Commission, October 29, 2018, No M.9019

EUROPEAN COMMISSION

Decision

MARS / ANICURA

Subject: Case M.9019 – Mars/AniCura

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/2004 (1)

Dear Sir or Madam,

(1) On 10 September 2018, the European Commission (the "Commission") received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Mars, Incorporated ("Mars" or the "Notifying Party", USA) intends to acquire, within the meaning of Article 3(1)(b) of the Merger Regulation, sole control of AniCura TC AB and its subsidiaries ("AniCura", Sweden), (the "Transaction"). (2) Mars and AniCura are further collectively referred to as the "Parties", whist the undertaking that would result from the Transaction is referred to as "the merged entity".

1. THE PARTIES

(2) Mars is a global privately held company active in various consumer product sectors. Through its business division Mars Petcare, Mars is a pet food and veterinary care provider, active in the dietetic pet food segment via its Royal Canin brand, which it markets worldwide, including in the EU. Mars Petcare also operates veterinary health businesses in North America and in the UK and is the world's biggest veterinary health group.

(3) AniCura operates a leading chain of veterinary clinics and hospitals throughout northern Europe, with significant operations (in order of importance in terms of turnover generated) in Sweden, Germany, Norway, the Netherlands and Denmark, and smaller operations in Austria, Italy, France and Spain.

(4) AniCura also operates VetFamily, a veterinary franchise operation described by the Parties as a "partnership network for independent veterinary clinics". VetFamily currently has over 1 000 independent members across Sweden, Norway, Denmark, Germany and the Netherlands. AniCura owns 17 of those members, all located in Denmark. AniCura is responsible for the procurement of products for these franchise veterinary clinics, including the procurement of dietetic pet food. VetFamily also offers a number of training events to its members.

(5) AniCura operates a similar veterinary franchise operation, called Sterkliniek, in the Netherlands which currently has 75 members (of which 27 are owned by AniCura).

2. THE OPERATION AND CONCENTRATION

(6) Pursuant to a sale purchase agreement entered into on 7 June 2018 between Mars (as buyer) and Nordic Capital, Fidelio Capital and other minority shareholders of AniCura (as sellers), Mars will acquire 100% of the issued and to be issued share capital in AniCura.

(7) As a result of the Transaction, Mars will obtain sole control over AniCura.

(8) Therefore, the Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. UNION DIMENSION

(9) The Parties have a combined aggregate world-wide turnover of more than EUR 5 000 million (3) (EUR: […]). Each of them has an Union-wide turnover in excess of EUR 250 million (Mars: EUR […]; AniCura: EUR […]), but each does not achieve more than two-thirds of its aggregate Union-wide turnover within one and the same Member State.

(10) The notified operation therefore has a Union dimension pursuant to Article 1(2) of the Merger Regulation.

4. APPLICABILITY OF THE EEA AGREEMENT

(11) Article 8 of the EEA Agreement (4) provides that, unless otherwise specified, the provisions of the EEA Agreement shall apply only to:

(a) products falling within Chapters 25 to 97 of the Harmonized Commodity Description and Coding System ("HS Nomenclature"), excluding the products listed in Protocol 2 to the EEA Agreement (5);

(b) products specified in Protocol 3 to the EEA Agreement (6), subject to the specific arrangements set out in that Protocol.

(12) The HS Nomenclature of dog or cat food, put up for retail sale, is 2309.10 and 2309.90 for other preparations of a kind used in animal feeding. Pet food therefore falls within Chapter 23, and not within Chapters 25 to 97, of the HS Nomenclature. Pet food is not covered in Protocol 3 to the EEA Agreement. Therefore, the EEA Agreement does not apply to pet food products and the assessment of the impact of the Transaction for pet food hence falls outside Article 57 of the EEA Agreement on merger control.

(13) The Notifying Party argues (7) that the Commission has exclusive jurisdiction to review the Transaction within the EEA, since the Transaction concerns the acquisition of a company active in the provision of veterinary services, which fall within the scope of the EEA Agreement.

(14) The Commission notes that the relevant downstream market in this case concerns not the provision of veterinary services, but the retail of pet food. The fact that the target company is also active in the provision of veterinary services is not sufficient to conclude that the downstream market is the provision of such services and that the Commission therefore has exclusive jurisdiction in the EEA.

(15) The assessment of the impact of the Transaction for pet food in the EFTA States hence falls outside the jurisdiction of the Commission. Consequently, the present Decision will analyse the effects of the Transaction on the EU market for pet food products and will not assess possible anticompetitive effects in Norway, Iceland and Lichtenstein.

5. RELEVANT MARKETS

5.1. Introduction

(16) The Transaction concerns two companies operating mostly at different levels of the supply chain. Mars is a manufacturer of dietetic pet food, which it supplies to veterinary clinics and animal hospitals. AniCura is the owner of a chain of veterinary clinics and animal hospitals (as well as of the VetFamily and Sterkliniek purchasing agreement networks of independent clinics), where dietetic pet food is sold to pet owners.

(17) "Dietetic pet food" (also referred to in the industry as "therapeutic" or "veterinary diet" pet food) is pet food that is intended to be formulated to meet the specific dietary requirements of a pet that is suffering from one or more specific health or dietary issues, and is typically recommended by a veterinarian. (8)

(18) Whilst AniCura also supplies ranges of private label dietetic pet food made available in its clinics in Denmark and in Sterkliniek clinics in the Netherlands, the horizontal overlaps with the supplies of dietetic pet food by Mars are very limited. (9)

(19) Mars owns and operates veterinary clinics in the UK, but given that AniCura is not present in the UK, no horizontal overlaps in veterinary services arise as a result of the Transaction.

(20) In order to assess the Transaction's impact on competition, the Commission has assessed the definition of the relevant upstream and downstream markets.

5.2. The upstream market – manufacture and supply of dietetic pet food

5.2.1. Relevant product market definition

5.2.1.1. The Notifying Party's arguments

(21) The Notifying Party claims that the relevant product market upstream concerns industrial (or prepared) pet food for dogs and for cats, (10) which could be sub- segmented into (i) dry dog food, (ii) wet dog food, (iii) dry cat food, and (iv) wet cat food products. (11) In particular, the Notifying Party does not believe that dietetic pet food forms a distinct product market. (12)

(22) The Notifying Party claims that there is a high level of demand-side substitutability between dietetic pet food and other pet food. (13) For example, in the Notifying Party's view, substitution between dietetic and 'conventional' (or mainstream, non-dietetic) pet food can occur where the pet owner supplements conventional pet food with over-the-counter medication or dietary supplements to manage the pet's health condition. (14)

(23) The Notifying Party also argues that there is a high level of supply-side substitutability between dietetic pet food and other pet food, since (i) many of Mars' competitors offer dietetic as well as non-dietetic pet food; (ii) the equipment processes required to manufacture dietetic and non-dietetic pet food are essentially similar and normally not regarded as a key determinant of differentiation (although the manufacturing processes are sometimes adjusted to reflect specific product requirements); and (iii) the investment into additional research and development, and product and brand awareness (including with professionals such as veterinarians), as well as specific product labelling and wider marketing, can be easily replicated by new entrants. (15)

(24) Finally, the Notifying Party also claims that […]. At the same time, the Notifying Party acknowledges that dietetic products have a more complex formulae, including a wide range of different (higher quality) ingredients (or specifically excluded ingredients) and vitamin and mineral additives, which manufacturers tailor to support their claims of assisting pets' fight against certain medical conditions. (16)

5.2.1.2. The Commission's assessment

(25) In its previous decisions relating to pet food, the Commission found that: (i) industrial dog and cat food is a distinct market, separate from home prepared pet food; (17) (ii) dog food and cat food are not part of the same relevant product market; (18) (iii) dry dog food, wet dog food, dry cat food, and wet cat food products each constitute a separate product market; (19) and (iv) it cannot be excluded that specialist (non-grocery) stores are a separate relevant product market from grocery stores. (20)

(26) The Commission in the present case particularly assessed the potential distinction of dietetic pet food and other types of pet foods. Based on the evidence available and on the results of the market investigation, the Commission finds that dietetic pet food constitutes a distinct relevant product market based on the following reasons.

(27) Demand-side substitutability between dietetic pet food and other pet food was shown to be very limited. None of the competitors and veterinarians that responded to the Commission's market investigation considered that non-dietetic pet food could be substituted for dietetic pet food from the view point of the consumer. (21) It was noted that dietetic pet food fulfils a particular purpose, being formulated to address the nutritional requirements of specific health conditions in pets. (22) For example, one market participant explained that "[f]rom a veterinary point of view, the use of dietetic feeds to support nutrition-related diseases […] is absolutely necessary and cannot be replaced by conventional feed." (23) It was further noted that dietetic pet food was not fit for healthy animals and that feeding healthy animals a dietetic pet food diet over a prolonged period of time may lead to malnutrition or other health problems. (24) Therefore, as was stressed by several market participants, a diagnosis and a medical indication from a veterinarian are required before a pet can be fed dietetic pet food. (25)

(28) A very small number of responding veterinarians stated that non-dietetic pet food could be substituted for dietetic pet food, but only if the former is modified by means of prescription or over-the-counter medicine and/or nutritional supplements. One veterinarian noted that "[s]ubstitution with feed prepared by oneself in accordance with a recipe is possible, but for most customers not practicable". (26) Another veterinarian explained that substitution is problematic for some specifically formulated dietetic pet food products, for example those designed to feed pets with allergies, or with kidney or urinary stones, given that those types of feed contain large reductions of certain raw materials (such as proteins and minerals). (27)

(29) There is very little evidence of switching between dietetic and non-dietetic (conventional) pet food once dietetic pet food has been recommended. For example, switching from dietetic to conventional pet food would occur only when the dietetic pet food product is no longer considered necessary, or if the pet does not find it palatable (refusing to eat it), in which case the recommended dietetic pet food is replaced by an alternative dietetic pet food product, or an alternative solution recommended by a veterinarian. (28) Market participants have explained that if a pet (especially with a long-term health condition) is switched to conventional pet food, the pet owner would generally switch back to giving the pet the dietetic pet food product once they notice that the health issue recurs and/or once the veterinarian at a follow-up visit draws their attention to the need to follow the recommended diet. (29)

(30) The results of the market investigation also show that dietetic pet food tends to be more expensive than non-dietetic pet food: the average prices for dietetic pet food products were estimated to be between 10-30% and up to 3 times higher than for non-dietetic pet food products. (30)

(31) As regards supply-side substitutability, the Notifying Party's arguments as to the high degree of substitutability were similarly not supported by the results of the market investigation, which revealed a very limited degree of supply-side substitutability. Most conventional pet food manufacturers do not manufacture dietetic pet food, (31) and specialised dietetic pet food manufacturers do not manufacture conventional pet food. (32)

(32) The key characteristic of dietetic pet food is the very specific nutritional product profile, (33) meaning that these products either contain or lack specific ingredients, substances, vitamins or minerals. Dietetic pet food therefore requires very different recipes from conventional pet food. One competitor explained that dietetic pet food is "characterised by a more rigorous attention to achieving exact nutrient levels – both at the design and ongoing manufacturing stages." (34) Another competitor explained that the formulation of dietetic pet food requires specialist knowledge and know-how, to ensure that it can be manufactured consistently and in particular, that "advanced nutritional mastery is required – either an experienced Animal Nutritionist well-versed in Clinical Conditions who understands the clinical condition, how to manage it from a nutritional standpoint and is well-versed in interpreting and applying PARNUTS, or a Veterinary Clinical Nutritionist." (35) Whilst competitors agreed that a conventional pet food manufacturer could achieve the specific nutritional product profile with the requisite attention to nutrient levels required for dietetic pet food, it would have to invest into R&D and gain expertise before it could start manufacturing dietetic pet food. (36)

(33) Dietetic pet food product development incurs significant research and development spending. All of the competitors that responded to the market investigation stated that the development of dietetic pet food products is more resource-intensive than the development of conventional pet food, since it requires more scientific research and takes significantly more time. (37) Mars itself admits that dietetic pet food requires a higher level of investment than conventional pet food, explaining that "[i]n addition to increased spend on research and development for certain health conditions, a key investment involves brand education and development, including with professionals in the pet industry, particularly veterinarians and breeders. […] such investment relates to awareness and education of certain conditions, effective treatments, and product performance." (38) Competitors have also referred to the need for the dietetic pet food manufacturer to provide a high level of clinical proof of efficacy in order to satisfy the high product quality standard demanded by veterinarians. (39)

(34) Dietetic pet food products must comply with the requirements of EU Directive 2008/38/EC (40) on animal feed for particular nutritional purposes (the so-called "PARNUTs" legislation), which is deemed by competitors to be "far more stringent than legislation for conventional pet food" (41). Directive 2008/38/EC prescribes the essential nutritional characteristics, the recommended length of time for the use of, and the specific labelling declarations that must be made with respect to the nutritional content of different types of, dietetic pet food. (42) Directive 2008/38/EC also requires specific wording to be indicated on the packaging of the dietetic pet food product: "It is recommended that a veterinarian's opinion be sought before use [or before extending the period of use]" (depending on the particular nutritional purpose in question).

(35) Further regulatory requirements are imposed by Article 13 of Regulation 767/2009, (43) which prescribes the conditions for the appearance of claims on pet food packaging and labelling. Thus, claims as to the absence or presence of a substance, or any specific nutritional characteristic or process, must be objective, verifiable by competent authorities, understandable by the user of the feed and supported by scientific substantiation when the feed is placed on the market. This means that dietetic pet food that is more likely to make such claims must comply with more stringent regulatory requirements than conventional pet food, which is less likely to make such claims. Furthermore, claims that the feed will prevent, treat or cure a disease are not allowed, nor are claims that the feed has a particular nutritional purpose, unless that purpose is one listed in Directive 2008/38/EC. In other words, dietetic pet food may display claims that are not allowed for non- dietetic pet food (and in turn is subjected to a heavier regulatory burden).

(36) Whilst the general plant and equipment used for the manufacture of dietetic pet food is similar or essentially the same as that used for the manufacture of conventional pet food, (44) special manufacturing processes may be required for dietetic pet food. For example, it is absolutely necessary to ensure consistency of nutritional and ingredient profiles between production batches. (45) Furthermore, certain types of dietetic pet food require specific quality controls or equipment adjustment. Mars explains that manufacturing processes are sometimes adjusted to reflect any specific product requirements (such as […]). (46) […]. (47)

(37) Finally, dietetic pet food is sold almost exclusively via the veterinary channel. Market participants estimate that the veterinary channel accounts for over 90% of dietetic pet food sales, especially in certain markets, like the Nordics. (48)

(38) In light of the foregoing and taking the results of the market investigation and all the evidence available to it into account, the Commission considers that the manufacture and supply of dietetic pet food constitutes a distinct relevant product market, separate from the market for the manufacture and supply of non-dietetic pet food.

5.2.2. Relevant geographic market definition

5.2.2.1. The Notifying Party's arguments

(39) The Notifying Party argues that the market definition can be left open but should not be sub-segmented below the national level, (49) noting also that the markets for (i) dry dog food, (ii) wet dog food, (iii) dry cat food, and (iv) wet cat food products have previously been defined as national in scope. (50)

5.2.2.2. The Commission's assessment

(40) In Nestle/Ralson Purina, the Commission considered that the relevant geographic market for industrial pet food is national in scope, given that the purchasing pattern even of internationally active retailers was predominantly national, and that significant price differences existed among Member States. (51)

(41) The market investigation in the present case has similarly shown that the relevant geographic market for the manufacture and supply of dietetic pet food is national in geographic scope, given that: (i) suppliers tend to have dedicated local presence, personnel and distributors in various countries, (52) (ii) the majority of competitors have indicated that they have different routes to market in different countries, (53) and (iii) there is evidence of varying brand presence in national markets, with regional and national actors present in certain national markets but not others. (54)

5.2.3. Conclusion on the relevant market for the manufacture and supply of dietetic pet food

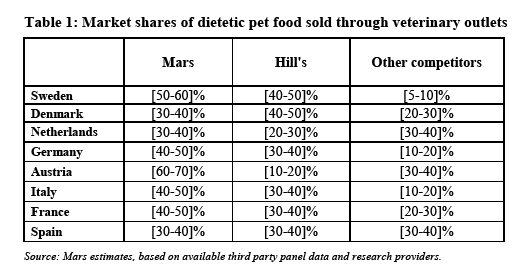

(42) In light of the above considerations and taking the outcome of the market investigation and all the evidence available to it into account, the Commission considers that the relevant product market upstream is the manufacture and supply of dietetic pet food, which constitutes a distinct relevant product market, separate from the market for the manufacture and supply of non-dietetic pet food.

(43) The market for the manufacture and supply of dietetic pet food is national in geographic scope.

5.3. The downstream market - retail of dietetic pet food through the veterinary channel

5.3.1. Relevant product market definition

5.3.1.1. The Notifying Party's arguments

(44) The Notifying Party submits that the relevant product market is the provision of veterinary services through veterinary practices. (55) The Notifying Party considers that in the absence of any horizontal overlap in this sector, there is no need to consider potential market definitions in any detail, although it also acknowledges veterinary services' ancillary activity as a distribution channel for pet food. (56)

5.3.1.2. The Commission's assessment

(45) The Transaction concerns the supply and sale of dietetic pet food through veterinary clinics, and not the provision of veterinary services.

(46) In Nestlé/Dalgety, the Commission found that it cannot be excluded that specialist (non-grocery) stores are a separate relevant product market for the sale of pet food from grocery stores. (57)

(47) The results of the market investigation in this case are firmly conclusive of the fact that veterinary clinics constitute a separate relevant product market for the sale of dietetic pet food, because: (i) dietetic pet food is sold almost exclusively through veterinary clinics; (ii) dietetic pet food sold through veterinary clinics tends to be more expensive than dietetic pet food sold via other channels (e.g. online) and (iii) suppliers tend to market dietetic pet food at a clinic-per-clinic level. (58)

5.3.2. Relevant geographic market definition

5.3.2.1. Notifying Party arguments

(48) The Notifying Party submits that the market for veterinary services, to the extent that these are relevant in the present case in light of the vertical relationship of their ancillary activity as a distribution channel for pet food, have to be considered at national level. (59)

5.3.2.2. The Commission's assessment

(49) In Nestlé/Ralston Purina the Commission concluded that, at the retail level, the prepared pet food markets are national in scope. The market investigation in that case revealed, inter alia, that the purchasing pattern even of internationally active retailers is still predominantly national, that significant price differences and market structures exist between Member States and that specialty shops purchase their pet food requirements almost exclusively at national level. (60) This conclusion was largely confirmed by the Commission's findings in Masterfoods/Royal Canin, where the Commission found that for the majority of respondents, purchasing patterns of demand were still essentially national as concerns the main grocery retailers, whilst they were nearly always national or even sub-national as concerns the specialty retailers. (61)

(50) The market investigation in the present case confirms that the retail of dietetic pet food via the veterinary channel is local in geographic scope, given that: (i) veterinary clinics tend to attract customers from their vicinity, and (ii) the majority of respondent market participants indicated that the maximum distance travelled by pet owners to veterinary clinics is less than 90 km. (62)

5.3.3. Conclusion on the relevant market for the retail of dietetic pet food via the veterinary channel

(51) The retail of dietetic pet food via the veterinary channel constitutes a distinct relevant product market, separate from the retail of dietetic pet food via other channels. This market is local in geographic scope.

(52) Notwithstanding the above, and given the significant presence of AniCura and VetFamily across the territory of Denmark and Sweden, for the purposes of this decision, the effects of the Transaction were considered having regard to the entirety of the territories of the countries concerned (i.e. national).

6. COMPETITIVE ASSESSMENT

(53) Mars is active in the supply of dietetic pet food throughout the EU, whereas AniCura is currently present in Denmark, Sweden, the Netherlands, Germany, Austria, Italy, France and Spain.

(54) The Transaction gives rise to vertically affected markets only where AniCura is also present, i.e. in Denmark, Sweden, the Netherlands, Germany, Austria, Italy, France and Spain.

(55) There is a also a very limited horizontal overlap in Denmark and the Netherlands, due to AniCura's supply of dietetic pet food under the VetPro brand in AniCura clinics in Denmark and Sterkliniek private-label dietetic pet food in AniCura- owned Sterkliniek clinics in the Netherlands. (63)

6.1. Legal framework for competitive assessment of vertical mergers

(56) Vertical mergers involve companies operating at different levels of the same supply chain. Pursuant to the Commission Guidelines on the assessment of non- horizontal mergers under the Council Regulation on the control of concentrations between undertakings (the “Non-Horizontal Merger Guidelines”) (64), vertical mergers do not entail the loss of direct competition between merging firms in the same relevant market and provide scope for efficiencies.

(57) However, there are circumstances in which vertical mergers may significantly impede effective competition. This is in particular the case if they give rise to foreclosure (65).

(58) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure: input foreclosure, where the merger is likely to raise costs of downstream rivals by restricting their access to an important input, and customer foreclosure, where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base (66).

(59) Pursuant to the Non-Horizontal Merger Guidelines, input foreclosure arises where, post-merger, the new entity would be likely to restrict access to its actual or potential rival in the downstream market to the products or services that it would have otherwise supplied absent the merger, thereby raising its downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger (67).

(60) For input foreclosure to be a concern, the merged entity should have a significant degree of market power in the upstream market. Only when the merged entity has such a significant degree of market power, can it be expected that it will significantly influence the conditions of competition in the upstream market and thus, possibly, the prices and supply conditions in the downstream market (68).

(61) Pursuant to the Non-Horizontal Merger Guidelines, customer foreclosure may occur when a supplier integrates with an important customer in the downstream market and because of this downstream presence, the merged entity may foreclose access to a sufficient customer base to its actual or potential rivals in the upstream market (the input market) and reduce their ability or incentive to compete which in turn, may raise downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger. This may allow the merged entity profitably to establish higher prices on the downstream market (69)

(62) For customer foreclosure to be a concern, a vertical merger must involve a company which is an important customer with a significant degree of market power in the downstream market. If, on the contrary, there is a sufficiently large customer base, at present or in the future, that is likely to turn to independent suppliers, the Commission is unlikely to raise competition concerns on that ground (70).

6.2. Market shares

6.2.1. Upstream market – manufacture and supply of dietetic pet food

(63) Mars is the market leader in the manufacture and supply of dietetic pet food in the EU. The second-largest supplier of dietetic pet food is Hill's.

(64) In the upstream market, Mars' shares in the supply of dietetic pet food are significant. Mars provided the following estimated market shares for dietetic pet food sold in 2017 via the veterinary channel in those Member States where AniCura is also present.

(65) According to Mars, this information constitutes its best estimate for the sales value of dietetic pet food products, taking into account its estimates of the proportion of non-dietetic pet food sold via the veterinary channel in each of the Member States concerned.

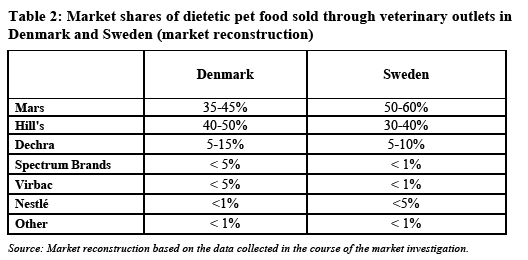

(66) On the basis of the responses received in the course of the market investigation, the Commission was able to reconstruct an approximation of the market shares of the other competitors active on the dietetic pet food market in Denmark and Sweden.

6.2.2. Downstream market – retail of dietetic pet food via the veterinary channel

(67) When calculating the shares of the Parties in the downstream markets, it is necessary to distinguish the shares of AniCura, which sources and resells dietetic pet food, from the shares of VetFamily member clinics. As explained above at paragraph (4), while VetFamily clinics are independent, they sign up to a purchasing framework controlled by AniCura through which they source a number of products for their practices, including dietetic pet food. The reasons why VetFamily shares are considered as shares controlled by the merged entity, in the competitive assessment, are assessed below at Section 6.3.2.4.

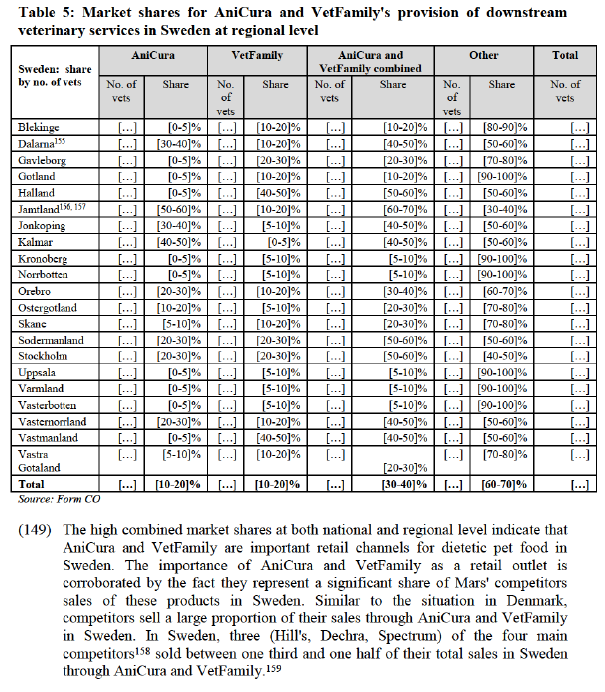

(68) While the geographic market definition is local, the Notifying Party was only able to provide complete market shares on the basis of turnover at national level. The narrowest geographic market share data that the Notifying Party was able to provide was at regional level (i.e. broader than local). The regional market shares are set out in the competitive assessment at country level at Sections 6.4, 6.5 and 6.6.

(69) In the downstream market, AniCura's and VetFamily member clinics' market shares in the provision of veterinary services, which were used as a proxy in the absence of reliable data on the shares in the retail sale of dietetic pet food, are also significant. These market shares are based on the veterinary clinics' turnover. The Notifying Party also provided market shares based on numbers of veterinary clinics and on the numbers of veterinarians. The Commission considers that shares based on turnover are likely to be closest in terms of judging the economic importance of the downstream clinics and consequently of their sales of dietetic pet food.

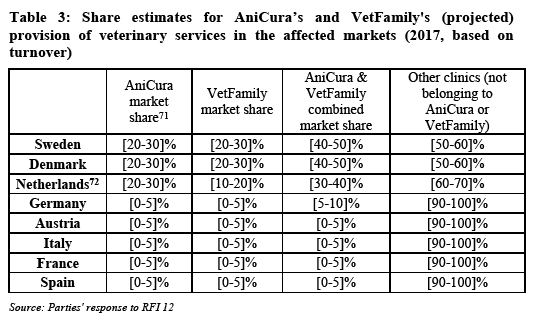

(70) As illustrated in Table 3 below, AniCura accounts for between [20-30]% and [20- 30]% of the market in Sweden, Denmark and the Netherlands, and when AniCura's market shares are considered together with VetFamily's, these increase to [40-50]% in Sweden, [40-50]% in Denmark and [30-40]% in the Netherlands.

(71) Finally, it must be noted that VetFamily has undergone a rapid expansion and is projected to continue to grow at a fast rate. Since AniCura purchased VetFamily in 2014, VetFamily has increased its membership from 120 clinics to over 1000 clinics. (73) By way of illustration of this rapid growth, between the date of notification and the date of this Decision, the number of VetFamily member clinics has increased by over [100-200] in total (by […]). (74)

6.3. General features of the markets

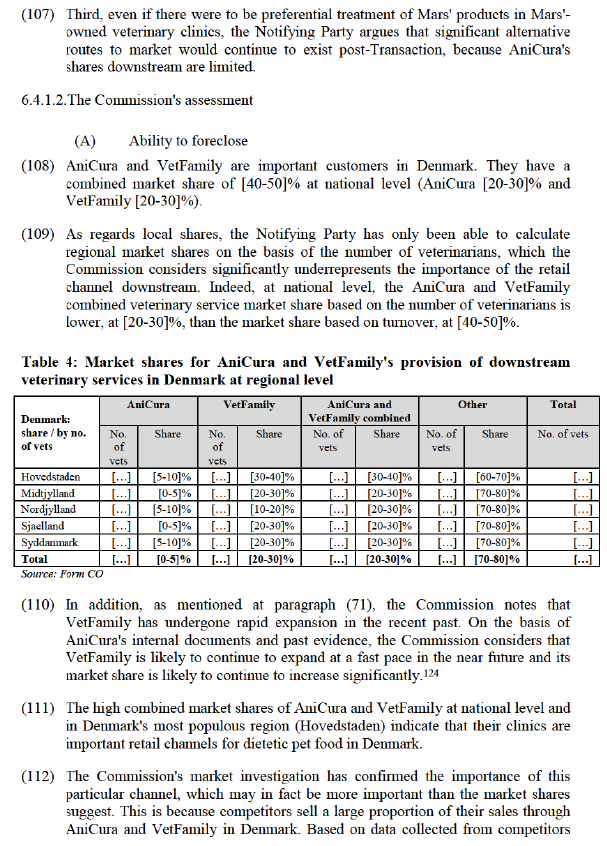

6.3.1. Notifying Party arguments

(72) The Notifying Party argues that the veterinary channel is of limited importance to the distribution of pet food.

(73) First, the Notifying Party estimates that no more than [20-30]% of overall pet food sold is distributed via veterinary practices (comprised almost entirely of dietetic pet food). (75) Royal Canin's internal strategy documents suggest that in 2016, the veterinary dog and cat food channel represented less than [0-20]% of the global veterinary market, and that although veterinarians are highly trusted by pet owners on the topic of pet food, only [0-20]% of pet owners buy pet food at a veterinary clinic. (76)

(74) Second, the Notifying Party also claims that even for those types of pet food that rely more heavily on veterinary distribution recommendation (i.e. dietetic pet food), there are ethical rules and behaviour driving the veterinary profession that prevent a veterinarian from pursuing commercial ends and instead ensure that the veterinary professional continues to recommend the best type of dietetic pet food for the pet in question. (77)

(75) Third, according to the Notifying Party, the existence of VetFamily and Sterkliniek are not relevant for the assessment of the transaction because clinics are free to procure pet food outside of the framework agreements concluded by and for the benefit of these purchasing organisations. (78)

(76) Fourth, the Notifying Party claims that the online channel is increasingly important in the distribution of pet food (79) and that there will remain significant alternative routes to market following the Transaction. (80)

6.3.2. Commission assessment

(77) The results of the market investigation in this case paint a different picture of the dietetic pet food market.

6.3.2.1. Veterinary channel as an essential distribution outlet for dietetic pet food

(78) Based on the results of the market investigation, the Commission finds that the veterinary channel is an essential distribution outlet for dietetic pet food, as it is indispensable to reach customers through a prescribing veterinarian.

(79) First, the veterinary channel is deemed by market participants to be the most important channel for the distribution of dietetic pet food. According to market participants' estimates, the veterinary channel accounts for over 90% of dietetic pet food sales, especially in certain markets, like the Nordics . (81)

(80) Second, the veterinary channel is important not simply as a retail outlet for physical sale of dietetic pet food, but also as an indirect promoter of dietetic pet food products, since without a recommendation by a veterinarian, pet owners are not likely to set out to purchase a specific dietetic pet food product by themselves. (82) For instance, on the importance of a veterinarian’s recommendations for the sale of dietetic pet food, a competitor explained that: "[v]eterinarians are already the main influencers on the worldwide global pet food market and from far, the main distribution channel for “therapeutic” pet food." (83)

(81) Third, dietetic pet food suppliers see access to veterinarians as a means of promoting their products to them as essential. (84) They invest heavily in promoting their dietetic pet food products to veterinarians by attending individual clinics, giving training and educational seminars to veterinarians in clinics as well as at conferences for veterinary professionals, and providing written product information and promotional materials to be displayed in veterinary clinics. (85) As one competitor explains, "[h]aving access to the staff in vet clinics is critical for pet food manufacturers because after attending training seminars in the clinics, vets are likely to have understood better the mode of action of the technology in question and the benefits of the products and are therefore more likely to recommend that specific brand for a pet who needs this type of diet." (86)

(82) Fourth, veterinarians have control over what dietetic pet food they recommend, this recommendation being typically trusted by pet owners. "People put their trust in a vet", (87) explained one competitor. Another competitor explained that "veterinarians play a key role in determining the appropriate food and their customers (pet owners) heavily rely on their veterinarian's recommendations before baking a purchase." (88) […]. (89) The results of the market investigation reveal that pet owners follow the veterinarian's recommendation as to the type, as well as the brand of dietetic pet food: an overwhelming majority of veterinarians stated that pet owners typically follow their recommendations, (90) with the majority also agreeing that pet owners tend to stay loyal to the brand originally recommended, (91) with one veterinarian stating that " *if the need for the diet has been understood, [pet owners] stick to the once-prescribed product". (92)

(83) As another veterinarian stated, "[m]ost pet owners follow our recommendations, as it is the best for their pet", (93) and yet another explained that "especialy [sic] in cases with Food allergies, owners tend to stick with a diet that reduces the animal's medical problems." (94) Veterinarians based in Denmark explained that owners "dont [sic] look for other options" if the dietetic pet food "works for their pet, and the pet likes it", (95) with another explaining that "[o]wners tend to stick" to the dietetic pet food prescribed by the veterinarian "as they consider it to be part of the treatment plan for a specific disease or as a preventive [sic] measure against developement [sic] of a more specific condition". (96)

(84) Fifth, similar views were expressed by the competitors, with all but one agreeing that pet owners typically follow vet recommendations. (97) One competitor remarked that pet owners who are prescribed a dietetic pet food product by their veterinarian "are usually loyal to the brand and stay with these products", (98) and another explained that in general, "a very high percentage […] of consumers will follow a recommendation of their vet which food to give their pets. An equally high amount of consumers will be loyal to that recommended brand throughout their pet's live [sic]". (99)

(85) Sixth, Mars itself recognises in internal documents the key importance of veterinary visits and prescription as a key opportunity of driving sales of its products. For example, in internal documents […] (100) […]. (101)

6.3.2.2. Veterinary prescriptions are affected by competition and commercial strategies of pet food manufacturers

(86) Based on the results of the market investigation, the Commission finds that competition among pet food manufacturers, and their commercial strategy, affect the choices made by veterinarians as to the prescribed dietetic pet food.

(87) First, given that a veterinarian's recommendation is generally required to start purchasing a dietetic pet food product, and that consumers tend to follow the veterinarian's recommendation, the choice as to the type and brand of dietetic product a consumer ends up buying is made by the veterinarian, and not by the consumer. As one veterinarian in Sweden explains: "Typically that is the available [dietetic pet] food at the local vet so they buy that. They do not have many choices. I have 85% royal canine and 15% Hills on my shelves." (102) The results of the market investigation also show that pet owners are not very likely to request generic or alternative dietetic pet food products to the ones recommended by their veterinarians, with only a minority of veterinarians reporting the occurrence of such requests. (103) This means that the choice of a local veterinary clinic to stock particular types and brand(s) of dietetic pet food is very likely to limit the choice that could otherwise be available to consumers.

(88) Second, whilst veterinarians may be guided by their ethical obligations and seek to have on offer a range of dietetic pet food that best suits the needs of the pets they treat, (104) the choice of brands to stock on the veterinary clinic's shelves (and subsequently to recommend) may be influenced by economic considerations (such as ease of procurement, rebates or other special pricing arrangements with a supplier). (105)

(89) Third, many market participants consider that the Transaction may have an impact on the market because of the economic or commercial considerations that influence a veterinarian’s choice of dietetic pet food brands in veterinary clinics. For example, one veterinarian's view is that "allowing Mars to acquire Anicura is a very bad idea. Veterinary practice needs to be independent to be able to remain objective and advise quality instead of only the products that the boss wants/produces" and that "health care should be about health and not about what is commercially attractive." (106) A competitor opined that "the free medical decision of the veterinarian who runs an Anicura Clinic as to which diet feed he recommends will be strongly influenced by the acquisition and the sales opportunities for us and other competitors will be severely impeded." (107)

(90) Fourth, the consumer's choice of veterinarian tends to be guided by factors other than the availability and price of dietetic pet food sold in-store. The choice of veterinarian is usually made on the basis of the type, quality and price of veterinary services, as well as the geographic location of the clinic. The sale of dietetic pet food is only an ancillary activity for veterinarians. This means that pet owners are not likely to switch veterinarians simply because their preferred brand of dietetic pet food is not available in-store.

(91) Fifth, there is evidence that exclusive purchasing arrangements between a chain of veterinary clinics and a supplier lead to a significant reduction in the sale of competing brands of dietetic pet food products. (108)

6.3.2.3. Online sales are not an alternative channel to veterinary prescribed dietetic food

(92) Based on the results of the market investigation, the Commission finds that online sales of dietetic food products are limited, and do not affect the primary importance of the veterinary channel in the retail of dietetic pet food.

(93) First, the market investigation confirmed that the online channel serves as a replenishment channel only, with consumers turning to buying dietetic pet food online only after the initial recommendation for a specific type (and often brand) of dietetic pet food has been made and the first purchase(s) of the product have taken place in the veterinary clinic. Indeed, as a competitor explained, "the online channel is not a substitute to the vet channel to enter or expand in the market for [dietetic] pet food." (109) This appears to be corroborated by Mars' internal documents. (110)

(94) Second, in any event, the online market accounted for a limited proportion of sales of dietetic pet food. The Notifying Party estimates that [10-20]% and [10- 20]% of sales of dietetic pet food in Sweden and Denmark respectively are made online. (111)

(95) This is broadly in line with estimates by competitors. Competitors estimate that less than 10% of their sales of dietetic pet food take place online in Denmark and no more than 20% (and often significantly less) in Sweden. (112) Whilst online sales are growing, they appear to be more important in countries in Europe other than Sweden and Denmark. (113)

6.3.2.4. VetFamily affects the procurement choices of its members.

(96) Based on the available evidence and on the results of the market investigation, the Commission finds that, despite the fact that VetFamily clinics are independent, their membership in the programme affects their procurement choices.

(97) First, even if there is no contractual requirement for VetFamily member clinics to purchase dietetic pet food under the VetFamily framework agreements (and no restrictions on purchasing outside those agreements), such purchases are strongly encouraged through contractual mechanisms.

(98) For example, a VetFamily contract for Denmark states that […]. (114)

(99) Second, […].

(100) Third, internal documents show that compliance of member clinics and that compliance in general already tends to be very high, between […]. Furthermore, compliance by VetFamily member clinics is directly rewarded through rebates from suppliers to the central VetFamily entity for purchases made under the framework agreements, and which account for […] of VetFamily's revenues. (115) This in turn reinforces further compliance with the framework agreements as the central VetFamily entity is directly incentivised to encourage independent clinics to purchase through the framework contracts, while the independent VetFamily clinics are able to benefit from lower prices.

(101) Fourth, in light of the particular features of the dietetic pet food market outlined above, and in particular of the fact that (i) recommendations by veterinarians drive sales and (ii) the assortment of dietetic pet food stocked by veterinary clinics limits and to a great extent determines consumer choice, it is competition that takes place on the upstream market that matters the most. For these reasons, purchasing alliances or buying groups (of which VetFamily is the largest) (116) play a very important role in driving product choice, by effectively incentivising veterinary clinics to stock a particular range of brands. Given the limited shelf space in veterinary clinics, preference is therefore more likely to be given to products procured at centrally-negotiated rates than to products for which a veterinary clinic would otherwise have to negotiate independently.

(102) Fifth, VetFamily arranges meetings for members once or twice per year, in order to discuss topics relevant for veterinary practice and to provide practice managers and opportunity to share their experiences and discuss best practices. (117) VetFamily also provides veterinary and leadership training for its members (118) and in Denmark acts as a forum where professionals from its member clinics discuss best practices and carry out training. (119) These activities can influence VetFamily members' choice of dietetic pet food to stock in veterinary clinics and/or recommend to pet owners.

(103) Sixth, VetFamily provides a range of other benefits to incentivise its members. For example, in Denmark, VetFamily provides marketing support to its members, primarily by helping clinics build websites, organising social media campaigns, and coordinating promotional campaigns with suppliers. (120) In Denmark, VetFamily also provides the VetPro range of own private label pet food, which consumers can buy from VetFamily members that choose to stock it, as well as in the VetFamily webshop. (121) In other countries, VetFamily also occasionally distributes to its members marketing or campaign materials on behalf of selected suppliers. (122) VetFamily has also developed a preventative care plan for pets, which is offered to customers on a subscription fee basis. VetPlan is managed with a specially developed IT system […]. (123)

(104) In conclusion, VetFamily affects the procurement choices of member clinics, and as VetFamily is controlled by AniCura, the downstream shares will be assessed as accruing to the merged entity in the context of the competitive assessment of the transaction.

6.4. Denmark

6.4.1. Customer foreclosure

6.4.1.1. The Notifying Party's arguments

(105) The Notifying Party argues that no competition concerns arise as a result of the Transaction, and in particular that there is no prospect of customer foreclosure, or input foreclosure, for a number of reasons. First, Mars' shares upstream and AniCura's shares downstream are not significant. Although Mars' shares may be above [30-40]% in a number of markets, significant competitors exist and continue to exert competitive pressure. Similarly, AniCura's shares in veterinary services are limited, representing less than [10-20]% of practices, less than [20- 30]% of veterinary service revenues and less than [10-20]% of veterinarians at national level.

(106) Second, the Notifying Party refers to an analogous situation in the United States, in order to argue that no competition concerns should arise. In particular, Mars notes that it already owns veterinary clinics in the United States where […]. Further, sales data indicates that […]. Mars argues that it intends to apply the same strategy in Europe, through its acquisition of AniCura.

during the course of the market investigation, the Commission notes that in Denmark, the main four competitors (Hill's, Dechra, Spectrum and Virbac) sold between one third and two thirds of their total sales in Denmark through AniCura and VetFamily. (125)

(113) When assessing the ability to foreclose, the Commission takes into account whether there are sufficient alternative outlets downstream for upstream competitors to sell their output. (126)

(114) In the present case, the Commission considers that in Denmark there are limited alternative outlets. Together, AniCura and VetFamily represent the largest retail outlet in Denmark, with a combined downstream market share of veterinary services of almost [40-50]% (see Table 4 above). The importance of AniCura and VetFamily as a retail outlet is corroborated by the fact that they represent a significant share of Mars' competitors sales of these products in Denmark. Other retail outlets are much more fragmented and sales through the online channel are low (on average 5-10% of sales are made online). Further, as noted at paragraph (93) the online channel merely serves as a replenishment channel.

(B) Incentive to foreclose

(115) Pet food purchases by veterinary clinics account for a limited proportion of their total procurement spend for veterinary items. For example, VetFamily members spent approximately [20-30]% of their purchases on dietetic pet food; this was significantly outweighed by other categories of spending, such as […]. (127) In addition, the sale of pet food by veterinary clinics is ancillary to their main activity of providing veterinary services to sick pets. For these reasons, the Commission considers that, if prices of dietetic pet food rise, veterinary clinics are unlikely to forego the convenience of purchasing through the VetFamily framework agreements in order to negotiate new contracts with other dietetic pet food suppliers. Rather, they are likely to pass those price increases to their customers.

(116) In addition, as noted at Section 6.3.2, upstream competition in this market is particularly important, while downstream switching is low. The purchase of dietetic pet food by customers visiting veterinary clinics is ancillary to the main purpose of the visit, which is to obtain veterinary services for their sick pet. Consequently, the Commission is of the view that the customer visiting a veterinary clinic is unlikely to switch away from a vet clinic if prices of dietetic pet food were to rise, or if the choice of dietetic pet food was limited to Mars' Royal Canin brand. This is particularly the case because Royal Canin is the leading brand of dietetic pet food in the EU and has the most extensive range of dietetic pet food. It is consequently likely to be an adequate substitute for any other brands that the veterinarian may have been stocking previously.

(117) In addition, the Commission notes that Mars' incentive to foreclose is increased in particular for the VetFamily member clinics. This is because VetFamily members are independent veterinary clinics and would not become part of the merged entity. Consequently, a reduction of choice or an increase in prices of dietetic pet food may not be offset by any decrease in customers for veterinary clinics, thus reducing the likelihood of a loss of profits for the merged entity in the downstream market.

(118) Further, the Commission notes that a merged entity's incentive to pursue a customer foreclosure strategy is stronger, where the upstream division of the merged entity can benefit from possibly higher price levels resulting from foreclosure of upstream rivals. (128) Mars' shares are significant upstream: in the market for manufacture and supply of dietetic pet food on the basis of its own estimates, Mars has a market share of [30-40]% in Denmark. However, the Commission considers that this may underestimate Mars' position and, as mentioned in paragraph (66), on the basis of the Commission's market reconstruction, Mars has a slightly higher market share within a range of 35-45%. The significant market position of Mars upstream would allow it to benefit from higher price levels upstream following the foreclosure strategy.

(B) Overall impact of customer foreclosure

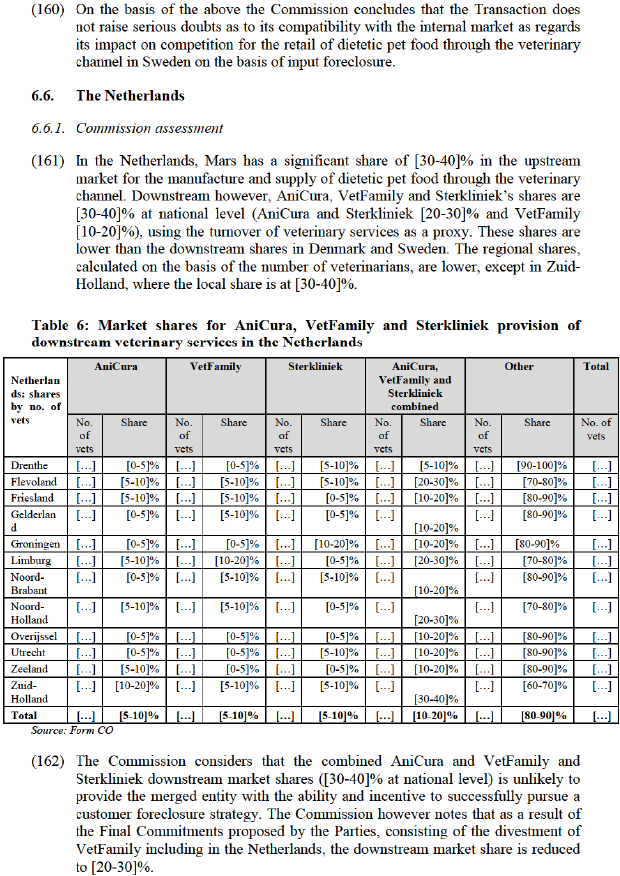

(119) The Commission considers that the merged entity may foreclose access to a significant customer base to its actual or potential rivals in the upstream market and reduce their ability or incentive to compete in Denmark. (129) As a result, also rival veterinary clinics in the downstream market are likely to be put at a competitive disadvantage, in particular due to raised costs of dietetic pet food. This in turn may allow the merged entity to profitably raise prices also in the downstream market.

(120) A number of market participants raised concerns that Mars could pursue a strategy to foreclose upstream competitors from the downstream retail channel. For example, one competitor noted that post-Transaction, Mars would likely give preferential treatment to its own brands in its downstream retail outlets (AniCura and VetFamily), resulting in reduced access to a key distribution channel and directly impacting their sales: "If this were to go ahead, Mars would have a dominant position in the Veterinary channel because they would own both the distribution channel and Food brands. They would most likely sell their own brands as a priority and block other brands including our own from this channel. This could potentially cut out a distribution channel/ key customer for our brands and reduce our selling potential." (130)

(121) Another competitor noted that Mars would, post-Transaction, sell its own products in the AniCura clinics, reducing the available retail outlets for its competitors: "With the acquisition of AniCura by Mars we expect that a number of clinics will take on Mars/Royal Canin’s pet food products, thereby reducing opportunities for [COMPETITOR] and other pet food competitors. Mars will most probably influence which pet foods the vet clinics in AniCura will use and/or sell." (131) Similar concerns were raised by veterinarians contacted during the market investigation, for example: “It is quite clear that Mars would push their own food lines into “their” clinics, so competition in the market would be reduced.” Another one mentioned, “AniCura-member clinics may sell only Royal Canin products and by this strengthens the brand.” (132)

(122) AniCura and VetFamily's combined downstream share of veterinary services is high, at [40-50]%. This means that almost half of the downstream retail outlets for dietetic pet food would effectively controlled by Mars, post-Transaction and represent channels from which Mars' competitors may be foreclosed. Further, the Commission notes that a sufficiently large fraction of upstream output appears to be affected by revenue decreases, due to the high percentage of competitor sales that are currently sold through AniCura and VetFamily, as mentioned at paragraph (112).

(123) The Commission considers that by restricting access to a significant customer base, the merger may put competitors at a competitive disadvantage, by increasing their costs to access the remaining customers. These increased costs could have an impact on their revenue streams and their ability to recoup costs. (133)

(124) In particular, for the competitors of Mars in dietetic pet food, the costs of establishing and maintaining presence in a country are high. As noted inSection 6.3.2 the importance of accessing the veterinary channel is crucial in order to sell dietetic products. Consequently, there are a number of important costs linked to local presence and developing relationships with veterinary clinics. The costs of entering a market (other than R&D spend and time it takes to develop a range of therapeutic diet) include distribution, marketing, brand awareness building (e.g. at veterinarian conferences and trade fairs), relationship building with veterinarians (visits and training in clinics, dedicated staff), staff training. (134) These costs are estimated, on average, at a minimum of EUR 0.5 million up to several million (EUR 5 million) depending on market size, characteristics, entry strategy and level of market presence. (135)

(125) If Mars' competitors' revenue streams are reduced upstream, the Commission considers that the merger may reduce their ability and incentive to invest in cost reduction, R&D and product quality. (136) This is particularly the case for the smaller competitors such as Dechra, Spectrum and Virbac, whose sales are significantly lower than Mars or Hill's. The Commission considers that the weakening of these competitors or their exit from the market may result in a loss of choice and of price competition in the upstream market, thereby enabling the merged entity to profitably raise prices in the downstream market. (137)

(126) Evidence that the merged entity may raise barriers to entry to potential competitors, making entry upstream by potential entrants unattractive by significantly reducing their revenue prospects (138) was also provided during the market investigation. In particular, competitors not already active in the Nordics, felt that entry, which is already difficult, would become even more so as a result of the Transaction. (139)

(127) The Commission considers that as a result of any potential Mars' customer foreclosure strategy, there is a risk that prices for dietetic pet food sold in the veterinary channel could increase. This risk of increased prices for dietetic pet food sold through the veterinary channel was highlighted by market participants, for example one veterinarian noted that, “AniCura destroys the market, if they fuse, they will be market leader and dictate prices.” (140)

(128) The market investigation also highlighted concerns regarding reduction of choice. In particular, market participants were concerned that as a result of the merger, veterinary clinics owned by Mars would be obliged to sells Mars' brand of dietetic food (Royal Canin) and that this could lead to a reduction in choice for the customer. For example, one competitor noted: "We do expect the acquisition to impact our business. Obviously all clinics will carry the RC [Royal Canin] brand as preferred/recommended brand. And since RC has by far the largest number of SKUs (141) of any therapeutic pet food company – this will effect and influence space management and limit competitors opportunities and restrict their number. Few clinics have the space and capacity to handle more than 3 brands." (142)

(129) In addition, a number of veterinarians expressed concerns that as a result of the merger, veterinary clinics belonging to Mars may no longer offer impartial advice, but would rather follow commercial imperatives to recommend Royal Canin pet food rather than being allowed to choose freely. For example, one veterinarian stated: "we think it could be problematic if animal hospitals are owned by a pet Food company. This might change the pet food market in an unfair manner. Furthermore, medical decisions could be influenced by economic interests." (143) A competitor raised similar concerns, noting that: "Veterinarians are already the main influencers…and… the main distribution channel for “therapeutic” pet food. If veterinarians were to lose their impartiality whilst recommending or prescribing such or such "therapeutic" pet food brand, it could lead to create / reinforce Mars dominant position in many countries." (144) Another competitor added: "as a consequence Mars as a pet food producer owns at the same time vet clinics where the products are used and sold. This might create a conflict between the commercial interest and the request for transparency in the vet profession." (145)

(130) The Notifying Party refers to the market situation in the United States, where Mars owns veterinary clinic chains, to support its argument that Mars would not foreclose customers in markets such as Denmark.

(131) However, the Commission notes that during the course of the merger proceedings, [AniCura future plans]. (146) […]. (147)

(132) The Commission considers it likely that […] significantly reduce the number of suppliers of dietetic pet food able to access the retail channels of AniCura and VetFamily. Further, the Commission considers it likely, […] that Mars, post- Transaction would have been selected […].

(133) The Commission also notes that as a result of the Transaction, Mars may face a reduction of countervailing buyer power. Mars' own internal documents note that […] (148) Post-Transaction in Denmark, Mars would no longer be subject to the same competitive pressure in pricing negotiations, due to the fact that it would then control a significant downstream purchaser (AniCura) that also operates a purchasing alliance.

(134) As explained above at Section (115) to (116), in view of the limited switching capability of downstream end customers, upstream competition has a prominent role in these markets, thereby making it likely that reduced upstream competition will result in higher downstream prices.

6.4.2. Other non-coordinated effects: access to confidential information of competitors

(135) Market participants also raised concerns that post-Transaction, Mars, as the owner of a downstream veterinary clinics, would gain an insight into the pricing of its competitors, to the extent that AniCura would continue to purchase dietetic pet food from these competitors. Examples of competitively sensitive information include: prices, quantities, level and timing of price increases, promotional activity grids, special pricing conditions, information about innovation and new product launches.

(136) The Commission notes that post-Transaction, through its ownership of VetFamily, Mars would obtain knowledge about its competitors' pricing (and other competitively sensitive information) to VetFamily clinics i.e. Mars' downstream competitors. As a result, and in line with what is described above in relation to the customer foreclosure concerns, Mars could subsequently adapt its commercial strategy to undermine any attempt by competitors to sell to [40-50]% of the market that would be controlled by Mars post-Transaction (i.e. Anicura's and VetFamily clinics). This is likely to put competitors at a competitive disadvantage, thereby dissuading them to enter or expand in the market. (149)

(137) For example, one competitor noted that the acquisition "will allow Mars to have access to significant sensitive and confidential information regarding [COMPETITOR] as well as other pet food suppliers." (150) Another competitor raised similar concerns, noting that: "As [Mars] are worldwide and European co- leaders in the "therapeutic" pet food business, we believe that it might impact negatively the relationship of the other players with those clinics (risk of leak of confidential information, lack of trust, partial choice of brand or even dereferencing of brand….)." (151)

(138) On the basis of the considerations in paragraphs (108) to (138) and in light of the results of the market investigation and of all the evidence available to it, the Commission concludes that the Transaction raises serious doubts as to its compatibility with the internal market as regards its impact on competition for the retail of dietetic pet food through the veterinary channel in Denmark, on the basis of (a) customer foreclosure resulting in increased prices for dietetic pet food sold through the veterinary channel, reduced choice, quality and innovation in dietetic pet food; and (b) the access to confidential information of competitors.

6.4.3. Input foreclosure

6.4.3.1. The Commission's assessment

(139) While the Commission notes that Mars has a strong position upstream (although it is the number 2 player in Denmark), and consequently may have the ability to restrict downstream customers from access to its dietary pet food products, the Commission considers that Mars would not have the incentive to foreclose. In its assessment, the Commission looks at whether the foreclosure would be profitable for the merged entity and the extent to which customers can be diverted away from downstream rivals. The effect is greater where the input, in this case dietetic pet food, represents a critical component of downstream rivals’ costs. (152)

(140) In this case, because the sale of dietetic pet food is not a key input to veterinary clinics, but is rather ancillary to the provision of veterinary services, the Commission considers that Mars would be unlikely to successfully divert customers away from AniCura’s downstream rivals, by restricting its supply of dietetic pet food to them. Rather, the Commission is of the view that Mars would face a greater risk of losing dietetic pet food sales, if it attempted an input foreclosure strategy regarding the supply of dietetic pet food. For these reasons, the Commission considers that Mars has the incentive to sell its dietetic pet food in as many retail outlets as possible.

(141) On the basis of the above, the Commission concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market as regards its impact on competition for the retail of dietetic pet food through the veterinary channel in Denmark on the basis of input foreclosure.

6.4.4. Horizontally affected markets

(142) The Notifying Party notes that there is a minimal horizontal overlap between the Parties’ activities in the supply of pet food in Denmark, which gives rise to a horizontally affected market. This is because AniCura sells limited quantities of a private label dietetic pet food product, VetPro, through its clinics and the VetFamily network and a webshop. These sales represent [0-5]% of pet food sold through the veterinary channel in Denmark. (153)

(143) The Notifying Party argues that this overlap will not cause a significant impediment to effective competition on any relevant market in Denmark, because: (i) the share increment attributable to AniCura’s activities is negligible and will not affect Mars’ competitive position; (ii) there is no overlap in the manufacture of pet food (since VetPro is manufactured by a third-party pet food supplier), so the Transaction will not remove production capacity from the market; (iii) the overlap that exists is very limited, since it relates solely to the supply of branded pet food in VetFamily and AniCura clinics; and (iv) the Danish pet food market has many suppliers that will act as a competitive constraint to the merged entity. (154)

(144) As regards the Commission's assessment, the Commission notes that while the merged entity would have a significant combined share upstream, the horizontal market share increment arising from the merger is extremely limited ([0-5]% at national level). In addition, the Transaction does not give rise to any increase in the manufacturing of dietetic pet food, since VetPro is manufactured by a third- party supplier. Finally, the Commission notes that this horizontal overlap will be removed as a result of the Commitments offered by the Parties, as described in Section 7.

(145) On the basis of the above, the Commission therefore concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market as regards its impact on competition for the retail of dietetic pet food through the veterinary channel in Denmark on the basis of horizontal overlaps.

6.5. Sweden

(146) The Notifying Party argues that no competition concerns arise in Sweden as a result of customer foreclosure or input foreclosure, for the reasons set out at Section 6.4.1.1.

6.5.1. Customer foreclosure

6.5.1.1. The Commission's assessment

(147) On the basis of the assessment set out below and the arguments also referred to in Section 6.4.1.2.A, the Commission considers that the Parties would have the ability to foreclose competitors in the market for the manufacture and supply of dietetic pet food in Sweden from downstream customers.

(148) In particular, AniCura and VetFamily are important customers in Sweden. They have a combined market share of [40-50]% at national level (AniCura [20-30]% and VetFamily [20-30]%). As regards regional shares, AniCura and VetFamily's combined shares are even higher, for example [50-60]% in Stockholm. Further, the Commission notes that this figure is likely to significantly underrepresent the importance of AniCura and VetFamily in the retail channel downstream, because it is calculated only on the basis of the number of veterinarians, rather than on the basis of turnover. Indeed, at national level, the AniCura and VetFamily combined veterinary service market share based on the number of veterinarians is significantly lower, at [30-40]%, than the market share based on turnover, at [40- 50]%.

(150) On the basis of the assessment set out below and the arguments also referred to in Section 6.4.1.2.B, the Commission considers that the Parties would have the incentive to foreclose competitors in Sweden from access to downstream customers.

(151) As regards Sweden, the Commission notes that, on the basis of Mars' own estimates, Mars' market share is [50-60]% in the manufacture and supply of dietetic pet food sold through the veterinary channel, which may in itself be evidence of Mars' dominant position. (160) On the basis of the Commission's market reconstruction, this may slightly underestimate Mars' position in Sweden, which calculated the higher range of [50-60%] instead. The Commission notes that a merged entity's incentive to pursue a customer foreclosure strategy is stronger, where the upstream division of the merged entity can benefit from possibly higher price levels resulting from foreclosure of upstream rivals. (161)

(152) Such customer foreclosure strategy would raise barriers to entry to potential competitors, making their entry upstream unattractive by significantly reducing their revenue prospects. (162)

(153) The foreclosure of upstream competitors would translate into negative effects in the downstream retail market. This risk of increased prices and reduced choice for dietetic pet food sold through the veterinary channel was highlighted by market participants in Sweden, for example a Swedish veterinarian noted: "For sure it would impact my business. Their dog food is already overpriced and there are not many alternatives. I have the feeling that with this merger their dominance will just further increase while they have a quite good source of medical information and distribution channel if the merger will happen. It is a very good entrance strategy from Mars." (163)

(154) As explained above at Section (115) to (116), in view of the limited switching capability of downstream end customers, upstream competition has a prominent role in these markets, thereby making it likely that reduced upstream competition will result in higher downstream prices.

6.5.2. Other non-coordinated effects: access to confidential information of competitors

(155) Market participants also raised concerns that post-Transaction, Mars, as the owner of downstream veterinary clinics, would gain an insight into the pricing of its competitors, to the extent that AniCura continued to purchase dietetic pet food from these competitors. Examples of competitively sensitive information include: prices, quantities, level and timing of price increases, promotional activity grids, special pricing conditions, information about innovation and new product launches.

(156) The Commission notes that post-Transaction, through its ownership of VetFamily, Mars would obtain knowledge about its competitors' pricing (and other competitively sensitive information also) to VetFamily clinics i.e. Mars' downstream competitors. As a result, and in line with what is described above in relation to the customer foreclosure concerns, Mars could subsequently adapt its commercial strategy to undermine any attempt by competitors to sell to [40-50]% of the market that would be controlled by Mars post-Transaction (i.e. Anicura's and VetFamily clinics). This is likely to put competitors at a competitive disadvantage, thereby dissuading them to enter or expand in the market. (164).

(157) On the basis of the considerations in paragraphs (147) and (156) and also the arguments referred to in Section 6.4.1.2.C, the Commission considers that the merged entity may foreclose access to a significant customer base to its actual or potential rivals in the upstream market and reduce their ability or incentive to compete in Sweden. (165) The Commission therefore concludes that the Transaction raises serious doubts as to its compatibility with the internal market as regards its impact on competition for the retail of dietetic pet food through the veterinary channel in Sweden, on the basis of: (a) customer foreclosure resulting in increased prices for dietetic pet food sold through the veterinary channel, reduced choice, quality and innovation in dietetic pet food; and (b) the access to confidential information of competitors.

6.5.3. Input foreclosure

6.5.3.1. The Commission's assessment

(158) While the Commission notes that Mars may have upstream market power, and consequently may have the ability to restrict downstream customers from access to its dietary pet food products, the Commission considers that Mars would not have the incentive to foreclose. In its assessment, the Commission looks at whether the foreclosure would be profitable for the merged entity and the extent to which customers can be diverted away from downstream rivals. The effect is greater where the input, in this case dietetic pet food, represents a critical component of downstream rivals’ costs. (166)

(159) In this case, because the sale of dietetic pet food is not a key input to veterinary clinics, but is rather ancillary to the provision of veterinary services, the Commission considers that Mars would be unlikely to successfully divert customers away from AniCura’s downstream rivals, by restricting its supply of dietetic pet food to them. Rather, the Commission is of the view that Mars would face a greater risk of losing dietetic pet food sales, if it attempted an input foreclosure strategy regarding the supply of dietetic pet food. For these reasons, the Commission considers that Mars has the incentive to sell its dietetic pet food in as many retail outlets as possible.

(163) For similar reasons to those set out at Section 6.4.3 and Section 6.5.3, the Commission also considers that the merged entity would not have the incentive to pursue an input foreclosure strategy in the Netherlands. In particular, although Mars may have upstream market power, and consequently may have the ability to restrict downstream customers from access to its dietary pet food products, the Commission considers that Mars would not have the incentive to foreclose.

(164) In this case, because the sale of dietetic pet food is not a key input to veterinary clinics, but is rather ancillary to the provision of veterinary services, the Commission considers that Mars would be unlikely to successfully divert customers away from AniCura’s downstream rivals, by restricting its supply of dietetic pet food to them. Rather, the Commission is of the view that Mars would face a greater risk of losing dietetic pet food sales, if it attempted an input foreclosure strategy regarding the supply of dietetic pet food. For these reasons, the Commission considers that Mars has the incentive to sell its dietetic pet food in as many retail outlets as possible.

(165) There is also a horizontally affected market in the retail of dietetic pet food in the Netherlands, due to the limited quantities of the supply of private label Sterkliniek dietetic pet food through Sterkliniek clinics (27 of which are owned by AniCura). As regards the Commission's assessment, the Commission notes that while the merged entity would have a significant combined share upstream, the horizontal market share increment arising from the merger is extremely limited (less than [0- 5]% at national level). (167) In addition, the Transaction does not give rise to any increase in the manufacturing of dietetic pet food, since the Sterkliniek dietetic pet food is manufactured by a third-party supplier.

(166) On the basis of the considerations in paragraphs (161) to (165) the Commission therefore concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market as regards its impact on competition for the retail of dietetic pet food through the veterinary channel in the Netherlands on the basis of vertical effects, or on the basis of horizontal overlaps.

6.7. Other markets

(167) The transaction also gives rise to vertically-affected markets in Germany, Austria, Italy, France and Spain.

(168) The Commission notes that AniCura’s presence in these countries is limited. The combined AniCura and VetFamily shares are as follows: Germany ([5-10]%), Austria ([0-5]%), Italy ([0-5]%), France ([0-5]%) and Spain ([0-5]%). Due to the low market shares downstream, the Commission considers that the merged entity would not have the ability to pursue a customer foreclosure strategy. For similar reasons to those set out at Section 6.4.3 and Section 6.5.3,the Commission also considers that the merged entity would not have the incentive to pursue an input foreclosure strategy.

(169) On the basis of the above, the Commission therefore concludes that the Transaction does not raise serious doubts as to its compatibility with the internal market as regards its impact on competition for the retail of dietetic pet food through the veterinary channel in Germany, Austria, Italy, France and Spain on the basis of vertical effects.

7. PROPOSED REMEDIES

7.1. Framework for the assessment of the commitments

(170) Where, as in this case, a notified concentration raises serious doubts as to its compatibility with the internal market, the parties may modify the notified concentration so as to remove the grounds for the serious doubts identified by the Commission with a view to having it declared compatible with the internal market pursuant to Article 6(1)(b) in conjunction with Article 6(2) of the Merger Regulation.