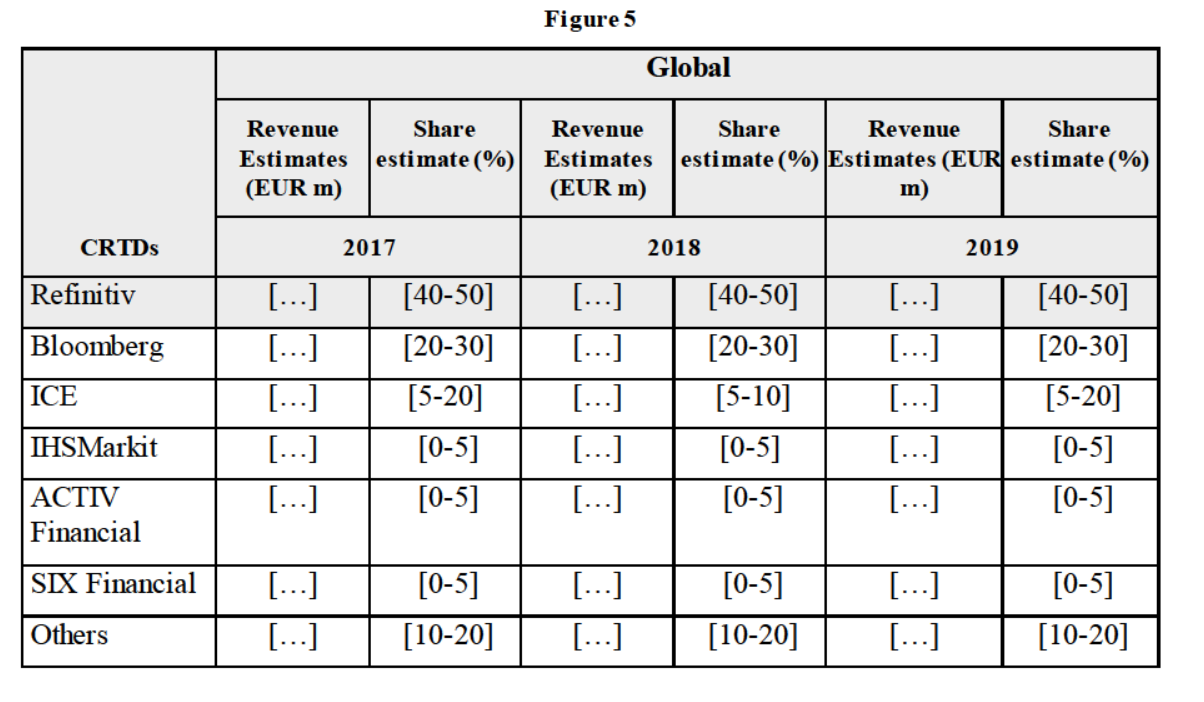

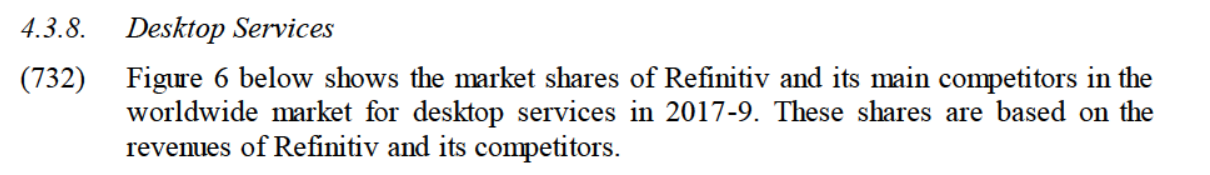

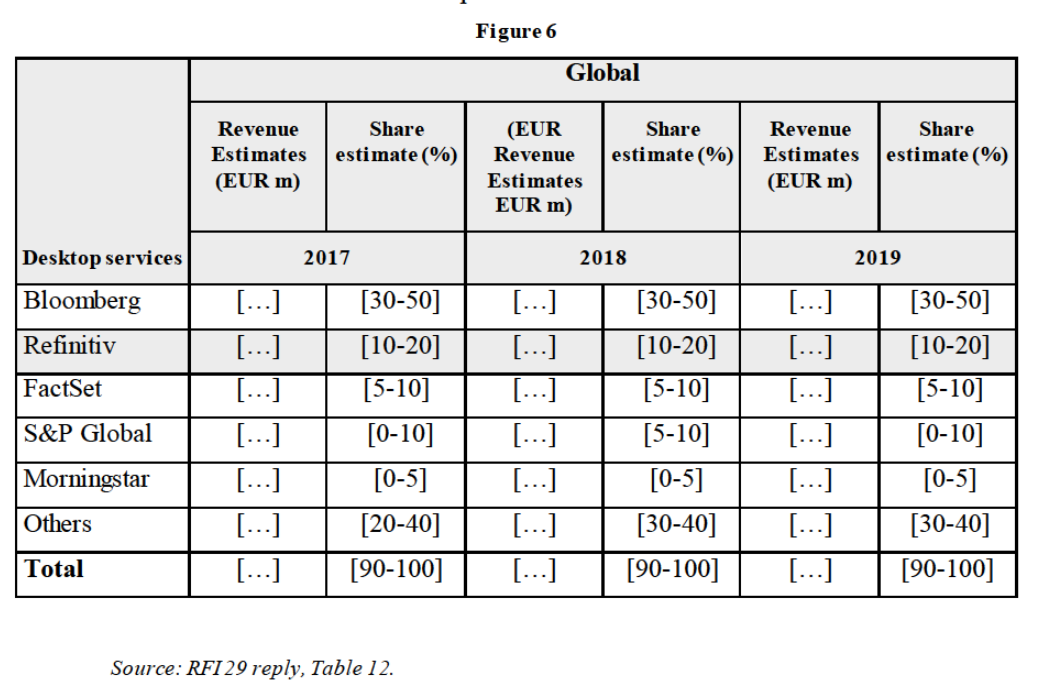

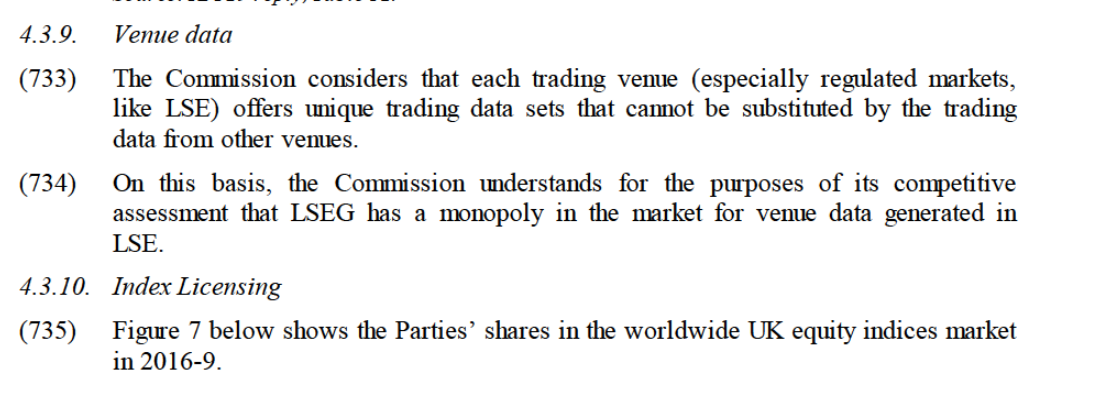

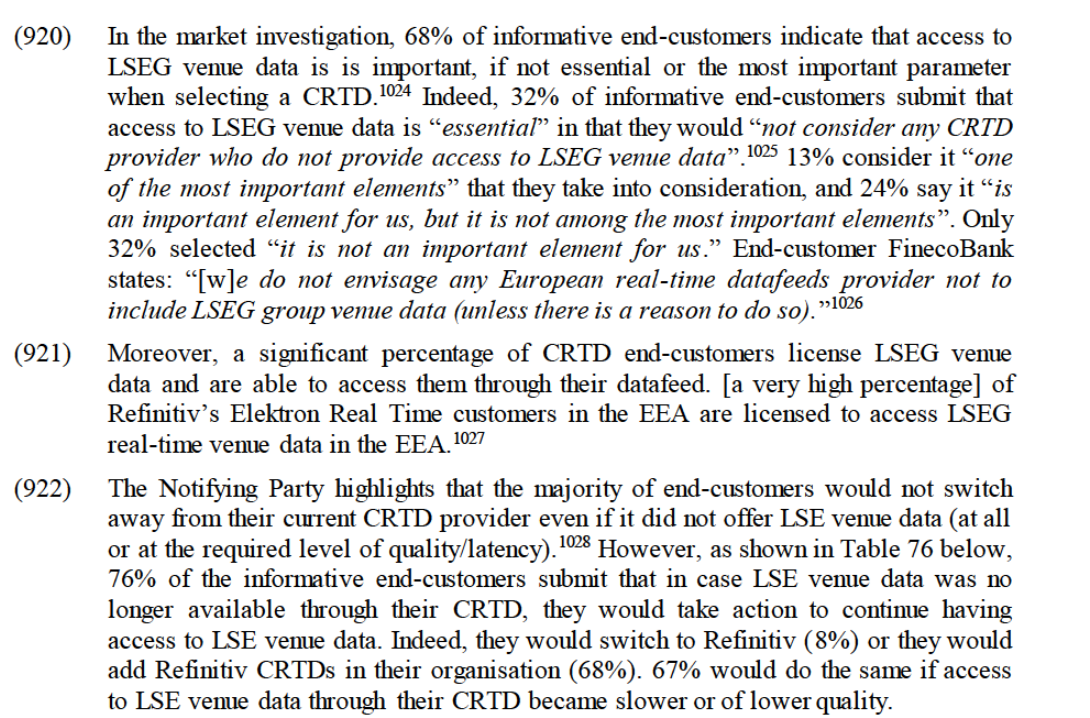

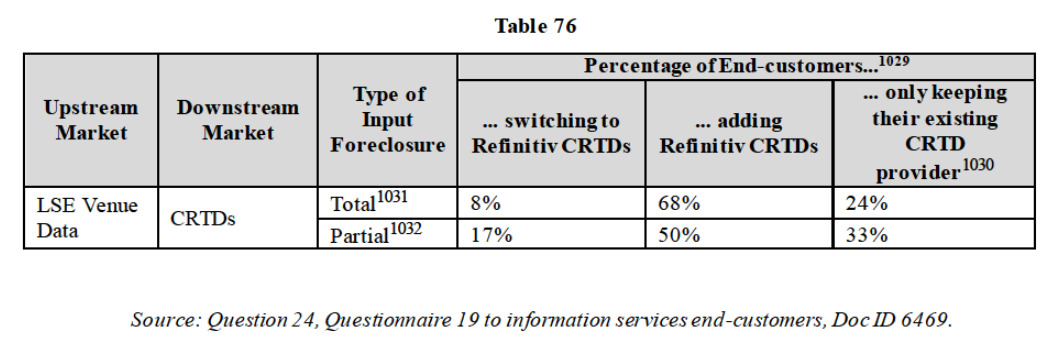

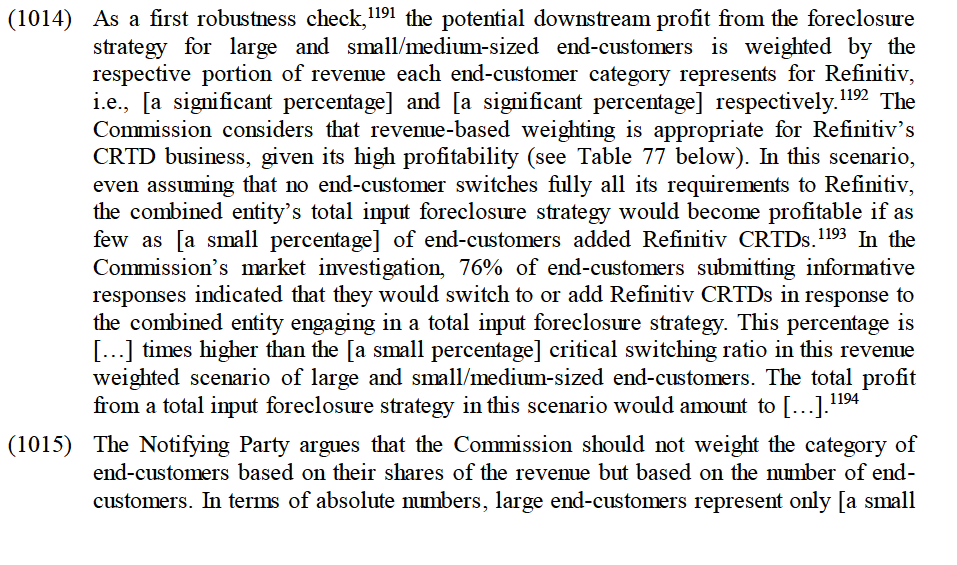

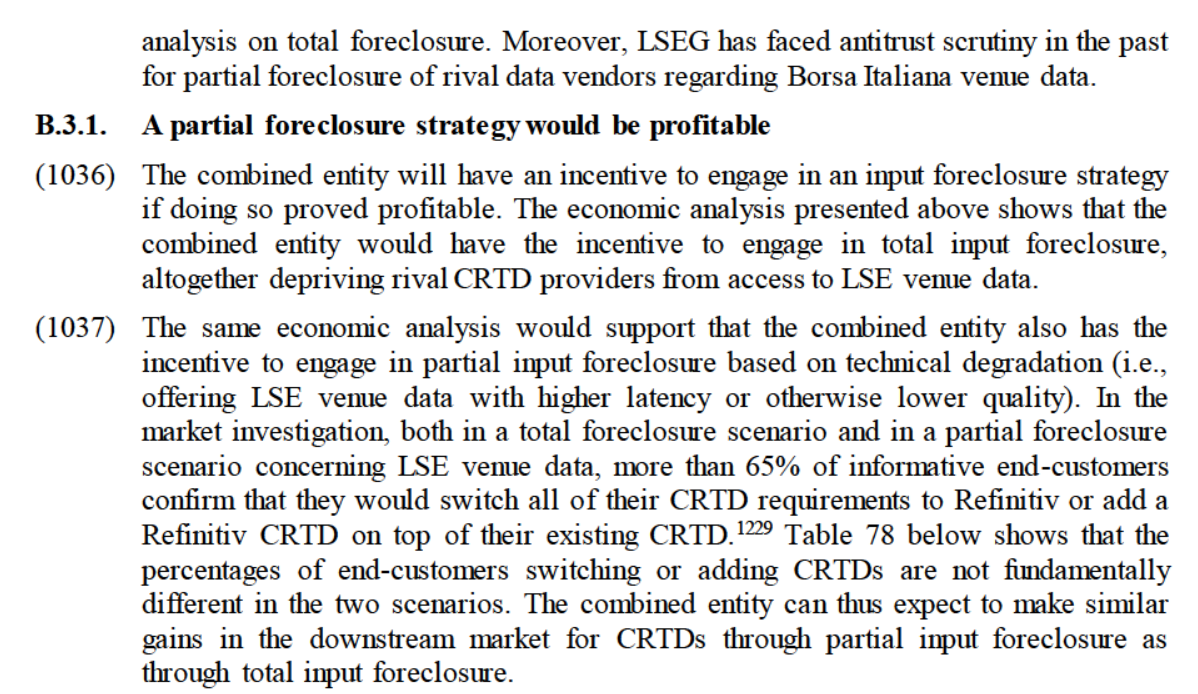

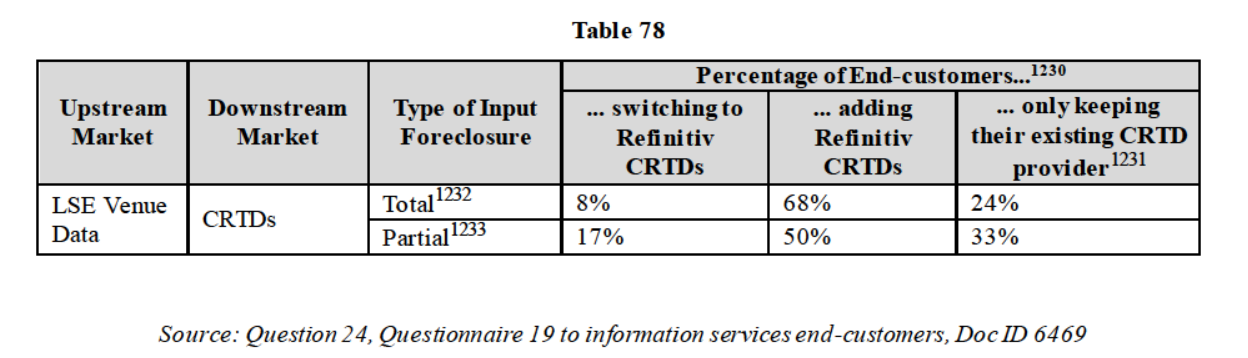

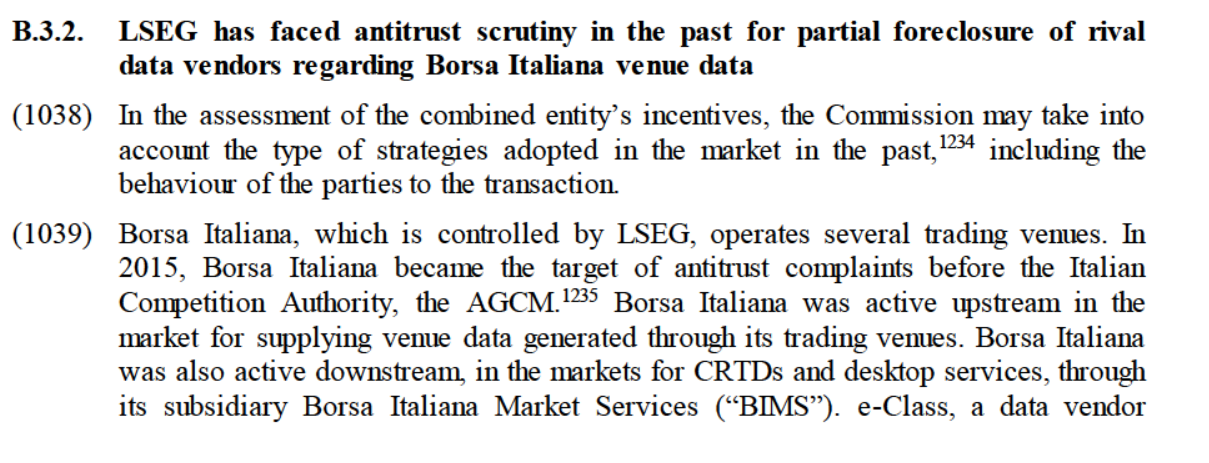

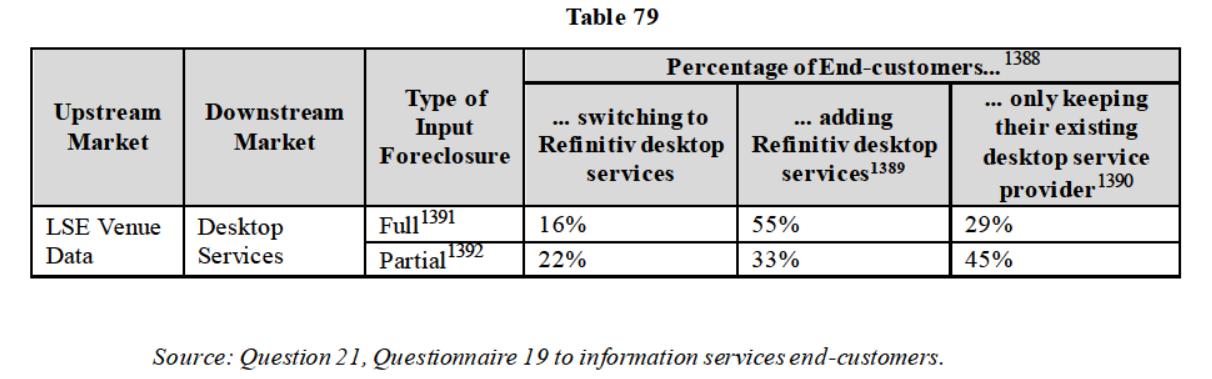

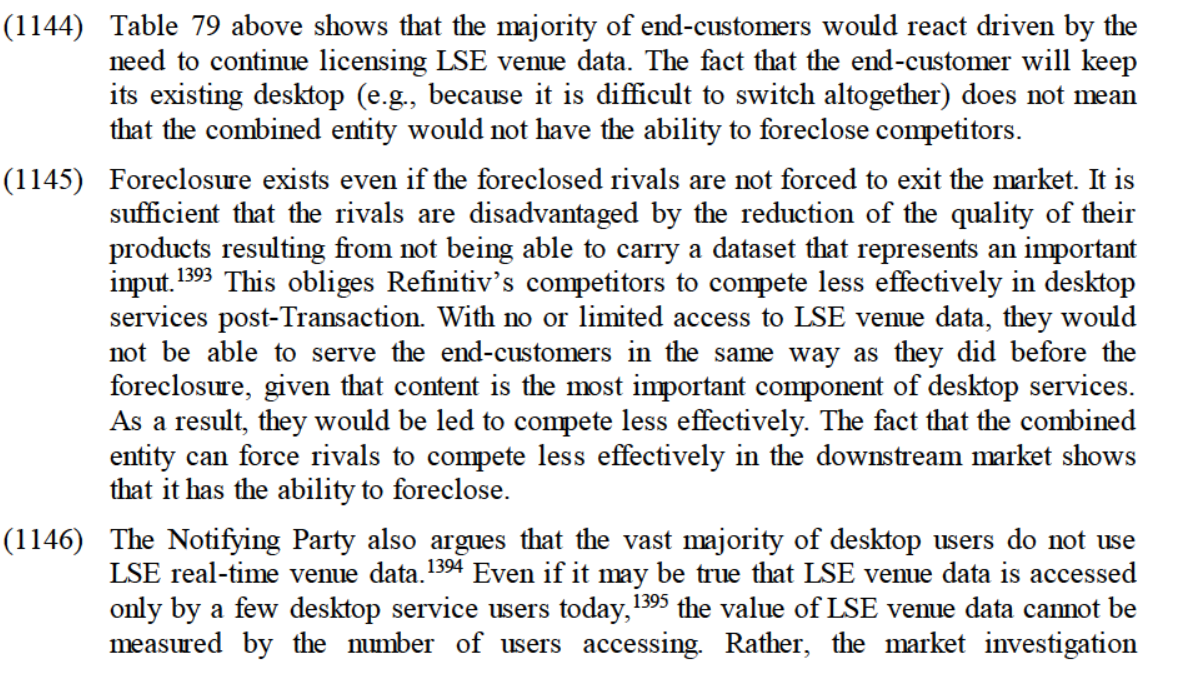

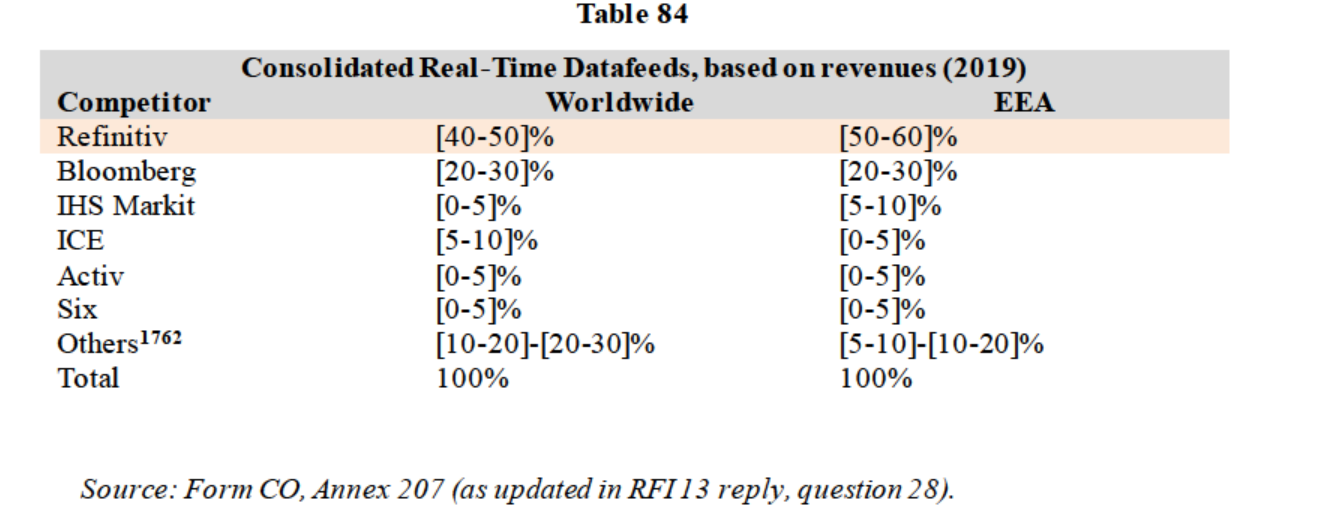

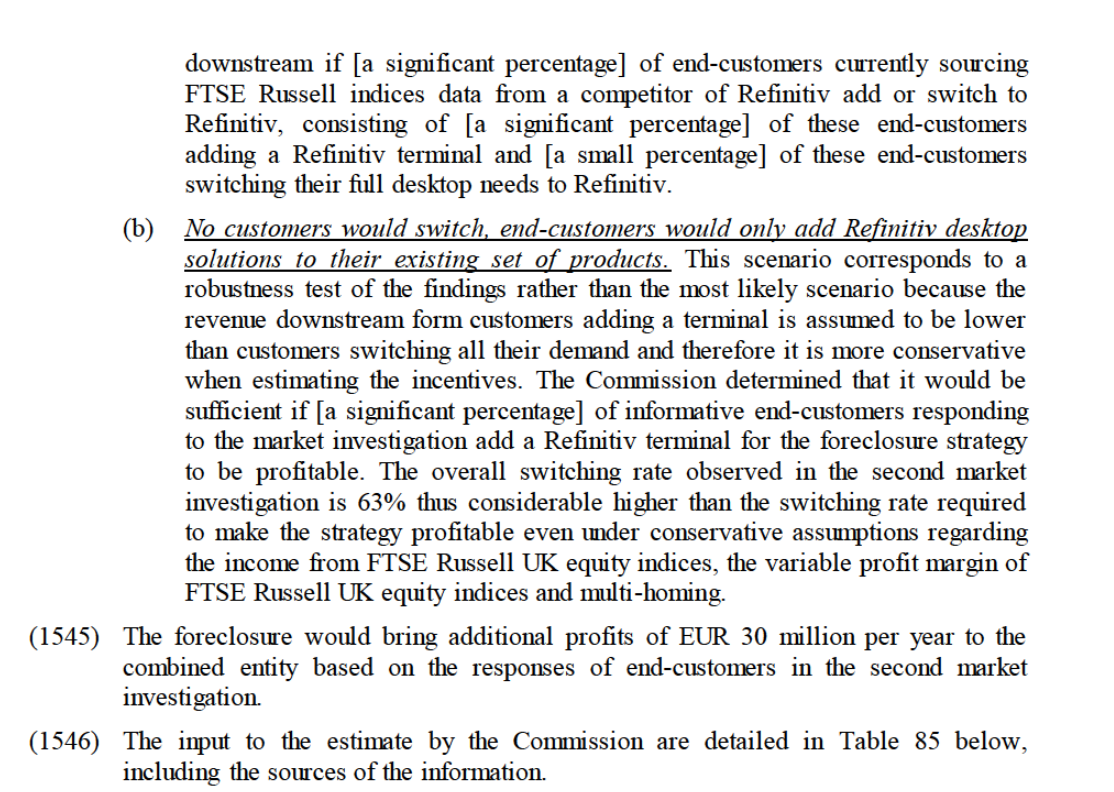

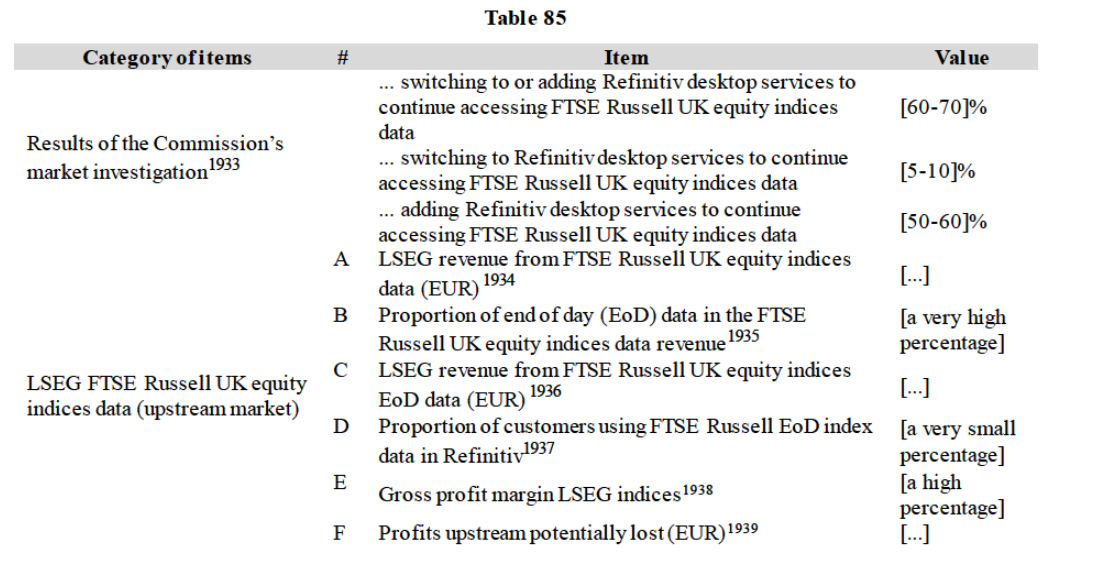

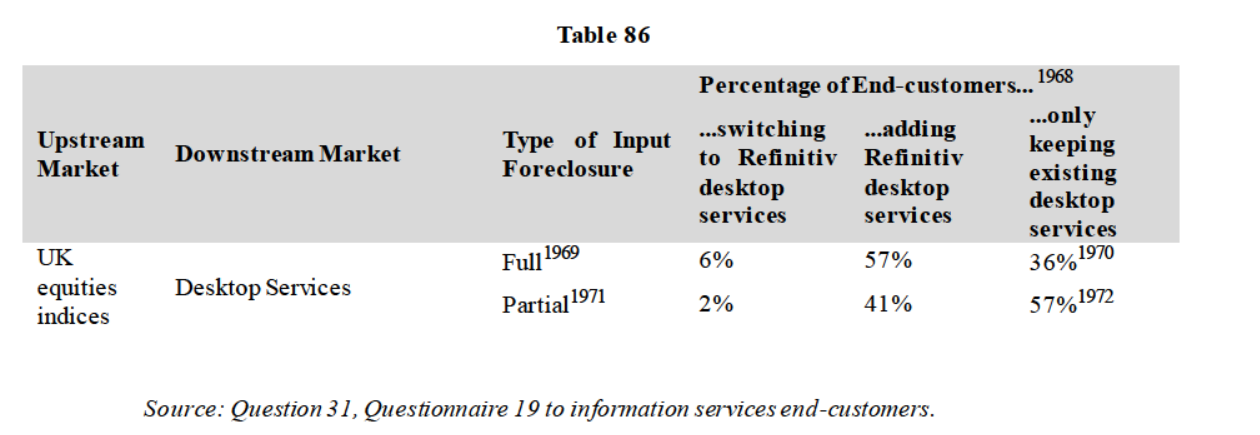

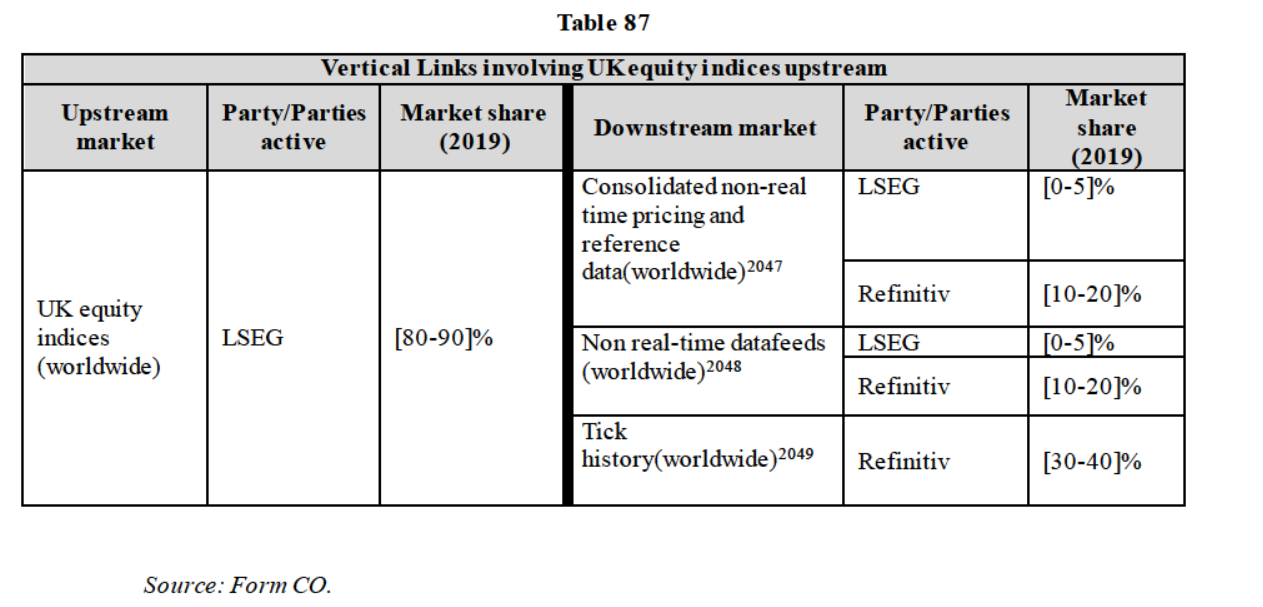

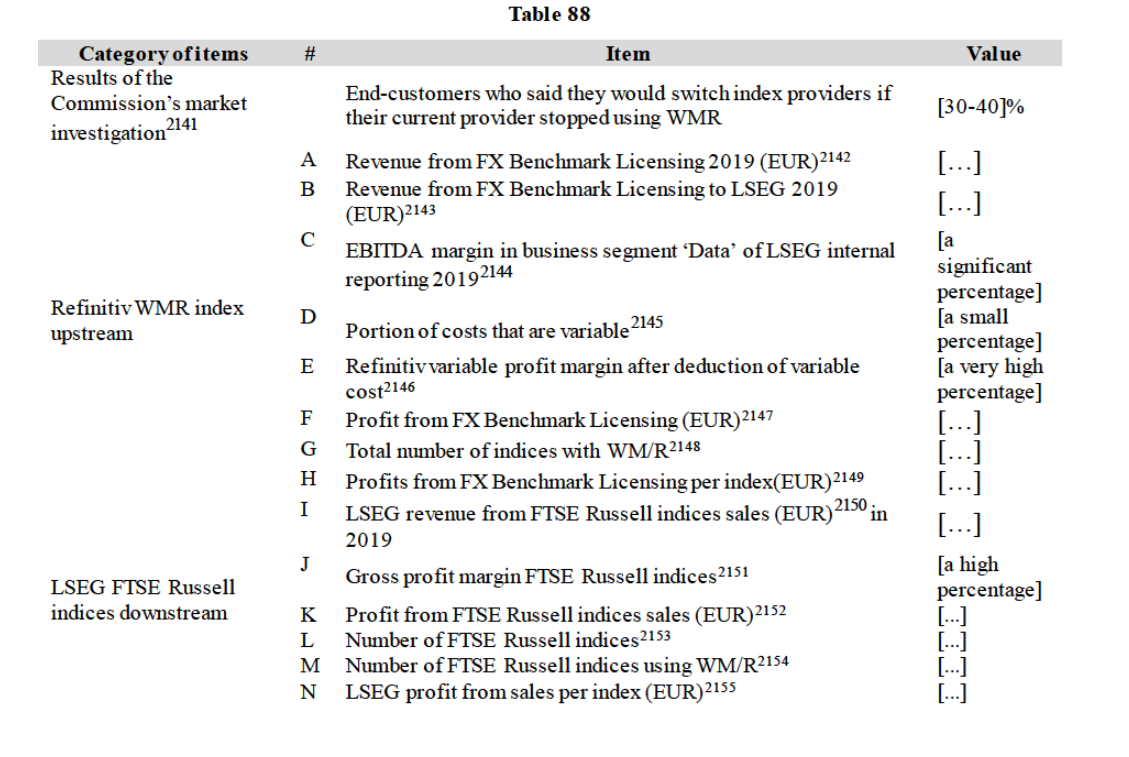

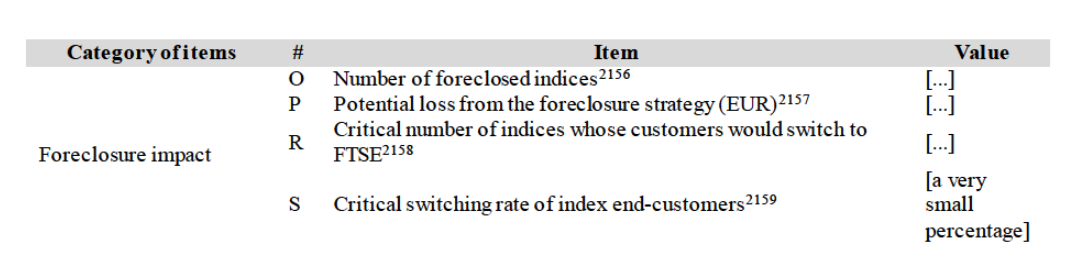

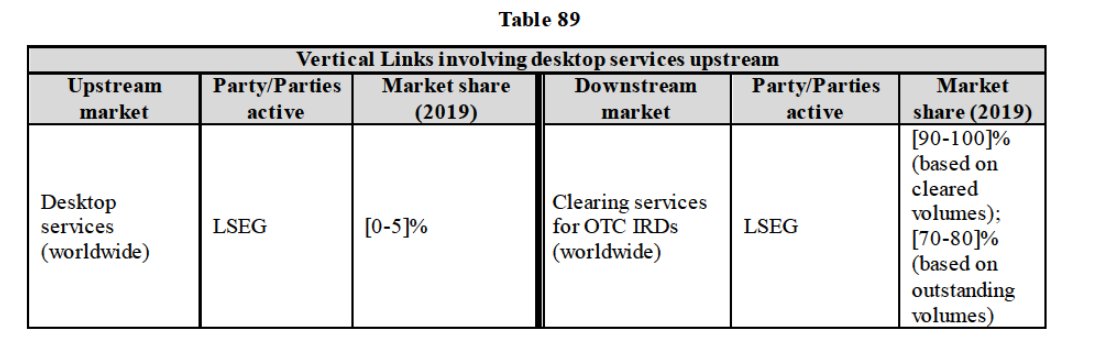

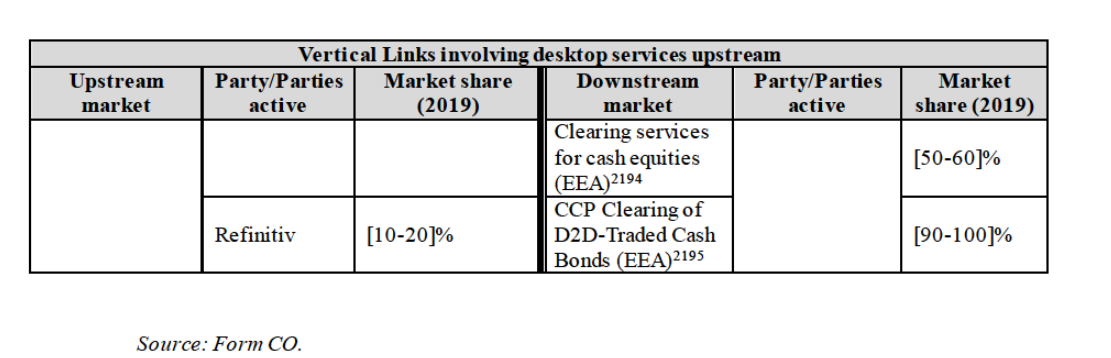

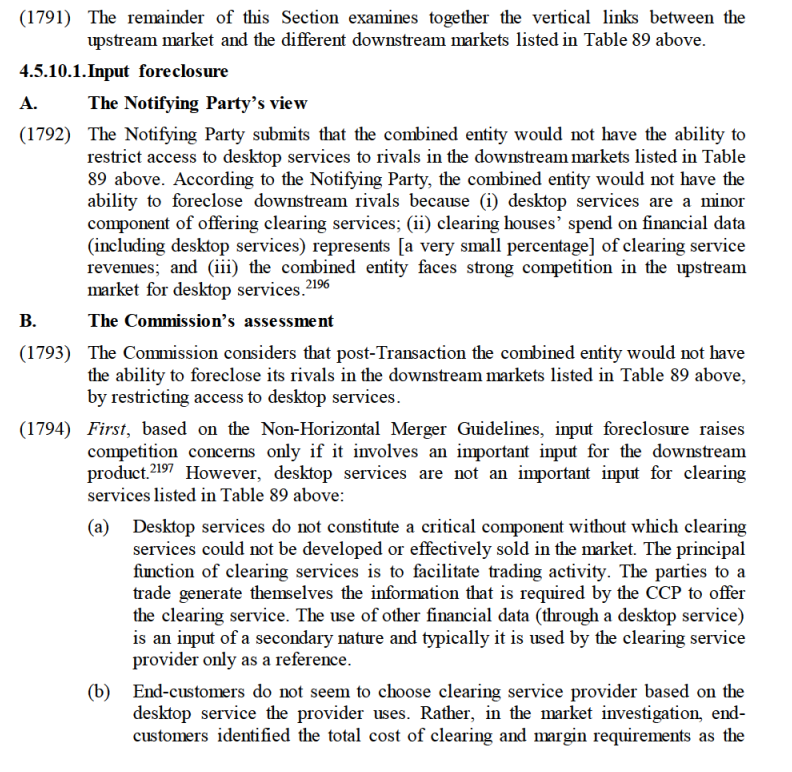

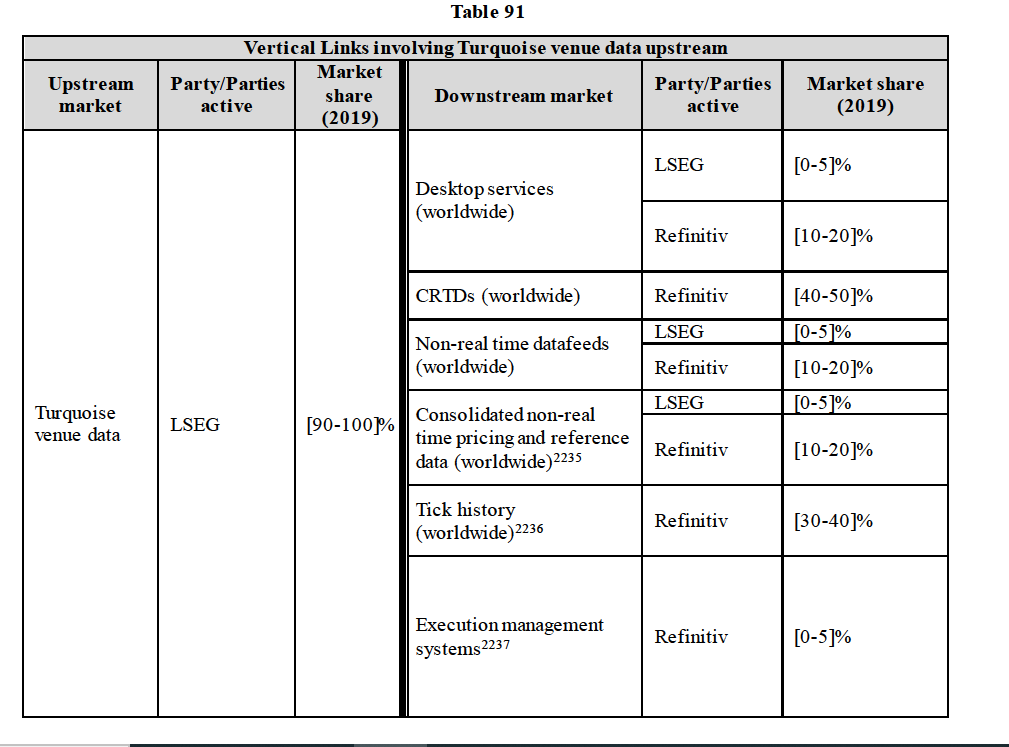

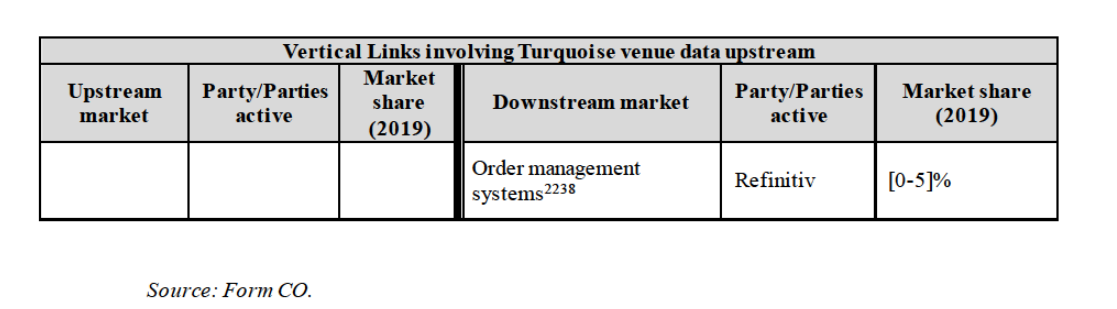

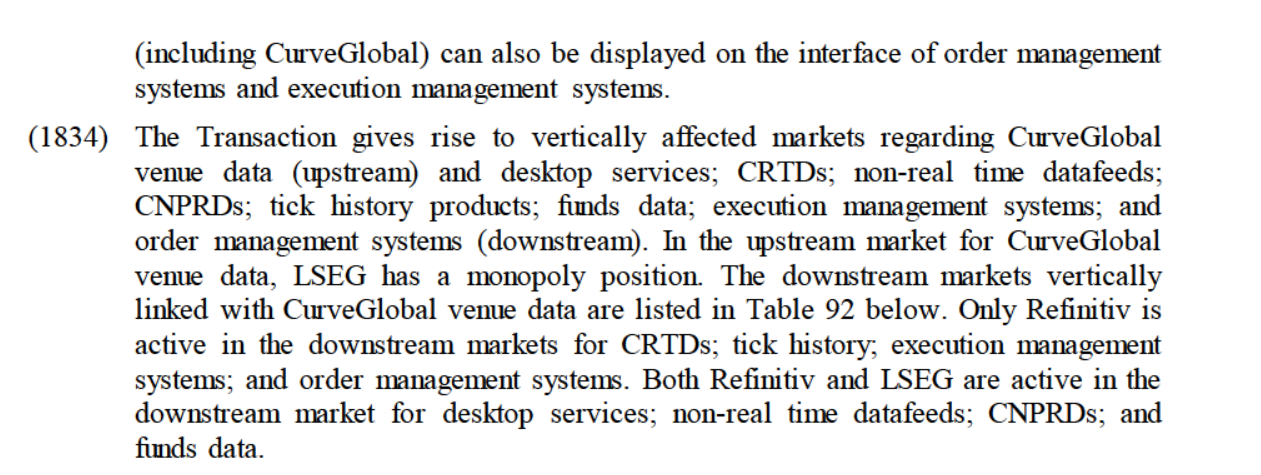

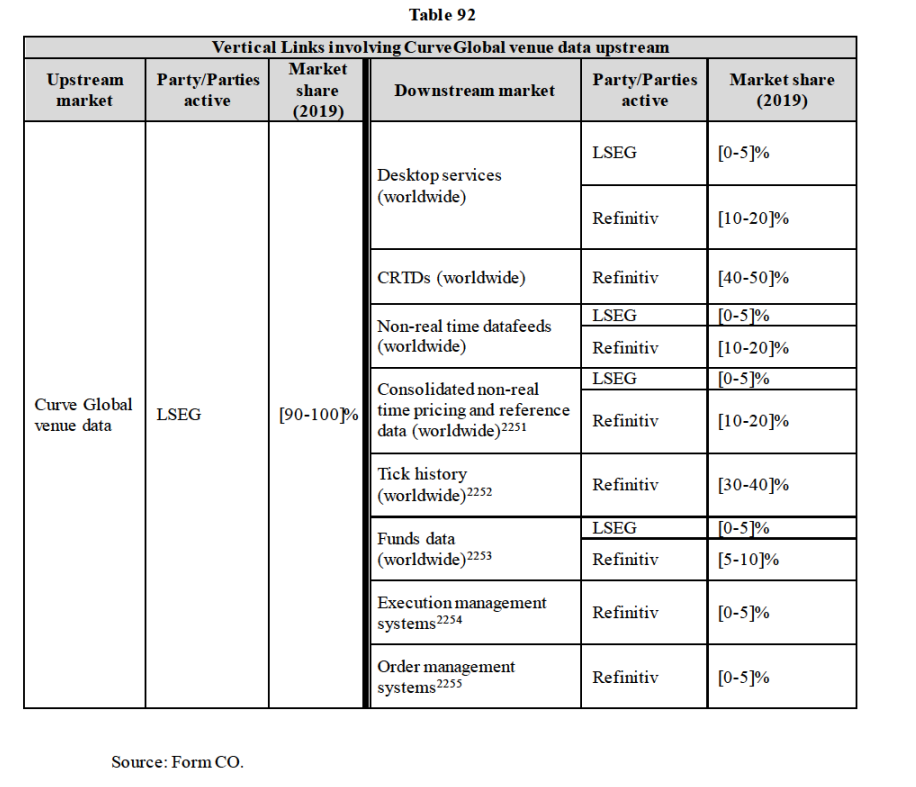

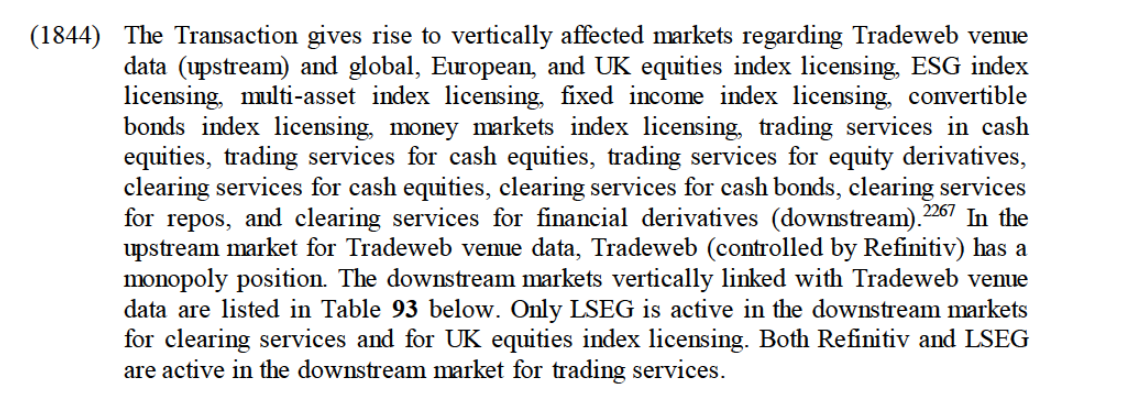

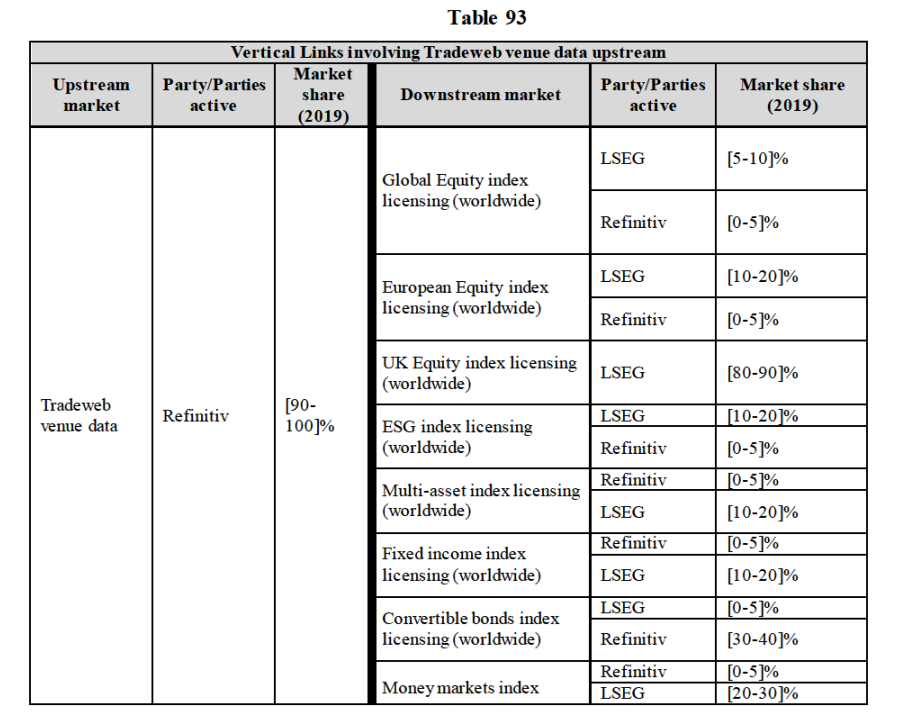

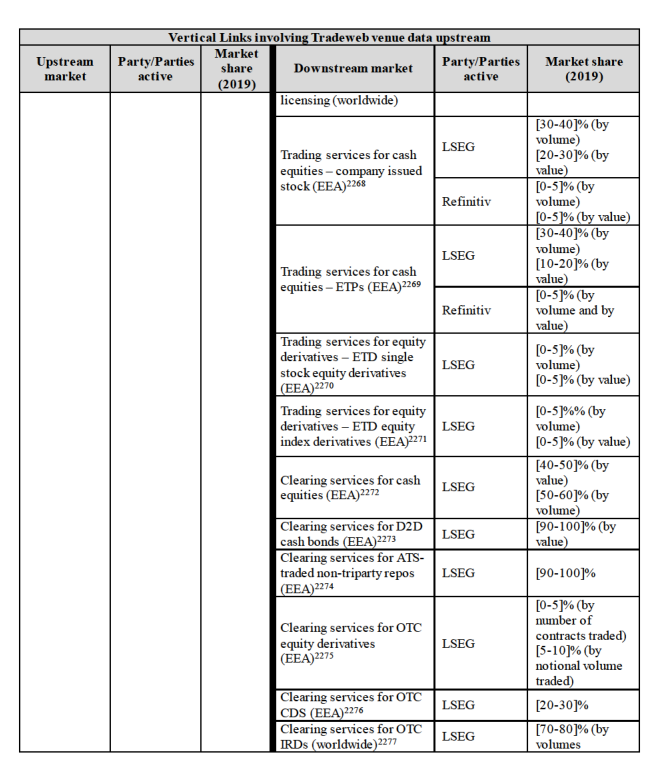

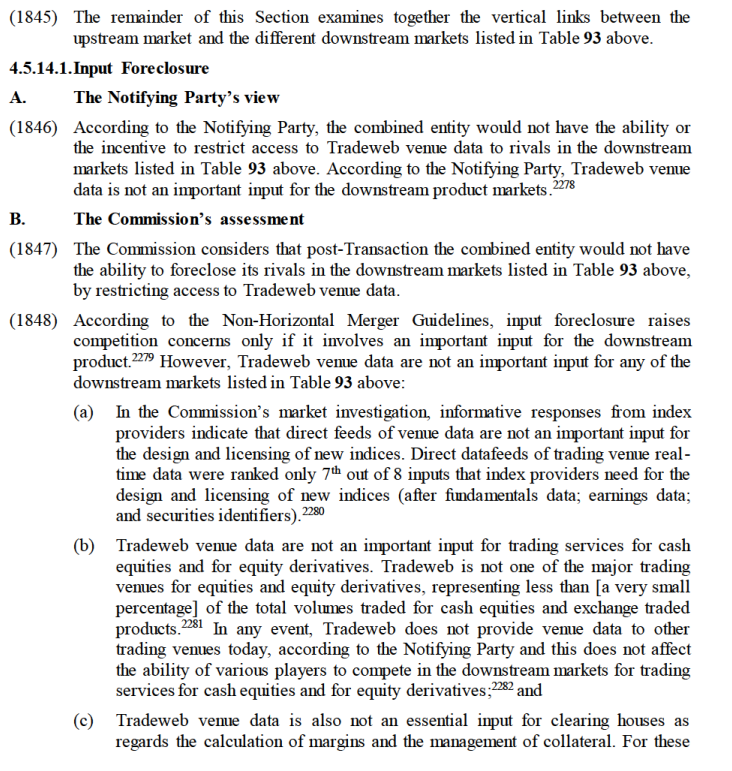

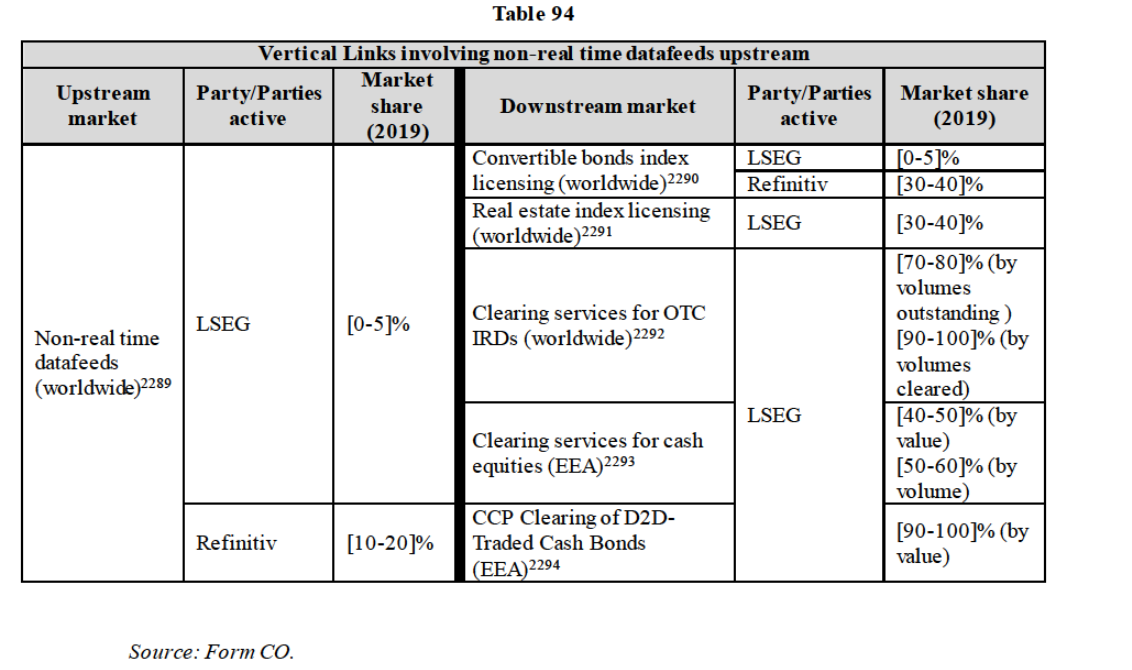

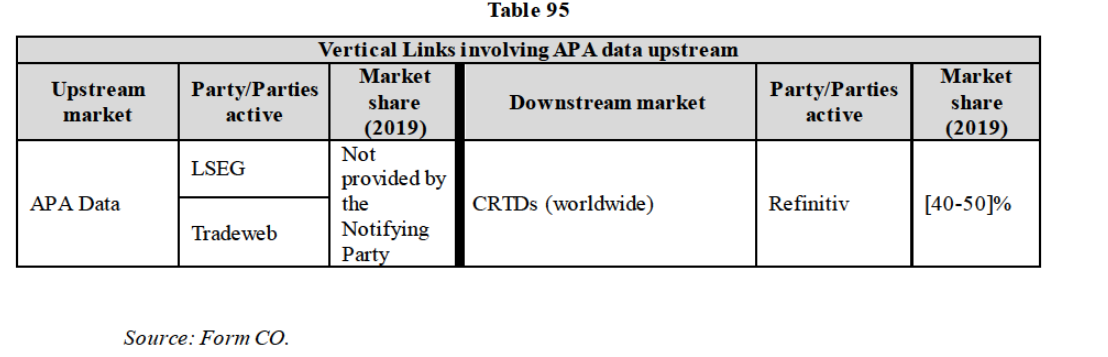

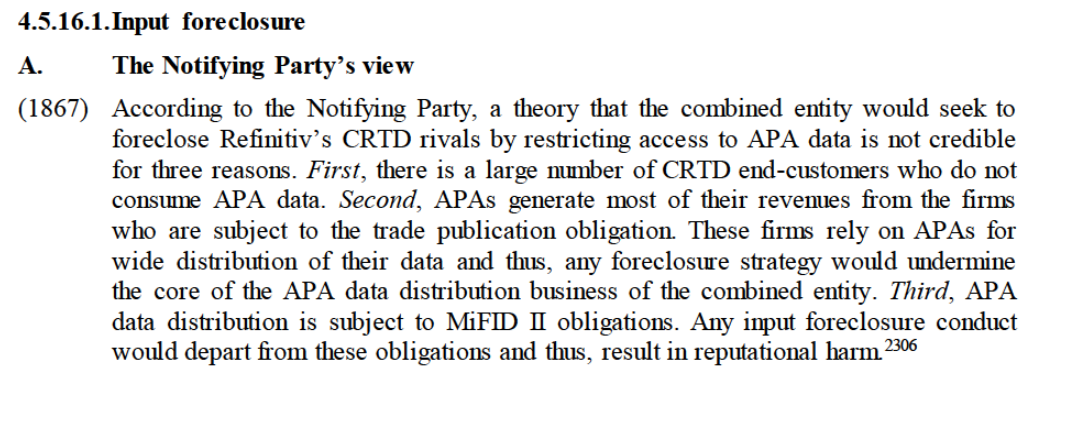

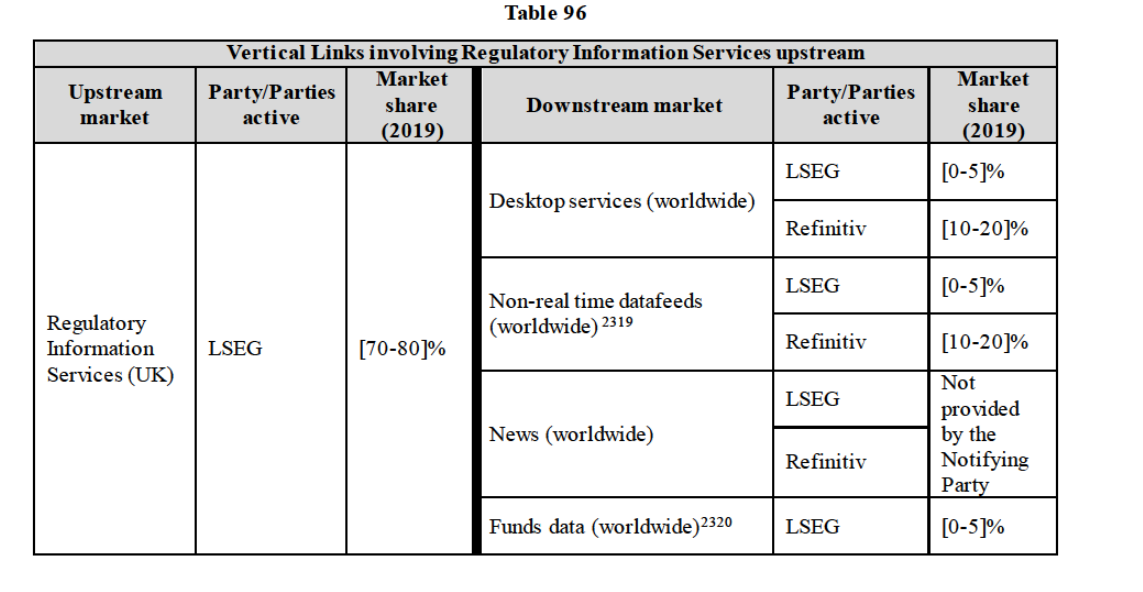

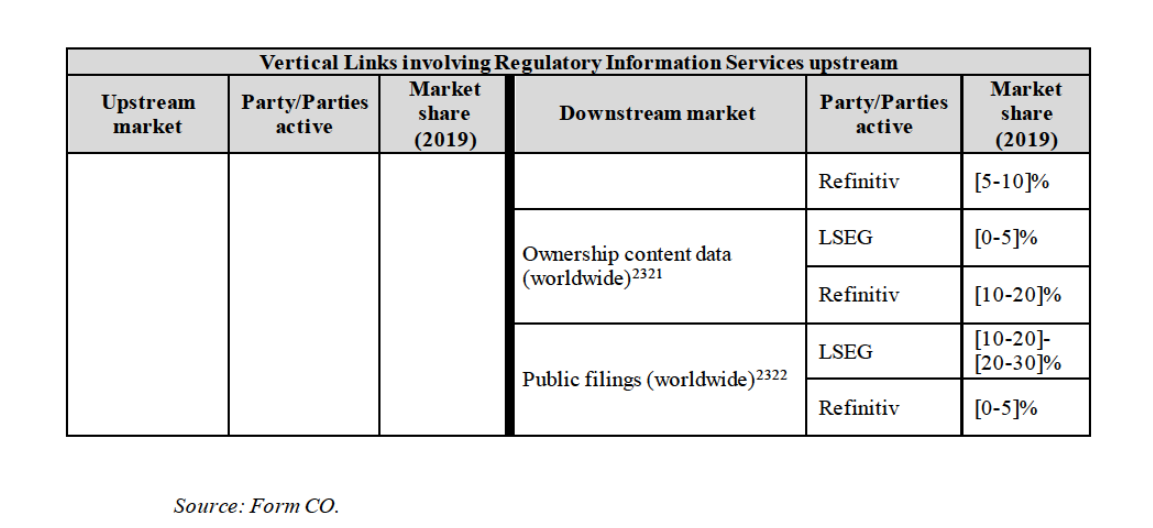

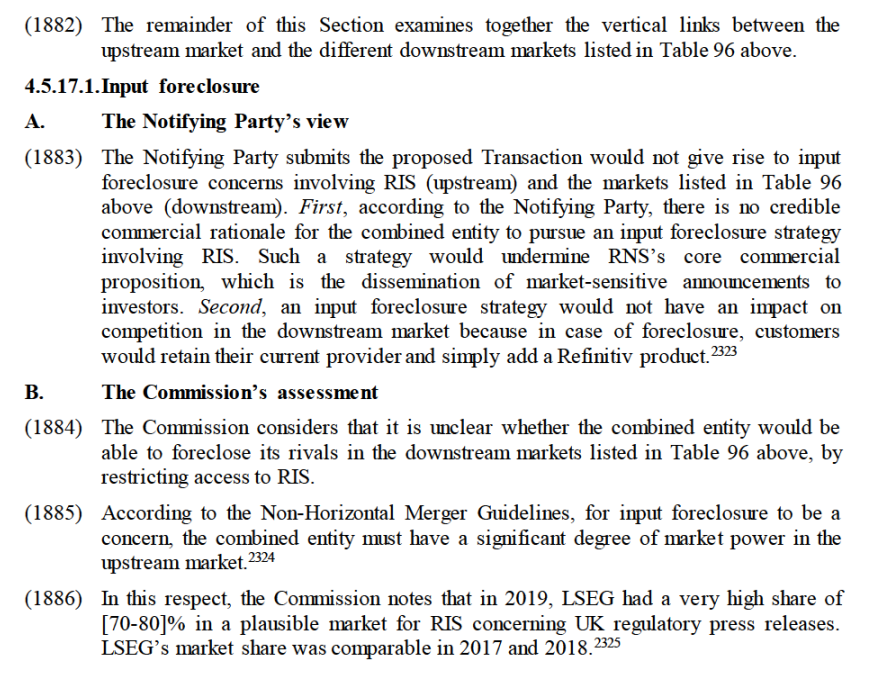

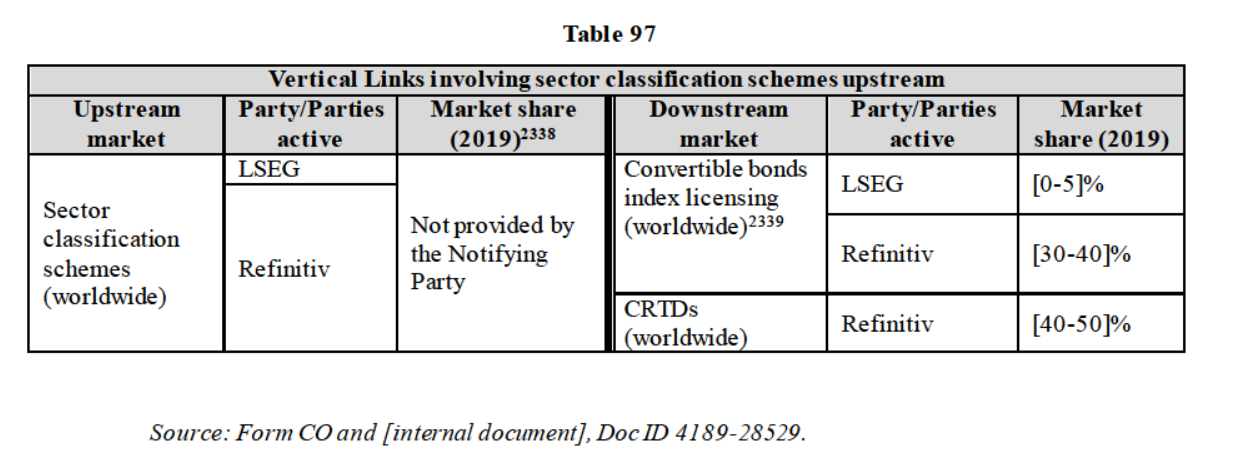

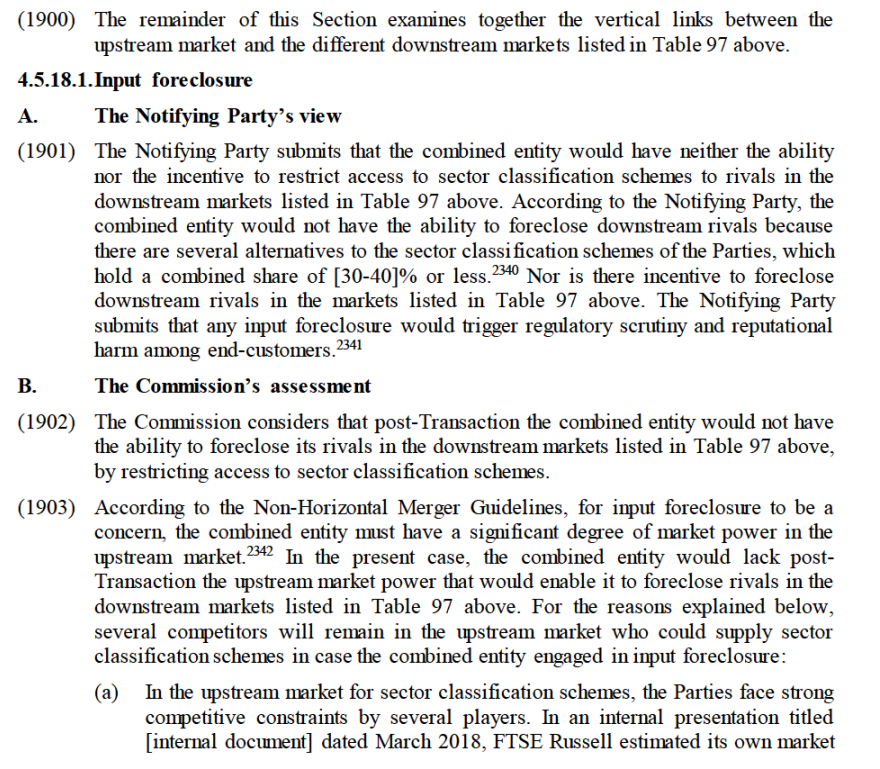

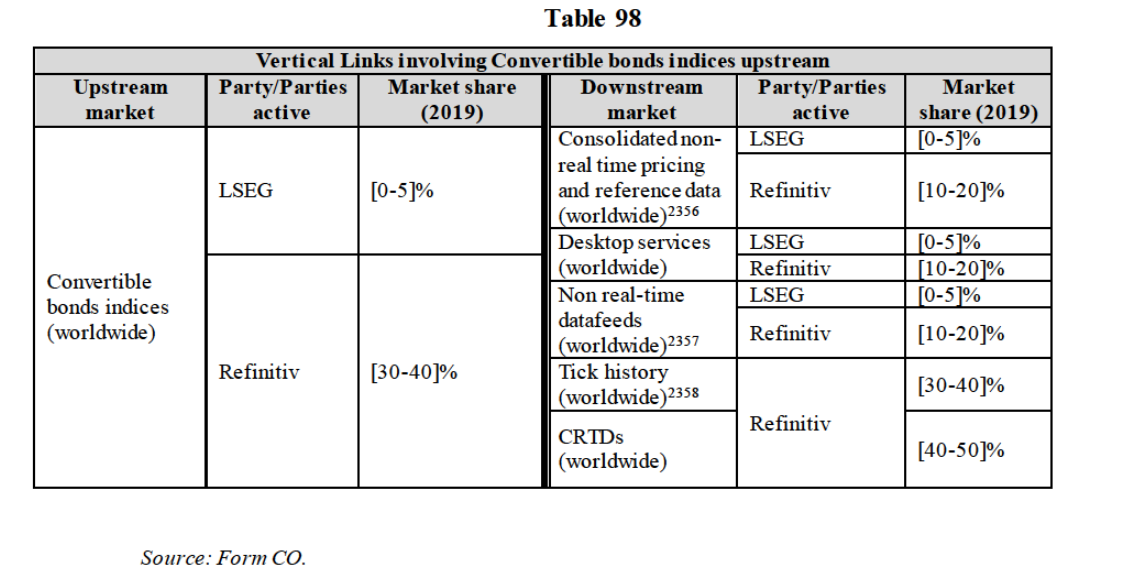

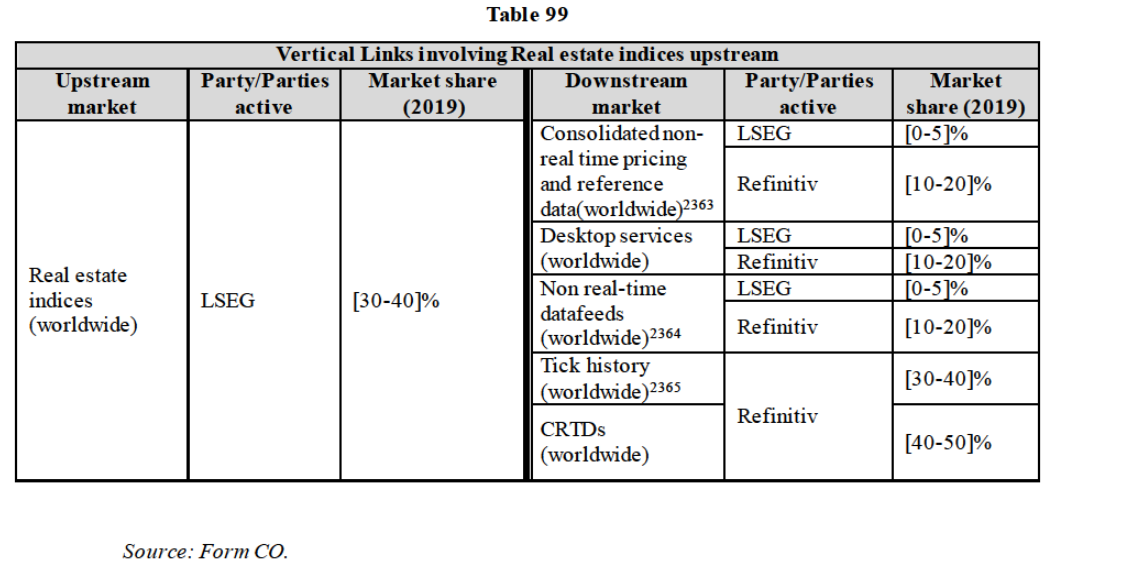

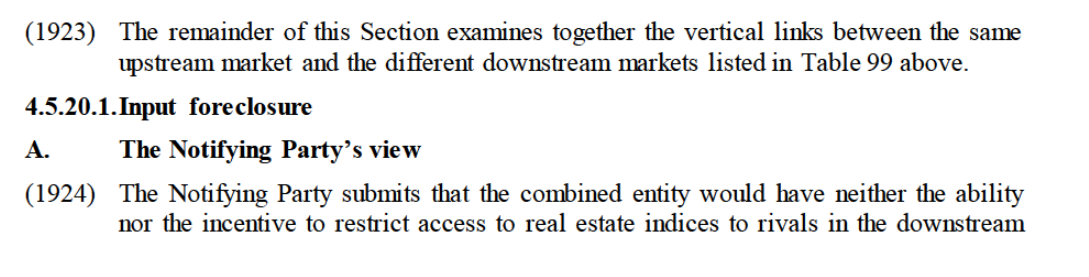

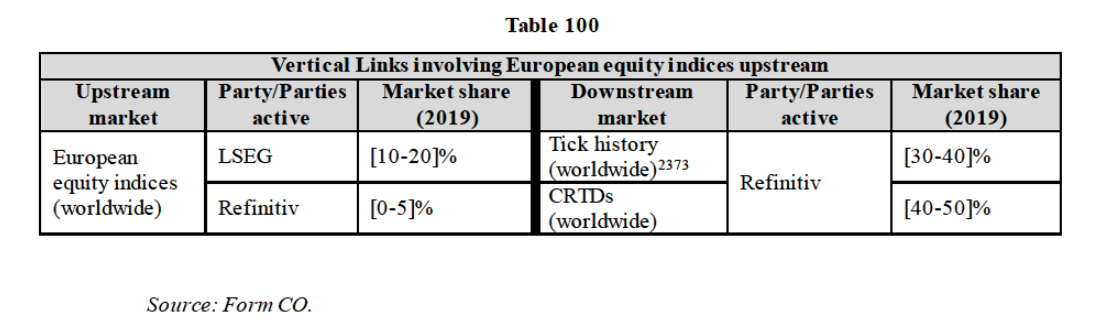

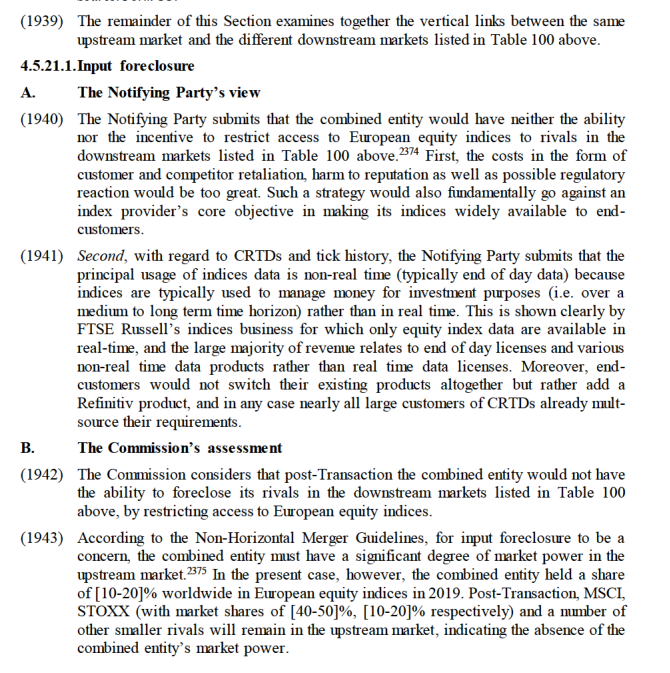

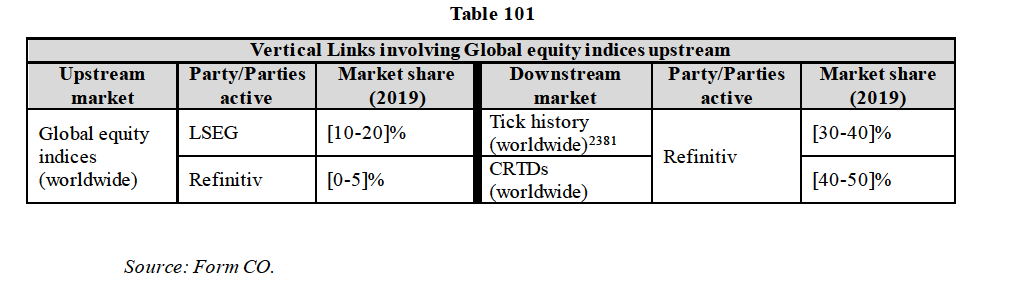

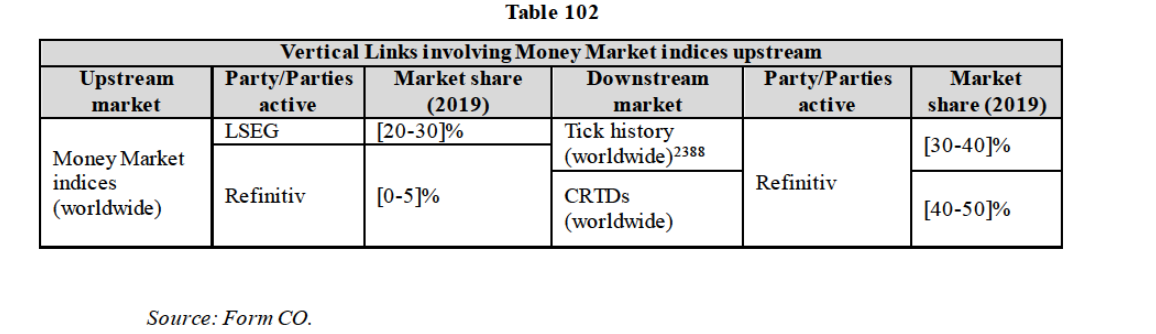

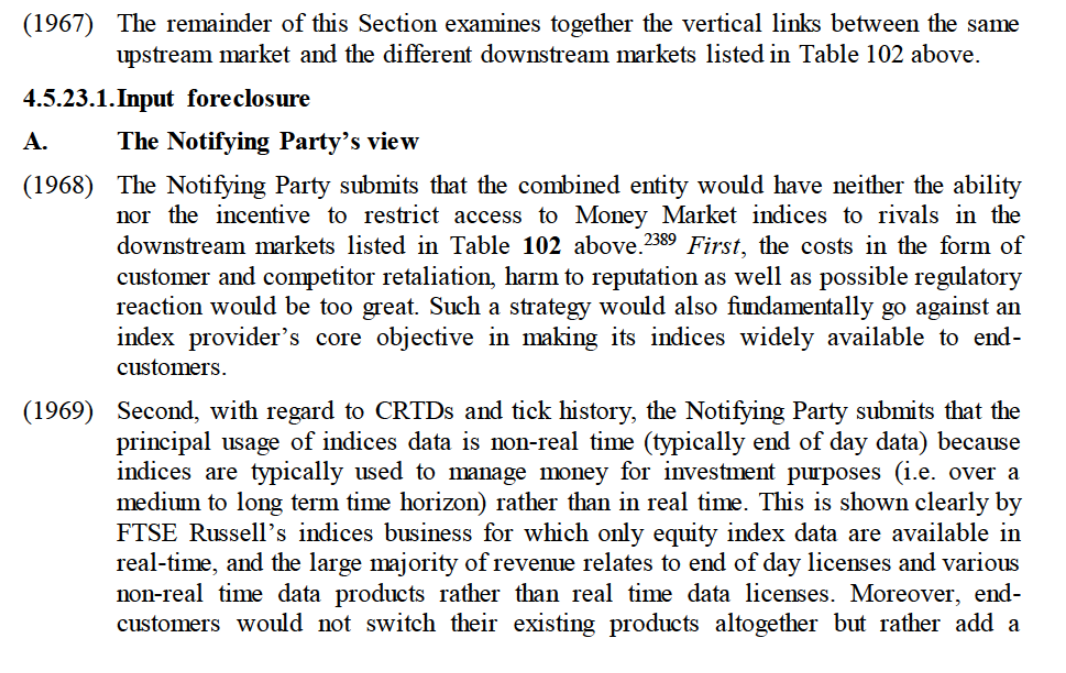

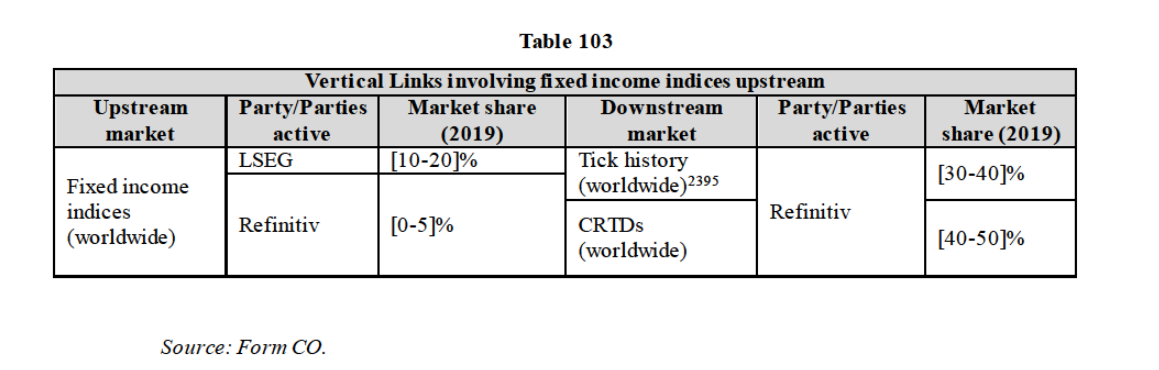

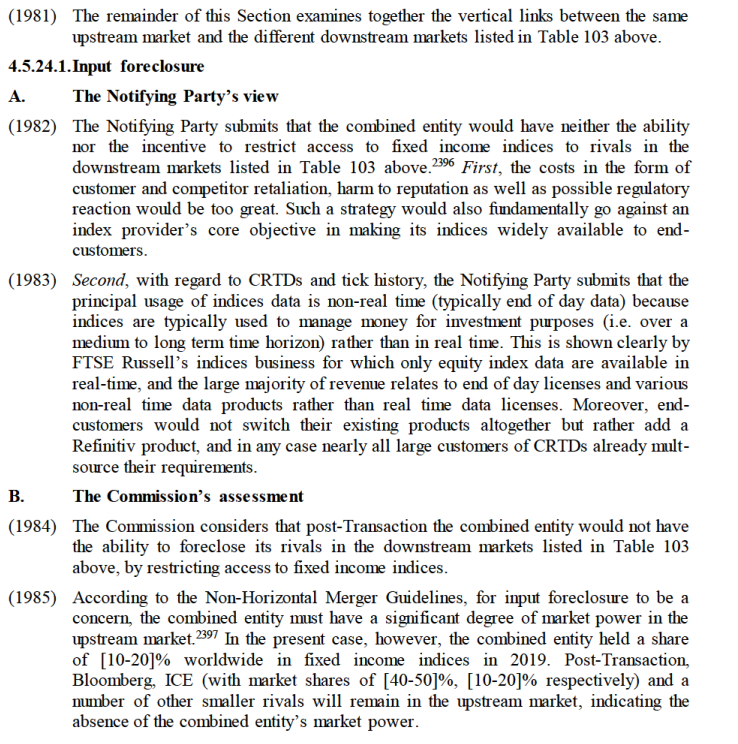

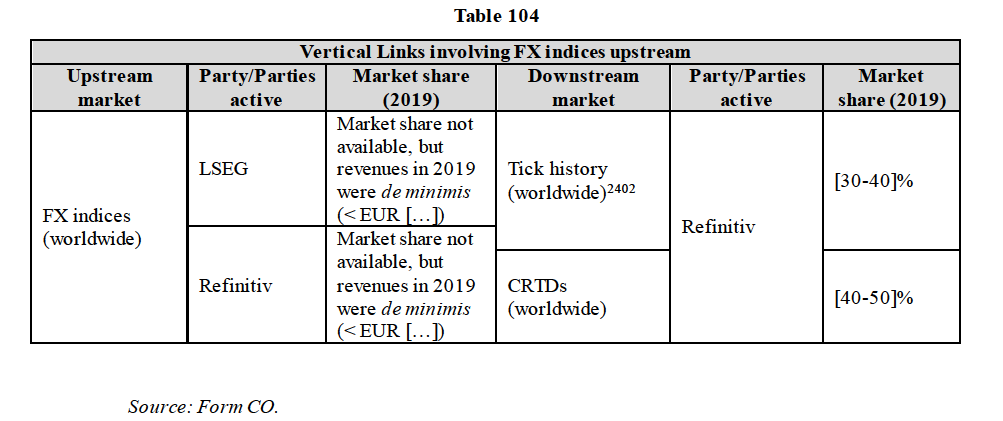

(135) Thirdly, the Commission assessed whether trading venues focusing on D2C trades (so-called “D2C venues”) provide trading services to D2D trades. As explained in recital (129) above, some inter-dealers trades are executed on D2C venues, which indicates that so-called D2C trading venues offer trading services for D2D trades. The market investigation indeed indicates that a large majority of sell-side customers execute D2D trades on D2C venues,188 e.g. when a dealer is a small bank, to trade OTC IRD trades subject to the trading obligation, or when dealers process a trade that was agreed by voice.