Commission, February 6, 2018, No M.8665

EUROPEAN COMMISSION

Decision

DISCOVERY / SCRIPPS

To the notifying party

Subject: Case M.8665 – Discovery / Scripps Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

Dear Sir or Madam,

(1) On 8 December 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Discovery Communications Inc. ('Discovery' or the 'Notifying Party', United States) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of Scripps Networks Interactive, Inc. ('Scripps', United States), by way of purchase of shares (the 'Transaction').3 Discovery and Scripps are hereinafter collectively referred to as the 'Parties'.

1. THE PARTIES AND THE CONCENTRATION

(2) Discovery is a global media company that provides content across multiple distribution platforms, including linear platforms such as pay television ('Pay-TV'), free-to-air ("FTA"), and various digital distribution platforms around the world. Discovery’s portfolio in the EEA includes: (i) non-fiction TV channels though its global brands (such as Discovery, Animal Planet); (ii) sports entertainment channels through Eurosport International ("Eurosport"); and (iii) across the Nordic region (Sweden, Norway, Denmark and Finland), a number of TV channels that feature non-fiction content, as well as locally produced entertainment programmes, sports and scripted series and movies from major studios through SBS Discovery Media AS (“SBS Nordic”).

(3) Scripps is a global media company providing primarily home, food, travel and other related programming. Scripps operates as two business units: (i) U.S. Networks which accounts for 84% of Scripps' total turnover; and (ii) International Networks which covers Scripps' activities outside the United States. In Europe, the International Networks operations include UKTV, a joint venture with BBC Worldwide in the United Kingdom, and TVN, a Polish media company acquired in 2015. TVN’s activities include TVN Media, an advertising sales house. TVN also holds a minority interest in ITI Neovision S.A. ("NC+"), which is active in the retail Pay-TV market in Poland.4

(4) On 30 July 2017, Discovery and Scripps entered into an Agreement and Plan of Merger pursuant to which Scripps will be merged with a direct wholly-owned subsidiary of Discovery and, therefore, become a wholly-owned subsidiary of Discovery. The Transaction therefore constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(5) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million5 (Discovery: EUR 5 869 million; Scripps: EUR 3 073 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Discovery: EUR […] million; Scripps: EUR […] million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension.

3. REFERRAL REQUEST

(6) On 4 January 2018, Poland via its Urząd Ochrony Konkurencji i Konsumentów (the Polish Competition Authority, the "PCA")6 requested a partial referral of jurisdiction over the Transaction from the Commission to the PCA pursuant to Article 9(2)(a) of the Merger Regulation (the "Referral Request").

(7) In its Referral Request, Poland considered that, pursuant to Article 9(2)(a) of the Merger Regulation and the Commission Notice on case referral (2005/C 56/02), (i) the Transaction threatens to affect significantly competition in the Polish market, and (ii) the Polish market presents all the characteristics of a distinct market. In addition, the PCA submits that it appears that the Transaction threatens to significantly distort competition only in the territory of Poland.

(8) The PCA submitted that the Transaction raises several competition concerns in Poland, namely: (i) increase in bargaining power of the merged entity arising from the combination of the Parties' channel portfolios; (ii) increase in dominance in specific basic Pay-TV genres, namely factual and lifestyle; (iii) strengthening of TVN's (TVN Media) position in the market for the sale of advertising on TV channels in Poland, (iv) possible vertical issues stemming from the fact that Mr. John Malone7 allegedly controls both Discovery (which, post Transaction, would include TVN) and Liberty Global (which operates as a Pay-TV distributor in Poland and is in the process of acquiring Multimedia Polska, another TV distributor), and (v) horizontal issues in the market for Pay-TV distribution arising from the fact that Mr. Malone post Transaction would control both Liberty Global and NC+, a satellite TV distributor in Poland, where each of TVN and Liberty Global have a minority stake.

(9) On 23 January 2018, the Commission sent a pre-rejection letter to the PCA, stating its reasons as to why it intended to reject the Referral Request and inviting the PCA to submit observations. On 24 January 2018, the Commission received the PCA's observations, which reiterated the Referral Request and referred to the arguments already set out therein.

(10) The Notifying Party was informed of Poland's Referral Request on 9 January 2018 and submitted its comments on 15 January 2017. The Notifying Party submitted that the Referral Request fails to demonstrate that the two cumulative criteria in Article 9(2)(a) of the Merger Regulation are satisfied and should be rejected on this basis alone. Furthermore, the Notifying Party states that, in any event, the Commission is the most appropriate authority to review the Transaction, and that the Referral Request should be rejected also on this basis.8

(11) On 6 February 2018, the Commission addressed to Poland a decision, pursuant to Article 9(3) of the Merger Regulation, rejecting the Referral Request (the “Rejection Decision”). The Commission motivated its decision on the basis that it is the most appropriate authority for dealing with the Transaction because, amongst others, there is a need to ensure consistency in the way different mergers falling into the Commission's competence in this sector are assessed throughout the Union and because the Commission has recent sector specific knowledge of the TV audiovisual markets across EEA Member States.

4. RELEVANT MARKETS

4.1. Introduction

(12) In previous decisions,9 the Commission set out the different levels of the TV value chain as follows: (i) the production and supply of commissioned TV content (including the supply of pre-produced TV content); (ii) the licensing of broadcasting rights for pre-produced TV content; (iii) the wholesale supply of TV channels; and (iv) the retail provision of TV services to end customers. A related market that is relevant here is (v) the sale of advertising on TV channels.

(13) While the Parties are active on different levels of the TV value chain in the EEA, they have significant activities only in the market for the wholesale supply of TV channels, the retail supply of TV services to end users and the sale of advertising on TV channels. Therefore, the Commission discusses the product and geographic market definition of only these markets in Section 4.2, Section 4.3 and Section 4.4.

4.2. Wholesale supply of TV channels

4.2.1. Product market definition

(14) TV broadcasters use the TV content that they have acquired or produced in-house in order to package it into linear TV channels. Linear TV channels are broadcast to end users either on a FTA basis or on a Pay-TV basis. This activity is situated at wholesale level as an intermediate activity between upstream production and licensing of content, and the downstream retail provision of TV to customers.

(15) In previous decisions, the Commission has identified a wholesale market for the supply of TV channels. Within that market, the Commission has further identified two separate product markets for: (i) FTA TV channels; and (ii) Pay-TV channels. The Commission has further concluded that within the Pay-TV channels market, there are separate markets for: (i) premium Pay-TV channels; and (ii) basic Pay-TV channels.10

(16) In previous decisions, the Commission also examined a number of other potential segmentations, including: (i) genre or thematic content (such as films, sports, news, youth, and others)11; and (ii) the different means of infrastructure used for the delivery to the viewer (cable, satellite, terrestrial TV and IPTV). 12 It has ultimately left the market definition open in all these regards.

4.2.1.1. Notifying Party's view

(17) The Notifying Party agrees with the decisional practice that the relevant markets for the wholesale supply of TV channels should be separated between FTA and Pay-TV channels, and further between basic Pay-TV and premium Pay-TV channels.

(18) However, the Notifying Party does not consider that a further distinction should be made between genre, linear and non-linear services, or between broadcasting technologies.

4.2.1.2. Commission's assessment

(19) The market investigation indicates that the segmentation between FTA and Pay-TV channels continues to be appropriate. Respondents highlight the differences in terms of content, pricing, audience and how broadcast rights are licenced. While a minority of respondents do not believe it is necessary to formally distinguish between basic Pay-TV and FTA channels as the content is broadly substitutable from a consumer perspective, most of the respondents consider this segmentation to be still proper highlighting the difference in terms of content, pricing and how broadcast rights are licensed. 13

(20) The results of the market investigation also suggest that a distinction should be made between basic Pay-TV and premium Pay-TV channels with most respondents considering them not to be substitutable. While some respondents consider this distinction to be blurred, most respondents note that premium Pay-TV channels typically offer very specific content which has a particular value to the customer and is not available on basic Pay-TV channels such as sports rights to the most popular events (e.g. Champions League football), first window movies or exclusive content. 14

(21) The results of the market investigation were mixed as to whether the market should be further sub-divided according to genre. From the supply side, most respondents indicate that it is difficult to switch from supplying one genre to another since it could imply significant costs. NC+ and ITV, for example, note that acquiring new content, brand building and specific know-how would require significant investment.15 From the demand side, the market investigation provided mixed results. While some respondents indicate that a channel from a specific genre cannot necessarily be replaced by a channel from a different genre (for example, replacing a factual channel with a news channel); other respondents indicate that a general entertainment channel could be replaced, under some circumstances, by a lifestyle, home or travel channel.

(22) With regard to a possible segmentation of TV channels depending on the type of infrastructure used for their transmission, the results of the market investigation did not indicate that there are any differences on either the demand- or supply-side of the market according to the type of infrastructure the TV distributor operates.16

(23) In light of the above, the Commission concludes that the relevant product markets for the purposes of this Decision are, irrespective of the type of infrastructure used for their transmission, each of the markets for the wholesale supply of (i) FTA, (ii) basic Pay-TV and (iii) premium Pay-TV channels. The question whether these markets should be further segmented based on the genre of the channel can be left open, as this would not change the outcome of the competitive assessment in this case.

4.2.2. Geographic market definition

4.2.2.1. Notifying Party's view

(24) The Notifying Party considers that, in line with Commission’s precedents, the geographic scope of the market is national or confined to a linguistic region.

4.2.2.2. Commission's assessment

(25) In previous decisions, the Commission found the market for the wholesale supply of TV channels to be either national in scope,17 sub-national,18 or by linguistic region encompassing more than one Member State.19

(26) According to the respondents to the market investigation, the agreements between TV broadcasters and retail TV distributors for the wholesale supply of TV channels are negotiated on either a national, sub-national or linguistic basis. While most of respondents indicate that agreements are negotiated on a national basis, few respondents indicate that negotiations occur on a supra-national level, including multiple countries/regions with a common language.20

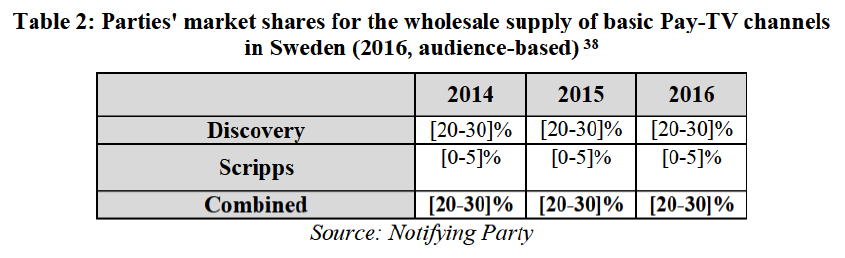

(27) In light of the above, the Commission concludes that the relevant geographic markets encompass the linguistic region including more than one Member State. The question whether these markets should be further segmented on either a national or a sub-national basis can be left open, as this would not change the outcome of the competitive assessment in this case.

4.3. Retail provision of TV services

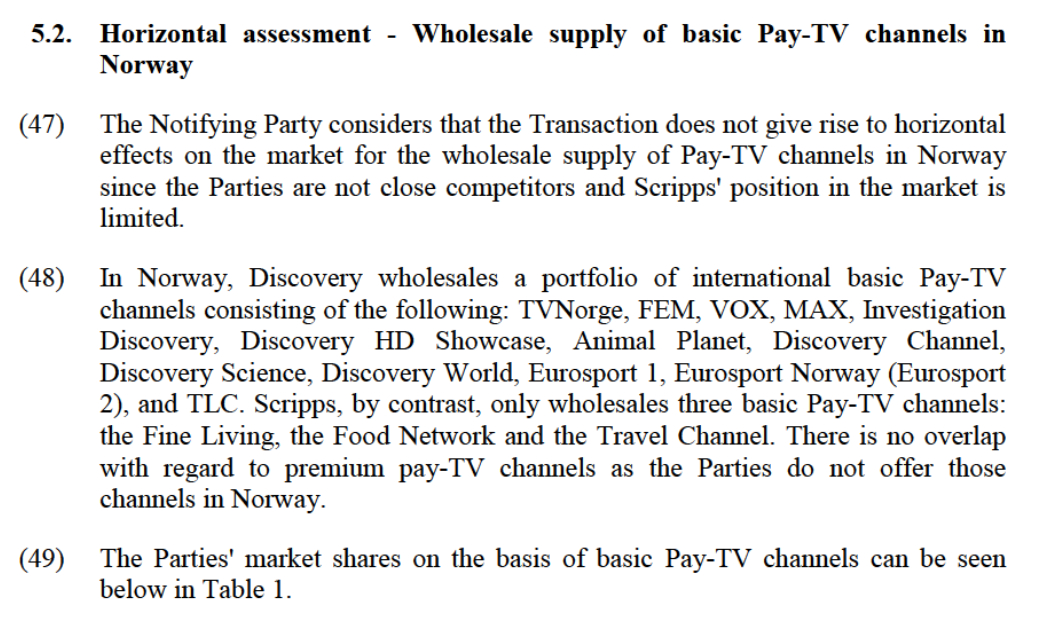

4.3.1. Product market definition

(28) TV distributors either limit themselves to carrying TV channels and making them available to end users, or also act as channel aggregators, which ‘package’ TV channels. The TV services supplied by TV distributors to end users consist of: (i) packages of linear TV channels (which they have either acquired or produced themselves); and (ii) content aggregated in non-linear services, such as Video on Demand ("VOD"), Subscription VOD ("SVOD"), Transaction VOD ("TVOD") and Pay Per View ("PPV"). TV content can be delivered to end users through a number of technical means including cable, satellite and IPTV.21 So-called over-the-top (“OTT”) players deliver channels and content in both a linear and non-linear fashion through the use of the internet.

4.3.1.1. Notifying Party's view

(29) The Notifying Party submits that, in accordance to Commission precedents, the market for the retail supply of TV services could be split into FTA and Pay-TV services.

(30) The Notifying Party does not consider it necessary to distinguish the market for the provision of TV services to end users according to: (i) distribution platform; (ii) linear vs non-linear; and (iii) premium vs. basic Pay-TV services since it would have not any impact on the assessment of the Transaction.

4.3.1.2. The Commission's assessment

(31) The Commission has previously defined separate product markets for the retail supply of television services in two separate markets: (i) FTA and Pay-TV22. The Commission also considered whether Pay-TV can be segmented further according to: (ii) linear vs non-linear Pay-TV services23; (iii) according to distribution technologies (e.g. cable, OTT, satellite, IPTV or terrestrial)24; and (iv) premium vs basic Pay-TV services25. In recent cases, the Commission has left open the market definition with regard to each of these potential sub-segments.

(32) The results of the market investigation did not provide reasons to depart from the Commission’s previous approach in this case.26

(33) In any event, the question whether the market for the provision of TV retail services should be further segmented based on the type of infrastructure, among FTA, basic and premium Pay-TV could be left open, as the Transaction does not raise serious doubts as to its compatibility with the internal market under any of these alternative product market definitions.

4.3.2. Geographic market definition

4.3.2.1. Notifying Party's view

(34) The Notifying Party considers that, in line with Commission’s precedents, the geographic scope of the market as being national or confined to linguistic region.

4.3.2.2. The Commission's assessment

(35) The Commission has previously considered that the market for the retail provision of TV services is either national, or limited to the geographic coverage of a supplier's cable network.27

(36) The results of the market investigation did not provide reasons to depart from the Commission’s previous approach in this case.28

(37) In any event, for the purpose of this decision, the exact geographic market definition for the retail provision of TV services can be left open, as the Proposed Transaction does not raise serious doubts as to its compatibility with the internal market whether considered nationally or by linguistic region.

4.4. Sale of advertising on TV channels

4.4.1. Product market definition

4.4.1.1. Notifying Party's views

(38) The Notifying Party submits that the market for the sale of advertising on TV channels should be considered as a whole and that no further segmentation between online and offline advertising is necessary. It further submits that in any event the Transaction will not give rise to any competition concerns, regardless of the possible alternative market definitions.

4.4.1.2. Commission's assessment

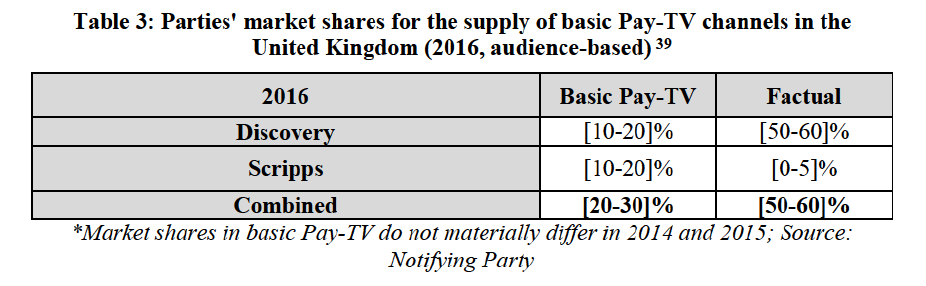

(39) The Commission has previously drawn a distinction between online and offline advertising, due to each channel's specificity and different pricing mechanisms.29 The Commission has also defined separate product markets for the sale of advertising space in national TV broadcasting respect to other offline advertising such as newspapers.30

(40) The results of the market investigation did not provide reasons to depart from the Commission’s previous approach in this case. 31 Therefore, it is likely that the sale of advertising space on TV channels constitutes a separate product market distinct from other forms of advertising.

(41) In any event, the exact product market definition can be left open, in particular as regards a possible distinction between online and offline advertising, as the Transaction does not raise serious doubts under any of the above possible market definitions.

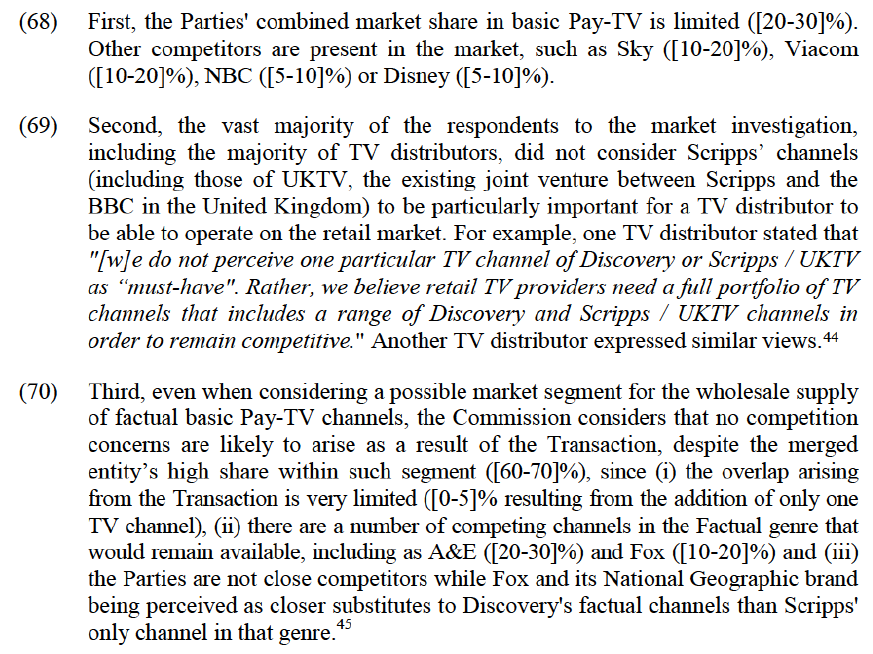

4.4.2. Geographic market definition

4.4.2.1. Notifying Party's views

(42) The Notifying Party considers that the geographic scope of the market for the sale of advertising space on TV channels is national and that it should not necessarily be defined along linguistically homogenous areas.

4.4.2.2. Commission's assessment

(43) In terms of geographic scope, previous Commission decisions have taken the view that the market for the sale of advertising space on TV channels is national32 or confined to linguistic region.33 The results of the market investigation did not provide reasons to depart from the Commission’s previous approach in this case. 34

(44) In any event, the precise geographic market can be left open, as the Transaction does not give rise to competition concerns with regard to TV advertising whether considered nationally or by linguistic region.

5. COMPETITIVE ASSESSMENT

5.1. Introduction

(45) The Transaction only gives rise to the following horizontally affected markets: (i) wholesale supply of basic Pay-TV channels in Norway (Section 5.2); (ii) wholesale supply of basic Pay-TV channels in Sweden (Section 5.3); (iii) wholesale supply of basic Pay-TV channels in the United Kingdom (Section 5.4); and (iv) wholesale supply of FTA35 and basic Pay-TV channels in Poland (Section 5.5). 36

(46) The Transaction also gives rise to vertically affected markets as a result of: (i) the Parties' upstream activities as wholesale suppliers of Pay-TV channels and Scripps' downstream activities in the retail supply of Pay-TV services, through TVN’s OTT platform in Poland (Section 5.6); and (ii) the Parties’ upstream activities as suppliers of advertising space on their own channels and Scripps' downstream activities, whereby TVN Media buys TV advertising time/space from TV channels for resale to media agencies, also in Poland (Section 5.7).

5.4.2. Notifying Party's view

(64) The Notifying Party submits that the Transaction would not give rise to competition concerns in the United Kingdom for the following reasons:

(a) First, a large number of basic Pay-TV channel suppliers will continue to compete with the merged entity, such as Sky ([10-20]% market share), Viacom ([10-20]%), NBC ([5-10]%), Disney ([5-10]%), Turner ([5-10]%)or A&E Networks ("A&E") ([0-5]%).40

(b) Second, Discovery's and Scripps' channels in the United Kingdom are not close competitors (Discovery focuses on factual and sports channels and Scripps, including UKTV, on general entertainment). Regarding the only genre where both Parties are present (i.e. factual), UKTV/Scripps' share only represents [0-5]% (and one channel) and the merged entity will face several competitors, such as A&E and Fox. Furthermore, factual programming is not emphasised by distributors in their sales41 and the Notifying Party considers that there is no clear demarcation as between what constitutes a "general entertainment" channel and a "factual" or a "lifestyle" channel.42

(c) Third, customers exert a very significant buyer power (namely BT, Sky, TalkTalk and Virgin Media) and will continue to do so post-Transaction.43

5.4.3. Commission's assessment

(65) With regard to a potential geographic market encompassing the United Kingdom and Ireland (linguistically homogeneous area) for the supply of basic-TV channels, the Commission notes that the Parties' combined market share in Ireland (Discovery: [0-5]%, Scripps: [0-5]%, combined [5-10]%) is significantly lower than in the United Kingdom. Therefore, the Parties' combined market shares in a potential market of the United Kingdom and Ireland combined would in any event be lower than in the United Kingdom. If there are no competition issues in the United Kingdom, competition issues can thus be excluded in a potential market encompassing both the United Kingdom and Ireland. The Commission will therefore undertake its assessment for the United Kingdom only.

(66) A limited number of respondents to the market investigation argued that the Transaction could give rise to higher wholesale fees as a result of an increase of Discovery’s bargaining power resulting from the acquisition of Scripps’ channel portfolio in the United Kingdom.

(67) The Commission considers that the Transaction does not raise serious doubts as to its compatibility with the internal market in relation to the wholesale supply of basic Pay-TV channels (and/or of basic Pay-TV channels belonging to the Factual genre within this market) in the United Kingdom for the following reasons.

*Market shares in basic Pay-TV do not materially differ in 2014 and 2015; Source: Notifying Party

5.5.2. Notifying Party's view

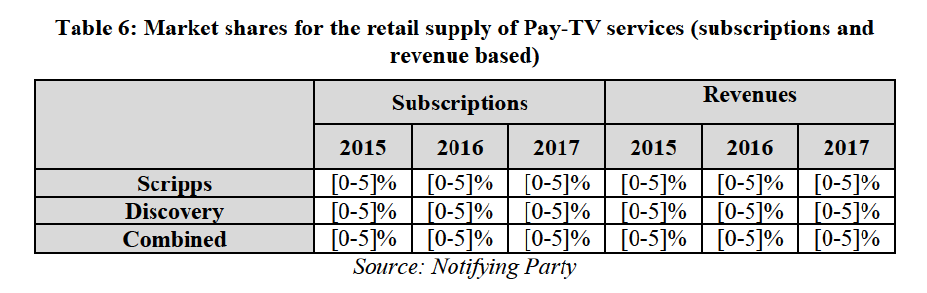

(72) The Notifying Party submits that the Transaction would not give rise to competition concerns in Poland for the following reasons:

(a) First, a large number of basic Pay-TV channel suppliers will continue to compete post-Transaction, such as Polsat, TVP, Viacom, NC+, Disney, Fox or Time Warner.47

(b) Second, Discovery's and Scripps' channels in Poland are not close competitors (Discovery is focused on factual and sports channels and TVN/Scripps on film and news). Regarding the genres where both are present (i.e. factual and lifestyle), the merged entity will face a number of competitors, such as Polsat, A&E and the BBC for lifestyle and Fox, A&E, Polsat and BBC for factual. In those two genres, the increments caused by the Transaction are limited ([10-20]% and one channel for Factual, and [10-20]% and one channel for Lifestyle). Furthermore, factual and lifestyle programming is not emphasised by distributors in their sales48 and the Notifying Party considers that there is no clear demarcation as between what constitutes a "general entertainment" channel and a "factual" or a "lifestyle" channel.49

(c) Customers (namely Cyfrowy Polsat, Liberty Global, Multimedia and Vectra) exert a very significant buyer power.50

(73) The Notifying Party also submitted that news channel viewership is volatile and news channels are insignificant to attract additional subscribers, that approximately half of TVN24's revenues are generated by sales of advertising airtime, which therefore suggests that TVN would have an incentive to ensure the widest distribution which would limit possible price increases and, more generally, that there is no increased bargaining power arising from the merged entity's wider portfolio of channels.51

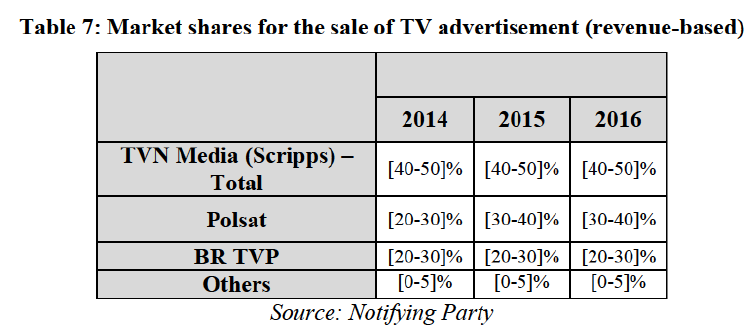

5.5.3. Commission's assessment

(74) Discovery and Scripps are active only in the wholesale supply of basic Pay-TV channels in Poland as neither party offer premium Pay-TV channels. Therefore, while the Transaction gives rise to an affected market for the wholesale supply of Pay-TV channels, including premium and basic channels, the Commission will assess the impact of the Transaction only on the narrower market for the wholesale supply of basic Pay-TV channels.

(75) The Commission considers that the Transaction raises serious doubts as to its compatibility with the internal market, as a result of horizontal unilateral effects in the market for the wholesale supply of basic Pay-TV channels, due to an increase in the merged entity's bargaining power vis-à-vis TV distributors.

(76) In more detail, the Commission considers that the merged entity will control a portfolio of channels which are important to Pay-TV distributors. Discovery's current portfolio includes the Discovery Channel and Eurosport, which are considered important, while TVN24, TVN's flagship news channel, which Discovery will acquire via the Transaction, is also considered particularly important by TV distributors and is among the most-watched Pay-TV channels in Poland. The addition of TVN24 to Discovery's existing portfolio will increase the merged entity's bargaining power. This concern is predicated on the fact that the Parties’ customers, namely TV distributors, have a preference for channel variety. As a result of the Transaction, Discovery would control a greater variety of channels than pre-merger. Post Transaction, Discovery would have a greater ability and incentive than pre-merger to raise the price for its increased channel repertoire when negotiating wholesale license fees with TV distributors by leveraging the importance that TVN24 has for retail customers.

(77) This is the case for the following reasons.

(78) First, although the merged entity’s combined market share in the wholesale supply of basic Pay-TV channels is moderate ([30-40]%), respondents to the market investigation indicated that certain TV channels in the Parties' portfolios are particularly important to TV distributors in Poland. These channels include Eurosport and the Discovery Channel from Discovery, and TVN24 from Scripps.

(79) With specific respect to the Scripps/TVN channels in Poland, the Commission notes that TVN and TVN7 are FTA channels which belong to a different product market where Scripps is present, but Discovery virtually absent, in Poland (see Section 4.2.1 and Footnote 35). In any event, the Commission notes that TVN is currently distributed for free and covered by a "must-offer" obligation, according to which Scripps is required to provide it for free to Pay-TV distributors.52 Similarly, TVN7, while not covered by a similar must-offer obligation, is also currently licensed under terms preventing Scripps from charging Pay-TV distributors for carrying this channel. These terms can only be amended with the consent of the Polish audiovisual regulator.53 Therefore, in the Commission's

watched the channel for 6 min or longer, 30 min or longer, 60 min or longer and 180 or longer within a month. In particular, TVN24 consistently ranked 1st when 180 min or longer where considered. Another aspect that shows TVN24's importance to Pay-TV distributors is that, according to the data provided by the Notifying Party, it represents [a significant share] of the carriage fees paid by TV distributors for all of Scripps' channels.57

(83) Third, the merged entity would likely have the ability and the incentive to jointly offer the licensing of its TV channel portfolio. The merged entity could increase the fees charged to TV distributors by exploiting the bargaining power gained through the addition to its portfolio of TVN24, a particularly important channel in the Polish Pay-TV market. It could also threaten TV distributors to withdraw its full channel portfolio which, given its variety, would force TV distributors to accept the merged entity's new conditions.

(84) Most respondents to the market investigation confirmed this.58 A number of respondents also mentioned Discovery's past behaviour, for example after its acquisition of Eurosport. As one respondent explained: "Discovery has not been reluctant to use their leverage in other markets in the past (e.g. Sweden and Norway where in both markets Discovery owns strong FTA channels for which they have suspended carriage in order to steer negotiations in their direction)." Another respondent described past negotiations of a competitor: "[a Pay-TV distributor] dropped Eurosport’s channels some time ago, but bought them again later on. [The Pay-TV distributor] after dropping Eurosport 1 and Eurosport 2 lost many subscribers. [S]ubscribers were complaining about the los[s] so they were pressed by the market to launch the channel again".59

(85) Conversely, the Commission considers that the Transaction would not give rise to serious doubts as to its compatibility with the internal market as a result of the combination of the Parties’ activities in specific channel genres within the wholesale supply of basic Pay-TV channels in Poland.

(86) As regards the wholesale supply of basic Pay-TV channels within the Factual genre, where the Parties' activities overlap, the Commission considers that (i) there are a number of other competing channels, such as Fox ([10-20]%), A&E ([10-20]%), Polsat ([5-10]%) and BBC ([0-5]%); (ii) Scripps/TVN’s factual channel (TVN Turbo) has not been identified by any of the respondents to the market investigation as one of the top factual channels in Poland,60 and (iii) the Parties are not close competitors, including based on a study from GfK submitted by one of the respondents, according to which National Geographic would be the Discovery Channel's closest substitute in terms of customers' spontaneous awareness and as first choice for factual content.61

foreclose downstream competitors: (i) the Parties would not hold significant market power in upstream market for the wholesale supply of basic Pay-TV services; (ii) several competitors would remain active in that market; and (iii) due to the Parties' low market shares in the market for the provision of retail pay-TV service, the revenues lost by Discovery upstream are unlikely to be recuperated by Scripps on the downstream retail market as its competitors would still be able to put together attractive packages using content from other providers.

5.6.3. Commission's assessment

(94) The Commission finds that the Transaction does not raise serious doubts as to its compatibility with the internal market as a result of possible input foreclosure effects since the merged entity would likely lack the incentive to reserve its channel portfolio to its own downstream OTT platform and, even if it were to do so, such conduct would likely not lead to foreclosure effects.

(95) This assessment is based on the fact that, post Transaction, first, the merged entity would only have a very limited presence in the provision of downstream retail Pay-TV services in Poland (including on the possible narrow segment for the retail provision of these services via OTT platforms) and, second, it is unlikely that a significant part of Pay-TV retail customers' demand would be diverted to the Parties' retail platforms. As a result, it is unlikely that the merged entity would have the economic incentive to reserve its channel portfolio to itself thereby foregoing the revenues that the Parties currently receive from the wholesale supply of their channels.

(96) Moreover, even it were to engage in this conduct in the narrow segment for the retail distribution of Pay-TV services via OTT platforms where they are active, it is not likely that the merged entity’s downstream competitors, which are currently much larger than the merged entity (for example, Netflix has market share over ten times larger than the Parties) would be foreclosed to the extent required to give rise to anti-competitive foreclosure effects.

5.7. Vertical assessment – Sale/purchase of TV advertising in Poland

5.7.1. Market shares

(97) The Transaction also gives rise to vertically affected markets between the sale of TV advertising in Poland, where both the Parties are active as suppliers of advertising airtime (upstream market), and the purchasing of such airtime to resell it to media agencies, where Scripps, through TVN Media, is active (downstream market) with a market share above 30%.

(98) The market shares of Scripps, through TVN Media, and its competitors on the basis of revenues and audience shares can be seen below in Table 7.

particular, Polsat sells advertising airtime for 18 of Polsat’s own TV channels as well as 46 channels from third party wholesale TV channel suppliers while BR TVP sells advertising airtime for 12 own TV channels and 13 third party wholesale TV channel suppliers.

6. COMMITMENTS

6.1. Introduction

(103) In order to remove the serious doubts arising from the Transaction described in Section 5.5 in relation to the market for the wholesale supply of basic Pay-TV channels in Poland, the Notifying Party submitted commitments pursuant to Article 6(2) of the Merger Regulation on 16 January 2018 (the "Initial Commitments").

(104) The Commission launched a market test of the Initial Commitments on 16 January 2018. Following the feedback received from the Commission, the Notifying Party submitted a final set of commitments on 30 January 2018 (the "Final Commitments").

(105) The Final Commitments are annexed to this decision and form an integral part thereof.

6.2. Analytical framework

(106) Where the Commission considers that a concentration will raise competition concerns the parties may seek to modify the concentration in order to resolve such competition concerns and thereby gain clearance of their merger.63

(107) In Phase I, commitments offered by the parties can only be accepted where the competition problem is readily identifiable and can easily be remedied. The competition problem therefore needs to be so straightforward and the remedies so clear-cut that it is not necessary to enter into an in-depth investigation. The commitments must be sufficient to clearly rule out "serious doubts" within the meaning of Article 6(1)(c) of the Merger Regulation. Where the assessment confirms that the proposed commitments remove the grounds for serious doubts on this basis, the Commission clears the merger in Phase I.64

(108) In assessing whether the proposed commitments will likely eliminate the competition concerns identified, the Commission considers all relevant factors including inter alia the type, scale and scope of the proposed commitments, judged by reference to the structure and particular characteristics of the market in which the competition concerns arise, including the position of the parties and other participants on the market.65

(109) In order for the commitments to comply with these principles, commitments must be capable of being implemented effectively within a short period of time.66 Where, however, the parties submit remedies proposals that are so extensive and complex that it is not possible for the Commission to determine with the requisite degree of certainty, at the time of its decision, that they will be fully implemented and that they are likely to maintain effective competition in the market, an authorisation decision cannot be granted.67

(110) As concerns the form of acceptable commitments, the Merger Regulation leaves discretion to the Commission as long as the commitments meet the requisite standard.68 Structural commitments will meet the conditions set out above only in so far as the Commission is able to conclude with the requisite degree of certainty that it will be possible to implement them and that it will be likely that the new commercial structures resulting from them will be sufficiently workable and lasting to ensure that the significant impediment to effective competition will not materialise.69

(111) Divestiture commitments are generally the best way to eliminate competition concerns resulting from horizontal overlaps, although other structural commitments, such as access remedies, may be suitable to resolve concerns if those remedies are equivalent to divestitures in their effects.70

(112) It is against this background that the Commission analysed the proposed commitments in this case.

6.3. Initial Commitments

6.3.1. Description of the Initial Commitments

(113) The Initial Commitments consisted in an obligation to offer distributors the right to distribute TVN24 and TVN24 BiS (the "Channels") in Poland on a non-exclusive and unbundled basis, for inclusion in a basic Pay-TV package on reasonable commercial terms (the "wholesale must-offer" commitment).

(114) To determine what constitute reasonable commercial terms, the Initial Commitments referred to terms charged before the Transaction to the Channels' distributors. These terms were distinguished according to the type of fee charged by TVN, namely (i) the current fee for distributors already carrying the Channels before the Transaction on a "per channel" fee basis; (ii) a per subscriber fee, calculated on the basis of a benchmark with comparable agreements, for new distributors; and (iii) the average carriage per-Channel rate based on the contractual terms in place with the three most comparable distributors in terms of number of subscribers for distributors carrying the Channels on the basis of a flat fee agreement for the entirety of Scripps' channel portfolio.

(115) The Initial Commitments provided for arbitration as a means of resolving possible disputes relating to the Notifying Party's compliance with its commitments. If a third party would claim that the Notifying Party was failing to comply with the commitments, it could submit its claim to a fast track dispute resolution procedure, administered by the Belgian Centre for Arbitration and Mediation – CEPANI. The Commission was allowed and enabled to participate in all stages of the procedure. In addition, the Notifying Party would appoint a monitoring trustee, to be approved by the Commission, to ensure compliance with the commitments.

(116) The Initial Commitments also contained two measures aimed at removing any concern that the Notifying Party could circumvent its obligation to license the Channels by either degrading their quality or moving attractive content that would normally be broadcasted in the Channels to other basic Pay-TV channels not covered by the commitments.

(117) First, the Initial Commitments provided that the Notifying Party would not knowingly do anything that has the effects of significantly and objectively reducing the quality of the Channels. In that context, the Channels' quality would be assessed in light of market developments and of the combination of the following metrics: audience shares, reach and advertising income.

(118) Second, the Initial Commitments provided that any other non-sport news channel launched by the Notifying Party in Poland after the Transaction would also be made available to distributors, in line with the obligations applying to the Channels.

(119) The duration of the Initial Commitments was four years from the date of the Transaction.

6.3.2. Commission's assessment

(120) The Commission initiated a market test of the commitments on 16 January 2018 and received responses from TV distributors and TV broadcasters in Poland. Taking into account the responses from the market test, the Commission subsequently assessed the commitments and concluded that they did not entirely remove its competition concerns.

(121) First, on the basis of information provided by respondents to the market test, the Commission considered that the scope of the ancillary rights included in the Initial Commitments was not appropriate. The Initial Commitments limited ancillary rights covered by its must-offer obligation to the right to include the Channels' programs as part of a TV everywhere service, which allow a subscriber to watch the Channels' program on multiple devices (such as smartphones or tablets). These rights were thus limited to the exclusion of other common ancillary rights, such as catch-up or recording and storing services that the Notifying Party may make available in the future.71

(122) Second, the Commission considered that the scope of distributors able to benefit from the commitments was inappropriately restrictive because it did not include distributors of linear TV channels over the internet (knows as "over-the-top" OTT providers). The Initial Commitments limited potential beneficiaries to traditional distribution models on cable, DTH, DTT IPTV or satellite platform and therefore risked excluding new and competitive forms of OTT distribution.72

(123) Third, results from the market test showed that distributors currently paying a flat fee across the entirety of Scripps' channel portfolio instead of a per-channel fee risked being imposed to an increase of their licensing fee as a result of the Initial Commitments.73 The reason for this increase was that the Initial Commitments provided that distributors carrying the Channels on the basis of a flat fee agreement would be offered a per-Channel fee which rate would be benchmarked on the average carriage rate based on the terms in place with the three most comparable distributors in terms of number of subscribers after the Transaction. The risk was therefore that the resulting per-Channel fee would end-up being higher than the implicit rate paid in current flat fee agreements.

(124) Fourth, the Commission considered that the Initial Commitments' duration was insufficient because it would likely not cover more than a single contract cycle given the usual duration of distribution contracts (3-4 years).74

(125) The Commission considered that other observations submitted by respondents to the market test did not warrant modifying the Initial Commitments.

(126) Several respondents to the market test suggested extending the scope of the commitments to additional channels, in particular those of Discovery.75 However, the specific change brought about by the Transaction relates to channels added to the Notifying Party's pre-merger channel portfolio and the resulting increase of bargaining power. Therefore, the Initial Commitments were sufficient to the extent that they provided for unbundled reasonable must-offer conditions for Scripps channels capable to increasing the merged entity's bargaining position. In light of that commitment, measures aimed at constraining the manner in which channels already owned by the Notifying Party before the Transaction would be offered to distributors post-merger appear to be disproportionate. With respect to TVN channels in addition to TVN24 and TVN24 BiS, no extension of the commitment's scope is warranted due to the conditions at which these channels will remain available to distributors after the Transaction (i.e. covered by a "must offer" obligation, as explained above in paragraph (79)), or due to their more limited importance to distributors.

(127) In addition, several respondents indicated that inflation adjustments were not common market practice in TV channel distribution agreements and feared that introducing such mechanism in the commitments would allow for fee increases.76 However, the Channels' distribution terms, in particular licensing fees, will be constrained under the Final Commitments in light of market conditions observable before the Transaction. Therefore, in the particular circumstances of the present case and in light of the duration of the Commitments, as amended, further preventing the Notifying Party to adjust its fees on the basis of a public index appears to be disproportionate and unnecessary to eliminate the serious doubts identified by the Commission.

6.4. Final Commitments

6.4.1. Description of the Final Commitments

(128) The Notifying Party submitted revised commitments on 30 January 2018, to address the shortcomings identified by the Commission subsequent to the market test. The Final Commitments contain several changes compared to the Initial Commitments.

(129) First, with respect to ancillary rights, the Final Commitments provide that any existing and future service, functionality or feature designed and offered to distributors as part of the Channels' broadcast experience will be included in the Notifying Party's wholesale must-offer obligation.

(130) Second, the Final Commitments extend the scope of distributors able to benefit from the commitments to any distributors offering a service that includes access to consumers to linear TV channels over the internet (howsoever delivered) via one or more devices.

(131) Third, the Final Commitments provide that "reasonable commercial terms" with respect to distributors currently paying a flat fee across the entirety of Scripps' channel portfolio will equate terms consistent with the existing contractual terms in place, albeit on an unbundled basis.

(132) Fourth, the Final Commitments extended the commitments' duration to seven years.

6.4.2. Commission's assessment

(133) In the Final Commitments, the Notifying Party amendments appropriately address the shortcomings identified by the Commission.

(134) First, under the Final Commitments, the scope of the Notifying Party's wholesale must-offer obligation unambiguously include all ancillary rights that the Parties currently or in the future will provide in relation to the Channels and will thus place every distributor on equal footing.

(135) Second, the Final Commitments will also benefit third party OTT distributors and therefore ensure that emerging internet distribution models would not be placed at a disadvantage vis-à-vis traditional TV distributors and the merged entity's own OTT platform.

(136) Third, the Final Commitments correct an inadequate determination of future "reasonable" distribution terms to distributors previously benefitting from a flat-fee agreement. In this respect, the Final Commitments impose an obligation on the merged entity to offer unbundled terms which are consistent with the implicit standalone fee charged for the Channels in current flat fee agreements and will therefore not allow the Notifying Party to depart from these terms to introduce a price increase. It should also be noted that, even if the Final Commitments impose an obligation on the merged entity to offer unbundled terms which are consistent with the implicit fee charged for the Channels in current flat fee agreements, they do not prevent the merged entity to conclude flat free agreements across a portfolio of channels reached in the context of arm's length negotiations.

(137) Fourth, the Final Commitments' seven year duration will cover at least two contract cycles. The Final Commitments will therefore cover a sufficient time period to prevent any anticompetitive effects in the foreseeable future.

(138) For the reasons outlined above, the commitments entered into by the undertakings concerned are sufficient to eliminate the serious doubts as to the compatibility of the Transaction with the internal market.

(139) Under the first sentence of the second subparagraph of Article 6(2) of the Merger Regulation, the Commission may attach to its decision conditions and obligations intended to ensure that the undertakings concerned comply with the commitments they have entered into vis-à-vis the Commission with a view to rendering the concentration compatible with the internal market.

(140) The achievement of the measure that gives rise to the structural change of the market is a condition, whereas the implementing steps which are necessary to achieve this result are generally obligations on the Parties. Where a condition is not fulfilled, the Commission's decision declaring the concentration compatible with the internal market no longer stands. Where the undertakings concerned commit a breach of an obligation, the Commission may revoke the clearance decision in accordance with Article 8(6) of the Merger Regulation. The undertaking concerned may also be subject to fines and periodic penalty payments under Articles 14(2) and 15(1) of the Merger Regulation.

(141) The commitments in section B of the Annex constitute conditions attached to this decision, as only through full compliance therewith can the structural changes in the relevant markets be achieved. The other commitments set out in the Annex constitute obligations, as they concern the implementing steps which are necessary to achieve the modifications sought by the commitments.

7. CONCLUSION

(142) For the above reasons, the Commission has decided not to oppose the notified operation as modified by the commitments annexed to the present decision and to declare it compatible with the internal market and with the functioning of the EEA Agreement, subject to full compliance with the conditions in section B of the commitments annexed to the present decision and with the obligations contained in the other sections of the said commitments. This decision is adopted in application of Article 6(1)(b) in conjunction with Article 6(2) of the Merger Regulation and Article 57 of the EEA Agreement.

FOOTNOTES :

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 431, 15.12.2017, p. 9.

4 NC+ is solely controlled by Canal +. See decision of 30 November 2012 in Case M.6741 - Vivendi Group / N-C + Entity.

5 Turnover calculated in accordance with Article 5 of the Merger Regulation.

6 Urząd Ochrony Konkurencji i Konsumentów (UOKiK), Office of Competition and Consumer Protection.

7 Mr Malone is one of the main shareholders of Discovery. In particular, Mr Malone owns 0.4% of Series A common stock and 93.1% Series B common stock of Discovery.

8 Notifying Party's submission to the Commission of 15 January 2018, "Observation by the Parties: The Polish Competition Authority's request for referral under Article 9(2)(a) Merger Regulation".

9 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky; see also, Commission decision of 24 February 2015 in case M.7194 – Liberty Global / Corelio / W&W / De Vijver Media; see also, Commission decision of 16 September 2014 in case M.7282 - Liberty Global/Discovery/All3Media.

10 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky, paragraphs 80 and 81; see also Commission decision of 18 August 2014 in case M.7194 - Liberty Global / Corelio / W&W / De Vijver Media, recital 90. In case M.7194, it was not necessary to make a distinction between FTA and Pay-TV channels iven the limited standalone presence of FTA channels

11 Commission decision of of 7 April 2017 in case M.8354 – Fox / Sky; Commission decision of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media, recital 92. Commission decision of 2 April 2003 in case M.2876 Newscorp/Telepiù, 2 April 2003, recital 76; Commission decision of 18 July 2007 in case M.4504 SFR/Télé 2 France, recitals 41–42; Commission decision of 26 august 2008 in case M.5121 News Corp/Premiere, recital 35; Commission decision of 21 December 2010 in case M.5932 News Corp/BskyB, recital 81; Commission decision of 10 October 2014 in case M.7000 Liberty Global/Ziggo, recital 89.

12 Commission decision of 24 February 2015 in case M.7194 - Liberty Global / Corelio / W&W / De Vijver Media, recital 98. Commission decision of 18 July 2007 in case M.4504 SFR/Télé 2 France, recital 44; Commission decision of 26 August 2008 in case M.5121 News Corp/Premiere, recital 22.

13 Responses to questionnaire Q1 – to TV distributors - the UK, questions 5-7; responses to questionnaire Q2 – to TV channel providers - the UK, questions 6-8; responses to questionnaire Q3 – to TV distributors - Poland, questions 5-7; responses to questionnaire Q4 – to TV channel providers - Poland, questions 6-8.

14 Responses to questionnaire Q1 – to TV distributors - the UK, questions 8-9; responses to questionnaire Q2 – to TV channel providers - the UK, questions 9-10; responses to questionnaire Q3 – to TV distributors - Poland, questions 8-9; responses to questionnaire Q4 – to TV channel providers - Poland, questions 9-10.

15 Responses to questionnaire Q1 – to TV distributors - the UK, question 11; responses to questionnaire Q2 – to TV channel providers - the UK, question 12; responses to questionnaire Q3 – to TV distributors - Poland, question 11; responses to questionnaire Q4 – to TV channel providers - Poland, question 12.

16 Responses to questionnaire Q1 – to TV distributors - the UK, question 12; responses to questionnaire Q3 – to TV distributors - Poland, question 12; responses to questionnaire Q4 – to TV channel providers - Poland, question 13.

17 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky; Commission decision of 21 December 2011 in case M.6369 HBO/Ziggo/HBO Nederland, recital 39; Commission decision of 15 April 2013 in case M.6880 Liberty Global/Virgin Media, recital 41; Commission decision of 10 October 2014 in case M.7000 Liberty Global/Ziggo, recital 98.

18 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky; Commission decision of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media.

19 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky; Commission decision of 21 December 2010 in case M.5932 News Corp/BskyB, recitals 86–88; Commission decision of 15 April 2013 in case M.6880 Liberty Global/Virgin Media.

20 Responses to questionnaire Q1 – to TV distributors - the UK, question 13; responses to questionnaire Q2 – to TV channel providers - the UK, question 13; responses to questionnaire Q3 – to TV distributors - Poland, question 13; responses to questionnaire Q4 – to TV channel providers - Poland, question 15.

21 IPTV is the abbreviation for Internet Protocol TV; it is a system through which television services are delivered using the Internet protocol over a packet-switched network such as the internet, instead of being delivered through traditional terrestrial, satellite signal and cable television formats.

22 Commission decisions of 18 July 2007 in case M.4504 SFR/Télé 2 France, recital 40, and of 25 June 2008 in case M.5121 News Corp / Premiere, recital 20. See also, Commission decision of 7 April 2017 in case M.8354 – Fox / Sky, paragraph 97; Commission decisions of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media, recital 119-120, of 25 June 2008 in case M.5121 News Corp/Premiere, recitals 15 and 21, and of 10 October 2014 in case M.7000 Liberty Global/Ziggo, recital 108).

23 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky, paragraph 98 and 99; Commission decision of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media, reictal 124. Commission decision of 25 June 2008 in case M.5121 News Corp/Premiere, recital 21. Commission decision of 10 October 2014 in case M.7000 Liberty Global/Ziggo, recitals 109–110.

24 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky, paragraph 100; Commission decision of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media, recital 127. Commission decision of 25 June 2008 in case M.5121 News Corp/Premiere, recital 22; Commission decision of 21 December 2010 in case M.5932 News Corp/BskyB, recital 105. Commission decision of 10 October 2014 in case M.7000 Liberty Global/Ziggo, recital 113.

25 Commission decision of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media, recital 119.

26 Responses to questionnaire Q1 – to TV distributors - the UK; responses to questionnaire Q2 – to TV channel providers - the UK; responses to questionnaire Q3 – to TV distributors - Poland; responses to questionnaire Q4 – to TV channel providers - Poland.

27 Commission decision of 7 April 2017 in case M.8354 – Fox / Sky; Commission decision of 24 February 2015 in case M.7194 Liberty Global / Corelio / W&W / De Vijver Media.

28 Responses to questionnaire Q1 – to TV distributors - the UK; responses to questionnaire Q2 – to TV channel providers - the UK; responses to questionnaire Q3 – to TV distributors - Poland; responses to questionnaire Q4 – to TV channel providers - Poland.

29 Commission decision of 9 September 2014 in case M.7288 – Viacom / Channel 5 Broadcasting, paragraph 35.

30 Commission decision of 3 November 2010 in case M.5932 - News Corp/BskyB, recital 267. Commission decision of 24 February 2015 in case M.7194 – Liberty Global / Corelio / W&W / De Vijver Media, recital 144.

31 Responses to email sent to TV Advertisers in Poland. See also, responses to questionnaire Q4 – to TV channel providers - Poland, question 14; responses to questionnaire Q3 – to TV distributors - Poland, question 26; responses to questionnaire Q4 – to TV channel providers - Poland, question 26.

32 Commission decision of 07 March 2008 in the case M.5051 - APW/GMG/EMAP; Commission decision of 21 December 2010 in case M.5932 News Corp/BskyB; Commission decision date 9 September 2014 in case M.7288 Viacom/Channel 5 Broadcasting; and Commission decision of of 7 April 2017 in case M.8354 – Fox / Sky.

33 Commission decision of 20 September 1995 in case IV/M.553 RTL/Veronica/Endemol, recital 27.; Commission decision of 24 February 2015 in case M.7194 – Liberty Global / Corelio / W&W / De Vijver Media, recital 145.

34 Responses to email sent to TV Advertisers in Poland. See also, responses to questionnaire Q1 – to TV distributors - Poland, question 26; responses to questionnaire Q2 – to TV distributors - Poland, question 26.

35 Given the de minimis overlap between the Parties’ activities in the wholesale supply of FTA channels in Poland (Discovery’s market share is [0-5]% in this market) and the fact that none of the respondents to the market investigation raised concerns as regards the impact of the Transaction on this market, the wholesale supply of FTA channels in Poland will not be further discussed in this Decision.

36 One respondent to the market investigation considers that the Transaction would strengthen NC+ competitive position in the market for the provision of retail Pay-TV services in Poland. See response to Questionnaire Q4 to TV distributors of 11 December 2017, question 24.

As regards the possible issues arising from the alleged acquisition of control by Mr. Malone over NC+ as a result of the Transaction, the Commission considers that, post transaction, NC+ will continue to be solely controlled by Canal +. See, Commission decision of 30 November 2012 in case M.6741 - Vivendi Group / N-C + Entity. Vivendi, through Canal+, controls 51% of the shares and votes in NC+. The remaining shares and votes are held by TVN, which holds a 32% stake, and Liberty Global, which holds a 17% stake. Pursuant to this amendment to the Shareholders Agreement of 2 October 2012, Canal+ has the right to appoint the majority of the supervisory board which, in turn, would have the power to approve NC+'s strategic commercial decisions (annual budget, business plan, and investments decisions are taken at simple majority). TVN does not have any veto rights on such strategic commercial decisions. Liberty Global does not have any veto rights.

40 Form CO, paragraph 334.

41 Form CO, paragraphs 335-339.

42 Form CO, paragraph 197.

43 Form CO, paragraphs 340-341.

47 Form CO, paragraph 312.

48 Form CO, paragraphs 313-315.

49 Form CO, paragraph 197.

50 Form CO, paragraphs 316-319.

51 Notifying Party's submission of 3 January 2018, "Bargaining power in wholesale channel supply", sections B.I, C.IV, D.I and E.

52 The Polish Broadcasting Act (the "PBA"), includes a must-carry/must-offer obligation that concerns both broadcasters and TV distributors, whereby TV distributors are obliged to air the following FTA channels: TVP1, TVP2, regional channels broadcasted by Telewizja Polska S.A., Polsat, TVN, TV4 and Puls. A corresponding must-offer obligation is imposed on the four relevant TV channel providers (including TVN) who shall grant any willing distributor a consent for the re-emission of the must-carry channels. Such consent cannot be conditional upon payment of any fee. See Notifying Party's response to the Commission's RFI 3 of 8 December 2017, question 9.

53 Notifying Party's submission of 3 January 2018, "Bargaining power in wholesale channel supply", B.III and Annex 1, which includes TVN7's licence terms in Annex 1. TVN7 licence conditions include a clause that prevents TVN from charging for carrying this channel "The channel will not be encrypted and will be available to recipients free of charge". Any change in these conditions would be subject to the Agreement of the National Broadcasting Council (the “NBC” or, in Polish, Krajowa Rada Radiofonii i Telewizji, “KRRiT), Poland's audiovisual regulator). See also Notifying Party's response to RFI 3 of 8 December 2017, question 9.

57 Notifying Party's submission of 3 January 2018, "Bargaining power in wholesale channel supply", E.III and Notifying Party's response to the Commission's RFI 7 of 26 January 2018, question 1.

58 Responses to Questionnaire Q3 to TV distributors of 11 December 2017, question 20 and non-confidential minutes of Commission's calls with TV distributors on 23 November and 7 December 2017.

59 Non-confidential minutes of the Commission's call with a Pay-TV distributor on 7 December 2017.

60 Responses to Questionnaire Q4 to TV distributors of 11 December 2017, question 17.

61 See Annex 8 in response to RFI 4 of 11 January 2018.

![]()

63 Commission notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the "Remedies Notice"), OJ 2008/C 267/01, Paragraph 5.

64 Remedies Notice, Paragraph 81.

65 Remedies Notice, Paragraph 12.

66 Remedies Notice, Paragraph 9.

67 Remedies Notice, Paragraphs 13, 14 and 61 et seq.

68 Case T-177/04 easyJet v Commission [2006] ECR II-1913, Paragraph 197.

69 Remedies Notice, Paragraph 10.

70 Remedies Notice, Paragraph 61.

71 Responses to Questionnaire Q3 of 16 January 2018, question 5.

72 Responses to Questionnaire Q3 of 16 January 2018, question 4.

73 Responses to Questionnaire Q3 of 16 January 2018, questions 6 and 9.

74 Responses to Questionnaire Q3 of 16 January 2018, question 13.

75 Responses to Questionnaire Q3 of 16 January 2018, question 6.

76 Responses to Questionnaire Q3 of 16 January 2018, question 11.

Case COMP/M.8665 – Discovery / Scripps COMMITMENTS TO THE EUROPEAN COMMISSION

Pursuant to Article 6(2) of Council Regulation (EC) No. 139/2004 as amended (the “Merger Regulation”), Discovery Communications, Inc. (“Discovery”) hereby enters into the following commitments (the “Commitments”) vis-à-vis the European Commission (the Commission) with a view to rendering the acquisition of Scripps Networks Interactive, Inc. (“Scripps”) by Discovery (the “Concentration”) compatible with the internal market and the functioning of the EEA Agreement.

This text shall be interpreted in light of the Commission’s decision pursuant to Article 6(1)(b) of the Merger Regulation to declare the Concentration compatible with the internal market and the functioning of the EEA Agreement (the “Decision”), in the general framework of European Union law, in particular in light of the Merger Regulation, and by reference to the Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the “Remedies Notice”).

A. DEFINITIONS

For the purpose of the Commitments, the following terms shall have the following meaning:

Affiliated Undertakings: undertakings controlled by Discovery whereby the notion of control shall be interpreted pursuant to Article 3 of the Merger Regulation and in light of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No. 139/2004 on the control of concentrations between undertakings (the “Consolidated Jurisdictional Notice”).

Ancillary Rights: the right to include programs from a Channel as part of a TV Everywhere Service or Linked Service or both, to the extent these rights are owned or controlled by one or more of Discovery and/or its Affiliated Undertakings.

Channels: TVN24 and TVN24 BiS, in the format(s) (e.g., standard definition (”SD”), high definition (”HD”), any other future format made available in the future) that these channels are available in from time to time, including Ancillary Rights offered by these channels.

Confidential Information: any business secret, know-how, commercial information, or any other information of a proprietary nature that is not in the public domain.

Conflict of Interest: any conflict of interest that impairs the Monitoring Trustee’s objectivity and independence in discharging its duties under the Commitments.

Discovery: Discovery Communications, Inc., incorporated under the laws of Delaware, the United States, with its registered office at Silver Spring, Maryland and registered with the Delaware Division of Corporation under number 4540106.

Distributor: a provider of TV distribution services via cable, DTT, IPTV, OTT or satellite distribution platforms.

Effective Date: the date of adoption of the Decision.

Linked Service: any existing service, functionality or feature that (i) is designed and offered to a third party Distributor as part of the broadcast experience of the Channels, and (ii) is offered to end users simultaneously with the linear transmission of the Channels, or before or after the linear transmission of the Channels for a period which is customary for such service, functionality or feature.

New Linked Service: any future service, functionality or feature that (i) is designed and offered to a third party Distributor as part of the broadcast experience of the Channels, and (ii) is offered to end users simultaneously with the linear transmission of the Channels, or before or after the linear transmission of the Channels for a period which is customary for such service, functionality or feature.

Monitoring Trustee: one or more natural or legal person(s), independent from Discovery, who is approved by the Commission and appointed by Discovery, and who has the duty to monitor Discovery’s compliance with the conditions and obligations attached to the Decision.

New Channel: any other non-sport news channel launched by Discovery in the Territory after the Effective Date.

New Distributor: a Distributor that is not distributing the Channels on the Effective Date.

OTT: any service that includes access to consumers to linear TV channels over the internet (howsoever delivered) via one or more devices.

Territory: the whole territory of Poland to the extent the rights included in the Channels extend to this whole territory.

TV Everywhere Service: a service allowing a subscriber to a Channel to watch the Channel and individual programs exhibited on the Channel on multiple devices, such as but not limited to tablets, desktop and laptop devices and smartphones, in the Territory.

B. COMMITMENT TO OFFER ACCESS TO THE CHANNELS

1. As of the Effective Date, Discovery will offer third party Distributors the right, on a non-exclusive and unbundled basis, to distribute one or both of the Channels in the Territory, through the inclusion in a pay-TV package, on reasonable commercial terms.

2. For the purpose of these Commitments, reasonable commercial terms shall mean:

a. For a third party Distributor already distributing the Channels on the Effective Date that have a “per channel” fee agreement in place, the terms in place with the applicable third party Distributor for the carriage of the Channels.

b. For a New Distributor, the standard cost per subscriber terms based on a benchmark of comparable agreements concluded between TVN and Distributors as of the Effective Date.

c. For those Distributors that have a flat fee agreement in place as of the Effective Date, terms consistent on an unbundled basis with the existing contractual terms in place.

3. Any New Channel will be made available to third party Distributors in line with the commitments described in paragraphs 1 and 2. The terms for the charge of the New Channel shall be benchmarked to those of the Channels as provided for in paragraph 2 of these Commitments.

4. Any New Linked Service will be made available to third party Distributors on fair, reasonable and non-discriminatory commercial terms.

5. If Discovery enters into a new agreement either with an existing third party Distributor at the expiry of the current contract or with a New Distributor during the period of the Commitments, then the “per channel” fee shall be the rate in place as at the Effective Date, subject to adjustment for inflation based on the consumer price index rate in Poland (“CPI rate”).

6. Discovery shall not knowingly do anything that has the effect of significantly and objectively reducing the quality of the Channels. The quality of such channels should be assessed in light of market developments and of the combination of the following metrics: audience share, reach and advertising income.

7. Discovery will not require any third party Distributor to purchase any of the other channels in its portfolio in order to rely on these Commitments.

C. MONITORING TRUSTEE

I. Appointment Procedure

8. Discovery shall appoint a Monitoring Trustee to carry out the functions specified in the Commitments for a Monitoring Trustee. Discovery commits not to close the Concentration before the appointment of a Monitoring Trustee.

9. The Monitoring Trustee shall:

a. at the time of appointment, be independent of Discovery and its Affiliated Undertakings;

b. possess the necessary qualifications to carry out its mandate, for example have sufficient experience as a consultant or auditor; and

c. neither have nor become exposed to a Conflict of Interest.

10. The Monitoring Trustee shall be remunerated by Discovery in a way that does not impede the independent and effective fulfilment of its mandate.

Proposal by Discovery

11. No later than two (2) weeks after the date of adoption of the Decision, Discovery shall submit a name or names of one or more natural or legal persons whom Discovery propose to appoint as the Monitoring Trustee to the Commission for approval.

12. The proposal shall contain sufficient information for the Commission to verify that the person or persons proposed as Monitoring Trustee fulfil the requirements set out in paragraph 9 and shall include:

a. the full terms of the proposed mandate, which shall include all provisions necessary to enable the Monitoring Trustee to fulfil its duties under these Commitments;

b. the outline of a work plan which describes how the Monitoring Trustee intends to carry out its assigned tasks.

Approval or rejection by the Commission

13. The Commission shall have the discretion to approve or reject the proposed Monitoring Trustee(s) and to approve the proposed mandate subject to any modifications it deems necessary for the Monitoring Trustee to fulfil its obligations. If only one name is approved, Discovery shall appoint or cause to be appointed, the individual or institution concerned as Monitoring Trustee, in accordance with the mandate approved by the Commission. If more than one name is approved, Discovery shall be free to choose the Monitoring Trustee to be appointed from among the names approved. The Monitoring Trustee shall be appointed within one week of the Commission’s approval, in accordance with the mandate approved by the Commission.

New proposal by Discovery

14. If all the proposed Monitoring Trustees are rejected, Discovery shall submit the names of at least two more natural or legal persons within one week of being informed of the rejection, in accordance with paragraphs 8 and 13.

Monitoring Trustee nominated by the Commission

15. If all further proposed Monitoring Trustees are rejected by the Commission, the Commission shall nominate a Monitoring Trustee, whom Discovery shall appoint, or cause to be appointed, in accordance with a trustee mandate approved by the Commission.

II. Functions of the Monitoring Trustee

16. The Monitoring Trustee shall assume its specified duties in order to ensure compliance with the Commitment set out in Section B. The Commission may, on its own initiative or at the request of the Monitoring Trustee or Discovery, give any orders or instructions to the Monitoring Trustee in order to ensure compliance with the conditions and obligations attached to the Decision.

17. The Monitoring Trustee shall:

a. propose in its first report to the Commission a detailed work plan describing how it intends to monitor compliance with the Commitments;

b. monitor compliance of the terms of the carriage agreements between Discovery and Distributors with the requirements of the Commitments set out in Sections B.1 to B.5;

c. monitor compliance with the Commitment to maintain the quality of the Channels set out in Section B.6 and not to require any third party Distributor to purchase any of the other channels in its portfolio as set out in Section B.7;

d. act as a contact point for any requests by third parties in relation to the Commitments;

e. propose to Discovery such measures as the Monitoring Trustee considers necessary to ensure Discovery’s compliance with the conditions and obligations attached to the Decision;

f. provide to the Commission, sending Discovery a non-confidential copy at the same time, a written report within fifteen (15) days after the end of every quarter, regarding the compliance by Discovery with the Commitments;

g. promptly report in writing to the Commission, sending Discovery a non-confidential copy at the same time, if it concludes on reasonable grounds that Discovery is failing to comply with the Commitments.

III. Duties and obligations of Discovery

18. Discovery shall provide and shall cause its advisors to provide the Monitoring Trustee with all such cooperation, assistance and information as the Monitoring Trustee may reasonably require to perform its tasks. The Monitoring Trustee shall have full and complete access to any of Discovery’s books, records, documents, management or other personnel, facilities, sites and technical information necessary for fulfilling its duties under the Commitments and Discovery shall provide the Monitoring Trustee upon request with copies of any document. Discovery shall make available to the Monitoring Trustee one or more offices on their premises and shall be available for meetings in order to provide the Monitoring Trustee with all information necessary for the performance of its tasks.

19. Discovery shall indemnify the Monitoring Trustee and its employees and agents (each an “Indemnified Party”) and hold each Indemnified Party harmless against, and hereby agrees that an Indemnified Party shall have no liability to Discovery for any liabilities arising out of the performance of the Monitoring Trustee’s duties under the Commitments, except to the extent that such liabilities result from the wilful default, recklessness, gross negligence or bad faith of the Monitoring Trustee, its employees, agents or advisors.

20. At the expense of Discovery, the Monitoring Trustee may appoint advisors (in particular for legal advice), subject to Discovery’s approval (this approval not to be unreasonably withheld or delayed) if the Monitoring Trustee considers the appointment of such advisors necessary or appropriate for the performance of its duties and obligations under the Mandate, provided that any fees and other expenses incurred by the Monitoring Trustee are reasonable. Should Discovery refuse to approve the advisors proposed by the Monitoring Trustee the Commission may approve the appointment of such advisors instead, after having heard Discovery. Only the Monitoring Trustee shall be entitled to issue instructions to the advisors. Paragraph 19 shall apply mutatis mutandis.

21. Discovery agrees that the Commission may share Confidential Information proprietary to Discovery with the Monitoring Trustee. The Monitoring Trustee shall not disclose such information and the principles contained in Article 17(1) and (2) of the Merger Regulation apply mutatis mutandis.

22. Discovery agree that the contact details of the Monitoring Trustee are published on the website of the Commission’s Directorate-General for Competition and they shall inform interested third parties of the identity and the tasks of the Monitoring Trustee.

23. For a period of four (4) years from the date of adoption of the Decision the Commission may request all information from Discovery that is reasonably necessary to monitor the effective implementation of these Commitments.

IV. Replacement, discharge and reappointment of the Monitoring Trustee

24. If the Monitoring Trustee ceases to perform its functions under the Commitments or for any other good cause, including the exposure of the Monitoring Trustee to a Conflict of Interest:

a. the Commission may, after hearing the Monitoring Trustee, require Discovery to replace the Monitoring Trustee; or

b. Discovery, with the prior approval of the Commission, may replace the Monitoring Trustee.