Commission, August 31, 2018, No M.9041

EUROPEAN COMMISSION

Decision

HUTCHISON / WIND TRE

Subject: Case M.9041 - HUTCHISON/WIND TRE

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

1. INTRODUCTION

(1) On 12 July 2018, the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 ("the Merger Regulation") by which CK Hutchison Holdings Limited ("Hutchison" or the "Notifying Party", Hong Kong) acquires within the meaning of Article 3(1)(b) of the Merger Regulation indirect sole control of the whole of Wind Tre S.p.A. ("Wind Tre", Italy) (the "New Transaction"). (3) The New Transaction is accomplished by way of purchase of shares. Hutchison and Wind Tre are hereinafter referred to as the "Parties".

2. THE PARTIES AND THE NEW TRANSACTION

(2) Hutchison is a multi-national conglomerate headquartered in Hong Kong, active in five core businesses: ports and related services, retail, infrastructure, energy and telecommunications. The telecommunications division includes interests in mobile and fixed operations in Austria, Denmark, Ireland, Italy, Sweden and the United Kingdom.

(3) Wind Tre is the largest mobile telecommunications operator in Italy with approximately 29 million mobile customers and over 2.7 million fixed line customers. Wind Tre is currently controlled by the Luxembourg based entity VIP- CKH Luxembourg S.à. R.L. ("VIP-CKH"). VIP-CKH is a joint venture between Hutchison Europe Telecommunications S.à R.L. ("HET") and VEON Luxembourg Holdings ("VLH"). HET is an indirect wholly-owned subsidiary of Hutchison. VLH is an indirect wholly-owned subsidiary of VEON Ltd ("VEON").

(4) Pursuant to a share purchase agreement entered into on 3 July 2018, Hutchison will acquire, by means of an indirect subsidiary, all the shares in VIP-CKH and thus sole control over Wind Tre. The New Transaction will thus lead to a change from joint control to sole control by Hutchison over Wind Tre and it constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation (the "Concentration").

3. UNION DIMENSION

(5) In 2017 (4), the undertakings concerned have a combined aggregate world-wide turnover of more than EUR 5 000 million (5) (Hutchison: EUR 45 083 million, Wind Tre: EUR 6 182 million). (6) Each of them has an EU-wide turnover in excess of EUR 250 million (Hutchison: EUR […] million, Wind Tre: EUR 6 182 million), but they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The Concentration therefore has a Union dimension.

4. COMPETITIVE ASSESSMENT

4.1. Introduction

(6) Wind Tre was created in 2016 through a transaction by which HET and VLH contributed to a newly created joint venture ("JV") their respective Italian telecommunication businesses H3G S.p.A. ("H3G") (7) and WIND Telecomunicazioni S.p.A. ("WIND") (8) (the "2016 Transaction").

(7) The 2016 Transaction was assessed by the Commission in the decision related to case M.7758 – Hutchison 3G Italy / WIND / JV ("the 2016 Clearance Decision"). (9) After an in-depth investigation, the Commission found that the 2016 Transaction would have significantly impeded effective competition for the following reasons.

(8) First, in the 2016 Clearance Decision, the Commission concluded that the 2016 Transaction was likely to give rise to non-coordinated anti-competitive effects on the retail market for mobile telecommunications services in Italy. Those effects would have arisen from the reduction of the number of mobile network operators ("MNOs") from four to three in a highly concentrated market with high barriers to entry. The 2016 Transaction would have removed from the market an important competitive force, H3G, as well as the competitive constraint exerted by WIND. H3G and WIND closely competed on the market, and exerted a competitive constraint on each other and the other MNOs. Following the 2016 Transaction, the JV would have had a significant market share, and would not have had the incentive to compete on the market in the same way as H3G and WIND did before the 2016 Transaction separately. Furthermore, the other MNOs, TIM S.p.A. ("TIM") and Vodafone Italia S.p.A. ("Vodafone"), would also not have had the incentive to vigorously compete against the JV to counter the anticompetitive unilateral effects of the Transaction. Mobile virtual network operators ("MVNOs") might have had the incentive to compete, but would have lacked the ability to do it effectively, and would thus have been unable to replace the competitive constraint exerted by H3G and WIND, which the 2016 Transaction would have removed. This would have resulted in significant price effects, which would not have been offset by buyer power or market entry. Therefore, the Commission concluded that that the 2016 Transaction would have significantly impeded effective competition in the retail market for mobile telecommunications services in Italy as a result of horizontal non-coordinated effects.

(9) Second, the Commission concluded that the 2016 Transaction was likely to give rise to coordinated anticompetitive effects in the retail market for mobile telecommunications services in Italy. Indeed, the 2016 Transaction would have increased the likelihood that the three remaining MNOs would be able to coordinate their behaviour and raise prices in a sustainable way, even without entering into an agreement or resorting to a concerted practice within the meaning of Article 101 of the TFEU. In particular, the 2016 Transaction would have led to an overall alignment of incentives of the JV, TIM and Vodafone to coordinate their competitive behaviour. Reaching terms of coordination would have been possible and coordination would have been likely to be sustainable after the 2016 Transaction. Therefore, the Commission concluded that that the 2016 Transaction would have significantly impeded effective competition in the retail market for mobile telecommunications services in Italy also as a result of horizontal coordinated effects. In the 2016 Clearance Decision, the Commission considered that the effects from coordination in the retail market for mobile telecommunications services in Italy would have materialised in addition to the non-coordinated effects arising from the 2016 Transaction, leading to additional harm to consumers (over and above the harm implied by non-coordinated effects).

(10) Third, the Commission concluded that the Transaction would have likely had anticompetitive effects in the wholesale market, by eliminating the important competitive constraints exerted by H3G and WIND in an oligopolistic market featuring a limited number of players and high barriers to entry. According to the 2016 Clearance Decision, those effects would have been particularly relevant with respect to MVNOs which were not contractually bound to an MNO in the short term and with respect to potential new entrants. Therefore, the Commission concluded that the Transaction would have significantly impeded effective competition on the wholesale market in Italy due to non-coordinated effects.

(11) The notifying parties to the 2016 Transaction (HET and VLH) offered commitments to address those concerns (the "2016 Commitments"). The 2016 Commitments consisted of a number of elements designed to allow the entry of a fourth MNO (the "New MNO") into the Italian market, that is: (1) the transfer of spectrum and the option to acquire/co-locate on macro access sites; (10) (2) an option to enter into a RAN sharing agreement; (3) a national roaming agreement; and (4) an option for […] and the provision of additional services. Each of these elements is described in turn below.

(12) First, HET and VLH committed to transfer to the New MNO a total of 2x35 MHz of spectrum (the "Divestment Spectrum"), belonging to different frequency bands and to make available to the New MNO up to […] macro network sites (the "Divestment Sites"). The Divestment Spectrum and the Divestment Sites were to be released on a […] phased basis in accordance with the release plan attached to the 2016 Commitment, and the release of spectrum and sites had to be completed by […]. (11)

(13) Second, HET and VLH also committed to offer an option to enter with the New MNO into one-way (non-reciprocal) RAN sharing solution in the less densely populated areas of Italy (the "RAN Sharing Option"). The RAN Sharing Option would be made available for up to […] years at commercial conditions to be agreed between HET, VLH and the New MNO.

(14) Third, HET and VLH committed to enter into a transitional national roaming agreement on the network of H3G or WIND (Wind Tre, following the consolidation of H3G and WIND networks) for all technologies (i.e. 2G, 3G, 4G and, if and when commercially launched, 5G; the "National Roaming Agreement") for an initial term of […] years, with an optional extension of a further […]-year term. The purpose of the National Roaming Agreement was to allow the New MNO to operate for a transitional period of time, whilst it is rolling out its network based on the Divestment Spectrum and the Divestment Sites. The capacity offered under the National Roaming Agreement can also be used by the New MNO to offer wholesale access.

(15) Finally, HET and VLH committed to […] to the New MNO to assist with the establishment and on-going operation of the New MNO’s network and to offer an option to provide transitional services, such as backhaul, transmission, interconnection, and SIM procurement.

(16) The 2016 Commitments were offered as fix-it-first solution: the New MNO selected by HET and VLH was Iliad S.A. ("Iliad").

(17) The 2016 Transaction was thus conditionally cleared on 1 September 2016. In the 2016 Clearance Decision the Commission also approved Iliad as New MNO.

(18) On 29 May 2018 Iliad started offering its services in Italy.

(19) At the date of adoption of this Decision, the implementation of the 2016 Commitments is on-going, in particular in relation to the transfer of the Divestment Spectrum and Divestment Sites and the implementation of the National Roaming Agreement.

(20) It is against this background that the Commission has assessed the effects of the New Transaction.

4.2. Relevant markets

(21) As mentioned in paragraphs (4) and (6), Wind Tre is the result of the combination of the Italian telecommunication businesses of HET and VLH and the New Transaction consists in a change of the quality of control exerted by Hutchison over Wind Tre, from joint control to sole control. Therefore, technically, no new horizontal overlaps or vertical links exist other than those raised by the 2016 Transaction. Thus, in the present case the Commission has investigated product and geographic market definitions for the relevant markets analysed in M.7758 – Hutchison 3G Italy / WIND / JV to assess whether any development has occurred since the adoption of the 2016 Clearance Decision which would justify departing from the definitions retained in the 2016 Clearance Decision.

4.2.1. Retail mobile telecommunications services

(22) Mobile telecommunications services to end customers or "retail mobile services" include services for national and international voice calls, SMS (including MMS and other messages), mobile internet with data services, access to content via the mobile network and retail international roaming services.

(23) In past decisions, the Commission has so far not segmented the overall retail mobile market further based on the type of service offered (voice calls, SMS, MMS, mobile Internet data services), or the type of network technology used (2G, 3G, 4G). Such market was considered distinct from the supply of retail fixed telecommunications services. The Commission has also considered a possible segmentation of the overall retail market for mobile telecommunication services between pre-paid and post-paid services and between private customers and business customers, but it has considered that, for the purpose of assessing the transaction at stake, these did not constitute separate product markets but represent rather market segments within an overall retail market. (12) In particular, in case M.7758 – Hutchison 3G Italy / WIND / JV, the Commission concluded that, for the assessment of the effects of the 2016 Transaction, that there was an overall product market for the retail provision of mobile telecommunications services. (13)

(24) From a geographical perspective, the Commission has in its previous decisions considered that the market for retail mobile telecommunications services is national in scope. (14) In particular, in case M.7758 – Hutchison 3G Italy / WIND / JV, the Commission concluded that the geographic scope of the relevant product market for the assessment of the 2016 Transaction was limited to the territory of Italy. (15)

(25) The evidence in the Commission's file has not revealed any new development in the present case which might justify departing from the conclusions reached with regard to the 2016 Transaction.

(26) For the purposes of this Decision, the Commission therefore considers that there is an overall product market for the retail provision of mobile telecommunications services, whose geographical scope is national and limited to the territory of Italy.

4.2.2. Wholesale services for access and call origination on mobile networks

(27) MNOs sell access to their mobile network and the ability to make calls and exchange data traffic. MNOs that own mobile networks constitute the supply side, whereas MVNOs (which do not own a mobile network and thus seek access to one or more of the MNO networks in order to provide their mobile retail services) constitute the demand side of this market.

(28) In previous cases, the Commission defined a single wholesale market including both access and call origination services on mobile networks, on the ground that MNOs generally supply these services jointly to MVNOs and both services are essential for MVNOs to be able to provide retail mobile communication services to end users. (16) In particular, in case M.7758 – Hutchison 3G Italy / WIND / JV, the Commission considered that there was a distinct wholesale market for access and call origination on mobile networks, which includes voice, SMS and data traffic. (17)

(29) In previous cases, the Commission has considered the wholesale market for access and call origination to be national in scope due to regulatory barriers stemming from the fact that licenses granted to MNOs are generally national in scope. (18) In particular, in case M.7758 – Hutchison 3G Italy / WIND / JV, the Commission considered that the wholesale market for access and call origination on public mobile networks was national in scope, that is to say limited to the territory of Italy. (19)

(30) The evidence in the Commission's file has not revealed any new development in the present case which might justify departing from the conclusions reached with regard to the 2016 Transaction.

(31) For the purposes of this Decision, the Commission therefore considers that the relevant product market is the wholesale market for access and call origination on mobile networks, which includes voice, SMS and data traffic and that the relevant geographical scope of that market is national and limited to the territory of Italy.

4.2.3. Wholesale international roaming services

(32) In order for a provider of retail mobile services to be able to provide its end customers with telecommunication services outside their home country, it must enter into agreements with providers of wholesale international roaming services, which are primarily active in other national markets. Roaming agreements can be concluded with a preferred foreign operator which offers tailor-made service conditions, as can be seen in particular in the creation of international roaming alliances. Wholesale roaming services are thus upstream to the retail market for mobile telecommunications services.

(33) In previous decisions, the Commission has defined a separate wholesale market for international roaming services comprising both terminating calls and originating calls. (20) For originating calls while roaming, the foreign or visited mobile network is used to make phone calls when abroad and a wholesale roaming charge is paid by the home network to the visited network. For terminating calls, the call is routed by the home network to the visited mobile network and the home network pays for the international carriage of the call and the normal termination charge to the visited network. Demand for wholesale international roaming services comes first from foreign mobile operators who wish to provide their own customers with mobile services outside their own network and also downstream from subscribers wishing to use their mobile telephones outside their own countries. (21)

(34) In its previous decisions, the Commission has defined wholesale market for call termination as national in scope. (22)

(35) Similar findings have been reached by the Commission in case M.7758 – Hutchison 3G Italy / WIND / JV. (23)

(36) The evidence in the Commission's file has not revealed any new development in the present case which might justify departing from the conclusions reached with regard to the 2016 Transaction.

(37) For the purposes of this Decision, the Commission therefore considers that the relevant product market is the wholesale market for international roaming services, comprising both terminating calls and originating calls and that the geographical market is national in scope.

4.2.4. Wholesale services for mobile call termination

(38) In order for an MNO to be able to deliver calls upon the mobile network of another MNO, it must purchase wholesale termination services on the network of the other MNO. MNOs provide wholesale mobile call termination services to one another on the basis of interconnection agreements, upstream of the provision of retail mobile telecommunication services to end customers.

(39) In its previous decisions, including in case M.7758 – Hutchison 3G Italy / WIND / JV, (24) the Commission has found that there are no substitutes for wholesale call termination on each individual mobile network, since the operator transmitting the outgoing call can reach the intended recipient only through the operator of the network to which that recipient is subscribed. (25) Therefore, each individual mobile network constitutes a separate wholesale market for call termination.

(40) In its previous decisions, including in case M.7758 – Hutchison 3G Italy / WIND / JV, (26) the Commission has defined wholesale market for call termination as national in scope. (27)

(41) The evidence in the Commission's file has not revealed any new development in the present case which might justify departing from the conclusions reached with regard to the 2016 Transaction.

(42) For the purposes of this Decision, the Commission therefore considers that the relevant product market is the wholesale market for call termination on each individual mobile network and that the geographical market is national in scope.

4.2.5. Wholesale services for call termination on fixed networks

(43) In its previous decisions, including in case M.7758 – Hutchison 3G Italy / WIND / JV, (28) the Commission established that each individual fixed network constitutes a separate wholesale market for call termination. (29) The Commission considered in its previous decisions that the geographic scope of each wholesale market for call termination should correspond to the dimensions of the operator’s network, which is limited to national borders due to regulatory barriers. (30)

(44) The evidence in the Commission's file has not revealed any new development in the present case which might justify departing from the conclusions reached with regard to the 2016 Transaction.

(45) For the purposes of this Decision, the Commission therefore considers that the relevant product market is the wholesale market for call termination on each operator's fixed network and that the geographical market is national in scope.

4.2.6. Wholesale services for fixed backhaul

(46) Backhaul services are the connections between the antennae in a mast and the switches in the core network and are used to ensure the proper functioning of a mobile network. Backhaul are general wired connections based on either (i) fibre optic cables or (ii) copper cables. Backhaul providers are primarily fixed operators who are able to provide fibre optic or copper cables from their fixed network.

(47) In previous cases, the Commission has left open the product market definition for backhaul services. (31)

(48) In case M.7758 – Hutchison 3G Italy / WIND / JV, the question of the exact product and geographic market definition for wholesale services for fixed backhaul was left open, as the 2016 Transaction did not raise competition concerns under any possible product market definition. (32)

(49) The evidence in the Commission's file has not revealed any new development in the present case which might justify departing from the approach taken with regard to the 2016 Transaction.

4.3. Impact of the New Transaction

(50) As mentioned in Section 4.1., in the 2016 Clearance Decision the Commission found that the 2016 Transaction would have significantly impeded effective competition only in the market for retail mobile telecommunications services in Italy and in the wholesale market for access and call origination on public mobile networks in Italy, while any competition concerns was excluded in relation to the other relevant markets identified in Section 4.2.

(51) As further explained in this Section, based on a first phase market investigation, the Commission considers that, other than the creation of Wind Tre and the commercial launch of Iliad, no significant change has occurred in the competitive landscape on the relevant markets in comparison to the competitive landscape assessed by the Commission in the 2016 Clearance Decision. Thus, in a scenario where the 2016 Commitments were not in place, the New Transaction would give rise to the same competition concerns as the 2016 Transaction.

4.3.1. Retail mobile telecommunications services

(52) The Commission considers that, other than the creation of Wind Tre and the commercial launch of Iliad, no significant change has occurred in the competitive landscape on the market for the provision of retail mobile telecommunications services in Italy.

(53) First, no new MNO (other than Iliad) has entered the market and only a few MVNOs have launched services since the adoption of the 2016 Clearance Decision.

(54) Second, most of the respondents to the market investigation in the present case considered that there has not been any material development in the Italian market for the provision of retail mobile telecommunications services (other than the creation of the Wind Tre and the entry of Iliad) since the adoption of the 2016 Clearance Decision. (33) The only relevant facts mentioned by respondents to the market investigation are the entrance of Iliad as a result of the 2016 Commitment and the launch of Ho.Mobile and Kena, respectively Vodafone's and TIM's low cost brands launched on 22 June 2018 and 30 March 2017. Respondents, including Tiscali and PosteMobile, highlighted how the launch of Vodafone's and TIM's low-brand offerings was in reaction to Iliad's entrance in the market.

(55) Few respondents to the market investigation, including Poste Italiane S.p.A. ("Poste Mobile") and Fastweb S.p.A. ("Fastweb"), the largest MVNOs in the Italian market, consider that Iliad, Ho.Mobile and Kena's entrance is creating a distortion on the market due to the fact that these new players benefit from artificial wholesale access conditions that are not replicable by other MVNOs. (34) In this respect the Commission notes that, first, Ho.Mobile and Kena are effectively second brands of MNOs and should be considered as such. Second, Iliad's wholesale access conditions are set forth in the 2016 Commitments precisely with a view to allowing Iliad to compete aggressively. Third, the fact that certain MVNOs are unable to effectively compete with the MNOs due to their access conditions is a separate issue, which the Commission already noted in the 2016 Clearance Decision. (35)

(56) Thus, it appears that, other than the creation of Wind Tre and the entry of Iliad as a result of the 2016 Commitments, the conditions of competition in the retail mobile market in Italy have not significantly changed since the adoption of the 2016 Clearance Decision.

(57) However, in the absence of Iliad’s entry and development as New MNO (which requires the full implementation of the 2016 Commitments, which is scheduled to occur over a long period of time (36)), the combination of Wind’s and H3G’s would likely result in the anticompetitive effects predicted in the 2016 Decision.

(58) In fact, the Commission considers that, if the 2016 Commitments were not confirmed (ensuring the full development of a competitive New MNO), the New Transaction would raise serious doubts as to its compatibility with the internal market with regard to the market for the provision of retail mobile telecommunications services on the basis of the same findings discussed in Section 7.3 of the 2016 Clearance Decision. In particular, as discussed in Section 4.1., the Commission considers that, if the 2016 Commitments were not confirmed, the New Transaction would likely give rise to both horizontal coordinated and non-coordinated anti-competitive effects on that market since, in the absence of the 2016 Commitments, the anticompetitive effects of the 2016 Transaction would likely materialise.

(59) Nonetheless, the Commission considers that the New Transaction will not raise additional competition concerns not identified in the 2016 Clearance Decision (and addressed by the 2016 Commitments).

(60) In this respect, the Commission notes that, first, the fact that the company combining Wind’s and H3G’s activities is jointly or solely controlled does not change the nature and breath of the competition problems stemming from the combination of Wind’s and H3G’s activities.

(61) Second, following the announcement of Iliad's entry and the implementation of the 2016 Commitments until the date of adoption of this Decision, mobile prices have continued to decline and competition among mobile operators has intensified. (37)

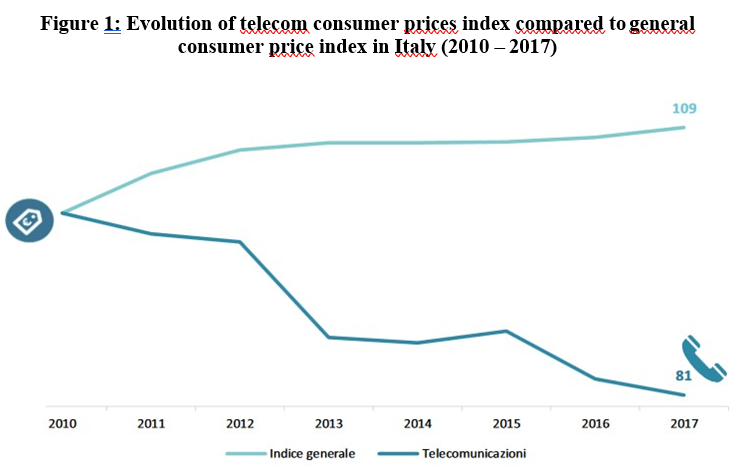

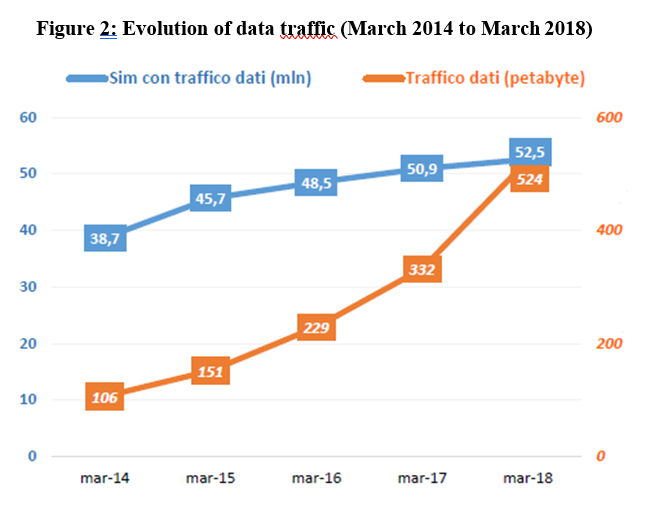

(62) In fact, data compiled by the Italian telecommunications regulatory authority, Autorità per le Garanzie nelle Comunicazioni ("AGCOM"), shows that, following the creation of Wind Tre and the announcement and the first phase of implementation of the 2016 Commitments (leading to Iliad’s entry in the Italian market), existing MNOs have continued to compete aggressively against each other and the MVNOs. The continuously declining mobile prices are inter alia reflected in average consumer prices on telecoms services reaching a historical low in 2017 (as shown in Figure 1) (38), while at the same time data usage and demand strongly increased (as shown in Figures 2 and 3) and the general consumer price index has also increased.

Source: AGCOM 2018 Annual Report, Figure 3.1.1. (available at:https://www.agcom.it/documents/10179/11258925/Relazione+annuale+2018/24dc1cc0-27a7-4ddd-9db2- cf3fc03f91d2)

Source: AGCOM's quarterly updates, 2/2018, page 15 (available at: https://www.agcom.it/documents/10179/11373550/Documento+generico+20-07-2018/d5191177-1864- 43d5-86d8-a0b3fd8fa687?version=1.0).

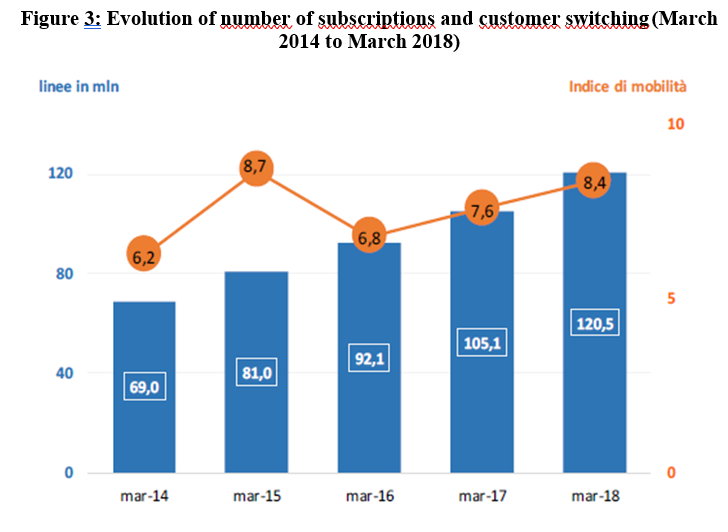

(63) The competitive nature of the Italian mobile telecommunications market, even prior to Iliad’s entry, is also reflected by the increased number of consumers switching their mobile provider, as shown by the mobile number portability data (MNP) published by AGCOM. Such data shows an upward trend between 2013 and 2017, and show an all-time peak in 2017.

Source: AGCOM's quarterly updates, 2/2018, page 16 (available at: https://w.agcom.it/documents/10179/11373550/Documento+generico+20-07-2018/d5191177-1864- 43d5-86d8-a0b3fd8fa687?version=1.0).

(64) The above data still not report the impact of the entry of Iliad, occurred on 29 May 2018. Nonetheless they reflect the fact that even the mere announcement of the entry of Iliad has preserved the competitive nature of the Italian retail mobile market. Indeed, the other players undertook several competitive measures in response to the announcement of such entry.

(65) The entry of Iliad has been perceived as significantly aggressive in the market, as shown by the responses to the market investigation, (39) but also analyst reports and press coverage. (40) The other MNOs reacted strongly to Iliad’s market entry offer by doubling or tripling the data allowances included in their respective underground offers compared to previous years, while keeping prices consistent as shown by Figure 4 below illustrating MNOs' offers in June 2018.

Figure 4: Comparison of MNOs' offers in June 2016, 2017 and 2018 to Iliad's offer 2016

[…]

Source: Parties' response to RFI 1, Figure 4.

(66) Consumer uptake of Iliad’s offer has been rapid with Iliad reporting that it has already reached 1 million customers within the first two months of operation, which corresponds to a market share of approximately 1,4% in the pre-paid segment based on 2017 subscriber numbers. (41)

(67) Thus, the conditions of competition in the retail mobile market in Italy do not appear to have degraded during the implementation of the 2016 Commitments until the date of adoption of this Decision.

(68) Third, most of the respondents to the market investigation considered that, if the 2016 Commitments were confirmed, the New Transaction would have a neutral or positive impact on the retail mobile market. (42) Only one respondent, Fastweb, considered that the New Transaction would have an impact on the Italian retail mobile telecommunications market. In particular, Fastweb considers that the removal of VEON as shareholder from the decision-making process may increase the risk of coordination in the Italian retail mobile telecommunications markets. First, the New Transaction would facilitate Wind Tre reaching terms of coordination with Iliad. Second, since Iliad is only focused on the low-end of the market, the remaining MNOs will have the ability and incentive to coordinate better than they did before on the remaining of the market. Third, according to Fastweb, the New Transaction will increase Hutchison’s incentives to coordinate with its competitors in the other European markets where it operates, namely the UK, Sweden, Denmark, Austria and Ireland. (43)

(69) In this regard, the Commission notes that, first, it is not clear why the removal of VEON as shareholder of Wind Tre would increase the risk of coordination in the Italian market. Indeed, Wind Tre is a full function joint venture, independent from an operational and financial perspective from its shareholders. Therefore, assuming that Fastweb's claim is based on a reduction of the number of players who would coordinate their market behaviour, Wind Tre's incentive to coordinate with the other market players would be the same irrespective of its ownership structure.

(70) Second, as explained in Section 4.2.1. there is no segmentation of the market for retail mobile telecommunications services based on different price points (such as "low-cost" vs "high-cost") and, as described also in the 2016 Clearance Decision, price is the most important parameter of competition for customers choosing retail mobile services in Italy. (44) Therefore, aggressive pricing would benefit all customers in the retail mobile telecommunications market, thereby disrupting a possible coordination.

(71) Third, the launch of low-cost brands by TIM and Vodafone in reaction to Iliad's entry shows that the MNOs in the market perceive Iliad as a threat and they are reacting to its entrance in order to defend their customer base. To the contrary, no attempt to search a new "equilibrium with Vodafone and TIM" with respect to the "higher spending segment" could be identified.

(72) Finally, with respect to Fastweb's claim that the New Transaction will increase Hutchison’s incentives to coordinate with its competitors in the other European markets, the Commission note that in no other market outside Italy Vodafone, TIM and Iliad are all present and Vodafone competes against Hutchison only in Ireland and the UK. Thus, the risk of coordination on retail markets different other than the Italian retail mobile market where WindTre is active is unlikely to increase as a result of the New Transaction.

4.3.2. Wholesale services for access and call origination on mobile networks

(73) The Commission considers that, other than the creation of Wind Tre and the commercial launch of Iliad, no significant change has occurred in the competitive landscape on the market for the provision of wholesale access and call origination services on mobile networks in Italy.

(74) First, no new MNO (other than Iliad) has entered the market and started offering wholesale access and call origination services in Italy, neither have the competent Italian authorities modified the regulatory framework concerning the provision of those services.

(75) Second, most of the respondents to the market investigation in the present case considered that there has not been any material development in the Italian market for the provision of wholesale access and call origination services on mobile networks (other than the creation of the Wind Tre and the entry of Iliad) since the adoption of the 2016 Clearance Decision. (45)

(76) A few MVNO respondents explained that there is still little competition in the market for wholesale access and call origination, that new MVNOs have difficulties to obtain an access agreement in Italy and that no new MVNO has entered the market since 1 September 2016 and small MVNOs have exited the market since that same date. (46)

(77) In this respect, the Commission notes that the difficulties in obtaining an access agreement in Italy from MVNOs were not merger specific in themselves already at the time the Commission assessed the 2016 Transaction. Indeed, the results of the market investigation in case M.7758 - Hutchison 3G Italy / WIND / JV indicated that MVNOs are rarely approached by MNOs unless the MVNO takes the initiative to a negotiation or announces its intentions. (47) As explained in the 2016 Clearance Decision, MNOs provide wholesale access in order to make use of spare capacity and the possibility to generate incremental revenue; however, because MNOs are vertically integrated and operate at both retail and wholesale level, there is a risk that they will lose some of their retail subscribers to the MVNOs they host (so called "risk of cannibalization"). Thus, only if the MNOs and the MVNOs target different customer segments in the retail market, the risk of cannibalisation is lower, and MNOs may be more inclined to provide wholesale access to the MVNO. (48) There is therefore no indication that the MVNOs’ difficulties to obtain an access agreement in Italy are the result of the 2016 Transaction, which was approved on the basis of Commitments designed to eliminate competition concerns also on the wholesale market, through the development of a New MNO having the ability and the incentives to grant wholesale access to MVNOs.

(78) Thus, it appears that, other than the creation of Wind Tre and the entry of Iliad as a result of the 2016 Commitments, the conditions of competition in the wholesale mobile market in Italy have not significantly changed since the adoption of the 2016 Clearance Decision.

(79) However, in the absence of Iliad’s entry and development as New MNO (which requires the full implementation of the 2016 Commitments), the combination of Wind’s and H3G’s would likely result in the anticompetitive effects predicted in the 2016 Decision.

(80) In fact, on the basis of the same findings discussed in Section 7.4 of the 2016 Clearance Decision, the Commission considers that, if the 2016 Commitments were not confirmed (ensuring the full development of a New MNO, having the ability and the incentives to compete also at the wholesale level), the New Transaction would raise serious doubts as to its compatibility with the internal market also with regard to the market for the provision of wholesale access and call origination services on mobile networks. In particular, as discussed in Section 4.1., the Commission considers that, if the 2016 Commitments were not confirmed, the New Transaction would likely give rise to horizontal non- coordinated anti-competitive effects on that wholesale market since, in the absence of the 2016 Commitments, the anticompetitive effects of the 2016 Transaction would likely materialise.

(81) Nonetheless the Commission considers that the New Transaction will not raise additional competition concerns not identified in the 2016 Clearance Decision (and addressed by the 2016 Commitments).

(82) In this respect the Commission notes that, first, the fact that the company combining Wind’s and H3G’s activities is jointly or solely controlled does not change the nature and breath of the competition problems stemming from the combination of Wind’s and H3G’s activities.

(83) Second, most of the respondents to the market investigation considered that the New Transaction would only have a neutral impact on the market for the provision of wholesale access and call origination services on mobile networks in Italy, with only a minority considering that the impact of the New Transaction could be negative. (49) Among such minority, Transatel stated that the "full takeover of WINDTre by H3G might change the governance of the 3rd Italian MNO and H3G shareholders vision might be actually to limit the wholesale business of H3G Italy in order to give more room to the retail business." In this respect the Commission notes that the reduction of the number of hosting MNOs from four to three and the creation of a larger player with less incentives to host MVNOs was in fact one of the elements underpinning the finding of competition concerns in the 2016 Clearance Decision and that the 2016 Commitments aimed at remedying.

(84) Finally, similar to its assessments in the 2016 Clearance Decision, (50) the Commission considers that it is not necessary to take a view on whether the New Transaction raises serious doubts as to its compatibility with the internal market due to horizontal coordinated effects on the wholesale market, as the commitments offered by the Notifying Party on 9 August 2018 would address such coordinated effects, as the 2016 Commitments did. (51)

4.3.3. Conclusion

(85) In light of the above, the Commission considers that, if the 2016 Commitments were not confirmed, the New Transaction would raise serious doubts as to its compatibility with the internal market with regard to the market for the provision of retail mobile telecommunications services on the basis of the same findings discussed in Section 7.3 of the 2016 Clearance Decision as well as with regard to the market for the provision of wholesale access and call origination services on mobile networks on the basis of the same findings discussed in Section 7.4 of the 2016 Clearance Decision.

5. COMMITMENTS

(86) In order to remove the serious doubts arising from the New Transaction described in Section 4, on 9 August 2018 the Notifying Party submitted commitments pursuant to Article 6(2) of the Merger Regulation (the "New Commitments"), which are annexed to this Decision and form an integral part thereof.

(87) In particular, since the 2016 Commitments have not yet been fully implemented, Hutchison has committed to fully comply, or to procure full compliance from any of its group companies, with the 2016 Commitments and to take full and sole responsibility for the implementation of the 2016 Commitments.

(88) The Commission considers that the New Commitments entered into by Hutchison are sufficient to eliminate the serious doubts as to the compatibility of the New Transaction with the internal market.

(89) First, as described in Section 4.3.1 and 4.3.2, the market investigation has shown that there have been no significant changes to the markets for the provision of wholesale and retail mobile services in Italy since the adoption of the 2016 Clearance Decision other than the creation of Wind Tre and the entry of Iliad. (52)

(90) Second, as described in Section 4.3.1 and 4.3.2, no new competition concerns arise from the New Transaction.

(91) Third, the Commission considers that there is no need to modify the 2016 Commitments since (i) their implementation is on track and all the main milestones laid down in the 2016 Commitments have been achieved so far (53) and (ii), as indicated above, the entry of Iliad following the first phase of implementation of the 2016 Commitments is maintaining effective competition in the relevant markets.

(92) In this respect, the Commission notes that the Italian competition authority, the Autorità Garante della Concorrenza e del Mercato, also considered that the 2016 Commitments had a beneficial effect on the Italian retail mobile telecommunications market both in terms of price and quality and such measures should be confirmed in the Commission's decision assessing the New Transaction. (54)

(93) As regards the wholesale market, the Commission notes that, since 1 September 2016 there has been new MVNOs launches. In particular, Nextus Telecom – hosted by TIM – launched its services in November 2016, Rabona Mobile in 2017 and Welcome Italia in 2018, both of them hosted by TIM. Moreover, ENEL is expected to launch its own MVNO by the end of 2018. Further, there have been migrations of MVNOs from one network to another (e.g. Optima previously hosted on the Hutchinson network moved in 2017 on Vodafone network). (55)

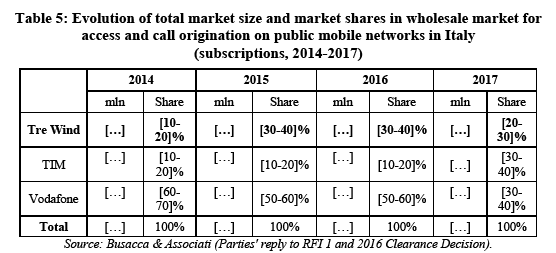

(94) Further the Commission notes that there has been a continuous increase of the total market size of the wholesale market in terms of subscribers before and after the 2016 Transaction, as shown by the data of the analyst firm Busacca & Associati, presented in Table 5 below.

(95) A similar increase in the number of subscribers of MVNOs (represented in terms of number of SIM cards) is also constantly reported by AGCOM, in its quarterly updates on key developments in the telecommunications sector. (56)

)(96) Thus, it appears that the implementation of the 2016 Commitments has preserved the conditions of competition in the wholesale mobile market in Italy as in the pre-2016 Transaction scenario.

(97) Fourth, no evidence in the Commission's file suggests that Hutchison is less likely or able to implement the Commitment than Hutchison and VEON together.

(98) Under the first sentence of the second subparagraph of Article 6(2) of the Merger Regulation, the Commission may attach to its decision conditions and obligations intended to ensure that the undertakings concerned comply with the commitments they have entered into vis-à-vis the Commission with a view to rendering the concentration compatible with the internal market.

(99) The achievement of the measure that gives rise to the change of the market is a condition, whereas the implementing steps which are necessary to achieve this result are generally obligations on the parties. Where a condition is not fulfilled, the Commission's decision declaring the concentration compatible with the internal market no longer stands. Where the undertakings concerned commit a breach of an obligation, the Commission may revoke the clearance decision in accordance with Article 6(3)(b) of the Merger Regulation. The undertakings concerned may also be subject to fines and periodic penalty payments under Articles 14(2) and 15(1) of the Merger Regulation.

(100) In accordance with the basic distinction between conditions and obligations described above, Section B (including Annexes 1 to 9) of Annex 1 to the New Commitments, constitute conditions attached to this Decision, as only through full compliance therewith can the structural changes in the relevant markets be achieved. Sections C to F of Annex 1 to the New Commitments constitute obligations, as they concern the implementing steps which are necessary to achieve the modifications sought in a manner compatible with the internal market.

(101) As a consequence of the entry into force of the New Commitments, VEON will be released from all of its obligations under the 2016 Commitments.

6. CONCLUSION

(102) For the above reasons, the Commission has decided not to oppose the notified operation as modified by the commitments and to declare it compatible with the internal market, subject to full compliance with the conditions in Section B (including Annexes 1 to 9) of Annex 1 to the New Commitments annexed to the present decision and with the obligations contained in the other sections of the said commitments. This Decision is adopted in application of Article 6(1)(b) in conjunction with Article 6(2) of the Merger Regulation and Article 57 of the EEA Agreement.

ANNEX 1

European Commission

DG Competition Place Madou 1 1210 Saint-Josse-ten-Noode

CASE M.9041 HUTCHISON / WIND TRE

COMMITMENTS TO THE EUROPEAN COMMISSION

9 August 2018

On 18 July 2016, in case M.7758, Hutchison Europe Telecommunications S.À R.L. (HET) and VimpelCom Luxembourg Holdings S.À R.L., which has since been renamed VEON Luxembourg Holdings (VLH), jointly entered into certain Commitments (the 2016 Commitments, attached in Annex 1) vis-à-vis the European Commission (Commission) with the view to rendering the creation of a joint venture, Hutchison 3G Italy Investments S.À R.L., which has since been renamed VIP-CKH Luxembourg S.à. R.L. (VIP-CKH), compatible with the internal market and the functioning of the EEA Agreement. The Commission cleared the creation of a joint venture, Hutchison 3G Italy Investments S.À R.L., subject to full compliance with the 2016 Commitments (the 2016 Clearance Decision).

On 3 July 2018, CK Hutchison Holdings Limited, which indirectly wholly owns and controls HET, and VEON Ltd, which indirectly wholly owns and controls VLH (together with other companies in their respective corporate groups) agreed that HET would acquire the entirety of VLH’s shareholding in VIP-CKH (the Transaction). Accordingly, HET will obtain sole control of VIP-CKH and VLH will cease being a shareholder in VIP-CKH.

Pursuant to Article 6(2) of Council Regulation (EC) No 139/2004 (the Merger Regulation), HET hereby enters into the following commitment (the Commitment) vis-à-vis the Commission with the view to rendering the Transaction compatible with the internal market and the functioning of the EEA Agreement:

HET commits to fully comply, or to procure full compliance from any of its group companies, with the 2016 Commitments.

Thus, HET will take full and sole responsibility for the implementation of the 2016 Commitments and, as of the closing of the Transaction, releases VLH from all of its obligations under the 2016 Commitments.

This Commitment shall take effect upon the date of adoption of the Commission’s Decision pursuant to Article 6(2) of the Merger Regulation to declare the concentration in case M.9041 compatible with the internal market and the functioning of the EEA Agreement (the Decision).

This text shall be interpreted in the light of the Decision, in the general framework of Union law, in particular in light of the Merger Regulation, and by reference to the Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the Remedies Notice). Annex 1 shall also be interpreted in light of the 2016 Clearance Decision.

EXECUTED by Hutchison Europe Telecommunications S.À R.L.

…………………………………… duly authorised for and on behalf of

Hutchison Europe Telecommunications S.À R.L.

Annex 1

European Commission

DG Competition Place Madou 1 1210 Saint-Josse-ten-Noode

CASE M.7758

HUTCHISON EUROPE TELECOMMUNICATIONS S.À R.L/ VIMPELCOM LUXEMBOURG HOLDINGS S.À R.L

COMMITMENTS TO THE EUROPEAN COMMISSION 18 July 2016

Pursuant to Article 8(2) and 10(2) of Council Regulation (EC) No 139/2004 (the Merger Regulation), Hutchison Europe Telecommunications S.À R.L. and VimpelCom Luxembourg Holdings S.À R.L. (together the Parties) hereby enter into the following commitments (the Commitments) vis-à-vis the European Commission (the Commission) with the view to rendering the creation of a joint venture, Hutchison 3G Italy Investments S.À R.L. (H3GII), (the Concentration) compatible with the internal market and the functioning of the EEA Agreement.

The Commitments shall take effect upon the date of adoption of the Decision (the Effective Date).

This text shall be interpreted in the light of the Commission’s Decision pursuant to Article 8(2) of the Merger Regulation to declare the Concentration compatible with the internal market and the functioning of the EEA Agreement (the Decision), in the general framework of Union law, in particular in light of the Merger Regulation, and by reference to the Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 (the Remedies Notice).

A. DEFINITIONS

1. For the purpose of the Commitments, the following terms shall have the following meaning:

2G National Roaming Services: has the meaning given in paragraph 21.

3G/4G MOCN Services: has the meaning given in paragraph 21.

[the most densely populated area]: means an area to be agreed between the Parties and the New MNO and corresponding to the most densely-populated areas of Italy […].

Affiliated Undertakings: means any undertakings controlled by the Parties and/or by the ultimate parents of the Parties, whereby the notion of control shall be interpreted pursuant to Article 3 of the Merger Regulation and in light of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings.

Annual Capacity Commitment: has the meaning given in paragraph 22(f)(ii).

Capacity Commitment: has the meaning given in paragraph 22(f)(ii).

Closing: means the completion of the Concentration whereby the Parties create a joint venture, H3GII.

Co-location Sites: means macro access network sites owned by the Parties (or their Affiliated Undertakings) on which the Parties co-locate with the New MNO in accordance with the Co-location Agreement.

Confidential Information: means any business secrets, know-how, commercial information, or any other information of a proprietary nature that is not in the public domain.

Conflict of Interest: means any conflict of interest that impairs the Monitoring Trustee’s objectivity and independence in discharging its duties under the Commitments.

[…]: […].

Divestment Spectrum: means:

· the 2x5MHz spectrum block ([…]) on the 900 MHz frequency currently held by […] (the 900MHz Spectrum);

· the 2x5MHz spectrum block ([…]) or, with the consent of the New MNO, the 2x5MHz spectrum block ([…]) on the 1800 MHz frequency currently held by […] (the 1800 MHz Spectrum Block 1);

· the 2x5MHz spectrum block ([…]) on the 1800 MHz frequency currently held by […] (the 1800 MHz Spectrum Block 2 and together with the 1800MHz Spectrum Block 1, the 1800MHz Spectrum);

· the 2x5 MHz spectrum block ([…]) on the 2100 MHz FDD frequency currently held by […] (the 2100MHz Spectrum Block 1);

· the 2x5 MHz spectrum block ([…]) on the 2100 MHz FDD frequency currently held by […] (the 2100MHz Spectrum Block 2 and together with the 2100MHz Spectrum Block 1, the 2100MHz Spectrum); and

· the two 2x5MHz spectrum blocks ([…]) on the 2600 MHz frequency currently held by […] (the 2600MHz Spectrum).

Effective Date: means the date of adoption of the Decision.

Extended Sites: means […] Sites in the [least densely populated area] (comprising approximately […] Transfer Sites and approximately […] Co- location Sites) or such lower number to which the Monitoring Trustee does not object in accordance with paragraph 12. More particularly, the Extended Sites will be located within the least densely populated areas of Italy […].

Extended Term: has the meaning given in paragraph 22(b).

Fast Track Dispute Resolution Mechanism: has the meaning given in paragraph 24.

Further Sites: means […] Sites in the [least densely populated area] (comprising approximately […] Transfer Sites and approximately […] Co-location Sites) or such lower number to which the Monitoring Trustee does not object in accordance with paragraph 12.

H3G: means H3G S.p.A., a joint stock company with a sole shareholder incorporated under the laws of Italy, whose registered office is at Via Leonardo Da Vinci 1, 20090 Trezzano sul Naviglio, Milan, Italy and registered with the Register of Enterprises of Milan with tax code and registration number 02517580920.

H3GII: means a joint venture company, Hutchison 3G Italy Investments S.À R.L., which upon Closing will be jointly controlled by HET and VIP, the holding companies of H3G and WIND.

HET: means Hutchison Europe Telecommunications S.À R.L., a société à responsabilité limitée incorporated under the laws of the Grand Duchy of Luxembourg, having its registered office at 7, rue du Marché-aux-Herbes, L- 1728 Luxembourg, Grand Duchy of Luxembourg, registered with the Luxembourg Trade and Companies’ Register under number B74649.

Indemnified Party: has the meaning given in paragraph 51.

Initial Sites: means […] Sites in the [most densely populated area] (comprising approximately […] Transfer Sites and approximately […] Co- location Sites) or such lower number to which the Monitoring Trustee does not object in accordance with paragraph 10.

Initial Term: has the meaning given in paragraph 22(b).

[least densely populated area]: means an area to be agreed between the Parties and the New MNO and corresponding to the least densely populated areas of Italy […] (i.e. all areas in Italy excluding the [most densely populated area]).

Monitoring Trustee: means one or more natural or legal person(s) who is/are approved by the Commission and appointed by the Parties, and who has/have the duty to monitor the Parties’ compliance with the conditions and obligations attached to the Decision.

Monitoring Trustee Proposal: has the meaning given in paragraph 27.

Network: means (as the context requires) the H3G or WIND publicly available cellular radio access network (including that of the combined business as it is consolidated post-Closing) in Italy from time to time. For the avoidance of doubt, the 2G National Roaming Services and 3G/4G MOCN Services shall be provided on the publicly available cellular radio access network operated or used by WIND in Italy (including that of H3G as it is consolidated with WIND post-Closing) and, once the consolidation has been completed, on the consolidated network.

New MNO: means Iliad S.A. a société anonyme incorporated under the laws of France, having its registered office at 16, rue de la Ville l’Evêque, 75008 Paris, France and registered in Paris in the Trade and Companies Register under no. 342 376 332 (or an Affiliated Undertaking).

New MNO Agreements: has the meaning given in paragraph 5(a).

RAN Sharing: has the meaning given in paragraph 18.

Ready for Service Date: has the meaning given to it in paragraph 22(a).

Request: has the meaning given to it in paragraph 25.

Response: has the meaning given to it in paragraph 25.

Sites: means the Initial Sites, the Further Sites and the Extended Sites as the context requires all of which shall be macro access network sites.

Transfer Sites: means macro access network sites which the Parties will divest to the New MNO in accordance with the Commitment in Section B.II. The assets/rights to be available at each Transfer Site consist of (i) the transfer of a ground lease or site use agreement for the Transfer Site (including any rights and obligations arising from such lease or agreement, and if applicable, any construction permits or agreements allowing the use of any such Transfer Sites), but excluding any permits relating to the operation of active equipment; and (ii) the transfer of title to the applicable passive equipment owned by the Parties at the Transfer Site. For the avoidance of doubt, radio base station equipment, microwave transmission equipment, and any other electronic equipment which carries traffic shall not be transferred to the New MNO.

VIP: means VimpelCom Luxembourg Holdings S.À R.L., a société à responsabilité limitée incorporated under the laws of the Grand Duchy of Luxembourg, having its registered office at 15, rue Edward Steichen, L-2540 Luxembourg, Grand Duchy of Luxembourg, registered with the Luxembourg Trade and Companies’ Register under number B199019.

WIND: means Wind Telecomunicazioni S.p.A, a joint stock company with a sole shareholder incorporated under the laws of Italy, whose registered office is at Via Cesare Giulio Viola, 48 Rome, 00148, Italy and registered with the Register of Enterprises of Rome with tax code and registration number 05410741002.

B. NEW MNO COMMITMENT

2. The Parties commit to (i) divest the Divestment Spectrum to the New MNO in accordance with paragraphs 6 and 7; (ii) divest the Initial Sites and/or co- locate with the New MNO on the Initial Sites in accordance with paragraphs 9 and 10; (iii) divest and/or co-locate with the New MNO in respect of the Further Sites and the Extended Sites in accordance with paragraphs 11 and 12, unless the New MNO enters RAN Sharing with the Parties in accordance with paragraphs 18 to 20; (iv) provide the 2G National Roaming Services and the 3G/4G MOCN Services to the New MNO in accordance with paragraph 22; and (v) offer […] to the New MNO in accordance with paragraph 23. With respect to (ii) and (iii) the Parties commit to comply with the procedure and terms set out in paragraphs 13 to 17.

3. Subject to paragraph 8 below, in order to maintain the structural effect of the Commitments, the Parties shall, for a period of 10 years after Closing, not acquire, whether directly or indirectly, the possibility of exercising influence (as defined in paragraph 43 of the Remedies Notice, footnote 3) over the whole or part of the New MNO’s activities in the mobile telephony sector in Italy and/or otherwise acquire the Divestment Spectrum or the Sites unless, following the submission of a reasoned request from the Parties showing good cause and accompanied by a report from the Monitoring Trustee, the Commission finds that the re-acquisition of some or all of the Sites or the Divestment Spectrum does not undermine the effectiveness of the Commitments.

4. The Concentration shall not be implemented before the Parties have entered into the New MNO Agreements and the Commission has approved the New MNO Agreements.

5. The Parties shall be deemed to have complied with the Commitments in Section B upon the Parties (and/or their respective Affiliated Undertakings) having:

(a) entered into the following agreements with the New MNO:

(i) the Framework and Transfer Agreement;

(ii) the Co-location Agreement;

(iii) the National Roaming Agreement; and

(iv) the RAN Sharing Agreement, (together the New MNO Agreements);

(b) transferred and released the Divestment Spectrum to the New MNO in

accordance with the dates indicated in paragraph 6;

(c) divested to the New MNO or entered into site specific agreements for co-location with the New MNO on the Initial Sites by […] in accordance with paragraphs 9 and 10;

(d) either (i) divested to the New MNO or entered into co-location with the New MNO on the Further Sites and Extended Sites in accordance with paragraphs 11 and 12; or (ii) enabled the Network for the provision of RAN Sharing in accordance with paragraph 18; and

(e) enabled the Network for the provision of the 2G National Roaming Services and 3G/4G MOCN Services to the New MNO by the Ready for Service Date in accordance with paragraph 22(a).

B.I: Divestment Spectrum

6. The Parties commit to divest the Divestment Spectrum to the New MNO on a [phased] basis substantially in accordance with the indicative spectrum release plan attached as Annex 1 (which may be modified from time to time in accordance with terms agreed between the Parties and the New MNO and approved by the Monitoring Trustee), subject to any adjustments required in order to obtain all necessary approvals required under applicable Italian legislation and regulation. The [phased] release of spectrum and transfer of rights to the New MNO to use the spectrum will be completed in its entirety by the following dates (subject to any changes to the release dates due to technical reasons which are agreed between the Parties and the New MNO, communicated to the Monitoring Trustee and approved by the Commission):

(a) in relation to the 900MHz Spectrum by […];

(b) in relation to the 1800MHz Spectrum (Block 1) by […];

(c) in relation to the 1800MHz Spectrum (Block 2) by […];

(d) in relation to the 2100MHz Spectrum (Block 1 and Block 2) by […]; and

(e) in relation to the 2600MHz Spectrum by […]. 7. […].

8. If following the transfer of the Divestment Spectrum and before the end of the Initial Term:

(a) the New MNO seeks to transfer more than […]% of the overall Divestment Spectrum (whether or not in the ordinary course of business) to any third party (excluding Affiliated Undertakings of the New MNO);

(b) the New MNO seeks to transfer […]% (or less) of the overall Divestment Spectrum outside of the ordinary course of business to any third party (excluding Affiliated Undertakings of the New MNO); or

(c) there is a combination or transfer of business or a sale of shares in the New MNO or any of its Affiliated Undertakings with or to a mobile network operator in Italy,

the Parties shall have the right, subject to applicable approvals under Italian and/or EU law and the approval of the Monitoring Trustee, to […]. […].

B.II: Sites

[Most densely populated area]

9. Subject to paragraph 10, the Parties commit to divest to the New MNO or to enter into co-location with the New MNO in respect of […] Initial Sites.

10. The number of Initial Sites can be reduced on a pro rata basis if the New MNO:

(a) obtains sites from a third party, provided that the New MNO obtains a total of approximately […] macro access network sites (through acquisition or co-location from the Parties and/or third parties) located in the [most densely populated area] by […]; or

(b) enables technical solutions to achieve substantially the same coverage in the [most densely populated area] as would be achieved with […] macro access network sites,

in each case provided that the New MNO notifies the Monitoring Trustee in advance and the Monitoring Trustee does not object.

[Least densely populated area]

11. In respect of the [least densely populated area], the Parties commit to either:

(a) activate the RAN Sharing with the New MNO in accordance with paragraph 18; or

(b) subject to paragraph 12, divest to the New MNO or enter into co- location with the New MNO in respect of […] Further Sites and […] Extended Sites.

12. The number of Further Sites and the number of Extended Sites can be reduced on a pro rata basis if the New MNO:

(a) obtains sites from a third party, provided that (i) the New MNO obtains a total of approximately […] macro access network sites (through acquisition or co-location from the Parties and/or third parties) located in the [least densely populated area] by the last date on which the RAN Sharing option may be exercised by the New MNO in accordance with paragraph 19 below; and (ii) the total number of sites obtained from third parties (together with Sites obtained from the Parties) enables the New MNO to achieve in the [least densely populated area] substantially the same coverage that would be achieved with […] macro access network sites; or

(b) enables technical solutions to achieve substantially the same coverage in the [least densely populated area] as would be achieved with […] macro access network sites,

in each case provided that the New MNO notifies the Monitoring Trustee in advance and the Monitoring Trustee does not object.

Terms of co-location

13. The Parties commit to co-locate with the New MNO on Co-location Sites substantially in accordance with the following:

(a) the New MNO shall have the right to install, operate, maintain and use its equipment in respect of Co-location Sites for the provision of current and future wireless and wireline communication services, provided that the New MNO shall not be permitted to operate any equipment, technology or spectrum except to the extent it is for its own sole use;

(b) the Parties shall offer co-location on each Co-location Site for a term of […] years starting from the date of the relevant agreement in respect of the Co-location Site and, at the New MNO’s request, the Parties will discuss in good faith with the New MNO a possible extension on terms and conditions to be agreed; and

(c) in consideration for co-location on each Co-location Sites, the New MNO shall pay a set-up fee covering the […] in connection with co- location and […] for each Co-location Site based on the rent, rates, energy, maintenance and other costs incurred by the Parties in respect of each Co-location Site.

Process for making Sites available

14. The Parties commit to making the Sites available for divestment or co-location in accordance with the indicative site release plan attached as Annex 2, which may be modified from time to time in accordance with terms agreed between the Parties and the New MNO and approved by the Monitoring Trustee. The release of the Sites to the New MNO will be completed in its entirety by […], subject to any change due to technical reasons which are agreed between the Parties and the New MNO, communicated to the Monitoring Trustee and approved by the Commission.

15. The procedure by which the Sites shall be made available for divestment or co-location shall be substantially in accordance with Annex 3.

Site suitability criteria and coverage

16. The Sites shall meet the site suitability criteria set out in Annex 4 save as otherwise requested by the New MNO and agreed between the Parties and the New MNO on a site by site basis.

17. The Initial Sites, the Further Sites and the Extended Sites (or the RAN Sharing sites as defined in paragraph 18) shall be capable of enabling the New MNO to provide outdoor coverage on the 900 MHz Spectrum for […]% of the Italian population ([…]% for indoor) provided the New MNO installs the appropriate equipment and takes the requisite steps needed to do so.

B.III: RAN Sharing option

18. The Parties commit to offer the New MNO an option to enter into a one-way radio access network (RAN) sharing solution covering a minimum of […] sites located in the [least densely populated area] (RAN Sharing) on substantially the following terms:

(a) the RAN Sharing shall be based on a multi-operator radio access network (MORAN) architecture and the New MNO shall gain access to the Parties’ active network equipment at the sites (including antennas, base stations, backhaul and radio network controllers);

(b) the RAN Sharing shall cover 3G and 4G technology, and, following commercial launch by H3GII, all future technologies (including 5G) as agreed between the Parties and the New MNO and subject to technical feasibility. The RAN Sharing shall be provided using the Divestment Spectrum;

(c) the RAN Sharing shall be activated on a [phased] basis as 3G/4G MOCN Services are phased out;

(d) the RAN Sharing shall be made available for a total term of […] from the date of initial activation and any extension shall be subject to terms to be agreed between the Parties and the New MNO;

(e) the procedure by which macro access network sites shall be made available for RAN Sharing shall be as agreed between the Parties and the New MNO and shall be substantially in accordance with Annex 5;

(f) in consideration for the RAN Sharing, the New MNO shall pay a set- up fee and a contribution to on-going costs as set out in Annex 6;

(g) the New MNO may request a unilateral deployment of new technologies on the RAN Sharing macro access network sites and the Parties shall implement such unilateral requests subject to certain conditions to be further discussed and agreed from time to time between the Parties and the New MNO; and

(h) the Parties shall ensure that the technical specifications of the hardware and software used to implement the RAN Sharing at each macro access network site to provide mobile telecommunications carriers on the New MNO’s radio access network are substantially equivalent to the technical specifications of the hardware and software used by the Parties at that macro access network site to provide mobile telecommunications carriers on the Parties own radio access network. This is subject to any differentiation due to: (i) the spectrum holdings of the New MNO and the Parties; (ii) the features, functionality and location of the New MNO’s and the Parties’ unilateral macro access network sites; and (iii) any fault of the New MNO.

19. The RAN Sharing option shall be exercisable by the New MNO at any time from […] until the later of: (i) […]; and (ii) […].

20. The number of sites referred to in paragraph 18 can be reduced on a pro rata basis, if the New MNO:

(a) obtains sites from a third party by the date referred to in paragraph 19, provided that the total number of sites obtained from third parties (together with Sites obtained from the Parties) enables the New MNO to achieve in the [least densely populated area] substantially the same coverage that would be achieved with […] macro access network sites; or

(b) enables technical solutions to achieve substantially the same coverage in the [least densely populated area] as would be achieved with […] macro access network sites,

in each case provided that the New MNO notifies the Monitoring Trustee in advance and the Monitoring Trustee does not object.

B.IV: 2G National Roaming Services and 3G/4G MOCN Services

21. The Parties commit to (or procure that one or more of their respective Affiliated Undertakings) enter into an agreement (the National Roaming Agreement) to (i) provide 2G national roaming services to the New MNO to allow the New MNO’s customers to roam onto the Network (2G National Roaming Services); and (ii) implement and operate a 3G and 4G MOCN solution to link the Network and the New MNO’s core network (3G/4G MOCN Services).

22. The 2G National Roaming Services and 3G/4G MOCN Services shall be provided on substantially the following terms:

(a) the Network will be ready for the provision of 2G National Roaming Services and 3G/4G MOCN services to the New MNO as soon as practicable within […] of Closing (the Ready for Service Date), subject to any delays caused by acts or omissions of the New MNO;

(b) the 2G National Roaming Services and 3G/4G MOCN Services shall be provided for an initial term ending at least […] from the Ready for Service Date (Initial Term) with the option for the New MNO to prolong for a further […] (Extended Term);

(c) in consideration for the provision of the 2G National Roaming Services and the 3G/4G MOCN Services the New MNO shall pay an initial set- up fee […] and, in addition, the fees described at paragraphs 22(e)(iii) and 22(f)(iii)-(iv) below;

(d) the Parties shall provide the 2G National Roaming Services and 3G/4G MOCN Services in a manner that enables the quality of the radio access network services provided by the New MNO to its retail customers to be non-discriminatory and substantially equivalent to the corresponding quality of radio access network services provided by the Parties to the Parties’ retail customers on the Network. […];

(e) in relation to the 2G National Roaming Services:

(i) the Parties shall provide 2G voice and SMS and 2G data services operated from time to time on the Network to the New MNO;

(ii) as from the […] contract year, the New MNO shall be subject […];

(iii) charges for 2G National Roaming Services shall be payable […]; and

(iv) the 2G National Roaming Services shall be provided on a national basis until the earlier of […];

(f) in relation to the 3G/4G MOCN Services:

(i) the 3G/4G MOCN Services shall cover 3G and 4G technology, and, following commercial launch by H3GII, all future technologies (including 5G) as agreed between the Parties and the New MNO and subject to technical feasibility;

(ii) the Parties shall make available a minimum of […] million gigabytes (Capacity Commitment) which the New MNO has agreed with the Parties to acquire during the first […] years of the National Roaming Agreement as follows (each an Annual Capacity Commitment):

[…];

(iii) For the first […], the following pricing structure for the 3G/4G MOCN Services shall apply:

(A) a fixed fee agreed between the Parties and the New MNO for the Capacity Commitment. For the avoidance of doubt, the fixed fee shall not vary in accordance […] served by the New MNO or the amount of data consumed […] served by the New MNO, in each case during the first […] of the National Roaming Agreement. No additional fee shall be charged for usage within the Capacity Commitment;

(B) for the volumes exceeding the Capacity Commitment a […] per gigabyte;

(C) for voice and SMS, […];

in each case substantially in accordance with Annex 7;

(iv) For the remaining term, the following pricing structure for the 3G/4G MOCN Services shall apply:

(A) […] per gigabyte; and

(B) for voice and SMS, a […];

in each case substantially in accordance with Annex 7;

(v) the New MNO shall be subject to overall 3G/4G capacity caps which shall be (during the […]) set at a level above the applicable Annual Capacity Commitment and which shall be calculated on an annual basis as a percentage of Network capacity in accordance with the principles set out in Annex 7;

(vi) as from the […] contract year, the New MNO shall be subject to a 3G/4G consumption cap of […] of the New MNO’s forecast traffic (subject to the overall capacity cap) in accordance with the principles set out in Annex 8, provided that (during the […]) the consumption caps shall be at least equal to the Annual Capacity Commitment. In the […], no consumption cap will apply;

(vii) in the event that the New MNO […] of its Annual Capacity Commitment in the […] contract year, it shall be entitled to […] a proportion of the […] Annual Capacity Commitment into the immediately ensuing contract year as follows: (A) at the end of the […] contract year, no more than […] of the Annual Capacity Commitment for the […] contract year and (B) at the end of the […] contract year, no more than […] of the Annual Capacity Commitment for the […] contract year. For the avoidance of doubt, there shall be no […] Annual Capacity Commitments […] and in any subsequent contract year;

(viii) […];

(ix) 3G/4G MOCN Services shall initially be provided on a national geographic basis. The New MNO may nominate macro access network sites on which the Parties shall withdraw 3G/4G MOCN Services (i.e. as the New MNO rolls out its own network). […] of such macro access network sites, the Parties shall […] to provide 3G/4G MOCN Services on […] in accordance with Annex 9 and the following:

(A) if the New MNO […], the Parties shall […] MHz spectrum on withdrawn macro access network sites during a […] from the date of the availability of the […]; or

(B) if the New MNO does […], the Parties will provide 3G/4G MOCN Services on […] to the New MNO on withdrawn macro access network sites […].

(x) If the New MNO exercises the […] option in accordance with paragraph 18, the Parties shall […] in the [least densely populated area] substantially in accordance with Annex 9.

B.V: […]

23. […].

B.VI: Fast Track Dispute Resolution

24. In the event that there is a dispute between the Parties and the New MNO as to the implementation of the Commitments in paragraphs 6 (including the relevant provisions of Annex 1), 14 (including the relevant provisions of Annex 2), 15 (including the relevant provisions of Annex 3), 16 (including the relevant provisions of Annex 4) and 17 of the Commitments, the New MNO shall have recourse to the following fast track dispute resolution mechanism (the Fast Track Dispute Resolution Mechanism) for the sole purposes of resolving matters of fact in relation to the implementation of these paragraphs of the Commitments.

Pre-dispute escalation

25. If the New MNO wishes to avail of the fast-track dispute resolution procedure, it shall send a written request to that effect (the Request) to the Parties, with a copy to the Monitoring Trustee. In the Request, the New MNO shall set out in detail the reasons leading it to believe that the Parties have not properly implemented the Commitments referred to in paragraph 24 above. If the Parties so wish, they shall provide a response (Response) by no later than […] working days following the receipt of the Request, with copies to the Monitoring Trustee.

26. Within a reasonable period of time not exceeding […] working days after receipt of the Request by the Parties (or Response by the New MNO, whichever is the later), the New MNO and the Parties will use their best efforts to resolve through cooperation and consultation all differences of opinion and to settle all disputes underlying the Request. If the settlement of the disputes fails within these […] working days, the CEOs of the Parties and a nominee of the New MNO may seek to resolve the matters in dispute within an additional […] working days from expiry of the initial […] working days period.