Commission, August 4, 2015, No M.7559

EUROPEAN COMMISSION

Decision

PFIZER/ HOSPIRA

To the notifying party:

Dear Madam(s) and/or Sir(s),

Subject: Case M.7559 - PFIZER/ HOSPIRA

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 15 June 2015, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Pfizer Inc. of the United States (“Pfizer” or “the Notifying Party”) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertaking Hospira Inc. (“Hospira”), of the United States.

(2) Pfizer and Hospira are collectively referred to as “the Parties”.

I. THE PARTIES AND THE OPERATION

(3) Pfizer is a global research based biomedical and pharmaceutical company active in discovering, developing, manufacturing, marketing, and selling innovative medicines for humans.

(4) Hospira is a global provider of injectable drugs and infusion technologies, with a broad portfolio of generic, branded and biosimilar medicines for humans.

(5) On 5 February 2015, Pfizer and Hospira entered into an Agreement by which Hospira will become a wholly owned subsidiary of Pfizer. Pfizer will therefore acquire sole control over Hospira within the meaning of Article 3(1)(b) of the Merger Regulation.

II. UNION DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million3 (Pfizer: EUR 37 339 million, Hospira EUR 3 360 million). Each of them has an EU-wide turnover in excess of EUR 250 million (Pfizer: EUR [5000-10000] million, Hospira: EUR [250-500] million), and they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has Union dimension within the meaning of Article 1(2) of the Merger Regulation.

III. RELEVANT MARKETS AND COMPETITIVE ASSESSMENT

(7) The Parties’ activities overlap with respect to human health pharmaceuticals, in two main areas: (i) biosimilars and (ii) speciality injectable pharmaceuticals (“sterile injectables”).

(8) The Parties both supply Active Pharmaceutical Ingredients ("API") to third parties and undertake contract manufacturing for third parties. However, there is no vertical relationship between the Parties where the downstream share (finished dose-level) is above 30%, irrespective of the upstream share (API-level), and vice-versa.

III.1. Biosimilars

III.1.1. Introduction

(9) Biological medicines have an active substance made by or derived from living organisms. Biosimilars aim to have the same therapeutic mechanism as original patented medicines, but, unlike small molecule generics, are not exact copies of the originator drugs. According to the guidelines of the European Medicines Agency (“EMA”), in order to obtain a marketing authorisation for a biosimilar, its manufacturer needs to demonstrate similarity (in terms of quality, safety and efficacy) to a reference biological product. The clinical trials may be performed for only one indication for which the originator drug had been approved, and on that basis the approval may be granted for all the indications of the originator drug (the “extrapolation principle”).

(10) The biosimilar segment of the pharmaceutical sector is relatively new. The first-generation biosimilars launched in Europe since 2006 have been relative simple proteins such as erythropoietin. The second-generation biosimilars, which are at the core of this transaction, are more complex monoclonal antibodies (“mAb”).4 The first mAb biosimilar, a copy of J&J's Remicade (infliximab), was approved in Europe in 2013.

(11) Given that biological drugs are also some of the most expensive therapies available, the entry of biosimilars is expected to allow wider access by patients to biological drugs. Furthermore, as the entry of the first biosimilar products have led to price decreases compared to the originator product, there are significant expectations across the EEA that biosimilars will be an important factor in relieving the financial pressure on healthcare systems.

(12) The Notifying Party submits that the development of a biosimilar can be divided in a number of steps:

a. Analysis and characterisation of the reference biologic product – Such an analysis focuses on both the structural attributes and the functions of the reference biological product and is carried out on several samples from multiple lots of the reference product over the lifetime of that product. This analysis should lead to a comprehensive physicochemical and biological characterisation of the reference biological product.

b. Non-clinical studies and development of the manufacturing process – In this phase, manufacturers carry out in-vitro studies to assess any difference between the biosimilar product being developed and the reference biological product. In addition, a manufacturing process that guarantees consistent quality of the biosimilar molecule is developed.

c. Phase I (pharmacokinetics-PK/pharmacodynamics-PD) clinical trials – PK studies appraise the way the body affects the biosimilar product, e.g. in terms of absorption, while PD studies appraise the way the product affects the body, e.g. through its mechanism of action. The purpose is to show comparability with the reference biological product, in particular as regards safety. Phase I trials are normally carried out in healthy volunteers.

d. Phase III (efficacy) clinical trials – As phase II clinical trials are not required for biosimilars, the final step of the development of a biosimilar consist of the demonstration of comparable clinical efficacy of the biosimilar and the reference biological product. Phase III trials are carried out for one approved therapeutic indication of the reference product, as data can be extrapolated to other indications if non-clinical and PK/PD studies demonstrate biosimilarity.

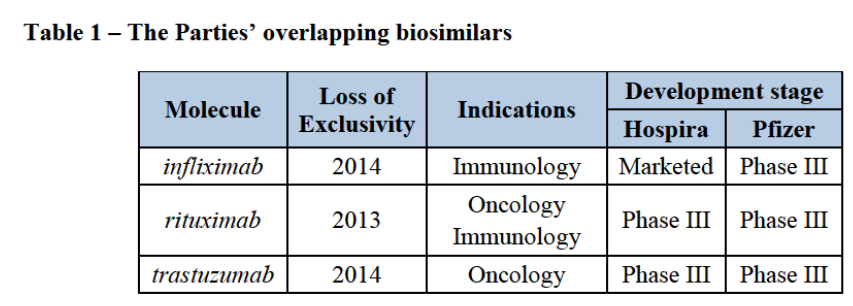

(13) The Parties’ activities overlap in the development of mAb biosimilars, for which they have three common molecules marketed or in clinical trials (phase I or phase III).

(14) While Pfizer develops and markets its mAb biosimilars in-house, Hospira markets (or will market, once new biosimilars have been developed) biosimilars developed by Celltrion of South Korea. This cooperation envisages [...].

III.1.2. Market definition

III.1.2.1. Product market

(15) When defining relevant markets in past decisions dealing with pharmaceutical products, the Commission has established a number of principles.5 In those decisions it noted that medicines may be subdivided into therapeutic classes by reference to the "Anatomical Therapeutic Classification" (ATC), devised by the European Pharmaceutical Marketing Research Association (EphMRA) and maintained by EphMRA and Intercontinental Medical Statistics (IMS).6

(16) The ATC system is a hierarchical and coded four-level system which classifies medicinal products according to their indication, therapeutic use, composition and mode of action. In the first and broadest level (ATC1), medicinal products are divided into the 16 anatomical main groups. The second level (ATC2) is either a pharmacological or therapeutic group. The third level (ATC3) further groups medicinal products by their specific therapeutic indications, i.e. their intended use. Finally, the ATC4 level is the most detailed one (not available for all ATC3) and refers for instance to the mode of action (e.g. distinction of some ATC3 classes into topical and systemic depending on their way of action) or any other subdivision of the group.

(17) In its past merger decisions in the pharmaceutical sector, the Commission has referred to the third level (ATC3) as the starting point for defining the relevant product market. However, in a number of cases, the Commission found that the ATC3 level classification did not yield the appropriate market definition within the meaning of the Commission Notice on the Definition of the Relevant Market. As a result, where appropriate and based on the factual evidence collected during the market investigation, the Commission has defined the relevant product market at the ATC4 level or at a level of molecule or a group of molecules that are considered interchangeable so as to exercise competitive pressure on one another.7 The overlap in therapeutic uses does not necessarily imply any particular economic substitution patterns between products.

(18) In its previous decisions, the Commission recognised that the market for biosimilars should be treated differently than the market for small molecule generics.8 However, the Commission did not previously assess the markets for infliximab, rituximab and trastuzumab biosimilars.

III.1.2.1.a. infliximab

(19) infliximab is an anti-TNF (anti-tumor necrosis factor) agent used in autoimmune diseases (such as rheumatoid arthritis). The originator product, Remicade, was developed by Johnson & Johnson9 and is marketed by MSD (Merck, Sharp & Dohme, hereinafter referred to as “Merck”) in Europe. Its annual 2014 sales exceeded USD 10 billion globally (#3 best-selling pharmaceutical). infliximab is currently the only mAb for which a biosimilar version (by Hospira and Celltrion) has been approved by the European Commission based on the opinion of EMA (in 2013), and which has already been prescribed to patients for example in Norway, the UK, Hungary and Finland.

(20) There are currently a number of anti-TNF agents approved by the EMA, including monoclonal antibodies such as adalimumab (Humira), certolizumab pegol (Cimzia), infliximab (Remicade) and golimumab (Simponi), as well as etanercept (Enbrel), a fusion protein. The Notifying Party submits that some anti-TNF agents may substitute for others in certain indications, while different ones, such as infliximab, may not.

(21) As to the substitutability between infliximab and other anti-TNF agents, the majority of respondents to the market investigation from the demand side indicated that they purchase infliximab pharmaceuticals (Remicade and the biosimilars) through competitive tenders,10 which are typically organised per molecule (for instance infliximab).11 The majority of leading medical professionals in the field (i.e. Key Opinion Leaders) that responded to the Commission's investigation confirmed that none of their patients on other anti-TNF agents (such as adalimumab or etanercept) had been switched to a biosimilar version of infliximab in the past 12 months, while for the rest of Key Opinion Leaders only a very small minority of such patients were switched to a biosimilar version of infliximab (the maximum amount being 5%).12

(22) The Notifying Party's views are further confirmed by one key competitor noting in particular that it "observed only little impact of infliximab biosimilars on other TNF-inhibitors [anti-TNF agents]". Indeed, as opposed to other anti-TNF agents which have a subcutaneous formulation, infliximab has to be administered intravenously and "normally patients used to subcutaneous medicines would not switch to an intravenous one".13 Accordingly, only a minority of respondents from the supply side expect the introduction of a biosimilar anti-TNF agent to exert downward pressure on prices of the originator products of other molecules sharing the same indications with the reference product.14

(23) In light of the above, the Commission takes the view that infliximab belongs to a separate product market from other anti-TNF agents.

(24) As to the substitutability between Remicade and infliximab biosimilars, it should be noted that both are approved by the EMA for the same indications (by virtue of the principle of extrapolation), and that they compete for the same tenders related to infliximab. In practice, in a number of situations (more than half of the analysed tenders),15 Remicade is co-awarded the tender along with one infliximab biosimilar.

(25) In light of the above, for the purpose of the present Decision, as regards the molecule concerned the relevant product market should comprise infliximab pharmaceuticals, including both the originator infliximab (Remicade) and infliximab biosimilars.

III.1.2.1.b. rituximab

(26) rituximab is a humanised monoclonal antibody that binds to the CD20 protein, used in autoimmune diseases (such as rheumatoid arthritis) and oncology (such as for certain types of leukaemia and lymphoma). The originator product, MabThera, was developed by Roche. Its annual 2014 sales were USD 7.4 billion globally (#6 best-selling pharmaceutical).

(27) For the purpose of the present Decision, it is not necessary to delineate the precise product market definition in relation to rituximab, as no competitive concerns arise on a hypothetical market for rituximab pharmaceuticals, as well as under any wider market definition.

III.1.2.1.c. trastuzumab

(28) trastuzumab is a humanised monoclonal antibody that binds to the HER2 protein, used primarily for treatment of early and metastatic breast cancer. The originator product, Herceptin, was developed by Roche. Its annual 2014 sales were USD 6.7 billion globally (#9 best-selling pharmaceutical).

(29) For the purpose of the present Decision, it is not necessary to delineate the precise product market definition in relation to trastuzumab, as no competitive concerns arise on a hypothetical market for trastuzumab pharmaceuticals, as well as under any wider market definition.

III.1.2.2. Geographic market

(30) The Commission has consistently considered that the markets for finished dose pharmaceutical products are national.16 For pipeline products, the Commission previously considered that the geographic scope of the relevant market is at least EEA-wide.17

(31) There appears to be no reason to depart from this conclusion in the present case. Since all overlaps related to biosimilars concern pipeline products, the relevant geographic scope for the assessment of biosimilars in the present Transaction is at least EEA-wide.

III.1.3. Competitive assessment

III.1.3.1. The competitive dynamics of biosimilar markets differ from those of generics

(32) As part of its analysis in the present case, the Commission considered, on the basis of the evidence of this case, the differences between competition in markets for biologic drugs on the one hand and competition in markets for small-molecule drugs and generics versions of such drugs on the other hand. In particular, the Commission considered (as part of its analysis of the transaction) the differences between generics and biosimilars in terms of product differentiation, interchangeability, regulatory framework, cost structure and barriers to entry, all of which are key for the competitive assessment of the proposed transaction.

(33) Small-molecule originator products and generic products based on the same active principle can generally be considered homogeneous products that compete mainly on price, especially in the case of hospital drugs procured through competitive tenders. While manufacturers, especially originators, may try to differentiate their product as a strategy to soften the intensity of price competition, measures have been taken in European countries to constrain their ability to do so. Such measures include for example incentives for physicians to write generic prescriptions (i.e. financial incentives based on targets of generic prescriptions), generic substitution by the pharmacist regardless of the brand name used by the prescriber, incentives for pharmacists to dispense the cheapest available versions of a given medicine (e.g. regressive margins, obligation to stock and dispense the cheapest generic), and incentives for patients to ask for the cheapest available versions of their medicines (i.e. differentiated patient co-payments based on relative prices). These measures are designed to encourage generic uptake by making prescribers, pharmacists and patients more sensitive to price differences. Evidence shows that they can be effective at fostering price competition.18

(34) Biological products are intrinsically differentiated due to their complex molecular structure. As discussed above, no biosimilar product is identical either to the original biologic product on which it is based, or to any other biosimilar product. Despite their similarity stemming from pre-clinical bioequivalence studies, regulatory authorities consider their differences sufficiently significant to request clinical trials to prove the clinical equivalence between every new biosimilar and the original biologic product on which it is based, for at least one major indication. In particular, the EMA establishes for every family of biological medicines19 a specific set of clinical evidence required for the regulatory approval of new biosimilars. As a consequence, not only the regulatory approval and the clinical evidence available for biosimilar products differ from that of generic products, but such clinical evidence also differs between different families of biological medicines.

(35) Originator biological products and biosimilar products are therefore not identical in terms of molecular structure, and moreover they are distinct in terms of clinical evidence available on their efficacy and safety. According to the EMA, "it is for each national (health) authority to decide on the interchangeability and substitution of the originator and the biosimilar based on the scientific evidence submitted to the EMA and other available data and information (...) the EMA is not involved in this second decision-making process at national level and there is no common European legal framework regarding interchangeability".20 Accordingly, physicians and pharmacists do not necessarily consider originator and biosimilars based on the same biologic molecule to be fully interchangeable. This applies equally to the interchangeability amongst biosimilars based on the same molecule, which are also not identical in their chemical structure and clinical evidence. In practice, the situation varies from Member State to Member State and from indication to indication, depending in particular on the perception of the clinical risks for the patient associated to product switches. Competition between original biologic products and biosimilar products, as well as between any pair of biosimilar products, is therefore characterised by the limited degree of substitutability for patients already undergoing treatment. Hence biosimilars differ from small-molecule generics, which being chemically identical show a much higher degree of substitutability for all patients. Biosimilars of the same molecule, by contrast, show lower degree of substitutability for patients already in treatment, while still showing a high degree of substitutability for new patients.

(36) This lower degree of substitutability for a segment of patients has an impact both on commercial strategies and market outcomes. Original biologic products have the chance of building a stock of potentially locked-in patients during the period of market exclusivity, especially for chronic treatments (e.g. for immunological disorders). Upon loss of market exclusivity, if the perceived clinical risks of switching are not negligible, new biosimilar entrants for a given monoclonal antibody are less likely to attract patients that have already initiated treatment with the original product. In this case, biosimilar competition takes place mainly for newly diagnosed patients that are about to initiate treatment so have not received a therapeutic drug yet. The commercial strategy of new biosimilar entrants can consist both of price undercutting and product differentiation, for instance through investment on the development of superior clinical evidence. The originator firm may have an incentive to exploit its stock of locked-in patients through price premiums, while still competing for treatment-naive patients via product differentiation, leveraging on brand and product recognition acquired during the period of market exclusivity.

(37) This results in the segmentation of patients by product and implies that not the entire market is contestable at any point in time. In terms of market outcomes, it results in slower market penetration by biosimilar products, compared to what is typically observed in markets for small-molecule generics, even though price discounts offered by biosimilar manufacturers can be of similar magnitude. The market investigation has in fact shown that payers typically need to procure both the original product and biosimilar products, to guarantee treatment continuity to all their patients. Hence, price differentials do not automatically translate into shifts in market shares in favour of biosimilars.

(38) To the extent that new biosimilar entrants manage to attract treatment-naive patients and build their own stock of locked-in patients, they face the trade-off between continuing to price low to attract additional patients and increasing prices to exploit their stock of locked-in patients. Given their inability to price discriminate between new and locked-in patients, this trade-off weakens their incentives to aggressively compete in price for new patients. Therefore, while biosimilar competitors have an incentive to price low at entry, such incentive diminishes as they establish their position in the market, resulting in less intense price competition.

III.1.3.2. infliximab

(39) The competitive landscape in relation to infliximab pharmaceuticals in the EEA is as follows:

a. the originator drug Remicade (off-patent since 2014) is exclusively marketed by Merck in the EEA;

b. there is one approved biosimilar, marketed co-exclusively between Celltrion (the developer of the product, marketing it through distributors under the brand name Remsima) and Hospira (marketing it under the brand name Inflectra) based on a duplicate marketing authorisation;

c. two companies have infliximab biosimilars in phase III clinical trials: Pfizer and Samsung Bioepis of South Korea; and

d. a number of other companies (such as Epirus, Amgen/Actavis and Dr. Reddy's) are at earlier stages in the development of infliximab biosimilars.

(40) The Notifying Party submits that the Transaction will not have a significant impact on competition with respect to infliximab. Post-transaction Remicade would remain on the market as an active competitor, there would be two infliximab biosimilars on the market (one from Celltrion, and one from the merged entity), and at least one short term potential entrant, who already is seeking approval (Samsung Bioepis). According to the Notifying Party, Samsung Bioepis appears as a credible potential competitor that will be the third to enter the market, well before the next potential entrant (Epirus or Pfizer). Given that Pfizer is not the next entrant on the market (and in fact is over [...] years away from possibly entering the market) and that the originator biologic remains a strong competitor, the Notifying Party submits that it is not the only credible competitor to Hospira and Celltrion. In addition, existing competition between Celltrion and Hospira, as well as potential competition from the next entrants, would preclude the emergence of any anti-competitive effects on the infliximab market. According to the Notifying Party, by the time that Pfizer's product will be ready for market launch there will be four if not five infliximab on the market from Merck (Remicade), Hospira, Celltrion, Samsung Bioepis and potentially Epirus.

Nature of competition in the market

(41) The market for infliximab is characterised by three types of competitive interactions, each of a different nature: (i) the competition between the originator biologic and biosimilars; (ii) the actual price competition between Hospira and Celltrion, which both market the same biosimilar in the EEA, and (iii) the future competition between three differentiated biosimilar products (Hospira/Celltrion’s, Samsung Bioepis’ and Pfizer’s).

(42) Regarding competition between the originator biologic and biosimilars, this competition manifests itself mainly in a one-way price constraint form biosimilars on the originator drug. Indeed, the market entry of Inflectra and Remsima at a lower price than Remicade led to Merck reducing the price of Remicade in order to mitigate the loss of market share.21 However, given that it is still early days for biosimilars and given that biosimilars are only "similar" to the originator, the price levels of Remicade generally remain higher than those of Inflectra and Remsima.22 This is consistent with Merck having an incentive to maintain a relatively higher price to benefit from locked-in patients. The fact that Remicade is co-awarded the tender along with one biosimilar in a number of situations illustrates that it has differentiating features that still allow Merck to charge a premium compared to the biosimilar suppliers and that biosimilars are not fully replacing the originator. This is consistent with the need of guaranteeing treatment continuity to patients already initiated on Remicade, avoiding any clinical risks associated to changing the prescribed product. Customers and Key Opinion Leaders confirmed that not all infliximab patients, in particular patients already on Remicade, are prescribed Remsima or Inflectra,23 which highlights the absence of full interchangeability of biosimilars, as a result of which the hospitals continue purchasing Remicade in spite of higher prices. The availability of Remicade is also of importance for patients with indications for which biosimilars were not tested in clinical trials (in relation to which physicians tend to be more sceptical). One competitor indeed highlighted that it "has noticed a certain reluctance of gastroenterologists to prescribe biosimilars and is aware of an ECCO [European Crohn´s and Colitis Organisation] position paper published 18 months ago which raises doubts on extrapolation of biosimilars in gastroenterological diseases without significant clinical trials",24 while a Key Opinion Leader confirmed that "once studies on switching patients to biosimilars have been published, also gastroenterologists' reluctance will be countered. Current reluctance mainly exists due to biosimilar infliximab having been tested only for RA [Rheumatoid Arthritis], while the application for the gastroenterological indications was only extrapolated from the efficacy in RA".25 This highlights that the competition between infliximab biosimilars and the originator may be weaker for extrapolated indications such as gastroenterological diseases.

(43) Therefore, Remicade can be considered a distant competitor to infliximab biosimilars.

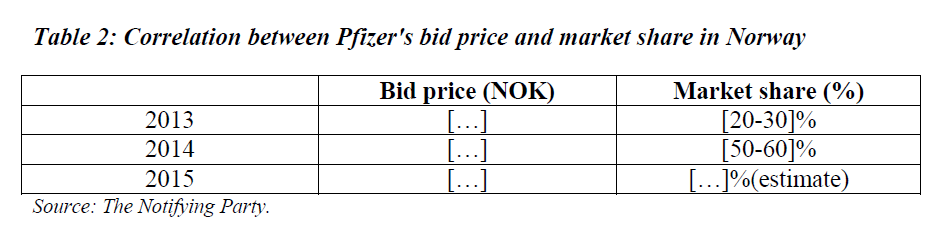

(44) Regarding actual competition between Hospira and Celltrion, respondents to the market investigation indicated that they are aware that Inflectra and Remsima are the same product, and that they generally select only one of the two (typically the cheapest).26 This is confirmed by the analysis of tender data across the EEA which shows that Inflectra and Remsima almost never win the same tender (whereas, as explained above, Remicade and one biosimilar often do).27 This is a unique feature of the market, specific to infliximab, where two commercially distinct biosimilar products are in fact identical in their molecular structure and clinical evidence. They compete as homogeneous products, with brand differentiation being consciously disregarded by customers, leading to intense downward pricing pressure in infliximab tenders since the entry of Hospira and Celltrion's biosimilars in 2013.

(45) Finally, the importance of future competition between differentiated biosimilar products (Hospira/Celltrion’s, Samsung Bioepis’ and Pfizer’s) also stems from the lack of full interchangeability between Remicade and infliximab biosimilars, as well as between the infliximab biosimilars. Provided that they all reach the market, each of them will show some degree of differentiation from each other, with its own clinical evidence being evaluated by the EMA for the purpose of regulatory approval. Indeed, the potential for market success of each of these biosimilars will depend on the degree of prescribers’ acceptance across therapeutic indications, which itself depends in particular on the robustness of the clinical data (as well as real-world experience) provided by each manufacturer. Therefore, contrary to generics, there is room for differentiation strategies and non-price competition between these three distinct biosimilars, with the likely result of less intense price competition than what has been observed so far between Hospira and Celltrion. In such circumstances, it is less likely that few biosimilar competitors can deliver significant price reductions than typically observed for small-molecule generics. The importance of the number of differentiated biosimilars for price competition is illustrated by the internal pricing forecasts of the Parties’, [...].28

(46) Given the limited experience so far with biosimilar products in general, it is difficult to assess at this stage the potential commercial success of each of these products (Hospira/Celltrion's, Samsung Bioepis', Pfizer's and the next entrants). However, the market investigation provided insights on the expectations of market participants (including the Parties).

Pfizer and Hospira/Celltrion are considered to be strong players in the field of biosimilars

(47) The majority of physicians and Key Opinion Leaders confirmed that the reputation of an individual biosimilar supplier plays a role (half of them "to some extent", the other half "to a large extent").29 In this context, Pfizer and Hospira are generally considered in the market to be very strong players in the field of biosimilars. Accordingly, they are often quoted by competitors, customers, physicians and Key Opinion Leaders alike as two of the five most important manufacturers/developers of biosimilars).30

(48) In particular, despite limited information available so far about the clinical evidence of Pfizer's biosimilars such as infliximab (none of which having being approved yet), customers perceive Pfizer's products as a strong potential competitor with the following strengths "brand name", "experience in biosimilars", "great manufacturer of biologicals", "experienced in rheumatology" and "marketing infrastructure".31 Such advantages seem consistent with Pfizer's internal documents showing [...].32

(49) Celltrion, on the other hand, is still working, in particular through partnerships, to gain market presence and reputation in the EEA. Leveraging on Hospira’s expertise and reputation in the EEA was indeed a key rationale for Celltrion to enter into a co-exclusive marketing agreement with Hospira for infliximab (and a number of other biosimilars). As evidenced by Celltrion, "for distributing its biosimilars, Celltrion Healthcare pursues a "dual channel" strategy, whereby each European country has two appointed distributors. For a number of biosimilars, including infliximab, Celltrion Healthcare manages one channel (and uses local distributors), and the other channel is Hospira".33 This lack of reputation is evidenced by customers which rarely identify Celltrion as one of the five most important manufacturers/developers of biosimilars.34

A future entrant still facing challenges: Samsung Bioepis

(50) Apart from Pfizer, Samsung Bioepis is the only other company with an infliximab biosimilar in phase III clinical trials. It submitted a marketing authorisation application to the EMA in March 2015.35 While it cannot be excluded that Samsung Bioepis' infliximab biosimilar will be marketed in Europe before Pfizer's, internal documents from the Parties suggest that [...].36 Furthermore, Samsung Bioepis does not have a marketing presence in the EEA and is partnering with Merck and Biogen Idec for the commercialisation of its biosimilars. Samsung Bioepis has a partnership with Merck to market its biosimilars in a number of countries (in particular in Europe). However, for infliximab, because Merck is marketing the originator drug Remicade in Europe, it was necessary for Samsung Bioepis to find another partner (it entered into a partnership with Biogen Idec in December 2013). [...].37

The other competitors are not expected to become a competitive constraint in the EEA in the foreseeable future

(51) Finally, the other competitors identified by the Notifying Party such as Epirus, Amgen/Actavis and Dr. Reddy's, do not have an infliximab biosimilar in advanced stages of development, and are therefore not expected to become a competitive constraint in the EEA in the foreseeable future.

(52) While Epirus has an infliximab biosimilar approved in India,38 it cannot readily use the same data to seek a marketing authorisation in the EEA. Indeed, it "plans to initiate a global [phase III] clinical program in late 2015/early 2016".39 This is confirmed by the EMA, which indicated that "side-by-side analysis of the biosimilar product (from commercial scale and site) with the EEA authorised reference product must be conducted". A comparative trial with a non-EEA authorised reference medicinal product would suppose that such product be approved by "a regulatory authority with similar scientific and regulatory standards as EMA (e.g. ICH countries)". 40,41

(53) Finally, Dr. Reddy's did not indicate having an infliximab biosimilar in its portfolio,42 and the Notifying Party highlights in its recent internal documents that [...].43

Barriers to entry

(54) Clinical trials required to provide the necessary evidence for regulatory approval are costly both in terms of financial resources and time, and require also certain R&D capabilities. Consequently, barriers to entry for biosimilars are typically higher than for generics and the pool of potential entrants upon patent expiry is typically smaller for biological drugs than for small-molecule chemical drugs. According to the Notifying Party, the development of a new biosimilar product takes on average between six and eight years of development, to which should be added on average one and a half year for regulatory approval.44 Small-molecule generic products, on the contrary, can be prepared for launch much faster.

(55) This has at least two consequences for the assessment of potential competition in markets of biologic drugs. On the one hand, the higher barriers to entry are likely to result in fewer successful entrants in the market. The larger sunk costs an entrant needs to incur (which range from USD [100-200] million to USD [300-400] million according to the Notifying Party) weaken the competitive constraints imposed by potential entrants. On the other hand, the length of the clinical development implies that the set of potential entrants can be easily identified, as the stage of development of each potential entrant can be observed early on.

Conclusion on the competitive landscape

(56) In light of the above, the Commission takes the view that the competitive landscape for the infliximab market in the foreseeable future is composed of one biosimilar co-marketed by Hospira and Celltrion (which are subject to intense price competition from each other), and two future differentiated biosimilar competitors from Samsung Bioepis and Pfizer, while the originator infliximab is a distant competitor to its biosimilars.

Effects of the proposed Transaction

(57) The proposed Transaction will therefore bring two infliximab biosimilars under the same ownership (Inflectra and Pfizer’s pipeline biosimilar). This situation will reduce

the Parties’ pre-merger incentives to compete in one of the two alternatives ways:

a) Pfizer will either delay or discontinue its pipeline biosimilar in order to focus on Inflectra, leading to the net loss of one of only three differentiated biosimilars marketed or in advanced stages of development. Pfizer’s internal documents [...];45 or

b) [Analysis of elements that could lead Pfizer to],46 hand back Hospira’s Inflectra rights to Celltrion, leading to the loss of price competition between Hospira and Celltrion.

(58) On the one hand, the reduced incentives to continue developing Pfizer's biosimilar translate into a lessening of innovation competition. Indeed, the delay or even cancellation of Pfizer's development program would deprive patients from timely access to a differentiated product that is currently assessed positively by market participants on the basis of available clinical evidence. It would lessen price competition for new patients in a market where, due to the presence of switching costs, every new entrant has an incentive to behave as an important competitive force , pricing low to gain market share.

(59) On the other hand, the return of Hospira's commercial rights to Inflectra to Celltrion would eliminate the particularly intense price competition currently observed between Hospira and Celltrion, which is a specific feature of these two biosimilar products due to the fact that they are the very same compound, and are perceived as homogeneous products fully interchangeable in clinical practice. The likely result of this would be higher prices at least for Hospira's and Celltrion's customers.

(60) The reduction of the Parties' pre-merger incentives to compete on the infliximab market was confirmed by competitors responding to the market investigation which indicated that a biosimilar company does not have any incentive to pursue the development of a pipeline biosimilar if it already markets a biosimilar for the same molecule.47 Customers and Key Opinion Leaders expressed concerns regarding the Transaction's effects on infliximab, leading either to “reduced price cuts” or to “Pfizer’s infliximab, which is a very good molecule, not becoming available”.48

(61) Therefore, based on all available evidence, the Commission concludes that the analysis of the proposed Transaction indicates that it is likely to significantly impede effective competition by either eliminating an important future competitive constrain (three-to-two differentiated biosimilars) or reducing the competitive pressure on the remaining competitors (loss of price competition), and thus raises serious doubts as to its compatibility with the internal market in relation to infliximab.

III.1.3.3. rituximab

(62) The Notifying Party submits that the competitive landscape in relation to rituximab pharmaceuticals in the EEA is as follows:

a. the originator drug MabThera is marketed by Roche in the EEA;

b. there is no approved biosimilar;

c. seven companies have differentiated rituximab biosimilars in phase III clinical trials: each of the Parties (Hospira in partnership with Celltrion), Sandoz (Novartis), Boehringer Ingelheim, Mabion, Amgen/Actavis and Merck Serono/Dr Reddy's; and

d. a number of other companies (such as Merck) are at earlier stages in the development of rituximab biosimilars.

(63) The market investigation broadly confirmed the competitive landscape in relation to rituximab biosimilars.49

(64) Furthermore, Pfizer's internal documents highlighted its intention to [...].50 Contrary to infliximab, which is already marketed by Hospira and Celltrion's distributors, Celltrion's rituximab biosimilar is still in development and estimated to enter the EEA in [...], and it is more likely than not that Celltrion would be able to find an alternative distributor in Europe (or distribute the product itself) should it obtain marketing authorisation.

(65) Excluding Mabion,51 none of the six companies appear to have a significant competitive advantage with respect to the development of their differentiated rituximab biosimilar. Internal documents from Pfizer highlight that [...].52 In any event, a number of future competitors of the merged entity will remain after the Transaction.

(66) Therefore, based on all available evidence, the Commission concludes that the proposed Transaction does not raise serious doubts as to its compatibility with the internal market in relation to rituximab.

III.1.3.4. trastuzumab

(67) The Notifying Party submits that the competitive landscape in relation to rituximab pharmaceuticals in the EEA is as follows:

a. the originator drug Herceptin is marketed by Roche in the EEA;

b. there is no approved biosimilar;

c. five companies have differentiated trastuzumab biosimilars in phase III clinical trials: each of the Parties (Hospira in partnership with Celltrion), Amgen/Actavis, Mylan/Biocon and Samsung Bioepis; and

d. a number of other companies (such as BioXpress and Nippon Kayaku) are at earlier stages in the development of trastuzumab biosimilars.

(68) The market investigation broadly confirmed the competitive landscape in relation to trastuzumab biosimilars.53

(69) Furthermore, Pfizer's internal documents highlighted [...].54 Contrary to infliximab, which is already marketed by Hospira and Celltrion's distributors, Celltrion's trastuzumab biosimilar is still in development and estimated to enter the EEA in [...], and it is more likely than not that Celltrion would be able to find an alternative distributor in Europe (or distribute the product itself) should it obtain marketing authorisation.

(70) None of the five companies appear to have a significant competitive advantage with respect to the development of their differentiated trastuzumab biosimilar. Internal documents from Pfizer highlight that [...].55 In any event, a number of future competitors of the merged entity will remain after the Transaction.

(71) Therefore, based on all available evidence, the Commission concludes that the proposed Transaction does not raise serious doubts as to its compatibility with the internal market in relation to trastuzumab.

III.2. Sterile injectables

III.2.1. General characteristics of sterile injectables markets

(72) The Parties are both active in the supply of generic sterile injectables. Even though Pfizer focuses its business activities on the development of new drugs, and is thus mainly active in originator drugs, it also markets generic drugs. Upon patent expiry (or shortly before), Pfizer's products are transferred to its Global Established Pharmaceuticals business ("GEP"). GEP is responsible for the commercialisation of the products that have lost or are about to lose patent protection and of generics. Approximately [...]% of Hospira's total sales in the EEA are accounted for by the sale of its generic sterile injectables.

(73) The term "sterile injectables" refers to a large group of medicines that are administered by the same route, i.e. with a hollow needle which is pierced through the skin. As such, sterile injectables do not correspond to a single relevant market within the meaning of the EU competition rules, but encompass a heterogeneous set of entirely different molecules which are not substitutable to one another. However, some characteristics relevant for the competitive assessment of the present merger apply to all the sterile injectables markets. These characteristics are described below.

Barriers to entry and to expansion

(74) The Notifying Party submits that the markets for sterile injectables within the EEA are fragmented with a significant number of suppliers present across different geographic areas. According to the Notifying Party there are no suppliers that hold a strong position in a particular molecule across different EEA countries. In that regard, the Notifying Party notes that geographic barriers to entry are low, and that a supplier active in one country could easily enter another geographic market (and even more so if it already provides other products in that geographic market) should prices increase post-Transaction.

(75) As regards the barriers to entry in sterile injectables, the Commission retained that the average duration to develop a generic sterile injectable is of four to six years, before the product reached the market. This implies two stages: development and the regulatory approval. The development of a generic drug typically takes from ten months (for companies specialising in generics) up to four and a half years depending on the complexity and sophistication of the originator drug, as well as on the process, formulation and method of use patents held by the originator. Each presentation will need to be developed, tested and (new) release methods or (new) analytics methods might have to be developed. Production batches would need to be made in order to see if the product under normal production capacity still tests out and meets specifications.

(76) Once the development of the drug has been finalised, a certain time is required for the administrative procedure. Development and administrative procedure may add up (depending on the product at hand) to more than one year and it might in individual cases take several years depending on the product. In addition to that, the Notifying Party submits that in general, API manufacturing leading times are of the order of [...] months, and fill and finish times are approximately [...] months. They are followed by freight and European re-testing (where appropriate) and release. This adds another [...] months to the time from the decision to manufacture a product to putting it on the market.

(77) As regards the barriers to enter into a geographically neighbouring market, the market investigation has revealed that once a supplier already markets a generic sterile injectable in certain countries, entry is only possible if a marketing authorisation has been granted. The supplier would also need a commercial organisation in that particular country.56 Even in case a marketing authorisation has already been obtained for a country where the supplier previously was not active, suppliers would still need to have a commercial organisation in order to be able to start selling and become a credible competitor in a new country.57

(78) In addition to the existence of a marketing authorisation and a local commercial organisation, suppliers take into consideration other factors as well when deciding to enter a new country, such as potential market size, prices of their competitors, tendering system, number of competitors.58

(79) In sum, entry can play a role in exerting competitive pressure for the supply of sterile injectables. However, barriers to entry cannot be qualified as low in an abstract and general way. The competitive constraint that entry can exert must be assessed on a case by case basis, taking into account in particular whether potential entrants supply the product in question in neighbouring countries, can scale up production to expand to a new geographic market, possess a marketing authorisation and a commercial organisation in the country concerned, and whether an hypothetical price increase would provide the financial incentive to enter such market.

Criteria for the selection of suppliers

(80) The Notifying Party submits that for generic sterile injectables, competition in most markets primarily takes place through tenders (with few exceptions), organised by individual hospitals, groups of hospitals or public authorities, depending on the country. Whilst in some countries tenders are organized for a number of products, suppliers are selected separately for each molecule (and sometimes even separately for particular presentations). Other criteria are qualitative and include, inter alia, type of packaging, packaging differentiation, shelf life, and ability to supply during the weekend or in the evenings.

(81) Price is an important criterion for the allocation of tenders. Each hospital chooses the exact importance attributed to price, but it usually accounts for an important part of the decision in the tender, which are in the vast majority of cases organised by the hospitals or purchasing groups.59 The replies to the market investigation have shown that indeed price is the main criterion taken into account by customers when choosing their sterile injectable suppliers, together with security of supply and range of strengths/concentrations.60 Other criteria mentioned as important, but not essential, were range of vials, capacity and long shelf life.

Switching

(82) For all the markets analysed in this case, the market investigation showed it is relatively easy for customers to change their supplier at the end of the contract.61 Moreover, the contracts with suppliers do not usually contain commitments to purchase minimum quantities of a given product.62 There are thus no legal barriers to switch.

(83) As regards the duration of the contracts, customers mentioned that in most of the cases these are between one and two years, sometimes also up to one year,63 therefore showing that in a relative short period of time they could have the possibility of switching their sterile injectable suppliers.

III.2.1.1. General approach to the product market definition

Therapeutic classes versus molecule approach

(84) As is explained above in paragraph 15 the Commission has in its previous decisions in the pharmaceutical sector referred to the third level (ATC3) as the starting point for defining the relevant product market.64 However, in a number of cases, the Commission found that the ATC3 level classification did not yield the appropriate market definition within the meaning of the Commission Notice on the Definition of the Relevant Market. As a result, where appropriate and based on the factual evidence collected during the market investigation, the Commission has defined the relevant product market at the ATC4 level or at a level of molecule or a group of molecules that are considered interchangeable so as to exercise competitive pressure on one another

Galenic form

(85) As the Commission has acknowledged in its previous decisions65 medicines are differentiated not only by their active ingredient(s), but also, in particular, as recognized by the European regulatory framework for medicines for human use, by their dosage, pharmaceutical form and route of administration and this may limit their substitutability.66

(86) For the purpose of the present decision the question of whether the relevant markets would comprise also other galenic forms than injectables can be left open, as the competitive assessment of individual markets would not change irrespective of galenic form concerned. Alternative candidate product market definitions would lead to fewer overlaps and less affected markets. Consequently, the Commission has focused its assessment of the competitive effects for injectable products at the molecule level.

Generics versus originator drugs

(87) Generics are in general less expensive, bioequivalent versions of originator drugs. In regulatory approval procedures, a generic drug manufacturer has to demonstrate that the generic version of the originator drug has the same qualitative and quantitative composition in terms of active substance and the same pharmaceutical form and is bioequivalent to the originator drug.

(88) In previous cases, the market investigation has often suggested that there may be differences in the demand for originator versus generic drugs, even when they are bioequivalent. This is the case more particularly in countries where the penetration of generics is lower and the importance of the brand is higher. On the other hand, the growing trend of regulatory pushes in some countries in favour of generics, such as for instance, mandatory substitution at the pharmacy level, mandatory INN prescription etc. increases the generic substitution. Finally, generic versions of originator medicines are specifically designed to compete with those medicines and normally represent the closest substitute to them.

(89) Also during the present market investigation, the large majority of respondents expressed that they thought of generics as a full alternative to originator products.

(90) Therefore, in line with the precedents and for the purposes of the present decision, the Commission considers that in relation to the overlapping molecules the product market includes both generic and originator versions.

Prescribed drugs versus over the counter ("OTC") drugs

(91) In certain cases, pharmaceutical products may be further subdivided into various segments on the basis of a variety of criteria, and in particular demand-related criteria. The Commission has in the past67 defined separate markets for medicines which can be issued only on prescription and those, which can be sold over the counter (OTC). Medical indications, side effects, legal framework, distribution and marketing tend to differ between these drug categories, even if the active ingredients are sometimes identical.

(92) This case only involves prescription drugs. Therefore the question as to whether separate relevant product markets for prescribed drugs and OTC drugs should be defined for the purpose of the present decision can be left open.

III.2.1.2. Relevant geographic market

(93) The Notifying Party has, in line with the Commissions prior decisions, submitted an overview of its activities on a country-by-country basis. The Commission has consistently considered that the markets for finished dose pharmaceutical products68 were national in scope. The market investigation in this case did not provide any indications that such market definition should be revisited, in particular in view of the purchasing practices, the national regulatory and reimbursement schemes and the fact that competition between pharmaceutical firms still predominantly takes place at a national level

(94) Therefore, for the purpose of this decision the Commission concludes that the scope of the geographic markets in relation to all assessed sterile injectable markets is national.

III.2.1.3. General approach to the competitive assessment

(95) In line with the past decisions,69 given a large number of affected markets in pharmaceutical mergers (numerous product and geographic markets), the Commission has applied a system of filters aimed at determining the group of markets where concerns are most likely and on which its focused its analysis.

(96) Based on this filter, pharmaceutical markets are analysed according to three categories:

* Group 1: where the Parties’ combined market share exceeds 35% and the increment exceeds 1%;

* Group 2: where the Parties’ combined market share exceeds 35% but the increment is less than 1%;

* Group 3: The Parties’ combined market share is between 20% and 35%.

(97) The Notifying Party has based its analysis mainly on the IMS data, measured by Standard Units (e.g., 1 vial), submitting that market shares by volume are the most relevant in this case. However, the Commission observed that these products are sold in different dosages (vials), which are all equally calculated as one unit, no matter the number or quantity that they comprise. Therefore, the Commission considers that the market shares in value are the most relevant in this case and show a better image of the market positioning of the different competitors.

(98) Based on this methodology, the Commission has identified all Group 1 markets under the narrowest plausible market definition, i.e. at the molecule level, in the following marketed molecules: carboplatin, cisplatin, cytarabine, epirubicin, fluorouracil, irinotecan, nitroglycerin, piperacillin/tazobactam, vancomycin and vincristine, a total number of 30 overlaps. Besides these ones, a total of 13 Group 2 and Group 3 affected markets were also examined.

(99) The markets which fall within Group 2 because the Parties' combined market shares exceeded 35% and the increment does not exceed 1% are the following: docetaxel in Spain, fluorouracil in Denmark, irinotecan in Spain, methotrexate in Italy and piperacillin/tazobactam in Belgium. Given the small increment, the fact that no concerns have been raised by customers or competitors in the course of the market investigation, and that respondents did not highlight any particular advantage of the Parties on these markets, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of these possible markets.

(100) The markets which fall within Group 3 because the Parties' combined market shares were between 20% and 35% are the following: calcium folinate in Norway, cisatracurium besilate in Spain, cisplatin in Italy, methotrexate in Portugal, piperacillin/tazobactam in Finland and the Netherlands, and vancomycin in the Netherlands and Spain. Given the moderate combined market shares in these markets, the fact that the combined entity will still face significant competition from a number of other competitors such as Teva, Intas, Fresenius, Mylan, Aurobindo or Novartis, and that no substantiated concerns have been raised by customers or competitors in the course of the market investigation, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market in respect of these possible markets.

(101) The remainder of the decision deals with the markets that fall within Group 1.

III.2.1.4. Product specific assessment

III.2.1.4.a. Carboplatin

Product market definition

(102) Carboplatin is a platinum compound used as a chemotherapy drug in the treatment of a number of different cancers (ovarian cancer, small cell lung cancer, head and neck cancer). The first platinum based drug that was developed was cisplatin. Carboplatin is a second generation drug that is administered intravenously as a short term infusion. Generic versions of carboplatin became available from 2004 onwards. Carboplatin belongs to the ATC3 class of platinum antineoplastics.

(103) The Commission, in its decision Teva/Barr, defined the relevant product market for carboplatin at the molecule level as the indications were only partially overlapping with other molecules in the same ATC class.70 Hospitals indicated that switching between molecules would be limited during the treatment of the serious illnesses that these medicines are aimed for. In another decision, Teva/Ratiopharm, the Commission left the market definition open, since under any alternative product market definition (ATC 3 class, ATC4 class or defined on the level of molecule) the transaction would not give rise to competition concerns.71

(104) The Notifying Party submits that in the present case the assessment should be carried out at the molecule level, since the substitutability between different types of platinum antineoplastics is limited and tendering procedures are very often organised on the level of the molecule only. The Notifying Party also submits that the product market definition could be ultimately left open, since the transaction would not significantly impede effective competition regardless of the product market definition.

(105) In the market investigation, the limited substitutability for carboplatin was confirmed. The indications for which carboplatin is prescribed only partially overlap with those of other molecules in the same ATC class. Moreover purchasing takes place on the level of the molecule, predominantly through molecule-specific tenders.

(106) On the basis of the above, the Commission concludes that for the purpose of the present decision the relevant product market should comprise sterile injectable carboplatin.

Competitive assessment

(107) In carboplatin, the Transaction give raise to two affected Group 1 markets in Belgium and Italy.

Belgium

(108) According to the Notifying Party, the market size of the carboplatin in Belgium was EUR [1-5] million in 2014. The combined market shares of the Parties reached [5060]% in value in 2014, with an increment of [10-20]% brought by Pfizer.

(109) The Notifying Party submits that on the Belgian market there are a number of other competitors, the main ones being Teva and Accord/Intas. The Notifying Party considers Teva as the strongest competitor with a market share of [30-40]%. In addition, Accord/Intas has entered the market and achieved a market share of almost [0-5]% in 2014, according to the Notifying Party.72 The Notifying Party expects that Accord/Intas' market share will grow, because the Notifying Party expects a growing number of tenders in the future due to a regulatory change in Belgium.73

(110) The Notifying Party submits that Hospira's market share has been significantly higher mainly due to the fact that it was the first generic on the market. However, between 2012 and 2014 its market share declined (in volume). The Notifying Party also submits that Pfizer's market share is relatively low, due to the fact that it does not have the [...] vials in its portfolio. According to the Notifying Party this weakens its competitive position, because hospitals typically choose one supplier for the whole range of dosages. The Notifying Party considers that request for this particular dosage will increase in the future and argues that Pfizer's competitive force on the market may therefore be decreasing.

(111) An analysis of the market share evolution over the last three years shows a relatively stable market size. As regards the positioning of the Parties, market shares in value which, as explained above provide a more appropriate picture of the situation in this case, show a slight increase in Pfizer's and a slight decrease in Hospira's position.

(112) The Commission also investigated whether there are enough alternative suppliers to the merged entity, taking into account that switching suppliers in this market appears to be relatively easy. The replies received during the market investigation have confirmed Teva as being the main challenger.74 However, even though the other competitor Accord/Intas confirmed its presence, it is considering withdrawal due to the fact that "the procurement decisions are opaque with a high degree of protectionism, local distribution is expensive and the unpredictable claw back tax regime".75 No other competitor amongst the respondent ones has confirmed presence, or intention to enter this market in near future.76 77

(113) The range of vials sold in Belgium is: 5ml, 15 ml, 45ml and 60ml, with a concentration of 10mg/ml.78 Competitors answering to questions posed during the market investigation did not identify the range of vials/products offered as a particular advantage of either Pfizer or Hospira. Nor did the market investigation confirm the decreasing importance of Pfizer for the Belgium market for carboplatin as a result of the current inability to provide the [...] vials. Moreover, an overview of the sales for the last five years did not reveal a decrease in volume, which would have been a plausible consequence of the preference of hospitals to buy bigger vials, as the Notifying Party claims. There are no other indications to show that Pfizer's lack of the [...] vial in Belgium represents a competitive disadvantage.

(114) Some customers in Belgium responding to the market investigation mentioned that they would expect lesser competition and price increases as a result of the transaction. Suppliers mentioned that Pfizer and Hospira's current main competitive advantage in carboplatin in Belgium is their pricing.79

(115) Customers in Belgium also pointed out that they feared that supply security would become an increasingly worrying issue. One important customer explained that with such a small number of credible players on the market it would be more difficult to negotiate guarantees on security of supply. The transaction would thus, according to those customers affect competition negatively.80

(116) According to well-established case law, very large market shares — 50 % or more — may in themselves be evidence of the existence of a dominant market position.81 It has been pointed out that in Belgium tendering procedures are not yet commonly adopted for sterile injectables.82 Therefore the market shares in Belgium reflect a strong market position that would stem from the transaction. The transaction would remove a competitive restraint from the market, in particular as Teva appears to be the only credible competitor to the merged entity. Moreover, a majority of Belgian based customers that responded to the questions posed to them during the market investigation expressed their substantiated concerns over the change in market structure as to the security of supply and pricing in the market concerned.

(117) Therefore, the analysis of the proposed concentration suggests that it would likely significantly impede effective competition, in the Belgian market for carboplatin, in particular as a result of the creation or strengthening of a dominant position. The Commission concludes that the transaction therefore raises serious doubts as to its compatibility with the internal market in relation to carboplatin in Belgium.

Italy

(118) According to the Notifying Party, its combined market shares only reached the level of a Group 1 market in 2012, with a share of [40-50]%. Since then, both Pfizer's and Hospira's market shares have been constantly decreasing to [30-40]% combined market share in 2013.. The combined market shares of the Parties reached only [10-20]% in value in 2014, with an increment of [5-10]% brought by Hospira. The market size of carboplatin in Italy was EUR [10-20] million in 2014.

(119) The other competitors on the market are Teva, Accord/Intas and Sun Pharma. The positioning on the market for carboplatin in Italy of all these suppliers has been strengthened since 2012. Teva increased its market share form [50-60]% in 2012 to [6070]% in 2014, confirming its market leader position and Intas from [0-5]% in 2012 to [5-10]% in 2014. Finally, Sun Pharma, a new entrant in 2013, reached [10-20]% market share in the next year. Post Transaction, the merged entity is expected to continue facing strong competition from a range first and foremost Teva, but also from Sun Pharma and Accord/Intas. These competitors are likely to increase their supply substantially should prices of the merged entity increase after the Transaction.83

(120) The range of vials sold in Italy is: 5ml, 15 ml, 45ml and 60ml, with a concentration of 10mg/ml.84 Pfizer is offering 5, 15 and 45ml vials and Hospira the whole range. Both Accord and Teva are offering the full range of vial as well.

(121) The Commission, taking into consideration all of the above, including the results of the market investigation, concludes that the transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to carboplatin in Italy, because the proposed concentration would not significantly impede effective competition, in the Italian market for carboplatin.

III.2.1.4.b. Cisplatin

Product market definition

(122) Cisplatin is the predecessor of carboplatin. It is used for the treatment of cancers including sarcomas, a number of carcinomas, lymphomas, bladder cancer, cervical cancer and germ cell tumours.

(123) The Commission previously investigated cisplatin in the same cases as carboplatin. The Commission did not need to conclude on the market definition in one case and defined the relevant product market at the molecule level in the other case.85

(124) The Notifying Party tables the same arguments to assess the cisplatin market on the molecule level, but suggests leaving open the relevant product market definition.86

(125) In the market investigation the limited substitutability between cisplatin and carboplatin was confirmed. The indications for which cisplatin is prescribed are only partially overlapping with those for other molecules in the same ATC class, including carboplatin. Moreover purchasing takes place at the level of the molecule, predominantly through molecule-specific tenders.

(126) On the basis of the above, the Commission concludes that for the purpose of the present decision the relevant product market should comprise sterile injectable cisplatin.

Competitive assessment

(127) In cisplatin, the Transaction give raise to two affected Group 1 markets in Finland and Greece.

(128) In Finland, the market size of the cisplatin was only EUR [0-1] million in 2014 and, according to the Notifying Party, has constantly decreased since 2012. The combined market shares of the Parties reached [40-50]% in value in 2014, with a small increment of only [0-5]% brought by Pfizer. Accord/Intas is also present in Finland and has reinforced its market position over the last two years from only [10-20]% in 2013 to over [50-60]% in 2014.87

(129) Pfizer's market share has been declining since 2012, when it had a market share of [2030]%. Pfizer offers cisplatin in vials of 100, 10 and 50ml. Hospira has a narrower range of only 100 and 50 ml vials. The main challenger Accord/Intas seems to have the broadest range of vials, comprising 10, 25, 50 and 100 ml. All suppliers offer the same concentration of 1mg/ml.

(130) In Greece, the market size of cisplatin was only EUR [0-1] million in 2014 according to the Notifying Party. The combined market shares of the Parties reached [50-60]% in value in 2014, with a small increment of [0-5]% brought by Pfizer. The other competitors are Teva ([40-50]%) and Medicus (less than [0-5]%). Novartis was also present until 2013, with a market share of [10-20]% in 2012 and [0-5]% in 2013.

(131) The Notifying Party submits that they base their submission on IMS data, which for Greece only tracks sales to pharmacies. Hospira [...]88 [...] sells cisplatin in Greece in a 100 mg vial. Hospira is unable to participate in tenders where the two most widely used vials (10mg and 50mg) are required. Thus, in a recent national tender, initiated in December 2014, Hospira was not able to submit an offer as the specifications included 10mg and 50mg vials only. Equally, in a tender organised in January 2015, Hospira was unable to submit any offer as it requested 50mg vials only.

(132) Nevertheless, Hospira's share has increased from [10-20]% to [50-60]% over the same period, showing significant variability in market shares. Pfizer's market share has drastically decreased since 2012 from [50-60]% to only [0-05]% in 2014. The fluctuations in market shares reflect the fact that Greece is a tendering market with a very small market size. In such a market variations in market shares occur rather often and market shares may overstate the actual market power.

(133) During the market investigation customers did not express concerns regarding the competitive effects of the proposed transaction. The competitors to the merged entity such as Teva, Medicus and Novartis are likely to increase their supply substantially should prices of the merged entity increase after the Transaction.89These competitors would constrain the merged entity sufficiently, should the merged entity try to increase its prices.

(134) In view of the above, the Commission concludes that the transaction does not give rise to serious doubts as to its compatibility with the internal market in relation to cisplatin in Finland and Greece, because the proposed concentration would not significantly impede effective competition, in the Finnish and Greek markets for cisplatin.

III.2.1.4.c. Cytarabine

Product market definition

(135) Cytarabine belongs to the ATC3 class of antimetabolites, including agents which prevent cells from multiplying. Cytarabine is a chemotherapy agent used for different types of cancer treatment affecting blood cells (leukaemia) and is also used to treat meningeal leukemia and lymphoma. Its patent protection ended in the 1980s.

(136) There are no prior Commission decisions involving cytarabine.

(137) The Notifying Party submits that the relevant product market should be defined at the molecule level, mainly because of the limited substitutability with other agents that prevent cells from multiplying for cancer treatment and because of the fact that tendering procedures are very often geared towards cytarabine only. The Notifying Party argues that the relevant product market definition can in any event be left open as no competition concerns would raise as a result of the transaction.

(138) In the present market investigation the limited substitutability for cytarabine was confirmed. The indications for which cytarabine is prescribed are only partially overlapping with those of other molecules in the same ATC class. Moreover purchasing takes place on the level of the molecule, predominantly through molecule-specific tenders.

(139) On the basis of the above, the Commission concludes that for the purpose of the present decision the relevant product market should comprise sterile injectable cytarabine.

Competitive assessment

(140) Cytarabine was originally launched by Upjohn (i.e. Pfizer) in the 1970s, under the brand name Cytostar. Pfizer acquired cytarabine following the Pfizer/Pharmacia deal in 2003.90 From 2005 onwards, generic versions of the drug became available, first one being Hospira's (Cytarabine Hospira).

(141) The Transaction gives rise to five affected Group 1 markets for cytarabine in Belgium, Denmark, Italy, Portugal and Sweden.

Belgium, Italy, Portugal and Sweden

(142) In Belgium, the market size of the cytarabine was EUR [0-1] million in 2014, according to the Notifying Party. The combined market shares of the Parties reached [60-70]% in value in 2014, with an increment of [10-20]% brought by Hospira.

(143) The only other competitor on the market is Mundipharma International, an UK based innovator drugs developer, with a market share of [30-40]% in 2014. The Notifying Party submits that IMS data is incomplete as, according to their own competitive intelligence, other competitors are present on the market, namely Accord/Intas and Fresenius. As Accord/Intas won recent tenders, the Parties' combined market share is – according to the Notifying party – likely to be significantly lower. Moreover, the Notifying Party estimates that, the number of tenders in the future will increase in 2015, therefore the level of competition will increase as well. In addition, the Parties note that Strides holds a marketing authorisation in Belgium. While it is currently not active, the Parties believe that it could start supplying cytarabine effectively and immediately, should it take a business decision to do so.

(144) The market investigation did not confirm the market structure advocated by the parties, revealing that Mundipharma is the only established competitor. Recently Accord/Intas also entered the market. Furthermore, the offers of those competitors do not seem to equal Pfizer's range of products, especially as regards the concentration offered.

(145) As regards the products offered, both Pfizer and Hospira offer the 100mg/ml concentration in 10ml and 20ml vials. On top of this Pfizer also has a concentration of 20mg/ml (which it offers in 5ml and 25ml vials). According to the Notifying Party, hospitals typically require a full range of products from the same supplier, and therefore Hospira would be at a competitive disadvantage. Accord/Intas only recently started supplying the 100mg/ml strength in vials of 1, 5, 10, 20, 40 and 50, while Mundipharma offers only 50 mg suspension for injection 10mg/ml in 5 ml vials.

(146) According to well-established case law, very large market shares — 50% or more — may themselves be evidence of the existence of a dominant market position.91 The market shares are rather stable and consistently high. The market investigation did not confirm the presence of a number of other credible competitors that are likely to increase their supply substantially, should prices of the merged entity increase after the Transaction.92

(147) Therefore, the Commission considers that the analysis of the proposed transaction would likely significantly impede effective competition, in the market for cytarabine in Belgium. The Commission concludes therefore that the transaction raises serious doubts as to its compatibility with the internal market for cytarabine in Belgium.

(148) In Italy, the market size for cytarabine was EUR [1-5] million in 2014, according to the Notifying Party. The combined market shares of the Parties were [40-50]%, with an increment of [5-10]% brought about by Hospira. In 2012 the combined market share was [50-60]% and in 2013 it was [70-80]%. The main competitor is Mundipharma International with a market share of [40-50]% in 2014.93 The other competitors are Fresenius and new entrant Accord/Intas, both with [0-5]% market share in 2014. Fresenius has not registered sales since 2013, when it had a market share lower than [05]%.

(149) Apart from the merged entity, Mundipharma International seems to offer as well a suspension cytarabine presentation in a concentration of 10mg/ml94 and they seem to have a well-established positioning on the Italian market, therefore proving that the dry presentation form is not at all a disadvantage in this market. However, MundiPharma International had problems with the supply, due to product recall caused by quality issues at third party manufacturer plant identified by the regulatory authorities.95

(150) As regards the presence of the other competitors, the market investigation did not confirm their positioning according to IMS data. Mundipharma International remains the main competitor of the merged entity, but with a much weaker position that the one indicated by the Notifying Party. The absence of a number of other credible competitors that may be likely to increase their supply substantially, should prices of the merged entity increase after the Transaction, together with the high combined market shares would lead the Commission to conclude that the proposed transaction raises serious doubts as to its compatibility with the internal market in relation to cytarabine in Italy.

(151) In Portugal, the market size for cytarabine was EUR [0-1] million in 2014, according to the Notifying Party. The combined market shares of the Parties reached almost [90100]% in 2014, with an increment of [5-10]% brought about by Pfizer. The Notifying Party only mentions Lab Unknown96 as being present with a market share of less than [0-5]% in 2014.

(152) The Notifying Party submits that, [...].97 The Notifying party argued that [...]However, Pfizer failed to submit credible evidence [...].