Commission, August 8, 2016, No M.7792

EUROPEAN COMMISSION

Decision

KONECRANES / TEREX MHPS

To the notifying party

Dear Madam(s) and/or Sir(s),

Subject: Case M.7792 - KONECRANES / TEREX MHPS

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2

(1) On 17 June 2016, the Commission received a notification of a proposed concentration

pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1) by which the undertaking Konecranes PLC (‘Konecranes’ or ‘the notifying party’, Finland) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the Material Handling and Port Solutions business part of Terex (‘Terex’, United States of America).3 Terex MHPS and Konecranes are designated hereinafter as the ‘Parties’.

I. THE PARTIES

(2) Konecranes is a global group of lifting businesses, serving a broad range of customers, including manufacturing and process industries, shipyards, ports and terminals. Konecranes provides material handling and port equipment, as well as services for lifting equipment and machine tools. The Konecranes group has 11,900 employees at 600 locations in 48 countries. Konecranes is listed on the NASDAQ Helsinki.

(3) Through its MHPS division, the US-based group Terex supplies industrial cranes, industrial crane components, and industrial crane services. The MHPS segment also manufactures container and bulk material handling equipment used in port and intermodal applications. Terex MHPS manufactures in 16 countries on five continents and operates a sales and service network in more than 60 countries. Terex MHPS will be hereinafter referred to as Terex.

II. THE CONCENTRATION

(4) Pursuant to a share and asset purchase agreement, dated May 16, 2016, Konecranes will acquire sole control over the Material Handling and Port Solutions business of Terex for a total consideration of approximately US$1.3 billion ("the Transaction").

(5) Upon completion of the Transaction, Terex will receive in exchange approximately 25% of Konecranes' shares and will have the right to nominate up to two members of the board of directors of Konecranes (depending on the level of its shareholding). Terex will own new class B shares of Konecranes, which will be created through a modification of the articles of association of Konecranes. Class B shares will have the same financial rights as Konecranes' ordinary shares but will carry no voting rights in certain matters and circumstances, which principally include the election of and other matters relating to the appointment of board members other than those appointed by Terex under its specific appointment rights, as well as share issuances pursuant to preemptive subscription rights of shareholders.

(6) The Commission considers that Terex will not acquire any control over Konecranes because of the acquisition of 25% of its shares. In particular, Terex will have no veto rights over key strategic decisions of Konecranes, such as the appointment or dismissal of the management, or the approval of the business plan or the annual budget. All strategic decisions will be taken by a simple majority of the votes of the board members, in which Terex shall have the right to appoint up to two board members out of a minimum of 5 and a maximum of 10 board members. Hence, Terex will not be in a position to place the board in a deadlock situation and will not be able to exert a decisive influence over the key strategic decisions of Konecranes.

(7) The Transaction therefore consists in Konecranes' acquisition of the MHPS division of Terex by purchase of assets and constitutes a concentration pursuant to Article 3(1)(b) of the Merger Regulation.

III. EU DIMENSION

(8) The undertakings concerned have a combined aggregate world-wide turnover of more

than EUR 2,500 million4 (Konecranes: 2,124 million, Terex: 1,388 million). In each of at least three Member States (Germany, France and the UK), the combined aggregate turnover of the Parties is more than EUR 100 million and the aggregate turnover of each of the Parties is more than EUR 25 million. Each of them has a EU-wide turnover in excess of EUR 100 million, but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The notified operation therefore has an EU dimension pursuant to Article 1(3) of the Merger Regulation.

IV. COMPETITIVE ASSESSMENT

(9) Both Parties are active in the manufacture and sale of industrial cranes (standard cranes and process cranes), hoists for industrial cranes, the provision of industrial crane services, and the supply of port equipment.

(10) The Transaction will give rise to a number of horizontally affected markets for standard cranes, hoists, the provision of industrial crane services, and the supply of container handling equipment.

IV.1. RELEVANT MARKETS

IV.1.1. Industrial cranes

(11) An industrial crane is an electromechanical or mechanical machine, generally equipped with a hoist having either wire ropes or chains that is able to move loads vertically and horizontally by relying on manual force or specific machinery. Industrial cranes allow handling loads, over 0.1 tons up to 100 tons.

(12) Both Konecranes and Terex are well-established players in the market for industrial cranes. Terex also has a strong product offering in a specific type of industrial cranes, the so-called modular cranes, which Terex commercialize under the "KBK" brand.

IV.1.1.1. Product market definition

(13) In a previous decision,5 the Commission has analysed the market for industrial cranes and has drawn a potential distinction between standard cranes, on the one hand, and special/engineering/process cranes on the other. The Transaction primarily concerns standard cranes as the market for process cranes would not be affected under any plausible market definition.

(14) Within standard cranes, modular cranes stand out as a potential further product category in view of their unique re-configurability feature. The Parties maintain however that modular cranes do not represent a product market distinct from standard cranes.

(15) Based on the results of the market investigation, the Commission considers that standard cranes and modular cranes may constitute separate markets in view of their different characteristics. Standard industrial cranes are mainly used for lifting heavy loads in industrial settings, whereas modular cranes are essentially used in the assembly areas of production sites for light loads. In particular, modular cranes appear to be characterized by lower lifting capacity (up to 2 tons), are used for short span (below 8 metres), are more precise than standard cranes, as well as more expensive (up to 5 times the price of a standard crane).

(16) In view of their different characteristics, their different use in applications, and prices, both customers and competitors indicated that there is limited degree of substitutability between standard and modular cranes.6

(17) In conclusion, the Commission considers that although there are indications that the ones of standard and modular cranes would constitute separate markets, for the purpose of this decision, the product market definition can be left open, as it does not have an impact on the competitive assessment of the Transaction.

IV.1.1.2. Geographic market definition

(18) In its past decision,7 the Commission has considered the geographic scope of the market for standard cranes to be essentially national.

(19) The notifying party submits that, although steps towards internationalization have been taken over the last two decades, there is still a strong local element of competition for standard cranes. Therefore, the Parties agree that the relevant geographic market for standard cranes is likely to be national in scope.

(20) In the course of the market investigation, the majority of customers indicated that they normally buy cranes prevalently in their own country of operation and have limited information about pricing and competitive offers made outside their countries of operation.8 Competitors indicated that crane prices tend to differ significantly across different EU countries and tend to focus their operation on one or few specific countries (on average 2).9 These elements suggest that crane markets are national in scope.

(21) In conclusion, whilst the Commission considers that there are indications that standard and modular cranes markets are national in scope, for the purpose of this decision, the geographic market definition can be left open as it does not have an impact on the competitive assessment of the Transaction.

IV.1.2. Hoists

(22) The hoist is the lifting device of a crane. Two general types of hoists exist, namely chain hoists and wire rope hoists. These products consist of mechanical machinery which handles the wire rope or chain attached to a hook, and in the case of electric hoists also includes a motor, a gear, and an electrical control. The key difference between chain hoists and wire rope hoists lies in the lifting capacity and lifting speed, with the wire rope hoists being able to lift heavier loads at higher speed. Serially produced wire rope hoists are available in tonnages up to 100 tons. Chain hoists are typically offered in lifting capacities of up to 2 tons but higher capacities up to 10 tons are not uncommon. According to the Parties, the largest volumes of chain hoists sold are in the capacity of up to 5 tons. Chain hoists are either operated manually or powered by electricity or compressed air.

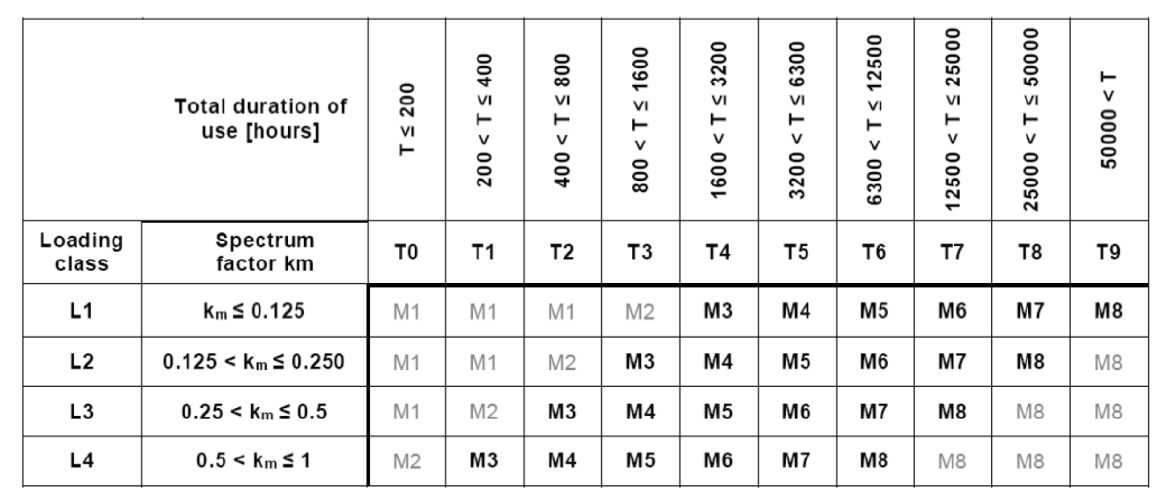

(23) In addition to lifting capacity, hoists are also categorized on the basis of classes ('M'-classes), defined by:

a. the intensity and duration of the duty (i.e. operating hours at specific loads); and

b. the distribution of the lifted loads in relation to the maximum lifting capacity of the hoist, i.e. how often the hoist is used at maximum capacity for a given duration.

(24) As a result, 8 M-classes of hoists have been identified (M1 to M8), which have also been adopted as ISO-standards (although M1 to M2 are rarely used).

(25) In addition to the class of duty, both electric chain hoists and wire rope hoists can be segmented in relation to their ability to change their lifting and travelling speed.10 Hoists offering a variable speed feature, namely the ability to continuously adjust their speeds, are particularly valuable in some industrial applications, especially where the load needs to be moved with care (e.g. a pot of liquid steel in steel mills) or with a high degree of precision (e.g. various components of the fuselage of an airplane).

IV.1.2.1. Product market definition

(26) The notifying party submits that, despite some differences between electric and manual chain hoists, both belong to the same product market. From a demand-side perspective, electric and manual chain hoists serve similar functions (i.e., the lifting of loads) and, from a supply-side perspective, they are generally produced in the same manufacturing facilities using similar equipment. Moreover, the notifying party submits that all competitors supply hoists of comparable quality and technical characteristics, including speed features, for all the M duty classes. Therefore, there is no need to further segment hoists on the basis of their technical characteristics.

(27) The majority of crane builders who answered in the market investigation noted that manual chain hoists differ from electric chain hoist to a certain extent in terms of lifting capacity, lifting speed and technology.11 Similar views were expressed by competitors in the market(s) for hoists12, while the views expressed by distributors of hoists were less conclusive.13 The majority of respondents to the market investigation also observed that the substitutability between manual and electric chain hoists is limited to some (lower lift/less intensive) applications.14 To this point, one crane builder noted "manual chain hoists can be used in maintenance and service work which is purely occasional. For prolonged use they are not considered as substitutes".15 Another one observed "Chain hoists used for maintenance can be substituted with electric chain hoists but the electric one are more expensive and need also a power supply that sometimes is not available. Electric chains hoists used in production lines cannot be substituted with manual chain hoists as their lifting speed is very low".16

(28) Regarding the degree of substitutability between electric chain hoists and wire rope hoists, the majority of crane builders, distributors and hoists' competitors stated that there are significant differences among the two in terms of lifting capacity, lifting speed and technology.17 In this regard, one crane builder explained "wire ropes are used for higher lifting stroke and frequent lifting intervals; chain systems for low lifting stroke and low usage".18 Another one noted "Chain hoists are mainly used for loads below 5.000 kg, occasional use and short lifting heights."19 One distributor of hoists noted "Electric chain hoists will be used mostly for loads less than 5,0 tons, a lifting height around 3,0 - 5,0 meters with low lifting speed. Electric rope hoists will be used for bigger loads with bigger lifting height and faster lifting speed.".20 One competitor in the hoists' market stated that "Electrical chain hoists and wire rope hoists are used in applications of high lifts, high capacity and intensive usage. Electric chain hoists tend to have lower lifts, lower capacities and less intensive usage. Electric wire rope hoists tend to substitute electric chain hoists the higher the lift, the higher the capacity and the more intensive the usage is."21

(29) From a supply side perspective it should also be noted that not all competitors in the market for hoists offer all types of hoists and/or with the technical features in hoisting.22

(30) In conclusion, for the purpose of this decision, the Commission considers that the manufacture and sale of manual, electric chain and wire rope hoists constitute separate product markets.

IV.1.2.2. Geographic market definition

(31) The notifying party submits that the relevant geographic market for hoists is global and in any event not smaller than EEA-wide. This conclusion is based on the consideration that hoists are small and relatively light, which makes long-distance transportation cost-efficient.

(32) According to the Parties, this is also reflected by the way the Parties, and as far as they are aware, their competitors, price their hoist products. Konecranes’ price lists are brand-specific and global. The price lists in the EEA are in Euros and are converted to Chinese CNY and American USD when selling into these countries. From the price list, distributors and crane builders are granted a discount based on individual negotiations. Volume is the main factor when considering the level of discount percentage to be granted to the distributor or the crane builder.

(33) Terex's price lists are also global. Terex's vendors apply a number of mark-ups and discounts to these list prices arriving at the net price on a given sale. The exact structure of mark-ups and discounts results from variations in customer expectations and reflects commercial negotiations. Terex believes that the net final price offered on any given hoist product in any given market to a similar type of customer is very consistent from geography to geography.

(34) The Commission considers that the market investigation has not confirmed the Parties' views regarding the geographic scope of the hoists markets.

(35) First, the Parties and their competitors' market shares display very significant variations across EU countries. For example, Konecranes' market share for electric chain hoists is [40-50]% in France ([60-70]% in Belgium) and only [5-10]% in Germany. Terex' share in Germany for electric chain hoists is twice as high as its share in France ([30-40]% vs [10-20]%) and Terex is almost not present in Belgium. In wire rope hoists, Konecranes share in Germany is [40-50]% whereas it is [20-30]% in the Netherlands and [5-10]% in Spain. Likewise, Terex' shares in wire rope hoists shows significant variations in terms of market shares between Germany ([20-30]%) and for example Belgium and Denmark ([0-5]% each).

(36) The main reason for these differences is that the Parties' brands are not equally present across EU countries, showing different degrees of brand strengths according to countries. For example, Konecranes' Verlinde brand achieves more than [60]% of its turnover in France and the Benelux but is virtually unknown in Germany. Stahl (Konecranes) and Demag (Terex) achieve respectively [more than 40]% and [more than 50]% of their turnover in Germany but have very limited sales in southern European countries such as Italy and Spain.

(37) The Commission considers that the above two indications would suggest that customers' perception of hoists brands changes from country to country. This in turn defines a country-specific competitive landscape for hoists, as opposed to having one single competitive landscape for the EEA, which naturally leads to prices that are also country-specific. The importance attached to hoists' brands by market participants has also been confirmed by the market investigation, which shows that brands are consistently included among the most relevant criteria for selecting a hoist supplier.23

(38) The Commission also finds that the market investigation provided indications (albeit not conclusive) of heterogeneity of hoists' prices across EU countries. The majority of hoists distributors stated that, based on their experience, hoists' prices tend to vary across EU countries24. This view was also shared by hoists' suppliers in relation to their (direct) sales to crane builders and/or other sales, but not for sales to hoists' distributors25. However, a number of crane builders has observed that the prices for hoists were rather homogenous across EU countries.26 The same crane builders have also observed that distributors in their country were generally more expensive than alternative suppliers in foreign countries.27

(39) The mix of distribution channels used by hoists' suppliers also varies across EU countries. To this point, one qualified hoists' competitor noted that "In Germany, France, Netherlands and Austria the general industrial distribution plays a bigger role. In all other countries the crane builders and buyers of crane components/ crane component distributors are more important. There is a high portion of direct sales from producers direct to the end customer. For electrical chain hoists 30% and for wire rope hoists 50% [...]".28 Terex has a direct sales presence in Germany but it uses a distributor in Nordic countries (Finland and Sweden notably).

(40) Finally, the Commission considers that there also appear to be some differences in terms of regulations on hoists and crane components across EEA countries.29 To this point, one competitor for hoists noted "Basically all countries follow the CE certification standards. But in a lot of countries specific regulations concerning safety factors, electrical standards and standards for the initial operation and inspection are different."30

(41) In conclusion, the Commission finds that, although there are indications that the geographic scope of the markets for hoists is national, for the purpose of this decision, the precise dimension of the geographic market can be left open, as the Transaction gives rise to serious doubts about its compatibility with the internal market even if the market were to be defined on a broader basis (i.e. EEA-wide in scope).

IV.1.3. Industrial cranes services

(42) Industrial cranes services include preventive maintenance inspections to identify risks and make recommendations for repair and/or improvements to the equipment, routine maintenance to adjust and lubricate the equipment; compliance inspections to satisfy regulatory requirements; repairs and retrofits (replacement of a hoist or component instead of repairing it or as an improvement), overhauls, modernizations and the sale of spare parts to companies who also perform maintenance on industrial cranes.

(43) Konecranes offers services for its own and for third-party industrial cranes. Terex has more limited service activities, which are primarily focused on its own installed base.31

IV.1.3.1. Product market definition

(44) The European Commission has previously indicated that the supply of services to industrial cranes constitutes a distinct market, which includes “the supply of spare parts, repair and maintenance, compliance with new regulations, modernization and improvement and cranes, and diagnostics.” The Commission noted that “[r]elated services generally do not require a high level of technical skills and must be provided rapidly at low cost. They are generally provided either by the relevant crane manufacturer or component provider or by easily–accessible local related services firms.” 32

(45) The Parties agree with the definition of this market adopted by the European Commission in prior decisions.

(46) For the purpose of this decision, the Commission considers that there are no apparent reasons to deviate from its past decisional practice and concludes that the supply of services to industrial cranes constitutes a distinct market.

IV.1.3.2. Geographic market definition

(47) Crane maintenance services require a relatively short distance to the customers due to the need of fast reaction time and low travelling costs. The Commission has in the past defined national geographic markets for crane and component related services.33

(48) In line with the Commission decisional practice, the Parties submit that the industrial crane service market tends to be national or regional in scope. Customers usually require fast and effective service which means that most service providers need to be able to offer services (such as field services and spare parts) locally or in the country in which the customer is based.

(49) The Commission's market investigation has provided additional elements suggesting that the market for industrial crane services has a national dimension. In fact, customers for standard cranes observed that, in addition to suppliers of cranes and/or crane components, they can turn to service providers other than crane suppliers for the servicing of their cranes (and cranes' components) as well as using internal resources for the servicing of their cranes.34 Such confirms the importance of a servicing capability close to the customer for reasons of immediate availability and reduced travelling costs. In addition, the prices for maintenance/repair services show a degree of variation across EU countries, as noted by the majority of competitors in this market.35

(50) In conclusion, the Commission considers that the market investigation has provided strong indications that confirm that the geographic scope of this market is national. However, for the purpose of the present decision, the precise dimension of the geographic market can be left open, as the Transaction does not give rise to serious doubts about its compatibility with the internal market even if the market were to be defined on a different basis.

IV.1.4. Container handling equipment

(51) The activities of the Parties also overlap in the supply of container handling equipment, which is used for the loading and unloading, transportation and handling of containers, in maritime and river ports and in intermodal terminals. Customers for this equipment are port authorities, terminal operators and shipping lines.

(52) The function of all terminals is the same, i.e. the transfer of containers from one form of transport (e.g. a ship) to another (e.g. a truck) and, if necessary, to store containers during the transfer process so that the unloading process for one form of transport does not need to be synchronized with the loading process for the other.

(53) A port container facility typically includes four areas hosting different categories of handling equipment. At the quayside, there is a variety of cranes which load and unload ships such as ship-to-shore cranes, mobile harbour cranes, and floating cranes. In the marshalling area, containers are placed directly on a transport vehicle for relocation to the container yard. Different types of vehicles are used for that purpose, including terminal tractors, reach stackers, or straddle carriers. In the container yard, containers are received and stacked by a specialized piece of equipment known as a gantry crane, which is either mounted on wheels (RTG) or rail (RMG). Finally, in the landside area, containers are transferred to or from the container yard to or from road or rail. Here the same equipment referenced above (RTGs/RMGs, straddle carriers, stackers) is used.

(54) Container handling equipment is in general operated manually but there are some terminals which are automated, either partly or fully. A fully-operated terminal is a terminal which has automated all operations mentioned above, except the loading and unloading of ships. In an automated terminal, the three other functions are carried out by automated pieces of equipment, such as automated tractors or straddle carriers for transport, and automated RTGs or RMGs for stacking. An automated RMG is called an automated stacking crane (ASC).

(55) The main overlap between the Parties' activities relates to (manually-operated) straddle carriers and ASCs. There is also a more limited overlap in reach stackers.36

IV.1.4.1. Product market definition for categories of container handling equipment

(56) Straddle carriers are used for both the horizontal transport and for stacking containers in the yard. Straddle carriers are generally manually operated by a driver from a cab that is integral to the machine.37 Straddle carriers are the primary transport and stacking equipment operated in large terminals, in contrast to small and mid-sized terminals where slower and lighter equipment (such as reach stackers and terminal tractors) can be used.

(57) ASCs are sophisticated products which are mounted on rails and are used for yard stacking and in-stack transportation of containers in the storage area and form the link between quayside and landside equipment. The characteristic of ASCs is automated performance through a management software system.

(58) In recent cases (Terex/Fantuzzi and Terex/Demag Cranes38), the Commission left open the product market definition for possible different categories of container handling equipment, but noted that that container handling machinery is appropriately segmented according to equipment type, such as terminal tractor, forklift trucks, reach stackers, straddle carriers, and gantry cranes (including ASCs). The Parties do not disagree with this approach. They however consider that all gantry cranes (RTGs, RMGs and ASCs) should be included in the same product market because all these products perform the same functions on container terminals

(59) The Commission understands that the respondents to the market investigation have confirmed that straddle carriers can perform different functions (transporting and stacking) in a container port and are therefore hardly substitutable with other types of equipment. Other equipment is exclusively designed to transport (terminal tractors) or others can only hoist and stack (various gantry cranes, reach stackers).39 Because of their versatility, straddle carriers constitute a distinct product market from other types of container transport and/or stacking equipment, such as reach stackers, terminal tractors or gantry cranes. For example, reach stackers are primarily designed to stack and pile containers and are used to transport them only over very short distances.

(60) As regards ASCs, the Commission understands that the respondents have not fully confirmed that ASC can be substituted with other gantry cranes such as RTGs (automatic or not) or RMGs.40 The choice between ASCs and RTGs also depends on the layout and planned logistic flows of each container terminal. Moreover, the desired operational characteristics of the terminal also play a role when customers are deciding between different equipment types: when the terminal has chosen to install ASCs, it is particularly difficult and even uneconomical to change them to RTGs or RMGs. In fact, some respondents have explained that substitution tends to go the other way around: ASCs tend to replace RTGs or RMG in totally new "green field" terminal or in automation plans in "brown field" terminals".

(61) In sum, the Commission considers that the precise product market definition for ASCs can be left open, as in any event it would not impact the competitive assessment to the effect of the present review.

IV.1.4.2. Geographic market definition for categories of container handling equipment

(62) The Parties submit that the markets for container handling equipment in general are global in scope, in light of the significant international trade flows, the ability to transport the products between continents and the homogeneity of prices globally.

(63) In previous cases the Commission found that the relevant geographic market for container handling equipment (and each product category therein) is at least EEA-wide, if not global, due to the homogeneity of the conditions of competition in different Member States, the low transport costs within the EEA and the homogeneity of prices across the EEA.

(64) This has been confirmed by respondents to the market investigation, where respondents have explained that container handling equipment suppliers are able to deliver their equipment globally. EEA customers have however explained that all straddle carriers are manufactured in the EEA, even if components are in general sourced from outside the EEA.41

(65) Against this background, the Commission considers that the exact scope of the geographic markets (EEA or global) can be left open, as the competitive assessment would in any event remain unchanged to the effect of the present review.

IV.2. COMPETITIVE ASSESSMENT

IV.2.1. Industrial cranes

The Transaction gives rise to horizontally affected markets in relation to the Parties' activities in standard cranes in 7 European countries, where the Parties' combined market share would range between [20-30]% (Denmark) and [30-40]% (Austria). As regards modular cranes, the Parties' overlap would result in horizontally affected markets in 11 countries, with combined market shares ranging from [20-30]% (Romania) to [50-60]% (Austria).

(66) According to the notifying party, post-transaction the Parties will continue to face intense competition from a large number of players, including both established international suppliers, such as Abus Kransysteme ([5-10]% market share at EEA level), Finismo ([0-5]% at EEA level), Munch Cranes AS ([0-5]% at EEA level), and several national/regional competitors active across the EEA. Moreover, the Parties maintain that standard cranes is a mature market, where barriers to entry are low and expansion is easy. In addition, according to the Parties, there are no switching costs for customers, who usually make their purchasing decision purely on the basis of cost considerations. Finally, the Parties argue that there is excess capacity in the market and that certain categories of customers of standard cranes, such as OEMs and automotive players, can exert a significant degree of bargaining power on standard crane suppliers.

(67) In the course of the market investigation, respondents indicated that Konecranes' main competitor is Terex both for standard and modular cranes.42 Abus emerged as the closest competitor to the Parties, in particular on standard cranes. In addition, a number of smaller crane suppliers, each being active mainly at national level in different countries, were identified by customers.

(68) According to customers, there is a certain degree of differentiation between Konecranes and Terex's cranes.43 In fact, Konecranes' brands have a price advantage vis-à-vis other crane competitors mainly due to their competitive prices, whereas Terex' advantage is more linked to the high quality, good reputation and the resulting high brand loyalty associated to its products. As regards modular cranes, Terex is perceived as the best player on the market thanks to its KBK modular crane brand.

(69) In relation to the impact of the Transaction, some competitors expressed negative views about the effects of the Transaction, fearing that the merger would increase the scale gap with the Parties and hence their ability to compete effectively on price.44 As regards customers, the sample was equally divided between those who feared the Transaction would have a negative impact on the markets in terms of price/choice and those who did not expect any change in the market further to the Transaction.45

(70) Despite some negative expectations about the impact of the Transaction, the Commission considers that the market investigation has revealed that the Parties will continue to face competition from national or regional competitors present in their home country and barriers to entry and expansion do not appear to be insurmountable. For example, the manufacturing of steel parts of the crane is mainly outsourced and the assembly of the crane does not require any significant investments in intellectual property or know-how. Therefore, in view of the findings of the market investigation, the Commission considers that the limited overlaps that the Transaction would create in relation to cranes do not raise serious doubts as their compatibility with the internal market.

(71) The Commission understands however that, amongst the crane customers, a few large industrial EU companies operating in different EU countries feared a strong reduction of choice of standard crane suppliers capable of meeting the demanding requirements of larger customers for extensive projects (a significant number of cranes to be delivered, sometimes with particular performance requirements and within a predefined time of delivery).

(72) Upon more careful review of this concern, the Commission finds however that the information on file would rather show that such large bulky projects tend to constitute the exception rather than the norm. Moreover, such projects normally concern large customers with a noticeable degree of bargaining power. It follows that it is unlikely that such large customers could effectively suffer a reduction of choice as a result of the Transaction. Moreover, a broad majority of those large customers have actually indicated that, besides the Parties, alternative suppliers were available for large crane projects.46

(73) Finally, the majority of crane suppliers are not vertically integrated players, but actually depend on external suppliers for the provision of crane key components, such as hoists. This implies that the presence of alternative suppliers for a key component such as hoists would likely eliminate all risks of anti-competitive effect of the Transaction in relation to the crane markets.

(74) In view of the above reasons, the Commission considers that the Transaction does not raise serious doubts as regards its impact on the internal market for the market for standard/modular cranes or its possible segments.

IV.2.2. Hoists

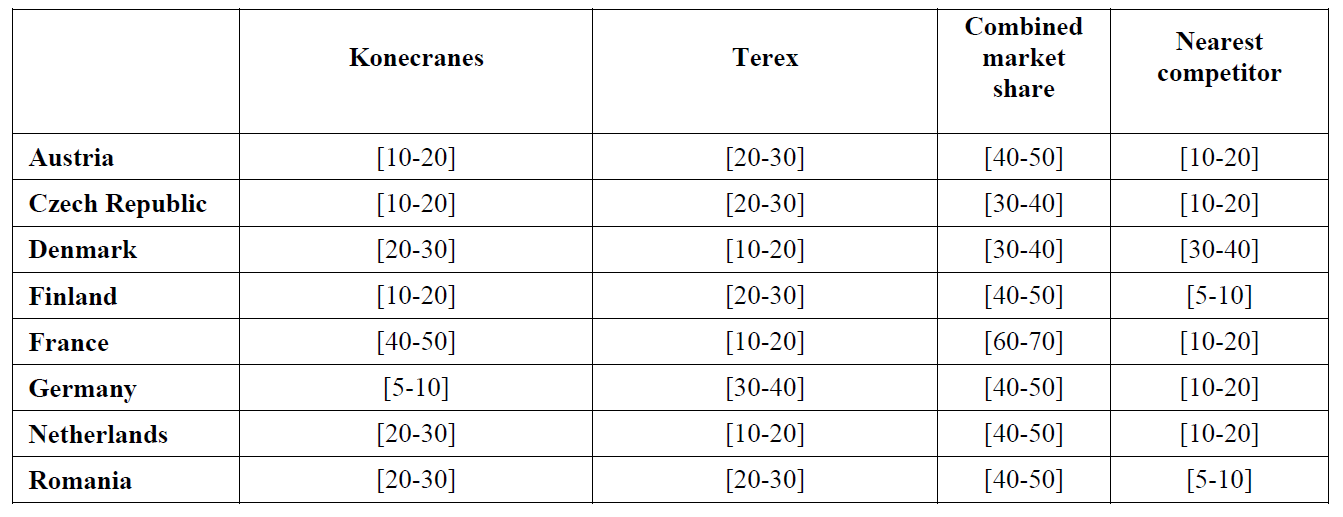

(75) This Transaction gives rise to horizontally affected markets in relation to the Parties' activities in electric chain hoists in 18 European countries, where the Parties' combined market share would range between [20-30]% (Lithuania) and [60-70]% (France).

(76) The table below lists the countries where the effects of the proposed Transaction are likely to be more pronounced for electric chain hoists due to the combined market share of the Parties, the extent of the overlap and/or the market shares of the main competitors of the Parties.47

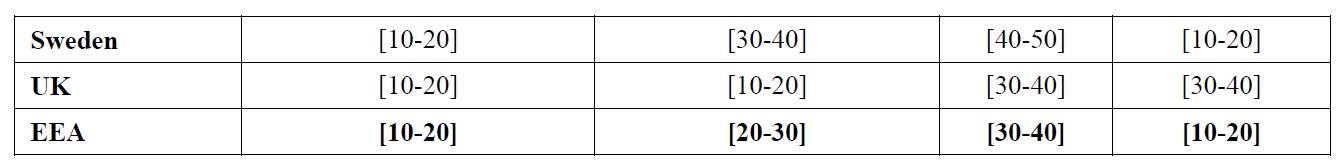

(77) Concerning wire rope hoists, the proposed Transaction gives rise to horizontally affected markets in relation to the Parties' activities in 17 European countries, where the Parties' combined market share would range between [20-30]% (UK) and [6070]% (Germany).48

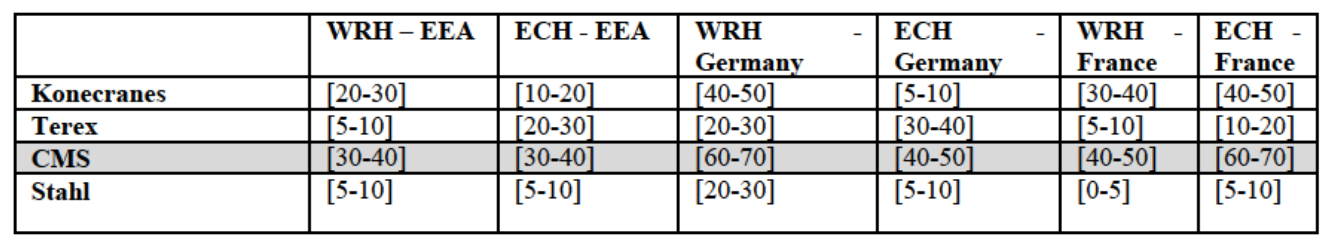

(78) The next table lists the countries where the effects of the proposed Transaction are likely to be more pronounced for wire rope hoists due to the combined market share of the Parties, the extent of the overlap and/or the market shares of the main competitors of the Parties.

(79) The Commission considers that, following the Transaction, the Parties would obtain high market shares for wire rope hoists and electric chain hoists in several EEA countries, notably in Germany/Austria (where Terex brand Demag is considered highly), France (where Konecranes has a strong position due to the strength of its Verlinde brand) as well as other EEA countries. Other players are much smaller and do not seem to be in a position to challenge the Parties' significant positions. It is worth mentioning that Germany is the largest market in Europe for hoists, accounting for more than [30-40]% of total EEA sales for electric chain hoists and for more than [20-30]% of total EEA sales for wire rope hoists.

(80) In terms of closeness of competition, the market investigation overwhelmingly confirmed that Konecranes and Terex are the closest competitors for hoists. In particular, depending on type of product, Terex was rated as the closest competitor of Konecranes by a significant majority of the market participants who replied to the market investigation. Konecranes' brands for hoists were considered as the closest competitors of Terex's at least by a vast majority of the respondents to the questionnaire sent by the Commission, depending on type of product. This is particularly the case for wire rope hoists.

(81) The Commission understands that Konecranes (Stahl, SWF, Verlinde) and Terex brands (Demag and Donati) are highly recognised amongst hoist users as high quality and expensive products which constitute the main alternative for customers. As explained by a crane builder "The above manufacturers have very good products but their prices appear to be set against each other and it is beckoning increasing difficult to get good value for money. Their products are all becoming increasingly expensive and in line with each other and it is becoming very hard to find competitive prices which was very easy before Kone bought out all the other companies"49

(82) The Commission considers for example that Stahl brand is very widely recognized as a high quality brand, especially in Germany and neighbouring countries. A Dutch crane builder put forward that "The Brand Stahl CraneSystems has a very wide range of products with high quality and leading in Explosion proof market. Price is higher than the other brands from Konecranes and more for the standard market".50 This is also the case for Demag according to another German respondent "Terex is the company with the best product on this market. Terex has a wider component base and has more technical capabilities".51

(83) The Commission understands that in the market investigation substantiated concerns were raised by market participants in relation to the effects of the Transaction. A majority of crane builders who replied to the market investigation stated that, as a consequence of the Transaction, there will not remain enough competition in the market to prevent the merged entity to increase prices for hoists.52 To this point, one respondent observed "Konecranes/Terex MHPS will control work shop cranes and crane service business. They can raise the prices for individual companies due the reason that there is no relevant competition. On the other hand when such competition arises they can always lower prices temporarily."53 Another one stated "Kone and Demag will be totally market dominant".54 When asked what impact the proposed Transaction will have on its business, one respondent replied "Kone has a monopoly already and this would make it worse for our business."55

(84) In particular, these concerns were confirmed by German customers, who expressed the view that the combination of Stahl, SWF and Demag, i.e. the three major German brands of the Parties, will considerably impede competition in Germany, in particular in relation to spare parts. As explained by a German customer, "The danger of the transaction is that the spare-part prices will increase. The independent service companies will not get the certificates for service and only one big company is doing the service on these products in future".56 Another German customer put forward that "I'll expect higher prices for servicing and spare parts for users of wire rope hoists and cranes. And I'll expect price pressure for component suppliers."57

(85) One German crane manufacturer and distributor has even indicated that in Germany there are hundreds of locally established companies in the crane service business that are at risk because of the dominant position that Konecranes will acquire following the merger and the possibility to dictate prices. Only Abus would remain as an alternative and it would considerable limit the possibilities of choice for German crane service suppliers.

(86) As a consequence of these views, the Commission understands that a majority of crane builders see the Transaction as having a negative effect on the concerned markets for hoists, in terms of higher prices lower services and decreasing innovation.58 The balance of views is stronger for wire rope hoists and electric chain hoists that allow adjusting (continuously) the utilization speeds of such hoists. One crane builder noted "the const[e]llation will be market dominant".59 Another explained "Market share of Konecranes/Terex MHPS in several countries will rise up to 80 % in Standard Cranes and Hoists especially in Finland and France".60

(87) The Commission understands that similar concerns have been echoed by distributors of hoists and to a lesser extent by competitors for hoists. In particular, a majority of the hoists' distributors who replied to the market investigation has observed that the proposed Transaction is likely to have a negative effect on markets for hoists in terms of higher prices or lower services, less innovation, etc.61 The balance of views was again more pronounced for wire rope hoists and electric chain hoists with variable speeds. When asked to explain its concerns, one distributor for hoists replied "because of significantly less competition".62

(88) On these bases, the Commission considers that, even if barriers to entry do not appear to be particularly high in technical terms, the current saturation of the hoist markets by the major manufacturers would make it particularly challenging to enter such markets, especially in Germany. As explained by a German customer "Related to wire rope hoists there's a very high market penetration by Terex (Demag), SWF, ABUS, Stahl Cranesystems. With a close net of service centers and dealers. In my opinion it would be hard to enter the market as a new manufacturer".63 This has been confirmed by another German customer, who stated that "Ein Zusammenschluss von Konecranes und Terex zu einem Konzern, würde vermutlich einen Markteintritt für mögliche neue Anbieter erschweren, da die Marktmacht dieses neuen Konzerns enorm wäre".64

(89) Finally, the Commission is concerned as to whether, after the proposed Transaction, there would remain sufficient competition to prevent the merged entity from raising the prices for hoists were also expressed by competitors for hoists.65 One respondent stated "they will dominate the market".66

(90) On the basis of the above, the Commission concludes that, in the absence of adequate remedies, the proposed Transaction raises serious doubts about its compatibility with the internal market for electric chain hoists and wire rope hoists.

IV.2.3. Industrial crane services

(91) The proposed Transaction gives rise to horizontally affected markets for the supply of industrial crane services in 8 European countries, where the Parties' combined market share would range between [20-30]% (Austria, Estonia, Hungary) and [50-60]% (Finland).

(92) The Commission understands that the market investigation has provided mixed answers in relation to the possible effects of the proposed Transaction on the market for industrial crane services. Crane builders are of the view that after the merger there will not remain enough competition on the market for industrial crane services67 and this will lead to price increases68. These views are however not shared by hoists' distributors69 and by competitors for hoists.70

(93) The Commission notes that, in light of the fact that Terex/Demag primarily services its own equipment, any potential harm due to this Transaction is likely to be confined to owners of Terex equipment, who can currently choose between Terex and Konecranes (as well as others).

(94) During the market investigation, market participants (especially independent service providers) raised concerns also in relation to the availability and prices of spare parts post-merger, as well as on the availability and accessibility of the certificates to be issued by the merged entity in order to allow third party suppliers to perform inspections/maintenance/repairs on cranes and cranes components. The Commission considers that those concerns are not specifically linked to the proposed Transaction as access to spare parts was already under the exclusive control of OEMs prior to the merger. In other words, OEM's commercial practices in relation to spare parts would still condition outcomes in the market for industrial crane services even if the merger did not take place.

(95) On the basis of the above, the Commission concludes that the Transaction does not raise serious doubts about its compatibility with the common market in respect of the affected markets for the supply of industrial crane services.

IV.2.4. Container handling equipment

Straddle carriers

(96) Like other container handling equipment, straddle carriers are procured by port authorities through tender processes. Demand is characterized by lumpy and infrequent orders. Accordingly, the Commission has been assessing market shares on a 3-year basis (in this case, 2012-2014).

(97) Over that period, the combined market shares of the Parties are [40-50]% worldwide (Konecranes: [5-10]%, Terex [30-40]%) and [50-60]% at EEA level (Konecranes: [510]%, Terex: [40-50]%). The main alternative is the Finnish company Cargotec/Kalmar with a share of [40-50]% globally and [40-50]% in the EEA. The fourth player Liebherr is much smaller (below [5-10]%).

(98) The Commission considers that the Transaction entails a reduction of the number of sizable players in the straddle carrier market from three to two. However, the Parties claim the merger will not affect competition in the straddle carrier market for three main reasons:

i. Konecranes is not a strong player. Its straddle carrier business has been

unprofitable for a number of years. Konecranes shut down its plant in Germany that was dedicated to straddle carriers and shifted to using subcontractors Consistent with this phasing-out strategy, Konecranes has adopted an extremely selective bidding strategy,[...].

ii. Konecranes and Terex are not close competitors. An assessment of the participation of rival bidders in straddle carrier opportunities for which Terex has submitted a bid indicated that Cargotec is by far the most frequently identified rival. In [...]% of these bids where a competitor has been identified, Cargotec has submitted a bid. By contrast, Konecranes is present in only [...]% of these bids.

iii. Other port equipment manufacturers are considering entering the straddle carrier market. In particular, the Parties submit that Chinese company ZPMC, which holds a very strong positioning in other container handling equipment such as ship-to-shore cranes, is believed to be bidding to supply straddle carriers in both U.S. and European opportunities

(99) The Commission understands that the respondents to the market investigation have confirmed that, in general, Cargotec/Kalmar is the main alternative and the closest competitor to Terex.71 Konecranes and Libherr are also mentioned, but mainly as second-tier players. This has been confirmed by competitors, which unanimously mentioned Kalmar as the main competitor of Terex in straddle carriers.72

(100) On these bases, the Commission considers that whilst there are few suppliers of straddle carriers in Europe and in general customers do not expect new entries in the EEA in the next three to five years, customers also consider that competition mainly takes place between the two major suppliers and that Konecranes plays a more limited role. As explained by a port equipment customer "The intense competition is mainly between the two leading suppliers – Terex and Kalmar".73 Another customer put forward that it had a limited experience with Konecranes as "price is too high".74

(101) Consequently, the Commission finds that the customers do not consider that the merger will have an impact on the straddle carriers market. As explained by a customer "There will be a rather moderate effects since Konecranes have very small market share today".75 No specific concerns were voiced by straddle carriers' customers in the course of the market investigation.

(102) In the light of the above, the Commission concludes that the Transaction does not raise serious doubts as regards its impact on the internal market for straddle carriers.

ASCs

(103) Over the 2012-2014 period, the combined market shares of the Parties are [30-40]% worldwide (Konecranes: [20-30]%, Terex: [5-10]%) and [40-50]% at EEA level (Konecranes: [10-20]%, Terex: [20-30]%). The main alternative at global level is ZPMC ([30-40]% globally but only [0-5]% in the EEA), followed by Cargotec ([2030]% globally, [30-40]% in the EEA) and the German firm Hans Kunz ([5-10]% worldwide, [20-30]% in the EEA). For all gantry cranes, the market shares are below [30-40]% at both the worldwide and the EEA level.

(104) The Parties submit that the merger would have no impact on the market for ASCs. This is because the overall project volume is low in the EEA and Terex has just sold one ASC in the EEA since 2008 (in 2014) and its share overstates its current potential. Besides, the Parties submit they will face aggressive price competition from ZPMC (although its presence in Europe remains fairly limited). Finally, a review of ASC tenders in the last 5 years shows that ZPMC and Cargotec are as present as Konecranes in tenders in which Terex submitted bids.

(105) The Commission understands that the respondents to the market investigation have confirmed that neither Terex nor Konecranes are considered as important suppliers for ASCs. In this relatively new market, competition for all contracts is intense, particularly for the larger international contracts that serve to attract even further business. As explained by one customer "Based on our evaluation criteria, neither Terex nor Konecranes overall are not leading suppliers in ASC market. There are certain areas that Terex and Konecranes are less competitive than other suppliers".76. Finally, no specific concerns have been voiced by ASCs customers in the course of the market investigation.

(106) In the light of the above, the Commission concludes that the Transaction does not raise serious doubts as regards its impact on the internal market for ASCs.

Reach stackers

(107) The Commission finds that, over the 2012-2014 period, the combined market shares of the Parties are [20-30]% worldwide (Konecranes: [10-20]%, Terex: [10-20]%) and [20-30]% at EEA level (Konecranes: [10-20]%, Terex: [5-10]%). The Parties will face competition from Cargotec ([30-40]% globally, [30-40]% in the EEA), followed by Hyster ([10-20]% globally, [10-20]% in the EEA). No specific concerns as regards reach stackers were voiced by customers in the course of the market investigation.

(108) In the light of the above, the Commission concludes that the Transaction does not raise serious doubts as regards its impact on the internal market for reach stackers

V. PROPOSED REMEDIES

(109) As a reminder, following its examination the Commission has concluded that the Notified Transaction would raise serious doubts as to its compatibility with the internal market in relation to electric chain hoists and wire rope hoists.

(110) In order to render the concentration compatible with the internal market as regards to the above doubts emerged in respect of the anticompetitive effects that the Transaction would bring in the affected markets for electric chain hoists and wire rope hoists, the notifying party has modified the Transaction as notified by entering into the following commitments.

(111) The notifying party submitted two sets of commitments: the first one on 15 July 2016 (the 'Initial Commitments') and, following the results of the market test, the final set of commitments on 1 August 2016 (the 'Final Commitments').

V.1. Scope of the Initial Commitments

(112) The proposed Initial Commitments offered by Konecranes consisted of the divestiture of the entire Stahl business (hereinafter referred to as the “Divestment Business”).

(113) Stahl is a company owned by Konecranes that manufactures, markets and sells standard and customized wire rope hoists, electric chain hoists and other lifting equipment. Stahl also engineers and sells cranes and is one of the power brands of Konecranes. Stahl products are sold to distributors, crane builders, EPC companies, machinery and systems builders as well as professional end customers in Germany and in more than 70 other countries worldwide. Stahl does not have its own service organization, other than the sale of spare parts. Stahl is primarily a component sales and manufacturing company with limited case-by-case standard crane sales. Stahl operates via distributors, crane builders and service companies who in turn carry out service activities and Stahl provides only spare parts to them. For those limited direct sales of standard cranes Stahl utilizes third-party service providers to manage post sales obligations. There is no commercial contract between Stahl and Konecranes where Konecranes would act as service provider for Stahl and its customers.

(114) The products sold by Stahl are mainly produced in its facility in Kunzelsau, Germany. In addition, Stahl sources some products and components internally from Konecranes. In particular, Stahl sources winches from Konecranes’ factories in Finland ([...] units with a value of Euro [...] million in 2014; no sourced winches in 2015) and some electric chain hoists, manual chain hoists and light crane systems from Konecranes’ Vernouillet factory. Stahl sources main girders, motors and some other components from other third-party suppliers.

(115) The Divestment Business includes:

a. The production facility in Kunzelsau, Germany.

b. [...] Stahl legal entities active worldwide in the sale of hoists and cranes.

c. The rights in all brands, patents and other intellectual property, technology and know-how currently used exclusively or primarily to develop, manufacture, sell and use the products of the Divestment Business. At the option of the Purchaser, Konecranes will grant a perpetual royalty-free global licence covering also technology non-primarily used in Stahl business. Conversely, the Purchaser will provide a perpetual royalty-free global licence covering the technology currently used primarily by Stahl, but also used by Konecranes outside Stahl's business.

d. All product lines currently produced and sold by Stahl, including but not limited to wire rope hoists, chain hoists, industrial cranes, crane components and spare parts, as well as products descriptions

e. All product descriptions and related information, including but not limited to information displayed on Stahl’ websites and brochures.

f. All existing inventory relating to the Divestment Business, at the time of closing of the divestiture sale to the Purchaser.

g. All customer information relating to the Divestment Business, including but not limited to customer records, customer reports, transactional data and customer accreditations, as well as all assignable customers agreements.

h. Konecranes will transfer all assignable customer agreements and will use its reasonable best efforts to facilitate the transfer of all other existing agreements related to the Divestment Business.

i. All the existing contracts relating to the personnel of the Divestment Business, including the key personnel.

j. All assignable distributorship contracts or will use its reasonable best efforts to facilitate the transfer of the other distribution contracts relating to the Divestment Business.

k. All assignable R&D and pipeline projects and related information, to the extent these concern exclusively or predominantly the new products or the other products under development within the scope of the Divestment Business.

l. All assignable contracts for the sourcing of the products exclusively included in the Divestment Business.

Moreover, at the option of the Purchaser, Konecranes will enter into a transitional agreement with Purchaser for the supply of products currently manufactured by Konecranes for the Divestment Business, negotiated on standard industry terms, for a term of up to one year after the Closing, extendable for one additional year.

V.2. Assessment of the Initial Commitments

(116) The Commission has assessed the appropriateness of the Initial Commitments in the light of the above-mentioned principles underlying its commitments policy and the results of the market test carried out.

(117) As set out in the Remedies Notice, the proposed commitments, once implemented, would need to fully and unambiguously resolve the competition concerns identified by the Commission. The Commission would therefore need to be able to conclude - with the requisite degree of certainty - that the new commercial structures resulting from the proposed remedies will be sufficiently workable and lasting to ensure that all grounds for serious doubts as to the compatibility of the Transaction with the internal market will be removed.

(118) The Initial Commitments include the divestment of Konecranes' Stahl subsidiary, which is active in the production and supply of Electric Chain Hoists (ECH), Wire Rope Hoists (WRH), industrial cranes, crane components and spare parts. The Commission notes that Stahl is one of the main brands for hoists and has a very strong reputation on the market, in particular linked to the made-in-Germany feature. Stahl is also considered as the closest competitor of Demag, which is the hoist brand Konecranes will acquire through the merger. Under the Initial Commitment, the proposed divestments include the transfer of Stahl's production facility in Kunzelsau, Germany, as well as other tangible and intangible assets exclusively or primarily used by Stahl. The remedy proposal includes an upfront buyer provision pursuant to which Konecranes will not close the Transaction before Stahl is divested to a suitable Purchaser.

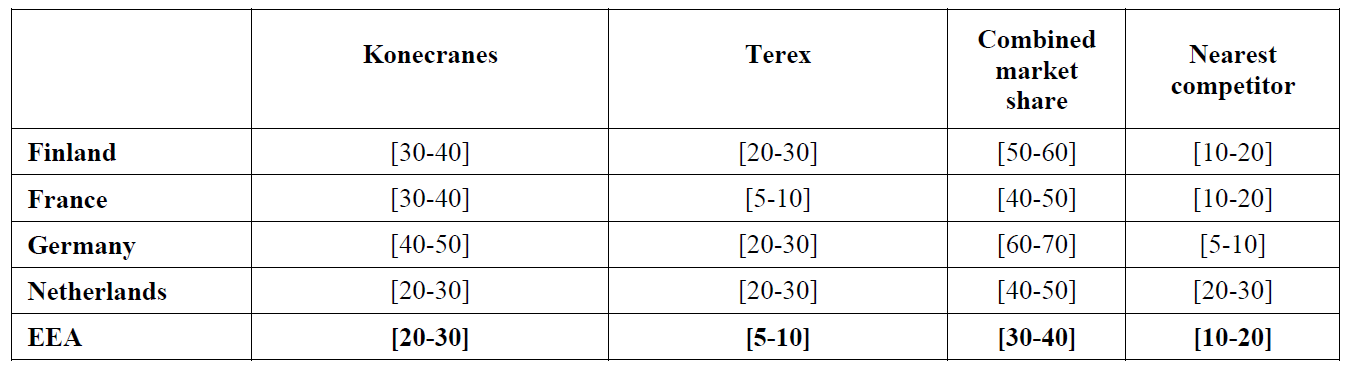

(119) The table below illustrates the reduction of the overlap produced by the divestment of the Stahl business at EEA level and in the two national markets with the highest overlaps.

(120) On this basis, the Commission considers that the remedy eliminates the whole overlap for wire rope hoists and about half of the overlap for electric chain hoists in the EEA and Germany, while removing about half of the overlap for wire rope hoists and electric chain hoists in France. The Commission recalls that the wire rope hoists is the market where the highest number of concerns has been voiced, especially in Germany where Stahl has a sizable position.

(121) Respondents to the market test have overall given positive feedback regarding the suitability of the Initial Commitments to remove the serious doubts identified by the Commission, as well as with respect to the long-term viability of the Divestment Business. They also considered that the proposed commitments are sufficiently clear to allow their effective implementation and reduce the risks linked to the implementation to a minimum Overall they agreed that the scope of the proposed commitments is sufficient to ensure that the Purchaser can run the Divestment Business as a viable and competitive force.

(122) The Commission accordingly concludes that the proposed package, including the upfront buyer provision, can be considered sufficient to address the competition concerns identified by ensuring a significant reduction of the overlaps and the immediate entry and/or expansion into the hoist market to the Purchaser. Moreover, Stahl can be considered a stand-alone business with a strong track record in mechanical engineering: the company was founded in 1876 and it has only been purchased recently, in 2005, by Konecranes.

(123) In the light of the above, the Commission considers that the Initial Commitments are considered suitable for removing the serious doubts identified in relation to the markets for electric chain hoists and wire rope hoists.

V.3. The Final Commitments

(124) On 1 August 2016, the notifying party submitted Final Commitments aimed at improving and refining the Initial Commitments, by completing the Divestment Business to ensure that the commercial structures resulting from the proposed remedies will be sufficiently workable and lasting.

(125) The Final Commitments include the following improvements to the Initial Commitments:

a. A time limitation of three years for the licence-back to Konecranes for the patents and other intellectual property, technology and know-how currently used by the Divestment Business primarily to develop, manufacture, sell and use products within the scope of the Divestment Business, but which are also currently used for the development, manufacturing, sale and use of the products of other Konecranes’ businesses outside the scope of the Divestment Business.

b. A provision allowing the Monitoring Trustee to appoint a third-party expert who will provide expert opinion to the Monitoring Trustee and will supervise the allocation and the transfer or license of the shared technology between Konecranes and the Purchaser.

c. A more precise (i.e. including indication of the names) and comprehensive list of key personnel, including key profiles of the Kunzelsau plant, such as Managers of the following functions: (i) Component Production; (ii) Quality, Facility; (iii) Strategic Purchasing and Materials; and (iv) Platform and Engineering.

d. A longer transitional supply agreement covering the supply of products currently manufactured by Konecranes for the Divestment Business for a term of up to two years, extendable by one additional year

(126) Against this background, the Commission considers that the additional features introduced in the Final Commitments ensure that (i) the Divestment Business is precisely defined as the entire Stahl business, and that (ii) all personnel, including the personnel that was shared by Stahl with Konecranes before the merger, is part of the Divestment Business so as to ensure its viability and competitiveness. .

V.4. Conclusion on the remedies

(127) In the light of the outcome of the market investigation and in view of the information made available to it, the Commission therefore concludes that the Commitments remove the serious doubts raised by the Transaction as to its compatibility with the internal market.

V.5. Conditions and obligations

(128) Under the first sentence of the second subparagraph of Article 6(2) of the Merger Regulation, the Commission may attach to its decision conditions and obligations intended to ensure that the undertakings concerned comply with the commitments they have entered into vis-à-vis the Commission with a view to rendering the concentration compatible with internal market.

(129) The fulfilment of the measures that give rise to the structural change of the market is a condition, whereas the implementing steps which are necessary to achieve this result are generally obligations on the concerned undertakings. Where a condition is not fulfilled, a Commission’s decision declaring the concentration compatible with the internal market is no longer applicable. Where the undertakings concerned commit a breach of an obligation, the Commission may revoke the clearance decision in accordance with Article 6(3) of the Merger Regulation. The undertakings concerned may also be subject to fines and periodic penalty payments under Articles 14(2) and 15(1) of the Merger Regulation.

(130) In accordance with the said basic distinction between conditions and obligations, the commitments laid down in Section B, paragraph 2, of the Annex I constitute conditions attached to this Decision, as only through their full compliance can the structural changes in the relevant markets be achieved. The other commitments laid down in the other paragraphs of Section B and in Section C, of the Annex I constitute obligations, as they concern the implementing steps which are necessary to achieve the modifications sought in a manner compatible with the internal market.

(131) Accordingly, the Decision not to raise objections is made conditional on full compliance by the notifying party with Section B, paragraph 2, of the Final Commitments constituting conditions. In addition, the notifying party shall comply with the remaining paragraphs of Section B and Section C, of the Final Commitments, constituting obligations.

(132) The full text of the Final Commitments is attached as Annex I to this Decision and forms an integral part of it.

VI. CONCLUSION

(133) For the above reasons, the Commission has decided not to oppose the notified operation as modified by the commitments and to declare it compatible with the internal market and with the functioning of the EEA Agreement, subject to full compliance with the conditions in Section B, paragraph 2, of the Final Commitments annexed to the present decision and with the obligations contained in the other paragraphs of Section B and in Section C of the Final Commitments. This decision is adopted in application of Article 6(1)(b) in conjunction with Article 6(2) of the Merger Regulation and Article 57 of the EEA Agreement.

FOOTNOTES :

1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'. The terminology of the TFEU will be used throughout this decision.

2 OJ L 1, 3.1.1994, p. 3 (the 'EEA Agreement').

3 Publication in the Official Journal of the European Union No C 233, 28.06.2016, p. 8.

4 Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Commission Consolidated Jurisdictional Notice (OJ C95, 16.4.2008, p. 1).

5 Case No IV/M.420 - CGP/GEC ALSTHOM/KPR/KONE CORPORATION, paras. 14-15.

6 See replies to Question 6 of Q4 – Questionnaire to customers of standard cranes and to Question 6 of Q5 - Questionnaire to competitors for standard cranes.

7 Case No IV/M.420 - CGP/GEC ALSTHOM/KPR/KONE CORPORATION, paras. 14-15.

8 See replies to Questions 8 and 9 of Q4 – Questionnaire to customers of standard cranes.

9 See replies to Questions 3 and 8 of Q5 - Questionnaire to competitors for standard cranes.

10 Most of the hoists only allow 1 or 2 (fixed) speeds, but not the ability of varying (continuously) the speed when it is being used. The ability of varying the speed is obtained by fitting a hoist with a frequency inverter.

11 See replies to Question 6 of Q1 – Questionnaire to crane builders.

12 See replies to Question 6 of Q3 – Questionnaire to hoists competitors.

13 See replies to Question 7 of Q2 – Questionnaire to hoists distributors.

14 See replies to Question 7 of Q1 – Questionnaire to crane builders, Question 8 of Q2 – Questionnaire to hoists distributors and Question 7 of Q3 – Questionnaire to hoists competitors.

15 See replies to Question 7.1 of Q1 – Questionnaire to crane builders.

16 See replies to Question 7.1 of Q1 – Questionnaire to crane builders.

17 See replies to Question 8 of Q1 – Questionnaire to crane builders, Question 9 of Q2 – Questionnaire to hoists distributors and Question 8 of Q3 – Questionnaire to hoists competitors.

18 See replies to Question 8.1 of Q1 – Questionnaire to crane builders.

19 See replies to Question 8.1 of Q1 – Questionnaire to crane builders.

20 See replies to Question 9.1 of Q2 – Questionnaire to hoists distributors.

21 See replies to Question 8.1 of Q3 – Questionnaire to hoists competitors.

22 See replies to Question 5 of Q3 – Questionnaire to hoists competitors.

23 See replies to Question 22 of Q1 – Questionnaire to crane builders, Question 20 of Q2 – Questionnaire to hoists distributors and Question 21 of Q3 – Questionnaire to hoists competitors.

24 See replies to Question 13 of Q2 – Questionnaire to hoists distributors.

25 See replies to Question 12 of Q3 – Questionnaire to hoists competitors.

26 See replies to Question 15 of Q1 – Questionnaire to crane builders.

27 See replies to Question 11 of Q1 – Questionnaire to crane builders.

28 See replies to Question 11 of Q3 – Questionnaire to hoists competitors.

29 See replies to Question 13 of Q1 – Questionnaire to crane builders, Question 11 of Q2 – Questionnaire to hoists distributors and Question 13 of Q3 – Questionnaire to hoists competitors.

30 See replies to Question 13 of Q3 – Questionnaire to hoists competitors.

31 Konecranes estimates that its revenues by servicing own equipment represent approximately 1/3 of the total. Revenues generated by servicing other manufacturers' equipment account for the remaining 2/3. Approximately 20% of MHPS’ service revenues are generated by servicing other manufacturers' equipment.

32 Case No IV/M.420 - CGP/GEC ALSTHOM/KPR/KONE CORPORATION, at para. 16.

33 See Case No IV/M.420 - CGP/GEC ALSTHOM/KPR/KONE CORPORATION, at para. 17.

34 See replies to Question 12 of Q4 – Questionnaire to customers for standard cranes.

35 See replies to Question 9 of Q5 – Questionnaire to competitors for standard cranes.

36 The combined market shares in other areas of overlaps such as ship-to-shore cranes, heavy forklift trucks and terminal tractors are always below 10% at worldwide and EEA level.

37 There are some automated straddle carriers called Automated Guiding Vehicles (AGVs) but only Terex offers these products.

38 M.5345 Terex/Fantuzzi of 19 November 2008 and M.6255 Terex/Demag cranes of 5 August 2011.

39 See replies to Question 8-9 of Q6 – Questionnaire to port equipment customers and replies to Questions 6-7 of Q7– Questionnaire to port equipment competitors.

40 See replies to Question 11-12 of Q6 – Questionnaire to port equipment customers and replies to Questions 9-10 of Q7– Questionnaire to port equipment competitors.

41 See replies to Question 13-16 of Q6 – Questionnaire to port equipment customers and replies to Questions 11-13 of Q7– Questionnaire to port equipment competitors

42 See replies to Questions 15 and 16 of Q4 – Questionnaire to customers for standard cranes.

43 See replies to Questions 13 and 14 of Q4 – Questionnaire to customers for standard cranes.

44 See replies to Questions 21, 22 and 24 of Q5 – Questionnaire to competitors for standard cranes.

45 See replies to Questions 24, 25 and 27 of Q4 – Questionnaire to customers for standard cranes.

46 See responses to Commission's Request of information to Customers of large projects for standard and modular cranes of 11 July 2016.

47 The proposed Transaction also gives rise to horizontally affected markets in Belgium, Ireland, Italy, Lithuania, Luxemburg, Portugal, Slovakia and Spain.

48 The proposed Transaction also gives rise to horizontally affected markets in Austria, Belgium, Croatia, Czech Republic, Denmark, Estonia, Lithuania, Luxemburg, Poland, Portugal, Slovakia, Sweden and the UK.

49 See replies to Question 23-1 of Q1 – Questionnaire to crane builders

50 See replies to Question 23-1 of Q1 – Questionnaire to crane builders.

51 See replies to Question 24-1 of Q1 – Questionnaire to crane builders.

52 See replies to Question 40 of Q1 – Questionnaire to crane builders.

53 See replies to Question 40.1 of Q1 – Questionnaire to crane builders.

54 See replies to Question 40.1 of Q1 – Questionnaire to crane builders.

55 See replies to Question 41 of Q1 – Questionnaire to crane builders.

56 See replies to Question 38 of Q2 – Questionnaire to hoists distributors.

57 See replies to Question 39 of Q2 – Questionnaire to hoists distributors.

58 See replies to Question 42 of Q1 – Questionnaire to crane builders.

59 See replies to Question 42.1 of Q1 – Questionnaire to crane builders.

60 See replies to Question 43.1 of Q1 – Questionnaire to crane builders.

61 See replies to Question 39 of Q2 – Questionnaire to hoists distributors.

62 See replies to Question 40.1 of Q2 – Questionnaire to hoists distributors.

63 See replies to Question 36.1 of Q2 – Questionnaire to hoists distributors.

64 See replies to Question 36.3 of Q2 – Questionnaire to hoists distributors

65 See replies to Question 36 of Q3 – Questionnaire to hoists competitors.

66 See replies to Question 36.1 of Q3 – Questionnaire to hoists competitors.

67 See replies to Question 40 of Q1 – Questionnaire to crane builders.

68 See replies to Question 42 of Q1 – Questionnaire to crane builders.

69 See replies to Question 37 of Q2 – Questionnaire to hoists distributors.

70 See replies to Question 36, 38 and 39 of Q3 – Questionnaire to hoists competitors.

71 See replies to Question 25 of Q6 – Questionnaire to port equipment customers.

72 See replies to Question 21 of Q7 – Questionnaire to port equipment competitors.

73 See reply to Question 29 of Q6 – Questionnaire to port equipment customers.

74 See reply to Question 22 of Q6 – Questionnaire to port equipment customers.

75 See replies to Question 30 of Q6 – Questionnaire to port equipment customers.

76 See replies to Question 38-1 and 39-1 of Q6 – Questionnaire to port equipment customers.

Case No. COMP/M.7792 – KONECRANES/MHPS

COMMITMENTS TO THE EUROPEAN COMMISSION

1 August 2016

Pursuant to Article 6(2) of Council Regulation (EC) No 139/2004 (the “Merger Regulation”), Konecranes Plc (“Konecranes” or the “Notifying Party”) hereby provides the following Commitments (the “Commitments”) vis-à-vis the European Commission (the “Commission”) with a view to rendering the acquisition of sole control of the Material Handling and Port Solutions business (“MHPS” or “Target”) of Terex (the “Transaction”) compatible with the common market and the functioning of the EEA Agreement.

This text shall be interpreted in light of the Commission’s decision pursuant to Article 6(1)(b) of the Merger Regulation to declare the Concentration compatible with the internal market and the functioning of the EEA Agreement (the “Decision”), in the general framework of European Union law, in particular in light of the Merger Regulation, and by reference to the Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the “Remedies Notice”).

Section A. Definitions

1. For the purpose of the Commitments, the following terms shall have the following meaning:

Affiliated Undertakings: undertakings controlled by the Konecranes and/or by the ultimate parents of the Konecranes, whereby the notion of control shall be interpreted pursuant to Article 3 of the Merger Regulation and in light of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings (the "Consolidated Jurisdictional Notice").

Assets: the assets that contribute to the current operation or are necessary to ensure the viability and competitiveness of the Divestment Business as indicated in Section B, paragraph 2 and described more in detail in the Schedule.

Closing: the transfer of the legal title to the Divestment Business to the Purchaser.

Closing Period: the period of [...] months from the approval of the Purchaser and the terms of sale by the Commission.

Confidential Information: any business secrets, know-how, commercial information, or any other information of a proprietary nature that is not in the public domain.

Conflict of Interest: any conflict of interest that impairs the Trustee's objectivity and independence in discharging its duties under the Commitments.

Divestment Business: the business or businesses as defined in Section B and in the Schedule which Konecranes commits to divest.

Divestiture Trustee: one or more natural or legal person(s) who is/are approved by the Commission and appointed by Konecranes or a Konecranes Affiliated Undertaking and who has/have received from Konecranes or a Konecranes Affiliated Undertaking the exclusive Trustee Mandate to sell the Divestment Business to a Purchaser at no minimum price.

Effective Date: the date of adoption of the Decision.

First Divestiture Period: the period of [...] months from the Effective Date.

Hold Separate Manager: the person appointed by Konecranes for the Divestment Business to manage the day-to-day business under the supervision of the Monitoring Trustee.

Key Personnel: all personnel necessary to maintain the viability and competitiveness of the Divestment Business, as listed in the Schedule, including the Hold Separate Manager.

Monitoring Trustee: one or more natural or legal person(s) who is/are approved by the Commission and appointed by Konecranes, and who has/have the duty to monitor Konecranes’ compliance with the conditions and obligations attached to the Decision.