Commission, December 7, 2018, No M.8832

EUROPEAN COMMISSION

Decision

KNAUF / ARMSTRONG

Subject: Case M.8832 - Knauf/Armstrong

Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/2004 (1) and Article 57 of the Agreement on the European Economic Area (2)

Dear Sir or Madam,

(1) On 17 October 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Knauf International GmbH ('Knauf') would acquire within the meaning of Article 3(1)(b) of the Merger Regulation all of the shares in (i) the subsidiaries of Armstrong World Industries, Inc. in Europe, the Middle East and Africa ('EMEA'), and Asia Pacific ('APAC'), and (ii) certain subsidiaries of Armstrong World Industries' 50/50 joint venture with Worthington Industries ('WAVE JV') with operations in EMEA and APAC (together 'Armstrong', or the 'Target') (the 'Transaction'). (3) Knauf and Armstrong are designated hereinafter as the 'Parties'. The Transaction was initially notified to the Commission on 20 June 2018 and subsequently withdrawn on 24 July 2018.

(2) The Transaction has been referred to the Commission by the Austrian Bundeswettbewerbsbehörde pursuant to Article 22(3) of the Merger Regulation (the 'Referral Request'). The Referral Request was subsequently joined by the national competition authorities of Germany, Lithuania, Spain, and the United Kingdom.

1. THE PARTIES

(3) Knauf is a manufacturer of insulation materials, dry-lining systems, plasters, and other products. Knauf has approximately 27 500 employees worldwide.

(4) Armstrong designs and manufactures commercial and residential ceiling, wall and suspension system solutions. Armstrong is the ceiling business of Armstrong World Industries, Inc. outside of the Americas and has over 3 800 employees.

2. THE OPERATION AND THE CONCENTRATION

(5) The Parties entered into a binding Share Purchase Agreement ('SPA') on 17 November 2017, amended and restated on 22 January 2018 and on 18 July 2018, which sets out Knauf's intention to acquire all of the shares in and, therefore, sole control of Armstrong.

(6) The Transaction therefore constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation.

3. EU DIMENSION

(7) The undertakings concerned have a combined aggregate worldwide turnover of ca. EUR […] (Knauf: EUR […]; Armstrong: EUR […]), but their turnover does not meet any of the other thresholds set out in Article 1 of the Merger Regulation. As a result, the Transaction does not have an EU dimension within the meaning of Article 1 of the Merger Regulation.

(8) On 7 February 2018, the Commission received the Referral Request from the Austrian Bundeswettbewerbsbehörde on the basis of Article 22 of the Merger Regulation. As mentioned, the Referral Request was joined by the national competition authorities of Germany, Lithuania, Spain, and the United Kingdom within the legal deadline. On 15 March 2018, the Commission adopted five decisions pursuant to Article 22(3) of the Merger Regulation accepting the Referral Request. (4) On this basis, the Commission acquired jurisdiction to examine the Transaction with respect to the territories of Austria, Germany, Lithuania, Spain and the UK.

4. PROCEDURE

(9) Following the referral of the Transaction, the Commission required Knauf to submit a notification pursuant to Article 4 of the Merger Regulation. On 20 June 2018, the Commission received initial notification of the Transaction. Knauf subsequently withdrew the notification on 24 July 2018 and then re-submitted it on 17 October 2018.

(10) Following a limited number of initial phone calls with market participants before notification of the Transaction on 20 June 2018, the Commission initiated a market investigation after that date. The Commission contacted the Parties’ customers, distributors and competitors requesting information pursuant to Article 11 of the Merger Regulation through electronic questionnaires, telephone calls and written requests for information. The Commission also collected sales and capacity data from the Parties’ competitors. The Commission continued that market investigation after re-notification of the Transaction on 17 October 2018.

(11) In addition, the Commission also sent several written requests for information to the Parties and reviewed internal documents of the Parties submitted during the phase I investigation.

(12) Knauf submitted proposed remedies on 16 November 2018, formally revising them on 19 November 2018 and 23 November 2018. After the Commission gathered the views of market participants and informed Knauf of the outcome of its market test, Knauf submitted further revised commitments on 30 November 2018, and further amended those formally on 6 December 2018.

5. RELEVANT MARKETS

5.1. Introduction

(13) The Transaction concerns the building materials sector and in particular suspended ceilings. The Transaction gives rise to horizontally affected markets in the production and sale of modular and open suspended ceilings.

(14) The Transaction also gives rise to vertical links regarding certain raw materials for suspended ceilings (upstream) and suspended ceilings (downstream). According to the Parties, these vertical links, while technically giving rise to vertically affected markets due to the Parties' combined market shares downstream, are very limited in scope and entirely ancillary to their ceilings business. These vertical links are further discussed in section 7 of this decision.

(15) Suspended ceilings are systems that are fixed to a framework or "grid", which is attached to the main structure of a building to create a void between the actual ceiling (the "soffit") and the suspended ceiling. This allows for technical equipment such as cables and air-conditioning equipment to be placed and concealed in between the two layers.

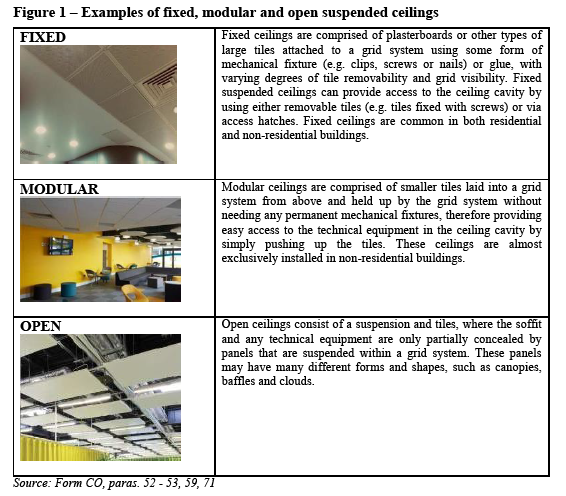

(16) There are three main types of suspended ceilings: fixed, modular and open. Modular and open suspended ceilings, are predominantly installed in non-residential buildings, such as offices, schools, retail facilities, healthcare facilities, and leisure facilities, whereas fixed suspended ceilings are common in both the residential and the non-residential segments. The main features of each type of suspended ceiling are described in Figure 1.

(17) Whereas all grids for suspended ceilings are made of metal, the tiles used for open and modular suspended ceilings are available in a variety of materials, mainly metal, mineral fibre, gypsum, and wood.

(18) The end-customer, who is a building owner, typically does not decide which type of ceiling to install and which material to choose. Instead, that decision is taken by a number of intermediate market participants who play a more or less decisive role in the purchasing decision. For larger projects, where a tender is typically organised, an architect or a "specifier" will often identify the desired supplier and product by naming a suspended ceiling manufacturer or even a specific product of a given manufacturer. The contractor, the distributor and the installer may also play a role by advising to purchase ceilings equivalent to those specified. For smaller projects, standard products are usually purchased off–the-shelf from a distributor directly by the contractor or the installer.

5.2. Product market definition

(19) In previous decisions, (5) the Commission has considered a market for all ceiling solutions while leaving the precise product market definition open.

(20) From a customer's perspective, distinctions can be drawn in the broader ceilings market between (i) fixed, modular and open suspended ceilings, (ii) tiles and grids for modular suspended ceilings, and (iii) tiles for modular suspended ceilings made of different materials. These are discussed separately in sections 5.2.1 to 5.2.3.

5.2.1. Fixed, modular and open suspended ceilings

5.2.1.1. Parties’ view

(21) The Parties are of the view that the relevant product market comprises at least modular suspended ceilings, including open suspended ceilings. (6) The Parties consider that open suspended ceilings are a type of modular suspended ceilings, that suppliers can easily switch production between open and modular suspended ceilings and that the two are highly substitutable in terms of end use for customers.

5.2.1.2. Commission’s assessment

(22) The Commission finds that, for the reasons outlined in paragraphs (23) to (27), modular and open suspended ceilings do not belong to the same relevant product market as fixed suspended ceilings while it can be left open whether modular suspended ceilings and open suspended ceilings belong to the same product market.

(23) First, from a demand side perspective, the different types of ceilings have different technical characteristics, performance, and price points. (7) On average, and in terms of total costs of ownership, fixed suspended ceilings tend to be more expensive than modular suspended ceilings. (8) As an example, Knauf estimates the price per m2 of a fixed suspended ceiling made of plasterboard (9) to be up to twice as high as the price per m2 of a standard modular suspended ceiling made of mineral fibre, (10) which is the predominantly used material for modular suspended ceilings. (11) Furthermore, tiles for fixed suspended ceilings, which are large boards, are produced in different production facilities than tiles for modular suspended ceilings, they offer a lower degree of flexibility of access to the ceiling cavity and have good acoustic performance even without any treatment. (12) Moreover, if an open suspended ceiling in a given room were to have the same acoustical performance as a modular suspended ceiling, it would on average be more expensive by the factor of approx. 2-2.5. (13)

(24) Second, while there appear to be some overlaps in terms of the end use for the different types of ceilings; modular, fixed and open suspended ceilings are more complements than alternatives to one another. (14) Indeed, in the same construction project the different types of ceilings can be used to meet different needs (e.g. in a hospital, the areas where patients are treated may require specific hygienic qualities, whereas acoustic qualities may be more important for the entrance hall). In light of this, one distributor explained "[t]hese ceilings do not feature on the same market and in general do not compete with each other". (15) [Strategic considerations by Knauf in relation to open suspended ceilings]. (16)

(25) Third, from a supply-side perspective, fixed suspended ceilings are produced through different processes than modular (or open) suspended ceilings. Moreover, the Parties submit that it may be possible to switch production from modular suspended ceilings to open suspended ceilings. However, it is also submitted that open suspended ceilings have higher manufacturing costs. (17)

(26) Fourth, Armstrong in its internal documents [strategic considerations by AWI in relation to open suspended ceilings]. (18) In the same document, it is also stated that [strategic considerations by AWI in relation to open suspended ceilings].(19)

(27) Fifth, with respect to open suspended ceilings, it can be left open whether this type of ceiling constitutes a separate relevant product market from modular suspended ceilings for the following reasons. First, the open suspended ceilings segment is much smaller than that of modular suspended ceilings representing around [5-10]% of demand for modular suspended ceilings in the EEA. (20) Second, its market structure is similar to that of modular suspended ceilings. (21) Therefore, competition concerns arise irrespective of whether suspended modular ceilings and open suspended ceilings are assessed together or separately.

(28) The Parties’ activities do not overlap with respect to fixed ceilings except for de minimis overlap in grids used in fixed ceilings for which the Target holds an estimated share of less than [0-5]% in the UK, Spain, Lithuania and Austria and Germany. (22) Therefore, this overlap will not be further analysed in the present decision.

5.2.1.3. Conclusion

(29) The Commission therefore considers that for the purposes of the present decision, fixed suspended ceilings on the one hand and modular and open suspended ceilings on the other hand constitute separate relevant product markets.

(30) Further, for the purposes of the present decision, it is not necessary to conclude whether modular and open suspended ceilings fall into the same or separate relevant product markets, since the Transaction raises serious doubts under both of those plausible alternative market definitions.

5.2.2. Tiles and grids for modular suspended ceilings

5.2.2.1. Parties’ view

(31) The Parties submit that within modular suspended ceilings, tiles and grids are part of the same relevant product market. (23) From a supply-side perspective, the Parties submit that increased demand for sales of tiles together with grids of the same supplier (“system sales”) has led almost all major suppliers to develop grid and tile production capabilities. In addition, the Parties consider that from a demand-side perspective customers often source ceiling solutions comprising grids and tiles from one supplier. (24)

5.2.2.2. Commission’s assessment

(32) The Commission finds that tiles and grids for modular suspended ceilings form two distinct product markets for the following reasons.

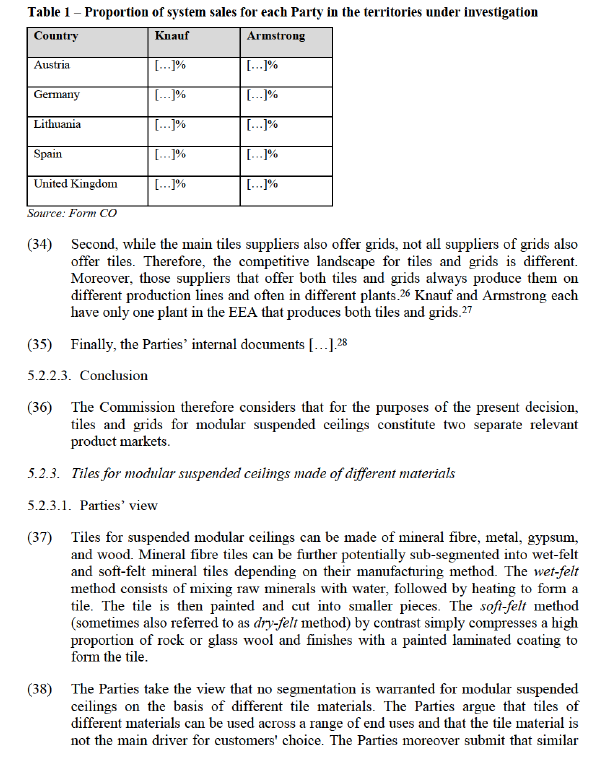

(33) First, as explained in paragraphs (15) to (17), tiles and grids perform very different functions and are inherently different products. The majority of competitors that responded to the market investigation indicated that in a significant number of cases tiles and grids for modular suspended ceilings are sourced from different suppliers. The Commission’s market investigation also provided indications that the percentage of customers that seek separate quotes varies greatly depending on a particular supplier. For example, the response of a competitor indicated that in 70% to 80% of instances it supplies only grids or only tiles. (25) This is also corroborated by the Parties’ own data. Table 1 below demonstrates that grids and tiles are often sold separately by the Parties themselves. Also, Table 1 shows that the share of system sales is very different for Knauf and Armstrong.

characteristics can be achieved with different materials and that price differences do not justify the conclusion that tiles made of different materials belong to separate product markets. (29)

5.2.3.2. Commission’s assessment

(39) The results of the Commission’s market investigation demonstrate that tiles made from different materials belong to different product markets, in particular that mineral fibre tiles, where the overlaps between the Parties’ activities are most significant, constitute a separate relevant product market for the reasons set out in paragraphs (40) to (43).

(40) First, there are differences between the materials in terms of technical characteristics (such as acoustic quality, hygiene-related qualities and fire resistance), look and design. While technical characteristics can overlap among tiles made of different materials, as claimed by the Parties, the intrinsic qualities of each material make it more or less suited for specific applications. A majority of customers and competitors that participated in the market investigation indicated that the different materials are not perfect substitutes to one another. (30) As one competitor explained "the performance of different materials are different. For plasterboard it is mainly focused on sound insulation, the price is cheap. For mineral fiber tile it is mainly focused on sound absorption e.g. acoustical performance". (31) Another competitor summarised as follows the differences among tiles made of different materials "Mineral fibra: good absortion. bad higiene, medium Price. short live Metal: good absortion, good higiene, Medium Price, long live, easy to shape Wood: good absortins, needs treatments to be hygienic, high Price, for small surfaces". (32)

(41) Second, there are considerable price differences between tiles made from different materials, in particular for the two largest material segments, i.e. mineral and metal, with some market participants indicating that metal tiles can be (significantly) more expensive than mineral fibre tiles. (33) Moreover, the majority of competitors that participated in the market investigation indicated that in case of 5-10% price increase of modular ceiling tiles made from mineral fibre their customers would not change their purchasing preferences or would change them only partly. (34) A majority of customers that participated in the market investigation confirmed the views expressed by competitors. (35) Customers' preference for mineral fibre tiles appears to be mainly driven by the fact that "acoustical performance of mineral fiber is much better than other materials" and "[b]ecause mineral fibre tiles are less expensive than the other materials". (36)

(42) Third, the Parties in their internal documents [information on how Knauf tracks the market]. (37) For instance, when reporting on market developments for its ceiling division, [information on how Knauf tracks the market]. (38)

(43) Finally, the Commission's investigation showed that mineral fibre tiles produced with the wet-felt and the soft-felt (also referred to as dry-felt) production methods compete with one another but that the products are differentiated and that wet-felt mineral fibre tiles may compete more closely with one another than with soft-felt mineral fibre tiles. (39) As one competitor explained "[t]he dry-felt ceiling tile is closest to the wet-felt ceiling tile, although they are still used for rather different purposes". (40) The differences between the products and lack of perfect demand-side substitutability is also reflected in [strategic considerations by Knauf relating to wet- felt and soft-felt mineral fibre tiles]. (41) Moreover, Knauf discusses the differences between mineral fibre tiles produced by the wet-felt method and the soft-felt method in its internal documents and also points out [strategic considerations by Knauf relating to wet-felt and soft-felt mineral fibre tiles]. (42) These aspects of closeness of competition will be taken into account in the competitive assessment.

5.2.3.3. Conclusion

(44) The Commission therefore considers that for the purposes of the present decision, tiles for modular suspended ceilings made of different materials constitute separate relevant product markets. There are thus separate product markets for (i) tiles for modular suspended ceilings made of mineral fibre (assessed in sections 6.3 and 6.5), (ii) tiles for modular suspended ceilings made of gypsum (assessed in section 6.6), tiles for modular suspended ceilings made of metal (assessed in section 6.6) and tiles for modular suspended ceilings made of wood (assessed in section 6.6). Within the product market of tiles for modular suspended ceilings made of mineral fibre, the differences between soft-felt and wet-felt mineral fibre tiles, albeit not forming a separate product market, will be taken into account in assessing the closeness of competition between the products of the different mineral fibre competitors.

5.3. Geographic market definition

5.3.1. Parties’ view

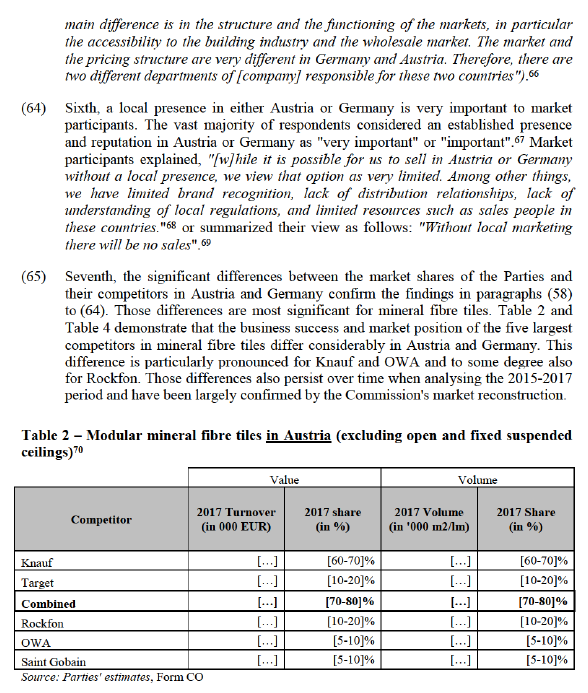

(45) The Parties consider that the markets for suspended ceiling tiles and grids are national in scope with the exception of two clusters of countries, which they claim constitute two regional markets comprising of (i) Austria and Germany, and (ii) Lithuania, Latvia and Estonia. (43)

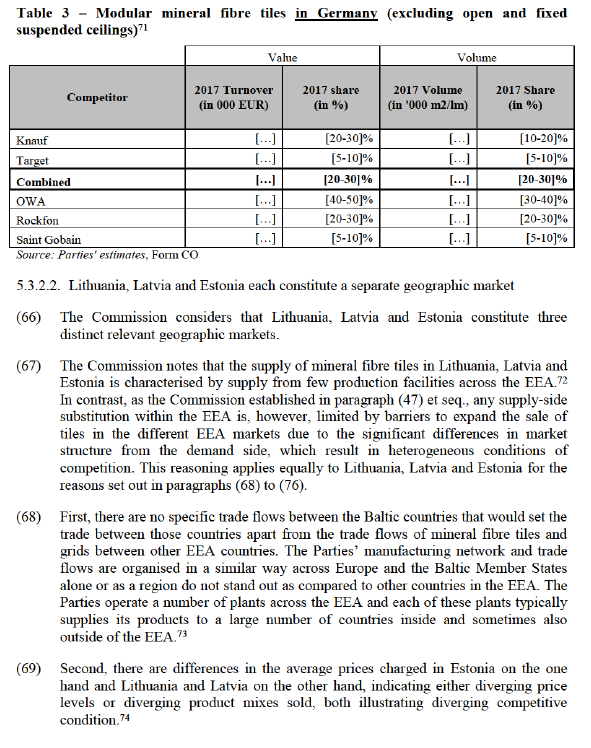

5.3.2. The Commission’s assessment for suspended ceiling tiles

(46) The Commission’s market investigation and other evidence available to it suggests that the geographic market for tiles for modular suspended ceilings, and of mineral fibre tiles in particular which is the main tile market assessed in the present decision, is limited to each of the EEA countries for which the Commission has jurisdiction (Austria, Germany, Lithuania, Spain and the UK) for the reasons set out in paragraphs (47) to (76).

(47) As regards supply-side considerations, the supply of tiles in the EEA is characterised by the producers having a limited number of production plants in the EEA, from which they serve their customers in the EEA. For instance, Knauf produces its mineral fibre tiles for the EEA in [Knauf’s mineral fibre production plants in the EEA]. Armstrong has [AWI’s mineral fibre production plants in the EEA]. The Parties’ competitors have a similarly centralized production in few EEA locations. Therefore, there may be a degree of supply-side substitution within the EEA, which, however, is limited by barriers to expand the sale of tiles in the different EEA markets due to the significant differences in market structure from the demand side. Those differences from a demand-side perspective result in heterogeneous conditions of competition in each of the EEA countries under review, which can be distinguished from neighbouring EEA countries because the conditions of competition are appreciably different as, set out in paragraphs (48) to (53).

(48) First, the demand structure is fragmented and national with a large number of customers active in each of the EEA countries that are generally not active in more than one or at most a few EEA countries.

(49) Second, the average prices for tiles are generally different in different Member States. For example, the Parties indicate that the average price for mineral fibre tiles is EUR/m2 […] in Austria, EUR/m2 […] in Germany, EUR/m2 […] in Lithuania, EUR/m2 […] in Spain and EUR/m2 […] in the UK. (44) The Commission’s market reconstruction indicates that the Parties appear to have underestimated those price differences and that they are actually larger. (45) Therefore, significant price differences can be observed between the five EEA countries under consideration. Those different prices may be caused by different prices charged for similar products depending on the country in question or by different product mixes sold in the different countries. Both suggest that diverging competitive conditions exist between the analysed EEA countries.

(50) Third, a local presence and local reputation are important for a suspended ceilings supplier to win sales in a given EEA country. (46) The reason is that different, and very often local, market participants decide about the manufacturer of suspended ceilings to be installed in a building project, mainly architects, contractors, distributors and the installers. (47) One market participant explained its strong market position in one EEA country by its well-functioning sales team that sufficiently covers all regions of this country. For another EEA country where this market participant is less strong and employs only one sales representative, this market participant explained that his sales representative "cannot address all relevant players in the same manner as his/her colleagues". (48)

(51) Fourth, brands play a role in the sale of tiles and grids for suspended ceilings and customers have different preferences for different brands across EEA countries. This is reflected in internal documents of Knauf, [strategic considerations by Knauf relating to the Armstrong brand]. (49), (50) Another example of brand importance is provided by one market participant from Lithuania, who explained that in Lithuania, the brand "Armstrong" is used as the generic name for suspended ceilings, albeit other suppliers are present in the market. (51)

(52) Fifth, [information on how the Parties track the market, in particular strategic considerations by Knauf on the markets in Germany and the UK]. (52), (53)

(53) Sixth, customers, who expressed their opinion in the course of the Commission’s market investigation, would switch to alternative suppliers outside of their country only when the prices for mineral fibre tiles increase significantly. (54)

(54) Seventh, the significant differences between the market shares of the Parties and their competitors in the different EEA countries confirm the findings in paragraphs (48) to (53). The business success of the same suppliers of mineral fibre tiles for modular suspended ceilings differ considerably across EEA countries, indicating diverging competitive conditions: According to the Parties’ estimates, Knauf's value-based market share in mineral fibre tiles in Austria is [60-70]%, in Spain [40-50]%, in Lithuania [30-40]%, in Germany [20-30]%, and in the UK [5-10]%. Armstrong's value-based market share in mineral fibre tiles in the UK is [40-50]%, in Spain [30-40]%, in Lithuania [20-30]%, in Austria [10-20]%, and in Germany [5-10]%. Such significant differences in market position between EEA countries persisted during the three year time period 2015-2017.

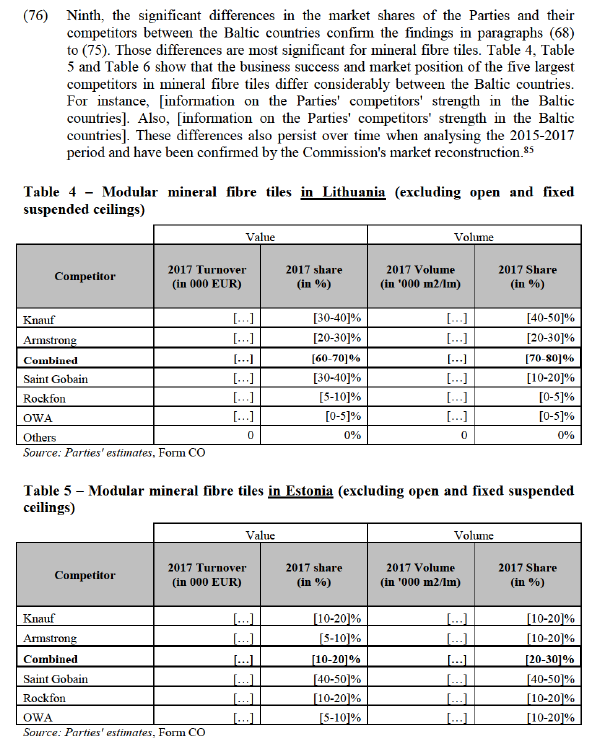

(55) Nevertheless, the Commission will also take into account certain EEA-wide considerations linked to the supply side of the markets, such as production capacities and production output at the EEA level in particular. As explained further in paragraphs (107) to (108), the capacity utilization of the few EEA production plants influences the profitability of the businesses and therefore has a direct influence on the competitive behaviour and aggressiveness of the individual suppliers. Those EEA-wide considerations will therefore be taken into account in the competitive assessment.

(56) The following sections 5.3.2.1 and 5.3.2.2 will address the Parties’ arguments specifically with respect to Austria and Germany on the one hand and with respect to the Baltic countries on the other hand.

5.3.2.1. Austria and Germany constitute two distinct geographic markets

(57) The Commission considers that Austria and Germany constitute two distinct relevant geographic markets.

(58) The Commission notes that the supply of mineral fibre tiles in Austria and Germany is characterised by supply from few production facilities across the EEA. (55) In contrast, as the Commission established in paragraph (47) et seq., any supply-side substitution within the EEA is, however, limited by barriers to expand the sale of tiles in the different EEA markets due to the significant differences in market structure from the demand side, which result in heterogeneous conditions of competition. This reasoning applies equally to Austria and Germany for the reasons set out in paragraphs (59) to (65).

(59) First, there are no specific trade flows between Germany and Austria that would set the trade between those two countries apart from the trade flows of mineral fibre tiles between other EEA countries. The Parties’ manufacturing network is not organized on the basis of an Austria-Germany region. The Parties operate a number of plants across the EEA and each of these plants typically supplies its products to a large number of countries inside and sometimes even outside of the EEA. The analysis of the suspended ceilings trade flows from the Parties' plants to Austria and Germany does not suggest that the Parties’ plants are focused specifically on producing for an Austria-Germany region. For example, Knauf’s plant in Grafenau/Germany delivers [Knauf deliveries from its Grafenau plant]. (56) Armstrong’s plant in Münster/Germany delivers [AWI deliveries from its Münster plant]. (57) Furthermore, neither Austria nor Germany can be singled out in this respect if compared to the other EEA countries. (58)

(60) Second, there are differences in the average prices charged in Austria and Germany as set out in paragraph (49), indicating either diverging price levels or diverging product mixes sold, both illustrating diverging competitive conditions.

(61) Third, while there are some customers that purchase suspended ceilings from the Parties both in Germany and in Austria, the market investigation also indicated that there are a considerable number of customers that operate only in either Austria or Germany. One market participant stated that it is "a regional distributor in [country] with a catchment area of 100 kilometres." (59) Another market participant stated, "[Company] is active only on [country] market and its competitors are also all based in [same country]." (60)

(62) Fourth, the existence of separate relevant geographic markets for Austria and Germany is supported by the Parties’ own assessment of those markets as reflected in internal documents submitted by the Parties. [Information on how the Parties track the market in Germany and Austria]. (61) [Information on how the Parties track the market in Germany and Austria].

(63) Fifth, the replies received from customers and competitors during the Commission’s market investigation support the view that the geographic markets are separate for Germany and Austria. A large number of respondents considered Germany and Austria to be separate markets. (62) Respondents to the market investigation stated, for instance, that "The market is specific to each country with often price / marketing / distribution deals and legislation creating barriers for cross border trade" (63) Other market participants explained that "[i]n Austria there is a different business culture, partners like [to] know each other" (64), or "that the markets are national or local. Even though the products are largely the same, the volumes are different, the building materials trade is partially organized in a different way and the way to market is the main reason for this view"). (65) A customer took the stance that "[t]he

(70) Third, the customer base differs significantly between the Baltic countries, as the largest customers are not identical across the Baltic countries.

(71) Fourth, the existence of separate relevant geographic markets for each of the Baltic countries is supported by the Parties’ own assessment of those markets as reflected in internal documents submitted by the Parties. [Information on how the Parties track the market in the Baltics]. (75), (76)

(72) Fifth, the replies received from customers and competitors during the Commission’s market investigation support the view that the geographic markets are separate for each of the Baltic states. The majority of responses to the Commission's market investigation, which took a position, indicate that markets are national in scope. (77)

(73) Sixth, the Parties' own distribution networks and customer purchasing patterns (including the requirement to have a local presence) point to each of the Baltic Member States constituting separate national markets. The majority of respondents to the market investigation indicated that sales representatives are required in order to compete efficiently. (78) The importance of local sales representatives is underscored by the fact that they have to know local architects well in order to propose their ceilings in an early stage of a construction project. Also, it appears that language acts as a barrier to purchase abroad. (79) That is also supported by the fact that product catalogues are translated into each language. (80) Customers also explained "suspended modular ceilings is a technically difficult product, therefore, a consultation, training, project calculation are necessary to participate in this market. Without local sales reps that would be very difficult." (81)

(74) Seventh, competition takes place at the national level. Distributors indicated that cross-border sales and purchases may occur in isolated cases but are not standard business practice. (82)

(75) Eighth, a well-established presence, i.e. "good reputation", was considered as important. (83) In Lithuania, "good reputation" typically means that a distributor can help to find a solution for specific spaces in a building, has not failed to deliver on time and has proven financial track record. (84)

(81) Third, several arguments, which apply for mineral fibre tiles are valid also for grids:

(a) A local presence and local reputation are important for a grid supplier to win sales in a given EEA country. (89)

(b) Brands play a role in the sale of grids for suspended ceilings and customers have different preferences for different brands across EEA countries. (90)

(c) [Information on how the Parties track the market in relation to grids]. (91)

(d) Customers would switch to suppliers outside of their country only when the prices for grids would increase significantly. (92)

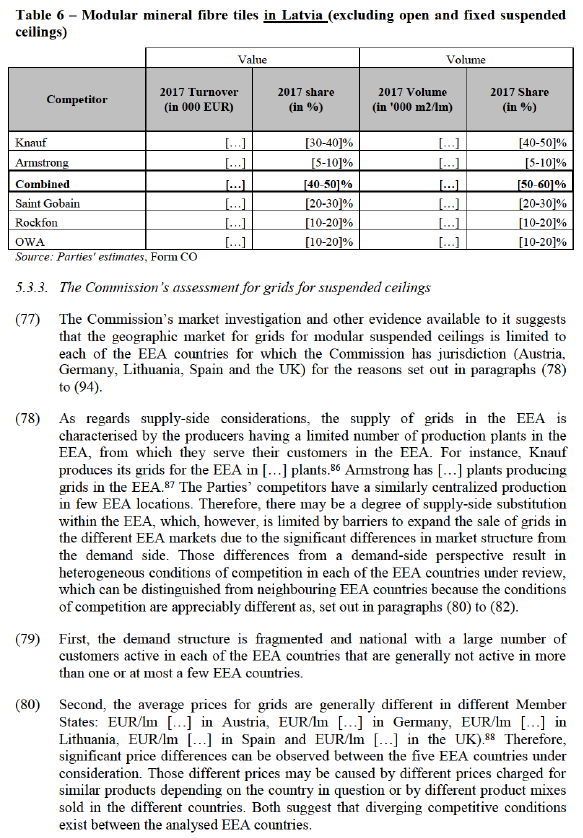

(82) Fourth, the significant differences between the market shares of the Parties and their competitors in the different EEA countries confirm the findings in paragraphs (79) to (81). The business success of the same suppliers of grids for modular suspended ceilings differ considerably across EEA countries, indicating diverging competitive conditions: According to the Parties’ estimates, Knauf's value-based market share in grids for modular suspended ceilings in Austria is [50-60]%, in Germany [20-30]%, in Spain [10-20]%, in the UK [10-20]% and in Lithuania [0-5]%. Armstrong's value-based market share in grids for modular suspended ceilings in Lithuania is [50-60]%, in the UK [40-50]%, in Spain [30-40]%, in Austria [10-20]% and in Germany [5-10]%. (93)

(83) Nevertheless, the Commission will also take into account EEA-wide considerations linked to the supply side of the markets, such as production capacities and production output at the EEA level. As explained further in paragraphs (120) to (122), the capacity utilization of the few EEA production plants influences the profitability of the businesses and therefore has a direct influence on the competitive behaviour and aggressiveness of the individual suppliers. Those EEA-wide considerations will therefore be taken into account in the competitive assessment.

(84) The following sections 5.3.3.1 and 5.3.3.2 will address the Parties’ arguments specifically with respect to Austria and Germany on the one hand and with respect to the Baltic countries on the other hand.

5.3.3.1. Austria and Germany constitute two distinct geographic markets for grids

(85) The Commission considers that Austria and Germany constitute two distinct relevant geographic markets.

(86)The Commission notes that the supply of grids in Austria and Germany is characterised by supply from few production facilities across the EEA. In contrast, as the Commission established in paragraph (78) et seq., any supply-side substitution within the EEA is, however, limited by barriers to expand the sale of grids in the different EEA markets due to the significant differences in market structure from the demand side, which result in heterogeneous conditions of competition. This reasoning applies equally to Austria and Germany for the reasons set out in paragraphs (87) to (89).

(87) First, there are no specific trade flows between Germany and Austria that would set the trade between those two countries apart from the trade flows of grids between other EEA countries. The Parties’ manufacturing network is not organized on the basis of an Austria-Germany region. The Parties operate a number of plants across the EEA and each of these plants typically supplies its products to a large number of countries inside and sometimes even outside of the EEA. The analysis of the suspended ceilings trade flows from the Parties' plants to Austria and Germany does not suggest that the Parties’ plants are focused specifically on producing for an Austria-Germany region. For example, [Knauf deliveries from its Viersen plant]. (94) [AWI deliveries from its Valenciennes plant]. (95) Furthermore, neither Austria nor Germany can be singled out in this respect if compared to the other EEA countries. (96)

(88) Second, further arguments that apply for mineral fibre tiles apply also to grids:

(a) The market investigation indicated that there are a considerable number of customers that operate only in either Austria or Germany. (97)

(b) The existence of separate relevant geographic markets for Austria and Germany is supported by the Parties’ own assessment of those markets as reflected in internal documents submitted by the Parties. (98)

(c) Customers and competitors replies during the Commission’s market investigation support the view that the geographic markets are separate for Germany and Austria. (99)

(d) Finally, a local presence in either Austria or Germany is very important to market participants. (100)

(89) Third, the significant differences between the market shares in grids of the Parties and their competitors in Austria and Germany confirm the findings in paragraphs (87) and (88). Table 7 and Table 8 demonstrate that the business success and market position of the largest competitors in grids differ considerably in Austria and Germany. This difference is particularly pronounced for Knauf and OWA, and to some degree also for Rockfon. Those differences also persist over time when analysing the 2015-2017 period and have been largely confirmed by the Commission's market reconstruction.

(92) First, there are no specific trade flows between the Baltic countries that would set the trade between those countries apart from the trade flows of grids between other EEA countries. The Parties’ manufacturing network and trade flows are organised in a similar way across Europe and the Baltic Member States alone or as a region do not stand out as compared to other countries in the EEA. The Parties operate a number of plants across the EEA and each of these plants typically supplies its products to a large number of countries inside and sometimes also outside of the EEA. (103)

(93) Second, further arguments that apply for mineral fibre tiles apply also to grids:

(a) The customer base differs significantly between the Baltic countries as the largest customers are not identical across the Baltic countries. (104)

(b) The existence of separate relevant geographic markets for each of the Baltic countries is supported by the Parties’ own assessment of those markets as reflected in internal documents submitted by the Parties. (105)

(c) Replies received from customers and competitors during the Commission’s market investigation support the view that the geographic markets are separate for each of the Baltic States. (106)

(d) The Parties' own distribution networks and customer purchasing patterns (including the requirement to have a local presence) point to each of the Baltic Member States constituting separate national markets. (107)

(e) Competition takes place at the national level. (108)

(f) A well-established presence, i.e. "good reputation", was considered as important. (109)

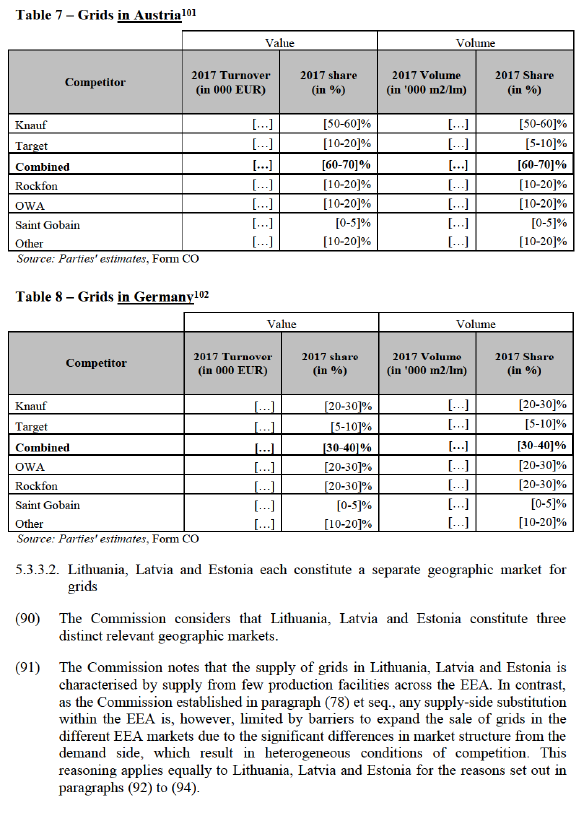

(94) Third, the significant differences in the market shares in grids of the Parties and their competitors between the Baltic countries confirm the findings in paragraphs (92) and (93). Table 9, Table 10 and Table 11 show that the business success and market position of the largest competitors in grids differ considerably between the Baltic countries. For instance, [information on AWI's strength in the Baltic countries]. Also, [information on AWI's strength in the Baltic countries]. These differences also persist over time when analysing the 2015-2017 period and have been confirmed by the Commission's market reconstruction. (110)

6. COMPETITIVE ASSESSMENT OF THE HORIZONTAL OVERLAPS

6.1. Analytical framework

(95) Under Article 2(2) and 2(3) of the Merger Regulation, the Commission must assess whether a proposed concentration would significantly impede effective competition in the internal market or in a substantial part of it, in particular through the creation or strengthening of a dominant position.

(96) In this respect, a merger may entail horizontal and/or non-horizontal effects. Horizontal effects are those deriving from a concentration where the undertakings concerned are actual or potential competitors of each other in one or more of the relevant markets concerned. Non-horizontal effects are those deriving from a concentration where the undertakings concerned are active in different relevant markets.

(97) As regards non-horizontal mergers, two broad types of such mergers may be distinguished: vertical mergers and conglomerate mergers. (111) Vertical mergers involve companies operating at different levels of the supply chain. (112) Conglomerate mergers are mergers between firms that are in a relationship, which is neither horizontal (as competitors in the same relevant market) nor vertical (as suppliers or customers). (113)

(98) The Commission appraises horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Horizontal Merger Guidelines. (114) Additionally, the Commission appraises non-horizontal effects in accordance with the guidance set out in the relevant notice, that is to say the Non-Horizontal Merger Guidelines. (115)

6.2. Horizontal non-coordinated effects

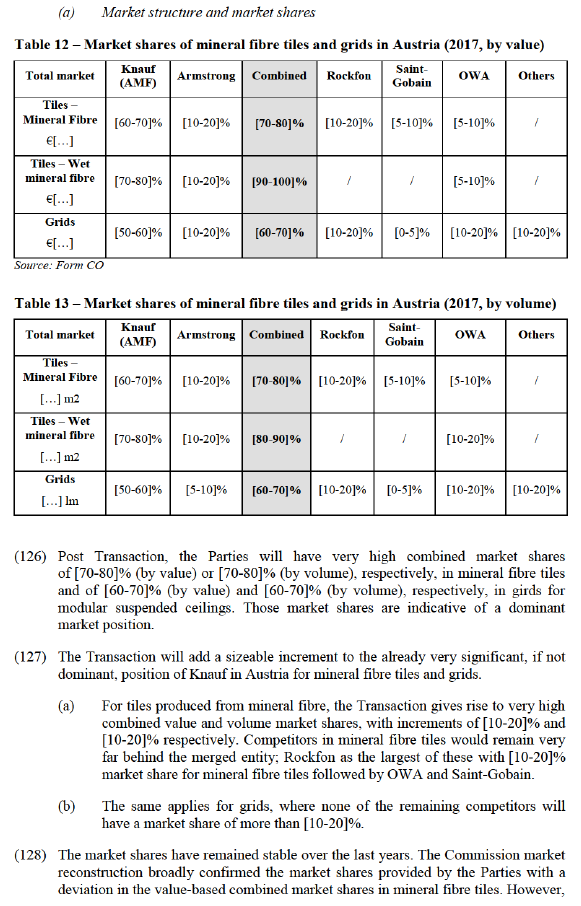

(99) The Horizontal Merger Guidelines distinguish between two main ways in which mergers between actual or potential competitors on the same relevant market may significantly impede effective competition, namely non-coordinated and coordinated effects. (116)

(100) Under the substantive test set out in Article 2(2) and 2(3) of the Merger Regulation, mergers that do not lead to the creation or the strengthening of the dominant position of a single firm may also be incompatible with the internal market. The Merger Regulation provides that "under certain circumstances, concentrations involving the elimination of important competitive constraints that the merging parties had exerted upon each other, as well as a reduction of competitive pressure on the remaining competitors, may, even in the absence of a likelihood of coordination between the members of the oligopoly, result in a significant impediment to effective competition". (117)

(101) The Horizontal Merger Guidelines list a number of factors which may influence whether or not significant horizontal non-coordinated effects are likely to result from a merger, such as the large market shares of the merging firms, the fact that the merging firms are close competitors, the limited possibilities for customers to switch suppliers, or the fact that the merger would eliminate an important competitive force. That list of factors applies equally, regardless of whether a merger would create or strengthen a dominant position, or would otherwise significantly impede effective competition due to non-coordinated effects. Furthermore, not all of these factors need to be present to make significant non-coordinated effects likely and it is not an exhaustive list. (118)

(102) Finally, the Horizontal Merger Guidelines describe a number of factors, which could counteract the harmful effects of the merger on competition, including the buyer power, entry and efficiencies.

6.3. Aspects common to the assessment of all five mineral fibre tiles markets under review

(103) The Transaction will create or strengthen the market leader in four of the five national markets under review, potentially leading to the creation or strengthening of a dominant position in several of those markets. As there are a number of aspects that are common to the assessment of each of the national markets for mineral fibre tiles in Austria, Germany, Lithuania, Spain and the UK, those aspects are set out in paragraphs (104) to (116).

(104) First, the supply of mineral fibre tiles is concentrated in all five Member States for which the Commission has jurisdiction. There are only five suppliers of mineral fibre tiles in each of those countries: the Parties, OWA, Rockwool (through its Rockfon branch) and Saint-Gobain (through its Ecophon and Eurocoustic branches). The Transaction therefore appears to be a 5-to-4 merger in mineral fibre tiles in each of those countries and, in fact, in the EEA as a whole, limiting the number of actual or potential suppliers in each of the national markets assessed in the present decision.

(105) Second, in the supply of wet-felt mineral fibre tiles, which are a sub segment of mineral fibre tiles albeit not forming a separate product market, there are only three suppliers of wet-felt mineral fibre tiles in each of the five Member States in question: the Parties and OWA. The Transaction therefore appears to be a 3-to-2 merger in wet-felt mineral fibre tiles in each of those countries and, in fact, in the EEA as a whole, limiting the number of actual or potential suppliers in each of the markets assessed in the present decision.

(106) Third, besides the Parties, there are only two other suspended ceiling manufacturers who are equally active across Europe and thus in Austria, Germany, Lithuania, Spain and the UK, i.e. Rockwool and Saint-Gobain. In contrast, OWA is a smaller supplier and is particularly focussed on Germany, where OWA is the current market leader in mineral fibre tiles. (119) In addition, even the European-wide players focus more on certain regions or certain countries within the EEA as has already become apparent from the differences in market shares of the Parties in different EEA countries as set out in paragraph (54).

(107) Fourth, the Parties would become the clear EEA-wide leader in terms of production capacity for mineral fibre tiles after the Transaction. Knauf has an EEA-wide capacity share of [20-30]% and Armstrong of [30-40]% in the EEA, (120) leading to a combined capacity share of [50-60]% in mineral fibre tiles, according to the Parties' estimates. The Commission market reconstruction roughly confirmed these shares. (121) That share is indicative of dominance also in the five Member States in question, in particular since the capacity is used in the EEA as a whole and therefore equally in each of the five Member States in question and the share of the next competitor OWA is estimated at [10-20]%, that is to say at less than a third the size of the merged entity.

(108) Fifth, [strategic considerations by the Parties in relation to capacity utilisation]. (122), (123)

(109) Sixth, the phase I investigation has resulted in evidence from the Parties' internal documents that Knauf and Armstrong were competing head-to-head in in the Member States under review prior to the Transaction. For instance, Armstrong characterised Knauf in 2016 as [strategic assessment of Knauf by AWI] and [strategic assessment of Knauf by AWI] (124) while Knauf commented in a document dated 16 September 2016 on Armstrong that Armstrong is [strategic assessment of AWI by Knauf]. (125)

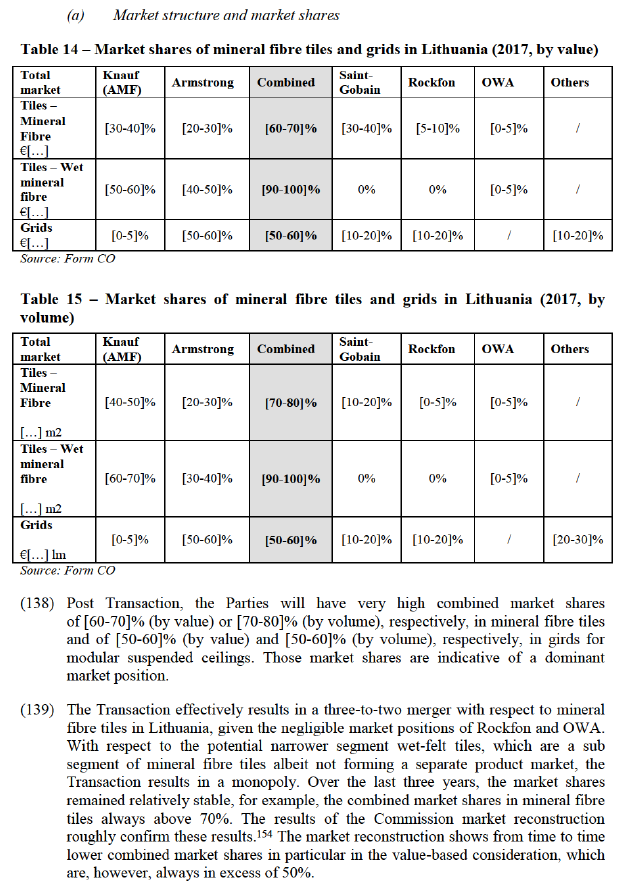

(110) Seventh, in contrast to the close competition between the Parties, and in line with the fact that the market for mineral fibre tiles is differentiated, not all three remaining competitors appear to be competing equally head-to-head with the Parties. In particular, competitor Saint-Gobain's mineral fibre companies either do not compete closely with the Parties or have certain shortcomings.

(a) Saint Gobain’s Ecophon products focus on higher value products and thus compete less closely with the Parties. As set out in Armstrong’s internal documents, Ecophon [strategic assessment of Ecophon by AWI] and has a [strategic assessment of Ecophon by AWI]. (126) Knauf has a similar perspective on Ecophon calling them a [strategic assessment of Ecophon by Knauf] (127) and [strategic assessment of Ecophon by Knauf]. (128)

(b) Saint Gobain’s Eurocoustic products appear to have limitations in terms of product portfolio. (129)

(111) Eighth, on the basis of the findings of the Phase I market investigation, the Commission considers it unlikely that the remaining competitors would have the ability and incentives to react sufficiently aggressively to counter-act any negative effects of the transaction, for instance by expanding output, for the reasons set out in paragraphs (112) to (117).

(112) In the first place, the product market is not homogeneous as there are differences in brand appeal and in product characteristics. That is to say in particular that customers may view the other competitors as less good alternatives due to lesser brand appeal with end customers, (130) due to differences in product characteristics (in particular for Rockfon and Saint-Gobain which sell soft-felt mineral fibre tiles) (131) and due to differences in product positioning (in particular for Saint-Gobain Ecophon which focuses on high quality and high price) or in product portfolio (in particular for Saint-Gobain Eurocoustic).

(113) In the second place, there are indications that the capacity utilization of competitors is higher than that of Knauf and Armstrong. This is indicated by the Commission's collection of capacity data from the three main competitors but also by the Parties' views as reflected in their internal documents: [strategic considerations in relation to capacity utilisation] (132) and [strategic considerations in relation to capacity utilisation]. (133)

(114) In the third place, the available spare capacity of competitors would not be used exclusively for sales in Austria, Germany, Lithuania, Spain and the UK, but all over the EEA and possibly also outside of the EEA. (134) The Commission notes in that context that the Parties' combined market shares in mineral fibre tiles in other EEA countries than the five countries under review are very high at more than [50-60]% and up to [90-100]% all across substantial parts of Eastern Europe (Czech Republic, Slovenia, Hungary, Croatia, Slovakia, Romania, Bulgaria,) but also at more than [60-70]% in Ireland and Greece and around [40-50]% in Poland and Portugal. (135) Therefore, if the merged entity were to increase its prices in countries where its market shares are high, competitors may have the same incentive to use their capacity for sales in those other EEA countries, limiting the spare capacity available for additional sales in Austria, Germany, Lithuania, Spain and the UK.

(115) In the fourth place, as regards incentives to expand output, the competitors would be faced with additional demand if the merged entity raised price or otherwise deteriorated supply conditions and customers tried to switch away after the Transaction. It could therefore be profitable for them to raise their prices in turn. This is particularly relevant against the background that the Parties [strategic considerations by the Parties in relation to capacity utilisation].

(116) In the fifth place, there are indications that in countries where the market structure is already strongly concentrated, prevailing prices may be higher, and they are not offset by the existence of spare capacities of competitors. This is for instance the situation in the United Kingdom as further detailed in paragraph (176). This may also be indicative of likely effects of the transactions in other markets, where the Transaction would bring about a significant increase in market concentration.

(117) Ninth, market entry in mineral fibre tiles in the five Member States under review that would constrain the merged entity after the Transaction is not likely. The majority of respondents in the market investigation providing a meaningful answer hold the view that a market entry of a suspended ceilings supplier within the next five years is rather unlikely or very unlikely. (136) This is echoed in the internal documents of the Parties that do not appear to mention any significant market entry in mineral fibre tiles to be expected in the next five years.

6.4. Aspects common to the assessment of all five grids markets under review

(118) The Transaction will create or strengthen the market leader in three of the five national markets for grids under review, potentially leading to the creation or strengthening of a dominant position in Austria, Spain and the UK. As there are a number of aspects that are common to the assessment of each of the national markets for grids in Austria, Germany, Lithuania, Spain and the UK, those aspects are set out in paragraphs (119) to (122).

(119) First, the supply of grids is concentrated. There are only five main suppliers of grids: the Parties, Rockwool, Saint-Gobain and OWA. (137) The Transaction therefore appears to be a five-to-four merger of main suppliers of grids.

(120) Second, the Parties would become the EEA-wide leader in terms of production capacity for grids after the Transaction. Knauf has a [10-20]% capacity share and Armstrong has a [10-20]% capacity share, leading to a combined capacity share of [30-40]% in the EEA. (138) They would be well ahead of the next two competitors Rockfon ([10-20]%) and Saint Gobain ([10-20]%). The remaining market is highly fragmented.

(121) Third, the Parties would become the leading supplier of grids for suspended ceilings in the EEA with a combined sales share of around [40-50]% in grids in the EEA. (139)

(122) Fourth, [strategic considerations by the Parties in relation to capacity utilisation]. (140) This would impact equally all five national markets for girds in the Member States under review.

6.5. Competitive assessment of mineral fibre tiles and grids by national market

6.5.1. Austria

6.5.1.1. The Parties' view

(123) The Parties maintain that the relevant geographic market is wider than only Austria and comprises Austria and Germany. Furthermore, the Parties consider that the relevant product market for suspended ceilings comprises grids as well as tiles made from all types of materials.

(124) Based on this, the Parties claim that the combined market shares of the Parties are moderate ([20-30]% on a value basis and [20-30]% on a volume basis) and hence below any presumption of a dominant market position. (141) Moreover, the Parties stress the exertion of strong competitive pressure in particular by OWA, Rockfon and Saint-Gobain, not leaving aside a "large number of smaller but highly renowned players present in the DA [Commission clarification: Germany-Austria] region". (142)

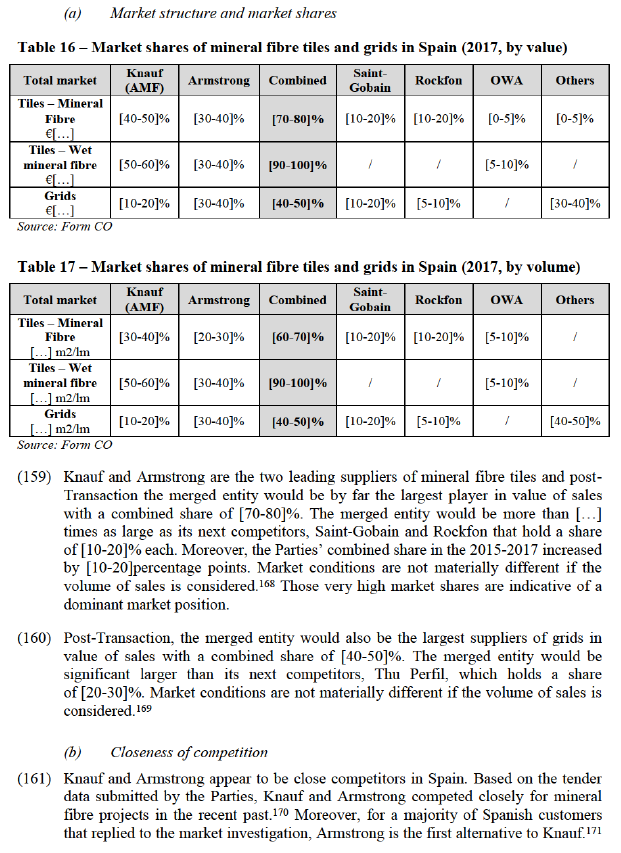

6.5.1.2. Commission's assessment

(125) Certain aspects of the competitive assessment apply across all of the national markets for mineral fibre tiles and grids under review as explained in sections 6.3 (143) and 6.4. (144) Those aspects apply fully to the Austrian markets and therefore argue in favour of raising serious doubts for Austria. The remainder of this section will only set out arguments specific to Austria that apply in addition to those cross-cutting aspects already set out in sections 6.3 and 6.4.

according to the Commission market reconstruction, the value-based market shares are in excess of 50% in mineral fibre tiles.

(b) Closeness of competition

(129) As regards mineral fibre tiles and grids, the market feedback points to existing close competition between Knauf and Armstrong in Austria. Respondents from Austria name Armstrong as an alternative to Knauf, and vice versa, even though other suppliers are being named as well. (145) In particular, when mineral fibre is considered the most suitable material for certain type of characteristics (standard, sound, fire reaction), both Parties are very often named as potential suppliers by Austrian market participants. (146)

(130) In other regards (such as the specific manufacturing method of wet-felt tiles, high- end or low-end products, etc.), the majority of the respondents maintain that the Parties are close competitors. (147) In particular as regards the differentiation between the production methods of mineral fibre tiles – wet-felt and soft-felt - one market participant explained that if a particular wet-felt product is named in the specifications for a project, it is practically not possible, mainly because of the price, to switch to soft-felt mineral fibre suppliers, that is to say to Rockfon or Saint Gobain. (148)

(c) Replies from the market investigation on the impact of the Transaction

(131) Most respondents are neutral as regards the impact of the transaction on their company. A minority expects a negative impact but no one a positive. Similarly, the majority of respondents assume that the prices will remain the same but a considerable number of market participants expect a price increase. (149)

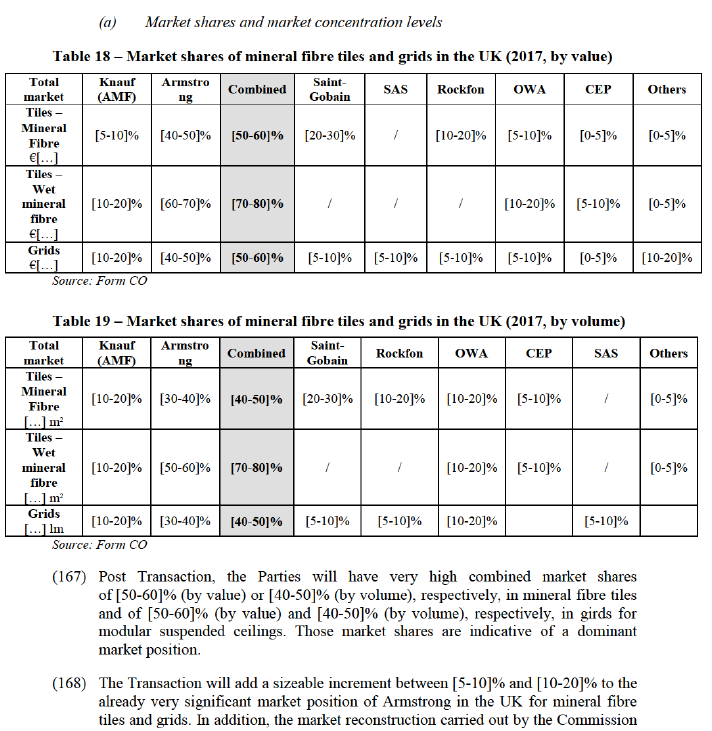

(132) Considering mineral fibre tiles only, there is a slight shift towards the opinion that in this product area, prices may increase as consequence of the Transaction. (150) For grids, the opinions that prices will increase or that the prices will remain the same, are rather balanced. (151)

(133) Overall, the Commission observes that whilst many respondents did not express any view on the impact of the transaction or remain neutral, there are more participants expecting a negative impact of the Transaction than those who do not, in particular because of increasing prices.

(134) The available market feedback thus suggests that the Transaction could reinforce Knauf's very strong, if not dominant, position in Austria, regarding both tiles and grids.

6.5.1.3. Conclusion

(135) In view of the reasons set out in paragraphs (125) to (134), the Commission finds that the Transactions raises serious doubts about its compatibility with the internal market as regards the Austrian markets for mineral fibre tiles and grids for modular suspending ceilings.

6.5.2. Lithuania

6.5.2.1. Parties' views

(136) The Parties consider that all Baltic Member States fall under one geographic market and, therefore, no competition concerns arise. Further, the Parties submit that all materials of modular suspended ceilings fall under single relevant product market definition. As a result, the Transaction would not result in the significant impediment of effective competition primarily because the Parties market share would be moderate and there would be other international competitors that would continue to exert sufficient competitive pressure on the Parties.

6.5.2.2. Commission's assessment

(137) Certain aspects of the competitive assessment apply across all of the national markets for mineral fibre tiles and grids under review as explained in sections 6.3 (152) and 6.4. (153) Those aspects apply fully to the Lithuanian markets and therefore argue in favour of raising serious doubts for Lithuania. The remainder of this section will only set out arguments specific to Lithuania that apply in addition to those cross- cutting aspects already set out in sections 6.3 and 6.4.

(140) The only other credible competitor is Saint-Gobain with [30-40]% market share value-based and [10-20]% volume-based. However, its market position under any segmentation will be much smaller if compared to the Parties post-merger. The other major players (Rockfon and OWA) have limited market shares in Lithuania – Rockfon [5-10]% value-based and [0-5]% volume-based, OWA [0-5]% value-based and [0-5]% volume-based – and are unlikely to constrain the parties sufficiently post-merger.

(141) As regards grids, the Parties submit that Knauf's position is minor in Lithuania ([0-5]% market share by both value and volume). The Parties further submit that Knauf entered the Lithuanian market later, which, according to them, explains Knauf's limited presence in grids. (155) Moreover, the parties take the view that while the merger would result in a strong market position of the merged entity with market shares above [50-60]%, over the past three years, however, the combined market shares decreased from above [60-70]% in 2015 to above [50-60]% in 2018. The Commission notes that the increment added by Knauf decreased from [10-20]% in 2015 to [0-5]% in 2017. The Commission market reconstruction confirms the market shares as well as the decrease of both the combined market shares and the increment. This indicates that the Transaction is unlikely to change the competitive landscape in grids in Lithuania.

(b) Closeness of competition

(142) The market investigation provided evidence that the Parties are close, if not the closest, competitors in Lithuania in mineral fibre tiles.

(143) First, the majority of customers and distributors responding to the Commission’s market investigation indicated that Armstrong is the closest alternative to Knauf and vice versa. (156) Only one distributor considered Saint-Gobain to be a close alternative to the Parties' mineral fibre tiles.

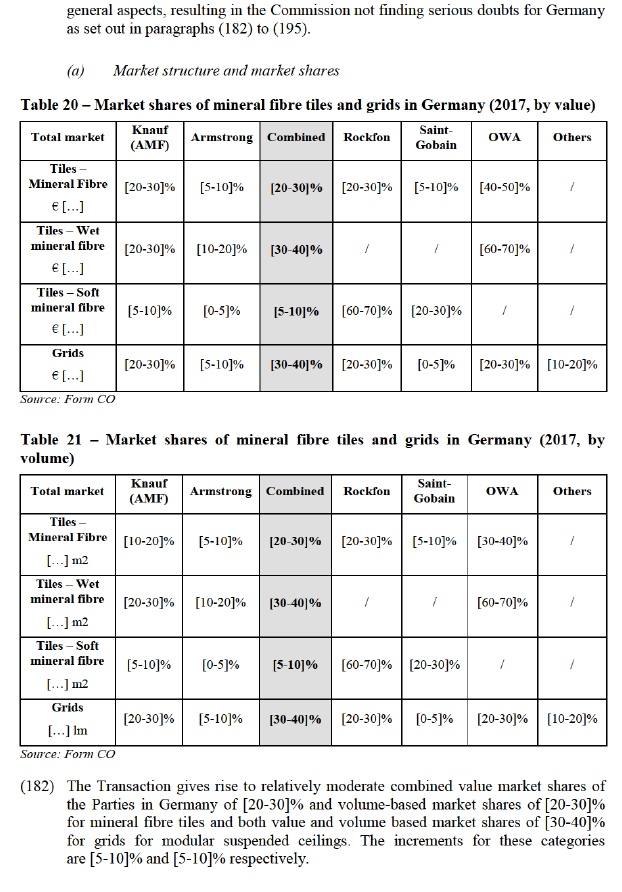

(144) Second, the Parties’ mineral fibre tiles and product portfolio are very similar and sometimes even professionals have difficulty to tell them apart. (157)

(145) Third, historically, Armstrong used to be the market leader in Lithuania holding around 50% market share around 8-10 years ago. (158) The "Armstrong" brand was used as a generic term for suspended ceilings irrespective of the actual manufacturer. However, in recent years Knauf has gained market share at the expense of Armstrong. (159)

(146) Fourth, the Parties are each other's close competitors when looking at specific price bands. The market investigation indicated that while Knauf is also active in the entry level DIY sales channel with economic (low-range) mineral ceilings in Lithuania, both Parties compete closely for mid- to high-segment which are meant for project sales. (160)

(147) Fifth, the head-to-head competition between Armstrong and Knauf in Lithuania is reflected in Knauf’s internal documents: [strategic assessment of AWI by Knauf in relation to Lithuania]. (161)

(148) In contrast, the market investigation did not provide evidence that the Parties are close competitors in Lithuania in grids due to Knauf's limited market position in grids in Lithuania.

(c) Architect and other specifiers specification acts as a barrier for non-specified manufacturers

(149) Reputation of the manufacturer/distributor is very important in Lithuania and architects and other specifiers are unlikely to specify manufacturers that they do not know or have not worked with before. In effect, this acts as a barrier for new players to enter the market for the following reasons.

(150) First, the majority of market participants indicated that in the vast majority of cases (around 75%) suspended ceiling specifications from an architect makes a reference to a particular manufacturer. (162)

(151) Second, once a particular manufacturer is specified, ceilings of such a manufacturer are likely to be bought. (163)

(152) Finally, construction companies are unlikely to buy from distributors that they have no experience with. (164)

(153) In conclusion, in contrast to competitors, the Parties' products are well known to architects and other specifiers. Hence, they are more likely to be referenced than those of competitors.

(d) Replies from the market investigation on the impact of the Transaction

(154) The majority of customers responding to the market investigation considered that the Transaction would have negative effects on competition. For example, a customer indicated, "Theoretically European market is open. Practically it is still segmented geographically per country basis. Merging of two leading suppliers of ceilings is probably not causing any competition problems in a big country. But such a merging can have crucial consequences in a small country like Lithuania, limiting competition almost to zero." (165)

6.5.2.3. Conclusion

(155) In view of the reasons set out in paragraphs (137) to (154), the Commission finds that the transactions raises serious doubts about its compatibility with the internal market as regards the Lithuanian market for mineral fibre tiles.

(156) In contrast, in light of the limited increment brought about by the transaction in grids and the fact that Knauf's market position in grids has declined constantly over recent years as set out in paragraph (141), no serious doubts arise in regards of grids with respect to grids for modular suspended ceilings.

6.5.3. Spain

6.5.3.1. The Parties' view

(157) As regards Spain, the Parties submit that all materials of modular suspended ceilings fall under a single relevant product market definition. As a result, the Transaction would not result in the significant impediment of effective competition primarily because the Parties market share would be moderate and there would be other international and local competitors that would continue to exert sufficient competitive pressure on the Parties.

6.5.3.2. Commission's assessment

(158) Certain aspects of the competitive assessment apply across all of the national markets for mineral fibre tiles and grids under review as explained in sections 6.3 (166) and 6.4. (167) Those aspects apply fully to the Spanish markets and therefore argue in favour of raising serious doubts for Spain. The remainder of this section will only set out arguments specific to Spain that apply in addition to those cross-cutting aspects already set out in sections 6.3 and 6.4.

Knauf is instead the first or the second alternative to Armstrong. (172) Finally, Knauf and Armstrong are practically the only two significant suppliers in the sub segment of mineral fibre tiles produced with the "wet" production method, as OWA has very limited presence in Spain with a [5-10]% market share in wet-felt mineral fibre tiles.

(162) As shown below, in its internal documents Armstrong identifies Knauf as a close competitor in Spain. (173)

Figure 2 – Closeness of competition in Spain

[Strategic considerations by AWI regarding the Spanish market and close competitor]

Source: RFI#1 AWI Confidential Annex 66.2

(c) Replies from the market investigation on the impact of the Transaction

(163) Finally, the majority of Spanish customers expect the Transaction to have a negative impact and, in particular, believe that it will lead to price increases. (174)

6.5.3.3. Conclusion

(164) In view of the reasons set out in paragraphs (158) to (163), the Commission finds that the Transaction raises serious doubts about its compatibility with the internal market as regards the Spanish markets for mineral fibre tiles and grids for modular suspending ceilings.

6.5.4. UK

6.5.4.1. Parties' view

(165) In the UK, the Parties submit that all materials of modular suspended ceilings fall under a single relevant product market definition. As a result, the Transaction would not result in a significant impediment of effective competition primarily because the Parties' combined market share and the increment brought by Knauf would be moderate. The Parties also take the view that there are other competitors that will continue to exert sufficient competitive pressure on the Parties.

6.5.4.2. Commission's assessment

(166) Certain aspects of the competitive assessment apply across all of the national markets for mineral fibre tiles and grids under review as explained in sections 6.3 (175) and 6.4. (176) Those aspects apply fully to the UK markets and therefore argue in favour of raising serious doubts for the UK. The remainder of this section will only set out arguments specific to the UK that apply in addition to those cross-cutting aspects already set out in sections 6.3 and 6.4.

shows that the Parties' actual market shares in the UK may be even higher than the estimates proposed by the Parties suggest. (177)

(169) With respect to mineral fibre tiles, the Transaction will in any case give rise to very high combined market shares around [50-60]%. The remaining competitors will remain well behind the merged entity, both in terms of value and volume: The strongest competitor in terms of market shares is Saint-Gobain with market shares around [20-30]% both value and volume based. The merged entity's position and the distance between it and remaining competitors would be even more significant in the wet mineral fibre segment, where the merged entity would have a market share in excess of 70%.

(170) The same applies for grids, where the merged entity's market share would be in excess of [50-60]% in value and in excess of [40-50]% in volume, whereas the remaining competitors would have a market share of ca. [10-20]% or less.

(171) Although the Target's market share has been declining both for mineral fibre tiles and for girds over the past 3 years, its position on the UK market is still very significant. In addition, because of the market share increment brought about by the Transaction, the merged entity's market share would be higher than was the Target's in 2015.

(b) Closeness of competition

(172) The Parties are close competitors in mineral fibre tiles in the UK.

(173) First, the Parties are two of only three wet felt tile manufacturers.

(174) Second, internal documents show that the Parties' product portfolios in the UK overlap to a very significant extent (up to [degree of portfolio overlap]%). (178)

(175) Third, independent research suggests that both Armstrong and Knauf are two of the five remaining mineral fibre tile manufacturers and the two main competitors in grids in the UK. (179)

(c) Price levels are already higher in the UK than in other EEA Member States

(176) The existing price levels in mineral fibre tiles in the UK indicate that, already before the Transaction, the remaining competitors did not expand aggressively to capture additional margins. This indicates that their reaction may be similar after the Transaction. The UK market could thus serve as an example of potential future effects of the Transaction on price levels in mineral fibre tiles. Indeed, internal documents indicate that price levels are higher in the UK than in other countries of the EEA. (180) Thus, the UK could be an example of a country where price levels are higher than elsewhere (indicating that there is additional margin to be captured) but the reaction from competitors has not been aggressive enough to bring prices down.

(d) Replies from the market investigation on the impact of the Transaction

(177) The market participants in the UK expressed negative sentiment with respect to this Transaction. Reduced product choice and increased prices were cited as the main concerns. For instance, one contractor stated "[t]here will be less choice and more control from fewer parties. Historically (5 years) in this sector the fewer the manufacturers the higher the price points". (181) Another said, "[p]rices are likely to rise as production capacity and product ranges are rationalised and specification share is high". (182)

(178) A majority of respondents to the Commission's market investigation expects the Transaction to have negative effects for customers. More specifically, half of the responding customers expects the Transaction to result in a price increase for both mineral fibre tiles (183) and grids (184) for modular suspended ceilings.

6.5.4.3. Conclusion

(179) In view of the reasons set out in paragraphs (166) to (178), the Commission finds that the Transactions raises serious doubts about its compatibility with the internal market as regards the UK markets for mineral fibre tiles and for grids for modular suspending ceilings.

6.5.5. Germany

6.5.5.1. The Parties' view

(180) The Parties are of the opinion that Germany and Austria belong to one market for suspended ceilings. Therefore, reference is made to the Parties' view with respect to Austria already set out in paragraphs (123) and (124).

6.5.5.2. Commission's assessment

(181) Certain aspects of the competitive assessment apply across all of the national markets for mineral fibre tiles and grids under review as explained in sections 6.3 (185) and 6.4. (186) Those aspects apply in principle to the German markets. However, the specific market structure and competitive conditions in Germany override those

(183) Both the current market leader OWA and Rockfon will remain active in mineral fibre tiles with significant positions around 20-30%, OWA will remain market leader with a share even beyond 30%. Moreover, Rockfon has been growing in market shares during the last five years, whereas OWA's and the Parties' shares are slightly on the decline and Saint-Gobain remains stable. Armstrong's market shares in German declined continuously throughout the last years. (187)

(184) Regarding grids, the Commission notes that Rockfon and OWA each have sizeable market shares [of 20-30]% and will thus be in a position to exercise significant competitive constraints on the merged entity post transaction.

(185) The Commission market reconstruction broadly confirmed the parties' market share estimates and thus supports this analysis.

(b) Market strategy Knauf

(186) The Commission observes that according to the assessment of Armstrong from 2016, Knauf follows a strategy [assessment of Knauf strategy by AWI] (188) However, so far Knauf's market shares 2015-2017 did not show any result of the strategy. (189)

(c)Closeness of competition

(187) As regards mineral fibre tiles, the market feedback indicates an existing competition between the Parties as respondents from Germany name Armstrong as an alternative to Knauf, and vice versa. However, the respondents name other suppliers at least as frequently as the Parties and overall confirm OWA's leading market position in Germany. (190) A significant amount of the respondents from Germany are of the opinion that the Parties do not compete closely with each other. (191)

(188) When mineral fibre is considered the most suitable material for certain type of characteristics (standard, sound, fire reaction), both Parties are often named as potential suppliers. The respondents, however, name OWA regularly as the most preferred supplier and also Rockfon and Saint-Gobain as alternatives from time to time. (192)

(189) In other regards (such as the specific manufacturing method of wet-felt tiles, high- end or low-end products, etc.), the replies from market participants are overall not conclusive with respect of closeness of competition of the Parties. (193)

(d) Impact of the transaction

(190) The majority of the respondents are neutral as regards the impact of the transaction on their company. A small minority expects a negative impact and none of the respondents a positive one. (194)

(191) No respondent expects the prices of tiles (across all materials) to decrease, some respondents expect a price increase but half of the German respondents assume that the prices will remain the same. (195)

(192) Considering mineral fibre tiles only, there is a slight shift towards the opinion that in this product area, prices may increase as consequence of the Transaction. (196) For grids, the opinions that prices will increase or that the prices will remain the same, are rather balanced. (197)

(193) Overall, the Commission observes that many respondents did not express any view on the impact of the transaction or remain neutral. This is roughly in balance with those participants expecting a negative impact of the Transaction, in particular because of increasing prices.

(e) Commission's conclusion

(194) Combined market shares in mineral fibre tiles of the Parties are moderate in Germany compared to other countries with OWA remaining the market leader post- transaction capturing a market share of about [40-50]%. As regards grids, the merged entity would assume market leadership in regards of the market shares. However, OWA and Rockfon remain strong competitors with their market shares almost equalling the Parties' combined market shares and thus exerting competitive pressure. Market participants perceive the Parties from time to time as close competitors but do not identify any particular closeness of competition between the Parties as opposed to the other competitors OWA, Rockfon and Saint-Gobain. None of the Parties is acting particularly aggressive on the German market and Armstrong's market shares are on the decline considering the last 10 years.

(195) In view of the above reasons, the Commission concludes that the evidence does not support serious doubts about the Transaction's compatibility with the internal market as regards the German markets for mineral fibre tiles and grids for modular suspending ceilings.

6.6. Competitive assessment of the overlaps in tiles made from other materials (metal, gypsum, wood)

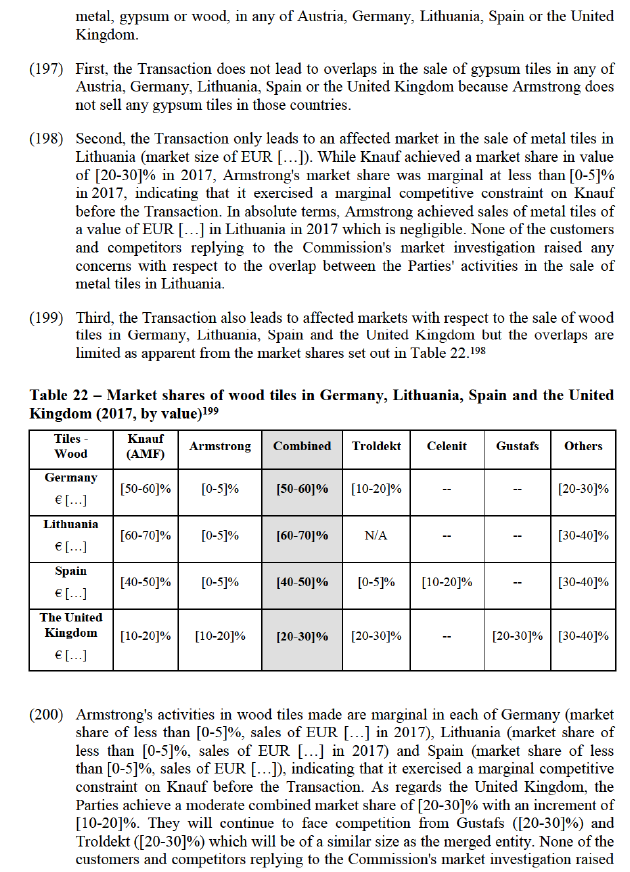

(196) For the reasons set out in paragraphs (197) to (200), the Transaction does not raise serious doubts as to its compatibility with the internal market with respect to the national markets for tiles made from other materials than mineral fibre, namely from

any concerns with respect to the overlap between the Parties' activities in the sale of wood tiles in any of Germany, Lithuania, Spain or the United Kingdom.

7. COMPETITIVE ASSESSMENT OF THE VERTICAL LINKS

7.1. Analytical framework – Vertical unilateral effects

(201) Vertical mergers involve companies operating at different levels of the same supply chain. For instance, a vertical merger occurs when a manufacturer of a certain product merges with one of its distributors.

(202) Pursuant to the Commission Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings (the “Non-Horizontal Merger Guidelines”) (200), vertical mergers do not entail the loss of direct competition between merging firms in the same relevant market and provide scope for efficiencies.

(203) However, there are circumstances in which vertical mergers may significantly impede effective competition. This is in particular the case if they give rise to foreclosure. (201)

(204) The Non-Horizontal Merger Guidelines distinguish between two forms of foreclosure: input foreclosure, where the merger is likely to raise costs of downstream rivals by restricting their access to an important input, and customer foreclosure, where the merger is likely to foreclose upstream rivals by restricting their access to a sufficient customer base. (202)

(205) Pursuant to the Non-Horizontal Merger Guidelines, input foreclosure arises where, post-merger, the new entity would be likely to restrict access to the products or services that it would have otherwise supplied absent the merger, thereby raising its downstream rivals' costs by making it harder for them to obtain supplies of the input under similar prices and conditions as absent the merger. (203)

(206) For input foreclosure to be a concern, the Merged Entity should have a significant degree of market power in the upstream market. Only when the Merged Entity has such a significant degree of market power, can it be expected that it will significantly influence the conditions of competition in the upstream market and thus, possibly, the prices and supply conditions in the downstream market. (204)